- Egypt’s hotels to reopen for domestic tourisms from 15 May — with conditions. (Speed Round)

- Gov’t cuts growth outlook for FY2020-2021 to 2%. (Speed Round)

- EBRD could open lines of credit worth a combined EUR 850 mn for five unnamed local banks –report. (What We’re Tracking Today)

- House approves new fees to help government plug the deficit as it spends bns to fight covid-19. (Speed Round)

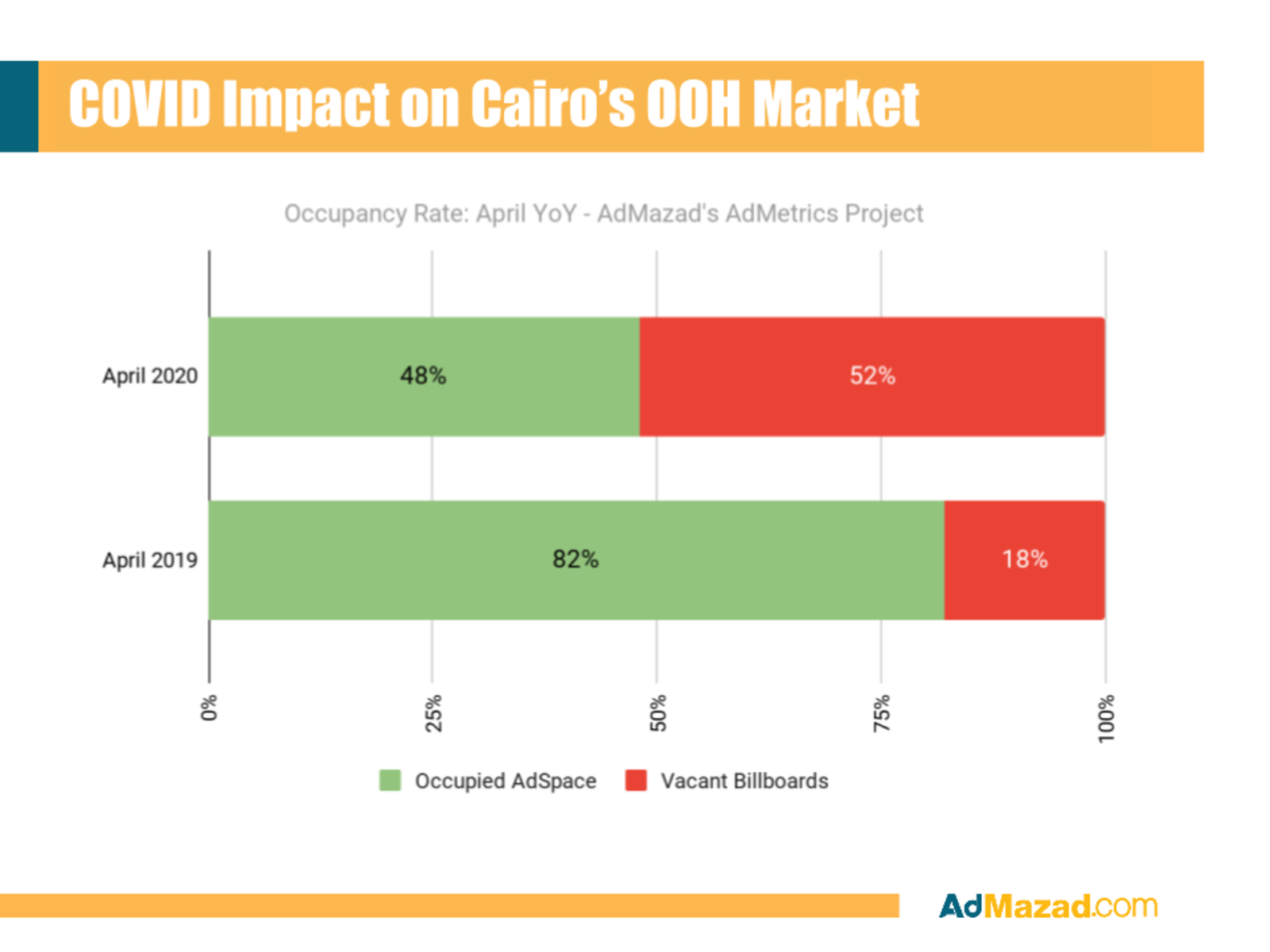

- More than half of Greater Cairo’s outdoor billboards were empty in April 2020. (Speed Round)

- Auto sales show solid growth in 1Q2020, but most of the gains came before covid hit in the second half of March. (Speed Round)

- As good as it gets? New US-China tensions could dampen the stock market recovery. (The Macro Picture)

- Do film and TV accurately depict the realities of private education? (Blackboard)

- The Market Yesterday

Monday, 4 May 2020

Ready for a staycation? Hotels can start reopening on 15 May.

