- Orange Egypt buys USD 440 mn of fresh bandwidth from the NTRA. (Telecoms)

- MTI will sell Apple products starting in 3Q2022. (Trade)

- 2022 financing agreement with ITFC coming this month. (Development Finance)

- e-Finance unit e-Cards enters Zimbabwe with smart card contract for healthcare provider TGI. (Fintech)

- Pharma firm Adwia to invest EGP 400 mn for new production lines this year. (Investment Watch)

- OFH subsidiary Klivvr partners with Visa to launch consumer services before taking on SMEs, small merchants and startups. (Fintech)

- El-Sisi rallies Djiboutian support on GERD during bilateral talks in Cairo. (Diplomacy)

- Zooba snags #38 spot in inaugural MENA 50 Best Restaurants ranking. (What We’re Tracking Today)

- Investment in our solar industry is key to decarbonization plans, a new study says. (Going Green)

- Is something shady going down in NFT trading? Plus: DrifterShoots gives us chills. (Planet Finance)

Tuesday, 8 February 2022

AM — Orange Egypt buys USD 440 mn of new bandwidth from telecoms regulator

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. It’s hump day, and our reward is pleasantly busy news morning — a relief after something like 12 days of drinking from a fire hose. We’ve got something for everyone this morning, from fintech to the restaurant business by way of solar power and pharma.

PSA #1- Say goodbye to single-digit weather. Cairo is finally warming up a bit as winter seems set to draw to a close. The national weather service is predicting warmer days and nights to come. Expect highs to reach up to 22°C through to Sunday, and lows of around 10-11°C at night. There’s no rain in the forecast before Friday, 18 February — a long way out and plenty of time for the forecast to change.

SMART POLICY- Dubai moves to outlaw plastic bags: Dubai will introduce a tariff on single-use plastic bags with a view to banning them completely within two years as the emirate looks to reduce plastic waste, Emirati state-owned news agency WAM reports. From 1 July, businesses will charge customers AED 0.25 for each bag in the initiative’s first phase.

Abu Dhabi could follow suit: The emirate could impose a ban on single-use plastic bags by the end of the year, an official from Abu Dhabi’s environment agency told the National last month. A similar tax on single-use plastics has been adopted in more than 30 other countries, and a partial or total ban has been enforced in 90 nations, according to WAM. The news comes barely a month after the UAE moved to a 4.5 day, Monday-Friday workweek, getting in step with the business in Europe and North America.

SPEAKING OF THE EMIRATES- Our friends at Zooba have made the inaugural edition of the Middle East and North Africa’s 50 Best Restaurants ranking, putting the spotlight on a homegrown brand that has gone from one restaurant in Zamalek a decade ago to eight branches in Egypt and international locations in New York and Riyadh. Founders Chris Khalifa (My Morning Routine) and chef Moustafa El Refaey were recognized an event in Abu Dhabi last night, where Zooba’s ranking at #38 was announced in front of an international audience of chefs, culinary experts, food critics and restauranteurs.

Zooba was one of four Egyptian restaurants included on the list. Izakaya, the popular Japanese-Peruvian fusion restaurant and bar in Sheikh Zayed, was ranked at #48. Restauranteur Ayman Baki’s Japanese restaurant and bar Kazoku took #19, and his flagship restaurant Sachi came in at #5 on the list, earning the title of Egypt’s best restaurant for 2022.

#1 on the list is Dubai’s uncharacteristically unflashy, reasonably priced (by UAE standards) homegrown restaurant, 3 Fils, known for its superior food and casual, friendly atmosphere. The list also included 6 restaurants in Israel. Tap or click here for the full ranking and profiles of the restaurants and founders.

MORNING MUST-READ- Janet Heckman, the former Egypt and regional boss at EBRD, responds to FT democracy criticism: Heckman, a former managing director of the European Bank for Reconstruction and Development (EBRD), isn’t impressed with criticism by an article in the Financial Times last month (which we picked up in What We're Tracking Today). The piece called out the bank for working with governments in Africa and Asia that it said have lackluster democracy credentials. In a letter to the FT, Heckman (My Morning Routine) defended the lender’s “outstanding” work to increase private sector involvement and transparency in the region, highlighting among other things its involvement in our Metro projects, which she indirectly supervised.

PSA #2- International flights to and from Morocco resumed yesterday, ending a two-month ban on all flights into the country that came into effect after the emergence of the omicron variant.

|

IN THE HOUSE TODAY- The House of Representatives is meeting in plenary session. It reconvened on Sunday, but the big-ticket items appear to have been saved for today’s final session. They include:

- Changes to the Real Estate Registry Act that aim to simplify property registration procedures, which received the green light from the House’s Legislative Committee last week.

