- The EGX slid again yesterday as analysts at home and abroad chew over the meaning of weekend protests. (Speed Round)

- Trump downplays protests in meeting with President Abdel Fattah El Sisi on the sidelines of the UN General Assembly in New York. (Speed Round)

- Gov’t committee looks set to recommend incentives for companies that list on EGX — and the investors who back them. (Speed Round)

- Egypt could lose tens of thousands of tourists after Thomas Cook files for liquidation. (Speed Round)

- First draft of new income tax law ready. (Speed Round)

- Schneider Egypt inks settlement on overdue export subsidies, becoming the second company to do so this week. (Speed Round)

- Is the dominance of the greenback under threat as digital currencies look to transform global financial system? (The Macro Picture)

- 3,600-year-old scrolls show principles of state-led healthcare at play in ancient Egypt. (On Your Way Out)

Tuesday, 24 September 2019

Will new EGX listings get tax incentives?

TL;DR

What We’re Tracking Today

While the business community and foreign investors alike continue to digest events of this past weekend, you can expect the domestic press to be preoccupied today by events over in New York.

That’s where the United Nations General Assembly’s general debate kicks off today at 3 pm CLT. President Abdel Fattah El Sisi is among the world leaders set to address the assembly. El Sisi, who has been in New York for two days in the run-up to the gathering, also met with US President Donald Trump yesterday and delivered a speech on Egypt’s universal health coverage at a high-level meeting. We have the full rundown in this morning’s Speed Round, below.

The UN headquarters saw no shortage of discussions on climate change this week, with high-profile Swedish teenage activist Greta Thunberg railing against world leader at the UN Climate Action Summit yesterday for their failure to take action on global warming, according to Reuters. And that’s to say nothing of her “steely look” at The Donald, who in words and deeds is one of the world’s top climate-change deniers.

A total of 87 multinationals with a combined market cap of USD 2.3 tn have committed to a campaign to keep global warming below 1.5°C, as part of the UN Global Compact, the Financial Times reports. The initiative, which launched earlier this year, requires signatory companies to set independently verified targets and create decarbonization plans within two years to start reducing their emissions.

CIB has made a pledge along the same line, promising make climate action and sustainability “central to its business” as it joined a coalition of 130 banks worldwide representing over USD 47 tn in assets,” according to a statement released yesterday. The statement emerged from the launch of the Principles for Responsible Banking, touted as the “beginning of the most significant partnership to date between the global banking industry and the UN.” Learn more in CIB’s statement here (pdf).

Back at home, the central bank’s Monetary Policy Committee will meet on Thursday to review key interest rates. Seven of the eight economists we surveyed expect the CBE to cut interest rates by 50-150 bps on the back of unexpectedly low inflation figures in August. Naeem Brokerage told us yesterday it’s expecting a 150 bps cut on the back of potentially lower inflation in September. The firm also cited a high real interest rate and a favorable base effect. Goldman Sachs and Abu Dhabi Commercial Bank, meanwhile, are forecasting a 100 bps rate cut, according to Bloomberg.

Conferences and events taking place this week:

- The second day of the Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS) gets underway today at the Kempinski Royal Maxim.

- A roundtable discussion titled “Investing in Renewable Energy and Sustainable Development” will take place at the Nile Ritz Carlton today.

- The launch of the Mediterranean Business Angels Network will take place at Techne Summit 2019, which runs 28-30 September at Bibliotheca Alexandrina in Alexandria.

