- EFG Hermes’ Awad on the AIB acquisition, taking his franchise outside Egypt, and what will bring foreign investors back to the market — part 1 of 2. (Spotlight)

- Biden + El Sisi talk a second time on Palestine, Libya, and GERD. (Diplomacy)

- Egypt is among the most vulnerable EMs to higher refinancing costs on sovereign debt –S&P. (Economy)

- Agri-fintech startup Mozare3 lands seven-figure pre-seed round from Algebra, Distruptech. (Startup Watch)

- IMF to release report on Egypt’s economic performance today (Last Night’s Talk Shows)

- Dongfeng plans to invest USD 12 mn in EV assembly with El Nasr. (Also on our Radar)

- WHO boss wants one third of all countries’ populations to be vaccinated by year-end. (Covid Watch)

- Just how bad is construction material pollution in Egypt? (Going Green)

- Planet Finance — EM debt levels rose at a faster pace than developed markets last year.

Tuesday, 25 May 2021

EFG Hermes’ Awad on the AIB acquisition, taking his franchise outside Egypt, and what will bring foreign investors back to the market

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to a packed issue this morning, with plenty of news spanning from diplomacy to M&A as we start pushing over hump day.

IT’S A BIG DAY FOR: Diplomacy, as Cairo continues to thaw relations with one of our most important Western allies — and mends fences with Qatar.

President Abdel Fattah El Sisi and US President Joe Biden have had their second call in less than a week, a clear end to a period of frosty relations between the two longtime allies that began when Biden moved into the White House. The two leaders discussed how to reinforce the Egypt-brokered ceasefire between Israel and Hamas — and, critically, also talked about GERD and Libya, according to readouts. We have chapter and verse in this morning’s news well, below.

US Secretary of State Antony Blinken will visit Egypt in the coming days as part of a peacebuilding trip to our neck of the woods, according to a statement by the US State Department. Blinken will visit Jerusalem and Ramallah first before heading to Cairo and finishing off with Amman, Jordan. Look for Blinken to sit down with President Abdel Fattah El Sisi and Foreign Minister Sameh Shoukry.

Meanwhile, it looks like we’re well on our way to becoming friends with Qatar once again as Qatari Foreign Minister Mohammed bin Abdulrahman Al Thani is meeting with Foreign Minister Sameh Shoukry in Cairo today as part of a two-day visit, Youm7 reports. Al Thani landed in Cairo last night, after making stops in Sudan and Libya. This is Al Thani’s first visit to Cairo since Egypt and the GCC blockaded Qatar in 2017, marking a milestone that indicates the rapprochement is properly underway, after the two countries restored ties earlier this year. The visit comes after Egypt played a central role in mediating the Palestine-Israel ceasefire, which is expected to be a key talking point for the ministers today.

Foreign Minister Sameh Shoukry is due to hold meetings in Athens next month with counterparts from Greece, Cyprus, and France, Cypriot Foreign Minister Nikos Christodoulides said in a statement picked up by Cyprus Mail. The EU could be looking to participate in the East Mediterranean Gas Forum and will send in a request soon, Christodoulides suggested.

ALSO THIS MORNING- We have an exclusive sitdown with EFG Hermes Group CEO Karim Awad. Part one this morning looks at the firm’s recently announced acquisition of commercial lender AIB in partnership with the Sovereign Fund of Egypt. Part two appears in EnterprisePM this afternoon and sees Awad digging deeper into what’s next for EFG Hermes and for the market at large.

LATER TODAY- Look for the release of an IMF report on Egypt’s reform program. We have more in Last Night’s Talk Shows, below.

THE BIG STORIES ABROAD this morning: The EU’s imposition of sanctions on Belarus for forcing down a flight with a dissident journalist leads the front pages, but the most business-relevant news for us here in Cairo:

- Multinationals could see tax engineering become a lot harder as the G7 nears a pact designed to make it difficult for corporations to shift profits between jurisdictions. Think of it, in part, as air cover for the Sisi administration’s drive to make sure that Big Tech pays its fair share of taxes here. (Financial Times)

- The “Wuhan lab theory” on the origins of covid-19 is solidly back in the headlines with both the Wall Street Journal and CNBC giving front-page ink to calls for an investigation.

|

***CATCH UP QUICK with the top stories from yesterday’s edition of EnterprisePM:

- Explaining the NFAs dip: Foreign investment in local treasury bonds and bills may have dipped in March after having hit a record high in February, driving a drop in the banking sector’s net foreign assets.

- We’re a great outsourcing destination: Egypt retained its position as the most attractive outsourcing and offshore operations destination in the MENA region, according to AT Kearney’s Global Services Location Index 2021.

