- Egypt gets lots of love from global energy majors as oil and gas conference dominates business news in Egypt. (Speed Round)

- Israel is struggling to find a way to export its gas to Egypt. (Speed Round)

- FinMin’s draft FY2019-20 state budget sees spending at EGP 1.5 tn. (Speed Round)

- Industry Ministry targets 8% industrial growth by 2020. (Speed Round)

- China Eximbank to finance USD 2.6 bn large-scale Attaqa hydroelectric plant. (Speed Round)

- House committee gives preliminary nod to E-payments Act. (Speed Round)

- Moody’s maintains positive outlook on Egypt’s banking system. (Speed Round)

- An MP is trying to sneak in changes to how salaries are taxed. (Speed Round)

- The Market Yesterday

Tuesday, 12 February 2019

Lots (and lots and lots) of oil and gas love.

TL;DR

What We’re Tracking Today

As we suggested yesterday, it is all oil and gas, all the time with the kickoff of the three-day Egypt Petroleum Show. Among the headlines so far:

- New energy contracts are nearly ready and will drive investment to undeveloped areas, Oil Minister Tarek El Molla told reporters;

- Peak Zohr: The Zohr supergiant offshore gas field will near peak production this year;

- Lots of love from BP: Global oil major BP invested more in Egypt last year than anywhere else in the world and will invest about USD 1.8 bn here this year, CEO Bob Dudley said yesterday;

- Locking in gas supply: BP has begun producing 400 mcf/d of gas from the second phase of its West Nile Delta project. A third phase due to come online at year’s end will lock volumes from the West Nile Delta project equivalent to about 20% of Egypt’s current natural gas production.

- LNG exports: Total and Eni separately expressed optimism about spinning up exports from Egypt’s two (almost) mothballed liquefaction plants.

Expect more news today, including details on the award of more than a dozen concessions to explore for oil and gas. We have chapter and verse on Monday’s developments in this morning’s Speed Round, below. The gathering wraps up tomorrow.

T-bill auction: The CBE sold USD 1.014 bn worth of one-year USD-denominated treasury bills yesterday with an average yield of 3.797%, Reuters reports. The average yield was unchanged from the last such auction in early January.

Germany is offering Egypt a USD 250 mn loan. The facility, from Germany’s KFW development bank, is due to be signed today and will support Egypt’s the IMF-backed reform program, according to a statement from the German embassy in Cairo. The embassy did not disclose the purpose of the funding.

Renaissance Capital’s investor trip to Egypt continues today. The gathering, which will see foreign investors meet Egyptian companies and government officials, wraps up tomorrow.

Bringing SMEs into the formal banking system is the topic of a paper the IMF will present today at a seminar at the American University in Cairo’s Tahrir campus, according to a statement.

The US government won’t shut down at the end of the week. Lawmakers reached a preliminary agreement on border security that will make possible a funding bill before an end-of-week deadline, avoiding a second shutdown of the US government this year, according to the Wall Street Journal. House and Senate negotiators agreed to provide USD 1.375 bn for a 55-mile barrier on the US’ border with Mexico, “a figure far lower than the USD 5.7 bn that President Trump had demanded for a border wall,” the New York Times notes.

The IMF’s new chief economist Gita Gopinath gave a thumbs-up to the US Federal Reserve’s decision to keep rates on hold, in an interview with the Financial Times (paywall). The Fed’s policy reversal has “certainly helped” emerging economies that struggled with liquidity problems last year, she said, adding that EM currencies are now enjoying some reprieve from the depreciation seen in 2018. The Fed’s hands-off approach to rates this year is bolstering the outlook for emerging markets, Eastspring Investments strategist Mary Nicola tells CNBC.

The FT asks: have the central banks lost their nerve? With the Fed and the Bank of England both rowing back on plans to raise rates in the coming months, the salmon-colored paper writes that policymakers are now taking note of the emerging headwinds in the global economy.

Are emerging markets not taking the US-China trade dispute seriously enough?: As US Treasury Secretary Steven Mnuchin and co. resume trade talks with China, Bloomberg thinks traders may not be freaked out enough about what the trade dispute could mean for emerging markets. The MSCI Emerging Markets Index closed last week in the red for the first time in 2019, as concerns about an impasse heightened. “While we are still bullish on the asset class based on valuations, technicals and the exogenous environment, we think the market may pause for break over the coming two to three weeks,” Fidelity International’s Paul Greer said. Asian and European stocks nevertheless rallied yesterday in anticipation of a breakthrough during the talks.

