- Annual inflation rises to 14.1% in May. (Speed Round)

- Non-oil business activity re-entered contraction territory in May. (Speed Round)

- The question on everyone’s lips: Where is the EGP heading? (Speed Round)

- Hassan Allam acquires controlling stake in German water treatment company Bioworks. (Speed Round)

- Standard Chartered has some nice things to say about us. (Speed Round)

- Investor demand is high for the government’s upcoming secondary offerings -Tawfik. (Speed Round)

- House of Representatives expected to sign-off on Mineral Resources Act amendments before the summer recess. (Speed Round)

- Ahmed Khaled Tawfik gets the Google Doodle treatment. (On Your Way Out)

- The Market Yesterday

Tuesday, 11 June 2019

Business activity contracts in May as inflation rises unexpectedly

TL;DR

What We’re Tracking Today

We hate to open on a down note, but yesterday wasn’t a great day for macro indicators: Both the purchasing managers’ index and inflation data for May rolled back progress seen in April, with non-oil business activity slipping back into contraction territory and inflation spiking to 14.1% from 13% the month before. Analysts say that the increase was more than expected, and is already driving speculation that any potential interest rate cut will be pushed back, particularly as we await the inflationary effects of the fuel subsidy cuts due to take place next month. We have chapter and verse in this morning’s Speed Round below.

Meanwhile, the budget debate continues in the House of Representatives today as MPs work toward bringing in a finished document in time for the start of the new fiscal year on 1 July. And if they miss the mark? There’s no US-style government shutdown here, folks — the current budget rolls forward and becomes the 2019-2020 budget until the new document is approved by the House and signed-off by President Abdel Fattah El Sisi.

On with the day’s proceedings: Energy will be the subject of a number of meetings and conferences today, including the Observatoire Méditerranéen de l'Energie (OME) in Paris, at which Oil Minister Tarek El Molla will deliver a keynote address, according to a ministry statement picked up by Ahram Gate. Then there’s Offshore Congress MENA, taking place at the InterContinental Semiramis today and tomorrow.

Also this week is the African Anti-Corruption Forum (AACF), which will be held in Sharm El Sheikh on Wednesday and Thursday.

Lots more is happening before summer break: Among the events you may want to mark on your calendars:

- Our friends at Pharos are holding their annual investor conference (pdf) in Hurghada this month from 19-20 June;

- President Abdel Fattah El Sisi is expected to attend US-Africa Business summit in Mozambique, which runs from 18-21 June;

- Middle East & Africa Rail Show will take place at the Egypt International Exhibition Center, Nasr City on 16-18 June;

- Seamless North Africa will be held at the Nile Ritz-Carlton on 17-18 June;

- Cairo Technology Week is running next week at the Hilton Heliopolis on 17-19 June.