- Bye bye, third wave? Covid-19 cases are likely to start declining as of next week, Ittihadiya health advisor Mohamed Tag Eldin said.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

In today’s issue: Construction materials are major sources of air pollution, with the most recent data available showing they account for at least 23% of Egypt’s (fairly sizable) greenhouse gas emissions. We look at the scale of the problem, in particular the role played by heavy polluters like cement and steel.

SPOTLIGHT

EFG Hermes’ Awad on the AIB acquisition, taking his franchise outside Egypt, and what will bring foreign investors back to the market — part 1 of 2

Few transactions have been as closely followed in Egypt’s banking and finance industries as has EFG Hermes’ acquisition of a controlling stake in the commercial bank AIB in a partnership with the Sovereign Fund of Egypt (SFE). Was the SFE serious about public-private partnership? Did EFG Hermes’ management have a vision for universal banking that could succeed where its earlier bid with Bank Audi never fully took off? Would the regulatory stars align?

The answers are “Yes,” “Yes,” and “It seems so” after the firm announced at the end of last week that it was acquiring a supermajority stake in Arab Investment Bank in a EGP 3.8 bn transaction that sees it partnering with the SFE. It’s a landmark transaction for the Sisi administration’s bid to show it is serious about partnering with the private sector to unlock growth.

The transaction in brief: Once the sale closes, EFG will become AIB’s controlling shareholder with a 51% stake, while the SFE will take 25% through its financial services and digital transformation sub-fund. The state-owned National Investment Bank will retain a 24% stake of AIB post-transaction, having previously held a 91.4% stake. We have background here and here. Group CEO Karim Awad confirms the acquisition should close in 3Q2021, subject to the usual post-closing conditions and regulatory approvals, including from the Central Bank of Egypt.

The stakes are high for EFG Hermes, which has now transformed itself from a huge fish in a small pond (Egypt investment banking) into a Cairo-headquartered universal bank with operations spanning 13 countries on four continents. On Awad’s watch, EFG established a market-leading non-bank financial services (NBFS — or non-bank financial institution, NBFI, as Awad calls it) platform that has leasing, factoring, payments, consumer finance, mortgage lending, microfinance and ins. under one roof. Its investment bankers, brokers, asset managers and private equity types now go to work each day in Cairo, London and New York — and in Dubai, Abu Dhabi, Riyadh, Nairobi and Lagos. Today, it’s on the verge of adding a commercial bank to its arsenal.

We sat down for an exclusive interview with Awad looking at what’s next for EFG Hermes and for the wider market. Edited excerpts follow. Part 1, covering the AIB transaction, is below. Part 2, which focuses largely on the domestic industry, will appear in this afternoon’s edition of EnterprisePM.

Among the key takeaways in part 1 of our discussion:

- The AIB transaction is about cross-selling and synergies, not lower costs of funds — EFG has no intention of changing how things work with the relationship banks its NBFS companies already work with.

- Partnering with the Sovereign Fund of Egypt has been a “great experience” and key policymakers have been supportive of the transaction.

- How have investors reacted?

In part two THIS AFTERNOON:

- Is EFG Hermes still in investment mode?

- Will Awad & Co. take the NBFS arm outside Egypt?

- What’s next for EFG Hermes the investment bank?

- What will bring foreign investors back to the market?

- Why is Awad excited about the state of the nation’s debt market?

ENTERPRISE: So, what have you done?

KARIM AWAD: We’re creating a one-stop shop for financial services of all descriptions, whether you’re a corporate client, an institutional investor or a retail client. Remember when we were talking on the podcast (listen: runtime, 34:07), and I said we wanted to transform the firm from a pure investment bank into a platform that can provide more services to clients? That’s what we had in mind. From leasing solutions to IPOs or long-term loans for corporates. From brokerage services through our app or at our physical branches, to a personal loan, ins., a mortgage or consumer finance for retail clients.

E: What will happen to the AIB brand name? Are we going to see EFG Hermes Bank?

A: I think it’s a bit early to discuss things like branding, but what’s clear to us is that there is plenty of potential at AIB. It’s a good bank with good potential — a good management team that has built infrastructure that includes a national branch network and a proper core banking system. Our ability to drive cross-selling will create a stronger brand there in the future, a brand that regardless of name will create a niche for itself in the market and provide its clients with a differentiated product offering.

E: Cross-selling is difficult, and most businesses struggle with it whether it’s the result of organic growth, M&A or a greenfield. Are you happy with how EFG is doing on this now?

