- The IMF is watching what happens to the EGP in January. (Economy)

- Suez Canal fund not privatization via the back door, gov’t says amid controversy. (Legislation Watch)

- We could be getting USD 4 bn from Chinese and Japanese investors for renewables projects. (Energy)

- Abu Dhabi Ports + Mwani in talks with gov’t to run Ain Sokhna, Safaga ports, El Wazir confirms. (Infrastructure)

- Local healthtech startup CheckMe acquires Doctor Online. (Startup Watch)

- It’s not just Egypt: Silicon Valley startups are looking to new sources of finance to avoid downrounds. (What We’re Tracking Today)

- The Bank of Japan just shocked the global markets. (Planet Finance)

- 2022: A year of headwinds for infrastructure players. (Hardhat)

Wednesday, 21 December 2022

AM — The IMF is watching what happens in January

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning ladies and gents. There may be only seven working days remaining of the year but 2022 shows no signs of wanting to take a time out. Here in Egypt we have a crucial central bank policy meeting tomorrow and — as the IMF’s Egypt mission chief reminds us — the probable unwinding of the dreaded L/C requirement by next week (more on that in the news well, below). Meanwhile abroad, the Bank of Japan just breathed new life into the 2022 rollercoaster ride that is the global financial markets — check out this morning’s Planet Finance for more on that.

THIS WEEK-

It’s the Central Bank of Egypt’s final policy meeting of the year on Thursday: Most analysts in a Reuters poll are expecting policymakers to close out 2022 with another king-size 200-bps rate hike to support the currency and tackle rising inflation — chiming with the majority of those we surveyed last week. Seven of the nine analysts and economists we spoke to are forecasting the central bank to raise rates, five of which see a 200-bps hike. This would take the policy rate to 15.25%, its highest level since early 2019.

PSA #1- MPs are now on a two-week break: The House of Representatives will be back in session on 2 January.

PSA #2- Another year with no state-funded Hajj trips: The Awqaf Ministry is once again suspending state-funded Hajj pilgrimages, making this the third consecutive year that the government has canceled its annual free Hajj trips. The action was first taken in 2020 when the ministry decided to redirect those funds to support those affected by the pandemic.

THERE ARE THREE BIG STORIES ABROAD THIS MORNING-

#1- Trump’s tax returns are finally going public after a House committee yesterday voted to release them. (AP | Reuters | WSJ | Washington Post | NYT)

#2- Sam Bankman-Fried will be extradited to the US from the Bahamas today to face a range of criminal charges related to the collapse of crypto exchange FTX. (Bloomberg | CNBC)

#3- Elon Musk will abide by the results of this week’s poll and will appoint a new CEO to take charge at Twitter as soon as one is found. (AP | Reuters | Bloomberg)

|

SIGN OF THE TIMES- Tech startups are scrambling amid funding drought: Silicon Valley tech startups are working overtime to keep themselves afloat and are turning to alternative sources of finance following a steep decline in VC funding, the Financial Times reports. Companies are looking at bridge loans and structured equity in efforts to avoid being forced to cut their valuations in down rounds.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, and urban development, as well as social infrastructure such as health and education.

In today’s issue: 2022: A year of headwinds for infrastructure players.

Somabay brings out the best in majestic natural elements where raw beauty and endless activities reign supreme. Immerse yourself into a picturesque getaway all year long. This is simply Somabay. For more information, call 16390 or visit www.somabay.com.

ECONOMY

The IMF is watching what happens to the EGP in January

The IMF will be keeping a beady eye on what happens to the exchange rate when the central bank ends import restrictions at the end of the month. Egypt has committed to permanently switching to a floating exchange rate in return for a USD 3 bn loan from the IMF, but is yet to cancel its requirement to use letters of credit to finance imports. “We know that the central bank has not intervened to inject reserves into the foreign exchange market since we reached staff level agreement. But we also know that the backlog of imports has not been cleared,” Ivanna Vladkova Hollar, the IMF mission chief for Egypt, told Reuters this week.

Import restrictions? Since March the central bank has required businesses to use letters of credit to finance most imports, a move designed to stem outflows of foreign currency amid a shortage triggered by the war in Ukraine. The decision has caused widespread economic disruption as imports have slowed to a crawl but has helped to support the EGP which has fallen sharply due to two devaluations this year.

