- Pickalbatros plans to open three new hotels in Hurghada. (The Big Story Today)

- This year hasn’t gone as planned, but optimism is still the order of the day. (Enterprise Reader Poll)

- What’s been keeping you up at night? Mostly the FX crunch — but we’ve officially forgotten covid-19. (Enterprise Reader Poll)

- Your budget expectations for next year see the EGP slipping further. (Enterprise Reader Poll)

- The outlook for M&A is slowing, while the forecasted IPO pipeline appears to be heating up. (Enterprise Reader Poll)

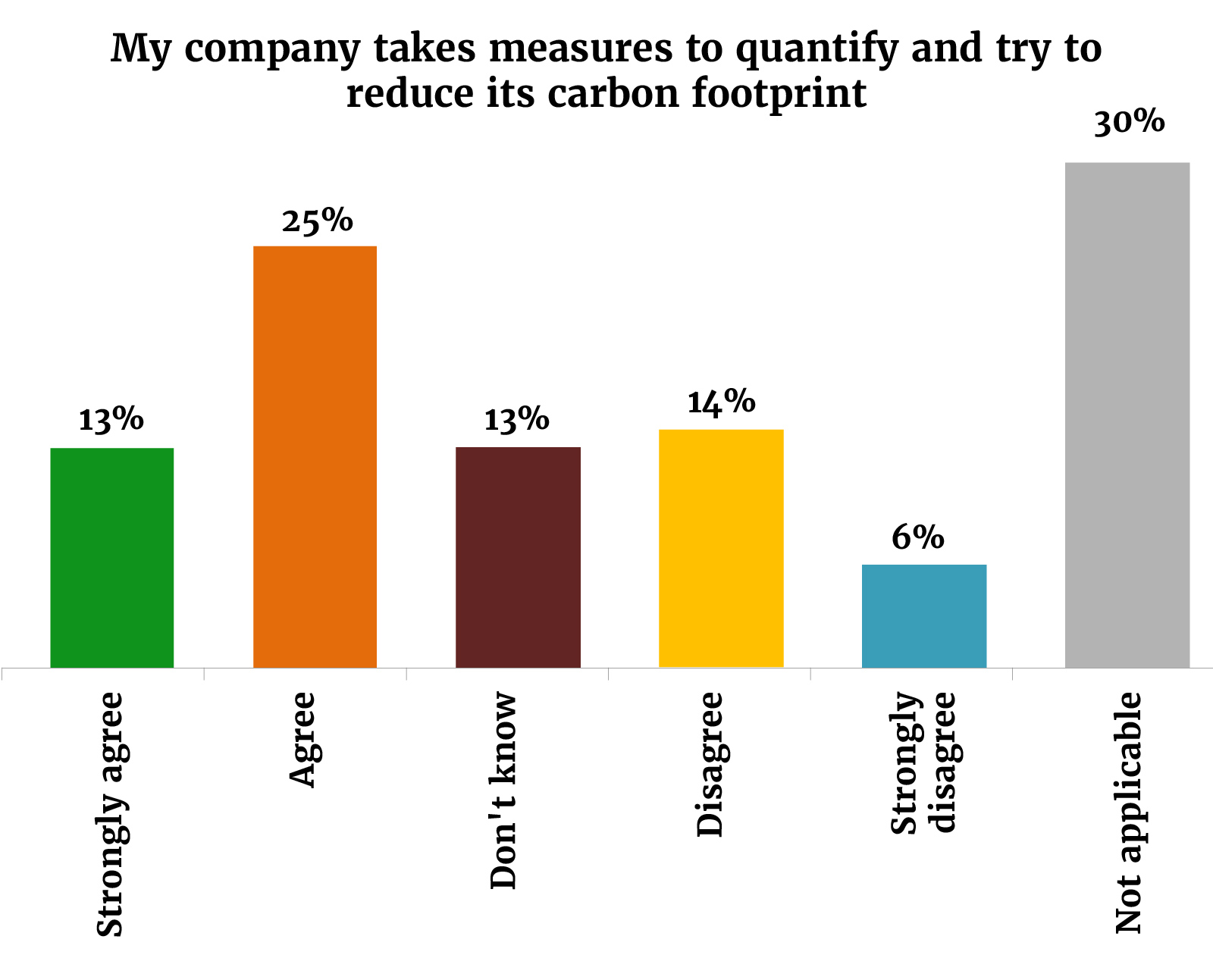

- You’re taking the environment seriously — and tracking your carbon footprint. (Enterprise Reader Poll)

Monday, 26 September 2022

PM — The Enterprise Fall 2022 Reader Survey: The results

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Happy Monday, wonderful people, and welcome to a slightly unorthodox issue of EnterprisePM. Today, in place of our typical For Your Commute and Enterprise Recommends sections, we bring you the results of the Enterprise Fall 2022 Reader Poll, wherein we round up your outlooks on everything from investments and IPOs to the FX rate you plan to use as we kick of budgeting season.

THE BIG STORY TODAY

Pickalbatros is planning to open three new hotels in Hurghada, Al Mal quotes Pickalbatros Group Chairman Kamel Abou Ali as saying. The company expects to invest USD 80-120k per room in each of the hotels, Abou Ali said.

THE BIG STORY ABROAD

The GBP plunged to record lows to trade at USD 1.03, before paring losses to sit at USD 1.09, on the biggest tax cut in 50 years, prompting speculation the currency will hit parity against USD before year end. UK Chancellor of the Exchequer Kwasi Kwarteng’s move to eliminate the top rate of income tax and scrap plans to hike corporate takes is widely predicted to take UK’s debt to unaffordable levels and fan the flames of inflation, which is at a four-decade high. These conditions are also expected to see the Bank of England call for an emergency interest rate hike.

The story is everywhere in the international press: Bloomberg | Reuters | The Guardian | Financial Times

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- Gov’t wants to raise USD 6 bn from stake sales by mid-2023: The Madbouly government expects to raise as much as USD 6 bn by selling stakes in state-owned assets by mid-2023, said Planning Minister and Sovereign Fund of Egypt Chair Hala El Said.

