- The results of our 2021 Reader Poll are in — and most of you are feeling optimistic. (What’s Next)

- It was a terrible, horrible, no good, very bad week for equities + BTC. (What We’re Tracking Today)

- Fawry eyes US listing. (Finance Watch)

- Nahr Elkhair shares to start trading on the EGX this week. (What We’re Tracking Today)

- The gov’t could issue its first sustainable bonds to finance the Decent Life initiative. (Debt Watch)

- Unvaccinated travelers to Egypt can now substitute PCR tests for rapid tests. (Tourism)

- Local covid cases hit their highest since June 2020. (Covid Watch)

- Its Egypt v Senegal / Salah v Mane in the World Cup Qualifiers. (Last Night’s Talk Shows)

- MNT-Halan launches its buy-now-pay-later service. (Also On Our Radar)

- Anghami inches toward SPAC completion as Vistas shareholders sign off on blank-check merger. (Planet Finance)

Sunday, 23 January 2022

AM — The results of our 2021 Reader Poll are in

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, nice people, and welcome to a chilly first day of the workweek.

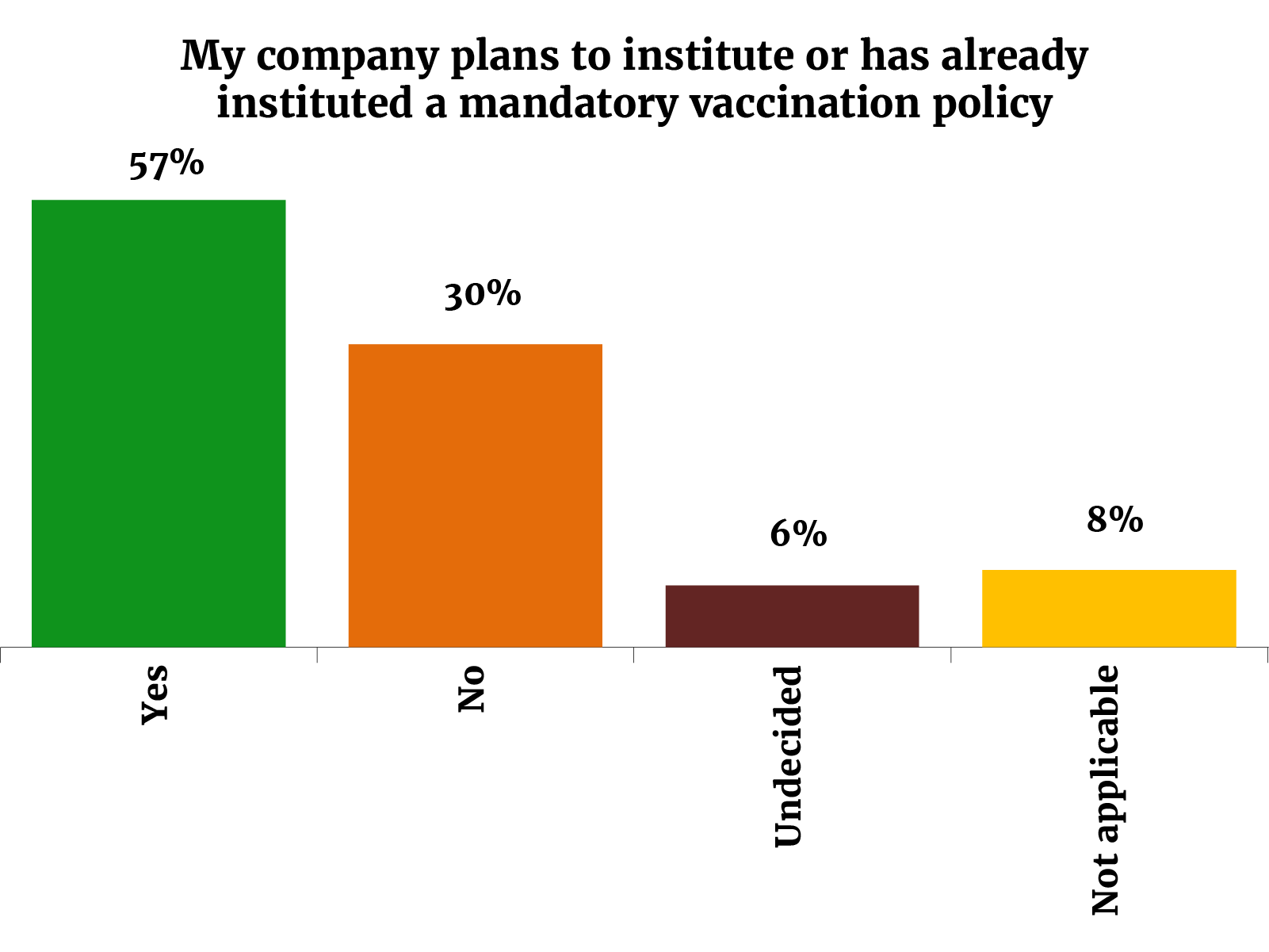

Our big story this morning: The results of our 2022 Reader Poll, our first since just after the pandemic kicked off — and our largest ever in terms of participation. Thank you all for helping everyone in our community not just get a better sense of where our collective head is at, but also for helping many of us refine our plans for the year.

The big finding in the poll: Y’all are very optimistic about 2022. We have the rundown on the results in this morning’s What’s Next (below) or you can tap or click here now to go see the full results on the web.

We’re going to announce later this week the names of eight readers who we’ll be inviting to join us for breakfast when this omicron wave subsides. A dozen more of you will be getting Enterprise mugs in which to consume your morning coffee.

SPEAKING OF this wave of the pandemic: The number of new daily cases hit its highest level yesterday since June 2020, meaning the official count of daily cases has doubled so far this month. The silver lining: The death toll has not doubled in tandem.

ALSO this morning: Unvaccinated travelers to Egypt can now enter using a negative PCR, rapid antigen or rapid molecular ID Now test taken no more than 72 hours before arrival, the Health Ministry announced in a statement on Thursday. The previous requirement allowed only a PCR test. We have more in today’s news well, below.

HAPPENING THIS WEEK-

Nahr Elkhair Development and Investment’s shares will start trading on the EGX on Tuesday, Al Borsa and Al Shorouk reported last night.