This comes as global investors are hedging against Armageddon, Bloomberg reports, pouring some USD 2.3 bn so far this year into an ETF that tracks 20+ year US treasuries. What are people jittery about? “Fears of worsening economic momentum coupled with geopolitical uncertainties and corporate earnings revisions that appear to have limited upside,” a strategist at State Street Global Advisors tells the business information service.

PSA- Expect ugly weather across the nation this week. The national weather service is predicting rain in the coming days and sand storms Wednesday through Saturday, Ahram Online says. Our favorite weather app suggests Wednesday and Thursday are likely to be the worst days for blowing sand, but doesn’t have rain in the forecast.

Enterprise+: Last Night’s Talk Shows

Still more Africa love with joint interviews from Addis Ababa: Masaa DMC, Hona Al Asema, ONTV, and Al Hayah Al Youm once again pooled their resources and aired joint interviews from Addis Ababa last night.

Growing intra-African trade is contingent on improving infrastructure and addressing energy shortages, COMESA Business Council Chairman Amany Asfour said (watch, runtime: 05:22). Asfour also discussed how fintech can be used to increase investment in Africa (watch, runtime: 08:01). Meanwhile, African Union legal advisor Namira Negm touched on measures to conserve Africa’s natural resources (watch, runtime: 02:32).

Amr Adib bucked the African Union trend and instead spent much of his night attacking Alaa Mubarak (watch, runtime: 06:23)

Speed Round

New, investor-friendly production-sharing agreements are in the spotlight as gov’t pushes Egypt as a regional energy hub. The three-day Egypt Petroleum Show, which got underway yesterday, is best thought of as the physical embodiment of the Sisi administration’s strategy to position Egypt as the premier eastern Mediterranean energy hub. Domestic and international media offered wall-to-wall coverage.

If you read nothing else, read this from Reuters: “Egypt’s gas output will get a boost this year as the country’s huge Zohr field nears peak production and with USD 1.8 bn in investment from BP, officials said on Monday, as Egypt returns to export markets and positions itself as a regional hub.” Egypt is leveraging its “strategic location and well-developed infrastructure to become a key international trading and distribution center for gas, a potentially remarkable turnaround for a country that spent about USD 3 bn on annual liquefied natural gas (LNG) imports as recently as 2016.”

Digging into the highlights from yesterday:

Egypt is “finalizing details” of investor-friendly production-sharing contracts, Oil Minister Tarek El Molla told Bloomberg. The contracts will be used to offer incentivize for oil companies to drill in underdeveloped areas. “We’re improving the cost-recovery process to be faster, less bureaucratic and more efficient,” the minister said, stopping short of providing details of how the contracts will be changed. Background: Ministry sources said in October that the new contract model will pass all exploration and production (E&P) costs to the private sector. Investing companies would receive a greater share of the output in return, as well as the freedom to sell it at their discretion. The current system gives producers one-third of the output to cover E&P costs and the remainder is split with the government, which has the right to company’s entire share at preset prices.

Qalaa Holdings’ USD 4.3 bn refinery will begin operations by the middle of 2019, the minister told the business information service.

BP brings Giza and Fayoum gas fields online: BP has begun gas production from Giza and Fayoum fields at an initial rate of 400 million cubic feet per day (mcf/d), the company said in a statement. Output from the two fields is expected to rise to 700 mcf/d in April this year. Giza and Fayoum comprise the second phase of the field operator BP’s three-stage West Nile Delta project. Production should begin late this year at the project’s Raven field, bringing “combined production from all three phases of the West Nile Delta project … to almost 1.4 bcf/d, equivalent to about 20% of Egypt’s current gas production. All the gas produced will be fed into the national gas grid,” BP noted.

BP will commit about USD 1.8 bn to Egypt this year, CEO Bob Dudley said and has shown a “deep deep commitment to Egypt” by investing more here in each of the last two years than in any other country in which it operates.

