- More of you are feeling downbeat about our economic prospects as headwinds mount. (Enterprise Reader Poll)

- Sukuk roadshow ends today. (What We’re Tracking Today)

- Sovereign Fund of Egypt reportedly eyeing a minority stake in El Ezaby. (M&A Watch)

- Three consortiums bid for Alexandria metro project. (Infrastructure)

- Magued Sherif steps down from SODIC after eight years. (Moves)

- Senate approves bill allowing informal industrial projects to get temporary licenses. (Legislation Watch)

- Heliopolis Housing shareholders approve scrapping Heliopark tender. (Also on our Radar)

- The USD is rebounding on raft of strong economic data. (Planet Finance)

- The changing landscape of retail banking in the Middle East. (A Message from HSBC)

- Teachers aren’t happy with their shrinking salaries. (Blackboard)

Monday, 20 February 2023

AM — The results of the 2023 Enterprise Reader Poll are here

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, ladies and gents. If you read nothing else this morning, make sure you check out the results of the 2023 Enterprise Reader Poll, which we’re publishing in this morning’s issue.

No sugarcoating: It doesn’t always make for cheery reading. In the four months since we last did this, you have become noticeably more gloomy about the prospects for the economy, and in between soaring inflation, a weaker EGP and struggles accessing FX, the results are as downbeat as you’re probably expecting.

Yes, but: That’s not to say it’s all bad news, though. Investment plans seem to be holding up and positivity over M&A and FDI prospects remains.

We have the full results in this morning’s news well, below.

WHAT’S HAPPENING TODAY-

Stay tuned for a sukuk update: Investment banks are expected to wrap up calls with investors regarding Egypt’s potential sovereign sukuk issuance today, meaning we could just be a few hours away from learning whether the sale is going ahead, and — if it is — how much the government could raise. Both Bloomberg and Reuters have reported that the Finance Ministry is planning to sell a benchmark-sized USD-denominated sukuk — usually at least around USD 500 mn — with a three-year tenor.

Who’s working on the issuance: Our friends at HSBC are acting as lead managers and bookrunners along with Citigroup, Credit Agricole, Emirates NBD Capital, First Abu Dhabi Bank and Abu Dhabi Islamic Bank.

Uzbekistan President Shavkat Mirziyoyev starts a two-day visit to Egypt: Mirziyoyev will hold “high-level talks on a wide range of issues to further strengthen Uzbekistan-Egypt relations,” a statement from the president’s office said, without disclosing details. The country’s investment, industry and trade minister, Laziz Kudratov, said the visit will “mark a new start for investment relations” between the two countries. Kudratov was speaking in Cairo yesterday at the Egyptian-Uzbekistan business council, during which several MoUs were signed between Egyptian private companies and the Uzbek government to invest in the pharma, textile, energy, electricity and healthcare sectors.

ON THE SENATE THE AGENDA-

- The Agriculture Committee will discuss problems facing the poultry industry;

- The Culture Committee will debate how to increase tourism to Rashid;

- The Education Committee will discuss increasing the number of language and Japanese schools to meet growing demand.

WATCH THIS SPACE- Good news for contractors: The state will soon start disbursing compensation to contractors and builders who have suffered losses on state projects due to recent economic reforms, according to a decision published in the Official Gazette last week. The House late last year approved amendments allowing contractors whose work on state projects has been impacted by the devaluation of the EGP to file for compensation.

THE BIG STORY ABROAD-

Leading the front pages in the global business press this morning: Facebook parent Meta is preparing to launch a monthly subscription service aimed at content creators called Meta Verified that will introduce additional features and new services. For USD 11.99 a month, El Face will give you “proactive account protection, access to account support, and increased visibility and reach,” a company spokesperson said. Meta Verified is set to be tested in Australia and New Zealand this week, with other countries to follow later. (Bloomberg | Financial Times | WSJ | CNBC)

|

COME TO OUR NEXT ENTERPRISE FORUM-

We’re excited to unveil our next C-level event: The Enterprise Exports & FDI Forum, where we will take a deep dive into two of the most critical topics affecting our community.

Exports and foreign direct investment (FDI) have never been more important to our economy — or our businesses — than in the wake of the float of the EGP. We think we have a once-in-a-lifetime chance to build an export-led economy that makes us a magnet for FDI and all the benefits that will come with it for our nation.

ICYMI-

Missed this week’s Inside Industry? In our weekly vertical exploring all things industry and manufacturing, we looked at draft legislation that would legalize hundreds of thousands of unlicensed industrial projects.

CIRCLE YOUR CALENDAR-

Egypt is hosting the U20 Africa Cup of Nations: The pan-African tournament kicked off yesterday with Egypt and Mozambique playing out a goalless draw and Senegal edging past Nigeria 1-0. Cairo International Stadium, Suez Canal Stadium and Alexandria Stadium are all hosting games which will be played over the next month. The final will take place in Cairo on 11 March.

The government-hosted Cairo Food Summit is taking place on 27 February. The summit will bring together public- and private-sector players in the agricultural sector and related industries to discuss sustainable economic growth, according to a statement (pdf).

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed.

In today’s issue: Surging inflation and the weakening EGP are making negotiating salary terms with foreign private teachers increasingly contentious. Local schools have limited capacity to respond to demands for hefty wage hikes, potentially leading to many of them leaving Egypt, sources tell us.

Somabay brings out the best in majestic natural elements where raw beauty and endless activities reign supreme. Immerse yourself into a picturesque getaway all year long. This is simply Somabay. For more information, call 16390 or visit www.somabay.com.

ENTERPRISE READER POLL

The consensus among Enterprise readers: 2022 was not a great year for business — and there’s uncertainty on what the future holds. Towards the end of last year, some 70% of you agreed that 2022 hadn’t lived up to expectations, with the outbreak of war in Ukraine, the weakening EGP, spiraling inflation, and import restrictions all piling pressure on local businesses.

Four months on from our last survey, and the outlook is looking even less rosy. Times are getting tougher for businesses which are having to deal with the impact of the EGP devaluation, the FX shortage, and accelerating inflation. The economic headwinds mean that you are now more uncertain about what the year ahead will bring.