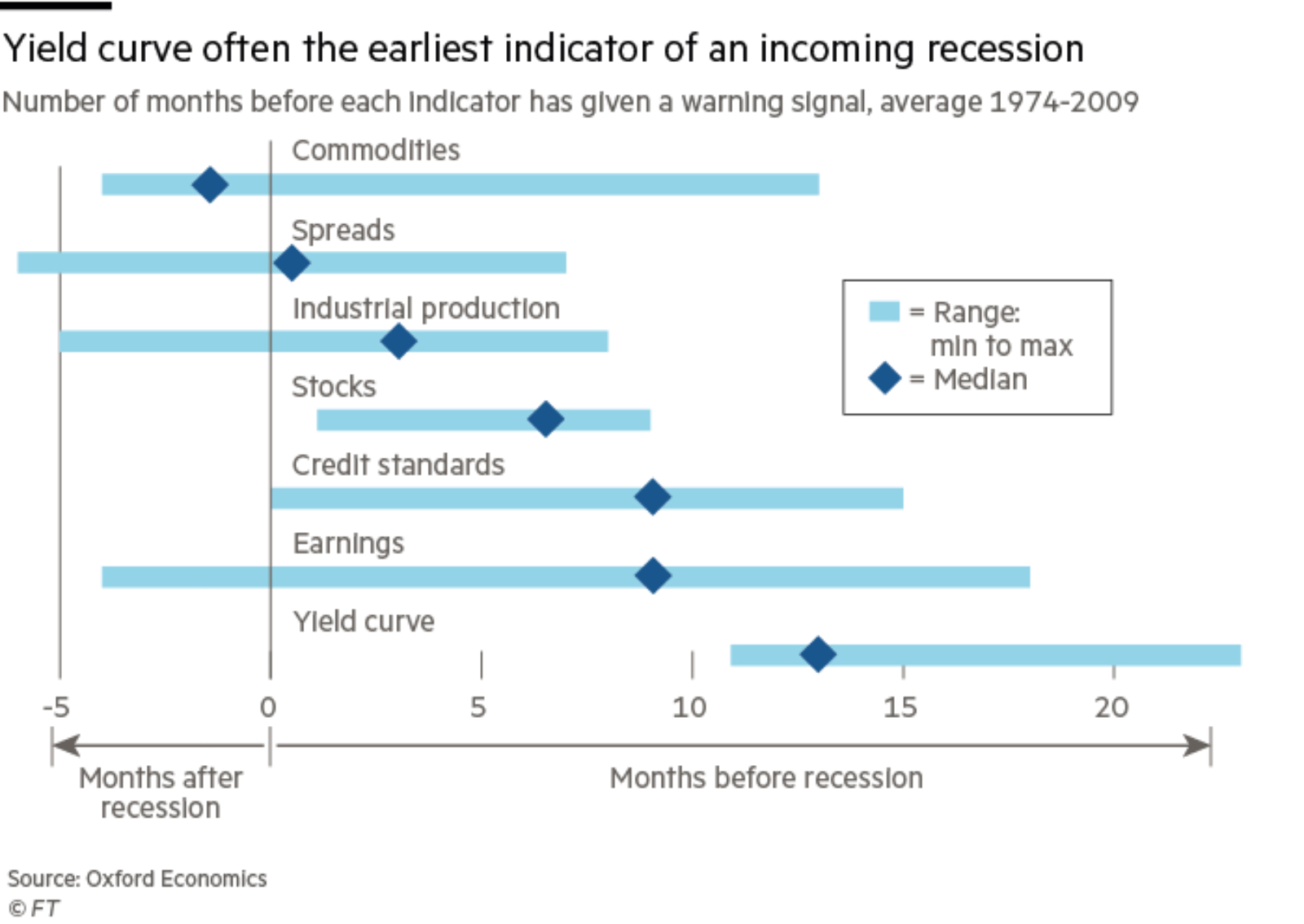

The yield curve in US bonds may have inverted in August — but six other recession indicators are yet to signal doom. Adam Slater, lead economist at Oxford Economics, says that although an inverted yield curve has preceded almost every (US) recession since 1974, it is too soon to panic while other indicators remain quiet. Earnings growth, while falling, remains higher than it was in 2015, and a recent spike in corporate bond spreads was not dramatic enough to ring the alarm bells. And although industrial output in developed countries looks to have dipped in the second quarter, it is so far no worse than the downturns in 2012 and 2015-2016, Slater says. The Financial Times has more.

But asset managers remain pessimistic: The FT has picked up a survey by Absolute Strategy Research (ASR) that found that 52% of global asset managers believe that a downturn is likely within the next year due to trade and geopolitical instability. The poll, based on responses from more than 200 financial institutions with a combined USD 4.1 tn of assets under management, shows that investment managers “have definitely bought into the bearish macro view,” David Bowers, head of research at ASR, said. “When you look at the pattern over the past four or five years, it is definitely quite an important inflection point.”

IPO advisors from Silicon Valley want to see more direct listings: Bankers at Morgan Stanley and Goldman Sachs and legal advisors at Goodwin Procter and Latham & Watkins are looking at how to change the game and expand direct listings “as a way for start-ups to raise money without undergoing a traditional initial public offering,” reports the Financial Times (paywall). They stand to gain from getting hired by companies eyeing direct listings, who would typically divide fees on fewer advisors.

