- Egytrans conditionally approves Hassan Allam Utilities purchase offer. (Speed Round)

- GSK Egypt rejects Acdima’s bid to start due diligence, closing the door to a sale. (Speed Round)

- Taaleem thinks its shares are worth up to EGP 6.02 apiece. (Speed Round)

- Remittance inflows survive 2020 despite pandemic. (Speed Round)

- From cave paintings to the cloud: Preserving art and culture in the digital age. (Tech + Culture)

- S&P says EMs have a long way to go before they recover from the pandemic. (Macro Picture)

- Abla Fahita makes her Netflix debut today. (On the Tube)

- Are you ready for Mother’s Day? (Eat This Tonight)

Monday, 15 March 2021

EnterprisePM — Taaleem gets green light to issue price range release for its IPO rather than cutting straight to the final price

TL;DR

WHAT WE’RE TRACKING TONIGHT

The flood of M&A news continues unabated this afternoon, folks, and we have a price range announcement on the Taaleem IPO to boot. Chapter and verse on this and more can be found in this afternoon’s news well.

SOUND SMART: The fact that Taaleem is being allowed to do a price range announcement is a big deal. In the wake of the flap over the IPO of Sarwa Capital back in 2018, the Financial Regulatory Authority limited companies to issuing only a fixed offer price ahead of the start of trading. That limited the ability of investment bankers to explore investor appetite within defined band before pricing a company’s shares.

HAPPENING NOW- Proposed changes to the Bankruptcy Act are one step closer to becoming law after the House gave initial approval to the amendments, which open more avenues for struggling borrowers to settle with lenders before filing for bankruptcy. The law passed in a plenary session this afternoon, Youm7 reports. The changes now make their way to Maglis El Dawla (the State Council) for one last legal review before getting a final vote, after which they will need to be ratified by the president. Alongside giving struggling companies access to loans from certain authorized banks to help avoid bankruptcy, the changes also allow creditors to vote on whether their debtors can continue operating, be placed into administration or liquidate their assets, among other things.

Also approved by MPs today: A recent agreement with the French Development Agency to support teaching French in public schools.

CATCH UP QUICK on the top stories from today’s issue of EnterpriseAM:

- Outdoor concerts and plays are okay nationwide, but churches in Qena are closing down through 3 April as covid-19 spreads in the governorate. Meanwhile, the hope is now that the first 6 mn of 8.6 mn AstraZeneca jabs we’ve ordered will arrive by the end of the month.

- Egypt will be back near pre-pandemic growth rates by next year, according to the latest report by the African Development Bank, but challenges remain.

- The Sisi administration is pushing ahead with for an EGP 100 bn program to offer 30-year financing at a subsidized rate for low- and middle-income earners who want to buy a home.

THE BIG STORY ABROAD: It’s interest rate week. The US Federal Reserve starts a two-day meeting of its Federal Open Markets Committee tomorrow. Observers see the Fed leaving rates on hold through 2023, though some are anticipating a hike as early as 2022. The UK and Norway are also expected to leave rates unchanged — despite rising borrowing costs — at their central bank meetings this week, while EM economies including Turkey and Brazil are seen raising rates to rein in inflation and prop up their currencies. But rate increases could hurt EM economics with a high foreign debt bill, with developing world debt rising to more than 250% of borrowing countries’ combined GDPs last year

The Central Bank of Egypt meets on Thursday, with all 12 analysts we spoke with for our regular poll saying they think the Monetary Policy Committee will leave rates on hold, accounting for a possible uptick in inflation due to a commodities boom and potential EM outflows as investors are lured away by rising US treasury yields.

SIGN OF THE TIMES- The pandemic is turning CEOs into vaccine activists in a bid to return to the office, with some granting paid leave and financial incentives to employees who get the jab, Bloomberg reports. In many US states, an employer can fire an employee for refusing to comply with a vaccine mandate, but the UK government has stated that while it’s up to businesses to determine immunization policies for their workforces, insisting that staff get jabbed could be discrimination, the BBC reports. As the legality of requiring vaccination is challenging, CEOs of major companies like Nestle, Danone and Unilever are opting for persuasion instead, using the company-wide townhalls to promote vaccination.