Looks like there won’t be an IPO after all: Sources told Al Shorouk that the company will not be required to offer shares to investors via subscription and will instead directly list its shares on the bourse on Tuesday. The company has set a reference price of EGP 0.25 per share for what now appears set to be a technical listing.

PSA #1- We can probably all look forward to a four-day workweek this week as the nation takes Thursday off in observance of 25 January. Prime Minister Moustafa Madbouly confirmed yesterday that public sector workers will take the day, though we’re yet to hear from the EGX, the Central Bank of Egypt or the Manpower Ministry.

PSA #2- Expect up to 5mm of rain and high winds on Wednesday with a high of 13°C, setting up a chilly (but crisp) Thursday.

THE BIG STORY ABROAD- UK accuses Russia of coup-plotting in Kiev: The UK has the front pages of the Western media to itself this morning after the Foreign Office took the extraordinary step of accusing Russia of plotting a coup in Ukraine, going so far as to name Moscow’s alleged replacement for pro-Western president, Volodymyr Zelensky. The UK presented no evidence for its claims but appears to have had the backing of the US. EU leaders are yet to respond to the allegations. In the West, the Foreign Office’s statement is front-page news everywhere from Bloomberg and Reuters to the New York Times and the BBC. Russian state news agency Tass carries the response from the Kremlin, which accused the UK of spreading misinformation.

The UK’s allegations came following another weekend of saber-rattling and “diplomacy” between the US and Russia over Ukraine. The Russians announced new global naval drills, while the US and UK began funneling arms into Ukraine, all while talks between US and Russian officials made little headway: Russia doesn’t want Nato forces in Ukraine and the US doesn’t want to talk about it.

Division in the ranks: France and Germany both signaled over the weekend that they’d prefer not to get sucked into an armed confrontation with another nuclear armed power and made moves to reduce tensions. Berlin refused to go along with Washington’s plan to export arms to Ukraine and blocked Estonia from doing so. Meanwhile, French president Emmanuel Macron called on European countries to enter separate talks with Moscow without the US (much to the chagrin of US officials).

And that seems to be what is happening: Officials from Russia, Ukraine, France and Germany will meet in Paris (without the US) later this week in a bid to dial back the tensions and end the frozen conflict between the Ukrainian government and Russian separatists in the east of the country, Reuters reports.