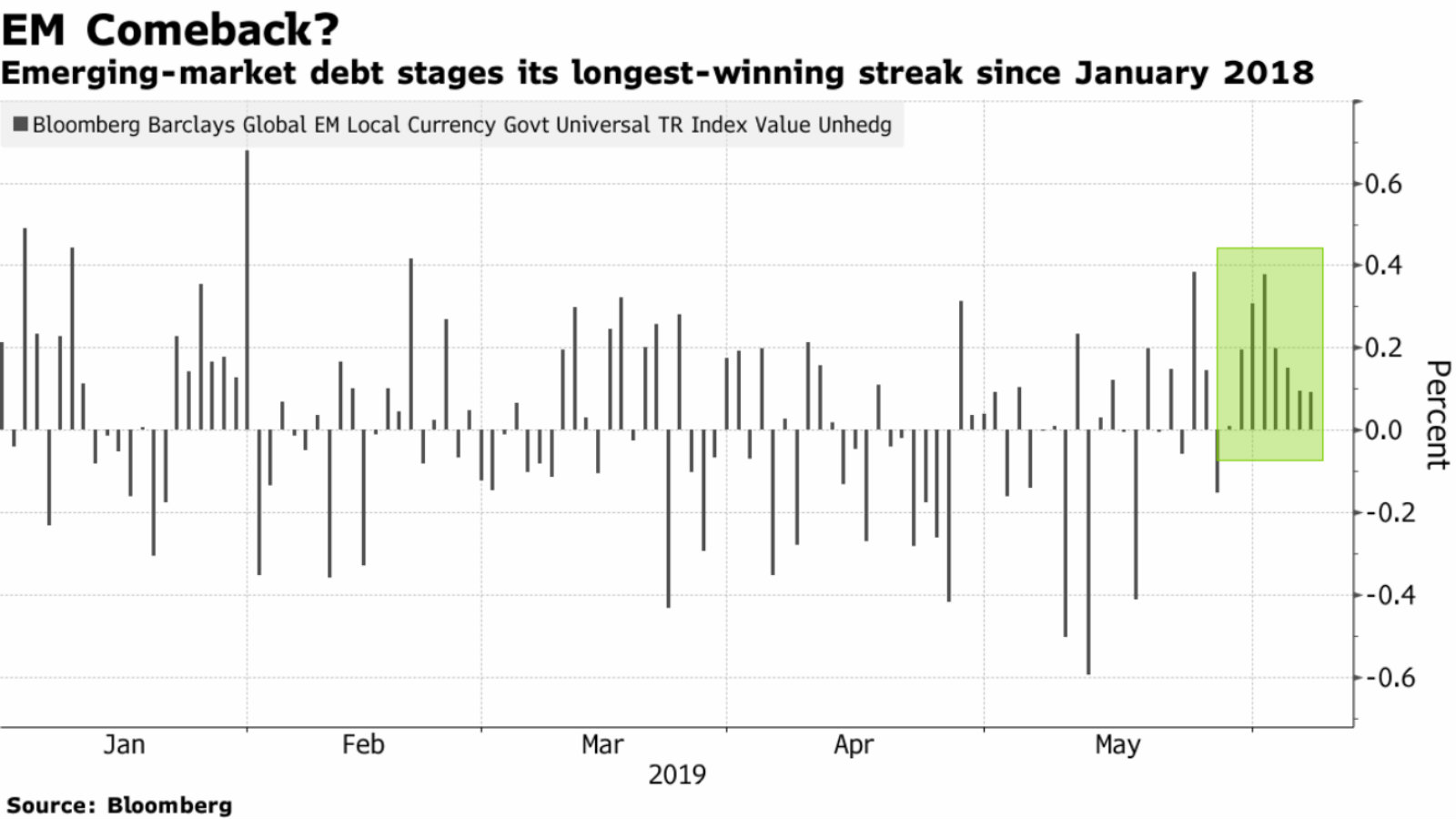

Emerging markets appear to be getting a reprieve from the recent trade-induced downslide: EM equities have posted their second consecutive week of gains, while EM debt has entered its longest winning streak since January 2018, according to Bloomberg.

Middle East shares are also looking up: Most exchanges in the region have rebounded since the Eid break. Both the EGX and the Tadawul closed yesterday up 1.7%.

This is good news, right? Although a reduction in equity-market volatility is obviously welcome, this is being driven by hopes that the US Federal Reserve will soon move to cut rates. To be clear, the Fed will only return to easing unless it believes that an economic downturn is a serious possibility. The Fed committee that sets interest rates next meets 18-19 June.

We’re not the only ones who like to grumble. A number of private-sector companies in Saudi Arabia are griping at the negative impact of de facto Saudi ruler Mohamed Bin Salman’s reforms, according to the FT. “There are about 7,000 industrial firms in Saudi Arabia and many of them are losing money or barely making money,” says a foreign executive. The real estate sector appears to be also feeling the heat from “Saudification” — the process of weeding out foreign workers from sectors. That, coupled events including the murder of the columnist Kamal Khashoggi and the extended stay packages offered to select wealthy guests at the Ritz Carlton, has left the private sector and foreign investors waiting in the sidelines of an ambitious reform program that depends on them, the salmon-colored paper says.

“Where’s my money?” said everybody to Abraaj: The now-defunct private equity firm still hasn’t paid many of its foreign workers their end-of-service benefits, sources tell the WSJ. The company has reportedly only paid out a quarter of what it owes to its foreign workers, while some employees who worked for more than 10 years at the firm are yet to receive any payment.

A “miniature time bomb” in Gulf human resources regulations? Abraaj’s situation points to a wider regulatory problem in the Gulf, where companies are not required to set aside cash to cover end-of-service benefits. A 2018 report by Willis Towers Watson estimated that almost 90% of companies in the Gulf have no plans in place to fund the payments, leading one analyst to describe the situation as a “miniature time bomb,” the FT reports.

UAE is the first country to approve Uber-Careem merger: March’s mega-merger of the MENA ride-hailing superpowers finally got the green light from UAE regulators yesterday, MENABytes reports. So far as we know, the Egyptian Competition Authority still objects to the tie-up.

International headlines worth a moment of your time this morning:

- One step closer to impeachment? Special counsel Robert Mueller has agreed to pass key evidence to Congress that could reveal whether President Donald Trump attempted to obstruct justice during the Russia investigation. (New York Times)

- This trade war just got personal: Trump has threatened to immediately impose new tariffs on Chinese imports if President Xi Jinping doesn’t personally meet him at the upcoming G20 conference in Japan. (Bloomberg)

WEATHER PSA: Our favorite weather app tells us that it will be overcast in the capital today, with daytime highs reaching 38ºC and lows of 23ºC. Expect more sun tomorrow, with temperatures dipping slightly to 22-35ºC.

Enterprise+: Last Night’s Talk Shows

The news that the EGP is currently the world’s second-best performing currency against the greenback this year got some airtime on Al Hayah Al Youm (watch, runtime: 1:21). The EGP has gained some 7% against the USD so far in 2019. We have a deeper look at the story in this morning’s Speed Round, below.

