- Will the Aramco IPO impact the timeline for the state’s stake sale program? (Speed Round)

- Public Enterprises Ministry could offer investors management rights to three bus companies. (Speed Round)

- Qalaa Holdings to IPO TAQA Arabia, Arab Refining Company next year. (Speed Round)

- Ora Developers in talks with Qatari Diar for 51% stake in Egypt’s CityGate. (Speed Round)

- An employee dispute has put a spanner in the works of Bank Audi’s NBG takeover. (Speed Round)

- Shell to divest from Western Desert to focus on Egypt’s offshore concessions. (Speed Round)

- Gov’t looking into setting natgas, electricity prices twice a year for all industries. (Speed Round)

- Finance leaders search for solutions on final day of IMF, World Bank annual meetings. (What We’re Tracking Today)

- The Market Yesterday

Monday, 21 October 2019

Lots and lots of IPO + M&A news today

TL;DR

What We’re Tracking Today

It’s shaping up to be a rather busy week for our elected representatives, who are due to host what feels like half of cabinet for hearings on proposed legislation or to respond to House inquiries, Youm7 reports. On the guest list:

- Trade Minister Amr Nassar, who will answer questions from the Industry Committee on problems facing investors regarding the allocation of industrial land;

- Housing Minister Assem El Gazzar, who will face questions on the country’s potable water and sewage systems;

- And the social solidarity, local development, health, manpower, and agriculture ministers, who will also either give speeches or meet with committees.

Up for discussion tomorrow: Public Enterprise Minister Hisham Tawfik will discuss the proposed amendments to the Public Enterprises Act (more on this in this morning’s Speed Round, below), while Higher Education Minister Khaled Abdel Ghaffar will outline a bill to establish the Zewail City of Science and Technology.

A delegation of US companies will be in Cairo on 18 November to explore investments in the energy, health, information technology sectors as part of AmCham’s US-Egypt Proposer Forum, CEO Sylvia Menassa said, according to the local press. AmCham will also participate in a Washington conference focused on water issues on 30 October, and hold the ‘Prosper Africa Event’ on 7 November.

President Abdel Fattah El Sisi and Ethiopian Prime Minister Abiy Ahmed are set to meet on the sidelines of the Russia-Africa summit this week to discuss the impasse over the Grand Ethiopian Renaissance Dam. Russian President Vladimir Putin seems to be positioned as a mediator between the two countries, which Kenyan publication the East African says is “one of [Russia’s] trickiest diplomatic forays yet.” The two-day event gets underway in Sochi on Wednesday.

Talks with Ethiopia are on the radar of the foreign press, with the Financial Times’ Heba Saleh noting the continued deadlock.

Speaking of water: Cairo Water Week kicked off yesterday at Al-Manara International Conference Center in New Cairo, under the title “Responding to Water Scarcity.” The conference will run until Thursday.

Other key dates to pencil into your agendas this week and next:

- The14th International Joint Oil Data Initiative (JODI) Conference kicked off in Cairo yesterday and wraps up later today.

- The Intelligent Cities Exhibition & Conference will take place at the Hilton Heliopolis on Wednesday and Thursday.

- A B2B conference for German and Egyptian companies will take place on Monday, 28 October in Cairo. Click or tap here to register.

- The US Federal Reserve will meet on 29-30 October to review key interest rates.

Final day of IMF, World Bank annual meetings reaches new levels of ominous: The final day of the IMF and World Bank annual meetings in Washington yesterday saw finance ministers and central bankers grapple with what is perhaps the biggest economic challenge of the decade: How to prevent the global economy from slipping into what some fear could be a deep recession with what is a dwindling basket of policy tools.

Confronting the uncomfortable reality: Central banks are being backed into a corner. Finance leaders are becoming concerned about the increasingly blunt monetary policy tools held by central banks, Bloomberg says. With interest rates already low across the developed world, few now believe that rate cuts have the ability to steer the global economy out of trouble like they once did. “They’re in a very difficult corner at the moment,” Axel Weber, chairman of UBS Group, said at a conference organized by the Institute of International Finance yesterday. “Central banks are running out of efficiency of their tools. Taking interest rates negative will not have the same impact.” And despite the recent relative thaw in US-China tensions, the Financial Times reports that ministers and central bankers are privately fearful that the volatile trade situation might yet push the global economy into recession.

