- Government raises fuel prices, phasing out remaining fuel subsidies — and public and private transport are now more expensive. (Speed Round)

- The central bank will leave key interest rates on hold this Thursday -Enterprise poll of economists. (Speed Round)

- Tourism is up, but FDI is down and the current account deficit has almost doubled. (Speed Round)

- Greece’s Energean is set to acquire Edison’s oil and gas portfolio for USD 750 mn. (Speed Round)

- Our African Cup luck has officially run out — and the EFA is falling apart in the aftermath. (What We’re Tracking Today)

- The (potentially stolen) 3000-year-old King Tut bust was sold at auction for a cool USD 6 mn. (Egypt in the News)

- The break we’ve all been waiting for: Parliament will start its summer recess this week. (What We’re Tracking Today)

- The Market Yesterday

Sunday, 7 July 2019

Goodbye, African Cup

TL;DR

What We’re Tracking Today

Welcome back, ladies and gentlemen — it’s a busy start to what’s likely to be a busy week. We have June’s inflation data coming out in the next few days, and on Thursday, 11 July, the central bank’s Monetary Policy Committee will meet to review key interest rates. The consensus among our poll of economists (which you’ll find in this morning’s Speed Round, below) is that the central bank will leave rates on hold for another month as it assesses the inflationary impact of the fuel subsidy cuts.

Speaking of which: Your commute is officially more expensive. Fuel prices rose between 16% and 30% over the weekend as the government pushed ahead with the latest round of subsidy cuts. We have chapter and verse in this morning’s Speed Round, below.

New fiscal data was also released over the weekend — and it doesn’t make great reading. Rising imports caused the current account deficit to almost double year-on-year in the first nine months of FY2018-19, while the balance of payments swung from enjoying an USD 11 bn surplus to turning a deficit of USD 350 mn over the same period. The full breakdown is also in Speed Round, below.

President Abdel Fattah El Sisi is in Niger today to attend an extraordinary African Union summit. The gathering will see the launch of the operational phase of the African Continental Trade Agreement (AfCFTA), which came into force on 30 May. We have more on this in Last Night’s Talk Shows, below.

The House of Representatives is scheduled to end its current legislative session and recess for the summer this week, unidentified sources told reporters yesterday, according to Ahram Online. Our esteemed representatives have a few more bills to get through before rushing to the beach, including a draft law to regulate the Bar Association and amendments the “old rent” law, among others. By law, President Abdel Fattah El Sisi must call in the first session of the House by the first Thursday of October. The next legislative season will be the last before new representatives are elected to parliament.

A World Bank delegation will visit several industrial zones in Qena on Tuesday, 9 July, according to Youm7.

Well, we’re officially out of Afcon: Our African Cup of Nations run was, sadly, cut short yesterday by South Africa, which netted an 85th-minute lead past Mohamed El Shennawy (even his sizeable hands couldn’t save us). Yesterday’s match result was not all that surprising, but it managed to set off a domino effect of chaos in Egypt’s football scene.

Egyptian Football Association (EFA) President Hany Abo Rida resigned from his post following the defeat, but will continue to lead the committee in charge of organizing Afcon until the tournament wraps up, the EFA said in an overnight statement. He also sacked the national team’s entire coaching staff, saying that “the decision is an ethical obligation.” Senior officials told Egypt Today following Abo Rida’s departure that authorities will launch an investigation into the EFA’s suspected “administrative and financial violations,” which allegedly had a direct correlation with the loss. Abou Rida has been at the helm of the association since August 2016. EFA board members Hazem Emam and Seif Zaher also announced their resignation shortly after Abo Rida’s, alongside Ahmed Megahed and Essam Abdel Fattah.