Global markets had their worst week in over a year as a drop in tech stocks spilled over into other sectors, the FT reports. The tech-heavy Nasdaq was the biggest loser, falling 7.6% last week — its biggest drop since the pandemic’s onset in March 2020 — as investors fled the high-risk growth stocks. Losses were accentuated by a 22% drop in Netflix shares on Friday as the company warned of slowing subscriber growth in its latest earnings release. The Nasdaq is down nearly 12% since the beginning of the year and is on course to record its worst month since the 2008 financial crisis, according to Bloomberg. Meanwhile, both the Dow Jones and the S&P 500 posted a third straight week of losses, with the S&P 500 down 5.7% for the week, CNBC reports.

Warren Buffett gains on Cathie Wood amid the upset in equities: The apparent growth-to-value rotation in the stock markets has led Warren Buffett’s Berkshire Hathaway fund to nearly overtake Cathie Wood’s tech-focused Ark fund in the post-pandemic performance table, the Financial Times reports.

Expect more movement in tech stocks amid big earnings reports this week: Microsoft is up on Tuesday, followed by Tesla on Wednesday and Apple on Thursday, the Wall Street Journal reports.

BTC dropped to a six -month low as risk-off sentiment grew, Bloomberg reported. The digital asset dropped 12% to below USD 36k on Friday, its lowest level since July, bringing the aggregate crypto market’s loss since the asset class began to fall in November to USD 1 trn. This marks the second-largest ever decline in dollar terms for both BTC and the wider market, according to Bespoke Investment Group analysts.

Russia could deal another blow to the crypto market: The world’s third-largest BTC miner has proposed a blanket ban on crypto trading and mining. Russia’s central bank said digital currencies pose a threat to citizens’ wellbeing and financial stability and likened the assets to a pyramid scheme in a report (pdf) published on Thursday.

Though the Fed could be more open to digital currencies: The US Federal Reserve issued a digital banking discussion paper (pdf) of its own on Thursday, kicking off a debate on the pros and cons of introducing a federal digital currency and inviting the public to submit comments over the next 120 days.

|

NOT ENOUGH DOOM AND GLOOM FOR YOU?

The global economy will face an “obstacle course” in 2022 as the pandemic and geopolitical tensions drive inflation amid record debt levels, IMF head Kristalina Georgieva said on the fifth and final day of the online Davos conference, the Financial Times reports.

Covid has written us one hell of a check: The pandemic will likely have cost the global economy around USD 12.5 tn by 2024, Georgieva said.

Georgieva called on countries with high USD-dominated debt to act quickly: The IMF managing director said that anticipated Fed rate hikes “could throw cold water on what for some countries is already a weak recovery,” adding that “If you have currency mismatches, now is the moment to address them.”

CIRCLE YOUR CALENDAR-

Startups can apply until 30 January for the spring 2022 cycle of EGBank’s Mint Incubator. The incubator offers two tracks: a sector-agnostic track for startups at the MVP stage, and a fintech track that accepts early-stage startups both at the ideation and MVP stages. Main founders must be between 16-35 years old. You can apply here.

The Cairo International Book Fair starts on Thursday at the Egypt International Exhibition Center. Members of the public will be allowed to enter without providing proof of vaccination, the Culture Ministry said last week. The two-week event runs through to 7 February.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s What’s Next day: We have our weekly deep-dive into what makes and shapes pre-listed companies and startups in Egypt, the UAE and KSA, touching on investment trends, future sector insights and growth journeys.

In today’s issue: The results of the Enterprise 2022 reader poll are out: You spoke and we listened and from what you’ve told us, your 2021 has been a year of recovery and a far cry from the doom and gloom of 2020. Most of you cannot wait to get the ball rolling in 2022, with the overwhelming majority feeling that business conditions will improve further.

We want to thank all of you for participating in this and we cannot wait to discuss these sentiments with some of you in person during our breakfast.

FINANCE WATCH

Fawry eyes capital increase, US listing

US listing in the works for Fawry? EGX-listed e-payments giant Fawry has received approval from its board of directors to create an American depositary shares (ADS) program, which would allow the company to list shares in the US, and is exploring an SEC-registered secondary offering to follow, CEO Ashraf Sabry said on an investor update call on Thursday. Sabry did not provide further details or a timeline for the potential offering, which remains subject to market conditions and shareholder and regulatory approvals, according to a disclosure to the EGX (pdf).

What’s an ADS listing? ADS are shares in a foreign company that are held in a US bank so that they can be traded within the country. The bank converts dividends on the shares into USD and disburses them. It is not quite the same thing as an American depositary receipt (ADR) program. Investopedia has your back if you want to dive deeper into the distinction.

