- WHO is giving us love for our covid response; cases rise to 576 over the weekend. (What We’re Tracking Today)

- Egypt cuts GDP growth forecast to 5.1% from 5.6% in FY 2019-2020; Maait is running best-case, worst-case scenarios. (Speed Round)

- High-performing EGP overvalued, could ease amid covid-19 EM asset dump -Bloomberg. (Speed Round)

- CBE expands industry stimulus package to agriculture companies. (Speed Round)

- Egyptians pour EGP 30 bn into new high-interest savings certificates. (Speed Round)

- Heavy net outflows from EM bond funds continue. (Speed Round)

- Trump signs off on historic USD 2.2 tn economic rescue package. (What We’re Tracking Today)

- The Market Yesterday

Sunday, 29 March 2020

Maait is running best-case, worst-case scenarios as Egypt reports 576 total cases

TL;DR

What We’re Tracking Today

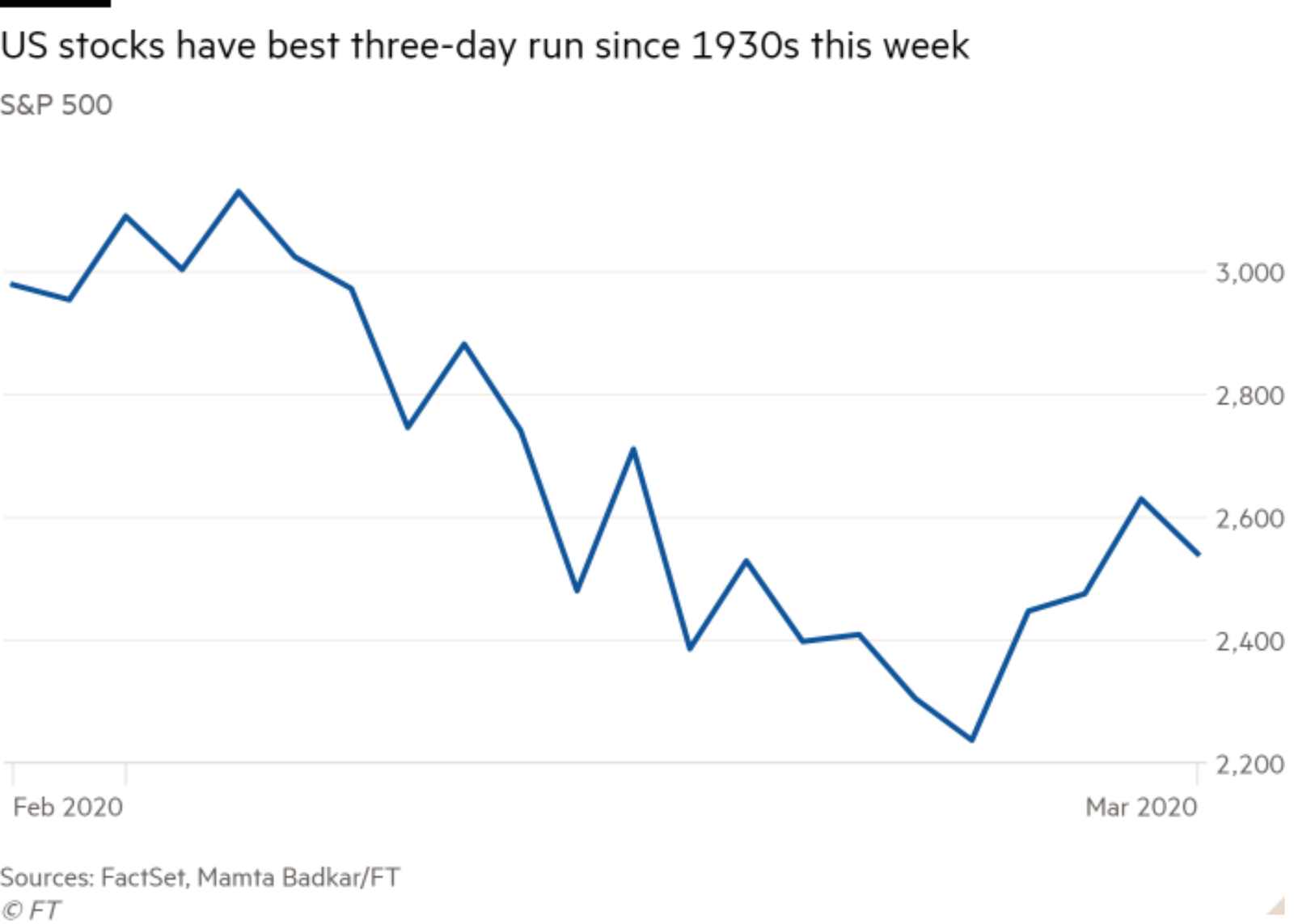

Wait, you mean the sell-off is over? US markets entered and exited bear market territory (defined as 20% off a recent peak) in record time. Insider buying and buybacks suggest there are at least a few people out there (including here in Egypt) who thing the sell-off is done, but this warning in the Globe & Mail rings true to us: “The magnitude of the decline merely matches the average bear-market since 1980, and pales next to the 52 per cent decline during the 2008-09 financial crisis.” In the global financial crisis, too, markets stabilized for a brief period before plunging again. Volatility will remain the order of the day, particularly as we’ve yet to see how the current circumstances have hit corporate earnings globally.

