- Egypt to beat debt-to-GDP target this year -Maait. (Speed Round)

- Actis inks agreement with sovereign fund to drive investment to Egypt. (Speed Round)

- Egypt continues to lead on FDI in Africa. (Speed Round)

- FinMin to place new income tax law up for public consultation in 2-4 weeks. (Speed Round)

- House committee wants to expand tax incentives under SMEs Act. (Speed Round)

- IMF forecasts “sluggish” growth on the eve of Davos. (What We’re Tracking Today)

- FRA mulls new regs for asset, portfolio managers. (Speed Round)

- Ebtikar submits proposal to set up two consumer finance companies. (Speed Round)

- The Market Yesterday

Tuesday, 21 January 2020

FinMin sees Egypt smashing its debt targets this year

TL;DR

What We’re Tracking Today

The World Economic Forum get underway this morning in Davos and runs through Friday. Read on for a taste of what’s attendees are debating or skim through the agenda here.

The IMF has forecast “sluggish” global growth over the next two years, revising downward its forecast for this year and the next in its annual pre-Davos update to its World Economic Outlook. The fund now projects global economic growth to come in at 3.3% in 2020 (down from 3.4% in its last outlook in October) and 3.4% in 2021 (down from 3.6%). The report attributes this “sluggish” pace of recovery to “negative surprises” in several EM economies such as India, and increasing social unrest.

The IMF expects EM growth to clock in at 4.4% in 2020 and 4.6% in 2021, marking a 0.2% downward revision for both years from the fund’s October forecasts. Growth prospects in the Middle East and Central Asia region have also taken a hit, with the fund now projecting 2.8% growth this year, down 0.1 percentage point from October.

The silver lining: Global growth looks like it bottomed out at the end of last year, and growth forecasts would have been even lower had it not been for the raft of monetary easing in several economies during 2H2019. The effects of the stimulus should continue to be felt in 2020, helping the global economy to recover in the early months of the year.

Capitalism has a PR problem: The majority of people surveyed in this year’s Edelman Trust Barometer believe that capitalism is doing more harm than good. The decades’ old survey polled 34k people in 28 countries and found that 56% of respondents saw capitalism as a negative force in the world. The results provide more evidence of a breakdown of trust in traditional institutions, with the majority of respondents losing faith in media, business and governing institutions. (Reuters | WSJ | CNBC | CBS | Quartz)

And corporate trust in the global economy isn’t much higher: Just a quarter of the 1,581 CEOs surveyed by PwC for its latest CEO poll (pdf) describe themselves as confident in their prospects for revenue growth in 2020 — the lowest proportion since 2009. Just over half see global growth slowing this year, while in the Middle East 57% expect continued slowdown with only 11% improved growth.

Technical and legal committees from Egypt, Sudan, and Ethiopia will be in Khartoum tomorrow to hammer out a draft agreement on the filling and operating timetable for the Grand Ethiopian Renaissance Dam (GERD) ahead of meetings at the end of the month. The final round of US and World Bank-sponsored talks in Washington last week ended without resolving key points of disagreement. The sides will return to Washington on 28-29 January to finalize an agreement.

Egypt to host trade event in Dubai tomorrow: The Egyptian embassy in Dubai will tomorrow hold a trade and investment conference to promote economic ties, Al Masry Al Youm reports. Egypt and the UAE have deepened commercial relations over recent months, with the UAE agreeing to set up a USD 20 bn investment platform with the Sovereign Fund of Egypt and the country’s investment council pledging to double its investments in Egypt to USD 14 bn by 2025.

Saturday is a day off for any private-sector companies for whom it would normally be a workday in official observance of Police Day, which is also the anniversary of the 25 January revolution.

Stuff you can go to this week and next:

- The International Forum on Migration Statistics meeting is on its third and final day today at InterContinental City Stars. The event is hosted by the African Union and the Egyptian government, which will this month hand its one-year chairmanship of the union to South Africa.

- Renaissance Capital’s annual North Africa Investors Conference (pdf) kicks off in Marrakech tomorrow and wraps on Thursday.

- Our friends at AmCham will host US Ambassador Jonathan Cohen for its monthly luncheon on Tuesday, 28 January. Cohen will discuss prospects for commercial ties between Egypt and the US. Members can register for the event here.

- CI Capital’s annual MENA Investors Conference gets underway on Tuesday, 28 January at the Four Seasons Nile Plaza. The three-day event will wrap on Thursday, 30 January.

EGP WATCH- January’s EGP surge against the greenback shows no sign of slowing, with the currency gaining another three piasters yesterday to reach 15.72 per USD. The EGP has now gained 28 piasters since 8 January when it was trading at exactly 16.00 per USD.