Some corporate chieftains are taking a harder line: United Airlines CEO Scott Kirby said he wanted to make vaccination a requirement for the company’s 60k employees, and that other companies should follow suit, CNBC reports. UK-based handyman firm Pimlico Plumbing has said “no jab, no job” on new contracts, the BBC reports.

|

HAPPENING TOMORROW- Talk about blockchain, AI and more with TEDx speaker Patrick Schwerdtfeger at an AmCham event that will look at how the business community can reposition in a world undergoing rapid technological change. You can register for the event here.

???? CIRCLE YOUR CALENDAR-

Photopia’s Cairo Photo Week 2021 is up and running until 20 March. The photo festival features over 100 activities including workshops, panels, photo challenges, exhibitions, portfolio reviews and photo walks throughout the week, all led by more than 80 local and international photographers. You can check out the event program on Photopia’s website, there’s plenty to look at on the group’s Instagram feed @cairophotoweek, and both physical and virtual tickets are available here.

AUC Press’s Mad March book sale will be ongoing for the rest of the month. The sale is open to the general public every day from 10am–6pm CLT at AUC Tahrir Bookstore & Garden.

???? FOR YOUR COMMUTE-

The UAE is following our FRA’s lead as it mandates that every listed company have at least one female director, according to The National. Just 28 of 110 listed companies in the UAE have women on their boards — and women account for just 3.5% of all serving board members, according to data from Aurora50. Our FRA mandated that all EGX-listed companies have a woman on their board by the end of 2020. 65% of companies were in compliance.

More asset managers are sounding the alarm on greenwashing oil firms, including Lauri Vaittinen, the CEO of newly the created USD 29 bn asset management arm of Mandatum, who told Bloomberg the firm will opt out of buying ESG products sold by corporations that aren’t clean across their balance sheets. Vaittinen’s comments come a week after the EU imposed new regulations to crack down on greenwashing — meaning companies that promote misleading claims about ESG credentials in a bid to attract investors.

Electric vehicle startups are forecasting record-setting revenue growth, with top players now listed on global stock markets or in the process of going public by merging with SPACs, writes The Wall Street Journal. EV makers Faraday Future, Arrival Group, and Fisker have all disclosed plans to surpass the USD 10 bn revenue mark within three years of launching sales and production — compare this to Google needing eight years to reach the same figure. The EV frenzy has been fueled by the shift away from gas-powered cars, and Tesla’s success only added to entrepreneurs’ confidence. The lofty valuations have caused some analysts to say the forecasts are unrealistic and need “haircuts.”

Crypto could be banned in India as the country gears up to discuss a law that would ban the currency and fine anyone found trading or holding crypto assets, a senior government official told Reuters. The bill would criminalise possession, issuance, mining, trading and transferring crypto assets in a potential blow to the red-hot asset class. Holders of cryptocurrencies would be given up to six months to liquidate their positions. Roughly 8 mn investors hold around USD 1.4 bn in crypto-investments in India, experts tell CNBC. The move would make India the first jurisdiction to full-out ban crypto currency; even China bans only trading and mining, not possession.

???? ON THE TUBE TONIGHT-

(All times in CLT)

Abla Fahita, Egypt’s favorite puppet, makes her Netflix debut today in the show Drama Queen. Season one of the show finds Abla falsely accused of a crime and separated from her daughter Caro and her son Boudi. The show marks the character’s first scripted series following her popularity in Abla Fahita: Live from the Duplex. Tap or click here to see the official trailer (watch, runtime: 2:16).

The Grammys took place last night. The largely virtual event was hosted by Daily Show anchor Trevor Noah and is being celebrated for showcasing female talent as artists including Billie Eilish, Megan Thee Stallion and Taylor Swift cleaned up at the show. Beyonce snagged her 28th Grammy, tying her with Quincy Jones for the most-awarded singer.

Among those taking home hardware last night:

- Everything I Wanted by Billie Eilish won record of the year while No Time to Die won best song written for visual media.

- Taylor’s Swift’s Folklore won album of the year.

- Dua Lipa’s Future Nostalgia was given the award for best pop vocal album.

- Megan Thee Stallion won best new artist.

- Bubba by Kaytranada won best dance/electronic album.

