- Egypt has been one of the Middle East’s M&A hotspots so far in 2021. (M&A Watch)

- Investors aren’t yet facing capital gains tax on share sales in January, says FinMin. (Capital Markets)

- Contact, Abou Ghaly to launch Abou Ghaly Finance in coming months, (Consumer Finance)

- FX reserves inch up in August. (Economy)

- On the airwaves: The back-to-school vaccine drive, EGX tax, and the sacking of Egypt’s national team coach. (Last Night’s Talk Shows)

- Covid cases could be 10x higher than reported, says Zayed. (Covid Watch)

- The first week of conference season continues. (What We’re Tracking Today)

- Egypt + Turkey resume Operation Let’s Make Up today. (What We’re Tracking Today)

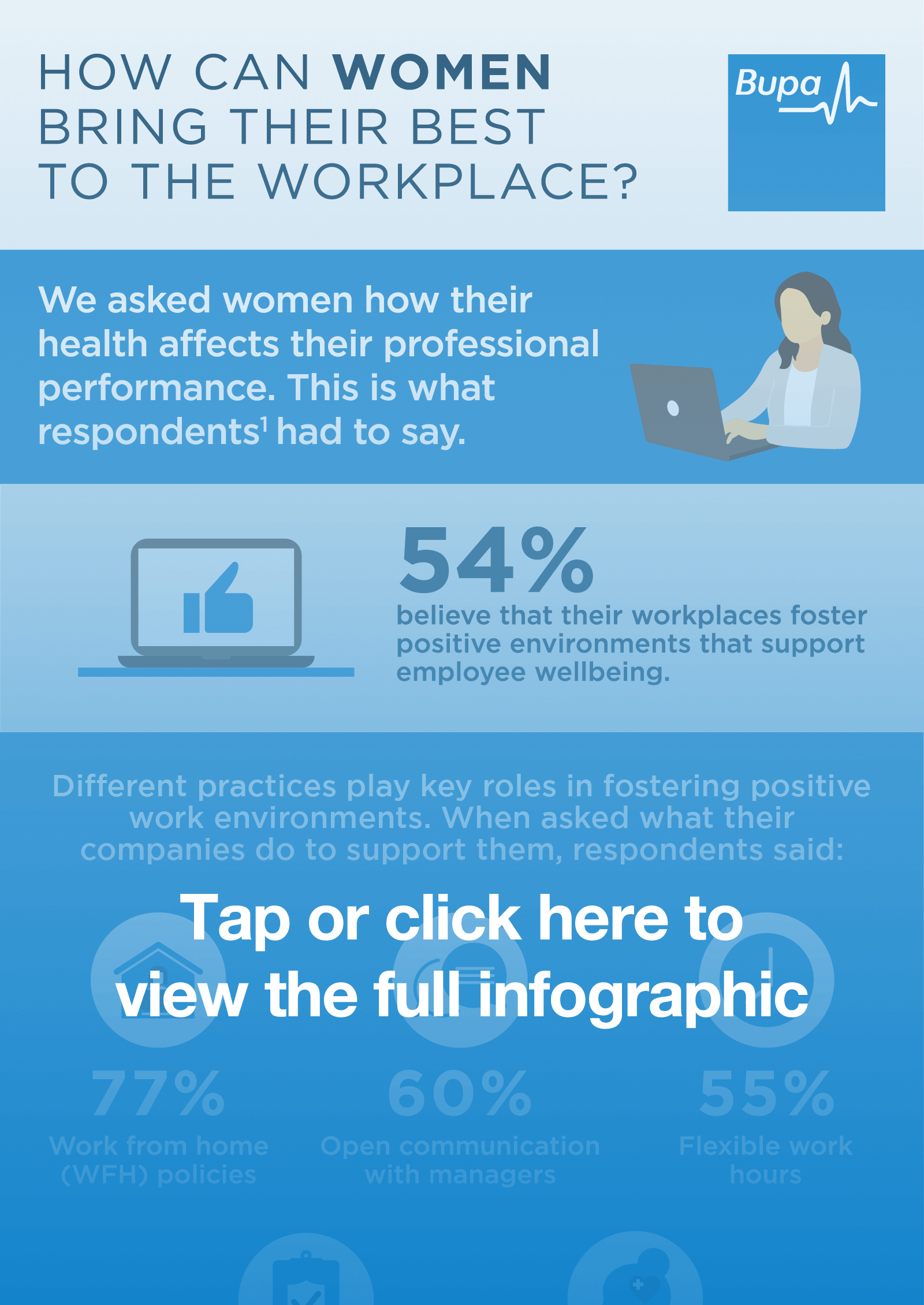

- The results of the Enterprise-Bupa Egypt Insurance poll are here. (Poll)

- Investor confidence in Egypt’s renewables is rising, but risks remain. (Going Green)

- Planet Finance— US regulators are rushing to get a handle on crypto.

