- House approves Tarek Amer's second term as CBE governor, but still nothing on that cabinet shuffle. (What We're Tracking Today)

- Rameda Pharma's retail offering was oversubscribed on its first day. (Speed Round)

- EGX to reclassify constituent industries, add new sectors. (Speed Round)

- FinMin issues new regs on dual taxation of yield on treasury bonds and bills. (Speed Round)

- Sarwa, Premium Int'l form JV to launch new consumer finance brand. (Speed Round)

- Can emerging markets still emerge? (The Macro Picture)

- The way investment analysis is being sourced and consumed is changing. (Worth Reading)

- Does last week’s M&A boom suggest the market has peaked? (What We’re Tracking Today)

- The Market Yesterday

Sunday, 1 December 2019

House approves Amer’s second term, but still no word on cabinet shuffle

TL;DR

What We’re Tracking Today

Would someone mind explaining where 2019 went? Or the past decade, for that matter? Happy December, everyone.

It’s official: Tarek Amer has been given a second and final four-year term as governor of the Central Bank of Egypt after the House of Representatives on Thursday voted in favor of President Abdel Fattah El Sisi’s decision to reappoint him, the local press reported. Bloomberg and Reuters also took note of the story.

But that cabinet shuffle? It may not happen before mid-month: The widely expected cabinet shuffle didn’t make it to the House on Thursday. The latest: Prime Minister Moustafa Madbouly is expected to finalize the list of changes by mid-week and ship it to parliament for approval when it reconvenes from recess on 8 December, sources with knowledge of the matter said, according to Masrawy. The shuffle could also be postponed until after the World Youth Forum, which wraps up on 17 December, the newspaper adds.

It’s a big week in foreign affairs:

Greek Foreign Minister Nikos Dendias is due in town today for talks with Sameh Shoukry over an agreement that Libya and Turkey signed to redraw their maritime borders, the Associated Press reports. The agreement has drawn sharp criticism from Egypt, Greece, and Cyprus. We have the full story in Diplomacy + Foreign Trade, below.

A new round of GERD talks is set to take place in Cairo tomorrow, led by irrigation ministers from Egypt, Sudan, and Ethiopia, according to Asharq Al-Awsat. The two-day gathering will be the second of four pre-arranged talks, with the next two rounds scheduled to take place in Washington on 9 December 2019 and 13 January 2020. The first round of the talks, which received US backing after a meeting in Washington last month, wrapped up in Addis Ababa a few weeks ago.

Meanwhile, bringing Egypt back into the Nile Basin Initiative (NBI) is at the “top of the to-do list” for Kenya during its one-year chairmanship of the initiative, according to Kenyan outlet the East African. Egypt had suspended its membership in the NBI in 2010 to protest plans by upstream countries to renegotiate a 1959 water-sharing agreement.

Egypt is attending the UN COP25 climate change conference, which begins in Madrid tomorrow and runs through 13 December, according to an Environment Ministry statement.

On the foreign trade front: China’s Dongfeng Motor Corp. is in town this week to discuss plans to manufacture electric cars in collaboration with state-owned El Nasr Automotive, according to the Public Enterprises Ministry (pdf). Meanwhile, the Egyptian Businessmen’s Association (EBA) is hosting on Monday a delegation of five Vietnamese agricultural importers and exporters, according to Youm7.

Stuff you can go to this week:

- The 2019 Payment and Digital Inclusion Forum and Exhibition gets underway at the International Exhibition Center tomorrow and runs until Wednesday.

- The annual RiseUp Summit opens its doors this Thursday, 5 December at the AUC campus in New Cairo. Tap or click here for the full agenda.

- The regional Pitch by the Pyramids competition takes place a week from today.

News triggers to keep your eye on in the coming days:

- The purchasing managers’ index for Egypt, Saudi Arabia and the UAE drops Tuesday, 3 December at 6:15am CLT.

- Foreign reserves figures for November will be released on Wednesday, 4 December.

- Inflation figures for November are out next Tuesday, 10 December.

Enjoy unforgettable experiences in our golf course that looks over the sea, the first of its kind in the Middle East. The award-winning Cascades Championship Golf Course is the first championship course in the Middle East, designed by international legend, Gary Player.

Enjoy unforgettable experiences in our golf course that looks over the sea, the first of its kind in the Middle East. The award-winning Cascades Championship Golf Course is the first championship course in the Middle East, designed by international legend, Gary Player.