We have more on markets below in this section.

Now is a great time to what? We don’t know the playwright and writer R. Eric Thomas, but his voice is in our head every time someone on Youtube / Instagram suggests that now is the best time ever to learn a new instrument / learn a foreign language / invest time in your hobby / write a screenplay:

“It’s been two weeks, can we all agree to drop the pretense that “we all” have “so much free time” now? Everyone I know is stretched to the limits of their emotional capacity and/or is dealing with an increased workload, professionally and/or domestically. What is this free time?”

Oh, and you think we (collectively) are experts in shiteema? You haven’t met Italian mayors (watch, runtime 1:46) — or this mayor in the US, who seems like the reincarnation of Gen. George S. Patton.

COVID-19 IN EGYPT-

Egypt has now reported a total of 576 cases of covid-19, 120 more than since we last wrote you on Thursday, while 15 people have died of the disease in the same period. The Health Ministry announced 40 new cases last night and said the six deaths were all of people aged 57-78. Some 121 people have made full recoveries and another 161 people who have sought treatment have since tested negative, suggesting they’re on the path to recovery.

*** PSA- The Health Ministry is holding a webinar for medical doctors at 11am CLT today to share information and best practices on covid-19. The 1.5-hour webinar will the disease, the Egyptian covid-19 management protocol, case discussions and a Q&A. Find out more here.

The World Health Organization is giving Egypt some love: The World Health Organization (WHO) has said that Egypt is making “substantial efforts” to contain the covid-19 outbreak and that its disease surveillance system “has proven effective” in preventing clusters of cases from spreading. “After several days of intensive meetings and field visits both inside and outside Cairo, we see that Egypt is making substantial efforts to control the covid-19 outbreak. Significant work is being done, especially in the areas of early detection, laboratory testing, isolation, contact tracing and referral of patients,” said Dr. Yvan Hutin, director for communicable diseases at WHO’s regional office.

“But more needs to be done” to control the outbreak, Hutin said. “We have agreed on several areas that can be scaled up, taking a whole-of-government and whole-of-society approach,” he said without elaborating.

We’re going to go a step further and suggest that from how the Health Ministry has managed things to the imposition of curfew and announcement of stimulus measures, the Madbouly government’s collective response to covid-19 has so far been on point. Would that our fellow citizens were taking things as seriously. A case in point:

All beaches are being closed nationwide following an order from the Ministry of Local Development. The announcement comes after photos made the rounds of people flocking to beaches over the weekend in Alexandria and Ain Sokhna.

The nation’s administrative and supreme administrative courts are now closed until 15 April on the order of the Council of State (Maglis El Dawla), according to state news agency MENA. Exceptions will be made for urgent matters and a handful of other circumstances, and courts will still be open to receive filings and to handle office duties.

Factory workers will be permitted to travel during curfew hours provided their employer obtains a permit from the governorate in which they’re based, the local press reports, citing the head the operations room at the Council of Ministers. Pick-up trucks will also be exempt from the 7pm-6am curfew if they’re removing goods from ports to warehouses.

Egyptian embassies around the world are working to bring back citizens who want to return home, according to a Foreign Ministry statement. Four flights today will bring folks back from the UK, and an EgyptAir flight is scheduled to fly from London Heathrow on Tuesday. Arrangements are also being made for an exceptional flight on Tuesday to return citizens still stranded in France, while others are in place for nationals who are presently in Saudi Arabia, UAE, Oman, Lebanon, and Jordan to follow soon.

If you’re coming back on one of those flights, you’ll need to self-quarantine for 28 days, according to a new directive from the Health Ministry. Anyone entering Egypt was previously required to self-isolate for 14 days.

EgyptAir and the US embassy in Cairo have arranged flights to Washington, DC, from Cairo. The flights are scheduled for Wednesday, 1 April and Friday, 3 April, and are for US citizens with “some allowances for legal permanent residents accompanying them.” The flights can be booked on EgyptAir’s website. See the embassy’s announcement here for more information.

Air Canada is operating a commercial flight from Cairo to Paris’ Charles de Gaulle airport on 31 March. You can get more information here or by Calling Air Cairo on 02 2266 3155 / 02 2268 9892 / 02 2269 5550. The flight is for Canadian visitors to Egypt who normally reside in Canada and want to return home.

All normal commercial flights into and out of Egypt remain suspended until at least mid-April. Cargo flights are not subject to the ban.

Jordan has shut down the traffic of goods coming by land from Egypt, Al Mal reports. The ferry line had stopped carrying passengers on 11 March but continued to carry cargo. Goods bound for Jordan will be held by Egypt’s authorities until further notice.

