- Who’s going to IPO this year? Find out in our first Enterprise IPO Poll of Analysts. (Go with the Flow)

- Speed Medical closing in on Al Safwa Hospital acquisition, says it will spin-off and IPO hospitals arm. (Speed Round)

- Do you go out? Laugh tonight with Beit El Comedy in New Cairo. (Out and About)

- It’s Superbowl Sunday. (On the Tube Tonight)

- Fat doesn’ make you fat — and eating lots of it (and very little carbs) can put your diabetes in remission.

- Women lie, men lie, but the numbers don’t. (Office Life)

- Emerging markets just posted their 10th straight month of positive inflows. (Macro Picture)

- We don’t need an “agonizing reappraisal” of US-Egypt relations… (Parting Shot)

Sunday, 7 February 2021

Welcome to the first issue of EnterprisePM

TL;DR

WHAT WE’RE TRACKING TONIGHT

Good afternoon, everyone, and welcome to our very first issue of EnterprisePM, your afternoon briefing on what’s going on in Egypt and emerging markets — and your guide to where you may want to spend your time and money tonight.

Wait, what? Are you moving to afternoons? Nope. EnterpriseAM will still be out each weekday day at 6am CLT, just as usual.

Tons of readers have been asking for an afternoon briefing for years…

…and we’re delighted to finally bring it to you in association with our friends at CIB and Act Financial.

EnterprisePM is designed to help you leave work behind when you check out of the office, whether your commute is across town, down the hall to your family room or entirely fake. Each issue will include:

- A quick update on the news of the day so you start your evening without FOMO;

- News analysis and explainers to take you behind the headlines;

- Arts, lifestyle and culture coverage, with an emphasis on what’s happening here in Egypt

- Stories on how to be a better boss or business owner — or how to become the boss or start your own business;

- Trend lines that go beyond the headlines — stories that talk about the defining issues of our generation, from technology and AI to climate change, healthcare and financial inclusion.

EnterprisePM will be out each weekday day by 3:45 pm, and we’d love to hear what you think about it on editorial@enterprise.press. And a little later this year, it’s going to be the vehicle through which we send you the thing you (in aggregate) have been asking for the most…

*** Look for EnterpriseAM, your essential rundown on the day ahead, in your inbox each morning at 6am CLT, Sunday through Thursday.

On an otherwise quiet afternoon, the BIG NEWS HERE AT HOME is the latest sign that the red-hot healthcare sector is not going to slow down anytime soon. Speed Medical is closing in on its acquisition of Al Safwa Hospital and is telegraphing that an IPO for the hospitals division could be in the cards.

Watch this space: Dubai plans to vaccinate “all eligible adults” by the end of the year, Bloomberg reports. And no, there’s still no sign that the UAE plans to allow non-residents to fly in and pay to be jabbed.

???? HAPPENING THIS WEEK-

What kind of week is it going to be? In a word: Workaday (adjective: not special or unusual; ordinary). The “new year, new you” kick of January is over and we’re well into a month in which the rubber needs to hit the road: Sales teams face empty columns in their trackers, finance folks are working on their FY2020 close, and product owners have a full year of stuff on their roadmap on which to start grinding.

It’s officially mid-year break for public schools. Office-bound readers can look forward to much smoother commutes from now through 18 February.

AUC is hosting a webinar headlined the Rise of Citizen Capitalism with guest speakers Michael O’Leary (Linkedin), MD at Engine No. 1, and Two Sigma partner Warren Valdmanis. It airs tomorrow evening at 7pm CLT and you can register for it here.

STAT OF THE DAY: Three. The number of TV crews shooting TV serials in Maadi this morning — a sure sign that the Holy Month is nearly upon us. There are 65 days left until Ramdan.

|

???? MARKET WATCH-

Bubble? What bubble? Investors expect a “strong growth environment based on expectations of additional fiscal stimulus and an improved vaccine outlook,” according to a recent Goldman Sachs note summarizing the results of its latest “Marquee QuickPoll” survey of more than 1k of its institutional investor clients. Goldman’s clients are looking beyond the GameStonk short squeeze, and 54% of them expect “mass US vaccine distribution by July.”

It’s a Bubble, Damnit, chapter 312: One of the world’s top value investors is worried that central bank policies and government stimulus have made it impossible to tell the true health of the economy — and with it, impaired our ability to gauge risk in the market. A data point on the journey, courtesy dotcom bubble fixture Henry Blodget (who now runs Business Insider): The “percentage of public companies that are losing money is now at an all-time high, exceeding even the dotcom boom…” Famed investor Jeremy Grantham said earlier today that the US stock market “is in a bubble with ‘very seldom seen levels of investor euphoria.’”

