What we’re tracking on 24 September 2019

While the business community and foreign investors alike continue to digest events of this past weekend, you can expect the domestic press to be preoccupied today by events over in New York.

That’s where the United Nations General Assembly’s general debate kicks off today at 3 pm CLT. President Abdel Fattah El Sisi is among the world leaders set to address the assembly. El Sisi, who has been in New York for two days in the run-up to the gathering, also met with US President Donald Trump yesterday and delivered a speech on Egypt’s universal health coverage at a high-level meeting. We have the full rundown in this morning’s Speed Round, below.

The UN headquarters saw no shortage of discussions on climate change this week, with high-profile Swedish teenage activist Greta Thunberg railing against world leader at the UN Climate Action Summit yesterday for their failure to take action on global warming, according to Reuters. And that’s to say nothing of her “steely look” at The Donald, who in words and deeds is one of the world’s top climate-change deniers.

A total of 87 multinationals with a combined market cap of USD 2.3 tn have committed to a campaign to keep global warming below 1.5°C, as part of the UN Global Compact, the Financial Times reports. The initiative, which launched earlier this year, requires signatory companies to set independently verified targets and create decarbonization plans within two years to start reducing their emissions.

CIB has made a pledge along the same line, promising make climate action and sustainability “central to its business” as it joined a coalition of 130 banks worldwide representing over USD 47 tn in assets,” according to a statement released yesterday. The statement emerged from the launch of the Principles for Responsible Banking, touted as the “beginning of the most significant partnership to date between the global banking industry and the UN.” Learn more in CIB’s statement here (pdf).

Back at home, the central bank’s Monetary Policy Committee will meet on Thursday to review key interest rates. Seven of the eight economists we surveyed expect the CBE to cut interest rates by 50-150 bps on the back of unexpectedly low inflation figures in August. Naeem Brokerage told us yesterday it’s expecting a 150 bps cut on the back of potentially lower inflation in September. The firm also cited a high real interest rate and a favorable base effect. Goldman Sachs and Abu Dhabi Commercial Bank, meanwhile, are forecasting a 100 bps rate cut, according to Bloomberg.

Conferences and events taking place this week:

- The second day of the Engineering Export Council of Egypt’s Home Appliance and Tableware Show (HATS) gets underway today at the Kempinski Royal Maxim.

- A roundtable discussion titled “Investing in Renewable Energy and Sustainable Development” will take place at the Nile Ritz Carlton today.

- The launch of the Mediterranean Business Angels Network will take place at Techne Summit 2019, which runs 28-30 September at Bibliotheca Alexandrina in Alexandria.

