- Non-oil private sector conditions worsened for the third consecutive month in February, but at a milder rate. (Speed Round)

- Ankara: Turkey and Egypt could negotiate an East Med maritime demarcation agreement if strained relations improve. (Speed Round)

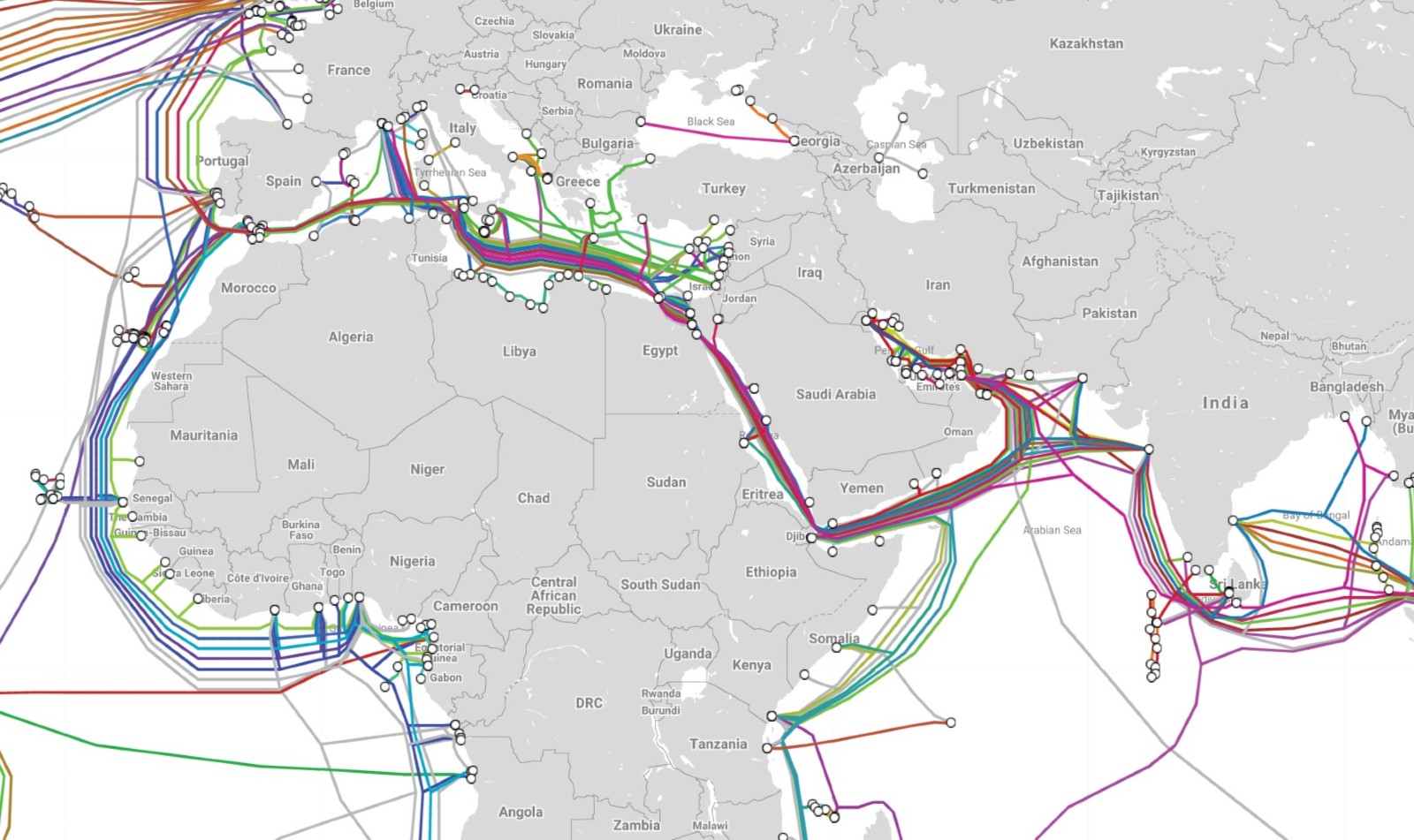

- Telecom Egypt is planning to connect landlocked and coastal African countries to Europe through a giant subsea system. (Speed Round)

- FRA wants listed companies to justify stock splits. (Go with the Flow)

- Witnesses for the defense are called up in the trial of the People vs short sellers. (The Macro Picture)

- Oh yeah, why aren’t we being watched over yet by machines of loving grace? (Artificial Intelligence)

- Sorry, Wayne Brady (or Comedy Central, rather). Dave Chappelle has his show back (his show back, his show baa…). (On the Tube Tonight)

Wednesday, 3 March 2021

EnterprisePM — Non-oil private sector contracts again in February

TL;DR

WHAT WE’RE TRACKING TONIGHT

Good Afternoon, everyone. And welcome to an action-packed and diplomacy-heavy issue.