Cairo Metro’s three lines are getting five extra trains during rush hour in a bid to ease overcrowding, according to Al Mal. The metro is now on an amended schedule after the government imposed a nationwide 11-hour curfew last week.

The Social Solidarity Ministry will be adding 80-100k families to its Takaful and Karama benefit programs at a cost of about EGP 800 mn, Al Mal reports. The ministry had said earlier last week that it would be adding some 60k families to its program.

TOLL ON BUSINESS- Mediterranean gas group Energean might cut its budget for Egypt by USD 140 mn as oil and gas companies cut back on spending amid the covid-19 pandemic and a simultaneous oil price war. Energean has already cut its planned outlay in Greece and Israel by USD 155 mn. Reuters has a company-by-company rundown here.

Some businesses are advocating for the state’s EGP 100 bn bailout package to cover wage subsidy to make it easier for them to pay workers’ salaries in the event factories are shut down or running fewer shifts, the local press reports.

A PROPOSAL WORTH DEBATING- Suspend remission of income tax and social insurance and give businesses a tax break by cutting wage taxes in half, suggests Maged El Menzelawi, chairman of the industry committee at the Egyptian Businessmen’s Association.

Egypt’s pharmaceutical companies generally have raw materials on hand sufficient for four months of production, Al Mal reports. Aly Ouf, head of the medicines Division in the Federation of Egyptian Chambers of Commerce. He noted that Egypt imports from China some 40% of the raw materials domestic producers need.

The silver lining for Egypt: Chinese factories are now ramping up, but they’re finding export markets in Europe and the US are in disarray, reports Bloomberg.

The Consumer Protection Agency boss Rady Abdel Moaty is warning retailers against price gouging, according to state news agency MENA.

The Customs Authority is giving importers a break to expedite the clearance of shipments from ports, allowing them to present contracts and transaction receipts in the place of standard documentation, Al Mal reports.

Authorities are cracking down on producers of counterfeit protective gear, Arab News reports.

Leading private sector education outfit CIRA has moved all classrooms at its schools and Badr University online with its distance learning protocol, with all of its non-essential staff working from home to curb the spread of covid-19, according to a statement (pdf). Of the company’s campuses that are still under construction, Regent British School in Mansoura is the only one expected to see delays after the company slowed down construction services.

School children are getting a break: End-of-year public school assessments will be based on lessons delivered until 15 March, rather than the full year’s curriculum, Education Minister Tarek Shawky said in a statement. The remaining parts of the curriculum will be covered next academic year. Assessments will take the form end-of-year projects (for grades 3-8) or electronic and seated exams (grades 9-12), we noted in last week’s edition of Blackboard. Technical and vocational education, meanwhile, will continue online until mid-to-late April, with students required to hand in an assessed report by 15 June.

ON THE GLOBAL FRONT-

The US has enacted a USD 2.2 tn stimulus package as The Donald signed it into law shortly after it was approved by the House of Representatives late last week. The bill is the largest relief package in US history, designed to support citizens struggling in the face of the covid-19 pandemic by offering direct payments and expanded unemployment insurance, the Wall Street Journal reports.

What’s in it? It includes roughly USD 290 bn in direct payments to US citizens, enhanced employment aid of USD 260 bn, loans and grants of USD 377 bn to small businesses, USD 504 bn to bail out airlines and large businesses, USD 100 bn for hospitals and other health providers, USD 16 bn for ventilators and other medical supplies, USD 30 bn for education, and a raft of tax cuts. Reuters has a longer run-down.

The story is being widely covered: Reuters ⎸New York Times ⎸Financial Times.

Last week’s rally in equity markets might go down as one of the biggest dead cat bounces ever: The sell-off in the global markets resumed on Friday even as Trump was preparing to sign off on the emergency stimulus package. Stocks launched a fierce three-day recovery last week after the Federal Reserve announced a flood of monetary stimulus and hopes grew for large-scale fiscal stimulus from countries around the world. The Dow Jones had its best week since 1938 and the S&P 500 rose 10%, its biggest gain since March 2009.

US and European stocks finished deep in the red on Friday: All three major US indices were down more than 3%, with the S&P 500 losing 3.4% and the Dow down more than 4%. It was slightly messier in Europe as markets all fell between 3-5%, with Germany’s DAX being the best performer (down 3.7%) and the FTSE 100 being the hardest hit (down 5.2%).

World already in recession -Georgieva: The covid-19 outbreak has already pushed the world into recession and policymakers must react with “very massive” spending to avoid widespread bankruptcies and emerging market bond defaults, IMF head Kristalina Georgieva said on Friday, Reuters reports. “It is now clear that we have entered a recession as bad or worse than in 2009,” she said at a news conference, adding that there is a good chance for a “sizeable rebound” next year if the virus is successfully contained and countries provide enough fiscal support to businesses.

EM countries need at least USD 2.5 tn in emergency funding to survive the crisis, Georgieva said. Eighty-one countries have so far approached the IMF to ask about emergency funding, including 50 low-income and 31 middle-income countries.