Mandatory L/Cs should be a thing of the past by the end of the month: Egypt agreed to fully phase out mandatory L/Cs by the end of the year under the agreement made with the IMF in October, which committed them to adopting a “durably flexible exchange rate.” In its statement last week, the Fund’s executive board changed its language, and now specifies that Egypt must “permanently” shift to a floating rate.

What happens next is key: Following the lifting of the restrictions, the IMF will be looking for “daily volatility in the exchange rate that is similar to the volatility observed in truly floating exchange rate regimes”, Vladkova Hollar said. “We will be looking very closely at how the FX market is functioning, which would then give us the ability to have a conversation with the authorities and our board as to [whether] what we are seeing is really consistent with a flexible exchange rate regime.”

A smaller first tranche than expected: The IMF agreed to disburse USD 347 mn immediately after the executive board signed off on the loan, less than half of the USD 750 mn the Finance Ministry was expecting in the first tranche.

The state ownership policy will be key: The long-awaited document, which will lay out which areas of the economy the state will divest from, will be the “first critical document that we need jointly to be able to develop a more concrete action plan,” Vladkova Hollar said.

Privatization and leveling the playing field for private companies are key conditions of the new loan: Egypt has committed to undertaking “wide-ranging” structural reforms to reduce state involvement in the economy and increase transparency. These include opening the books of state-owned enterprises, publishing audit reports done by the Central Auditing Organization, and making public information relating to government contracts worth more than EGP 20 mn.

LEGISLATION WATCH

Suez Canal fund not privatization via the back door, gov’t says amid controversy

The government is moving to stem controversy over the new Suez Canal fund: The Madbouly government yesterday denied claims that a proposal to set up a fund for the Suez Canal Authority will enable it to privatize assets by the back door.

ICYMI- MPs this week gave initial approval to legal amendments that would allow the SCA to “buy, sell, lease, exploit and benefit from fixed and movable assets” owned by the authority in order to capitalize a new EGP 10 bn fund. It would also allow it to use its own financial resources and revenues. It’s not clear whether this includes canal revenues, a key source of FX income for the public purse.

Cue controversy: A large number of MPs voted against the law on Monday, voicing concerns that it will pave the way for the SCA to sell assets without parliamentary oversight. “Establishing a fund in the Suez Canal is tantamount to emptying Egypt of its funds, and turning public money into private money,” said Mohamed Abdel Alim Daoud, a Wafd Party MP. It also triggered a storm on social media, with speculation about whether the amendments would allow the SCA to sell the canal trending all day.

The cabinet moved to calm fears over transparency, saying yesterday that the fund’s accounts will be supervised by the Central Auditing Organization and that the SCA would not sell off its assets by the back door. It did not acknowledge complaints about the lack of parliamentary supervision.

The canal is not for sale, says House Speaker: The fund will only be able to sell fixed and moveable assets, not the canal itself, House Speaker Hanafi Gebali said (pdf) during yesterday’s session, suggesting that selling the canal would be unconstitutional. “The fund will do what all funds do in terms of buying, selling, and leasing assets, but it says nothing at all that it will sell Suez Canal.”

ENERGY

We could be getting USD 4 bn from Chinese and Japanese investors for renewables projects

A Chinese company and a Japanese company have submitted bids to the Electricity Ministry to invest over USD 4 bn in renewable energy projects in Egypt over the next eight years, Al Borsa reports, citing what it says are ministry sources. It’s not clear whether the firms would invest in plants already in the pipeline, or look to build fresh projects.

The companies are also in talks with five Egyptian contractors and electricity firms who could partner with them to build the projects, the sources are quoted as saying. The talks should advance in 1H 2023, the sources said.

How will they get the funds? The companies have reached initial agreements with lenders in both China and Japan to finance the projects, the sources said, adding that they will negotiate the financing details once they get the final project approvals from the Electricity Ministry

REMEMBER- Egypt signed initial agreements for some 29.5 GW worth of wind power projects worth up to USD 34 bn during COP27, equivalent to nearly half of the country’s total installed power generation capacity. We have also set an ambitious target of sourcing 42% of our energy from renewables by 2030.

