- Egyptian economy to grow at 5.8% in FY 2019-2020 -poll. (Speed Round)

- Vodafone refuses to comment on STC acquisition talks. (Speed Round)

- First Abu Dhabi Bank confirms acquisition talks with Bank Audi. (Speed Round)

- Raya receives 12 bids for non-controlling stake in Aman Holding. (Speed Round)

- RenCap sees Egypt, Morocco leading MENA industrial growth. (Speed Round)

- FRA amends listing rules to allow wider participation in private placements. (Speed Round)

- CIRA, Germany’s Saxony International School in partnership talks. (Speed Round)

- Here’s why stablecoins probably aren’t the answer to financial inclusion. (The Macro Picture)

- The Market Yesterday

Sunday, 26 January 2020

Is Saudi Telecom in talks to acquire Vodafone Egypt?

TL;DR

What We’re Tracking Today

We have plenty of M&A news for you this morning with a report that Vodafone Group may be looking to exit its majority stake in its Egyptian subsidiary and confirmation that FAB is in talks to acquire Bank Audi’s Egypt unit. We have both stories in this morning’s Speed Round, below.

Will we finally get an agreement when the final final round of GERD talks kick off in DC this week? The Egyptian, Ethiopian, and Sudanese foreign and irrigation ministers are returning to Washington, DC, this Tuesday, 28 January for a two-day meeting on the Grand Ethiopian Renaissance Dam. Technical and legal teams from the three countries wrapped up on Thursday meetings designed to lay the groundwork for a final agreement on the filling and operating timetable for the dam, which the ministers hope to reach in the US capital. The last round of DC talks — billed as the deadline for reaching an agreement — produced progress but failed to find a breakthrough on the dam’s long-term filling and operating timetable.

Stuff you can go to this week:

- AmCham will host US Ambassador Jonathan Cohen for its monthly luncheon on Tuesday, 28 January. Cohen will discuss prospects for commercial ties between Egypt and the US. Members can register for the event here.

- CI Capital’s annual three-day MENA Investors Conference gets underway on Tuesday, 28 January at the Four Seasons Nile Plaza.

- The British Embassy and IFC’s StartEgypt Forum 2020 will pit 45 startups against each other in a pitch competition on Wednesday, 29 January at the Greek Campus.

- This year’s Cairo International Book Fair runs through to Tuesday, 4 February at the New Cairo International Exhibition and Convention Center.

News triggers to keep your eye on with the new month approaching:

- The purchasing managers’ index for Egypt, Saudi Arabia and the UAE is due out on Tuesday, 4 February at 6:15am CLT.

- Foreign reserves figures for January will be released on Tuesday, 4 February.

- Inflation figures for January are out Monday, 10 February.

EGP WATCH- The EGP rally could keep up for a while longer: The USD might break the EGP 15 barrier in the next period as Egypt’s macroeconomic indicators continue improving and FX inflows rise, secretary-general of the foreign exchange bureau division at the Federation of Egyptian Chambers of Commerce Ali Al Hariri told Al Monitor. The EGP reached 15.78 per USD 1 on Thursday.

Former President Hosni Mubarak underwent surgery on Thursday. Mubarak’s eldest son Alaa wrote on Twitter that the 91 year-old’s condition is now “stable,” without giving further details. The Associated Press has the story.

Egyptian business delegation to visit DR Congo this week, discuss cooperation on Inga Dam: Hassan Allam, El Sewedy, Taqa Arabia, Orascom Construction, and the Arab Contractors will accompany Electricity Minister Mohamed Shaker to DR Congo this week to discuss how Egyptian private sector companies can get involved with the Inga Dam project, unnamed sources told the local press.

On the legislative agenda today: The House of Representatives will discuss the Income Tax amendments, the tax dispute bill, the Consumer Credit Act, and amendments to the Railway Act, according to the local press.

From 30 January to 6 February, Miss Germany returns to Somabay for the official Miss Germany Camp 2020. The candidates will enjoy all that Somabay has to offer – sea & beach, water-sports, Spa, golf and delicious culinary treats. The Miss Germany Camp is hosted at The Lodge by The Cascades Golf Resort, Spa & Thalasso introducing the candidates at a glittering evening event on 31 January.

From 30 January to 6 February, Miss Germany returns to Somabay for the official Miss Germany Camp 2020. The candidates will enjoy all that Somabay has to offer – sea & beach, water-sports, Spa, golf and delicious culinary treats. The Miss Germany Camp is hosted at The Lodge by The Cascades Golf Resort, Spa & Thalasso introducing the candidates at a glittering evening event on 31 January.