***This is your last chance to take our annual reader poll: Tell us what you think will happen in 2020 and maybe get an Enterprise mug and our very own coffee. Every year we ask you, our readers, to weigh in on what you expect for the year ahead: Are you investing? Do you plan to hire new staff in 2020? How do you think the EGP will perform? What’s your take on interest rates? Tell us, and we’ll share the results with the entire community in early January to help you shape your view of the year. The survey is quick, we promise.

You can take the Enterprise Reader Poll here.

As a token of our thanks, we’re going to send up to 50 readers their very own Enterprise mug and a bag of our special coffee blend, produced in association with our friends at 30 North. Want a chance to get a mug of your own? Make sure you give us your name and complete contact information at the bottom of the survey.

The third impeachment trial in US history begins today: Senate Majority Leader Mitch McConnell yesterday moved to block evidence against the president revealed in the House without a separate vote, hours after Trump’s defense team demanded that the Senate move quickly to acquit him, the New York Times reports. Trump’s lawyers put forward a legally-dubious case, asserting that the president cannot be removed for abuse of power or obstruction of justice because there was no specific legal violation.

With the tedium of the Democratic presidential debates over and done with, the race for the nomination is about to get serious. We’re just two weeks away from the starting gun of Democratic primary season, with the Iowa Caucus set to take place on 3 February. We seem to be down to a three-way race in the state, with progressive senator Bernie Sanders taking the lead in the latest Des Moines Register poll, with national frontrunner Joe Biden trailing behind Senator Elizabeth Warren and South Bend Mayor Pete Buttigieg. The New Hampshire primary will take place on 11 February, and the Nevada Caucus on 22 February, before the candidates head into Super Tuesday on 3 March when 15 states go to the polls. RTE has a full timeline of events as we start counting down to the 2020 presidential election. The New York Times editorial board, meanwhile, is making headlines for having endorsed two candidates representing two different paths for democrats: Elizabeth Warren and Amy Klobuchar.

