- Parliament pushed out a bundle of legislation as MPs begin to race towards the summer recess. (Speed Round)

- Actis received FRA approval to take over the management of Cleopatra Hospitals majority shareholder, Creed Healthcare. (Speed Round)

- The beef between Emaar and El Nasr is finally over. (Speed Round)

- Emerging markets will reap the benefits of a Fed rate cut -Bloomberg survey. (The Macro Picture)

- The AU has officially launched the African Continental Freetrade Area. (Speed Round)

- Sergio Ramos was in town — can we blame him for our embarrassing Afcon exit? (Last Night’s Talk Shows)

- Is Jumia’s African success story actually just a new kind of colonialism? (Worth Reading)

- Stop sending your colleagues emails during the weekend unless you want them to burn out faster. (What We’re Tracking Today)

- The Market Yesterday

Monday, 8 July 2019

House passes string of legislation in a race to the summer

TL;DR

What We’re Tracking Today

News from the weekend’s fuel subsidy cuts keeps rolling in: The government has agreed with pasta manufacturers to cut prices of subsidized pasta offered on ration cards to EGP 7.25, from EGP 8, according to a Cabinet statement. Subsidized pasta now costs 35% less than the regular stuff sold on the market, according to the local press. The price cut aims to mitigate the effects of the fuel subsidy cuts implemented over the weekend, which are expected to raise inflation and further increase the cost of living.

The post-mortem of Egypt’s disastrous Afcon exit begins: A day after the Egyptian Football Association (EFA) fired manager Javier Aguirre and the entire national team’s coaching staff, authorities have begun an investigation into the governing body’s administrative and financial wrongdoings, according to Youm7. We have the international reaction to the Pharaohs’ shock 1-0 loss to South Africa on Saturday in this morning’s Egypt in the News section, below.

Across the pond, football is also the talk of the town after the US brought home the women’s World Cup following a 2-0 victory over the Netherlands yesterday, reports Reuters. Yesterday’s win was a “record-extending” fourth consecutive World Cup title for America’s women’s team.

The central bank’s Monetary Policy Committee will meet on Thursday to review key interest rates. Our poll showed on Sunday a consensus among nine economists that the CBE will leave rates on hold. The MPC last cut interest rates in February, when the overnight deposit and lending rates were reduced by 100 bps to 15.75% and 16.75%, respectively.

The House of Representatives is unlikely to wrap up its legislative session before Thursday, House Speaker Ali Abdel Aal said yesterday, according to Ahram Online. MPs itching to get on their summer break are pushing through a pile of pending bills with final and early votes, including amendments to the Investment Act and the Mineral Resources Act and a draft law to allow foreigners who invest in Egypt to apply for citizenship. We have the full roundup in Speed Round, below.

Easy money will only get emerging markets so far: As growth across emerging markets stalls, investors are banking on a response from the central banks. But experience shows us that the short-term high of inflated asset prices does little to generate productive investment and stable economic growth, Jonathan Wheatley writes in the FT. EM assets have done well off the back of expectations for easing by the US Federal Reserve, but problems lie down the road should global headwinds pick up. “The fizz of EM assets in the second half of last year has begun to fade but they have been supported by the shift in expectations for the Fed,” William Jackson, chief EM economist at Citibank, said. “But as the global economy continues to weaken, it could cause risk appetite to worsen and make the second half tougher for EM assets.”

A contrarian view: The results of Bloomberg’s quarterly emerging-market survey provides a more optimistic view of the six months ahead — provided you don’t pay too much attention to the global backdrop. We cover this in more detail in this morning’s Macro Picture, below.

Deutsche to cull a fifth of its workforce, reduce investment arm by a third: Deutsche Bank could cut some 18k jobs as it embarks on a radical restructuring of its investment banking arm. Germany’s largest bank has seen its share price fall by a quarter over the past year after poor financial results and a string of scandals. The board plans to slash the bank’s non-European securities trading, close most of its Asia-Pacific equity businesses, and dump up to EUR 80 bn in risk-weighted assets. The BBC, FT and Bloomberg have more.