The 2020 World Economic Forum wrapped up in Davos on Friday. Here are some of the highlights from the final two days:

- WEF takes further steps towards global crypto framework: The forum set up a global body tasked with creating a regulatory framework for cryptocurrencies. This came as experts called for the creation of a digital USD to be set up in response to China’s digital yuan, which is expected to launch this year. (CNBC)

- Mnuchin, Lagarde disagree on climate: The final day of the WEF saw US Treasury Secretary Steve Mnuchin and Governor of the European Central Bank Christine Lagarde publicly disagree on combating climate change, with Mnuchin arguing that long-term planning against is useless and Lagarde suggesting that its effects can be mitigated. (CNN)

- Everyone was talking about stakeholders: Less than six months after the Business Roundtable called for a more inclusive definition of corporate purpose, ‘stakeholder’ was the word on everyone’s tongue. (Quartz)

Al Mashat met with EBRD CEO: International Cooperation Minister Rania Al Mashat met the European Bank for Reconstruction and Development CEO Suma Chakrabarti on the sidelines of the forum to discuss the bank’s projects in Egypt and its potential future investments, according to Al Shorouk. Al Mashat also met with Google VP for Government Affairs and Public Policy Karan Bhatia to talk about contributing to Egypt’s plan for sustainable development, empowering youth and women, and digital transformation.

Al Mashat talks youth employment with ILO director, Islamic Development Bank president at Davos: Al Mashat discussed with International Labor Organization Director General Guy Ryder ways to increase job availability for youth, according to a ministry statement. Al Mashat and Oil Minister Tarek El Molla also discussed youth employment, infrastructure projects, and private sector finance with Islamic Development President Bandar Al-Hajjar.

Chinese President Xi Jinping has stepped into the growing coronavirus crisis as the death toll yesterday rose to 56, Sky News reports. Jinping told the politburo that the country was facing a “grave situation” as the spread of the virus accelerates. The total confirmed cases in China is now at 1,975. The Financial Times reported at the weekend that China has expanded travel restrictions to nine cities. Train and bus connections in Wuhan and the surrounding cities have been heavily monitored and regulated since the outbreak last week.

Security at airports has been heightened globally as France, Japan, Australia, Malaysia and the US confirmed cases of the infectious disease within their borders. Passengers arriving to Cairo from China or those showing signs of sickness upon arrival at the airport will also be undergoing screening by health monitors, Reuters reports. And Bloomberg is attempting to map the outbreak with a series of graphics.

Fears about the outbreak finally brought some volatility to US equities on Thursday, with the S&P 500 falling almost 1% — its biggest decrease in nearly four months, Bloomberg reports.

But analysts say there’s still no need to panic: Investors are showing caution with stocks close to all-time highs, due to the still-unknown nature of the virus, which could develop into something more severe. But some analysts note that even in the worst-case scenario — a full-blown pandemic over the next six months — the S&P 500 would fall 10-15% and bounce back relatively quickly.

Investors (over)reaching for yield in fixed-income securities is becoming a “dangerous and aggressive” tendency, while those seeking stronger credit protections are finding them harder to get, Brian Chappatta writes for Bloomberg. Analysts say investors are putting aside their safety concerns as they hunt for maximum yields on collateralized loan obligations (CLOs), junk bonds, and high-yield, high-risk contingent convertibles across Europe and the US. Some CLO managers are reportedly also really leaning into loopholes in the rules governing them, which is weakening buyer protections but not quite putting off yield hunters, Adam Tempkin writes in a separate piece.

It’s all fun and games now, but there’s a tipping point: While “flexibility in an illiquid market may be a good thing when prices are fluctuating,” this trend may be fast approaching a tipping point that could see investors incur severe losses if the credit cycle turns, Chappatta warns.

The US and Israel are trying to resuscitate The Donald’s Middle East peace plan: The US is set to unveil in the next couple of days the political component of its Mideast peace plan, President Donald Trump told reporters on Thursday, according to Bloomberg. Israel’s caretaker Prime Minister Benjamin Netanyahu and his centrist rival Benny Gantz are set to visit the White House on Tuesday to discuss the plans. The plan, which has been in the works for several years, has been met with multiple delays, the latest of which was the resignation of Middle East peace envoy Jason Greenblatt’s resignation in September.

Surprising nobody, Trump predicts Palestinians will react “negatively at first” to the proposed plan, but maintains that “it’s actually very positive for them.” The Palestinian Authority has reportedly not been invited to participate in any talks, Palestine’s presidential spokesperson said, according to Reuters. Sources who have been briefed on the plan say it could be setting the stage for Israel annexing a large part of the West Bank and the Jordan Valley, the newswire says in a detailed refresher on the main tenets of the proposed strategy. The economic component of the plan would give Egypt some USD 9 bn-worth of investment, but some are suspicious the quid-pro-quo would entail us giving up a chunk of Sinai to resettle Palestinians.

Last week’s Libya agreement didn’t even last a week. A number of countries have already broken last Sunday’s agreement to stop sending arms to factions fighting in Libya, the UN said yesterday. “Over the last 10 days, numerous cargo and other flights have been observed landing at Libyan airports in the western and eastern parts of the country providing the parties with advanced weapons, armoured vehicles, advisers and fighters,” the UN mission in Libya said. What are the chances we’ll actually see some UN sanctions?

