- Uni students can now get jabbed in less than 24 hours. (Covid Watch)

- Egyptian banks launch EGP 1 bn fintech fund. (Fintech)

- The world’s largest water treatment plant was inaugurated in Egypt yesterday. (Last Night’s Talk Shows)

- Flat6Labs raised USD 7 mn in second close for Tunisia fund. (Startup Watch)

- Palm Hills to borrow EGP 2.5 bn for New Cairo project. (Debt Watch)

- Oil prices hit a three-year high on gas fears + tech stocks wilt, yields rise on Fed taper talk. (What We’re Tracking Today)

- The global commodities boom is putting Egyptian solar players under pressure. (Going Green)

- Planet Finance— EM bonds see heavy outflows on Evergrande crisis, Fed taper.

Tuesday, 28 September 2021

State banks launch EGP 1 bn fintech fund + oil prices hit a three-year high

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, wonderful people, and welcome to a Hump Day issue that feels a lot like the (relative) calm before the storm. It’s a brisk but not hectic news morning, with the biggest story being covid, covid and still more covid: walk-in vaccination clinics are real, digital vaccination records are coming to Egypt, and university students can now get jabbed within 24 hours of registering.

There’s also lots of interesting news from planet startup, where Cairo-headquartered Flat6Labs has hit second close on its Tunisia fund and state-owned banks have announced the launch of an EGP 1 bn fintech fund.

Expect the news cycle to pick up pace today through Thursday as companies look to get news out before the House of Representatives comes back into session — and starts dominating newsflow — this weekend.

THE BIG STORIES TODAY are all abroad, where we note that EM bonds are seeing outflows thanks to events in China — where, incidentally, a looming power crisis threatens an even more interesting winter for a world waking up to the notion that supply shortages are going to be more than a transient thing.

We have more on all of these stories below.

BIG STORY #1- As expected, Republican lawmakers in the US are pushing the government towards default, last night refusing to back a Democratic bill that would have raised the debt ceiling and prevented a government shutdown when the new fiscal year begins on 1 October. If Congress can’t agree to raise the debt ceiling by Thursday, the government will enter a partial shutdown and be on its way to default as soon as mid October, threatening a financial catastrophe as the country’s economy recovers from the pandemic.

The Federal Reserve is weighing in: Two Fed officials warned yesterday that the central bank would be powerless to prevent an “extreme kind of reaction in markets” that would be triggered by a shutdown and called for bipartisanship to raise the debt ceiling. Everyone from Reuters and the AP to the Wall Street Journal and the New York Times has this on their front pages this morning.

BIG STORY #2- Straight to voicemail: US Treasury Secretary Janet Yellen has not returned calls from IMF chief Kristalina Georgieva, sources familiar with the matter told Bloomberg, amid accusations that Georgieva pressured staff to manipulate data in order to boost China’s business-climate rating. An IMF ethics committee is reviewing the allegations, which Georgieva has strongly denied. The results of the review will likely be decisive for the IMF head’s fate.

Is Georgieva the victim of “anti-Beijing hysteria”? That’s the contention of US economist Jeffrey Sachs, who in a Financial Times opinion piece describes her treatment by US officials and lawmakers as “McCarthyite” and implores the IMF not to “capitulate” by forcing her out.

Whatever happens, it’s going to make for an awkward atmosphere at the IMF and World Bank meetings next week.

BIG STORY #3- WATCH THIS SPACE- What happens when the world’s largest manufacturer has a power crisis at the height of a global supply crunch? Nothing good, we’d bet. But this is what we’re now faced with, as power shortages in China shutter factories across the country, Reuters reports. Manufacturers supplying some of the world’s biggest companies — including Apple and Tesla — are having to wind down production as surging coal prices leaves the country facing a shortfall in electricity. The news isn’t good for China, but it could be worse for the rest of the world, which was already facing supply shortages of a growing list of goods — all at the same time as rising inflation, trade disruptions, and rising post-lockdown demand put pressure on global supply chains.

** IN CASE YOU MISSED IT in yesterday’s edition of EnterprisePM:

- The EGX30 was down 1.4% yesterday as global energy shortages and supply chain disruption dominate the conversation in the local business press and market watchers sound the alarm.

- Architects are designing homes to be cooler: Architects around the world are trying to combat the wicked cycle, instead introducing new building techniques that lower temperatures indoors without using ACs.