Saudi Aramco is on course to break the record for the world’s largest IPO after bids last week reached USD 44.3 bn — around 1.7x the USD 25 bn targeted by the company. Local investors have accounted for almost 90% of all orders. The story is getting ink in the Financial Time and the Wall Street Journal.

Speaking of oil and gas: The US is now officially a net exporter of oil for the first time since the 1940s, exporting 89k more barrels of crude and refined petroleum than it imported in September, the FT says.

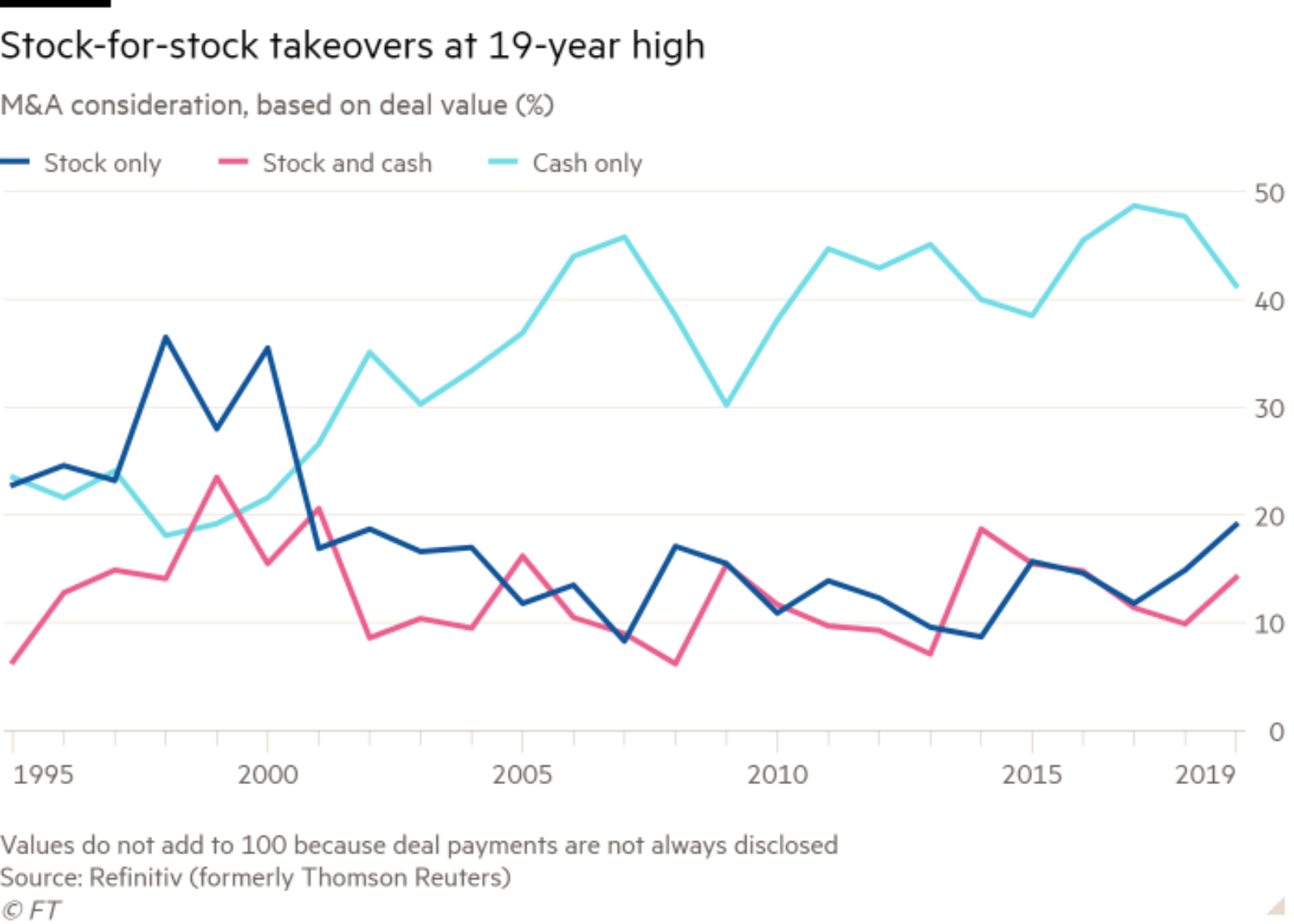

The blockbuster week for M&A is raising red flags — has the bull market peaked? The increase in stock-for-stock M&A and high company valuations is raising concern among analysts that the market is close to topping out, according to the Financial Times. Surges in M&A activity have in the past been followed by a market peak as companies look to buy growth (rather than develop organically) — and last week’s USD 70 bn buying spree could be no different, one analyst tells the salmon-colored paper. Another warns that equities look “toppy” and warns of high valuations and stalling earnings.