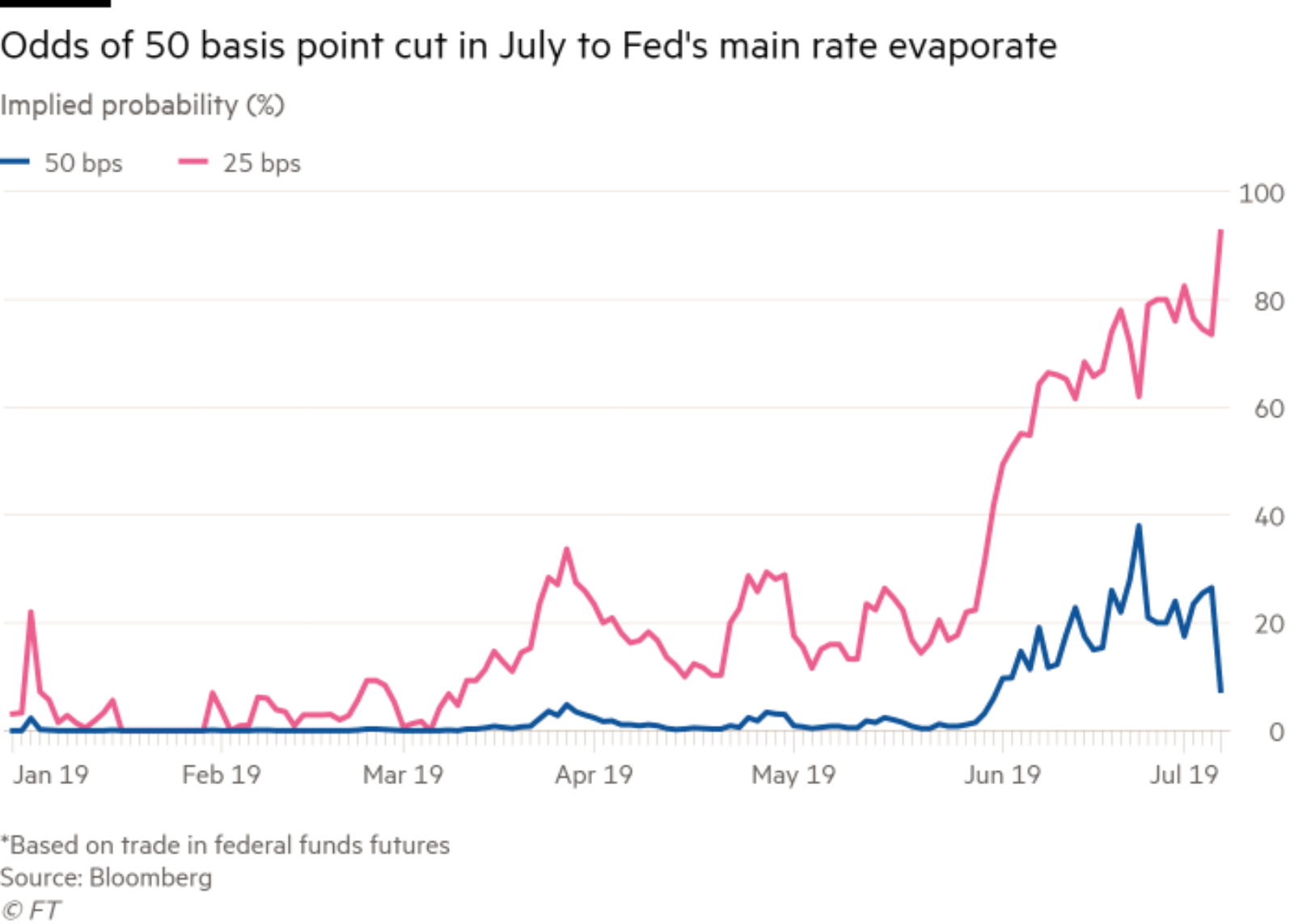

Strong US jobs report dampens expectations for deep Fed rate cut: US jobs growth surged in June, beating out economists’ predictions and shortening the odds of a deep rate cut by the US Federal Reserve later this month, the FT reports. Nonfarm payrolls tripled to 224k last month from the 72k added in May, making June the best month of 2019 for job growth. The positive data lessens the pressure on the Fed to make a deep rate cut when it meets on 30-31 July, and increases the possibility that officials will instead opt for a minor 25 bps cut.

Wall Street didn’t see the positives: The three main US indices closed in the red on Friday, with the Dow down 0.16%, the S&P 500 shedding 0.18% and the Nasdaq losing 0.10%. The yield on US 10-years meanwhile moved back above 2% on the news.

The market is getting “carried away” with expectations for multiple Fed rate cuts- El Erian: Market predictions for several rate cuts by the US Federal Reserve this year are unrealistic, market guru Mohamed El Erian told CNBC’s ‘The Exchange’ on Friday (watch, runtime: 3:09). “We as the market base have gotten carried away, carried away thinking it will be 50 bps in July, thinking we’re going to get three cuts by the end of the year,” he said. “We’re going to get one in July and maybe, maybe two, and that’s about it.”

El Erian predicts that the Fed will make a 25 bps cut when it meets this month, instead of a deeper 50 bps cut recently forecast by many market watchers.

Do we finally have a truce in Sudan? Military and protest leaders in Sudan agreed on Friday to share power in a joint military-civilian council tasked with seeing the country through a three-year transitional period before elections in 2022, the Wall Street Journal reports. The truce could mark an end to months of protests and violence for our southern neighbor, which led to the ouster of long-time President Omar Bashir in April.

