The Enterprise 2023 Reader Poll: More of you are feeling downbeat about our economic prospects as headwinds mount

The consensus among Enterprise readers: 2022 was not a great year for business — and there’s uncertainty on what the future holds. Towards the end of last year, some 70% of you agreed that 2022 hadn’t lived up to expectations, with the outbreak of war in Ukraine, the weakening EGP, spiraling inflation, and import restrictions all piling pressure on local businesses.

Four months on from our last survey, and the outlook is looking even less rosy. Times are getting tougher for businesses which are having to deal with the impact of the EGP devaluation, the FX shortage, and accelerating inflation. The economic headwinds mean that you are now more uncertain about what the year ahead will bring.

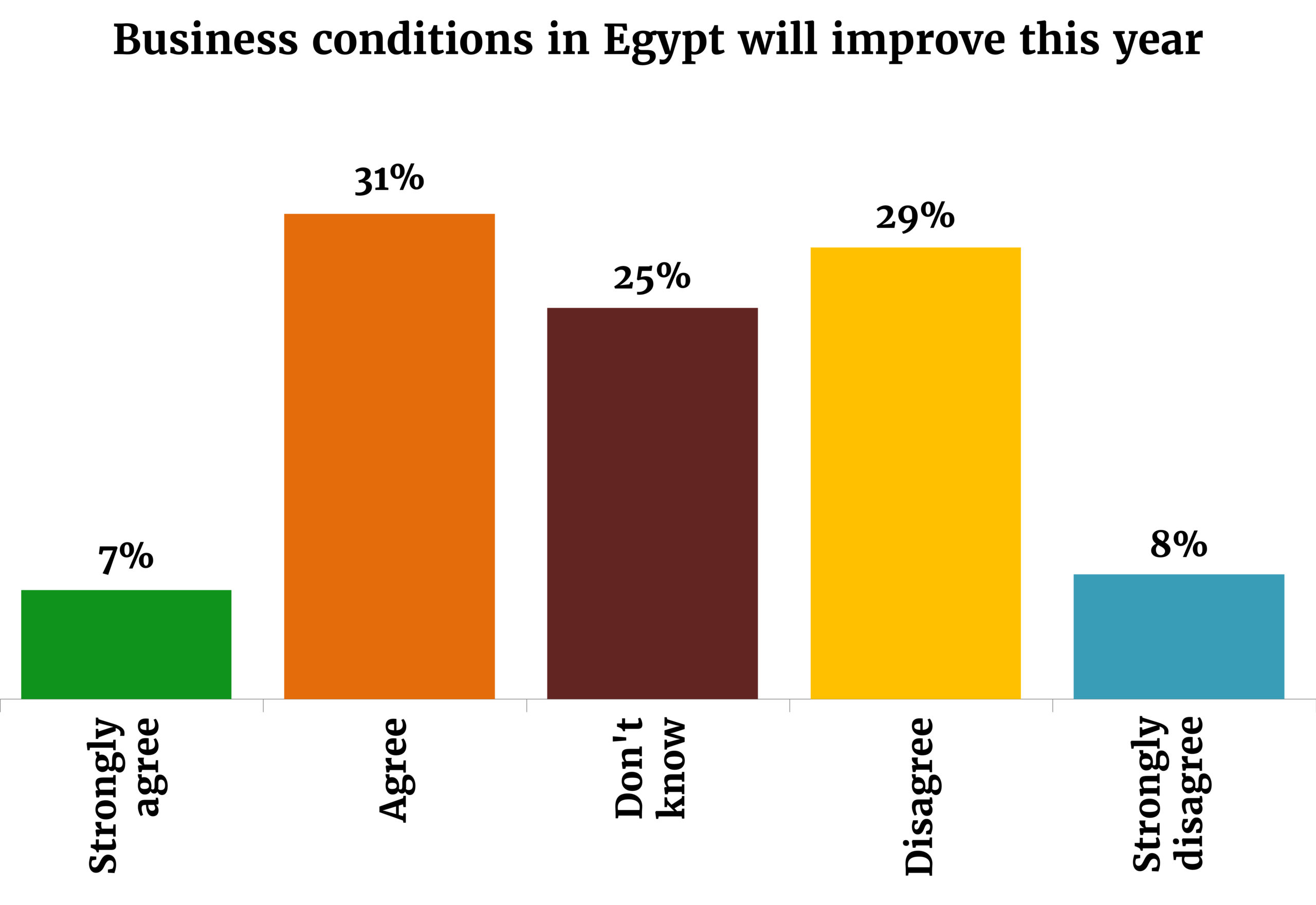

Your outlook on the year ahead is markedly less optimistic than it was just a few months ago. Back in September, 48% of respondents thought business conditions would improve in 2023. Today, you’re evenly split: 38% of respondents saying they see conditions improving over the course of 2023, while 37% don’t see that happening — and a quarter of you are uncertain about what the year holds in store.

