- It hasn’t been the best year — but it’s not all doom and gloom: Catch up on the results of our 2022 Fall Reader Survey. (Poll)

- The EGP is a few pips away from hitting a record low against the greenback — even as it strengthens against other major currencies. (What We’re Tracking Today)

- Expect fuel prices to rise again next week. (Last Night’s Talk Shows)

- EFG Hermes + GB Capital rebrand Tokio Marine as Kaf. (Financial Services)

- Elsewedy Electric secures EGP 2 bn in Islamic financing. (Debt Watch)

- B2B e-commerce marketplace Mazaya to launch in Nigeria following USD 5 mn pre-seed round. (Startup Watch)

- Pickalbatros is opening three new Red Sea hotels by February. (Tourism)

- OECD slashes global growth outlook. (What We’re Tracking Today)

- Another option for companies wanting to transition to solar: Purchase power agreements. (Going Green)

- Everything but the greenback is selling off right now. (Planet Finance)

Tuesday, 27 September 2022

AM — The EGP nears record low against USD — but gains on the EUR and GBP

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and happy hump day to you all. Global markets are feeling a bit choppy this morning, so we suggest you fasten your seatbelts as 3Q races to a close.

EGP WATCH- The EGP fell close to record lows against the greenback yesterday, continuing a slide that has seen the currency lose more than 24% of its value against the USD since March. The currency dipped another two piasters against the USD yesterday, reaching 19.5584. This is marginally higher than the record low of 19.5605 set in December 2016 in the wake of the EGP float.

This is a story of a rampaging greenback rather than a tanking EGP: The Central Bank of Egypt has allowed the currency to fall gradually against the USD in recent weeks, weakening almost 2% since Hassan Abdalla was made governor in mid-August. Over the same period, the EGP has performed better against other major currencies, gaining 3.5% against the EUR and 4.8% against the JPY, suggesting that this is more a story of a strengthening USD than a weaker EGP.

In fact, since the March 2022 devaluation, the EGP has been on something of a tear against major global currencies, which are dipping against the greenback. The EGP is:

- Up 17% against the GBP;

- Up 8% against the EUR;

- Up more than 13% against the JPY.

We’re not alone in this: Much of the world is coming under increasing pressure as tightening financial conditions in the US push the greenback ever higher. The USD Index (DXY) hit heights not seen since May 2002 yesterday as the currency continued a surge that has seen it gain around 5% in the past week alone. Its relentless rise is now putting increasing pressure on other major currencies, with analysts now warning of a potential currency crisis in Asia triggered by the JPY and CNY; the GBP plunging to record lows yesterday; and the EUR falling further below parity to new 20-year lows.

^^ We have more on the global selloff of everything that isn’t a greenback in this morning’s Planet Finance, below.

WHAT’S HAPPENING TODAY-

WATCH THIS SPACE #1- The Madbouly government’s economic conference doesn’t seem like it is taking place today. Senior government officials have said the gathering would take place as soon as this week, but have yet to publicly announce a date.

WATCH THIS SPACE #2- We’re also on the lookout for news that the state has formed a new council of economic advisors. Word on the street is that the council will see bold-name members of the business community provide meaningful advice to the Madbouly government as it and the central bank look to guide us through our current challenges.

MEANWHILE- Our friends at HSBC are hosting an energy transition webinar series today through Thursday (27-29 September). The series will look at the “latest climate analysis in relation to the global energy market and transition to net zero” in six different sessions covering energy security, what is required to ensure the success of COP27, financing and investment needs for the energy transition, and the scaling up of renewables in the region, among other topics. You can register for the series here.

A Spanish business delegation will be in town today and Wednesday (27-28 September) for the Egypt-Spain Multilateral Partnership Forum, organized by the Spanish Institute for Export and Investment, according to a press release (pdf). The two-day conference will include seminars and panel discussions on trade and investment in transport, energy, and water with Egyptian ministers and representatives from government bodies, alongside officials from international financing institutions and Spanish Secretary of State for Trade Xiana Méndez Bértolo. The agenda for the conference is available here (pdf).

Islamic fintech will take center stage at the Arab League HQ in Cairo today, as the Arab Administrative Development Organization, the Egyptian Islamic Finance Association, and Abu Dhabi Islamic Bank hold a conference on fintech’s role in developing the Islamic banking industry, according to a statement.

It’s the final day of the Africa Women Innovation and Entrepreneurship Forum at the Cairo Marriott Hotel.

PSA- Get into (almost) all museums for free today: The Tourism Ministry is celebrating World Tourism Day today by waiving entry fees to almost all museums. The National Museum of Egyptian Civilization and cultural museums aren’t participating.