The Iran nuclear agreement is on the verge of collapse: Iran will begin enriching uranium beyond the 3.67% limit agreed in 2015 with world powers, raising pressure on Europe, China, and Russia to find a way of mitigating the effects of US economic sanctions, the Wall Street Journal reports. This is the second time in a week that Iran has broken the terms of the accord. Hours after the announcement, US President Donald Trump said the country “better be careful,” Reuters reported.

Tehran and London are in a war of words: The UK stoked tension on the weekend after it seized an Iranian oil tanker in Gibraltar it claims was heading to Syria in violation of international sanctions. In a tit-for-tat response, Iran has threatened to detain a British tanker if its vessel is not released. The BBC has the story.

Do you tend to send emails on Saturday evening to get a head start on the work week ahead? You might be part of the reason your employees are burning out, the Wall Street Journal says. According to healthcare professionals, nearly two thirds of working adults aged 23-38 say they feel obligated to be reachable and responsive for work outside of regular working hours, which expectedly puts a damper on their weekends and time off. Some companies in the US are now addressing work creep by imposing “a vacation-blackout policy [which] bars employees from attending to business during time off.”

The upshot? Having the space to disengage from the constant flow of emails and Slack messages usually gives employees a better sense of whether something can wait until the morning or after their vacation — “and 99% of the time it can absolutely wait.”

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s visit to Niger dominated the nation’s airwaves for the second consecutive night. El Sisi chaired yesterday the African Union’s (AU) extraordinary summit, which saw the launch of the African Continental Trade Area (AfCFTA) agreement. We have the full story in Speed Round, below.

El Sisi’s speech in the summit’s opening ceremony got some airtime on Al Hayah Al Youm. Host Khaled Abou Bakr also highlighted AU Commission Chairperson Moussa Faki’s comment that “AfCFTA was an old dream of the founding fathers of the Organization of African Union (OAU),” among them former President Gamal Abdel-Nasser. Abou Bakr then phoned the OAU’s former assistant to the secretary general Ahmed Haggag for his two cents (watch, runtime: 5:37).

The details of the AfCFTA agreement were the main point of focus for Hona Al Asema’s Reham Ibrahim in her coverage of the summit (watch, runtime: 1:31).

And for your daily dose of miscellany, Sergio Ramos was in Hurghada: Spanish footballer Sergio Ramos left Hurghada on Sunday after a five-day family retreat at the Red Sea resort town, Al Hayah Al Youm noted. Ramos is “deeply grateful” for the hospitality and generosity he experienced during the visit, going as far as to call the trip “one of the best trips ever” in a Facebook post (watch, runtime: 4:19). Remember when an Egyptian lawyer wanted to make Ramos pay EUR 1 bn for injuring Mo Salah and damaging our collective psyche last year? Maybe we can blame him for our Afcon misfortunes, too.

Speed Round

Speed Round is presented in association with

LEGISLATION WATCH- It was a busy day at the House of Representatives as MPs rush to clear bills off their tablebefore flocking to Sahel for their annual summer recess.

Amendments to the Investment Act that aim to extend incentives to existing projects got a final nod at the House general assembly yesterday, the Investment Ministry said in a statement. The amendments add a clause to Article 12 that allows companies developing existing projects to benefit from incentives offered to new projects established after the law was issued in 2017.

Amendments to Article 48 cap notary fees on contracts at EGP 10k or 0.25% of the value of paid-up capital in a bid to lower costs for investors. The notary fees have previously been arbitrary and was an area of concern to investors.

The law also means GAFI is now in charge of monitoring FDI: The General Authority for Investments (GAFI) will be responsible for calculating FDI in order to produce accurate figures. The Central Bank of Egypt has traditionally issued FDI data along with the Investment Ministry.

Amendments to the Mineral Resources Act also received initial approval,MENA reports. The new amendments would introduce additional incentives for companies to invest in the mining sector. They would allow for the expansion of concession areas, granting a new authority the power to issue licenses for areas of unlimited size. If the amendments are passed, companies would be able to renew their licenses for more than one term. Separate contracts would be used for exploration and excavation areas, and royalties will be capped at 20% of the value of annual production. You can read more details about the amendments here.