Lobna Assal also noted on Al Hayah Al Youm thatFitch Group’s Fitch Learning has announced it’s launching a first-of-its-kind international academy in Egypt to train credit and risk financial professionals.

AFCON preparations: Masaa DMC’s Eman El Hosary highlighted President Abdel Fattah El Sisi’s meeting with senior government officials to discuss preparations for the African Cup of Nations which will kick off on 21 June. El Sisi directed his administration to make available all necessary resources to ensure the tournament is a success (watch, runtime: 1:11).

We’ve sorely missed El Hekaya’s Amr Adib since the Ramadan talk show hiatus began five weeks ago: El Adib showed some love to Arab tourists, lauding a recent statistic from the interweb that suggests Egypt was the most popular Eid destination for Emiratis (watch, runtime: 1:39).

Speed Round

Speed Round is presented in association with

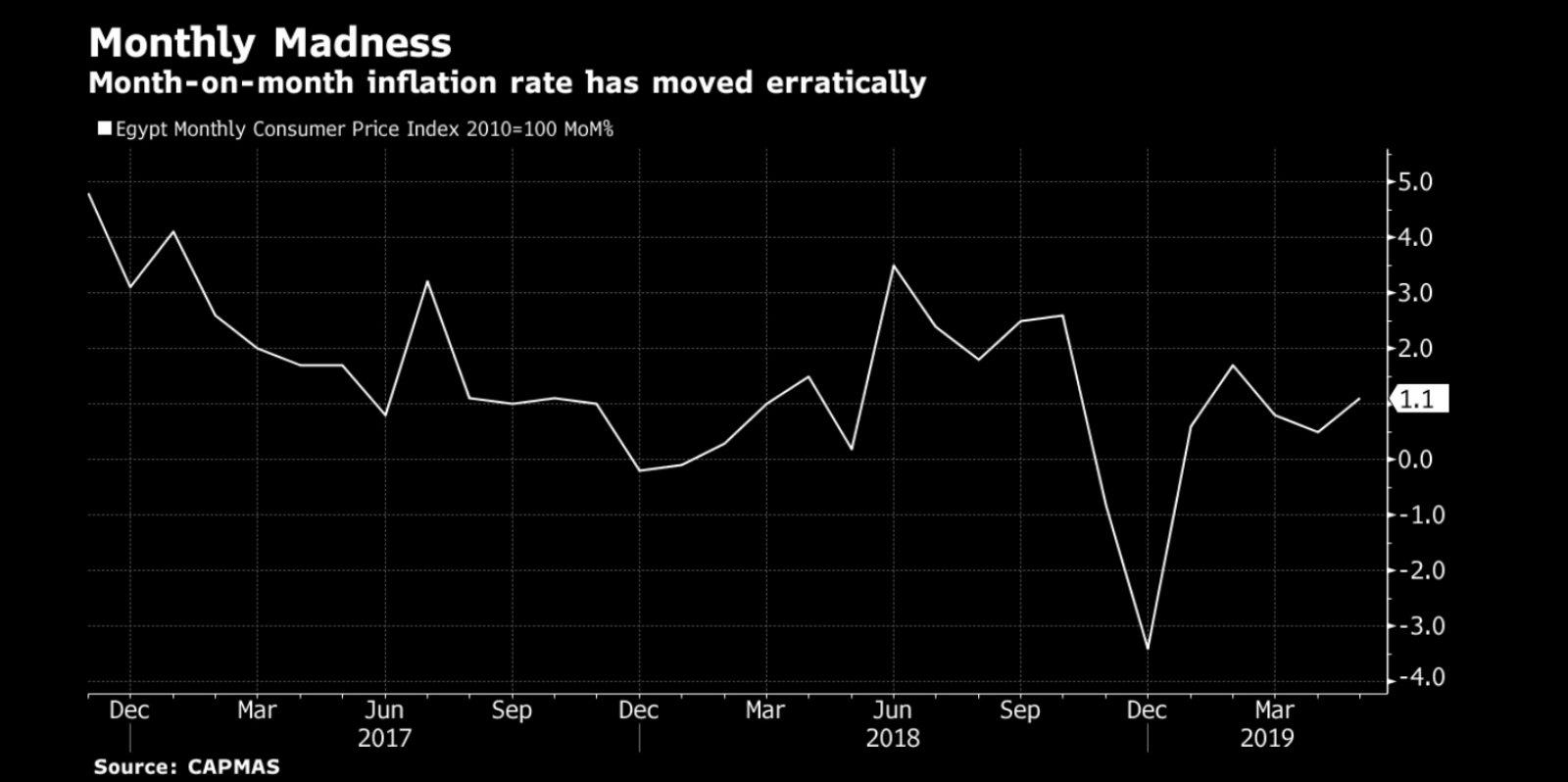

Inflation accelerates in May: Egypt’s annual headline inflation rose to 14.1% in May from 13% in April, the CBE said in a statement on Monday (pdf). A 15.1% increase in food and nonalcoholic beverages prices, up from a 13% increase the previous month, contributed to the jump, CAPMAS said. Month-on-month inflation was at 1.1% in May, up from 0.5% the previous month, the statistics agency said, while annual core inflation came at 7.8%, down from 8.1 percent in April. The story was also picked up in the foreign press: Reuters | Bloomberg.