Key highlights on the diplo (which we cover in full in the Speed Round below), include:

- Infrastructure diplomacy victory: Telecom Egypt is working on a sub-sea cable that could connect Africa with Europe.

- Is Turkey walking back its aggressive stance on East Med relations with Egypt?

- Will Egypt join other African countries in the WBG’s new vaccine financing initiative?

- Tariffs, tariffs and more tariffs

- Ethiopia reacts to Sudan and Egypt’s united front on GERD.

But first, it’s PMI Day, where we break down in the Speed Round below why non-oil business activity contracted for the third straight month. The good news: the contraction in February was at a slower pace.

COMING UP THIS WEEK- The House Economics Committee has a busy week with key legislation: The draft Unified Insurance Act has finally made it to the House Economic Committee, Al Mal reported today. The committee will discuss the bill, which has been in the making for at least three years, once it's done with ongoing discussions of the Sovereign Sukuk Act and changes to the Competition Act, committee head Ahmed Samir said. The proposed insurance legislation would raise the minimum capital requirement for life and property insurers and grant the Financial Regulatory Authority (FRA) sweeping new powers to oversee the sector.

|

???? CIRCLE YOUR CALENDAR-

AUC is holding Mad March this month, their biggest book sale of the year with up to 75% off on all books. The book sale is on everyday from 10am–6pm CLT at AUC Tahrir Bookstore & Garden and is open to the public.

Tough Mudder’s resilience-testing obstacle course will take place this weekend. You can learn more about Tough Mudder Egypt and register for the event on their website.

The IDC Future of Work conference is kicking off next Monday, 8 March, under the theme “The Path to Business Resiliency”.

The Cairo International Furniture Show, Le Marche, is set to take place from 11-14 March at the Egypt International International Convention Centre, with over 300 local and international brands to showcase their pieces.

The Cairo Fashion & Tex trade show will take place at Cairo International Convention Center from 11-13 March.

???? FOR YOUR COMMUTE-

Biden’s SEC nominee wants to take on Bitcoin: Bitcoin took a 3% dip yesterday after a Senate confirmation hearing from SEC nominee Gary Gensler, who is less than enthusiastic about the cryptocurrency, reports Bloomberg. Gensler suggested that more government oversight of cryptocurrencies is a definite possibility to ensure “appropriate investor protection” amidst debate about whether the rapidly evolving market constitutes a legitimate new asset class or a bubble ripe for abuse, according to Quartz. Tuesday’s Bitcoin slide comes after a 65% rally since December.

You could attend your next event through a hologram: Microsoft has unveiled software tools to make it easier and cheaper to bring virtual reality (VR) and augmented reality (AR) technology to the masses, reports Bloomberg.The company’s Mesh software will allow users to work and play together virtually by interacting with the same set of holograms through devices such as Microsoft’s USD 3.5k HoloLens AR goggles and Facebook’s USD 300 Oculus as well as other VR headsets while cell phones and computers will also enable users to get a 2D view. Mesh could pave the way to hold events such as concerts or company meetings where users can holoport in from anywhere.

Niantic Labs — the creators of Pokemon Go — has already jumped into the fold to collaborate with Microsoft to create more VR and AR-based games through Mesh, the company said on Twitter. The thread comes with a video showcasing some of the possibilities of the new games such as walking around in a world of Pokemon while feeding and interacting with them.

???? ON THE TUBE TONIGHT-

Guess who got his show back: We haven’t said this in a while, but Netflix came through with a pleasant surprise, dropping the ENTIRETY of Chappelle’s Show for Egypt audiences yesterday. For those born after 1995, Dave Chappelle is that old, buff, chain-smoking uncle that likes to give funny (or semi-funny, to be honest) lectures on politics and race relations. But to elder millennials, he was so much more. His brand of satirical standup on race hadn’t really been seen since the Richard Pryor days. He was also a mainstay of the stoner comedies (Half Baked). Oh, and he happened to create the greatest sketch comedy show ever made.