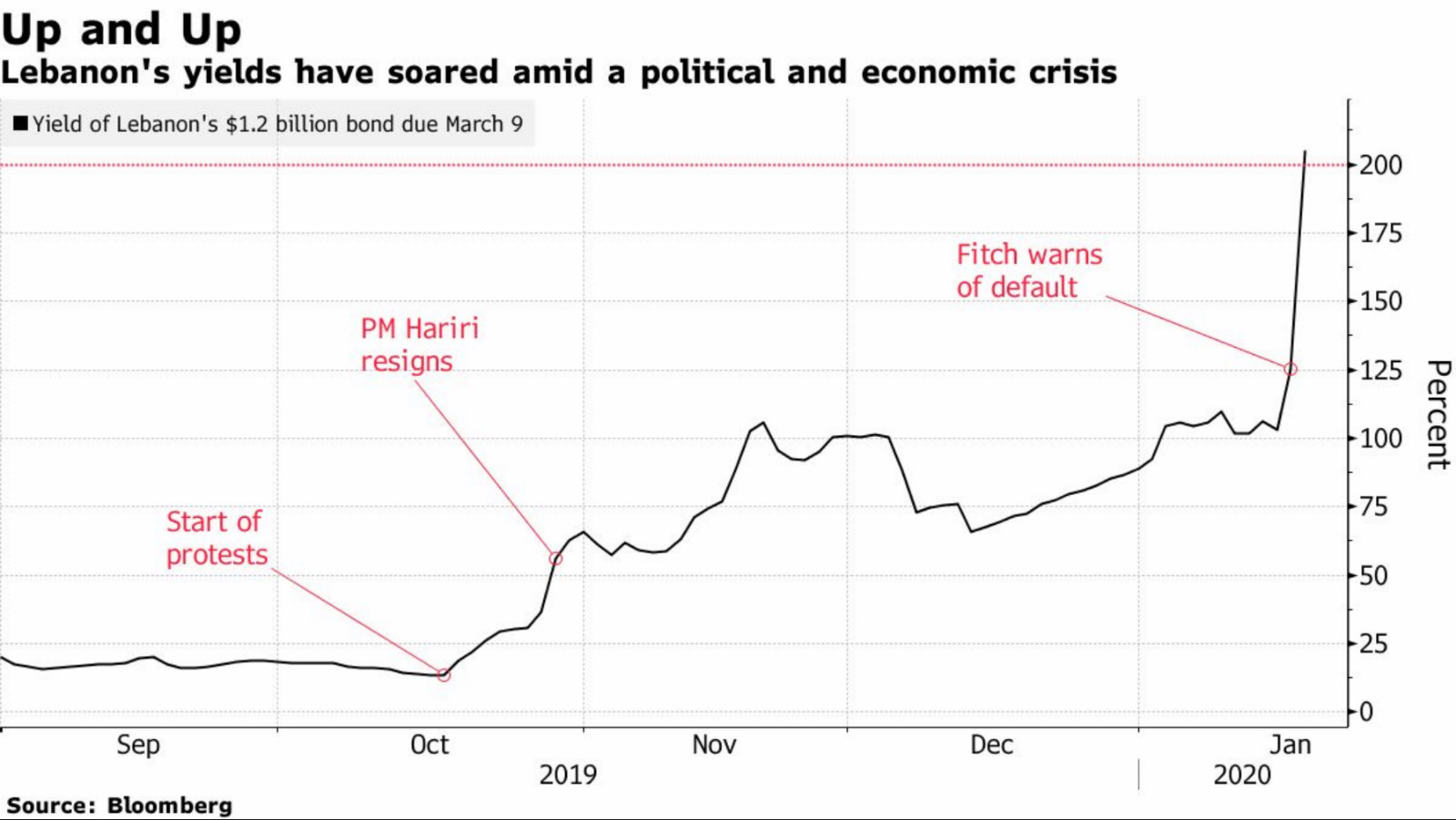

The yield on Lebanon’s next Eurobonds to mature rocketed to more than 200% last week amid renewed tensions between protestors and the police, according to a Bloomberg video (watch, runtime; 04:46). The USD 1.2 bn bond will mature on 9 March, and is being seen by investors as a key test for the country will default. The sell-off was triggered after Fitch warned that it would downgrade the country’s credit rating to ‘selective default’ if Central Bank Governor Riad Salamé went ahead with a plan to persuade local bondholders to swap into longer-dated bonds when it matures.

Bankers don’t think you’re rich unless you have USD 25 mn: For US elite private bankers, the benchmark for economy-class is higher than normal at USD 25 mn in investable wealth during an era described as one of hyper-wealth and hyper-inequality, according to Bloomberg. What is business class, then, you might ask. That’s USD 100 mn. First class? USD 200 mn. Private-jet rich? Try USD 1 bn. But it’s not all lush rides and fancy get-ups — being rich comes with its own set of complications, which wealth managers and bankers try to resolve by selling them “peace of mind.”

Speaking of wealth: Anyone else more than just a little uncomfortable that the 2k wealthiest people in the world hold more than the poorest 4.6 bn people combined? Canada’s CBC has more.

PSA- It looks like it’s going to rain today: The Egyptian Meteorological Authority is forecasting rainfall across Cairo as well as some cold weather to boot with a daytime high of 16°C and an overnight low of 9°C.

Enterprise+: Last Night’s Talk Shows

Yesterday’s UK-Africa Investment Summit took the spotlight on the talk shows last night: Al Kahera Alaan’s Lamees El Hadidi (watch, runtime: 5:40) and Min Masr’s Reham Ibrahim (watch, runtime: 2:11) both took note of President Abdel Fattah El Sisi’s speech, which stressed

Africa's needs for infrastructure and empowering youth and women. Live from London, Masaa DMC’s Ramy Radwan interviewed UK Investment Minister Graham Stuart who said that the summit reflected the UK government's intention to invest in Africa and noted that the UK is Egypt’s biggest investor (watch, runtime: 7:35). The Egyptian Ambassador to London Tarek Adel also praised the summit, telling Lobna Assal on Al Hayah Al Youm that it will create many partnerships between Africa and the world and help to combat illegal financial flows (watch, runtime: 5:33). We have more on the goings-on at the summit in this morning’s Speed Round below.

The Finance Ministry’s presser received some airtime by talking head numero uno Al Kahera Alaan’s Lamees El Hadidi, who covered most of the headline figures in a short segment (watch, runtime: 2:41). We have an elaborate rundown of yesterday’s press conference in the Speed Round below.

There was still room for some GERD-talk: ‘Let’s not get ahead of ourselves’ was the message delivered by former Foreign Minister Nabil Fahmy in an interview with El Hadidi last night, who didn’t sound totally optimistic on the chances of the latest round Grand Ethiopian Renaissance Dam talks delivering a final agreement (watch, runtime: 24:01).