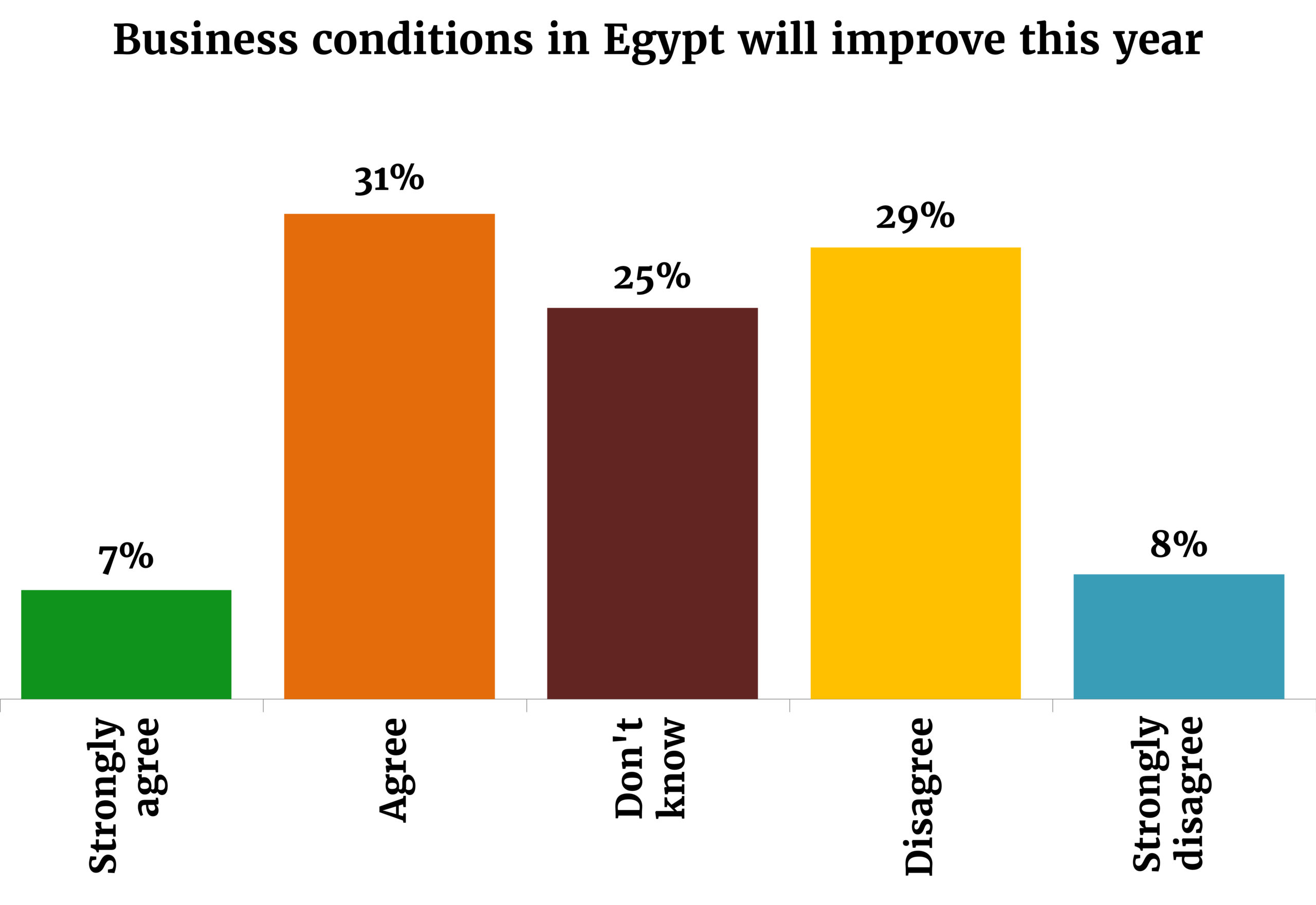

Your outlook on the year ahead is markedly less optimistic than it was just a few months ago. Back in September, 48% of respondents thought business conditions would improve in 2023. Today, you’re evenly split: 38% of respondents saying they see conditions improving over the course of 2023, while 37% don’t see that happening — and a quarter of you are uncertain about what the year holds in store.