Former Bank of England governor calls for sea change in economic thinking to prevent “armageddon”: Mervyn King yesterday warned that the US economy faces “financial armageddon” unless policymakers take inspiration from the 1930s and adopt new approaches to monetary policy, the Guardian reports. “Another economic and financial crisis would be devastating to the legitimacy of a democratic market system. By sticking to the new orthodoxy of monetary policy and pretending that we have made the banking system safe, we are sleepwalking towards that crisis,” he said.

The answer? It’s complicated.IMF head Kristalina Georgieva’s call for more flexibility on fiscal policy received a mixed reception from attendees, Bloomberg reports. While Japan and the US said they were ready to deploy fiscal stimulus where necessary, Austria and Germany are continuing to prioritize their budget surpluses. Others, meanwhile, were debating the utility of so-called Modern Monetary Theory (a set of economic principles that advocate large-scale government spending and the use of taxation to control inflation) to solving our problems. In short, there seems to be little consensus among the economic powers-that-be about how to bring an end to economic stagnation.

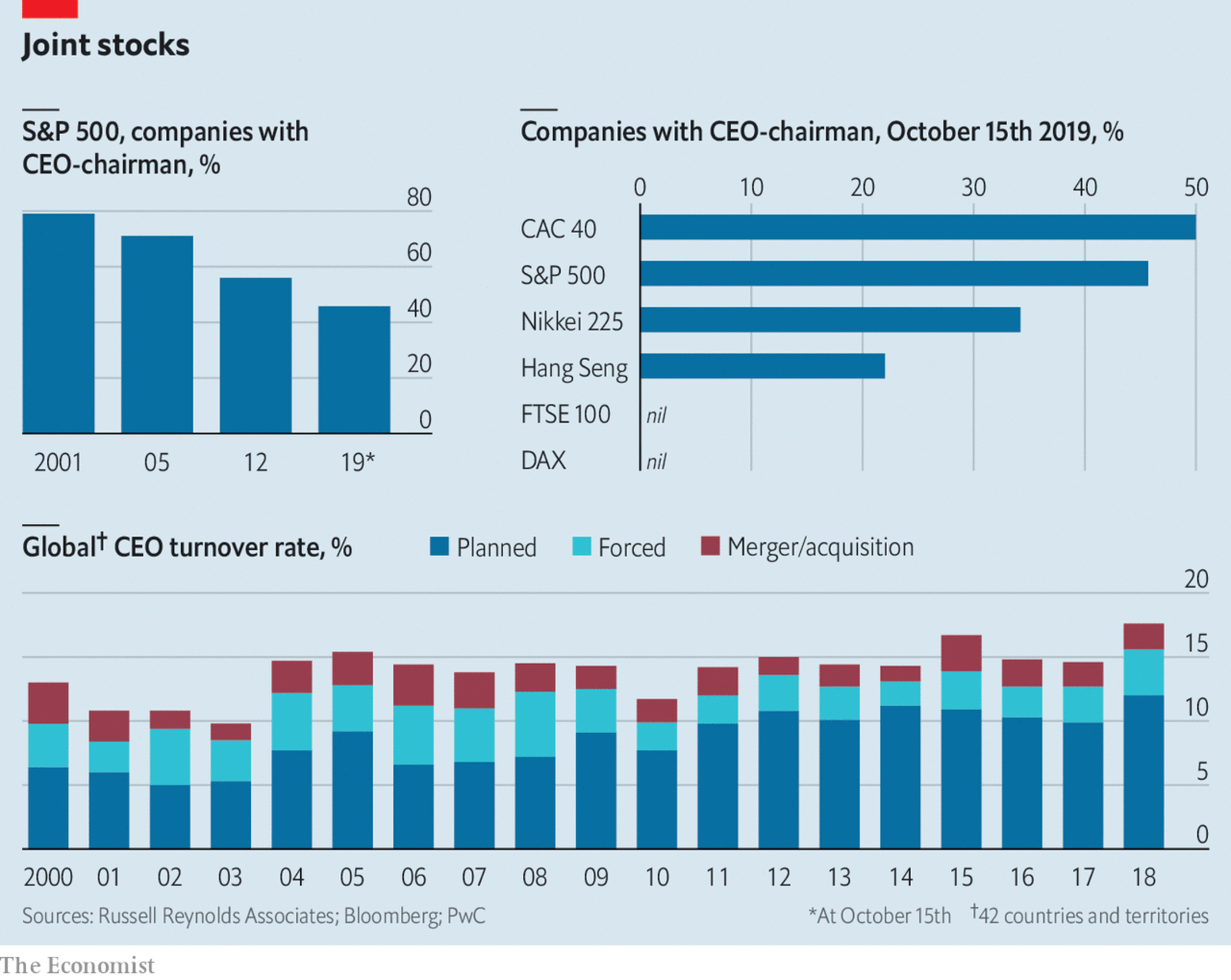

Is CEO duality a thing of the past? Companies that have grappled with governance and misconduct scandals (ahem, Tesla, Boeing, and Renault) are moving away from the idea that CEOs can simultaneously act as chairs of the board of directors, the Economist says. As seen in the chart above, the percentage of S&P 500 companies with CEO-chairmen has nearly halved between 2001 and 2019. Interestingly enough, the Economists suggests there are no inclusive studies that link the practice to worsening company performance.

Saudi Aramco has postponed its IPO once more, confirming a report in the Financial Times this weekend and prompting speculation by some in the industry that the latest postponement could signal the transaction is postponed. What does this mean for Egypt? We have thoughts in this morning’s Speed Round, below.

