- Enterprise poll: CBE to leave interest rates on hold at Christmas Eve meeting. (Poll)

- No big New Years party for you as covid case rate accelerates + more Chinese vaccine coming. (Covid Watch)

- The state privatization program could be making a comeback. (Privatization Watch)

- Edison out. Energean in + lots more M&A news. (M&A Watch)

- It’s best not to look at this year’s tourism figures. (Tourism)

- Fresh eurobonds aren’t in the cards yet -Maait. (Debt Watch)

- Another 2.4k GW of electricity generated from renewable sources by 2022? (Energy)

- Healthtech startup Clinido raises six-figure USD seed round. (Startup Watch)

- Planet Finance: Portfolio investors ❤ EMs again.

Sunday, 20 December 2020

CBE seen leaving interest rates on hold at Christmas Eve meeting

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. It’s both interest rate week and Christmas week — happy holidays to all those who celebrate. It is also — blessedly — the second-last business week of 2020.

Look for the central bank to leave rates on hold when it meets this Thursday, according to our poll of analysts and economists. We have the full rundown below.

Because it’s Christmas week: It’s Deck The Halls — but also, War Pigs (watch, runtime: 0:53).

Not in the resident 13-year-old’s stocking: Cyberpunk 2077, the most hotly anticipated video game in years — whose hype machine fell apart last week.

Holiday tip: Take photos. Lots of photos. And print them. You’ll one day be very grateful you did. As the photographer, podcaster and Welsh sage Kevin Mullins says: A photo doesn’t have to be good, it just has to be important to you.

Will you travel in the new year? Probably in the second half, and almost certainly only once you’ve been vaccinated.

Oh, and those side effects? They’re normal. And they’re really, really, really unlikely to do you any lasting harm at all.

But first: You ain’t gonna party like it’s 1999. The Tourism Ministry issued this weekend a ban on hotels, restaurants, and other establishments from holding large events around the end of the year in a bid to curb the spread of covid-19. We have the full story in this morning’s Covid Watch, below.

We’ve added to our roster of lobbyists in DC, recruiting former Senator Mark Begich (a Democrat) to a bipartisan team of lobbyists from Brownstein Hyatt Farber Schreck, according to Politico, as the Sisi administration prepares to navigate the transition from the Trump administration to a White House led by Joe Biden.

Egypt has been given the green light by the IMF to draw the second, USD 1.67 bn tranch of its USD 5.2 bn standby loan after the international lender’s executive board completed its first review of the country’s reform program, the IMF said in a statement on Friday. This brings the total disbursement under the 12-month agreement to USD 3.6 bn.

The Fund lauded Egypt’s handling of the economic disruption caused by the pandemic, but warned that the government will face challenges implementing the reform program due to global uncertainty. It called for transparent policymaking to maintain public support for the reform program, which aims to strengthen market competition, improve transparency, and reduce public debt.

The funds should be safely tucked away in our treasury within a week, Finance Minister Mohamed Maait told Kelma Akhira’s Lamees El Hadidi. A third and final review is scheduled for June 2021, Maait said (watch, runtime: 1:26).

AUC’s Women on Boards Observatory has launched its Board Ready Women database to help companies find qualified women board members, according to a press release (pdf). The database has over 400 qualified women with backgrounds from a variety of industries.

Reminder: FRA regulations require listed companies to have at least one female board member by the end of the year. When we checked earlier this month, almost half of EGX30 companies still had all-male boards.

|

CIRCLE YOUR CALENDAR-

Prime Minister Moustafa Madbouly will headline the Arab Media Forum with a keynote address. The event takes place virtually on Wednesday, 23 December.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

POLL

Hold your horses

ENTERPRISE POLL- The Central Bank of Egypt (CBE) will leave rates on hold when its Monetary Policy Committee holds its final meeting of the year on Thursday, according to an Enterprise poll. All 10 economists and analysts we surveyed expect the central bank to hold off on further easing, citing rising inflation, the ongoing pandemic, and implications for the carry trade.

Where rates stand currently: The CBE’s overnight deposit rate is now at 8.25% and the lending rate is 9.25%. The main operation and discount rates are now at 8.75%. The central bank has so far cut rates by 400 bps this year, including a record 300 bps cut in March and 50 bps cuts at each of the last two meetings.