A: I’m increasingly satisfied, yes. We’ve been particularly successful with our corporate clients, where you see our investment banking team discussing strategies and solutions that can include classical IB solutions, but also, for example, factoring and leasing. We’ve done this in a number of large transactions, particularly in the past couple of quarters.

We would like to see more of that on the retail side. I’m not as satisfied with where we’re at on that front, but it takes time for businesses to integrate and start talking to each other. Leasing and finance are the pathfinders at EFG Corp Solutions, though — they’re showing what’s possible, and we’ll get there on the NBFI and, eventually, the banking sides.

E: What’s missing from the banking or NBFS platforms?

We already have everything from mortgages and ins. to leasing, factoring, consumer finance, microfinance and payments all of that under one roof. Where the bank comes in is that you can do deposit taking, so that makes possible credit card lending, personal loans, corporate loans. In a market as fast-growing as Egypt, the NBFI and commercial banking businesses don’t compete with each other — there’s lots of room for growth, and if they work together, the synergy creation will be incredible.

E: How much is this about reducing your overall cost of funds by being able to take deposits?

A: That’s not the objective at all. It’s about cross-selling and synergies. Look, our NBFI business is very well funded with relationship banks and there will be no changes whatsoever on that front. If [AIB] wants to lend to our leasing or factoring businesses, and if that’s allowed within the regulatory framework and our rules on related-parties transactions, then so be it. Where we think we can help the bank, for example, is that we can help them get access to more microfinance, helping it meet its target of 25% of loans being to micro, small and medium-sized enterprises under the CBE’s directives.

E: How have investors reacted to the transaction?

A: Our shareholders know where we’re taking the business — that we’re a patient management team in the sense that we try to build a solid foundation. We’re creating value for our shareholders, but in a sustainable way. We were the number-one investment bank when we started down this path, and we charted out a series of moves that would enhance and smooth out our earnings. That’s why we pushed more into the buy side, it’s why we launched our NBFI and it’s why we’re now going ahead with AIB.

E: How is life with the Sovereign Fund of Egypt as a partner?

A: It’s been a great experience. We’re on the same wavelength with the team at the SFE when it comes to just about everything — what we want to do with the bank, our vision for the future. They’ve been helpful and supportive — instrumental, really. I also think it’s important that our community not just understand that the SFE is serious about public-private partnership, but that we’ve had the full support of the governor of the Central Bank of Egypt Tarek Amer and of Planning Minister and SFE Chair Dr. Hala El-Said, as well as of our chairperson, Dr. Mona Zulficar.

DON’T MISS PART 2 in this afternoon’s EnterprisePM, in which Awad discusses EFG Hermes’ forays into merchant banking and direct investment, as well as the expansion abroad of its NBFS arm. Karim also discusses what’s next for the debt market, and what obstacles foreign institutional investors see in Egypt.

ECONOMY

Egypt among the most vulnerable EMs to higher refinancing costs –S&P

Egypt, South Africa, Ghana and Kenya are the four emerging markets that could suffer the most from higher sovereign debt refinancing rates, S&P Global Research said yesterday. The ratings agency ran stress scenarios to gauge the effect that rapidly rising borrowing costs for sovereigns would have on budget deficits, looking at scenarios where refinancing rates rose by 100 bps, 200 bps, and 300 bps.

In a “rate shock” scenario where refinancing rates rose 300 bps, Egypt’s interest expenditure as a ratio of GDP would rise 1.2 percentage points (ppt) in the first year. This is slightly lower than the 1.3 ppt increase S&P sees South Africa facing in this scenario, and higher than the 0.9 ppt increase Ghana and Kenya would face. According to the ratings agency, Egypt, India, and Nigeria’s debt service payments already exceed 30% of state revenues in calendar year 2021 — without any changes in current refinancing costs. In the draft state budget for the upcoming fiscal year, Egypt’s Finance Ministry said it expects debt service costs to account for nearly a third of overall government spending.

Part of the problem is the fact that Egypt has a “relatively sizable” portion of its sovereign debt in FX, which complicates its ability to control financing costs, S&P says. Colombia, Ghana, Kenya, Turkey, and Ukraine are also in the same boat as Egypt. On the opposite end of the spectrum, Brazil, China, India, South Korea, the Philippines, and South Africa have greater control over their financing costs because they “finance themselves almost exclusively in local currency.”

The shock isn’t a certainty, however, and depends largely on why rates end up rising: “If rates rise quickly to reflect rapid employment gains and buoyant GDP growth, against the backdrop of steady increases in productivity, the higher cost of debt servicing will almost certainly be offset by improving state revenue and more rapid consolidation of the primary (non-interest) government accounts,” S&P says. The risk scenario is if rates jump because of a “delayed” response from central banks tightening their monetary policy to face inflation as a result of stagnant post-covid productivity. In this scenario, interest rate shocks might be even more severe, resulting in a scenario where “growth would falter, exchange rates weaken, and credit fundamentals suffer.”

