- Roll up yer sleeve: The vaccine rollout is underway. (Covid Watch)

- Gov’t eyes new valuation for Abu Qir as it prepares timeline for a new secondary offering. (Privatization Watch)

- Revenge of the Luddites, Part III: Chapter II: Vezeeta strikes back. (Dispute Watch)

- Who’s going to tuck King Tut in at night? (Tourism)

- Our railways are getting safer with a USD 440 mn World Bank loan. (Development Finance)

- State institutions lose access to a tax loophole + real estate registry, tax officially postponed. (Legislation Watch)

- Catch up from EnterprisePM: Covid jabs roll out to the public + contracts were awarded for the world’s largest water treatment plant. (What We’re Tracking Today)

- Egypt and Sudan setting a GERD ultimatum for Ethiopia? (Diplomacy)

- Planet Finance — Oil spiked + Taper Tantrum 2.0

Sunday, 7 March 2021

Vaccine rollouts + Revenge of the Luddites, Part III, Chapter II

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to a brand new week.

THE BIG STORY HERE AT HOME is President Abdel Fattah El Sisi’s visit to Sudan. Talks included how to boost bilateral relations as well as the way forward on the Grand Ethiopian Renaissance Dam. The visit dominates the news cycle this morning and was all over the airwaves last night. We have chapter and verse in the news well, below.

Expect Sudan to stay in the headlines for the next few days, with Sudanese Prime Minister Abdalla Hamdok expected to touch down in Egypt this Thursday, 11 March for a two-day visit. GERD will most certainly be on the agenda when Hamdok lands, Ittihadiya spokesperson Bassem Rady told Ala Mas’ouleety’s Ahmed Moussa yesterday (watch, runtime: 9:44).

THE BIG STORY INTERNATIONALLY: The US senate passed President Joe Biden's USD 1.9 tn stimulus plan in a party-line vote after an all-night "vote-a-rama" on Saturday, paving the way for Biden's first legislative victory if approved by the House in the coming days, CNN reports. The House aims to reconcile several key changes, pass the bill on Tuesday, and send it back to Biden’s desk for his signature before 14 March — just days before unemployment programs expire for mns of Americans. The story is front-page news everywhere from the New York Times to Bloomberg.

*** CATCH UP QUICK with the biggest stories from Thursday’s EnterprisePM:

- The Health Ministry began rolling out covid-19 vaccines to the wider public.

- Contracts have been awarded for the world’s largest wastewater treatment plant right here in Egypt.

- The commodities supercycle looks like it’s touching metals in Egypt.

|

CIRCLE YOUR CALENDAR-

We’re likely going to be talking about Turkey when Greek Foreign minister Nikos Dendias lands tomorrow for a two-day visit. Dendias plans to discuss the demarcation of maritime zones — including a recent push by Ankara to draw up an East Med maritime demarcation agreement with Egypt — as well as developments in Libya and the Eastern Med in general, according to a Greek Foreign Ministry statement. The visit comes days after Shoukry called for “a unified, firm policy” against Turkey’s “destructive practices” in the region.

There’s three days left of the EFG Hermes Virtual Investor Conference. The conference is headlined as “Frontier Emerging Markets Regaining Momentum” and brings together executives from 197 companies and more than 700 investors from 253 global institutions to exchange insights on the current state of frontier and emerging markets. The event runs until Tuesday, 9 March.

Key data points in the coming days and weeks:

- Foreign reserves figures should be out within the next few days.

- Inflation data will drop on Wednesday, 10 March.

- The Central Bank of Egypt will discuss interest rates on Thursday, 18 March.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

COVID WATCH

Roll up yer sleeve: The vaccine rollout is underway

The first day of the covid-19 vaccine rollout to the wider public saw 1,141 individuals get a jab, the Health Ministry said in a statement on Thursday. Both the Sinopharm and Oxford-AstraZeneca vaccines are being deployed. Sinopharm is taken in two jabs administered 21 days apart, while folks getting the Oxford-AstraZeneca vaccine take a second dose after a three-month period.

The Health Ministry reported 588 new covid-19 infections yesterday, up 579 the day before. The ministry also reported 45 new deaths, bringing the country’s total death toll to 10,916. Egypt has now disclosed a total of 185,334 confirmed cases of covid-19.