In international miscellany:

- Erdogan decided to fire Turkey’s central bank governor, complaining that the country’s high interest rates are hurting the economy, according to the Financial Times.

- Has Qatar’s massive construction boom run its course? A USD 200 bn infrastructure push in preparation for the 2022 World Cup has transformed the Gulf state over the past decade, but the news that construction shrank 1.2% in 1Q2019 (compared to almost 23% growth in the same period a year earlier) shows that the country must now find a new source of economic growth, Bloomberg reports.

Folding phones aren’t dead, Samsung insists: Two months after its Galaxy Fold disaster, Samsung is planning a relaunch in a bid to resuscitate its ambitions to become a global leader in the still-gimmicky folding phone market. The FT has more.

PSA- Calling all prospective MBA students: Stanford Business School is holding an information session at AUC’s Tahrir Square campus on Wednesday, 10 July at 7 pm. The session is a chance for prospective students to get an overview of the MBA program at Stanford and have their questions answered.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s visit to Niger was the talk of the town on the airwaves last night. El Sisi is set to chair the African Union’s extraordinary summit, which will take place later today, to launch the operational phase of the African Continental Trade Agreement (AfCFTA).

The agreement is “the beginning of a new era for Africa, and marks a milestone in the continent’s development,” the vice president of the Egyptian Council for African Affairs Salah Halima told Al Hayah Al Youm’s Lobna Assal (watch, runtime: 2:47).

Hona Al Asema’s Reham Ibrahim focused on the technicalities of the agreement. AfCFTA aims to make doing business on the continent easier and encourages African countries to trade among each other, while addressing issues that stifle intra-African trade such as high transport costs and cumbersome customs, among others. The agreement also aims to increase the volume of intra-African trade from 17% to 60% by 2022 (watch, runtime: 7:16).

Speed Round

Speed Round is presented in association with

Government raises fuel prices, phasing out remaining fuel subsidies: The government raised fuel prices by between 16% and 30% over the weekend as it introduced the latest round of fuel subsidy cuts, the Oil Ministry announced in a statement. The price of 95 and 92-octane rose by 16% and 18.5%, respectively, while diesel and 80-octane prices increased by 22.7%. The prices of most petroleum products will now reflect their actual cost, although the government will continue to subsidize butane gas cylinders, and fuel for bakeries and electricity plants, a ministry official told Reuters Arabic service. The full price breakdown is as follows:

- 95 octane petrol at the pumps will now cost EGP 9 per liter, up from EGP 7.75;

- 92 octane petrol rose to EGP 8 per liter, from EGP 6.75;

- 80 octane petrol, diesel fuel, and kerosene increased to EGP 6.75 per liter, from EGP 5.50;

- Cooking gas cylinders now cost EGP 60, from EGP 50;

- Gas cylinders for commercial ventures jumped to EGP 130, from EGP 100;

- Compressed natural gas for automobiles rose to EGP 3.5 per cubic meter, from EGP 2.75;

- The price of fuel oil (mazut) to factories rose to EGP 4.5k per tonne for bricks, cement, and other sectors except food and electricity, from EGP 3.5k per tonne.

Bread prices will remain unchanged, but other commodities are set to rise: The Supply Ministry will bear the increase in diesel prices for bakeries in order to keep the price of subsidized bread unchanged, head of the bakeries union Abdullah Ghorab confirmed to Youm7. Other food commodity prices — especially the price of oils and dairy products — are expected to increase, head of the food commodities division at the Giza Chamber of Commerce, Yehia Kasseb, told the press.

The production cost of all types of building materials could rise between 2% and 5%, Kamal El Dessouki, deputy head of the Federation of Egyptian Industries’ (FEI) building materials industries division, told the press. Cement prices, meanwhile, are forecast to increase by between EGP 50-70 per tonneas a consequence of the fuel hikes, an unnamed cement company executive told Al Mal. This is expected to lead to a “slight” increase in property prices, division head Ahmed El Zeiny separately told Al Shorouk. The price of industrial land in government tenders, however, will see no such increase, Industrial Development Authority boss Magdy Ghazi told the press.

Oh, and for the commute:

- Ride-hailing companies are lining up fare hikes: Careem has hiked fares by up to 22% in both Cairo and Alexandria, and Uber has already sent messages to its drivers that it will issue new rates “soon” once it completes a study of the impact of the new fuel prices. Swvl, meanwhile, is yet to make a decision on how to respond to the price increases.

- Public transportation fares will also climb, but not trains: The Cairo governorate has raised fares charged by white taxis, Masrawy reported, citing an unnamed official. Public bus ticket prices also increased EGP 1, and the new Mowasalat Misr buses will apply new yet-to-be-disclosed rates as of today. Train ticket prices, meanwhile, will see no change, at least not “anytime soon,” Egyptian Railway Authority (ERA) head Ashraf Raslan told Egypt Today.