Production at Zohr, the supergiant gas field, should ramp up to near peak in 2019: The flagship gas asset is expected to produce about 3 bcf/d by 2019-end from 2.1 bcf/d currently, El Molla said during the conference. The country’s natural gas production should reach 7 bcf/d by April, El Molla said.

Total is considering investing in Egypt’s downstream petchem sector after having acquired a stake in Idku, one of two liquefaction plants in Egypt,CEO Patrick Pouyanne said, according to Reuters.

Eni and its partners are looking to spin up the country’s other idle liquefaction plant this year. “There is no date, however there is a strong interest for all involved parties in having Damietta restart as soon as possible,” said Eni Chief Midstream Gas and Power Office Massimo Mantovani. Background: Egypt is in talks with the Spanish-Italian JV to have the European outfit drop a USD 2 bn arbitration claim over a supply disruption that forced it to mothball the plant.

The Oil Ministry wants oil prices to return to the USD 60-70 bbl range, El Molla said in a separate interview with CNBC. “If prices of crude increase significantly we would start to see inflation and an exaggeration in the slowdown in consumption… If we see prices go down below a certain price, then we will see a slowdown in investments,” he said during the conference.

Energy sector key to attracting inflows, Madbouly says: Egypt’s energy sector are key to attracting more inflows,Prime Minister Mostafa Madbouly said during his speech, noting the government’s good track record of paying arrears to international companies and what he characterized as the country’s improving investment climate. Total inflows of foreign currency to Egypt topped USD 163 bn over the past three years, Prime Minister Mostafa Madbouly said in a keynote address, according to Reuters’ Arabic service.

Madbouly also held talks with the CEOs of BP, Total: Madbouly sat down with Total and BP CEOs Patrick Pouyanne and Bob Dudley.

Middle-finger emoji to Turkey from Ali Abdel-Aal: The Speaker of the House wasn’t at the petroleum show, but in Nicosia for a meeting with his Greek and Cypriot counterparts — from whence he still managed to put points on the board as he “appeared to push back Monday at Turkey's opposition to offshore drilling operations that Turkey isn't part of, saying cooperation between Egypt, Cyprus and Greece sent a message to any countries that tried to stop them,” the Associated Press reports.

OPEC: Wallahi we’re not a cartel. Begad. We promise: Mohammad Barkindo, secretary-general of the group of oil exporters, said yesterday that his group isn’t a “cartel” and isn’t in the business of fixing oil prices. OPEC is rather working for the sake of market stability to help investors plan and ensure a stable supply of energy, he told Reuters on the sidelines of the forum. The statement came as a US House of Representatives’ committee gave a green light to a bill that could, if it becomes law, see OPEC face antitrust suits.

Israel is struggling to find a way to export its gas to Egypt. The southern Israeli gas pipeline that is meant to carry gas from the Leviathan and Tamar fields to the East Mediterranean Gas (EMG) pipeline into Egypt does not have the capacity to carry the volumes the fields’ partners have contracted to sell to Egypt, Haartez reports. Under the USD 15 bn contract with Dolphinus Holdings (a group fronted by the industrialist Alaa Arafa), Delek Group and Noble Energy should deliver 3.5 bcm from each field for a combined total of 7 bcm — but the Israeli pipeline’s current capacity does not exceed 3 bcm, the Israeli newspaper says. “Israel’s Natural Gas Authority added to the problem after it made clear that the pipeline couldn’t handle even that amount. In an announcement, the authority said that it couldn’t promise continuous access to the pipeline, but only when capacity was available.”

Background: Reports emerged earlier this year that Egypt and Israel were in early talks to build a new underwater natural gas pipeline to get around the capacity restrictions posed by Israel’s domestic pipeline network. The new pipeline could also pave the way for future deliveries of Israeli natural gas to Egypt when Leviathan is operating at full capacity. Dolphinus’ import agreement paved the way for Noble Energy and Delek, along with their Egyptian partner East Gas, to acquire a 39% stake in EMG — a crucial milestone in Egypt becoming the regional export hub for the East Mediterranean gas fields. International arbitration cases were settled to pave the way for the deal and Israel expects imports to begin in a few months’ time.