Capital increase coming: Fawry is looking to raise its capital by EGP 800 mn through a rights issue to existing shareholders, according to the regulatory filing. The capital increase should close in 1H2022, subject to approvals, according to the investor update presentation. This follows the company’s last EGP 400 mn capital increase through a rights issuance in June of last year.

Where’s the fresh capital going? The majority of funds raised through the capital increase will go towards expanding the company’s non-banking financial services (NBFS) offering. This includes consumer financing, digital ins. and money market funds. Fawry recently obtained a consumer financing license and is planning to launch a mutual fund with Misr Capital this month or next, Sabry said.

A large portion of the funds will focus on turning MyFawry into a super app. This includes being able to issue MyFawry pre-paid cards, host digital accounts, and issue instant payment notifications (IPNs) for transfers between any bank and the MyFawry card. Over 40 mn customers use the Fawry network, and the MyFawry app was downloaded 4.3 mn times as of September 2021.

The rest will fund fresh investments, including in startups that complement Fawry’s offerings, including new entrants in e-commerce, fintech, logistics and other sectors.

The plans come as the company is expecting its entire business to grow more than 40% this year, Sabry said on the call. Fawry’s consumer finance stream will start to impact the company’s numbers in 2023, after the company launches its buy-now-pay-later (BNPL) product in 3Q2022.

EDITOR’S NOTE- This story was corrected on 23 January, 2022 to reflect that Fawry’s most recent capital increase was in June 2021, not November 2020.

DEVELOPMENT FINANCE

Korean presidential visit brings USD 1.3 bn in new financing, raft of cooperation agreements

We could have a trade agreement with South Korea soon: President Abdel Fattah El Sisi and South Korean President Moon Jae-in agreed on Thursday to conduct a joint feasibility study of a bilateral trade liberalization agreement, according to the Korean press. If it comes to fruition, the agreement would be Korea’s first trade pact with an African country. Moon was here from Wednesday through Friday last week, marking the first time a South Korean president has visited Egypt in 16 years.

Korea is set to provide us with soft loans worth USD 1 bn over the next five years to finance construction and infrastructure projects, including transport and water infrastructure, as per an MoU the two presidents signed on Thursday. The funding from Korea’s Economic Development Cooperation Fund will also be used to fund new and renewable energy projects, the International Cooperation Ministry said in a statement. South Korea’s ambassador in Cairo announced the planned loan earlier last week.

The two sides also inked a USD 251.6 mn development finance agreement that aims to upgrade the signaling systems for the Egypt-Luxor High Dam railway line, according to the International Cooperation Ministry. This comes in addition to a fresh USD 7.9 mn development grant from the Korean International Cooperation Agency (KOICA) with the aim of establishing a public e-procurement system, including training and technical support.

Cooperation on culture: The two countries also signed an agreement to work together on archeological sites, restoration, and museum management — including the use of technology, and combating illegal trafficking in antiquities. It will begin with the restoration of the first edifice at the Ramesseum Temple in Luxor, according to a statement from the Tourism Ministry.

What else was on the agenda? El Sisi and Moon also discussed localizing the manufacture of electric vehicles, according to an Ittihadiya statement, as well as cooperation on communications, tourism, mining, security, and potential Korean involvement in El Sisi’s Decent Life development initiative.

Trade between Egypt and South Korea tops out at about USD 2 bn annually, while Korean investment in Egypt rings in at about USD 800 mn, Moon said, according to a cabinet statement. He added that some 33 Korean companies operate in Egypt.

ENERGY

More oil investment from Transglobe + Pharos

Transglobe, Pharos Energy sign USD 506 mn oil E&P agreements: The Oil Ministry signed oil exploration and production agreements with Canada’s Transglobe and London-based Pharos Energy that will see them spend a combined minimum of USD 506 mn, in addition to a USD 67 mn signing bonus, according to a ministry statement on Thursday. The two companies will drill a total of 12 new wells under the agreements, the statement says.

The agreements include a 3.5-year extension to Pharos Energy’s exploration license in the El Fayum concession in the Western Desert, according to a company statement. The extension agreement includes “an additional obligation on [the] contractor to drill two exploration wells and acquire a 3D seismic survey in the northern area of the license.”