Speed Round

Speed Round is presented in association with

Egypt to beat debt-to-GDP target this year + all you need to know about FinMin’s epic presser: The Finance Ministry expects to reduce its debt-to-GDP ratio to 83% by the end of the current fiscal year, easily beating the 89% target included in the FY 2019-2020 budget, Finance Minister Mohamed Maait said at a press conference yesterday. The primary surplus improved slightly to 0.5% of GDP in the first half of FY2019-2020 from 0.4% a year earlier, Maait also said, reiterating figures announced at last week’s cabinet economic group meeting. The ministry is looking to narrow the primary deficit to 2% by the end of the fiscal year.

Gov’t raises growth expectations for current fiscal year: The ministry now expects the economy to grow at a rate of between 5.8% and 5.9%, up from a previous 5.6% forecast, Maait said. Egypt’s GDP is expected to grow at an annual clip of at least 5.5% over the next few years, according to a quarterly report published by the government last month.

But the budget deficit is growing: Despite debt-to-GDP falling this year, state finances are falling deeper into the red, with the budget deficit rising to 3.8% of GDP in the first six months of FY2019-2020 compared to 3.6% a year earlier. Maait said the increase was caused in part by the government’s EGP 49 bn in interest paid between July and December 2019.

Tax revenues came in at EGP 304 bn in 1H FY2019-2020, Al Mal quoted Vice Minister of Finance Ahmed Kouchouk as saying. Sovereign tax revenues (including the Suez Canal, the Central Bank of Egypt, and interest on government debt instruments) fell 27% y-o-y, while non-sovereign tax revenues increased 10%. The Finance Ministry had expected Egypt’s tax revenues in FY2019-2020 to comprise 14% of the country’s GDP in a report last year.

New incentives for industry on the way: Maait said that the finance and trade ministries will launch a package of measures to support local industry, which could include VAT incentives, export subsidies, or fuel price cuts for factories. In recent weeks we have gotten word that the government will pass VAT amendments to remove paper companies from paying VAT on raw materials, and a gas pricing scheme for petchem companies. Meanwhile, exporters have been demanding changes to the government’s new EGP 6 bn export subsidies framework.

Speaking of export subsidies — more settlements on the way: The ministry will sign 40 agreements with exporters in “the coming days” to disburse overdue subsidies, Hapi Journal quoted Kouchouk as saying. A total of 370 companies are currently owed money by the government under an old framework which promised to pay out export subsidies through the Export Subsidy Fund, which said last month it will disburse 40% of the total overdues before mid-2020. Settlements of the overdue payments have reportedly been moving forward since last September, in tandem with the launch of the new framework.

Ministry sets up green bonds committee: Kouchouk said that the ministry has formed a committee to plan for the issuance of green bonds, according to Al Mal. Maait told us last week that green bonds will likely take the lead in the government’s debt sales for the remainder of the fiscal year.

Also from the presser: The ministry will decide by the end of February how it will amend taxation on EGX trades, Reuters quoted Maait as saying. We have background on this here and here.

INVESTMENT WATCH- Actis inks MoU with sovereign fund to drive investment to Egypt: UK-based private equity giant Actis yesterday signed an agreement with the Egyptian government that will see it invest alongside The Sovereign Fund of Egypt (TSFE) in “energy and infrastructure and directly support [the fund’s] objective to attract private investment in critical sectors for Egypt’s economy,” it said in a statement. The agreement was inked on the sidelines of the UK-Africa Investment Summit in London.

Priority sectors will include infrastructure, renewable energy, health and education, said Planning Minister Halal El Said, who attended the signing along with UK Secretary of State for International Trade Liz Truss.

We’re unclear how much capital Actis is pledging to commit over the coming period, but at the summit El Said told reporters (watch, runtime: 2:35) that the agreement will see some GBP 3 bn worth of investment in infrastructure, health and education over the next three years. We’re reading that as the total investment the partnership will allocate, including capital committed by Actis and potentially others, and assets brought into the equation by TSFE. That’s the fund’s reason for being: Get private-sector investors to bring cash and know-how while it contributes state-owned assets. The sum total is the value of the investment.

Egypt is one of Actis’ most important markets, said Actis partner and head of MENA Sherif Elkholy. Both Youm7 and Reuters have coverage, which Reuters positions the agreement as Actis and TSFE “teaming up” to “help attract and steer private investment into Egypt and to cooperate in energy and infrastructure projects.”

Actis has made “strong” bid for power plants: TSFE CEO Ayman Soliman said yesterday that the fund has received a “strong proposal” from the firm for a stake in one of the three 4.8 GW Siemens-built combined-cycle power plants. “We consider Actis’ proposal to be a strong sign reflecting its underlying interest in expanding its investments in Egypt and we look forward to unlocking further appetite and value through such partnerships,” Soliman said. Actis is one of six investors in the running to obtain a stake, alongside France’s Engie, China Datang Overseas, Blackstone Group’s Zarou and Edra Holdings. Electricity Ministry sources had said previously that Blackstone’s Zarou had submitted the best financial offer, making it the top contender. Planning Minister Hala El Saed met its CEO earlier this month. The transaction is set to be completed this year.