To say the show was revolutionary is an understatement (though very cliche). And coming at a time when Saturday Night Live was going stale, that was no easy feat. Everyone from Amy Schumer to Key and Peele, owe their success in some measure to Chappelle. The show also introduced many up and coming musical talents, including the now-former Mr Kardashian, and inventor of the iPlane One, Kanye West. And reintroduced some old ones: if you went to college in the mid-2000s, you certainly knew who Rick James was.

Chappelle vs The Man (Comedy Central): Netflix running the show follows a brief campaign started by the comedian to boycott watching the show. He revealed in an intensely dark standup act (watch, runtime: 18:33) how essentially Comedy Central took the rights of his show in perpetuity. And that’s all she wrote, apparently. We’re hoping this is a chance to get the band back together — minus the late, great Charlie Murphy, who passed away in 2017 — and get another season going. Ashy Larry really needs a gig.

A new independent streaming service for MENA cinema was launched this month: Shasha provides a platform to watch films and documentaries created by filmmakers in the region that wouldn’t normally get picked up by larger streaming sites like Netflix. Time Magazine was quick to pick up news of the new streaming service and talked to Founder and Iraqi-Irish curator Roisin Tapponi who brings up the problem that while many of these films are screened in Western film festivals, they often are never shown to “the people they’re made by and for and about”. Tapponi created Shasha after noticing this gap of showcasing films in the region, citing a lack of distribution and support as key factors that successful filmmakers remain unnoticed.

The English Premier League has had one hell of a gameweek, and fantasy PL players must be pleased. Today’s match itinerary includes Burnley versus Leicester City at 8pm CLT and Sheffield United versus Aston Villa also at 8pm CLT. The night will finish off with Crystal Palace playing against Man United at 10:15pm CLT.

Meanwhile, Serie A has a whopping total of seven matches on today and the matches to look out for are Milan against Udinese, Fiorentina against Roma, and Parma against Inter Milan, all at 9:45pm CLT.

A match to look out for tonight: Barcelona is playing against Sevilla today at 10pm CLT in the second leg of the Copa del Rey semi-finals. The competition has been stiff between the two teams, with Sevilla winning 2-0 against Barcelona in February, but made a comeback on Saturday winning Sevilla 2-0, reports SB Nation. The winner will go on to play in the Spanish cup’s final.

???? EAT THIS TONIGHT-

If you’ve been to France, you’ve probably seen a handful of Brioche Dorée kiosks and cafes all over, and after sitting in one of those cafes in Paris and coming back to Brioche Dorée Egypt, we can confidently say that the French vibes are very present. We were told that the ingredients they use for their croissants are imported from France (and are some of the best we’ve ever had). You’ll also never see a lovelier glass display filled with colorful and detailed pastries and tarts. We recommend going there for breakfast, because what’s better than coffee, eggs, a croissant, and a tart to start off your day. You can find Brioche Dorée at Cairo Festival City, Downtown Mall, Mall of Egypt, Dandy Mall, and Zamalek.

???? OUT AND ABOUT-

The French Institute in Cairo is kicking off their African Cinema Month today at 6pm CLT with the showing of Le Sapeur by David-Pierre Fila. African films will be screened every Wednesday throughout March to discover the contemporary creations of the continent including dance, performance, fashion, and music.

Magal Explore is holding a fundamentals of chess workshop starting Saturday, 6 March. We’ve heard a bunch of you tell us that you like playing chess, so this could be a good way to destress and hone your chess skills. Magal Explore also has other courses you could look into such as gardening, video production, or graphic design.

The Candy Gang are leaving Ibiza for Egypt this weekend and are set to perform tomorrow at Maadi’s Blue Nile Boat club Tempo (Google Maps). A surprise guest is also expected to hit the stage later on in the night.

???? UNDER THE LAMPLIGHT-

Get a better feel for the rich history of our capital with Cairo since 1900, an architectural guide written by MIT’s Mohamed Elshahed that surveys the city’s eclectic modern constructions, turn-of-the-century revivalism and romanticism, concrete expressionism, and modernist designs. The guide includes entries for more than 220 buildings and sites of note, each entry consisting of concise, explanatory text describing the building and its significance accompanied by photographs, drawings, and maps.

