- CBE keeps rates on hold in first MPC meeting of 2020. (Speed Round)

- Egypt top MENA target for inbound M&A. (Speed Round)

- Egypt tops EBRD’s annual investments for second consecutive year. (Speed Round)

- EastMed gas nations finalize forum charter. (Speed Round)

- Egypt’s economy to be fastest growing in North Africa -UN. (Speed Round)

- New Budget legislation ready for cabinet approval. (Speed Round)

- Egypt remains regional solar leader — and we need more of it, despite having excess generation capacity today, industry association says. (Speed Round)

- El Sisi in Berlin for Libya peace conference. (What We’re Tracking Today)

Sunday, 19 January 2020

CBE leaves interest rates on hold, but you can still expect cuts this year

TL;DR

What We’re Tracking Today

President Abdel Fattah El Sisi is in Berlin for the Libya peace conference, which kicks off today. A summit in Moscow last week failed to produce an agreement between eastern military commander Khalifa Haftar and UN-recognized Fayez Al Serraj after Haftar walked out on the talks. Haftar has reportedly signaled his commitment to observe the existing ceasefire, Reuters reports.

Haftar’s play for leverage: Militia allied to Haftar have shut down oil export terminals in the east of the country ahead of the conference, causing the country’s oil output to more than halve, Bloomberg reported yesterday.

Turkey’s Recep Erdogan is in a war of words with Haftar, who he threatened to “teach a lesson” after his Moscow walk-out. The Turkish president also penned a column in Politico on Saturday calling on Europe to intervene against what he described as a “coup” by Haftar and his “anti-democratic” supporters Egypt, Saudi Arabia and the UAE. All of the antagonism is because Ankara wants to advance political Islam, Kori Schake argues in an opinion piece for Bloomberg.

President Abdel Fattah El Sisi is in London tomorrow alongside 21 other African leaders for the UK-Africa Investment Summit, according to a CBC report (watch, run time: 2:58).

The private-sector gets a day off on Saturday in observance of Police Day, which is also the anniversary of the 25 January revolution, Manpower Minister Mohamed Saafan said on Friday.

The World Economic Forum gets underway on Tuesday in Davos, Switzerland. CNBC and Bloomberg have previews or you can tap or click here to check out the full agenda.

Tax on bourse transactions to be decided next month: The Finance Ministry will decide next month whether it’s implementing a capital gains tax on EGX transactions, the local press quoted unnamed sources as saying. You can check our rundown on the tax here.

International Cooperation Minister Rania Al Mashat has been the made the government’s representative at the World Bank, European Bank for Reconstruction and Development, and Arab Bank for Economic Development in Africa, Masrawy reported.

It’s the end of the world as we know it, part 1- Epidemiologists are warning about a mysterious, deadly virus out of China that has infected as many as 1.7k people — some 35x more than previously reported, according to the Financial Times. The coronavirus has now been detected in Japan, and US airports including JFK in New York are screening some passengers arriving from central China. The virus could spread faster this week as mn of Chinese travel for the Chinese Lunar New Year holiday which falls this year on 25 January, Reuters wants. Business Insider also has the story, noting that the virus is related to the deadly SARS bug.

It’s the end of the world as we know it, part 2- A company you’ve never heard of is about to end public anonymity by making your face searchable, the New York Times reports. “Searching someone by face could become as easy as Googling a name. Strangers would be able to listen in on sensitive conversations, take photos of the participants and know personal secrets. Someone walking down the street would be immediately identifiable — and his or her home address would be only a few clicks away,,” the piece concludes. The service operates by scraping your image from social media feeds including Facebook and Twitter.

It’s the end of the world as we know it, part 3- Egypt’s sovereign credit rating is at risk from rising sea levels, which will pose a long-term threat to income, assets, health and safety, according to a recently-released report from Moody’s (paywall). Look for disruptions to farming, tourism and trade, an increase in natural disasters, loss of life and widespread health issues, and forced migration — all of which threaten the economy, according to Reuters, which cites the report. Other countries flagged as particularly vulnerable include Vietnam, Suriname, and the Bahamas.

Wall Street’s biggest (not longest) bull run may be close at hand as the benchmark S&P 500 and Nasdaq Composite set record highs for an eighth consecutive trading session on Friday, the Financial Times and Reuters reported, noting that “the S&P 500 … is 5% away from posting its largest ever rise without falling more than 20%.” Bank of America analysts appear to be concerned that valuations are becoming stretched, according to Bloomberg, which cautioned in a separate op-ed against using valuation as an indicator for jumping in and out of the market.