- An overhauled Tourism and Hotels Act, which is set to simplify licensing rules for hotels and tourism companies and earned preliminary approval from the House at the end of January.

- Amendments to the Education Act that would see an EGP 500-1k fine imposed on parents whose children miss school without sufficient reason. The House will discuss a report from its Education Committee on why it struck down the amendments last week.

THE BIG STORY ABROAD on this fine late-winter morning- No single story has captured the imagination of the international business press. The collapse of SoftBank’s USD 66 bn sale of its chipmaking business Arm to Nvidia leads at the Financial Times, while both Reuters and the Wall Street Journal are running with US President Joe Biden’s promise to shut down the Nord Stream 2 pipeline linking Russia to Germany. (Nevermind the small issue that it’s under German control and that Chancellor Olaf Sholz gave the idea tepid support — at best.) Bloomberg, meanwhile, has news that Bahrain may offer permanent residence to some foreigners while CNBC notes that Meta is promising to turn off Facebook and Instagram ads in Europe over a data-sharing dispute.

OVER IN BEIJING- Russia, Canada and China top the medal table in the Winter Olympics by total volume of hardware their athletes have so far won. The Netherlands and Italy round out the top five.

CIRCLE YOUR CALENDAR-

TODAY is your last day to apply to join the Fortune Global Women's Mentoring Program, which will take place from 8-28 May 2022. The program aims to bring emerging women leaders from around the world to the US to meet and learn from the Fortune Most Powerful Women community, which includes executive women mentors from companies such as Accenture, Johnson & Johnson, and Aetna. The deadline to apply for the program is 8 February. You can begin your application by signing up here via our friends at the US Embassy in Egypt.

Inflation figures are due out this Thursday, 10 February. Annual urban inflation rose to 5.9% in December from 5.6% in November. While analysts we spoke with expect prices to continue rising, they don’t see them going outside the central bank’s target range of 7% (±2%) by 4Q2022.

The Finance Ministry has begun holding public consultations on the draft budget for next fiscal year with the next round due to take place on Thursday, 10 February at 5pm CLT.

German Foreign Minister Annalena Baerbock will be in town this Friday, 11 February for a two-day visit that will see her meet with Foreign Minister Sameh Shoukry and other officials for bilateral talks, the German Embassy in Cairo said in a statement. Baerbock is also expected to discuss potential collaboration between the two countries on the COP27 climate summit in Sharm El Sheikh this November.

Egypt will host the Arab League’s Arab Sustainable Development Week from Sunday, 13 February to Tuesday, 15 February. Held at Arab League headquarters in Tahrir Square and the Nile Ritz-Carlton, the forum will bring together ministers, senior officials, policymakers and private sector players from across the region to discuss ways to strengthen sustainable development. Arab League Secretary General Ahmed Aboul Gheit, Planning Minister Hala El Said, and IMF Executive Director Mahmoud Mohieldin are among those set to speak at the conference.

MARKET WATCH-

Oil yesterday finally took a breather from a seven-week rally that saw it reach eight-year highs, Bloomberg reports, as the market reacted to the resumption of talks on the 2015 Iran nuclear agreement in Vienna later today. Brent crude fell 0.6% yesterday to settle under USD 93 per barrel.

The talks could ultimately see Iranian supply restored to global markets after years of sanctions. Motivation to pull that off has likely never been higher in the West, as a supply crunch and rising geopolitical tensions with Russia — a major producer — over Ukraine drive a search for alternative energy suppliers. The US last week restored sanctions waivers to Iran to allow international nuclear cooperation projects, a positive sign as the talks enter their final phase.

Crypto might not be so wintery after all: BTC gained 5.7% to break USD 44k as of midnight on Monday, while Bloomberg reports that riskier memecoins made even bigger gains, led by dog-inspired Shiba Inu, which surged by around 50%. The fifth consecutive day of gains for BTC marks its longest rally since September, as traders seemingly stage a partial return to high-risk digital assets following a Fed-induced selloff that saw BTC drop by as much as 50% from its November peak of nearly USD 69k.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

In today’s issue: Investing in solar plant construction in strategic locations in Egypt should be a priority for investors wanting to boost Africa’s decarbonization efforts, according to a new continent-wide study conducted by Oxford University’s Environmental Change Institute and published last month. Constructing solar farms, rather than fossil fuel alternatives, would reduce emissions, improve energy security, and bring financial benefits, the study shows.

