- Breaking down how the newly-established pension fund will work. (Speed Round)

- Cabinet passes legislative amendments to restrict legal action against the SWF. (Speed Round)

- Egypt ties for the top spot in the list of emerging or “off-the-beaten-path” destinations for 2020. (Speed Round)

- Azimut to launch USD 10 mn Egypt-focused equity fund in February. (Speed Round)

- CBE steps in to speed up resolution of legal disputes between state-owned banks and manufacturers. (Speed Round)

- Looking into the crystal ball for Egypt and emerging markets in 2020. (What We’re Tracking Today)

- El Sisi galvanizes support on Libya from Trump, Putin, Conte. (Speed Round)

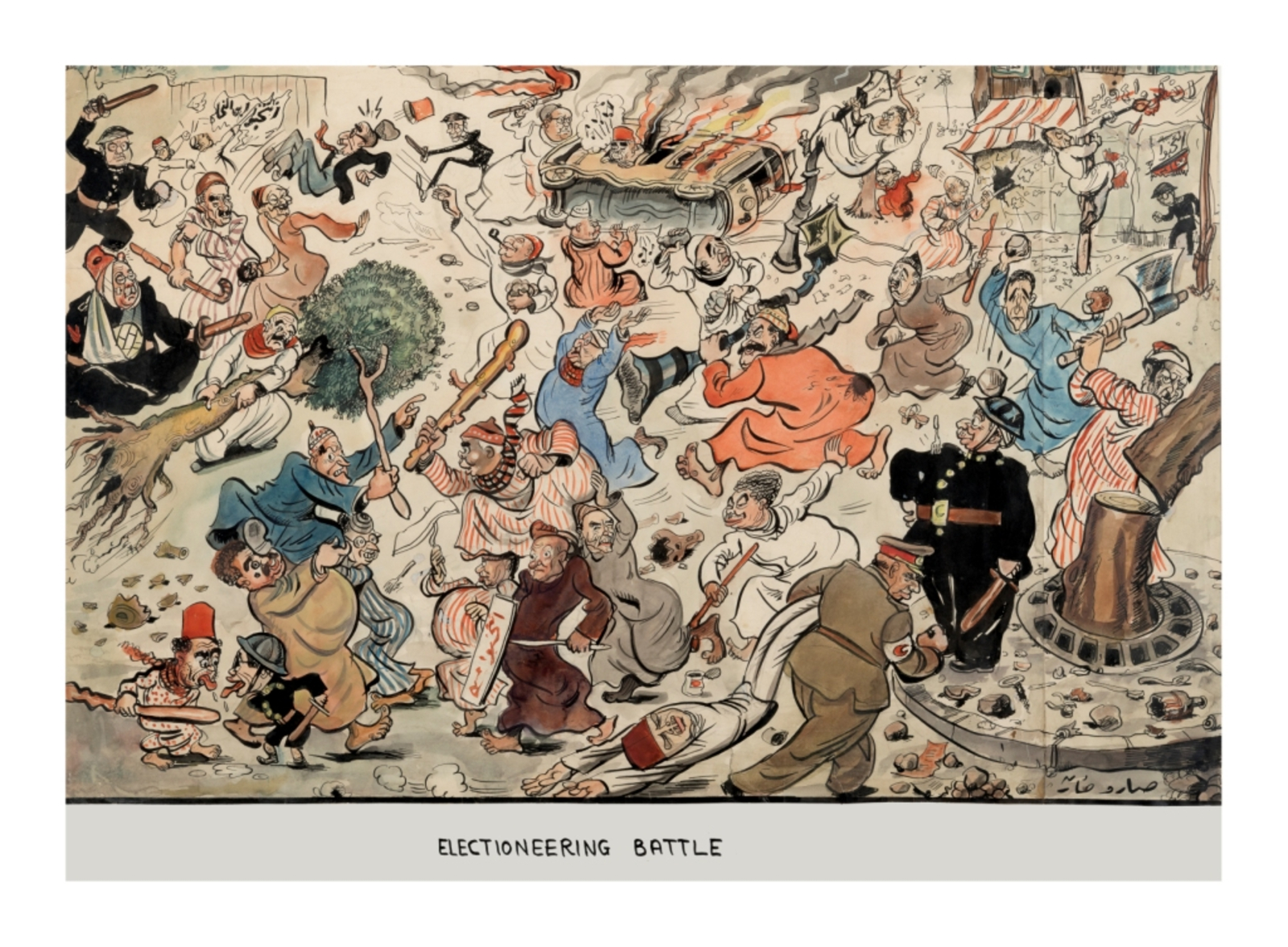

- Egyptian cartoonists of the past century brought together in Ubuntu Art Gallery exhibition. (Image of the Day)

- The Market Yesterday

Sunday, 29 December 2019

What everyone is paying into the new pension fund — and when

TL;DR

What We’re Tracking Today

Fuel price decision this week -gov’t sources: The government committee in charge of setting fuel prices under the new pricing mechanism is reportedly due to meet this week for its quarterly review, a government source said, according to Al Shorouk. Rumor has it that prices could remain unchanged at the meeting as Brent futures, which hovered above the USD 60 / bbl mark for the better part of 4Q2019, have largely been in line with government expectations. The new pricing mechanism, which allows local fuel prices to fluctuate ±10% in tandem with global prices, took hold earlier this year.