Tuesday, 7 September 2021

Egypt has been one of the Middle East’s M&A hotspots so far in 2021

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to an extra-busy news day, feature stories on everything from M&A in Egypt (up a lot over 2020) and FX reserves (up a bit) to the prospect of a capital gains tax on EGX transactions in early 2022 (not likely?) and the government’s back-to-school vaccination drive. We have chapter and verse on all of this — and more — in this morning’s Speed Round, below.

WHAT’S HAPPENING TODAY-

The first week of fall conference season continues in earnest:

The GlobalCapital Sustainable and Responsible Capital Markets Forum 2021 kicks off today and features Vice Minister of Finance Minister Ahmed Kouchouk. The conference will run until tomorrow.

The three-day Egy Health Expo starts today at the Al Manara International Conference Center.

It’s day three of the Arab Labor Conference, which is running through to 12 September at the InterContinental CityStars Hotel in Heliopolis. Government officials, ambassadors, trade union reps and business owners’ association delegates from 21 Arab countries are participating in the gathering.

It’s the final day of the Arab Security Conference, which is taking place at the Nile Ritz-Carlton in Downtown Cairo.

Second time’s the charm? A second round of talks between Egypt and Turkey kicks off in Ankara today, after a previous meeting between the two countries in May ended without a breakthrough. The two-day talks between Deputy Foreign Minister Hamdy Loza and Turkish officials announced by our foreign ministry last week come amid a thaw in tensions between Turkey and the UAE, and attempts by Ankara to mend relations with another of its long-standing regional rivals, Saudi Arabia.

Also happening internationally today-

Canada’s borders reopen today to vaccinated travelers and visa holders who have been fully jabbed with Johnson & Johnson, Pfizer / BioNTech, Moderna or AstraZeneca. Under the new rules that went into effect just as we were hitting “send” on this morning’s edition, all travelers are welcome provided they are fully vaccinated and took a negative PCR test no more than 72 hours before their flight took off. None will face quarantine. You can read the rules yourself on Canada’s website here or check out coverage by CBC.

SMART POLICY- Booster shots for already-vaccinated travelers could be in the cards by year’s end, Health Minister Hala Zayed said yesterday. That’s great news for people with, say, two doses of Sinopharm in their arm who want to travel to, say, Canada without quarantine. We have more on the story in Last Night’s Talk Shows, below.

US Secretary of State Anthony Blinken has landed in Qatar for crisis talks over Afghanistan: Blinken and Defense Secretary Lloyd Austin will hold talks with senior Qatari officials, in the most high-level US visit to the region since the Taliban’s rapid takeover of Afghanistan last month. Doha hosts the Islamist group’s only political office outside of Afghanistan, and played a key role facilitating peace talks that led to the US agreeing to withdraw from the country. Blinken is not expected to meet Taliban officials during the visit.

*** IN CASE YOU MISSED IT-

- Capmas to conduct a survey on family health in Egypt: The survey will focus on the health of mothers and children, and fertility and family planning, which will be used to inform the government’s health policies.

- Three startups have been awarded EGP 150k each in the Agri-Digital Startup Competition: farm monitoring solutions provider ReNile, agricultural community platform Croposa, and e-commerce platform Cotton Town.

- It’s ‘80s week On The Tube Tonight: We decided to start with none other than Stanley Kubrick’s Full Metal Jacket — one of the greatest ever cinematic depictions of the Vietnam War.

CORRECTION- We had reported an incorrect (and overly ambitious) statement in yesterday’s Enterprise PM that Egypt had attracted the second largest number of inbound M&A transactions globally during 1H2021. Egypt attracted the second largest number of inbound M&A transactions from the Middle East in 1H2021, according to a Baker McKenzie report (pdf). We have the full story in this morning’s Speed Round, below.

|

CIRCLE YOUR CALENDAR-

Key news triggers remaining in the first two weeks of September:

- Inflation: Inflation data for August will drop at the end of this week.

- Interest rates: The Central Bank of Egypt will meet to review interest rates on Thursday, 16 September.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

In today’s issue: Since 2016, Egypt has seen a substantial uptick in renewable energy investment. Still, covid-19 and an electricity supply glut have slowed our renewables transition down. Today, we look at how risky Egypt’s public and private sectors consider investment in renewables. There’s good news from an April report by RES4Africa and PwC, which finds that overall investor confidence in Egypt’s renewable energy sector has improved markedly in the last five years. Still, for the private sector in particular, regulatory and policy issues, worries about dispute resolution and tax remain notable areas of concern.