You can get the book at AUC Press’s Mad March book sale, and the MIT Architecture department is holding an online lecture with Mohamed Elshahed on Friday at 1am CLT ([redacted] the time difference).

???? TOMORROW’S WEATHER- Tomorrow is the last of cold days. Our favorite weather app anticipates highs of 21℃ and lows of 11℃ tomorrow, but the weather should pick up as we go into next week, reaching temperatures of 30℃ on Tuesday and 32℃ on Wednesday.

SPEED ROUND: MACRO

New foreign business supports Egypt’s private sector, still in “contraction” territory

Non-oil private sector conditions worsened for the third consecutive month in February, but at a milder rate than the past two months as new exports supported demand, according to IHS Markit’s monthly survey of businesses. The purchasing managers’ index (PMI) gauge rose slightly to 49.3 in February from 48.7 the month before. The gauge remained below the 50.0 mark which separates expansion from contraction.

New foreign business grew at its sharpest in nearly 10 years, helped by “a strong upturn in export demand.” The “upside” made February the slowest month of decline since a dip first seen in December due to the resurgence in covid-19 cases. Businesses said they got into more new contracts and witnessed a “slight” improvement in tourism activity last month.

The pace of overall output contraction was only “modest,” and reflects what could shape up into a recovery as we head further into the year. The same applies to new sales, which dropped at a “less marked” rate compared to January.

“Demand trends have moved closer to stabilisation, particularly as export sales picked up at a record pace … Further growth in exports should help improve overall sales … as the impact of the covid-19 pandemic subsides,” said IHS Markit economist David Owen.

On the downside, firms are less optimistic about the next 12 months, with some citing the risk of permanently going out of business “due to the steep economic downturn caused by the pandemic.” Only 29% forecast growth this year, down from 40% last time around. Some responses “suggested that some businesses may fail before the economy makes a full recovery," Owen said.

Input purchases continued to drop on the back of the fall in output and new orders, and businesses drew from existing stock, but only “marginally.” Renewed pressure on inventories first appeared in January, when firms held back purchases at the sharpest pace in four years.

Most are citing growing input cost inflation, but at a rate that was the weakest since September 2020. This was led by metal commodities, primarily iron and steel. Some of it passed down to clients, yet “only fractionally overall.”

Want to know why input costs are rising? Head back to yesterday’s PM edition for our take on where Egypt stands as commodity prices continue to surge globally, giving way to talks of a potential “supercycle.”

Meanwhile, the employment gauge fell at its slowest rate in 16 months, IHS Markit said. This came as some firms continued to step up hiring due to an increased workload.

Read the report: Tap/click here (pdf) for the press release with more on the main findings.

Elsewhere in PMI land:

- Saudi Arabia’s non-oil private sector improved at a slower pace in February, with the PMI (pdf) dropping to 53.9 from 57.1 in January and output expanding at its slowest since November 2020. The gauge remained in expansion territory after having dramatically shot up at the start of 2021.

- Activity in the UAE improved but continued to do so mildly. New orders resisted rising due to renewed lockdown measures, which led to a drop in the PMI reading to 50.6 in February, from 51.2 the previous month, IHS Markit said (pdf).

- The Eurozone’s PMI (pdf) remains firmly in contraction, despite rising to 48.8 in February from 47.8 a month earlier, as the bloc continues to suffer from a double-dip recession due to persisting lockdowns. There’s still a case for optimism, though, amid hopes for a wider vaccine rollout.

SPEED ROUND: TELECOMS & ICT

Big infrastructure diplomacy “W” in African subsea cables

Telecom Egypt (TE) is planning to connect landlocked and coastal African countries to Europe through a giant subsea system that will circle all of Africa, the state-owned company said in a press release (pdf) this afternoon. The Hybrid African Ring Path (Harp), which TE is set to complete by 2023, will form two main arteries that will begin from a landing point in South Africa to points in three southern European countries. The first will run upwards from the southern tip along the east coast and into France and Italy and second along the west coast into Portugal, forming a harp-shaped structure. The company made no mention of how much the planned project is expected to cost or any other project details beyond the timeline.

