What we’re tracking on 23 April 2020

Ramadan Kareem, everybody. Dar Al Iftaa confirmed last night that Friday is the first day of the holy month, meaning we are T-21 hours (give or take a few minutes) to when fasting begins, as Fajr prayers will start at 3:45 am CLT. Here’s hoping things slow down a bit after the excitement (understatement of the year) of the last few months.

So, when do we eat? Maghreb on Friday will be at 6:28 pm CLT, according to Islamic FInder.

The Madbouly government is expected to announce today whether our nighttime curfew will be changed during Ramadan. It will also announce how it will handle other measures that may remain in place or be implemented throughout the month to limit the spread of covid-19, according to a cabinet statement.

President Abdel Fattah El Sisi warned that we could be facing “difficult and harsh” measures to contain the virus if citizens fail to abide by social distancing and hygiene practices (watch, runtime: 5:05).

PSA- There’s a strong chance of dusty winds today and a sand storm tomorrow to mark the first day of Ramadan, according to the national weather service and our favorite weather app.

HOLIDAY WATCH- Saturday, 25 April is Sinai Liberation Day. The holiday will be observed on Saturday and there will be no “replacement holiday” on Sunday, according to a statement. Labour day (1 May) also falls on a weekend.

Some readings to keep your brain engaged during fasting hours tomorrow:

The year ahead for the coronavirus, an epic feature from the New York Times that has predictions and ideas that apply to countries around the world — including Egypt. Read it alongside Business Insider editor Nicholas Carlson’s I am personally planning a return to 'normal' in Fall…2021 and Farhad Manjoo’s reminder to us in the NYT that even if things calm down soon (unlikely), life won’t return to normal for most parents until the kids go back to physical school in the fall: Two Parents. Two Kids. Two Jobs. No Child Care.

Also worth a read (if a bit angsty): What will our new normal feel like? Hints are beginning to emerge, which looks at the psychic toll of what’s likely to be “a world of half-closures and intermittent lockdowns.”

Silicon Valley types have (deservedly) taken a lot of [redacted] for conflating “virality” on the internet with virology. But Marc Andreessen spoke to our heart in It’s time to build, wherein he declares, “It’s time for full-throated, unapologetic, uncompromised … support … for aggressive investment in new products, in new industries, in new factories, in new science, in big leaps forward.” For newbies: Andreessen is the one who changed our reality by inventing this thing called Netscape and who today runs one of the most high-profile VC outfits in the US of A.

The death of retail, part 937: “Shuttered flagships. Empty malls. Canceled orders. Risks of bankruptcy. The coronavirus has hit the behemoths of the retail world,” warns the NYT in The Death of the Department Store: ‘Very Few Are Likely to Survive’.

Corporate leaders, don’t be a Di[sney]. The film, TV and cartoon giant is casting itself as the chief corporate baddie in a feature film about how to be a terrible, horrible, no good, very bad employer, having stopped paying 100k workers even while protecting its executive bonus schemes. The Financial Times has more, including the question of whether Disney will stay on track with a semi-annual USD 1.5 bn dividend payment.

A break from covid for iSheep: Federico Viticci’s review of the new Magic Keyboard for iPad Pro was the review we wanted. But John Gruber’s take at Daring Fireball was the review we never knew we needed.

MAKING IT IS BACK- The second season of our podcast on building a great business in Egypt launches today, just in time to keep you entertained on Thursdays during Ramadan.

Tap or click here to listen to the first episode on: Our website | Apple Podcast | Google Podcast. We’re also available on Spotify, but only for non-MENA accounts.

Our first guest is Mohamed El Kalla, CEO of CIRA, one of the largest private-sector education companies covering everything from K-12 through university. The business has grown from a small family concern into an EGX-listed giant that caters learners from all income levels across the country. CIRA today operates 19 K-12 schools and one university under names including Futures, Maverick schools, British Columbia schools, and Badr University, among others.

And with 30k students, it had to pivot on a dime to offer e-learning when this whole coronavirus thing hit.

The CIRA episode is the first one we’ve produced entirely from home — other episodes had already been recorded by the time we went WFH … oh … about 18 years ago, from the feel of things now.

Making It is made possible thanks to the generous support of: Our friends at CIB and the United States Agency for International Development (USAID).

Need some background? Tap or click here to listen to our trailer (runtime: 05:24), wherein we grumble about producing a podcast (and the Morning Edition you’re reading now) from home.