INFRASTRUCTURE

Abu Dhabi Ports + Mwani in talks with gov’t to run Ain Sokhna, Safaga ports, El Wazir confirms

Abu Dhabi Ports + Qatar’s Mwani have their eyes on our ports: The government is in early-stage negotiations with Abu Dhabi Ports and Qatar Ports Management Company (Mwani) to manage and operate ports in Egypt, Transport Minister Kamel El Wazir told reporters (watch, runtime: 1:44) yesterday. The Gulf logistics companies are interested in acquiring contracts to run the Ain Sokhna and Safaga ports, he said.

Gulf companies could soon be in charge of many of Egypt’s Red Sea terminals: ADP has already been hired to build and run a terminal at the port of Sokhna and is bidding to build a new terminal at Safaga port, while local media has reported that the Qatar Investment Authority (QIA) is in talks with the Madbouly government to develop and manage the port of Safaga under a 25-year contract. DP World has been strengthening its position at Ain Sokhna port, completing a major expansion at the port late last year and recently signing an agreement to build a new logistics zone.

MEANWHILE- An Egyptian-Dutch JV will build and manage a grain logistics hub at Alexandria port, under an MoU signed yesterday between the two companies and Alexandria Port Authority, the Transport Ministry said. Egyptian-Dutch Shipping Company (EDSCO) is a joint venture between a Dutch firm named Vitra and Egypt’s El Fateh, according to the statement. We weren’t able to find an online presence for either firm or their joint venture.

Our ports are not up for sale: Amid a backlash from some opposition MPs over government privatization plans, Transport Minister Kamel El Wazir reiterated that the government is not selling ports, but is rather entering partnerships with both local and foreign private-sector players to manage and operate them.

STARTUP WATCH

Local healthtech startup CheckMe acquires Doctor Online

Healthtech startup CheckMe has acquired a majority stake in virtual clinic app Doctor Online in a transaction that gives CheckMe a total market value of USD 20 mn, a statement (pdf). The acquisition will help CheckMe tap into more verticals to create the next “healthtech superapp” in Egypt and across the region, Ahella El Saban, co-founder of sell-side advisor Exits, told Enterprise. El Saban declined to disclose the size of the stake or the value of the transaction.

About the startups: Founded in 2020 by Adham Youssef (LinkedIn) and its CEO Nesma El Talawy (LinkedIn), CheckMe’s app provides on-demand lab services. Doctor Online, founded by CEO Mahmoud Abdelhakim (LinkedIn), is a virtual clinic mobile app offering various online medical services.

The acquisition will allow CheckMe to expand to comprehensively cover patients’ needs, and to tap Doctor Online’s database of both users and clinicians, El Saban said.

LAST NIGHT’S TALK SHOWS

No canals for sale here: The nation’s talking heads spoke in unison last night carrying the government’s message about the proposed Suez Canal fund, which has generated controversy among MPs and on social media about the privatization of assets owned by the Suez Canal Authority. The government yesterday denied accusations from some lawmakers that the fund will enable the sale of assets by the back door while House Speaker Hanafi Gebali sought to dampen rumors that the amendments will pave the way for the sale of the canal itself. More on this in Legislation Watch, above.

Kelma Akhira (watch, runtime: 13:04), Masaa DMC (watch, runtime:7:52) and Al Hayah Al Youm (watch, runtime: 5:03) all covered the story. Yahduth Fi Masr’s Sherif Amer talked to former SCA boss Mohab Mamish (watch, runtime: 4:30) and Khaled Abu Bakr, an advisor to the SCA chairman, appeared on Ala Mas’ouleety to deny the claims (watch, runtime: 5:40).

The expat car import scheme is yet to take off: In the first five weeks since its launch, around 4k expats have submitted requests to import vehicles under the government scheme, which will likely net the state just USD 62 mn, Kelma Akhira’s Lamees El Hadidi said (watch, runtime: 3:13). The government was originally hoping to draw USD 2.5 bn in FX from the scheme, which expires at the end of February.

“These low numbers are an indication that this initiative has issues,” El Hadidi said, blaming the fluctuating EGP/USD exchange rate and the timing of the initiative for the slow demand.

