- Egyptian economy to grow 3.5% in FY2020-2021 –Reuters poll. (Speed Round)

- How the FinMin is cutting by nearly half its spending on fuel subsidies in 2020-2021 budget. (Speed Round)

- Egypt now has 3,659 confirmed cases of covid-19 (+169). (What We’re Tracking Today)

- Was the gov’t planning new cement licenses despite a supply glut? (Speed Round)

- Contact, Aman awarded Egypt’s first consumer financing licenses. (Speed Round)

- The week the oil markets turned upside down. (The Macro Picture)

- Listen to season two of Making It, our podcast on building a great business in Egypt. (What We’re Tracking Today)

- Forget a ‘V-shaped’ recession and buckle up for a long, drawn-out recovery. (What We’re Tracking Today)

- My WFH Routine: Fatma Ghaly, partner and CEO of Azza Fahmy Jewelry.

- The Market Yesterday

Thursday, 23 April 2020

Happy Ramadan, y’all. Plus: Egypt’s economy could grow 3.5% next year, but we’re looking at a V-shaped recovery globally

TL;DR

What We’re Tracking Today

Ramadan Kareem, everybody. Dar Al Iftaa confirmed last night that Friday is the first day of the holy month, meaning we are T-21 hours (give or take a few minutes) to when fasting begins, as Fajr prayers will start at 3:45 am CLT. Here’s hoping things slow down a bit after the excitement (understatement of the year) of the last few months.

So, when do we eat? Maghreb on Friday will be at 6:28 pm CLT, according to Islamic FInder.

The Madbouly government is expected to announce today whether our nighttime curfew will be changed during Ramadan. It will also announce how it will handle other measures that may remain in place or be implemented throughout the month to limit the spread of covid-19, according to a cabinet statement.

President Abdel Fattah El Sisi warned that we could be facing “difficult and harsh” measures to contain the virus if citizens fail to abide by social distancing and hygiene practices (watch, runtime: 5:05).

PSA- There’s a strong chance of dusty winds today and a sand storm tomorrow to mark the first day of Ramadan, according to the national weather service and our favorite weather app.

HOLIDAY WATCH- Saturday, 25 April is Sinai Liberation Day. The holiday will be observed on Saturday and there will be no “replacement holiday” on Sunday, according to a statement. Labour day (1 May) also falls on a weekend.

Some readings to keep your brain engaged during fasting hours tomorrow:

The year ahead for the coronavirus, an epic feature from the New York Times that has predictions and ideas that apply to countries around the world — including Egypt. Read it alongside Business Insider editor Nicholas Carlson’s I am personally planning a return to 'normal' in Fall…2021 and Farhad Manjoo’s reminder to us in the NYT that even if things calm down soon (unlikely), life won’t return to normal for most parents until the kids go back to physical school in the fall: Two Parents. Two Kids. Two Jobs. No Child Care.

Also worth a read (if a bit angsty): What will our new normal feel like? Hints are beginning to emerge, which looks at the psychic toll of what’s likely to be “a world of half-closures and intermittent lockdowns.”

Silicon Valley types have (deservedly) taken a lot of [redacted] for conflating “virality” on the internet with virology. But Marc Andreessen spoke to our heart in It’s time to build, wherein he declares, “It’s time for full-throated, unapologetic, uncompromised … support … for aggressive investment in new products, in new industries, in new factories, in new science, in big leaps forward.” For newbies: Andreessen is the one who changed our reality by inventing this thing called Netscape and who today runs one of the most high-profile VC outfits in the US of A.

The death of retail, part 937: “Shuttered flagships. Empty malls. Canceled orders. Risks of bankruptcy. The coronavirus has hit the behemoths of the retail world,” warns the NYT in The Death of the Department Store: ‘Very Few Are Likely to Survive’.

Corporate leaders, don’t be a Di[sney]. The film, TV and cartoon giant is casting itself as the chief corporate baddie in a feature film about how to be a terrible, horrible, no good, very bad employer, having stopped paying 100k workers even while protecting its executive bonus schemes. The Financial Times has more, including the question of whether Disney will stay on track with a semi-annual USD 1.5 bn dividend payment.

A break from covid for iSheep: Federico Viticci’s review of the new Magic Keyboard for iPad Pro was the review we wanted. But John Gruber’s take at Daring Fireball was the review we never knew we needed.