Also at the summit: CIB took on a USD 100 mn loan from the CDC Group, the UK government-owned development finance institution said in a statement. The facility, which is subject to regulatory approval, is part of CDC’s bid to invest GBP 2 bn in African businesses by 2021, with USD 400 mn in financing agreements announced at the summit yesterday. CDC last year became the first company to be granted a license from the Central Bank of Egypt to act as a “tier two” lender. The company said then that it plans to offer as much as USD 200 mn to Egyptian banks.

Egypt, UK announce economic partnership to realise Egypt's 2030 vision: International Cooperation Minister Rania Al Mashat and UK Secretary for International Development Alok Sharma agreed to establish a “joint economic partnership” to help Egypt realise its Vision 2030 development strategy, a ministry statement said. The UK will provide GBP 13 mn in financial aid to support economic growth, social development, and youth empowerment, a GBP 3 mn financial inclusion grant, and a GBP 8 mn grant to invest in youth employment programs, in addition to technical assistance to support structural reforms and private sector development. Al Mashat also met CDC executives who said they plan on opening a branch in Cairo by the middle of this year.

Egypt wants to build “serious partnerships” between Africa and the UK, President Abdel Fattah El Sisi said during his speech at the summit. The summit was one of the last events El Sisi will attend in his capacity as African Union chair, with the presidency set to pass to South African President Cyril Ramaphosa next month. Al Masry Al Youm has more on the speech.

The summit also played host to diplomatic gatherings: Foreign Minister Sameh Shoukry held talks with his British counterpart Dominic Raab, while El Sisi met Mauritius President Pravind Jugnauth and his Congolese counterpart Félix Tshisekedi.

Egypt continues to lead Africa on FDI: Egypt remained the largest recipient of foreign direct investment in Africa last year, seeing inflows rise 5% y-o-y to USD 8.5 bn, according to the UN Conference on Trade and Development’s latest Global Investment Trends Monitor (pdf). The report said that the country’s efforts to implement economic reforms have resulted in increased investor confidence, but that FDI is still driven by the oil and gas sector, with the telecommunications, real estate and tourism sectors also seeing major investments.

Flows across the continent also picked up last year, with Africa seeing a 3% increase to reach an estimated USD 49 bn. The report noted that investment in Africa is still dogged by economic uncertainty and the slow pace of reforms seeking to address structural productivity impediments in many economies. North Africa didn’t perform so well, with FDI declining 11% to USD 14 bn due to a 45% fall in flows to Morocco, which attracted just USD 2 bn last year.

The report said that FDI flows are expected to rise slightly in 2020, despite last year’s concerns about a global slowdown, with investment, GDP growth, and trade all projected to rise. However, high debt levels among emerging and developing economies, geopolitical volatility, and shifts towards protectionist policies will continue to present significant risks.

LEGISLATION WATCH- The Finance Ministry’s new income tax law will be up for public consultations in 2-4 weeks, Minister Mohamed Maait announced during a press conference held yesterday. The law would raise the personal income tax exemption threshold to EGP 24k, close tax avoidance loopholes for foreign companies, and introduce new rules on the resolution of tax disputes. The bill would replace the 2005 Income Tax Act, which has effectively become a patchwork after multiple rounds of legislative amendments.

Don’t get this confused with the Income Tax Act amendments currently making their way through the House: The amendments would raise the income tax exemption threshold to EGP 14k and raise the upper limit of each tax band — at least until the new Income Tax Act becomes law. The amendments received committee approval last week.

VAT Act amendments will also be ready in 2-4 weeks: The ministry is still finalizing changes to the VAT Act, which Maait announced last year in tandem with announcing the new income tax law, the minister added. Aside from VAT-exemption for local paper companies, the ministry has been scant on details about the amendments, but reassured taxpayers at the time that there would be no changes to the headline VAT rate.

LEGISLATION WATCH- House committee wants to expand tax incentives under SMEs Act: The House SMEs Committee has sent a proposal to the Finance Ministry to exempt SMEs from all taxes for five years under the draft SMEs Act, committee deputy chair Hala Abou El Saad said. As it currently stands, the proposed legislation would exempt SMEs from the stamp tax as well as the fees to register contracts to set up companies and credit facilities for five years from the commercial registration date. Abou El Saad appears to be gunning for these exemptions to include all taxes. The ministry has not signaled whether this change is in the realm of possibility, only telling the committee that it needs time to look into the feasibility of the request.