Softbank moves to oust WeWork parent CEO: Adam Neumann, co-founder of WeWork and the CEO of its parent We Company, is being pressured by board members and investors to step down and opt for a different role in the future of the communal workspace startup, reports Reuters. Neumann shelved the company’s multi-bn USD IPO plans last week, handing a “blow” to one of its biggest investors, SoftBank.

I spy with my little eye, something that starts with Google: Google apologized for allowing human reviewers to listen to audio from Google Assistant. The tech company has issued a new policy that will inform users that their audio may be listened to if they opt into a feature that also improves audio quality, Nino Tasca, senior product manager of Google Assistant, wrote in a blog post yesterday.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s ongoing visit to New York continued to dominate the airwaves last night. The talking heads also still emphasizing what they say is the role of the Ikhwan in inciting protests this past weekend.

Among the highlights from the UNGA: Hona Al Asema’s Reham Ibrahim had a live broadcast of the press conference by El Sisi and US President Donald Trump (watch, runtime: 6:45), while Al Hayah Al Youm gave airtime to the president’s speech on universal health coverage (watch, runtime: 8:15). Al Hayah Al Youm’s Khaled Abu Bakr also reported from New York on El Sisi’s meetings with top execs from American companies active in Egypt during a banquet hosted by the US Chamber of Commerce. We have the full story in this morning’s Speed Round, below.

The Ikhwan is using fabricated videos and disseminating false news as part of its attempts to sow dissent in Egypt, Beshir Abdel Fattah, an analyst at Al-Ahram Center for Political and Strategic Studies, told Hona Al Asema’s Reham Ibrahim. Abdel Fattah said the group is going bankrupt and is reliant on political and financial support from foreign entities (watch, runtime: 6:38). The analyst also surmised that the group is trying to undermine Egypt’s economic progress over the past several years (watch, runtime: 6:40).

Social media manipulation was once again the main focus of Al Hayah Al Youm’s Lobna Assal’s coverage of the protests (watch, runtime: 52:19). Assal and El Hekaya’s Amr Adib gave a shout-out to pro-government demonstrators in Suez for taking to the streets for a second consecutive day (watch, runtime: 2:07 and runtime: 2:35).

Speed Round

Speed Round is presented in association with

Shares on the Egyptian Exchange slid again yesterday as investors and the business community alike continued to wrestle with the meaning of anti-government protests this weekend. The benchmark EGX30 fell another 1.5%, extending a sell-off that saw the index shed 5.3% on Sunday. Steel companies were among the hardest hit, with Egyptian Iron & Steel down 7.0% and Ezz Steel off 6.3%. Orascom Investment Holding was the day’s biggest loser, shedding 7.3%.

Margin calls exacerbated selling pressure, Naeem Brokerage’s Allen Sandeep told Bloomberg, noting that local investors began dumping shares after selling by Arab investors triggered a round of margin calls.

Lest we forget, the EGX has been one of the best performing indexes this year: “It should be still kept in mind that EGX 30 is one of the global outperformers… the reason for the outperformance being strong structural reforms undertaken by the government,” Century Financial’s Arun Leslie John said.

Egyptian USD bonds, ETF dropped: The 2049 USD bond dropped 3.1 cents to 106.1 cents in the USD, and the 2040 bond fell 1.9 cents to 96.7 cents, Reuters reported, citing Refinitiv data. Egypt’s domestic and external bonds “may come under some pressure in the coming days,” Goldman Sachs said. The VanEck Vectors Egypt Exchange-Traded Fund (EGPT), the only Egypt ETF trading in the US, dropped 6.2% yesterday “and broke below both its short- and long-term trendlines at the 50- and 200-day simple moving averages,” according to ETF Trends.

Meanwhile, the 12-month non-deliverable forwards on the EGP spiked to 18.38 to the greenback from yesterday’s spot rate of EGP 16.29, marking the biggest rise since March 2017, according to Bloomberg — meaning the market sees the EGP coming under pressure in the period ahead.

The unrest shouldn’t affect foreign inflows into Egyptian debt as real interest rates remain competitive compared to other EM and developed countries, Monica Malik, chief economist at Abu Dhabi Commercial Bank, said.

Is there more to this than just protests? Protests this past weekend coincided with a number of factors that have combined to increase market volatility, Shuaa Securities’ head of research, Amr Elalfy, wrote in a note yesterday. Rates on Egypt’s five-year credit default swaps have risen sharply since the attacks on Saudi Aramco’s oil facilities last week, which historically has negatively correlated with share prices. Stocks have also been de-rated in light of last week’s appreciation of the EGP and forecasts for continued strengthening before the end of 2019.