So how did the guinea pigs in the world’s first 20-hour flight fare? Apparently, not so badly. Twenty hours on a plane is nobody’s idea of fun, and this 16,200 km non-stop flight from New York to Sydney involved some quite prescriptive monitoring of its few dozen passengers to assess their physical and mental well-being. On balance, it’s challenging but well worth it to skip layovers and queues, writes Angus Whitley in this piece for Bloomberg.

Enterprise+: Last Night’s Talk Shows

Lamees is back on the airwaves as she soft-launches a new show: After a long absence from the small screen, the queen of nighttime talk is back: Lamees El Hadidi quietly launched Al Kahera Alaan on Al Hadath TV, marking her return to the airwaves with an interview with the IMF’s David Lipton on what the international lender could do to help the government in Beirut handle ongoing protests (watch, runtime: 04:07).

It’s not the Egyptian business / economy-focused show of old — not necessarily a surprise when you consider she’s appearing on a regionally-focused broadcast platform that’s owned by Al Arabiya. After the Lipton-Lebanon segment, Lamees segued into a discussion of GERD and an in-studio interview with former irrigation minister Nasr Allam, followed by sit-downs with her fellow Al Hadath anchors and an hour-long interview with Tunisian actor Dhafer Al Abdeen.

The show begins for Lamees’ Egyptian audience tomorrow, we suspect: That’s when she is scheduled to run a longer interview with Lipton about Egypt, while an interview with Egyptian national football team manager Hossam Albadry is set to be the lighter segment. The show runs for two hours — half broadcast live on Al Hadath TV and the other half broadcast solely on social media platforms, the outfit says in a statement. You can catch all the details on the show’s Youtube channel.

Egypt bears responsibility for the crisis over the Grand Ethiopian Renaissance Dam,and should’ve been the one to build it for Ethiopia, prominent space scientist and geologist Farouk El Baz tells El Hekaya’s Amr Adib (watch, runtime: 01:09). El Baz said Egypt already had experience in the area and should have guided Addis Ababa with its expertise and connections, instead of letting the crisis unfold for years before suddenly waking up to a problem.