Legislative amendments that would allow foreigners who hold assets in Egypt to apply for citizenship were also granted approval by the House, Al Masry Al Youm reports. The prime minister will be able to grant Egyptian passports to foreigners who buy a state-owned or private property, set up a project in accordance with the Investment Act, or deposit hard currency once the changes are signed into law by President Abdel Fattah El Sisi and the executive regulations governing them are published. An authority comprised of foreign, investment, and interior ministry officials, as well as other security authorities, will be set up to consider applications. We noted last month that the applications, not the actual passport, would cost around USD 10,000 or the EGP equivalent.

Updated on 8 July 2019 to add context

M&A WATCH- Actis gets regulatory approval to manage Cleopatra Hospital’s majority shareholder: EM private equity fund Actis received approval from the Financial Regulatory Authority (FRA) to take over the management of Creed Healthcare Holdco from now-defunct EM private equity giant Abraaj, Al Mal reported, citing unnamed sources. Creed Healthcare, also known as North Africa Hospital Holdings, owns a 69% stake in Cleopatra Hospital Group (CHG). The sources said that Actis’ takeover will not change the ownership structure of CHG.

No impact from ongoing criminal investigations into Abraaj officials: Actis was also given approval to manage another fund that was previously managed by Abraaj, sources said. The management change will not be impacted by ongoing investigations and court cases of previous Abraaj officials, the sources said.

Background: Abraaj was the largest EM private equity firm in the world before it collapsed last year amid concerns that funds were being misused. Executives Mustafa Abdel-Wadood and Arif Naqvi were arrested in April and released on bail the following month, and Abdel-Wadood pled guilty to racketeering and fraud charges earlier this month. Bloomberg reported last week that Actis received the support of 75% of investors, allowing it to take over the USD 1.6 bn Abraaj Private Equity Fund IV and the USD 990 mn Africa Fund III. Actis had reportedly made an offer last September to acquire “the bulk” of Abraaj’s EM funds.

DISPUTE WATCH- The Emaar vs. El Nasr beef is finally over: Property developers Emaar Misr and state-owned El Nasr Housing will drop all arbitration cases against each other as part of a dispute resolution agreement signed last week, Emaar said in a bourse filing (pdf). The agreement settled all technical, financial, and procedural points and is set for review by the cabinet. No further details were given about the settlement.

Background: El Nasr brought an arbitration case against the local subsidiary of UAE-based Emaar in June 2017, alleging the company had failed to develop 3 mn sqm of land allotted to it in 2005, and that it unlawfully took 215k sqm within the borders of its Uptown Cairo project. Public Enterprises Minister Hisham Tawfik was quoted in the press earlier this year as saying that the two companies would sign the final contracts to resolve the dispute.

Administrative court suspends 15% import fee on iron billets: The Supreme Administrative Court has suspended the 15% import duty on iron billets imposed by the Trade Ministry in April, Mubasher reported. The court is now seeking expert opinion to ascertain the effects of the duty on local industry. Twenty-one iron factories had filed a lawsuit against the ministry’s decision after the increased price of iron forced them to stop production, according to Al Masry Al Youm. The ministry imposed the 15% levy, together with a 25% import fee on steel rebar, in mid-April for a period of 180 days.

Al Marakbi considers counter-lawsuit: Hassan Al Marakbi, chairman of Al Marakbi Steel Company, told Al Masry Al Youm that he is considering filing a lawsuit against the court’s decision to suspend the duties, arguing that the local industry will be hit by an influx in foreign iron imports.

EXCLUSIVE- Gov’t mulling tax incentives for prospective EGX listings: The government is studying a proposal to provide tax breaks to companies that decide to list shares on the stock exchange as part of a strategy to drive new listings and increase market capitalization, government sources told us. The proposal could also include breaks on cash dividends for already-listed shares. There will be a single discount rate, as opposed to brackets based on factors such as the number of shares to be listed, the sources said, without disclosing the planned size of the tax breaks.