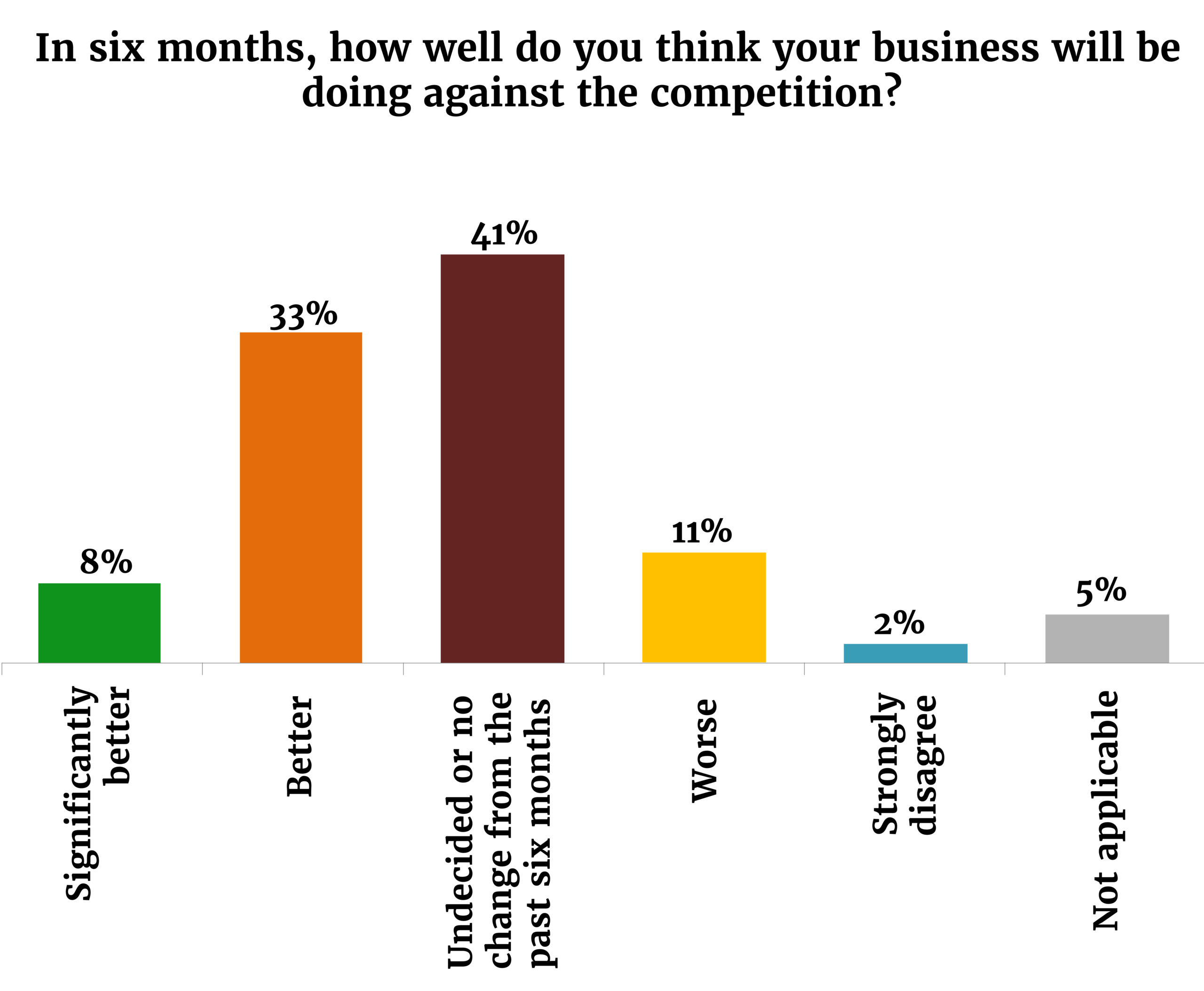

There’s also less certainty among our readers when it comes to their competitive advantage: Some 13% of respondents think their business will fare worse than the competition this year, while 41% think they’ll do better. Another 41% aren’t sure or think the status quo will be maintained for the year. That’s more mixed than how you all felt in September — today, a smaller percentage of respondents see the competitive landscape holding steady.

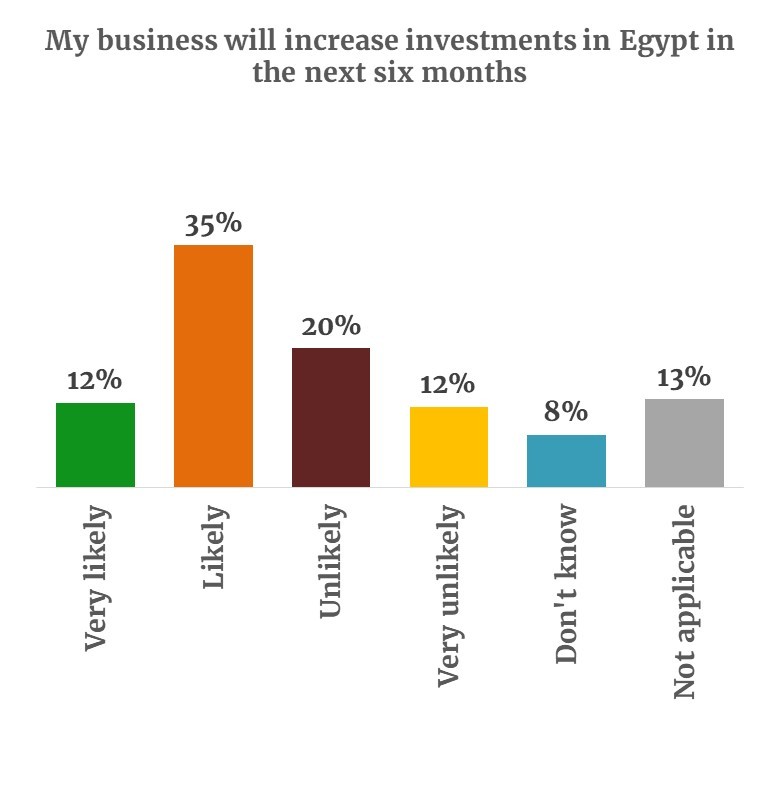

You’d think that all this uncertainty would translate into scaled back investment plans, but that doesn’t seem to be the case: Almost half (47%) of respondents said they’re planning to commit fresh investment in Egypt in 2023 (up from 40% in September), while 30% of you said that new investments are unlikely to be part of your 2023 plans. Last time we checked in, 39% of respondents said they probably wouldn’t be investing within six months’ time.