EXCLUSIVE- FinMin’s draft FY2019-20 state budget sees spending at EGP 1.5 tn: The draft FY2019-20 state budget forecasts government spending at EGP 1.5 tn, a senior government official tells us. Public wages will account for EGP 294.9 bn of total spending, up from EGP 266 bn in the current fiscal year, which ends in June. On the flipside, the Finance Ministry expects spending on subsidies and social benefits to drop to EGP 312 bn, from EGP 332 bn on the back of subsidy cuts and the fuel pricing mechanism for 95 octane fuel that is expected to come into effect in April. Other highlights of the draft budget include:

- A budget deficit of 7% of GDP, or EGP 380-390 bn, down from 8.4% in the current fiscal year;

- Revenues rising to EGP 1.1 tn, up from EGP 989 bn in the current fiscal year, on the back of tax revenues rising to a projected EGP 863 bn from EGP 770 bn this year;

- Investments in health, education, and housing will clock in at around EGP 150 bn;

- Debt service dropping to EGP 502 bn, down from EGP 541 bn currently, as the ministry begins implementing its debt control strategy;

- A primary budget surplus of EGP 122 bn.

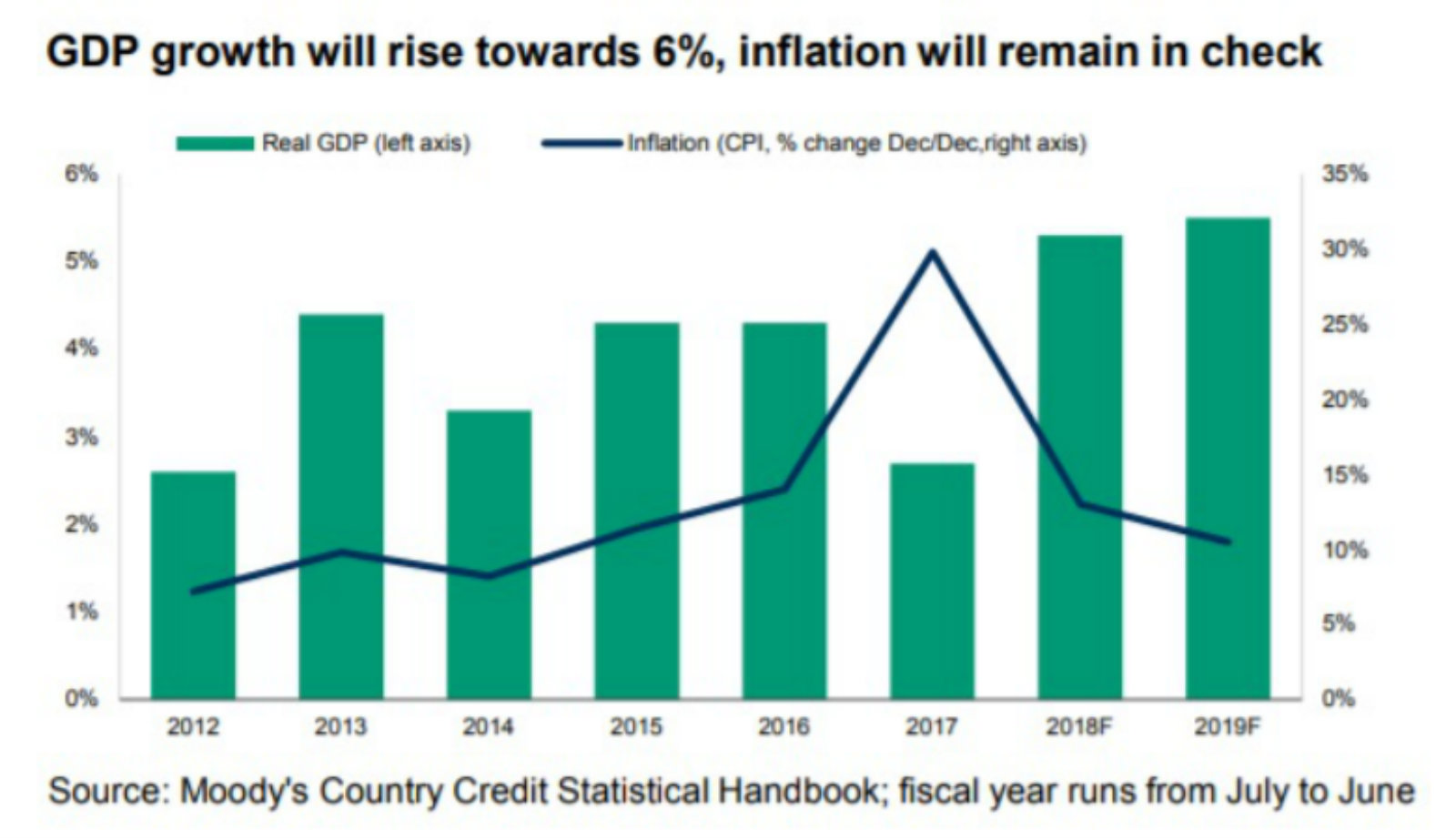

The Finance Ministry expects GDP growth accelerate to 6.2% in FY2019-20, it said earlier this week in its mid-year review of the FY2018-19 budget. The ministry also said it expects the average price of a barrel of oil to come in at USD 67 in FY2019-20.

Industry Ministry targets 8% industrial growth by 2020: The Industry Ministry wants to see industry growing at an 8% annual clip by 2020, the ministry said in a statement. It is also wants to see manufacturers account for 21% of GDP, up from 18% today, while also boosting the contribution of SMEs and the private sector to the economy in general.

China Eximbank to finance USD 2.6 bn large-scale Attaqa hydroelectric plant: The Egyptian Electricity Holding Company has signed a financing agreement with the Export–Import Bank of China for the USD 2.6 bn, 2400 MW Attaqa pumped-storage hydroelectric plant, sources from the ministry said. EEHC is expecting to finalize the contracts for the project with China’s Sinohydro, the company developing the plant, by no later than late June. Plans for the massive-scale plant came into fruition during the EEDC, but were stalled for years until the president’s recent visit to China, where initial contracts were inked.