When can we expect the changes to take hold? The changes are one component of a “package of amendments” which the sources expect will be finalized in no more than 10 days. The amendments are meant to incentivize stock trading activity, and are part of a directive by Prime Minister Moustafa Madbouly. They would restore the old tax rate of 10% on gains from the sale of shares in both EGX-listed and non-listed companies, the details of which we noted last week.

The proposed changes are looking set to make their way to the House of Representatives in its next legislative cycle, which begins in October.

Meanwhile, the provisional stamp tax will remain unchanged at 0.15% until May 2020 under draft amendments approved by the House Planning Committee yesterday. The tax was scheduled to increase to 0.175% on 1 June but the Finance Ministry called off the increase in a move designed to ease the financial burden on traders. The ministry introduced the tax at 0.125% in 2017, and planned to hike it annually over a three-year period.

African Union launches African trade zone at Niger summit: The African Union (AU) formally launched the African Continental Trade Area (AfCFTA) at a two-day summit in Niger on Sunday, Reuters reports. The agreement to set up a USD 3.4 tn African economic zone comes after four years of talks. All but one of the 55 AU member states have now signed the accord, but only 25 have ratified it. Nigeria — the continent’s largest economy — recently agreed to participate in the zone and signed the agreement at the summit. Egypt and 43 other countries signed AfCFTA in March 2018.

The trade zone will see AU members eliminate tariffs on most goods to boost intra-regional trade and strengthen supply chains. This will potentially increase trade in the region by 15-25% in the medium term and as much as 52.3% in the long term. Intra-regional trade in Africa accounted for just 17% of exports in 2017, compared to 59% in Asia and 69% in Europe. The AU summit is expected to determine the trade zone’s headquarters, when trading will start, and exactly how the process will work. Seven member states, including Egypt, have submitted bids to host the AfCFTA headquarters, according to an AU statement released prior to the summit.

El Sisi hails the agreement: “The eyes of the world are turned to Africa,” President Abdel Fattah El Sisi, who chaired Sunday’s meeting, said during the summit’s opening ceremony. AfCFTA “will reinforce our negotiating position on the international stage. It will represent an important step.”

Egypt stands to be a key beneficiary: Countries with large manufacturing bases, including Egypt, South Africa, and Kenya are poised to be net beneficiaries of AfCFTA. Being able to quickly expand outside of their usual export markets will give them an advantage over manufacturers from other countries. The removal of tariffs will also enable Egypt to import raw materials at lower costs from within Africa, rather than having to look further afield, and Egyptian cotton is expected to be in high demand throughout the continent.

But substantial challenges remain: Growth and integration have been hampered by poor infrastructure set up to serve trade outside the continent, along with bureaucracy and corruption. The IMF has warned that “reducing tariffs alone is not sufficient,” and that these other issues must be tackled if AfCFTA is to succeed. Negotiations have also been hindered by the disparity in economic weight and motivation between countries. Over 50% of the continent’s cumulative GDP is contributed by Egypt, Nigeria and South Africa, and only 1% comes from the six sovereign island nations. Although Egypt and South Africa stand as two of AfCFTA’s largest beneficiaries, Nigeria is likely to see far fewer immediate gains.

EARNINGS WATCH- Ezz Steel has reported a consolidated net loss of EGP 1.28 bn in 1Q2019, compared to a EGP 184 mn profit during the same period the previous year, according to the company’s financial statement (pdf). Top line net sales were effectively unchanged over the year, recording EGP 12.62 bn during 1Q2019, up slightly from EGP 12.61 bn the year before.

CORRECTION- Lamia Mokhtar remains deputy minister of investment and international cooperation. A story we carried yesterday saying otherwise came after we fell for a hoax and took inadequate steps to verify its authenticity. We deeply regret the error and apologize unreservedly to Lamia and to our readers. The story has been removed from the web edition of Enterprise.