- SPACs were so 2020: A significant rise in redemptions indicates that blank-check firms are starting to lose their appeal among investors.

HAPPENING THIS WEEK-

White House National Security adviser Jake Sullivan will visit Cairo this week as part of a brief Middle East tour that will take him to Saudi Arabia and the UAE, sources with knowledge of the matter tell Axios.

Today is the deadline to register for the AUC Business School’s Private Equity Diploma.

Winter retail opening hours in effect from Thursday: Shops and malls will close one hour earlier at 10pm (11pm on Thursdays, Fridays and national holidays) while cafes and restaurants will shutter at midnight rather than 1am. As during the summer, essential services such as grocery stories, supermarkets and pharmacies are exempt from the rules and can open and close their doors when they want.

Conference season continues this week:

- ITIDA’s DevOpsDays Cairo 2021, takes place tomorrow, 29 September.

- The Cairo International Fair opens on Thursday, 30 September at the Cairo International Conference Center. It runs through 8 October.

- The Egypt Projects 2021 construction expo also opens on Thursday at the Egypt International Exhibition Center and wraps on Saturday, 2 October.

- Dubai’s Expo 2020 opens on Friday, 1 October. The event, which takes place somewhere on the planet once every five years, runs for six months and will be open seven days a week. You can learn more here.

|

CIRCLE YOUR CALENDAR-

PSA #1- Next week is a short work week. You can expect to have a three-day weekend 7-9 October in observance of Armed Forces Day, which is on 6 October. Folks whose workdays are tied to banks and the market can expect confirmation from the Central Bank of Egypt and EGX early next week.

PSA #2- We’re probably also looking at a long weekend starting Thursday, 21 October in observance of the Prophet’s Birthday, which is formally Monday, 18 October.

PSA #3- Your commute is going to get worse at the end of next week. Public schools are back in session for the fall term on Saturday, 9 October.

We’re inching closer to the end of 3Q2021 and the beginning of another month. Here are some of the key dates coming up in October:

- MPs and senators are returning from recess to start the new legislative session: The House of Representatives will reconvene on Saturday, 2 October and the Senate will be back in Session Tuesday, 5 October.

- PMI: September’s purchasing managers’ indexes for Egypt, Saudi Arabia and the UAE will land on Tuesday, 5 October.

- Foreign reserves: September’s foreign reserves figures will be out sometime during the first week of October.

- Inflation: Inflation figures for September will be released on Sunday, 10 October.

- IMF + World Bank meetings: The IMF and the World Bank will hold their annual meetings during the week beginning 11 October.

- Interest rates: The Central Bank of Egypt will meet to review interest rates on Thursday, 28 October.

- A little further out: The Middle East Angel Investment Network is hosting its Angel Oasis in El Gouna on 27-29 October, with separate pricing for in-person and virtual attendance.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

MARKET WATCH-

Oil prices hit a three-year high yesterday as concerns that the escalating global gas crunch could impact the crude market grew, the FT says. Brent crude hit its highest level since September 2018 at USD 79.60 per barrel, continuing its rally after OPEC this month forecast 2021 demand to exceed 2019 levels. Brent has already risen 50% since the start of the year, and Goldman Sachs analysts now tip it to hit USD 90 before the end of the year, according to Bloomberg.

Fed taper talk sees yields rise: Yields on US 10-year treasuries climbed to three-month highs yesterday as investors dumped US government debt in anticipation of a tapering of monetary stimulus later this year. Yields briefly topped the key 1.5% level for the first time since June before closing at 1.49% in response to last week’s Federal Reserve meeting when policymakers signalled they could tighten policy in November and raise rates in 2022.

Tech stocks under pressure: Rising yields isn’t a great sign for tech stocks, which are vulnerable to sell-offs in the bond market due to their low dividends and current overstretched valuations, one analyst told Bloomberg.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

In today’s issue: 2021 has seen global commodities prices soar to record highs on pent-up post-lockdown demand and continued supply chain disruptions, prompting speculation from some quarters that the world may be seeing the start of a new supercycle. Today, we ask how the commodities boom is impacting local solar companies, who are reliant on metals like copper and aluminum to deliver projects. Companies tell us that in order to cope with the new reality, they have increased their prices, delayed projects, or absorbed the costs and accepted squeezed margins.