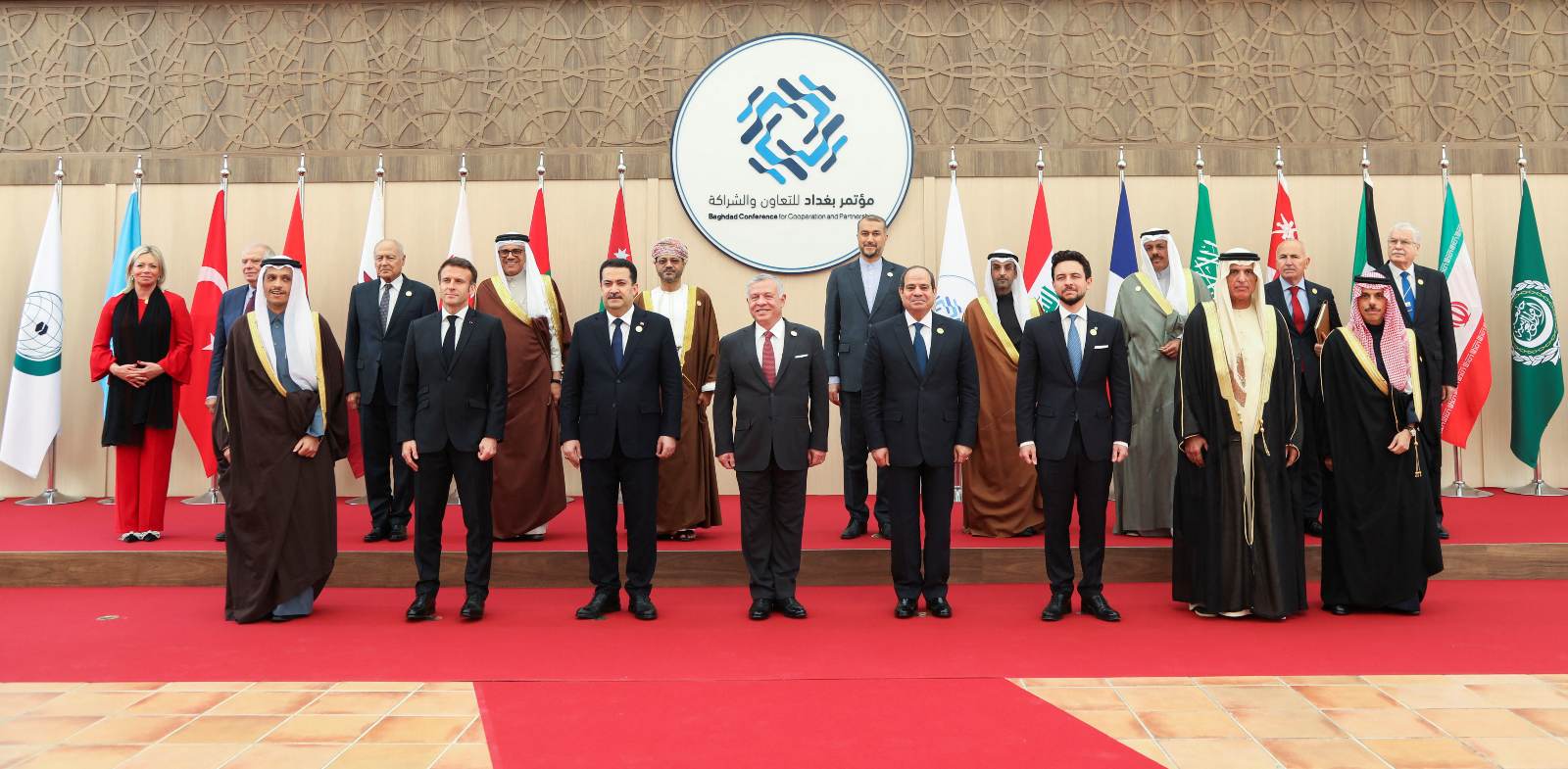

ELSEWHERE ON THE AIRWAVES- President Abdel Fattah El Sisi’s participation in the Baghdad II gathering in Jordan yesterday got attention from Masaa DMC (watch, runtime: 9:20) and Al Hayah Al Youm (watch, runtime: 4:05). More on that in Diplomacy, below.

EGYPT IN THE NEWS

It’s another mixed morning in the international press, with no single story grabbing the attention of foreign journos. Among the headlines:

- The National takes a look at the soaring cost of living and how some Egyptians are finding it hard to make ends meet.

- The New York Times takes a tour of South Sinai’s overlooked hiking trails managed by Bedouin.