The latest figures came as a surprise to analysts: “Inflation in May came slightly above our expectations of 12.8% y-o-y and 0.5% m-o-m, which was based on the surprisingly low April inflation,” Pharos said in a research note.

Don’t expect a rate cut anytime soon: The higher-than-expected inflation means that the CBE will likely delay cutting key interest rates, Capital Economics said in a note. “Policy makers will also want to await more details on upcoming subsidy cuts and assess the impact that they will have on inflation,” Jason Tuvey, senior EM economist, said. The CBE kept its overnight deposit and lending rates on hold last month and is expected hold back from any easing until 4Q2019 at the earliest.

Expect inflation to continue on its upward trajectory this month as the government slashes subsidies. “Going forward, we expect annual inflation to hover around 14% during the summer as the period between June – August 2019 will witness anticipated fiscal consolidation measures as well as a historically high inflation season,” Pharos said.

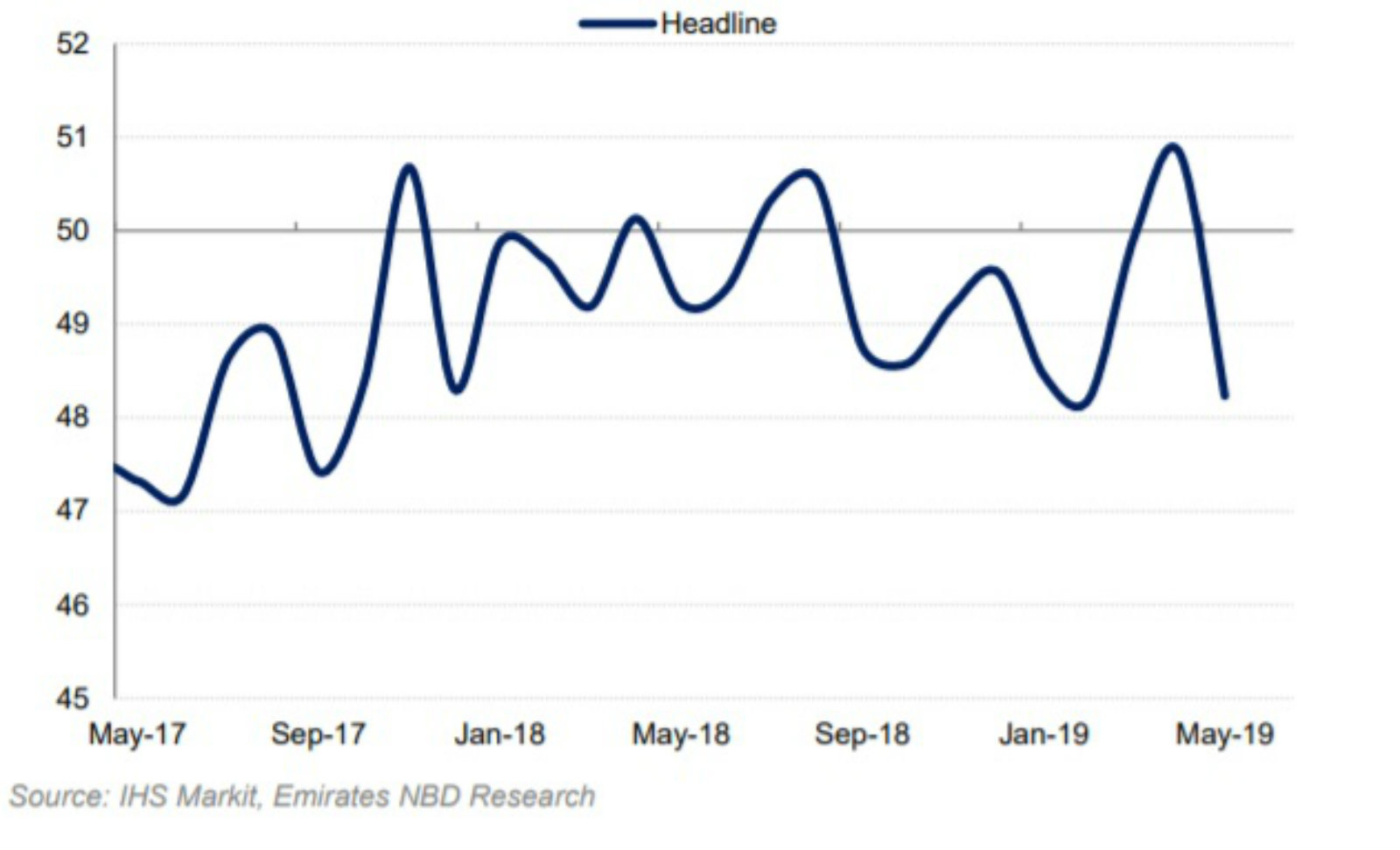

Non-oil business activity fell back into contraction territory in May: Non-oil business activity contracted in May after having expanded the previous month for the first time since August 2018. The latest purchasing managers’ index fell to 48.2, down from 50.8 in April, signalling "a moderate deterioration in the health of the sector after a slight improvement in the previous month," according to the Markit / Emirates NBD PMI gauge (pdf). A reading above 50.0 shows that business activity is expanding, while a figure below this indicates contraction.