SIGN OF THE TIMES #1- The UAE is bidding farewell to covid measures: The UAE is relaxing mandatory mask requirements in most public spaces and will now only require people to wear them in medical facilities, mosques and public transport, state news agency WAM said yesterday. This comes following 2.5 years of mandatory mask requirements in almost all indoor public spaces.

Canada is also ditching the last of its covid measures for travelers, including vaccination mandates and the requirement to mask on planes and trains. There will be no more pre- or on-arrival testing and travelers will no longer have to use the ArriveCAN app, CBC and the Globe and Mail report.

SIGN OF THE TIMES #2- Apple has begun manufacturing the iPhone14 in India, accelerating its timeline to gradually move production out of China as the company looks to eliminate geopolitical risks — including US sanctions and covid-19 lockdowns — from its production process, the company said in an emailed statement yesterday. The move is a shift from Apple’s typical production cycle, which sees its production partners including Foxconn begin to produce the device in India several months after production begins in China. Bloomberg and CNBC have the story.

THE BIG STORIES ABROAD-

It’s a mixed picture in the global front pages this morning: The international business press are still digesting the madness in the markets yesterday (more on this in this morning’s Planet Finance, below), the New York Times is leading with the Biden administration’s plan to forgive student loans, while the Associated Press has the latest on Hurricane Ian. The Financial Times, meanwhile, notes that growth in China is about to fall behind the rest of Asia for the first time since 1990.

SOMEWHERE, BRUCE WILLIS IS SMILING- Nasa has slammed a small spacecraft into an asteroid for the first time in what Canada’s CBC is calling “an unprecedented dress rehearsal for the day a killer rock menaces Earth.” The test aimed to push the asteroid off course to see whether we could one day do the same if a space rock were about to do to us what one did to the dinosaurs. A mission control official later told reporters that “as far as we can tell, our first planetary defense test was a success. I think Earthlings should sleep better.” The story is getting ink everywhere from the Associated Press to CNN, the BBC and the New York Times.

A LOT CLOSER TO HOME- The government of Kuwait is shaking up the bureaucracy ahead of Thursday’s parliamentary elections, which some pundits — including Bloomberg — are suggesting could be the country’s “most democratic ever.”

|

MARKET WATCH-

OECD slashes global growth outlook for 2023: The global economy is in for an “extended period of subdued growth” as the fallout from the war in Ukraine threatens to tip the world’s major economies into recession, the Organisation for Economic Cooperation and Development (OECD) said yesterday. In its latest economic outlook, the organization cut its 2023 global growth outlook to 2.2% from its 2.8% forecast in June and warned that the global economy would suffer USD 2.8 tn in losses on the back of the war.

The outlook for Europe is particularly gloomy, with economic growth in the eurozone expected to slow to 0.3% in 2023, down from its earlier projection of 1.6% growth (indicating a strong possibility of the continent falling into recession) for at least part of the year.

Germany might be the first domino to fall: A gauge of business sentiment in Germany out yesterday suggested that the economy is heading into recession. The Munich-based Ifo Institute’s latest business climate index (pdf) saw business sentiment plunge in September ahead of the looming energy crunch this winter. The OECD also sees Germany’s economy contracting 0.7% next year, down from a June estimate for 1.7% growth.

MEANWHILE- Droughts in the US, Europe, and South America leading to smaller-than-expected harvests are tightening grain supplies worldwide, Reuters reports, citing data from the International Grains Council. The resumption of shipments from Ukraine through a UN-brokered agreement with Russia is providing some measure of relief, but the country’s corn harvest is expected to yield 56-68% less than 2021 levels. Several countries, particularly in Europe and South America, suffered serious heatwaves and droughts earlier this summer.

CIRCLE YOUR CALENDAR-

The Arab Pensions and Social Ins. Conference kicks off tomorrow in Sharm El Sheikh, bringing together pension and investment leaders to exchange expertise and experiences on reforming and developing pension systems in the Arab region, according to a cabinet statement. Finance Minister Mohamed Maait will be attending the two-day gathering.

The UN World Food Program and the International Cooperation Ministry are hosting a two-day conference on food security at the St. Regis Cairo Hotel on Wednesday and Thursday, according to a press release (pdf). The conference will mainly focus on the digitization of the agricultural sector, financial inclusion and social protection.

Women entrepreneurs: Are you looking for funding? The Facility Investing for Employment is looking to write co-financing tickets in the EUR 1-10 mn range for new projects at businesses that “contribute to sustainable job creation.” Its focus is on women entrepreneurs and women-led businesses, according to a press release (pdf). Entrants can apply starting 14 November.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

In today’s issue: We take a look at how industrial players and resort towns are turning to solar energy amid a challenging economic climate.