Wait and see: "The central bank will slow down before lowering rates again to assess developments in the global economy, global monetary policy, the pandemic and financial portfolio flows, as well as the impact of the 400 bps of cuts made during 2020,” says Radwa Swaify, head of research at Pharos.

Inflation on the rise: Most analysts cited the recent uptick in inflation in their forecasts, noting that while it remains below its 9% (+/- 3%) target range, the central bank will likely respond to the rise by leaving rates unchanged. Ahmed Hafez, head of MENA research at Renaissance Capital, notes that rising inflation over the past two months has primarily been in seasonal goods, and sees inflation averaging at 6% through 2021. Arqaam Capital’s Noaman Khalid sees inflation inching up until March and averaging at 7% in 2021, partially because of the base effect.

Do we care about Turkey’s big rate move last month? The Turkish central bank’s huge 475-bps rate hike last month could provide strong competition, according to Sigma Capital’s Abu Bakr Imam, who says that the central bank does not want to lose precious greenbacks.

Maybe not: HC Securities suggests that Egypt’s position as the preeminent EM darling isn’t under threat from Turkey, with its real, after-tax yield of 3.03% comfortably above Turkey, which is now at -1.6%. Egypt also has a lower credit risk profile, increasing the attractiveness of Egyptian paper vis-a-vis Turkey. Still, Ankara is expected to raise rates by another 150 bps when it meets on Thursday.

This is exactly where the CBE wants real rates, according to EFG Hermes’ Mohamed Abu Basha. “With the return of inflation to normal levels and with the reduction in the previous two meetings, the level of real interest has become in the range of 3%, which is the rate I think the central bank wants to maintain,” he says.

The carry trade can withstand significantly lower rates: The central bank could cut rates by another 250-275 bps and Egyptian bonds would still remain attractive to foreign investors, RenCap’s global chief economist, Charles Robertson, wrote in a note over the weekend.

‘Tis the season: The central bank may also want to hold off on making an adjustment at this time of year given the potential for a muted response during the holiday season, HC Securities says.

Another cut would soften the currency: Further rate cuts would push the EGP down to 16.50-17.00- to the greenback by the end of 2021, making the currency more competitive and avoiding large moves in the medium term, Robertson wrote.

Easing to resume early in 2021: The central bank is likely to resume its easing cycle early in 2021, according to several analysts. HC expects the CBE to make a 100-bps cut in 1Q2021, while RenCap predicts a total of 100-150 bps of over the next 12 months/

And further into the future: Beltone’s Alia Mamdouh says that the central bank will continue its accommodative stance through to 2023, when it could hike rates by 150 bps due to rising inflation and commodity prices.