President Abdel Fattah El Sisi visited the Military Academy yesterday, Al Hayah Al Youm’s Lobna Assal noted (watch, runtime: 04:17). El Sisi also met the governor of El Monoufeya to focus on infrastructure and SME initiatives (watch, runtime: 03:35).

The inauguration in Heliopolis yesterday of the largest metro station in the Middle East also earned some airtime with Assal (watch, runtime: 06:03). Hona Al Asema’s Reham Ibrahim and Adib were also excited about it (watch, runtime: 05:51) and (watch, runtime: 03:28). We have more on this in this morning’s Automotive + Transport section, below.

Speed Round

Speed Round is presented in association with

PRIVATIZATION WATCH- Aramco’s IPO could be reason to postpone government’s stake-sale program, says NI Capital boss: The initial public offering of oil giant Saudi Aramco could cause Egypt to push the date for resuming its stake sale program to either January or February 2020, NI Capital CEO Mohamed Metwally told Reuters. The program was expected to resume in 4Q 2019, after it kicked off with a single sale of a 4.5% stake in Eastern Tobacco earlier this year. The Aramco IPO, which could raise north of USD 20 bn, has been pulling liquidity from the global equity market as investors positioned themselves to move on a prospectus by November, Metwally said in an interview before it was confirmed that the Aramco IPO has been postponed. Also a factor, he suggested: global headwinds including the US-China trade war, which has led to temporarily lower company valuations.

This would be the latest in a series of delays: NI Capital is the state-owned investment bank that serves as the coordinating body for a privatization program that includes minority stake sales in existing companies as well as the IPO of other assets. It was hoping to see stakes offered in Alexandria Container and Cargo Handling (ACCH) and Abu Qir Fertilizers by December at the latest. Both companies could have gone to market this month, a timeline that slipped to 4Q2019, Public Enterprise Minister Hisham Tawfik said. Both companies were initially looking to go to market before Ramadan.

Now that the Aramco IPO has been delayed, does that mean the window is re-opening for the state stake sale program, at least? Metwally’s interview with Reuters was out before the news emerged that the Aramco IPO had been pushed again from a previously-announced November date. The Financial Times reported last Thursday that the kingdom had delayed signing off on the sale until after the company’s earnings are released, in hopes of proving to investors that its finances are still in good health after attacks on its facilities last month. Reuters also has the story.

Let’s keep it all in perspective, shall we? Neither NI Capital nor the investment bankers they hire to quarterback individual transactions are going to give anyone any more clarity on timeline to market than they would in a private-sector transaction — nor are they going to rush to market in adverse conditions to tick a box that says “we did it” and burn an offering in the process.

Oh, and as for IPOs of state-owned assets? Look to 1H 2020 at the earliest, folks. None of them are in the market right now, although at least two are committed to moving ahead in the new year.

PRIVATIZATION WATCH- Egypt is bringing its privatization drive to bus companies. The Public Enterprises Ministry could offer private investors the management rights to three bus companies before merging them together, Minister Hisham Tawfik said, according to Al Mal. The move to privatize the management of Upper Egypt for Transport, West Delta Bus Company, and Middle Delta Bus Company is meant to lay the groundwork for their restructuring and return to profitability, Tawfik said.

Is this the new flavour of privatization? Alongside stake sales and IPOs on the EGX, state-owned Heliopolis Housing is already offering management rights alongside a 10% stake sale. Under proposed amendments to the Public Enterprises Act, private-sector companies would be allowed to own stakes of just under 50% in the Public Enterprises Ministry’s holding companies. The amendments would also introduce private-sector-friendly board regulations by setting a cap on the number of government seats on the boards of state holding companies to seven.

IPO WATCH- Qalaa Holdings to kick off four-year IPO program next year by listing shares of TAQA Arabia, ARC: Qalaa Holdings is planning to move ahead with the IPO of several of its subsidiaries next year, with IPO of TAQA Arabia scheduled to take place in 2Q 2020 and the Arab Refining Company (ARC) in 4Q 2020, Qalaa Chairman Ahmed Heikal tells Reuters in an interview. Heikal did not provide details on the size of either offering, but had said last year that ARC would list around 30% of its shares. ARC is the largest shareholder in Qalaa’s more than USD 4 bn Egyptian Refining Company (ERC) in Mostorod. The company plans to move ahead with IPOs of its other subsidiaries over the course of four years, until 2023.

