- US, Iran move to calm tensions after missile strike on Wednesday. (What We’re Tracking Today)

- Egypt’s banking sector looks good to international investors, Seeking Alpha says. (Speed Round)

- Ezdehar fund acquires majority stake in meat products company Rich Food. (Speed Round)

- Heliopolis Housing to extend management rights contract to 10 years. (Speed Round)

- Egypt will welcome 15 mn tourists in 2020 -WTO official. (Speed Round)

- Egypt retains #14 world ranking for job offshoring in 2019 index. (Speed Round)

- Egypt, France, Greece, and Cyprus condemn Turkish intervention in Libya. (Speed Round)

- Egypt scraps customs on Turkish cars + mulls new tariffs for charging of electric vehicles. (Automotive + Transportation)

- The Market Yesterday

Thursday, 9 January 2020

Egypt’s banking sector looks good to foreign investors.

Plus: US, Iran appeared to de-escalate tensions overnight

TL;DR

What We’re Tracking Today

Chances of a regional conflagration occurring in the first week-and-a-half of the new decade appeared to go down overnight as both sides took a breath. US President Donald Trump yesterday delivered a relatively conciliatory statement in response to Iran’s missile strikes. Although he opened declared that Iran will never have a nuclear weapon on his watch and announced “punishing” new sanctions on the Islamic Republic, The Donald called for diplomacy and an end to the conflict. “Iran appears to be standing down, which is a good thing for all parties concerned and a very good thing for the world … The United States is ready to embrace peace with all who seek it,” he said in a televised statement. The New York Times has more.

At least 176 people were killed yesterday after a Ukraine-bound Boeing 737 crashed shortly after taking off from Imam Khomeini International Airport in Tehran, CNBC says. Initial reports from Iranian media suggested that the Ukraine International Airlines flight suffered a technical malfunction. But conflicting and confusing accounts over the plane’s fate offered by Iran and Ukraine have shrouded the incident in uncertainty, and Iran’s refusal to hand the black box to Boeing isn’t doing much to ease the situation.

Some 136 of those on board were destined for Canada, where many were students and / or citizens and permanent residents returning after visiting family in Iran over the winter holiday, the Globe & Mail reports.

The EGP fell against the greenback for the first time in more than three weeks yesterday. The EGP-USD rate dropped slightly to EGP 16, having held steady at 15.99 for the previous 22 days.

Inflation figures for December are set to be released today. Annual urban inflation accelerated in November for the first time in six months as the favorable base effect began to wane.

Expect the inflation reading to play into the Central Bank of Egypt’s decision on key interest rates when its Monetary Policy Committee meets a week from today. The meeting was originally scheduled to take place on 26 December, but was postponed until a new CBE board and MPC are formed. We’re expecting the new committee to be announced in the coming days, after President Abdel Fattah El Sisi last week appointed the bank’s new board of directors. Economists we surveyed last month broadly expected the MPC to keep rates on hold during the meeting.

The House Economic Committee will begin discussing on Tuesday the new Banking and Central Bank Act that was approved by cabinet last October, the local press reports, citing unnamed parliament sources. Officials from the central bank will participate in discussions of the draft law with the committee. The act would, if passed, set aside the unpopular industry development tax and would introduce a number of licensing and regulation amendments.

It’s the second day of Chinese Foreign Minister Wang Yi’s three-day visit to Cairo today. Yi is in Egypt to follow up on recent agreements signed with China, he told Al Ahram in a long interview without going into further details. Egyptian and Chinese companies signed a number of financing, manufacturing, and communications agreements when President Abdel Fattah El Sisi attended the Belt and Road Forum in Beijing last April, including some USD 3 bn in Chinese financing for the new capital’s central business district. Yi hinted during the interview that major Chinese investments will continue to focus on the new capital and the Suez Canal.

Talks on the Grand Ethiopian Renaissance Dam continue in Addis Ababa today ahead of mediation-that-isn’t-mediation in Washington, DC, next week. The story is dominating headlines on Egypt in the international press, as we note in Egypt in the News this morning.

Ghosn is looking to the Lebanese legal system to get out of his mess: Former Nissan boss Carlos Ghosn is asking to be tried in Lebanon instead of Tokyo after fleeing from Japan in a big black box, claiming that Japan’s legal system is unjust and that he was victim of a plot to topple him, according to the Financial Times. Ghosn alleged in more than two-hour-long presser yesterday (watch on Youtube) that executives at Nissan wanted to prevent him from merging the Japanese car manufacturer and Renault. Ghosn’s Beirut-based lawyer said trying him in Lebanon would involve “either a handing over or co-operation” between the two countries’ justice ministries.