COVID WATCH

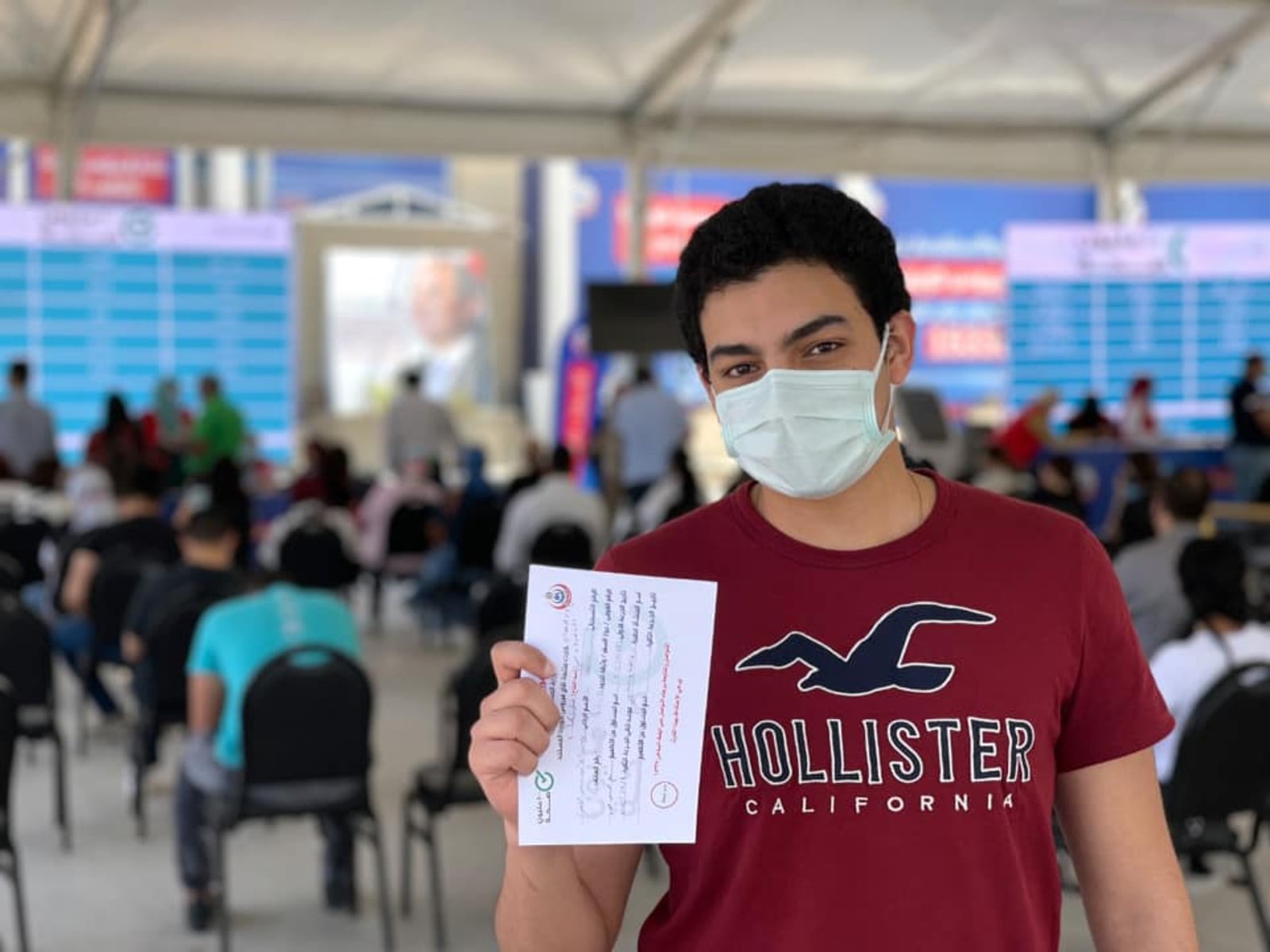

Uni students can now get jabbed in less than 24 hours

University students will receive a covid-19 vaccine appointment within 24 hours of registering starting today, the Health Ministry announced yesterday as it steps up its efforts to get as many students vaccinated as possible before the beginning of the new academic year next month. Students can go to 830 vaccination clinics and 270 youth centers around the country, which will be able to administer a vaccine within a day of registration, ministry spokesperson Khaled Megahed said.