Tourism companies want to buy 200k doses of covid-19 vaccines for Egyptians going to Hajj in a bid to preserve a significant source of business for the industry. The Egyptian Tourism Federation’s tour operators division are lobbying the health, interior, and foreign ministries and the covid-19 crisis committee to make the jabs available for purchase, federation board member Wahid Assem said, according to Al Shorouk. The proposal would see the companies covering the costs of the jabs, some of which would be distributed to airports employees.

More affordable PCR tests for outbound travelers, please: The tourism industry also wants the Health Ministry to offer PCR tests to travelers leaving Egypt on international flights at the same USD 30 fixed rate offered to inbound tourists, according to Al Shorouk.

Morocco has suspended flights to Egypt and Algeria until 21 March due to covid concerns, the Moroccan Airports Authority said in a statement on Friday. EgyptAir confirmed that it has stopped flights to Morocco “until further notice” starting Friday.

Kuwait is extending its travel ban for non-citizens until further notice and has introduced a one-month nighttime curfew to battle the pandemic as the country reported a new record daily case count, its cabinet said on Thursday. The government on 22 February closed land and sea borders until 20 March.

It’s a different story in Saudi Arabia, where the government is easing restrictions. The kingdom is reopening diners and cafes, malls, gyms, and in-door leisure facilities, state-owned Saudi Press Agency reported. A travel ban and border closure remains in effect until 17 May.

Eva Pharma will begin distributing Japanese antiviral medication Avipiravir to pharmacies, the pharma company said in a statement.

WATCH THIS SPACE- Anti-covid-19 pill in the making? A mid-stage study on an experimental antiviral med shows the pill is able to “significantly reduce” the infectious virus after five days of treatment, the Wall Street Journal reports, citing one of the med’s developers. The Tamiflu-like capsule is still under study to prove its efficacy in treating severe covid-19 cases, but could be a key stepping stone to cutting down on hospitalizations.

The World Health Organization has warned of possible third and fourth waves of covid-19, and urged governments to guard against complacency amid the global vaccine rollout, WHO official Mike Ryan said at a press briefing on Friday, according to Reuters.

Landmark for Covax: Covax has so far delivered over 20 mn doses to 20 countries and another 14.4 mn doses to be delivered to 31 nations this week, WHO director-general Tedros Adhanom Ghebreyesushe said at a briefing on Friday.

The EU is turning to the US to ramp up doses of AstraZeneca’s covid-19 jab as its vaccine rollout program continues to stumble, urging Washington to ensure the flow of shipments of essential vaccine components needed in European production, the Financial Times reports, citing the European Commission. The EU also adopted a new export control mechanism to ensure manufacturers respect their contracts, allowing Italy to bar exports of the vaccine destined for New Zealand after AstraZeneca failed to deliver the 205k-dose shipment it promised Europe on time, according to the Wall Street Journal.

PRIVATIZATION WATCH

Shaking off the cobwebs

The government is going to do a new valuation on Abu Qir Fertilizers as it prepares a new timeline for a secondary offering of the company’s shares, Al Mal reports, citing what it says are unnamed sources in the know. A new valuation is necessary after the pandemic and ensuing capital market sell-off. It’s not clear how long the process will take, or when the government committee managing the privatization program expects to kick off the roadshow for the sale. Renaissance Capital’s head of MENA research Ahmed Hafez previously told us Abu Qir could be brought to market if there’s a strong rally in commodity prices, and markets are now awash with talk of a commodities supercycle.

Advisors: Renaissance Capital and CI Capital were tapped to lead the transaction. White and Case and Shalakany Law Office are providing counsel.

Background: The offering, which was supposed to go to market in 2019, would have seen the government sell as much as 20% of the company via an accelerated book build on the EGX. The final decision remains unconfirmed. The sale was put on hold at the end of 2019, and then again last year because of the pandemic. This listing gets an Enterprise Realness Rating of 4.

DISPUTE WATCH

Revenge of the Luddites, Part III: Chapter II: Vezeeta strikes back

Vezeeta has denied that it has broken the law with its newly-launched e-pharmacy business after the Pharmacists Syndicate last month accused the company of illegally selling products online. In a statement (pdf) issued Thursday, the digital healthcare platform rejected the syndicate’s claims that it sells meds without a pharmacy license, saying that its service is an online store for its own physical pharmacies that are run and supervised by licensed pharmacists. The store is a registered commercial licensed by the General Authority for Investment (GAFI), it added.