TL;DR

What We’re Tracking Today

Egypt took a big step last night toward the reopening of an economy that never went fully to sleep as the Madbouly government said it would allow hotels to re-open by mid-month for domestic tourism. We have full details on the state’s drive to promote staycations in this morning’s Speed Round, below.

We’re now at 3.5 mn cases of covid-19 globally, but the “rate of fatalities and new cases has slowed from peaks reached last month,” Reuters’ tells us, adding that, “North America and European countries accounted for most of the new cases reported in recent days, but numbers were rising from smaller bases in Latin America, Africa and Russia.”

Predicting the Future #1- We’ve been wondering aloud for some time why certain countries are really hard hit by the virus that causes covid-19, while others … simply aren’t. There are still no good answers. A recent roundup by the New York Times offers everything from genetics to demographics by way of government policy and simple luck as possible explanations.

With prospects of a second, deadlier wave this fall (see: 1918, the pandemic of) and a third wave next year, we’d all do well to keep in mind Harvard health expert Ashish Jha’s words of wisdom, as American as they sound: “We are really early in this disease. If this were a baseball game, it would be the second inning and there’s no reason to think that by the ninth inning the rest of the world that looks now like it hasn’t been affected won’t become like other places.”

Predicting the Future #2- What do markets want? The Financial Times argues that a pandemic-induced slump in demand and the Great Oil War of 2020 may have hastened the approach of peak oil, while the Wall Street Journal notes that the earnings apocalypse and an unprecedented slowdown in global growth are “so obscuring the outlook for financial markets that some investors say it is as if they are flying blind.”

Oh, and the notion of immunity passports? The science still doesn’t back up the idea. Still, Switzerland’s Roche has gotten FDA approval for an antibody test for exposure to the virus that causes covid-19, according to a company statement. The company says it could have “high double-digit” mns of tests ready to deploy this month.

The EGX30 closed down 3.4% yesterday as shares in Egypt caught up with the Friday sell-off in US markets — and were dragged down by a slump in regional equities led by Saudi Arabia, where the Tadawul plunged 7.4%. Saudi’s main index tumbled after the kingdom’s finance minister said over the weekend that strict fiscal measures would be needed to face down fallout from covid-19 and the recent slump in oil prices.

Markets today: It’s the start of the trading week in global markets, and shares in South Korea, Hong Kong, and Japan opened sharply lower amid fears that tensions between Beijing and Washington are again flaring after the US alleged the virus that causes covid-19 originated in a Chinese research lab (we have more on this below). Chinese shares were up as we headed toward dispatch this morning, while futures point to US and European equities opening in the red later today.

We have more on what the month of May could have in store for global stocks and risky assets in this morning’s Macro Picture, below.

So, when do we eat? Maghrib prayers are at 6:34pm and you’ll have until 3:33am to finish caffeinating. Fajr is coming one minute earlier every day through the end of the Holy Month.

COVID-19 IN EGYPT-

Egypt has now disclosed a total of 6,465 confirmed cases of covid-19 after the Health Ministry reported 272 new infections yesterday. The ministry also said that another 14 people had died from the virus, taking the death toll to 429. We now have a total of 2,041 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 1,562 have fully recovered.

EBRD could open lines of credit worth a combined USD 850 mn for five unnamed local banks as part of covid-19 assistance package that would help plug liquidity gaps and support SMEs and businesses in industries hard-hit by covid-19, according to Al-Mal. The NBE and Banque Misr had submitted requests last month for help from the EBRD to help shore up their liquidity positions. The newspaper says the funding would be targeted to industries hardest-hit by covid-19 including tourism as well as front-line sectors including transport, agriculture and producers of medical supplies.

The court system began the slow process of reopening yesterday, with criminal courts set to operate two days a week instead of six and focusing on hearings to decide on the extension of pretrial detention orders, Youm7 reports. Criminal and family courts alike will also focus on handing down final rulings in cases where verdicts had been reached, but postponed by the corona-induced shutdown. Appeals courts will also tiptoe back into session, but neither appellants nor the public will be allowed in open court. The nation’s courts had been closed since 15 March.

Make sure you keep up with your kid’s vaccination schedule, Unicef warns, suggesting that as many as 10 mn children under the age of five across the Middle East are at risk of missing out on polio vaccinations and another 4.5 mn may miss out measles vaccinations as healthcare efforts are being diverted to treating covid-19, the UAE’s The National reports.

DONATIONS-

Al-Ahram Beverages has donated EGP 5.6 mn to the government, in addition to providing ethanol supplies to the Unified Procurement Authority to produce disinfectants and sanitizers for hospitals and medical facilities, according to Youm7.