Some 90% of university lecturers and faculty staff have received at least one shot of a vaccine, Higher Education Minister Khaled Abdel Ghaffar told Youm7 yesterday. Some universities have managed to vaccinate more than half of their students, he said, without giving a total figure.

Covid-19 vaccination was made mandatory for all 18+ year-old students, educators and staff at Egyptian schools and universities in August as part of the government’s back-to-school vaccination drive.

Around 1 mn doses have so far been provided to universities, and another 2 mn doses would be supplied soon, Megahed said in a phone interview with Kelma Akhira’s Lamees El Hadidi (watch, runtime: 10:53) last night, adding that all university students will be offered no-cost QR-code vaccine passports.

In schools: More than 50% of public sector teachers and administrative staff have received at least one dose of a covid vaccine, according to a Health Ministry report picked up by Youm7. Out of 1.6 mn workers, 286k are fully vaccinated, while 541k have received a single jab.

But younger kids aren’t going to be getting jabbed any time soon: Egypt will begin to study the possibility of gradually lowering age limits to vaccinate children within two to three months, Health Ministry Advisor Noha Essam said in another phone call with El Hadidi (watch, runtime: 6:56), adding that Egypt would first look to vaccinate its 20 mn vulnerable citizens who are at greater risk if they catch the virus.

THOSE WALK-IN VACCINATION CLINICS the government announced would open at youth clubs this week? They’re real, according to multiple reports in the domestic press. Youm7 has coverage from clinics in a number of different governorates and Masrawy has video footage from a center in Cairo. We have independently seen centers open for business in Sheikh Zayed and Mansoura.

An app that confirms users’ vaccination status will be launched within days, Megahed told El Hadidi (watch, runtime: 10:53). He also said that the ministry is considering offering booster shots to vaccinated Egyptians who suffer from chronic conditions.

The Health Ministry reported 702 new covid-19 infections yesterday, up from 680 the day before. Egypt has now disclosed a total of 302,327 confirmed cases of covid-19. The ministry also reported 37 new deaths, bringing the country’s total death toll to 17,224.

FINTECH

Egyptian banks launch EGP 1 bn fintech fund

State-owned banks launch EGP 1 bn+ fintech fund: Several state-owned banks will next month join forces to launch a fund to support fintech startups, in a new push to develop the local sector and bring more of the population into the formal economy, according to a statement (pdf) out yesterday. The fund is being established by the National Bank of Egypt, Banque Misr, and Banque du Caire on the instruction of President Abdel Fattah El Sisi, and will have a minimum capital of EGP 1 bn, the statement said. Other financial institutions are welcome to participate in the fund.

The fund will support both local fintech startups and international outfits that want to establish themselves in the Egyptian market. It will also work on enabling more applications of fintech which would facilitate the process of providing and delivering financial services.

The fund goes hand-in-hand with the recent legislation designed to develop Egypt’s fintech sector: Last year’s Banking Act and draft legislation authored by the Financial Regulatory Authority aim to cement Egypt’s position as one of the MENA region’s fintech centers — while also driving financial inclusion in the wider population, a key driver of investor interest in the fintech industry. The Banking Act ended some of the regulatory uncertainties facing the sector, establishing a mechanism for the licensing of e-payments and fintech firms, and for the first time provided a framework for the licensing of digital banks. The FRA bill will establish new licensing and supervisory powers for nano-finance, crowdfunding, robo-advisory and insurtech firms, and is still being discussed by lawmakers.

STARTUP WATCH

Flat6Labs raised USD 7 mn in second close for Tunisia fund

Flat6Labs announced the second close for its Tunisia-based Anava Seed Fund, during which it raised USD 7 mn, pushing the fund’s total commitments to USD 10 mn, the company announced (pdf). The fund aims to invest in 75 Tunisian early-startups in a five-year period.

The fund was launched in 2017 in partnership with the Tunisian American Enterprise Fund, BIAT Bank and Meninx Holding. Since its launch, the fund invested in over 50 startups in Tunisia operating in 22 sectors between fintech, education, delivery services and aeronautics, which have created over 500 jobs.

Anava Seed Fund investors: Sawari Ventures is the most recent investor with an investment of USD 1.6 mn. Other investors include the International Finance Corporation, the International Arab Bank of Tunisie, the Tunisian American Enterprise Fund and Meninx Holding.