LEGISLATION WATCH- House committee gives preliminary nod to E-payments Act: The House of Representatives’ Economic Committee has preliminarily approved the final draft of the E-payments Act, according to reports in the local press. The House general assembly is kick the tires of the final bill — which seeks to guide Egypt’s transition to a cashless economy — “soon.” If passed, the law’s executive regulations will be out within six months of approval. The Madbouly Cabinet signed off on the final draft last October.

What’s the bill about? According to documents leaked to the domestic press, the bill force demand electronic payment for everything under the sun, particularly big-ticket items including taxes and customs payments, subscriptions to IPOs, investment funds and share purchases, and just about every form of state fee. The law would only cover payments made in EGP.

Background: The bill is part of the government’s plan to gradually transition towards a cashless, paperless economy. The Cabinet had announced last year its intention to make all government transactions electronic by the start of this year, and the Finance Ministry announced last week it will make electronic payment of government fees mandatory by early May for amounts exceeding EGP 500.

Moody’s maintains positive outlook on Egypt’s banking system: Moody’s Investors Service said in a report on Monday (pdf) that it has maintained its positive outlook on Egypt’s banking system amid “an improving operating environment.”

Stable funding and liquidity in EGP, FX to remain under pressure: The ratings agency said banks will continue to enjoy access to stable funding as well as sizeable volumes of liquid assets, especially in EGP. It pointed, however, to the decline in banks’ foreign assets over the past year, saying FX funding and liquidity — although stable — will remain under pressure partially due to global monetary policy tightening. Banks’ net foreign assets registered EGP 72 bn in September, down from EGP 73 bn in March. "We expect balance sheet growth of around 15% in 2019 and for banks to maintain ample local currency funding, high liquidity, and strong and stable profitability,” says Constantinos Kypreos, senior vice president at Moody's Investors Service.

Bad loan levels stable, but vulnerable: Moody’s sees non-performing loan (NPL) levels remaining generally stable amid strong economic growth, but said “a future turn in the economic cycle due to large of volumes of untested new loans and ongoing security risks” is a concern.

GDP growth expected at 5.5% in FY2019-20: Moody’s expects Egypt’s real GDP growth to reach 5.5% in FY2019-20 and 5.8% in FY2020-21, citing private and public investment, higher exports and the country’s recovering tourism industry. “Accelerating growth in Egypt reflects increased public and private-sector investment, higher exports and a recovery in tourism,” Kypreos said.