- Al Masry Sporting Club has hired Zilla Capital as financial adviser on a planned EGP 4 bn sports complex in Port Said.

- Egypt’s liquefied natural gas (LNG) exports reached USD 8 bn last fiscal year, according to an infographic released by the cabinet yesterday.

|

FOR TOMORROW-

PSA- Get into (almost) all museums without charge tomorrow: The Tourism Ministry is celebrating World Tourism Day on 27 September by waiving entrance fees to almost all of its museums. The National Museum of Egyptian Civilization and cultural museums aren’t participating. (Kelma Akhira | watch, runtime: 7:01)

Our friends at HSBC are hosting an energy transition webinar series tomorrow through Thursday (27-29 September). The series will look at the “latest climate analysis in relation to the global energy market and transition to net zero” in six different sessions covering energy security, what is required to ensure the success of COP27, financing and investment needs for the energy transition, and the scaling up of renewables in the region, among other topics. You can register for the series here.

A Spanish business delegation will be in town tomorrow and Wednesday (27-28 September) for the Egypt-Spain Multilateral Partnership Forum, organized by the Spanish Institute for Export and Investment, according to a press release (pdf). The two-day conference will include seminars and panel discussions on trade and investment in transport, energy, and water with Egyptian ministers and representatives from government bodies, alongside officials from international financing institutions and Spanish Secretary of State for Trade Xiana Méndez Bértolo. The agenda for the conference is available here (pdf).

???? CIRCLE YOUR CALENDAR-

The UN World Food Program and the International Cooperation Ministry are hosting a two-day conference on food security at the St. Regis Cairo Hotel on Wednesday and Thursday, according to a press release (pdf). The conference will mainly focus on the digitization of the agricultural sector, financial inclusion and social protection.

A call for women entrepreneurs: Looking for investors? Look no further. The Facility Investing for Employment will select a number of Egyptian projects that contribute to sustainable job creation to award financing ranging between EUR 1-10 mn, with a focus on women entrepreneurs and women-led businesses, according to a press release (pdf). Entrants can apply starting 14 November.

☀️ TOMORROW’S WEATHER- Expect the weather to be pretty much the same as it was today, with a daytime high of 36°C and a nighttime low of 25°C, our favorite weather app tells us.

ENTERPRISE READER POLL

Optimism still abounds, even if things didn’t go as planned

The Enterprise Fall Reader Survey says: 2022 isn’t panning out how many of you had hoped — but you’re still an optimistic bunch. At the start of the year, more than three-quarters of you expressed optimism that 2022 would bring better business conditions to Egypt — even after broadly agreeing that 2021 was a good year to do business here. That was before the outbreak of war in Ukraine hit the global economy. In the time since, we’ve seen investors punch out of emerging markets, inflation spiral, the EGP slide more than 20% against the greenback, and the imposition of import restrictions that are weighing heavily on businesses.

Nine months into the year, most of you agree that 2022 hasn’t lived up to expectations, with 70% of respondents saying that this year hasn’t been good for business.

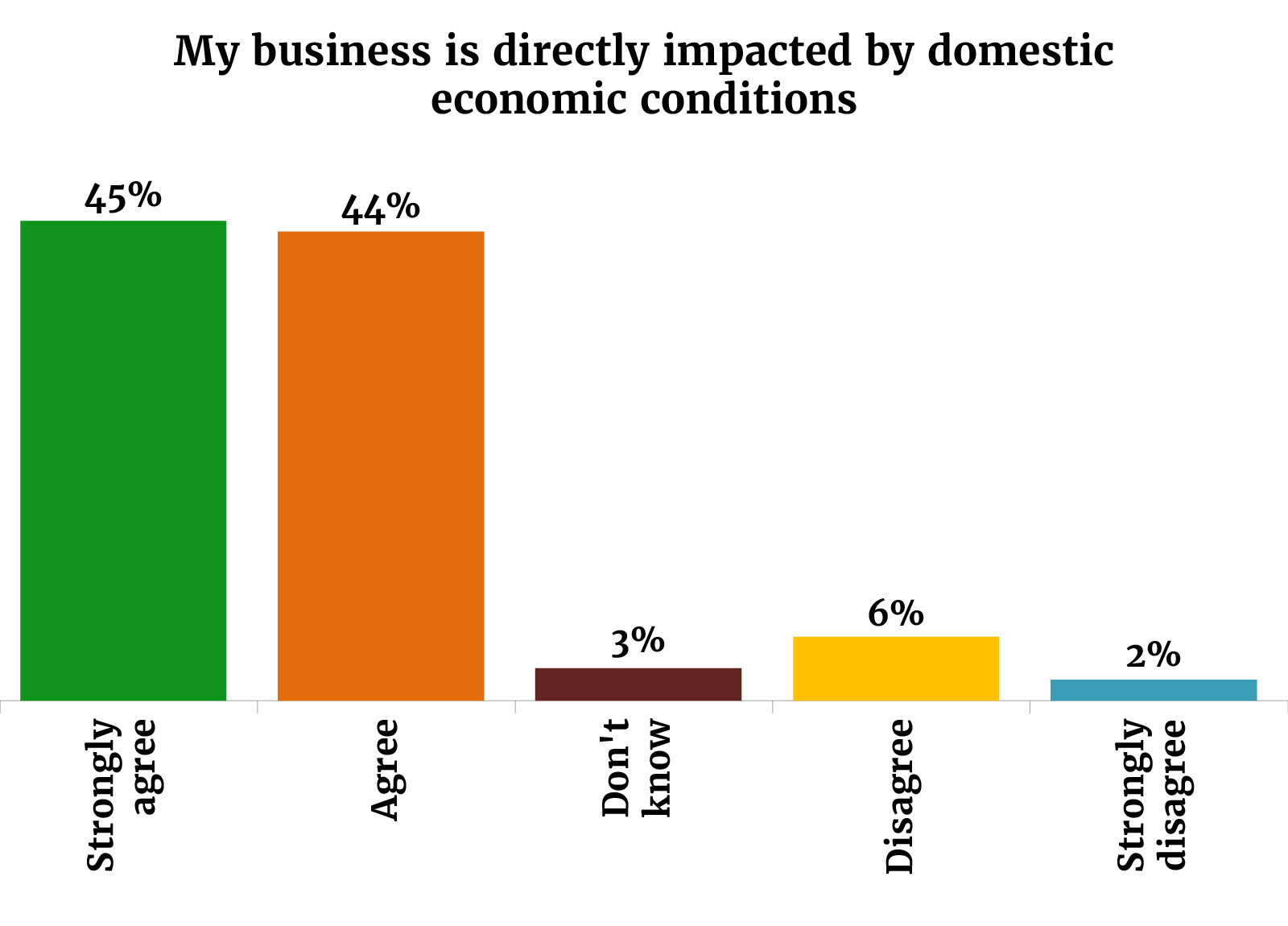

It’s not hard to understand why: A whopping 89% of respondents agree that domestic economic conditions are directly affecting their business, with only 8% appearing to be unscathed.