COVID WATCH

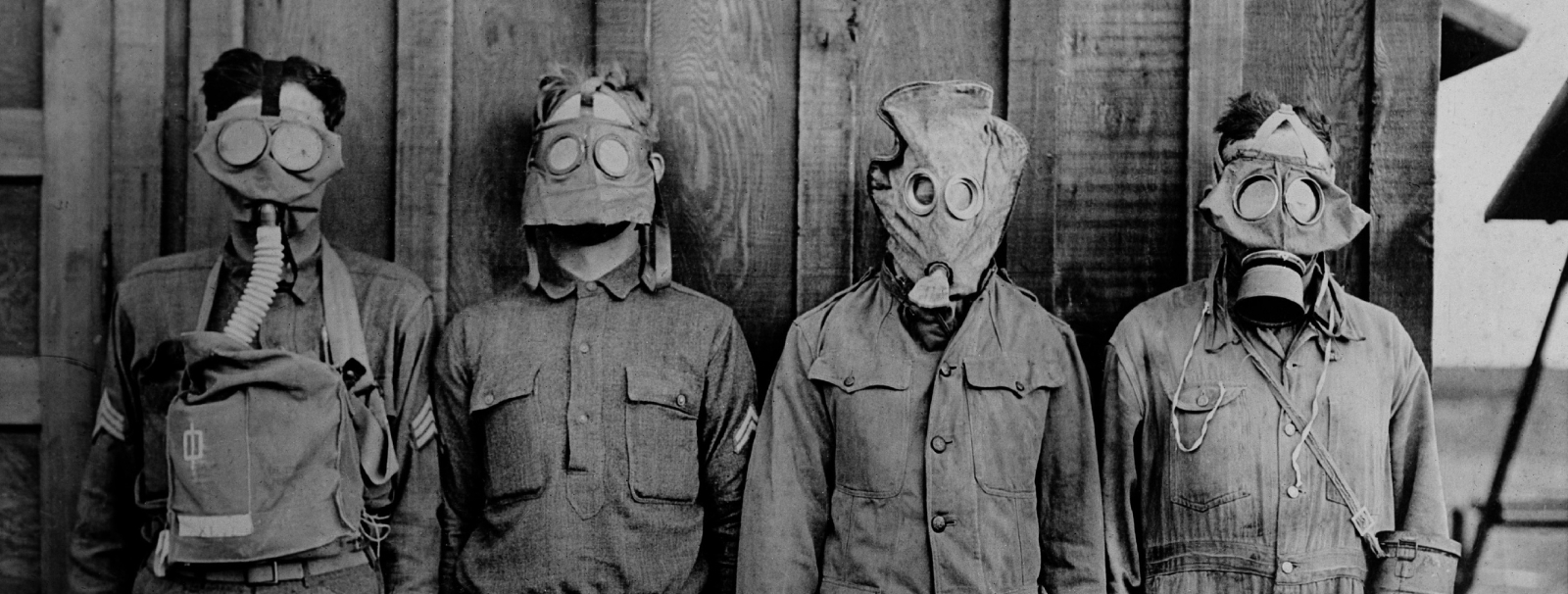

Wear your [redacted] mask

No big new year’s party for you as covid bites. Hotels, restaurants, and other large venues are under strict instructions from the Tourism Ministry not to allow large gatherings around the new year, El Watan reports. Restaurants and hotels that don’t play ball could face unspecified fines and penalties. The government has repeatedly urged citizens to observe social distancing precautions and warned that we could re-enter a partial lockdown if we don’t start taking covid seriously as this second wave gains force.

Egypt’s churches will not open Christmas Mass to the public, deciding instead to have limited prayer services with top members of the clergy, and will extend an invitation to Ittihadiya to attend, head of the Evangelical Church Association Andre Zaki told Kelma Akhira’s Lamees El Hadidi. The Evangelical Church has also decided to suspend all prayer services, funerals, and other activities in its churches until mid-January (watch, runtime: 4:38).

The new restrictions on celebrations come as daily covid-19 cases have been steadily rising since the end of October, leading cabinet to warn last week that it could tighten measures around end-of-year celebrations to curb the spread of the virus.

The Health Ministry reported 611 new covid-19 infections yesterday, up from 579 the day before — the highest level since late July. The ministry also reported 28 new deaths, bringing the country’s total death toll to 7,069. Egypt has now disclosed a total of 124,891 confirmed cases of covid-19.

Among those to test positive: The governor of Alexandria, who is reportedly feeling okay and working from home.

In the UK, covid has canceled Christmas: The UK scrapped plans to allow mixing between households over the holiday period in London and parts of Southeast England after a rapid surge in covid-19 cases and the discovery of a new, more infectious strain of the virus dubbed VUI2020/12/01. London cases doubled over the past week, with the new virus strain responsible for 60% of infections.

VACCINE WATCH- We’re getting additional shipments of China’s Sinopharm vaccine this week, Health Minister Hala Zayed said in a statement following a visit to the UAE over the weekend. Clinical trials in the UAE showed that state-owned Sinopharm’s vaccine is 86% effective against covid-19 and Egypt has plans to begin the rollout of our 500k doses of the jab in January, starting with medical professionals and high-risk citizens.

China is planning to vaccinate 50 mn people with vaccines produced by Sinopharm and Sinovac before the Lunar New Year holiday season on 11-17 February, and will offer the two jabs to the general public in April, the Wall Street Journal reports.