Potential risks: The firm cites high interest rates and inflation as two factors that could hamper growth. Moody’s also said the EGP could suffer due to global financial tightening as well as a decline in investment inflows. Security risks could also harm the recovering tourism industry, it said.

LEGISLATION WATCH- An MP is trying to sneak in changes to how salaries are taxed: The House Planning and Budget Committee will discuss in the coming days new amendments to the Income Tax Act that would change the tax code and rates on salaries, Al Mal reports. The amendments, proposed by Rep. Mervat Alexan with the stated aim of “reducing pressure on low-income Egyptians,” include:

- increasing the basic salary tax exemption to EGP 9,000 per year (up from EGP 8,000)

- a 10% tax on incomes between EGP 9-30k

- a 15% tax on incomes between EGP 30-45k

- a 20% tax on incomes between EGP 45-200k

- a 22.5% tax on incomes between EGP 200-500k

- a 25% tax on incomes over EGP 500k.

Background: This comes as the government pushes through changes to the tax code relating to how banks account for income coming from their holdings of government paper.

The CBE is looking likely to relaunch its EGP 16.8 bn debt relief program by no later than April, sources familiar with the matter said, according to Al Mal. The program was launched by the central bank between June-December 2018 and was designed have state-owned banks waive EGP 16.8 bn-worth of interest payments on non-performing loans provided the struggling borrowers repay their outstanding principal amounts. The CBE targeted an estimated 3.5k companies and 337k individuals in the first phase. It failed, however, to attract the target number of beneficiaries due primarily to its short duration and requiring debtors to make one-time principal repayments. The state-owned banks taking part in the program have suggested a longer duration for the program for this time around, covering credit card customers and providing more flexible principal repayment terms.

REGULATION WATCH- Financial Regulatory Authority is zeroing in on non-bank financial services: The Financial Regulatory Authority’s comprehensive non-banking services strategy has entered the implementation phase, the authority said in a statement yesterday. The statement sets out ambitious goals for the sector, which the FRA presents as an engine of growth that will enhance access to capital while also mobilizing funding for national projects, among other benefits. Key for business: The FRA explicitly notes it will lead on legislation and regulation for the sector in a bid to improve transparency and curb corruption. The four-year strategy, which was first announced last year, would also see the FRA take an active role in growing the volume of Egypt’s mortgage financing market.

Egypt imported EGP 227.7 bn-worth of food products in 2018, according to a Customs Authority report cited by Youm7. Spending on vegetables totaled EGP 60.3 bn (26.3% of import spend) while EGP 42.3 bn (18.5%) was spent on wheat — Egypt’s biggest stand-alone import. EGP 27.7 bn was spent on meat imports (around 12% of imports). A large proportion of last year’s imports were staples subject to little or zero customs duties, the report noted, with no mention of last year’s figures or an annual percentage change.

M&A WATCH- Pioneers Holding subsidiaries submit MTO for 41.46% of Electro Cable Egypt: Three of Pioneers Holding’s subsidiaries have submitted a mandatory tender offer for 41.46% of Electro Cable Egypt, or 294.9 mn shares at par value of EGP 1.35, according to Al Mal. Pioneers already owns 48.5% of Electro Cable through its subsidiary Summu Consulting and would raise its stake in the company to 90% if the transaction goes through.

** WE’RE HIRING: We’re looking for smart, talented, quirky people to join our team and help us make both the product you’re reading now and some exciting new stuff. We’re particularly interested in:

- Journalists with print, audio and / or video skills — both editors and reporters (for both our English and our Arabic editions);

- Research analysts whose strength runs to words as much as models;

- Software developers who are passionate about what we do;

- A head of product — a technical person who speaks editorial or an editorial person who speaks tech;

- Events managers who know how to produce outstanding live content.

Interested? Send your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. Email us at jobs@enterprisemea.com.

Up Next

The central bank’s Monetary Policy Committee will meet to decide on interest rates on Thursday.

The EGP 500 mn first part of the fourth phase of Cairo Metro Line 3 will open between 15-17 February, Al Mal reports.

Suez Canal Authority boss Mohab Mamish will be in Moscow on February 17 to move forward an agreement on a USD 7 bn Russian Industrial Zone, Al Mal reports.