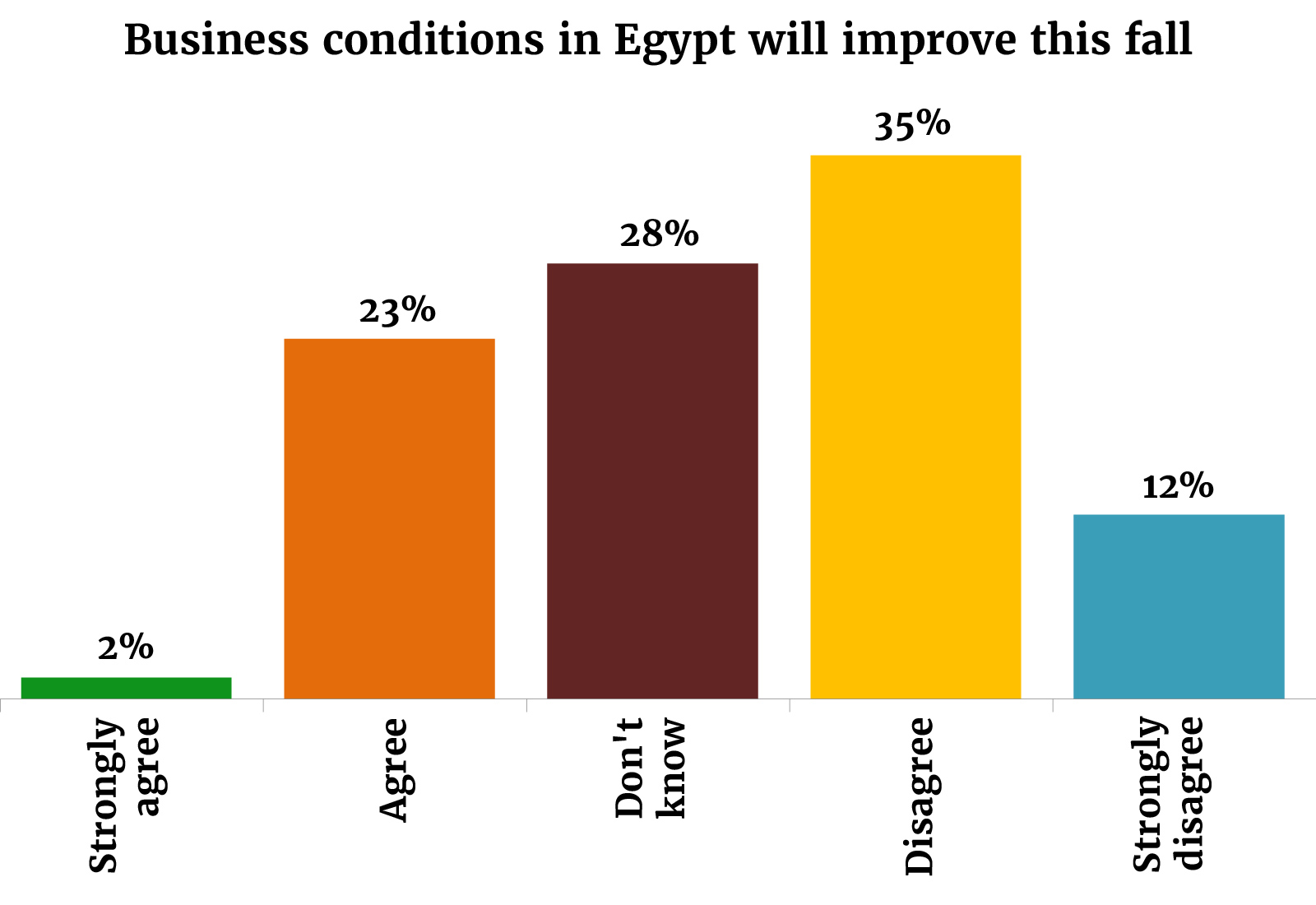

You’re realistic that many of the issues facing Egypt’s economy will take time to resolve — meaning business conditions are unlikely to improve soon. Nearly half of you (47%) don’t think that business conditions will improve before 2022 is out and 28% don’t have clarity on what 4Q will bring. That’s more than the 25% of you who believe the final quarter of the year will see the tide turning.

But your long-term outlook is much more optimistic: Almost half (48%) of respondents believe that 2023 will bring better conditions for the business community. But with import restrictions in place and the FX situation still unclear, a full one third of you don’t have enough visibility to make a call about ‘23.