TELECOMS

Orange Egypt lands new cellular bandwidth for USD 440 mn

Orange Egypt has snapped up 30 MHz of new bandwidth from the National Telecommunications Regulatory Authority (NTRA), the regulator announced in a statement yesterday. The frequency band came with a price tag of USD 440 mn, with the proceeds earmarked to help develop mobile phone services across the country, it said.

2020, part II: The latest award comes as a continuation of the 2020 government tender that saw 80 MHz in new frequencies sold to mobile operators for almost USD 1.2 bn.

Orange was the only telco not to get its hands on new frequencies back in 2020. Vodafone Egypt bought two 20-MHz bands, while Etisalat Misr and Telecom Egypt got two 10-MHz bands each. Orange was reported to have bid in the original auction, only to lose out to Etisalat.

Background: Mobile network operators have repeatedly asked the NTRA to provide access to new bandwidth since 2017 when the regulator first launched 4G in the country.

TRADE

MTI to sell Apple products in Egypt starting 3Q2021

iSheep rejoice: MM Group for Industry and International Trade (MTI) will sell Apple products in Egypt from 3Q2022 after signing an agreement with Apple Trading Egypt, it said in an EGX disclosure (pdf) yesterday. The move will give MTI an increased market share in the mobile phone distribution market, said Chairman and CEO Khaled Mahmoud.

Apple holds a small (if lucrative) chunk of Egypt’s mobile market, which is dominated by Samsung, and Chinese manufacturers Oppo, Xiaomi and Realme, whose devices are sold at lower price points.

There are still no official Apple stores in Egypt — or anywhere in Africa for that matter. There has been persistent chatter on social media since early 2021 that Apple had acquired land in the new administrative capital at which to open its first flagship store on the continent. Prime Minister Moustafa Madbouly had pitched the idea to Apple CEO Tim Cook on the sidelines of the World Economic Forum back in January 2019.

Who else sells Apple products here? The iPhone maker’s products are only available through local resellers and repair stores. Other authorized distributors in Egypt include Tradeline, Switch Plus and Raya as well as at mobile network operators Etisalat, Orange, Vodafone Egypt and We.

The cost of mobile phones has risen in recent months following the government’s decision to double tariffs on imported mobile phones to 10%. In December, market intelligence firm International Data Corporation forecast prices to rise 10% during 4Q2021 on the back of the move and ongoing supply shortages, leading vendors to resort to increasing stock of cheaper models. It said that growth in Egypt’s smartphone market will likely slow to 1% this year due to the duty as well as ongoing shortages of mobile phone components.

DEVELOPMENT FINANCE

More financing from ITFC could be coming our way in February

The Madbouly government plans to finalize as early as this month a new financing program for 2022 with the International Islamic Trade Finance Corporation (ITFC), the Planning Ministry said yesterday in a statement, adding that part of the funding will go towards supporting micro, small, and medium-sized enterprises. The statement did not disclose further details on the program

A USD 2.6 bn package? In a meeting with Trade Minister Nevine Gamea last month, ITFC CEO Hani Sonbol said the corporation had approved USD 2.6 bn in funding for “development projects” in Egypt, according to a ministry statement. No further details were given on where the money would be spent, nor when it would be disbursed.

Planning Minister Hala El Said is currently in Jeddah, where ITFC is headquartered. El Said discussed potential cooperation with Sonbol, including launching an academy for exporting in Egypt as well as programs for women’s economic empowerment, the statement said.

2021 was “a record year” for ITFC funding to Egypt, the statement quotes El Said as saying. The ITFC provided the General Authority for Supply Commodities (GASC) and the Egyptian General Petroleum Corporation USD 2.3 bn in financing last year for the import of basic commodities including wheat, and petroleum products.

FINTECH

e-Finance signs first agreement outside of Egypt

e-Finance steps out of Egypt: e-Cards, a subsidiary of EGX-listed fintech player e-Finance, has signed a 10-year contract with Zimbabwean healthcare company Tres Groupe International to supply smart cards, e-Finance announced in a statement (pdf) to the EGX yesterday.

The contract: The company will provide more than 2 mn people with prepaid cards that can be used to pay for health services, in addition to 7k POS machines. e-Cards will also manage the system on behalf of TGI for the 10-year period.

What they said: “This marks the beginning of the group’s strategic plans to expand its service offering to Africa,” e-Finance Chairman Ibrahim Sarhan said in the statement. “[The] partnership with TGI in Zimbabwe is a stepping stone for e-Finance as a group to begin offering its experience and various digital solutions across Africa.”