Either way, a new round of sustained protests is unlikely to do much good for the economy, Jason Tuvey, senior EM economist at Capital Economics, wrote in a note yesterday. “Past experience suggests that this would be disruptive for the economy and government efforts to quell unrest, such as fiscal loosening and keeping a tight grip on the currency, could fuel a renewed build-up of macro imbalances. Structural reforms needed to boost productivity growth and living standards would be put on the backburner,” he said.

US President Donald Trump extended his support to President Abdel Fattah El Sisi amid the recent protests during a meeting yesterday on the sidelines of the UN General Assembly in New York, according to Reuters. The newswire quoted Trump as saying “everybody has demonstrations. I’m not concerned with it. Egypt has a great leader.” Asked about the weekend events, El Sisi directly attributed the protests to “political Islam.”

The two also discussed “reinforcing peace and stability in the Middle East” and “ways to revive” the Palestinian-Israeli peace process,as well as economic reform and cooperation and bolstering the activity of American companies in Egypt, according to an Ittihadiya statement. El Sisi pledged to make it easier for US companies to do business in Egypt during a dinner hosted by the American Chamber on Sunday, the presidency said.

El Sisi separately gave global leaders a rundown on his administration’s healthcare initiatives, including the “100 mn healthy lives” initiative and the elimination of surgical waitlists during the General Assembly high-level meeting on universal health coverage, according to a transcript of his speech released by Ittihadiya.

Meetings with other leaders: El Sisi also met with European leaders, including Italy’s Prime Minster Giuseppe Conte, with whom he discussed the ongoing investigation into the murder of Italian PhD student Giulio Regeni, according to a statement. The two also touched on illegal immigration and other regional issues. The president separately discussed terrorism with Belgian Prime Minister Charles Michel and cooperation with a focus on energy and logistics with Norwegian Prime Minister Erna Solberg.

EXCLUSIVE- Gov’t committee close to finalizing package of incentives for new EGX listings: A government committee has been working to put the final touches on a package of proposed incentives to stimulate IPO activity in the market and attract more foreign investment into Egyptian equities, the Finance Ministry told Enterprise in an exclusive statement. The committee, which Prime Minister Moustafa Madbouly formed earlier this year, includes Vice Minister of Finance Ahmed Kouchouk, Tax Authority head Abdel Azim Hussein, and ECMA board member Ayman Sabry. The proposal could be before Finance Minister Mohamed Maait for review “within weeks,” we’re told.

The package looks likely to include a mix of tax breaks for both Egyptian residents and non-residents, according to our sources, including a 50% tax break for seven years for companies that list 35% or more of their shares on the stock exchange. The proposal was put forth by the Egyptian Capital Markets Association (ECMA) earlier this year.

Also likely to be included in the package is a capital gains tax exemption for non-residents, while resident investors could see a full exemption from the stamp tax, which is currently set at 0.15%. The committee is also looking at mandating Misr for Central Clearing, Depository, and Registry (MCDR) with handling listed companies’ tax files to simplify procedures.

Thousands of Thomas Cook reservations in Egypt canceled as company goes bust: Egypt could lose thousands of tourists after British travel group Thomas Cook yesterday went into liquidation. Local operator Blue Sky Group was expecting 100k tourists to visit Egypt via Thomas Cook in 2020 and has canceled 25k reservations booked up to April 2020, Chairman Hossam El Shaer said in a statement sent to Reuters.

“Evacuations” from Egypt: The collapse of the world’s oldest travel firm has prompted a huge operation by governments and insurance companies to bring some 600k travelers stranded around the world back home, including 1.6k in Hurghada. Private carrier Nile Air has begun operating twice-weekly flights from Marsa Alam to the UK to transport stranded British tourists back home, Managing Director Yousry Abdel Wahab told Al Mal. The British government will reportedly cover the costs of the flights, according to Abdel Wahab.

The potential loss of thousands of visitors is a bit more than a rounding error for Egypt’s tourist industry, which has only recently been recovering from setbacks earlier this decade. Egypt was one of Thomas Cook’s most rapidly growing markets, with bookings up by 30-40% in 2019 as tourists flocked to Hurghada and Marsa Alam. Tourism Ministry sources speaking to the local press expect the effect to only last a month or two — with the winter season bearing the brunt of the impact — before bookings return to their normal levels before the tour operator’s bankruptcy.