But: Borrowing costs need to fall to unlock that capex. One-fifth of you say the Central Bank of Egypt needs to cut interest rates by more than 600 bps to help you increase capital spending, while 26% of you think that interest rate cuts anywhere between 300-500 bps would do the trick. Some 10% believe they can make do with less, saying that just 50-200 bps rate cuts could be enough.

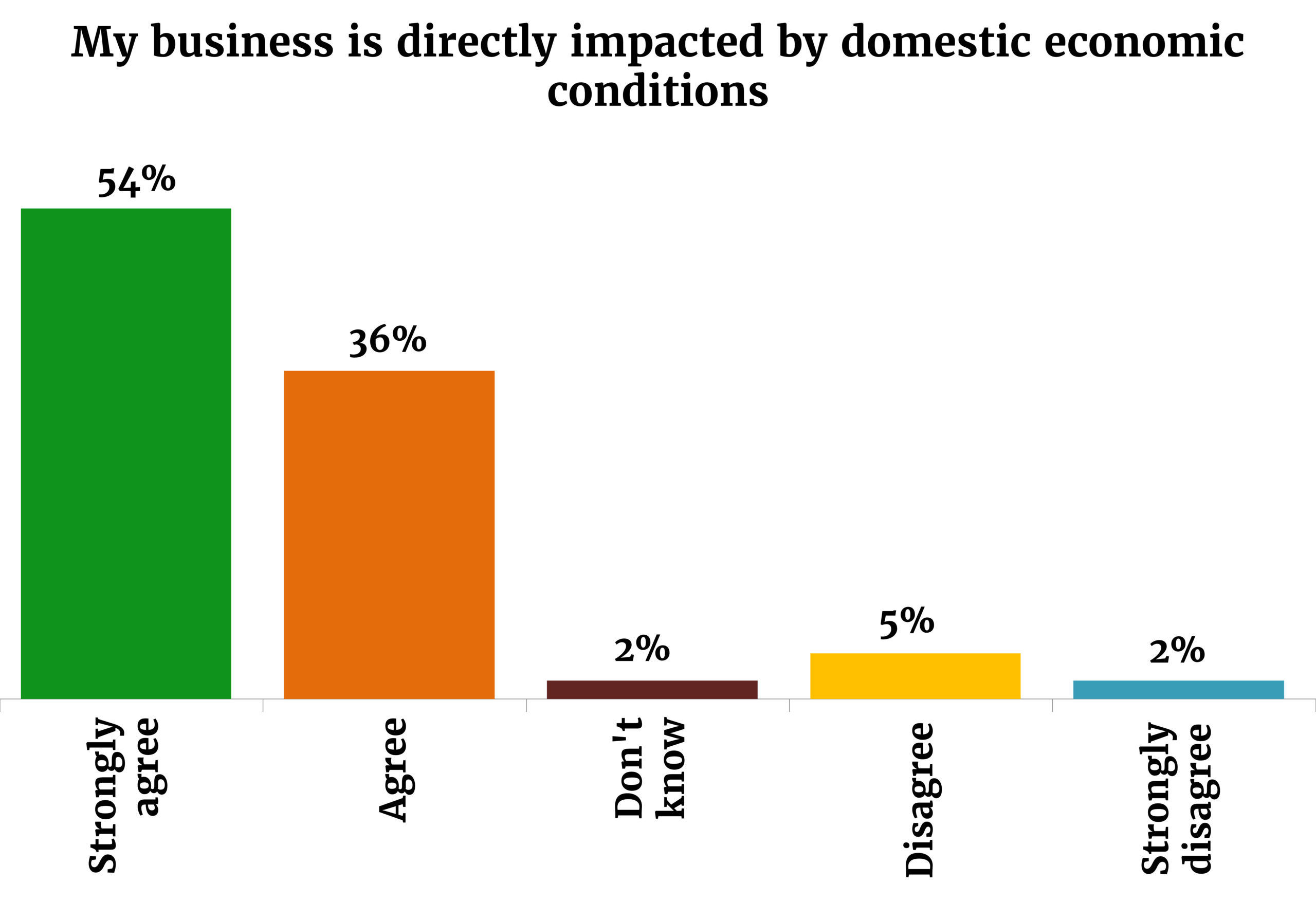

The vast majority of you (90%) said that your business is being directly impacted directly by the crisis here at home, while a mere 7% said there’s no direct effect. Inflation is taking its toll on almost everyone (88%) who responded to the survey, while more than two-thirds (68%) said the FX shortage is impacting their businesses.