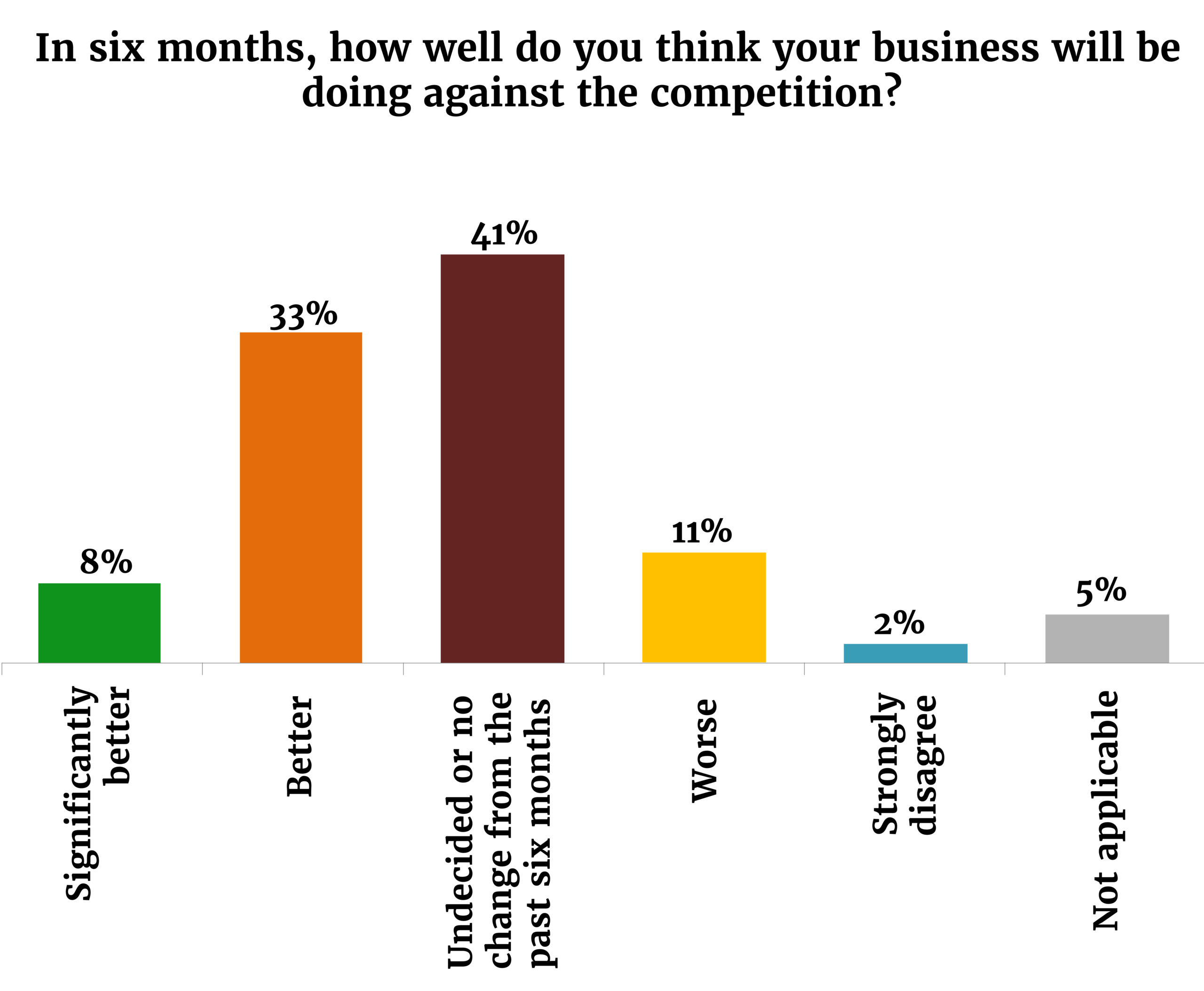

There’s also less certainty among our readers when it comes to their competitive advantage: Some 13% of respondents think their business will fare worse than the competition this year, while 41% think they’ll do better. Another 41% aren’t sure or think the status quo will be maintained for the year. That’s more mixed than how you all felt in September — today, a smaller percentage of respondents see the competitive landscape holding steady.

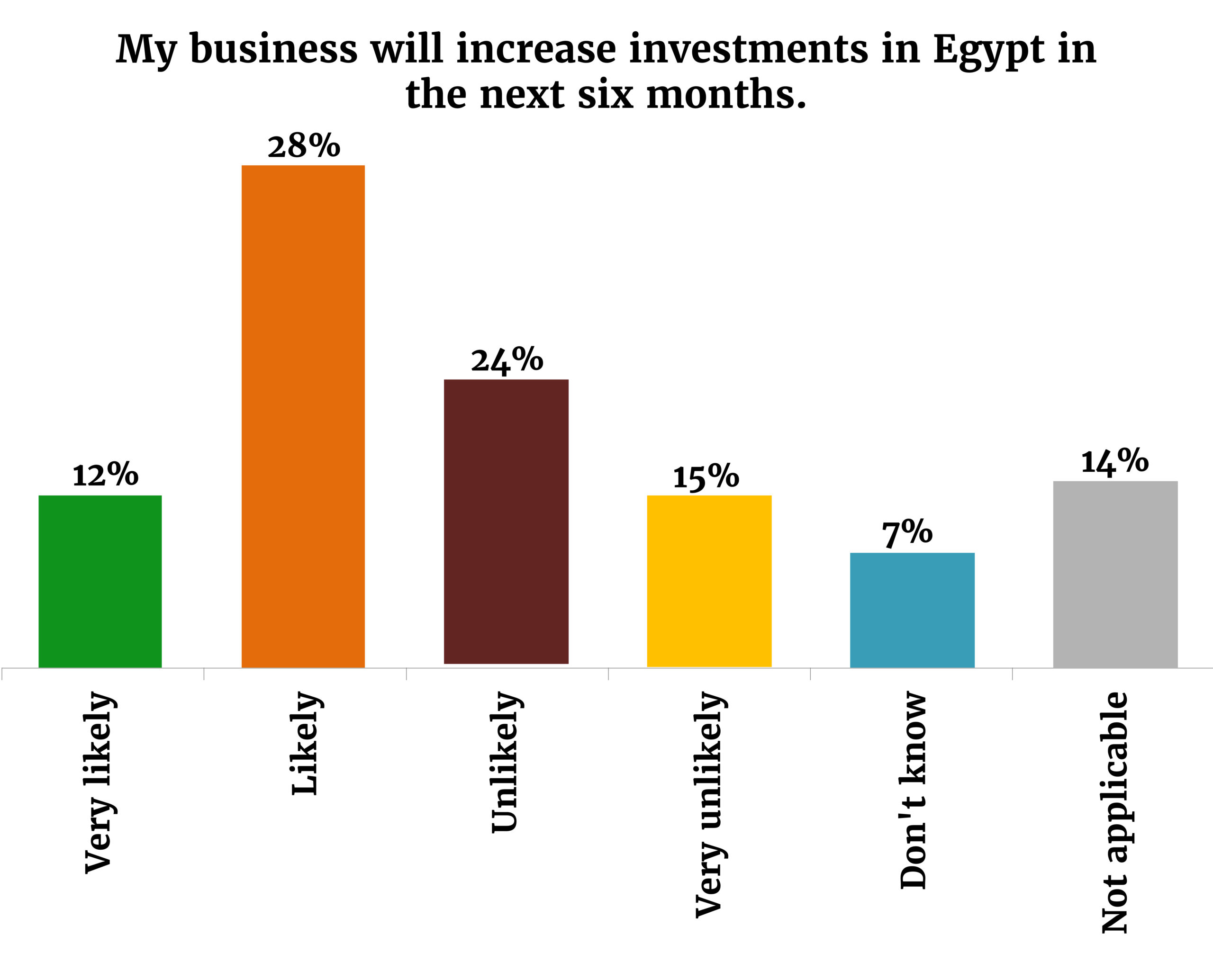

You’d think that all this uncertainty would translate into scaled back investment plans, but that doesn’t seem to be the case: Almost half (47%) of respondents said they’re planning to commit fresh investment in Egypt in 2023 (up from 40% in September), while 30% of you said that new investments are unlikely to be part of your 2023 plans. Last time we checked in, 39% of respondents said they probably wouldn’t be investing within six months’ time.

But: Borrowing costs need to fall to unlock that capex. One-fifth of you say the Central Bank of Egypt needs to cut interest rates by more than 600 bps to help you

increase capital spending, while 26% of you think that interest rate cuts anywhere between 300-500 bps would do the trick. Some 10% believe they can make do with less, saying that just 50-200 bps rate cuts could be enough.