Goldman Sachs hopes more openness could drive up share price: NYSE-listed Goldman Sachs is planning to make more details in its quarterly reports available to the public as it looks to counter investor skepticism and build upward momentum for its share price, according to the Wall Street Journal.

Enterprise+: Last Night’s Talk Shows

Developments in Libya got the headline treatment on the talk shows last night: All eyes were on yesterday’s meeting of foreign ministers in Cairo, which saw Egypt, France, Greece, and Cyprus join together to condemn the Turkish intervention in Libya. Al Hayah Al Youm’s Lobna Assal rang up strategic expert Samir Farag, who praised Egypt’s political leadership, diplomats, military for their handling of the crisis (watch, runtime: 9:33). Masaa DMC’s Ramy Radwan also had a short segment on the meeting (watch, runtime: 2:12), as did Min Masr’s Amr Khalil (watch, runtime: 2:24). We have the latest on the unfolding situation in Libya in this morning’s Speed Round below.

The talking heads are confident that we’ll see a final GERD agreement this week: As the final round of negotiations between Egypt, Sudan, and Ethiopia kicked off yesterday, Min Masr’s Amr Khalil claimed that there are only a few hurdles left before an agreement can be finalized (watch, runtime: 2:41). Meanwhile, former Irrigation Minister Mohamed Nasr Allam told Yahduth Fi Misr’s Sherif Amer that the three sides have already worked out controversial issues such as the time for filling the Ethiopian dam's reservoir (watch, runtime: 5:15).

Your significant other isn’t proposing because of geopolitics: Gold prices are rising due to the tension between the US and Iran, according to Deputy Head of the Gold Division Rafik Abbas who told Yahduth Fi Misr’s Sherif Amer that the prices possibly could decline soon (watch, runtime: 3:12).

International football stars gather in Hurghada: Al Hayah Al Youm’s Lobna Assal covered the CAF 2019 awards at Sahl Hasheesh, which was notable for the absence of Mohamed Salah who won an award for best attacker in Africa (watch, runtime: 4:37).