The Trump impeachment trial is set to dominate the news cycle across much of the Western press over the next two weeks: Opening statements will begin this week after the House impeachment managers and the president’s defense were selected over the weekend. Trump’s team — made up of his personal lawyer Jay Sekulow, the White House counsel Pat Cipollone, Alan Dershowitz and Ken Starr — yesterday called the charges as a “brazen and unlawful” attempt to kick him out of office in its formal response to the impeachment charges, the New York Times reports.

Oh, and Harry and Meghan have decided to drop drop their royal titles, stop receiving public funds, and spend most of their time outside of the UK in a move that’s being described as a decisive break with the royal family, the BBC reports.

The CEO of Edita teaches us a few lessons in finding inspiration and pursuing dreams: Edita was always the dream for Hani Berzi, the CEO and founder of the food manufacturing brand. Berzi played football, studied engineering, and went into trading for a while, but nothing called to him. Not until he had a packed croissant and decided that he would create the “second generation of snack foods” for the Egyptian public. It goes to show that inspiration can come from the most simple places. And come it did. Fast forward over two decades later and the company has become a household name here in Egypt.

You can listen to the episode (runtime: 36:11) on: Our website | Apple Podcast | Google Podcast

Enterprise+: Last Night’s Talk Shows

It was all about the international scene on talk shows last night, from Berlin to Libya and Ethiopia.

El Sisi in Berlin for Libyan peace talks: Al Hayah Al Youm’s Lobna Assal reported President Abdel Fattah El Sisi's arrival in Berlin for a peace conference on Libya. World leaders including Russia’s Vladimir Putin, Turkey’s Recep Erdogan and France’s Emmanuel Macron, as well as to US Secretary of State Mike Pompeo and British Prime Minister Boris Johnson, will all be in attendance (watch, runtime: 2:33).

What are the prospects of peace? El Hekaya’s Amr Adib rang up Hussein Kneiber, a Berlin-based reporter for Al Arabiya, who said that the conference would focus on disarming the militias through a Libyan security committee, in addition to forming an international committee to supervise the implementation of a ceasefire. Kneiber did not sound very optimistic about the outcome, saying that there are limited expectations for this conference given that there may not be direct talks between the two Libyan rivals Fayez Al Serraj and General Khalifa Haftar (watch, runtime: 2:43).

Adib also spoke with the spokesman for Haftar’s Libyan National Army, Maj. Gen. Ahmed Al Mismari, who spoke on his decision to shut down Libyan oil ports at Brega, Ras Lanuf, Hariga, Zueitina and Sidra. Al Mismari claimed that closing the ports would protect the country from external interference (watch, runtime: 2:48).

Optimism for GERD agreement with Ethiopia: Former Irrigation Minister Mohamed Nasr Eldin Allam told Adib that he remains cautiously optimistic after agreement during last week’s talks in Washington to the initial phase of filling the dam’s reservoir. The ministers will meet in Washington again on 28 and 29 January to finalize an agreement (watch, runtime: 8:02).

Speed Round

Speed Round is presented in association with

CBE leaves rates on hold: The Central Bank of Egypt’s Monetary Policy Committee (MPC) left interest rates unchanged when it met on Thursday, the CBE said in a statement (pdf). The central bank cited domestic factors such as inflation accelerating in December on the back of the dissipating favorable base effect and unemployment increasing slightly in 3Q2019, combined with macro headwinds such as volatility in international oil prices. The MPC had lowered interest rates four times over the course of 2019, delivering a total 450 bps in cuts between February and November. Reuters and Bloomberg also had the story.

Who called it? Only three of the seven economists surveyed in our updated Enterprise poll ahead of the meeting — Pharos’ Radwa Elswaify, Shuaa Esraa Ahmed, and Beltone’s Alia Mamdouh — had predicted that the CBE would pause its easing cycle in last week’s meeting. Last month’s inflation figures had pushed some to change their forecasts from December, when the meeting was originally scheduled to take place. Seven of 10 economists we polled at the time had expected rates to remain unchanged.

Capital Economics says the central bank’s decision took it by surprise: The decision “suggested that policymakers want to wait and see the effects of previous policy loosening,” Capital Economics’ senior EM economist Jason Tuvey wrote in a note on Friday.