What’s in it for each side: The extension agreement will raise the London-based company’s cost recovery percentage, allowing it to use 40% of gross revenues from all its current and future Egyptian concessions to recover costs, up from 30% previously. At the same time, Pharos will “waive its rights to recover a portion of the past costs pool (USD 115 mn).” The company will also cut its excess cost recovery petroleum share in half to 7.5%.

Refresher: The signing of the agreement was a key precondition for Pharos’ planned sale of a 55% working interest in each of its El Fayum and North Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun. The c. USD 63.4 mn transaction is expected to be completed during 1Q2022, Pharos said when it announced the agreement last year.

Transglobe, meanwhile, signed a new agreement that will consolidate its three existing concession agreements in the Eastern Desert (West Gharib, West Bakr, and North West Gharib), according to the ministry.

The agreement will see the Canadian firm spend some USD 200 mn here over the next fifteen years, according to a company statement. The amount includes a minimum USD 50 mn the company committed to spending “over each five-year period for the 15 years of the primary term,” as well as an annual USD 10 mn payment each year for the next five years.

DEBT WATCH

Gov’t could turn to sustainable development bonds to help fund Decent Life

Egypt is considering the issuance of sustainable development bonds to finance the Decent Life initiative, International Cooperation Minister Rania Al Mashat said last week during talks with UN officials.

Sustainable development bonds? Think green bonds, but instead of financing energy efficiency and renewable energy initiatives, the money can be channeled into a wider range of projects considered socially beneficial (like education, health, housing or transportation).

But #1: It remains unclear precisely how regulators are defining their terms and we are yet to see the criteria laying out exactly how projects will be classified as socially beneficial.

But #2: We’re also a little unclear about whether the Financial Regulatory Authority would need to put together a new legal framework for the new securities or whether the government could issue sustainable development bonds under the existing green bond guidelines.

Think of this as the ministry planting a sign post. It will need in future to explain which authority could issue the bonds, when they could issue them, the size of the issuance, and the specifics on what the proceeds would finance.

This would be the first time the Egyptian government has issued a sustainable development bond, though it was responsible for selling the MENA region’s first-ever sovereign green bond back in 2020.

Sustainable development bonds on the EGX: The FRA is putting in place a framework that will allow companies to list sustainable development bonds on the EGX together with incentives to draw capital from hedge funds and private equity firms.

The Decent Life initiative: The four-year, multi-bn USD infrastructure project is attempting to upgrade infrastructure and basic services for rural communities across the country. By mid-2023, the government is pledging to have overhauled the delivery of public healthcare and education, upgraded road networks, built swathes of new housing, and improved access to sanitation and electricity in villages across Egypt.

Check out our project profile of the Decent Life initiative here.

TOURISM

Unvaxxed travelers now have more ways to prove negative covid status

Unvaccinated travelers to Egypt can now enter using a negative PCR, rapid antigen or rapid molecular ID Now test taken no more than 72 hours before arrival, the Health Ministry announced in a statement on Thursday. Unvaccinated travelers had previously been required to take a PCR test no more than 72 hours before arrival. The measures apply to travelers of all nationalities aged 12 and above.

Travelers who arrive to tourist airports in the Red Sea, Luxor and Aswan without the correct covid test certificates will not be sent home but rather take a rapid test at the airport and isolate in their hotels if the result is positive, Health Ministry Spokesperson Hossam Abdel Ghaffar said in a phone call yesterday with Al Hayah Al Youm (watch, runtime: 8:43)

BUT: Travelers from South Africa, Botswana, Mozambique, Namibia, Lesotho, Zimbabwe, or Eswatini cannot enter using an ID Now rapid covid test. All passengers traveling from the group of seven countries must present proof of vaccination or a negative PCR or rapid antigen test taken within 72 hours of arrival.

COVID WATCH

Egypt covid cases at 18-month high + Fresh batch of AstraZeneca jabs from Belgium, Germany

Egypt covid cases hit highest level since June 2020: The Health Ministry reported 1,569 fresh cases of covid-19 yesterday, the highest daily tally since late June 2020, during the initial wave of the pandemic.

Daily cases have doubled so far this month as omicron spreads across the country. Egypt disclosed a total of 408,495 confirmed cases of covid-19 since the beginning of the pandemic in February 2020.

The death toll hasn’t seen a similar surge: The ministry yesterday reported 41 new deaths, the highest number since December, bringing the country’s total death toll to 22,330.

Egypt received 667k AstraZeneca jabs from Belgium and Germany on Friday as part of the Gavi / Covax program, announced acting Health Minister Khaled Abdel Ghaffar. Covax began delivering jabs in February 2021 to 144 countries including Egypt, which signed an agreement to receive 40 mn vaccine doses through the initiative in 2021.