COVID-19 IN EGYPT-

Egypt now has 3,659 confirmed cases of covid-19 after the Health Ministry reported 169 new infections yesterday. The ministry also said that another 12 people had died from the virus, taking the death toll to 276. We now have a total of 1,270 confirmed covid cases that have since tested negative for the virus after being hospitalized or isolated, of whom 935 have fully recovered.

Authorities have detected nine different subtypes of the virus in Egypt that trigger varying levels of symptoms, head of the Health Ministry’s pandemic science committee Hossam Hosny said (watch, runtime: 1:51:19).

The Central Bank of Egypt is easing its cap on daily withdrawals during Ramadan to EGP 20k from ATMs and EGP 50k for in-branch transactions, the bank said yesterday (pdf). The new limits will only apply during Ramadan and deposit limits will remain unchanged, Masrawy reports, citing a CBE official. The CBE late last month capped in-branch withdrawals for individuals at EGP 10k, and ATM withdrawals at EGP 5k per day. The new limits go into effect tomorrow morning.

Telecom Egypt isn’t going to cut you off just yet. The fixed-line provider is kicking the deadline to pay your April landline bill to mid-June, according to Hapi Journal.

GAFI will provide temporary six-month operating licenses for new and existing businesses in investment zones, especially those focused on medical supplies and food commodities, a cabinet statement said. A three-month grace period will also be granted for insurance payments and the deadline for investors to provide letters of guarantee reserve units in the zones.

The government is still planning to bring back more than 3.5k Egyptians stranded abroad, President Abdel Fattah El Sisi said yesterday (watch, runtime: 1:37).. A repatriation flight brought home 259 citizens from Saudi Arabia yesterday, according to Al Masry Al Youm.

With food security in the global spotlight, El Sisi also called on farmers to reduce the amount of wheat they warehouse and sell more of their stock to the Supply Ministry to secure strategic commodity reserves (watch, runtime 18: 47). The president’s remarks came as he inaugurated national projects east of the Suez Canal, including the USD 100 mn Al Mahsama agricultural drainage treatment and recycling plant developed by a JV of Hassan Allam and Metito, according to an emailed statement (pdf). The plant, the largest of its kind in the world, will bolster food security by contributing to the cultivation of some 70k acres in Sinai.

Diagnostics kit provider Cellex is coming to Egypt after having inked an agreement that makes Prime Speed Medical Services the sole agent for its virology and antibody diagnostic tests, according to a regulatory filing (pdf). Medical diagnostics outfit Speed Medical is a 30% shareholder since March in Prime Speed.

TV stations give advertisers breathing room for Ramadan campaign payment: Egypt TV, CBC and Al Hayat will allow advertisers to pay for their primetime Ramadan campaigns over four monthly installments starting from April company cashflows feel the pinch of corona, Al Mal reports.

DONATIONS-

- Papermaker Fine has doubled its MENA relief fund, from which Egypt benefits, to USD 2 mn. (statement)

- Henkel Egypt launched a EGP 2 mn initiative to support healthcare personnel in cooperation with the Egyptian Cure Bank. (Masrawy)

- China State Construction Engineering Corporation has gifted Egypt with EGP 12 mn-worth of medical supplies, including respirators. (Youm7)

ON THE GLOBAL FRONT-

Saudi Arabia will allow Ramadan-evening Taraweeh prayers at the Two Holy Mosques, but will reduce the prayer to five rounds and not allow worshippers inside the mosques, according to Reuters. Saudi Arabia is also looking to loosen its lockdown and curfew hours during Ramadan. Khaleej Times has the new curfew timetable.

The UAE is continuing to ramp up corona testing: The UAE has now tested around 10% of the population for covid-19, Bloomberg reported a government spokesman as saying. The Gulf state has opened drive-thru test centers and has made the test free for vulnerable groups and people showing symptoms.

US President Donald Trump signed yesterday an executive order to temporarily suspend issuing permanent residency cards to immigrants, reports the Associated Press. The 60-day pause is meant to stop foreign workers from competing for jobs amid rising covid-19 unemployment, Trump said, but comes with a laundry list of exemptions, the newswire notes.

US lawmakers edged overnight toward passage of a USD 484 bn stimulus package for small businesses and hospitals, the Wall Street Journal reports. The move comes less than a month after the country passed a historic USD 2.2 tn stimulus bill.