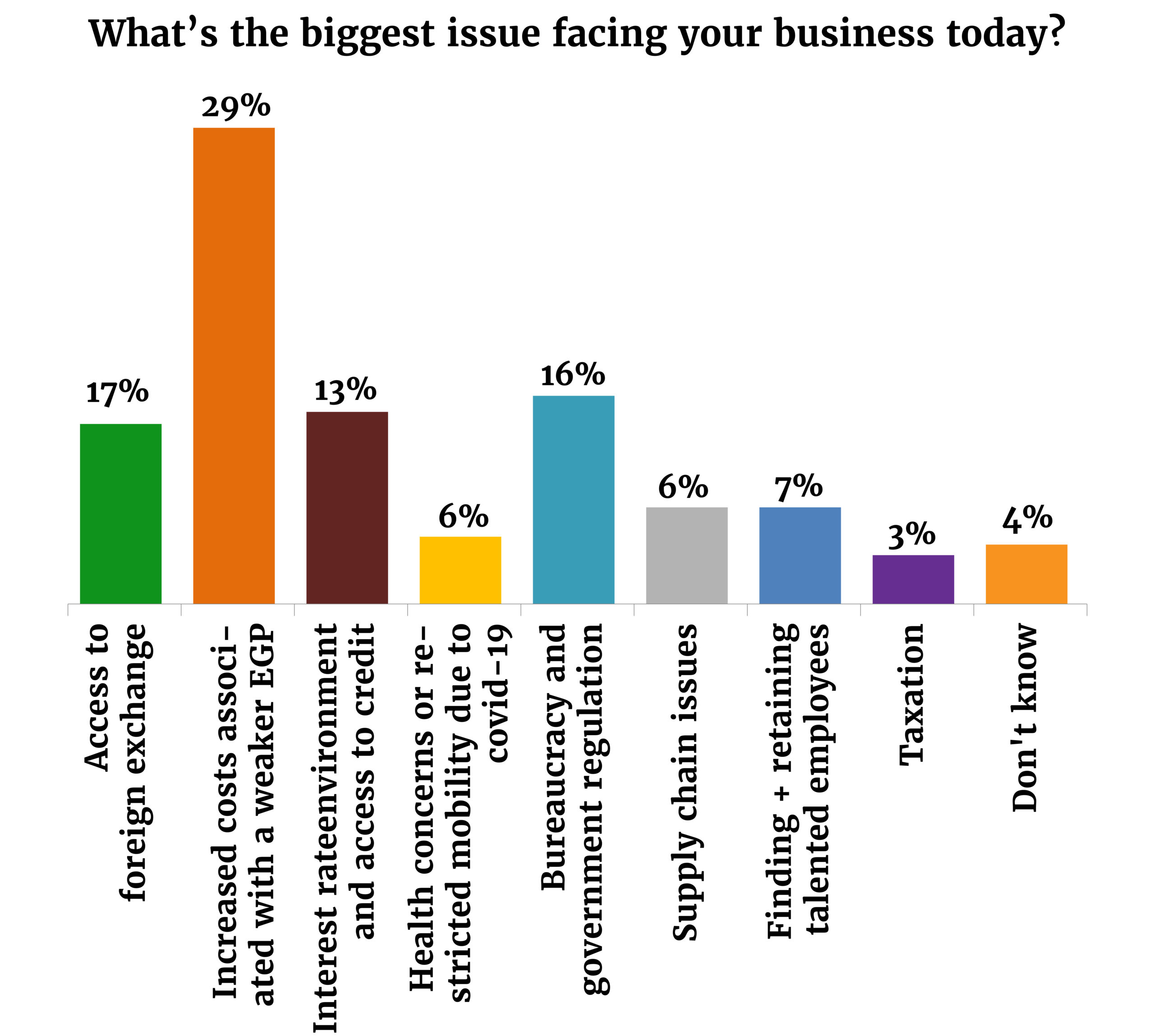

It’s no surprise that the weaker exchange rate and the FX shortage are the two single-biggest challenges facing businesses: Almost a third (30%) see the devaluation of the EGP — which has seen the local currency lose nearly half its value against the greenback over the past year — as posing the greatest challenge for their businesses, while 17% cited the inability to access FX as the biggest issue.

What’s your forecast for the exchange rate? Only 26% of you see the EGP returning to below 30.00 to the greenback by the end of 2023. More than two-thirds think the currency will weaken further from its current 30.62 level, with 41% expecting the currency to end the year between 30.01-35.00 and 27% forecasting a decline past 35.01. That more or less matches your budgeting plans for the year: the majority (52%) are budgeting for a USD rate of EGP 30.01-35.00 and 16% are on the more conservative side and planning for a rate above EGP 35.00.

Next up: Bureaucracy and government regulation, which 13% of respondents cited as their business’ biggest headache. That’s lower than the 19% of you who said the same in September, and it shows in your sentiment on the Madbouly Cabinet.

Sentiment on the council of ministers has improved: Five months ago, 62% of you saw the council of ministers as unsympathetic to the needs of business. In our most recent survey, that figure has dropped to 50%. Some 29% of all respondents think Cabinet is in tune with the needs of the business community.

Pushed to the back burner: Supply chain issues, finding and retaining talent, and taxation have been pushed off your worry list by the FX situation.