What’s the issue here? The syndicate last month filed a complaint with the prosecutor-general’s office claiming that Vezeeta is acting illegally by selling to customers directly online without using licensed, brick and mortar pharmacies. It also claimed the app violates a law that bans advertising meds on social media and television. The syndicate last year reported Vezeeta to the Consumer Protection Authority and the Interior Ministry’s tech crimes department.

Background: This isn’t the first time the Pharmacists’ Syndicate has been on the warpath against modern technology: Ibnsina Pharma backed down from its purchase of digital pharmacy platform 3elagi last year after the syndicate filed a similar complaint against 3elagi and called on syndicate members to boycott Ibnsina Pharma.

TOURISM

Meet the folks who’ll tuck King Tut in at night

A consortium of local and foreign companies led by Hassan Allam Holding has been awarded management rights for the Grand Egyptian Museum (GEM) in a tender that finally wrapped up last week following over two years of negotiations, cabinet said on Thursday. The statement didn’t disclose which companies would work alongside HAH, but said that the group is made up of several Egyptian, British, French, and Emirati firms. Maj.Gen. Atef Moftah, who is supervising the project, declined to disclose the names of the companies when approached by Enterprise.

Al Kharafi came close to landing the job: The consortium was one of five that had been competing in the later stage of the tender, which was then whittled down to three, the other two being a consortium of Orascom Construction and an unnamed French company, and another led by Kuwait’s Al Kharafi, Moftah told us. This was then narrowed down to Hassan Allam and Al Kharafi, he added.

A final contract is expected to be signed in the next 45 days, by which time the government hopes to wrap up the final negotiations and legal procedures, Motfah said. The contract will bring the companies on board to run services at the soon-to-be inaugurated GEM, which Moftah said will include a pre-arrival booking platform for tourists, on-site tours, programs both in GEM and the nearby Pyramids Plateau area, and developing and executing a full-fledged promotion scheme for GEM and ancient Egyptian civilization.

So, when can we go to the GEM? Provided covid is brought under control and vaccination programs run successfully, it should be open to the public in 2H2021, Tourism and Antiquities Minister Khaled El Anany said recently. Construction is already at least 98% complete, but an official opening will still need to wait due to the pandemic.

DIVE DEEPER: Check out our two-part Hardhat series on the Giza Pyramids development project: Part I | Part II.

TAX

El Sisi ratifies OECD dual taxation standards

The Organization for Economic Cooperation and Development’s (OECD) convention on double taxation is now official in Egypt after President Abdel Fattah El Sisi ratified an agreement Egypt first signed in 2017 to modify its double taxation treaties with other countries. Tax officials will now begin revising over 30 bilateral agreements the country had signed in the past on double taxation. Egypt is now the 26th country to ratify the treaty, which has so far been signed (pdf) by a total of 95 nations.

The convention will allow us to grow tax revenue from e-commerce as it will redistribute taxes paid by tech companies such as Facebook and YouTube based on where the income is coming from, Ramy Mohamed, the finance minister’s advisor for international taxation, told Enterprise. As things stand, e-commerce companies with cross-border operations pay taxes only in countries where they’re registered, he said.

We’re not alone in looking for Big Tech to pay its fair share of taxes. France imposed a 3% levy on digital revenues, prompting a spat with the previous US administration and the Biden administration insists that this type of levy is unfair double taxation. Aid groups are pushing emerging economies to tax big tech and the debate has spilled over into the pages of the Financial Times and other bastions of the global business elite.

Speaking of e-commerce tax revenues: The draft E-Commerce Act is currently with the Madbouly Cabinet for review, and is expected to make its way to the House of Representatives soon. The proposed law would, if passed, provide a clear tax framework for online ads and the sale of goods and services and potentially net new taxes from the operations of tech giants including Google, Netflix, Amazon and Facebook here in Egypt.

DEVELOPMENT FINANCE

Big train a-comin’

The safety and quality of service of Egypt’s railways are getting an upgrade with a USD 440 mn loan from the World Bank, which reached an agreement with the International Cooperation Ministry to allocate the funding for the Railway Improvement and Safety for Egypt (RISE) project, according to a press release (pdf).