In other fintech news:

- e-Finance’s digital payments arm Khales has applied to the Financial Regulatory Authority to obtain consumer finance and microfinance licenses, Sarhan said at a presser yesterday. (Al Borsa | Al Mal)

- The National Bank of Egypt has committed USD 30 mn to a UAE-based fintech investment fund and will invest EGP 100 mn in Digital Finance Holding’s upcoming venture debt fund Camel Ventures. (Al Borsa)

FINTECH

OFH subsidiary Klivvr to launch app + payment cards early this year

Klivvr partners with Visa to launch financial services: Orascom Financial Holding’s fintech subsidiary Klivvr has signed a partnership agreement with Visa to help launch the fintech firm’s financial services — including physical and digital payment cards, and an app — in early 2022, according to an OFH statement (pdf). In a phased plan, the two firms will first provide consumer financial services before expanding their focus to small merchants, SMEs, and startups.

What they said: ”Klivvr’s financial app, slated for launch in early 2022, is the first in a roster of upcoming digitally enabled financial products that we plan to rollout over the coming year, all as part of our strategy of capitalizing on financial markets’ growing preference and adoption of tech-driven digital solutions,” OFH CEO and Klivvr Chairman Nils Bachtler (My Morning Routine) said in the statement.

Background: The news comes after Klivvr landed an initial license from the Central Bank of Egypt to launch a mobile application and issue payment cards in partnership with Arab African International Bank.

INVESTMENT WATCH

Adwia to invest EGP 400 mn in 2022 to add production lines

Pharma manufacturer Adwia will invest EGP 400 mn this year to add new production lines and make upgrades at its 10th of Ramadan factory, Al Borsa quoted company head Mohamed Khattab as saying. The company is also planning to take 11 new products to market this year, and to tap new export markets.

About Adwia: A pan–African pharma investment fund launched by the European Bank for Reconstruction and Development, the UK’s CDC Group, and Development Partners International acquired 99.6% of the drugmaker for USD 126 mn in late 2020. The company produces more than 100 meds for the Egyptian market, and exports its products to several Arab and African countries, according to Al Borsa.

LAST NIGHT’S TALK SHOWS

The talking heads are not quite over AFCON yet: Kelma Akhira (watch, runtime: 38:12), El Hekaya (watch, runtime: 3:22), and Al Hayah Al Youm (watch, runtime: 51:03) all marked the Pharaohs’ return from Cameroon by revisiting the team’s performance with analysts, former players and even national team goalkeeper Mohamed Abo Gabal, who was El Hekaya’s guest for the evening. Ala Mas’ouleety (watch, runtime: 3:31) also gave AFCON some airtime.

Also getting coverage: Djiboutian President Ismail Guelleh’s visit for talks with President Abdel Fattah El Sisi. Former assistant foreign minister Mohamed Hegazy looked at the strategic importance of the visit on a phone call with Masaa DMC (watch, runtime: 10:06), while Khaled Okasha, general manager of thinktank Egyptian Center for Strategic Studies, weighed in on a call with Al Hayah Al Youm’s Lobna Assal (watch, runtime: 3:00; 2:03). We have more on the story in our Diplomacy section, below.

EGYPT IN THE NEWS

MNT-Halan gets more international ink: The Financial Times carries an interview with MNT-Halan co-founder and CEO Mounir Nakhla, where he shares the fintech outfit’s origin story and expansion plans. Nakhla also went into some more detail on the company’s plans to launch supply chain financing, saying it could introduce a new product that would “disrupt” Egypt’s famous koushk (kiosk) industry by allowing the 50k merchants it has in its client base to order stock through its app, “cutting out the middleman.”

Tourism, antiquities and cultural heritage are also getting plenty of mentions this morning: The BBC looks at how the 3k-year-old city of Aten near Luxor — known as Egypt’s Pompeii or “golden city” — promises to uncover more about life under Amenhotep III, while archeologists tell Newsweek that over 18k inscribed ceramic pieces unearthed in the Nile Delta include samples of lines written by school pupils as a “Bart Simpson-like punishment.” Female-led Egyptian ensemble Mazaher is keeping the traditional art form of Zar music alive, Reuters reports. Meanwhile, the latest Hollywood release is generating coverage for luxury Nile cruises — some of which are “just as lavish as anything in Kenneth Branagh’s Agatha Christie adaptation Death on the Nile,” according to Time Out.

ALSO ON OUR RADAR

Egypt to buy 4 mn tonnes of local wheat this season: Egypt plans to purchase 4 mn tonnes of wheat from local farmers this season, up from 3.6 mn tonnes last year, Supply Minister Ali El Moselhy said yesterday, according to a ministry statement. The amount would cover the equivalent of some 19% of local consumption for the 12 months to the end of September 2022, on the basis of the most recent estimates (pdf) from the US Foreign Agricultural Service.