** WE’RE HIRING: We’re looking for smart, talented journalists and analysts to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in people with writing plus either audio or video skills.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

The Macro Picture

Emerging markets to reap the benefits of a Fed rate cut -Bloomberg survey: Emerging market equities, bonds, and currencies will reap the benefits if the world’s major central banks go ahead with expected rate cuts, according to a quarterly poll of 42 fund managers, traders, and strategists conducted by Bloomberg. Falling interest rates in developed economies will fuel the search for yield among investors, increasing inflows into EM assets during the second half of 2019. “Things have improved slightly for emerging markets as we now have the support of a dovish US Federal Reserve along with other major central banks,” Hironori Sannami, EM currency trader at Mizuho Bank, told Bloomberg. “With the worst being avoided in the US-China trade war for now, higher-yielding assets are probably going to see demand.”

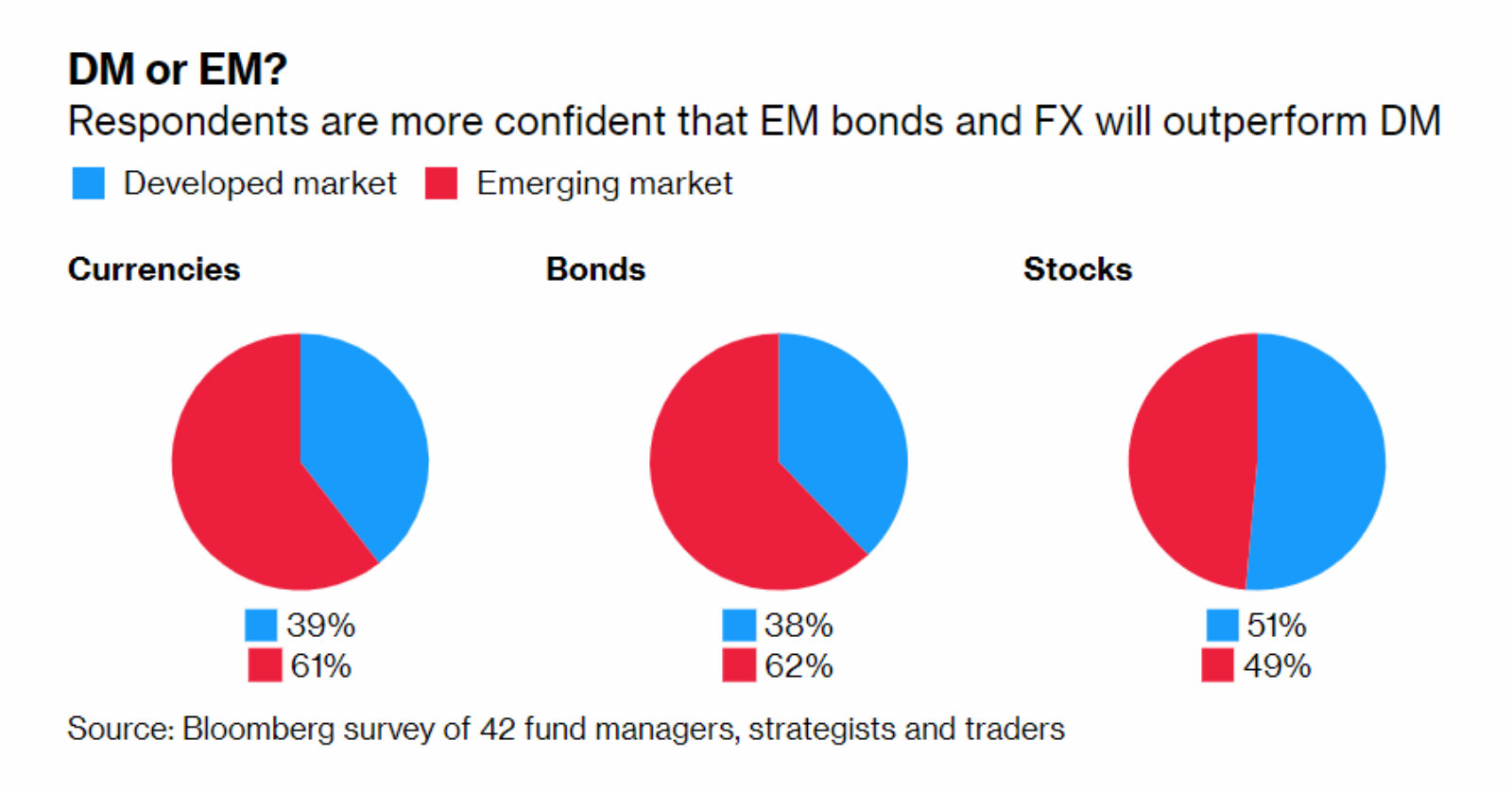

EM currencies and bonds to best advanced economies: Almost two-thirds of survey respondents believe that EM currencies and bonds will outperform those in developed economies during the second half of the year, while just under half (49%) think that EM equities will be more favorable.

EMEA the weakest region across all asset classes: Equities, bonds and currencies in Europe, the Middle East and Africa (EMEA) will be the weakest performers over the coming six months. Respondents predict that Latin American bonds, and Asian stocks and currencies will perform the best.

But what happens next depends on the Fed: US monetary policy is seen by survey respondents as the most important factor in driving market sentiment, surpassing the US-China trade conflict and the global economic outlook.

Egypt in the News

Egypt’s 0-1 Afcon defeat at the hands of South Africa is overwhelmingly dominating coverage in the foreign press today, with many outlets observing that Mohamed Salah was not at his best and describing the Pharaohs’ overall performance as “flat” and “lackluster.” Coach Javier Aguirre has assumed sole responsibility for the upset, over which he was fired, but nevertheless expressed his pride in the team. Despite the shock of losing, Egyptian home fans gave the South African team a standing ovation as they left the pitch (BBC | Reuters | The National | Xinhua).

On The Front Pages