Speed Round

Speed Round is presented in association with

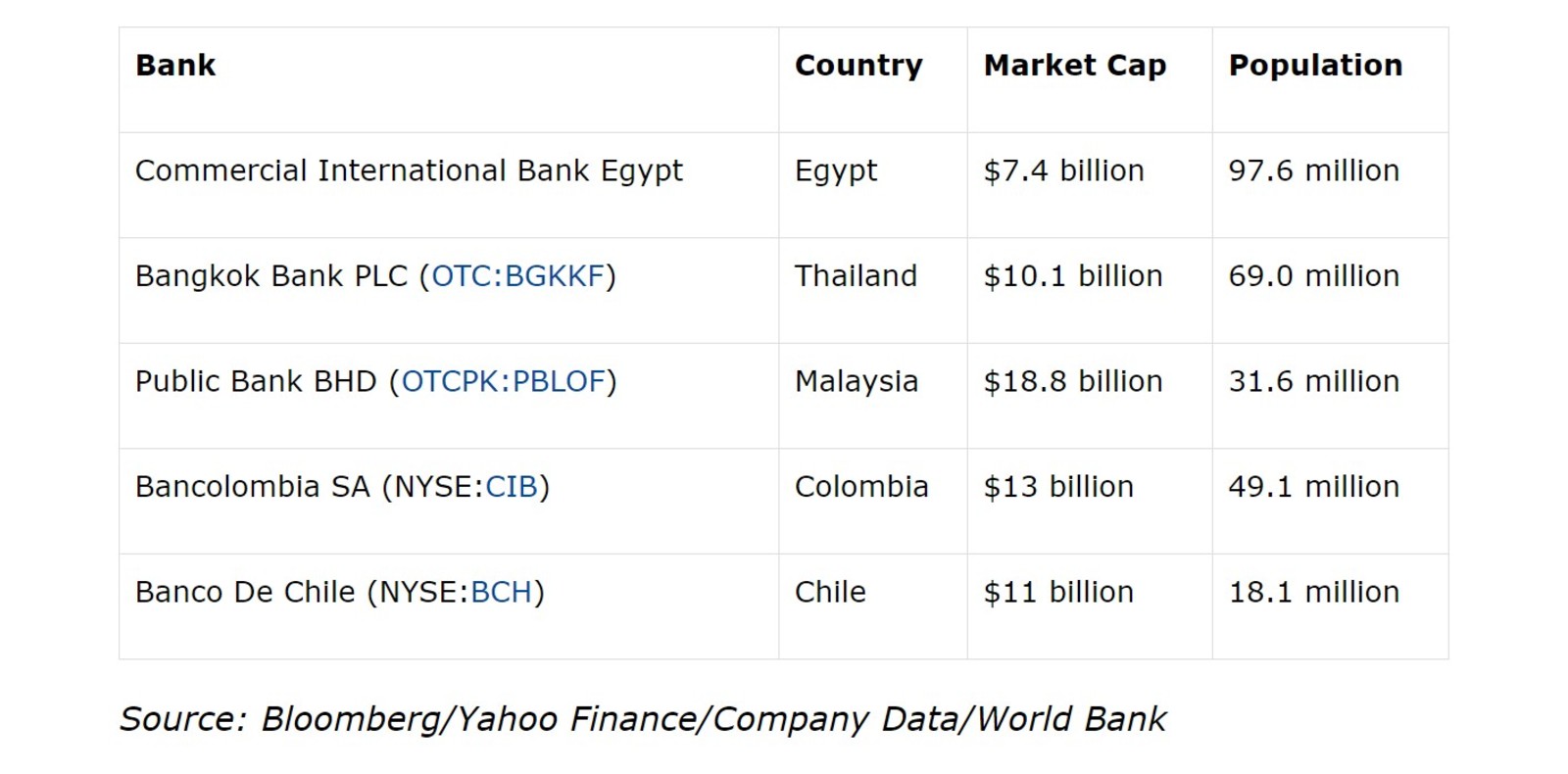

Egypt’s banking sector offers solid prospects for international investors: Egypt’s favorable interest rate climate, the relatively small market capitalization of some of the country’s largest banks compared to emerging market peers, and a largely unbanked population are all draws for international investors, Dylan Waller writes in Seeking Alpha. Indicators are moving in the right direction after the 2016 float of the EGP: falling inflation, an increase in foreign exchange reserves, a reduction to the current account deficit, and an increasingly stable EGP are backed by robust economic growth, which banks are now set to capitalize on, Waller argues.

Know this: Bank loans in Egypt grew 13.6% y-o-y and deposits grew 12.3% y-o-y in FY2018-2019, while the total number of debit and credit cards in use has nearly doubled since FY2010-2011.

Interest rates continue to outperform EM peers despite easing cycle: Declining interest rates have allowed banks to enjoy healthy net interest margins, but the benchmark rate in Egypt remains higher than many other EMs. And reductions in the cost of capital will support local businesses, as well as banks such as CIB that provide loans to them. Meanwhile, factors including the relatively small market capitalization of some of the largest banks in Egypt, compared with their EM peers (CIB has a market capitalization of USD 7.4 bn), and the country’s large unbanked population (only an estimated 32.8% of Egypt’s population currently has access to a bank), shows how much room there is for growth.

What’s Seeking Alpha tipping? Start with CIB, Waller’s go-to option for international investors to gain exposure to Egypt’s banking sector. The largest bank in Egypt in terms of net income and assets, CIB has “an exceptional retail footprint in Egypt” and has delivered bottom-line growth of 450% between 2009 and 2019, Waller says. The bank’s stock price also remained relatively strong during Egypt’s last economic downturn, he notes.

Then look at Global X MSCI Egypt ETF, which offers broad exposure to the stock market, investing over 20% of its assets in the financial services sector in Egypt, while also offering exposure to some of the country’s top consumer and healthcare companies, including Cleopatra Hospitals, Eastern Tobacco, Juhayna, and Telecom Egypt. The ETF is trading at a near three-year low, Waller argues.

M&A WATCH- Ezdehar acquires majority stake in Rich Food: Ezdehar’s Egypt Mid-Cap Fund has acquired a majority stake in the meat products and cold cuts company Rich Food, according to a statement (pdf). The value and size of the stake was not disclosed. Sources said the fund plans to purchase new equipment to increase the company’s production capacity, and open between seven and 10 new branches. Rich Food’s Amr Eltazy will remain on the company’s board, but will no longer be CEO. Amr Farrag has been tapped to succeed Eltazy as CEO.

Advisors: Ragy Soliman & Associates (Adsero) served as the legal advisor to the selling party alongside Moonstone Capital Partners who acted as the financial adviser. Al Tamimi & Company and the Dutch Van Campen Liem provided legal advice to Ezdehar.