MAKING IT IS BACK- The second season of our podcast on building a great business in Egypt launches today, just in time to keep you entertained on Thursdays during Ramadan.

Tap or click here to listen to the first episode on: Our website | Apple Podcast | Google Podcast. We’re also available on Spotify, but only for non-MENA accounts.

Our first guest is Mohamed El Kalla, CEO of CIRA, one of the largest private-sector education companies covering everything from K-12 through university. The business has grown from a small family concern into an EGX-listed giant that caters learners from all income levels across the country. CIRA today operates 19 K-12 schools and one university under names including Futures, Maverick schools, British Columbia schools, and Badr University, among others.

And with 30k students, it had to pivot on a dime to offer e-learning when this whole coronavirus thing hit.

The CIRA episode is the first one we’ve produced entirely from home — other episodes had already been recorded by the time we went WFH … oh … about 18 years ago, from the feel of things now.

Making It is made possible thanks to the generous support of: Our friends at CIB and the United States Agency for International Development (USAID).

Need some background? Tap or click here to listen to our trailer (runtime: 05:24), wherein we grumble about producing a podcast (and the Morning Edition you’re reading now) from home.

COVID-19 IN EGYPT-

Egypt now has 3,659 confirmed cases of covid-19 after the Health Ministry reported 169 new infections yesterday. The ministry also said that another 12 people had died from the virus, taking the death toll to 276. We now have a total of 1,270 confirmed covid cases that have since tested negative for the virus after being hospitalized or isolated, of whom 935 have fully recovered.

Authorities have detected nine different subtypes of the virus in Egypt that trigger varying levels of symptoms, head of the Health Ministry’s pandemic science committee Hossam Hosny said (watch, runtime: 1:51:19).

The Central Bank of Egypt is easing its cap on daily withdrawals during Ramadan to EGP 20k from ATMs and EGP 50k for in-branch transactions, the bank said yesterday (pdf). The new limits will only apply during Ramadan and deposit limits will remain unchanged, Masrawy reports, citing a CBE official. The CBE late last month capped in-branch withdrawals for individuals at EGP 10k, and ATM withdrawals at EGP 5k per day. The new limits go into effect tomorrow morning.

Telecom Egypt isn’t going to cut you off just yet. The fixed-line provider is kicking the deadline to pay your April landline bill to mid-June, according to Hapi Journal.

GAFI will provide temporary six-month operating licenses for new and existing businesses in investment zones, especially those focused on medical supplies and food commodities, a cabinet statement said. A three-month grace period will also be granted for insurance payments and the deadline for investors to provide letters of guarantee reserve units in the zones.

The government is still planning to bring back more than 3.5k Egyptians stranded abroad, President Abdel Fattah El Sisi said yesterday (watch, runtime: 1:37).. A repatriation flight brought home 259 citizens from Saudi Arabia yesterday, according to Al Masry Al Youm.

With food security in the global spotlight, El Sisi also called on farmers to reduce the amount of wheat they warehouse and sell more of their stock to the Supply Ministry to secure strategic commodity reserves (watch, runtime 18: 47). The president’s remarks came as he inaugurated national projects east of the Suez Canal, including the USD 100 mn Al Mahsama agricultural drainage treatment and recycling plant developed by a JV of Hassan Allam and Metito, according to an emailed statement (pdf). The plant, the largest of its kind in the world, will bolster food security by contributing to the cultivation of some 70k acres in Sinai.

Diagnostics kit provider Cellex is coming to Egypt after having inked an agreement that makes Prime Speed Medical Services the sole agent for its virology and antibody diagnostic tests, according to a regulatory filing (pdf). Medical diagnostics outfit Speed Medical is a 30% shareholder since March in Prime Speed.

TV stations give advertisers breathing room for Ramadan campaign payment: Egypt TV, CBC and Al Hayat will allow advertisers to pay for their primetime Ramadan campaigns over four monthly installments starting from April company cashflows feel the pinch of corona, Al Mal reports.

DONATIONS-

- Papermaker Fine has doubled its MENA relief fund, from which Egypt benefits, to USD 2 mn. (statement)

- Henkel Egypt launched a EGP 2 mn initiative to support healthcare personnel in cooperation with the Egyptian Cure Bank. (Masrawy)

- China State Construction Engineering Corporation has gifted Egypt with EGP 12 mn-worth of medical supplies, including respirators. (Youm7)

ON THE GLOBAL FRONT-

Saudi Arabia will allow Ramadan-evening Taraweeh prayers at the Two Holy Mosques, but will reduce the prayer to five rounds and not allow worshippers inside the mosques, according to Reuters. Saudi Arabia is also looking to loosen its lockdown and curfew hours during Ramadan. Khaleej Times has the new curfew timetable.