The cuts will save the government EGP 37 bn a year: The latest round of cuts will slash the government’s expenditure on fuel subsidies to EGP 52.96 bn from EGP 89.75 bn, according to the FY2019-2020 budget passed last week by the House of Representatives. The government is reportedly studying entering into foreign exchange hedging contract with a bank to “safeguard” the fuel subsidy bill from any unexpected increase, government sources told the press yesterday.

The automatic fuel pricing mechanism will be applied to all petroleum products from 4Q2019, the official told Reuters. The mechanism, which was introduced on 95-octane in 2Q2019, will see the government re-price fuel by as much as 10% each quarter in order to bring prices in line with international markets.

Could we receive the final USD 2 bn tranche from the IMF this week? Sources told the local press that the International Monetary Fund’s (IMF) executive board will vote this week on disbursing the final USD 2 bn tranche from the USD 12 extended fund facility. The removal of fuel subsidies was part of the reform program agreed upon with the IMF in November 2016. Egypt reached a staff-level agreement in May for the tranche disbursal but we are yet to hear anything from the board on when the funding will be released.

SURVEY- CBE to leave key interest rates on hold this Thursday: The Central Bank of Egypt will leave key interest rates on hold when the Monetary Policy Committee (MPC) meets this Thursday, according to all nine economists polled by Enterprise. Respondents cited the inflationary effects of last weekend’s fuel subsidy cuts, which saw prices rise between 15% and 30%. “The government just increased fuel prices, hence we think that the CBE will wait for a month or two to assess the inflationary impact of the move,” Mohamed Abu Basha, head of macroeconomic analysis at EFG Hermes, told Enterprise. The MPC last cut interest rates in February, when the overnight deposit and lending rates were reduced by 100 bps to 15.75% and 16.75% respectively.

Inflation to pick up in the coming months: Economists see inflation picking up in the coming months as a result of the latest wave of subsidy cuts, but agreed that it would fall to within the CBE’s 9% (+/-3%) target range by the end of 2020. “The measures will have a one-off moderate impact of inflation and will not drive inflation to very high levels,” said Mubasher International’s Head of Research Hisham El-Shebiny. Beltone Financial’s Alia Mamdouh, meanwhile, predicts an average annual inflation reading of 13.8% over the coming months, before falling to within the bank’s target by the end of 2020. Annual headline inflation rose unexpectedly to 14.1% in May from 13% in April, driven by a 13% increase in food and non-alcoholic drink prices.

Don’t expect any further rate cuts until 4Q: Most of the economists polled do not see the CBE making any moves until the final quarter of this year. Radwa El Swaify, head of research at Pharos Holding, said that she expects the CBE to keep rates on hold until the end of 3Q2019 before resuming the easing cycle in 4Q. However, CI Capital and EFG Hermes believe that the central bank could cut rates at its September meeting if the second round effects of the subsidy cuts have dissipated, and global oil prices remain at a reasonable level. EFG is maintaining its prediction for the central bank to make between 100-200 bps of cuts before the end of the year.

Good news for the carry traders: “For the foreign portfolio investors, the carry trade is still very attractive for them and they still get high yields from the treasury bills which is even higher when we add the appreciation of the pound against the USD,” El Swaify said.

Current account deficit almost doubles in 3Q2018-2019 as non-oil imports rise: The current account deficit almost doubled during 3Q2018-2019 to USD 3.75 bn from USD 1.93 bn the previous year due to a rise in non-oil imports, Reuters reported, citing its own calculations based on central bank data (pdf). The deficit increased 38% to USD 7.6 bn during 9M2018-2019, up from USD 5.5 bn during the same period a year earlier, primarily caused by an 11% rise in non-oil imports to USD 41.8 bn.

Balance of payments (BoP) generated a USD 1.4 bn surplus in 3Q but recorded a USD 351.2 mn deficit over the first nine months of the year, thanks to the USD 1.77 bn deficit during 1H2018-2019.

Egypt’s non-oil FDI falls to lowest level since 2014: Egypt’s non-oil foreign direct investment (FDI) fell to USD 400 mn in 1Q2019, down from USD 720 mn in 1Q2018, according to Reuters calculations. This is the lowest level recorded since 2014. High interest rates, low consumer demand, and the slow rate of privatization are all affecting Egypt’s ability to attract more FDI, economists said.