There is by no means a consensus: Other analysts point to the recent interest rate cuts by major central banks to suggest that the market has still got plenty of room to grow. Seen in that light, acquisitions “could fuel and lengthen any ongoing rally in the stock market.”

Wait … haven’t we heard this song before? Germany doesn’t want non-EU foreigners to take stakes in its tech companies, and a proposal could see Berlin use public funds to “temporarily” acquire stakes in select companies to prevent them falling into foreign hands, the Financial Times reports.

We’ve lost count of the number of death-by-climate change reports published this year. Greenhouse gas emissions surged to a record level last year, and global temperatures are also set to soar by over twice the agreed warming limit, according to a new UN report (pdf), which reveals the startling inadequacies of the world’s efforts thus far.

The good news: The Paris Agreement target of limiting global warming to 1.5°C is still achievable.

The bad news: The world needs to cut emissions by a massive 7.6% a year over the coming decade, which will require a “major transformation” of how we structure our economies and societies.

The message: The world needs to start getting its [redacted] together or you can kiss that Venetian getaway goodbye.

Not worried yet? The report is the backdrop to that Madrid conference Egypt is attending (above). The New York Times does an awfully good job putting it all in context.

It was a big weekend for regional news:

- Qatar’s foreign minister has made an unexpected appearance in Riyadh, raising speculation that the two countries may finally be nearing rapprochement after two-and-a-half years of simmering hostility, two sources told Reuters.

- Iraqi Prime Minister Abel Abdul Mahdi announced his resignation on Friday, a day after Iraqi security forces killed over 40 protesters amid continued anti-government demonstrations, the Associated Press reports.

- Lebanon bought itself some time in its worst financial crisis in decades after it successfully paid off a USD 1.5 bn eurobond due to mature on Thursday, but Beirut has ground to a halt amid a gas station strike.

PSA- Warm fall weather continues here in the nation’s capital, with daytime highs of 23°C forecast for Cairo over the next three days. You can expect overnight lows of 15°C, the Meteorological Authority (pdf) suggests.

The second episode of our new podcast Making It dropped Friday: In the latest episode, we talk to the brains behind Elves — Abeer El Sisi and Karim El Sahy — about the challenges of being a married couple while trying to build the best AI-based digital concierge service provider there is. Listen here on our website or try Apple Podcast or Google Podcast.

Enterprise+: Last Night’s Talk Shows

The government’s focus on youth inclusion and employment was the top theme on the airwaves: The talking heads were focused last night on the high number of young deputy governors sworn in last week’s shake-up as well as other government efforts to empower the youth. Both Al Hayah Al Youm’s Lobna Assal and Hona Al Asema’s Reham Ibrahim had lengthy segments on the topic.

What the talking heads are saying: Egypt is giving its youth a platform. Ibrahim spoke to Dakahlia’s new young deputy governor Haytham El Sheikh, who said the change-up is a dream come true for many young people and shows they are being entrusted with influential public administration roles (watch, runtime: 23:19). Assal, meanwhile, sat down with a small factory owner in one of the state-sponsored SMEs complexes that encourage youth-led businesses by eliminating red tape (watch, runtime: 19:40). Those complexes appeared following a 2014 presidential initiative to lend to SME entrepreneurs at a discounted rate.

El Hekaya’s Amr Adib took note of the second round of meetings between Egyptian, Sudanese, and Ethiopian irrigation ministers to hash out the technical issues of building the Grand Ethiopian Renaissance Dam scheduled to take place on Monday and Tuesday in Cairo (watch, runtime: 8:26). We have more on this in What We’re Tracking Today, above.

Gov’t to continue accepting appeals for reinclusion in subsidy rolls: The Supply Ministry has extended to 15 December its deadline to continue accepting appeals for reinstatement in the food subsidies program from those that had been removed earlier this year under the Great Subsidy Rolls Purge, Assal reports (watch, runtime: 12:40).