In details: The RISE project is valued at a total USD 681.1 mn, which includes the World Bank’s loan and another USD 241.1 mn the Egyptian National Railways (ENR) will contribute. The World Bank’s financing will help finance signaling modernization and rail track upgrades, with a focus on the Cairo-Beni Suef segment of the rail network. The project will also buttress “reforms needed to enhance ENR’s performance and competitiveness,” the statement said. RISE will “support the momentum for reform and the demand for urban mobility and reliable public transport, integral to achieving the 2030 Sustainable Development Goals,” Minister Rania Al-Mashat said.

Speaking of railways: Phase 1 of Cairo’s USD 4.5 bn mega-monorail project — which runs 45 km to connect East Cairo to the new administrative capital — is slated for inauguration by the end of May 2022, Transport Minister Kamel El Wazir said at a site tour yesterday. Meanwhile, the second and final phase of the project (extending over 11.5 km) is scheduled to open in February 2023, El Wazir said.

ENERGY

Not green eggs and ham — green _hydrogen_

Belgium’s DEME Group will work with Egypt on exploring green hydrogen under an MoU with the oil and electricity ministries and the Egyptian navy, cabinet said in a statement on Thursday. The MoU will be followed by studies to look into producing the gas on a trial basis “as a step toward expanding in this field … [and possibly] exporting,” the statement says. The agreement came following a meeting last month between President Abdel Fattah El Sisi and three CEOs of a Belgium alliance of infrastructure players including DEME, Fluxys, and the company running the Port of Antwerp. Egypt is currently probing green hydrogen, which is produced without burning fossils, as a cleaner energy source to integrate into its energy mix by 2035. Siemens was brought on board earlier this year for a pilot project.

OTHER ENERGY NEWS- Public spending on fuel subsidies is continuing to drop, falling 45% in the first half of FY2020-2021 to EGP 8.4 bn from EGP 15.2 bn in the same period last fiscal year, Oil Minister Tarek El Molla told Reuters on Thursday. This puts the government on track to comfortably beat the EGP 28.2 bn spending target this fiscal year. Spending on fuel subsidies fell 77% in FY2019-2020, helped in no small part by the collapse in oil prices due to the pandemic.

LEGISLATION WATCH

Of tax breaks and loopholes

The loophole that gave tax breaks to state institutions investing in government debt is now officially closed after President Abdel Fattah El Sisi ratified a bill that repealed an income tax exemption on income derived from treasury holdings, Al Mal reports.

Background: The bill, which was proposed by the Finance Ministry last year, covers specific state institutions as well as government-owned bodies, in addition to private ins. firms and some civil society groups.

The reworked Real Estate Registry Act won’t go into effect until 30 June 2023 — and a 2.5% tithe on real estate sales is no longer a prerequisite for utility access, according to a separate presidential decree, according to Masrawy. The tax was provided for by two new contentious clauses in the Income Tax Act that would have made access to utilities and infrastructure for new properties contingent on their being officially registered and the 2.5% tax on a real estate asset’s value at sale being paid up.

A refresher: The House of Representatives’ general assembly signed off last week on the suspension of amendments to the Real Estate Registry Act. The votes came one day after El Sisi issued the decree ordering a two-year freeze to allow time for public consultations on the legislation. The law was set to go into effect yesterday, mandating new procedures for property owners to register their properties. The Income Tax Act had separately stipulated in a years-old article that properties must be registered at the Real Estate Registry before getting access to basic utilities. The Madbouly Cabinet is now working on a draft bill that would set the new fees and procedures for real estate registry until the reworked Real Estate Registry Act is prepared.

DIPLOMACY

GERD ultimatum?

Egypt and Sudan have reportedly agreed to set a 15 April deadline to reach a binding agreement with Addis Ababa on the Grand Ethiopian Renaissance Dam (GERD) covering the rules for filling and operating the dam, Al Arabiya reports. The decision came during President Abdel Fattah El Sisi’s visit to Khartoum — his first since the ouster of Omar Al Bashir in 2019 — in which he stressed the importance of returning to the negotiating table before the next flooding season. The president also reiterated the importance of Egypt and Sudan’s coordination over the issue during meetings with the head of Sudan’s Sovereignty Council, Abdel Fattah Al Burhan and Sudanese deputy head of state Mohamed Hamdan Dagalo. Reuters also had the story.