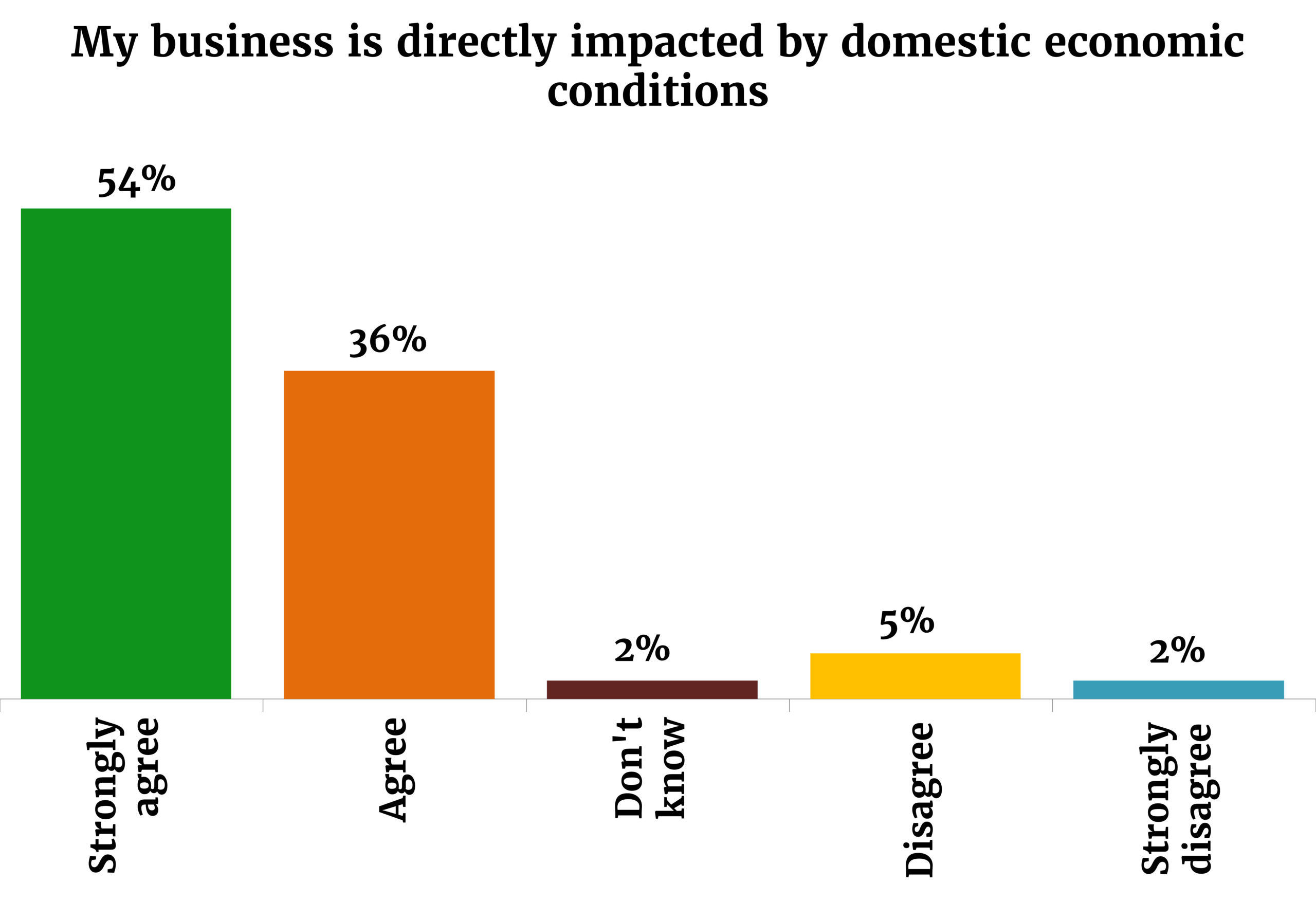

The vast majority of you (90%) said that your business is being directly impacted directly by the crisis here at home, while a mere 7% said there’s no direct effect. Inflation is taking its toll on almost everyone (88%) who responded to the survey, while more than two-thirds (68%) said the FX shortage is impacting their businesses.