Cairo Festival City mall and Misr El Kheir Foundation have launched an initiative to support service workers in hospitals and quarantine facilities, according to a statement carried by the domestic press. The initiative aims to donate Ramadan provisions to 20k workers.

ON THE GLOBAL FRONT-

“It’s all China’s Fault”: US policymakers are ramping up rhetoric claiming that the virus that causes covid-19 escaped from a lab in China. Secretary of State Mike Pompeo said yesterday that “enormous evidence” points to SARS-CoV-2 originated in a research lab in Wuhan, while The Donald suggested obliquely that “I think they made a very horrible mistake,” adding, “They tried to cover it.” Bloomberg and the New York Times have the story.

The Warren Buffett Show is still commanding the attention of the global financial press a little more than a day after Berkshire Hathaway held its AGM via videoconference. You can watch the full, epic live stream here (watch, runtime: 5:23:49), catch a cutdown version on video (watch, runtime: 15:31) or get the highlights in the Financial Times, Reuters, Bloomberg or CNBC. The Coles / Cliffs Notes version: “The pandemic can’t stop Amreeka — or Berkshire. But I’ve sold all my airline stock.” The meeting included a call-in question from none other than actor Bill Murray.

Developed economies could be hit by a “second wave of job losses,” despite governments moving to ease lockdown measures, says the Financial Times, as some businesses revisit their ability to cope with continued social distancing.

US and European banks are getting ready to set aside over USD 50 bn in loan loss provisions for the first quarter, “an indication of the severe economic damage wrought by coronavirus,” according to the FT. US-based banks are the most cautious, booking USD 25 bn for bad loans, up 350% y-o-y.

US 1Q2020 earnings season continues this week: InvestorPlace has a list of seven to keep an eye on — including Disney, PayPall, Uber, the once great Activision Blizzard, Canada’s Shopify, beer giant AB InBev, and pharma chain CVS Health.

Saudi Arabia is cautiously rolling back lockdown measures just as plummeting crude oil prices have left Saudi’s bonds more vulnerable than neighboring Abu Dhabi and Qatar, Vanguard Asset Management reps tell Bloomberg. We noted yesterday that investors were mostly bearish on Saudi stocks and mixed on those in the UAE, according to a Reuters poll.

Saudi is under pressure to push fiscal reforms instead of abandoning its peg to the USD, Goldman Sachs suggests in a research report picked up by Bloomberg wherein the bulge bracket bank says it sees oil at USD 40 / bbl by the end of this year and USD 60 by the end of 2021. If oil stays at USD 30 with the FX rate unchanged, KSA would face substantial pressure to abandon the peg lest it run reserves dry.