The UAE is continuing to ramp up corona testing: The UAE has now tested around 10% of the population for covid-19, Bloomberg reported a government spokesman as saying. The Gulf state has opened drive-thru test centers and has made the test free for vulnerable groups and people showing symptoms.

US President Donald Trump signed yesterday an executive order to temporarily suspend issuing permanent residency cards to immigrants, reports the Associated Press. The 60-day pause is meant to stop foreign workers from competing for jobs amid rising covid-19 unemployment, Trump said, but comes with a laundry list of exemptions, the newswire notes.

US lawmakers edged overnight toward passage of a USD 484 bn stimulus package for small businesses and hospitals, the Wall Street Journal reports. The move comes less than a month after the country passed a historic USD 2.2 tn stimulus bill.

EVERYTHING MACRO-

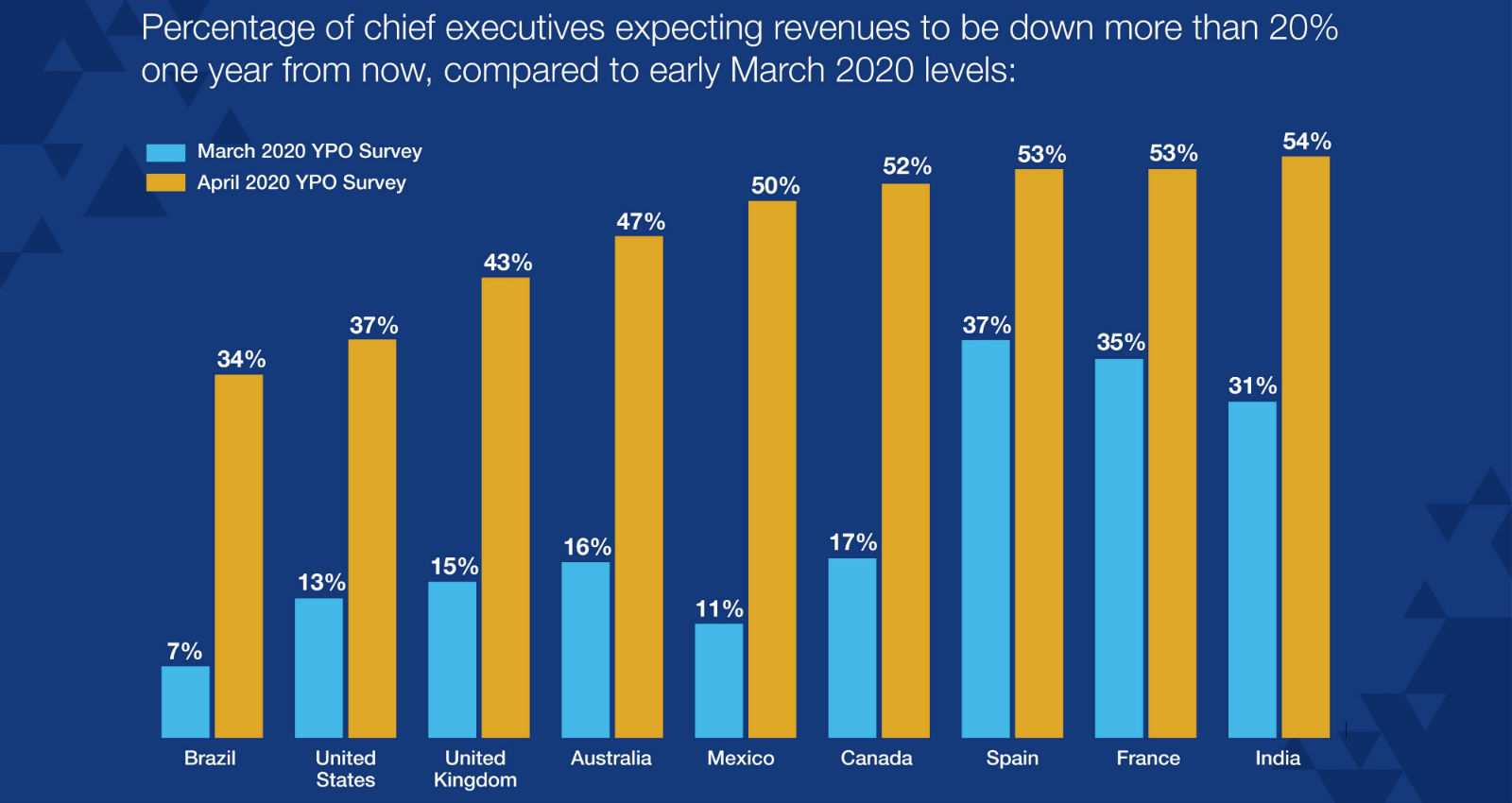

Global business chiefs abandon hope for ‘V-shaped’ recession, prepare for long, drawn-out recovery: Business leaders around the world are pessimistic about the chances of a rapid recovery from the corona recession and many are bleak about their companies’ chances of survival, a major poll of chief executives showed yesterday. More than 60% of the more than 3.5k CEOs surveyed by YPO now expect a ‘U-shaped’ recession — indicating a longer recovery — rather than a short-lived V-shaped downturn, with 64% expecting their revenues to still be suffering a year from now and 43% forecasting a 20% drop in revenues.

The gloom is real: The outlook has darkened significantly since YPO’s last survey in March which found a majority of CEOs expecting no significant impact from factors relating to the pandemic. Yesterday’s poll — conducted in the middle of this month — now shows that 56% believe the impact will be significantly more negative and more than 10% expressed fear that their businesses could collapse.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s inauguration yesterday of national projects east of the Suez Canal was in the limelight on last night’s talk shows. The projects inaugurated yesterday included tunnels running under the canal, New Ismailia City, a new agricultural drainage treatment plant constructed by Hassan Allam and Metito and a floating bridge in Ismailia, among several others, Al Hayah Al Youm’s Hossam Haddad said (watch, runtime: 3:40). Min Masr’s Amr Khalil (watch, runtime: 7:49) and Yahduth fi Misr’s Sherif Amer (watch, runtime: 5:01) also had coverage.

