- COP27 starts today — here’s what you need to know. (COP Watch)

- The global climate summit is all the nation’s talking heads could talk about last night. (Last Night’s Talk Shows)

- COP27 in the international press: Is there hope for agreement on loss and damage? (Egypt in the News)

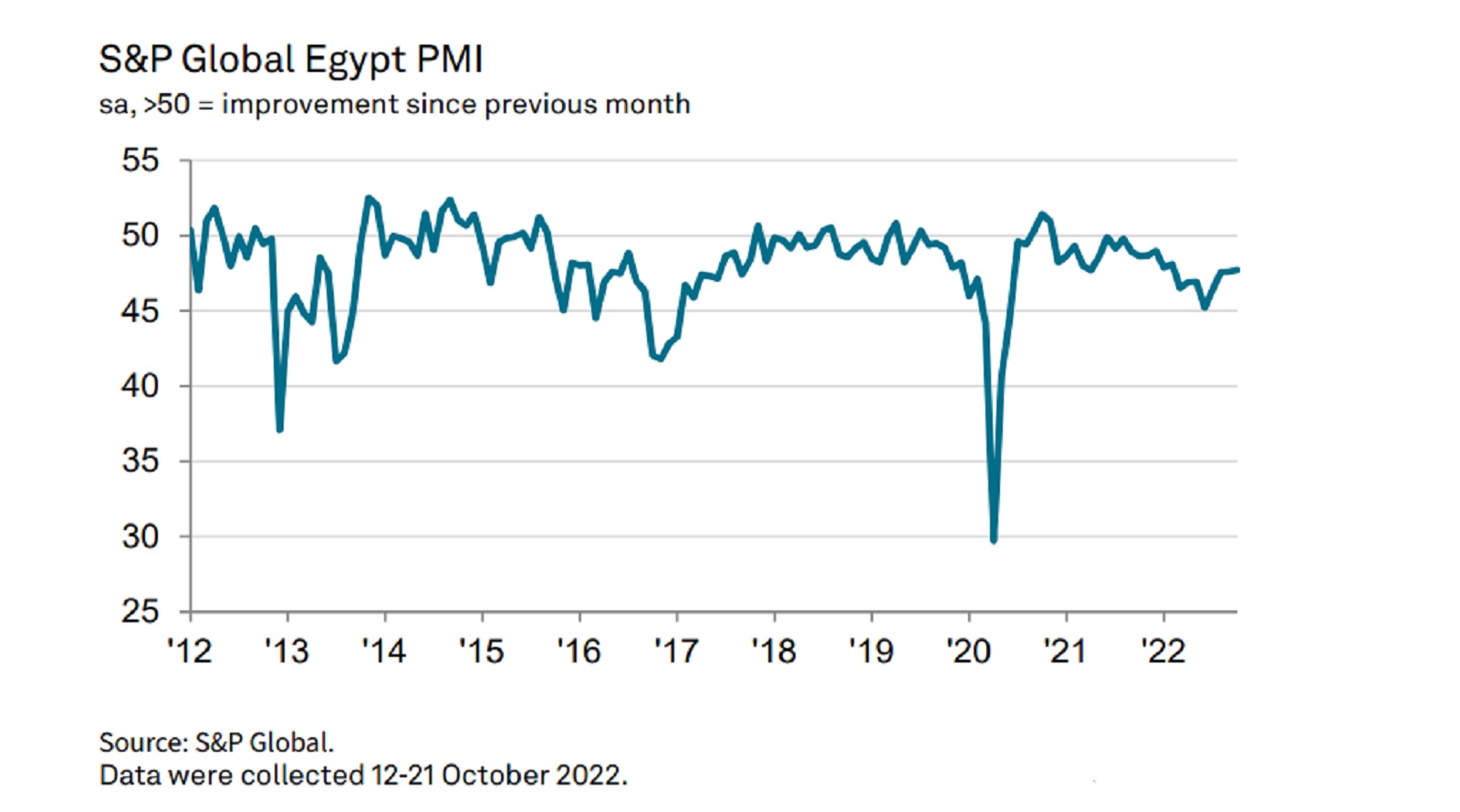

- Business activity in the private sector contracts for 23rd consecutive month. (Economy)

- UAE’s National Paints makes play for Pachin. (M&A Watch)

- Key shareholders aren’t happy about the Capricorn-NewMed tie-up. (M&A Watch)

- Foreign reserves stable in October. (What We’re Tracking Today)

- Banks face new reporting requirements under new CBE sustainable finance regs. (Banking)

- Empower expands IPO on high demand (again). (Planet Finance)

Sunday, 6 November 2022

AM — It’s COP o’clock, folks

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to day one of COP27 as the eyes of the world swivel to Sharm El Sheikh for the kickoff of the UN climate summit.