STARTUP WATCH

Mozare3 lands seven-figure pre-seed round from Algebra, Distruptech

Agri-fintech startup Mozare3 has raised a seven-figure investment in a pre-series A funding round led by Algebra Ventures and Disruptech, according to a press release (pdf). The statement made no mention of how the company plans to deploy the funds. Mozare3 provides “innovative financial products, markets, and agronomy support” to small farmers across Egypt.

Boosting efficiency for small farmers: Despite contributing to more than 10% of Egypt’s GDP and employing 25% of its workforce, the agrifoods industry is “very fragmented” with over 40% of farms smaller than 1 acre, Mozare3 co-founder Tamer El-Raghy said. Such fragmentation is an opening for Mozare3 “to bring efficiencies to the supply side,” and offer support to farmers he added, in order to, “fulfil the growing demand of consumers, processors and exporters.”

Mozare3 was founded last year by El-Raghy and Hussein Abou Bakr with backing from Distruptech founder and former Fawry CEO Mohamed Okasha. Abou Bakr (LinkedIn) previously founded Plantform, now a leading agri-processor and exporter, while El-Raghy (LinkedIn) is the managing director of Africa-focused agri VC fund manager Acumen Capital Partners.

*** A MESSAGE FROM IDG ***

If you are ready to expand your business operations, industrial complexes by Egypt’s North Coast are the place to be. Our industrial park e2 Alamein makes long-term business planning quick and seamless, and offers you smart solutions aligned with a circular economy that optimize shared resources, helping you leave a positive impact on your surroundings. An up-and-coming trade center with proximity to vacation spots, trade ports, and agricultural land, the park has all your business needs covered, from land plot sales to tailored leasing, pre-built factories and warehouses; a pollution-less business environment; and business partners that will handle all licensing and permissions for you. Powered by Industrial Development Group, e2 Alamein is redefining industrial operations in Egypt, and is right where your business should be.

For more information, visit e2-Alamein.com.

DIPLOMACY

Biden + El Sisi talk Palestine, Libya, and GERD

President Abdel Fattah El Sisi and US President Joe Biden discussed yesterday reviving the Palestine-Israel peace process after reinforcing the Egypt-brokered ceasefire between Israel and Hamas, according to an Ittihadiya statement. In their second phone call in less than a week, the two presidents “consulted on the urgent need to deliver humanitarian assistance to those in need in Gaza and to support rebuilding efforts in a manner that benefits the people there and not Hamas,” the White House said in a statement. The US is “determined to work to restore calm” in Palestine, Ittihadiya said. Reuters and Bloomberg also had coverage.

Expect more engagement between Cairo and Washington on Palestine — as well as GERD, Libya and Iraq: The US will work with Egypt and “all international partners” to support the Palestinian Authority and the reconstruction process in Gaza. Biden said he plans to continue consulting and coordinating with El Sisi on these issues, and thanked Egypt for successfully mediating the ceasefire currently in place. El Sisi and Biden touched on Iraq and Libya, agreeing to work towards upholding both countries’ sovereignty.

The head-of-state level discussion of GERD is key: Biden “acknowledged Egypt’s concerns about access to Nile River waters and underscored the U.S. interest in achieving a diplomatic resolution that meets the legitimate needs of Egypt, Sudan, and Ethiopia,” the White House statement read. The two agreed to ramp up diplomatic efforts in the coming period to reach an agreement that would protect all countries’ water rights and development interests.

We can expect to see the Biden administration getting “more deeply involved” in resolving the GERD impasse than the Trump administration, although Biden will likely be slower to move as he “absorbs” all the different facets of the situation, veteran political pundit Abdel Moneim Said told Kelma Akhira’s Lamees El Hadidi last night (watch, runtime: 17:13).

And, of course, human rights came up: The two statements were brief in their mention of human rights, but its inclusion makes clear that the Biden White House will continue to apply pressure on this front. The conversation was “characterized by understanding, frankness and credibility in all issues of concern to the two countries and the region,” El Sisi said in a tweet following the call.

Reading the tarot cards: The call between El Sisi and Biden is a sign that US-Egypt relations are thawing, after a few months of Washington giving us the cold shoulder when Biden first assumed office, Said told Lamees. Lamees expressed a similar view, saying that the Biden administration’s concerns over Egypt’s human rights situation will not cancel out our strategic political importance (watch, runtime: 3:00).