Masaa DMC’s Ramy Radwan took note of IMF projections that Egypt’s GDP growth will slow to 2% this year, but will remain the only country in the MENA region to avoid a contraction watch, runtime: 2:55). We covered the report in depth last week.

New withdrawal caps for Ramadan: Federation of Egyptian Banks head Mohamed El Etreby had a chat with Sherif Amer to explain the Central Bank of Egypt’s decision to raise the limits on daily in-bank and ATM withdrawals, which we take note of in What We’re Tracking Today, above (watch, runtime: 3:06).

Speed Round

Speed Round is presented in association with

Egyptian economy to grow 3.5% in FY2020-2021 –Reuters poll: Egypt’s economy will grow at a 3.5% clip in FY2020-2021, down from 5.9% in a similar poll just three months ago, according to a Reuters poll of economists. Growth for the current fiscal year will come in at 3%, a downgrade from a previous estimate of 5.8%, according to the 20 analysts polled. The economy expanded 5.6% in 1H2019-2020 but is expected to slow substantially in the second half of the fiscal year as the covid-19 pandemic causes widespread domestic disruption and the global economy enters one of the deepest recessions in living memory.

Just one respondent sees a possible recession: NKC African expects the economy to contract by 1.7% in the coming fiscal year due to “weaker consumption, investment and exports.”

Inflation to remain steady: The analysts predict that inflation will remain within the central bank’s 9% (+/-3%) target range, slowing to 6% in the current fiscal year before accelerating to 7.5% in FY2020-2021.

More rate cuts on the way? Respondents see the central bank making another 50 bps cut to its overnight lending rate by the end of June 2020, bringing it down to 9.75%. The CBE left rates on hold on 2 April, less than three weeks after the 300 bps cut, leaving its discount rate at 9.75%. The CBE’s monetary policy committee next meets on 14 May.

Fitch sees rates being left on hold: The CBE will hold off on making further cuts to interest rates for the rest of the year due to the global turmoil caused by the novel coronavirus, Fitch Solutions said in a report picked up by Al Mal. The central bank, which last month made an emergency 300 bps cut as a “preemptive” move against covid-19, will keep its foot off the pedal until 2021 as external finance tightens, the ratings agency said.