Background: The act will include tax and non-tax incentives to support the sector and encourage small businesses to go legit. If passed, SMEs would be exempt from land registration fees for their projects, among other things. The overall tax incentives package could cost the government EGP 1.5-2 bn each year.

Where does the legislation currently stand? Last we heard, the committee said it would wrap up its discussion of the proposed legislation sometime in March.

REGULATION WATCH- FRA mulls new regs for asset, portfolio managers: The Financial Regulatory Authority (FRA) is studying new regulations for asset and portfolio managers in a bid to strengthen investor protection and improve market governance, Al Mal reports, citing anonymous sources.

Preventing investor interference: One of the proposals on the table is a new set of regulations to prevent investors from interfering in the investment decisions of fund managers. The proposal was reportedly met with disagreement from some members of the FRA’s advisory committee, who argued that investors should have the right to prevent a fund manager from selling or buying a security if they see fit.

Surprise inspections: Another idea being floated is the introduction of surprise inspections that could lead to disciplinary measures for those found in regulatory violation. This case-by-case approach would avoid the need to introduce new market-wide regulations that could over-burden all companies operating in the market.

Discussions will continue this week, and are expected to wrap up in “a short period of time,” the sources said.

Ebtikar wants to set up two consumer financing companies: B Investments’ Ebtikar has submitted documents to the General Authority for Investment to establish two consumer finance companies, according to the local press. No details were provided on the value of the companies. CEO Ayman El Desouki previously said that one of the companies would provide financing for cars and the other for consumer goods. Ibtikar launched its microfinance activity last January through its subsidiary Vitas Misr for Microfinance. We reported in December that Vitas is planning to extend EGP 300 mn in loans to SME clients this year. The company is also in talks with four local banks for a EGP 200 mn loan.

MLF — the NBFS firm set up by Samih Sawiris and others — begins operations: MLF, a EGP 1 bn non-banking financial services (NBFS) firm set up last year by Samih Sawiris and seven other business figures, recently began operating, CEO Ahmed Zahran told Al Mal. The company is licensed under a mechanism that has just been launched by the Financial Regulatory Authority (FRA). This new mechanism allows NBFS firms to provide leasing, mortgage financing, and factoring services under a single license. Alongside Sawiris, MLF’s founding shareholders reportedly include SIAC Construction CEO Nehad Ragab, Egyptian Businessmen’s Association Vice Chairman Fathallah Fawzy, Mabany Edris CEO Mohamed Edris, Kandil Glass head Khalil Kandil, and Dorra Real Estate Development Chairman Mohamed Hassan Dorra and Managing Director Omar Dorra.

DEBT WATCH– Talaat Moustafa to launch sukuk program in April: Talaat Moustafa Group (TMG) will kick off its three-year EGP 4.5-5 bn sukuk program in April, CEO Hisham Talaat Moustafa told Habi Journal, without disclosing the size of the initial issuance. Sources told the press in December that the company could move to issue EGP 2 bn in sukuk in January to finance the company’s real estate leasing projects. EFG Hermes will reportedly lead a EGP 1 bn sukuk issuance for the company after obtaining a license from the Financial Regulatory Authority (FRA). This would make it the second financial institution in Egypt to set up a specialized arm for issuing the sharia-compliant bonds.

Background: The FRA released sukuk regulations last April which oblige companies to obtain approval by a religious committee before offering sukuk on the market. Companies must issue a minimum EGP 50 mn in sukuk, while the maximum offering will be determined on a case-by-case basis based on the company’s credit rating and the purpose of the issuance.

DP World sees Egypt as growth market: DP World CEO Sultan Ahmed Bin Sulayem described himself as “bullish” on Africa and praised Egypt’s economic policies as being pro-growth during an interview with Bloomberg ahead of the World Economic Forum in Davos (watch, runtime: 4:48). “I’m very bullish on Africa. Look at Egypt, for example. With good policies, with sound policies. There is growth. That mirrors our expansion,” he said, referring to a number of projects being developed by the company in Egypt. The Dubai-based company has invested USD 520 mn into building a second dock at its Ain Sokhna port that will double its capacity after it completes construction in 2Q2020. The company is also planning to establish a logistics zone in Tenth of Ramadan City.

EGPC signs USD 450 mn in oil and gas E&P agreements: The state-owned Egyptian General Petroleum Corporation (EGPC) yesterday signed nine oil and gas exploration and production agreements that will see companies invest at least USD 452 mn to drill 38 wells in concessions in the Mediterranean and Western Desert, the cabinet said in a statement. The House of Representatives authorized the ministry last month to sign off on the agreements, which also include signature grants worth USD 84 mn.