S&P has lowered its crude price forecasts by USD 10/bbl for 2020 as the price war between Saudi Arabia and Russia continues to bring down prices and covid-19 hits global demand, according to a research note (paywall). The ratings agency now sees Brent averaging USD 30/bbl this year and US crude trading at USD 25/bbl until the end of the year.

Riyadh isn’t signalling that it’s ready to kiss and make up: Saudi Arabia said on Friday that no communication has taken place with Russia to balance oil markets despite the US ramping up pressure on Riyadh to end the price war, according to Reuters.

Covid-19’s pressure on corporate earnings could push global FDI down 35% in 2020-2021 -UNCTAD: Earnings revisions in multinational enterprises (MNEs) since the spread of the covid-19 virus suggest that the effect of the outbreak will extend beyond supply chain disruptions and will create downward pressure of around 35% on global FDI, UNCTAD said in a revised investment trends monitor (pdf). “On average, the top 5000 MNEs, which account for a significant share of global FDI, have now seen downward revisions of 2020 earnings estimates of 30% due to Covid-19, and the trend is likely to continue,” UNCTAD says.

Cross-border M&A, which count as a portion of FDI, could also decline 50-70% for part of 2020, and M&A transactions that have already been completed are now facing delays that could turn into cancellations, according to the report. The full scale of decline in global FDI depends how long the pandemic lasts, its level of severity, and “the scope of containment measures” being enacted by governments to mitigate the virus’ spread.

Enterprise+: Last Night’s Talk Shows

The nation’s talk shows were back last night with all the latest on the covid-19 outbreak: Min Masr’s Amr Khalil covered the Health Ministry’s statement yesterday that announced 40 fresh cases, bringing the total number to 576, and six new fatalities that raised the overall death toll to 36 (watch, runtime: 1:34) (watch, runtime: 7:12). El Hekaya’s Amr Adib spoke with Health Ministry spokesman Khaled Megahed (watch, runtime: 25:33) to cover the updates, and chatted to the prime minister’s media advisor Hany Younis, who said that the prime minister has instructed local industries to produce ventilators and promised them government support, but no details or timeframe were discussed (watch, runtime: 2:26). Adib also covered the World Health Organization’s report which reported favorably on Egypt’s handling of its covid-19 outbreak (watch, runtime: 2:45).

Egyptians stuck abroad: Masaa DMC’s Eman El Hosary spoke with Immigration Minister Nabila Makram who said that the government is working with embassies abroad on tallying up the number of Egyptians struggling to return home. She said that four planes were arriving to Cairo today from the UK as well as another on Tuesday, and a flight is being arranged to repatriate Egyptians in France on Tuesday. She added that many honeymooners are stranded in South Asian countries and efforts are underway to ensure they don’t incur fines from their extended stays until they return (watch, runtime: 8:07). Min Masr’s Amr Khalil (watch, runtime: 17:25) had the same report.

Covid-19 could peak this week -Zayed: Health Minister Hala Zayed suggested to Adib on Friday night that the virus could peak this week. She noted that in other countries the outbreak has tended to reach its height after the sixth or seventh weeks, and that Egypt is now entering its seventh week since the first case was discovered. Because of this, the following two weeks will be crucial if Egypt is to finally get a handle on the crisis and start flattening the curve (watch, runtime: 26:14).

Rumors debunked: El Hosary covered the cabinet statement denying rumors circulating on social media that claimed that the government’s call for workers to stay home if they can meant that the state will pay private sector salaries (watch, runtime: 1:02). Min Masr’s Amr Khalil mentioned the same posts as well as others that claimed government workers would be getting raises and that petroleum prices were dropping. (watch, runtime: 2:54)

Relief for farmers: Adib spoke with Agriculture Minister El Sayid El Qusair who discussed the Central Bank of Egypt’s efforts to assist farmers which include suspending loan payments for six months (watch, runtime: 4:58).

Speed Round

Speed Round is presented in association with

Gov’t revises downwards economic growth forecast this fiscal year to 5.1%: The government has cut its GDP growth forecast for the fiscal year ending in June 2020 to 5.1% from 5.6% as the covid-19 outbreak takes its toll on the global economy, said Planning Minister Hala El Said, according to Reuters. Growth was already expected to slow to 5.2% in 3Q2019-2020 and to 4% in the fourth quarter of the fiscal year compared to 5.6% in 1H2019-2020, itself a slower growth rate than the 6% targeted in the annual budget. The government had forecast GDP to grow at an annual clip of at least 5.5% over the next few years.

Cabinet has also revised its targets for the coming fiscal year: The economy is expected to grow at a 4.2% clip in FY2020-2021 — instead of an initially estimated 6% — if the pandemic is brought under control before the beginning of the new fiscal year in July. But if the crisis continues into the new year, growth could slow to as little as 3%, El Said said, according to a cabinet statement.

This is much more optimistic than what the analysts are projecting: Capital Economics said last week that the economy will likely contract 1.3% this year before rebounding significantly to grow at a 7.8% clip in the coming fiscal year. Renaissance Capital also said last week that the government’s measures to contain the covid-19 outbreak — including imposing a nighttime curfew and partial closure of restaurants — could threaten 30% of Egypt’s nominal GDP.