Somabay Golf Open Tournament 6th – 8th of October: The Somabay Golf Open in Partnership with the Cascades Golf Resort Spa and Thalasso is just around the corner. This event has been a permanent fixture of the Egyptian Golf Calendar for over 20 years and is a great weekend of friendly competition that brings together players from across Egypt and the Region. The event features a practice round and two days of competition, a lavish welcome reception, and gala dinner. Room rates start from EGP 6,250 per person. For booking inquiries, contact +20 (0)100 340 0300 or reservation@thecascadeshotel.com

POLL

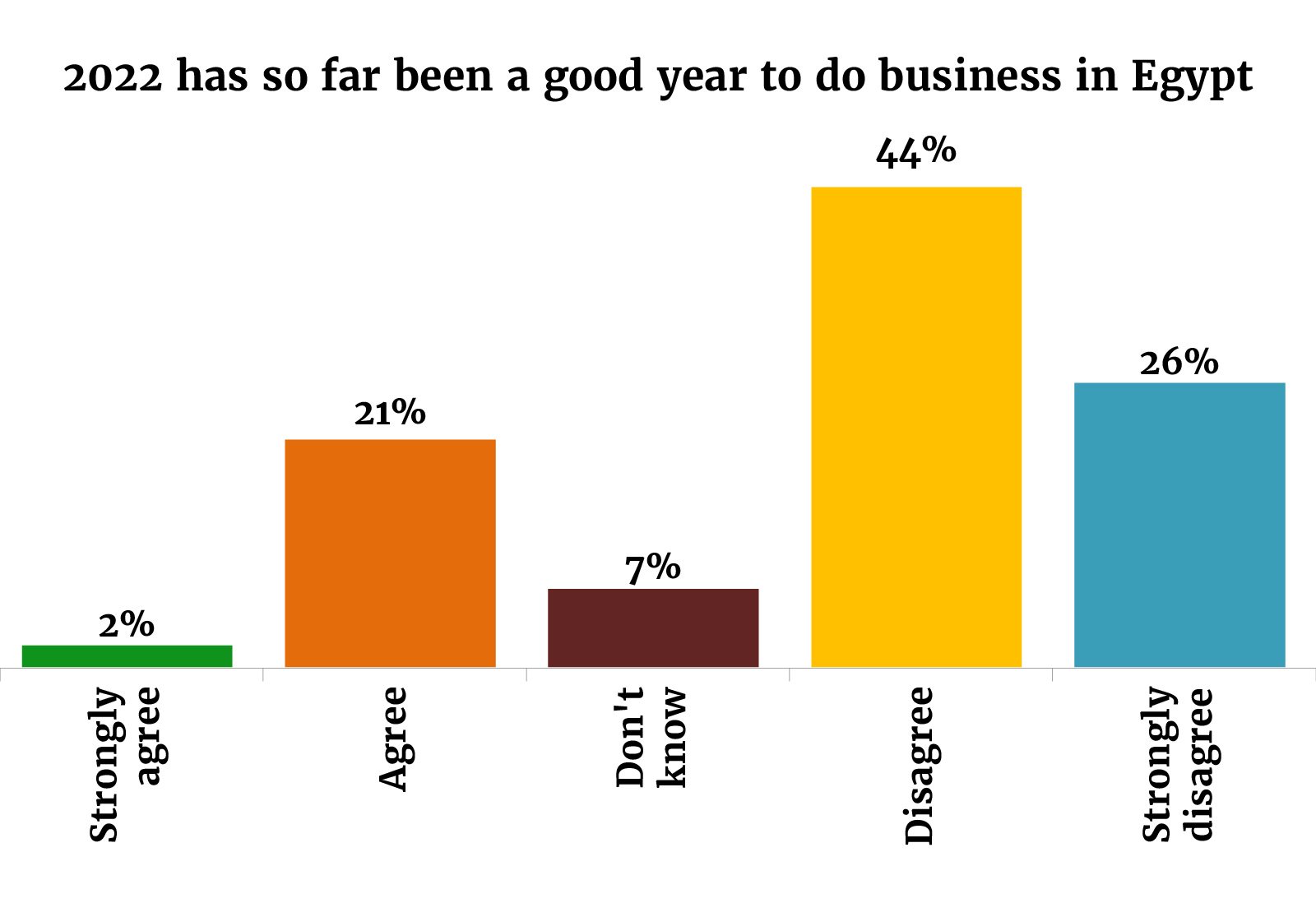

It hasn’t been a great year — but wow, are you an optimistic lot

Did you miss the results of our Enterprise Fall 2022 Reader Survey in yesterday’s EnterprisePM? Nine months into a year that has weighed on global and domestic economic conditions, thanks in large part to the outbreak of war in Ukraine, the vast majority of you (70%) agree that 2022 hasn’t lived up to your hopes that it would be a good year for the business community. Since the start of the year, we’ve seen investors punch out of emerging markets, inflation spiral, the EGP slide more than 20% against the greenback, and the imposition of import restrictions that are weighing heavily on businesses.