EVERYTHING MACRO-

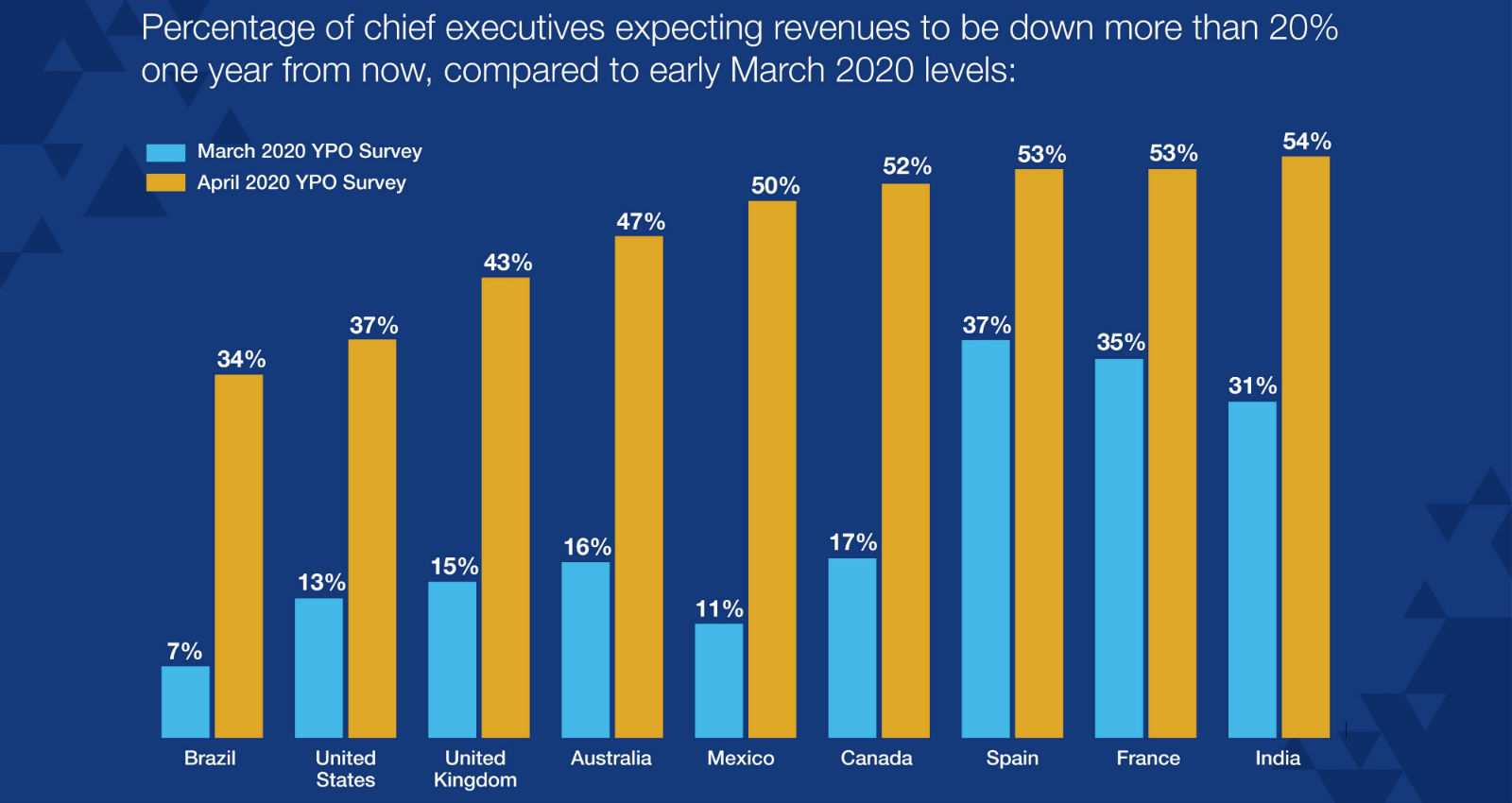

Global business chiefs abandon hope for ‘V-shaped’ recession, prepare for long, drawn-out recovery: Business leaders around the world are pessimistic about the chances of a rapid recovery from the corona recession and many are bleak about their companies’ chances of survival, a major poll of chief executives showed yesterday. More than 60% of the more than 3.5k CEOs surveyed by YPO now expect a ‘U-shaped’ recession — indicating a longer recovery — rather than a short-lived V-shaped downturn, with 64% expecting their revenues to still be suffering a year from now and 43% forecasting a 20% drop in revenues.

The gloom is real: The outlook has darkened significantly since YPO’s last survey in March which found a majority of CEOs expecting no significant impact from factors relating to the pandemic. Yesterday’s poll — conducted in the middle of this month — now shows that 56% believe the impact will be significantly more negative and more than 10% expressed fear that their businesses could collapse.