Where rates now stand: The CBE’s overnight deposit rate remains at 12.25% and its lending rate is at 13.25%. The main operation and discount rates are 12.75%.

The central bank still has room to resume its easing cycle throughout the remainder of 2020, with some analysts saying Thursday’s decision was likely just a brief pause to assess the impact of the 450 bps rate cuts delivered in 2019. “It was normal to take a breather to monitor the impact of the last two cuts on the market, before the resumption of easing in 1Q2020,” El Swaify — who is predicting the CBE to make a 100-bps cut this quarter — told Enterprise. Capital Economics, meanwhile, is maintaining its forecast for the overnight deposit rate to be cut by 225 bps to 10% by the end of the year, although it did not forecast when the central bank will resume the easing cycle.

Egypt is prime MENA target for inbound M&A; EFG Hermes tops ECM league table for second year in a row: Egypt was the second-highest target of inbound M&A in MENA last year in terms of value, but accounted for one of the lowest regional shares of the M&A market in terms of volume, according to Refinitiv’s 2019 MENA Investment Banking Review. Our share of M&A transactions dropped to 2% from 8% in 2018. Across the region, energy and power continued to take up the lion’s share of M&A at 77%, with financials coming in second at 15%.

Proceeds from equity capital markets (ECM) issuances in Egypt dropped 69% y-o-y, whereas Saudi Arabia’s proceeds soared 1,860% y-o-y thanks to blockbuster transactions including Aramco and Arabian Centres. The top ECM transaction in Egypt was Rameda Pharma’s IPO in December, which reeled in USD 109.3 mn. Proceeds from our debt capital market (DCM) eased 5% y-o-y, closing 2019 just shy of USD 10 bn, with the government’s USD 4 bn eurobond issuance in February of last year accounting for the largest DCM transaction.

Our friends at EFG Hermes retained their spot at the top of the MENA ECM league table in 2019. The homegrown investment bank accounted for 5% of the total regional market across five transactions, edging out Saudi Arabia’s Sambacapital by raising some USD 1.336 bn. ECM fees soared 95% y-o-y in 2019, according to the report. Standard Chartered PLC was the top DCM bookrunner last year, and HSBC Holdings was the top M&A financial advisor in the region.

Egypt was the top market for investment from the European Bank of Reconstruction and Development (EBRD) for the second consecutive year, receiving EUR 1.2 bn in 2019, according to a press release (pdf). The EBRD’s total investments in the southern and eastern Mediterranean (SEMED) region were EUR 1.8 bn. The funding to Egypt was directed towards 26 projects, most of which were in the private sector and the green economy to facilitate the country’s transition to renewable energy.

The EastMed Gas Forum is finally becoming a thing: Officials from the seven founding member states of the Eastern Mediterranean Gas Forum have finalized a charter that will officially establish the organization with Cairo as its headquarters, the Oil Ministry announced in a statement. The organization, which held its third annual meeting on Thursday in Cairo, will serve as a space for “structured dialogue” and the creation of shared regional energy policies, the statement said. The other founding member states are Greece, Cyprus, Italy, Israel, Jordan and Palestine.

Private, public sector companies also on board: An advisory committee that will include representatives of government-affiliated or private sector gas companies will be set up within the organization, Oil Minister Tarek El Molla confirmed at a press conference following the meeting.

We need the European Union’s blessing before pens can be put to paper. The European Commission will need to ascertain whether the charter complies with European law before EU member states are allowed to join, the statement said.

The charter has been in the works since the forum’s first launch meeting last year, in which the founding members agreed to move ahead with creating a regional market to develop the eastern Mediterranean’s estimated 122 tn cubic feet of gas reserves.

France and the US want to get in on the action: France formally requested to join the forum as a member during the meeting, while the US asked to be a permanent observer, according to a separate ministry statement.

Which brings us to the Turkey-shaped elephant in the room: Greek Energy Minister Kostis Hatzidakis told the forum that its members should work to bring Turkey into the fold provided Ankara respects international law. Turkey has recently escalated tensions in the Med due to its legally-dubious gas exploration activities off the Cypriot coast and its maritime border agreement with the internationally-recognized Libyan government.

Turkey’s Foreign Ministry threw shade on the idea, calling the forum on Thursday an “unrealistic initiative” started for “political motives” designed to shut Ankara out of the East Med gas rush. Turkish President Recep Erdogan on the same day announced that Turkey would push ahead with its gas exploration efforts and begin drilling as soon as possible this year.