Trump is going to make it really tough to get your kids that US passport: The US State Department is set to issue new regulations that would “make it more difficult” for pregnant women to travel to the US on a tourist visa, in a bid to curb birth tourism, the Associated Press reports. The regulations would require pregnant women to prove they are traveling to the US not just to give birth, but it seems the idea will be more difficult to implement, particularly as it remains unclear how immigration officers would determine whether a woman is (or will soon become) pregnant.

When Lina Mowafy, the founder of TAM Gallery, saw a Matisse painting at the age of nine, she knew she was meant to be an artist. But fast forward over a decade and a bachelor’s degree in art later, she couldn’t find an entryway into the Egyptian art scene. It was her own experience as a struggling artist that inspired the idea to open TAM Gallery, which was formerly known as The Arts Mart. Along with her childhood friend, Dina Shaaban, TAM came to life in 2011 and now has an online gallery, a physical gallery, and a corporate company to its name.

You can listen to the episode (runtime: 29:21) on: Our Website | Apple Podcast | Google Podcast

Enterprise+: Last Night’s Talk Shows

It was another slow day on the airwaves last night: Revolution/Police Day stole the limelight among most of the talk shows. Al Hayah Al Youm’s Lobna Assal dedicated a lengthy segment (watch, runtime: 29:06), while Masaa DMC’s Eman El Hosary interviewed the family members of dead policemen (watch, runtime: 5:22). Min Masr’s Amr Khalil also had coverage (watch, runtime: 1:01).

Mohamed Ali has apparently thrown in the towel: Khalil reported that actor and ex-military contractor Mohamed Ali had announced in a video to stop discussing politics online after Egyptians ignored his calls to protest. Ali has now taken down his Facebook page (watch, runtime: 10:59).

Plans in place for combating Wuhan virus: The head of Health Ministry’s Preventive Medicine Sector Alaa Eid told Al Hayah Al Youm’s Lobna Assal that Egypt was one of the first countries to prepare a preventive plan. The ministry has raised the alert level in all health centers, and has reportedly equipped fever hospitals with the necessary equipment. The authorities also keep a 14-day follow-up period with visitors coming from infected regions (watch, runtime: 8: 32).

No cases have been reported in Egypt as of yet, Cairo University professor Nasr El Bahy told Masaa DMC’s Eman El Hosary (watch, runtime: 10:31), while El Hekaya’s Amr Adib phoned Cairo Airport boss Magdy Ishak, who said that any passengers suspected of carrying the virus would be isolated immediately and transferred to the fever hospital for treatment (watch, runtime: 2:32).

Speed Round

Speed Round is presented in association with

Egypt’s economic growth will accelerate to 5.8% in the current fiscal year, up from 5.6% in FY2018-2019, a Reuters poll finds. This prediction is in line with the Finance Ministry’s recently-update growth expectations of 5.8-5.9%. The 20 economists polled by the newswire see the economy growing at 5.9% in the upcoming FY2020-2021.

The forecast is an improvement from an October poll by the newswire that saw economists suggesting a growth rate of only 5.5% during the ongoing fiscal year, and 5.7% in FY2020-21. Last fiscal year, growth registered 5.6%.

The improved outlook is supported by recovering household spending: “We expect a slight increase in household consumption accompanied by higher exports and lower imports,” Naeem Brokerage’s Allen Sandeep said.

Despite this rosy outlook, the better part of our recent economic expansion was state-led. Non-oil private sector activity, as measured by the IHS / Markit Purchasing Managers' Index (PMI), has expanded in only six individual months since the government kicked off the IMF-backed economic reform program in November 2016. In December, the PMI gauge showed activity has contracted for the fourth consecutive month.

Analysts are also expecting inflation to speed up, despite forecasting the opposite in October, Reuters noted. Annual urban inflation will slow to 6.8% throughout FY2019-2020, but will edge up to 7.5% in FY2020-2021, and to 8.0% the following fiscal year, they predict. Inflation effectively doubled to 7.1% last month due to rising food prices, after nosediving to 3.1% in October — its lowest level in nine years. “December 2019’s inflation print confirms our expectation that prices will continue to accelerate in months to come as favorable base effects diminish,” NKC African’s Callee Davis said.

EGP to continue weakening until FY2021-2022 to EGP 17.08 per USD 1: The economists expect the USD exchange rate to end the fiscal year at EGP 16.10, up from 15.80 last Thursday. The EGP will then trade at 16.50 to the greenback by the end of FY2020-2021, and at EGP 17.08 by the end of FY2021-2022. Davis says we should begin to see the EGP’s sustained 12-month appreciation come to an end this April as a USD 1 bn eurobond repayment is due.

Finally, the poll sees the Central Bank of Egypt lowering key overnight lending rates to 11.75% in 2020, and further to 10.75% in 2021 and 2022. Earlier this month, the CBE held its overnight deposit rate at 12.25% and its overnight lending rate at 13.25%.