The impact on Orascom’s El Gouna projects is “immaterial”: Orascom Development Egypt (ODE) said it is insulated from the impact of the liquidation despite having an EGP 200 mn agreement with Thomas Cook to open two new hotels in El Gouna. The impact on Orascom’s operations of the bankruptcy is expected to be “immaterial” in the short term, Orascom Development Holding said in a statement yesterday. The agreement to develop Casa Cook Hotel and rebrand Arena Inn into Cook’s Club Hotel was announced in December 2018, with Cook’s Club originally scheduled to open its doors in August and Casa Cook in October. “Fortunately, we are in the situation to confirm that we already collected the upfront payments from the company for these hotels and that we are finalizing the construction of the new 100 room hotel planned to be operational in October,” the statement reads.

Background: The collapse of the industry giant came early yesterday after it failed to reach an agreement with its creditors. The company — involved in tourism in Egypt since the late 1800s — had struggled in recent years under a USD 1.7 bn debt pile. We reported in April that it was seeking investors after seeing its share price plummet around 80% in the previous year. Its mounting interest bill prevented it from keeping up with online competition, and events including Britain’s ban on flights to Sharm El Sheikh in 2015, a coup attempt in Turkey in 2016, and Europe’s 2018 heat wave all impacted its profit margin.

On the bright side: Our tourism sector was ranked first among African peers for the first time since 2013 by Bloom Consulting in its Country Brand Ranking report (pdf) released yesterday. “Egypt is a role model for other countries in all continents due to its ability to show resilience and reinventing itself, despite a period of political unrest and being a target of terrorist attacks,” the company said.

LEGISLATION WATCH- Initial draft of new income tax law ready: The Finance Ministry has completed incorporating suggestions from the business community and finalized an initial draft of a new income tax law, Minister Mohamed Maait said yesterday during the Future of Investment in Egypt conference, according to a ministry statement. The draft will now be up for public consultations before making its way to Cabinet for approval. Once approved, it will then be handed over to the House of Representatives for a discussion and a final vote before getting signed into law by the president. Maait said in July that the new law would not enact any changes to income tax rates.

Background: We reported in May that the government began drafting significant changes to the Income Tax Act that may be extensive enough to require a new legislation. The new legislation is expected to impact how tax appeals are handled, the ministry’s internal tax committees, and the procedures for filing tax returns, Tax Authority boss Abdel Azim Hussein told us. It would also include introducing a new chapter in the tax code for the treatment of online businesses, new powers to combat tax evasion, and a review of how tax incentives are structured.

Manufacturers to get “preferential treatment” in Real Estate Tax Act: Separately, new real estate tax act would see manufacturers receive “preferential treatment,” Maait also said at the conference, according to the ministry statement. Factory owners had voiced concerns over the current real estate tax system, which imposes taxes on idle industrial land, according to Al Shorouk.

The government is looking to reduce Egypt’s budget deficit to 5% within two years, which would bring it to a level that international institutions deem “safe,” Finance Minister Mohamed Maait said yesterday, according to Amwal Al Ghad. Speaking at the Future of Investment in Egypt conference, Maait said that Egypt is on track to meet its budget deficit targets of 7.2% in FY2019-2020 and 6% in FY2020-2021. Official documents seen by Enterprise back in June indicated that the ministry was expecting the budget deficit to narrow to 6.2% and 4.8% during the next two fiscal years, respectively.

M&A WATCH- Arab Dairy waiting on FrieslandCampina to make an acquisition offer: Netherlands-based FrieslandCampina has completed due diligence to acquire cheesemaker Arab Dairy without making an offer, but negotiations are ongoing, the latter said in an EGX disclosure (pdf). The Panda cheese producer gave the Dutch company the green light to conduct due diligence to acquire 100% of its shares in June.

Advisors: EFG Hermes has been providing financial advice to FrieslandCampina while Sharkawy and Sarhan Law Firm was appointed as legal advisor, the local press reported. Arab Dairy is close to 70% owned by Pioneers Holding, which had hired CI Capital to advise it on the sale.

Background: UAE-based Gulf Capital backtracked on plans to buy out the company in July, saying their “strategy and expansion plans are not in line” with its investment mandate.

Schneider inks settlement on overdue export subsidies: Schneider Electric has signed an agreement with the government that should see it receive overdue export subsidies by the end of the year, President for North East Africa and the Levant Walid Sheta said, according to Masrawy. The agreement is expected to contribute to increasing the company's exports next year, Sheta added. Schneider is studying setting up a new factory in the Suez Canal area, which could take up to three years to be up and running, Sheta told the newspaper. This is possibly part of the agreement: Larger corporations are encouraged under the new export subsidy framework announced last July to commit to new investments to speed up their late payments.