The launch of the African Continental Trade Area (AfCFTA) during an African Union summit in Niger topped the front page of state-owned Al Akhbar. We recap the story in full in Speed Round, above. Both Al Ahram and Al Gomhuria’s websites are down for yet another morning.

Worth Reading

It’s been hailed as a great African success story, but does Jumia represent a new kind of colonialism? The Nigeria-based online retailer — which had raised around USD 770 mn from investors by the time it filed for an IPO on the NYSE in March this year — operates in 14 African countries, including Egypt, and became the first entirely Africa-focused e-commerce company to list on the US stock exchange in April. But having been incorporated in Berlin, with French executives based in Dubai comprising the most senior level of management, and with most of its capital having been raised in Europe and the US, critics are questioning whether Jumia is really African at all, the FT reports.

Surely anything that attracts investment, capitalizes on Africa’s potential as a tech hub, and contributes to the expansion of its consumer economy is a good development? That’s exactly what some Jumia’s supporters say. The company’s Egypt CEO Hesham Safwat argued in April that the IPO would increase investor confidence and encourage private sector development. Investor interest in African startups is certainly growing, and with cities like Nairobi and Lagos gaining reputations as thriving tech hubs, Jumia’s advocates believe that the company’s success is paving the way for large-scale investment in African tech startups as a whole.

Colonialism for the tech generation: The charge of investor bias towards expats who found African startups is leveled with regularity, and a study of startups in east Africa cited by the FT found that 90% of funding had gone to foreign founders in 2018. Cameroon-based tech entrepreneur Rebecca Enonchong argues vociferously that Jumia is not African, but a “copy paste” version of an idea pioneered in Silicon Valley, rolled out by the German company Rocket Internet. This model, she believes, throttles Africa’s own tech industries, which can’t compete with the kind of capital companies like Jumia have access to. Enonchong argues instead that Africans with capital should be investing in early-stage local companies to support the growth of their own industries. “We cannot expect Silicon Valley to invest in African start-ups. It is our responsibility to take more ownership,” she says.