The meeting came just two days after Israeli gas began flowing to Egypt: Egypt is initially importing 200 mcf/d of gas from Israel’s Tamar and Leviathan gas fields. Around 2.1 bcm of gas will be shipped each year from Leviathan alone, rising to 4.7 bc a year by the second half of 2022. Egypt could begin to re-export some of the gas to Europe within the next few months, Israeli Energy Minister Yuval Steinitz said last week. The landmark USD 19.5 bn agreement will see Egypt receive 85 bcm of Israeli gas over the next 15 years. Talks are also moving forward between the Cypriot government and its foreign partners to begin work on the planned USD 1 bn pipeline connecting its Aphrodite gas field to Egypt’s Idku LNG facility.

El Molla claims Israel pipeline plans unlikely to get off the ground: Israel faces a number of hurdles to achieving its goals of constructing a direct pipeline between its gas fields and the European mainland, El Molla told El Hekaya’s Amr Adib (watch, runtime: 7:46). The minister suggested that resistance in Italy due to environmental concerns, a potential lack of commercial feasibility, and the need to pass through contested waters could present issues for the project.

This is probably wishful thinking though: Although Italy’s foreign minister did cast doubt on the feasibility of the project over the weekend, Israel and Greece have already signed an agreement to begin work on the USD 6 bn pipeline, which threatens to undermine Egypt’s ambitions of becoming a regional gas hub.

In related news: Egypt has halved its natural gas exports to Jordan to 140 mcf/d from 350 mcf/d, an unnamed source told the local press. The decline was made at the request of the Jordanian government which has seen the country’s energy consumption fall during the winter.

The story received plenty of digital ink in news outlets: Cyprus News Agency | Reuters | Financial Mirror | New Europe | Xinhua | Asharq Al Awsat.

Natgas market regulator to hike fees for use of state grid: The Gas Regulatory Authority will this year raise the price private sector companies pay to use the state natural gas grid, Al Mal reports, citing an unnamed source. The source did not disclose the size or timing of the expected hike. The authority had said last month it cut the fees by about USD 0.09 to USD 0.29 per mmbtu, down from USD 0.38. This price was implemented throughout 2019, according to authority head Karem Mahmoud. The gas market regulator was established in 2017 as part of moves to liberalize the Egyptian gas market.

Egypt’s GDP growth forecast among the highest in North Africa, debt sustainability remains a concern -UN: Egypt’s GDP is expected to grow at a 5.8% clip in 2020 and 5.3% in 2021, one of the highest in North Africa, according to the United Nations’ 2020 World Economic Situation and Prospects report (pdf). Growth will be spurred by recovering domestic demand and easing pressures on the country’s balance of payments, while the expectation of further rate cuts, the government’s improving fiscal position, greater exchange rate stability, and higher levels of reserves all contribute to a positive outlook for the country’s economy, the report says.

What the continent’s economic outlook is looking like: Growth in North Africa is expected to be driven by domestic demand in 2020, as expanding populations in countries such as Egypt continue to provide large markets for companies and investors. However, the short-term risks across African subregions are tilted to the downside due to weather-related shocks, political conflicts, and social and security matters posing uncertainty in the continent. The UN says it is unlikely that the region’s governments will achieve a key development goal of eliminating extreme poverty by 2030. In Egypt, the percentage of the population living below the poverty line increased to 32.5% during FY2017-2018, up from 27.8% in 2015.

Africa’s debt addiction is raising concern: Egypt, Benin, and Ghana collectively raised more than USD 7.6 bn from issuing eurobonds, marking a recent upsurge in the issuance of foreign currency-denominated bonds in Africa. Egypt successfully issued USD 2 bn-worth of USD-denominated eurobonds in a triple-tranche issuance that went to market last November, and is expected to be the final USD-denominated issuance for the fiscal year, Finance Minister Mohamed Maait told us last week. The report says this uptick in debt has raised concern over the sustainability of these countries’ debts as the growth outlook remains fragile and a mismatch persists between debt maturity and the timelines of the projects the proceeds are used to fund.

BUDGET WATCH- New Budget Act ready for cabinet approval: The Finance Ministry has finalized drafting a new Budget Act and will send it to the cabinet today for approval before being submitted to the House of Representatives, minister Mohamed Maait was quoted by Al Mal as saying. The new act will merge legislation governing the annual fiscal budget and government accountability into an updated bill that accounts for modern budget preparation processes and erases overlap between different pieces of legislation. The bill was said to have been finalized back in August last year but nothing has been heard for the past five months.