There’s nothing to report on the interest rate front after the Central Bank of Egypt postponed to 16 January the meeting of the Monetary Policy Committee originally scheduled for Thursday, as we reported last week. Seven of the 10 economists we surveyed before the meeting was post expected the rates to be left on hold.

We expect to hear as early as this week about the roles and responsibilities of the reconstituted Ministry of Information.

Egypt set to reopen restored Alexandria synagogue in January: The restoration works for the 168-year-old Eliyahu Hanavi synagogue in Alexandria have been completed, and the temple will officially open its doors in January 2020, the Tourism and Antiquities Ministry said in a statement. Egypt had earmarked USD 22 mn to restore the synagogue and has since been in talks with representatives of Egypt’s Jewish community to re-open it.

Wednesday is New Year’s Day. We hope you’re spending it with family and friends.

*** Tell us what you think will happen in 2020 and maybe we’ll send you an Enterprise mug and our very own coffee, sourced from our friends at 30 North. Every year we ask you, our readers, to weigh in on what you expect for the year ahead: Are you investing? Do you plan to hire new staff in 2020? How do you think the EGP will perform? What’s your take on interest rates? Tell us, and we’ll share the results with the entire community in early January to help you shape your view of the year. The survey is quick, we promise.

Israeli Prime Minister Benjamin Netanyahu has been re-elected as the leader of Likud, beating former cabinet minister, Gideon Saar, according to Bloomberg. Final results from Thursday’s vote showed Netanyahu re-elected with 72.5% of the votes against Saar’s 27.5%, and the PM will lead the party into Israel’s third election in less than a year on 2 March, which is predicted to also end in a stalemate.