CORRECTION – 11 January 2020

An earlier version of this story, which cited the local press, incorrectly said that Amr Eltazy would retain his position as CEO. The story has been updated with an official release and the correct information.

PRIVATIZATION WATCH- HHD to extend management rights contract to 10 years: State-owned Heliopolis Housing and Development (HHD) has decided to extend the tenor of the management contract it plans to hand to a private investor to 10 years from an originally planned seven, Al Mal reported. A number of companies bidding for the contract had sought the extension, the newspaper reports, citing sources it says have knowledge of the process. HHD will award management rights and a 10% stake in the company to the winning investors as part of its wider plan to offer a 25% stake under the state privatization program.

What’s next? Public Enterprises Minister Hisham Tawfik met last week with the four companies that purchased the prospectus for the management rights and 10% stake sale — SODIC, BPE Partners, Palm Hills, and Arkan — to address questions, the newspaper reported. Tawfik reportedly signaled his willingness to be “flexible” with the terms of the contract, the sources say. The door for bids on the contract will remain open until 14 January; state-owned investment bank NI Capital will announce the selected bid by the end of January, Tawfik told us previously.

Egypt tourist numbers to hit 15 mn in 2020 -WTO official: Egypt is poised to receive some 15 mn tourists this year, up 15% from 13 mn in 2019, a World Tourism Organization (WTO) official told MENA, citing figures from the global tourism body. WTO economic adviser and member of the UN Economic Commission for Europe Saeed El Batouti said that Egypt's stability and current policies are increasing the country’s attractiveness as a tourist destination, but called for the country to do more to tap new markets and increase religious tourism. El Batouti, a board member of the German Travel Association, noted that German tourist arrivals grew the fastest last year, reaching 2.5 mn from just 707k in 2018.

The WTO isn’t the only one hyping Egypt’s tourism prospects for the year ahead: Egypt is increasingly being noted internationally as a top destination for travel for 2020. Egypt has tied for the top spot in the list of emerging or “off-the-beaten-path” destinations for 2020, according to the results of annual travel trends survey released by the United States Tour Operators Associations (USTOA). Luxury tour group Abercrombie and Kent last month predicted that Egypt would be one of the year’s hottest tourist destinations, while the Grand Egyptian Museum (GEM) has also got us onto the Insider’s travel list of “12 places you should visit in 2020”.

Egypt retains #14 world ranking for job offshoring in 2019 index: Egypt continues to be an attractive outsourcing destination for multinational services companies due to the low cost of doing business and the quality of the labor force, according to a survey by global management consultancy AT Kearney. The firm’s 2019 Global Services Location Index, which ranks countries in terms of attracting offshored IT and business process jobs, shows Egypt retaining its #14 global ranking and continuing to lead Middle East and African countries. Egypt has remained competitive in part due to the construction of new technology parks outside of Cairo and the government’s focus on improving cybersecurity, the report notes.

Egypt, France, Greece and Cyprus condemn Turkish intervention in Libya: The foreign ministers of Egypt, France, Greece and Cyprus called the deployment of Turkish troops in Libya a “serious violation” of international law that puts at risk regional stability. The four ministers spoke by way of a final communique following talks yesterday in Cairo. They also claimed that the maritime border agreement signed between Turkey and the UN-backed Government of National Accord is an illegal pact that violates the sovereignty of other Mediterranean states. French Foreign Minister Jean-Yves Le Drian also discussed the situation with President Abdel Fattah El Sisi yesterday, according to an Ittihadiya statement.

Background: The meeting came a day after a number of Arab and European states denounced Turkey’s decision to begin sending troops to Libya to reinforce Prime Minister Fayez Al Serraj’s Tripoli-based government, which is under siege by forces loyal to General Khalifa Haftar. Egypt and France are both supporting Haftar’s bid to seize control of the Libyan capital, putting them further at odds with Turkey, which has been busy escalating tensions in the Mediterranean as it tries to expand its claim to territory in which it can explore for natural gas while also trying to constrain Cyprus, Egypt and Israeli efforts to explore for gas and bring it to market.

Turkey and Russia yesterday called on all parties in Libya to declare a ceasefire by midnight on 12 January. The two made the call after talks between Putin and Erdogan in Moscow, Reuters reports. The two countries, which are backing opposing forces in the conflict, issued a joint statement calling on Libyan forces and their foreign backers to “declare a sustainable ceasefire, supported by the necessary measures to be taken for stabilizing the situation on the ground and normalizing daily life in Tripoli and other cities.”