M&A WATCH- Vodafone won’t comment on STC acquisition talks: A senior Vodafone official yesterday refused to comment on reports that Vodafone Group had entered into talks with Saudi Telecom Company (STC) to offload its 55% stake in Vodafone Egypt, the local press reported. Sources in the telecoms sector told Youm7 earlier in the day that Vodafone International and STC were in talks on the sale.

STC has long been interested in getting a piece of Vodafone Egypt: Press reports way back in 2013 alleged that the Saudi firm was eyeing up the 45% stake owned by state-owned landline monopoly Telecom Egypt.

What about the remaining stake? Telecom Egypt official said last February that the company has no plans to sell its stake in Vodafone Egypt in the medium term, despite Beltone’s prediction that it could look for a buyer “after securing solid ground in the mobile market” of over 7% in 2019 following the launch of subsidiary We as the fourth national mobile network operator. Vodafone Egypt last year paid Telecom Egypt EGP 5.5 bn in dividends.

M&A WATCH- First Abu Dhabi Bank (FAB) has confirmed it is in talks to acquire Bank Audi’s Egypt unit in a statement (pdf) to the Abu Dhabi stock market. The bank said that a “working group” had been set up to evaluate the acquisition and that an agreement is in line with its growth strategy, but stressed that “no valuations have been announced and there is no certainty that these discussions will result in a transaction.”

The portfolio: Bank Audi began operations in Egypt in 2006 and has 50 branches, with total assets standing at USD 4.4 bn as of the end of September, CFO Tamer Ghazaleh previously told Reuters. It reported a 6.5% rise in net profit in 3Q2019, primarily due to an increase in net interest income and gains from financial investments. S&P Global downgraded Bank Audi’s credit rating further into junk status in November amid a liquidity squeeze in the Lebanese banking sector.

Background: Bank Audi said recently that it was in talks with several potential buyers following press reports claiming it was looking to exit the country due to the ongoing financial crisis in Lebanon. FAB was one of three banks that had expressed interest in acquiring Audi’s Egypt unit, the other two being the National Bank of Kuwait and Emirates NBD. Audi had been looking to acquire the National Bank of Greece’s Egypt unit before the Lebanese banking crisis erupted. The banks had reportedly been making headway in the acquisition, despite an NBG employee pay dispute preventing them from obtaining CBE approval.

M&A WATCH- A total of 12 domestic and international investors are looking to acquire a minority stake in Raya subsidiary Aman Holding, Raya said in an EGX disclosure (pdf). Aman Holding was set up earlier this month to parent Raya’s three non-banking financial service arms — Aman for Financial Services, Aman for E-Payments, and Aman for Microfinance. The company has EGP 375 mn in capital and holds 99% stakes in the former two businesses and a 74.5% stake in the latter.

In other Raya news, Aman’s sister company Raya Restaurants has signed a franchise agreement to bring Australia-based restaurant and cafe Jones the Grocer to Egypt, according to Al Mal. Raya will begin by opening two branches in Sheikh Zayed and the Fifth Settlement, and then four more, at a total cost of EGP 60 mn. Jones the Grocer has at least 15 branches in the UAE, two in Singapore, and one in each of Qatar and Cambodia.

RenCap sees Egypt, Morocco leading industrialization-based growth in MENA: Egypt and Morocco are seeing “promising changes” that should help improve the overall picture for MENA countries’ economic competitiveness, Renaissance Capital Chairman Christopher Charlier said at RenCap’s annual MENA Investors Conference, according to an emailed statement (pdf). Morocco is expected to see continued FDI inflows, while Egypt could be on the cusp of a manufacturing FDI boom, global chief economist Charles Robertson said. The two North African countries enjoy “proximity to the EU and wage levels … [that] are 20-50% of central European levels and 7-17% of France’s level,” which lend further support to FDI flows, Robertson said.

REGULATION WATCH- FRA amends listing rules to allow wider participation in private placements: High net-worth individuals and institutional investors can now invest smaller amounts in the private component of IPOs and stake sales under amendments to EGX listing regulations issued by the Financial Regulatory Authority (FRA). The changes remove a EGP 1 mn minimum stake purchase value for the former group and EGP 10 mn for the latter.

Before the changes: Institutional investors looking to participate in private placements had to purchase a minimum of 1% of the total shares on offer, the value of which had to exceed EGP 10 mn. High net-worth (HNW) individuals could also only take part with a minimum of 0.5% of the offering worth no less than EGP 1 mn. High net-worth individuals are defined by the FRA’s most recent version of the complete listing regulations (pdf) as those with at least of EGP 5 mn in investable wealth.

After the changes: Institutional and HNW investors are still required to purchase 1% and 0.5% of the total shares on offer but no longer have to meet the EGP 1 mn/EGP 10 mn minimum stake value, allowing them to take part in smaller offerings.