El Sisi isn’t the only one pushing for real negotiations: Egypt is calling for a “serious and effective” negotiation process that is led by the African Union (AU) and engages foreign partners to reach an agreement on the dam before Ethiopia starts its planned second filling in the summer, Foreign Minister Sameh Shoukry told UN Secretary General António Guterres in a phone call on Friday, according to a statement. Two days earlier, Ethiopia rejected Egypt and Sudan’s calls to bring more mediators into the fold, saying that doing so could undermine the AU’s efforts to find a resolution to the impasse.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The airwaves followed the press print’s lead last night with wall-to-wall coverage of President Abdel Fattah El Sisi’s visit to Khartoum yesterday (which we cover in the news well, above). Ala Mas’ouleety’s Ahmed Moussa, meanwhile, was particularly concerned with the warm welcome El Sisi received (watch, runtime: 3:40).

Egypt and Sudan putting up a united front on the Grand Ethiopian Renaissance Dam (GERD) could change the power balance in the negotiations, as the two countries are coordinating more closely than ever before since the talks over the dam began several years ago, Kelma Akhira’s Lamees El Hadidi said (watch, runtime: 8:43). El Hekaya’s Amr Adib echoed Lamees’ thoughts, saying that our relations with Sudan have improved dramatically since last year (watch, runtime: 3:12) and suggested that now is the best time for Egyptian investors to take their business to Sudan (watch, runtime: 4:49).

Cairo and Khartoum’s main priority going forward is to push for international mediation, Sudanese writer and pundit Shawky Abdel Azim told Lamees (watch, runtime: 9:11).

El Sisi’s visit is also coming at an important time for Sudan for reasons other than GERD, particularly as it is in a separate stand-off with Ethiopia at their shared border as a result of the Tigray conflict in Ethiopia, Sudanese political commentator Ammar Awad told Masaa DMC’s Eman El Hosary (watch, runtime: 10:11).

EGYPT IN THE NEWS

Human rights is again leading the conversation on Egypt in the foreign press this morning, ending a quiet week for Egypt. Amnesty International called on the Egyptian government to investigate what it says was the forced disappearance of a family in Alexandria in 2019, the Associated Press reports. Meanwhile, the wife of detained Palestinian-Egyptian activist Ramy Shaath urged Egyptian authorities to release her husband in an interview with France 24.

Meanwhile, a decision to require Egyptians and foreigners who are financially capable to pay for their covid-19 vaccines is under fire from a group of medical professionals and activists, who are filing a lawsuit to “challenge” the fee, according to the Wall Street Journal. Health Minister Hala Zayed has said that the government will cover the cost of the jabs for those on welfare programs and others who prove they can’t afford the USD 12 fee. The 40 mn doses distributed via Covax will not be subject to fees, Cabinet spokesperson Nader Saad told the newspaper.

Also making headlines:

- Book review: Raphael McCormack’s “Midnight in Cairo” explores the “vibrant film, theater, music and cabaret scene” of 1920s Cairo, and tells the stories of female performers such as Mounira El Mahdeya and Rose Al Youssef who would soon be forgotten after the 1952 revolution. (Wall Street Journal)

- Egypt’s “Scorpion King”: Scorpion venom is being produced in a laboratory, named “Scorpion Kingdom,” in Egypt’s Western Desert and is sold at USD 7.55k per gram – which is equivalent to venom of 3,000-3,500 scorpions. (AFP)

ALSO ON OUR RADAR

A consortium of El Didi Group and Gama Construction is mulling setting up a 15-acre dry port in Damietta, near the Damietta Port, in cooperation with the Holding Company for Maritime and Land Transport. Earlier press reports had suggested a consortium of three state-owned entities expressed interest in building the dry port, which was expected to cost USD 200 mn.

Other things we’re keeping an eye on this morning:

- The first flights from Lithuania and Moldova after a pandemic-induced hiatus landed at Hurghada International Airport over the weekend.

- Lebanon has signed off on resuming imports of Egyptian potatoes, on the condition that exporters issue permits from Lebanese authorities.

- The Court of Cassation has upheld Mubarak-era Information Minister Anas El Fekky’s three-year prison sentence for pre-revolution corruption charges.

- Memaar Almorshedy is looking to secure EGP 1 bn in financing to back two developments, one on the North Coast and the other in East Cairo.