WHO backs wider use of boosters, recommending wider distribution of covid-19 boosters with priority given to vulnerable groups, upgrading its initial guidance to restrict boosters to “limited circumstances,” the Financial Times reports.

LAST NIGHT’S TALK SHOWS

Leading the conversation on the airwaves last night: It’s Salah v Mane in the World Cup qualifiers. Egypt will need to beat Senegal if they are to make it to this year’s World Cup, in a match that’ll see Liverpool teammates Mohamed Salah and Sadio Mane go head-to-head. The two countries were drawn together yesterday in the final round of African qualifiers for the tournament, which will be held in November in Qatar. Kelma Akhira (watch, runtime: 0:39), Al Hayah Al Youm (watch, runtime: 8:24), El Hekaya (watch, runtime: 8:55), and Hadeeth El Kahera (watch, runtime: 2:30) all covered the news.

Civil society groups have another year to comply with the NGOs Law after the cabinet last week agreed to extend the deadline until January 2023. Al Hayah Al Youm (watch, runtime: 0:59) and Masaa DMC (watch, runtime: 9:29) had coverage of the decision.

EGYPT IN THE NEWS

It’s cultural resurrection vs cultural destruction in the foreign press this morning: Reuters becomes the latest outlet to look at the livelihoods and historic graves in the City of Dead that are under threat as the Madbouly government goes ahead with the construction of a new bridge as part of its infrastructure drive in the capital. On the flipside, Bloomberg is out with a piece looking at the ways in which Egyptians are tapping into their history to restore some of Cairo’s cultural identity, while ARTnews reports on a pair of limestone sphinxes unearthed at the ancient Egyptian temple of Amenhotep III in western Luxor by a team of German-Egyptian researchers. Meanwhile, DW has a piece on the wave of solidarity among Egyptian women amid an “ongoing crackdown” on rights.

In business news: Khaleej Times says that online fashion platform 6thStreet will open in Egypt some time this year.

ALSO ON OUR RADAR

Fintech firm MNT-Halan has launched a buy-now-pay-later (BNPL) service in its app,according to a statement (pdf). Backed by Halan’s recently-launched Neuron core banking system, the BNPL service allows customers to pay using credit on purchases made through the Halan app or direct from vendors, whether online or in a physical store.

The new service comes as MNT-Halan looks to grow its service menu in Egypt to include cards and supply chain financing, CEO and co-founder Mounir Nakhla said earlier this month. The company currently offers microfinance solutions, P2P transfers, bill payments, and remittances in addition to its BNPL loans.

Other things we’re keeping an eye on this morning:

- Elsewedy Electric subsidiary Egytech Cables signed (pdf) two turnkey agreements worth EGP 686 mn for the design, supply, and installation of underground cables in a residential city in Kuwait.

- Cairo University has partnered with the US government to open a disability service center, which will advocate for university-wide policies and provide services and equipment to students with disabilities.

PLANET FINANCE

Anghami takes one step closer to its SPAC listing: The streaming platform’s merger — which would value the company at around USD 220 mn — with blank-check firm Vistas Media Acquisition Company was approved by Vistas shareholders at a special stockholders meeting last week, the companies announced in a joint statement.

Anghami and Swvl are in something of a race to close their SPACs: Queen’s Gambit is looking to close with Swvl this month, the domestic press quoted Swvl CEO Mostafa Kandil as saying last month. Anghami is looking to close by 11 February. You can check out its latest investor presentation here.

But they haven’t picked a great time for it: SPACs, IPO stocks and tech are in the middle of a heavy sell-off triggered by the Federal Reserve’s announcement that it will hike interest rates several times this year. Seven SPACs have written to the US Securities and Exchange Commission to cancel IPO plans this month as poor performance coupled with increasing regulatory scrutiny hurts the asset class.

Closer to home though, SPACs are only getting started: We could see our first homegrown SPAC established within the next month, Financial Regulatory Authority (FRA) chief Mohamed Omran said last week.