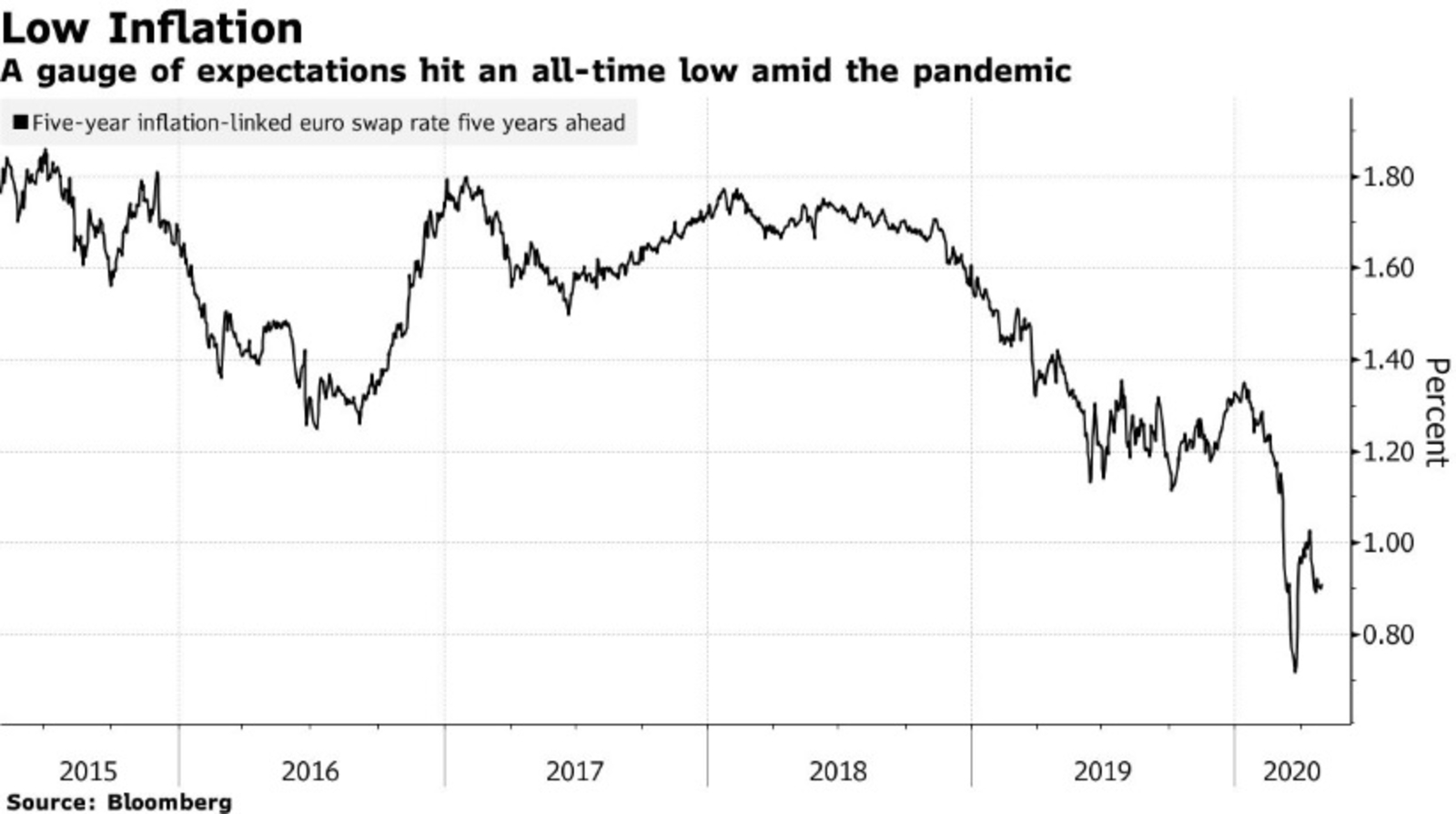

Are we looking at the return of inflation> That’s what some analysts are expecting as policymakers take measures that, along with supply chain disruptions and the release of pent-up consumer demand, may “stoke inflation” once lockdown measures are lifted, according to Bloomberg. Although a contained uptick in prices would actually be welcome for some economies, others — particularly developing countries — would likely struggle to contain inflation in the aftermath of the pandemic.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: As Egypt settles in for a month of heavy prime-time TV watching, we ask whether film and TV accurately depict the realities of private education in Egypt.

Enterprise+: Last Night’s Talk Shows

It was yet another quiet Ramadan night on the airwaves last night. The only segment worth noting was a phone call Al Kahera Alaan’s Lamees El Hadidi had with Tourism and Antiquities Minister Khaled El Anany. This came after the government reopened hotels for local tourists, which we recap in detail in Speed Round, below.

Speed Round

Speed Round is presented in association with

Gov’t to allow staycations from 15 May as it seeks relief for tourism sector: Hotels will be permitted to open their doors to domestic holiday makers from 15 May on the condition they take precautionary measures against the spread of covid-19, cabinet ministers said yesterday. Hotel operators will be capped at 25% capacity for the first two weeks of the re-opening before increasing this to 50% by 1 June, cabinet said in a statement.

What protections need to be in place? Companies will need to install sterilization equipment, screen all incoming guests for fever, only take bookings online, and hold no weddings or entertainment events or offer shisha on site. Doctors will also be required to be stationed at the premises, all workers will need to be tested when entering resorts and all hotels will need to have a designated quarantine area to house people suspected of carrying the infection.

The decision will take effect on 15 May, Tourism Minister Khaled El Anany told Al Kahera Alaan’s Lamees El Hadidi last night. Only companies that comply with the rules will be allowed to increase their capacity to 50% at the beginning of June and those found in violation will have their licenses revoked, he said (watch, runtime: 16:55).

Foreign tourists will not be back “anytime soon”: The government isn’t factoring in the return of inbound tourism “anytime soon,” and “we are waiting for the appropriate time,” El Anany said.

El Hekaya’s Amr Adib also took note of the decision to put hotels back in business, stressing that the government should not make rash decisions if it is to reassure foreign tourists that it is safe to travel to Egypt post-covid (watch, runtime: 3:30).

The tourism and hospitality industries have effectively ground to a halt after the government suspended flights and ordered hotels, restaurants, and cafes closed in March. This has led to losses estimated at USD 1 bn a month, according to Reuters. It has also placed considerable strain on the economy as the sector accounts for 12%-15% of GDP, as well as shut down a key source of foreign currency. Minister Mohamed Maait told us in March that he thinks it will take a year for the industry to mount a full recovery.