More wheat at higher prices: The government is paying 13% more for local wheat this year than it did in 2021, after a global supply squeeze saw prices hit a new ten-year high. The price hikes are expected to take an additional EGP 12 bn out of the state budget this fiscal year, and the Supply Ministry is currently preparing to taper bread subsidies to soften the impact of rising prices. Meanwhile, the looming conflict between Ukraine and Russia is already pushing prices for imported wheat yet higher. The world’s largest wheat importer, Egypt is also the largest consumer of Ukrainian wheat, last year purchasing the equivalent of around 14% of its total wheat consumption from the eastern European country.

Other things we’re keeping an eye on this morning:

- Banque Misr will invest (pdf) USD 201.1 mn in African Export-Import Bank (Afreximbank), of which USD 80.5 mn is paid-in. This increases BM’s stake in Afreximbank to 5.8% from 3.1%, making it the bank’s largest non-sovereign shareholder.

- The Financial Regulatory Authority has directed (pdf) Egyptians for Housing Development & Reconstruction (EHDR) to delay for 60 working days its offer to acquire a 51% stake in Emerald Real Estate through a share swap that would raise EHDR’s ownership in the firm to 90%.

- Kuwait Airways will launch direct flights to Sharm El Sheikh, Alexandria and Sohag in May.

COVID WATCH

Australia reopens to vaccinated tourists + 1 in 3 Turkish lawmakers has covid

The Health Ministry reported 2,272 new covid-19 infections yesterday, down from 2,301 the day before. Egypt has now disclosed a total of 441,923 confirmed cases of covid-19. The ministry also reported 57 new deaths, bringing the country’s total death toll to 22,993.

The vaccine tally: 27,398,696 people are now fully vaccinated against the virus, while some 10.7 mn people have received only their first shots and 657,257 people have received booster shots.

Australia will reopen its borders to double-vaccinated travelers after nearly two years on 21 February, as the country tries to revive its tourism industry, the government announced yesterday. (That means Novak Djokovic still isn’t welcome, and Kanye West might not be either).

The Turkish parliament has suspended sessions for a week after 200 representatives tested positive for covid-19, Sky News Arabia reports. Turkish President Recep Tayyip Erdogan is currently isolating at home with his wife Emine, after both tested positive for the omicron variant earlier this week.

PLANET FINANCE

All is not quite as it seems in the pixelated, unregulated world of NFTs: “Irregular sales” on nonfungible token (NFT) trading platforms are raising eyebrows among crypto insiders, who say that many multi-bn USD transactions on the digital assets may be “wash trades” that give false impressions of high demand, and would not be allowed in traditional equities markets. Sellers may be trading their own NFTs back and forth across multiple blockchain wallets, according to a Reuters review of publicly available blockchain records — giving the lie to claims by blockchain promoters that transparency is at the technology’s core. Case in point: Data shows that the 27 biggest NFT sales in January — worth a combined USD 1.3 bn —- originated from just two such wallets.

THE ONE NFT MAKER who gives us heart palpitations: @DrifterShoots, known for his Where My Vans Go (WMVG) series of his shoes high, high above cities. Check out the New York Times profile here.

In other international business news:

- IPO WATCH: Abu Dhabi Ports has raised USD 1.1 bn from its IPO ahead of its debut on the ADX tomorrow. The company, which is owned by Abu Dhabi sovereign wealth fund ADX, put 1.25 bn shares up for sale at AED 3.20 (USD 0.87) each. (Bloomberg)

- DEBT WATCH: Qatar is considering refinancing more than USD 10 bn in debt due for repayment next year. (Bloomberg)

- CRIME WATCH: Swiss banking giant Credit Suisse faced charges of money laundering for Bulgarian drug traffickers in a Swiss court yesterday, in the country’s first criminal trial of a major bank. (Reuters)

|

|

EGX30 |

11,549 |

-1.2% (YTD: -3.4%) |

|

|

USD (CBE) |

Buy 15.66 |

Sell 15.76 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

12,249 |

+0.4% (YTD: +8.6%) |

|

|

ADX |

8,734 |

+0.0% (YTD: +2.9%) |

|

|

DFM |

3,189 |

+0.6% (YTD: -0.2%) |

|

|

S&P 500 |

4,484 |

-0.4% (YTD: -5.9%) |

|

|

FTSE 100 |

7,573 |

+0.8% (YTD: +2.6%) |

|

|

Brent crude |

USD 92.69 |

-0.6% |

|

|

Natural gas (Nymex) |

USD 4.28 |

+1.1% |

|

|

Gold |

USD 1,822 |

+0.0% |

|

|

BTC |

USD 44,062 |

+5.7% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 1.2% at yesterday’s close on turnover of EGP 947 mn (11.4% below the 90-day average), its sharpest decline since 19 January. Foreign investors were net sellers. The index is down 3.35% YTD.