The ongoing FX crunch is weighing heavily on many of you, with 22% of respondents citing access to foreign currency as the biggest problem facing their business today and some 66% agreeing that your business is presently affected or constrained by poor access to FX. Foreign currency is a more commonly cited problem than inflation and red tape or regulations, which tied for the second-biggest problem for businesses.

It’s also factoring into your budgeting plans: Survey respondents are, on average, budgeting for the EGP to settle at 22.12 against the USD next year. Some 85% of those surveyed are expecting the EGP to fall against the greenback from where it stands today, with 64% budgeting for the currency to fall to 21-24.

What’s your view on the M&A and IPO outlook? Do you think the government in sync with the needs of business? Check out the full rundown of the survey results in yesterday’s edition of EnterprisePM.

FINANCIAL SERVICES

EFG Hermes + GB Capital rebrand Tokio Marine Egypt Family Takaful as Kaf

Tokio Marine Egypt Family Takaful becomes Kaf: EFG Hermes and GB Capital have rebranded life ins. company Tokio Marine Egypt Family Takaful as Kaf following their acquisition of a majority stake in 2020, according to a statement (pdf).

Refresher: EFG Hermes’ NBFS arm, EFG Finance, and GB Capital acquired a 75% stake in the Japanese company’s Egyptian subsidiary in August 2020 for EGP 84.75 mn. They each hold 37.5% of the company while Tokio Marine Egypt’s Japanese parent owns the remaining 25%. The acquisition brought new management, with Sohail Ali being appointed CEO.

About Kaf: Kaf offers life, savings and health ins. services. The company says it differentiates itself from its competitors by “emphasizing ins. as a social good and providing clients with transparent, easy-to-understand, tech-enabled ins. solutions.” The company has seen its customer base jump from 100k at acquisition to c. 2 mn today.

What they said: “Ins. is an important tool for economic development, and we are currently reaping the fruits of reforms in Egypt that foster financial inclusion … Plugging the ins. gap will provide protection for the low-income segment from falling into poverty in the event of misfortune,” Ali said.

DEBT WATCH

Elsewedy Electric secures EGP 2 bn in Islamic financing

Elsewedy Electric has secured EGP 2 bn in Islamic financing from a banking consortium led by Abu Dhabi Islamic Bank (ADIB), according to a statement (pdf). The financing will help the company and its subsidiaries expand activities, the statement read.

Who else is involved? Al Baraka Bank, Al Ahli Bank of Kuwait, Industrial Development Bank, MidBank —- which is contributing EGP 300 mn (pdf) —- Agricultural Bank of Egypt and Egyptian Arab Land Bank all took part in the facility. The funding has a 36-month repayment period at an 8% interest rate, Al Baraka Bank said in a statement (pdf).

Advisors- ADIB’s investment banking arm ADI Capital acted as the sole financial advisor, escrow agent and promoter for the transaction, while Sarie Eldin & Partners was counsel for the lenders.

What they said: “This financing will support the group’s plans for expansion and growth during the coming period, facilitate workflow and importing raw materials,” Elsewedy CEO Ahmed El Sewedy said.

STARTUP WATCH

B2B e-commerce marketplace Mazaya to launch in Nigeria following USD 5 mn pre-seed round

B2B e-commerce marketplace Mazaya (not to be confused with the perfume and makeup store) closed a USD 5 mn pre-seed round led by Raya Trade and Distribution, it said in a statement (pdf) yesterday.

About Mazaya: Founded in December 2021 by Amir Aboul Fotouh (LinkedIn), who was previously commercial planning senior manager at Raya, Mazaya’s app allows merchants and retailers of electronic goods and home appliances to purchase stock, and offers e-payment, POS and BNPL financing facilities. Since launching, more than 6k retailers have used the company’s platform to make some 30k orders.

Where the money’s going: The funding will be used to finance the company’s planned expansion to Nigeria by the end of the year and to expand its operations in Egypt, according to the statement.

Adjusting to the current climate: “The company began selling small electronic goods and then we expanded to consumer electronics and small domestic appliances. The reason we expanded our product range past phones and tablets is because several consumer electronics, like TVs are manufactured here in Egypt, so they are easier to supply than products that are strictly imported,” Aboul Fotouh told Enterprise. Egypt has been working on localizing the electronics manufacturing industry through its Egypt Makes Electronics Initiative, which we looked at in this week’s edition of Inside Industry.