Gov’t again cuts growth outlook for FY2020-2021: The government has revised downward its growth outlook for FY2020-2021 to 2% from 3.5% should the covid-19 pandemic continue into December, according to a statement by Planning Minister Hala El Said carried by the press. Growth projections for the coming year had already been lowered less than two weeks ago to 3.5% from 4.5% based on the assumption that the crisis would abate by June. GDP figures will be cut by another 30% if it extends past that point, El Said said at the time.

Private sector investment could also fall by up to 30% in FY2020-2021 if the crisis persists until December, El Said said. The government still expects around EGP 740 bn in total investments in the coming year, helped by the 33% increase in state investment to EGP 281 bn allocated in the draft FY2020-2021 budget.

A worse-er case scenario? The government estimated at the end of March that GDP would slow to 3.3-3.5% if the pandemic was to continue through December, labelling this as a “worst case scenario.” The Finance Ministry left its projections for FY2020-2021 GDP growth unchanged from the original assumptions when the ministry drafted the budget before the virus hit but made clear it would revisit its forecasts once the economic impact of the pandemic became clearer.

LEGISLATION WATCH- House approves new fees to help government plug the deficit as it spends bns to fight covid-19: The House Planning and Budgeting Committee approved yesterday a series of new “development fees” proposed by the Finance Ministry to help it plug the fiscal deficit as the state mobilizes cash to fight covid-19, according to Al Shorouk. The measures will see everything from mobile phones to pet food get just a little bit more expensive.

Among the newly imposed or newly hiked fees:

- Mobile phones and accessories would be subject to a 5% fee on the total cost after tacking on VAT and other taxes;

- Commercial internet bills would be subject to a 2.5% fee;

- Pet food would be subject to a fee equivalent to 25% of the customs invoice for the product;

- A EGP 2 fee will be applied to all transactions charged EGP 0.05 or more in stamp tax, with the exception of butane cylinders and individual tickets for railway and land transport;

- Fees for concerts and other entertainment events in hotels or public spaces would rise to 12% from 10%. Events hosted by both the state and by organizations affiliated with the Culture Ministry would be exempt;

- Contracts between sporting teams and foreign or local athletes or coaches would be subject to a 3-10% fee, depending on the value of the contract;

- Raw tobacco would be subject to a fee of EGP 1.5/kg, while manufactured tobacco products and shisha tobacco would be subject to a EGP 3/kg fee;

- Imported finished steel products sold on the local market would be subject to a 10% fee after customs and taxes.

One fee that didn’t make it past the committee: A new EGP 0.30 / liter development fee on gasoline and EGP 0.25 / liter on diesel, according to the local press.

Sign of the times: More than half of Greater Cairo’s outdoor billboards were empty in April 2020, compared to a vacancy rate of just 18% during the same month last year, according to a study (pdf) outdoor advertising aggregator AdMazad. Most industries cut back on their outdoor billboard advertising during the month, with real estate ads accounting for 27% of occupied billboard space, compared to 43% in April 2019. FMCG and banking ad space also dipped y-o-y. On the flipside, the healthcare industry’s billboard ads soared 70% y-o-y — but the jump is not necessarily attributable to the covid-19 pandemic, since the majority of these were already penciled in last year. AdMazad expects outdoor ad space occupancy to begin rebounding next month, but will likely still fall short of last year’s figures. The company surveyed 1.9k “large billboards” in March and April.

Auto sales show solid growth in 1Q2020, but most of the gains came before covid hit in the second half of March: Automotive sales grew at a 50% clip y-o-y in 1Q2020 to nearly 53k units 35k in the same period a year earlier, according the latest figures from the Automotive Information Council (AMIC). The quarterly figures were driven by strong sales of passenger cars, which increased by 58% to 37k from 23k in the same quarter last year. Egypt’s distributors moved 16.7k cars in March, up marginally from 16.6k in February.

Take these figures with a grain of salt: Industry sources tell us that a number of distributors were not reporting sales to AMIC in 1Q2019, so this is not exactly a like-for-like comparison.

Don’t expect the positive figures to continue into April: Egypt’s automotive companies saw business grind to a near-complete standstill when the government introduced measures to combat the spread of the coronavirus towards the end of March. Sales are expected to have slowed down “significantly” in April due to the government’s suspension of new vehicle licensing and reduction of working hours. Traffic police offices re-opened for new car registration last week.

Mediterranea Capital Partners closed its EUR 286 mn MC3 Fund which will be investing in new and existing SMEs across eight African countries including Egypt, Al-Mal reports. MC3 has already disbursed 60% of its targeted investments in five companies across Morocco, Tunisia, Egypt along with West and Central African locations according to Khaled Sabaa, Mediterranea’s advisor to Egypt, and the company has plans to invest in Cairo Scan.