These findings should not come as a surprise: Economists told us in April that FDI was always going to take time to recover after the devaluation of the currency in late 2016. EFG Hermes’ Mohamed Abu Basha said that it is “unrealistic” to expect a post-float spike in FDI given the pressure exerted on the economy by the government’s economic reforms. Naeem Brokerage’s Allen Sandeep, meanwhile, predicted that we would need to wait until the reform program is 5-10 years old before seeing a recovery in FDI.

Tourism revenues surged to USD 9.4 bn in 9M2018-2019, up from USD 7.3 bn the year before.

Other key data points (9M2018-2019):

- Remittances dipped slightly to USD 18.2 bn from USD 19.4 bn;

- Suez Canal receipts rose by 2.8% y-o-y to USD 4.3 bn, up from USD 4.2 bn;

- Non-oil exports declined by 3.1% y-o-y to USD 12.4 bn, from USD 12.8 bn, mainly due to falling gold exports.

M&A WATCH- Greece’s Energean to acquire Edison’s oil and gas portfolio for USD 750 mn: Greek energy company Energean Oil & Gas is due to buy the oil and gas portfolio of Italy’s Edison, which includes substantial assets in Egypt, the company announced in a statement (pdf). Energean will pay an initial USD 750 mn, in addition to a further USD 100 mn after gas production from the offshore Italian Cassiopeia field begins, which is expected to happen in 2022. The Greek company will fund the transaction via an equity placing and a loan. The acquisition “establishes Energean as the leading independent, gas focused E&P company in the Mediterranean,” said Mathios Rigas, Energean chief executive.

What exactly is Energean purchasing? Egyptian gas fields are a core part of Edison’s oil and gas unit, make up 24% of the company’s portfolio. Its Egypt portfolio includes three producing concessions and six exploration concessions. Of the production assets, it owns a 100% stake in Abu Qir, a 60% stake in West Wadi El Rayan and a 20% stake in Rosetta. It also has a 100% stake in three exploration assets, and shares ownership of the remaining three with state-owned companies EGAS and EGPC. These assets are expected to produce an average 50k boe/d this year.

Energean’s expansion into the gas-rich eastern Mediterranean has been a long time coming: We reported in February 2018 that the Greek company planned to list on the London Stock Exchange in order to finance expansion in the region. The company finally made its bid for Edison’s oil and gas portfolio in June of this year, competing with Cairn Energy up until last week.

INVESTMENT WATCH- Raya Auto plans to invest EGP 300 mn in three years: Raya Holding’s automotive unit Raya Auto is planning to invest around EGP 300 mn over the coming three years to manufacture motorcycles and electric vehicles, CEO Tamer Abdel Aziz said, according to the local press. The company has inaugurated the second production line at its 6 October production facility. We reported last week that the company is in talks with three Indian and Chinese companies to cooperate on the manufacturing process.

FX reserves inched up slightly to USD 44.35 bn at the end of June, up from USD 44.27 bn the previous month, the Central Bank of Egypt said in a statement.

EXCLUSIVE- Cigarette prices may rise soon thanks to a potential tax increase: The Finance Ministry is studying a proposal to increase the fixed tax on cigarette packs, two government sources told Enterprise over the weekend. The increase could range between EGP 1.5 to 2, the sources estimate. As the law stands, the rates are EGP 3.50 for packs sold at less than EGP 18, EGP 5.50 for packs costing between EGP 18 and 30, and EGP 6.50 for packs priced over EGP 30. Cigarettes are also subject to a separate 50% levy on their end-user price.

How will the increase be applied? Representatives from tobacco companies the ministry met with suggested setting new rates based on whether the cigarettes are imported or produced locally. The ministry will study the “legal and financial implications” of the proposal, and decide whether to make the switch from taxing based on the cigarettes’ selling price. The proposed change will be drafted and referred to the Madbouly Cabinet “within days,” the sources said.

Egypt exchange to establish new derivatives clearing company ahead of market launch later this year: The EGX will set up a new derivatives clearing company with Misr for Central Clearing, Depository and Registry (MCDR) in time to launch the new derivatives market by the end of the year, EGX Chairman Mohamed Farid said, according to Youm7. The exchange is currently making changes to the electronic platform to enable traders to buy and sell derivatives.

The bourse is ready for short selling: Farid said that the stock exchange is ready to activate short selling in the coming period pending some final touches, Youm7 reported. Financial Regulatory Authority (FRA) deputy head Khaled El Nashar said last week that short selling is expected to be activated in 3Q2019. The Financial Regulatory Authority has so far issued licenses to four brokerage arms enabling them to facilitate short selling.