- Stay High by Brittany Howard was awarded the best rock song trophy.

- The New Abnormal by The Strokes won best rock album.

You can check out the full list of nominees and prizewinners on the Grammy website. The New York Times has coverage, while Rolling Stone thinks you should watch Megan Three Stallion and Cardi B perform “WAP” for the event.

Football has died down a bit after yesterday’s flurry of matches. National Bank will face off with Al Ittihad at 5pm in the Egyptian Premier League. Abroad, you can catch Wolves against Liverpool at 10pm in the English Premier League, while Barcelona play Huesca in La Liga at 10pm.

???? EAT THIS TONIGHT-

Get ahead of Mother’s Day with these cool food options: Gourmet has put together a special cookie decorating kit for Mother’s Day that comes with an assortment of icing, sprinkles, and cookies shaped to read I ♥️ MOM. You could decorate them and give them to mama as a surprise or make it a bonding activity you can do together. Gourmet’s Instagram page (@gourmetegypt) has some decoration inspiration you can use to get creative. Meanwhile, Sunrise Tray has perfectly put together Mother’s Day trays so you can serve mom breakfast in bed along with that “World’s Best Mom” mug you just picked up. Choose from their tray menu or customize your own, but you need to place an order three days in advance.

PSA- Egyptian mother’s day is on Sunday, 21 March. The day is observed on Sunday, 9 May in Canada and the United States. Are you a Brit? You’re already a day late — give Mom a ring now, as yesterday was mother’s day.

???? OUT AND ABOUT-

(All times in CLT)

It’s poetry night at El Sawy Culture Wheel, with Mohamed Ali, Mohamed Samir and Mina Nader set to recite and sing their poems at 9pm.

The Darkroom Cairo is holding an astrophotography workshop in Baharia Oasis this weekend, from 19-20 March focusing on how to make images of the night sky using film photography. The event is organized in collaboration with El Heiz observatory and you will have to bring your own film SLR camera and tripod; film will be provided.

A gala at Abdeen Palace on 20 March will include professional portraits by Beit El Sura founder Ahmed Hayman, a tour around the palace, and a food reception that includes live music. You can check out the event on the Instagram page of Events around Egypt, which is organizing the gathering on behalf of the Tourism Ministry.

???? UNDER THE LAMPLIGHT-

Can big companies still create a startup culture? The Startup Way by Eric Ries lays out a system of entrepreneurial management that he says will allow businesses of all sizes and from every industry find a path to sustainable growth and long-term impact by changing the firms’ culture.

???? TOMORROW’S WEATHER- Expect daytime highs of 25°C and lows of 12°C tomorrow, according to our favorite weather app.

SPEED ROUND: M&A WATCH

Egytrans conditionally approves Hassan Allam Utilities purchase offer

Transport player Egytrans has conditionally accepted an offer submitted by HA Utilities Holding (HAUH) last week to acquire a controlling stake in the company via a reverse merger, the listed company said in a regulatory filing (pdf). The company’s board “carefully reviewed the proposal and unanimously concluded that the proposal merits further review,” Egytrans chairperson and managing director Abir Leheta said in a statement (pdf).

How Egytrans sees the partnership: “This potential partnership aligns with Egytrans’ ambitious strategy of expansion” into Africa, Leheta said. The company will open talks with HAUH to get a clearer idea of the latter’s vision and value contribution to the proposed partnership while also mapping out potential operational synergies.

The story so far: HAUH last week submitted a non-binding offer to acquire a 65% stake in Egytrans via a share swap. The transaction would see Egytrans acquire 100% of one of the company’s subsidiaries and HAUH take a stake in Egytrans. HAUH estimates Egytrans to be worth EGP 375-405 mn based on a EGP 12-13 share price, and said its subsidiary could be valued at EGP 680-800 mn.

What’s next? The approval paves the way for Egytrans to conduct due diligence and a fair value assessment on HAUH. Egytrans has not decided when it will start due diligence on HAU, Leheta told us. Hassan Allam will kick-off its due diligence when Egytrans decides on a date, a company representative told us.

Advisors: Egytrans has appointed Grant Thorton and an unnamed investment bank as its financial advisors, while Matouk Bassiouny & Hennawy will serve as counsel. White & Case will provide counsel to Hassan Allam, but the company declined to disclose who they have tapped as financial advisors.