Advisors: Qalaa has tapped EFG Hermes and HSBC to manage the TAQA Arabia IPO.

What we already know about the IPO plans: Heikal previously said that Qalaa plans to take all eight of its existing subsidiaries to market. The initial schedule would have seen Dina Farms and ASCOM listing in 2020, while Tawazon, the National Development and Trading Company, the National Printing Company, the United Foundries Company, and Nile Logistics debuting on the bourse between 2021 and 2023. It remains unclear how much this timeline has shifted. Qalaa is planning to retain controlling stakes in all eight companies, and will not sell down its stakes in either ARC or TAQA when they IPO, a company official told Enterprise earlier this year.

Qalaa’s ERC is also set to ramp up its production capacity next year to 5.5 mn tonnes per year, up from a current 4.2 mn, Heikal tells Reuters. ERC successfully began hydrocracker operations last month, making all the plant’s units operational. Heikal said in May he expects the refinery to generate EGP 50-55 bn in revenues next year.

M&A WATCH- Ora Developers in talks with Qatari Diar for 51% stake in CityGate: Naguib Sawiris’ Ora Developers is in “advanced talks” to acquire a 51% stake in the Qatari Diar-owned company developing the CityGate project in New Cairo for USD 800 mn, unnamed sources said, according to Al Shorouk. The transaction, which is reportedly set to close before the end of the month, would see Ora lead the development of the 8.5 mn sqm project in partnership with the Egyptian subsidiary of the Doha-based company. Sawiris was reported last year to have made a EGP 35 bn offer to buy out all of the company’s Egypt assets.

Advisors: Ora tapped multinational law firm Baker McKenzie, which operates in Egypt as Helmy Hamza & Partners, to act as a legal advisor on the transaction.

Agreement expected to resolve regulatory disputes: CityGate has been the subject of a legal row with NUCA for over four years. EGP 3 bn of the USD 800 mn (c. EGP 13 bn) Naguib would pay would be used to settle a portion of the fines Qatari Diar owes to the Egyptian government. The bn’aire would also resolve other disputes over the project’s land with government authorities as part of the agreement. The settlement would be based on the value of the land when Diar signed a development contract with the New Urban Communities Authority (NUCA) years ago. But since Diar completed less than 3% of the project, the Housing Ministry has the right to conduct a reevaluation of the land to reflect today’s real estate prices, an anonymous government source said.

M&A WATCH- NBG needs more time to soften things up with its staff before Bank Audi acquisition can get the go-ahead. The National Bank of Greece (NBG) has asked the Central Bank of Egypt (CBE) for a grace period until the end of October to resolve a disagreement with employees over its sale to Bank Audi, a central bank source told Masrawy. The CBE was expected to green-light the acquisition last month, however a pay dispute between NBG and its staff led it to postpone its approval. Employees are demanding that the Greek bank pay them their legally-entitled compensation — equivalent of two months’ salary for each year they have worked in the company — before it is sold to Bank Audi. Bank Audi had confirmed to the central bank that it intended to keep on NBG’s staff, appoint them to the same positions, and maintain their current salaries. The CBE is legally obligated to insure that employee rights are protected before it can sign off on the agreement.

Background: Bank Audi announced back in May that it would acquire NBG’s Egypt arm, including a book “mostly of Egyptian-risk loans, deposits and securities (total assets of c. EUR 110 mn), a branch network of 17 branches and c. 250 employees.” NBG decided to exit the market last year as part of a wider plan to reduce its overseas presence under an EU-supervised restructuring.