Also revised in the upcoming fiscal year’s budget: The council of ministers revised upward its public debt target to 82.7% of GDP, from an initially targeted 80%, and raised the overall deficit to 6.3% from 6.2%. The budget, which earned cabinet approval, will now be shipped to the House of Representatives, where the Planning and Budget Committee is set to begin reviewing it on 12 April.

EXCLUSIVE- Gov’t starts planning best, worst case scenarios for economic outlook following covid-19 pandemic: The government sees the worst case scenario as the pandemic persisting until the end of December 2020, which would drive down Egypt’s economic growth to 3.3-3.5% in FY2020-2021, Finance Minister Mohamed Maait tells Enterprise. The best case scenario would see the outbreak curbed by July, in which case the government expects GDP to grow at a 4.5-5% clip in the fiscal year running July 2020 through June 2021. A middle ground scenario, in which the crisis would end sometime between July and December, would deliver growth levels between 3.3% and 5%. The FY2020-2021 state budget has been amended according to this middle ground.

The government would consider asking the IMF for new funding if necessary to finance its spending needs, Maait tells us. Egypt had previously ruled out signing up for a new loan from the IMF and was in talks with the lender for a non-loan agreement following the expiry of the USD 12 bn Extended Fund Facility. The extenuating circumstances created by the crisis means the government is obliged to revisit all its options to cover its finances, the minister says.

How individual industries are expected to fare: Once the economy cools down, it naturally takes time for the wheels to start turning again, particularly as many industries are interconnected and driven by consumer demand, which falls during times of recession, the minister tells us. Maait expects tourism — the most negatively affected industry in Egypt so far — to take a year to stage a full recovery. Other industries would also take some time to get back on track, but tourism is expected to have the longest recovery period since global spending on tourism post-covid will likely be minimal. Maait also pointed out that the cancellation of this year’s initial travel exhibitions, during which tourism companies in Egypt typically sign agreements and partnerships for the year ahead, means the industry has missed out on a year’s worth of potential agreements.

High-performing EGP “overvalued,” likely to fall amid covid-19 EM asset dump -Bloomberg report: The EGP has continued performing well amid the fallout from the global covid-19 pandemic, in stark contrast to many African currencies that have fallen sharply in the last month. But investors are increasingly seeing the EGP as overvalued, and the currency is likely to ease against the USD despite the significant gains seen this year, Bloomberg reports.

The EGP is the world’s strongest currency this year after Myanmar’s and has maintained its resilience despite surging EM outflows over the past month in response to covid-19. But with gains of 2.1% posted against the USD this year, Morgan Stanley analysts are now advising investors to reduce exposure to EGP-denominated bonds, especially following the 650 bps in rate cuts the Central Bank of Egypt has enacted since last July. Prior to the escalation of the pandemic at the end of February, the EGP had surged to new three-year highs of 15.49 against the greenback. The EGP is currently changing hands at 15.69.

The EGP gained almost 13% against the USD between early 2019 and late February 2020. The surge was driven by strong investor appetite for Egyptian debt, remittance flows from Egyptians living and working overseas, increasing tourism revenues, and a decrease in businesses and individuals hoarding USD, starting in early 2017.

CBE expands industry stimulus package to agriculture companies: The Central Bank of Egypt (CBE) has expanded its EGP 100 bn industry stimulus initiative to include companies in agriculture and agricultural production, including export terminals and packaging plants, according to a statement (pdf). Fish, poultry and livestock companies with annual revenues between EGP 50 mn and EGP 1 bn can also access the financing package through soft loans, which the CBE had updated earlier this month to support the local industry against the covid-19. Companies in the agriculture sector with revenue between EGP 250k and EGP 50 mn can access similar incentives at a 5% interest rate under the CBE's 2017 small companies program.

Will the CBE include microfinance in its debt relief initiative? Lenders want the central bank to extend its emergency initiative that extends the tenor of banks loans by six months to clients of microfinance companies, Mubasher reports. Raya Holding’s Aman Microfinance and Vitas Misr for Microfinance have both asked the Financial Regulatory Authority to discuss with the CBE adding microfinance companies to the initiative, which currently only applies to businesses and individuals with bank loans. The CBE announced the measure earlier this month to ease pressure on borrowers during the current economic upheaval. Up to 5 mn borrowers could benefit from the initiative, a CBE official said on Thursday.

The latest to comply with the CBE initiative is leading private sector bank CIB, which announced Thursday it had rescheduled its portfolio of personal and housing loans.

EGP 30 bn pours into new high-interest savings certificates: Egyptians invested EGP 30 bn into the new 15% fixed rate savings certificates launched by Banque Misr and the National Bank of Egypt last Sunday, Al Masry Al Youm reports. NBE reported that the new savings product had attracted EGP 20 bn within the first five days of launch while Banque Misr said EGP 9.3 bn had been invested into its certificates. The new certificates are part of government efforts to shore up the currency against a potential move by savers into the USD in response to the market turmoil caused by the covid-19 pandemic. NBE has also cut the interest rate on its USD certificates in an effort to deter people from holding the greenback.