- 50 doctors, 14 hours, three operating theaters: A woman received a life-saving lung transplant from her two brothers in the country’s first operation of its kind to use live donors. (The National)

- Antiquities alarm: MP Doha Assy tells the National that unchecked construction and waste dumping are damaging the country’s heritage sites.

- China is the new capital’s biggest funder but this year the country has become more circumspect about lending to Egypt amid concerns about the country’s debt sustainability. (Al Monitor)

ALSO ON OUR RADAR

EGX–

#1- Watania Kuwatia could make its EGX debut as soon as January: Local agriculture player Watania Kuwatia is planning on making its market debut during 1Q 2023, Chairman Mohamed El Gammal reportedly told Al Borsa. The company recently raised its capital from EGP 250 mn to 300 mn via a private subscription of shares, El Gammal said.

About Watania Kuwatia: Established by a consortium of unnamed Kuwaiti and Egyptian investors in 2017, the company owns a sheep farm in Matrouh governorate and is building an EGP 60 mn brick factory in Ain Sokhna, according to Al Borsa.

#2- Amer demerger: Amer Group shareholders approved a plan to spin off some of the company’s activities into a separate firm dubbed A Capital Holding with the intention of listing it on the bourse, it said in an EGX disclosure (pdf).

MANUFACTURING–

China’s Jushi has started operations at its new USD 320 mn fiberglass production line, upping the capacity of its factory in the TEDA trade zone to 250k tons from 50k tons, the Suez Canal Economic Zone said in a statement Friday.

SCZone head Walid Gamal El Din plans to visit China in 1H 2023 to promote investment in local green fuel feeder industries, he told Chinese Ambassador to Cairo Liao Liqiang at the inauguration of the Jushi production line.

Cooperation with Malaysia on our vegetable oil localization drive: The Egyptian Commercial Service is in talks with Malaysian authorities to build a USD 30 mn palm oil processing factory in the Suez Canal Economic Zone for export to the African continent, Al Borsa reports. A USD 10 mn bottling plant would be built in a first phase, with a USD 20 mn refinery to follow. Malaysia is one of the world’s biggest producers of palm oil.

PHARMA-

Rameda Pharma acquired the exclusive rights to sell nasal decongestant spray Physiomer in Egypt, in what it says is a “strategic entry point into the medical devices segment,” according to a statement (pdf) yesterday.

PLANET FINANCE

Global markets were shaken yesterday after the Bank of Japan announced (pdf) a surprise loosening of its “yield curve control” policy, triggering sell offs in the global bond and equity markets and sending the JPY soaring more than 4% against the greenback, the Financial Times reports.

What happened? The central bank said it will allow yields on long-term bonds to rise to 0.5% from 0.25%, an abrupt switch in its radically-loose monetary policy that has for years suppressed yields in a bid to end the country’s chronic low inflation problem. This position has become increasingly untenable amid a wave of monetary tightening around the world that has sent the JPY plunging to its lowest level in more than 30 years.

BOJ chief Haruhiko Kuroda pushed back against the idea that the central bank had tightened policy but that’s not how markets interpreted the move, with Japanese equity and bond markets seeing heavy sell-offs and the JPY notching its biggest one-day gain in years. The news fed through to the global markets too, with global bond yields rising and shares across much of the world ending in the red.

This could be a good thing for the rest of the world: The move could put further downward pressure on the greenback, which will be welcome news to Egypt and much of the rest of the world which has struggled to deal with a rampaging USD this year.

But then again…: A heavy sell-off in USD assets in favor of the JPY wouldn’t be great news for global financial markets.

Saudi wealth fund wants a piece of Tabreed’s local unit: The Public Investment Fund (PIF) is reportedly in talks to buy a USD 250 mn stake in the Saudi arm of Dubai-listed district cooling firm Tabreed, Bloomberg reported yesterday. The transaction would hand it a “significant holding” in the company ahead of a potential IPO in the next 24-36 months, the news outlet reported, citing people familiar with the matter. Tabreed has been expanding aggressively in the region and entered the Egyptian market earlier this year.