Startups funded by the Anava Seed Fund include: MooMe, an IoT system and platform designed to help farmers, Fabskill, a cloud solution to digitize and automate the recruitment process using Artificial Intelligence and Optimalogistic, a marketplace connecting truck drivers and transportation companies with customers.

Flat6Labs in Egypt: Back in May, Cairo-headquartered Flat6 completed the second close of its Egypt-focused Flat6Labs Accelerator Company (FAC), raising the fund size to EGP 207 mn from EGP 50 mn. FAC in turn raised its seed offering for its Cairo Seed Program to up to EGP 1.5 mn, while post-program follow-on funding will now be raised to EGP 3 mn for selected startups.

ALSO FROM PLANET STARTUP-

Dubai-based workspace firm Hotdesk raised USD 1 mn in a seed funding round and will launch in Egypt, UAE and Spain, according to a press release (pdf). The round was led by UAE-based company Virtuzone, and featured participation from the VC arm of real estate group AlZayani Investments, Zayani Venture Capital (ZVC), as well as several angel investors including Swvl CFO Youssef Salem. The statement provided no details on how the company would use the funding or about its planned launch in Egypt.

DEBT WATCH

Palm Hills to borrow EGP 2.5 bn for New Cairo project

A Palm Hills Development (PHD) subsidiary will borrow EGP 2.5 bn from Banque Misr and the National Bank of Egypt after signing a long-term financing agreement with the banks, NBE said in a statement (pdf) yesterday. Palm Investment and Real Estate Development will use the money to finance the company’s Palm Hills New Cairo residential development, which is being built on a 2 mn sqm plot in New Cairo. The loan is being split 50/50, with the banks lending EGP 1.25 bn each, and will be repayable over a 7.5-year period.

This new financing will enhance the financial position of the project and support the company’s plan to accelerate the pace of construction work, Tarek Tantawy, Palm Hills Development co-CEO and managing director said.

CORRECTION- In yesterday’s EnterpriseAM we incorrectly stated that Ezdehar is expecting its Ezdehar Egypt Mid-Cap Fund II to raise USD 160-180 mn during its second close alone. The USD 160-180 mn figure actually refers to the final total of commitments the firm plans to raise in the first and second closes combined. The story has been amended on our website.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The opening of the Bahr Al Baqr wastewater treatment plant by President Abdel Fattah El Sisi topped the coverage on last night’s talk shows. The biggest of its kind in the world, the plant cost EGP 18 bn to build and can process 5.6 mn cubic meters of water daily. The water will be transferred to North Sinai to contribute to the reclamation of 476k feddans, while the 190km-long Bahr Al Baqr drain stretches from South Cairo via Port Said, Ismailia, Sharqiya, Dakahlia and Qalyubia to Lake Manzala. The project was built by Orascom Construction and Arab Contractors, and was funded in part by the Arab Fund for Economic and Social Development and the Kuwait Fund for Arab Economic Development, and has directly and indirectly generated around 40k jobs. El Hekaya (watch, runtime: 3:09), Alaa Mas’ouleety (watch, runtime: 6:32 | 17:16), Kelma Akhira (watch, runtime: 5:06), Masaa DMC (watch, runtime: 1:47) and Pen and Paper (watch, runtime: 2:27) all had the story.

The removal of illegal structures encroaching on state land and infrastructure will be completed within six months: El Sisi said the state will not accept silence over encroachments on land, canals, or bridges, adding that if necessary, the Interior Ministry, governorates, and the Army will help to remove within six months the remaining encroachments that have built up in the last 30 years. El Sisi said that stopping land encroachment is a national security issue, as many Egyptians work in agriculture “and either we achieve self-sufficiency or we import in USD, which represents a burden on the national economy.”

WATER EFFICIENCY PLAY- The president added that lining the nation’s canals to improve efficiency of water use will cost EGP 80 bn in total, a cost that will not be passed onto farmers. Al Tase’a (watch, runtime: 5:08 | 1:45) had coverage.

EGYPT IN THE NEWS

High export tariffs on Russian wheat could put Egypt and other buyers in a “grave situation,” the managing director of a Black Sea-region agricultural research firm writes for the Financial Times. Introduced by the Russian government earlier this year, the tariffs, alongside heightened fertilizer prices, could see farmers lose 15-30% of their income, potentially having a devastating impact on the country’s wheat industry as well as serious ramifications for its biggest buyers, such as Egypt. Russian grain accounts for nearly a quarter of global exports, and is Egypt’s biggest source of wheat.