TE’s 2Africa cable project will be part of Harp: The 2Africa submarine cable project — in which TE is taking part alongside seven other big names including Facebook, Vodafone, and China Mobile — will be one cable that will form the overall Harp, TE Senior IR Director Sarah Shabayek told us. The planned Harp route will branch out to a new landing point in Sharm El Sheikh and connect to several cities on the Gulf of Suez.

Background: Egypt is a hub for internet submarine cables, with a total of 13 cables landing in the country. The country’s unique geographical location linking Europe with Asia made us an ideal node, and to take advantage, TE has acquired additional stakes in submarine cables and embarked on building new cables from scratch.

DIVE DEEPER- We had a detailed look at our position as a sub-sea cable hub, and the investment needed to exploit this, in a recent issue of Hardhat, our weekly vertical on all things infrastructure. Egypt’s ambitions to emerge as a data hub was also another topic we explored in a recent three-part series by Hardhat (click/tap here for part one, part two, and part three).

SPEED ROUND: DIPLOMACY & FOREIGN TRADE

Are Turkey and Egypt about to put aside their differences in the EastMed?

Turkey and Egypt could negotiate an East Med maritime demarcation agreement if strained relations improve, Turkish Foreign Minister Mevlut Cavusoglu said at a press conference Wednesday, according to Reuters. Egypt’s oil and gas exploration bid round last month had respected Turkey’s territorial claims in the region, which is being looked on positively by Ankara, Cavusoglu said.

Relations between the two countries turned (more) frosty last year when Turkey refused to recognise an agreement between Egypt and Greece creating a joint economic zone in the Eastern Mediterranean, accusing the two countries of infringing on its continental shelf. Ankara vowed it would not allow Greece and Egypt to explore in the area, and pressed ahead with its own gas surveys and naval exercises in an effort to stake its claim to the zone. The Egypt-Greece agreement was itself a reaction to moves by Ankara, which set up a joint zone with the Tripoli-based government in Libya and launched gas exploration efforts in disputed territory.

Turkey is the subject of an Arab League meeting taking place today in Cairo: Foreign Minister Sameh Shoukry is presiding over a ministerial meeting to discuss Turkey’s interference in the internal affairs of Arab countries, according to a Foreign Ministry statement. Meanwhile, Assistant Foreign Minister Badr Abdel Aty sat down with his Russian counterpart Sergei Ryabkov, who expressed interest in Egypt’s plans for the EastMed Gas Forum and discussed unrest within Europe such as in the West Balkans.

Also from the Arab League: Former Egyptian foreign minister Ahmed Aboul Gheit was reappointed as the organization’s secretary-general for a second five-year term, the Associated Press reports, citing MENA. The veteran diplomat was the only nominee for the position, having been nominated by President Abdel Fattah El Sisi in January.

Meanwhile, an LNG carrier arrived at the Damietta liquefaction plant this morning, and began loading a shipment that will be the second to leave the facility since it resumed operations last month, industry sources told Youm7. The carrier will make its way to China with some 157k cbm of LNG on board. The plant was brought back to life recently, after operator Eni last year reached an agreement with the government and its former partner Naturgy.

GERD WATCH-

Over on the Red Sea side of things, Ethiopia is ready to continue GERD negotiations “in good faith” with the mediation of the African Union, the country’s foreign ministry spokesperson said at a press conference Wednesday, Al Arabiya reports. The comments came in response to a joint statement issued by Egypt and Sudan Tuesday, in which both countries reiterated their commitment to a proposal by Sudan to set up an international quartet of the AU, EU, US, and UN to mediate the dam negotiations, and called on Ethiopia to demonstrate “good will” and return to the negotiating table.

COVID WATCH-

Could Egypt be in line for covid-19 funding from the WB Group? The World Bank will deploy emergency financing to around 30 African countries to help the nations access covid-19 vaccines, including the DR Congo, Ethiopia, Niger, Mozambique, Tunisia, eSwatini, Rwanda and Senegal, the bank told Reuters. It did not disclose the amount of funding under discussion, but explained that the financing would “be on grant or highly concessional terms,” the spokesperson said.

It is unclear if Egypt is among the thirty countries. African countries will have to request the financing, several officials tell us. None seem aware if Egypt has made a bid for the financing so far.