The big show starts on Monday with the world leaders’ summit, which includes roundtables on climate and development finance, the future of energy, and water security, among other issues. President Abdel Fattah El Sisi will be in Sharm tomorrow to inaugurate the summit. Some 40k people have registered to attend.

So, what’s happening today? It’s the official opening. COP26 President Alok Sharma, COP27 President Sameh Shoukry, IPCC Chair Hoesung Lee, and United Nations Framework Convention on Climate Change (UNFCCC) executive secretary Simon Stiell, will open the conference in a session at 10am CLT. A number of other groups will hold closed-door meetings, including the Arab and African groups, groups representing low-income and developing countries, and non-governmental organizations. You can check out the full agenda for the day here (pdf).

We have a primer on what you can expect below in this morning’s news well. COP features heavily on our roundup of Last Night’s Talk Shows and is driving the conversation on Egypt in the international press.

The gathering will dominate the news cycle here in Egypt through 18 November, though you can expect interest (and announcements) from the business community to rise and fall depending on the “theme” of the day. Major corporate backers of the gathering include our good friends at Infinity Power, Orascom Construction, SODIC, Mashreq Bank and Hassan Allam.

EGP WATCH- The EGP slightly slipped again against the greenback on Thursday, ending the day down 0.3% to trade at EGP 24.3158, according to central bank figures. The currency has now fallen by 23.0% since the CBE’s move towards “a durably flexible” exchange rate at the end of October. It is now down 54.1% since the initial devaluation in March.

PM sings the praises of a flexible exchange rate: Exchange rate flexibility will “help boost exports by making them more competitive — and make [pure] imports less attractive,” Prime Minister Moustafa Madbouly said in a letter to officials leading the National Dialogue, who met yesterday. The PM said his government aims to double tourism revenues to USD 30 bn “over the next few years” through a variety of means including more flights and yacht tourism.

Madbouly expects the impact of inflation to be transitory and said his government expects to see local production of wheat rise to 5 mn tons as the state raises the price it pays for local wheat in the 2023 growing season.

WATCH THIS SPACE #1- Last month’s Egypt Economic Conference generated 125 recommendations and the government will set up a committee to implement them, Madbouly said. A digital platform will be set up allowing public participation, he said, without elaborating. Madbouly didn’t provide any information on what the recommendations are or when they could be implemented.

IN BRIEF-

DATA POINT #1- Egypt’s net foreign reserves inched up to USD 33.4 bn in October from USD 33.2 bn in September, according to central bank data out Thursday.

DATA POINT #2- We’re exporting more natural gas. Egypt’s LNG exports rose to 1.5 bn cubic feet per day starting November, up from 700 mn cubic feet per day in September, an unnamed Egyptian Natural Gas Holding Company (EGAS) official told Bloomberg Asharq.

SUNDAY MORNING KUDOS- The US and Egypt inaugurated the restored British archaeologist and Egyptologist Howard Carter’s house during the centennial ceremony of the discovery of King Tut’s tomb, according to a US statement. The restoration was funded through our friends at USAID.

PSA #1- Got a complaint about an NBFI? There’s a website for that. The Financial Regulatory Authority (FRA) has launched a demo version of an online portal the public can use to submit complaints about non-bank financial service providers, it said in a statement (pdf).

Want to complain? You’ll need to set up an account and provide the FRA with your national ID and contact details.

PSA #2 + CORRECTION- Clocks fall back one hour in much of North America today, meaning New York, Boston and Toronto will be seven hours behind us — not five, as we wrote on Thursday. The story has since been updated on our website; we can only plead sleep deprivation. H/t Beverly C. and Karim M.

THE BIG STORIES ABROAD-

Americans voters head to the polls in the US midterms on Tuesday: All 435 seats in the House, 35 of 100 Senate seats, and 36 of 50 state governor positions are up for grabs in a landmark election that will test the mettle of the Biden presidency and set the tone for the 2024 presidential race. Republicans have a non-zero chance of taking the House and the Senate. Polls in the key swing states that will decide who controls the Senate suggest that the race remains too close to call, according to Politico. (AP | NYT | The Guardian | CNN)

AND- Twitter is everywhere in the global press this morning after the social media platform began charging users USD 8 for the coveted “blue checkmarks,” the first major change made by Elon Musk. The company also dominated the news flow over the weekend after the company’s new owner and CEO began laying off as many as half of its workforce/ (Associated Press | Reuters | Bloomberg | WSJ).

MEANWHILE- How much have US oil companies made from the 2022 oil shock? More than USD 200 bn, according to the Financial Times.

|

HAPPENING THIS WEEK-

The Techne Summit continues at the Bibliotheca Alexandrina today, bringing together entrepreneurs and investors from various sectors in the Mediterranean region. The global multi-industry gathering runs until Tuesday as a hybrid event.