The ongoing detention of Safwan and Seif Thabet, the top execs at EGX-listed Juhayna, is the subject of this Reuters report that has been widely picked up by global media outlets.

The UK is coming in for criticism over its refusal to accept the vaccination status of travellers from countries including Egypt. Writing for Bloomberg, journalist John Bowker says the policy, which has been called discriminatory and racist, exemplifies the UK’s “post-colonial approach” and sends “all the wrong messages.”

ALSO ON OUR RADAR

South Africa’s Rand Merchant Bank has named Egypt the most attractive African country for investment in a report. “While Egypt’s economy was hard hit by the pandemic, it was also one of the first to bounce back to a path of growth. This, owing to the swift measures it introduced and the fact that it had been on a stronger footing at the outbreak of covid-19,” the financial services company wrote. The ranking — which placed Morocco in second place and South Africa in third — assesses economic activity, the business environment and the state of public finances in African countries.

PLANET FINANCE

EM bonds see heavy outflows over Evergrande, Fed taper: Investors made a hasty exit from exchange-traded emerging-market bond funds last week, as China’s wobble over the Evergrande crisis and expectations for a Fed taper later this year led investors to withdraw from riskier debt. Investors withdrew almost USD 83 bn from EM debt ETFs last week, according to Bloomberg data. The biggest fund, the USD 20 bn iShares JPMorgan USD Emerging Markets Bond ETF, saw portfolio managers withdraw USD 781 mn last week, its biggest weekly outflow in almost seven months.

On the bright side: EM equities gained enough fresh investment to offset the debt-fund losses, with EM stock ETFs seeing USD 256.3 mn of inflows during the week. One money manager told Bloomberg that the debt-buying dip is simply “a healthy pause and small correction” to the recent recovery in EM bonds: “I see it as a bit of indigestion with two big risk events that took place last week: US Fed and Evergrande.”

ACWA Power sets share price in USD 1.2 bn IPO: ACWA Power has set its share price at SAR 56 per share ahead of its IPO on the Saudi bourse next month, banking sources told CNBC Arabia yesterday. The public offering of 81.2 mn shares, or an 11.1% stake, is set to raise USD 1.2 bn, the sources said. Bookbuilding on the IPO ended today, while subscription for individual investors will run from 29 September to 1 October. Our friends at EFG Hermes KSA are bookrunners alongside Emirates NBD Capital and FAB.

Abu Dhabi National Oil Company (Adnoc) completed the bookbuild and public subscription for its Drilling Company’s IPO, raising USD 1.1 bn, the company announced (pdf). The company received bids worth USD 34 bn from institutional investors, making the offering 31x oversubscribed. The company will go public and start trading on the ADX on 3 October. The company was initially offering 7.5% of its drilling unit at AED 2.30 per share, valuing the company at USD 10 bn, but increased the offering size after being met with huge demand. Our friends at EFG Hermes UAE are bookrunners on the transaction along with Emirates NBD Capital, Merrill Lynch and Société Générale.

|

|

EGX30 |

10,496 |

-1.4% (YTD: -3.2%) |

|

|

USD (CBE) |

Buy 15.66 |

Sell 15.76 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

11,369 |

+0.1% (YTD: +30.8%) |

|

|

ADX |

7,751 |

-0.3% (YTD: +53.6%) |

|

|

DFM |

2,817 |

-0.5% (YTD: +13.1%) |

|

|

S&P 500 |

4,443 |

-0.3% (YTD: +18.3%) |

|

|

FTSE 100 |

7,063 |

+0.2% (YTD: +9.3%) |

|

|

Brent crude |

USD 79.53 |

+1.8% |

|

|

Natural gas (Nymex) |

USD 5.80 |

+1.7% |

|

|

Gold |

USD 1,750.50 |

-0.1% |

|

|

BTC |

USD 43,083 |

-1.11% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 1.4% at yesterday’s close on turnover of EGP 1.27 bn (20% below the 90-day average). Regional investors were net buyers. The index is down 3.2% YTD.

In the green: GB Auto (+1.0%).

In the red: Ezz Steel (-9.9%), MM Group (-6.2%) and Egyptian Resorts Company (-5.9%).