Yesterday’s call coincided with major diplomacy and foreign policy activity from Egypt: El Hekaya’s Amr Adib stressed on the significance of the two leaders speaking twice in the span of four days while Foreign Minister Sameh Shoukry was in Ramallah and Amman yesterday, and is scheduled to meet with Qatar’s foreign minister today and US Secretary Antony Blinken before the week is out. This activity, Adib said, helped shift the “aggressive” tone Biden had adopted towards Egypt during his presidential campaign (watch, runtime: 23:53).

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

President Abdel Fattah El Sisi and US President Joe Biden’s phone call yesterday on reinforcing the Palestine-Israel ceasefire and reviving the peace process was in the limelight on last night’s talk shows. Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 5:35) and Masaa DMC’s Jasmine Zaky (watch, runtime: 3:58) had cut-and-dry coverage, while the rest of the nation’s chattering class provided more color on how the call signals a shift in Washington’s tone towards Egypt. We have the full story in this morning’s news well, above.

Elsewhere, the IMF is expected to release today a staff report on Egypt’s economic performance and policies, IMF Executive Director Mahmoud Mohieldin said in an extended conversation with Kelma Akhira’s Lamees El Hadidi. The report is not expected to hold any surprises, with Egypt showing economic stability since the outbreak of the pandemic and making significant progress on the government’s reform program, Mohieldin said.

On the global front, the IMF is expecting to see 6% economic growth in 2021, Mohieldin said, but stressed that this figure is subject to revisions, depending on how individual countries’ vaccination programs progress. The former investment minister noted that leaving individual countries or regions lagging behind the rest of the world in vaccinating their populations will have spillover effects. The IMF has proposed a USD 50 bn grant and loan package from international financial institutions to make vaccines available to countries that are struggling to access enough doses, Mohieldin said (watch, runtime: 26:11).

The report comes after the IMF praised economic reform program II: An IMF delegation praised Egypt’s new three-year program of structural reforms in a meeting with Planning Minister Hala El Said yesterday, according to a statement. The fund also lauded the program’s alignment with the UN’s sustainable development goals and for building on the first phase of the IMF-supported economic reform program that kicked off in 2016.

EGYPT IN THE NEWS

Aside from President Abdel Fattah El Sisi and US President Joe Biden’s phone call yesterday, there is no single story driving the conversation on Egypt in the foreign press this morning. Among the stories making the rounds: A EGP 100 mn factory will manufacture locally made replicas of artefacts to compete with Chinese-made ones. (The National)

ALSO ON OUR RADAR

China’s Dongfeng has upped its planned investments in a plan to locally assemble EVs with El Nasr Automotive to USD 12 mn from USD 10, as part of a USD 60 mn plan. The two state-owned companies are set to sign a final agreement within three weeks, Public Enterprises Minister Hisham Tawfik said.

Other things we’re keeping an eye on this morning:

- The National Bank of Egypt plans to invest EGP 150 mn this year to upgrade e-payments player Al Ahly Momken’s services and infrastructure network. The NBE’s Al Ahly Capital acquired a 75% stake in Momken in late April.

- Mariout Hills will establish a USD 3.4 bn atmospheric water generator in New Alamein city, through which it will extract moisture from humid air to produce 50k liters of drinking water per day, Chairman Ahmed Hassan said.

- A bill that would see the Endowments Ministry establish a charitable endowment fund to raise donations for social welfare, healthcare, higher education and cultural institutions, and other public non-profit works was greenlit yesterday during a House of Representatives plenary session, and will now be shipped to the Senate for discussion.

COVID WATCH

WHO wants 1 in 3 people vaccinated by year’s end

The Health Ministry reported 1,149 new covid-19 infections yesterday, up from 1,145 the day before. Egypt has now disclosed a total of 254,984 confirmed cases of covid-19. The ministry also reported 45 new deaths, bringing the country’s total death toll to 14,766.

WHO boss wants one third of all countries to be vaccinated by year-end: World Health Organization Director-General Tedros Ghebreyesus called yesterday on the World Health Assembly to “support a massive push” to get at least 10% of each country’s population vaccinated against covid-19 by September, and to push that figure to 30% by the end of the year. To reach the September target, some 250 mn individuals in low- and middle-income countries need to be vaccinated within four months, Ghebreyesus noted. These targets can be reached by ramping up global vaccine manufacturing to fulfill demand and for vaccine manufacturers to commit half of their output to the Covax program.