TARIFF WATCH-

Egyptian aluminum exports to the US will continue to face tariffs of 12.11% after a review by the US Department of Commerce upheld a decision last year to impose tariffs on 18 countries accused of dumping aluminium sheets in US markets at below market prices. Egypt and other countries will also face an additional 10% tariff imposed by former president Trump under a national security law.

Egypt is imposing its own anti-dumping tariffs on Chinese and Thai truck tire imports for the next five years, according to a Trade Ministry statement. The decision came after an investigation into the practice found that Chinese companies were dumping tires at prices that were 10-37% below their market value, while Thai companies were dumping at prices 7.5%-31% below normal prices. Indian and Indonesian tire imports were also being investigated, but were ultimately not penalised due to comprising less than 3% of the Egyptian tire import market each.

GO WITH THE FLOW

FRA clamps down on stock splits, harassment in the workplace

The EGX30 fell 0.7% at today’s close on turnover of EGP 1.59 bn (8% above the 90-day average). Foreign investors were net sellers. The index is up 5.05% YTD.

In the green: Sidi Kerir (+0.7%), EKH (+0.6%) and CIB (+0.5%).

In the red: Pioneers (-7.6%), MM Group (-6.3%) and Orascom Financial (-5.9%).

MARKET NEWS- EGX-listed companies now need to make a strong case to justify stock splits and seek approval from the Financial Regulatory Authority (FRA) each time they’re planning to split the par value of their stock, according to an FRA decree (pdf) published this morning. The companies have to state “justifications” for the move, and can only call a general assembly meeting to vote on the stock split after obtaining the go-ahead from the FRA.

SMART POLICY FROM THE FRA- The authority has been working with the Planning Ministry and the National Council for Women to draw up a code of ethics to clampdown on harassment in the workplace. It issued a circular to companies today to follow an official charter that requires EGX-listed and non-banking financial services companies to have in place a mechanism to report incidents to a specialized committee that will be set up by the FRA.

ARTIFICIAL INTELLIGENCE

Why we aren’t all taking our orders from Skynet right now

Our growing dependence on machine learning AI comes with its own set of risks: Machine learning AI software is constantly being boasted as the technology of the future that will allow cars to drive themselves, help us make smarter investments, and yield more efficient and accurate healthcare services.

But the introduction of these programs are sometimes beset with problems: Self-driving cars sometimes get into accidents, AI-driven investments turn losses, and incorrect diagnoses are given, underlining the pitfalls of AI’s ability to independently make increasingly complex decisions.

What makes machine learning go wrong? The likelihood of errors depends on a lot of factors, including the amount and quality of the data used to train the algorithms, the specific type of machine-learning method chosen, and the algorithm system, according to the Harvard Business Review. It also depends on the environment in which machine learning was created and operates. For example, if a machine-learning algorithm for stock trading has been trained using data only from a period of low market volatility and high economic growth, it may not perform well when the economy enters a recession because the data isn’t reflective of current conditions.

Not to mention the ethical dilemmas: When given the freedom of making autonomous decisions, machine-learning AI can sometimes be put in situations with a moral dilemma where they might not make the “ethical decision” based on their own algorithms. This could include discriminating against certain genders or races when giving a loan, or self-driving cars needing to decide whether to compromise a vehicle in the next lane or a person on the street.

.

Does that mean we should reel it in? One possible way to control the level of learning an AI program delves into is to introduce only tested and locked versions at intervals as opposed to letting it constantly evolve — that or risk another Hitler Twitter bot. The US FDA decided to take that route and has typically only approved medical softwares with locked algorithms. However, evidence is now showing that these reeled in softwares are just as risky. Locked-algorithm AI doesn’t necessarily lower the occurrence of inaccurate decisions, environment-bound data, or moral risks.

So what is the solution? We’re still pooling ideas: A group of AI researchers at Apple, Amazon, Google, Facebook, IBM, and Microsoft created the Partnership on AI (PAI) in 2016 to develop best practices on AI, improve public understanding of the technology, and reduce potential harm of AI, reports Tech Talk. Among their ventures, PAI created the AI Incident Database which is a repository of documented failures of AI systems in the real world. The database aims to help relevant parties benefit from the past incidents. Engineers can use the database to find out the possible harms their AI systems can cause while managers and risk officers can determine what the right requirements are for a program they are developing.