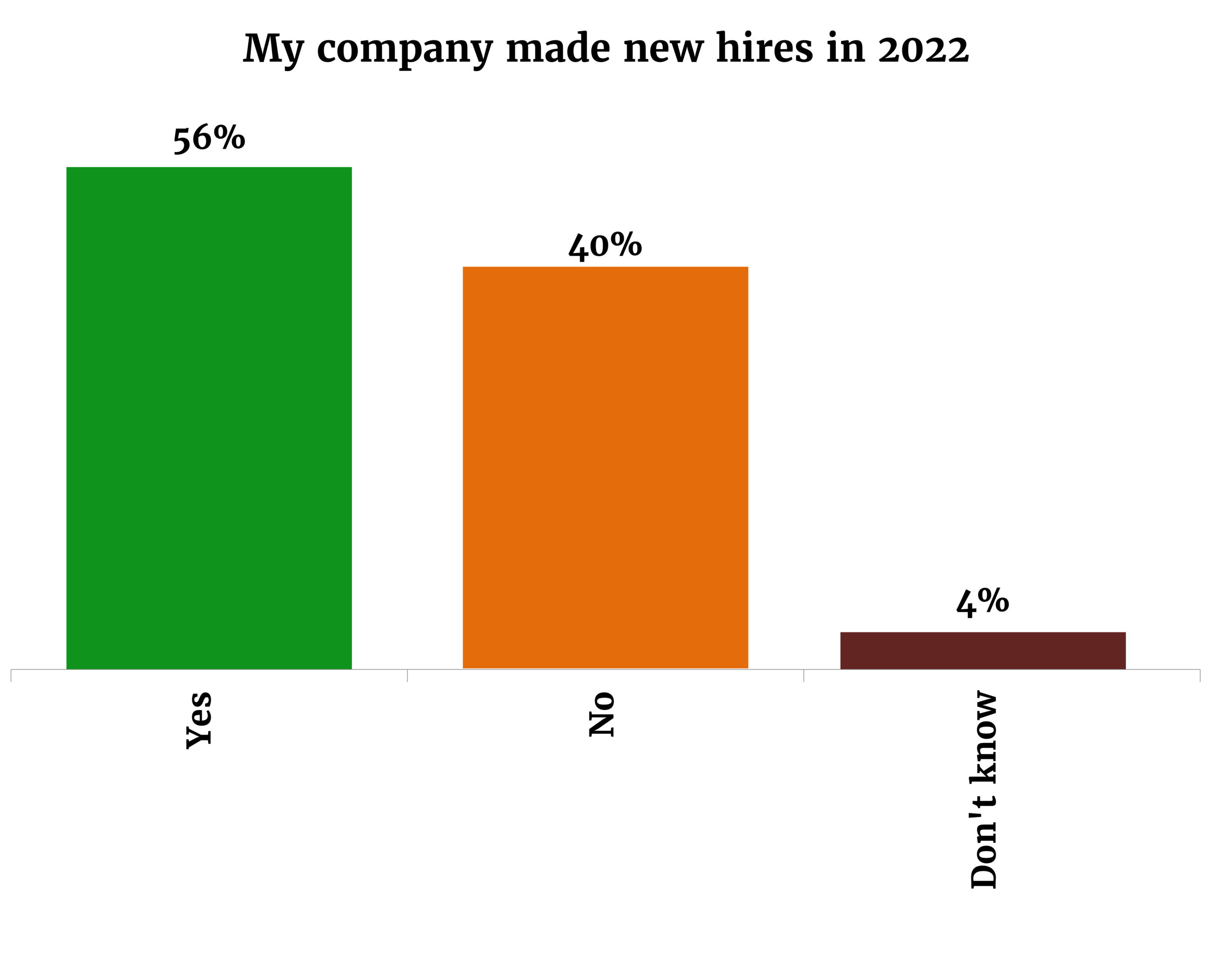

Most of you grew your headcount last year — and plan to continue growing it in 2023: More than half (56%) of respondents made new hires in 2022 and 58% say they’re going to make even more hires this year. For 22% of respondents, layoffs and staff downsizing were part of the territory last year — and around the same percentage expect 2023 to bring headcount cuts.

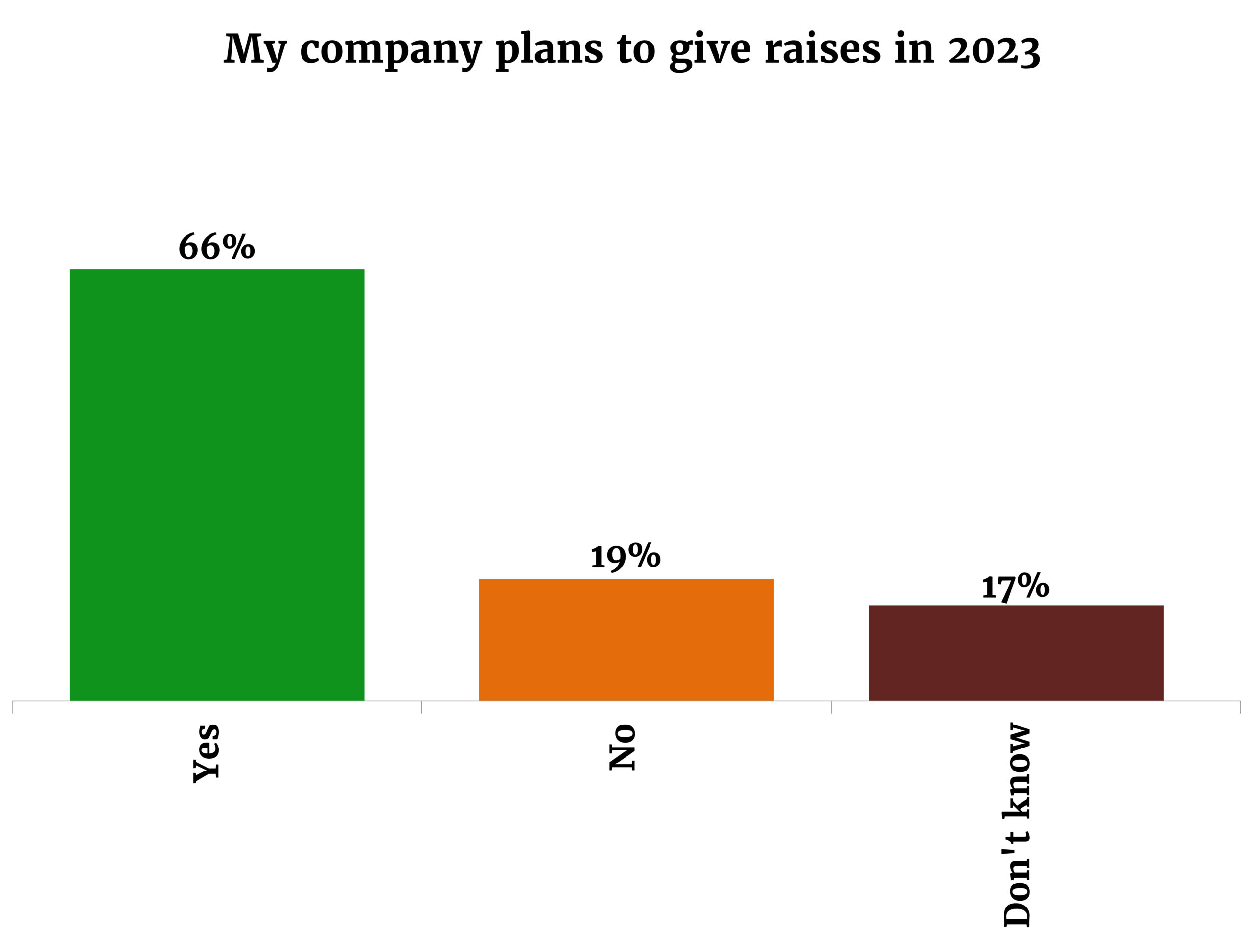

For the staff that you’re keeping around, raises — or salary adjustments — are coming, with two-thirds of respondents saying their companies plan on doling out raises this year.