In the green: e-Finance (+4.1%), Telecom Egypt (+0.8%) and Abu Dhabi Islamic Bank (+0.7%).

In the red: Fawry (-5.7%), MM Group (-5.2%) and Heliopolis Housing and Development (-3.1%).

Major benchmarks in Asia are mixed this morning. Shanghai and Hong Kong are down at dispatch time, while the Nikkei, Kospi and ASX 200 were all in the green. Futures suggest a mixed open in Western Europe later this morning and that Wall Street still has a shot at opening (weakly) in the green.

DIPLOMACY

Guelleh, El Sisi talk GERD: President Abdel Fattah El Sisi yesterday discussed coordination on the Grand Ethiopian Renaissance Dam (GERD) in talks with his Djibouti counterpart, Ismail Guelleh, according to an Ittihadiya statement.

The two sides also signed MoUs on political consultation, renewable energy, and the establishment of an Egyptian logistics zone in Djibouti, plans for which have been in the works since 2019. El Sisi also stressed the importance of bolstering bilateral cooperation on trade, infrastructure, energy, health, aviation, education, and supporting SMEs.

Banque Misr lands in Djibouti + direct flights in the works? A Banque Misr branch will be opened in Djibouti soon, El Sisi said at a press conference following the meeting, adding that direct flights could also be launched between the two countries.

The meeting comes as Egypt ramps up efforts to increase African alliances in light of the ongoing GERD dispute, with El Sisi meeting with Senegalese President Macky Sall to discuss the crisis just last week. The Washington Post and the Associated Press also took note of the sit-down with Guelleh.