DISPUTE WATCH- Acumen files EGP 20 mn lawsuit against FRA boss for “reputational damage”: A Giza court is expected to rule on 30 July on a EGP 20 mn lawsuit filed by Acumen Holding against Financial Regulatory Authority (FRA) boss Mohamed Omran for reputational damage, the local press reported. The company is demanding EGP 20 mn in compensation for harm caused to its reputation as a result of an FRA ban in 2017 that was later overruled, Acumen Chairman Rana Adawi said.

Background: An administrative court last month overturned the FRA’s decision to ban Acumen from buying Egypt Gas shares for three months and ordered the regulator to pay EGP 30k in compensation. The FRA had banned Acumen in October 2017 after alleging that Egypt Gas shares had been subject to stock manipulation. Acumen had denied the allegations and challenged the FRA’s decision.

LEGISLATION WATCH- The Finance Ministry has completed the executive regulations of the Public Contracts Act and will send them to Cabinet for review, Youm7 reports. The new regulations aim to promote fair competition for government tenders, increase interest, and improve the transparency of the bidding process. The regulations lengthen the payment period for tender participants, and cap the rate of primary insurance at 1.5% of the estimated value of the process. An electronic procurement system, automatically updated to ensure transparency, will also be set up.

Background: The bill (previously known as the Auctions and Tenders Act), which originally passed the House of Representatives last July, aims to decentralize and streamline government tenders as well as support SMEs and entrepreneurship. The Finance Ministry said in December that SMEs will get priority treatment and a 20% quota of government tenders under the law.

CABINET WATCH- Cabinet agrees to draft decree on civil servants’ minimum wage: The Madbouly Cabinet has agreed to draft a decree setting civil servants’ minimum wage at EGP 2k for the lowest rank and EGP 7k for the highest rank starting FY2019-2020, according to a statement. Ministers also agreed to issue the executive regulations for a temporary law on settling building code violations. They also greenlit a presidential decree allocating state-owned land in Suez governorate to the Egyptian General Petroleum Corporation (EGPC) to construct pumping stations and store petroleum products.

El Sisi swears in new Court of Cassation, Administrative Prosecution Authority heads: Judge Abdallah Assr was sworn in before President Abdel Fattah El Sisi yesterday as the head of the Court of Cassation, the nation’s highest appeals court, according to an Ittihadiya statement. The president also swore in Essam El Din El Menshawy as the new head of the Administrative Prosecution Authority. El Sisi was granted the power to appoint the heads of four major judicial bodies — the Court of Cassation, the Council of State (Maglis El Dawla), the State Lawsuits Authority, and the Administrative Prosecution Authority — under controversial amendments to the Judicial Authorities Act in 2017.

MOVES- Nijman appointed GTH CEO: Gerbrand Nijman (LinkedIn) was appointed Global Telecom’s chief executive on 1 July, replacing Vincenzo Nesci who is now a non-executive director, the company said in a statement to the EGX (pdf) on Thursday. Nijman had been the company’s chief financial officer for four years prior to his promotion.

Egypt in the News

The sale of a 3000-year-old bust of King Tutankhamun at auction for GBP 4.7 mn (USD 6 mn) tops coverage of Egypt in the foreign press today (BBC | New York Times | Washington Post | Financial Times). Despite repeated calls from Egypt to return the bust, auction house Christie’s went ahead with the sale, denying claims by Egypt’s foreign ministry that the bust was probably stolen from Karnak temple in the 1970s. The Antiquities Ministry, disgruntled by the sale, will hold an “urgent meeting” at the start of the week to discuss measures it could take, including a potential lawsuit, it said in a statement.

The Egyptian market is of great importance to Israel’s attempts to export its surplus natural gas,even as Egypt itself becomes a bigger producer, the New York Times’ Clifford Krauss says. While energy executives say gas could strengthen the relationship between the two countries, they also acknowledge that doing business is risky for both sides, especially considering the 2012 gas pipeline sabotage.

Other headlines worth a skim this morning:

- A theory that ancient Egyptian merchants used reed boats to journey some 3k km across the Mediterranean and as far as the Black Sea is about to be put to the test by adventurers who will set off from Bulgaria next month, Reuters reports.

- Mo Salah continues to face heavy criticism for his defense of teammate Amr Warda against allegations of [redacted] harassment, with the Washington Post highlighting the disappointment felt by women in Egypt who had viewed him as an ally.

- A British tourist’s claim that his wife died from food poisoning in Egypt is “entirely speculative,” a coroner has ruled, according to Metro.

On The Front Pages

El Sisi directs senior officials to build eco-friendly ports: President Abdel Fattah El Sisi’s meeting with Prime Minister Moustafa Madbouly and the finance, environment, and transport ministers to develop Egypt’s ports into more eco-friendly facilities topped the front page of state-run Al Akhbar. Egypt’s disappointing loss to South Africa was relegated to the sidelines. Both Al Ahram and Al Gomhuria’s websites were (still) down this morning.