Asian markets are mixed this morning, with the Nikkei and Kospi both in the red and shares in both Hong Kong and Shanghai hanging onto their gains. Futures suggest the sell-off on the tech-heavy Nasdaq could continue at the opening bell this afternoon, while both the Dow and S&P should open in the green. The CAC 40, DAX 30 and FTSE 100 are all set to open in positive territory in a few hours’ time.

DIPLOMACY

Egyptian special forces joined Saudi Arabia, the UAE and Greece in a joint military exercise, dubbed “Hercules 21” in Greece yesterday, the Armed Forces said in a statement yesterday.

AROUND THE WORLD

The German vote count is in. Now for the horsetrading: The center-left SDP won the most votes in the German elections, but the party hasn’t yet made it to government. Neither the SDP nor the outgoing chancellor Angela Merkel’s Christian Democratic Union won a majority of the vote, meaning weeks of negotiations on a coalition lie ahead. The two parties that hold the balance of power, the Greens and the liberal FDP, both upped their vote share and are set to enter coalition talks with SDP leader party leader Olaf Scholz, who hopes to put a government together in the coming weeks. Reuters, the FT and the NYT have more.

Israel and Iran trade barbs at UN debate: Israeli Prime Minister Naftali Bennett accused Iran of crossing “all red lines” with its nuclear program and reiterated that Tehran would not be allowed to develop a weapon during his first UN General Assembly speech yesterday, Reuters reports. In response, Iran’s ambassador to the UN called Bennett’s speech “full of lies.”

“What about Apple?” Google asked an EU court yesterday, as the tech firm kicked off its attempt to get repealed a record EUR 4.3 bn antitrust fine handed to it last year for anticompetitive practices relating to its Android mobile operating system, according to Reuters. Lawyers for the Silicon Valley giant told the court that Apple, too, had acquired significant market power and framed its activities as disrupting spaces dominated by Tim Cook and co.

How are Egypt’s solar players being impacted by the commodities boom? 2021 has seen global commodities prices soar to record highs on pent-up post-lockdown demand and continued supply chain disruptions, prompting speculation from some quarters that the world may be seeing the start of a new supercycle. Unsurprisingly, local solar producers have hardly been insulated from the skyrocketing prices, reliant as they are on copper, aluminum, steel and silicon to establish new PV plants. Companies tell us that in order to cope with the new reality, they have increased their prices, delayed projects, or absorbed the costs and accepted squeezed margins.

Commodities prices have surged this year as a world coming out of lockdown struggles to return global supply chains to normal, and economies witness a rush of new construction and industrial activity. Aluminium prices reached new multi-year highs earlier this month, rising 54% year-to-date to reach more than USD 2,957 per tonne — the highest level since July 2008. Global steel prices have hit record highs this year, as have copper futures, which despite falling back since peaking in May remain up 28% YTD.

This has been reflected on the ground here: Copper, aluminum, steel and silicon prices have increased by up to 40% in the Egyptian market, says founder and MD of SolarizEgypt Yasseen Abdelghaffar.

As gas prices went up, so did the price of aluminum — the main component of solar panel mounting structures, says Cairo Solar Managing Director Hatem Tawfik. Aluminum and copper cables also saw price increases, as did the inverters that transfer energy from the panels to the electricity grid, he tells us.

Naturally, this pushes up the cost of solar energy: Since March, the price of solar cells — which are made of silicon — has risen by almost a third to USD 0.24-0.25 per watt, up from USD 0.19, Tawfik tells us.

The commodities boom has flipped the script on solar prices: This reverses a long-term trend which over the past five years has seen the price of solar cells fall from USD 0.52 per watt as production and demand have increased. “We’re feeling a crunch and it’s reversed the cycle in which the overall cost of solar was predictably decreasing,” says Abdelghaffar.

Cost increases have been further driven by post-lockdown solar project backlogs: The demand driving current raw material price increases comes largely from the recent resumption of projects following delays, Mokhtar Abul Ata, head of business development for North Africa and the Levant at Infinity, tells Enterprise. Suppliers couldn’t match the quick resurgence in demand for solar panel systems, especially in China, after many factories halted production during the height of covid, says Tawfik. Manufacturers had a two-year-long list of orders to catch up on, he adds.

As well as rising import costs from China: The cost of moving commodities from China to other countries went up due to US trade restrictions. A container of raw materials that used to cost USD 3k to transport shot up to USD 15k, Tawfik adds.