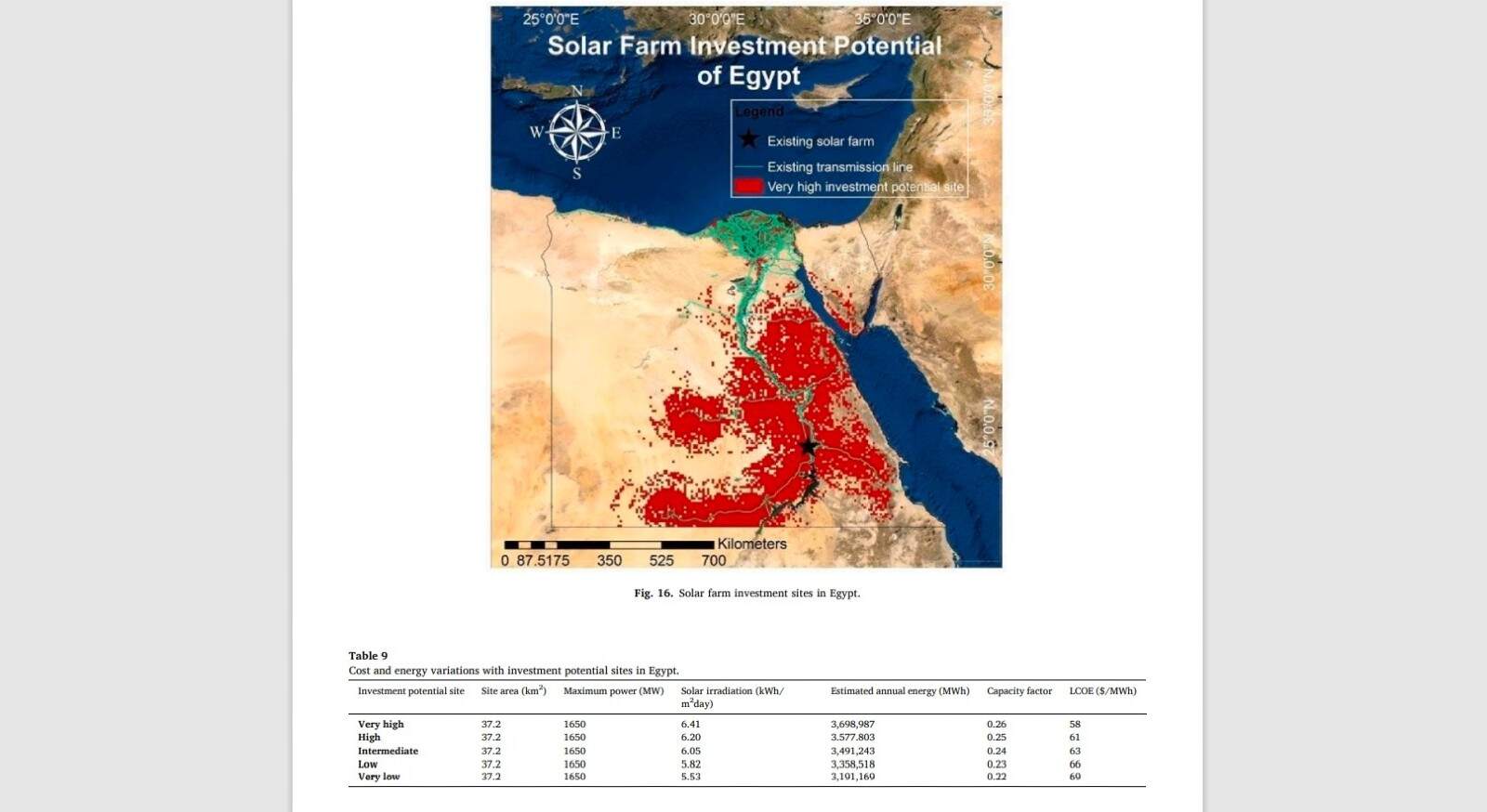

Strategic investment in Egypt’s solar energy is among the most effective ways to decarbonize, says new Africa-wide study: Investors wanting to make substantial climate-related impact in Africa should be channeling their USD into particular strategic investments — with solar farm construction in Egypt being one of the most effective, according to a new continent-wide study (pdf) conducted by Oxford University’s Environmental Change Institute, published last month. The study used multiple factors to identify sites where solar and wind farm investments would pack the most punch in decarbonizing the energy sector.

Solar plant construction in strategic locations in Egypt should be an investment priority, if the goal is a rapid shift away from our current fossil fuel reliance, the study concludes. It would also bring clear financial benefits, it adds.

The bottom line for Egypt: the electricity sector could save much by constructing solar farms, rather than fossil fuel alternatives, the new report tells us. The levelized cost of electricity (LCOE) in constructing solar farms in optimum zones in Egypt is 29.7% lower than investing in combined-gas turbines, and 37% lower than investing in diesel generators, says the study. LCOE “represents the full life-cycle of electricity generation technologies per MWh of electricity produced,” enabling comparison between the generation costs of different technologies, it adds.

And avoid potential carbon lock-ins — where planners effectively commit to a certain amount of greenhouse gas emissions because they’ve invested in expensive infrastructure in heavily-emitting industries. A gas-fired power plant has an estimated life-cycle of 30 years, while the life-cycle of a cement plant is around 40 years.

This is especially relevant when considering how existing fossil fuel plants had set a ceiling for renewables growth, industry insiders told us a few years back. Egypt has faced an electricity supply glut — seeing us able to generate around 60 GW but with a peak demand of only around 30 GW — which has hurt the growth of solar and utility-scale renewables in the country.

Egypt’s “current heavy electricity dependence on fossil fuels means there’s great potential for emissions reduction from the power sector,” the Oxford report notes. Some 165.7 bn kWh of Egypt’s electricity is produced by fossil fuels, it estimates. As recently as 2019, natural gas made up an estimated 77% of Egypt’s electricity mix, according to data that originally came from the BP Statistical Review of World Energy. And though solar saw notable growth in our power generation mix between 2019 and 2020, natgas still occupies far and away the biggest share, according to the Apicorp MENA Energy Outlook 2021-25 (pdf).

Meanwhile, our renewables are primed for substantial growth: Egypt’s installed renewable capacity is set to rise by 68% or 4 GW in the coming five years, according to IEA estimates. This would bring our total capacity to around 10.1 GW by 2026, up from 6.1 GW currently — and up from 3.8 GW in 2017-18 — according to the New and Renewable Energy Authority (NREA) data. Egypt has “213 MW of solar PV IPP projects under construction, one 250 MW wind IPP project under construction, and 120 MW of wind capacity,” which the NREA is building, according to the Apicorp report. Another 2 GW of wind and 1 GW of solar PV projects are set to be added to our capacity further down the road, it adds. Egypt — along with Jordan and Morocco — is on track to meeting its renewables targets (albeit “to a lesser extent” than our two regional peers), Apicorp adds.

Reducing our dependence on fossil fuels isn’t just about emissions reduction — it’s also important for energy security, the Oxford report argues: Diversifying Egypt’s energy mix away from fossil fuels by channeling investments towards utility-scale solar farm constructions would improve Egypt’s energy security and boost its decarbonization strategy all at once, it adds. Why is this? Although natural gas may be Egypt’s electricity generation powerhouse, plans to export it and put it in our cars could hit supply, says the Oxford report.

Meanwhile, our ballooning population will also massively increase energy demand, the Oxford report anticipates. “With a projected population increase of 69.5 mn by 2050, the country needs a major power sector reform to meet its energy demand while complying with the obligations set out in the Paris Agreement,” it says.