Is lagging tourism the culprit? A decline in output and new export orders drove the index down in May. “New export orders contracted at a quicker pace, with respondents citing a deterioration in tourism activity,” the report noted.

Expect the contraction to continue: "While easing price growth in recent months – CPI inflation fell to 13.0% y-o-y in April – has offered some respite, upcoming subsidy reforms and a renewed pause in the CBE's cutting cycle mean that conditions remain difficult for private firms," said Daniel Richards, MENA economist at Emirates NBD. “The private sector has continued to bear the brunt of ongoing reform economic efforts in Egypt, and will likely remain over pressure over the summer period,” he added. Firms are expected to continue with discounts to shore up demand, they added.

There is cause for optimism though: “Although private Egyptian companies will remain under pressure over the summer months, we maintain our outlook that conditions will improve. Stronger GDP growth should bolster demand, and some of the more difficult economic reforms are behind them,” the report noted. Survey respondents share our view, with 38% anticipating an increase in activity over the year.”

ANALYSIS- The question on everyone’s lips as we ponder the kickoff of budget season at most companies after the summer break: Where is the EGP heading? The EGP has been on a good run this year, appreciating by about 7% YTD against the USD to 16.7917. But this isn’t set to last: analysts polled by Enterprise predict that a period of depreciation will set in later this year, although few are speculating on a specific FX rate at the moment.

It’s a matter of seasonality, says Mohamed Abu Basha, head of macroeconomic analysis at EFG Hermes. “We might see some additional appreciation in the coming months due to seasonal conditions of low demand during the summer. But seasonality won’t be as supportive to the EGP in 4Q when demand for FX typically picks up ahead of the new year and when foreign investors look to repatriate profits,” he noted. He said the appreciation in the past couple of months was backed by low demand for FX rather than foreign inflows into debt.

Have we hit peak EGP? HC’s Sara Saada thinks the EGP's rise has peaked at both the carry trade and remittance levels. The EGP should stabilize for a while before it begins to gradually depreciate by the end of the year — “especially if there is an easing in interest rates that would spark profit-taking by investors.”

How far could the pound fall later this year? Barring a dramatic pick-up in external headwinds, FX volatility should remain low and any EGP depreciation will occur at a gradual rate. Pharos’ Head of Research Radwa Elswaify told us that we can expect the EGP/USD rate to hover between 16.50 and 17.50 through the end of 2019 depending on inflows and appetite for Egyptian debt.

Could we go back down to EGP 18 per USD? Capital Economics has predicted that the EGP will fall by around 7% to EGP 18 by the end of 2019. Higher-than-expected inflation in some of Egypt’s key trading partners will increase the likelihood of a devaluation to maintain the currency’s competitiveness.

This was not so far off from what analysts were saying a few months ago: EFG Hermes said in March that the EGP would hover between 17.45 and 18.00 to the greenback throughout the year, taking into consideration that the attractiveness of the EGP carry trade will diminish if the currency appreciates by more than 4-5%. The firm had predicted that the currency would stabilize at 17.10 in the short term with increased volatility in 2H19 when investors are more likely to repatriate profits. Shuaa Securities Egypt, meanwhile, said last month that the currency could slide back to the high EGP 17 range after the government makes further cuts to fuel and electricity subsidies next month.

Why has the EGP been appreciating? Some analysts have cited increased inflows from portfolio investors as the main reason for the appreciation in addition to a reduced imports bill and increased tourism receipts. Shuaa points to many of the same factors. Unnamed bankers speaking to Reuters earlier this year speculated about whether the CBE was manipulating the currency.

M&A WATCH- Hassan Allam buys majority stake in German water treatment company: Hassan Allam Holding B.V. has acquired a controlling stake in German water treatment firm Bioworks AG, the company announced in a statement (pdf). This is Hassan Allam’s first European acquisition as it pushes ahead with an expansion into the waste and water treatment sector. The founders of Bioworks will continue to manage the company’s operations following the acquisition. “We are very excited to welcome the advanced technology and global expertise of Bioworks to our group of companies,” CEO Hassan Allam said. “Water poverty is a global concern, and with investments like these, Hassam Allam advances its efforts to be part of the solution.”

Bioworks AG describes itself as a global player in the design and construction of extended aeration process water treatment systems. The company has completed 120 projects in 25 countries around the world and has a strong footprint in the MENA region, as well in Europe and the US.