New int’l wheat tender: State grains buyer GASC is seeking an unspecified amount of wheat in an international tender this week, Reuters reported. The deadline for offers has been set for Monday, 7 November, it said. Shipping is set for 15-30 December and/or 1-15 January.

CIRCLE YOUR CALENDAR-

WATCH THIS SPACE #2- Russian oil price cap soon: A price cap on Russian oil will be finalized and announced by the G7 later this month, Reuters reported. The news comes following weeks of negotiations between the US and G7 countries over the plan, which is expected to come into force on 5 December. “The coalition has agreed the price cap will be a fixed price that will be reviewed regularly rather than a discount to an index,” a source told the newswire.

Fifteen global green startups will pitch at COP27 as part of the government’s ClimaTech competition: The International Cooperation Ministry has selected its 15-strong shortlist from the 422 startups that applied to the ClimaTech Run competition — which is supported by our friends at USAID through their Business Egypt program. Finalists will pitch their businesses to a judging panel composed of top UN officials as well as representatives of Afreximbank, Microsoft, and Google during the climate summit’s Youth Day, the ministry said last week.

The Knowledge Hub Universities and Nova University Lisbon’s newly inaugurated Cairo campus will host the QS Reimagine Education awards and conference from 6-7 December. The hybrid event will also take place online and at the Wharton School campus in Pennsylvania, and offers awards of up to USD 50k for innovative projects in higher education.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

2CELLOS — LIVE AT SOMABAY on 18 November, 2022: Mark your calendars — world-renowned and wildly popular cellist duo, 2CELLOS will be performing at Somabay on 18 November, 2022. Having racked up a bn-plus audio streams, countless sold-out concerts, and mns of fans across the globe in their 10 years together as 2CELLOS, the Croatian duo of Luka Šulić and HAUSER will be visiting Egypt in their long-awaited 2022 Dedicated World Tour. Book your ticket now: https://www.ticketsmarche.com/tickets/buy-tickets-2-cellos.html. Call us 16390.

COP WATCH

It’s COP o’clock — here’s everything you need to know

Everything you need to know as COP27 kicks off: Today is the first day of the two-week UN climate summit and Sharm El Sheikh is glowing green as it welcomes over 40k participants who registered to take part in the event.

More than 120 world leaders will attend this year’s COP, special representative for the COP27 presidency Wael Aboulmagd told reporters over the weekend, the Associated Press reports. That includes US President Joe Biden who will be in Sharm El Sheikh on 11 November.

Several key figures will be absent: Neither Chinese President Xi Jinping, Indian Prime Minister Narendra Modi, nor Russian President Vladimir Putin are listed on the provisional list of speakers, while Canadian PM Justin Trudeau, and Australian PM Anthony Albanese have confirmed that they will not attend.

Theme #1 of this year’s COP: Doing, not talking. Implementation is the main theme for this year’s COP, Aboulmagd said (watch, runtime: 8:59), adding that it is time to start executing the Paris Agreement and other previously agreed climate pledges. “It's fine to show good intentions and get the headline. But if there's no follow-up, it becomes empty words and people start losing confidence in the entire process,” he told S&P Global, regarding the global pledge agreed at last year’s COP to reduce methane emissions by 30% by 2030.

Theme #2: Leave politics at the door. “It has to be a watershed moment where the world rises above differences that exist outside of the realm of climate change to come together to address what is perhaps the most universally acknowledged threat to humanity,” Aboulmagd said. This comes amid rising tension between the US and China and further escalations in Russia’s war with Ukraine. “Everyone is now aware of the gravity of the situation, of the enormity of the challenge, and have come here hopefully to work together,” he added.

Theme #3: Climate finance for those on the frontlines. Developed nations have so far failed to fulfill their financing commitments to poorer countries, Aboulmagd said, adding that developing nations need tns of USD in financing and getting them to fund it through debt is not sustainable. Funding, including compensation for loss and damage, has been a major topic for policymakers we’ve spoken with in the run-up to the summit, including Egypt climate czar Mahmoud Mohieldin (here and here).

The World Bank weighed in with climate finance advice ahead of the summit: Developing countries can cut their emissions by 70% by 2050 if they invest an average of 1.4% of their annual GDP — a “manageable amount with appropriate private sector involvement,” the World Bank said in its latest climate change and development report (pdf), which looks at how climate change impacts development goals in 20 developing countries. But low-income countries will need financing from richer economies in order to cover their investment needs for climate action, which in some cases amount to more than 5% of their GDP, the bank notes.

Theme #4: Energy security. Each country needs to balance decarbonization targets with ensuring access to energy, Aboulmagd said, pointing to the role of gas as an increasingly accepted ‘transition fuel.’ He asserted developing nations’ right to continue to exploit fossil fuels as they push for growth, but added that it’s not constructive to pitch the debate as a battle between developed countries’ climate goals and developing countries’ need for growth.