Despite some concerns over transparency and peer review results of China’s vaccines, developing countries are pushing ahead with purchases of its jabs along with Russian-developed Sputnik V, the Washington Post says. This push comes as supplies of other vaccines remain insufficient, meaning the Chinese and Russian vaccines are the “immediate options,” but medical experts maintain that they should not be dismissed as ineffectual.

PRIVATIZATION WATCH

Privatize all the things

The state privatization program could be making a comeback in the coming months after Public Enterprises Minister Hisham Tawfik told Bloomberg over the weekend that the government has earmarked five companies to be offered to investors. Improving market conditions and increased foreign appetite for Egyptian equities has prompted the government to revisit its plans to sell stakes in state-owned companies on the EGX, Tawfik said.

Who’s on offer remains a mystery as Tawfik declined to provide further details, saying only that he had held a ministerial committee to discuss the planned sales.

The privatization program has been on ice since the pandemic first hit global markets and the Egyptian economy in March. Banque du Caire and e-payments firm E-Finance were due to become the first state companies to IPO under the second wave of the program earlier this year, but were forced to abandon plans due to market volatility. BdC has shelved plans to sell 20-30% of its shares indefinitely while E-Finance has penciled in 1Q2021 to debut on the exchange.

But problems predate the pandemic: Since the program was announced in 2018, sales have been postponed multiple times and only a single offering has materialized: Eastern Tobacco’s 4.5% secondary offering in March last year. In addition to BdC and E-Finance, Alexandria Containers, Abu Qir Fertilizers and Sidi Kerir Petrochemicals were due to sell secondary stakes to investors over the past three years, but each has been put on pause.

Companies in Egypt + UAE eye military firm

Adnoc, Taqa Arabia in the running for Wataniya: A number of investors at home and abroad have expressed interest in acquiring a majority stake in the military-owned oil distribution company Wataniya Petroleum, Bloomberg reported on Thursday.

Buyer #1: State-owned Abu Dhabi National Oil Company (Adnoc), which produces most of the UAE’s oil, is interested in partnering with the Sovereign Fund of Egypt (SFE) on full ownership of Wataniya, which operates over 200 refueling stations across the country, people familiar with the talks said. Adnoc’s services arm, Abu Dhabi National Oil Company for Distribution, previously said it plans to expand in Egypt. The plan would come as part of the USD 20 bn joint investment platform Adnoc set up with the SFE last year.

Buyer #2: Qalaa Holding’s Taqa Arabia is eyeing a majority stake in the company with the SFE as a partner, sources said.

Background: Wataniya is one of two companies that have been chosen to kickstart a privatization program of firms owned by the military’s National Service Products Organization (NSPO), the other being the National Company for Producing and Bottling Water (Safi). SFE chief executive Ayman Soliman said last week that the company has already “attracted [interest from] a lot of investors” but declined to provide specifics. The SFE is looking at 10 NSPO subsidiaries to offer them up for co-investment as an initial phase ahead of potential IPOs on the EGX.

In other privatization news: The planned IPO of football club Ghazl El Mahalla aims to raise EGP 75 mn through a public offering and EGP 25 mn through a private placement, Tawfik said in a statement to reporters on Thursday, Masrawy reports. Plans to list the club in 1Q2021 were announced by the minister earlier this month.

M&A WATCH

Tons and tons of M&A news

Greek energy company Energean has completed the acquisition of Edison’s energy portfolio, which includes substantial oil and gas assets in Egypt, the company said in a statement (pdf). Having originally asked for USD 850 mn, the Italian company agreed to slash its asking price by more than 60% to USD 284 mn earlier this year as the coronavirus pandemic roiled energy markets. Edison received USD 203 mn as a net consideration.

What has Energean bought? Egyptian fields were a core part of Edison’s oil and gas unit, making up 24% of its portfolio. It includes three producing concessions and six exploration blocks. The production assets included a 100% stake in Abu Qir, a 60% stake in West Wadi El Rayan and a 20% stake in Rosetta. They also covered 100% stakes in three assets under development, including the North Amriya and North Idku fields. These assets averaged a production of 48.1k barrels of oil equivalent a day in the first nine months of the year, Energean said.