Italy was attempting to host direct talks between Serraj and Haftar at the same time all this was going on. The Guardian reported that Italian PM Giuseppe Conte was facing an uphill battle yesterday after it emerged that Serraj was refusing to meet him after learning he had already met with Haftar.

Clashes continued on the ground: Pro-Serraj forces continued to clash with the Libyan National Army, a day after Haftar’s militia seized control of the coastal town of Sirte. The LNA is now advancing westward towards Tripoli, and hopes to take control of the strategic town of Misrata before Turkish reinforcements arrive, Gulf News reported.

CABINET WATCH- Cabinet approves undisclosed Information Ministry media policy, agrees on role of ministry: The Madbouly Cabinet announced yesterday that it had greenlit Information Minister Osama Heikal’s media policy, but did not disclose details about what the minister had proposed. Ministers also agreed on the role that the newly-reinstated ministry will play, but the statement offered little detail. Cabinet’s legal counsel will soon draft the ministry’s mandate and responsibilities before Prime Minister Moustafa Madbouly gives final approval and issues a regulatory framework.

Background: Heikal was appointed information minister during last month’s cabinet shuffle, having previously held the post after 25 January 2011 and prior to the ministry’s dissolution in 2014. There have been questions from the House on what the ministry’s role would entail, given that the 2018 Press and Media Act set up a Supreme Media Council.

Amendments to law giving gov’t power of eminent domain: Cabinet approved legislative amendments to the 1990 Eminent Domain Act, which granted the president the right to seize private property for projects that promote the “public good.” Among other provisions, the law allows the president to take privately-owned land under eminent domain and offer compensation that includes a 20% premium on the value of the land.

What are the changes? The government will have more time to make public a ministerial order or contract with the landowner. Previously, the government had to publish the information in the Official Gazette within two years of the transfer. The new amendments extend this to three years to give the authority enforcing the decree more time to complete the procedures.

ْCompensation for those affected by High Dam construction: The cabinet approved the disbursement of compensation for those impacted by the construction of the High Dam. Entitled citizens will be able to claim land, residential units, or cash compensation.

More from the cabinet meeting:

- Changes to Terrorist Entities Act: Cabinet also greenlit changes to the 2015 Terrorist Entities Act to widen the definition of “[terror-linked] funds” to include both assets and resources such as oil.

- Draft law on public planning: Cabinet approved draft legislation that would aim down a plan for medium- and long-term development, evaluate this plan, follow up on its implementation, and define the roles and relationships of bodies responsible for public planning.

Cabinet to look into post-2011 court decisions scrapping privatization bids: The Madbouly Cabinet will soon begin examining court decisions that have overruled government bids to privatize state-owned assets, Public Enterprises Minister Hisham Tawfik told Al Mal. The House passed legislation in June that allows the government to step in when a court threatens to block privatization by referring the matter to the cabinet’s dispute resolution committee.

The usual suspects aregetting attention: The government now intends to look into familiar cases including the Nile Cotton Ginning Company, Omar Effendi, Tanta Linen, El Nasr for Steam Boilers, Middle East Paper Company (Simo), Shebin El Kom Spinning, and Al Arabia Foreign Trade Company, Tawfik said.

Gov’t approaching settlement on Nile Cotton Ginning case? The Nile Cotton Ginning case could be settled for EGP 500 mn, Al Mal says, citing unnamed sources. This figure was reported after Tawfik told the newspaper that the government will allow the company’s private shareholders to retain their stakes in return for a payment. Management will also be allowed to use industrial land for planned real estate projects under the settlement agreement. The foreign shareholders of Nile Cotton, who collectively own a 20% stake, were previously said to have been planning to take the case to international arbitration in London, we noted back in October 2018. Shareholders had authorized Chairman El Sayed El Saify to seek a settlement of up to EGP 250 mn in a recent general assembly meeting noted by Al Mal. This is less than the EGP 500 mn the government is reportedly after, but signals they are open for an agreement.

MOVES- Shawkat El Maraghy (LinkedIn) has been appointed as the managing director of Prime Holding, according to a company disclosure (pdf). El Maraghy had been managing director of HC Brokerage since 2009. Prime Holding also appointed Hany Genena (LinkedIn) as its head of research. Genena was formerly head of research at Beltone and at Pharos.