How could this ever end badly? Third SPAC ETF launch taps into blank-check company boom.

???? FOR YOUR COMMUTE-

⁉️ WHAT THE [REDACTED] IS… Dogecoin? The cryptocurrency has been having a moment on Twitter the past few weeks and is now worth a total of more than USD 6 bn. But it started out as a joke — literally — back in 2013 and is based on a meme of a “Shiba Inu dog with bad spelling habits.” The inventor “set out to create a coin so ridiculous it could never be taken seriously. In return for solving mathematical puzzles, dogecoin miners operating fast-running computers received anywhere from one dogecoin to hundreds of thousands of dogecoins.” Who brought it back to life? None other than Elon Musk in a tweet. The WSJ has the full story.

Stop us if this sounds familiar: The UK is about to roll out a tax on folks whose bottom lines have grown too heavy in this era of covid — and has a new online sales tax in the works, Reuters reports, stopping short of saying how much the one-off “excessive profits tax” would work. The announcement should drop in the first week of March.

That’s not the only idea that just won’t die: The hunt for the mythical creature known as a “four-day workweek” is still a thing, at least if the nice people at CNBC are to be trusted, writing that the Spanish government decided last week to try a four-day workweek for a three-year period. Read: A 4-day work week might be edging closer — here’s why.

Are you / your kid / your little sister going into healthcare, finance, law or, uh, “computers, math”? Odds are good robots won’t be claiming your / their jobs in the next 10 years, the Wall Street Journal suggests, predicting they’re among the fields likely to see the most job growth through 2029. Figures in the story are from the US of A, but the trends will hold.

???? Fat doesn’ make us fat — and eating lots of it (and very little carbs) can put your diabetes in remission. It may also help prevent Alzheimer’s disease, which some researchers are now referring to as “diabetes of the brain.” Go read the Guardian’s awesome interview with science journalist Gary Taubes, who has spent 20 years beating the drum that low fat is nonsense and that the “calories in, calories out” theory of weight loss is … complete rubbish. Sold? Want to go deeper? Go snag a copy of his The Case for Keto: Rethinking weight control and the science and practice of low-carb / high-fat eating.

EGYPTIANS DOING WELL ABROAD- An Egyptian-American just became the first Muslim to be named head of the Harvard Law Review in its 134-year history. And you want badass? Check out this Egyptian peacekeeper on patrol in Bukavu, Congo:

???? FROM THE DEPT. OF URBAN PLANNING-

The Cairo Eye is shaping up to be an eyesore and politicians are taking a step back. The proposed EGP 500 mn ferris wheel doesn’t belong to the Tourism Ministry, minister Khaled El Anany emphasized in remarks to MPs. House Tourism Committee head Nora Ali wants authorities to move it off the island of Zamalek, where residents worry that it will snarl traffic. The development was announced last month. Count elder statesman Amr Moussa among those who really — really — doesn’t like the thing.

Also unpopular with local residents: A planned bridge near the Virgin Mary Catholic Cathedral in Heliopolis. Members of a cathedral committee say it would be an eyesore — and could threaten the structural integrity of the building, Masrawy reports. Church officials have the backing of the Maronite and Roman Orthodox Church and are jointly appealing to MPs and members of the Senate asking that action be taken.

???? ON THE TUBE TONIGHT-

???? It’s Superbowl Sunday for folks who follow American football with the Tampa Bay Buccaneers (14 and 5 for the season) facing off against the Kansas City Chiefs (16-2). Kickoff is at 1:30am CLT. CBS Sports has three bold predictions for the game, including that it will be settled in OT. The real highlight for readers of a certain age: Wayne and Garth are back as Mike Meyers and Dana Carvey bring their iconic Wayne’s World characters back to life in a spot for Uber Eats that will also feature Cardi B.

Look for the stock market to do better this year if the Buccaneers come out on top, says a market watcher in this fun piece from CNBC.

⚽️ In (real) football: Starting with the Premier League, the Spurs will have already faced West Brom by the time this issue reaches your inbox, but you can start off your after-work day with the Wolves who will play against Leicester City at 4pm CLT or Liverpool’s match against Manchester City at 6:30pm CLT. Sheffield United and Chelsea will also hit the field at 9:15pm tonight.