Will there be protests? Global media has been banging the drum about the likelihood of Egypt refusing to allow protests at COP, but AP reports that “Aboulmagd said activists will get their space, with special arrangements already put in place ‘for those who want to organize demonstrations or protests or stand-ins.’” A large rally midway through the talks “will be taken care of” if organizers “submit the names of contact persons” and agree the protest march route with Sharm city officials, Aboulmagd added.

US Secretary of State Anthony Blinken called on Egypt to allow civil society groups to participate in COP27 during a phone call with Foreign Minister Sameh Shoukry, according to a State Department readout of the conversation. The US’ top diplomat said Egypt had made “tangible progress” on human rights but called on the government to continue to pardon detainees and improve due process. Shoukry said that authorities will allow NGOs and representatives from the private sector to participate in the summit, the Egyptian Foreign Ministry said.

KEY DATES-

- World leaders’ summit: 7-8 November

- Finance day: 9 November

- Decarbonization day: 11 November

- Adaptation and agriculture day: 12 November

- Water day: 14 November

- Energy day: 15 November

PARALLEL EVENTS-

- Saudi Arabia’s Middle East Green Initiative: 7 November

- Terra Carta Action Forum organized by the Prince of Wales’ Sustainable Markets Initiative: 7-8 November

- COP27 Leaders’ Event: Accelerating Adaptation in Africa: 8 November

- ClimaTech Run competition pitch day, brought to you in association with USAID: 10 November

- Saudi Green Initiative event: 11-12 November

- UNFCCC’s capacity building hub

OUR GREEN HYDROGEN + LNG EXPORT AMBITIONS-

We could be exporting more LNG to Germany and getting hold of green hydrogen tech: Two declarations of intent signed between Egypt and Germany could see Berlin increase imports of Egyptian LNG and share technology for producing green hydrogen, the German government and the Egyptian Oil Ministry said Thursday.

The details: The first agreement will see knowledge exchange on green hydrogen including the localization of German technology, cooperation on specific green hydrogen projects, and the promotion of joint investment and research to help build our nascent green hydrogen sector. The second agreement could see us export more LNG to Germany as Berlin continues to search for new suppliers to replace Russian gas.

SMART GREEN GOVERNORATES SHORTLIST-

The local green projects that will present at COP: The government’s Smart Green Governorates initiative has selected its 18-project shortlist to be presented for funding at COP, it said Friday. The projects all use technological solutions to address environmental issues and were chosen based on their feasibility, scalability and impact. They include e-scooter startup Rabbit Mobility and the early warning climate system initiative. The projects were picked by a jury including UN High-level Climate Champion for Egypt Mahmoud Mohieldin and other senior officials and climate experts. We sat down with the initiative’s coordinator, Hisham Badr, last month to find out more.

LEGISLATION ON CLIMATE ADAPTATION?

Egypt might be getting its first legislation of its kind on climate adaptation after Rep. Amira Saber submitted a draft bill on the topic, Al Shorouk reported. Saber said she submitted the bill to underscore that policymakers are serious about climate change and lining up funding for green economy projects. The bill targets addressing shortcomings in the country’s existing environmental legislation, she said.

Climate neutrality by 2050? The bill sees the state committed to achieving climate neutrality by 2050, with substantial action that includes a comprehensive survey for all state institutions to measure their carbon footprint by no later than December 2023. It also seeks the establishment of a non-governmental advisory committee at the National Council for Climate Change and a monitoring and reporting unit at the council.

OTHER COP NEWS:

- EgyptAir goes green: EgyptAir yesterday flew COP delegates into Sharm El Sheikh from Paris on its first commercial flight to use “sustainable aviation fuel,” in cooperation with Neste. (Statement)

- Who’s keeping the lights on during COP? Infinity Power, a JV between our friends at Infinity and UAE’s Masdar, said its 6 MW solar plant in Sharm is now operational. (Statement) Maintenance contractor Gila Al Tawakol and Intro Group’s Intro Sustainable Resources added another 5 MW of capacity to their solar power plant in Sharm El Sheikh, which will power COP conference rooms. (Statement, pdf)

- COP31? Australia will bid with Pacific nations to host the climate summit in 2026. (Reuters)

ECONOMY

Private sector activity contracts for 23rd consecutive month

Activity in Egypt’s non-oil private sector continued to contract in October, remaining effectively unchanged from the month before as inflation, supply disruptions, and falling demand abroad continued to weigh on businesses, according to S&P Global’s purchasing managers’ index (pdf). The PMI index registered 47.7 last month, climbing just 0.1 points from September and remaining firmly below the 50.0 threshold that separates growth from contraction.

It has been a long time since we saw growth: This is the 23rd consecutive month that activity in the private sector has been in contraction.