Egypt’s agricultural exports have hit 5.1 mn tonnes year-to-date, according to Agricultural Quarantine Authority figures cited by Ibrahim (watch, runtime: 7:21). Citrus fruits accounted for a large share of the total — followed by potatoes, onions, and grapes, reports Ahram Gate.

Egypt’s quality of road infrastructure has climbed 90 spots since 2014 in a global index cited by lecturer at the Arab Academy for Transportation, Maritime and Technology and roads and traffic consultant Emad Nabil in a phone-in with Assal (watch, runtime: 4:52). This has reflected on the rate of road accidents, which dropped 41% between 2017 and 2019, Nabil says.

Aswan wins UNESCO award for being one of the world’s top 10 “learning cities”: Aswan received on Friday the UNESCO Learning City Award for its sound practices in improving learning quality and its locals access to education, both Ibrahim (watch, runtime: 1:50) and Assal (watch, runtime: 1:53) reported.

Speed Round

Speed Round is presented in association with

IPO WATCH- Rameda Pharma retail offering oversubscribed on first day: The retail component of Rameda’s IPO was oversubscribed at the close of play on Thursday, market sources told the local press. Retail investors put in orders for 19.65 mn shares, handily covering the 18.83 mn shares offered by the pharma company. The subscription period for retail investors is scheduled to close on Wednesday.

Background: Rameda last week announced that it would offer a 49% stake (376,606,000 shares) at EGP 4.66 per share in an IPO on the EGX. The bulk of the shares (357,775,700) will be offered to institutional investors, with the remainder going to small investors. Greville Investing, the selling shareholder, will separately acquire 125 mn newly-issued shares via a closed subscription. Shares are expected to begin trading on 11 December under the ticker RMDA. You can learn more about Rameda in its intention to float (pdf). Rameda’s IPO will be the second on the EGX this year, after e-payments company Fawry floated in August.

Advisors: HSBC and Investec are joint global coordinators and bookrunners for the international offering, while CI Capital is joint bookrunner. Compass Capital is the IPO advisor, and Inktank is investor relations advisor.

EXCLUSIVE- EGX to reclassify constituent industries, add new sectors: The EGX is currently reviewing its classification system for the sectors of its constituent companies in a bid to both add new sectors and set a mechanism to better classify companies, a government official tells Enterprise. The bourse is looking to add new sectors in this review after determining investor interest in them and their importance to the economy, the source added without naming the sectors the bourse is looking to add. The review will be completed “soon,” we’re told.

Why does this matter? Setting aside active investors for a moment, tweaking industry offerings and classifications matters to passive investors who follow indexes and others who want to build and trade baskets of, say, healthcare shares in emerging markets or financial shares in MENA.

Adding new sectors could draw new attention from active regional investors who want to look at an industry holistically, says CIRA CEO Mohamed El Kalla. “That is why we are hoping education is among the new sectors that will be added to the bourse,” El Kalla told Enterprise. The move could help the government’s policy of ensuring that “qualified” and “serious” foreign investors enter strategic and sensitive sectors such as education, said El Kalla. He explains that the desire to ensure what he calls “qualified” investors is why the government moved to restrict foreign investment in Egyptian private schools to 20% — a move which caused backlash from the private sector.

How will multi-industry companies be treated? As part of the EGX’s review, a company that record revenue from activities across a wide spectrum of industries may be classified by the sector that makes the largest contribution to its top line.

LEGISLATION WATCH- FinMin finalizes draft law to resolve tax disputes: The Finance Ministry has drawn up a temporary, six-month law to facilitate the process of resolving open tax disputes, according to a cabinet statement. The bill, which is being fast-tracked, has been sent to Cabinet for approval. The government expects the legislation to be approved by the House of Representatives and signed into law by no later than the end of the month. It would come in the form of two new sections to article 110 of the Income Tax Act, which legislates late tax payment fees.

What does the bill entail? The draft law would, if passed, limit the period over which to determine the late fees to three years. It would also provide discounts of up to 30% on fines for late payment provided the taxpayer makes the full disputed tax payment and does so before the committee mediating the dispute issues its decision.

The draft law looks like it will replace the Tax Dispute Resolution Act that expired earlier this month. The act, which had passed the House in September 2016, took tax disputes away from courts and handed them over to newly-established expert committees to seek amicable settlements.