SPEED ROUND: M&A WATCH

GSK Egypt rejects Acdima’s bid to start due diligence, closing the door to a sale

GlaxoSmithKline Egypt’s board of directors has rejected a request submitted by Acdima to start due diligence on the company, GSK said in an EGX disclosure (pdf) this morning following a board meeting Sunday. Acdima submitted the request last week following the breakdown of talks between GSK and the UK’s Hikma Pharma.

This isn’t a surprise: GSK Egypt’s parent company said in a statement on Sunday that it was no longer willing to sell its 91.2% stake in the unit, but that the local board would meet Monday to discuss the offer. GSK had previously received separate takeover bids by Acdima and Rameda Pharma but said last month that it would focus exclusively on the talks with Hikma Pharma, which fell through last week for unknown reasons.

ON THE BIDDING WAR FOR ALEX MEDICAL- Alexandria Medical Services says it is unaware of a potential takeover bid by a consortium of Mabaret Al Asafra Hospitals and investment firm Tana Africa Capital, the company said in an EGX disclosure (pdf). The company has not received any information concerning the potential offer, nor has it been contacted by Mabaret Al Asafra or Tana Capital, it said. Reports in the local press earlier this week had said the two companies planned to submit an offer to acquire 100% of Alex Medical before the end of March. The consortium had reportedly reached out to majority shareholder Abu Dhabi Commercial Bank (ADCB) back in January to discuss acquiring its 51.5% stake. ADCB has since confirmed that it is looking to exit the company.

Another consortium is also looking to acquire Alex Medical: Saudi’s Tawasol Holdings (already a 26% shareholder in Alex Medical) and Speed Medical subsidiary Speed Hospitals Company will reportedly offer to purchase the company’s shares at EGP 38.09 apiece.

ALDAR APPOINTS ADVISOR FOR SODIC BID- CI Capital has been tapped by the UAE’s Aldar to advise on its potential bid for a controlling stake in real estate developer Sodic, Al Mal reports. Aldar has submitted a non-binding offer to acquire at least 51% of Sodic’s shares at EGP 18-19 apiece, valuing the company at a median of EGP 6.6 bn.

SPEED ROUND: IPO WATCH

Taaleem thinks its shares are worth up to EGP 6.02 apiece

Taaleem Management Services has priced its initial public offering on the Egyptian Exchange at EGP 5.48-6.02 per share, according to a statement (pdf) released this afternoon. The transaction will see about 49% of the company (or some 358 mn shares). The price would give the education outfit — which would be the second biggest education constituent on the EGX — a market cap of up to EGP 4.4 bn. The transaction received the sign off of the Financial Regulatory Authority last Thursday, the statement notes.

Who’s selling? The 49% offering comes courtesy of Sphinx Obelisk, a special-purpose vehicle, which will offload s shares in a secondary sale, which will include offerings to both institutional investors in Egypt and abroad as well as retail investors here at home. CI Capital is expected to be among those selling down its position through Sphinx. We previously noted that CI Capital, acting as a merchant bank for the first time, and a group of co-investors acquired a 60% stake in Taaleem in 2019 from Thebes Education Management Holdings in an EGP 1.2 bn transaction. Co-investors at the time included StonePine ACE Fund, a JV between StonePine Capital and ACE. Ahmed Badreldin’s RMBV is also a shareholder, having partnered with Taaleem founder Seddik Afifi in 2015. Badreldin is also vice-chairman at Taaleem.

The timeline: The transaction is expected to be completed in 2Q2021 “subject to market conditions” and approvals, the company noted in the statement.

Advisors: CI Capital is sole global coordinator and joint bookrunner while Renaissance Capital and First Abu Dhabi Bank are joint bookrunners. Matouk Bassiouny & Hennawy are domestic counsel to Taaleem and Norton Rose Fulbright are doing international duties. White & Case is local and international counsel to the joint bookrunners.