Who’s working on the concessions? Shell has signed four agreements to drill 23 wells in the the Western Desert’s East Horus, Abu Sennan, Western Fayoum, Badr-2 and Badr-17 concessions. The Dutch oil giant will invest at least USD 117 mn and receive USD 61 mn in additional grants to develop the fields. EGPC signed two agreements with Apache, which will invest at least USD 26.3 mn to drill 10 wells in the Western Desert’s West Knaiss and West Kalabsha concessions, receiving USD 10 mn in grants. State-owned gas company EGAS signed two agreements with Shell and Malaysia’s Petronas that will see at least USD 309 mn invested into drilling five wells in the Al Fanar and North Sidi Gaber concessions, with USD 13 mn in grants.

Changes to gas price from Mediterranean El Burg concessions: The government also signed an agreement with Shell and BP to change the price of gas pumped from the El Burg and North El Burg concessions in the Mediterranean. The statement did not disclose further information.

Will these concessions be operated under the new production sharing terms? It remains unclear whether the agreements will be subject to the friendlier oil and gas sharing terms rolled out by the ministry earlier this year. The new terms, which will be applied in a tender the South Valley Egyptian Petroleum Holding Company (Ganope) launched for 10 oil and gas exploration blocks off the Red Sea coast back in March, give producers larger portions of output in a bid to cut the time it takes for them to hit profitability on any one concession, as well as raise the cost-recovery ceiling on contracts.

Looking ahead: EGPC plans to drill 40 new exploration and development wells with investments of EGP 2.6 bn, and bring its total production to about 106 bbl/d in FY2020-2021, according to figures in the Oil Ministry’s planning budget picked up the local press.

Egypt in the News

This morning in the foreign press: Egypt is apparently “unruffled” by Israel’s pipeline project that would allow it to ship gas directly to Europe without using Egypt as an intermediary, writes Hagar Hosny for Al Monitor. Greece, Cyprus, and Israel earlier this month signed an agreement to move ahead with the project, but this is unlikely to do much to dent Egypt’s ambitions to emerge as a regional energy hub. World Energy Council member Maher Aziz said that Egyptian gas is bound to reach European shores, whether through a new agreement to link Egypt to the Israeli pipeline or through existing plans to link Egypt to Cyprus.

Worth Listening

Sustainability over profitability, not your common business model: Hani Berzi, the CEO of Edita, wanted his business to be sustainable. He wasn’t convinced that the ‘family business’ model would allow his snack food company to survive from generation to generation. At the same time, Berzi was against the idea of someone else acquiring the business after a bad experience suffered by his father. With a blockbuster IPO on the EGX back in 2015, Edita ensured it’s sustainability and pushed its name even higher up the ranks in the food manufacturing industry. Today, the homegrown company is a fierce competitor against global multinationals such as Nestle and Cadbury. If you’re in university getting Molto in between classes, or a parent putting Bake Rolz in your kid’s lunch box, it’s worth listening to the story behind some of your favorite snacks.

You can listen to the episode (runtime: 36:11) on: Our website | Apple Podcast | Google Podcast

Energy

Egypt electricity exports fall 15% from July to November

Egypt’s electricity exports fell 15% to 47 mn KWh in November from a peak of 55 mn KWh in July, Al Mal quoted unnamed sources as saying. The sources said that the political situation in Libya, the seasonal fall in consumption, and efforts in Jordan to become energy self-sufficient had caused the decline. The news came on the same day that sources in the Electricity Ministry revealed that it is studying increasing its electrical connection capacity with Jordan above 400 MW. Egypt — which is currently linked with Jordan, Palestine, Libya, and most recently Sudan — is also finalizing an interconnection agreement with Saudi Arabia, which is due to be signed in May. A USD 4 bn EuroAfrica project to connect the electricity grids of Egypt, Cyprus, and Greece is also scheduled for completion by December 2022.

Automotive + Transportation

Infinity-E to install EGP 300 mn of electric car chargers by 2023

Infinity Solar subsidiary Infinity-E is planning to install EGP 300 mn of electric car charging docks over the next three years, CEO Shams El Din Abdel Ghaffar was quoted by Al Mal as saying. The company has already deployed 15 last year and plans to have installed 100 points by the end of 2020 through planned contracts with retail giant Majid Al Futtaim’s City Centre Alexandria and Mall of Egypt and with Hyde Park Developments’ compound in New Cairo. The company last year inked contracts with MAF’s City Centre Almaza, Palm Hills Developments, and New Giza.