Also worth noting this morning: UAE-based renewable energy firm Masdar plans to more than double its operations this decade, driven in part by the acquisition of power firms in the US and Europe, Bloomberg reports CFO Niall Hannigan saying. The subsidiary of Abu Dhabi’s Mubadala sovereign wealth fund could get the capital for its “significant” growth ambitions from the UAE government, international capital markets, or the potential sale of its first corporate bond next year.

|

|

EGX30 |

11,732 |

+0.1% (YTD: -1.8%) |

|

|

USD (CBE) |

Buy 15.66 |

Sell 15.76 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

12,291 |

+0.3% (YTD: +9.0%) |

|

|

ADX |

8,706 |

+0.3% (YTD: +2.6%) |

|

|

DFM |

3,210 |

+1.3% (YTD: +0.4%) |

|

|

S&P 500 |

4,398 |

-1.9% (YTD: -7.7%) |

|

|

FTSE 100 |

7,494 |

-1.2% (YTD: -1.5%) |

|

|

Brent crude |

USD 87.89 |

-0.6% |

|

|

Natural gas (Nymex) |

USD 4.00 |

+5.2% |

|

|

Gold |

USD 1,834 |

-0.6% |

|

|

BTC |

USD 35,428 |

-3.8% (as of midnight) |

THE CLOSING BELL-

The EGX30 rose 0.1% on Thursday on turnover of EGP 746 mn (35.2% below the 90-day average). Local investors were net sellers. The index is down 1.8% YTD.

In the green: EFG Hermes (+1.4%), GB Auto (+1.1%) and CIB (+1.0%).

In the red: Fawry (-3.3%), AMOC (-3.0%) and Raya Holding (-2.6%).

CALENDAR

1Q2022: Launch of the Egyptian Commodities Exchange.

1Q2022: Swvl acquisition of Viapool expected to close.

1Q2022: Waste collection startup Bekia plans to expand to the UAE and Saudi Arabia.

1Q2022: Rameda Pharma will begin selling its generic version of Merck’s oral antiviral covid-19 med.

1Q2022: Pharos Energy’s sale of 55% stake in El Fayum, Beni Suef concessions to IPR Energy Group subsidiary IPR Lake Qarun expected to close.

Early 2022: Results to be announced for the second round of the state’s gold and precious metals auction.

1H2022: Target date for IDH to close its acquisition of 50% of Islamabad Diagnostic Center.

1H2022: e-Finance’s digital healthcare service platform, eHealth, will launch its services.

1H2022: The government will respond to private companies’ bids to build desalination plants.

1H2022: Egypt’s second corporate green bond issuance expected to be announced.

January: Sovereign Sukuk Act executive regulations expected to be finalized.

January: Tenth of Ramadan dry port tender to be launched.

January: Three-month trial period of ACI for air freight to begin.

9 January – 6 February (Sunday-Sunday): 2021 Africa Cup of Nations, Cameroon.

Second half of January: Egypt will host the Egyptian-Bahraini Joint Committee.

Second half of January: Regulations for installing EV charging stations will be published.

23 January (Sunday): Deadline for Macro Pharma to IPO on the EGX.

25 January (Tuesday): The IMF will release its World Economic Outlook.

25 January (Tuesday): 25 January revolution anniversary / Police Day.

25 January (Tuesday): Techne Summit announces awardees of Corporate Innovation Program.

25-26 January (Tuesday-Wednesday): Federal Reserve interest rate meeting.

27 January-7 February (Thursday-Monday): Cairo International Book Fair, Egypt International Exhibition Center.

27 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30-31 January (Sunday-Monday): Ins. Federation of Egypt medical ins. forum.

End of January: The Egyptian-Romanian business forum will take place with the aim of strengthening joint investment relations.

January-February 2022: Construction work on the Abu Qir metro upgrade will begin.

February: Hassan Allam Construction’s new construction firm established with Russia’s Titan-2 to handle construction work on the Dabaa nuclear power plant begins its operations.

February: Ghazl El Mahalla shares will begin trading on the EGX this month.

February: Suez canal transit fees set to increase 6%, exempting cruise ships and LNG carriers.

Mid-February: End of grace period to comply with new minimum wage for firms who sent in exemption requests.

Mid-February: A Hungarian delegation will arrive in Egypt for talks over a potential investment in an industrial area in the SCZone.

3 February (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3 February (Thursday): January PMI figures for Egypt, Saudi Arabia, and the UAE will be released.

4-20 February (Friday-Sunday): 2022 Winter Olympics, Beijing.

11 February (Friday): Deadline for Anghami SPAC merger.

11-13 February (Friday-Sunday) FIBA Intercontinental Cup, Cairo.