La Liga has a few matches on today that could catch your eye: Real Sociedad are currently on the field against Cádiz, with the next match at 5:15pm CLT between Valencia and Athletic Club. Osasuna will head off against Eibar at 7:30pm CLT, while Barcelona will play against Real Betis and Atlético Madrid will play against Celta Vigo, both at 10pm CLT.

Serie A sees two matches to be played at 4pm CLT between Udinese and Vorona and between Milan and Crotone. Parma will play against Bologna at 7:30pm CLT, with the league finishing up the day with a 9:45pm CLT match between Lazio and Cagliari.

DO WE NEED TO REMIND YOU about the Al Ahly-Bayern Match playing tomorrow? The Egyptian team qualified for the semi-finals of the Club World Cup after beating Qatar’s Al Duhail 1-0 on Thursday.

???? OUT AND ABOUT-

Need a laugh? Catch Beit El Comedy standup comedy night at 8:30pm CLT featuring seven performers. Venue: The Room New Cairo.

Karim El Hayawan’s Between Here & Elsewhere exhibition opens this evening at 6-9pm CLT and runs through 25 February. El Hayawan looks at the history of the rugs that lay within some of Cairo’s most iconic mosques. Venue: Zamalek’s Soma Art School & Gallery.

The Cairo Opera is paying tribute to legendary Italian violinist Niccolò Paganini with a concert by The Cairo Chamber Music Youth Ensemble. The performance gets underway at 8pm CLT tonight — get your tickets here.

What could be George Bahgory’s “very last [exhibition] while the artist is still alive” is on at Downtown’s Mashrabia Gallery. A Sketch is a Sketch is a Sketch closes on 17 February.

???? TOMORROW’S WEATHER- We’re looking at three of sunny skies with cloudy periods and unseasonably warm daytime hights of 27°C Monday through Wednesday. Have we mentioned, lately, that Egypt has the world’s best winters?

SPEED ROUND: M&A WATCH

M&A and an IPO in the works for Speed + Savola looking at an Egypt acquisition

Speed Medical closing in on Al Safwa Hospital acquisition, says it will spin-off hospitals arm ahead of IPO: A consortium led by Speed Hospitals — a subsidiary of diagnostics and healthcare firm Speed Medical — is looking to acquire a 100% stake in Six of October’s New Al Safwa Specialized Hospital in a transaction worth c. EGP 185 mn, according to a disclosure (pdf). Speed Hospital itself wants at least 50% plus one share of Al Safwa along with management rights, with the rest of the equity to be placed with unnamed local and regional investors.

Among those investors: Sister company Prime Speed Medical Services, which said in a regulatory filing (pdf) that it’s in for 10% of New Al Safwa Specialized at a cost of EGP 18.5 mn.

EFG Hermes Leasing is providing Speed Hospitals with financing worth EGP 92.5 mn to complete the transaction. Our friends at Pharos Holdings are said to be advising on the transaction.

Speed Hospitals could IPO within three years: Speed Medical is looking to grow its hospitals arm before spinning off the division ahead of a potential IPO, which is expected to happen at some point in the coming three years, according to the disclosure. Speed Hospitals plans to raise Al Safwa Hospital’s capacity to 150 beds from a current 67, while also growing its own facility in Obour City to 140 beds. The company wants to have 300 beds under a single corporate umbrella by the time of the IPO. Speed Medical became last year the first company to make the jump from Nilex baby bourse to the EGX.

Attractive healthcare sector goes red hot: This is the second major healthcare M&A we’ve heard of so far in 2021 following the Cleopatra Hospital – Alameida merger late last year. A consortium made up of Mabaret Al Asafra Hospitals and Africa-focused investment firm Tana Africa Capital are reportedly bidding on Abu Dhabi Commercial Bank’s (ADCB) 51.5% stake in Alexandria Medical Services.

IN OTHER M&A NEWS- Saudi Arabian food conglomerate Savola Group is considering acquiring food companies in Egypt and other markets as part of its regional expansion in Egypt, Savola Foods’ chief strategy officer Mohamed Badran tells Masrawy. The target of the acquisition is a company that produces products that Savola currently does not have market share in, he added. He hopes that the acquisition — which comes as part of the company’s five year plan to expand its footprint in the region — will be completed by the end of the year.