Nutrien exits Egypt stage left

Canadian fertilizer producer Nutrien will sell its entire 26% stake in state-owned Misr Fertilizers Production Company (Mopco) in a USD 540 mn transaction, the company said in a statement on Friday. Nutrien, which holds some 59.57 mn of Mopco’s 229.12 mn shares, said that the investment had contributed between USD 15-20 mn a year to its adjusted earnings.

Egypt to pay out mns of USD in settlements: The company said that it expects to receive USD 540 mn before the end of December, which includes the value of the shares and settlements from arbitration cases filed against Mopco subsidiary the Egyptian Nitrogen Products Company (ENPC). Nutrien predecessor Agrium last year filed a case against ENPC in the International Court of Arbitration seeking USD 140 mn in damages for what it said was ENPC’s failure to stick to a marketing agreement.

OTHER M&A NEWS- Madinet Nasr for Housing and Development (MNHD) is unhappy with an offer from Odin Investments to acquire its subsidiary, El Nasr Civil Works. A mandatory tender offer Odin lodged last week for 90% of the company at EGP 11 per share is low compared to El Nasr’s earnings and financial position, MNHD said in a regulatory filing (pdf) on Thursday. MNHD has asked El Nasr’s board to appoint an independent financial advisor to revalue the company. The developer holds 52.4% in El Nasr, with 19.3% held by the Holding Company for Construction and Development and 5% by the worker’s union; the rest is in freefloat. El Nasr shares closed on Thursday at EGP 15.33, up 5% from the day before.

More on the M&A front:

- Africa-focused private equity fund Nationbuilders Capital Partners was the unnamed UK party that had acquired 100% of Samih Sawiris’ New City Housing and Development (formerly Orascom Housing Communities) along with a subsidiary of Raouf Ghabbour’s GB Capital in an EGP 365 mn transaction last week. Tap / click here for more about the fund.

- Switzerland-based CEVA Logistics has acquired a majority stake in its Egypt agent IBA Freight Services for an undisclosed sum.

TOURISM

It’s best not to look at this year’s tourism figures

Egypt is set to close out the year with only 3 mn tourist arrivals — just 23% of the record 13 mn who visited the country last year, Deputy Tourism Minister Ghada Shalabi told Sky News on Thursday (watch, runtime: 2:21). The country’s tourism sector has been one of the hardest hit by the pandemic after the flight suspension in the second quarter all but shuttered the industry and concerns about the virus weighing on arrivals in the second half of the year.

Light at the end of the tunnel: Shalabi said that we could see a return to pre-pandemic revenues in 2022. Tourism revenues last year reached USD 1 bn per month and accounted for 15% of GDP. Colliers has also predicted a rebound next year, seeing hotel occupancy rates rising by 88% in Hurghada, and 78% in Sharm El Sheikh.

A second wave of pain: Hotel occupancy rates in the popular resort town of Marsa Alam are now at 5% following the emergence of a second wave of the pandemic, said the head of the Marsa Alam Investors Association, Tarek Shalaby, Al Mal reports. He doesn’t expect to see a rebound before March of next year as vaccines are rolled out.

A “Go Local” winter break drive: The Tourism Ministry has launched an initiative titled "Enjoy Your Winter Break in Egypt," offering discounts on flights and hotel rooms, in a bid to boost domestic tourism this winter season, a ministry statement said on Friday.

DEBT WATCH

Fresh eurobonds aren’t in the cards yet -Maait

The Finance Ministry doesn’t have any immediate plans to take a USD 7 bn eurobond sale to market in 1H2021, Finance Minister Mohamed Maait told Kelma Akhira’s Lamees El Hadidi yesterday (watch, runtime: 3:17). Maait denied an earlier report from Asharq Bloomberg suggesting that Egypt is actively moving towards a sale, explaining to Lamees that the state budget gives the Finance Ministry the license to borrow up to USD 7 bn through debt instruments in the international market. Whether or not the ministry decides to issue that amount of international debt — or any debt at all, for that matter — depends entirely on the circumstances as the fiscal year progresses, Maait explained.