A tentative return to easing in 2021: Fitch anticipates that the CBE will take a more accommodative turn in 2021 and cut rates by 50 bps. A more aggressive cut could be in store if the economy fails to rebound as expected, it said.

Egypt to withstand corona blowback despite growth slowdown -BNP Paribas: Egypt’s stable financial sector and ample liquidity will help the economy weather the corona storm, according to BNP Paribas, which is forecasting GDP to dip to 2.6% in 2020 before recovering slightly to post 3.4% growth in 2021. Fiscal reforms over the past several years will enable the government to keep servicing debt repayments and its current account deficit, and its healthy FX reserves will support the EGP’s performance against foreign currencies and help the government to accommodate any temporary decline in foreign investment.

Stimulus package gets props: The French bank lauded the state’s EGP 100 bn stimulus package and the CBE’s 300 bps rate cut, for helping alleviate the financial burden on average citizens and limiting potential corporate losses.

FinMin nearly halves projected fuel subsidy spending in 2020-2021 budget: The Finance Ministry is allocating EGP 28.1 bn to subsidies for petroleum products in FY2020-2021, down by nearly half from EGP 52.9 bn in FY2019-2020 forecasts, according to figures obtained by Masrawy. Prior subsidy cuts, the collapse in global oil prices, and price hikes for electricity companies have given the government room to cut fuel subsidies while reducing energy prices for manufacturers to help them weather the covid-19 storm, officials we’ve spoken with tell us.

Factor #1- Lower global prices automatically trim our oil spending: The new draft budget sets the average crude price at USD 61 / bbl, USD 7 lower than the price used in last year’s forecasts. This means that next fiscal year’s predictions will naturally be over USD 20 bn less on an annual basis since, according to ministry calculations, each USD 1 decrease in the price of oil leads to savings of between EGP 3-4 bn in fuel subsidy spending.

Factor #2- Fewer fuel products today receive subsidies: Subsidies on most fuel products were lifted last summer, raising their prices by up to 30%. An automatic fuel pricing mechanism that allows prices to move in tandem with global indices was also rolled out around the same time, and has seen two cuts in fuel prices since then — one this month and another last October. Those cuts have offset the original hike by nearly 50%, but was not enough to cause subsidy spending to rebound, another official said.

Lowering energy prices for factories didn’t add to the subsidies bill: This move, which saw the government respond to demands from industry late last year to slash gas prices for certain types of factories with expectations to do more, was offset by a parallel move to raise the price at which electricity plants receive natural gas. Although most electricity providers are owned by the state, they operate independently and so the cost of subsidies was transferred from the state’s budget to their own.

Overall, the government now needs to allocate much less in budget forecasts for fuel subsidies. In fact, forecasts for the ongoing fiscal year turned out much less than what was originally budgeted. The government ended up spending only EGP 9.88 bn in the first half despite expecting to dole out five times this amount throughout the year.

The government also still has in place a fuel hedging mechanism that it had resorted to several times in recent years, says Finance Ministry spokesperson Sara Eid, who notes that hedging will remain an important tool next fiscal year. This means that if prices don’t recover from their current crash, state coffers could pocket more savings than currently expected.

Was the gov’t considering new cement licenses in FY2020-21? The government was planning to license new cement producers starting July despite a supply glut in the industry, according to a document breaking down the FY2020-2021 budget seen by Reuters’ Arabic service. A figure showing that the state expects to make EGP 620 mn next fiscal year from licensing appeared in the document that surfaced this week, despite having been absent from last year’s budget forecast. However, it seems like the plan was scrapped on the back of the covid-19 crisis, an official who spoke to us yesterday on the condition of anonymity said.

Background: Cement companies in Egypt have suffered through losses and shutdowns in 2019, which many blame on an oversupplied market. Annual production capacity ranges between 80-85 mn tonnes, while domestic consumption levels barely touch the 50 mn mark. Major private sector cement players told us that if the situation was not remedied by reducing supply and ending the fragmentation in the market, 2020 will be a worse year, particularly during covid-19. You can read more in this week’s edition of Hardhat.

So why were more licenses on the table? The government had based its projections on an expected boom in construction and was planning to issue the new licenses to ensure an adequate supply of low-cost building materials to pave the way for this boom, a source close to the matter said. The source told us that the government is considering scrapping the new licenses as covid-19 has changed projections.