Image of the Day

Egypt celebrates Coptic Christmas: Egypt’s Coptic Christians joined the practitioners of Orthodox Christian traditions around the world, including in Russia, Serbia and Ethiopia, in their Christmas celebrations on Tuesday. Many families and some politicians, members of parliament, and government officials went to Christmas Mass in the Cave Church in Mokattam, as this Voice of America photo essay shows.

Egypt in the News

The ongoing Grand Ethiopian Renaissance Dam negotiations in Addis Ababa is earning digital ink in the foreign press this morning: The National’s Nick March says — perhaps prematurely — that the trilateral talks between Egypt, Ethiopia, and Sudan mark “a new and positive phase of diplomacy” in the region that steps away from traditional alliances. Meanwhile, AFP highlights the importance of the dam for regular Ethiopians, who are banking on it to end a severe electricity shortage. “This is about the existence of our nation and, in my opinion, it will help us break free from the bondage of poverty,” one GERD worker tells the newswire.

Scottish tycoon vanishes off Egyptian coast: A 67-year-old Scottish businessman who embarked on a 5k mile sailing trip has been pronounced missing after his yacht was found washed up on a Red Sea reef.The story has been picked up across the UK media: BBC | Sky News | Telegraph | Times | Daily Mail | Sun | Scotsman.

Controversial pop song continue to make headlines: The Egyptian pop song Salmonella is still grabbing the media’s attention, with debates raging on whether the song is a sarcastic take down of male chauvinism or a boon to harassers, Menna Farouk writes for Reuters.

Cairo is getting some love from Bloomberg’s Where to Go in 2020 podcast, mainly thanks to this year’s opening of the Grand Egyptian Museum (GEM) (runtime: 29:48, with the discussion on Egypt running from approximately 06:00 to 08:00). Not only will GEM serve as an “extraordinary new showcase for Egypt’s treasures,” the podcast says, but Cairo’s new hotels and a generally revamped experience will offer visitors comfort alongside their culture fix.

Worth Watching

Businesses need to adapt to the concerns of the “woke” generation: Capitalism needs to be reset in 2020 to start delivering on the needs and expectations of younger generations who will soon be the customers of businesses, the Financial Times says in this short video (watch, runtime: 04:45). Environmental and social concerns have changed and industries need to start becoming good stewards of the environment if they are to remain competitive among the younger demographic. This means that no-meat diets, renewable energy, and green bonds are likely to be the way forward for corporates trying to win over a generation more concerned with purpose and promises than ever before.

Diplomacy + Foreign Trade

El Sisi talks Belt and Road with Chinese FM: President Abdel Fattah El Sisi yesterday held economic talks with Chinese Foreign Minister Wang Yi on the first day of his diplomatic visit to Egypt, according to an Ittihadiya statement. The two sides discussed China’s Belt and Road Initiative and its integration with the Egyptian development efforts. El Sisi and Yi also talked about ongoing security issues in the region, particularly in the Gulf and Libya.

Egypt’s cotton exports dropped 17% y-o-y during the first three months of this season, Cotton Exporters Association head Azza Rashwan tells Masrawy. Rashwan expects export volumes will continue to decrease during the current season on the back of lower areas planted and a decline in productivity per feddan Last season saw the land used for cotton cultivation shrink by 36.8% due to poor weather conditions and low selling prices. The export season in Egypt starts in September 2019 and ends in August 2020.

Egypt’s exports of fresh oranges are expected to dip to 1.7 mn metric tonnes (MT) in marketing year (MY) 2019-2020, down from 1.5 mn MT in MY 2018-2019, according to a report by the US Department of Agriculture’s Cairo office (pdf). The report says that exports will be hit as weather conditions cause production to fall by 20% to 3 mn MT this year from 3.6 mn in 2018-2019. Russia, Saudi Arabia, China, and the Netherlands will likely remain the top importers of Egyptian oranges this year, the report says.

Energy

China’s Gezhouba signs USD 287.5 mn contract to build solar plants in Egypt

Chinese state-owned construction and engineering company China Gezhouba has secured a USD 287.5 mn contract to build an undisclosed number of solar plants across Egypt with a combined capacity of 500 MW, according to Renewables Now. The agreement is for a period of three years.

Electricity Ministry to issue tender for 200 MW solar plant in February

The Electricity Ministry is preparing to issue a tender in February for a USD 210 mn, 200 MW solar plant, according to Al Mal. Technical and financial offers will be due within three months of the tender being issued. The plant will be implemented under a build-own-operate framework.