M&A WATCH

Egypt has been one of the Middle East’s M&A hotspots so far in 2021

Egypt saw a strong pickup in M&A activity during the first six months of the year, becoming one of the most popular countries in the region as the economy continued to rebound from last year’s covid shock, Baker McKenzie (pdf) said yesterday. Egypt saw 18 transactions worth USD 1.8 bn during the six-month period, figures published by the law firm show, making it the most popular country in the region for M&A by value and the second by transaction count. Firms based in Egypt were the third most-active in cross-border M&A in our region, with eight reported during the period.

Investors from the US (21 transactions) and the UK (nine) were the most active sources of inbound investment into the region, followed by Egypt (eight transactions). Inbound M&A activity was dominated by the energy and power, consumer products and service, financial and high-tech industries, the report said.

For outbound transactions from the Middle East into other regions: Egyptian investors pulled the trigger on 18 transactions, followed by the UK with 11 M&As worth USD 1.7 bn. The US knocked both of them out of the top spot for volume, with 22 transactions during the first half of the year. Outbound activity was dominated by regional investors, with energy and power, retail, and tech proving the most attractive sectors.

The appetite for tech companies in MENA will continue to grow in the months ahead, Baker McKenzie’s Osama Audi said, predicting a “sustained increase” in regional and out-bound tech M&As.

What’s driving the surge? Ultra-low interest rates, increasing appetite for risk and tns of USD sloshing around private equity groups are all driving the swell in activity.

Global dealmaking has surged this year, putting 2021 on course to smash records, as we reported yesterday morning, citing a Financial Times report based on data from citing Refinitiv. Almost USD 4 tn of transactions were agreed in the first eight months of the year, with USD 500 bn coming in August alone, the Financial Times reported earlier this week,.

But Baker McKenzie’s regional figures show a slightly different story, suggesting by its math that total regional transaction values actually fell slightly this year, reaching USD 40.3 bn from USD 43.5 bn in 1H2020, despite the number of transactions rising by almost 60% to 307.

Several big-ticket tech transactions have occurred in the region in recent months: Egyptian transport company Swvl agreed to a USD 345 mn SPAC merger in July that values it around USD 1.5 bn and paves the way for an IPO on the Nasdaq next quarter. Music streaming service Anghami will also list on the Nasdaq after agreeing a similar SPAC merger in March, while cloud kitchen platform Kitopi closed a huge USD 415 mn series C funding round led by SoftBank in July.

CAPITAL MARKETS

The EGX capital gains tax won’t be making its comeback in January 2022

Investors are not yet facing new taxes on stock market transactions, the Finance Ministry said yesterday after reports in the local press fuelled speculation that the government is planning to introduce a capital gains tax on shares at the beginning of next year.

What’s the fuss about? Tax regulations published by local media suggested that a 10% tax on gains made from share disposal will come into force on 1 January. The rules — which outline taxes on the selling of shares and treasury bills — will only apply to resident investors, exempting foreigners from paying the 10% tax.

But the ministry says that this isn’t the case: The ministry denied that the circular indicated that the tax will come into force next year, saying it was issued in order to clarify pre-existing regulations.

We’ve been aware since last year that the CGT could make a comeback: As part of a raft of measures to support investment in Egyptian equities, the government last year postponed the reintroduction of a capital gains tax on EGX transactions until 1 January 2022.

What happens now? We talk about it. With the postponement due to expire at the end of the year, policymakers will soon restart discussions on the future of an EGX capital gains tax, local media quoted EGX Chairman Mohamed Farid saying, explaining that officials will have to weigh the tax’s impact on the market. The ministry did not address when the tax could be reintroduced.

Plans for the capital gains tax were first introduced in 2015 before being postponed to 2017 due to concerns over its negative impact on investments. When 2017 rolled around, the capital gains tax was replaced by a 0.125% stamp tax on stock market transactions and shelved for a three-year period. Then in 2019, the tax was back on the table when it was reported that officials were in serious talks over bringing it into effect in 2020, but the destabilizing effect of covid-19 on markets pushed its implementation back even further.

Policymakers have delayed the tax to shore up investor confidence, but this has attracted criticism from the IMF which said that in its absence the tax burden would disproportionately fall on poorer Egyptians.

Meanwhile, investors in real businesses continue to pay capital gains and dividend taxes because we, unlike retail investors in the EGX, lack a bright, shiny gauge to which we can point and complain.