- A quarter of businesses (24%) plan to raise salaries by 11-15%.

- %) are on the more conservative side, planning to hike wages by 6-10%

- One fifth (20%) of you expect to raise salaries by 16-20% this year.

- Many of you (44%) are also penciling in the possibility of cost of living adjustments if inflation remains high and your balance sheets permit.

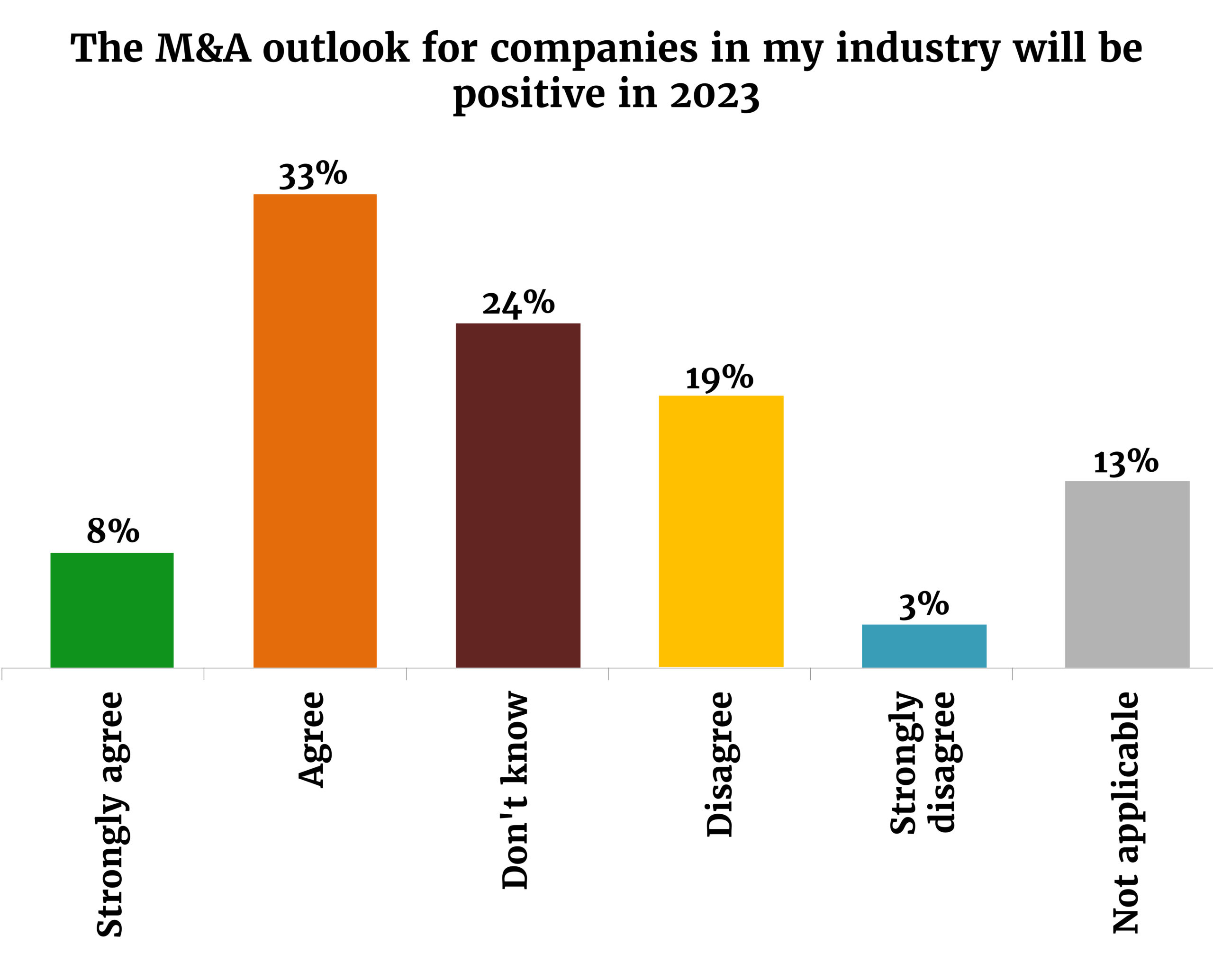

The outlook for M&A appears to be warming up again: Some 41% of you have a positive outlook on M&A in your industry (up from 38% in September), while 22% of you don’t think that’s going to be the case.