Infrastructure

Egytech Cables consortium signs EGP 1.2 bn contract to upgrade Cairo control center

A consortium led by Elsewedy Electric subsidiary Egytech Cables has signed a EGP 1.2 bn contract with the Egyptian Electricity Transmission Company to upgrade the Cairo Regional Control Center on a turnkey basis, according to a statement (pdf). The consortium also includes NARI Group Corporation, Huawei International, and Huawei Technologies Egypt. Egytech will provide EGP 583.7 mn of the costs, with the project set to be implemented over a 20-month period.

Basic Materials + Commodities

Shalateen Mining, Z-Gold Resources partner up to extract gold from three Eastern Desert concessions

Shalateen Mining and Z-Gold Resources will join forces to search for gold in three Eastern Desert concessions after the two firms signed a partnership agreement, according to Al Mal. Shalateen will control a 53% stake in the Al Sadd, Al Fawakhir, and Atallah concessions while Z-Gold will hold the remaining 47%. Z-Gold is co-owned by Egyptian Zaher Mining Group and Canadian exploration company Nuinsco Resources Ltd. The Canadian company is close to finalizing studies for the Al Sadd and Al Fawakhir areas, while the study on the Atallah area is pending unspecified procedures.

Health + Education

Al Ahly Medical to open EGP 100 mn hospital in Mokattam

National Bank of Egypt-owned Al Ahly Medical Services plans to open a EGP 100 mn hospital in Mokattam in the coming period, NBE Vice President and Al Ahly Non-Executive Chairman Yahya Aboul Fotouh told Al Mal.

Telecoms + ICT

NACCUD, Orange Egypt sign contract to establish new capital data center

The New Administrative Capital for Urban Development Company signed a USD 135 mn contract with Orange Egypt to establish, operate and manage the data center at the new administrative capital, according to Al Masry Al Youm. The data center aims to make the capital a smart city that uses smart technology to provide a range of services, including internet of things (IoT) solutions, artificial intelligence platforms, cloud computing, and triple play.

Automotive + Transportation

Egypt scraps customs on Turkish cars

The Egyptian Customs Authority has begun applying the 0% customs rate on imported Turkish cars as stipulated in the Egypt-Turkey Free Trade Agreement, according to a brochure seen by the local press. Turkish exporters, which previously paid a 10% customs rate, will still pay VAT and development fees. Low customs rates for foreign car manufacturers have been controversial among local auto companies, which have complained that they are unable to compete with the imported European vehicles.

Egypt to introduce new tariff structure for charging EVs by the end of 2020

The government is planning to introduce before the end of the year a tariff structure for charging electric vehicles, government sources told the local press. Companies that rent out spaces to dock chargers at gas stations are currently charged EGP 1.4-1.45 per kWh, the same rate applied to households that consume over 1000 kWh per month. We noted last year that the House Energy Committee is drafting a law to regulate EVs in Egypt. The bill would, among other things, provide a framework for the creation of networks of charging docks. The current status of the bill remains unclear.

Suez Canal Authority to raise toll prices for dry bulk, LPG carriers from April 2020

The Suez Canal Authority (SCA) will increase the toll prices of dry bulk carriers and liquefied petroleum gas (LPG) carriers by 5% starting April 2020, while transit tolls for other types of carriers will remain the same, according to the SCA website.

Banking + Finance

Palm Hills negotiates EGP 500 mn loan to refinance debts

Palm Hills Developments (PHD) is negotiating with Ahli United Bank to obtain a loan of EGP 500 mn in order to refinance existing debts from other local banks, a source familiar with the matter told Al Mal. PHD had also signed a EGP 1.1 bn medium-term loan agreement with CIB last month to restructure its debts.

Other Business News of Note

Egypt’s Raya Holding sets up parent company for NBFS businesses

Raya Holding has set up a new parent company for its three non-banking financial service businesses, the company said in an EGX filing (pdf). The new company, Aman Holding, has EGP 375 mn in capital and holds 99% stakes in Aman for Financial Services and Aman for E-Payments, and a 74.5% stake in Aman for Microfinance.

Egypt Politics + Economics

Prosecutors release nine suspects arrested for Mansoura harassment

Dakahlia prosecutors released nine suspects allegedly involved in a mass [redacted] harassment case in Mansoura against two young women on New Year’s Eve, Al Masry Al Youm reported. The victims were unable to identify the suspects in the police lineup, but were reportedly seen in video of the incident. Videos of the assault went viral on the internet, provoking fury among women’s rights activists. Authorities had arrested 16 suspects in total, several of whom reportedly confessed to harassing the girls after they were shown the footage.