The plan would have also seen new steel bar producers licensed to enter the market. The steel industry, like cement, has problems of its own. Small-scale rolling mills repeatedly threatened to halt production as they challenge the protectionist duties in place on iron billets, a key input they import. The tariffs were introduced last year at 16% for billets, with plans to be gradually reduced over three years, but the first round of the three-year plan to taper the duties was called off earlier this month to keep larger factories afloat amid the covid-19.

Contact, Aman awarded Egypt’s first consumer financing licenses: Contact, a subsidiary of consumer- and structured-finance player Sarwa Capital, has been awarded Egypt’s first consumer finance license, the Financial Regulatory Authority (FRA) said yesterday. The FRA also granted Raya Holding subsidiary Aman the second license.

Other consumer finance outfits applying to receive licenses include EFG Hermes’ valU, Premium Card, and CI Capital’s Souhoola. The licenses will be awarded under the Consumer Credit Act, which President Abdel Fattah El Sisi ratified last month.

DEBT WATCH- Raya looks to re-issue asset-backed securities with lower interest following CBE cuts: Raya Holding is looking to recover EGP 500 mn in securitized bonds it issued in October, Al Mal reports, citing unnamed informed sources. The company has called on the bond holders — CIB, the National Bank of Egypt (NBE), and Attijariwafa Bank — to consider relinquishing the remainder of the first tranche of the issuance, estimated at EGP 200 mn. Raya is seeking to capitalize on the CBE’s 300 bps interest rate cut, and pay out a 10.5% return instead of the original c.13%, the sources said. Raya aims to reissue a EGP 700 mn tranche, which includes the outstanding EGP 200 mn and a new EGP 500 mn tranche, in two months, the sources added.

Egyptian banks' net profits jumped 18% y-o-y to EGP 83.1 bn by the end of 2019, the Central Bank of Egypt said in a report (pdf). Revenues reached EGP 154.95 bn at the end of 2019, up 17.5% from EGP 131.9 bn in 2018. The country’s five biggest banks accounted for EGP 41.67 bn of the sector’s total net profit, according to another report (pdf).

M&A WATCH- Technolease acquires 10% of Mohandes Insurance for EGP 104.5 mn: Bayt El Khebra for Leasing (Technolease) has acquired a 9.89% stake in Mohandes Insurance (5.94 mn shares), according to a regulatory disclosure (pdf). Technolease bought the shares at EGP 17.6 apiece, bringing the total to EGP 104.55 mn. Osool ESB Securities Brokerage managed the transaction.

LEGISLATION WATCH- Corporate income tax relief program gets House approval: The House of Representatives approved in its plenary session yesterday a bill allowing the government to move ahead with its tax relief package to help companies cope with the economic impact of covid-19. Companies will need to commit to zero layoffs if they sign up for the program, according to Mubasher.

The House also approved the Unified Income Tax Act after the government agreed to raise the exemption threshold to EGP 9k from EGP 7k, according to Mubasher. The bill in its final form also introduced a new top rate for those earning more than EGP 400k per year. The current tax bands will now be as follows:

- Those earning between EGP 15-30k will be taxed 2.5%;

- Those earning between EGP 30-45k will be taxed 10%;

- Those earning between EGP 45-60k will be taxed 15%;

- Those earning between EGP 60-200k will be taxed 20%;

- Those earning between EGP 200k-400k will be taxed 22.5%; and

- Those earning more than EGP 400k will be taxed 25%.

The House failed to convince the government to include annual special bonuses in the wages of state-owned company employees, according to Al Mal. Public Enterprises Minister Hisham Tawfik agreed to reconsider this clause after the covid-19 pandemic is over, but noted that including the bonuses as part of the main salary would raise state companies' expenditures by EGP 700 mn.

Parliament also approved the SMEs Development Act and amendments to the Emergency Law that expand presidential powers to combat the covid-19 pandemic. Reuters took note of the Emergency Law amendments.

EARNINGS WATCH- Pioneers Holding net profits increased more than 10% in 2019, rising to EGP 1.35 bn from EGP 1.23 bn the year before, according to an EGX filing. ٌRevenues were up more than 9% during the year to hit EGP 9.5 bn from EGP 8.5 bn in 2018.

Etisalat Misr’s net profits before interest and tax rose to EGP 1.8 bn in 1Q2020, up from EGP 1.36 bn during the same quarter last year, according to Etisalat Group’s quarterly report (pdf). Revenues in 1Q2020 increased to EGP 4.3 bn from EGP 3.4 bn last year.