Education spending in FY2020-2021 nominated to rise by 33%: An investment plan reviewed by the Prime Minister Moustafa Madbouly indicated that earmarks for education and research will rise 33% in the FY2020-2021 budget, according to a cabinet statement. The proposal did not state the figure but given that the government allocated EGP 132 bn to education in the FY2019-2020 budget, a 33% increase on this would amount to EGP 176 bn. The plan details spending across several aspects of education, including the Egyptian-Japanese schools, STEM schools, technical education and the related research centers, as well as earmarking EGP 10 bn to build 39k new classrooms across 2555 projects.

What we already know about the budget: The Finance Ministry is eyeing 6.4% GDP growth in FY2020-2021, up from a targeted 6% for the current fiscal year. The ministry is also planning to narrow the overall budget deficit to 6.2%, from an expected 7.2% in FY2019-2020 and has projected a 6.5% y-o-y reduction in government spending, which is likely to include more than just trimming subsidy spending. The budget will also look to lower Egypt’s debt-to-GDP ratio to 80%. The ministry is set to release its preliminary budget for the upcoming fiscal year in 3Q2019-2020.

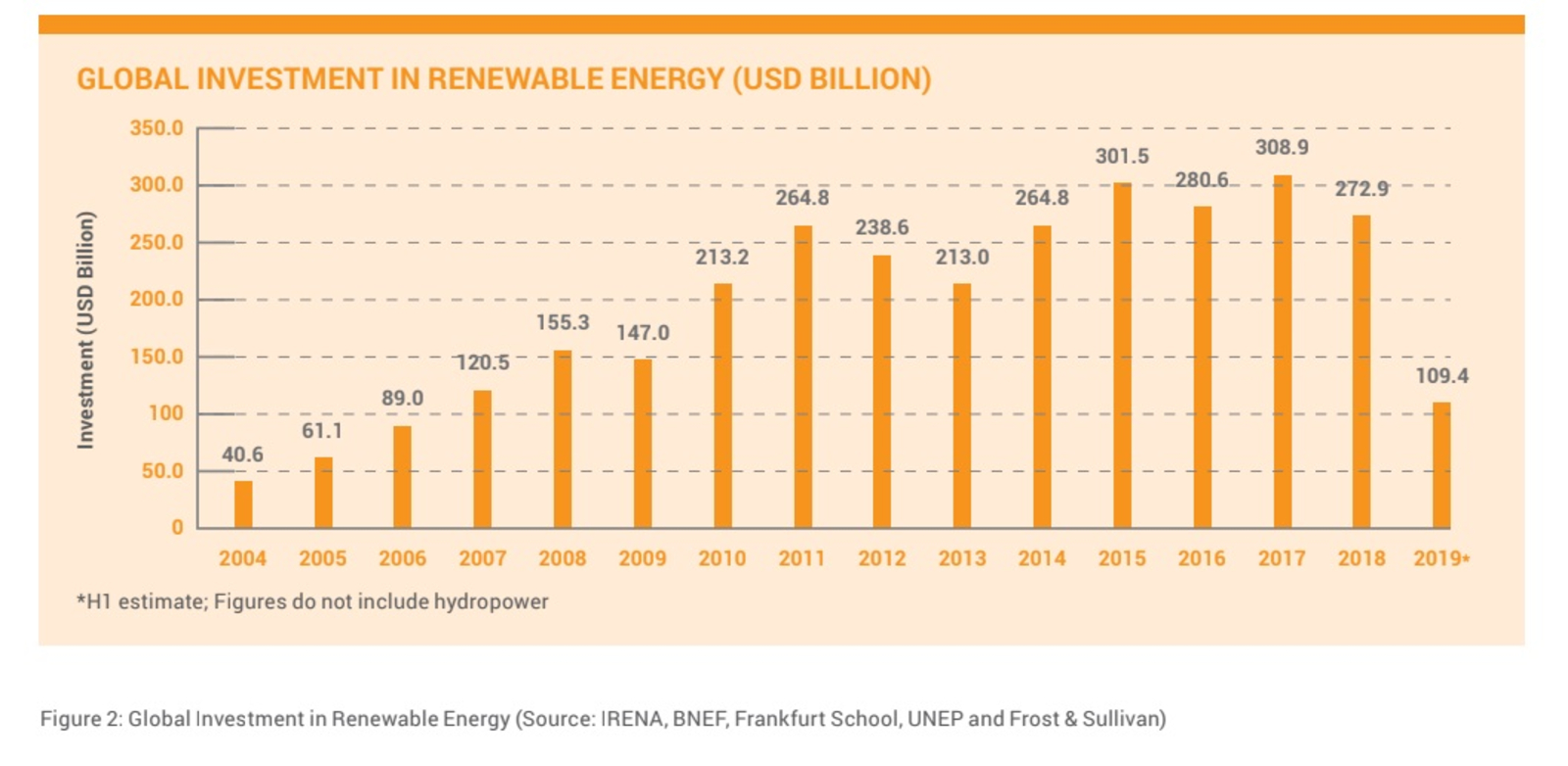

Egypt, Morocco, and Jordan remain regional leaders in the development of solar power, the Middle East Solar Industry Association (MESIA) says in its 2020 Middle East Solar Outlook (pdf). Despite Egypt being a top solar developer and having excess generation capacity today, the report says Egypt still needs “substantial additional power capacity” to accommodate an anticipated increase in electricity demand to 67 GW in 2030 from 27.6 GW in 2019.

Renewables are accounting for a larger share of the regional energy mix, bringing new challenges: As more projects come online, MENA countries’ biggest challenge in accommodating the shift towards solar and other renewable sources of energy will be maintaining grid stability and flexibility, according to MESIA. The report also highlights the importance of scrapping fossil fuel subsidies and introducing regulatory frameworks that are more favorable for renewables. “In addition to setting high renewable energy targets, stable tariff regimes, clear permitting rules, net metering, wheeling and grid connections conditions are required.”

Attorney-general deports two, releases three Anadolu Agency employees: Egyptian authorities have released five staff members at Turkish state-broadcaster Anadolu Agency who were arrested on Tuesday during a raid on the agency’s Cairo office, reports Al Masry Al Youm. The Turkish agency had initially reported on Wednesday that one Turkish man and three Egyptians had been arrested. However, local media reported yesterday that two Turks had been deported while the three Egyptians were released on bail on the attorney-general’s orders.