CIRA, Saxony International School in partnership talks for planned German schools in Sixth of October: Cairo for Investment and Real Estate Development (CIRA) and Germany’s Saxony International School are in talks to set up an unspecified number of German schools in Sixth of October City, the Egyptian private education outfit said in an EGX disclosure (pdf), confirming a report from Al Mal out on Wednesday. Sources close to the talks told the newspaper that the two sides are “nearing” an agreement, and that the partnership will expand in later stages beyond Sixth of October.

What about those foreign ownership limits? Saxony will own 20% of a planned JV, the sources said, confirming that the foreign ownership will be within the limits imposed last year by the government. CIRA was among three companies reported to have applied last week for an exemption from the Education Ministry’s foreign ownership limits. Investor backlash prompted the ministry to walk back slightly on the plans, announcing in November that it would grant exemptions on a case-by-case basis.

Analysts have cast doubt on Egypt’s ability to sell liquefied natural gas (LNG) for USD 5 per mn British thermal units under long-term agreements, according to S&P Global Platts. Oil Minister Tarek El Molla last week announced plans to sell gas at USD 5/mmBtu under renewable long-term agreements instead of spot contracts in response to falling gas prices. LNG analyst Davd Ledesma suggests that low European gas prices and high competition in Asia and the Middle East mean that Egypt will struggle to find customers for their target price. "If Egypt is targeting the European market, then an 18-month [Free on Board contract] at USD5/mmBtu might be quite challenging…And if they are looking to sell into Asia, they will face strong competition from other Asian and Middle Eastern suppliers," he said.

Egypt needs as close to USD 5 as it can get: Egypt has to contend with a high breakeven point, which Platts Analytics estimates is just under USD 5/mmBtu.

But average price forecasts for 2020 are significantly below this: JKM futures have priced in an average LNG price of USD 4.41/mmBtu this year while Platts Analytics sees just USD 3.49/mmBtu, both of which are significantly below Egypt’s current target price. "Subscribing for a flat USD 5/mmBtu would mean that some people would be betting on an LNG price recovery," International Energy Agency analyst Gergely Molnar said. "But the sentiment is bearish, given record high storage stocks in Europe (23 Bcm above the five-year average) and limited demand response in Asia."

Egypt is currently “awash with gas”: Low domestic demand, falling demand in its only pipeline export market Jordan, and the start of gas imports from Israel earlier this month are all contributing to oversupply. IEA senior gas analyst Jean-Baptiste Dubreuil told S&P Global Platts that reopening the Damietta LNG terminal would help mitigate this. El Molla last week intimated that the facility could open within the coming weeks, finally ending a six-year hiatus and helping the government to export another 700 mcf/d by the end of the year.