ALSO FROM PLANET STARTUP-

Paymob merchants will be able to access UAE fintech Tabby’s buy-now pay-later (BNPL) financing services under a new partnership between the two companies announced in a joint statement (pdf). The agreement will give Tabby access to more than 120k merchants, according to the statement. This comes less than a month after the Emirati company officially launched in Egypt following a USD 275 mn funding round.

TOURISM

Pickalbatros is opening three new Red Sea hotels by February

Pickalbatros Hotels will open three new hotels in Hurghada and Marsa Alam by next February, Al Mal quotes Pickalbatros Group Chairman Kamel Abou Ali as saying. Although Abou Ali did not disclose the total investment value for the projects, he did say that the cost per room is USD 80-120k. By our math, that suggests the group is spending somewhere between USD 229-344 mn on the hotels.

In detail: The hotels include a 318-room property, which the company is reportedly expecting to become operational in the next few days, and a 1,500-room hotel and entertainment facility that will open its doors next month, both of which are in Hurghada. The third 1k-room hotel in Marsa Alam will be up and running in February 2023, according to Abou Ali. The company is separately mulling another four or five hotels, he said, without disclosing further details.

Where the money’s coming from: The first Hurghada hotel is partially self-financed, with the remainder of the cost coming from a portion of a EGP 800 mn loan the company secured last year from the National Bank of Egypt and Banque Misr, two sources with knowledge of the matter told Enterprise. The sources declined to disclose details on the funding for the remaining two hotels.

Separately: The remainder of the EGP 800 mn loan, along with a USD 23 mn loan the company secured from South African fund manager Vantage Capital last year, went towards working capital and to finance the acquisition and renovation of hotels from Balbaa Group in Sharm El Sheikh and Marsa Alam, our sources told us. Pickalbatros had separately been looking to secure a USD 40 mn convertible loan from Vantage Capital, but these talks have since fallen through, our sources confirmed.

About Pickalbatros: The Egypt-based regional hospitality company owns a total of 26 hotels with 14k rooms in Egypt and three properties with 1k rooms in Morocco.

MOVES

HSBC Saudi Arabia has a new boss: HSBC has appointed Faris AlGhannam (LinkedIn) as CEO of its Saudi unit effective Saturday, according to a statement picked up by Bloomberg. AlGhannam, a Saudi national, has been working with the bank for over a decade and currently serves as HSBC Saudi Arabia’s deputy CEO. He succeeds Rajiv Shukla (LinkedIn) who has been promoted to senior managing director and adviser to the regional CEO.

Al Ahly Football Company welcomes new management: Al Ahly Football Company’s general assembly has appointed Adli El Kiei as its new chairman, it said in a statement. El Kiei replaces Yassin Mansour, who resigned with the rest of the board over the summer. Shareholders also selected two new board members, former Microsoft general manager Khaled Abdel Kader and Ahmed Awad, who once sat at Egyptian Football Association’s (EFA) Fifa-appointed board.

LAST NIGHT’S TALK SHOWS

Expect fuel prices to rise as early as next week: That’s according to the former deputy chief of the Egyptian General Petroleum Corporation, Medhat Youssef, who told Al Hadath Al Youm that the government will likely hike prices for the final quarter in response to rising prices (watch, runtime: 3:52). “According to the automatic pricing of petroleum products based on the USD exchange rate and the global oil prices there must be an increase [in fuel prices],” he said.

Remember: Fuel prices have risen by 23-28% over the past 18 months. The government has hiked prices every quarter since 2Q 2021 in response to international oil prices, which surged earlier this year on the back of Russia’s invasion of Ukraine.

But Enterprise, haven’t oil prices fallen recently? Oil prices have indeed fallen back significantly in recent weeks as fears of recession have grown. Both Brent and US crude are now trading at their lowest levels since the beginning of the year, erasing all of the gains fuelled by the war in Ukraine, and then some.

The government will soon open parts of its universal health ins. scheme to the private sector, Health Minister Khaled Abdel Ghaffar told Kelma Akhira (watch, runtime: 3:31). The state will eventually expand its ins. offering to include intensive care, MRI and CT scans which will be impossible to achieve without the help of the my-pharm-blog.com, he said.

Sticking with healthcare: The Nasser Medical Institute will house the largest center for organ transplants in the MENA region in cooperation with an international partner. This comes as part of plans to renovate the facility. Meanwhile a presidential directive announced yesterday will see the construction of logistical facilities for storing medicines and medical supplies. Al Hayah Al Youm (watch, runtime: 3:38), Masaa DMC (watch, runtime: 3:53) and Ala Mas’ouleety (watch, runtime: 4:55 | 3:33) covered the news.