Banking + Finance

Emirati company looking to establish microfinance unit in Egypt

A major Emirati company is considering launching a microfinancing arm in Egypt, Al Mal reports, citing three sources familiar with the matter. They said the company is currently assessing the Egyptian market and will submit a licensing request to the Financial Regulatory Authority this year, with one confirming that it also intends to establish a specialized arm in consumer finance after the microfinancing unit has launched.

On Your Way Out

Egypt’s first female lawyer, Mufidah Abdul Rahman, was celebrated on Google’s search page yesterday for what would have been her 106th birthday, according to the National. Mufidah Abdul Rahman was the first woman to enroll in Cairo University’s Faculty of Law, and the first mother to graduate from the institution. The graphic was designed by local designer Deena Mohamed.

The Market Yesterday

EGP / USD CBE market average: Buy 15.72 | Sell 15.85

EGP / USD at CIB: Buy 15.73 | Sell 15.83

EGP / USD at NBE: Buy 15.76 | Sell 15.86

EGX30 (Monday): 13,774 (-1.0%)

Turnover: EGP 511 mn (22% below the 90-day average)

EGX 30 year-to-date: -1.4%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 1.0%. CIB, the index’s heaviest constituent, ended down 1.0%. EGX30’s top performing constituents were Abu Dhabi Islamic Bank up 0.5%, Telecom Egypt up 0.1%, and Egypt Kuwait Holding up 0.1%. Yesterday’s worst performing stocks were Ezz Steel down 3.4%, Egyptian Resorts down 3.3% and Cleopatra Hospital down 3.2%. The market turnover was EGP 511 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -19.9 mn

Regional: Net short | EGP -36.7 mn

Domestic: Net long | EGP +56.6 mn

Retail: 56.1% of total trades | 52.9% of buyers | 59.3% of sellers

Institutions: 43.9% of total trades | 47.1% of buyers | 40.7% of sellers

WTI: USD 58.66 (+0.2%)

Brent: USD 65.25 (+0.6%)

Natural Gas (Nymex, futures prices) USD 1.94 MMBtu, (-3.2%, February 2020 contract)

Gold: USD 1,560.60 / troy ounce (+0.0%)

TASI: 8,469 (+0.2%) (YTD: +1.0%)

ADX: 5,213 (+0.8%) (YTD: +2.7%)

DFM: 2,850 (-0.4%) (YTD: +3.1%)

KSE Premier Market: 7,123 (-0.2%)

QE: 10,689 (-0.2%) (YTD: +2.5%)

MSM: 4,075 (+0.1%) (YTD: +2.4%)

BB: 1,642 (+0.1%) (YTD: +2.0%)

Calendar

January: 1,000 artifacts to be displayed when Hurghada Museum opens.

21-24 January (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

22-23 January (Wednesday-Thursday): Renaissance Capital’s North Africa Investors Conference, Marrakech, Morocco.

23 January 23-February 4: Cairo International Book Fair 2020, New Cairo International Exhibition and Convention Center, Egypt

25 January (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

27 January (Monday): Cairo Economic Court will look into minority shareholder’s lawsuit against Fincorp Investment Holding as Adeptio AD Investments’ financial advisor for its mandatory tender offer (MTO) for Americana Egypt.

27-29 January (Monday-Wednesday): African Private Equity and Venture Capital Association’s North African Fund Manager Masterclass, Sheraton Cairo Hotel, Galaa Square, Cairo.

28 January (Tuesday): AmCham to host US Ambassador Jonathan Cohen for monthly luncheon.

28-30 January (Tuesday-Thursday): CI Capital’s annual MENA Investors Conference, Four Seasons Nile Plaza, Cairo.

28-29 January (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

28-29 January (Tuesday-Wednesday): Egypt and Ethiopia to meet again in Washington, DC, for mediation on GERD.

February: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February: A delegation of Swiss businesses will visit Egypt to discuss investment.

February: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

3-5 February: The Arab-African International Forum, Jeddah, Saudi Arabia.

4 February (Tuesday): Court hearing for PTT Energy Resources’ USD 1 bn lawsuit against Egyptian government.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

9-10 February (Sunday-Monday): The the 33rd ordinary African Union (AU) Summit where Egypt will hand over the African Union presidency to South Africa

11-13 February (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

23 February (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot. It was previously postponed to 24 November 2019 and then to 5 January 2020, and now 23 February.

23 February (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous

27 February (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March (Wednesday-Thursday): Women Economic Forum, Cairo.

7 March (Saturday): International Conference for Investment organized by Suez Canal Economic Authority, Al Galala City, Egypt

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

9 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April (Sunday): Easter Sunday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

21 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

2 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.