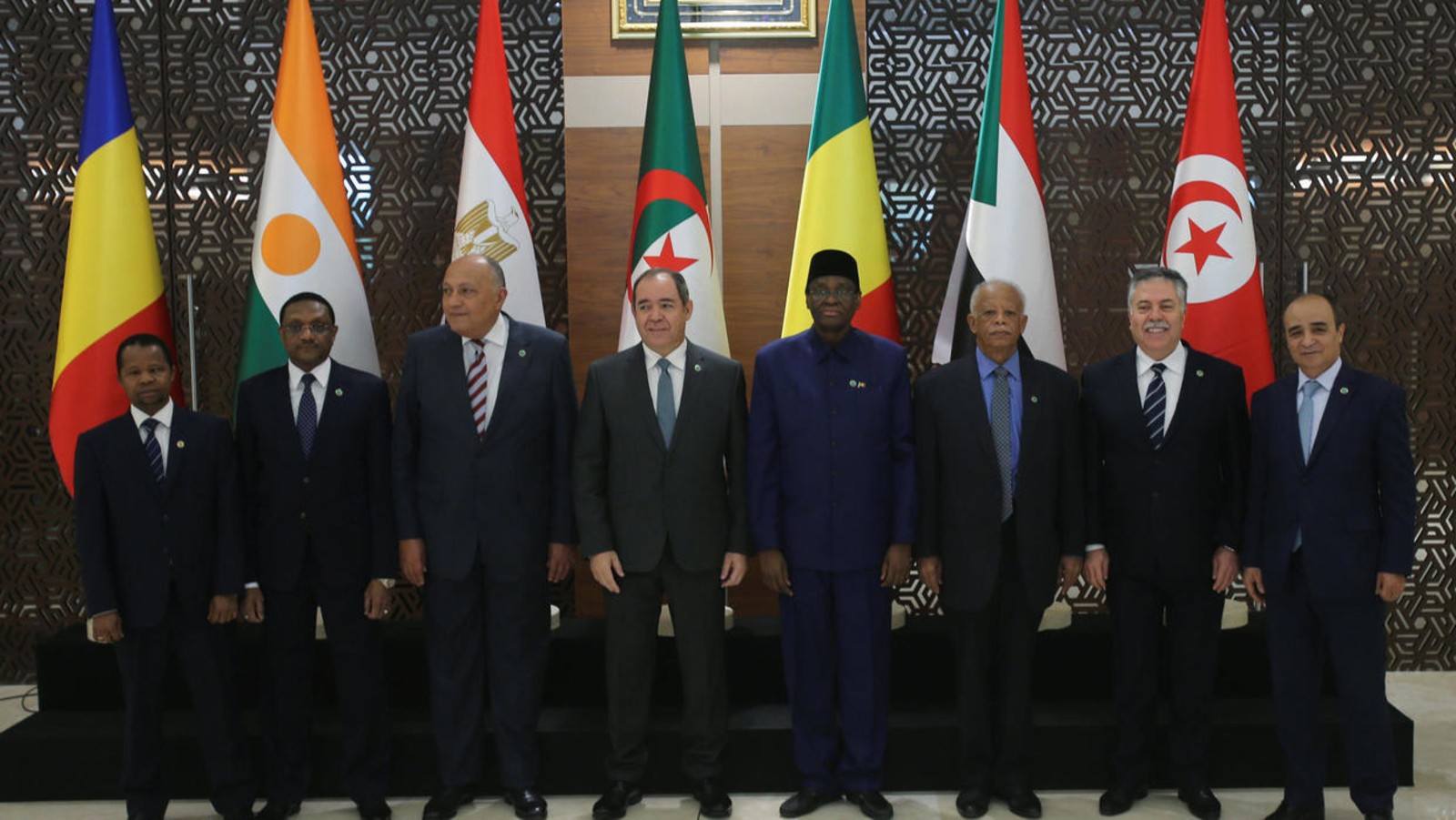

Countries neighboring Libya meet in Algeria to strengthen truce: Egyptian officials joined representatives from Tunisia, Chad, Niger, Sudan and Mali, as well as the German foreign minister, for a meeting in Algeria last week, intended to strengthen a fragile truce agreed between rival Libyan factions, according to Reuters. Libya’s UN-recognized Government of National Accord (GNA), led by Prime Minister Fayez Al Serraj, is backed by Turkey, Italy, and Germany, while eastern military commander Khalifa Haftar is backed by Egypt, Russia, the UAE and France. Escalation of the Libyan conflict has alarmed neighboring countries, who fear it may fuel armed militant groups operating in the Sahel and spur a new refugee crisis.

Egypt accuses Turkey of causing confusion in Libya: Foreign Minister Sameh Shoukry called for all parties to abide by the outcomes of last Sunday’s Berlin conference, during which 12 countries pledged to end interference in the country’s years’ long civil war, and Haftar and the GNA agreed to further truce talks while maintaining an informal ceasefire on the ground. Shoukry accused Turkey of causing confusion in Libya and that militia active in the country needed to be fought. Turkish President Recep Erdogan said on Friday that military personnel being sent to Libya are supporting and training Serraj’s forces.

Libya’s oil production will fall to its lowest level since the overthrow of Gaddafi, head of the country’s National Oil Company said last week. Haftar’s forces have blocked ports in the east and center of the country, and shut down a pipeline connecting the country’s largest oil field to the coast. NOC Chairman Moustafa Sanalla said that the country’s production had already fallen to 400k bbl/d from 1.3 mn, and warned that it fall further still to 72k bbl/d “within days.”

The Macro Picture

Here’s why Libra and ‘stablecoins’ probably aren’t the answer to financial inclusion: The noise from the Libra hype train has been noticeably quiet these past few months. Having emerged last year with a swashbuckling raison d’etre to overturn the global financial system as we know it, successive beatdowns from regulators in large economies seem to have put a cap in its grandiose ambitions for now. What’s more, as three financial experts at the World Bank and Bank of International Settlements highlight in this VoxEU piece, the problems inherent with scaling up a stablecoin system are only magnified in emerging markets and developing economies (EMDEs), meaning their usefulness to increasing financial inclusion will likely be negligible.

Part of this is due to resource constraints in EMDEs: Countries, especially those with populations living over very large, remote areas, will face uphill battles trying to provide widespread service coverage: whether that be ensuring everyone has adequate phones and internet connectivity to use stablecoin systems, or that users have a physical agent in reach to convert their digital currency into local notes. Then there’s the issues of security, privacy and regulation. Fears that even advanced economies would be unable to prevent stablecoins being used for nefarious purposes has been one of the prominent arguments against projects like Libra taking root. And EMDEs, which tend to have weaker regulators and supervisory capacity, would likely find these challenges even harder to surmount.

An influx of stablecoins probably wouldn’t be good for EMDE financial systems: The monetary policies of the currencies that back the stablecoin would effectively be exported to EMDEs as its use proliferates. “‘Stablecoin-isation’ could mean less effective monetary transmission and, in the extreme, countries that face shocks – political, economic or financial – could face deposit outflows from banks and capital flight,” they write. This would be even more disruptive in EMDEs, which are more susceptible to liquidity shocks given their thin interbank and FX markets.