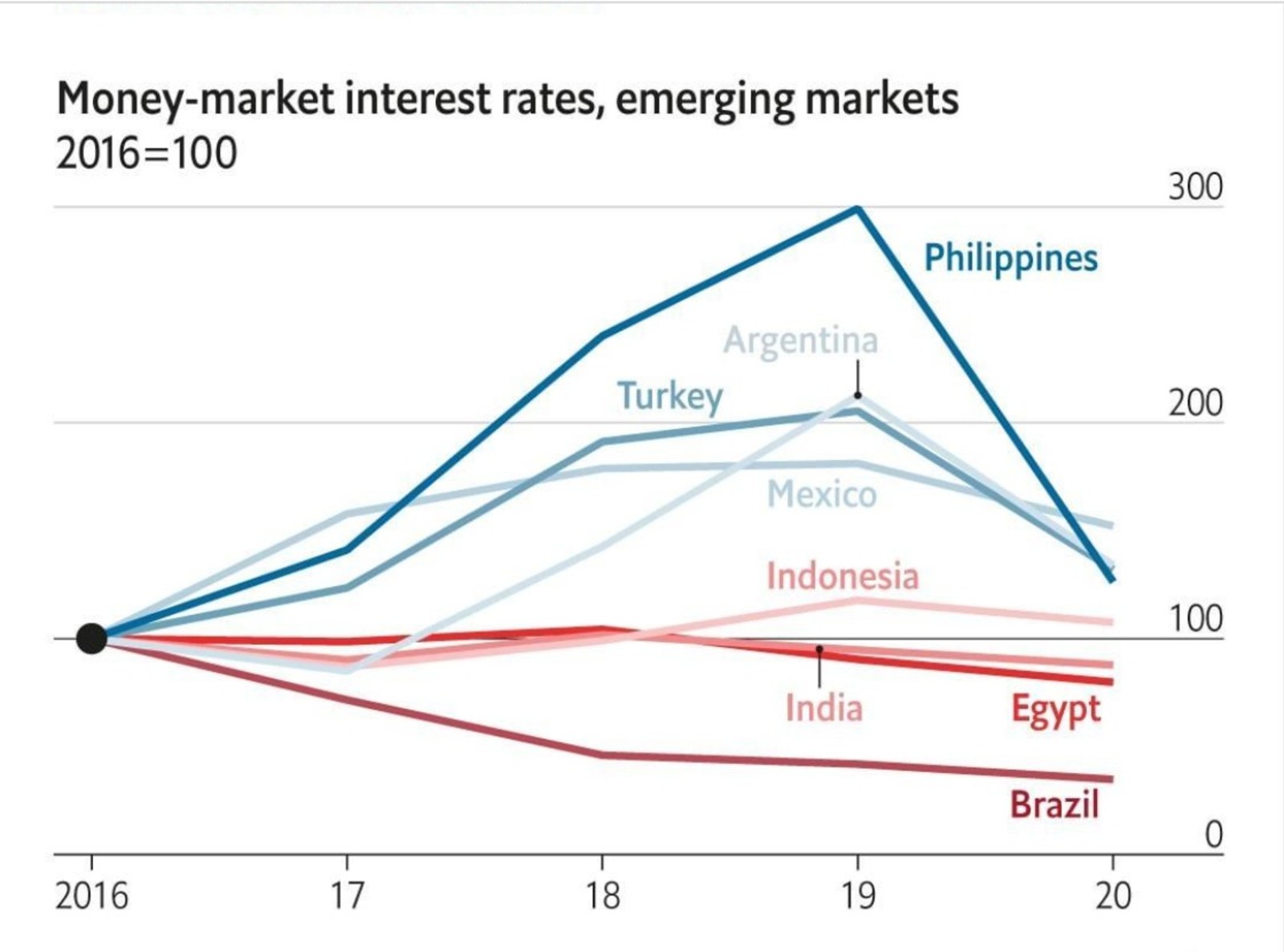

What can emerging market investors expect from 2020? It’s still not clear whether the year will bring a global recession, but EM currencies seem to be well positioned if it does, writes Henry Curr in the Economist. The world teeters on the brink of an unusual trade-war recession from the continued US-China dispute, which in 2019 caused a reduction in business confidence, global manufacturing, investment, and interest rates, he argues. While this means that all economies will need stimulus, the only central banks that will really be able to provide it are those in emerging markets, thanks to their higher interest rates and the positive impact of looser Fed policy on EM currencies.

Egypt, meanwhile, is one of several countries where EM investors should seek returns if they want to capitalize on potentially favorable conditions for EMs while avoiding the negative impact of political and economic difficulty in countries with big index weights, such as Mexico, Brazil, and Russia, the Financial Times says. Social instability in individual countries could still blight a generally positive macro environment for EM risk. So too could the health of the US economy, which some analysts argue has been held back by an overly aggressive Fed raising interest rates more than it should have, with negative consequences for EMs in particular and global growth in general.

In another potential boon for Egypt, we are likely to lead MENA bond sales next year, along with Saudi Arabia, Oman, and Bahrain, as plummeting oil prices and supplies that outpace demand keep upping the pressure to borrow, Bloomberg reports.

But investors in MENA economies will see plenty of risks in 2020 too: Potentially unpopular economic reform programs bring the continued risk of protests in several countries that have struggled with instability, including Egypt, Iraq, Lebanon, Algeria, Iran and Sudan, a director at Fitch Ratings says. And while a thawing in the rift between Qatar and Egypt, Saudi Arabia, the UAE and Bahrain would be a powerful boost for regional investment, Bloomberg argues, such a rapprochement still seems far from certain. Lebanon’s currency crisis could lead to a default on its bond repayments, and the bns of USD expected to flow into Kuwait when it is added to the MSCI EM index in June 2020 could prove a mixed blessing. Meanwhile, investor concerns over disruption risks following September’s drone and missile strikes on Saudi Aramco’s facilities continue to dog the company, despite its shares having risen 10% since its USD 25.6 bn IPO.

Take a step into our phenomenal world & celebrate 2020 with The Lemon Tree & Co. at Somabay. Family & Friends Reunion IV, Music Festival is happening on the 29th & 30th of December and the celebration extends to NYE, December 31st where GALERIE presents a full night of elegance, admiration & laughter. For reservations: http://nye2020tlt.com/

Take a step into our phenomenal world & celebrate 2020 with The Lemon Tree & Co. at Somabay. Family & Friends Reunion IV, Music Festival is happening on the 29th & 30th of December and the celebration extends to NYE, December 31st where GALERIE presents a full night of elegance, admiration & laughter. For reservations: http://nye2020tlt.com/

For better or worse, market sentiment in the US going into 2020 on a high note, as indications that an interim trade agreement with China is on track to be signed next month caused the country’s three major US stock indices to reach new records, the Financial Times reports. The Nasdaq rose 0.8%, while the S&P 500 climbed 0.5% and the Dow Jones Industrial Average gained 0.4%, pushing all three indices past their previous record highs. Decreased unemployment, signs of a rise in oil prices, and a rally in gold has fueled the buoyant mood on Wall Street, the salmon-colored paper says.

The trade agreement is just one area in which The Donald has embraced more populist policy approaches, traditionally more in line with US Democrats than Republicans, in 2019, the Washington Post argues. Whether or not these policies — which include a rehaul of a trade agreement with Mexico and Canada, pushing the Fed to cut interest rates, and an expansion of government spending — are being implemented in the interests of working people is unclear. But they represent a striking break with core Republican policy.

With New Year’s just around the corner on Wednesday, we’re getting antsy about 2020 and the new decade. Among the stuff we’ve been reading on that front:

- What will the world look like in 2030? (New York Times)

- The shape of things to come: What the 1920s can teach us about the 2020s (Globe & Mail)

- The decade tech lost its way (New York Times)

Making It, our first podcast series, is on hiatus until January 9, which gives you the perfect chance to catch up on season one: Previous guests on our show about how to build a great business right here in Egypt have included:

- Jalal Abugazaleh, founder of Gourmet Egypt

- Karim El Sahy and Abeer El Sisi from high-profile AI startup Elves

- Karim Awad, group CEO of EFG Hermes

- Fatma Ghali, Managing Director of Azza Fahmy

- Hazem Moussa, co-founder and CEO of Sarwa Capital

The episodes are available on our website | Apple Podcast | Google Podcast.