The agreement is the second reported settlement after one with Sumitomo Tires announced last week. That’s when the government started implementing a new EGP 6 bn export subsidy framework and said it was taking steps to settle overdue payments promised by the Export Subsidy Fund under an old program. Under an agreement reached with exporters in May, settling companies will receive their arrears through either writing off the overdue amounts against their taxes or applying for industrial land at a discount through the government’s new online land allocation portal.

The arrears have accumulated since 2011 to reach EGP 25 bn,Finance Minister Mohamed Maait said yesterday at the Future of Investment in Egypt conference, according to Amwal Al Ghad. This is the first official statement about the size of the expected settlements, and is more than double the Egyptian Businessmen Association’s rough estimate of EGP 9 bn that was reported last year.

Is the electric railway getting the first tranche of China Exim Bank’s USD 1.2 bn loan this month? The Export-Import Bank of China (China Exim Bank) will disburse USD 105 mn to the Trade Ministry as a first tranche of a USD 1.2 bn loan to fund the East Cairo electric rail line by the end of September, sources close to the matter told Al Mal. The line will link Salam City with 10th of Ramadan City and the new administrative capital. The ministry and China’s Aviation Industry Corporation of China (AVIC) have completed all the necessary procedures to kickstart disbursals according to schedule, the sources said, adding that contractors would be paid immediately after the transfers are made. Local contractors, which include Orascom Construction, Arab Contractors, Petrojet, and Hassan Allam Holding, have already begun working on the project’s infrastructure.

Pressure to speed up construction schedule: Contractors have apparently been instructed to complete the project six months earlier than previously thought, tightening the construction schedule to 18 months instead of 24. Talks are ongoing to expedite supply contracts for the project, the sources said without explaining further.

Pharos Securities Brokerage has been granted a license to practice short selling on the EGX by the Financial Regulatory Authority (FRA), according to a statement (pdf) yesterday. Pharos joins a growing number of firms licensed to practice short selling, which is expected to begin on the Egyptian stock market in November.

The Macro Picture

Is the dominance of the greenback under threat as digital currencies look to transform global financial system? A fundamental transformation of the global financial system may be underway as the adoption of digital currencies gains traction among governments and central banks across the world, Dave Michaels and Paul Vigna write in the Wall Street Journal. Although central banks already issue a form of digital money to commercial banks, the radical idea of digitizing national currencies is an entirely different ball game. Central banks in Sweden, Canada, Switzerland, the Eastern Caribbean, and at the lead, China, are among those exploring how digital currencies could fit into their own financial systems. How the system would be implemented is still a mystery, but the implications could be profound, affecting commerce, interest rates, banking, trade, and individual privacy.

This spells trouble for the USD status quo. The growth of national digital currencies — faster and cheaper than conventional money — threatens to undermine the USD’s reserve currency status. Michaels and Vigna suggest that this could trigger a new type of currency war, pitting digital currencies against USD supremacy. While the USD dominance in international trade once made sense when the US accounted for over a quarter of global trade, the status quo no longer fits in a world where the US only produces 8.8% of the world’s exports. Central bankers are slowly beginning to acknowledge this reality, with Bank of Governor Mark Carney calling for a paradigm shift at last month’s Federal Reserve Symposium in Jackson Hole.

Is Facebook’s Libra the spark? It may have been Facebook’s unveiling of its Libra cryptocurrency that spurred policymakers into considering state-backed digital currencies, according to the Financial Times. Regulators have pushed back hard against the idea that a privately-issued means of transaction could perhaps supersede state-controlled currencies, and G7 countries are now rapidly working to produce a response. Central banks, meanwhile, have been researching the idea for years, with some more circumspect than others. Sweden’s Riksbank has been one of the leaders in the field, and is about to test an “e-krona” in response to falling use of cash. There is more concern in the Eurozone about how a digital currency would impact its banking sector, given its reliance on banks to transfer finance between savers and borrowers.

Egypt in the News

The response to the weekend’s protests continues to lead the conversation on Egypt in the foreign press: Security forces have arrested more than 370 people following the recent demonstrations, most of whom are being detained in security facilities and facing possible charges of belonging to a terrorist group, spreading fake news, and joining unauthorized protests, the Washington Post reports. Rights lawyer Mahienour El Massry is among those arrested, having been detained on Sunday as she left the State Security Prosecutor's headquarters in Cairo, Qantara reports. The Associated Press, Reuters, and the BBC also had the story.