Stablecoins probably don’t have a future in their current iteration, but they have nonetheless highlighted the challenges of increasing financial inclusion and building accessible and secure international payment systems, the report says. Instead we’re likely to see an acceleration towards digital currencies issued and controlled by central banks, although this model too will encounter challenges. All eyes on China in the coming months.

Egypt in the News

The conversation on Egypt over the weekend focused on the anniversary of the 25 January uprising. The Associated Press reported President Abdel Fattah El Sisi’s speech on Thursday during which he said Egypt had become “an oasis of security and stability.” The wire service contrasted that with widespread arrests that followed protests in September 2019. France24, focuses on the 2011 protesters that remain behind bars, and the National leads with El Sisi’s “upbeat” speech at the police academy. Voice of America, meanwhile, notes that the anniversary of the revolution was “marked without fanfare.” The Guardian’s Ruth Michaelson was out with a piece saying “nine years after [the] uprising, Egyptians face strict controls on political activity and free speech.”

Human rights in Egypt are also on the agenda: Jonathan Guyer asks to what extent liberal arts institutions such as AUC should be speaking out to defend freedom of expression — especially when their own affiliates are targeted — in a piece for the American Prospect.

Energy

Belectric to develop 50 MW Zaafarana solar plant

The New and Renewable Energy Authority has awarded Germany’s Belectric a tender to develop a 50 MW solar photovoltaic power plant in Zaafarana, reports Afrik21. No details were provided on the expected cost of the plant.

Tourism

Egypt hotel revenue to grow 5-13% this year -Colliers International

Egyptian hotels in Cairo, Alexandria, Sharm El Sheikh and Hurghada will see their average revenue per available room (RevPAR) rise by 5-13% in 2020, according to a Colliers International report picked up by the local press. Sharm El Sheikh will see the highest increase at 13%, Hurghada at 11%, Alexandria at 9%, and Cairo at 5%. The current highest RevPAR is in Cairo at USD 126, while the lowest is in Sharm at USD 54. RevPAR grew 20% across Egypt in 2019, the report said, lower than Collier's estimate of 30%. Egypt has been one of the top-growing tourism markets in the MENA region this year, Colliers International MENA senior manager James Wrenn said last year.

Tourism Ministry suspends new licenses for travel companies in Egypt

The Tourism Ministry will not issue new licenses for travel companies this year after Minister Khaled El Enany issued a decree in the Official Gazette, the local press reports. The decision comes in light of a boom in newly-established travel companies the ministry finds sufficient for current market needs.

Al Sharif Group to sign contract for EGP 1.4 bn Shepheard Hotel renovation

Al-Sharif Group Holding (ASG) will sign a contract to renovate the Shepheard Hotel next month, Holding Company for Tourism and Hotels Chairman Mervat Hataba told Masrawy. The Saudi company will finance the EGP 1.4 bn renovations of the historic hotel and will get a cut of revenues once it is operational again.

Telecoms + ICT

Egypt climbs up from the bottom of the list list of global internet speeds

Egypt has jumped 34 places since last month in Speedtest’s latest December update, to rank 97 out 177 countries in fixed broadband download speed. Our ranking has improved strikingly from 154 last July and from 166 in December 2018. The average download speed, 26.52 mbps is still quite far from a global average of 73.58. We’re still, however, behind a host of African countries including South Africa (96), Cape Verde (89), Congo (88), Ghana (79), and Madagascar (72). The improvement in fixed broadband appears to be due to Telecom Egypt investing close to USD 16 bn since mid-2018 to improve internet infrastructure. On the mobile internet front, we dipped 8 places to 108 out of 140 countries since July.

Banking + Finance

MIDOR completes USD 300 mn financing agreement

The Middle East Oil Refinery (Midor) has secured a USD 300 mn medium-term syndicated loan from CIB and Al Ahli Bank of Kuwait (ABK), according to Al Mal. Midor plans to use the loan to finance its crude oil imports and their working capital.

Legislation + Policy

MP proposes draft bill criminalizing child marriage in Egypt

House Defense Committee Chairman Kamal Amer has drafted a bill that would criminalize child marriage and impose a prison sentence and a EGP 5-10k fine on violators, according to Youm7. Amer says addressing child marriages would help curb population growth.

Egypt Politics + Economics

Misr Technology Services to set up digital one stop shop for Egypt’s customs

The Customs Authority will be signing soon an agreement with public-private special purpose vehicle Misr for Technology Services (MTS) and the National Telecommunications Regulatory Authority to set up a digital “one stop shop” for customs procedures, according to a Finance Ministry statement. MTS is 20% owned by private sector player Amiral Management Corporation and 80% owned by state-owned fintech company e-Finance.