CLARIFICATION- An earlier version of this story suggested that Savola is eyeing a particular Egyptian food company for its acquisition plan. The Saudi conglomerate is currently studying several potential targets.

SPEED ROUND: DEBT WATCH

Management of Tamweel’s EGP 500 mn bond issuance up for grabs?

Mortgage and consumer finance company Tamweel Holdings is planning a EGP 500 mn securitized bond issuance some time in 2Q2021, managing director Mohamed El Kahkaky says. The move is likely meant to grow the company’s mortgage finance portfolio to EGP 700 mn in 2021, up from around EGP 606 mn in 2020, he added. The company has yet to decide who will manage the issuance, El Kahkaky added.

No word yet on when Tamweel will be spun off: Parent company Ebtikar is planning to spin off Tamweel and Vitas Egypt from its e-payment businesses Bee and Masary ahead of a planned IPO by Ebtikar in the second half of 2021, Omar El Labban, the IR director of majority shareholder B Investments, told Enterprise last week. El Kahkaky did not mention when the planned spin off will take place.

CATCH UP QUICK-

- Zamalek FC’s board caught another “L” courtesy of the Administrative Court, which reaffirmed the suspension of the board and its chairman Mortada Mansour, Al Masry Al Youm reports.

GO WITH THE FLOW

Who’s going to IPO in 1H2021? We asked four top analysts.

Welcome to the first EnterprisePM IPO poll, where top sell-side actors talk up their expectations of who’s going to market — and when.

IN THE HOT SEAT TODAY- CI Capital co-head of research Monsef Morsy, HC head of research Nemat Choucri, Prime Holding’s head of research Amr ElAlfy, and Renaissance Capital’s head of MENA research Ahmed Hafez.

In our 2020 year in review, we identified a 2021 IPO pipeline anchored by seven companies, based on our Enterprise Realness Rating. Today, we take the pulse of four leading analysts on whether they think we got it right — or are out to lunch.

CI Capital’s plan to take Taaleem Educational Services public in 1Q2021 is on track, Morsy conrirmed. CI said it is planning to list up to 40% of its education management venture in 1Q2021. Choucri is also confident the IPO will take place in the same timeframe, but ElAlfy thinks it could happen later in the first half. The Education Ministry’s move to scrap the 20% cap on foreign ownership of private schools is unlikely to impact the timeline, but could positively impact the valuation, ElAlfy adds.

Three of the four believe NBFS player Ebtikar is also very likely to go to market: Choucri believes it could happen as early as 1Q2021, Morsy believes it could happen a little later (likely in 2Q) while ElAlfy sees it in 2H2021.

Integrated Diagnostics Holding, which a report in the press claims could pull the trigger on its dual listing of ordinary shares on the EGX before 1Q2021 is out, looks like it will almost surely happen in 2021, with Morsy and Hafez favoring the first half.

Three of the four think e-Finance will happen this year: Hafez believes the sooner the IPO takes place, the better. Choucri thinks it could happen in 1Q, while ElAlfy sees 2Q as the likely scenario, but also believes e-Finance should have gone to the public market in 2020 following Fawry’s successful sale. Morsy thinks another state-owned company could likely IPO before e-Finance.

On the flipside: Morsy favors Banque du Caire for 1H2021, while ElAlfy and Choucri think the initial public offering by the state-owned giant could slip to the second half or even 2022. Choucri points to weak investor sentiment towards the banking sector in 2020, outside EGX30 heavyweight CIB. Hafez believes the IPO is unlikely in 2021, citing the same reasons.

Macro Pharma is flying below the radars of three of the four analysts, and the interesting food outfit Galina said an EGP 600 mn stake sale via private placement being quarterbacked by RenCap. A full listing on the EGX listing would follow, the company’s founder said, but it’s not likely to be this year.

Who did we miss? Choucri is on the lookout for Raya Holdings NBFS arm Aman Financial Services, which we had recently reported was eyeing an IPO within the coming two years. ElAlfy believes we could see IPOs from the Public Enterprises Ministry or the military’s National Service Products Organization in 2H2021.

What about stake sales of partially privatized state-owned companies? Hafez thinks Abu Qir Fertilizers could come to market if there’s a commodity price rally driven by China.

When’s the best time to go to market? While 1H will be welcoming to payments and NBFS offerings in a market hungry for new paper, ElAlfy and Choucri think 2H2021 looks more promising, expecting both a more comprehensive rollout of vaccines against covid-19 (here and in global markets) as well as further interest rate cuts by the CBE to boost appetite for Egyptian equities. Hafez believes 1H is best if a company is ready.