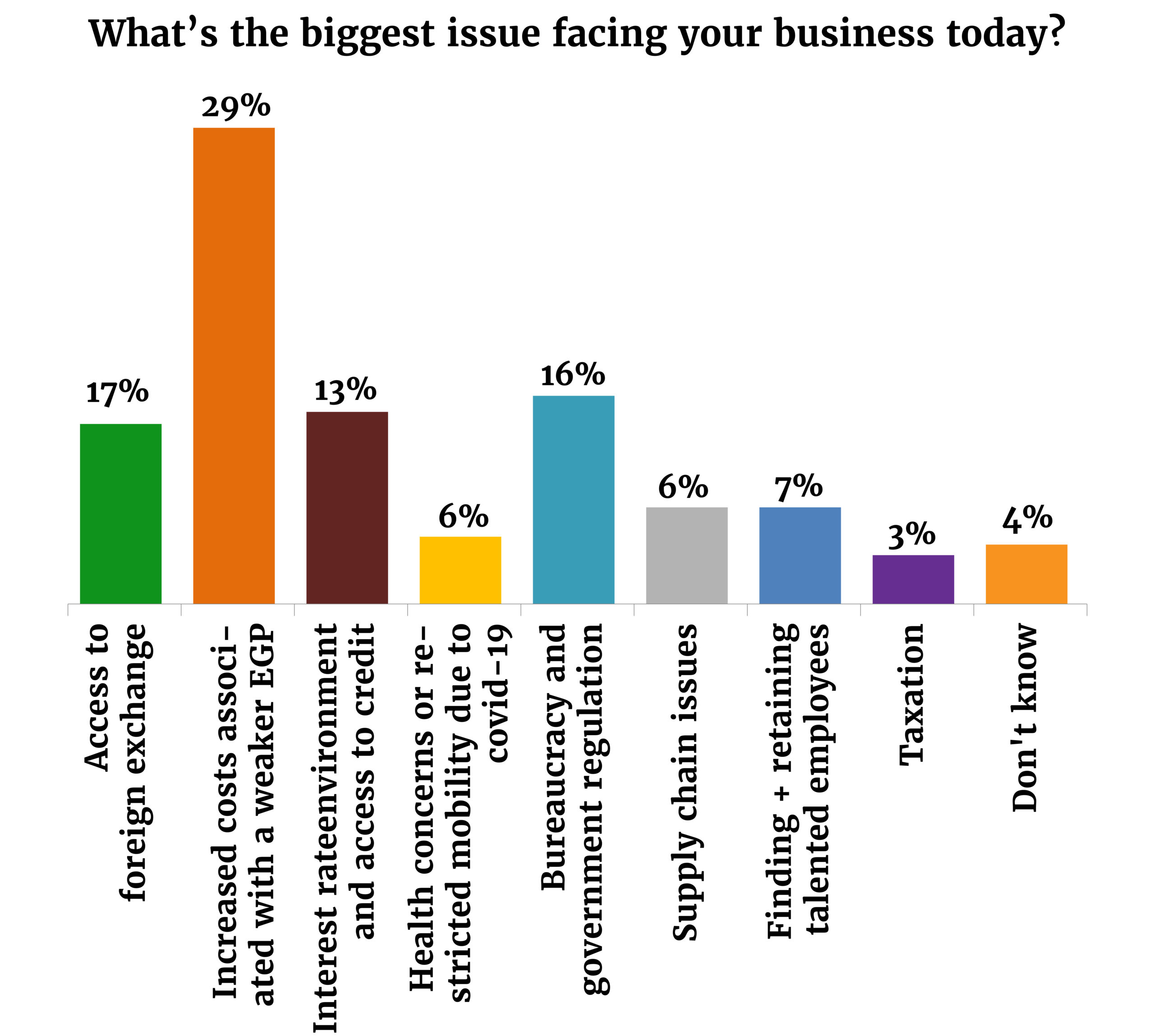

It’s no surprise that the weaker exchange rate and the FX shortage are the two single-biggest challenges facing businesses: Almost a third (30%) see the devaluation of the EGP — which has seen the local currency lose nearly half its value against the greenback over the past year — as posing the greatest challenge for their businesses, while 17% cited the inability to access FX as the biggest issue.

What’s your forecast for the exchange rate? Only 26% of you see the EGP returning to below 30.00 to the greenback by the end of 2023. More than two-thirds think the currency will weaken further from its current 30.62 level, with 41% expecting the currency to end the year between 30.01-35.00 and 27% forecasting a decline past 35.01. That more or less matches your budgeting plans for the year: the majority (52%) are budgeting for a USD rate of EGP 30.01-35.00 and 16% are on the more conservative side and planning for a rate above EGP 35.00.

Next up: Bureaucracy and government regulation, which 13% of respondents cited as their business’ biggest headache. That’s lower than the 19% of you who said the same in September, and it shows in your sentiment on the Madbouly Cabinet.

Sentiment on the council of ministers has improved: Five months ago, 62% of you saw the council of ministers as unsympathetic to the needs of business. In our most recent survey, that figure has dropped to 50%. Some 29% of all respondents think Cabinet is in tune with the needs of the business community.

Pushed to the back burner: Supply chain issues, finding and retaining talent, and taxation have been pushed off your worry list by the FX situation.

Click / tap here to read the full survey.

M&A WATCH

Sovereign Fund of Egypt reportedly eyeing a minority stake in El Ezaby

Yesterday in M&A: A report in the local suggests that the Sovereign Fund of Egypt is interested in purchasing a minority stake in El Ezaby Pharmacy alongside a mystery investor while the shareholders of tourism developer Remco have agreed to sell a five-star hotel in Sharm El Sheikh to a company owned by the military.

IS THE SFE EYEING A PIECE OF EL EZABY?

The Sovereign Fund of Egypt’s (SFE) health and pharma sub-fund is eyeing a minority stake in pharma giant El Ezaby Pharmacy in partnership with an unnamed investment firm, Al Mal reports, citing unnamed sources it says are in the know. The size and value of the expected acquisition wasn’t disclosed.

The SFE’s mystery partner could well be B Investments: The sovereign fund and B Investments last month agreed to together channel more than EGP 2 bn into local healthcare and pharma businesses. As part of the agreement, the investment firm is making an undisclosed investment in the SFE sub-fund, which aims to raise an initial EGP 1.2 bn of capital. The sub-fund aims to invest in local pharma players to help them expand into under-served cities around the country and improve their digital offering.

Where’s the money going? The investment will be channeled as a capital increase and is expected to be used to pay some of the company’s debt, according to the news outlet.

MILITARY TO ACQUIRE 5-STAR HOTEL IN SHARM FROM REMCO-

Tolip will be the new owner of the Stella di Mare hotel: The shareholders of tourism developer Remco agreed on Thursday to sell 100% of the Stella di Mare Beach Hotel in Sharm El Sheikh to the military-owned Tolip Hotels and Resorts for EGP 700 mn, according to a bourse filing (pdf). The company submitted an initial offer for the hotel in October.

The buyer: Tolip is owned by the military’s National Service Projects Organization, and owns more than 20 hotels and resorts across the country.

The purchase: The five-star hotel is situated next to Naama Bay and has almost 300 rooms, 26 executive suites and a diving center.

What’s next: Remco will move forward with final procedures for the acquisition and signing of contracts, the statement reads.

Advisors: FinBi was the sell-side financial advisor on the transaction, according to the statement.

INFRASTRUCTURE

Offers roll in to build the EUR 1.6 bn Alexandria metro project

Three consortiums bid for the Alexandria metro project: Three consortiums of local and international contractors have submitted final bids in a tender for the EUR 1.6 bn project to convert Alexandria’s Abu Qir railway into an underground metro, unnamed sources reportedly told Al Shorouk. The three bidders beat out five others who were eliminated in a previous round of the tender, according to the newspaper.

Who wants in?

- French rail manufacturer Alstom, Hassan Allam Holding, Arab Contractors and Concord;

- France’s Thales and Orascom Construction;

- China Road and Bridge Corporation, China Railway Signal & Communication Co., Concrete Plus, El Soadaa Group, and Adler.

What’s next: We were previously told that the Transport Ministry will look into the financial and technical bids in March.

Who’s paying? The European Investment Bank and the European Bank for Reconstruction and Development are investing a combined EUR 1 bn in the project, while the government will finance 15% of the cost, according to local media.

A MESSAGE FROM HSBC

The changing landscape of retail banking in the Middle East

Retail banking across the Middle East has witnessed a period of intense change over the past five years. This has largely been driven by greater global connectivity, itself spurred by increased digital innovation, responding to rising demand for wealth management solutions from a customer base that is increasingly international. Customers want financial services and products that give access to a full range of investment opportunities, as well as an ability to make those investment choices where they want, when they want, and whether on mobile or on desktop.

My colleagues and I have an ambitious agenda for the coming year. We’ll soon be unveiling a new raft of digital services for our customers across the region. We have a strategic goal to “digitize at scale” for the benefit of our wealth and retail businesses, particularly with reference to international connectivity, digitization and wealth management.

For me, delivering bespoke, user-friendly and accessible banking services to our customers is paramount, and something I’ve learned during my career in multiple markets and global banks. As an example of this customer-driven innovation, we’ve invested significantly to streamline the process of changing banks or opening an account when a customer arrives in a new country to reduce the stress, time and the complexity of the process.

HSBC Premier embodies our approach to wealth management for our customers, an approach built around family, mobility and international banking. Launching HSBC International Education in Egypt to help customers with the transition of their children moving abroad to continue their education, is such one example.