ITIDA disburses second batch of export subsidies to tech firms: The CIT Ministry’s Information Technology Industry Development Agency (ITIDA) has signed off on disbursing EGP 11.9 mn in dues to 27 medium-sized technology companies eligible for the export support program, according to a statement (pdf). The companies mark the second group of 110 eligible recipients of the support program set to receive funds. ITIDA has so far disbursed some EGP 17 mn to a total of 52 firms.

LEGISLATION WATCH- The draft law that will establish the Egyptian Commodity Exchange will be with the cabinet within days for review after the Supply Ministry finished drafting the bill, according to a statement. Ministers green-lit initial proposals for the exchange at the start of the year, paving the way for the establishment in March of the company tasked with managing the exchange. The exchange will reportedly allow traders to buy and sell spot contracts for six commodities — wheat, rice, corn, potatoes, onions, and oranges — and is expected to officially launch in September.

Military kills 126 terrorists during North Sinai retaliatory raids: The Armed Forces killed a total of 126 terrorists in 36 raids in North and Central Sinai, according to a statement yesterday. A total of 15 troops were killed or injured during the second round of raids that came in response to a terrorist bombing in Bir El Abd on Friday that left 10 members of the Armed Forces dead.

The story is getting ink in the foreign press: AP | Reuters | Gulf News.

MOVES- CI Capital has tapped Hesham Gohar (LinkedIn) as CEO of its investment banking arm (covering IB, capital markets and brokerage) according to a company statement (pdf). Gohar has been with CI Capital since 2012. The group has also named staffers Ahmed Abdel Latif as COO, and Amr Abol-Enein as CEO of asset management.

MOVES- Malak El Baba (bio) has been tapped as Visa’s Egypt country manager after previously serving as senior director of marketing for North Africa, the Levant, and Pakistan, according to Al Mal.

CORRECTION- A couple of mea culpas from yesterday’s issue. We incorrectly said that our friends at CIB donated EGP 80 mn to the Egyptian Food Bank. The sum was directed towards an emergency and crisis account set up by the Federation of Egyptian Banks and the Central Bank of Egypt. CIB has also donated USD 2.5 mn to expand the nation’s ability to test for covid-19 and EGP 1.6 mn to help feed the families of 10k day laborers.

We also incorrectly interpreted an article in the draft Banking Act as saying that the boards and chairmen of state-owned banks will only be allowed to serve two terms. The term limit actually applies only to representatives of state-owned banks with seats on the boards of banks and companies in which these banks hold a stake. Our apologies in both cases for the errors.

The Macro Picture

As good as it gets? New US-China tensions could dampen the stock market recovery: A string of uncertainties could conspire to knock the wind out of the sails of global stock markets this month as investors fret about the potential of renewed US-China conflict complicating the already dire prospects for the global economy, Justin Corrigan writes for Bloomberg. A flood of global stimulus and hopes for a rapid economic recovery caused stock markets around the world to rally through much of April, with US equities giving us their best month since 1987. Signs of a reversal came on 1 May after a number of companies issued new profit warnings and The Donald once again pointed fingers at China’s trade policies and questioned its handling of the outbreak. The S&P 500 was down 2.8% by Friday’s market closing, US Treasuries rallied, and the Bloomberg Dollar Index rose for the first time in six days.

The uneasiness continued in Middle Eastern markets yesterday: The Saudi Tadawul closed the session down 7.4% after the country’s finance minister telegraphed plans to make deep cuts to public spending, while Abu Dhabi and Dubai’s main indices also clocked losses of 3-4%. The EGX also fell 3.4% during the session driven by a sell-off among foreign investors. This, Corrigan suggests, was a “taste of what may be in store for the rest of the world.”

A May sell-off is pretty much business-as-usual for emerging markets: Even without a pandemic, an economic crisis and a reheating US-China conflict, a sell-off in EM stocks, currencies and bonds in the month of May would be nothing out of the ordinary. All three asset classes have finished May in the red during eight of the past 10 years. Adding the prospect of renewed tensions between Washington and Beijing to the cluster of problems already besetting many in the emerging world only makes further EM instability more likely. “The biggest new development that could weigh on emerging markets is the pick-up in geopolitical tensions between the U.S. and China,” Bloomberg quoted Eric Stein, co-director of global fixed income at Eaton Vance, as saying. “Negativity still hangs over the asset class,” despite the unprecedented quantities of fiscal and monetary stimulus that has helped to resurrect EM assets over the past month, he added.

Egypt in the News

Leading the conversation in the foreign press this morning: Amnesty International has published a new report critical of the treatment of journalists in Egypt. The report is receiving coverage in: AP | Sky News | Voice of America | ITV

The death in prison of photographer and filmmaker Shady Habash is still getting ink: Financial Times | the Independent.