On Your Way Out

Care to hear what an Ancient Egyptian might’ve sounded like? Scientists have managed to nail down a single prolonged vowel thanks to the mummification process’ unique and careful preservation of the soft tissue in vocal tracts, expertly recreated by way of advances in 3D printing, RT reports. Big Think and Science Focus have also picked up the story.

The Market Yesterday

EGP / USD CBE market average: Buy 15.73 | Sell 15.86

EGP / USD at CIB: Buy 15.73 | Sell 15.83

EGP / USD at NBE: Buy 15.76 | Sell 15.86

EGX30 (Thursday): 13,728 (-0.2%)

Turnover: EGP 468 mn (28% below the 90-day average)

EGX 30 year-to-date: -1.7%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 0.2%. CIB, the index’s heaviest constituent, ended down 0.8%. EGX30’s top performing constituents were Telecom Egypt up 4.6%, Juhayna up 2.1%, and Egyptian Iron & Steel up 2.0%. Thursday’s worst performing stocks were Eastern Co down 1.8%, CIRA down 1.3% and Heliopolis Housing down 1.0%. The market turnover was EGP 468 mn, and regional investors were the sole net buyers.

Foreigners: Net long | EGP -10.0 mn

Regional: Net short | EGP -24.5 mn

Domestic: Net long | EGP +14.5 mn

Retail: 51.6% of total trades | 53.2% of buyers | 50.0% of sellers

Institutions: 48.4% of total trades | 46.8% of buyers | 50.0% of sellers

WTI: USD 54.19 (-2.5%)

Brent: USD 60.69 (-2.2%)

Natural Gas (Nymex, futures prices) USD 1.89 MMBtu, (-1.7%, February 2020 contract)

Gold: USD 1,578.20 / troy ounce (+0.4%)

TASI: 8,386 (-0.5%) (YTD: -0.0%)

ADX: 5,244 (+0.2%) (YTD: +3.3%)

DFM: 2,837 (-0.4%) (YTD: +2.6%)

KSE Premier Market: 7,105 (+0.2%)

QE: 10,624 (-0.5%) (YTD: +1.9%)

MSM: 4,069 (+0.3%) (YTD: +2.2%)

BB: 1,653 (+0.1%) (YTD: +2.7%)

Calendar

January: 1,000 artifacts to be displayed when Hurghada Museum opens.

23 January- 4 February: Cairo International Book Fair 2020, New Cairo International Exhibition and Convention Center, Egypt

27-29 January (Monday-Wednesday): African Private Equity and Venture Capital Association’s North African Fund Manager Masterclass, Sheraton Cairo Hotel, Galaa Square, Cairo.

28 January (Tuesday): AmCham to host US Ambassador Jonathan Cohen for monthly luncheon.

28-30 January (Tuesday-Thursday): CI Capital’s annual MENA Investors Conference, Four Seasons Nile Plaza, Cairo.

28-29 January (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

28-29 January (Tuesday-Wednesday): Egypt and Ethiopia to meet again in Washington, DC, for mediation on GERD.

29 January (Wednesday): StartEgypt Forum 2020, the Greek Campus, Downtown, Cairo

February: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February: A delegation of Swiss businesses will visit Egypt to discuss investment.

February: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

2 February (Sunday): Cairo Economic Court will issue its verdict on two Americana Egypt lawsuit, one looking into minority shareholder's lawsuit against Fincorp Investment Holding as Adeptio AD Investments' financial advisor for its mandatory tender offer (MTO) for Americana Egypt and the other is concerned with an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

3-5 February: The Arab-African International Forum, Jeddah, Saudi Arabia.

4 February (Tuesday): Court hearing for PTT Energy Resources’ USD 1 bn lawsuit against Egyptian government.

8 February (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

9-10 February (Sunday-Monday): The the 33rd ordinary African Union (AU) Summit where Egypt will hand over the African Union presidency to South Africa

11-13 February (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

14-16 February (Friday-Sunday): A Euro-Mediterranean Organization for Economic and Development Cooperation delegation will visit Egypt to discuss cooperating in the field of organic cotton and home textiles

23 February (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot. It was previously postponed to 24 November 2019 and then to 5 January 2020, and now 23 February.

23 February (Sunday): Court session for Amer Group, Porto Group compensation claim against Antaradous

20 February (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

3 March (Tuesday): Business Today’s bt100 awards ceremony, Cairo.

4-5 March (Wednesday-Thursday): Women Economic Forum, Cairo.

7 March (Saturday): International Conference for Investment organized by Suez Canal Economic Authority, Al Galala City, Egypt

17-18 March (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

7 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April (Sunday): Easter Sunday.

20 April (Monday): Sham El Nessim, national holiday.

23 April (Thursday): First day of Ramadan (TBC).

25 April (Saturday): Sinai Liberation Day, national holiday.

28-29 April (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5-7 May (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

14 May (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17-20 June (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June (Sunday): June 2013 protests anniversary, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

5 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

17 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.