PLANET FINANCE

Emerging market debt levels rose quicker than those in the developed world in 2020, and this “increasing divide” threatens to undermine the post pandemic recovery in many vulnerable nations, according to Moody’s Analytics. Debt levels worldwide spiraled to a record USD 24 tn during the pandemic year, after more than doubling in EMs, a report published by Moody’s last week showed. Indebted EMs now account for a third of debt globally, despite developing economies having smaller GDPs, according to the report. EMs have, in general, been slower to roll out vaccines, adding to the recovery headwinds.

Also worth knowing:

- Shareholders will vote tomorrow on US oil and gas corporation ExxonMobil’s board members, with hedge fund Engine No. 1 pushing for a shakeup in response to Exxon’s ineffective climate change policy, the Financial Times reports.

- Oil prices are inching back up after after Iran said more still needs to be done to reach a nuclear agreement, which would pave the way for the official return of Iranian oil to global markets and see the US lift sanctions on Tehran, according to Bloomberg.

- Saudi Arabia is planning to raise USD 55 bn through its privatization program by 2025 in a bid to narrow its budget deficit, Finance Minister Mohammed Al Jadaan told the Financial Times.

|

|

EGX30 |

10,761 |

-0.5% (YTD: -0.8%) |

|

|

USD (CBE) |

Buy 15.62 |

Sell 15.72 |

|

|

USD at CIB |

Buy 15.62 |

Sell 15.72 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

10,319 |

-0.3% (YTD: +18.8%) |

|

|

ADX |

6,615 |

+1.1% (YTD: +31.1%) |

|

|

DFM |

2,788 |

– (YTD: +11.9%) |

|

|

S&P 500 |

4,197 |

+1.0% (YTD: +11.7%) |

|

|

FTSE 100 |

7,052 |

+0.5% (YTD: +9.2%) |

|

|

Brent crude |

USD 68.69 |

+0.3% |

|

|

Natural gas (Nymex) |

USD 2.89 |

– |

|

|

Gold |

USD 1,879.70 |

-0.4% |

|

|

BTC |

USD 39,161.92 |

+11.7% |

The EGX30 fell 0.5% yesterday on turnover of EGP 1.75 bn (27.7% above the 90-day average). Local investors were net sellers. The index is down 0.78% YTD.

In the green: ElSewedy Electric (+1.7%), Eastern Company (+0.5%) and CIB (+0.3%).

In the red: Pioneers Holding (-3.0%), Alexandria Mineral Oils (-2.9%) and Citadel Capital (-2.8%).

Major Asian indexes are solidly in the green this morning and futures suggest more of the same when markets open in Europe and on Wall Street.

Just how bad is construction material pollution in Egypt? And which materials should we be worried about? Construction is a major contributor to air pollution, and as we know, Egypt’s pollution levels are dangerously high. The World Bank’s recently-greenlit USD 200 mn loan shows substantial (and expensive) steps are needed to improve air quality. Reducing the harmful impacts of construction material production is urgent. But to do this, we need to understand the scale of the problem, and which materials are most harmful.

Globally, construction accounts for some 40% of greenhouse gas (GHG) emissions, estimates Deloitte, citing (pdf) data from 2018 by the World Business Council for Sustainable Development.

Construction materials produce two kinds of emissions — fuel combustion emissions and industrial process emissions — which are measured separately. Global GHG emissions are measured within four specific categories: energy, industrial process and product use (IPPU), waste and agriculture, forestry and other land use (AFOLU), following UN guidelines. Fuel combustion emissions from construction materials fall under energy, and industrial process emissions fall under IPPU, this EMEP/EEA guidebook (pdf) notes.

Egypt’s most recent available stats show construction accounts for at least 23% of our GHG emissions: Egypt’s 2015 GHG emissions totaled 325 mn metric tons carbon dioxide equivalent (Mt CO2e), according to a 2018 Environment Ministry report (pdf). Energy emissions accounted for 64.5% (roughly 210 mn Mt CO2e) and IPPU emissions for 12.5% (about 40 mn Mt CO2e) of total emissions. Construction and manufacturing emissions made up 23% of these energy emissions (47 mn MT CO2e). And construction material production contributed at least 75% (30 mn Mt CO2e) to Egypt’s 2015 IPPU emissions. So in total, at least 23% of Egypt’s total 2015 GHG emissions (77 mn Mt CO2e) came from construction.

Egypt probably falls just outside the world’s top 20 biggest emitters of GHG: Egypt produced 329 mn Mt CO2e GHG emissions in 2018, according to the World Resources Institute CAIT database. Italy — number 20 in the Union of Concerned Scientists’ list of the world’s heaviest CO2 emitters — produced some 386 mn Mt CO2e in the same year, the CAIT database tells us.