The ministry is in talks with potential advisors so that it is in “standby mode” when an issuance is needed and the market conditions are right, head of the ministry’s debt management unit Mohamed Hegazy confirmed to Enterprise. Hegazy denied a local press report claiming that a sale of USD 3-4 bn-worth of EUR- or USD-denominated eurobonds could come in 1Q2021, telling us that there is no schedule set in stone since Egypt currently has its financing needs secured. The report had also suggested that the issuance would be structured in a similar way to a USD 5 bn sale Egypt closed in May, which had several tranches, one of which carried a tenor of 30 years — all of which Hegazy denied. The government has been consistently tapping the debt market over the past four fiscal years, raising upward of USD 20 bn to diversify its debt portfolio and keep building its stock of foreign reserves.

ALSO NOT IN THE CARDS RIGHT NOW: Egypt’s planned sale of Samurai and Panda bonds, which the government is pushing to FY2021-2022 because of complications caused by covid-19, Finance Minister Mohamed Maait tells the local press. The government has been mulling the yen- and yuan-denominated bonds since 2018, and said last year that it would issue the bonds in 1Q2020 but postponed the issuance. Marketing foreign bonds in Asian markets requires more complicated clearance procedures such as new ratings assessments by Asian ratings agencies.

The bid to diversify its debt portfolio would also see the government sell floating-rate sovereign bonds, and take to market our sovereign sukuk issuance after a draft law gets final approval next year. The government earlier this year sold USD 750 mn in greenbonds for the first time in Egypt’s history. Besides diversifying sources of funding and introducing new debt instruments, the government’s debt policy also aims to extend the average tenor of debt to reduce the annual debt servicing bill.

RENEWABLES

Boom time for renewables?

Another 2.4k GW of electricity generated from renewable sources by 2022? The Electricity Ministry is negotiating renewable energy projects with a capacity of 1.4 GW, on top of an agreement to implement 1 GW of plants signed last Saturday, Minister Mohamed Shaker said in a statement to the local press on Thursday. The ministry will soon finalize agreements for projects with a capacity of 400 MW, Shaker said, without providing further details. All projects will be implemented by 2022, and next year Egypt will add another 500 MW to the grid, taking the country’s total renewable generation capacity to 6.37 GW, he added. The plans are part of a larger vision of the oil and electricity ministries to ensure that 42% of the country’s energy is generated from renewable sources by 2035.

REGULATION WATCH

Send in the lawyers

A new arbitration center to settle non-banking finance related disputes will be up and running soon. The Financial Regulatory Authority (FRA) is getting ready to appoint a chief executive with expertise in arbitration and dispute resolution, a board of trustees headed by the FRA’s chairman to launch the center, and a seven-member expert advisory board, FRA boss Mohamed Omran said in a statement. Omran’s statement came after a cabinet decree (pdf) greenlighting the new center’s role and statute. The FRA-run center will specialize in handling arbitration disputes involving non-banking financial service providers, especially those arising between companies and their investors.

Background: The non-banking arbitration center was formed with a presidential decree last year. The center was envisioned under the 2009 law (pdf) that set up the FRA, which was originally known as the Egyptian Financial Regulatory Authority. The law also established the general regulatory framework for the non-banking industry. A specialized arbitration center for the industry would come as welcome news for foreign investors, who have long faced obstacles presented by Egypt’s slow judicial system and weak contract enforcement.

STARTUP WATCH

Healthtech startup Clinido raises six-figure USD seed round

Egyptian healthtech platform Clinido raised a six-figure USD investment in a seed funding round from two unnamed angel investors, the firm said in a press release (pdf). Launched earlier this year, the company offers clinic bookings and telehealth services via an online platform. This year it has reached 12k patients and has 1.5k listed healthcare providers from Greater Cairo and Upper Egypt with plans to expand into Alexandria. The investment will be used to develop new products and services as well as increase the number of providers on the platform.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The acceleration of daily covid-19 cases and prospects for Egypt’s vaccination campaign led the conversation on the airwaves last night. The case and death tallies are just the figures the Health Ministry is informed of, stressed Masaa DMC’s Eman El Hosary, who reminded viewers that the official figures are meant to act as “guidelines” and that officials have previously said the real figures are likely ten- or twentyfold (watch, runtime: 1:33).