PLANET FINANCE

Rising US treasury yields continued to hit tech stocks last week, as investor unease about sky-high valuations grew. The Nasdaq has lost USD 1.6 tn in market value over the past three weeks following its heaviest sell-off since October, according to Bloomberg. Despite inching up 1.6% on Friday, the tech-heavy equities gauge closed the week 1.9% lower, leaving it down nearly 10% from a February peak, though with valuations still well above the five-year average.

Tesla was among the biggest losers: Elon Musk has lost USD 27 bn since Monday as the company’s shares tumbled. Musk still retains his spot as the world’s second richest man, but he’s now USD 20 bn below Jeff Bezos after having overtaken the Amazon mogul last week.

Bond sell-off resumes: Bond traders have become increasingly anxious about the combined threat of inflation and an earlier-than-expected rate hike in past weeks, leading to a large sell off and spiking yields which is increasingly being felt in the equity markets. After a pause early in the week, the sell-off resumed after Fed Chairman Jerome Powell failed to reassure investors that the bank would step in should yields continue to rise. The 10-year note closed at 1.547% on Thursday, its highest closing level since February 2020.

Emerging markets are increasingly being caught in the cross-fire: Emerging markets saw daily outflows for the first time since October last week as fears of rising rates cause investors to pull back from risk assets. A tracker run by the Institute for International Finance using data from 30 EMs showed that investors pulled USD 290 mn each day last week, compared to USD 323 mn of net inflows in February, the Financial Times says.

IIF calls the Taper Tantrum 2.0: “Flows have turned negative and that’s really a surprise, as we were still early on in the rebound from a cataclysmic 2020,” said Robin Brooks, the IIF’s chief economist. “The honeymoon that began after positive vaccine headlines in November is unfortunately over. We are in a repeat of the 2013 taper tantrum.”

Oil spiked after OPEC+ votes to maintain supply curbs: Oil prices rose more than 5% on Thursday after the OPEC+ alliance of oil producers went against expectations and decided to maintain current curbs on supply. OPEC said in a statement that it would keep output at current levels through April, though Russia and Kazakhstan were allowed to increase the production by a small amount. Saudi Arabia will extend its 1 mn barrels per day voluntary production cut into April.

This caused prices to hit a near-two-year high: Brent futures climbed USD 2.68 to USD 66.73 per barrel and US crude rose USD 2.55 to USD 63.83 a barrel, according to Bloomberg.

|

|

EGX30 |

11,334 |

-0.5% (YTD: +4.5%) |

|

|

USD (CBE) |

Buy 15.63 |

Sell 15.73 |

|

|

USD at CIB |

Buy 15.63 |

Sell 15.73 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

9,242 |

-0.7% (YTD: +6.4%) |

|

|

ADX |

5,693 |

-0.1% (YTD: +12.8%) |

|

|

DFM |

2,569 |

-0.8% (YTD: +3.1%) |

|

|

S&P 500 |

3,842 |

+2.0% (YTD: +2.3%) |

|

|

FTSE 100 |

6,631 |

-0.3% (YTD: +2.6%) |

|

|

Brent crude |

USD 69.36 |

+3.9% |

|

|

Natural gas (Nymex) |

USD 2.70 |

-1.6% |

|

|

Gold |

USD 1,698.50 |

-0.1% |

|

|

BTC |

USD 49,347.27 |

+1.8% |

The EGX30 fell 0.5% on Thursday on turnover of EGP 1.16 bn (21.1% above the 90-day average). Local investors were net buyers. The index is up 4.5% YTD.

In the green: GB Auto (+2.9%), Orascom Investment (+2.7%) and Orascom Development (+2.1%).

In the red: Sidi Kerir (-2.3%), Qalaa Holding (-1.5%) and SODIC (-1.5%).