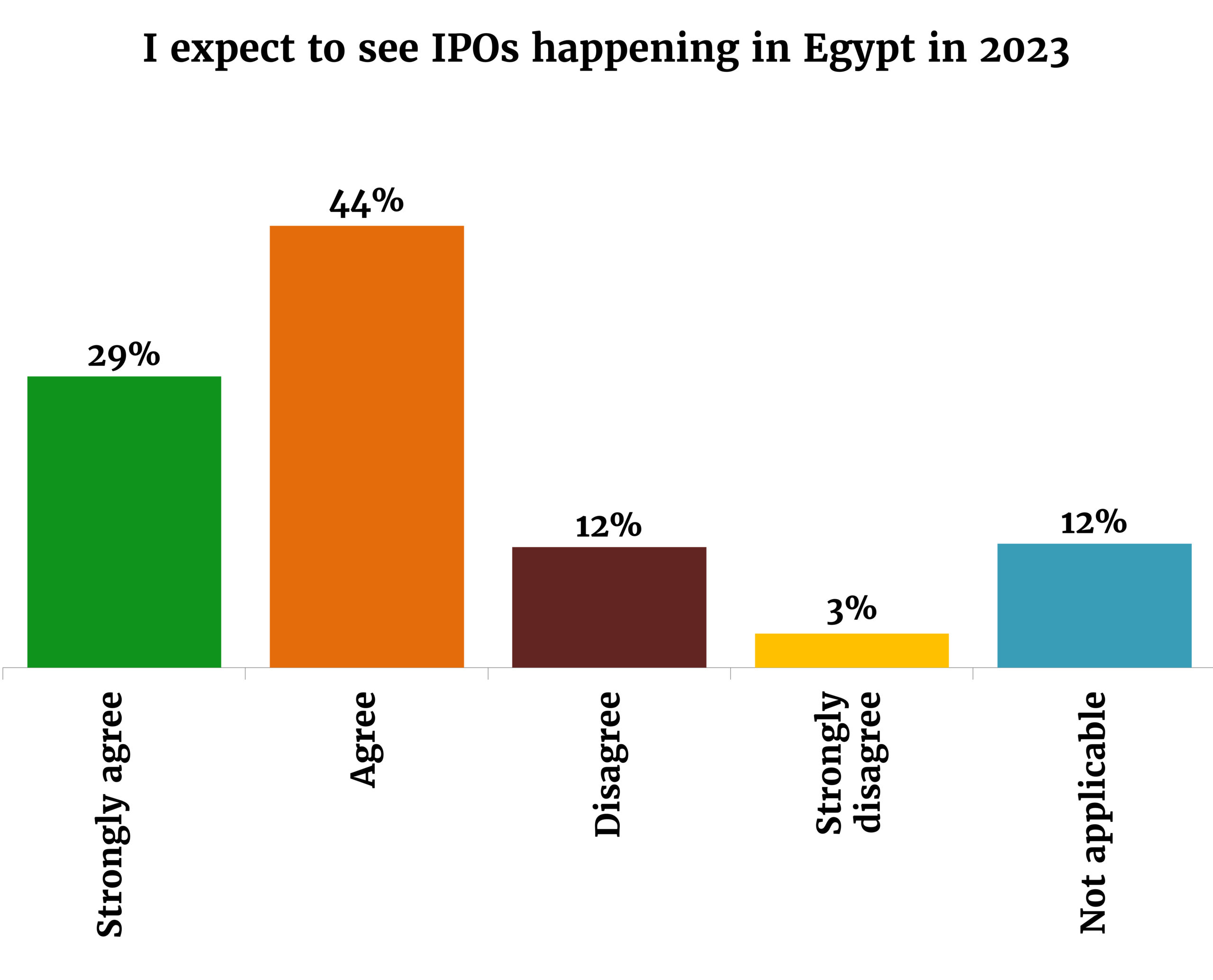

And the IPO outlook is more confident, too: Today, 73% of respondents expect to see the EGX getting some fresh listings before the year is out, while 22% of you think the IPO pipeline is looking dry. In September, 69% of you said you think we’re going to see IPOs happening in Egypt in 2023.

That uptick in confidence comes as the Madbouly Cabinet recently unveiled an ambitious rebooted state privatization program, which will see the government selling stakes in 32 state-owned companies and assets over the next year.