Enterprise+: Last Night’s Talk Shows

We’re still taking a break from our TV sets and will bring back our daily roundup of last night’s talk shows next month.

Speed Round

Speed Round is presented in association with

LEGISLATION WATCH- Breaking down how the newly-established pension fund will work: The body that administers the state pension fund issued a circular on Thursday detailing how the pension fund established under the Social Security and Pensions Act will operate, Masrawy reports. The circular outlines the criteria for employees covered by the act, which as far as we can tell, is everyone in the public and private sectors, including temporary and seasonal workers.

How much is everyone paying? The act, which was ratified by President Abdel Fattah El Sisi in August, will see a share of public and private sector workers’ salaries going towards the fund. This includes 21% of employee salaries (with employers required to contribute 12% and employees the remaining 9%), which will cover the pension pay-out for old age, disability, and death. This percentage will increase 1% once every seven years system-wide until it hits 26%. Additional items covered by the pension fund (including health and unemployment benefits) will also be added to bring the total amount deducted from employees’ monthly salaries to 28.25% for government workers and 29.75% for private sector workers. Salaries will be calculated as the total of employees’ base salaries and all other forms of compensation, including bonus comp. Public sector workers often have a low base salary that is then complemented by a laundry list of perks, allowances, and special payouts.

Minimum and maximum pay-ins: According to the circular, the minimum pay-in as of January 2020 has been set at EGP 12k per annum (at a rate of EGP 1,000 per month), with a ceiling set at EGP 84k per year (i.e. EGP 7,000 per month). The minimum and maximum rates will be hiked 15% at the beginning of each year for seven years, after which they will be adjusted according to inflation rates.

The law will also set up a bonus system that will take 2% of the monthly pay-ins (with employers and employees each contributing 1% of the monthly payment) and invest the sum on behalf of workers. It remains unclear whether the bonus system is mandatory, and whether the amount is automatically deducted from the base pay-in or if those who elect to subscribe to the bonus system will be required to contribute a higher percentage of their salaries.

When does it go into effect? This latest amendment to the SI scheme goes into effect on 1 January 2020.

CABINET WATCH- Cabinet passes amendments to restrict legal action against Egypt’s SWF: The Madbouly Cabinet greenlit on Thursday legislative amendments that would limit the scope of legal action that can be taken against the Sovereign Fund of Egypt (SFE), according to a statement out following cabinet’s weekly meeting. The changes would, if passed, shield contracts the fund has signed from third-party legal challenge. The fund cannot be challenged in a legal context for “any measures” it had undertaken “to achieve its goals.” The only exception allowed is in the case that the fund or the party that has signed a contract with the fund is implicated in criminal wrongdoing related to the contract. Presidential decrees to transfer public assets to the fund can also only be appealed by the entity which directly owns those assets or by the fund’s management team. The fund’s goals were broadly specified in a 2018 law as “contributing to sustainable economic development [in Egypt].”

Why is this necessary? Think for a moment about what certain grandstanding members of the bar have done with the power to file third-party lawsuits.

SFE now legally entitled to manage state assets, closing legal loophole: The wording of an article of the SFE law was changed to give the fund the legal right to manage state-owned assets. The article describing the fund’s activities now states that among its responsibilities is to “manage assets and holdings of state-owned entities and bodies, or [state-]affiliated bodies and companies” when called for. Also, the fund’s official name is now “the Egyptian sovereign wealth fund for investment and development.”

SFE-affiliated companies will also be receiving VAT refunds: Another amendment to the SFE law will provide value-added tax (VAT) refunds to any company that is more than 50% owned by the SWF and its sub-funds. The fund is already exempt from all types of taxes and other fees under the unamended law, but not its sub-funds and companies in which it holds stakes.

Draft clinical research law also approved: The council of ministers also gave a thumbs up to a draft law to regulate clinical research and protect human subjects. The House of Representatives had initially signed off on the law in May of last year, but President Abdel Fattah El Sisi refused to ratify the bill, citing a number of concerns. House Speaker Ali Abdel Aal then ordered the establishment of a sub-committee to review the law and address El Sisi’s concerns, including provisions that set harsh penalties for the transfer of human research samples outside of Egypt without government approval, which the president said could be problematic for future scientific exchange with other countries.

A handful of recent grants and funding agreements were ratified during Thursday’s meeting, which was the first since last week’s cabinet shakeup. The agreements include:

- A EUR 1.02 bn funding package arranged by the Hungarian Export-Import Bank and Russia’s State Specialized Russian Export-Import Bank for Egypt’s purchase of 1,300 railcars from Russia’s Transmashholding;

- A KWD 25 mn (c. USD 82.4 mn) facility from the Kuwait Fund for Arab Economic Development (KFAED) to fund the construction of a road that connects the tunnel running under the Suez Canal with Sharm El Sheikh; and

- A CNY 300 mn (c. USD 42.9 mn) grant agreement signed with China on 23 November for unspecified projects.