EARNINGS WATCH- CIRA reports solid profit, revenue growth in 1Q2019-2020: Cairo for Real Estate and Investment’s (CIRA) profit jumped 47% y-o-y to EGP 109 mn in the first quarter of its 2019-2020 fiscal year (September-November), according to the company’s earnings release. Revenues rose 56% y-o-y during the quarter, growing to EGP 313.1 mn. “CIRA [is] reporting solid growth in Q1 2019/2020 across the full spectrum of its financial and operational performance metrics and continuing to deliver exceptional value for its students and shareholders alike,” CEO Mohamed El Kalla said. Enrolment at CIRA’s flagship Badr University increased by 31% to 10.3k students during the quarter. Enrolment at CIRA’s K-12 segment, meanwhile, rose 11% to 26.8k students.

CIRA will inaugurate in September the Regent British School in New Mansoura, the latest K-12 facility to join the leading private education outfit’s portfolio. “The addition of the new school … comes as part of our wider geographic expansion efforts,” El Kalla said.

In other company news, the board has approved a EGP 100 mn loan from Ahli United Bank, according to an EGX filing (pdf). Proceeds will be used to finance projects, the filing says, without providing further details.

MOVES- Adsero-Ragy Soliman & Associates law firm has tapped Osman Mowafy (LinkedIn) as co-founding partner to lead the dispute resolution practice group at the firm, according to an emailed statement (pdf). Mowafy, who has been practicing for 30 years, was most recently head of litigation at Matouk Bassiouny.

Egypt in the News

The slow progress made during GERD talks last week is continuing to dominate the coverage in the foreign press: Takes range between the optimistic (AFP | AP) to the cautious (Voice of America | Foreign Policy).

The fallout from the death of Mostafa Kassem in Egyptian custody is still taking up a lot of column inches: Two Democratic senators are calling for the US government to place sanctions on Egypt in retaliation for Kassem’s death, according to a letter seen by the Washington Post. Senators Christopher Van Hollen and Patrick Leahy described Kassem’s treatment as “particularly egregious,” given that Egypt is one of the top recipients of US military aid. An opinion piece in the same paper by human rights activist and former detainee Mohamed Soltan urges the US government to demand the release of people unjustly imprisoned. The Independent is running a similar piece written by Omar Soliman, whose brother is also detained in the Egyptian prison system.