Worth Watching

During recessions, investors tend to shy away from triple-C debt. Sounds like a no-brainer, right? Not quite. Monetary policy makers tend to respond to recessions with rate cuts, which set the stage for a trend that makes corporate borrowers much better equipped to repay their debt. With the Fed feeling the sting of slowing global growth and signaling that the cuts may be on their way, US corporate bonds should by extension become more attractive. “But for the junkiest of the junk, the trend doesn’t hold,” the Financial Times’ Brooke Fox explains (watch, runtime: 3:21).

Basic Materials + Commodities

Supply Ministry signs EGP 23 bn-worth contracts for projects

The Supply Ministry signed on Sunday eight contracts worth a combined EGP 23 bn with various investors to build logistics zones, shopping malls, and hotels in a number of governorates, Hapi Journal reports. HyperOne, Seoudi, Stone District, and MWS for Development and Commercial Investment were among the companies that signed contracts. MWS will set up a EGP 2 bn commercial logistics zone in Beheira comprising a shopping mall, hypermarket, hotel, aquapark, recreational areas, sports facilities, and a car showroom and maintenance center, CEO and Chairman Mohamed El Sherif separately told the local press.

Egypt’s strategic rice reserves sufficient until 15 October

Egypt has strategic rice reserves to last until 15 October and 4.5 months-worth of wheat reserves, Supply Minister Ali El Moselhy said, according to a MENA report picked up by Reuters’ Arabic service. Rice prices will also be lowered soon, the statement noted without giving more details. El Moselhy had previously said that Egypt’s reserves of rice are sufficient until December. The government announced in April that it will no longer settle for a three months-worth “strategic” stock of commodities, and raised the floor to between five and six months.

Manufacturing

Saudi’s Al-Romaizan to set up EGP 500 mn gold factory in Egypt

Saudi’s Al-Romaizan for Gold & Jewellery is planning to set up a EGP 500 mn gold processing factory in Egypt, a company source told the press. The facility will be located in either 6 October or Obour City, will employ between 500-1000 workers in the first three years, and is expected to produce between 5-10 tonnes of gold a year.

Health + Education

AUC, Cairo University, Ain Shams feature in QS World University Rankings 2020

The American University in Cairo (AUC) has once again assumed its ranking of #395 out of the 1k universities ranked in the 2020 annual publication of the Quacquarelli Symonds (QS) World University Rankings. This is up from its ranking of #420 in the 2019 edition, bringing it back to its 2018 position. Cairo University landed in the 521-530 bracket, and Ain Shams ranks among the top 801-1000 universities.

Tourism

ODE to open two new Gouna hotels in coming months

Orascom Development Egypt (ODE) will open two new hotels in Red Sea resort town El Gouna in the coming few months, CEO Khaled Bishara said. ODE had signed an EGP 200 mn agreement with Thomas Cook to develop a Gouna hotel and rebrand another in the same town. The agreement will see Orascom Hotels Management (OHM), an ODE subsidiary, develop Casa Cook Hotel, which will open in October, and rebrand Arena Inn into Cook’s Club Hotel, which will open in August.

Egypt’s new admin capital airport launches trial operations

Trial operations at the new administrative capital’s Capital International Airport are scheduled to begin tomorrow, sources from the Civil Aviation Ministry said, according to Masrawy. The ministry has finalized all necessary preparations, and opened the dutyfree shops at the arrivals and departure halls. The new airport, which was built on the old air force base in Katameya, will cater to the residents of Shorouk, Badr City, East Cairo, Heliopolis, canal governorates, and the new capital.

Banking + Finance

NACC begins talks with major banks for EGP 20 bn financing

The New Administrative Capital Company (NACC) has begun preliminary talks with a number of local banks to secure EGP 20 bn in financing for infrastructure works and various investment plans, sources told Al Mal. The National Bank of Egypt, Banque Misr, the Arab African International Bank, and CIB are all in talks with NACC, the sources said, adding that the lenders prefer a syndicated loan.