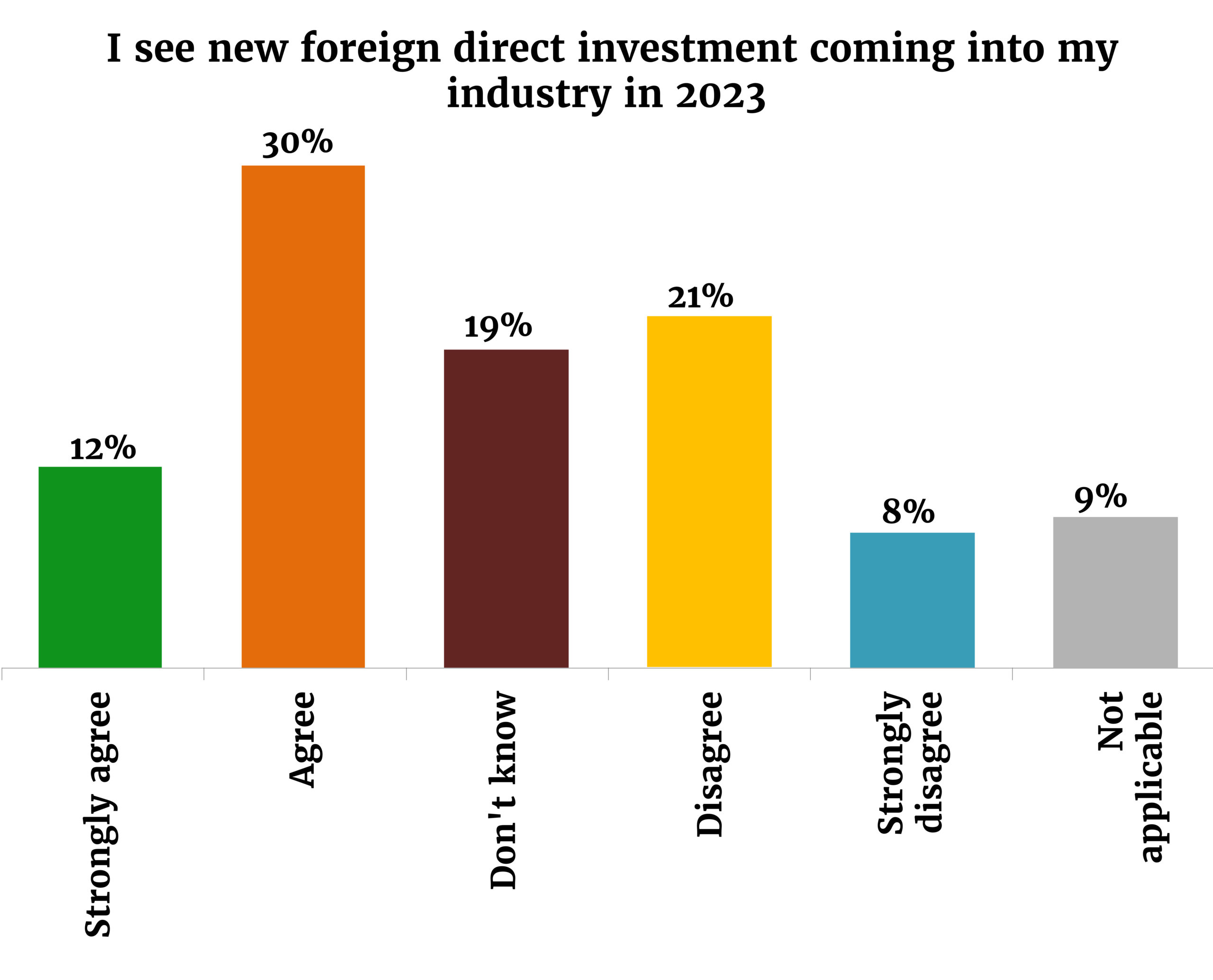

But you’re split almost exactly down the middle on whether or not your industry will see FDI inflows in 2023, with 42% of respondents expecting to see foreign direct investment coming in this year and 40% saying that’s unlikely to be the case.

We’re of the mind that FDI (along with exports) are the way forward for Egypt’s economy — and that we have a chance to build an export-led economy that will make us an FDI magnet. Want to join the conversation? Drop us a line on events@enterprisemea.com.

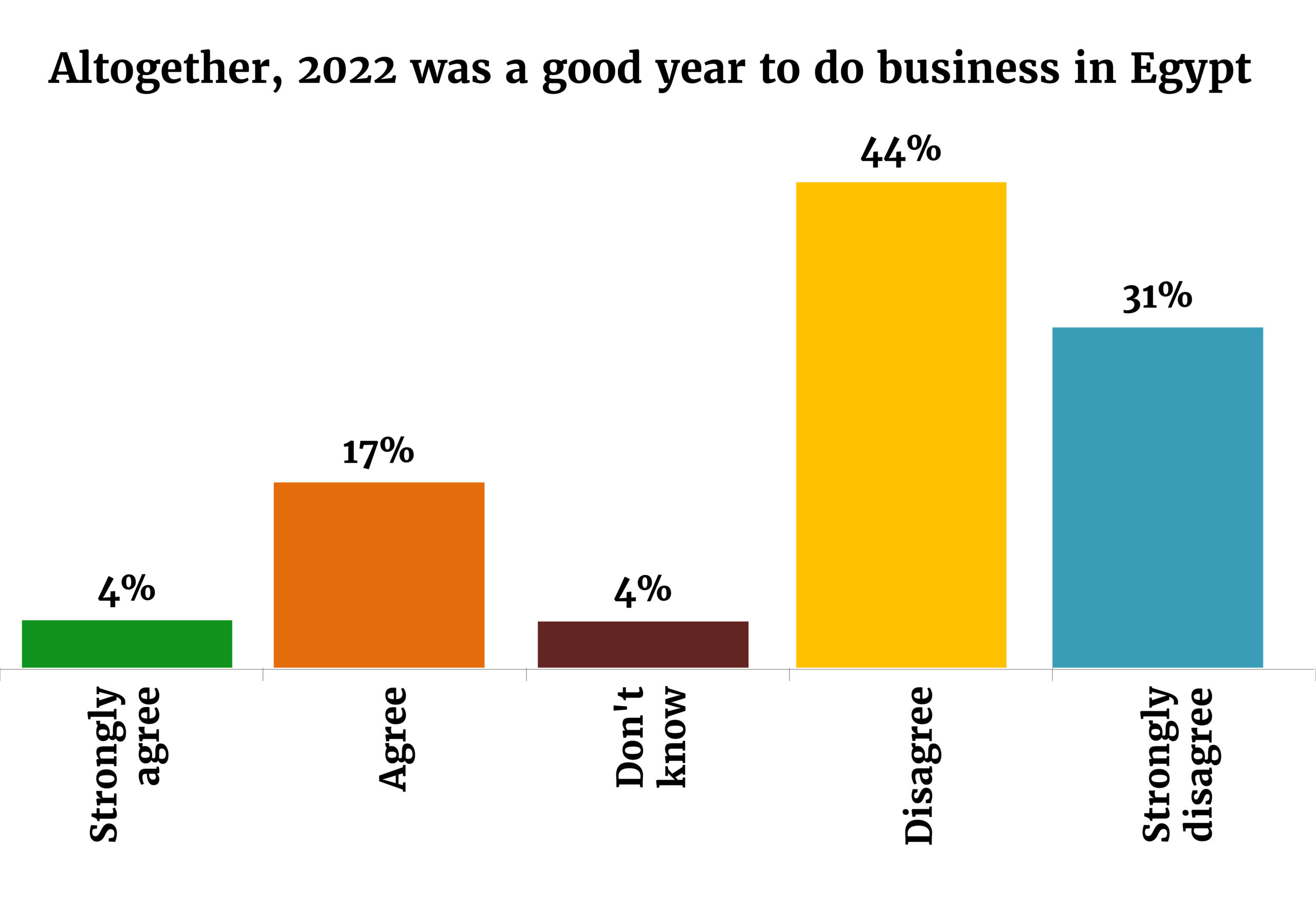

IN THE REARVIEW MIRROR- Only 21% of you think that 2022 was overall a good year to do business in Egypt. That’s more or less on par with how you were feeling in September, when 23% of respondents said business was good nine months into the year.

How does that compare to previous years? For starters, it’s worse than the Year of Covid, when 42% of you said business conditions in 1Q 2020 were good, and only 24% disagreed. In 2021, three quarters of all respondents said it was a good year for business.