ON YOUR WAY OUT

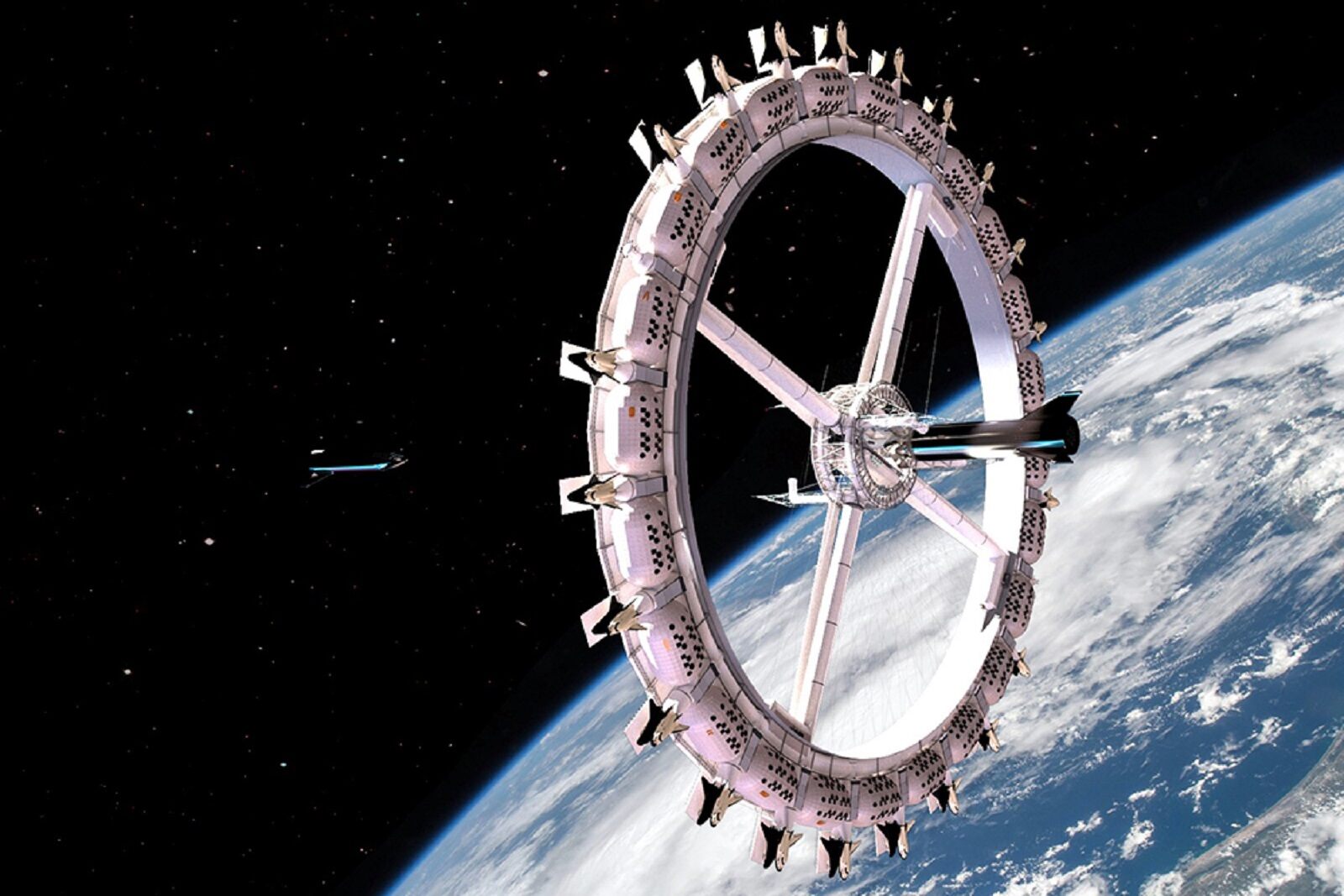

The world will have its first space hotel, Voyager Station, by 2027. According to the Washington Post, Orbital Assembly Corporation will start construction work on the project in 2026 instead of the previously set 2025 thanks to covid-19 disruptions. A half-a-week stay at the hotel orbiting the Earth will set you back USD 5 mn. Travel to and from the hotel will be handled by SpaceX while the rotation of the wheel-shaped craft will produce gravity for the inhabitants.

CALENDAR

March: Potential visit to Cairo by Russian President Vladimir Putin.

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

11-12 March (Thursday-Friday): Sudan’s Prime Minister Abdalla Hamdok will arrive for a two-day visit to follow up on GERD talks.

11-13 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

11-14 March (Thursday-Sunday): First edition of Afaq Real Estate Expo, Tolip El Galaa Hotel, Cairo, Egypt.

11-15 March (Thursday – Monday): Al Bazaar fair for handicrafts and house decors, Cairo International Conference Centre, Cairo, Egypt.

11-20 March (Thursday-Saturday): Photopia’s Cairo Photo Week 2021 will take place with this year’s theme being Depth OFF Field.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

29-30 March (Monday-Tuesday): Arab Federation of Exchanges Annual Conference 2021.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.