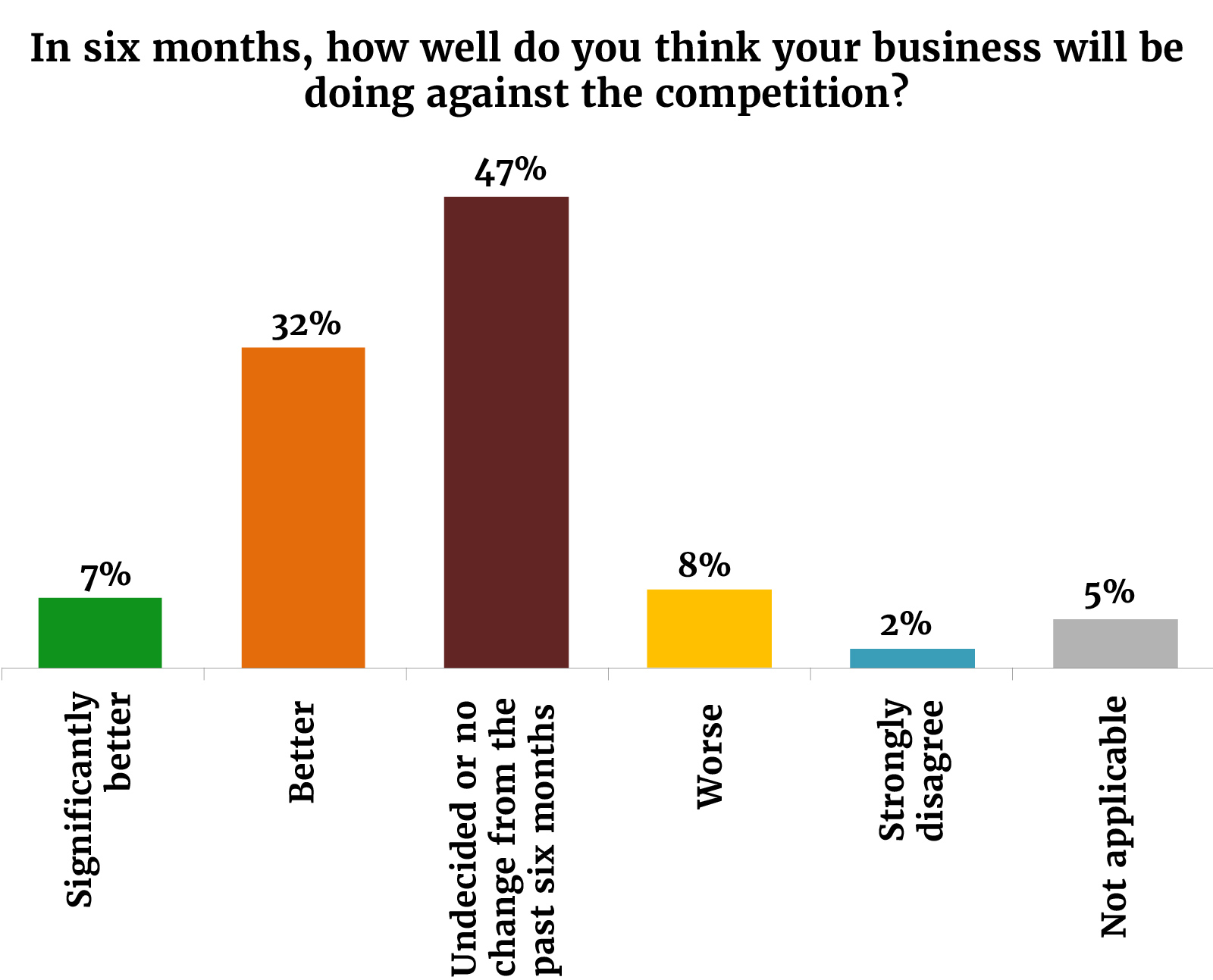

That optimism also (mostly) carries through to how you view your competitive advantage: Thirty-nine percent think their companies will do better than the competition in six months. That’s less bullish than the 69% of readers who had the same sentiment at the beginning of the year, but only 10% of you think you’ll be doing worse than the competition. The broad majority (47%) are on the fence, saying things will likely remain unchanged — or they’re not certain what the future holds.