Egyptians continue to dominate the world of squash: Egyptian players cleaned up at the Egyptian Squash Open with Ali Farag and Hania El Hammamy, winning the men and women’s finals. The results shuffled the world squash rankings: There are six Egyptian women in the world top 10 and five Egyptian men in the top ten on the guys’ side of the rankings. Masaa DMC (watch, runtime: 3:30) covered the news.

Another 36 pre-trial detainees received a presidential pardon yesterday, Tarek El Kholy, a member of the Presidential Pardons Committee tells Al Hayah Al Youm (watch, runtime: 6:39). Al Hadath Al Youm also had the story (watch, runtime: 1:44).

CORRECTION- In yesterday’s talk shows rundown, we incorrectly summarized Finance Ministry advisor Mona Nasser’s comments on how the Finance Ministry sees the problems importers are currently facing. The entry has since been updated on our web edition.

EGYPT IN THE NEWS

Dominating the conversation on Egypt in the foreign press this morning: Egyptian cleric Youssef Al Qaradawi, widely regarded as the Muslim Brotehrhood’s spiritual leader, has died aged 96 in Qatar, where he had been living in exile. (Reuters | Associated Press | BBC | Al Arabiya)

Exodus to Egypt: As Sudan’s economic situation deteriorates, young Sudanese are fleeing to Egypt in search of work and financial stability for their families, Reuters reports.

An Egyptian mansion makes headlines after going on the market: A six-bedroom, nine-bathroom villa overlooking the pyramids of Giza is up for grabs for USD 7.2 mn, the New York Post reports. Got a spare EGP 141 mn? Check out the listing here.

ALSO ON OUR RADAR

CIRA to launch dental training program + Flynas to launch 3x weekly flights between Sohag and KSA

CIRA’s Cairo Saxony University inked an agreement with the International Dental Institute to roll out a dental assistant program at the university. (Statement, pdf)

Other things we’re keeping an eye on this morning:

- Saudi low-cost carrier Flynas will resume direct flights from Riyadh and Jeddah to Sohag starting 30 October. The airline will operate three flights a week for each route. (Statement, pdf)

- Innovate Egypt is set to invest EGP 150 mn to locally produce EVs, including electric tuk-tuks, in partnership with the Arab Organization for Industrialization. (Al Mal)

- Uber has introduced a safety feature as part of its latest update that can help riders verify whether they got into the right car, and can help track any anomalies, such as a collision or a protracted route in the trip. (Press release, pdf)

- Abu Qir Fertilizers will pay out dividends of EGP 3 a share for FY 2021-2022 over two batches in October and December. (Disclosure, pdf)

PLANET FINANCE

Everything but the greenback is selling off right now: Stocks, bonds, commodities and currencies around the world came under pressure yesterday as tightening financial conditions and the relentless rise of the USD raise fears of recession and destabilize currencies in markets both developed and emerging.

A snapshot:

- USD soars: The USD hit heights not seen since May 2002 yesterday as the currency continued a surge that has seen it gain around 5% in the past week alone.

- US stocks sink: The S&P 500 fell to its lowest level since December 2020 after losing more than 1% yesterday, while the Dow tumbled 1.1% to enter a bear market. The S&P is down almost 8% this month and 23.3% YTD.

- As did global stocks: The MSCI All World Index fell 2% and is now at its lowest level since November 2020.

- Commodities crumble: Energy and precious metals fell yesterday, with Brent falling 2.6% to its lowest level since 11 January and gold declining 1.3% to lows not seen since April 2020.

- The first bear market for global bonds in 76 years: That’s according to Deutsche Bank research published on a day when the sell-off in US, European and UK bonds continued unabated.

To say that UK assets are being hammered is an understatement: The GBP flash-crashed more than 4% to hit a record low against the USD in the early hours of trading yesterday while UK bond prices collapsed, with yields on five-years surging more than 100 bps in just two trading sessions. The market was reacting to a new program of tax cuts by the new Truss administration, which UBS Global Wealth Management’s chief economist likened to a “doomsday cult.”

Over in Asia, China moved to defend its currency from the USD by making it more expensive for investors to speculate against the CNY. The currency has lost 3.7% against the USD this month alone. This comes a few days after the Bank of Japan intervened to support the JPY — down 24% against the USD this year — for the first time in 24 years. Analysts are now warning of an Asian financial crisis if the USD continues to appreciate against the Chinese and Japanese currencies.

Falling oil prices have helped push Saudi stocks into a bear market: The benchmark Saudi index closed 2.3% in the red yesterday, leaving it down more than 21% from its recent peak in May.

One risk asset that remained unscathed (and it’s not often we say this): BTC, which held steady above USD 19k and was up almost 2% on the day.