Sports

Egypt wins two awards in CAF ceremony hosted in Hurghada

Egypt earned the Best Football Federation in Africa award in the 2019 CAF Awards ceremony, which was held in Hurghada on Tuesday. Mo Salah was one of three who went home with an award for the best attacker, but fell short of being crowned the best male player in Africa for a third consecutive year, with Liverpool teammate Sadio Mane taking home the trophy. Nigeria’s Asisat Oshoala was named the best female player in Africa. You can see the full list of awards here.

Egyptian women’s volleyball team beats Nigeria in 2020 Olympic qualifier

The Egyptian women’s volleyball team beat Nigeria 3-0 in the second match of the 2020 Tokyo Olympic Games qualifiers, Nigerian media reported. The qualifiers are running from Sunday to Thursday in Yaoundé, Cameroon.

My Morning Routine

*** My Morning Routine is on hiatus and returns next week.

The Market Yesterday

EGP / USD CBE market average: Buy 16.00 | Sell 16.10

EGP / USD at CIB: Buy 15.99 | Sell 16.09

EGP / USD at NBE: Buy 15.98 | Sell 16.08

EGX30 (Wednesday): 13,542 (+2.5%)

Turnover: EGP 785 mn (15% above the 90-day average)

EGX 30 year-to-date: -3%

THE MARKET ON WEDNESDAY: The EGX30 ended Wednesday’s session up 2.5%. CIB, the index’s heaviest constituent, ended up 2.5%. EGX30’s top performing constituents were Egyptian Resorts up 7.8%, Emaar Misr up 7.1%, and SODIC up 5.4%. The market turnover was EGP 785 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -14.6 mn

Regional: Net long | EGP +1.9 mn

Domestic: Net long | EGP +12.7 mn

Retail: 46.3% of total trades | 42.3% of buyers | 50.4% of sellers

Institutions: 53.7% of total trades | 57.7% of buyers | 49.6% of sellers

WTI: USD 60.12 (-4.1%)

Brent: USD 65.91 (-3.5%)

Natural Gas (Nymex, futures prices) USD 2.15 MMBtu, (-0.6%, February 2020 contract)

Gold: USD 1,557.70 / troy ounce (-1.1%)

TASI: 8,124 (-0.9%) (YTD: -3.2%)

ADX: 5,019 (-0.7%) (YTD: -1.1%)

DFM: 2,713 (-1.2%) (YTD: -1.9%)

KSE Premier Market: 6,799 (-0.1%)

QE: 10,337 (+3.2%) (YTD: -0.9%)

MSM: 3,944 (-0.1%) (YTD: -0.9%)

BB: 1,585 (-0.4%) (YTD: -1.5%)

Calendar

January 2020: 1,000 artifacts to be displayed when Hurghada Museum opens.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Thursday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

9-10 January 2020 (Thursday-Friday): Egypt, Ethiopia and Sudan will hold talks in Addis Ababa on GERD.

11 January 2020 (Saturday): Postponed court session for the case filed by the Emirati Aditya Group, which owns the Egyptian Company for International Touristic Projects, against the Financial Supervision Authority.

13 January 2020 (Monday): Egypt, Sudan, and Ethiopia move to Washington, DC, for a fourth (and final?) round of negotiations on GERD.

15 January 2020 (Wednesday): The Grievance Committee of the Financial Regulatory Authority will look into minority shareholder's complaints over Adeptio AD Investments' mandatory tender offer (MTO) for Americana Egypt.

16 January 2020 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

3-5 February 2020: The Arab-African International Forum, Jeddah, Saudi Arabia

4 February (Tuesday): Court hearing for PTT Energy Resources’ USD 1 bn lawsuit against Egyptian government

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

9-10 February 2020 (Sunday-Monday): The the 33rd ordinary African Union (AU) Summit where Egypt will hand over the African Union presidency to South Africa

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

23 February 2020 (Sunday): Court session for Arabia Investments Holdings’ lawsuit against Peugeot. It was previously postponed to 24 November 2019 and then to 5 January 2020, and now 23 February.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

12 April 2020 (Sunday): Easter Sunday

20 April 2020 (Monday): Sham El Nessim, national holiday.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

25 April 2020 (Saturday): Sinai Liberation Day, national holiday.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

17-20 June 2020 (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

6 October 2020 (Tuesday): Armed Forces Day, national holiday.

29 October 2020 (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.