So why solar in particular? It isn’t just our sunshine, it’s also our stability: Egypt’s high yearly average insolation (or exposure to the sun’s rays) is a key factor explored by the study. But it also takes into account legal, political, environmental, socio-economic and investment risk factors. Key criteria Oxford looked at for solar and wind power placement include proximity to grid lines, road networks and settlement areas, says the report. Investors also want political stability, robust supply chains and “attractive policy landscapes,” it adds.

Where is it suggesting we build utility-scale solar? There’s so much more than Benban: Very high potential solar investment sites in Egypt are often found in the south and east of the country, the report indicates. These sites hit the sweet spot of high insolation, along with “suitable temperatures [and] adequate land characteristics, while being close to settlement areas, grid and road networks.”

Your top climate stories for the week:

- Solar-powered hotels in Marsa Alam: Some of Marsa Alam’s hotels and resorts will be powered through KarmSolar's newly launched Marsa Alam Solar Grid.

- New green fund coming: Impact investor Finance in Motion reportedly plans to launch a new fund that will invest in green tech, alternative energy, and agribusiness projects in countries including Egypt, as it looks to issue USD 50 mn in financing this year.

- Carbon credit exchange plans: The Environment Ministry is working with the EGX on a proposal to set up a platform that would allow companies to buy and sell carbon credits.

- False promises: Pledges from major global firms on net-zero or carbon-neutral targets are misleading and insufficient to stave off the worst consequences of climate change, new research shows.

CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

February: Ghazl El Mahalla shares will begin trading on the EGX.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

4-20 February (Friday-Sunday): 2022 Winter Olympics, Beijing.

11-12 February (Friday-Saturday): German Foreign Minister Annalena Baerbock will be in Cairo for a two-day visit.

11-13 February (Friday-Sunday) FIBA Intercontinental Cup, Cairo.

13-15 February (Sunday-Tuesday): Arab Sustainable Development Week. Arab League headquarters, Nile Ritz Carlton.

14-16 February (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

14-19 February (Monday- Saturday): An art exhibition created by marginalized children will be held at Townhouse Gallery. The event is organized by the Sawiris Foundation for Social Development, AlexBank, Townhouse Gallery, Al Ismaelia for Real Estate Investment, and Ubuntu Art Gallery.

15 February (Tuesday): The Industrial Development Authority’s deadline for receiving offers from companies for licenses to manufacture steel products.

15 February (Tuesday): Orange Ventures’ deadline to receive applications from seed-stage fintech startups.

19 February (Saturday): Public universities begin the second term of the 2021-2022 academic year.

19-21 February (Saturday-Monday): Nebu Expo for Gold and Jewelry 2022.

21 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

22 February (Tuesday): The Egyptian National Railway is holding a forum to gauge public interest in its plans to delegate the management and operations of freight transport to the private sector.

22-24 February (Tuesday-Thursday): Investment Forum, General Authority For Investments (GAFI) Main Office, Nasr City.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

27 February (Sunday): British-Egyptian Business Association (BEBA) green finance event with Finance Minister Mohamed Maait, Semiramis Intercontinental, Cairo

28 February- 1 March (Monday-Tuesday): The Future of Data Centers Summit.

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

March: The Salam – new administrative capital – 10th of Ramadan Light Rail Train (LRT) line will start operating.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

24 March (Thursday): Egypt will host Senegal in the first leg of their 2022 FIFA World Cup qualifiers' playoff.

26 March (Saturday): Egypt-EU World Trade Organization dispute settlement consultations end.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

29 March (Tuesday): The second leg of the 2022 FIFA World Cup qualifiers' playoff between Egypt and Senegal.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

April: Fuel pricing committee meets to decide quarterly fuel prices.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

14 April (Thursday): European Central Bank monetary policy meeting.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

4 May (Wednesday): 3 February (Thursday): Deadline to send in applications for Cultural Property Agreement Implementation projects to the US Embassy in Cairo.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

9 June (Thursday): European Central Bank monetary policy meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H2022: The government will have vaccinated 70% of the population.

July: A law governing ins. for seasonal contractors will come into effect.

July: Fuel pricing committee meets to decide quarterly fuel prices.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

21 July (Thursday): European Central Bank monetary policy meeting.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

8 September (Thursday): European Central Bank monetary policy meeting.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

October: World Bank and IMF annual meetings in Washington, DC

October: Fuel pricing committee meets to decide quarterly fuel prices.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

7-18 November (Monday-Friday): Egypt will host COP27 in Sharm El Sheikh.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.