SPEED ROUND: ECONOMY

Remittance inflows survive 2020 despite pandemic

Egypt’s remittance inflows defied expectations to grow more than 10% in 2020 despite the shock of the pandemic, a trend that may have been fuelled by the return of expats and high-interest savings products offered by banks, analysts tell us. Central bank data (pdf) released today reveals that remittance inflows rose to USD 29.6 bn last year, up 10.5% from the USD 26.8 bn that entered the country in 2019, showing that inflows held up remarkably well despite most of the world plunging into a recession and GCC economies being rocked by the collapse in oil prices. Remittances grew 7% y-o-y to USD 7.5 bn during the fourth quarter of 2020.

Making sense of the numbers: Official numbers show that worker transfers were more or less unscathed by the pandemic. The only time they fell was at the height of the initial wave of the virus in 2Q2020 when much of the world entered some form of lockdown. The drop at the time (by 10% y-o-y to USD 6.21 bn) was swiftly offset by an 11% increase the following month, and then by solid performance in subsequent quarters (here and here), despite the ominous predictions offered by economists at the outset of the crisis.

Expats could’ve been returning home with their savings: Remittances are highly correlated with global GDP growth, and the fact they grew despite a worldwide recession can be explained by other factors, possibly that many white- and blue-collar workers either lost their jobs and returned home with their savings or were able to come back and work remotely, Pharos’ head of research Radwa El Swaify tells us. The fact that the EGP remained stable through the worst of the crisis and that the government didn’t introduce a full lockdown made people more confident to reallocate their money back home, she added.

NBE and Banque Misr’s high-interest CDs also played a role: The incentive to save is another factor that helped to stimulate inflows, says Arqaam Capital’s Arqaam Capital’s Noaman Khalid. He suggests the uptick in remittances is a repeat of what we saw in 2016, when inflows surged after the central bank hiked interest rates following the EGP float and banks launched high-interest, three-year CDs. Last year, the National Bank of Egypt and Banque Misr introduced 15% fixed-rate savings certificates to help bolster the financial system, attracting EGP 383 bn in inflows.

GO WITH THE FLOW

The EGX30 fell 0.6% at today’s close on turnover of EGP 1.1 bn (25.6% below the 90-day average). Regional investors were net buyers. The index is up 3.48% YTD.

In the green: GB Auto (+3.0%), Eastern Co. (+1.2%) and EKH (+1.0%).

In the red: Orascom Financial (-4.2%), Credit Agricole (-3.7%) and Heliopolis Housing (-3.3%).

TECH & CULTURE

From cave paintings to the cloud

How Egyptian art and culture are being archived in the digital age: While the impulse to archive — to preserve a record of our current reality — dates back to the cave paintings of prehistoric times, the archive has needed to take on new forms over the centuries by utilising new technologies. Until recently, archiving major cultural items and documents have been the domain of large institutions such as museums or governments, and are therefore not neutral spaces: Those with power write the history. But with the internet, that’s all been done away with.

Today, archives are not an instrument of perpetuating state narratives as much as they are a collective memory bank, writes Artwork Archive. This hivemind can help bring attention to unknown artists by leveling the playing field for the art market, and it can also mean that marginalized pockets of history find a second life through the attention of researchers, who have access to more material than ever before. But part of an archivists’ role is to sort and curate the masses of information. Left unfiltered, the risks are that sensory overload could stop us making much sense of the information we’re presented with.

Egypt has experienced its own archive fever this past decade, with initiatives ranging from the artistic to the political to the nostalgic popping up on digital platforms and in physical spaces. Artists have reflected on archiving as an act of resistance against forgetting the events of 2011 and the following years and have enshrined the period online in multiple ways. 858 is an initiative by a group of young filmmakers who uploaded over 858 hours of crowdsourced footage of pivotal events in the period surrounding 2011 onto a digital archive, while the Tahrir Documents platform preserves pamphlets and posters of that time in pdf form.

AUC is among the big institutions that have also begun to realize the importance of having an online archive, making their historical records, photographs and recordings available to a larger audience and preserving the fragile items in a (kind of) unassailable medium through their Digital Archive and Research Repository.

Egyptian art galleries are also going online: TAM Gallery (formerly the ArtsMart) Co-Founder Lina Mowafy started her business as an online art gallery. Today her collection consists of over 9,000 pieces and a portfolio of 500 artists. LISTEN TO THIS: We sat down with Mowafy on our podcast Making It (listen, runtime: 29:19).