THE MACRO PICTURE

Putting the shorts on trial

Are short sellers good or bad? They lost big at the start of 2021 as hordes of retail investors took to a Reddit forum to prop up shares, pulling off one of the most aggressive short squeezes in history. More than just being a targeted assault on Wall Street elites that defraud the public, it meant short sellers will now have to constantly look over their shoulders as this newfound power of mns of ordinary Joes coming together threw the entire premise of shorting into disarray.

Short-sellers definitely got their slice of Humble Pie this year. The GameStop frenzy saw a loss making, heavily shorted company's share price surge an astonishing 1200% in a little over two weeks. This led to at least USD 5 bn in losses for hedge funds and investors that were taking short positions in this company alone. Short sellers lost more than USD 70 bn in January alone. The impact was so immense that Citron Research, which has been in the business of identifying promising shorts for 20 years, announced it will now only offer analysis for investors that go long. Melvin Capital, Carson Block, and other multi-bn hedgies also made u-turns as they lick their wounds from the GameStop mania.

Politicians in South Korea, where short-selling is banned, are taking note. They’re banking on the renewed distrust to convince regulators to extend the ban and win over smaller investors ahead of special elections in April.

The anti-shorts stigma isn’t new. The first time short sellers were painted as wrong-doers dates back to 1609, when Flemish merchant Isaac Le Maire tried to short the Dutch East India Company, driving down the company’s stock price by spreading false information and rumors. The company convinced authorities to outlaw the practice, arguing that those who profit from and call for lower stock prices are a menace to innocent shareholders. If they’ve survived until now, isn’t that (perhaps) an indication that there’s some value to their work?

Are short sellers really the bad guys? While “few tears are being shed” for hedge funds that profit from the demise of stocks, it’s only sensible to give some credit to those that (methodically) attempt to pick fault in fraudulent businesses. By some accounts, it wouldn’t be too far-fetched to say that a fair share of short sellers are unsung heroes of the global financial system.

Fans of short selling would agree. They say it’s a necessary and much-needed endeavour, helping to single out companies with a questionable existence. The most recent example in our collective consciousness is Wirecard, the once-high-flying German fintech outfit that was exposed to EU regulators and public pension funds for bad accounting practices, with the help of short sellers.

Not convinced? Netflix’s Dirty Money has a prime example of this in an episode how short-sellers poked holes in Canadian pharma giant Valeant’s acquisition-driven business model. There’s also The China Hustle (also on Netflix), which covers how short-sellers uncovered fraudulent SPACs bringing Chinese firms with fraudulent financials to US markets.

Short-sellers also remind us of the importance of fundamentals as those that had paid attention and invested right seldom are in a position to be hurt by campaigns against companies targeted by shorts in the first place. They give an alternative view and help companies reach a fair value.

Still not convinced? Maybe this Forbes piece can change your mind: If You Don’t Like Short Sellers, Then You Wish Blockbuster, NetZero And Circuit City Still Existed.

If short sellers are that great, what’s the fuss about? The main argument against them is that they contribute to market volatility. They also practice a risky art that’s often leveraged with hefty debt, and a collapse of a large hedge fund would have far-reaching consequences.

And they’re an easy pinata for the sins of the whole market: Short sellers weren’t the only ones affected, and it’s “far from” clear if they’ll be the first to tap out, Allianz Chief Economist Mohamed El Erian writes in an op-ed for Bloomberg. The sellers were part of a triad, which also includes intermediaries (who are racing to protect themselves and are forced to “cough up”) and the retail traders themselves (who are now empowered like no other time in history), says El Erian. Even if some natural punch kicks one player out the game, regulators and politicians won’t stay quiet for long. We can expect to see some form of “small investor protection, investment suitability criteria, margin limits, possible collusion and price manipulation, and market structure,” adds the Egyptian-American guru.

More on short-selling:

- What’s a short? Come on, you should know that by now. If you don’t, go read Enterprise.

- Here at home: Short selling was launched on the EGX at the end of 2019 but has had a lackluster year since. In the first four months of 2020, the bourse only saw “a handful” of short selling transactions worth EGP 100k.

CALENDAR

March: Potential visit to Cairo by Russian President Vladimir Putin.

1 March: Eastern Mediterranean Gas Forum comes into effect.

4 March (Thursday): The 14th OPEC and non-OPEC ministerial meeting.

1-5 March (Monday-Friday): Aswan Forum for Peace and Development will take place virtually.

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

11-13 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.