Standard Chartered gives thumbs up to Egypt’s economic reform program: Egypt will be the only oil-importing Middle East, North Africa, and Pakistan (MENAP) economy to see accelerating economic growth in the coming years, Standard Chartered has said in a report. The British bank predicts anaemic growth in other MENAP oil-importers, despite low crude prices. But it’s not just oil-dependent states suffering in the current environment: global headwinds will drive down the region’s average growth rate to 2.5% in 2019 from 3.6% last year, the report says.

What are we getting right? Growth is expected to speed up on the back of the “improved external position and [renewed] investor confidence as the country prepares for the conclusion of its IMF programme by the end of 2019,” Standard Chartered says. The reports expects the economy to grow at a 5.8% clip in FY2019-2020 and a 6% clip in FY2020-2021, up from 5.5% during the current fiscal year. This will be further supported by rising natural gas output and the resumption of exports. Other key forecasts made in the report include:

- Inflation will cool down to 11.1% by the end of FY2019-2020 after hovering at an average of 14.8% during the current fiscal year;

- The budget deficit will narrow to 9.2% of GDP by the end of the ongoing fiscal year, quite a way short of the government’s 8.4% target. Energy subsidy cuts remain key to achieving fiscal targets.

- The IMF will likely remain engaged with Egypt via “post-program monitoring.”

Demand is high for further secondary offerings -Tawfik: There is high demand for the next two secondary offerings scheduled take place in the first wave of the state privatization program, Public Enterprise Minister Hisham Tawfik told Al Mal during a forum at the Egyptian Center For Economic Studies, without naming the companies. Low demand from local investors has in the past forced the government to postpone offerings. But during the last month there has been a “marked improvement in [local] market conditions,” he said.

To which companies was Tawfik referring? We’ll go out on a limb here and hazard a guess that Abu Qir Fertilizers and Alexandria Containers and Cargo Handling Company (ACCH) are next in line for privatization. Unnamed sources told Al Mal last week that Abu Qir could proceed with a 20% stake sale on the EGX shortly after the Eid break, and that preparations for ACCH’s secondary offering were also underway.

When can we expect the sales? Government officials have been reluctant to commit to timeframes, repeating instead that sales are contingent on market conditions. It’s possible that we may not have much in the way of official for the next offering: Eastern Company’s sale in March, it must be remembered, came entirely out of the blue.

The second wave of the program will proceed in September as planned, Tawfik told us earlier this week. The second phase will be made up exclusively of IPOs, as opposed to the first wave which is only comprised of secondary offerings.

LEGISLATION WATCH- Legislative amendments that would allow foreign asset holders to apply for Egyptian citizenship have received committee-level approval at the House of Representatives, according to Egypt Today. Prospective applicants would have to have bought a state-owned or private property, set up a project in accordance with the Investment Act, or deposited hard currency. Applications would cost around USD 10,000 or the equivalent in EGP. An authority comprised of foreign, investment, and interior ministry officials would be set up to consider applications. The amendments will now be up for a final general assembly vote. If passed, they need signoff from President Abdel Fattah El Sisi and then would become real only when the executive regulations governing them are published.

Also on the legislative agenda: A proposal to set up a new pharma regulator was discussed in the House yesterday at committee level, according to local press reports. It is unclear whether the new watchdog would replace the existing regulator — which operates under the auspices of the Health Ministry — or establish an entity separate from the ministry altogether.

Expect more activity from the legislature in the coming days as MPs prepare for the summer recess.

LEGISLATION WATCH- Mineral Resources Act amendments expected to receive House sign-off before the summer recess: The House of Representatives is expected to give its final approval on the amendments to the Mineral Resources Act before it goes on recess in July, an Oil Ministry source told Al Shorouk on Monday. The amendments received committee-level approval last week.

Expect tenders to be issued soon after the law is passed. The source revealed that the ministry is planning to issue new mining tenders some time this year once the law is approved.

What exactly are the changes that are coming: We previously noted that the amendments would set up a new authority in charge of licensing mines and quarries, taking the power to issue and control licenses away from governorates. They would also lift a previous 16k sqm area limit, allowing the authority to issue licenses to areas of unlimited size. Licenses could also be renewed for more than one term.

The ministry source spilled the beans on other amendments:

- There will be separate contracts and agreements for exploration and extraction.

- Companies will have to pay a minimum royalty of 5% of annual production, with a 20% cap being set.

- Mining firms will have to pay 6% of a mine’s annual production to the home governorate.

- Governorates can recommend amending this “rent” but a final say can only come from the prime minister. Under current legislation, governorates had the power to dictate the payout every four years.