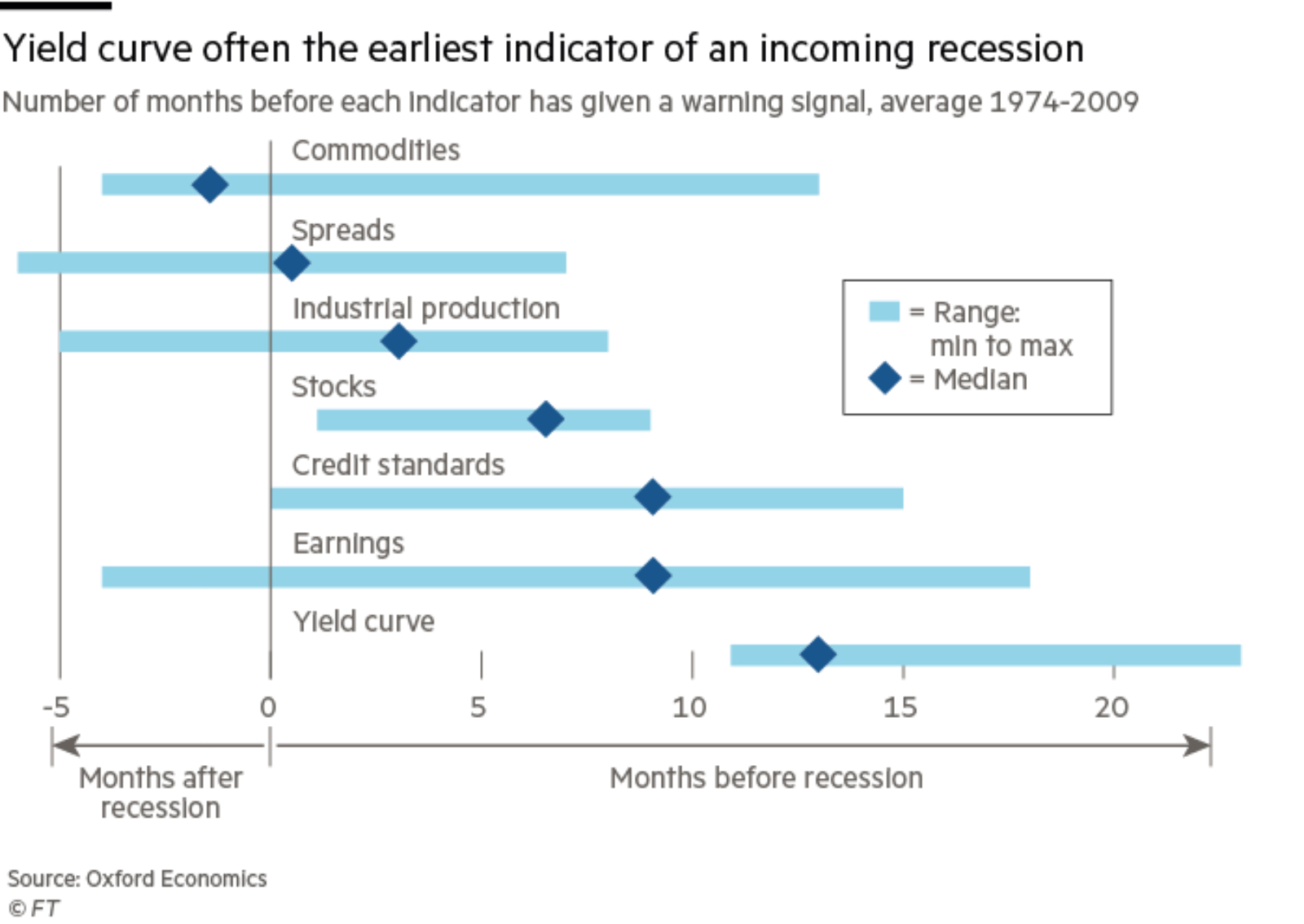

The yield curve in US bonds may have inverted in August — but six other recession indicators are yet to signal doom. Adam Slater, lead economist at Oxford Economics, says that although an inverted yield curve has preceded almost every (US) recession since 1974, it is too soon to panic while other indicators remain quiet. Earnings growth, while falling, remains higher than it was in 2015, and a recent spike in corporate bond spreads was not dramatic enough to ring the alarm bells. And although industrial output in developed countries looks to have dipped in the second quarter, it is so far no worse than the downturns in 2012 and 2015-2016, Slater says. The Financial Times has more.

But asset managers remain pessimistic: The FT has picked up a survey by Absolute Strategy Research (ASR) that found that 52% of global asset managers believe that a downturn is likely within the next year due to trade and geopolitical instability. The poll, based on responses from more than 200 financial institutions with a combined USD 4.1 tn of assets under management, shows that investment managers “have definitely bought into the bearish macro view,” David Bowers, head of research at ASR, said. “When you look at the pattern over the past four or five years, it is definitely quite an important inflection point.”

IPO advisors from Silicon Valley want to see more direct listings: Bankers at Morgan Stanley and Goldman Sachs and legal advisors at Goodwin Procter and Latham & Watkins are looking at how to change the game and expand direct listings “as a way for start-ups to raise money without undergoing a traditional initial public offering,” reports the Financial Times (paywall). They stand to gain from getting hired by companies eyeing direct listings, who would typically divide fees on fewer advisors.

Softbank moves to oust WeWork parent CEO: Adam Neumann, co-founder of WeWork and the CEO of its parent We Company, is being pressured by board members and investors to step down and opt for a different role in the future of the communal workspace startup, reports Reuters. Neumann shelved the company’s multi-bn USD IPO plans last week, handing a “blow” to one of its biggest investors, SoftBank.

I spy with my little eye, something that starts with Google: Google apologized for allowing human reviewers to listen to audio from Google Assistant. The tech company has issued a new policy that will inform users that their audio may be listened to if they opt into a feature that also improves audio quality, Nino Tasca, senior product manager of Google Assistant, wrote in a blog post yesterday.