OTHER CAPITAL MARKETS NEWS:

The number of registered investors on the EGX has risen by 74% y-o-y in the first seven months of 2021, EGX Chairman Mohamed Farid said yesterday. He said there were 3.3. mn registered EGX investors in the January-July period, compared with 1.9 mn in the same period last year. Farid attributed the increase to EGX ad campaigns aimed at encouraging bourse activity, as well as new rules that came into effect in February allowing 16-21 year-olds to trade on Egypt’s stock exchange.

A MESSAGE FROM BUPA EGYPT INSURANCE

CONSUMER FINANCE

Contact, Abou Ghaly to launch Abou Ghaly Finance

Consumer finance provider Contact Financial and Abou Ghaly Motors will join forces to launch Abou Ghaly Finance within the coming months, a company that will offer financing solutions to those wishing to purchase an Abou Ghaly vehicle, Contact Financial CEO Saeed Zater told us. The company has applied for a license from the Financial Regulatory Authority and hopes to receive it in the coming months, Zater said.

The new company will aggregate several services, offering clients a choice of payment plans and methods, as well as solutions to help them pay for maintenance costs, spare parts, various types of ins., according to a statement (pdf).

This isn't Contact's first time partnering with automotive outfits, previously providing financing to clients of Mercedes, BMW and Kia, Zater said.

Contact rebranded from Sarwa Capital earlier this year: The company currently has a 28.5% market share of the consumer financial services market, Zater told us, adding that currently there are currently 26 licensed consumer finance providers.

The market has boomed over the past year, with a number of companies acquiring consumer finance licenses including CI Capital’s Souhoola, GB Auto’s Drive and Abdul Latif Jameel.

Contact is also looking to launch an e-payments company soon and is hoping to acquire its e-payment license this month, Zater told us. The company will initially start operating through 250 Contact-affiliated outlets across the country with e-payments processing capabilities in the initial stage of the rollout, after which the company will install payment machines to serve its clients.

Another play in the e-payments Egyptian market? Though big names like Fawry and Valu have dominated the market, e-payments is a fast-growing segment, increasing sevenfold since the start of the pandemic as more Egyptians go digital.

ECONOMY

FX reserves inch up in August

Egypt’s foreign currency reserves inched up by USD 62.9 mn in August, reaching USD 40.67 bn from USD 40.61 bn in July, according to official figures released by the Central Bank of Egypt yesterday. Egypt’s reserves had increased USD 3 mby n in July, after jumping USD 116 mn in June.

Reserves are getting closer to their pre-covid levels: The country’s stockpile fell by almost USD 10 bn from the USD 45.5 bn peak in February 2020 due largely to the covid-induced sell-off of emerging-market assets.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

Last night’s talk shows focused on the run-up to the new 2021-2022 school year: Some 800k people working in Egypt’s education system have so far received at least one dose of a covid vaccine in preparation, Education Minister Tarek Shawki said in a phone call with El Hekaya (watch, runtime: 1:10 | 1:24 | 3:39). The ministry is aiming to vaccinate a total 1.6 mn school employees as we approach the start of the new school year, which kicks off on 12 September for international schools regulated by the Education Ministry and 9 October for public schools. Some 95% of teachers and school staff have registered to receive jabs, he said..

Covid-19 vaccination became mandatory in August for all 18+ year-old students, teachers and staff at Egyptian schools and universities. Unvaccinated employees in the education sector must receive a covid-19 vaccine, which will be offered to them at no charge.

Schools will not close except in “the gravest of circumstances,” Shawki said, emphasizing that efforts are being made to ensure a complete academic year. He said coursework and attendance would be marked, adding that university students, Thanaweya Amma or even younger students could be given vaccines if enough are available. Egypt’s pharma regulator is yet to approve the use of covid vaccines for people under the age of 18.

The ministry has finalized rules for private schools that charge fees, and an announcement will be made soon, the minister said. Fees will be paid electronically under the ministry’s supervision, and this will apply to all schools, whether international, Japanese, or private experimental. Shawki pledged to investigate any complaints made against schools accused of unreasonable fee hikes (1:27 | 2:51 | 1:45).

Maait talks capital gains tax: Meanwhile, Finance Minister Mohamed Maait appeared on Ala Mas’ouleety to reiterate that the ministry has no plans to introduce a capital gains tax on EGX share sales next year (watch, runtime: 23:04), while his tax advisor Ramy Youssef was on Kelma Akhira to explain the differences between capital gains tax and stamp duty (watch, runtime: 4:56). We have the full story in this morning’s Speed Round, above.