Worth Watching

A first look at Saudi Aramco’s damaged facilities: Attacks on the Khurais and Abqaiq oil facilities consisted of an “assault” by 25 different projectiles — 18 drones and seven cruise missiles — Saudi Arabian officials say. Now the country has brought the international media to see the damage, part of building a body of evidence intended to show that Iran is behind the attacks, the Wall Street Journal tells us (watch, runtime: 03:12). The video shows the damage to one of the stabilizers at Khurais after four missiles struck the plant, as well as a 2 meter hole in a sheet of metal from one of the 11 spheroids damaged at Abqaiq. The attacks wiped out half of the kingdom’s oil capacity, and reduced daily global supply by 5%.

The facilities may take months to repair, far longer than the 10 weeks publicly stated by the company, sources told the WSJ. Aramco is offering to pay premium rates to get the facilities operational as quickly as possible, which a Saudi official estimated could reach into the hundreds of mns of USD.

Infrastructure

NUCA begins third phase of Sixth of October water purification plant

The New Urban Communities Authority (NUCA) has begun building the third phase of a EGP 1.5 bn water purification plant in Sixth of October, Housing Minister Assem El Gazzar said, according to the local press. The phase will have a production capacity of 400k sqm per day.

Construction of Alexandria metro line to start this year

Construction of a metro line linking east and west Alexandria will begin after 2-3 months, Governor Abdel Aziz Konsowa said, according to Masrawy. A study of the project was recently completed, he said.

Real Estate + Housing

Mountain View signs contracts worth EGP 1.7 bn for iCity in 2019

Mountain View has signed contracts with four construction companies worth EGP 1.7 bn so far this year for its iCity project in New Cairo, Chairman Amr Soliman told Al Mal. The real estate developer aims to sign EGP 2.5 bn-worth of contracts by the end of 2019, he said. iCity is a partnership between the New Urban Communities Authority (NUCA), Mountain View, Saudi’s SISBAN, and the Housing Ministry, which owns a 40% stake in the project.

Tourism

Tourism companies face penalties for failure to notify police of itineraries

Tourism companies that fail to notify the General Administration of Tourism and Antiquities Police of their itineraries could have their licenses withdrawn and face criminal charges, the local press reported. The authority said failing to provide exact itineraries or amending them without notification could lead to tourists ending up in dangerous situations that damage the country’s image.

Telecoms + ICT

Egyptian, French CIT ministers discuss cooperation on digital transformation

CIT Minister Amr Talaat discussed cooperation in promoting digital transformation with his French counterpart Cédric O yesterday, according to a ministry statement. The meeting saw an announcement of a competition which will be backed by France to “encourage Egyptian startups to innovate, and devise smart solutions in the fields of health, fintech, and sustainable cities.”

Banking + Finance

Solidarity Ministry to receive World Bank loan tranche for employment initiative next month

The Finance Ministry could disburse EGP 800-900 mn from a recently agreed USD 500 mn World Bank loan to the Social Solidarity Ministry for its employment initiative in October, sources told the local press. The World Bank in July agreed to give Egypt an additional USD 500 mn facility on top of an initial USD 400 mn loan granted in 2015 to support the Takaful and Karama cash subsidy programs. A source previously told the local press that disbursements wouldn’t begin until FY2020-2021.

Egypt Politics + Economics

Access to social media and news sites disrupted in Egypt on Sunday

Telecom Egypt and Raya internet users were unable to access a number of news and social media sites on Sunday, cybersecurity group NetBlocks reported. NetBlocks, which monitors internet shutdowns, reported intermittent problems accessing Facebook’s image and upload servers as well as Facebook Messenger. Access to the BBC and Alhurra news sites was also disrupted. Head of the Supreme Council for Media Regulations Makram Mohamed said yesterday that news websites were blocked for “inaccurate” coverage of recent protests, according to Ahram Online. The State Information Service on Sunday called for journalists to “strictly abide” by professional journalistic standards.

ERC announces legal action to scrap USD 40 mn-worth contracts

The Egyptian Resorts Company (ERC) has announced legal action to scrap contracts for four land plots sold in June 2015 for USD 40 mn due to the companies’ failure to make payments, the company said in an EGX disclosure (pdf). ERC did not name the companies involved, but said they only paid USD 10 mn of the above mentioned amount, which they had agreed to pay in five years at most. A Court of Urgent Matters will look into the case on 3 October.