GAFI boss joins cabinet economic group: Prime Minister Moustafa Madbouly has restructured the cabinet economic group to give the head of the General Authority for Investments (GAFI) a seat at the table. The group, which is led by the prime minister, is now comprised of the central bank governor, the ministers of planning and economic development, finance, trade and industry, and public enterprises, alongside the head of GAFI. Prior to the restructuring, the GAFI head would attend meetings on a “by-invitation” basis.

Reminder: GAFI boss now acts as de-facto investment minister: The move came after the prime minister delegated to the head of GAFI several of the responsibilities of the now-displaced investment minister. He or she will be accountable for several articles of the investment and company acts which refer to the ‘minister in charge of investment affairs.’ Among the GAFI head’s new responsibilities are approving public bond and share offerings by companies and approving the appointment of board members in companies that manage public utilities, as well as extending the period during which new projects are eligible for incentives. The GAFI boss will not, however, be able to sign off on issuing regulations or amendments to regulations concerning both laws, among other restrictions. GAFI is currently led by interim head Mohamed Abdel Wahab, who took on the role after his former boss, Mohamed Adel, ended a one-year term at the helm of the authority.

On a related note, Madbouly has dissolved the two ministerial committees that were each responsible for settling and resolving investor disputes in the Investment Ministry era. Two new ones, one led by the prime minister and another by the justice minister, were set up by new decrees, according to a separate statement.

Egypt’s travel industry is expected to get a nudge in 2020: Egypt is increasingly being noted internationally as a top destination for travel for 2020, which should bode well for the already resurgent industry. Egypt has tied for the top spot in the list of emerging or “off-the-beaten-path” destinations for 2020, according to the results of annual travel trends survey released by the United States Tour Operators Associations (USTOA). Egypt, Croatia, and Colombia tied as the top destinations in the list. “Egypt topping the list is the epitome of a destination comeback story,” said Terry Dale, president and CEO for USTOA. “It reinforces a strong return in popularity and demand among travelers, after several challenging years.” Of those expected to arrive in Egypt, 60% are baby boomers at 51 years of age and older while the next largest age group is 35 to 50 years old, representing 20% of tourists.

The Grand Egyptian Museum (GEM) has got us onto the Insider’s travel list: Meanwhile, the Insider’s list of “12 places you should visit in 2020” mentions the USD 1.1 bn Grand Egyptian Museum (GEM) set to open next year. GEM will be the second largest museum in the world and the largest museum dedicated to a single civilization.

Forecasts predict Sharm El Sheikh tourism to increase by 20%: Tourism inflow to Sharm El Sheikh is expected to increase 20% y-o-y in 2020, South Sinai Governor Khaled Fouda told Sputnik. He attributed the projected increase to the UK's decision to lift its ban on flights to Sharm El Sheikh. Fouda added that he hopes Russia follows suit and allow charter flights to SInai, after it suspended them following the 2015 Metrojet crash.

To the UK press, it’s damned if you do, damned if you don’t: While Sharm El Sheikh’s security has improved (and the growing security infrastructure has been providing employment), some measures are “redundant,” writes the Independent’s travel correspondent Simon Calder. He suggests that these might put off travelers and recommends adopting some of the measures incorporated by Israel for ts airports.

Tourism upward trajectory continues: Tourism revenues rose to USD 4.194 bn in 1Q2019-2020 from USD 3.931 bn in 1Q2018-2019, according to the CBE’s balance of payments report out last week. This marks a “significant” increase that could make 2020 “another record year” if revenues remain on an upwards trajectory, Naeem Brokerage’s Allen Sandeep said last week.

Trade Ministry finalizes method to calculate local content’s added value under larger automotive strategy: Trade Ministry officials have finalized a new method to calculate the percentage of local content under a planned automotive industry strategy to encourage car manufacturers, Al Mal reported, citing an unnamed official. The proposed method should be handed over to Trade Minister Nevine Gamea for approval soon, the official said. This calculation appears to be part of the in-the-works package of incentives that would provide manufacturers customs breaks based on a threshold of local components they’ll have to meet. The incentives, we were told earlier this year, would link custom discounts afforded to manufacturers to a sliding scale based on how much local content they use.

What exactly is this new method? According to the official, the method will give more weight to the ‘value added rule’ when calculating the minimum percentage of local inputs. The source was otherwise short on details, but this appears to mean the strategy will consider the cost that went into the local components used when deciding whether a car qualifies to be considered locally-made.

When should we expect to see the strategy being implemented? The calculation method was due to be handed over for ministerial approval early last week, but had to be postponed until newly-sworn in Gamea was brought up to speed on other agenda items, the official said. This approval would serve as a starting point for a larger plan to draft an automotive strategy that, as far as we know, may be similar to the scrapped automotive directive, but watered down to avoid drawing criticism from Egypt’s EU trade partners. Uplifting the automotive industry a matter of urgency as the sector has been hurt by the removal of tariffs on EU-imported cars, and by a plan to do the same on Turkish imports at the start of the year.

Azimut to launch USD 10 mn Egypt-focused equity fund in February: Italy-based asset manager Azimut will launch a fund to invest in Egyptian equities in February 2020, Managing Director Ahmed Aboul Saad told the local press. The USD 10 mn fund will be launched in Luxemburg and will focus on collecting funds from Egyptian expats to invest in the local market. Azimut previously said it would launch the fund this year. The company has also submitted a request to the Financial Regulatory Authority to access “new financial tools,” Aboul Saad said, without disclosing what these tools, saying only that they focus on attracting foreign investments. He noted that the FRA’s approval is still pending, and did not say when the approval is expected to come through.