CORRECTION- We mistakenly said in yesterday’s issue that the European Bank for Reconstruction and Development holds EUR 1 tn in its relief fund. The correct figure is EUR 1 bn. The story has been amended on our website. H/t Soha El-T.

The Macro Picture

The week the oil markets turned upside down: With all the havoc wrought upon the global economy by the coronavirus over the past six weeks, the oil markets have held up relatively well. The key word here is relatively — up until the beginning of this week WTI prices had plunged more than 61% since the beginning of the year. But until a few days ago prices had held their ground in the mid-USD 20 range since the end of March despite all available evidence pointing to an intensifying supply crisis.

Saudi Aramco’s price cuts in its attritional oil war with Russia combined with the shuttering of much of the global economy only pointed one way. On Monday, US crude finally caved: Prices crashed from USD 55.90/bbl to USD -37.63. With just two days left before the expiry of the May futures contract, traders for the first time in recorded history began throwing money at any buyers they could find in a frantic bid to avoid taking delivery. It was a rampage that some observers speculate could sign the death warrant for WTI as the US benchmark.

WTF happened to WTI? The shutdown of swathes of the global economy combined with the ill-timed Saudi-Russia-US battle for market dominance has resulted in a chronic case of oversupply and an unprecedented demand slump. Across the world, airlines are grounded, cars gather dust in garages, and entire sectors of economies lie anaesthetized by governments desperate to stamp out the spread of the virus. Add to this the price war and Aramco spewing crude at full throttle and you have a world drowning in oil — mns of barrels lying stationary on newly-deployed supertankers and storage sites full to the brim. All this has left Cushing — the sleepy Oklahoman hub for US crude — practically overflowing with oil. Traders, seemingly unable to take physical delivery, were at one point paying USD 37.63/bbl to anyone who would take it off their hands.

Was this merely a blip — or a sign of a more profound imbalance in the markets? Granted, WTI’s momentary trip into sub-zero prices was hardly reflective of the broader market. Contracts further ahead on the curve remained in positive territory, and the more widely-used Brent benchmark fell by a comparatively modest 7.7%. The nature of WTI contracts also played a major role in the sell-off. Contracts for US crude, unlike Brent, do not allow cash settlements, forcing traders to take delivery if held until expiry. This would have provided little assurance to traders though: The next day, prices of the June contract plunged 43% to just USD 11.57 and June Brent joined the selloff, falling 24.4% to settle at USD 19.33.

A portent of things to come? This extension of volatility into longer-term contracts betrayed a more troubling reality: as long as the status quo persists, Monday’s dive into negative prices may not be merely a historic blip but a portent of things to come. “If we have not recovered from covid in July so that enough driving has come back and storage is full, then the price of crude oil is going to be zero,” one analyst said.

Egypt in the News

Egypt’s shipment of personal protective equipment to the US earlier this week is still getting attention in the foreign press, with AFP and the National taking note.

Energy

Kom Ombo solar plant starts operations in Aswan

The New and Renewable Energy Authority (NREA) has brought online the 26 MW Kom Ombo solar plant, according to the local press. The NREA had started trial operations on the plant, which was constructed by Spain’s TSK, two weeks ago.

Enppi targeted by spear phishing attack, cybersecurity firm says

Cybersecurity firm Bitdefender says state-owned oil and gas company Enppi has been targeted by a spear phishing malware attack, Energy Voice reports. Emails claiming to represent the company, impersonating tender documents and referencing the Rosetta development, went out starting on 31 March, in an attempt to gain insider information.

Automotive + Transportation

Other Business News of Note

My WFH Routine

Fatma Ghaly, partner and CEO of Azza Fahmy Jewelry: Speaking to us this week is Fatma Ghaly, partner and CEO of Azza Fahmy Jewelry, an international, family-owned, 50 year-old artisanal jewelry brand.

Azza Fahmy Jewelry is a family business, and I've been there for 20 years. I started as a junior in the marketing department and held roles in different departments, working my way up until I took on the position of managing director in 2016. In 2019, I became the CEO.

My WFH days vary, but meditation and exercise are a must to give me energy and clarity, and keep me productive. I usually wake up around 8am and meditate for 30-40 minutes. Then I do an online workout at home from 10-11am with Sarah Helmy at TheStudio. Recently I took up running, which I sometimes do in the afternoon. Now I have some extra time, I’ve been able to go back to painting — something I hadn’t done in years — and I actually displayed a painting last month at a TAM Gallery exhibition.