Others have taken a more fluid approach to the archive, producing interactive documentaries like Womanhood that take video testimony as their medium, or producing plays that tackle Egypt’s history that are reliant on the archive as a source.

Social media can also act as an alternative archival space: The History Collective (@historycollective) explores events and phenomena ranging from Egyptian Jazz, the feminist revolution, and the decolonization of Egypt, while @fananeenmasr takes a more modern approach to creating an archive, showcasing contemporary Egyptian artists who create paintings, digital art, sculptures, or photography.

While social media can act as a repository for images, they may not always be accompanied with the requisite meaning to create an “archive.” Taking the example of the tens of “nostalgic” Facebook groups dedicated to sharing photos of Egypt in the good old days, scholar Lucie Ryzova highlights that social media can sometimes facilitate the decontextualization of images from their meanings, leaving them up for grabs to be assigned new ones, and leading to possibly untrue conclusions (example: everything was always better in the past) by people skimming the surface of the archive. And it begs the question: Can we trust social networks, as for-profit corporations, to be around for decades to come and preserve our collective experience?

THE MACRO PICTURE

S&P says EMs have a long way to go to recovery

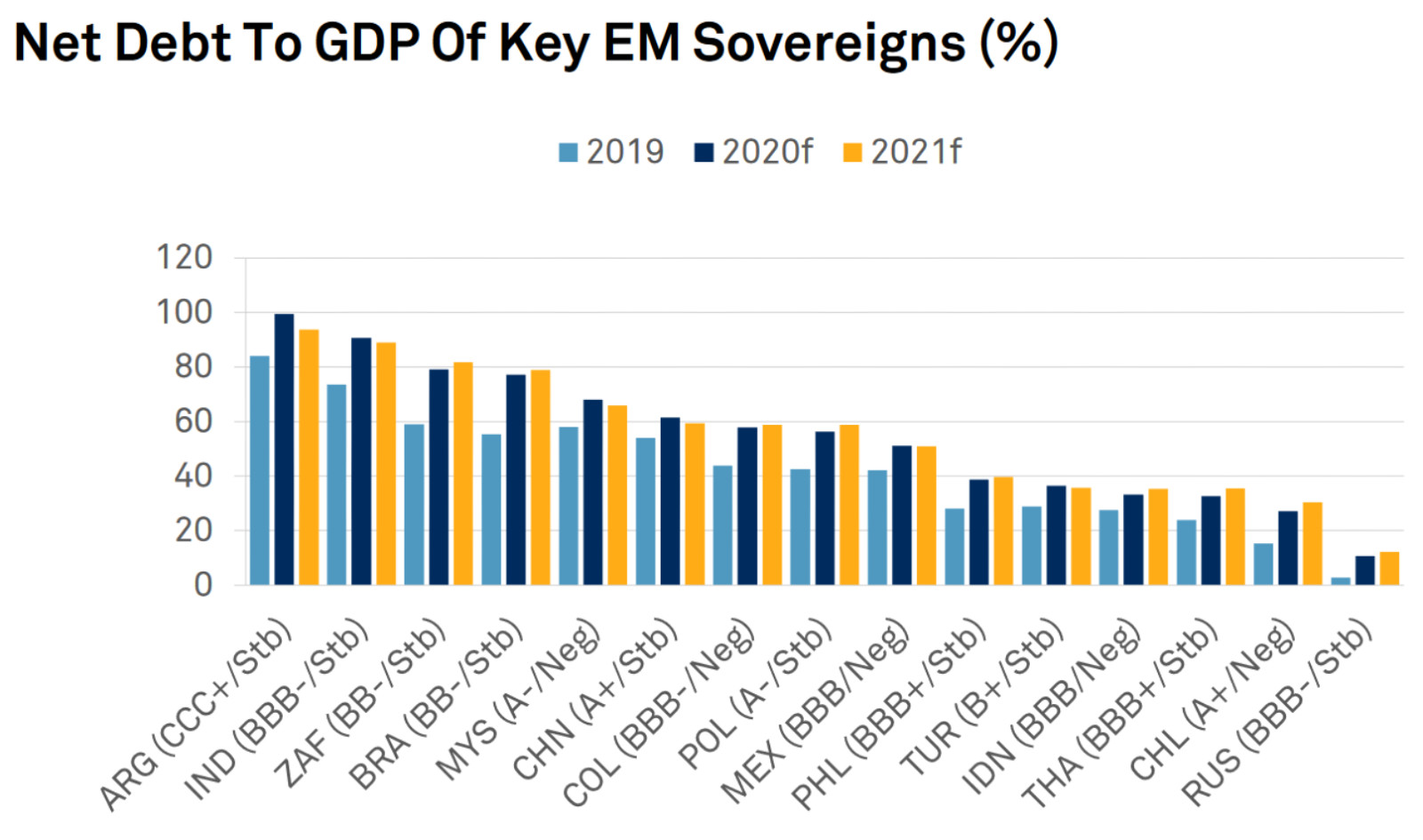

Governments in the emerging world have few bullets left in the policy chamber to fight the pandemic, making a speedy vaccine rollout and a swift recovery all the more important, S&P Global has said in its 2021 Global Outlook. “Most EMs have limited flexibility to provide additional fiscal or monetary support without hurting their credit quality,” meaning that reforms will be critical to boost growth, productivity and tax revenues,” the ratings agency writes.

Not many of the 16 biggest EMs have a lot of leeway to accrue more debt: The ratings agency has either downgraded or revised its outlook to negative for eight of the 16 major EMs while five still carry negative outlooks — Chile, Colombia, Mexico, Indonesia, and Malaysia. And because S&P’s methodology doesn’t permit corporate and banking ratings to exceed the sovereign, further downgrades could also mean lower ratings throughout the economy, pushing up debt costs and restricting access to credit.

Where is the corporate recovery going to come from? S&P expects that consumer staples, essential retail, healthcare, telecom and tech companies will see earnings in emerging markets return to pre-pandemic levels this year, while most sectors will stage a complete rebound in 2022.