October’s contraction was attributed primarily to inflation + supply issues: Inflationary pressures, fueled by import controls imposed by the Central Bank of Egypt earlier this year and a weakening EGP, “meant that a number of businesses again struggled to acquire relevant inputs.” The cost pressures eased somewhat last month, but “the rate of input cost inflation was still sharp and above the series trend.” These cost pressures led to lower output rates and weakening consumer demand, S&P Global notes.

Sentiment hits record low: Business optimism fell sharply to its lowest level since the series began more than a decade ago, with just 4% of those surveyed saying they are confident of growth over the next 12 months. That drop in confidence also led firms to make layoffs, according to the survey. That’s off the mark from our Fall 2022 Reader Survey, which showed almost half of respondents anticipating that 2023 will bring better conditions for the business community.

The release got coverage internationally: Reuters | Zawya | Arab News.

FROM THE REGION-

The UAE’s non-oil private sector saw “robust” growth in October, with the PMI (pdf) rising to 56.6 from 56.1 in September, which S&P Global notes is just shy of August’s three-year high of 56.7. A pickup in purchasing activity led firms to recruit at the fastest pace in more than six years, while reduced transport and fuel costs allowed businesses to lower their output prices.

Saudi Arabia’s non-oil private sector expanded at a quicker pace in October, with its PMI (pdf) recording 57.2 from 56.6 a month earlier. The growth came on the back of strong demand and output.

M&A WATCH

UAE’s National Paints wants Pachin

UAE’s National Paints makes play for Pachin: Dubai-based National Paints Holdings (NPH) has launched a takeover bid for Paint and Chemical Industries (Pachin), becoming the third company this year to express interest in acquiring the state-owned firm. NPH has submitted a non-binding offer to purchase 100% of Pachin for EGP 29 per share, the Egyptian paint company said in an EGX disclosure (pdf) Thursday. The offer values the EGX-listed company at EGP 696 mn.

No final price yet: Pachin said NPH made the start of due diligence a condition of determining a final price. Pachin said it is currently reviewing the offer with advisor Al Ahly Pharos.

NPH’s initial offer is far higher than what two existing bidders had put on the table: Universal Building Materials and Chemicals (Sipes) has offered to purchase 100% of the company at EGP 17.50-18.50 per share. Before it dropped its bid, Saybad Industrial Investment had offered to pay EGP 16.50-18.75 per share, valuing the firm at up to EGP 450 mn.

NPH wants to be big in Egypt: NPH wants to acquire Pachin to “deepen and expand its position” in Egypt, and aims to eventually become the market leader, the company wrote in its offer letter to Pachin.

REMEMBER- The play for Pachin comes amid the government’s privatization push, which should see it reduce its involvement in or exit certain industries to make way for the private sector. Pachin is currently approximately 54% owned by state-owned companies and banks.

Advisors: Al Ahly Pharos is providing financial advice to Pachin while Adsero-Raji Soliman & Associates is counsel.

CAPRICORN SHAREHOLDERS COULD TANK NEWMED TIE-UP-

Major shareholders in Capricorn aren’t happy about the proposed NewMed merger: Six shareholders of Capricorn Energy have spoken out publicly against plans to sell the firm in an all-share tie-up with Israel’s NewMed, Reuters reports. The investors are seeking to block the transaction, which they say undervalues Capricorn.

Bad news for us? The Capricorn-NewMed merger would hand NewMed control of Capricorn’s assets in Egypt, paving the way for closer energy ties between Israel and Egypt and creating what the companies had described as a “MENA gas and energy champion.” That could boost Egyptian ambitions to take Russia’s place as one of Europe’s go-to energy suppliers, particularly after Egypt and Israel signed a landmark gas export agreement in June to ramp up exports to the EU.

The shareholders control more than a third of the company, and include the firm’s second-largest shareholder, Madison Avenue Partners, which holds an 8.06% stake.

What’s the issue? The co-chief investment officer of Kite Lake Capital Management, which owns almost 7.4% of Capricorn, said the terms are “unnecessarily biased” towards NewMed while Madison Avenue believes the transaction undervalues the business. The head of climate solutions at Legal & General, which owns almost 4% of the company, said that “we are not convinced that this proposal is the best path forward to maximize shareholder value and minimize future environmental risks.”

This wouldn’t be the first time: This is the second time Capricorn shareholders have revolted against management’s sale plans, after scuppering a proposed merger with Tullow Oil earlier this year.

BANKING

CBE issues binding regulations for sustainable finance for banks

It’s time for more responsible banking: The Central Bank of Egypt issued binding regulations designed to promote sustainable finance in the banking system in a circular (pdf) released Thursday.

According to the rules, banks will be required to:

- Establish an independent unit for sustainability and sustainable finance by 1 April 2023;

- Submit periodic reports, including a quarterly report on sustainable finance activities, and a yearly sustainability report no later than 31 March of each year, starting 2024;

- Hire an environmental consultant certified by the Environment Ministry to assess environmental risks for major projects seeking funding starting July 2023;

- Incorporate sustainable finance policies into lending and investment policies.