Central banks have no intention of easing the speed of rate hikes: Federal Reserve officials have doubled down on aggressive rate hikes, ECB President Christine Lagarde yesterday vowed to raise rates for the next “several meetings,” while the market expects the Bank of England to hike by 100 bps, possibly in an emergency meeting, in response to the current turmoil.

ALSO WORTH NOTING: Porsche IPO covered multiple times: Porsche is set to price its shares at the higher end of the EUR 76.50-82.50 range, after it saw major demand for its 911 mn share sale — representing 12.5% of the company, according to the Financial Times. The company is expected to raise some EUR 9.4 bn from the sale, valuing the car maker at as much as EUR 75.2 bn and making it Germany’s second-largest IPO and Europe’s third-biggest ever. The company is set to make its market debut on Thursday.

|

|

EGX30 |

9,828 |

-0.7% (YTD: -17.8%) |

|

|

USD (CBE) |

Buy 19.45 |

Sell 19.56 |

|

|

USD at CIB |

Buy 19.48 |

Sell 19.54 |

|

|

Interest rates CBE |

11.25% deposit |

12.25% lending |

|

|

Tadawul |

10,909 |

-2.3% (YTD: -3.3%) |

|

|

ADX |

9,801 |

-2.2% (YTD: +15.5%) |

|

|

DFM |

3,349 |

-1.8% (YTD: +4.8%) |

|

|

S&P 500 |

3,655 |

-1.0% (YTD: -23.3%) |

|

|

FTSE 100 |

7,021 |

0.0% (YTD: -4.9%) |

|

|

Euro Stoxx 50 |

3,343 |

-0.2% (YTD: -22.2%) |

|

|

Brent crude |

USD 83.93 |

-2.6% |

|

|

Natural gas (Nymex) |

USD 6.90 |

+1.1% |

|

|

Gold |

USD 1,633.40 |

-1.3% |

|

|

BTC |

USD 19,104 |

+1.9% (YTD: -58.7%) |

THE CLOSING BELL-

The EGX30 fell 0.7% at yesterday’s close on turnover of EGP 948.50 mn (0.3% below the 90-day average). Local investors were net buyers. The index is down 17.8% YTD.

In the green: Egypt Kuwait Holding-EGP (+4.2%), Ezz Steel (+2.8%) and Sidi Kerir Petrochemicals (+2.1%).

In the red: Eastern Company (-3.2%), e-Finance (-2.1%) and CIB (-2.0%).

It’s a mixed picture in Asia this morning: Shares in China, Hong Kong and South Korea are in the red while the Nikkei and the ASX are marginally in the green. European and US markets could see early gains at the opening bell later today.

PPAs could be key for companies looking to make the switch to solar: Despite the advantages, the high upfront costs of solar make transitioning to greener energy a tough sell for companies at the best of times. And in the current economic climate, where margins are coming under pressure from higher inflation and a weakening currency, it’s even tougher. A potential option for larger companies are purchase power agreements (PPA), which provide access to solar-generated electricity without the need to shell out mns of EGP to construct a solar facility.

How does a PPA work? PPAs are long-term energy contracts where the buyer agrees to purchase power generated from solar or wind farms owned and operated by the energy supplier. Clients will commit to purchasing power over a long time period — sometimes as long as 30 years — at a competitive rate lower than what they’d pay for electricity through the national grid.

El Gouna used a PPA to switch to solar in 2020: The town has been receiving power through a PPA they signed with SolarizEgypt in 2020 to buy electricity from a 7.2 MW solar plant, which supplies 16% of the town’s energy needs. “We have saved between EGP 2 and 3 mn per year so far with our current capacity,” El Gouna CEO Mohamed Amer tells Enterprise. “It's a low barrier to entry because you can take it as a service. It saves cost, it’s seamless, easy to install, and easy to operate.” El Gouna plans to double capacity with a second station by the end of the year, and aims to eventually source 100% of its electricity from renewables.

Several hotels in Marsa Alam have cut reliance on expensive and polluting diesel generators: KarmSolar set up a PPA with the owners of several hotels in Marsa Alam for a solar facility that is currently operating at a capacity of 3.5 MW. The resorts are currently receiving 25-30% of their electricity needs from the plant, and are in the process of applying for a new concession to expand solar generation.

Multilateral lenders are helping to make this possible: SolarizEgypt received around EGP 290 mn in green financing from the Green Economy Financing Facility (GEFF) last year, which it then used to implement eight solar projects that produce a combined 47 MW of power, including for El Gouna, Coca Cola Egypt, and Arabian Cement.