Other sectors will need to wait another two years to see a full recovery: Hospitality, tourism, airlines and non-essential retail firms won’t recover until 2023, the ratings agency suggests.

Banks have so far been able to minimize damage to their portfolios: Emergency measures taken to ease pressure on borrowers and buffer banks’ capital reserves and liquidity have meant that loan losses have so far been minimal. “Key EM banks have been able to delay the effect of the pandemic on their portfolios mainly by extending payment holidays and adopting more lenient accounting for these loans,” S&P says.

But this will change if things don’t start improving soon: “A deeper and longer economic shock will put additional strain on banks’ asset quality, fueled by mounting SME bankruptcies and unemployment.”

The recovery is slower than anticipated: The recent escalation of the pandemic in many EMs and developed countries will weigh on economic activity through 1Q2021, S&P says.

But China could make all the difference in the second half of the year, particularly to EMs reliant on commodity exports such as Brazil, South Africa and Indonesia.

But what are the key risks?

#1 A slower recovery: A longer, more drawn out global recovery or slow vaccine rollouts will likely result in higher debts and more pressure on public finances, resulting in credit downgrades. Companies could also see their ratings slide should further economic disruption hit earnings, potentially resulting in bankruptcies among those rated B and lower.

#2 Crowds on the streets: Rising levels of poverty, fraying public services and growing frustration with lockdown restrictions could provoke social unrest and political instability should these trends remain unaddressed.

CALENDAR

March: Potential visit to Cairo by Russian President Vladimir Putin.

11-15 March (Thursday – Monday): Al Bazaar fair for handicrafts and house decors, Cairo International Conference Centre, Cairo, Egypt.

11-20 March (Thursday-Saturday): Photopia’s Cairo Photo Week 2021 will take place with this year’s theme being Depth OFF Field.

15 March (Monday): AmCham event featuring life coach Arfeen Khan.

16 March (Tuesday): AmCham webinar featuring business tech expert Patrick Schwerdtfeger. Non-members can register here.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

23 March (Tuesday): The British-Egyptian Business Association (BEBA) virtual conference on sustainable manufacturing in Africa.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

29-30 March (Monday-Tuesday): Arab Federation of Exchanges Annual Conference 2021.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

31 March (Wednesday): Income tax deadline for individuals. Real estate tax deadline.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.