The new regulations come as part of efforts to achieve sustainable development goals. The CBE said it saw a “necessity in issuing a binding framework to bolster sustainable finance activities in banks” following a survey. The issuance of the regulations comes a little over a year after the CBE announced guiding principles for the strategy.

SUEZ CANAL

SCZone might be getting an investment arm

SCZone to get investment arm? The Suez Canal Economic Zone (SCZone) plans to establish an investment company to channel finance into projects being established in the zone, SCZone head Walid Gamal El Din said Saturday, without providing further information.

This isn’t the same thing as the Suez Canal Authority’s new fund: Ministers in July approved plans to allow the Suez Canal Authority (SCA) to set up a EGP 10 bn investment fund. Neither the government or the SCA has disclosed how this money will be used, saying only that it will be deployed to support the authority’s economic development.

This is part of a package of measures designed to boost FDI inflows that was approved by the SCZone board yesterday. Among them: New investment incentives and an SCZone investors’ association, the statement said, without disclosing details. The board also discussed ambitions to establish the zone as an “offshore global financial center.”

A green energy hub: The board also discussed its strategy to turn the SCZone into a regional hub for clean energy such as green hydrogen and green ammonia. The authority is expected to sign a number of agreements with international companies to establish green hydrogen and ammonia plants at the COP27 climate summit this month. Initial agreements worth some USD 33 bn have been signed this year, the most recent of which was with Maersk for a huge USD 15 bn facility capable of producing 3 mn tons of fuel a year.

EARNINGS WATCH

MNHD income more than doubles in 9M 2022 + CIB’s bottomline rises 16% in 3Q 2022

Madinet Nasr Housing and Development’s (MNHD) net income was up 112% to record EGP 545 mn in the first nine months of 2022, according to the company’s earnings release (pdf). Revenues were up 129% to EGP 3.0 bn for the nine-month period. The strong results came on the back of a sharp rise in the number of units delivered to more than 1.1k, up from 570 in the same period last year.

A solid 3Q: Revenues almost tripled to hit EGP 1.2 bn in 3Q 2022 while net income was up more than twelvefold to EGP 308.1 mn during the quarter. MNHD delivered some 281 units in the third quarter of 2022.

MNHD’s gross contracted sales recorded EGP 6.7 bn in 9M 2022, up 218% on the same period last year, and rose more than fivefold in 3Q 2022 to EGP 3.3 bn. Sales growth in the first nine months was supported by the launch of MNHD’s Taj Ville and Elect projects in Taj City.

Steady as she goes: CEO Abdallah Sallam expects the company to maintain current profitability in the coming quarters. “We’re reaping some of the benefits of [action] done in Q1 and Q2, including resolving things related to distressed clients and cancellations, restoring confidence through new campaigns, strategies in dealing with clients and new launches,” he told CNBC Arabia (watch, 7:31).

CIB’s net income rose 16% y-o-y to EGP 4.4 bn in 3Q 2022, according to the bank’s latest earnings release (pdf). The bank recorded revenues of almost EGP 8.5 bn, up 18% from the same period last year, backed by a 25% rise in net interest income. In the first nine months of the year, net income rose 24% to EGP 12.2 bn while revenues were up 17% to EGP 23.1 bn.

CIB bank reported growth in both loans and deposits and delivered improved margins in 3Q, noting that “despite competitive environment,” margins could continue to strengthen “as interest rates continue to rise and reinvestment of the portfolio occurs.” Notably, the proportion of non-performing loans in CIB’s portfolio has decreased over the year despite challenging market conditions. Management said it is “optimistic, though cautiously so” about the economic outlook in the wake of the float of the EGP and the announcement of a staff-level agreement on an IMF facility.

MOVES

Oil Minister Tarek El Molla appointed new heads to a number of state-owned oil and gas companies including Suez Oil Company, Fanar Petroleum Company (Fanpetco), and Fajr Egypt, the Oil Ministry said Friday.

Higher Education Minister Ayman Ashour has announced the appointment of new leaders at several public universities, the ministry said in a statement Saturday.

LAST NIGHT’S TALK SHOWS

It was all about COP27 yesterday on talk shows: On the eve of the global climate summit, the nation’s talking heads recapped the issues at stake and how the government has prepared for the gathering. Kelma Akhira’s Lamees El Hadidi was broadcasting live from Sharm: she spoke about the preparations, the agenda for the summit and what to expect (watch, runtime: 10:02), and talked to Foreign Minister and COP27 President Sameh Shoukry, Egypt climate czar Mahmoud Mohieldin, and Environment Minister Yasmine Fouad.

Shoukry emphasized the importance of implementing previous climate pledges: “The world is facing extraordinary circumstances, but the climate change issue is one that will continue with us for years to come,” he said (watch, runtime: 4:02).