CBE overshoots t-bill auction target for the first time in weeks: The Central Bank of Egypt sold EGP 25.96 bn of treasury bills in two auctions that sought to raise EGP 20 bn, according to the official data. The CBE sold EGP 12.42 bn of six-month bills in a EGP 10 bn offering at a 13.55% yield. In the EGP 10 bn one-year offering, investors bought EGP 13.54 bn of bills at a 13.56% yield. The government has faced issues selling its target amount of bonds in recent weeks as pressure on the state’s finances caused by covid-19 caused investors to demand higher yields.

M&A WATCH- National Investments Co. has acquired a 21% stake in Sohag National Food Industries’ (SNFI) for EGP 190 mn, SNFI Chairman Mamdouh Fouad told Al Mal. The agreement was executed through the Helwan Securities Brokerage, as opposed to the EGX, informed sources added. The investment will be used to fund a new pasta plant and a solar power facility, Fouad said.

EARNINGS WATCH- Orascom Construction profits dipped 16.2% y-o-y in 2019 to USD 121.3 mn, compared to USD 144.7 mn the previous year, the company said in its earnings release (pdf). Revenues for the year increased 5.7% to USD 3.184 bn. The company attributed the drop in profits to higher net financing costs through the first three quarters of 2019, in addition to “a one-off negative contribution from Besix.” The company’s profits dropped 16.6% y-o-y in 4Q2019, while revenues rose 15.5% y-o-y during the quarter. OC’s consolidated EBITDA jumped 89.2% y-o-y to USD 68.5 mn in 4Q2019, and rose 29.5% y-o-y to USD 268.2 mn in 2019.

The company’s consolidated backlog excluding Besix increased 25.2% y-o-y to USD 5.4 bn as of 31 December 2019. Consolidated new awards jumped 51.15% y-o-y to USD 3.5 bn in 2019. Including the group’s 50% share in Besix, pro forma backlog as of the end of the year rose 15.4% y-o-y to USD 8.1 bn. OC will be distributing dividends to its shareholders at USD 0.21 per share. “While our FY 2019 financial results and current financial position allow us to distribute a higher dividend, we elected to take a more prudent approach given the potential uncertainty related to covid-19,” said CEO Osama Bishai. The company could revisit a second dividend distribution later in 2020.

Fawry profits almost double in 2019: Fawry’s net profits surged by 88% in 2019, hitting EGP 130.4 mn compared to EGP 69.2 mn in 2018, according to the company’s earnings statement (pdf). Revenues rose to EGP 884.1 mn during the year, up 45% from EGP 609.7 mn.

MOVES- Fawry MD resigns to set up USD 25 mn fintech investment fund: Mohamed Okasha has resigned from his position as managing director of e-payments platform Fawry, according to a regulatory filing (pdf). Okasha has plans to head a USD 25 mn early stage fintech investment fund once the fallout from the covid-19 outbreak begins to cool, he told the local press. Fawry CEO Ashraf Sabry will act as interim MD following Okasha’s departure. Reuters also covered the news.