Diplomacy + Foreign Trade

President Abdel Fattah El Sisi held talks on economic cooperation with Jordanian Prime Minister Omar Al Razzaz in Cairo last week, according to an Ittihadiya statement. The meeting came as Al Razzaz and Prime Minister Moustafa Madbouly held the Egyptian-Jordanian Higher Committee meeting, during which the two sides signed a number of cooperation agreements.

Egypt’s exports to the rest of Africa climbed 26.9% y-o-y to USD 4.7 bn in 2018, up from USD 3.7 bn in 2018, according to CAPMAS figures cited by Al Masry Al Youm. North Africa and Sudan accounted for the lion's share of exports into the continent. Egypt’s imports from African nations for the year totaled USD 2.1 bn, up 15.2% y-o-y from USD 1.9 bn in 2017. Algeria was also Egypt’s top importer, having imported USD 397.7 bn-worth of goods last year, followed by Kenya, Zambia, and Sudan.

Energy

Italy’s Eni in talks over LNG facility in Egypt

Italy’s Eni is in talks over an LNG facility in Damietta that should begin operations “soon this year,” Reuters quoted CEO Claudio Descalzi as saying, without providing any further details.

Mexico’s PetroBal makes oil discovery in Sinai field

Mexico’s PetroBal has made a discovery in one of Egypt’s oldest Sinai fields, the company said in a report to the Oil Ministry. The company is working on a development strategy for the region in which the field falls, which includes 10 wells at a capacity of at least about 3k barrels per day, to step up production.

Four companies express interest in Egypt power projects

Four companies — Hyundai, Toyota, Voigt and VINCI — have made offers to the Electricity Ministry to cooperate in building two water pumping and storage stations to generate power in Luxor and Qena, Minister Mohamed Shaker told the local press. The two stations are expected to have a production capacity of 4 GW and cost a combined USD 4.7 bn.

El Sisi ratifies Egypt-Cyprus pipeline agreement

President Abdel Fattah El Sisi ratified an agreement between Egypt and Cyprus to build a natural gas pipeline, the local press reported. The pipeline will allow natural gas from the Aphrodite gas field to be transported to Egypt’s liquefaction facilities at Idku and Damietta, and re-exported as liquefied natural gas. Parliament had signed off in March on the agreement, which was signed in September.

Infrastructure

Metito to establish EGP 1.6 bn desalination plant in El Arish

UAE-based water treatment company Metito will establish a EGP 1.6 bn water desalination plant in El Arish with a capacity of 100k cubic meters per day, the local press reports. The project is being constructed in cooperation with Orascom, and is slated for completion in 2021, Metito CEO Karim Medour said.

Health + Education

SODIC-supported initiative Educate Me inks MoU with Education Ministry

SODIC-supported initiative Educate Me (Alemny) has inked an MoU with the Education Ministry to support public education on a national scale, the upmarket real estate developer said in press release (pdf). Educate Me is a non-profit supported by SODIC and self-styled venture philanthropy organization Alfanar. It operates a pre-school in Talbiya, as well as a government-certified community school. The organization also trains public school teachers.

Egypt, Cyprus sign MoU to increase cooperation in engineering education

Around 570 Egyptian engineering students will receive technical training by the Cypriot University of Neapolis after Investment and International Cooperation Minister Sahar Nasr signed an MoU with the university on Thursday, the ministry said in a statement (pdf). Nasr discussed expanding the program to include other professions such as commerce, as well as a plan for the university to set up a branch in Egypt.

Tourism

Iberia Airlines to launch direct Madrid-Cairo flights in March 2020

Spain’s Iberia Airlines will begin operating four direct flights a week between Madrid and Cairo from 2 March, 2020, the company said in a statement.

Banking + Finance

Aman in talks with four banks to increase credit portfolio to EGP 700 mn

Raya Holding’s microfinance arm Aman is in talks with four banks to increase its credit portfolio to EGP 700 mn by the end of 2019, up from EGP 445 mn, head of microfinance Ahmed El Khatib said, according to Al Mal. The company said last month it intended to increase its portfolio to about EGP 500 mn by the end of the year.

Other Business News of Note

Edita to break ground on USD 20 mn Morocco production facility this month

Edita Food Industries will begin constructing its USD 20 mn snack food production facility in Morocco before the beginning of August, Al Mal reports. The plant will be built in collaboration with Morocco’s Dislog Group, and is expected to begin production in 1Q2020. The project was first announced back in March 2018, and was originally expected to cost USD 10 mn and start operations this year. The two companies agreed to set up a JV in December 2017 named Edita Food Industries – Morocco, with Edita owning a 51% stake.