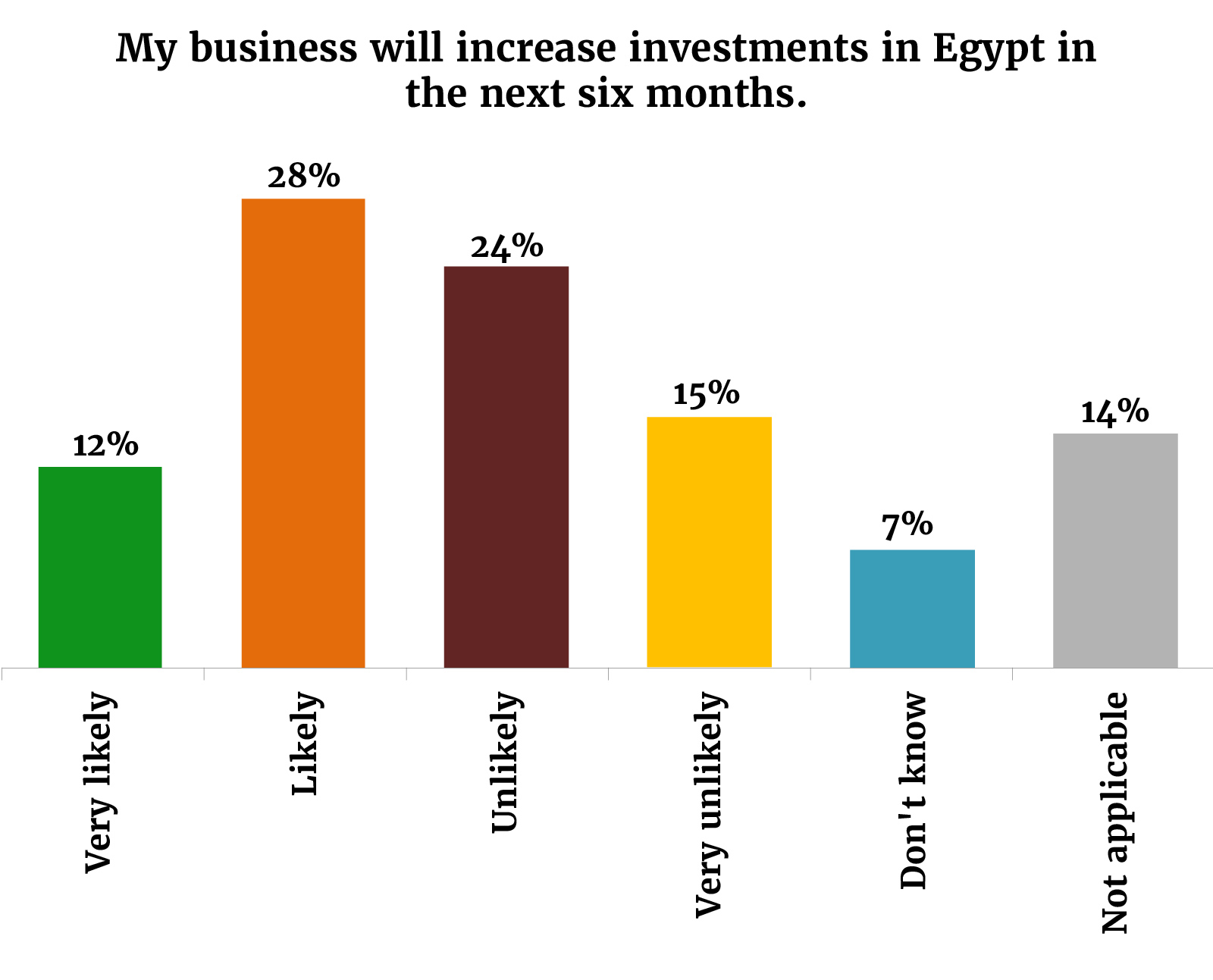

Respondents are split nearly exactly down the middle on whether they will commit fresh investment in Egypt over the next six months, with 40% saying it is either likely or highly likely, and 39% saying it’s just not in the cards.

On average, your peers think the EGP will settle at 22.12 to the greenback. Most of you see the EGP slipping further against the USD as you prepare your 2023 budgets, with 85% of you expecting to see the USD : EGP exchange rate above where it stands today. The bulk of you (64%) see the rate somewhere between EGP 21-24, while 8% think we’re in for an exchange rate of above EGP 24 / USD 1. There’s a small optimistic minority (7%) budgeting for the EGP to remain relatively stable or even rally.

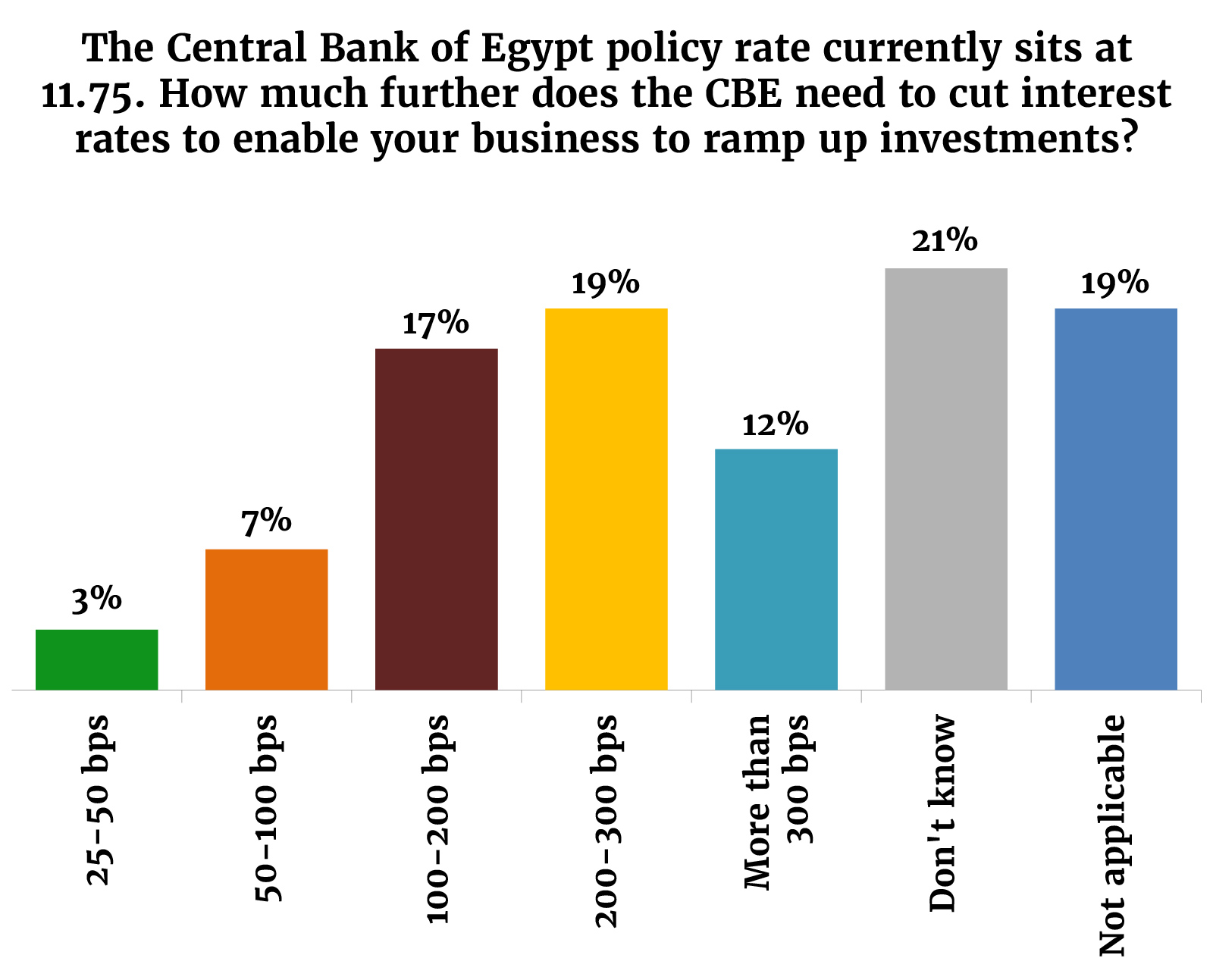

The current high-interest environment also plays a role in determining investment plans: More than one-third of you (36%) say you need to see the Central Bank of Egypt cutting interest rates by anywhere between 100-300 bps to help you unlock CAPEX spending. Twelve percent need even more, saying interest rates need to be 300 bps lower to allow for new investments.

So, what’s been on your mind? The top concern cited by survey respondents is access to foreign currency. Twenty-two percent see Egypt’s FX situation — including requirements the Central Bank of Egypt imposed earlier this year for importers to use letters of credit (L/Cs) to purchase non-essential items amid a shortage of greenbacks — as the biggest problem facing their business today. Exactly two-thirds of you (66%) agree that your business is presently affected or constrained by poor access to FX.