And CO2 makes up some 73% of our GHG emissions: CO2 is the biggest contributor to GHG emissions globally, and known as the “most dangerous” greenhouse gas. In 2015, Egypt’s estimated CO2 emissions stood at 237 mn Mt CO2e, meaning CO2 accounted for some 73% of our total GHG emissions.

Where’s it coming from? Globally, concrete is the worst offender. But steel, glass, red brick, paint, and solvents also play a big role. Concrete — of which cement makes up 10-15% of the mix — is responsible for some 4-8% of the world’s CO2 emissions. Only coal, oil and gas are greater sources of GHG emissions. An estimated 1.83 tons of CO2 is emitted for every ton of steel produced. Glass production is a major source of emissions, a Berkeley study (pdf) shows. Fired-clay (red) bricks are also very energy-intensive, according to a joint study (pdf) by BUE and several Scandinavian universities. Paint and solvents are major sources of volatile organic compounds (VOCs), which react with the air’s oxygen to produce ozone, the most toxic component of smog.

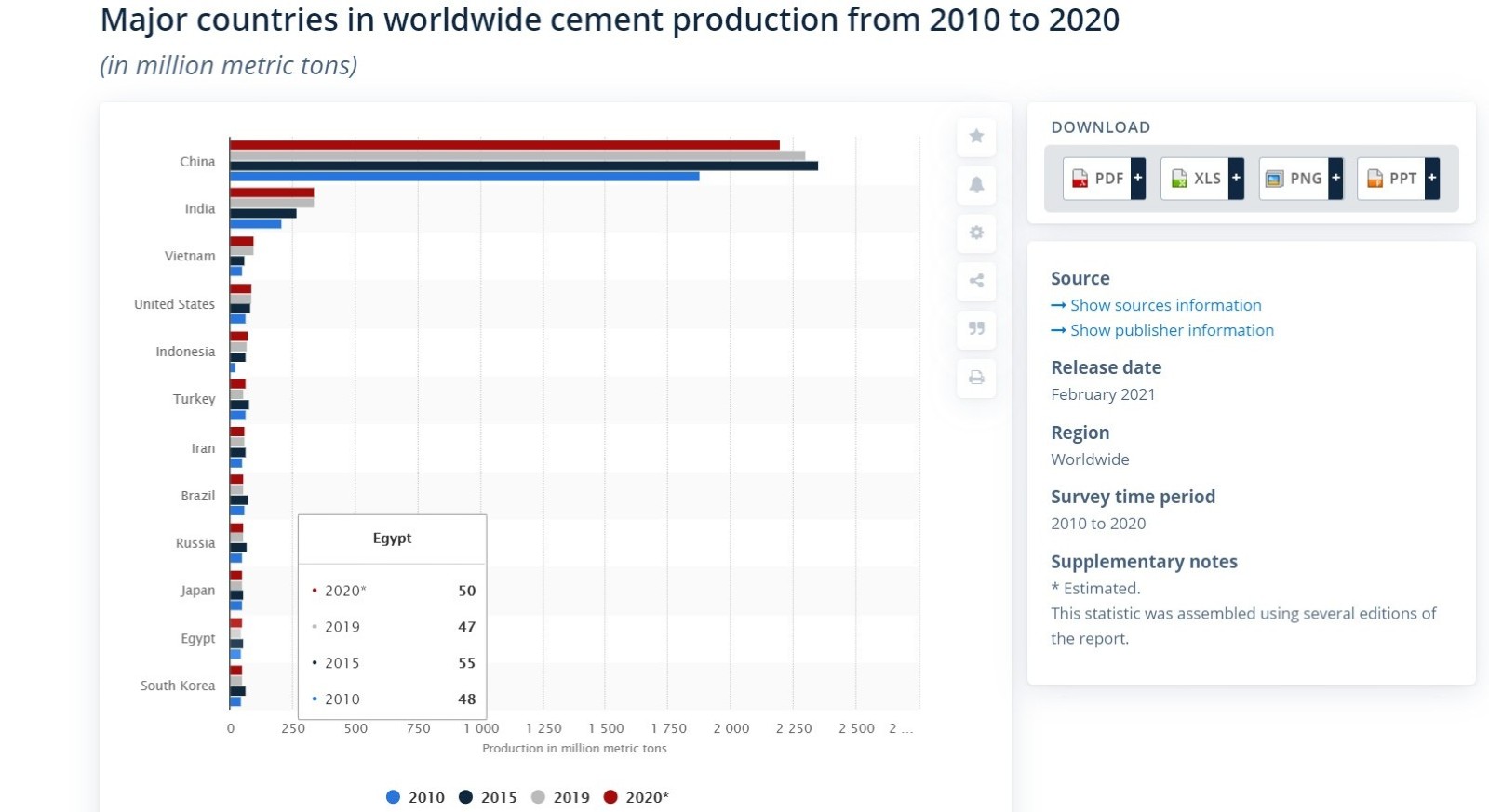

Egypt’s a top producer and consumer of some of these materials: Egypt was among the top 12 producers of cement from 2010-2020, producing an estimated 50 mn metric tons of cement in 2020, according to Statista. Egypt is the largest steel consumer in the MENA region, according to a 2020 OECD report (pdf). We produced 7.3 mn metric tons of steel in 2019, ranking 23 in a list of the world’s 50 top steel-producing countries in a 2020 report (pdf) by the World Steel Association.

Egypt’s CO2 emissions from cement were already bad in 2014-15: Egypt’s CO2 emissions from cement production alone saw an average annual growth rate of 6.85% between 1965 and 2014, according to tech company Knoema Corporation. Cement production was responsible for roughly 8% of Egypt’s total CO2 emissions in 2015, the Environment Ministry report shows.

Iron and steel made up 1% of Egypt’s CO2 emissions in 2015: Out of a total of 3.5 mn Mt CO2e emitted by the metal industry in 2015, 3.1 mn Mt CO2e came from the iron and steel sector — some 1% of Egypt’s overall CO2 emissions.

We’re doing a poor job just keeping track of polluting construction materials: There’s no current official estimate for which construction materials are the most polluting in Egypt, sustainability consultant and Egypt Green Building Council board member Hoda Anwar tells Enterprise. “But we know from experience that cement and steel are the biggest contributors,” she says. A 2016 Egypt-Japan University of Science and Technology (E-JUST) study (pdf) notes a “remarkable shortage” of specialized studies of the Egyptian cement industry using Life Cycle Assessment (LCA) — a technique that assesses the environmental impacts of all stages of a product's life.

And construction is growing rapidly: Construction was termed one of Egypt’s “more stable sectors” by EFG Hermes in its 2021 Year Ahead report. Building construction was estimated to grow at 6.6% y-o-y from 2005-2030, according to 2018 Capmas figures. Our cement industry alone grew from four factories producing 4 mn tons of cement clinker a year in 1975 to 14 factories producing some 38 mn tons in 2016, the E-JUST study tells us.