Hossam El Badry gets the boot: There was also much talk of the EFA’s decision to replace head coach Hossam El Badry and his backroom staff after Egypt’s 1-1 draw with Gabon in its World Cup qualifier this week. A new coach and staff will be announced within days, with two Egyptians, Hossam Hassan and Ihab Galal, making the candidate list alongside three Portuguese picks. Kelma Akhira (watch, runtime: 2:14 | 1:50 | 12:11), Masaa DMC (watch, runtime: 14:46), Hadith Al-Qahera (watch, runtime: 31:20), Al Hayah Al Youm (watch, runtime: 37:43), Alaa Mas’ouleety (watch, runtime 27:45) and El Hekayah (watch, runtime: 8:44) all had the story.

EGYPT IN THE NEWS

Is there drinkable water on Mars? There could be if Egyptian mechatronics engineer Mahmoud Elkoumy and his robot have their way. The robot, which cost just USD 250 to build, turns moisture in the air into drinking water. Adorably, it also introduces itself. (Reuters)

ALSO ON OUR RADAR

The Transport Ministry is considering 16 local and international consortiums to implement Alexandria’s Abu Qir metro project, unnamed sources at the ministry told Al Mal. The consortiums include Egypt’s ElSewedy Electric-Siemens, Orascom-Arab Contractors as well as India’s Larsen & Toubro and South Korea’s Hyundai Rotem, Spain’s Construcciones y Auxiliar de Ferrocarriles, Italy’s WSPHT, China’s NORINCO International, Japan’s Hitachi Group and a French-Egyptian consortium led by Alstom, among others.

Speed Medical will buy back 20 mn shares in a bid to support its share price, which has come under pressure since the end of its bid for Prime Speed. The company’s shares have fallen more than 25% since the end of August when relations between the two companies broke down, with Speed publicly airing a list of grievances against Prime and closing the door on its takeover bid. The company will now buy back shares amounting to 1.8% of its capital, it announced in a disclosure (pdf) yesterday, a transaction that based on yesterday’s share price would cost EGP 34.4 mn. The company’s share price fell 13.5% yesterday to EGP 1.72.

COVID WATCH

Covid cases could be 10x higher than reported, says Zayed

Covid cases on the ground are probably 10 times as many as the reported figures: The official figures of any epidemic only reflect about 10% of the actual number of infections, Health Minister Hala Zayed said during an interview with Lamees El Hadidi (watch, runtime: 2:14). These figures include cases that go undiagnosed, she added.

We could be in line for booster shots here in Egypt by the end of the year: In the interview with El Hadidi (watch, runtime: 6:19), Zayed said that the ministry is hoping to start offering third booster shots by the end of the year, but added that the rollout would depend on people taking up the government’s offer of vaccines and could not begin until all those on waitlists had at least received a first shot.

The fourth wave could peak sometime at the end of September or in the first half of October, Zayed said (watch, runtime: 6:39), adding that case numbers are expected to escalate “in a very big way” at the end of this month. The government had been preparing for the fourth wave of the virus by increasing its oxygen stores and updating the medication protocol for those who are infected, she said, adding that there is currently no shortage of available beds in intensive care units.

The Health Ministry reported 368 new covid-19 infections yesterday, up from 343 the day before. Egypt has now disclosed a total of 290,395 confirmed cases of covid-19. The ministry also reported 12 new deaths, bringing the country’s total death toll to 16,801.

IN GLOBAL COVID NEWS-

Chile will vaccinate kids as young as six using the Sinovac jab, after a panel of medical experts voted to approve the use of the jab for young children, Bloomberg reports. The decision comes after a June study showed that the Chinese vaccine could be administered safely to children aged three and above.

Sinovac is becoming the dominant vaccine in Egypt as state-owned Vacsera ramps up production of home-made jabs. President Abdel Fattah El Sisi this week said that Egypt could start providing vaccines to children under the age of 18 at schools once the necessary approvals are in place.

Sinopharm wants to produce its own mRNA vaccine, making it the first big Chinese company to consider doing so, the FT says. The company is currently conducting clinical trials on a vaccine that uses the mRNA technology, which some studies have shown to be more effective than traditional inoculation methods. The Moderna and Pfizer vaccines are the only mRNA jabs currently approved for use.

PLANET FINANCE

US regulators are rushing to get a handle on crypto: From “bank-like” institutions that hold and lend digital currency deposits, to the murkier world of decentralized finance — known as DeFi — where anonymous traders buy and sell on automated markets, the New York Times reports that US lawmakers have been confounded by the rapid rise in cryptocurrency financial services. The years-long process of building a regulatory framework is glacial compared to the pace of technological innovations in the field and consumers’ readiness to buy in.