Projects are being delayed: Both Saudi Arabia’s ACWA Power and the UAE’s Al Nowais have asked to delay large-scale projects in recent weeks, which a senior official at the New and Renewable Energy Authority (NREA) told us was due to rising price pressures. ACWA is reportedly trying to postpone work on its 200 MW Kom Ombo plant for nine months and Al Nowais wants to hold off until June 2022, which the NREA’s Deputy Director Ehab Ismail said was due to the rising costs of solar cells and shipping putting the projects over budget.

And more may be on the way: “I tried to delay the agreements until the beginning of 2022 because we have a feeling that inflation will start to recede by the end of the year,” Tawfik says.

Some are passing on costs to their offtakers: According to Tawfik, Cairo Solar has upped prices by 10% for clients that are willing to pay, while Infinity has also upped its prices to protect its already-low margins. “Although we absorbed part of the impact in our margins, selling prices went up,” Infinity’s Abul Ata says, without disclosing how much it raised them.

How are customers reacting? “The price increase is already raising a lot of questions with customers we’ve been talking to for a while, given that these are long-lead projects that take time to conclude,” Abul Ata says. Customers that understand global supply chain dynamics are understanding of the slight price change, he adds. Tawfik notes that the approach depends on the client — if they’re comfortable with the price increase or believe that prices won’t go down, Cairo Solar executes their projects immediately. If not, it will push them to next year.

The silver lining? The main materials in solar project construction are often purchased annually, in bulk with a price locked in, offering some protection against fluctuating prices. Inverters and solar panels, the main construction materials in solar projects, are usually purchased under annual agreements with large suppliers, keeping prices relatively constant, says Abdelghaffar. This means for now, agreements with suppliers that have enough equipment in their warehouses for the next 6-9 months form a buffer against cost increases, he adds.

Nevertheless, the commodities boom needs to reverse over the next 6-9 months to avoid a serious slowdown in solar deployment. “If it isn’t resolved soon, we’ll start to see a 30-40% increase across the whole project cycle,” Abdelghaffar concludes.

Your top climate stories for the week:

- Egypt wants to host COP27: President Abdel Fattah El-Sisi announced that Egypt would bid to host the 2022 UN Climate Change Conference during climate talks at the UN General Assembly last week.

- The EBRD will nearly double its “priority investments” in its Green Cities program, to around EUR 1.9 bn by end-2023, up from EUR 1.01 bn as of this August. That could mean more green infrastructure funding for program members Cairo, Alexandria and Sixth of October.

- Saudi Arabia’s sovereign wealth fund will soon announce its first green debt issuance, with borrowing linked to sustainability, marking the first issuance of its kind by a sovereign fund.

- As the world gets warmer, architects are designing homes to be cooler: Architects at Egyptian firm ECOnsult are among those introducing new building techniques that lower temperatures indoors without using ACs.

CALENDAR

14-30 September (Tuesday-Thursday): 76th session of the UN General Assembly, New York.

29 September (Wednesday): DevOpsDays Cairo 2021 is being organized by ITIDA and the Software Engineering Competence Center in cooperation with DXC Technology, IBM Egypt and Orange Labs.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

30 September (Thursday): Winter opening hours for shops and restaurants begins.

30 September: Closing of 2021’s first oil and gas tender in the Gulf of Suez, Western Desert, and the Mediterranean.

30 September (Thursday): First tranche of overdue subsidy payouts will be handed to eligible exporters.

30 September (Thursday): Direct flights between Egypt and three Libyan airports resume.

October: Romanian President Klaus Iohannis could visit Egypt in mid this month to discuss ways to boost tourism cooperation between the two countries.

1 October (Friday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 October (Friday): Expo 2020 Dubai opens.

1 October (Friday): Deadline for state-owned companies and government agencies to sign up to e-invoicing platform.

2 October (Saturday): House returns from recess; new legislative session begins.

5 October (Tuesday): Senate returns from recess; new legislative session begins.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

9 October (Saturday): Public schools begin 2021-2022 academic year

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28 October (Thursday): Second tranche of overdue subsidy payouts will be handed to eligible exporters.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo, Egypt International Exhibition Centre.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

8-10 December (Wednesday-Thursday): Global Forum for Higher Education and Scientific Research (GFHS), Cairo, Egypt.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

15 December (Wednesday): Deadline for joint stock companies and investment companies in Cairo to join e-invoicing platform.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.