The madness of Zoom meetings and calls begins at 11:30am and lasts until 6 or 7pm. It’s often a little more stressful than being at the office. We have two types of meetings — crisis management and planning — and together they take up a big chunk of the day.

I usually go for a walk in Zamalek, where I live, after finishing my work day around 6pm. I’m really noticing and enjoying the use of public space on the island now, and it feels like I'm getting to know the neighborhood differently. Afterwards I head home, shower, watch some TV, spend some time with my family and head to bed very early.

The current environment is very challenging financially as jewelry is not a necessity. I’m aware that we provide luxury goods that people can easily live without, so when our revenues take a hit we have to reassess everything we’re doing, especially from an organizational perspective. It's a very challenging time but the circumstances have forced us to become creative, and some of our new approaches will continue beyond the current situation.

Managing production costs and determining how to continue operations are our major challenges. We have craftsmen who cannot work remotely. In mid-March, we reduced the number of people in our factory from 160 to 10 of the most essential workers living close to the factory.

We’re operating with a mindset of survival, rather than growth. We shut the office in mid-March, and our sales, marketing, and commercial departments transitioned to WFH quite easily, then we followed up with operational reductions. Shops remain open between 10am and 5pm, but we’ve cut staff numbers down to two people per shift, and one shift a day.

Good communication has been instrumental in easing everyone’s anxiety. Regular communication from the partners to the team through e-meetings, calls, and even personal WhatsApp messages have been key to maintaining that connection.

Right now I'm watching the silliest stuff you could imagine: The IT Crowd, with its dark, cynical British humor, has been at the top of my list. I’m also re-watching Yes, Prime Minister, which is one of my all-time favorite shows and highlights the failure of bureaucratic institutions. I had started watching Narcos: Mexico before the height of the pandemic, but I can no longer watch it right now.

Now I’m in the mood for fiction, and getting caught up in a story that helps me think of lighter things. I currently have at my bedside Elena Ferrante’s Neapolitan Novels, which people have repeatedly recommended. And I recently read The Golem and the Jinni by Helene Wecker, which is great. I felt a connection to the people and relationships depicted, but it's also pure escapism, which is what I need at the moment.

I really miss human interaction. I miss sitting with all the people that I love and physically giving them a hug.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.68

EGX30 (Wednesday): 9,801 (-0.8%)

Turnover: EGP 1.7 bn (163% above the 90-day average)

EGX 30 year-to-date: -29.8%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session down 0.8%. CIB, the index’s heaviest constituent, ended down 1.2%. EGX30’s top performing constituents were Dice up 9.8%, Sidi Kerir Petrochemicals up 4.3%, and Heliopolis Housing up 3.1%. Yesterday’s worst performing stocks were Eastern Co down 2.6%, Cleopatra Hospitals down 2.3% and Pioneers Holding down 1.8%. The market turnover was EGP 1.7 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -204.6 mn

Regional: Net Long | EGP +9.2 mn

Domestic: Net Long | EGP +195.4 mn

Retail: 32.0% of total trades | 33.8% of buyers | 30.2% of sellers

Institutions: 68.0% of total trades | 66.2% of buyers | 69.8% of sellers

WTI: USD 13.93 (+1.09%)

Brent: USD 20.52 (+0.74%)

Natural Gas (Nymex, futures prices) USD 1.93 MMBtu, (-0.52%, May 2020 contract)

Gold: USD 1,733.30 / troy ounce (-0.29%)

TASI: 6,541.47 (+0.69%) (YTD: -22.03%)

ADX: 3,987.06 (+3.28%) (YTD: -21.45%)

DFM: 1,862.28 (+2.01%) (YTD: -32.64%)

KSE Premier Market: 5,074.38 (+0.38%)

QE: 8,500.23 (+2.09%) (YTD: -18.47%)

MSM: 3,449.58 (+0.21%) (YTD: -13.35%)

BB: 1,308.53 (-0.32%) (YTD: -18.73%)

Calendar

24 April (Friday): First day of Ramadan.

23 April (Thursday): Earliest date on which suspension K-12 and university instruction is set to be lifted.

23 April (Thursday): Suspension of international flights to / from Egypt expires.

23 April (Thursday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29 April (Sunday): House of Representatives covid-19 recess ends.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.