What do they want to see more of? Morsy tips banking. ElAlfy would like to see more ins. companies. Choucri, meanwhile, highlights payments and education (noting the performance of CIRA and Fawry over 2020) and thinks the fundamentals speak in favour of NBFS given the very wide swath of companies under-served by more risk-averse banks.

TODAY’S MARKET CLOSE-

The EGX30 ended today’s session flat on turnover of EGP 1.75 bn (19.5% above the 90-day average). Foreign investors were net sellers. The index is up 7.0% YTD.

In the green: Orascom Investment (+7.5%), Pioneers Holding (+6.1%) and GB Auto (+4.1%).

In the red: Sidi Kerir Petrochemicals (-1.3%), Abu Qir Fertilizers (-1.1%) and Heliopolis Housing (-1.0%).

WHAT’S DRIVING THE MARKET today? We asked Prime Holding’s chief economist, Mona Bedeir:

“Macro triggers like interest rates and monetary easing have limited impact on trading,” says Bedeir, pointing to the market’s muted reaction to 400 bps worth of rate cuts in 2020. “It was expected that the CBE wouldn’t act in this meeting.” What does have an impact on trading? The current retail-driven market is on the lookout for IPOs and M&A activity to open the door for “fresh product, a fresh injection of money, and new investors.”

While it won’t impact trading, Bedeir is anticipating the core inflation reading to get a proxy indicator on demand pressure inflation. Core inflation is on a downtrend and is currently less than its 10-year average, she adds, which is considered “muted inflation pressure” and therefore muted demand. From the corporate perspective, it gauges how much room a firm has to adjust their pricing strategy if the cost of inputs increases, which is difficult when there’s no demand, she says.

OFFICE LIFE

Women lie, men lie, but the numbers don’t

How we lie in job interviews: Chances are, there were at least a few white lies and half-truths that made their way into the conversation. And while that’s quite common, they don’t necessarily translate into getting you the job, or long-term job satisfaction. As both sides of the job interview tend to do it, it doesn’t mean the employer gets the best employee for the job. By polling psychologists, consultants, hiring managers, etc. Wall Street Journal has prepared a nifty guide on the lies potential employees and employers tell each other in a job interview.

The applicant: It is typically the younger, more competitive, and (obviously) narcissistic and psychopathic applicants that are likeliest to fib on an interview, according to a 2020 study. There lies are diverse: from disingenuous compliments, to omissions, to exaggerations and outright fabrications.

Not all of them are all that bad, though: Compliments cannot hurt. But more importantly, there may be information that a candidate should obscure from the CV, says Kathryn Minshew, chief executive of careers site the Muse. These include hiding your birthdate and address to avoid bias in hiring based on age and location. She also highly recommends not divulging particular medical conditions.

The interviewer: Exaggerating the importance of a company role, and ease of mobility within it, along with minimizing downsides appears to be the common thread with them.“Every interviewer swears that they’ve got a fabulous corporate culture,” says Judson Vaughn, CEO of First Impressions HQ in Atlanta.

And a common pitfall they fall into is willful ignorance. Hiring managers are so desperate to fill the position, they will almost accept a candidate’s lie at face value without probing.

As with any relationship, honesty is the best way to go: The lesson here isn’t to train hiring managers to be Stazzi interrogators or to infuse applicants with the charm of Bernie Madoff. It’s to highlight that while lying in job interviews is common, honesty is the best way to secure a long term hire, as ultimately faking it till you make it can only get you so far.