Shell to divest Western Desert onshore assets to focus on offshore concessions: Shell is planning to divest its onshore upstream assets in the Western Desert “in order to fully concentrate on growing its Egyptian offshore exploration and integrated gas business,” according to a company statement (pdf). The company expects to open negotiations with potential buyers in 4Q2019, Shell Egypt Country Chair Khaled Kacem said.

What’s for sale? Shell’s portfolio in the Western Desert includes stakes in 19 oil and gas assets including the Badr El Din and Obaiyed area, as well as the North East Abu El Gharadig, West Sitra, Bed 1 gas, and West Alam El Shawish concessions, according to the company website.

Not for sale: Shell’s offshore assets, downstream lubricants, and its share in Egyptian LNG are not up for grabs as part of the transaction, the company noted. The announcement comes as the energy company said over the weekend it has applied for the upcoming Red Sea bid round and is interested in future tenders for Mediterranean concessions.

Private investors to take the reins in new govt-backed Africa-focused brokerage and marketing company: A new government-backed brokerage and marketing company will be majority-owned by private investors, Public Enterprises Minister Hisham Tawfik said. Private investors will own a 56% stake in the company, and public sector companies will be allocated 24%. The National Bank of Egypt, Banque Misr and Banque du Caire — which yesterday reached agreements with the government over setting up the company — will split the remaining 20% between them. Negotiations are currently underway with investors. The company will be established with an initial USD 10 mn, and its marketing arm will focus on promoting Egyptian products in Africa.

Gov’t looking into setting natgas, electricity prices twice a year for all industries: The government will revise the price at which it sells natural gas and electricity to factories every six months, Public Enterprises Minister Hisham Tawfik told reporters yesterday, according to Reuters’ Arabic service. Prime Minister Moustafa Madbouly has put together a committee that would assess energy prices on a biannual basis and determine whether to shift prices for industry, Tawfik said. This decision expands on an earlier move that saw the government lower the price of natural gas or the cement, metallurgy, and ceramics industries and agree to review it every six months.

Industry has been lobbying for a flexible pricing mechanism for weeks. The Egyptian Federation of Investors Associations (EFIA) said earlier this month it will ask the Finance Ministry to introduce a monthly rate akin to the old customs exchange rate which was scrapped in September. Although the EFIA wanted gas prices to be reviewed on a monthly basis, it appears that the government is compromising with a biannual review. The move is designed to offset the recent surge in operating costs, and boost output and exports.

Islamic Development Bank launches USD 500 mn fund for Egyptian startups: The Islamic Development Bank (IsDB) has set up a USD 500 mn fund to support youth-led startups through the Investment Ministry’s Egyptian Entrepreneurship Investment Company (Egypt Ventures) and ministry-supported startup accelerator Falak, according to an Investment Ministry statement. Investment Minister Sahar Nasr and IsDB President Bandar Al Hajjar also agreed during a meeting yesterday to organize a startup competition next month during a meeting on the sidelines of the IMF and World Bank annual meetings in Washington. The bank has set aside EGP 3 bn until 2021 as part of a strategy to partner with Egypt’s private sector on projects in the transport, education, and electricity sectors.

Nasr meets with other heads of int’l development institutions: Nasr separately held talks with International Development Finance Corporation (DFC) CEO Adam Boehler, UN Development Programme (UNDP) head Achim Steiner, and EBRD President Suma Chakrabarti yesterday. Boehler’s DFC, a US federal agency set up last year to consolidate the Overseas Private Investment Corporation (OPIC) and USAID’s Development Credit Authority, is in ongoing talks with the government to cooperate on Egypt’s electricity interconnection projects in Africa. The agency is also planning to finance transport, desalination and renewable energy projects, as well as fund SMEs.

Also from Washington: Egypt has joined the G20’s Global Infrastructure Hub, Nasr said yesterday. The country’s admission into the program, which was established in 2014 as an initiative by G20 member countries, “will pave the way for public and private organizations to increase their investment in Egypt and Africa's infrastructure sectors,” Nasr said. The program, has funded USD 69 bn-worth of water, energy, transport, and communications projects across 40 countries.