M&A WATCH- Market regulator grants one-month extension to Titan Group on MTO deadline for Alexandria Cement: The Financial Regulatory Authority (FRA) extended by one month the deadline for Greek cement company Titan Group to present its mandatory tender offer (MTO) to acquire Alexandria Portland Cement, the FRA said in a statement. The new deadline is 26 January.

Background: Titan launched its MTO for 100% of Alexandria Portland Cement at EGP 6 per share, which made it an indirect majority owner through a related party and therefore triggered an MTO requirement. The FRA had ordered the Greek company last month to present an MTO, including a fair value assessment of Alexandria cement’s shares. Titan has yet to hire a financial advisor.

M&A WATCH- MM Group’s board of directors approved last week the acquisition of 50% of Tamweel Group’s automotive factoring arm, the company said in a statement to the EGX (pdf). The statement did not disclose the value of the transaction. MM Group had earlier said that it was planning to complete its acquisition of Tamweel by the end of last May in partnership with a group of unnamed investors.

Background: MM Group, which focuses primarily on the distribution of consumer electronics and automobiles, is diversifying into financial services and wants to add factoring, reinsurance and mortgage finance as core business activities. Last June, a consortium led by Ebtikar, which is majority-owned by MM Group through its microfinance arm Vitas Egypt, completed the acquisition of Orascom Development Holding’s (ODH) 87% stake in Tamweel Group.

CBE steps in to speed up resolution of legal disputes between state-owned banks and manufacturers: The Central Bank of Egypt is intervening to expedite solving the legal disputes between banks and manufacturers, and agreed with the Egyptian Federation of Investors Associations to form a specialized committee to resolve these disputes, according to Youm7. The National Bank of Egypt, Banque Misr, and Banque du Caire were directed to solve these issues as soon as possible and stop all legal procedures.

This is part of the CBE’s drive to prop up local industry: Thousands of factories have defaulted on facilities in the past few years for a range of reasons, from poor management, to funding, cost of production, and marketing problems. The government and the CBE had launched an initiative earlier this month to exempt nearly 5.2k factories from accrued interest payments and see their names removed from a blacklist maintained by the CBE. The total amount of overdue payments reached EGP 31 bn. The CBE also earmarked EGP 100 bn to boost domestic manufacturing by allowing medium-sized factories access to subsidized loans at a declining 10% interest rate.

The Supply Ministry has so far reinstated 2.6 mn citizens to the country’s subsidy rolls after accepting their appeals against being removed from the subsidy system, Masrawy reports, citing two unnamed sources. The Ministry had already returned 1.8 mn citizens to the rolls last October and the ministry is currently looking into the rest of the cases. Around 6 mn grievances have been filed since the ministry began accepting them, the sources added. As of August, Egypt had purged some 8 mn citizens from the subsidy rolls, with plans for another 400k to be removed by September.

The on-again-off-again Leviathan gas field should begin production on Tuesday: Israel’s Leviathan natural gas field should begin production on Tuesday after obtaining approval from the Israeli Environmental Protection Ministry, Reuters reports. Production of gas had been delayed from the field until the ministry assesses the field’s greenhouse gas emissions. The project’s leading company, Delek Drilling, said it has received the required approval and will begin gas production on 31 December.

Background: The field was due to go online on 24 December, but the ministry told field operators Noble Energy and Delek Drilling that it still needs further validation that the emissions analysis is accurate. The companies said they remained “ready and prepared” to kick off production. Egypt is due to start receiving Israeli gas under a landmark agreement signed by Alaa Arafa’s Dolphinus with Texas-based Noble Energy and Israel’s Delek Drilling in mid-January. News earlier this month that an Israeli court imposed a temporary injunction on the Leviathan field, which will produce most of the Egypt-bound natgas, threatened to delay the first shipments. The court injunction was lifted shortly thereafter.

El Sisi galvanizes support on Libya from Trump, Putin, Conte: President Abdel Fattah El Sisi held phone calls with US President Donald Trump, Russian President Vladimir Putin and Italian Prime Minister Giuseppe Conte to discuss the latest on the military cooperation agreements between Turkey and Libya’s Government of National Accord (GNA). Egypt backs the GNA’s rival, General Khalifa Haftar. El Sisi and Trump had said that “urgent steps” need to be taken to resolve the situation and that “foreign exploitation” in Libya is unacceptable, according to Reuters. Similarly, El Sisi agreed with Putin and Conte to work together to resolve the crisis and restore stability in Libya, while ending illegal foreign intervention in the country’s internal affairs.

The GNA’s request for Turkish troops may be met as early as next month, says Erdogan: Turkey will send troops to Libya as early as next month, Turkish President Tayyip Erdogan has said, following a formal request made last week by the GNA, according to Reuters. The call for military support from Turkey comes as the GNA struggles to fend off Haftar’s forces, which are closing in on Tripoli. One senior Turkish official has said that the country plans to send its navy to defend the capital, while its troops train and coordinate the forces of Libyan Prime Minister Fayez al-Sarraj.

