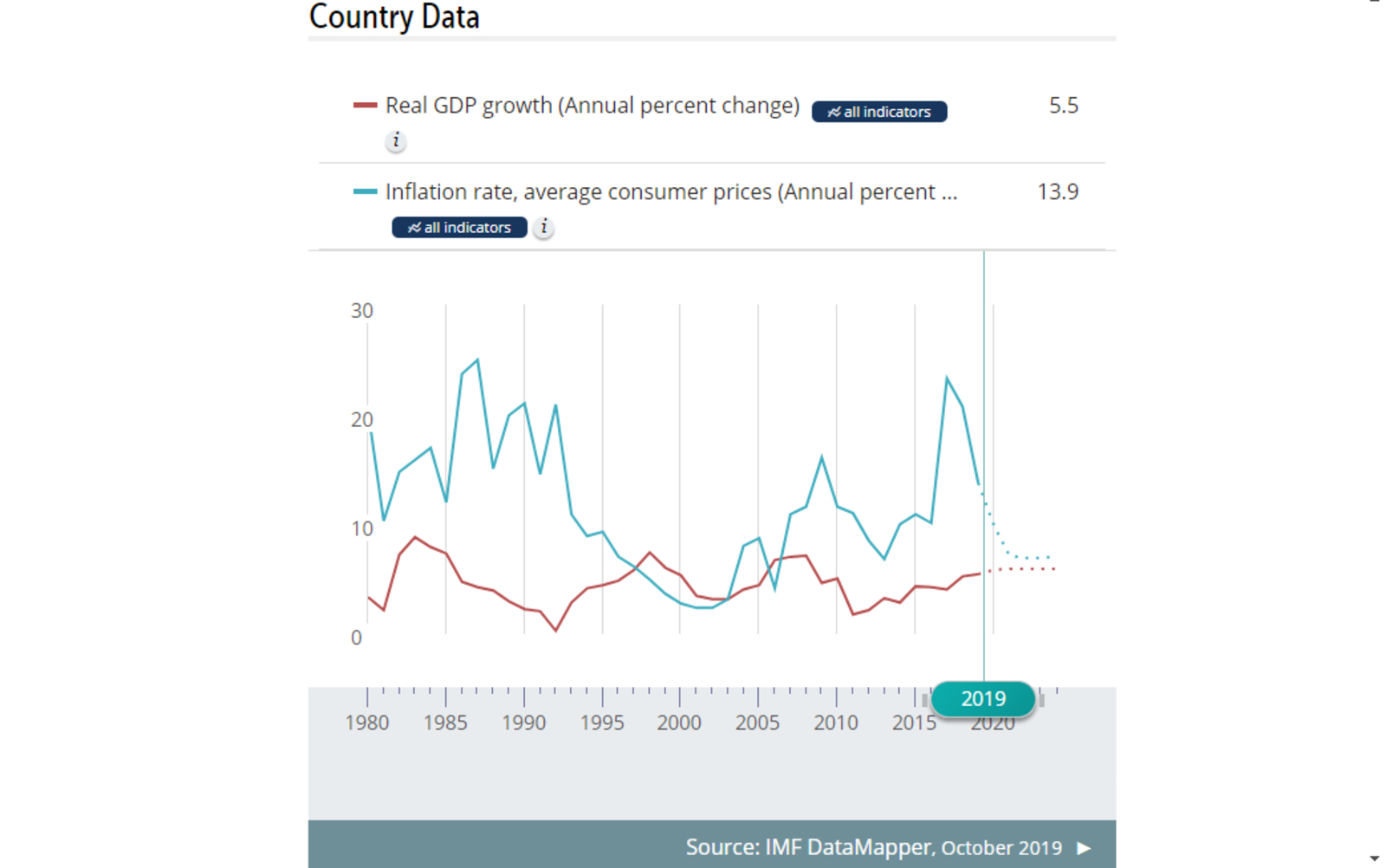

Egypt’s economic growth to slow slightly to 5.5% in FY2019-2020 -poll

Egypt’s economic growth to slow slightly to 5.5% in FY2019-2020 -poll: Egypt’s economic growth will slow to 5.5% in the current FY2019-2020 fiscal year, down from 5.6% last year and below the government’s target of 6% growth in FY2019-2020 and overall target range of 6-7%, according to a Reuters poll of economists. The poll confirms economists’ July projections for the current fiscal year, but the respondents downgraded their expectations for FY2020-2021 to 5.7% from 5.8%. Reuters notes that Egypt’s non-oil private sector has expanded only six months since beginning the IMF-backed economic reform program in November 2016. The IHS / Markit Purchasing Managers’ Index showed the sector contracted for the second consecutive month in September.

Inflation is seen slowing to 10.2% in FY2019-2020 and to 9.2% in FY2020-2021 from 33% in July 2017, the analysts said. “We expect prices to continue to decelerate in October 2019 before rising to high single digits by the end of the calendar year 2019 as they come off a lower base from the previous year,” said Jacques Verreynne, an economist at NKC African Economics. Headline inflation cooled in September for the fourth consecutive month to 4.3%, its lowest recording in nearly seven years.

As inflation continues on a downward trajectory, analysts expect more rate cuts before the year is out, which could unlock corporate borrowing for capex. “As of now, capex growth indications still remain muted,” Allen Sandeep, head of research at Naeem Brokerage told the newswire. “Assuming interest rates are cut by another 300 basis points, the hope for 2020 and 2021 is that pent-up demand finally kicks in.” Sandeep noted that retail lending growth has crossed 20% and could rise to more than 30% next year, signaling a return to health for the private non-oil economy.