Tied for number 2: 19% of respondents said red tape and regulations as their biggest headache — a figure that has remained steady since the beginning of the year (indeed, since we began this survey years ago). Your sentiment on the Madbouly Cabinet appears to have shifted somewhat, with 62% of you seeing the council of ministers as unsympathetic to the needs of business. At the beginning of the year, 45% of you said you felt cabinet was in tune with the needs of business.

The same with inflation: 19% of you said rising prices weigh the most on your business. Interestingly, although it wasn’t the biggest issue cited by the majority of you, 88% of respondents agree that inflation is impacting their business.

Supply chain and procurement issues come in next, with 11% of respondents naming that as the biggest hurdle. Access to credit and the interest rate environment follows closely after (10%). Other problems like finding and retaining talent — which has been a persistent complaint among businesses — and taxation have largely fallen down the list of priority issues, with less than 10% of you citing either of these as the biggest thorn in your side.

How the times have changed: We’ve officially said goodbye to the pandemic, as a mere 1% of you cited health concerns or restricted mobility due to covid-19 as a top-of-mind concern. That’s a sea-change from the 27% of you who had covid-19 issues as their biggest issue two years ago. Speaking of covid-19, 37% of you have carried over some sort of hybrid work model from the pandemic years, while 56% of readers are fully back in the office.

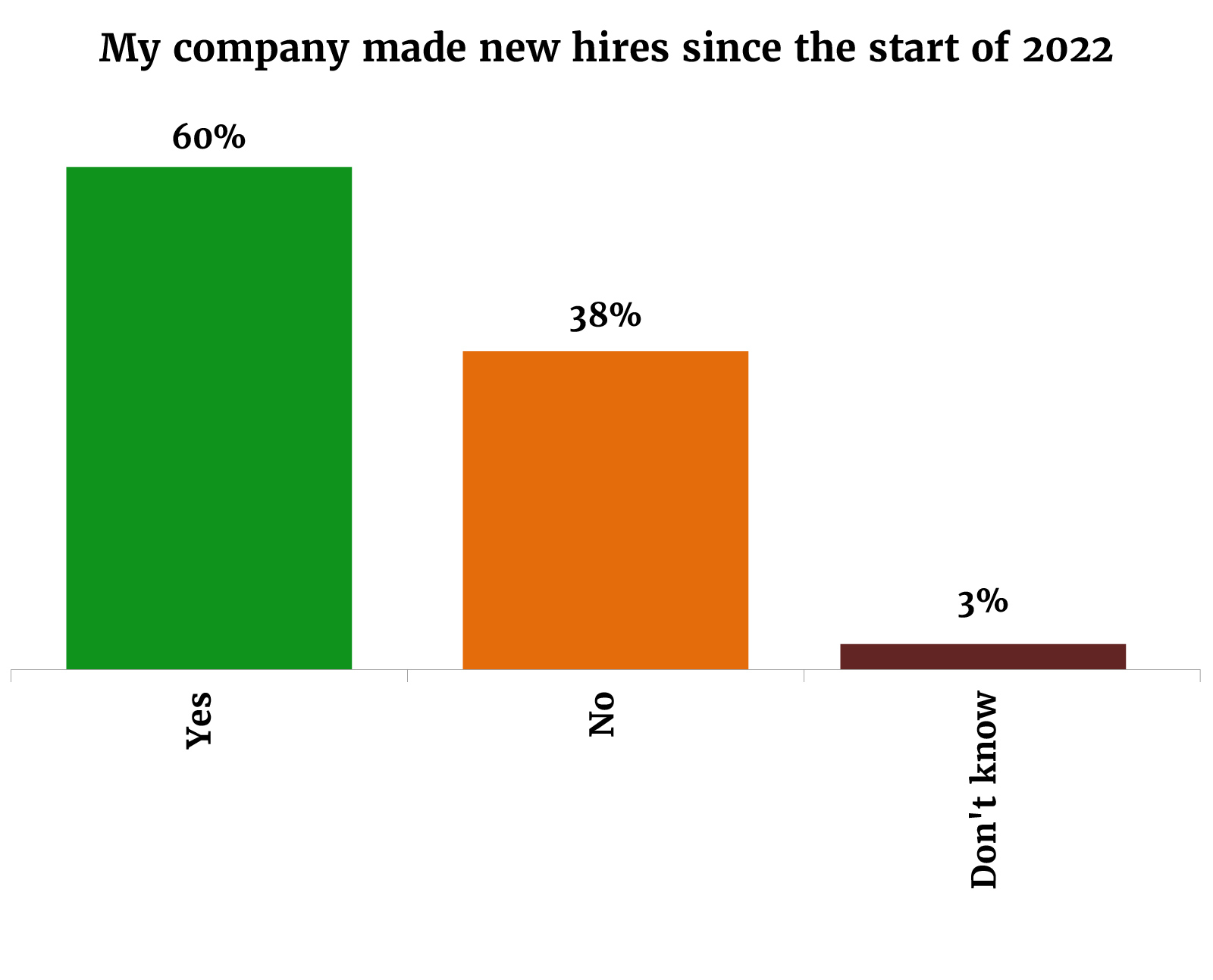

These problems didn’t stop you from hiring staff this year… Sixty percent of survey takers said their company made new hires in 2022, while 38% haven’t grown their teams.