Meanwhile, rebel groups fighting alongside Turkey in northern Syria are expected to be brought in to guard the GNA in Tripoli, Bloomberg reports.

El Sisi, Trump also discussed GERD: In their call on Thursday, El Sisi and Trump also discussed developments related to the Grand Ethiopian Renaissance Dam (GERD), with El Sisi reiterating his appreciation for the US support during the negotiations. Egypt and Ethiopia remain at an impasse when it comes to the timeline for filling the dam’s reservoirs, as we noted last week. Egypt has remained adamant that a minimum of 40 bcm of Nile water must flow into the country per annum, requiring Ethiopia to fill the dam’s reservoirs at a slower pace than it wants. The foreign ministers of Egypt, Ethiopia, and Sudan have agreed to finalize their negotiations by no later than mid-January, and scheduled three rounds of technical talks, the last of which wrapped up in Khartoum on Sunday. But with a solution still not been reached, a further meeting has been scheduled for 9-10 January in Addis Ababa, before the ministers are due to reconvene in Washington, DC, on 13 January.

_StoryTags_! Beltone, Investment Banking, Intro Group, CEO, Mohamed ElAkhdar

MOVES- Mohamed ElAkhdar returns to Beltone as head of investment banking platform: Mohamed ElAkhdar (LinkedIn) is going back to Beltone after a nine-month stint at conglomerate Intro Group. ElAkhdar will become CEO and managing director of Beltone Financial’s investment banking arm starting January, the local press reports, citing an unnamed source.

MOVES- Prime Holding has removed Rafeeq Fahd Al Tarzi (LinkedIn) from his position as CEO of the investment banking division, according to a disclosure to the EGX (pdf). Al Tarzi will retain a seat on the company’s board of directors as a non-executive member. The board hasn’t yet named a successor.

Image of the Day

Cartoonists of the past century brought together in Ubuntu’s group exhibition: Cairo-based Ubuntu Art Gallery has put on a humorous exhibition that features 220 cartoons by 78 Egyptian artists that tickled Egyptians’ funny bone over the past 100 years. The exhibition shows a variety of topics Egyptian cartoonists covered over the course of the past century and pays homage to those who used humor and art to portray social, economic, and political challenges facing the country. However, these caricaturists are struggling socially and financially. Samir Abdelghany, who curated the exhibit and is a cartoonist himself said, “all of the contemporary cartoonists in this exhibition agree on one thing: We are battling for survival,” according to Al-Monitor. You can see the gallery page with the caricatures displayed here.

Egypt in the News

Topping coverage on Egypt in the foreign press this morning: Two separate road accidents on a Port Said highway and Zaafarana that killed a total of 28 people, including Indian and Malaysian tourists, are bringing plenty of attention to the state of Egypt’s roads. (Associated Press | The National | AFP | Deutsche Presse Agentur | Arab News)

Egypt is racing against Ethiopia to export its surplus electricity within Africa: Egypt is ready to export 20% of its surplus electricity to African countries at half the average cost of electricity production and wants to start the process before Ethiopia can begin exporting electricity generated by the Grand Ethiopian Renaissance Dam (GERD) to neighboring countries, Al Monitor reports. This accords with the country’s strategic goals of serving as a regional energy hub and promoting economic integration in Africa.

But two challenges remain: the current lack of transmission lines with other African countries and the ongoing conflict with Ethiopia, whose dam risks exacerbating Egypt’s water shortages and whose own aspirations to generate and export electricity may threaten to derail Egypt’s.

Other headlines worth noting:

- Egyptian comedian arrested, allegedly over YouTube video: US-based Egyptian online comedian Shady Sorour was arrested upon his arrival in Cairo Airport last week because of a YouTube video in which he reportedly criticized President Abdel Fattah El Sisi, AP reports.

- Young Christians want to see the government enforce civil marriage laws to simplify processes such as marriages, adoptions, divorces, and inheritance settlements, which are currently protracted and complicated when they take place between people of different sects or religious groups, says UK Christian publication the Express.

- Egypt made USA Today’s “20 of the most dangerous countries for LGBT travelers” at number 20. Number one on the list is Nigeria, followed by Qatar; many other Arab states and African have also made the list.

- Egypt set a new Guinness World Record for the largest coffee cup mosaic, which uses 7,260 coffee cups to depict King Tutankhamun's famous gold mask, Xinhua reported.

Energy

Al Nowais in negotiations with Siemens Gamesa to build a 500 MW wind plant

UAE’s Al Nowais is in negotiations with Siemens Gamesa to set up 500 MW-worth of wind plants in Ras Ghareb, according to the local press. The two sides are looking into how many plants to build and the total cost of the project. Al Nowais hopes to reach an agreement with Siemens or another company to execute the construction works by 1H2020. Al Nowais had earlier this December signed an EGP 16 bn agreement to build the Ras Ghareb wind plant and another 200 MW solar plant in Aswan. The company is turning to renewable energy projects after the government had canceled its coal plant project last October.