Western sanctions are already inflicting pain on Russia’s oil sector: Seaborne exports of Russian crude plunged 54% in the first week after the introduction of the G7 price cap, according to Bloomberg.

|

|

EGX30 |

14,523 |

-1.5% (YTD: +21.5%) |

|

|

USD (CBE) |

Buy 24.68 |

Sell 24.77 |

|

|

USD at CIB |

Buy 24.68 |

Sell 24.75 |

|

|

Interest rates CBE |

13.25% deposit |

14.25% lending |

|

|

Tadawul |

10,280 |

+0.9% (YTD: -8.9%) |

|

|

ADX |

10,343 |

-0.2% (YTD: +21.9%) |

|

|

DFM |

3,348 |

+0.3% (YTD: +4.8%) |

|

|

S&P 500 |

3,822 |

+0.1% (YTD: -19.8%) |

|

|

FTSE 100 |

7,371 |

+0.1% (YTD: -0.2%) |

|

|

Euro Stoxx 50 |

3,802 |

-0.2% (YTD: -11.5%) |

|

|

Brent crude |

USD 79.74 |

-0.1% |

|

|

Natural gas (Nymex) |

USD 5.35 |

-8.6% |

|

|

Gold |

USD 1,818.07 |

+1.7% |

|

|

BTC |

USD 16,870 |

+1.7% (YTD: -63.5%) |

THE CLOSING BELL-

The EGX30 fell 1.5% at yesterday’s close on turnover of EGP 2.36 bn (54.5% above the 90-day average). Local investors were net buyers. The index is up 21.5% YTD.

In the green: Palm Hills Development (+10.8%), Telecom Egypt (+4.9%) and Juhayna (+3.0%).

In the red: Mopco (-4.2%), EFG Hermes (-4.1%) and Elsewedy Electric (-3.9%).

It’s a mixed picture in Asia this morning: Shares in China and Hong Kong are the green but the Nikkei is continuing to feel the effects of the Bank of Japan’s policy switch yesterday and is down 0.7%. Shares in Europe and the US are expected to rise later today.

DIPLOMACY

El Sisi attends Iraq-focused Middle East summit in Amman: President Abdel Fattah El Sisi was in Jordan yesterday to attend a summit organized by France to provide international support to Iraq. “Egypt affirms its rejection of any external interventions in Iraq's affairs and reiterates the importance of continuing joint efforts to enhance the capacity of the Iraqi state’s institutions,” El Sisi said during his speech at the summit, echoing statements made by French President Emmanuel Macron. The Baghdad II gathering follows a similar meeting in Iraq last year, and aims to “provide support for the stability, security and prosperity of Iraq,” the French presidency said in a statement picked up by AFP.

On the sidelines:

- Egypt x Jordan x Iraq: Leaders from the three countries discussed regional issues including instability in Iraq, and issues of trilateral cooperation including energy and food security. (Ittihadiya | Jordan News Agency)

- El Sisi x Abdullah: The two leaders discussed recent developments in Palestine and other regional issues. (Jordan News Agency)

- El Sisi x Macron: The president held talks with Macron on supporting Iraq, “bilateral relations … and regional and international issues,” Ittihadiya said without providing further information.

** Baghdad III will be held in Egypt, Jordanian Foreign Minister Ayman Safadi said yesterday.

AROUND THE WORLD

Tunisia will hold a runoff vote for seats in its legislative assembly in February 2023, after a vast majority of seats (131 out of 161) remained undecided following Saturday’s elections, Bloomberg reports. Almost 90% of eligible voters refused to cast ballots in the vote, triggering fresh calls by opposition groups for the resignation of President Kais Saied, who they accuse of a power grab.

EU-Qatar bribery scandal spreads to global trade union body: The head of the International Trade Union Confederation (ITUC) has resigned less than a month after entering office after admitting to receiving cash donations from a former MEP at the center of a corruption scandal, according to the Financial Times.

Year in review: The biggest headwinds infrastructure players faced in 2022: Over the past year practically no infrastructure player across has been spared from the pressures of soaring commodity prices, inflation, import restrictions and the devaluation of the EGP. How hard they’ve been hit varies by sector but for most, the consequences of a tough macroeconomic environment have been far reaching in 2022.