The Macro Picture

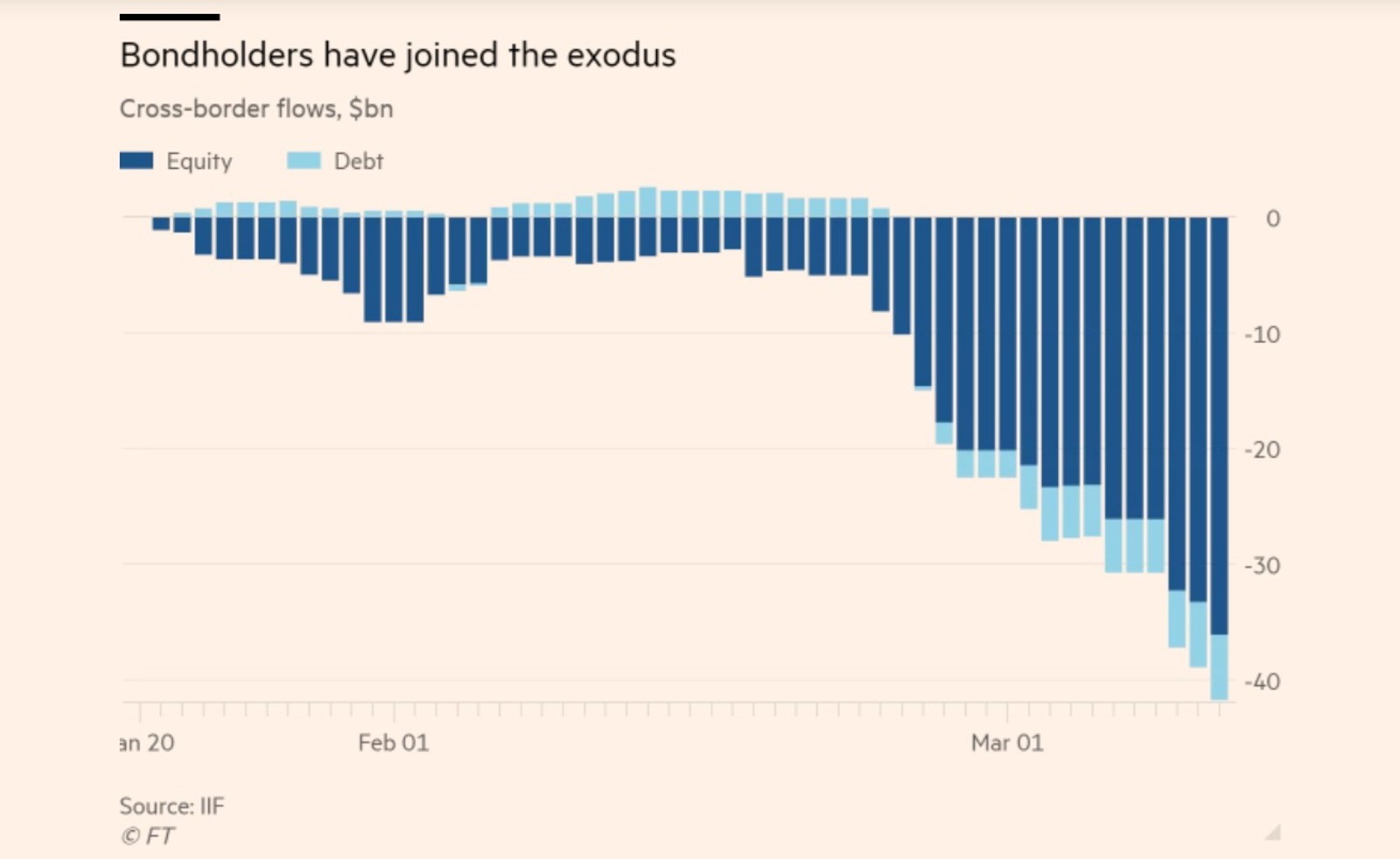

Emerging market bond funds are continuing to see heavy net outflows, as investors seek to dump debt amid the economic turmoil resulting from covid-19, the Financial Times reports. Data from EPFR Global shows that EM bond outflows hit USD 17 bn in the week leading up to 25 March, following a record USD 18.8 bn the week before. Outflows in the past four weeks hit USD 47.7 bn, the equivalent of 10.2% of all assets under management. Asset dumping has now erased a third of the USD 140 bn of net inflows to EM bonds that took place over the past four years, according to Bank of America, and for the first time since the start of the crisis, the outflow from local-currency EM bond funds exceeds that exiting hard-currency vehicles.

March has seen a rapid turnaround for EM bonds once termed “immune to coronavirus.” EM bonds were holding up well at the beginning of March, supported by investors’ continuing search for yield, according to Absolute Strategy Research economist Adam Wolfe. But amid the global slowdown, investors have been rushing to dump EM assets and seek the safety of cash. The sell-off — which far exceeds that seen at the beginning of the 2008 financial crisis — will see households, businesses and governments starved of credit, according to International Institute of Finance Chief Economist Robin Brooks.

What does this mean for Egypt? Just months ago, Egypt was considered a highly promising market, thanks to the real interest rate on our bonds, which in November last year stood at 9.42%, far exceeding the Turkish bond yields in second place at 5.14%. But the central bank’s emergency 300 bps rate cut two weeks ago is likely to accelerate outflows of foreign debt securities, according to EFG Hermes economist Mohamed Abu Basha. Despite this, EGP debt remains “relatively attractive,” according to HC Securities’ Monette Doss. Yields on Egyptian government debt will offer a 0.95% real interest rate (accounting for the 3% rate reduction and HC’s forecast for 9% inflation through 2020) compared to 0% for Turkey, she said.

It’s the worst 1Q on record for EM debt fund outflows, but there could be brighter days ahead. While JPMorgan’s core index of hard currency-denominated debt is down 10.9% this year, outflows for EM bonds still haven’t reached the levels seen in other periods of turmoil, according to Morgan Stanley. Total EM sovereign issuance for March 2020 is down to USD 4 bn from USD 31 bn in March 2019. But some EM governments, including Panama, Latvia and Israel, did sell new bonds this week, which analysts see as an encouraging sign. And while investors are waiting for a weakening USD and a clearer idea of how the covid-19 crisis will develop in the southern hemisphere before returning to the asset class, the US government’s USD 2.2 tn stimulus package and global central bank liquidity measures do seem to be bolstering confidence and supporting risk appetite.

Diplomacy + Foreign Trade

El Sisi agrees with three African leaders to create fund to combat covid-19 spread, aid economic recovery: President Abdel Fattah El Sisi agreed with the presidents of South Africa, Kenya, and Congo and the chairperson of the African Union Commission to create a fund to support efforts to combat the covid-19 pandemic and limit its expected economic effect on African countries during an online mini-summit on Thursday, according to an Ittihadiya statement.