The Egyptian, Sudanese and Ethiopian foreign and irrigation ministers will be in Cairo on 20 February for talks over the Grand Ethiopian Renaissance Dam, Foreign Minister Sameh Shoukry told Extra News.

A Russian delegation will visit Sharm El Sheikh and Hurghada airports in the second half of February to run a final security sweep ahead of a decision on whether to allow the resumption of direct flights, AMAY reports.

Antitrust ruling: The Cairo Economic Court is due to deliver a decision on an appeal by pharma distributors of an antitrust fine on 19 February.

FinMin to present debt control strategy to El Sisi in March: The Finance Ministry will present the final, reviewed version of its comprehensive public debt control strategy to President Abdel Fattah El Sisi in March, Finance Minister Mohamed Maait said.

Execs from 50 Japanese companies will be in Cairo in March to discuss potential investment opportunities, Youm7 reports.

The Macro Picture

Lagarde emphasizes importance of financial inclusion for SMEs in the Arab world: IMF managing director Christine Lagarde spoke on Sunday in Dubai about the importance of convincing SMEs to join the formal economy in Arab states, according to Zawya — and banks need to increase their appetite for the segment. Lagarde said the region’s SMEs have attracted only 7% of bank lending, despite representing some 96% of registered companies.

Arab governments must come up with incentives for companies to go legit, including lower tax rates for certain segments of small businesses, says EFG Hermes’ Mohamed Abu Basha. Egypt has already passed laws on the SME sector and is looking to introduce incentives such as a proposed 1% VAT for SMEs, which could be an effective way to begin to widen the tax base. Low taxes could then be raised over time for each annual ‘class’ of new entrants to the financial system.

Want to dig deeper? Have a look at this piece from Ahram Online last year on SMEs as engines of job creation.

Egypt in the News

Topping coverage of Egypt on a slow morning is news that two Palestinians died inside a tunnel on the Gaza-Egypt border from inhaling poisonous gas, according to the Times of Israel.

Commentary on the proposed constitutional amendments also continues to make the rounds, with the Associated Press noting that the House of Representatives appears to be accelerating the process of their approval. The amendments indicate that “Egypt has witnessed a de-democratisation in the sense that any trace of democracy cannot be observed,” Ismail Numan Telci writes for Turkey’s TRT World.

Also picking up attention in the foreign press this morning:

- Ikhwan-era Planning Minister Amr Darrag asks Europe to “address the autocracy” of the Egyptian government in a piece for the Guardian.

- The “golden age” of Arab music lives on in Egypt through performances of songs by Umm Kulthum, Abdel Wahab, and Asmahan, reports the AFP.

On The Front Pages

Egypt’s role in the African Union continues to be the top story in state-owned dailies Al Ahram, Al Akhbar, and Al Gomhuria. The latter also notes that the Education Ministry began distributing yesterday educational tablets to Thanaweya Amma students.

Worth Listening

How money changed the English Premier League: Over past decades the English Premier League (EPL) has grown to become the most lucrative football league in the world, raking in bns from international media rights, but that wasn’t always the case. This podcast put together by The Guardian explores how Europe’s most competitive league acquired its immense wealth — and how doing so almost caused it to fall apart (listen, runtime: 27:42).

Basic Materials + Commodities

Delta Sugar beet output increases to 1.4 mn tonnes

Delta Sugar has upped its sugar beet production to 1.4 mn tonnesfor the current season as compared to 1.2 mn tonnes in the previous season, Chairman Ahmed Abul Yazeed said in a statement cited by Reuters.

Tourism

Egypt’s tourist arrivals reach 11.3 mn in 2018

Tourist arrivals in Egypt reached 11.3 mn visitors last year, up from 8.3 mn in 2017, a World Tourism Organization official said, according to the local press. European tourists accounted for the majority of the visitors, with 1.7 mn German tourists leading the charge. A considerable number of visits also came from Ukraine, Britain, Italy, Saudi Arabia, Sudan and Libya.

National Security

Mohamed Zaki, Mohamed Farid meet CentCom boss

Defense Minister Mohamed Zaki and Chief of Staff Mohamed Farid met in Cairo yesterday with US Central Command boss Joseph Votel to discuss security cooperation and coordination between the two countries, according to an Armed Forces statement.