Even crypto execs didn’t predict the explosion in the market: “At every juncture, the speed at which decentralized finance has just, like, started to work, has caught myself and everybody off guard,” said the founder of DeFi platform Compound — who is now worth tens of mns of USD on paper after starting the company three years ago. But while few can say how long integrating crypto into the formal banking system might take, Fed Chairman Jerome Powell has joined other central banks globally in suggesting a shortcut: “You wouldn’t need stablecoins, you wouldn’t need cryptocurrencies if you had a digital US currency,” he said in July. “I think that’s one of the stronger arguments in its favor.”

|

|

EGX30 |

11,064 |

-0.3% (YTD: +2.0%) |

|

|

USD (CBE) |

Buy 15.65 |

Sell 15.75 |

|

|

USD at CIB |

Buy 15.65 |

Sell 15.75 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

11,407 |

+0.6% (YTD: +31.3%) |

|

|

ADX |

7,628 |

-0.1% (YTD: +51.2%) |

|

|

DFM |

2,907 |

-0.2% (YTD: +16.7%) |

|

|

S&P 500 |

4,535 |

-% (YTD: +20.8%) |

|

|

FTSE 100 |

7,187 |

+0.7% (YTD: +11.3%) |

|

|

Brent crude |

USD 72.22 |

-0.5% |

|

|

Natural gas (Nymex) |

USD 4.70 |

-0.4% |

|

|

Gold |

USD 1,824.90 |

-0.5% |

|

|

BTC |

USD 52,491 |

+1.4% (as of midnight) |

THE CLOSING BELL-

The EGX30 fell 0.3% at yesterday’s close on turnover of EGP 1.7 bn (11.6% above the 90-day average). Local investors were net sellers. The index is up 2% YTD.

In the green: Fawry (+4.4%), Oriental Weavers (+2.5%) and T M G Holding (+1.2%).

In the red: Speed Medical (-13.5%), Egyptian for Tourism Resorts (-4.9%) and Raya (-4.9%).

Futures suggest traders are feeling optimistic about life after the Labor Day long weekend in the United States and Canada: Wall Street and Bay Street are both on track to open in the green later today. The outlook for European shares is mixed, and Asian markets are largely in the green as we head toward dispatch time this morning.

DIPLOMACY

Palestine, investment focus of Egypt-Norway talks: Foreign Minister Sameh Shoukry discussed the Israel-Palestine conflict and bilateral investment with his Norwegian counterpart Ine Eriksen Søreide during a phone call yesterday, the Egyptian Foreign Ministry said in a statement. Søreide invited Shoukry to participate in the UN’s Ad Hoc Liaison Committee that works to deliver aid to Palestinians, which will meet on the sidelines of the upcoming UN General Assembly later this month.

Investor confidence is rising in Egypt’s renewables, but major risks are still seen in some areas: Since the launch (pdf) of Phase Two of Egypt’s solar feed-in-tariff (FiT) program and the completion of the 1.5 GW Benban solar park, Egypt’s been a hotbed of renewable energy investment. Wind energy investment is also well underway, with players keen to get in on projects like the Ras Gharib wind farm.

Covid-19 and the electricity supply glut slowed the renewables transition: Egypt’s renewable energy ambitions have been tempered by our electricity supply glut. To avoid exacerbating overcapacity amid pandemic-driven reduced energy demand, the government took steps last year to limit renewable energy generation. We should expect investment in renewables to slow down substantially over the next 18-24 months, the CEO of a prominent renewable energy company told us at the time.

An April 2021 report (pdf) by RES4Africa and PricewaterhouseCoopers assesses the perceived risk of investing in renewable energy, in seven countries in the Southern and Eastern Mediterranean (SEMED). It follows an earlier 2016 report (pdf). The 2021 report’s Egypt-focused section uses data from five public sector and 21 private sector survey participants.

The good news: overall, Egypt’s renewables investment environment is seen as less risky than it was in 2016. Investor confidence in Egypt’s renewable energy sector has improved markedly in the last five years, with Egypt now considered medium-risk rather than high-risk.

How does Egypt compare to its regional peers? Regionally, overall perceived investment risk in renewables has decreased since 2016. Morocco’s risk level is lowest. Egypt, Jordan and Tunisia are all considered medium-risk markets, and Algeria, Libya and Lebanon high-risk. Like Egypt, Morocco, Jordan and Tunisia all see pronounced gaps in risk perception between the public and private sectors, the report notes.