Why the six-month time limit? It appears that the draft law would be put in place until the ministry wraps up an overhaul of the 2005 Income Tax Act, which is expected to have a built-in tax mechanism to resolve tax disputes. The mechanism would a tiered system whereby investors would be able to pay a percentage of the disputed amount to resolve the issue without the need for lengthy resolution procedures. Enterprise saw a copy of the draft last October. Last we heard, the bill was close to being handed to cabinet for approval, but it remains unclear when it would then make it to the House for a vote.

FinMin issues new regs on dual taxation of yield on treasury bonds and bills: The Finance Ministry issued on Thursday a decision that allows non-residents to pay taxes on yields from Egyptian treasury bonds and bills at the rate stipulated by a dual taxation agreement with their country of residence, according to a cabinet statement. The regulations will allow these investors to claim rebates on the taxes they have paid on Egyptian treasuries if the dual taxation agreement sets a lower rate, or file for complete exemption where applicable. Under the regulations, Egypt’s Tax Authority will be required to complete the tax remittance process within 30 days of the investor filing the necessary documents. The decision came into effect yesterday.

In related news, Egypt became a signatory to the Yaoundé declaration (pdf), which is designed to combat tax evasion and the flows of illicit financing through a network of information exchange between African countries, the Finance Ministry said yesterday. The declaration was first signed in November 2017, and a total of 27 African countries (including Egypt) have signed the treaty.

Sarwa, Premium Int’l form JV to launch new consumer finance brand: Leading structured and consumer finance player Sarwa Capital and Premium International for Credit Services have set up a joint venture to launch a new consumer finance product, the two parties said in a press release (pdf) quoting Sarwa Chairman and CEO Hazem Moussa and Premium Founder and CEO Paul Antaki. The two partners will split the JV 50-50 and expect it to begin operating in a few months’ time under a separate brand. Sarwa, perhaps best known in the market for its Contact brand, brings to the table extensive experience “structuring and financing retail credit and managing risk,” the statement said. Premium, a consumer finance player known for its Premium Card product, said it will leverage its network of more than 480 merchants, which together have more than 5k outlets nationwide. Sarwa has financed more than EGP 19 bn since 2002, while Premium has 120k clients and executes more than 1 mn transactions each year.

Ibnsina Pharma has signed an agreement with US multinational Mundi Pharma to import and distribute their products in Egypt, the company said in a statement (pdf). Mundi’s product range covers six therapeutic areas including oncology, respiratory, ophthalmology, pain, specialty care, and consumer health. Ibnsina expects revenues from the partnership to reach EGP 120 mn by the end of 2020. The Egyptian pharma company signed a similar agreement in September with Swiss firm Roche, which will see it import and distribute 40 products in Egypt.

Nasr, Maait drum up British investments in Egypt during UK doorknock mission: Investment Minister Sahar Nasr and Finance Minister Mohamed Maait called on British companies to ramp up their investments in Egypt during the UK doorknock mission in London last Friday. The mission, which was organized by the British Egyptian Business Association, saw Nasr sit down with European Bank for Reconstruction (EBRD) Chief Risk Officer Betsy Nelson to discuss boosting cooperation in renewables and transportation projects in Egypt, according to a ministry statement. Maait also gave investors a rundown of Egypt’s reform efforts and improved macro indicators, as well as recently enacted legislation designed to encourage investments in the country, his ministry said.

MOVES- Janet Heckman (LinkedIn) will be retiring from the European Bank for Reconstruction and Development (EBRD) as of 20 December. Heckman is currently the EBRD’s managing director for the southern and eastern Mediterranean (SEMED) region and country head of Egypt, a position she has held since February 2017.

EARNINGS WATCH- Real estate company Heliopolis Housing and Development posted net profits of EGP 29.4 mn in 1Q2019-2020, up from EGP 8.7 mn in the same period last year, it said in a statement to the EGX (pdf). The company’s revenues recorded EGP 248.2 mn during the quarter, compared to EGP 193.8 mn in 1Q2018-2019. HHD is presently preparing to offer for sale to a strategic investors a 10% stake in the company plus management rights.

CORRECTION- We incorrectly reported on Thursday that EFG Hermes had made a request to the Financial Regulatory Authority to suspend its fixed income trading business. The firm requested permission of the FRA to suspend the activities of a dormant subsidiary for which it had obtained a license in 2011. EFG Hermes had made the announcement through the Membership Management, which gives news to all listed brokers about other brokers and their subsidiaries and affiliates, and not through the EGX trading floor as was previously stated. The story has since been updated on our website.