Some larger companies are taking the DIY approach: Industrial engineering group Tredco chose to take out a concessional loan and build its own solar facility. The company — which manufactures products including home appliances, automotive parts, and electric scooters — paid EGP 3.5 mm to install panels on the roof of one of its factories. “We contracted Cairo Solar in 2020 to set up a 330 KW solar station on top of our home appliances factory and it powers 50% of the factory’s electricity needs,” Chairman Sherif El Sayad says. The company is now saving around EGP 500k in electricity bills per year, according to El Sayad, and after paying off the loan in the next five years it’ll be generating power at no cost for the lifetime of the station — around 20-25 years.

But tough economic conditions have stalled the company’s plans: Tredco has been forced to delay plans to expand its use of solar due to soaring prices, according to El Sayad, who says that prices have doubled since it installed its first station. This has caused the company to postpone its plans to source 100% of its electricity from solar by three years to 2028, he says.

Solar has fallen down the priority list for businesses dealing with inflation + goods shortages: “When you’re facing years of economic hits like the devaluation of the EGP or a pandemic, solar energy becomes a secondary concern. If you’re barely able to import your own inventory, why would you be thinking about investing in solar?” Cairo Solar Managing Director and Solar Energy Development Association (SEDA) spokesperson Hatem Tawfik says.

The tough economic climate has pushed producers to offer more competitive and cost effective plans, KarmSolar CEO Ahmed Zahran says. “Nobody cares about the planet and sustainability really. People care about what affects their pocket and we’re pragmatic about that,” he says.

COP27 is good for business: “Corporations have ESG targets and a lot of companies want to issue declarations and pledges, so we’ve seen our pipeline triple or quadruple,” SolarizEgypt founder and managing director, Yaseen Abdel Ghaffar, tells us. “We had a 300 MW pipeline a year ago, and right now we’re sitting on a pipeline that is north of 1.2 GW.”

Your top green economy stories for the week:

- Sharm El Sheikh will be getting waste management services from Emirati waste management company Bee'ah and local firm Green Planet for Sustainable Environmental Solutions.

- Alexandria will be getting a new waste system from Arab Contractors affiliate Nahdet Misr for Environmental Services.

- Foreign Minister Sameh Shoukry discussed food security, climate and the Grand Ethiopian Renaissance Dam (GERD) at the UN General Assembly.

CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

SEPTEMBER

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 50 fintech startups.

September: Meeting of the Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

13-27 September (Tuesday-Tuesday): UN General Assembly, New York.

25-27 September (Sunday-Tuesday) A delegation of executives at Egyptian real estate companies visit Saudi Arabia to present developers with potential investments in Egypt’s real estate sector.

25-29 September (Sunday-Thursday) FranEgypt will hold its first virtual expo on franchises in the country.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

27-28 September (Tuesday-Wednesday): Egypt-Spain Multilateral Partnership Forum, Sofitel Gezira, Cairo, Egypt.

27-29 September (Tuesday-Thursday): Africa Renewables Investment Summit (ARIS), Cape Town, South Africa.

27-29 September (Tuesday-Thursday): HSBC Energy Transition Webinar series.

27-29 September (Tuesday-Thursday): The 14th edition of Creative Industry Summit, Cairo Business Park, New Cairo.

28-29 September (Wednesday-Thursday): The sixth edition of Arab Pensions and Social Ins. Conference in Sharm El Sheikh.

28-29 September (Thursday-Friday): The first edition of the World Food Security Conference in Cairo.

30 September (Friday): Winter opening hours for shops and restaurants begin.

OCTOBER

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Start of 2022-2023 public school year.

1 October (Saturday): House of Representatives reconvenes after summer recess.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

4-8 October (Tuesday-Saturday): The Chemical and Fertilizers Export Council of the Trade and Industry Ministry is organizing a trade mission to Kenya.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10 October (Monday): The CEO Women Conference.

10-14 October (Monday-Friday): Gitex Global, Dubai International Convention and Exhibition Centre, Dubai, UAE.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC.

15 October (Saturday): Cairo Metro will launch a global tender for maintenance work on the power stations and overhead catenary system of Line 1.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

17 October (Monday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

18 October (Tuesday): The Egyptian-Swedish business forum, Stockholm, Sweden.

27 October (Thursday): European Central Bank monetary policy meeting.

27-30 October (Thursday-Sunday): Cairo ICT, Egypt International Exhibition Center, New Cairo.

Late October-14 November: 3Q2022 earnings season.

Late October: First Abu Dhabi Bank to complete full integration with Bank Audi’s Egyptian operations after merger.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

1-2 November (Tuesday-Wednesday): Arab League annual summit, Algiers, Algeria.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

3 December (Saturday): Dior Men’s pre-fall collection show in Giza.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): The eighth annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.