Early in the year it became clear that infrastructure players were up against some serious challenges amid a turbulent macro environment: By 2Q 2022, soaring prices of commodities and building materials, rising global interest rates, and volatility in international financial markets saw USD 20 bn in portfolio outflows from Egypt. Contractors were especially hard hit due to import restrictions that significantly hindered many businesses’ access to building and raw materials essential for their operations. Some 10-20% of real estate developers have at some point halted their construction projects this year due to fiscal and logistical pressures, sources have previously told us. Some have even sold off projects before starting construction.

Inflation was among the most significant challenges infrastructure players have had to grapple with: As the Central Bank of Egypt (CBE) in March took measures to keep the fallout from Russia’s war in Ukraine in check, including an out-of-schedule rate hike, the EGP slid 16% against the USD by the end of March, delivering a painful blow to infrastructure players. By November, inflation had continued to accelerate, reaching a five-year high of 18.7% on the back of the CBE’s decision to float the EGP at the end of October, which caused the currency to lose c.25% of its value against the greenback.

This of course has led expenses skyrocketing for most companies: Telecom providers, digital payments providers, and real estate developers have throughout the year come under increasing pressure from mounting input costs. In real estate development, the effect has been particularly pronounced with the cost of embarking on a new project in August having risen by an estimated 40% since the start of the year due to weak exchange rates, high financing costs, higher construction materials prices, and more labor costs.

Russia’s war in Ukraine still had a hand in all this: Though it might seem like a distant memory, Russia’s invasion of Ukraine in February has been a culprit in the uptick of commodity prices and oil prices at the start of the year. Local clay brick prices went up 10% in the wake of the war in Ukraine while cement price inflation averaged at about 70-100% immediately after Russia’s invasion, according to industry insiders we’ve previously spoken to. The economic fallout from the war in Ukraine was also closely linked to the rationale behind the CBE hiking interest rates in March — which ultimately caused further cost pressures on infrastructure players.

Higher interest rates globally were responsible for an extra pinch: Developed markets have continued to see high interest rates in response to inflation and fiscal uncertainty around the world throughout 2022. Higher rates have led to a squeeze in foreign-currency liquidity in the banking system and caused Egypt's FX reserves to fall.

Our natural gas price hike has played a role. The government earlier this year enforced price increases on natural gas supplied to cement producers and brick kilns in a bid to direct more gas to export to build up the country’s reserves of much-needed FX. The move raised the price of natural gas to cement manufacturers to USD 12.00 /mmBtu, from USD 5.75 / mmBtu in. Brick kilns have been charged EGP 110.00 / mmBtu, up from EGP 73.00 / mmBtu.

So has the price of coal: The price of coal, which is used by some 16 out of 18 cement companies, has risen more than 5x during the past year, industry players have told us. The price increase remains significant for cement producers whose energy bills make up some 70% of their expenses.

Your top infrastructure stories for the week:

- Ministers have awarded a golden license for a USD 5.5 bn green ammonia plant in Ain Sokhna.

- Beni Suef dry port up for grabs: The General Authority for Land and Dry Ports will launch a tender for the management and operation of the Beni Suef dry port next year.

- More subsea cables: Telecom Egypt and Greek telecoms company Grid Telecom signed an agreement to lay a subsea data cable across the Mediterranean.

CALENDAR

DECEMBER

19-20 December (Monday-Tuesday): The Arab Administrative Development Organization’s conference on Modern Methods in Hospital Management, Cairo.

20 December (Tuesday): EGX-listed Pachin will brief shareholders on offers received to acquire the company in an ordinary general assembly.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

25 December (Sunday): Senate back in session.

31 December (Saturday): E-invoicing registration deadline.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

January: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

2 January (Monday): House back in session.

7 January (Saturday): Coptic Christmas.

24 January-6 February: Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): President El Sisi will visit India as “chief guest” at celebrations to mark the 74th anniversary of Indian independence.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

1 April (Saturday): Deadline for banks to establish sustainability unit.

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

30 April (Sunday): Deadline for self-employed to register for e-invoicing.

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday): National holiday in observance of Labor Day (TBC).

4 May (Thursday): IEF-IGU Ministerial Gas Forum, Cairo.

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

10 June (Saturday): Thanaweya Amma examinations begin.

19-21 June (Monday-Wednesday): Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

End of December/early January: SFE’s pre-IPO fund to kick off roadshow.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q 2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

End of 2022: Decent Life first phase scheduled for completion.

2023: The inauguration of the Grand Egyptian Museum.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q 2023: Internal trade database to launch.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.