The Macro Picture

Can emerging markets still emerge? The rapid pace at which jobs are automated and declining birth rates will make it harder for emerging markets to escape the middle income trap and transition to developed country status, writes Christopher Wood, global head of equity strategy at Jefferies. The labor-based, mass manufacturing economy — used by developing countries such as South Korea, China and Taiwan to build advanced economies — is increasingly under threat from new technologies and data-driven business models. This means that the next generation of newly-emerging economies will find themselves without a blueprint and be forced to find their own development paths.

Slowing population growth will also give emerging markets a headache: Asian emerging markets, in particular, will struggle to maintain productivity levels as workforces age and population growth rates stall. As far as Egypt is concerned, we are likely to face quite the opposite problem, with UN population estimates forecasting our population to spiral in the coming decades.

Deglobalization isn’t helping: The global financial crisis and the Donald Trump-inspired destabilization of global supply chains has succeeded in cutting off a significant amounts of foreign direct investment that could prove vital for helping emerging markets escape the middle income gap. In the 12 years since 2007, FDI inflows to EMs as a proportion of GDP has halved to 1.9% from 3.8%.

Worth Reading

Squeezed by regulation and passive investing, investment analysis is being reshaped: Financial regulations and the growth of passive funds is causing investment research to undergo radical changes, the Financial Times reports. Europe’s Mifid II regulations — a response to the global financial crisis that aims to increase transparency and protect investors — require asset managers to pay directly for analysis or make the costs transparent to their clients, instead of bundling them into transaction fees. This is causing funds to reconsider the amount of research they purchase, “changing the whole nature of investment research,” markets consultancy Tabb Group wrote in a recent report. The increasing popularity of tracker funds is posing similar problems for analysts, whose skills are irrelevant for passive investors.

Analysts are using technology and data science to extract new information and present it in a personalized way: Technology and data science have become the core tools for analysts to tailor information — and the way it is presented — to clients. Analysts increasingly scour non-traditional sources such as satellite imagery and credit card data, as well as making use of AI techniques like machine learning and natural language processing to extract insights from more traditional areas. And not only are banks seeking to capitalize on the potential offered by new technology to enhance their analysis, but several have actually set up independent businesses focusing on this process. UBS’s Evidence Lab is one example of a self-contained entity that provides “insight-ready datasets” to clients. There is both more of an emphasis on providing clients with well-organized raw data — rather than opinions — and a clear change in how the content itself is presented, with a trend towards reports being punchier, and research being presented through accessible media such as videos, podcasts, and social media.

Egypt in the News

International reaction to last week’s raid on Mada Masr continues to roll in: It’s the Economist’s turn to give its two cents in a piece that calls the raid a “warning” that reveals the state’s concerns over the continued existence of independent media. Agence France-Presse, meanwhile, reports that two journalists and a lawyer detained last week have been charged with joining a “terrorist group.”

Also getting attention in the foreign press:

- Lagging FDI in the construction sector: The Egyptian government needs to embark on serious bureaucratic and legislative reform to reduce the dominance of parastatal companies in the construction sector and increase foreign direct investment, Zvi Bar’el writes in Haaretz.

- GERD dispute continues to get ink: Egypt and Ethiopia’s longstanding dispute over the Grand Ethiopian Renaissance Dam is explained in detail in this long read from Gulf News.

- A pre-election warning: With parliamentary elections imminent, Egypt needs to consolidate economic gains and ensure the benefits are felt more widely to avoid simmering discontent erupting into protests, says an opinion piece by Petroleum Economist.

- Cairo airport harassment doesn’t fly: A Cairo airport worker has been arrested after an American passenger accused him of [redacted] harassment, unnamed officials told the Associated Press. The Daily Mail also picked up the story.

- Debate over Mo Salah at Tokyo Olympics: The National took note of the debate that erupted almost instantly after Egypt’s U23s won the African Cup of Nations last week about whether Mo Salah would join them in the 2020 Tokyo Olympics.

Diplomacy + Foreign Trade

Egypt, Greece, Cyprus denounce Turkey-Libya agreement to redraw Mediterranean maritime boundaries: The Egyptian government has condemned as illegal the signing of two agreements on maritime boundaries in the Mediterranean and security cooperation between Turkey and Libya. The agreements — signed between Turkish President Tayyip Erdogan and Libyan PM Fayez Al Serraj in Istanbul on Wednesday — have “no legal effect” since the 2015 Skhirat peace agreement only grants the cabinet the power to sign legally-binding international agreements, Egypt said. The maritime boundaries agreed by Libya and Turkey remain unclear. Greece and Cyprus also denounced the agreement as illegal under international law, the Associated Press reports. The fallout comes amid heightened tensions over oil and gas drilling in the eastern Mediterranean.