Mohieldin stressed that climate finance will, if we get it right, help bring in more jobs and boost economic growth (watch, runtime: 5:04). Climate finance isn’t a luxury, Mohieldin said: Egypt is among the countries most sharply impacted by climate change, despite our low emissions.

Egypt will announce a voluntary carbon market during the summit, Fouad told El Hadidi (watch, runtime: 5:20). The market would stimulate the private sector to slash emissions and sell carbon credits, she said. The minister highlighted the role of the country’s strategy for climate in attracting investments by the private sector. “If we drift away from where the world is heading [in terms of sustainability], our economy will not rise,” she said.

El Sisi to inaugurate the summit tomorrow: President Abdel Fattah El Sisi is set to use his opening address tomorrow to present a roadmap aimed at turning previous climate pledges into realistic and concrete solutions, El Hadidi said.

Also getting a mention: The National Dialogue’s board of trustees meeting to discuss the

Economic Conference’s recommendations got coverage from Al Hayah Al Youm (watch, runtime: 1:15).

EGYPT IN THE NEWS

COP27 is dominating the conversation on Egypt in the foreign press this morning as the global climate summit gets underway today. The questions on most people’s lips ahead of the start of the conference: can the developed and developing worlds come to an agreement on who pays? Many outlets are focusing on the critical question over “loss and damage” this morning including the Financial Times, AFP, Sky News and the Guardian.

MEANWHILE- Bloomberg, the Associated Press, the New York Times, and CNN are all focusing on whether climate activists will have room to operate, while the Independent argues that sky-high hotel rates are pricing out people from developing nations.

Tellimer’s equity research chief isn’t convinced by the IMF program: While the recently-agreed USD 3 bn IMF loan will help Egypt rebuild its foreign reserves, the IMF didn’t go far enough in pushing for deeper structural reforms that could break Egypt’s cycle of economic crises, Tellimer’s’ head of equity research, Hasnain Malik, tells Bloomberg TV (watch, runtime: 5:48).

Float or just another deval? Malik casts doubt on whether the EGP is now operating on a truly flexible exchange rate, calling last month’s depreciation “a big devaluation to a new managed float” and expressing disappointment that the Fund didn’t force through flexibility.

Pushing for private-sector growth: Malik also wanted to see the IMF be more assertive in forcing the government to roll back the state- and military-owned enterprises from the economy and stimulate private-sector growth. “Without fixing that systemic problem, all we’ve done is started the countdown to the next crisis, devaluation and bailout from external partners,” he said. Bloomberg’s Bobby Ghosh is also out with a piece criticizing the IMF for not pushing Egypt hard enough to up private-sector participation in the economy.

Also making headlines:

- Activist Alaa Abdel Fattah is making headlines again as he reportedly escalates his hunger strike from today, while British MP Caroline Lucas is the latest to call in the Guardian for his release. (Washington Post | The Guardian | BBC)

- Ikhwan leader dies: The acting leader of the banned Muslim Brotherhood, Ibrahim Munir, died in London on Friday. (Reuters | AP)

- Archaeologist and former antiquities minister / Egyptian Indiana Jones Zahi Hawass speaks to NBC News about a recent discovery in Saqqara. (NBC News)

ALSO ON OUR RADAR

Gov’t dual-fuel car swap scheme rolled out to another five governorates: People in Ismailia, Sharqiya, Beheira, Beni Suef and Sohag are now able to apply to the government scheme to swap their vehicles with a dual-fuel car, the Finance Ministry said Saturday.

AND- Cabinet has sent amendments to the 2017 Investment Law to the House of Representatives that would extend until 2029 tax breaks for manufacturers that are set to expire in 2023. (Youm7)

Other things we’re keeping an eye on this morning:

- Beltone SME is in talks with eight unidentified banks about contributing to its EGP 1 bn investment fund, which the firm expects to launch in 1Q 2023. The fund was initially set to launch last year. (Al Mal)

- A delegation from the World Health Organization is set to inspect Vacsera’s covid jab production lines ahead of granting it an emergency use license to export the vaccines. (Statement)

- Contractors will break ground on the USD 1.8 bn Egypt-Saudi electricity interconnection project on 1 December. (Youm7)

PLANET FINANCE

Emirates Central Cooling Systems (Empower) has for the second time bumped up the number of shares on offer in its IPO due to high demand. It will now offer a 20% stake in the company, up from 15%, raising as much as AED 2.7 bn (USD 724 mn), according to Bloomberg.

MBC Group could IPO in 2023: The largest broadcaster in the Middle East could list on the Saudi stock exchange as early as next year, Bloomberg reports, citing sources with knowledge of the matter. MBC has reportedly tapped JPMorgan Chase and our friends at HSBC as initial advisors, the people said, without disclosing the planned date, size, or value of the IPO. The Saudi government owns 60% of MBC, with the remaining 40% controlled by founder and chairman Waleed Al Ibrahim.