In Egypt, it’s still early days when it comes to making construction materials more environmentally-friendly — but players are getting on board: Some traditional construction companies are starting to integrate environmentally-friendly approaches into their operations. We look at what they’re doing in part 2.

Your top climate stories for the week:

- Fossil fuel funding on the decline: For the first time ever, bank finance for renewable energy projects could this year outpace funding lenders have made available for fossil fuels.

- SWFs pour into climate sectors: Sovereign wealth funds nearly doubled their total investments last year, with a particular focus on climate change-related sectors like agritech, forestry and renewable energy.

- ESG investors ♥ EM: Investors with environmental, social, and governance (ESG) mandates are turning to emerging markets, which have traditionally been slow on the uptake of green investments.

CALENDAR

20-28 May (Thursday-Friday): Gouna International Squash Open 2021.

24-26 May (Monday-Wednesday): British Egyptian Business Association virtual healthcare week.

26 May (Wednesday): Final day for Africa-based startups to apply for the French government-sponsored AFD Digital Challenge (pdf).

27-29 May (Thursday-Saturday): Informa Markets’ Nextmove real estate exhibition, Cairo International Convention Center, Nasr City.

30 May (Sunday): Al Mal GTM is organizing the Portfolio Egypt conference under the theme ‘Growth under the weight of the pandemic.’

31 May (Monday): Egypt is hosting Trescon Global’s World AI Show with the support of ITIDA.

7 June (Monday): British Egyptian Business Association hosts an event featuring Oil Minister Tarek El Molla.

14 June (Monday): Egypt's Green Economy Forum.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

17-20 June (Thursday-Sunday): The International Exhibition of Materials and Technologies for Finishing and Construction (Turnkey Expo), Cairo International Conference Center.

22-27 June (Tuesday-Sunday): The CIB PSA World Tour Finals for 2020-2021 will take place in Cairo.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): The IMF will complete a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

30 June (Wednesday): 30 June Revolution Day.

30 June- 15 July: National Book Fair.

July + August: Thanaweya Amma exams take place.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

1 July (Thursday): Large taxpayers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

1 July (Thursday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

15 June (Saturday): EGX-listed will have to complete filing their financial disclosures for the period ended 31 March.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday).

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

May 2022: Investment in Logistics Conference, Cairo, Egypt.

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.