The timing of the news comes as Aton Resources announced progress on its recently announced capital raising: Toronto-listed, Egypt-focused mining firm Aton Resources said it has closed on the first tranche of its USD 1.5 mn private placement, issuing a total of 36,000,000 common shares at USD 0.025 per share for proceeds of USD 900,000, the company said in a statement (pdf). “The funds being raised now will allow us to continue exploration at our Abu Marawat concession area, but at the same to await the investor friendly reforms coming in Egypt to the mining terms and conditions, which investors are waiting to see and we believe will be enacted before the year-end,” President and CEO Mark Campbell said. Campbell praised last year the long-awaited amendments to the Mineral Resources Act, suggesting that the scrapping of production sharing agreements among other changes would have a positive impact on investment in the sector.

Vodafone Egypt fined for poor service: The National Telecom Regulatory Authority (NTRA) has fined Vodafone Egypt EGP 10 mn after its mobile network allegedly faltered for several hours last Tuesday, according to an NTRA statement picked up by Reuters Arabic. In a clear message to operators, the NTRA notes that this is the first time a mobile network operator has received a fine for a service interruption.

It issued a warning to other companies that it would not hesitate to impose fines in the future to ensure the quality of service.

MOVES- Nissan has appointed Mike Whitfield (LinkedIn) as head of Nissan Motor Egypt, effective 20 June, Car Mag reports. Whitfield joined Nissan in 1981, and since 2008 has been managing director of Nissan South Africa where the company posted a “record market share” in the past financial year.

CORRECTION- We reported yesterday that GTH anchor shareholder Veon was nearing an EGP 2.2 bn agreement to settle a tax dispute between GTH and the Finance Ministry. In doing so, we misidentified the firm serving as lead counsel for Veon in relation to Egyptian legal matters. It is Shalakany Law Office. We have corrected the story on our website

** WE’RE HIRING: We’re looking for smart, talented journalists and analysts to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested people with writing plus either audio or video skills.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

EM ETFs attract USD 84 bn in inflows in 16 months — but not all markets are equal: ETFs that specialize in emerging markets drew some USD 84 bn in the 16 months leading up to mid-April. But statistics from financial data provider EPFR show that 80% of inflows went to the stocks of companies in only five countries: China, South Korea, India, Brazil and Taiwan. This trend shows that EM investors are consciously “picking sides,” rather than adopting a broadly diversified approach to fund acquisition, The Wall Street Journal says.

China and India are attracting the lion’s share of passive inflows: Both India and China’s shares of ETF money exceed their current weightings in the MSCI Emerging Markets Index, with India accounting for 11% of ETF inflows (despite having an MSCI index weighting of 9.5%) and China hoovering up a whopping 41% of inflows (despite a weighting of 31%). Investment in these high-growth economies makes sense, say analysts, but a few factors have enhanced China’s appeal. 2018’s relatively slow GDP growth and the prospect of a trade war with the US led to stocks on the Shanghai Composite Index falling 30%. This was then followed in early 2019 by initial optimism around US-China trade talks, government stimulus and the prospect of an economic overhaul to kickstart the Chinese economy, all of which served as a “magnet” to investors.

Several strong markets have been overlooked: The WSJ piece lists several EMs that have been given a wide berth by investors despite being strong economies. Vietnam, for instance, attracted only 0.6% of ETF money in the 16-month period despite its high-growth economy.

This is the EM beyond BRICs effect we were talking about yesterday. As we noted in yesterday’s Macro Picture, the competition for inflows between non-BRICs emerging markets and frontier markets are intensifying, particularly during periods of EM instability. This results in some of the stronger emerging markets struggling to attract foreign capital.

Egypt in the News

The sole story featured in the foreign press yesterday is gaining traction this morning: The Guardian and The Independent have picked up on Egypt’s efforts to prevent the auction of a 3,000 year-old quartzite bust of Tutankhamun, which experts believe was stolen from Karnak Temple.

Other headlines worth a moment of your time:

- Formerly Egypt’s comedy superstar, Bassem Youssef discusses the limitations of satire and his new life in the US, in an interview with the Financial Times.

- As the foreign press continues to draw parallels between Egypt in 2011 and Sudan and Algeria today, Killian Clarke in Foreign Affairs urges Sudanese and Algerian protesters to learn lessons from Egypt “to help keep their own transitions on track”.

- The newly-released short story collection The Book Of Cairo captures the mixture of humor, disconnection, and “hidden lives” that coexist in our city, The National reports.

On The Front Pages

Egypt’s AFCON preparations top front pages: President Abdel Fattah El Sisi’s meeting with Prime Minister Moustafa Madbouly and other senior officials to discuss preparations for the upcoming African Cup of Nations topped the front pages of all three government dailies this morning (Al Ahram | Al Akhbar | Al Gomhuria).

Energy

Siemens signs EETC to supply Egypt’s first digital power transformer

Siemens has signed an agreement with the Egyptian Electricity Transmission Company (EETC) to supply Egypt with its first digital power transformer — the Siemens Sensformer — Zawya reports. Siemens will supply 14 Sensformers by May 2020, a process that will involve engineering and design, building and setting up the power transformers, and site management and maintenance.