What’s helped reduce perceived risk? A more stable macroeconomic climate and support from DFIs. The government has improved Egypt’s credit rating, stabilized the macroeconomic climate, and drawn financing and technical support from development finance institutions (DFIs), the report tells us. 73% of private sector survey respondents now see financing availability in Egypt as being of low concern.

Thanks to gov’t efforts to improve the legislative framework, Phase 2 of the FiT attracted much more interest than Phase1, the report tells us. Phase Two’s contractual arrangements included a 25-year Power Purchase Agreement (PPA) with the Egyptian Electricity Transmission Co. (EETC) and a sovereign guarantee backing the payment obligations of energy-purchasing parties.

Now, investors feel the likelihood of not seeing project revenues is low: Over 60% of private sector respondents see risks related to project counterparties (usually EETC), capital transfer or termination as being of low concern. Phase Two’s PPA and the sovereign guarantee upped investor confidence substantially over five years, the report tells us.

Meanwhile, construction, operational, social and environmental risks aren’t a worry: Construction and operation concerns remain low, perhaps driven by the affordability of local raw materials and components, competitive terms offered by Egypt’s engineering companies, and our highly qualified workforce, the report says. 80% of private sector respondents see obtaining licenses and permits as of low concern — a substantial improvement from five years ago. And perceived environmental and social risks are low, perhaps because of the job-creation potential renewable projects offer, the report notes.

Still, major investment concerns remain — particularly among the private sector. Despite gov’t reforms, the regulatory framework tops them all. The law is considered the most problematic risk area among investors, with perceived risk actually increasing in the last five years, “in contrast to the improvement in all other areas.” But while 79% of private sector respondents consider regulatory and policy issues to be of very high concern, only 20% of public stakeholders agree. More business-government dialogue is needed to bridge this perception gap, the report says.

What’s driving this? EETC’s perceived high influence over gov’t policy: Many investor concerns relate to a dispute about the cost-sharing agreement between the EETC and Benban project companies, where the EETC unilaterally raised the cost-sharing costs, the report says. Investors see the EETC as able to exert undue influence over government policy, it adds.

Along with the belief that non-megaprojects face greater risks than megaprojects: The private sector sees Egypt’s legal framework as inadequate to support investment in renewables projects, aside from government-backed megaprojects, the report says. Projects that aren’t megaprojects face more uncertainties when it comes to permitting, wheeling charges and curtailment, investors believe.

And lingering concerns about dispute resolution: Dispute resolution was particularly challenging during Phase One of the FiT, when international arbitration was banned, the report says. Though this was resolved during Phase Two, investor concerns remain about the quality of Egypt’s judicial processes. Egypt ranked 166 globally for contract enforcement in the 2020 World Bank Doing Business Report (pdf) — well below the MENA average, the 2021 report notes.

Some 60% of private sector respondents also have concerns about Egypt’s tax regime, the report tells us. Although a 30% tax deduction on net income for renewables projects was among the incentives introduced by the new Investment Act of 2017, investors are said to be concerned that new taxes may be introduced in the wake of the pandemic to make up any budgetary shortfalls.

The public and private sectors are much more aligned on FX risks, which are heightened by pandemic-driven instability, the report says. Although the FX rate has stabilized since the 2016 devaluation, covid-19 and decreased tourism revenues have driven the value of the EGP down. The central bank issued a convertibility guarantee, which offers investors some relief, but more FX stability is needed to lend it credibility, the report adds.

The report has a series of recommendations for how to reduce perceived risk: These include working to reduce the influence of the EETC, and increasing business-government dialogue. Dispute resolution timeframes should be shortened, and the quality of Egypt’s judicial processes improved. The EGP should be stabilized to maintain the government convertibility guarantee — a crucial part of boosting investor confidence, it says. Small and medium-sized projects should see increased access to private capital. Renewables projects should continue to receive tax breaks, and fossil fuel subsidy reductions should continue.

Your top climate stories for the week:

- Is the carbon emissions market the next big thing? Energy trading houses are focusing their attention on carbon-trading operations as economies around the world begin to put price tags on emissions.

- We probably can’t invest our way out of a climate disaster: Markets’ inability to adapt for a green economy now means they will experience “a much bigger transitional shock later, says the ex-CEO of Norway’s sovereign fund.

- A call to action: Over 200 journals published a joint editorial calling for action to keep global temperature rises below 1.5°C.

- New Zealand just experienced its warmest winter to date: The country's National Institute of Water and Atmospheric Research shared that its 2021 winter was 1.32°C degrees above average.