El Sisi holds economic talks with Hungarian president: President Abdel Fattah El Sisi discussed economic cooperation with Hungarian President Janos Ader in Cairo on Thursday, according to an Ittihadiya statement. The two sides touched on trade and investment, as well as Hungary’s involvement in the government's EGP 22 bn contract with Russia’s Transmashholding to manufacture 1,300 railcars. Egypt and Hungary signed an agreement in September to cooperate on manufacturing projects, technology transfer, and human resource development. The Hungarian president is currently on a four-day diplomatic visit.

Energy

BP, Eni to drill new natgas exploration wells

BP plans to drill two gas exploration wells in the Nooros and Atoll fields in 1Q2020, an EGAS source told Al Shorouk. Eni, meanwhile, will drill an exploration well this month in its Mediterranean North El Hammad exploration block, the source said.

Infrastructure

Military Production Authority, ATB Water sign wastewater treatment MoU

The Military Production Authority signed on Wednesday an MoU with German company ATB Water to exchange expertise on the use of sequencing batch reactor (SBR) technology in the treatment of wastewater, according to a cabinet statement. SBRs are industrial processing tanks that use biological processes to treat wastewater.

Manufacturing

Holding Co for Spinning and Weaving issues tender to modernize cotton gins

The Holding Company for Spinning and Weaving has launched a tender for state-owned and private sector companies to modernize its cotton gins, according to Al Mal. The winning bidder, which will be selected later this month, will help the company establish several modern new factories, oversee construction, and create technical designs.

Real Estate + Housing

Egypt’s Housing Ministry approves new mechanism for PPP projects

The Social Housing Fund approved in a board meeting yesterday a new mechanism for partnership on housing projects with real estate developers, according to a Housing Ministry statement. No further details were provided on the new system. We noted in October that the ministry was in talks with representatives from several private real developers to form public-private partnerships on social housing projects.

Tourism

EgyptAir launches flights to Hangzhou

EgyptAir launched its new route between Cairo and Hangzhou on Friday, with the maiden flight taking 260 passengers to the Chinese city, according to Al Shorouk. The flag carrier will fly the route twice a week, and comes as part of the strategy to increase tourism from the Far East, said Chairman Ashraf El Khouly.

Arab Int’l Company for Hotels to spend EGP 1 bn renovating Hilton Ramses

The Arab International Company for Hotels and Tourism will spend EGP 1 bn renovating the Hilton Ramses Hotel over the next four years, the local press reports. The first phase of the renovation process will take place over 10 months, and will include 200 rooms and 15 suites at a cost of EGP 140 mn. The rates for the rooms will be increased over the next six years to compensate for the renovation costs.

Telecoms + ICT

Orange Egypt to return to profitability this year -CEO

Orange Egypt will turn a profit in 2019 for the first time in several years as it increases revenue from data services, CEO Yasser Shaker said, according to Al Shorouk. Yasser declined to provide an exact figure for the company’s anticipated profits, but said at a presser the numbers are “very positive.” The company is projected to earn 50% of its revenue from data services next year, up from 25-30% in 2018, Shaker said. The company lost almost EGP 666 mn in 9M2018 — the last time the company reported earnings after delisting from the EGX.

Automotive + Transportation

Bombardier to manufacture monorail components in 1Q2020, start assembly in June

Canada’s Bombardier will manufacture the main components for the two monorails linking Sixth of October City to Giza and Nasr City to the new administrative capital in 1Q2020, and start assembly in June 2020, Bombardier’s president for the UK region Matt Byrne told Transport Minister Kamel El Wazir last week, according to a cabinet statement. Egypt signed a 30-year contract with Bombardier, Orascom Construction, and Arab Contractors in August that will see the consortium construct, operate, and maintain the lines.

Banking + Finance

Egypt’s e-Finance to increase subsidiary e-payments transactions to 2.7 bn by 2024

State-owned e-Finance aims to increase the number of electronic payment transactions carried out through its subsidiary ‘Khales’ to 2.7 bn by 2024, according to Al Mal. This includes utility bill payments, as well as tuition fees and transport service payments.