MACRO PICTURE

We’re happy when EMs score USD 53.5 bn in a month

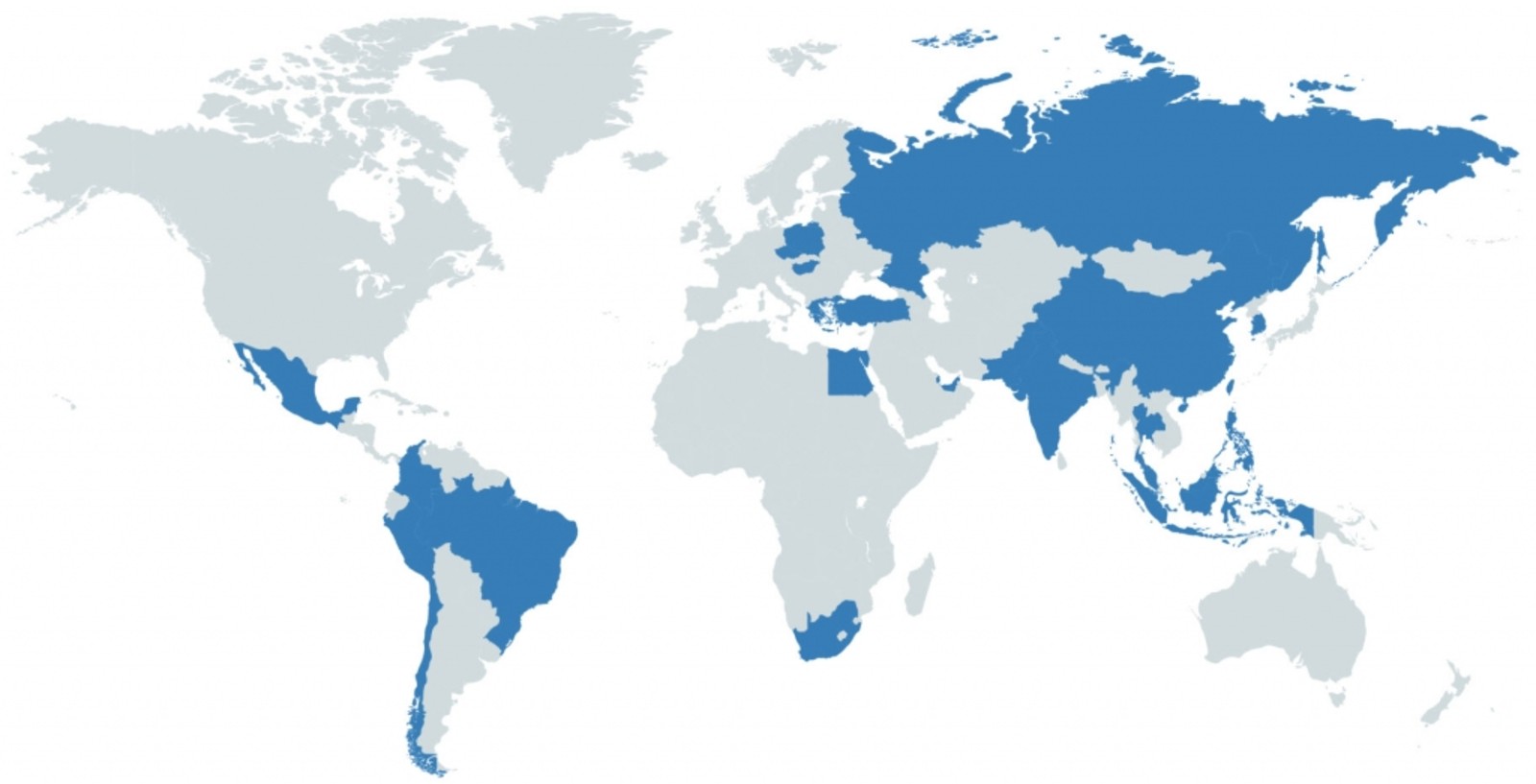

Emerging markets posted their tenth consecutive month of positive net portfolio inflows, a sign that EMs are in favor with global investors, according to the Institute of International Finance’s (IIF) monthly capital flows tracker picked up by Reuters. EM stocks and bonds attracted some USD 53.5 bn of net inflows in January, with USD 44.2 bn going towards debt instruments, and USD 9.4 bn going to EM equities.

China (which the IIF still thinks is an EM) was at the top of the leaderboard: The world’s second-largest economy brought in some USD 15.4 bn in debt inflows and USD 2.7 bn into equity, the IIF’s tracker showed. This came despite an “important outflow episode” from Asian stocks and bonds in the last week of January, highlighting “lingering weaknesses across EM in a post-covid-19 scenario.”

February could be a good month for EM equities, says Barron’s: EM equities saw net inflows of USD 5.7 bn in the first week of February, marking 19 out 20 weeks of “large inflows” in recent months, strategists at Bank of America said, according to Barron's (paywall). Investors prefered the EM stocks over those of the US, which witnessed USD 7.3 bn in net outflows (their largest in the past six weeks). While the S&P 500 was up just over 4% for the week, the iShares MSCI EMs exchange-trade fund gained more than 5%.