Other stories getting pickup in the foreign press:

- Residents in flooded neighborhoods in Alexandria have taken to social media frustrated by what they say has been a lack of action on the part of local officials to address the recurring problem of winter flooding that has left rainwater mixed with sewage remain uncleared in their neighborhood, France 24 reports.

- Instagrammer arrested for climbing the pyramids: Vitaly Zdorovetskiy was detained in Egypt for five days after posting a picture of himself sitting at the top of one of the Giza pyramids, according to the Daily Mail.

- A social entrepreneur is turning rice straw into a resource: A small NGO is giving young people, women, and people with disabilities workshops on creating products made out of agricultural refuse, Arab News reported.

Diplomacy + Foreign Trade

Shoukry talks Libya developments with Greek, Italian FMs: Foreign Minister Sameh Shoukry discussed the latest developments in Libya with his Greek and Italian counterparts, according to a ministry statement. The three ministers agreed that Turkey saying it would begin sending troops to Libya would hamper the resolution of the situation in Libya.

World Bank executives meet Sisi, Madbouly, key cabinet members: President Abdel Fattah El Sisi met with World Bank senior executives for the first time since 2014 to review the government's economic reforms, visit projects the bank is financing, and discuss future cooperation, according to an Ittihadiya statement. The delegation also talked about the second phase of the government’s economic reform program and private sector growth with Prime Minister Moustafa Madbouly, the planning, finance, trade and international cooperation ministers, and the head of GAFI, according to a cabinet statement.

Energy

ABB snaps electricity transformer contract for Canal Sugar

Canal Sugar Company has awarded a contract to design and supply customized electricity distribution transformers to ABB, Al Mal reported. The company did not disclose the value of the agreement nor the timetable for its implementation.

Infrastructure

New Valley to establish EGP 2.5 bn logistics zone

The New Valley Governorate has begun work on a EGP 2.5 bn logistics zone that will be designated for dates and crops, according to the local press. The governorate signed a partnership contract with the Internal Trade Development Authority in June last year to establish a 100-feddan logistics zone to serve as a hub for the governorate's dates and agricultural crops production.

Four new PPP desalination projects announced this year

The Finance Ministry’s PPP division will issue tenders for four new desalination plants in 2Q2020, division head Ater Hanoura tells Al Mal. One plant is set to be constructed in Hammam on the North Coast and the three others along the Red Sea coastline between Safaga and Quseir.

Basic Materials + Commodities

Italian development agency to contribute to UNIDO Egypt tomato program

The Italian Development Cooperation will contribute more than EUR 4.55 mn to two United Nations Industrial Development Organization (UNIDO) projects in Egypt and Iraq, with the Egypt project focusing on the tomato market, according to a UNIDO statement. An undisclosed amount will support UNIDO’s program in Egypt to support the tomato supply chain Egypt is the world’s fifth-largest producer of fresh tomatoes, yielding about 8 mn tonnes per year, of which only 3-4% is processed.

Health + Education

Construction on new capital medical city begins

Housing Minister Assem El Gazzar laid the foundation stone for Egypt's medical city Capital Med, which is being implemented by the private sector, according to a cabinet statement. The Egypt Care, which is implementing the project, intends to launch the first phase of the EGP 18 bn city in 30 months, Chairman Hassan Al Qalla said. This is EGP 3 bn more than Al Qalla

Banking + Finance

Monorail financing to be clear by end of June

International financial institutions interested in financing the Sixth of October City to Giza and Nasr City to the new administrative capital monorail projects will take a final decision by the end of June, unnamed sources told the local press. The list of institutions includes the International Finance Corporation, the European Bank for Reconstruction and Development (EBRD), and the European Investment Bank (EIB). A consortium comprised of the African Development Bank, EBRD, and EIB has been in negotiations with the government to provide funding for the project. Consulting firms interested in the management, design, and supervision of the project were supposed to have placed their bids at the end of December but no information has so far been forthcoming.

Legislation + Policy

Egyptian MP suggests raising harassment fine to EGP 500k

Rep. Maged Toubia has proposed raising the fine for [redacted] harassment to EGP 500k, as well as sentencing perpetrators to prison time, according to Masrawy. Egypt’s penal code currently imposes different fines depending on the type of harassment. Verbal offenders can be fined EGP 3k-5k, while incidents of workplace harassment can result in a fine of up to EGP 50k.