These innovations are only part of the story however. We have to always adapt, respond and innovate, building on our strengths. Banking has always been a competitive business, but I believe HSBC is well positioned to respond to new challenges and to invest to keep us at the forefront of the industry.

Our established heritage in the Middle East — where our origins date back to 1889 — our international footprint that covers more than 90% of global financial flows, and our investments to ensure we are a great place to work and a great place to bank; all combine to attract great talent. There are very few truly global financial organizations, and our international reach is what keeps us competitive. Global trends of international connectivity and digitization are clear and have great momentum in this region, which is what makes the road ahead one of exciting opportunity.

This op-ed was written by Dinesh Sharma (Linkedin), regional head of wealth and personal banking at HSBC Bank Middle East. HSBC’s column in Enterprise appears every second Monday.

LEGISLATION WATCH

Senate approves bill allowing informal industrial projects to get temporary licenses

Senators greenlight temporary relief to informal industrial projects: The Senate approved yesterday a government-drafted bill that would allow unlicensed industrial projects to obtain temporary licenses. The two-article bill would grant the Industrial Development Authority (IDA) the power to allow unlicensed projects to operate for a temporary one-year period while they work to legalize their positions. The period could be extended for an additional two years by the trade and industry minister upon the recommendations of the IDA and after they observe standards stipulated by the Environment Ministry and civil defense authorities.

Thousands to benefit: Some 60k unlicensed industrial projects currently operate without a license, Wafdist and Mostaqbal Watan Senators Yasser El Hodeibi and Mohamed Azzmi said. "Most of these are small and medium-scale industrial enterprises that have been unable to get a license since 2017," he said, adding that "bureaucratic” requirements by the IDA have made it difficult for such projects to obtain licenses. "I hope that the IDA will improve its performance and scrap complicated bureaucratic measures to help speed up the process of integrating unlicensed industrial projects into the formal economy," he said.

Bureaucratic? Who, me? Trade and Industry Minister Ahmed Samir dismissed claims that the IDA’s requirements hindered efforts by informal industrial businesses to go legit. Industrial firms can obtain a license within a month at most, he said, adding that applications can now be submitted online. Low-risk firms can receive a license within one week after paying EGP 1k (plus VAT) while higher-risk businesses must pay EGP 20k and may have to wait a month before receiving their licenses, the minister said.

MOVES

Magued Sherif (LinkedIn) is stepping down as managing director of leading real estate developer SODIC as of 14 April, according to a company disclosure to the EGX (pdf). Sherif will continue to serve on the board as a non-executive board member.

Sherif spent eight years at the helm of the company, following C-suite roles at Palm Hills Developments, Majid Al Futtaim Properties and Hyde Park Developments. During his tenure, the company quadrupled its sales and grew its land bank to become one of the largest companies in the market, according to the disclosure.

Former SODIC COO Ayman Amer (LinkedIn) is replacing Sherif at the head of SODIC with the new title of general manager as of 15 February. Amer has worked at SODIC for 13 years, following stints at Turner Construction Company and Orascom Construction.

REMEMBER- SODIC has been under new Emirati ownership for more than a year. Aldar Properties and sovereign wealth fund ADQ acquired 85.5% of SODIC in late 2021 for EGP 6.1 bn.

Axa Egypt has appointed Sameh Anas (Linkedin) as managing director in addition to his current role as COO, it said in a statement (pdf) yesterday. Anas has been with the ins. company since 2019 and spent 16 years at MetLife between 2001 and 2017.

QNB Al Ahli last month appointed former CFO Sameh Badry (LinkedIn) as its COO, replacing Ihab Raafat (Linkedin), who has retired. Badry and Raafat have both worked at the bank for over a decade.

LAST NIGHT’S TALK SHOWS

Expect food prices to dominate the conversation on the airwaves talk shows in the coming weeks as households try to stock up on food ahead of Ramadan amid surging inflation.

Amr Adib calls on public, food producers to donate to the poor amid cost of living crisis: El Hekaya’s Amr Adib called on Egyptians to maintain the seasonal generosity typically seen during Ramadan and donate to vulnerable families being hit hard by the soaring cost of food (watch, runtime: 2:59). Adib asked food producers to donate to the poor, stressing that they were among sectors that benefited from high demands during the pandemic and the year that followed (watch, runtime: 3:00). “All those in the industry have made sizable profits. It’s time to give back,” he said.

The government’s Ahlan Ramadan discount supermarket expo also got a mention, with Ala Mas’ouleety focusing on a high demand seen at several of the expo’s new locations in some parts of Giza yesterday (watch, runtime: 3:13). The expo has banned the sale of large quantities of rice after some attempted to hoard supplies, Federation of Egyptian Chambers VP Adel Nasser told Ala Mas’ouleety (watch, runtime: 4:53).

The earthquake in Turkey and Syria is still getting attention amid the growing food crisis in northern Syria. Food aid being sent to Syria is now “packaged and ready to eat” food due to the destruction leaving many families without the ability to cook food, Abir Atefa, a spokeswoman for the World Food Programme, told Kelma Akhira (watch, runtime: 5:50). Show host Lamees El Hadidi followed Amr Adib on Saturday in accusing western nations of double standards in their refusal to provide aid to Syria. “There should be a way to send the aid to Syria even if there is a conflict [between the West] with the ruling Syrian regime,” she said (watch, runtime: 2:07).

The disaster could exacerbate a cholera outbreak in Syria given the lack of proper infrastructure, Mey Al Sayegh, the International Federation of Red Cross and Red Crescent Societies’ (IFRC) head of communications, told Masa’a DMC (watch, runtime: 7:10).

EGYPT IN THE NEWS

There’s no single story grabbing the headlines in the foreign press this morning. Here are a selection of stories getting international attention:

- Partying with the Pharaohs: A Tourism Ministry-organized performance by Swiss techno duo Adriatique at Luxor’s Temple of Hatshepsut last week sparked debate on social media about the proper use of archaeological sites. (Arab News)

- Old Cairo residents are getting acquainted with their heritage: Heritage management expert May al-Ibrashy’s Athar Lina initiative opens the historic buildings of Islamic Cairo to the neighborhood’s residents. (AFP)

- Al Qaeda has another Egyptian at the helm: Intelligence collected by the US State Department indicates that the Iran-based Egyptian, Saif Al Adel, is the new de-facto leader of al-Qaeda after the death last year of Ayman El Zawahiri, also an Egyptian national. (AFP)

ALSO ON OUR RADAR

REAL ESTATE-

Heliopolis Housing shareholders approve scrapping Heliopark tender: The shareholders of state-owned Heliopolis Housing approved on Saturday the company’s decision to scrap plans to co-develop its Heliopark project in New Cairo with Mountain View, according to a bourse filing (pdf). The company’s board chose Mountain View a year ago in a tender to find a partner to co-develop Heliopark, only to call the agreement off in January, citing the current economic conditions and rising land valuations.