Just in time for Ramadan: Do film and TV accurately depict the realities of private education? Egyptian TV and cinema have not been kind to private sector education, frequently portraying the industry as an immensely profitable and predatory business. In the spirit of Ramadan mosalsalat, we spoke to a number of private school operators on whether these depictions are fair and if the perception has had an impact on their businesses. With the exception of a few bad apples, we’ve found that far from being a fair reflection of reality, the portrayals are more a reflection of a deep-seated scepticism of the free market that often results in the vilification of business.

TROPE: Extortionist tuition fees: A common trope of films and television series on private education in Egypt are the high tuition fees. Television series, including Bela Daleel, usually feature a struggling middle class family overworking themselves just so that they can make tuition payments, neglecting their kids in the process.

A trope everyone can get in on: Inflation is among the biggest financial concerns for many Egyptian households, and education isn’t a budget item parents traditionally skimp on. The trope thus underscores a common anxiety. High tuitions and fees are the biggest source of criticism private education receives, whether from the press, parents or even the government. Parents in various schools and parents associations frequently take to the press and social media to complain of tuition hikes. Another common complaint is of rising fees for non-academic services, particularly bussing and uniforms, which is an almost annual complaint. Most recently, parents have been lobbying the government and the House of Representatives for deferments and discounts on tuition and services for the second semester of the 2019-20 academic year. The issue is also reflected in universities, with protests by AUC students back in 2016 over the university’s tuition increases receiving widespread coverage amid a spiraling currency crisis.

In turn, many MPs, including Rep. Mona El Shabrawy, have taken up the cause and called for hearings amid allegations that some schools have violated a cap on price hikes imposed as the country dealt with runaway inflation after the float of the EGP in late 2016.

Tuition hike caps, regulatory framework make this depiction unjustified, say school owners: Private-sector operators we’ve spoken with chafe at caps on tuition hikes that have seen costs rise faster than revenues since the float of the EGP. A tight regulatory landscape requires careful coordination with state officials before announcing fee hikes coupled with the fact that tuitions are subject to a 15% cap on annual increases set forth by the Education Ministry severely limits the ability to unjustifiably inflate prices, says Karim Mostafa, chairman of Starlight Education, the company that owns the British Columbia Candanian International School (BCCIS).

Ample competition puts a natural ceiling on average tuitions: Around 8k private schools currently operate across the country, 3.5k of which charge tuitions that fall between EGP 3k-5k annually and the rest carry tuitions that generally fall below EGP 20k, Badawy Allam, a vice president of the Private School Owners Association, tells us. Only a narrow playing field of some 260 high caliber international schools can charge sums approaching what films and soap operas have made the target of their mockery, he added. Many international schools also justify their higher tuition rates through much higher costs, as they often rely on foreign teachers who require larger salaries.

The depiction does not hold water with universities, Ashraf El-Shihy, chairman of the board of trustees at the Egyptian Chinese University (ECU), tells Enterprise. While private universities enjoy fewer regulatory restrictions than those seen in primary and secondary private schools and their tuition fees face no restrictions on annual increases, universities still see slow and modest gains due to the high costs of running them. Universities take an average of seven years to become profitable on a minimum investment of some EGP 500 mn, according to El-Shihy.

TROPE: The education profiteer: By far the most common trope is that of the high-rolling investor concerned only with profits to the detriment of the children’s education and the quality of their schools. We see this in Valentino and films Al-Basha Tilmiz and Ramadan Mabrouk Abu Alamein Hamouda. This is part and parcel of how business leaders are too-often depicted in domestic media, which would be right at home in a 1950s Moscow movie theater — or any Egyptian theater from the 1950s onwards for that matter. We certainly cannot recall any heroic depictions of entrepreneurs.

How profitable are private schools? A minimum starting capital of some EGP 100 mn is needed to establish a private educational institute and their margins typically do not exceed 10%, Allam tells us. COGS account for 65-80% of revenue, representatives from six international association schools in Cairo and Alexandria told us last year. “Teachers’ salaries alone account for nearly 70% of the overall costs at my school,” one school operator who wished to remain nameless tells us. Private schools have to invest in the quality of their services and their reputations to stay competitive, says Allam.

Bad apples do exist: The shoe fits for some private schools, who neglect curriculum guidelines and circumvent tuition controls by marking up the price of less-regulated transport, ancillary and activity fees, Walaa Shabana, an education consultant who previously served as head of the private education department at the Education Ministry, tells us. She went so far as to say that most schools she’s dealt with find it difficult to fully abide by the ministry’s directives.