On Your Way Out

Egyptian soprano makes it big and signs record contract with Warner classics: Fatma Said signed a recording contract with international music label Warner Classics to release her debut album later this year, Warner and the singer announced on social media. “I feel so lucky and blessed to have an amazing and super supportive team working with me on my first debut album,” she wrote. The 29-year-old opera singer studied at the Hanns Eisler School of Music in Berlin and in 2016 was named a BBC New Generation Artist.

The Market Yesterday

EGP / USD CBE market average: Buy 15.76 | Sell 15.88

EGP / USD at CIB: Buy 15.77 | Sell 15.87

EGP / USD at NBE: Buy 15.80 | Sell 15.90

EGX30 (Thursday): 13,824 (+0.4%)

Turnover: EGP 740 mn (11% above the 90-day average)

EGX 30 year-to-date: -1.0%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.4%. CIB, the index’s heaviest constituent, ended up 0.6%. EGX30’s top performing constituents were Abu Dhabi Islamic Bank up 3.4%, Juhayna up 2.3%, and Orascom Construction up 1.9%. Thursday’s worst performing stocks were Egyptian Iron & Steel down 2.3%, Pioneers Holding down 1.8% and Cleopatra Hospitals down 1.6%. The market turnover was EGP 740 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -25.7 mn

Regional: Net short | EGP -15.1 mn

Domestic: Net long | EGP +40.8 mn

Retail: 51.0% of total trades | 49.0% of buyers | 53.0% of sellers

Institutions: 49.0% of total trades | 51.0% of buyers | 47.0% of sellers

WTI: USD 58.54 (+0.0%)

Brent: USD 64.85 (+0.4%)

Natural Gas (Nymex, futures prices) USD 2.00 MMBtu, (-3.6%, February 2020 contract)

Gold: USD 1,560.30 / troy ounce (+0.6%)

TASI: 8,459 (+0.3%) (YTD: +0.8%)

ADX: 5,179 (+0.1%) (YTD: +2.0%)

DFM: 2,828 (+0.4%) (YTD: +2.3%)

KSE Premier Market: 7,089 (-0.0%)

QE: 10,698 (+0.6%) (YTD: +2.6%)

MSM: 4,060 (+0.5%) (YTD: +2.0%)

BB: 1,639 (+0.2%) (YTD: +1.8%)

Calendar

January: 1,000 artifacts to be displayed when Hurghada Museum opens.

19 January (Sunday): International peace talks between Libya’s warring leaders, Berlin, Germany (Berlin Conference on Libya).

20 January: UK-Africa Investment Summit 2020, London, United Kingdom.

21-24 January (Tuesday-Friday): World Economic Forum (WEF) Annual Meeting, Davos-Klosters, Switzerland.

23 January 23 – February 4: Cairo International Book Fair 2020, New Cairo International Exhibition and Convention Center, Egypt

25 January (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

27 January (Monday): Cairo Economic Court will look into minority shareholder’s lawsuit against Fincorp Investment Holding as Adeptio AD Investments’ financial advisor for its mandatory tender offer (MTO) for Americana Egypt.

27-29 January (Monday-Wednesday): African Private Equity and Venture Capital Association’s North African Fund Manager Masterclass, Sheraton Cairo Hotel, Galaa Square, Cairo.

28-29 January (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

28-29 January (Tuesday-Wednesday): Egypt and Ethiopia to meet again in Washington, DC, for mediation on GERD.

February: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February: A delegation of Swiss businesses will visit Egypt to discuss investment.

February: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

3-5 February: The Arab-African International Forum, Jeddah, Saudi Arabia.

4 February (Tuesday): Court hearing for PTT Energy Resources’ USD 1 bn lawsuit against Egyptian government.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

9-10 February (Sunday-Monday): The the 33rd ordinary African Union (AU) Summit where Egypt will hand over the African Union presidency to South Africa

11-13 February (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

23 February (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot. It was previously postponed to 24 November 2019 and then to 5 January 2020, and now 23 February.

23 February (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous

27 February (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March (Wednesday-Thursday): Women Economic Forum, Cairo.

7 March (Saturday): International Conference for Investment organized by Suez Canal Economic Authority, Al Galala City, Egypt

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

9 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April (Sunday): Easter Sunday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

21 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

2 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.