REMEMBER- The parent company of Heliopolis Housing is reportedly in talks with Gulf investors who are interested in investing in Heliopark.

FINTECH-

e-Finance subsidiary e-Khales will offer digital payment solutions to Contact Financial Holding under an agreement between the two firms, according to an EGX disclosure (pdf). This will allow Contact customers to pay for household utilities, school fees, ins., club subscriptions and other bills in Contact branches and via its mobile app, which was launched last month, the statement reads.

ENERGY-

Gov’t sets solar plant licensing fees: Solar plants producing up to 500 KW will have to pay EGP 7k to obtain a license, while licenses for facilities producing more than 500 KW will cost EGP 35k, according to a fresh set of regulations (pdf) recently approved by the Egyptian Electric Utility & Consumer Protection Regulatory Agency (Egyptera). Projects generating less than 500 KW can also apply to Egyptera for an exemption from the licensing requirements.

PLANET FINANCE

The USD comeback: The USD is up some 3% against a basket of six other major currencies so far this month — erasing January losses, the Financial Times writes. The currency had shed more than 11% between October and January from a 20-year high in September, as cooling inflation data out of the US gave the Federal Reserve breathing room to slow its tightening cycle. New figures suggesting growth remains strong in the US are now reversing that trend, with Fed officials now hinting they could once again slam on the brakes with a 50-bps interest rate hike in March.

A flash in the pan? Some investors are expecting the currency to continue rising this quarter before resuming its “downward trajectory as global growth and risk sentiment improve,” UBS analysts said.

Investment-grade corporate bonds are all the rage: Investors have poured a record USD 19 bn into funds that invest in investment-grade corporate debt since the beginning of the year, as yields rocket on the safe haven assets, the Financial Times writes, citing data from fund flow tracker EPFR. Fixed-income yields have risen across the board after monetary tightening from the Federal Reserve caused a historic selloff in the global bond market last year — meaning investment-grade bonds are now offering a golden combination of high returns and low risk. “People basically think that fixed income in general looks a lot more attractive than it has in prior years,” one strategist said.

|

|

EGX30 |

17,327 |

-0.9% (YTD: +18.7%) |

|

|

USD (CBE) |

Buy 30.53 |

Sell 30.62 |

|

|

USD at CIB |

Buy 30.52 |

Sell 30.62 |

|

|

Interest rates CBE |

16.25% deposit |

17.25% lending |

|

|

Tadawul |

10,493 |

-0.5% (YTD: +0.1%) |

|

|

ADX |

9,977 |

+0.2% (YTD: -2.3%) |

|

|

DFM |

3,458 |

-0.3% (YTD: +3.7%) |

|

|

S&P 500 |

4,079 |

-0.3% (YTD: +6.2%) |

|

|

FTSE 100 |

8,004 |

-0.1% (YTD: +7.4%) |

|

|

Euro Stoxx 50 |

4,275 |

-0.5% (YTD: +12.7%) |

|

|

Brent crude |

USD 83.00 |

-2.5% |

|

|

Natural gas (Nymex) |

USD 2.28 |

-4.8% |

|

|

Gold |

USD 1,850.20 |

-0.1% |

|

|

BTC |

USD 24,534 |

-0.4% (YTD: +48.5%) |

THE CLOSING BELL-

The EGX30 fell 0.9% at yesterday’s close on turnover of EGP 1.51 bn (22.5% below the 90-day average). Foreign investors were net sellers. The index is up 18.9% YTD.

In the green: Orascom Construction (+0.4%),CIB (+0.2%) and CIRA Education (+0.1%).

In the red: Sidi Kerir Petrochemicals (-4.8%), Edita Food Industries (-3.8%) and Juhayna (-3.5%).

Asian markets are mixed on the first day of trading this week: Chinese shares are comfortably in the green while the Kospi and the Nikkei are treading water. US shares are on course to fall when Wall Street opens this afternoon while European shares could see early gains.

AROUND THE WORLD

No showdown at UN over Israel settlements: The UAE will not push for a vote at the UN Security Council today demanding that Israel "immediately and completely cease all settlement activities in the occupied Palestinian territory,” Reuters reported, citing a document that it has seen. Abu Dhabi will instead work on drafting a formal statement in which the 15-member council needs to approve unanimously. "Given the positive talks between the parties, we are now working on a presidential statement which would garner consensus," the note said. “Accordingly, there will not be a vote on the draft resolution on Monday…,” it added. The move comes days after the Gulf country circulated the text of a resolution that it drafted with the Palestinians to the Security Council.

A push for peace in Libya: The African Union is working on a national reconciliation conference for Libya, AU Commission chief Moussa Faki Mahamat told AFP yesterday. "We have met with the different parties and we are in the process of working with them on a date and place for the national conference," he said. The meeting will be headed by Congo President Denis Sassou Nguesso, who chairs the AU committee on Libya, he added.

Private school teachers are feeling the impact of inflation and the EGP devaluation: Over the past year, salaries for teachers at private schools in Egypt have been coming under increasing strain from the rising cost of living and the EGP devaluation, leaving schools scrambling to find ways to keep salaries in step with inflation and teachers facing shrinking real wages. For international schools that pay their teachers’ salaries in a combination of local and foreign currency, salary terms are especially contentious and could lead foreign teachers to exit international schools, our sources suggest.

Teachers at international schools are paid under a variety of arrangements — but most depend on foreign currency: At many international schools, foreign teachers have their salaries set in foreign currency, with a portion paid out in FX and the rest in EGP equivalent. For teachers hired locally, many get paid entirely in the EGP equivalent to their foreign currency-based salaries, which means schools need to be paying more to ensure that teachers’ real wages aren’t declining.

Contracts signed last year still stand: “This year we are engaged in active contracts; there’s nothing that we can change. We’re honoring contracts signed with any teacher at any of our five schools currently and paying them in the agreed upon foreign currency,” Eduhive CEO Karim Mostafa tells us. Some schools, like El Alsson, which set numerical values for the local currency portion of their salaries, rather than paying the EGP equivalent of USD denominated salaries, are under a little less pressure. “I never changed my contracts. From day 1 we pay 25% in foreign currency and 75% in local currency,” El Alsson Executive Director Karim Rogers tells us.