A quarter of Credit Suisse could be owned by Middle East investors once the struggling bank is through with its USD 4 bn capital increase, as Qatar’s sovereign fund looks to up its existing 5% stake in the Swiss lender, the Financial Times reports, citing sources close to the transaction. Saudi National Bank, the Qatar Investment Authority, and Saudi-owned investment group Olayan could together own some 20-25% of Credit Suisse as a result of its share sale.

Investors have punished Saudi National Bank since it announced its plans to become Credit Suisse’s single biggest shareholder by acquiring a 9.9% stake worth USD 1.16 bn, Bloomberg reports. The bank has seen some USD 7 bn wiped off its market value since the transaction was announced last week, after analysts cast doubt on the benefits to SNB.

Also worth mentioning this morning:

- M&A Watch: AD Ports Group is acquiring 80% of Dubai-based Global Feeder Shipping for AED 2.9 bn (USD 800 mn) in efforts to expand its global operations. (Statement, pdf)

- A record-breaking recession in the UK? The Bank of England said it expects the UK economy to suffer its longest-ever recession as it raised interest rates by 75 bps on Thursday. (BBC)

|

|

EGX30 |

11,262 |

+0.2% (YTD: -5.8%) |

|

|

USD (CBE) |

Buy 24.20 |

Sell 24.30 |

|

|

USD at CIB |

Buy 24.18 |

Sell 24.28 |

|

|

Interest rates CBE |

11.25% deposit |

12.25% lending |

|

|

Tadawul |

11,439 |

-0.8% (YTD: +1.4%) |

|

|

ADX |

10,482 |

+1.0% (YTD: +23.5%) |

|

|

DFM |

3,350 |

+0.6% (YTD: +4.8%) |

|

|

S&P 500 |

3,771 |

+1.4% (YTD: -20.9%) |

|

|

FTSE 100 |

7,335 |

+2.0% (YTD: -0.7%) |

|

|

Euro Stoxx 50 |

3,688 |

+2.7% (YTD: -14.2%) |

|

|

Brent crude |

USD 98.57 |

+4.1% |

|

|

Natural gas (Nymex) |

USD 6.40 |

+7.1% |

|

|

Gold |

USD 1,676.60 |

+2.8% |

|

|

BTC |

USD 21,329 |

+0.7% (YTD: -53.8%) |

THE CLOSING BELL-

The EGX30 rose 0.2% at Thursday’s close on turnover of EGP 880.5 mn (18.3% below the 90-day average). Local investors were net buyers. The index is down 5.8% YTD.

In the green: Telecom Egypt (+4.3%), Egypt Kuwait Holding-EGP (+3.9%) and CIB (+1.2%).

In the red: Juhayna Food Industries (-3.5%), Alexandria Containers and Cargo Handling (-2.3%) and Cleopatra Hospitals (-1.9%).

AROUND THE WORLD

Bibi is back: Former Israeli Prime Minister Benjamin Netanyahu is on course to making a dramatic return to power after winning last week’s election, according to the Associated Press. Incumbent prime minister Yair Lapid conceded defeat on Thursday after final results showed Netanyahu’s Likud party securing a majority in the Knesset alongside allied far-right parties.

CALENDAR

NOVEMBER

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

5-8 November (Saturday-Tuesday): Techne Summit, Bibliotheca Alexandrina, Alexandria, Egypt

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): Middle East Green Initiative, Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

9 November (Wednesday): Finance Ministry to host “Finance Day” at COP27.

11-12 November (Friday-Saturday): Saudi Green Initiative, Sharm El Sheikh.

7-13 November (Monday-Sunday): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

13 November (Sunday): Senate back in session.

15-16 November (Tuesday-Wednesday): G20 summit, Bali, Indonesia.

20 November (Sunday): House back in session.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

22 November- 23 November (Tuesday-Wednesday): The Fingerprint Summit will be held at the Nile Ritz Carlton Hotel.

27 – 28 November (Thursday-Friday): The first edition of the Egypt Media Forum.

27-30 November (Sunday-Wednesday): Cairo ICT, Egypt International Exhibition Center, New Cairo.

DECEMBER

1 December (Thursday): Sphinx International Airport will begin operating international flights.

1 December (Thursday): Contractors to break ground on Egypt-Saudi interconnection project.

3 December (Saturday): Dior Men’s pre-fall collection show in Giza.

5-8 December (Monday-Thursday): QS Reimagine Education Awards and Conference, multiple locations.

10-12 December (Saturday-Monday): The 2nd edition of the Nebu Expo for Gold and Jewelry kicks off.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egyptian Automotive Summit.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

1 April (Saturday): Deadline for banks to establish sustainability unit.

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

End of November: SFE’s pre-IPO fund to kick off roadshow.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q2023: Internal trade database to launch.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.