We should be getting 20 mn doses of whichever vaccine the government’s scientific committees decide on sometime in 1Q2021, WHO Medical Officer Amgad Elkholy told Kelma Akhira’s Lamees El Hadidi (watch, runtime: 3:14). El Hekaya’s Amr Adib, meanwhile, chewed over some people’s hesitation to take the vaccine in Egypt and abroad (watch, runtime: 2:03).

The Tourism Ministry’s decision to ban New Years celebrations is in the tourism industry’s long-term interest, since the sector will not stage a real recovery until covid-19 is fully under control, Chairman of the Red Sea Hotels Association Alaa Akel told Kelma Akhira’s Lamees El Hadidi (watch, runtime: 6:19)

Also on the airwaves last night:

- Egypt’s U-20 football team has been evacuated from Tunisia and is back in Cairo after at least 17 members of the team tested positive for covid-19 last week, Sports Minister Ashraf Sobhy said (Amr Adib on El Hekaya | watch, runtime: 14:08).

- The European Parliament’s report on Egypt’s human rights record relied on inaccurate and incomplete information, leading to a biased final product, said Egyptian Organization for Human Rights Secretary General Essam Shiha (Lobna Assal on Al Hayah Al Youm | watch, runtime: 5:14).

EGYPT IN THE NEWS

Human rights are again leading the conversation in the foreign press this morning: US President-elect Joe Biden should use US assistance to Egypt as leverage to promote human rights in Egypt, the Bloomberg editorial board argues. And in a second Bloomberg piece, Bobby Ghosh calls on Italian prosecutors to take action against Giulio Regeni’s killers. Meanwhile, Alaa El Aswany’s new (non-fiction) book gets a mention in the Financial Times.

ALSO ON OUR RADAR

Egypt needs to cancel dutyfree access for imported cars if it wants to encourage domestic car assembly and become a regional export hub, Nissan managing director for Africa Mike Whitfield told the Africa Report. While fully assembled vehicles from the EU enter Egypt at zero customs, companies like Nissan have to pay duties on parts imported for local assembly which Whitfield suggests holds back the local industry. Nissan positions itself as the only global vehicle manufacturer with a 100%-owned plant in Egypt, as opposed to most manufacturers, which grant licenses to (or partner with) local players.

Global IT solutions and services provider Softline has chosen its Egypt office to act as a regional center of its operations in MENA, reports the local press. Softline had exited the Egyptian market back in 2011, but reentered earlier this year due to the stable environment for investment, VP of International Business Development Evgeny Tkachenko said.

PLANET FINANCE

Inflows into emerging markets in 4Q2020 have boomed at the fastest rate in seven years, the Financial Times reports, citing data from the Institute of International Finance. Foreign inflows reached USD 145 bn in November alone, while USD 37 bn has gone into bonds and USD 40 bn into equities over the past month. It marks a sharp reversal of the capital flight from EMs earlier this year, when outflows reached USD 243 bn during the first four months of the pandemic.

But what happens next year is anyone’s guess: While some analysts expect the trend to continue well into next year, with 2021 becoming a “breakout year” for emerging markets, others warn that the rally driven by excess cash in search of investments — and the expectation that the pandemic’s end could be within view — will invariably lose momentum. Strategists from HSBC and Societe Generale are cautioning investors not to be swept up by the bullish crowd across emerging markets, arguing that stocks are overvalued and pointing out the mounting piles of debt, uncertainties over vaccine distribution, and the potential for uneven economic recoveries, Bloomberg reports.

Good news for emerging markets? The USD is nearing six-year lows after the US Fed vowed to maintain easy monetary policy and leave in place its large bond-buying program brought in in response to covid-19, reports Axios. Reminder: A weaker greenback reduces debt servicing costs for emerging markets and provides EM policymakers with more room for stimulus without the fear of inflationary shocks.