El Sisi received a call from Tunisian President Kais Saied to coordinate efforts to combat covid-19 and exchange information, Ittihadiya said.

Infrastructure

Transport Ministry receives three bids for Damietta port’s second container terminal

The Transport Ministry has received bids from three international consortiums to build the second container terminal at Damietta Port in a project worth USD 300 mn, Al Shorouk reports, citing sources close to the ministry which didn’t name the companies. The European Bank for Reconstruction and Development agreed in principle last year to lend the Damietta Port Authority EUR 400 mn to finance the construction of the terminal.

Basic Materials + Commodities

Egypt sees delays in offloading grain shipments

Egypt has encountered delays in offloading Black Sea supplies of corn and wheat for the private market, with at least four cargoes reportedly delayed at ports as offices closed due to covid-19 slow down paperwork, Reuters reports. The government has said it is well stocked with strategic supplies for the coming four months.

Gov’t to halt exports of legumes for three months

The Trade Ministry will suspend all exports of beans and legumes for three months to ensure domestic demand is met amid the economic fallout from the covid-19 outbreak, it said in a statement.

Automotive + Transportation

Four int’l companies withdraw bids to build Giza-Beni Suef rail signal boxes

Four international companies have withdrawn their bids to build signal boxes for the Giza-Beni Suef railway line, Al Shorouk reports, noting only that the companies are Chinese and Spanish. Magdy Saleh, general manager at Intelligent Micro Solutions (IMS), the local agent for one of the Chinese companies, said that their bid was withdrawn when the National Railway Authority refused to extend the tender by three months due to the covid-19 outbreak, despite purchasing a conditions booklet. The report does not note the tender’s original deadline.

On Your Way Out

Around 11.5k antiquities from Egypt and Iraq are being repatriated by Hobby Lobby president Steve Green, who had collected them for display in the Museum of the Bible in Washington, DC, the Wall Street Journal reports. Hobby Lobby was at the center of a scandal over how it was able to acquire its artifacts, and was forced to pay USD 3 mn in 2017 in a lawsuit filed by the US government that alleged it had smuggled 3.8k Iraqi antiquities out of the country by mislabelling them, all of which were returned two years ago. The latest trove of artifacts to be repatriated consist of some 5k ancient papyrus fragments and 6.5k ancient clay objects.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Thursday): 9,913 (+0.5%)

Turnover: EGP 674 mn (12% above the 90-day average)

EGX 30 year-to-date: -29.0%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.5%. CIB, the index’s heaviest constituent, ended down 0.1%. EGX30’s top performing constituents were GB Auto up 8.0%, Kima up 7.9%, and Pioneers Holding up 5.0%. Thursday’s worst performing stocks were Eastern Company down 1.3%, and CIB down 0.1%. The market turnover was EGP 674 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -155.3 mn

Regional: Net short | EGP -4.3 mn

Domestic: Net long | EGP +159.6 mn

Retail: 48.5% of total trades | 49.4% of buyers | 47.6% of sellers

Institutions: 51.5% of total trades | 50.6% of buyers | 52.4% of sellers

WTI: USD 21.51 (-4.82%)

Brent: USD 24.93 (-5.35%)

Natural Gas: (Nymex, futures prices) USD 1.67 MMBtu, (-1.07%, May 2020 contract)

Gold: USD 1,654.10 / troy ounce (-0.37%)

TASI: 6,326 (+1.90%) (YTD: -24.58%)

ADX: 3,770 (-3.84%) (YTD: -25.71%)

DFM: 1,809 (-0.76%) (YTD: -34.57%)

KSE Premier Market: 5,281 (-1.14%)

QE: 8,479 (-0.65%) (YTD: -18.67%)

MSM: 3,538 (-0.49%) (YTD: -11.11%)

BB: 1,388 (+0.27%) (YTD: -13.75%)

Calendar

31 March (Tuesday): Houses of worship expected to be reopened to the public.

2 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

2-4 April (Thursday- Saturday): Global Forum for Higher Education and Scientific Research (GFHS2020) under the theme “Future in Action,” new administrative capital, Egypt.

12 April (Sunday): House of Representatives covid-19 recess ends.

12 April (Sunday): Easter Sunday.

12 April (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous.

13 April (Monday): Schools and universities expected to resume classes after covid-19 closure.

15 April (Wednesday): International flight suspension in Egypt expected to be lifted.

16 April (Thursday): New deadline for individuals to file their tax returns to the Egyptian Tax Authority.

17-19 April (Friday-Sunday): IMF, World Bank will hold virtual Spring Meetings.

18 April (Saturday): One half of renowned duo 2CELLOS, Stjepan Hauser, known simply as Hauser, will be performing his only show in Egypt and it will take place in Somabay, Hurghada on April 18th. Tickets on sale at Ticketsmarche soon.

19 April (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot.

19 April (Sunday): Coptic Easter Sunday, national holiday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

June: Circular Economy Summit, Egypt, venue TBA.

4-6 June (Thursday-Saturday): 2020 Africa-France Summit, Bordeaux, France.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.