Sports

Ismaily SC reinstated in Egyptian Champions League

Egyptian football club Ismaily SC has been reinstated in the Egyptian Champions League by the Confederation for African Football following a decision by the appeals board, reports GhanaWeb. The club was expelled from the competition due to crowd disturbances during their second round match against Tunisian Club Africain.

On Your Way Out

How to survive Valentine’s Day? With music. If, like us, you do your best to avoid the deluge of paper hearts and red teddy bears that appear at this time of year, this weekend has a selection of live music taking place throughout the city. French pianist Richard Clayderman is playing a selection of melodies at Al Manara in New Cairo on 15 February. The event is being sponsored by our friends at SODIC and tickets can be purchased through TicketsMarche. Cairo Jazz 610 will host guest DJs from Ibiza Oriol Calvo and Manu Gonzalez joining Omar Sherif on 14 February, and Egyptian contemporary classical composer Rageh Daoud is performing with the Cairo Symphony Orchestra at the Cairo Opera House on 16 February.

Hundreds of young Egyptians donned boots and gloves to pick up trash from the Nile’s banks in Cairo,according to Reuters. The good samaritans participating in the “Youth for the Nile” program, which hopes to raise awareness about pollution, have similar clean-ups scheduled across the country for the rest of the year.

The Market Yesterday

EGP / USD CBE market average: Buy 17.56 | Sell 17.66

EGP / USD at CIB: Buy 17.55 | Sell 17.65

EGP / USD at NBE: Buy 17.55 | Sell 17.65

EGX30 (Monday): 14,785 (+0.1%)

Turnover: EGP 928 mn (7% above the 90-day average)

EGX 30 year-to-date: +13.4%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session up 0.1%. CIB, the index heaviest constituent ended up 0.9%. EGX30’s top performing constituents were Oriental Weavers up 3.5%, Pioneers Holding up 2.0%, and Kima up 1.9%. Yesterday’s worst performing stocks were GB Auto down 3.5%, Egyptian Resorts down 2.4% and Ezz Steel down 1.6%. The market turnover was EGP 928 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +49.0 mn

Regional: Net Short | EGP -36.1 mn

Domestic: Net Short| EGP -12.9 mn

Retail: 58.0% of total trades | 55.5 % of buyers | 60.5% of sellers

Institutions: 42.0% of total trades | 44.5% of buyers | 39.5% of sellers

WTI: USD 52.46 (-0.49%)

Brent: USD 61.56 (-0.87%)

Natural Gas (Nymex, futures prices) USD 2.65 MMBtu, (+2.48%, Mar 2019)

Gold: USD 1,311.60 / troy ounce (-0.52%)

TASI: 8,543.39 (-0.35%) (YTD: +9.16%)

ADX: 5,046.46 (-0.70%) (YTD: +2.67%)

DFM: 2,496.35 (-1.32%) (YTD: -1.32%)

KSE Premier Market: 5,456.73 (+0.27%)

QE: 10,302.41 (-1.33%) (YTD: +0.03%)

MSM: 4,141.54 (-0.41%) (YTD: -4.21%)

BB: 1,398.65 (-0.78%) (YTD: +4.59%)

Calendar

11-13 February (Monday-Wednesday): Renaissance Capital Egypt Investor Trip, Cairo.

11-13 February (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

14 February (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

19 February (Tuesday): Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

23 February (Saturday): The Supreme Administrative Court will rule in an appeal by Uber and its competitor Careem against a lower court ruling ordering the suspension of their operations.

24-25 February (Sunday-Monday): EU-Arab League summit, Sharm El-Sheikh, Egypt.

26 February (Tuesday): BLOCKCHAIN: What is it? Potential Applications Beyond Cryptocurrencies, TIEC Smart Village Building (B5), Cairo, Egypt.

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral

Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

10 March (Sunday): CIB to hold EGM meeting to look into planned capital increase.

March (date TBD): Traders Fair, Nile Ritz Carlton, Cairo, Egypt.

17 March (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen, seeking EUR 150 mn in damages.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg)

18-19 March (Monday-Tuesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

April: The EUR 250 mn first phase of Egypt’s national waste management program kicks off.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna (Bloomberg)

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

29 August (Thursday): Islamic New Year (TBC), national holiday.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Cairo, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.