Sports

Turki Al-Sheikh sells Pyramids FC to Salem Al-Shamsi

Emirati investor Salem Al-Shamsi has formally acquired Egypt’s Pyramids FC from Saudi General Entertainment Authority chairman Turki Al-Sheikh, the club announced last week. Al-Sheikh had said in February that he had sold the club to Al Shamsi, before changing his mind, Ahram Online reports. Pyramids FC, formerly called Al-Assiouty, stands at second place in the Egyptian Premier League, four points behind Al Ahly. Turki Al-Sheikh invested significant funds in the club in a bid to dethrone Al Ahly, as part of a complex and well-documented relationship with Egyptian football.

The Market Yesterday

EGP / USD CBE market average: Buy 16.54 | Sell 16.67

EGP / USD at CIB: Buy 16.55 | Sell 16.65

EGP / USD at NBE: Buy 16.58 | Sell 16.68

EGX30 (Thursday): 13,997.40 (-0.99%)

Turnover: EGP 723 mn (3% above the 90-day average)

EGX 30 year-to-date: +7.4%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 0.99%. CIB, the index heaviest constituent ended down 0.2%. EGX30’s top performing constituents were Sarwa Capital up 3.0%, and Qalaa Holdings up 1.0%. Thursday’s worst performing stocks were Ezz Steel down 7.9%, Egypt Kuwait Holding down 3.7% and Emaar Misr down 3.1%. The market turnover was EGP 723 mn, and regional investors were the sole net sellers.

Foreigners: Net long | EGP +32.6 mn

Regional: Net short | EGP -43.2 mn

Domestic: Net long | EGP +10.6 mn

Retail: 60.8% of total trades | 63.5% of buyers | 58.1% of sellers

Institutions: 39.2% of total trades | 36.5% of buyers | 41.9% of sellers

WTI: USD 57.51 (+0.30%)

Brent: USD 64.23 (+1.47%)

Natural Gas (Nymex, futures prices) USD 2.42 MMBtu, (+0.33%, August 2019 contract)

Gold: USD 1,400.10 / troy ounce (-1.46%)

TASI: 8,846.53 (-0.08%) (YTD: +13.03%)

ADX: 4,999.46 (+0.20%) (YTD: +1.72%)

DFM: 2,660.53 (-0.21%) (YTD: 5.17%)

KSE Premier Market: 6,544.28 (+0.59%)

QE: 10,566.52 (-0.23%) (YTD: +2.60%)

MSM: 3,822.59 (-0.06%) (YTD: -11.59%)

BB: 1,511.20 (+0.85%) (YTD: +13.01%)

Calendar

July: Customs officials from Egypt and the US will sit down to discuss “procedural and administrative matters” as part of the Trade and Investment Framework Agreements (TIFA).

July: The National Railway Authority will launch a tender for the purchase of 100 new locomotives expected to be financed through an agreement with the European Bank for Reconstruction and Development (EBRD).

7 July (Wednesday): The FRA will hear an appeal filed by Adeptio AD Investments, the lead shareholder of Egyptian International Tourism Projects Company’s (Americana Egypt), against an order to submit an MTO for Americana

11 July (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

19-21 July (Friday-Sunday): LED Middle East Expo, Egypt International Exhibition Center, Nasr City, Cairo.

21 July (Sunday): Amer Group and Antaradous Touristic Development will face off in court over a 2014 dispute brought by the Syria-based company for a fallout in their partnership to develop the Porto Tartous tourist resort. The date was postponed from 23 June.

23 July (Tuesday): 23 July revolution anniversary, national holiday.

28 July-02 August (Sunday-Friday): Fab15 Conference and Graduation Ceremony, TU Berlin, El Gouna, Egypt.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

August: Meetings of the Egyptian-Belarussian Committee for trade, economic, scientific and technical cooperation, Minsk.

August: The National Railway Authority is expected to sign a 15-year maintenance agreement for 1,300 railcars it had agreed to purchase from Russia’s Transmashholding under a EGP 22 bn contract.

03-04 August (Saturday-Sunday): Fab15 Festival, Tours, and Conference Closing, Greek Campus, Cairo.

7-11 August (Wednesday-Sunday): Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

28-30 August (Wednesday-Friday): Tokyo International Conference on African Development (TICAD), Yokohama, Japan.

29 August (Thursday): Islamic New Year (TBC), national holiday.

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

03-04 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

18 September (Wednesday): E-Commerce Summit 2019, Nil Ritz Carlton, Cairo.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.