Many private school operators we’ve spoken with acknowledge that teachers are underpaid, including CIRA’s Mohamed El Kalla, who spoke to us on the subject for the Making It podcast. This has largely been behind why teaching is not a popular career path in Egypt, something which is fuelling a dearth in teaching talent, he says. At public schools, annual salaries range from EGP 24k-84k, and those at private schools teaching domestic curriculum lean closer to this payscale than they do to the more lucrative positions for foreign teachers at top-tier international schools (around EGP 480k a year).

TROPE: Snake oil salesman / carpetbagger: Private schools portrayed in popular series, such as Bela Daleel and Ehna El Talaba, offer brand-name recognition, but no substance. These schools usually sell the allure of international education as a point of prestige, with the shows calling into question the quality of an international education. We’ve seen this criticism in the press, including this report by the Arabic Independent, which claims private schools rely upon background checks for admissions rather than student academic performance. Not helping matters is the underrepresentation of Egyptian international universities in global university rankings, with AUC usually being the only one to make the grade, and government policy which has restricted foreign investment in private schools. Back in 2017, Education Minister Tarek Shawki blocked licenses to schools offering an American high school diploma on the basis that the US relies on multiple boards of education to certify quality and curriculums, instead of a single one.

Yet there is no denying that the popularity of international private schools rests in their ability to get their graduates into foreign universities, especially when considering that students have to go through the hurdle of standardized tests such as the IGCSE’s, SATs, and IB. Curriculums offered at international private schools are based on internationally recognized standards, according to El-Shihy. It would be difficult to veer away from clear targets outlined by international learning institutions like the British Council, Cambridge International and Pearson Education, he said. Furthermore, many of the practices we’re seeing now — whether it is the education reforms or mass adoption of e-learning — started out in the private sector. The trope also falls apart on the higher education level, where the government has made it a matter of policy to “internationalize” private and public universities. Furthermore, graduates of top name international schools such as AUC have found success in the job market, where 86% of students who used the AUC Career Center’s services in 2017 have found employment.

These skewed portrayals in the media haven’t dampened demand for quality education: Demand for private school enrollment isn’t declining — 2.5 mn students are looking for kindergarten seats this coming fall, Mostafa tells us. And appetite for university seats is just as strong, says Abada Sarhan, president of Future University in Egypt.

Your top education stories of the week:

- Investment: Egypt and North Africa-focused PE outfit SPE Capital is looking at new investments in the Egyptian education sector.

- Training: The Health Ministry has launched a number of new educational courses for frontline medical teams working in public sector hospitals.

- Exams: The Education Ministry has denied sending WhatsApp messages to students caught cheating on their exams.

The Market Yesterday

EGP / USD CBE market average: Buy 15.69 | Sell 15.79

EGP / USD at CIB: Buy 15.70 | Sell 15.60

EGP / USD at NBE: Buy 15.68 | Sell 15.78

EGX30 (Sunday): 10,200 (-3.4%)

Turnover: EGP 879 mn (30% above the 90-day average)

EGX 30 year-to-date: -26.9%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session down 3.4%. CIB, the index’s heaviest constituent, ended down 3.0%. EGX30’s top performing constituent was Cleopatra Hospital up 1.2%. Yesterday’s worst performing stocks were Dice down 10%, GB Auto down 8.2% and Porto Group down 7.3%. The market turnover was EGP 879 mn, and foreign investors were the sole net sellers.

Foreigners: Net Short | EGP -53.5 mn

Regional: Net Long | EGP +3.5 mn

Domestic: Net Long | EGP +49.9 mn

Retail: 73.9% of total trades | 73.7% of buyers | 74.1% of sellers

Institutions: 26.1% of total trades | 26.3% of buyers | 25.9% of sellers

WTI: USD 19.78 (+4.99%)

Brent: USD 26.44 (-0.15%)

Natural Gas (Nymex, futures prices) USD 1.89 MMBtu, (-3.03%, Jun 2020 contract)

Gold: USD 1,700.90 / troy ounce (+0.40%)

TASI: 6,585.58 (-7.41%) (YTD: -21.50%)

ADX: 4,105.68 (-2.95%) (YTD: -19.11%)

DFM: 1,946.34 (-3.96%) (YTD: -29.60%)

KSE Premier Market: 5,248.07 (-2.02%)

QE: 8,687.59 (-0.87%) (YTD: -16.67%)

MSM: 3,538.15 (-0.04%) (YTD: -11.13%)

BB: 1,310.73 (+0.16%) (YTD: -18.60%)

Calendar

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 May (Saturday): Earliest date on which suspension of international flights to / from Egypt expires.

23 May (Saturday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

31 May (Sunday): A postponed court session for the lawsuit filed by Cairo Development and Auto Industry, a subsidiary of Arabia Investment Holding, against Peugeot Automotive to demand EUR 150 mn compensation.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 June (Sunday): Anniversary of the June 2013 protests, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.