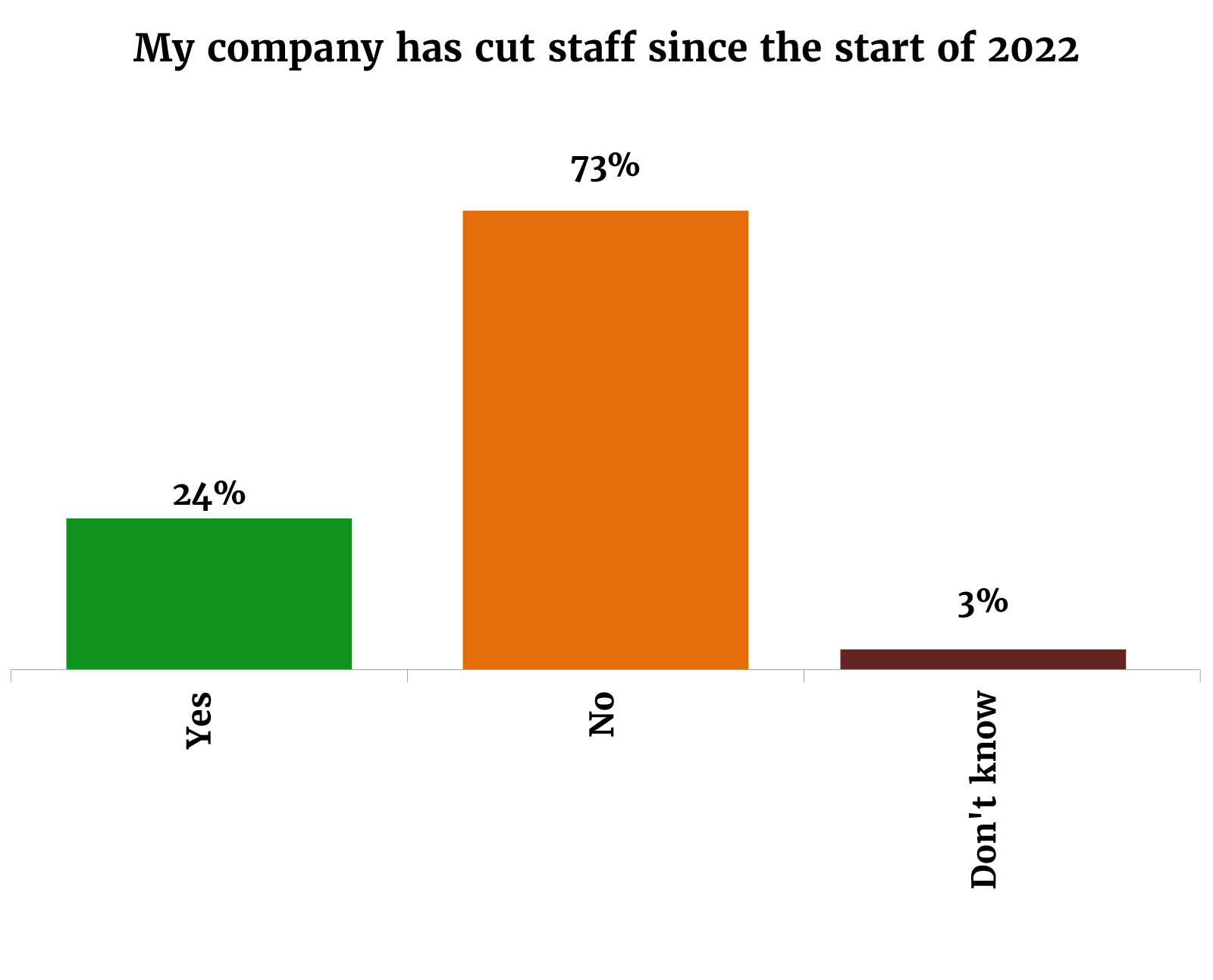

…And isn’t leading many of you to cut the proverbial fat on your teams: Nearly three-quarters (73%) have held off on layoffs or otherwise cutting staff since the beginning of the year. Twenty-four percent of you, however, reported downsizing your teams this year.