Egypt Politics + Economics

Exiled Mohamed Ali referred to Egyptian court on charges of tax evasion

Army contractor-turned-political dissident Mohamed Ali has been referred to a criminal court on charges of tax evasion, reports Ahram Online. The public prosecutor’s office said in a statement that it had concluded in an investigation opened on the request of the finance minister that “[Ali] had avoided paying VAT by lying on tax records and through fake companies.” Ali, who is in self-imposed exile in Spain, posted a series of viral videos earlier this year accusing the Egyptian government of corruption and public funds mismanagement.

National Security

Egyptian, British special forces conduct joint counter-terrorism drill

Egyptian and British special forces conducted a joint counter-terrorism drill for the first time last week, Ahram Online reports.

On Your Way Out

Game of Thrones meets Cairo Film Festival: Actress Nathalie Emmanuel, who is most known for her portrayal of Missandei on Game of Thrones, was in town for the closing ceremony of the Cairo International Film Festival on Friday, according to Arab News. The Mexican drama “I’m No Longer Here” earned the festival’s top accolade, the Golden Pyramid. Ahram Online has the full lineup of award winners from the festival.

The Market Yesterday

EGP / USD CBE market average: Buy 16.06 | Sell 16.16

EGP / USD at CIB: Buy 16.06 | Sell 16.16

EGP / USD at NBE: Buy 16.05 | Sell 16.15

EGX30 (Thursday): 13,849 (+0.7%)

Turnover: EGP 327 mn (54% below the 90-day average)

EGX 30 year-to-date: +6.2%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 0.7%. CIB, the index’s heaviest constituent, ended up 1.4%. EGX30’s top performing constituents were Emaar Misr up 5.4%, Kima up 2.2%, and Egyptian Iron and Steel up 2.0%. Thursday’s worst performing stocks were Cleopatra Hospital down 1.5%, Qalaa Holdings down 1.3% and Ibnsina Pharma down 1.1%. The market turnover was EGP 327 mn, and foreigners investors were the sole net buyers.

Foreigners: Net Long | EGP +24.0 mn

Regional: Net Short | EGP -15.1 mn

Domestic: Net Short | EGP -8.9 mn

Retail: 65.7 total trades | 64.5% of buyers | 67.0% of sellers

Institutions: 34.3% of total trades | 35.5% of buyers | 33.0% of sellers

WTI: USD 55.17 (-5.06%)

Brent: USD 60.49 (-4.39%)

Natural Gas (Nymex, futures prices) USD 2.28 MMBtu, (-8.8-%, January 2020 contract)

Gold: USD 1,472.70 / troy ounce (+0.81%)

TASI: 7,859.06 (+0.08%) (YTD: +0.41%)

ADX: 5,030.76 (-0.25%) (YTD: +2.35%)

DFM: 2,678.70 (-1.22%) (YTD: +5.89%)

KSE Premier Market: 6,519.36 (+1.08%)

QE: 10,147.88 (-0.23%) (YTD: -1.47%)

MSM: 4,064.14 (-0.46%) (YTD: -6.00%)

BB: 1,526.95 (+0.52%) (YTD: +14.18%)

Calendar

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company.

December: Indian automotive delegation to visit Egypt.

1-6 December (Sunday-Friday): Vietnamese trade delegation visits Egypt.

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

2-3 December (Monday-Tuesday): The irrigation ministers of Egypt, Sudan, and Ethiopia the second round of Grand Ethiopian Renaissance Dam negotiations in Washington, DC.

2-13 December (Monday- Friday) The COP25 Climate Change Conference, Madrid

3 December (Tuesday): Emirates NBD / Markit PMI for Egypt released.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

4 December (Wednesday): Subscription to the Aramco IPO will begin (expected).

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus.

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids.

8-9 December (Sunday-Monday): The 6 th CEOs THOUGHTS 2019.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10 December (Tuesday): Egypt Automotive summit, Nile Ritz Carlton, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO (expected).

11-12 December (Wednesday-Thursday): “Forum on peace and sustainability in Africa,” venue TBD, Aswan.

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

5 January (Sunday): Postponed lawsuit hearing against Peugeot Automobile filed by Cairo for Development and Cars Manufacturing.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

1 February 2020 (Saturday): The administrative court will look into an appeal by Adeptio AD Investments against a Financial Regulatory Authority to submit a mandatory tender offer (MTO) for Americana Egypt.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

1 March 2020: A conference on “logistics and its impact on the movement of goods and industry,” venue TBD, Alexandria.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.