Al Ahly Capital in talks for USD 350 mn loan for Al Canal factory in Minya

Al Ahly Capital has been in talks with international organizations for a USD 350 mn loan to be used for the USD 1 bn Al Canal sugar beet processing factory in Minya, banking sources told Al Shorouk. UAE’s Al Ghurair and Murban signed in December a shareholder agreement with Al Ahly Capital for the factory.

Egypt to launch electronic database for vehicles bought through loans

The CBE signed last month a cooperation agreement with the Interior Ministry and the Egyptian Credit Bureau (I Score) to set up an electronic database for vehicles bought using bank loans, it said in a statement (pdf). The new service will allow people with car loans to easily access information and complete procedures such as license renewal.

Raya’s microfinance arm Aman to start collecting installments online

Raya Holding’s microfinance subsidiary Aman will start accepting installments from its clients online after obtaining Financial Regulatory Authority approval, CEO Ahmed El Khatib said, according to Mubasher. The company will collect payments through Raya’s other subsidiary Aman for E-Payments.

Banque Misr to launch e-wallet with Telecom Egypt

Telecom Egypt (TE) has signed an agreement with Banque Misr to launch an e-wallet enabling clients to transfer and receive cash via a secure mobile app, the company said in a press release (pdf).

On Your Way Out

Dahab has launched an initiative to become a no-plastic zone in a push to protect the environment and safeguard marine life, Egyptian Streets reports. The City Council is running a campaign to raise awareness of the harm caused by plastic waste, and is providing training sessions to hotel workers. Voluntary clean-ups are also taking place, targeting waste on the beach and in the sea. Red Sea governor Ahmed Abdullah banned single-use plastics in June 2019, and officials in Hurghada have been seeking to provide alternatives to plastic bags to help enforce the ban.

The Market Yesterday

EGP / USD CBE market average: Buy 16.54 | Sell 16.67

EGP / USD at CIB: Buy 16.55 | Sell 16.65

EGP / USD at NBE: Buy 16.57 | Sell 16.67

EGX30 (Sunday): 14,013 (+0.1%)

Turnover: EGP 470 mn (32% below the 90-day average)

EGX 30 year-to-date: +7.5%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.1%. CIB, the index heaviest constituent ended up 0.8%. EGX30’s top performing constituents were Eastern Company up 3.4%, and Emaar Misr up 1.9%. Yesterday’s worst performing stocks were Ezz Steel down 6.0%, Egyptian Iron & Steel down 3.5% and Sarwa Capital Holding down 3.1%. The market turnover was EGP 470 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -59.4 mn

Regional: Net Short | EGP -41.8 mn

Domestic: Net Long | EGP +101.2 mn

Retail: 57.3% of total trades | 60.1% of buyers | 54.6% of sellers

Institutions: 42.7% of total trades | 39.9% of buyers | 45.4% of sellers

WTI: USD 57.63 (+0.21%)

Brent: USD 64.36 (+0.20%)

Natural Gas (Nymex, futures prices) USD 2.46 MMBtu, (+0.04, August 2019 contract)

Gold: USD 1,395.70 / troy ounce (-0.31%)

TASI: 8,811.11 (-0.40%) (YTD: +12.58%)

ADX: 5,003.29 (+0.08%) (YTD: +1.79%)

DFM: 2,648.59 (-0.45%) (YTD: +4.70%)

KSE Premier Market: 6,623.13 (+1.2%)

QE: 10,518.2 (-0.46%) (YTD: +2.13%)

MSM: 3,816.73 (-0.15%) (YTD: -11.73%)

BB: 1,537.05 (+1.71%) (YTD: +14.94%)

Calendar

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

July: The National Railway Authority will launch a tender for the purchase of 100 new locomotives expected to be financed through an agreement with the European Bank for Reconstruction and Development (EBRD).

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

21 July (Sunday): Amer Group and Antaradous Touristic Development will face off in court over a 2014 dispute brought by the Syria-based company for a fallout in their partnership to develop the Porto Tartous tourist resort. The date was postponed from 23 June.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

7-11 August (Wednesday-Sunday): Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.