On Your Way Out

3,600-year-old scrolls show principles of state-led healthcare at play in ancient Egypt: Egyptian papyri texts dating back between 3,100 and 3,600 years, discovered in 2015, show that the precursor to universal healthcare may have originated in ancient Egypt, the Financial Times reports. The scrolls showed that workers in Deir El Medina who crafted tombs for royalty in the Valley of the Kings received paid sick days, were provided with a kind of company doctor who was paid by the state, and were occasionally the recipients of state-rationed medication. While it doesn’t exactly constitute universal healthcare, it nevertheless shows a progressive and pragmatic approach to keeping workers healthy.

Tutankhamun exhibition draws record 1.42 mn visitors in Paris: A new Tutankhamun show, with over 150 treasures from the monarch’s tomb — including 60 that had never left Egypt before — set a new all-time record for visitors in France, with a turnout of 1.42 mn AFP reports. Tutankhamun: Treasures of the Golden Pharaoh, described as a “once in a generation” show, will open in London in November and run until May 2020. It will later move on to as-yet undisclosed cities, before returning to Egypt in 2024.

The Market Yesterday

EGP / USD CBE market average: Buy 16.24 | Sell 16.36

EGP / USD at CIB: Buy 16.24 | Sell 16.34

EGP / USD at NBE: Buy 16.24 | Sell 16.34

EGX30 (Monday): 13,753 (-1.5%)

Turnover: EGP 1.3 bn (98% above the 90-day average)

EGX 30 year-to-date: +5.5%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down 1.5%. CIB, the index’s heaviest constituent, ended down 2.5%. EGX30’s top performing constituents were Cleopatra Hospital up 4.7%, Egyptian Resorts up 4.2%, and Eastern Co up 3.9%. Yesterday’s worst performing stocks were Orascom Investment Holding down 7.3%, Egyptian Iron & Steel down 7.0% and Ezz Steel down 6.3%. The market turnover was EGP 1.3 bn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -213.8 mn

Regional: Net Long | EGP +11.3 mn

Domestic: Net Long | EGP +202.5 mn

Retail: 42.7% of total trades | 39.8% of buyers | 45.6% of sellers

Institutions: 57.3% of total trades | 60.2% of buyers | 54.4% of sellers

WTI: USD 58.38 (-0.44%)

Brent: USD 64.77 (+0.76%)

Natural Gas (Nymex, futures prices) USD 2.53 MMBtu, (+0.20%, Oct 2019 contract)

Gold: USD 1,527.40 / troy ounce (-0.27%)

TASI: 7,954.14 (+0.34%) (YTD: +1.63%)

ADX: 5,075.30 (-0.93%) (YTD: +3.26%)

DFM: 2,835.27 (+0.67%) (YTD: +12.08%)

KSE Premier Market: 6,253.75 (+1.11%)

QE: 10,362.85 (-0.81%) (YTD: +0.62%)

MSM: 4,006.70 (+1.04%) (YTD: -7.33%)

BB: 1,519.43 (+0.50%) (YTD: +13.62%)

Calendar

23-24 September (Monday-Tuesday): World Economic Forum: Sustainable Development Impact Summit, New York, USA.

23-25 September (Monday-Wednesday): Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS), Kempinski Royal Maxim, Cairo

24 September (Tuesday): A roundtable discussion titled “investing in renewable energy and sustainable development” organized by Media Avenue, Nile Ritz Carlton, Cairo.

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

27 September (Friday): The Justice Ministry’s dispute resolution committee will hear a case filed by Raya Holding against the Financial Regulatory Authority (FRA).

28-30 September (Saturday-Monday): Techne Summit, Alexandria.

28 September (Saturday): Smart Vision Egyptian Women’s Forum, venue TBA.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

October: German businessman delegation will visit Egypt to discuss good projects in order to spend German funds into Egypt

October: A delegation of 40-50 Saudi companies will visit Egypt to discuss increasing exports of Egyptian furniture.

5-6 October (Saturday-Sunday): Annual International Federation of Technical Analysts (IFTA) conference. Cairo Marriott Hotel.

6 October (Sunday): Armed Forces Day, national holiday.

8-10 October (Tuesday-Thursday): A delegation of 20 Korean companies visits Egypt.

10-13 October (Thursday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 December (Thursday-Saturday): RiseUp Summit, to be announced and Pitch by the Pyramids, Giza Pyramids

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.