Looking ahead, the IIF is “relatively constructive” on its outlook for EMs. The global association expects inflows into the EM asset-class to continue generating momentum, citing heightened liquidity in markets and the vaccine rollout. EM equities will continue doing well, and a so-called “reinflation” in global trade will lead to more inflows coming their way, Citizens Bank head of global markets Tony Bedikian tells Barron’s.

Also, equity valuations across EMs are quite reasonable, Citi strategists said recently.

One thing to keep in mind, though: The performance of EM assets is a cyclical trend, rather a structural change we can expect to last long, says US-based portfolio manager Brandywine Global macro strategist Anujeet Sareen.

How are we doing in Egypt on the foreign inflows front? Foreign investment in EGP bonds has continued to rebound through the beginning of 2021 after a covid-inspired sell-off that swept emerging markets. Total holdings stood at USD 26 bn in mid-January, up from USD 23 bn at the end of November and is less than USD 2 bn shy of pre-pandemic levels. In terms of inflows into equities, the strong EM rally could spill over to Egypt, potentially reversing the 2020 trend that saw foreign institutional investors firmly positioned as net sellers every month on the EGX, Renaissance Capital’s head of MENA research Ahmed Hafez said in a note last month.

PARTING SHOT

We need to avoid an “agonizing reappraisal of basic United States policy.” Observers of the US-Egypt relationship could do much worse than to read former ambassador Frank Wisner’s recent piece headlined The United States and Egypt: Constant interests require consistent policies in the Cairo Review of Global Affairs, wherein he subtly reminds the Biden administration that “No other Arab platform—not Saudi Arabia, nor the UAE—offers the United States the same potential of partnership which Egypt does. We have developed over the decades strong habits of cooperation with Egypt’s military, intelligence services, diplomacy, government and business and academic communities. These ties matter in the design and execution of policy.”

And on the other side of the Atlantic? “Egypt should think carefully about how contribute to the relationship with the United States. … Egypt has daunting challenges in the years ahead and needs sustained economic growth to provide for the wellbeing of its population. America can be a source of investment, trade and technology, provided Egypt’s policies are conducive.”

(With apologies to the heirs of Mr. John Foster Dulles.)

CALENDAR

February: France’s finance minister, Bruno Le Maire, is set to visit Egypt.

6-7 February (Saturday-Sunday): African Union annual summit.

6-8 February (Saturday- Monday) Students will be able to upload their educational certificates on the Higher Education Ministry’s electronic university admissions site

6-18 February (Saturday-Thursday): Mid-year school break (public schools — enjoy the break from bumper-to-bumper traffic).

7-28 February (Sunday-Sunday): The Finance Ministry will receive applications from companies wishing to take part in the second phase of its program for the immediate payout of export subsidy arrears to exporters, minus a 15% fee.

8 February (Monday): Egypt leads an emergency Arab League minister-level meeting on the Israel-Palestine peace process.

8 February (Monday): AUC will hold a webinar titled ‘The Rise of Citizen Capitalism’ featuring Michael O'Leary, the managing director of Engine No. 1, and Warren Valdmanis, a partner at Two Sigma.

9 February (Tuesday): International Conference on Global Business, Economics, Finance and Social Sciences, Ramses Hilton, Cairo, Egypt.

10-11 February (Wednesday-Thursday): Egypt will host an arm of the World Conference on Science Engineering and Technology, Hotel Pavillon Winter, Luxor, Egypt.

12 February (Friday): Deadline to reach a settlement with the Tax Authority on overdue income, value-added, or real estate taxes without all the late fees. Late taxpayers are still eligible for a 50% exemption on interest fees and late penalties until 12 February under a bill passed last year, Tax Authority boss Reda Abdel Kader said.

12-15 February (Friday-Monday): Students will be able to apply for placement at private universities on the Higher Education Ministry’s electronic university admissions site

20 February (Saturday): Final results of applications for private university places will be announced on the Higher Education Ministry’s electronic university admissions site

22-24 February (Monday-Wednesday): Second Arab Land Conference on land management, efficient land use, among other topics.

22 February- 5 March (Monday-Friday) Egypt will host the World Shooting Championship in 6 October’s Shooting Club, with 31 countries set to participate

26 February (Thursday): The Afro Future Summit will take place virtually.

28 February (Sunday) Deadline for businesses, sole traders, and those generating income from sources other than their day job to file wage tax returns through the electronic filing system.

March: Potential visit to Cairo by Russian President Vladimir Putin.

4-6 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

31 May-2 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt,

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.