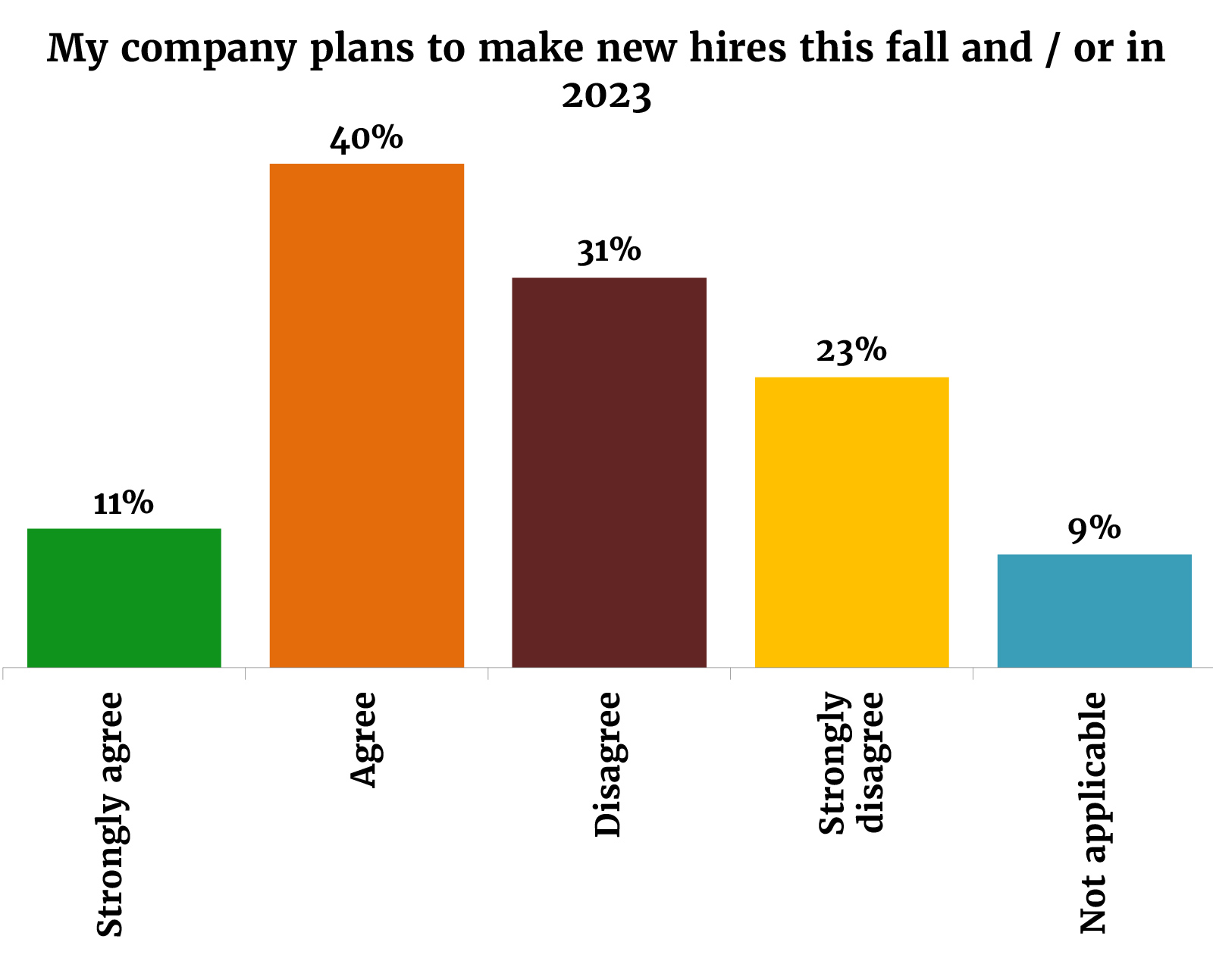

But you’re not necessarily going to grow your headcount: A slightly larger number of you (54%) are pausing on making new hires this fall or next year than those of you (51%) who are planning on hiring additional staff.

Sixty-four percent of respondents said their companies gave out annual raises last year — and y’all were pretty generous. The majority (47%) of those of you who did raise wages last year handed out a 10-14% increase, while 26% handed out 15-20% raises.

More of you are compliant with the national minimum wage for the private sector than was the case at the beginning of the year: Only 21% say your companies need to raise salaries to be compliant, down from 27% at the beginning of the year.

It appears the streak of M&As will cool down in the months ahead: Only 38% of you have a positive outlook on M&A in your industry, while 18% don’t see much consolidation ahead. A quarter of you are uncertain of what to expect as far as M&As are concerned.

And the outlook for FDI is mixed: Some 35% of readers see new foreign investments coming into their industry in 2023, compared to the 60% of you who saw FDI inflows in the cards for 2022. One-third of readers have written off FDI for their industry in 2023 and 23% are unsure.

But your expectations for IPOs are pretty high: Sixty-nine percent of readers see IPOs happening in Egypt in 2023, compared to 28% who aren’t holding their breath for new paper. At the beginning of the year, 41% of readers expected to see an IPO happening in their industry this year.

After a dearth of listings, the EGX might be seeing fresh IPOs thanks to simplified listing regulations: So far, the EGX has only seen Macro Group’s EGP 1.3 bn IPO. Five or six private sector companies are “in serious talks” with the EGX about possibly listing on the bourse, EGX Chairman Ramy El Dokany said earlier this month, attributing their interest to newly-introduced rules that make listing procedures a bit simpler. State-owned institutions could also bolster Egypt’s IPO pipeline, as the government is working to reboot its privatization program through the Sovereign Fund of Egypt’s new pre-IPO fund, which will offer stakes in state-owned companies to strategic investors and sovereign funds ahead of listing them on the bourse.

A positive note to end on: You’re taking the environment seriously. Thirty-eight percent of polled readers reported their company is taking steps to measure their carbon footprints — and actively try to reduce it. A smaller number of you (20%) said this isn’t the case.

???? GO WITH THE FLOW

The EGX30 fell 0.7% at today’s close on turnover of EGP 948.50 mn (0.3% below the 90-day average). Local investors were net buyers. The index is down 17.8% YTD.

In the green: Egypt Kuwait Holding-EGP (+4.2%), Ezz Steel (+2.8%) and Sidi Kerir Petrochemicals (+2.1%).

In the red: Eastern Company (-3.2%), e-Finance (-2.1%) and CIB (-2.0%).

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

SEPTEMBER

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 50 fintech startups.

September: Meeting of the Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

13-27 September (Tuesday-Tuesday): UN General Assembly, New York.

25-27 September (Sunday-Tuesday) A delegation of executives at Egyptian real estate companies visit Saudi Arabia to present developers with potential investments in Egypt’s real estate sector.

25-29 September (Sunday-Thursday) FranEgypt will hold its first virtual expo on franchises in the country.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

27-28 September (Tuesday-Wednesday): Egypt-Spain Multilateral Partnership Forum, Sofitel Gezira, Cairo, Egypt.

27-29 September (Tuesday-Thursday): Africa Renewables Investment Summit (ARIS), Cape Town, South Africa.

27-29 September (Tuesday-Thursday): HSBC Energy Transition Webinar series.

27-29 September (Tuesday-Thursday): The 14th edition of Creative Industry Summit, Cairo Business Park, New Cairo.

28-29 September (Wednesday-Thursday): The sixth edition of Arab Pensions and Social Ins. Conference in Sharm El Sheikh.

28-29 September (Thursday-Friday): The first edition of the World Food Security Conference in Cairo.

30 September (Friday): Winter opening hours for shops and restaurants begin.

OCTOBER

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Start of 2022-2023 public school year.

1 October (Saturday): House of Representatives reconvenes after summer recess.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

4-8 October (Tuesday-Saturday): The Chemical and Fertilizers Export Council of the Trade and Industry Ministry is organizing a trade mission to Kenya.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10 October (Monday): The CEO Women Conference.

10-14 October (Monday-Friday): Gitex Global, Dubai International Convention and Exhibition Centre, Dubai, UAE.

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC.

15 October (Saturday): Cairo Metro will launch a global tender for maintenance work on the power stations and overhead catenary system of Line 1.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

17 October (Monday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

18 October (Tuesday): The Egyptian-Swedish business forum, Stockholm, Sweden.

27 October (Thursday): European Central Bank monetary policy meeting.

27-30 October (Thursday-Sunday): Cairo ICT, Egypt International Exhibition Center, New Cairo.

Late October-14 November: 3Q2022 earnings season.

Late October: First Abu Dhabi Bank to complete full integration with Bank Audi’s Egyptian operations after merger.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

1-2 November (Tuesday-Wednesday): Arab League annual summit, Algiers, Algeria.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

3 December (Saturday): Dior Men’s pre-fall collection show in Giza.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): The eighth annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.