CALENDAR

5-12 September (Sunday-Sunday): Arab Labor Conference, the InterContinental CityStars Hotel, Cairo, Egypt.

5-7 September (Sunday-Tuesday): The Arab Security Conference, The Nile Ritz-Carlton, Cairo, Egypt.

7-8 September (Tuesday-Wednesday): Euromoney Conferences will host the GlobalCapital Sustainable and Responsible Capital Markets Forum 2021, featuring Vice Minister of Finance Minister Ahmed Kouchouk.

7-8 September (Tuesday-Wednesday): Egypt, Turkey hold diplomatic talks in Ankara.

7-9 September (Tuesday-Thursday): Egy Health Expo, Al Manara International Conference, Cairo, Egypt.

8-9 September (Wednesday-Thursday): Egypt-International Cooperation Forum (ICF), Cairo

11-12 September (Saturday-Sunday): International Conferences on Economics and Social Sciences, Cairo

12 September (Sunday): International schools begin 2021-2022 academic year

12-15 September (Sunday-Wednesday): Sahara Expo: the 33rd International Agricultural Exhibition for Africa and the Middle East.

14-30 September (Tuesday-Thursday): 76th session of the UN General Assembly, New York.

15 September (Wednesday): The CFO Leadership & Strategy Summit is taking place in Egypt.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 September (Saturday): Expiration of United Nations Investigative Team to Promote Accountability for Crimes Committed by Daesh/ISIL

21-22 September (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

22-25 September (Wednesday-Saturday): Cityscape Egypt, Egypt International Exhibition Center, Cairo, Egypt.

29 September (Wednesday): DevOpsDays Cairo 2021 is being organized by ITIDA and the Software Engineering Competence Center in cooperation with DXC Technology, IBM Egypt and Orange Labs.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

30 September-8 October (Thursday-Friday): The Cairo International Fair, Cairo International Conference Center, Cairo, Egypt.

30 September: Closing of 2021’s first oil and gas tender in the Gulf of Suez, Western Desert, and the Mediterranean.

October: New legislative session begins — must be held by the first Thursday of October.

October: Romanian President Klaus Iohannis could visit Egypt in mid this month to discuss ways to boost tourism cooperation between the two countries.

1 October (Friday): Businesses importing goods at seaports will need to file shipping documents and cargo data digitally to the Advance Cargo Information (ACI) system.

1 October (Friday): Expo 2020 Dubai opens.

1 October (Friday): State-owned companies and government service bodies selling goods and services to customers that have not yet signed on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

9 October (Saturday): Public schools begin 2021-2022 academic year

11-17 October (Monday-Sunday): IMF + World Bank Annual Meetings.

12-14 October (Tuesday-Thursday): Mediterranean Offshore Conference, Alexandria, Egypt.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

24-28 October (Sunday-Thursday) Cairo Water Week, Cairo, Egypt.

27-28 October (Wednesday-Thursday) Intelligent Cities Exhibition & Conference, Royal Maxim Palace Kempinski, Cairo, Egypt.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 October – 4 November (Saturday-Thursday): The first edition of Race The Legends, Egypt.

November: The French-Egyptian Business Forum is set to take place in the Suez Canal Economic Zone.

November: Egypt will host another round of talks to reach a potential Egyptian-Eurasian trade agreement, which can significantly contribute to increasing the volume of Egyptian exports to the Russia-led bloc that includes Armenia, Belarus, Kazakhstan and Kyrgyzstan.

1-3 November (Monday-Wednesday): Egypt Energy exhibition on power and renewable energy, Egypt International Exhibition Center, Cairo, Egypt.

2-3 November (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

16-17 November (Tuesday-Wednesday): Africa fintech summit, Cairo.

26 November-5 December (Friday-Sunday): The 43rd Cairo International Film Festival.

29 November-2 December (Monday-Thursday): Egypt Defense Expo.

7-8 December (Tuesday-Wednesday): North Africa Trade Finance Summit.

12-14 December (Sunday-Tuesday): Food Africa Cairo trade exhibition, Egypt International Exhibition Center, Cairo, Egypt.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

14-19 December (Tuesday-Sunday): The Cairo International Festival for Experimental Theater.

14-15 December (Tuesday-Wednesday): The Federal Reserve meets to review interest rates.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-16 February 2022 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

1H2022: The World Economic Forum annual meeting, location TBD.

22-24 April 2022: World Bank-IMF spring meeting, Washington D.C.

May 2022: Investment in Logistics Conference, Cairo, Egypt

16 June 2022 (Thursday): End of 2021-2022 academic year for public schools

27 June-3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.