14-16 February (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

15 February (Tuesday): The Industrial Development Authority’s deadline for receiving offers from companies for licenses to manufacture steel products.

15 February (Tuesday): Orange Ventures’ deadline to receive applications from seed-stage fintech startups.

19 February (Saturday): Public universities begin the second term of the 2021-2022 academic year.

19-21 February (Saturday-Monday): Nebu Expo for Gold and Jewelry 2022.

21 February (Monday): Hearing at Cairo Economic Court (pdf) on FRA lawsuits filed against Speed Medical.

26 February (Saturday): Speed Medical will elect a new board during ordinary general assembly (pdf).

https://enterprise.press/wp-content/uploads/2022/01/Speed-Medical-statement_190122.pdf

End of February: Lebanon to receive gas from Egypt via a pipeline crossing Jordan and Syria.

March: Rollout of the government financial management information system (GFMIS), a suite of electronic tools to automate the government’s financial management processes (pdf) that will replace the existing “closed” financial management system.

March: 4Q2021 earnings season.

March: Deadline for the World Health Organization’s intergovernmental negotiating body to meet to discuss binding treaty on future pandemic cooperation.

March: World Cup playoffs.

March: The government hopes to sign a final contract between El Nasr Automotive and a new partner for the local production of electric cars.

March: Target date for Saudi tech firm Brmaja to IPO on the EGX.

March: Egypt to host World Tourism Organization Middle East committee meeting.

9-18 March (Wednesday-Friday): The 55th edition of the Cairo International Fair.

15-16 March (Tuesday-Wednesday): Federal Reserve interest rate meeting.

24 March (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

28-29 March (Monday-Tuesday): The Egypt International Mining Show (EIMS 2022) will take place virtually.

31 March (Thursday): Deadline for submitting tax returns for individual taxpayers.

31 March (Thursday): Vodacom purchase of Vodafone Group’s stake in Vodafone Egypt expected to be completed by this date.

31 March (Thursday): Supply Ministry expected to take final decision on bread subsidies by this date.

2 April (Saturday): First day of Ramadan (TBC).

3 April (Sunday): Bidding begins on the Industrial Development Authority’s license to manufacture tobacco products.

4 April (Monday): CDC Group will formally change its name to British International Investment.

22-24 April (Friday-Sunday): World Bank-IMF spring meeting, Washington D.C.

24 April (Sunday): Coptic Easter Sunday (holiday for Coptic Christians).

25 April (Monday): Sham El Nessim.

25 April (Monday): Sinai Liberation Day.

28 April (Thursday): National Holiday in observance of Sham El Nessim.

30 April (Saturday): Deadline for submitting corporate tax returns for companies whose financial year ends 31 December.

Late April – 15 May: 1Q2022 earnings season

May: Investment in Logistics Conference, Cairo, Egypt.

1 May (Sunday): Labor Day.

3-4 May (Tuesday-Wednesday): Federal Reserve interest rate meeting.

5 May (Thursday): National Holiday in observance of Labor Day.

2 May (Monday): Eid El Fitr (TBC).

19 May (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

14-15 June (Tuesday-Wednesday): Federal Reserve interest rate meeting.

15-18 June (Wednesday-Saturday): St. Petersburg International Economic Forum (SPIEF), St. Petersburg.

16 June (Thursday): End of 2021-2022 academic year for public schools.

23 June (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

27 June-3 July (Monday-Sunday): World University Squash Championships, New Giza.

30 June (Thursday): June 30 Revolution Day, national holiday.

End of 2Q2022: The Financial Regulatory Authority’s new Ins. Act should be approved.

End of 1H2022: Emirati industrial company M Glory Holding and the Military Production Ministry will begin the mass production of dual fuel pickup trucks that can run on natural gas.

2H2022: The inauguration of the Grand Egyptian Museum.

2H2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

July: A law governing ins. for seasonal contractors will come into effect.

1 July (Friday): FY 2022-2023 begins.

8 July (Friday): Arafat Day.

9-13 July (Saturday-Wednesday): Eid Al Adha, national holiday.

26-27 July (Tuesday-Wednesday): Federal Reserve interest rate meeting.

30 July (Saturday): Islamic New Year.

Late July – 14 August: 2Q2022 earnings season.

18 August (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

September: Egypt will display its first naval exhibition with the title Naval Power.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

18-20 October(Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

Late October – 14 November: 3Q2022 earnings season.

November: Cairo Water Week 2022.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

January 2023: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.