The US drone market just got scrambled after the Trump administration slapped sanctions on Mavic-maker DJI as part of a wider move against Chinese tech companies.

|

|

EGX30 |

10,845 |

-1.3% (YTD: -22.3%) |

|

|

USD (CBE) |

Buy 15.66 |

Sell 15.76 |

|

|

USD at CIB |

Buy 15.66 |

Sell 15.76 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

8,712 |

-0.1% (YTD: -3.8%) |

|

|

ADX |

5,135 |

-0.4% (YTD: +1.2%) |

|

|

DFM |

2,550 |

+0.4% (YTD: -7.8%) |

|

|

S&P 500 |

3,709 |

-0.4% (YTD: +14.8%) |

|

|

FTSE 100 |

6,529 |

-0.3% (YTD: -13.4%) |

|

|

Brent crude |

USD 52.26 |

+1.5% |

|

|

Natural gas (Nymex) |

USD 2.70 |

+2.4% |

|

|

Gold |

USD 1,888.90 |

-0.1% |

|

|

BTC |

USD 23,938.24 |

+4.1% |

The EGX30 fell 1.3% on Thursday on turnover of EGP 1.4 bn (2.8% above the 90-day average). Foreign investors were net sellers. The index is down 22.3% YTD.

In the green: Ezz Steel (+5.1%), Cleopatra Hospital (+2.2%) and Sidi Kerir Petrochemicals (+1.6%).

In the red: Juhayna (-3.4%), Pioneers Holding (-3.3%) and CIB (-2.1%).

Also worth knowing:

- OPEC+ will now meet monthly instead of bi-annually to enable the group to react faster to changes in the oil market, with the next meeting slated for 4 January to decide whether to maintain production cuts, Bloomberg reports.

- Tesla’s shares closed the week with a 6% surge off the back of its imminent inclusion in the S&P 500 index, meaning Tesla shares are now up 730% YTD, the Financial Times reports.

AROUND THE WORLD

The European Parliament released a statement Thursday condemning human right breaches in Egypt, China, and Iran, pointing to Egypt’s arrest and release of Egyptian Initiative for Personal Rights staff members and the suspension of the investigation into the death of Italian student Giulio Regeni. The Egyptian Senate responded with a strongly worded statement of its own, accusing the European Parliament of bias, superficiality and of using human rights as a pretext to interfere in Egypt’s affairs.

IN DIPLOMACY: Egypt, US ink refinery financing pact: Egypt has signed two agreements with the US Trade and Development Agency worth USD 1.4 mn to conduct feasibility studies to develop the refineries.of the Amreya Petroleum Refining Company and the Suez Oil Processing Company, a cabinet statement said on Friday.

INTERNATIONAL BUSINESS- Trade Minister Nevine Gamea discussed ongoing trade talks with the Eurasian Economic Union in a meeting on Thursday with the Eurasian Economic Commission’s Andrey Slepnev. Meanwhile, International Cooperation Minister Rania Al Mashat chaired a government meeting on the shift away from Libor and its effect on Egypt.

PEACE PROCESSES- President Abdel Fattah El Sisi discussed yesterday the situation in Palestine with Palestinian Foreign Minister Riyad Al-Maliki and Jordan’s deputy PM, while General Intelligence chief Abbas Kamel met with Libyan National Army commander Khalifa Haftar in Benghazi yesterday to reiterate Egypt’s support for the 5+5 joint military committee and the ceasefire between Libyan factions.

CALENDAR

December: Egypt-US Trade and Investment Framework Agreement (TIFA) talks.

December: A meeting to finalize membership and trading rules governing Egypt’s Commodities Exchange (Egycomex).

23 December (Wednesday): Prime Minister Moustafa Madbouly will deliver the keynote address at the 19th edition of Dubai’s Arab Media Forum, held virtually this year.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

31 December (Thursday): Egypt-UK post-Brexit trade agreement to take effect.

31 December (Thursday): Deadline for car owners to comply with traffic regulations to install a RFID electronic sticker on their cars.

1Q2021: The Annual Egypt Automotive Summit will be held.

1H2021: Egypt’s Commodities Exchange (Egycomex) will begin trading.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids.

Mid-January: Local expo to display natural gas-powered and dual-engine vehicles for Egypt’s car replacement program.

17 January 2021 (Sunday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria in case 445 of 2019.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February 2021 (Saturday-Thursday): Mid-year school break.

20 February 2021 (Saturday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

30 May-15 June 2021 (Wednesday-Thursday): Cairo International Book Fair.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

17 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

30 June- 15 July 2021: National Book Fair.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

5 August 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

16 September 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 October 2021-31: March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

28 October 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-17 December 2021: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.