Basic Materials + Commodities

Wheat cultivation areas in Egypt fall by 13% in 2019

Egypt cultivated 2.7 mn feddans of wheat at the end of the official season, dropping 13% y-o-y and falling short of the 3.5 mn feddans the Agriculture Ministry had set as a target for the year, the local press reported, citing unnamed sources from the ministry. “Unregulated” practices in agriculture and climate change have taken their toll on agriculture as a whole and affected wheat and most other crops, head of the General Syndicate of Egyptian Farmers Farid Wasil said.

Manufacturing

Military Production Ministry and France’s JAB sign a protocol to develop projects in Damietta’s Furniture City

The Military Production Ministry and France’s JAB Holding Company has signed a cooperation protocol that will see the two building, financing, and managing developmental projects in Damietta’s Furniture City, according to a cabinet statement. The size of the investment and the timeline of the projects have not been announced. The ministry aims to establish a furniture mall, two hotels and exhibitions, and design centers. The ministry also plans to facilitate international exhibitions in Damietta and in Europe as part of the furniture city’s development.

Law

Matouk Bassiouny opens new office in Algeria

Matouk Bassiouny has opened an office in Algeria in association with Algerian law firm SH-Avocats, it said in a statement (pdf). Part of the firm’s regional expansion efforts, the new outpost will join a team of 170 lawyers based in Egypt (Matouk Bassiouny & Hennawy), the UAE (Matouk Bassiouny & Ibrahim), and Sudan (Matouk Bassiouny in association with AIH Law Firm). The firm in Algeria is led by Houda Sahri, founding and managing partner of SH-Avocats, and Jean-Jérôme Khodara, partner with Matouk Bassiouny’s corporate / M&A practice group and head of Matouk Bassiouny’s Algeria practice.

On Your Way Out

Umm Kulthum hologram to perform at Dubai Opera: Umm Kulthum is still holding concerts and in January of this year, the Egyptian singer starred in the Arab world’s first hologram concert at Tantora Festival in Saudi Arabia's Al Ula, according to The National. This week, she’s coming to Dubai on Thursday, 26 December and Friday, 27 December at their opera and will be backed by a live orchestra. The Umm Kulthum hologram was created from scratch when Egyptian actress Sabreen was enlisted to recreate her stage movements which were then digitally rendered by technicials from the Arab World, China, and the US. Sabreen had previously starred as Umm Kulthum in the popular 1999 Ramadan television series named after the legendary singer.

The Market Yesterday

EGP / USD CBE market average: Buy 15.99 | Sell 16.09

EGP / USD at CIB: Buy 15.99 | Sell 16.09

EGP / USD at NBE: Buy 15.99 | Sell 16.09

EGX30 (Thursday): 13,885 (+1.0%)

Turnover: EGP 392 mn (44% below the 90-day average)

EGX 30 year-to-date: +6.51%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.1%. CIB, the index’s heaviest constituent, ended up 1.8%. EGX30’s top performing constituents were CIRA up 4.3%, Orascom Development Egypt up 3.8%, and Ibnsina Pharma up 2.1%. Thursday’s worst performing stocks were Telecom Egypt down 2.2%, EFG Hermes down 0.8% and Sidi Kerir Petrochemicals down 0.7%. The market turnover was EGP 392 mn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +51.6 mn

Regional: Net Short | EGP -0.6 mn

Domestic: Net Short | EGP -51.0 mn

Retail: 51.1% of total trades | 38.5% of buyers | 63.8% of sellers

Institutions: 48.9% of total trades | 61.5% of buyers | 36.2% of sellers

WTI: USD 61.72 (+0.06%)

Brent: USD 68.16 (+0.35%)

Natural Gas (Nymex, futures prices) USD 2.23 MMBtu (-2.36%, January 2020 contract)

Gold: USD 1,518.10 / troy ounce (+0.24%)

TASI: 8,353.14 (+0.12%) (YTD: +6.73%)

ADX: 5,050.49 (-1.03%) (YTD: +2.76%)

DFM: 2,764.88 (-0.30%) (YTD: +9.29%)

KSE Premier Market: 6,926.21 (-0.43%)

QE: 10,426.37 (-0.17%) (YTD: +1.24%)

MSM: 3,866.41 (-0.22%) (YTD: -10.58%)

BB: 1,604.00 (+0.06%) (YTD: +19.95%)

Calendar

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: Indian automotive delegation to visit Egypt.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 1,000 artifacts to be displayed when Hurghada Museum opens.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing.

7 January 2020 (Tuesday): Coptic Christmas, national holiday.

9-12 January 2020 (Thursday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

9-10 January 2020 (Thursday-Friday): Egypt, Ethiopia and Sudan will hold talks in Addis Ababa on GERD.

13 January 2020 (Monday): Egypt, Sudan, and Ethiopia move to Washington, DC, for a fourth (and final?) round of negotiations on GERD.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

3-5 February 2020: The Arab-African International Forum, Jeddah, Saudi Arabia

4 February (Tuesday): Court hearing for PTT Energy Resources’ USD 1 bn lawsuit against Egyptian government

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

17-20 June 2020 (Wednesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.