But the economic landscape has changed, even if contract terms haven’t: Most teachers’ active contracts were signed before the start of the school year and ahead of the most recent EGP slide that led the exchange rate to surpass EGP 30 / USD 1. “Current contracts were signed back when the USD was at EGP 15.75. At the time we had set a ceiling of EGP 18 and a floor of EGP 14 to accommodate for future currency changes,” Mostafa tells us. This flexibility, however, has not been sufficient to keep up with the current exchange rate.

These conditions are putting teachers under strain: The majority of active contracts were signed under the pre-October devaluation exchange rate, but in a bid to reduce their expenses many schools have capped the maximum exchange rate they are willing to pay teachers, our sources tell us. “A lot of schools do this at different levels. Some capped it last month, some did it a few months before then. But the problem is that it's below the market rate of the USD so [as a teacher] you’re getting less than you should be,” a teacher at a private school who requested to remain anonymous tells us. Teachers are also facing difficulty exchanging their EGP for foreign currency they need to transfer abroad, Rogers explains.

There’s only so much that school administrators can do to raise wages: “Teacher salaries account for about 65% of most schools’ costs,” CIRA Education CEO Mohammed El Kalla tells us. Salaries need to go up by about 25-30% to sufficiently cover rising inflation but tuition increases are capped at 7% annually, meaning schools have limited room to meet these demands, El Kalla explains. For foreign teachers, salaries would have to increase by 100% in order for them to remain steady, El Kalla says.

For now, schools are absorbing some of these increases. “The average increase in salaries we’re seeing this year is 10-12% and schools are bearing the bill for it,” El Kalla tells us. Without being able to raise tuition, schools can only roll out salary increases to teachers over multiple years. For larger school operators with multiple branches, “they have the size and scale to be able to absorb more because of economies of scale but for single-school operators it's becoming a nightmare,” he said.

For international teachers, Egypt is becoming a less attractive destination to work: “When people research Egypt they can clearly see an issue. They’re worried about taking their wage in EGP,” Rogers says. Foreign teachers are also increasingly concerned about their ability to repatriate their income in FX once they leave the country, El Kalla tells us.

Some schools are reconsidering the demographic makeup of their teaching staff in response. As foreign teachers become increasingly more expensive to keep on payroll, international schools might instead opt for local teachers to replace them in the upcoming academic year. “International schools will have major concerns about whether they’ll be able to continue paying international teachers,” El Kalla tells us. As a cost cutting measure, we’re likely going to see “more local hiring take place this year across schools,” Rogers says.

But that could open the door to a whole new set of problems: While there are many qualified Egyptian teachers that can take on these roles, fewer foreign teachers could pose some problems for international schools, according to several sources we’ve spoken to. One of the key reasons international schools opt for foreign teachers is because international certification requirements obligate them to hire a certain number of foreign teachers every year — failing to do so could put these schools’ certifications in jeopardy, El Kalla explains. Another reason is because of a perception that foreign teachers have expertise in areas that locally hired teachers might lack, according to several sources we’ve spoken to.

Even with local hires stepping in, there are some concerns about quality: “Hiring and training locals to provide the same service takes time; it doesn’t happen overnight,” El Kalla tells us. But even with more local hires, concerns about salaries not keeping pace with inflation throughout the current academic year remains a major sticking point. “You can't pay less and expect the same return from your teachers … it's inevitable that you have teachers who are holding grudges or who are not going to give it their all in other areas of their job,” our anonymous source tells us.

Moving forward, schools are looking at some stopgap measures: “We can reduce margins, while parents pay a little more and the Education Ministry leaves us with a little more leeway on the fees they collect from us so that we can all make it through,” Mostafa says. Meanwhile, El Kalla thinks it would be helpful for the Education Ministry “to grant schools a one-year exception to the 7% cap on tuition specifically to raise teacher salaries.”

Your top education stories for the week: Columbia University topped the Financial Times’ Global MBA Ranking for the first time since it was first published in 1999, after the paper tweaked its methodology.

CALENDAR

FEBRUARY

19 February-11 March (Sunday-Saturday): 2023 Africa U20 Cup of Nations, Egypt, various locations.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

23 February (Thursday): Telecom Egypt to announce its 2022 results.

24-26 February (Friday-Sunday): The Egyptian Private Equity Association and the African Private Equity and Venture Capital Association are hosting a three-day private capital funds masterclass.

MARCH

March: 4Q2022 earnings season.

March: Gov’t to launch the National Governance Index.

Beginning of March: Rice to be added to the EMX.

3 March (Friday): Journalists’ Syndicate midterm elections.

5 March (Sunday) Nahda Economic Forum, Intercontinental Cairo Semiramis.

6-9 March (Monday-Thursday): EFG Hermes One-on-One conference, Atlantis, Dubai.

21-22 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

23 March (Thursday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

30 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

APRIL

April: GAFI to launch the country’s first integrated electronic platform to facilitate setting up a business.

1 April (Saturday): Deadline for banks to establish sustainability units.

10-16 April (Monday-Sunday): IMF / World Bank Spring Meetings, Marrakesh, Morocco.

16 April (Sunday): Coptic Easter

17 April (Monday): Sham El Nessim.

21 April (Friday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

30 April (Sunday): Deadline for self-employed to register for e-invoicing.

30 April (Sunday): End of Mediterranean, Nile Delta oil + gas exploration tender.

Late April – 15 May: 1Q2023 earnings season.

MAY

1 May (Monday): Labor Day.

2-3 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Thursday): National holiday in observance of Labor Day (TBC).

4 May (Thursday): IEF-IGU Ministerial Gas Forum, Cairo.

9-11 May (Tuesday-Thursday): First edition of the Arab Actuarial Conference, Cairo.

16-18 May (Tuesday-Thursday): Egypt will host its first conference on cybersecurity and defense intelligence systems (CDIS-Egypt).

18 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

20-21 May (Saturday-Sunday): eGlob Expo, St. Regis Almasa Hotel, Cairo.

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE

7-10 (Wednesday-Saturday): The second edition of Africa Health Excon.

10 June (Saturday): Thanaweya Amma examinations begin.

13-14 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

19-21 June (Monday-Wednesday): Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

22 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

25-26 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

AUGUST

3 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

SEPTEMBER

19-20 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

31 October – 1 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

NOVEMBER

2 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

DECEMBER

12-13 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

21 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

EVENTS WITH NO SET DATE

2023: The inauguration of the Grand Egyptian Museum.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

1Q 2023: Egypt + Qatar to launch joint business forum.

1Q 2023: FRA to introduce new rules for short selling.

1Q 2023: Internal trade database to launch.

1Q 2023: The Madbouly government will choose which state-owned hotels will be merged into a new hotels company ahead of an offering to foreign and Gulf investors.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.