Banking + Finance

Raya Holding subsidiary to increase credit portfolio to c.EGP 500 mn

Raya Holding’s microfinance arm Aman intends to increase its credit portfolio to about EGP 500 mn by the end of 2019, the company said in an EGX disclosure (pdf). The company aims to use the credit increase to finance SMEs, it added, without providing further details.

On Your Way Out

Prolific Egyptian science fiction writer Ahmed Khaled Tawfik was celebrated with a Google Doodle yesterday, on what would have been his 57th birthday. Tawfik wrote over 500 books before his death in 2018, including the bestselling horror series Ma Waraa Al Tabiaa, which Netflix is adapting as its third Arabic original series. Google’s tribute to Tawfik was picked up widely in both the local and foreign press.

The Market Yesterday

EGP / USD CBE market average: Buy 16.69 | Sell 16.79

EGP / USD at CIB: Buy 16.67 | Sell 16.77

EGP / USD at NBE: Buy 16.71 | Sell 16.81

EGX30 (Monday): 14,149 (+1.7%)

Turnover: EGP 932 mn (21% above the 90-day average)

EGX 30 year-to-date: +8.5%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 1.7%. CIB, the index heaviest constituent ended up 1.1%. EGX30’s top performing constituents were Oriental Weavers up 6.6%, Madinet Nasr Housing up 5.2%, and Arabia Investments Holding up 4.0%. Yesterday’s worst performing stocks were Juhayna down 1.5% and Sarwa Capital Holding down 1.1%. The market turnover was EGP 932 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -34.3 mn

Regional: Net Long | EGP +8.7 mn

Domestic: Net Long | EGP +25.6 mn

Retail: 48.9% of total trades | 48.3% of buyers | 49.4% of sellers

Institutions: 51.1% of total trades | 51.7% of buyers | 50.6% of sellers

WTI: USD 53.33 (+0.13%)

Brent: USD 62.29 (-1.58%)

Natural Gas (Nymex, futures prices) USD 2.36 MMBtu, (+0.25%, Jul 2019 contract)

Gold: USD 1,332.90 / troy ounce (+0.27%)

TASI: 8,849.21 (+1.72%) (YTD: +13.06%)

ADX: 4,997.83 (+0.84%) (YTD: +1.68%)

DFM: 2,674.77 (+0.90%) (YTD: +5.73%)

KSE Premier Market: 6,438.89 (+1.05%)

QE: 10,503.55 (+2.02%) (YTD: +1.99%)

MSM: 3,973.03 (+0.46%) (YTD: -8.11%)

BB: 1,451.41 (+0.37%) (YTD: +8.54%)

Calendar

1H2019 (date TBD): Investment Minister Sahar Nasr will head a delegation of businessmen into Mexico City to explore cooperation avenues with the Latin American country.

June: International Forum for small and medium enterprises (SMEs).

June: Egypt will host the first economic forum for Union for the Mediterranean (UfM) countries to promote trade and investment in the 43 member states.

June: The Egyptian Businessmen’s Association will host a delegation of 20 Saudi real estate companies to explore investment prospects.

11-12 June (Tuesday-Wednesday): Offshore Congress MENA, InterContinental Semiramis, Cairo.

12-13 June (Wednesday-Thursday): The African Anti-Corruption Forum (AACF), Sharm El Sheikh

15 June (Saturday): An administrative court will look into an appeal by steel manufacturers to cancel the recently-imposed duties on imported steel rebars and pellets.

Mid-June: A delegation of Egyptian businessmen will head to Estonia and Latvia to explore investment prospects in the two eastern European nations.

16 June (Sunday): Builders of Egypt Conference, Al Masah Hotel, Cairo.

16-18 June (Sunday-Tuesday): Middle East & Africa Rail Show, Egypt International Exhibition Center, Nasr City, Cairo.

17-18 June (Monday-Tuesday): Seamless North Africa, Nile Ritz-Carlton, Cairo.

17-19 June (Monday-Wednesday): Cairo Technology Week, Hilton Heliopolis, Cairo.

18-21 June (Tuesday-Friday): President Abdel Fattah El Sisi to attend US-Africa Business summit in Mozambique.

18 June (Tuesday): IDC CIO Summit, Marriott Hotel Zamalek, Cairo.

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

19-20 June (Wednesday-Thursday): Pharos Holding Annual Investor Conference, El Gouna, Egypt.

23 June (Sunday): Cairo Arbitration Court hearing for Amer Group vs. Antaradous for Touristic Development.

25-26 June (Tuesday-Wednesday): US-backed conference on the ‘economic dimension’ of Trump’s Mideast peace plan, Manama, Bahrain.

25-26 June (Tuesday-Wednesday): OPEC conference, OPEC and non-OPEC ministerial meeting, Vienna, Austria.

28-29 June (Friday-Saturday): G20 Global Economic Summit, Osaka, Japan.

30 June (Sunday): June 2013 protests anniversary, national holiday.

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, GrEEk Campus, Cairo.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.