Edita receives EGP 25.4 mn grant from Morocco’s gov’t under manufacturing incentive program for foreign investors: Edita’s Moroccan subsidiary, Edita Food Industries Morocco, has landed an MAD 15 mn (c. EGP 25.4 mn) grant from the Moroccan government. The grant is part of a Moroccan program to attract foreign direct investment, the company said in an EGX disclosure (pdf

Edita entered Morocco via a joint venture with Dislog Group, a leading Moroccan distributor for top multinational brands, back in 2017. Edita holds a 51% stake in the JV, which is set to begin production from its USD 20 mn snack food production facility in 1Q2020.

LEGISLATION WATCH- MPs voice concerns over Central Depository and Registration Act amendments: Members of the House Economic Committee yesterday voiced concerns that proposed amendments to the Central Depository and Registration Act could have a negative impact on the securities market, Ahram Online reports.

What would the proposed amendments do? Amendments proposed by the Financial Regulatory Authority (FRA) in June would allow joint venture companies to obtain licenses to provide clearing and depository services and permit the formation of new non-bank financial institutions to clear and settle securities. The changes would also pave the way for government bond issuances to be cleared with Belgium-based clearinghouse Euroclear.

Why are MPs concerned? Article 35 — the section that regulates clearing companies — is proving particularly controversial among some MPs. The article grants the FRA significant powers over companies licensed to provide clearing and depository services, according to Masrawy. Under article 35, the regulator would determine the ownership structure of companies, set the conditions for board formation, and determine the minimum amounts of issued and paid-in capital. The FRA would also determine the conditions and procedures of licensing, while companies licensed for clearing and settlement of forward contracts would need to have a list of rules and procedures approved by the authority.

What are they saying? “As far as I see, the amendments impose restrictions on the companies currently performing clearance and settlement activities and this could harm the securities market,” Ahram Online quoted House spokesman and chairman of the Freedom Party, Salah Hasaballah, as saying. Deputy chairman of the econ committee, Ashraf Al Araby, urged MPs to carefully consider the more controversial aspects of the legislation to assess how they will impact the market.

The discussions came a day after the government signed an agreement with Euroclear on the sidelines of the IMF and World Bank annual meetings in Washington. The agreement will allow Egyptian debt to be Euroclearable once the amendments to the Central Depository and Registration Act are signed into law and the central depository company is set up.

EGX, Supply Ministry to set up company to manage commodities exchange next month: The Egyptian Stock Exchange (EGX) and the Supply Ministry will establish a company to manage the Egyptian Commodity Exchange in November after it completed the feasibility study for the exchange yesterday, sources told the local press. The company will manage all the functions of the exchange, including the trading system, quotations, pricing and risk management.

The company running the commodities exchange will be a JV between the two state entities, with the EGX holding the majority of the equity. EGX Chairman Mohamed Farid announced the completion of the study in a statement earlier in the day.

LEGISLATION WATCH- House gives preliminary nod to Public Enterprises Act amendments: The House of Representatives has approved “in principle” amendments to the Public Enterprises Act, which would scrap mandatory arbitration and allow disputes between public sector companies and state institutions to be settled in court, the local press cited MENA news agency as reporting. President Abdel Fattah El Sisi earlier this month formed a committee to work on the amendments, chaired by his assistant for national and strategic projects, and including Public Enterprises Minister Hisham Tawfik as well as representatives from the finance and planning ministries, general intelligence, the Administrative Control Authority, and national security. Tawfik reportedly said in April that the amendments would remove listed companies in which the government owns a 75% stake from the legislation, and bring them within the scope of the Companies Act.

State gets sharper teeth to fight building violations: The Housing Committee approved yesterday amendments to the Unified Building Code, granting powers to the Agriculture Ministry to seize buildings that were illegally erected on fertile land and fine the violators, the local press reported.

USD 62 mn IFAD support package gets committee-level approval: Meanwhile, the Agriculture Committee approved a presidential decree on a USD 62 mn package from the International Fund for Agricultural Development (IFAD) to support agricultural development and small-time investors in Marsa Matrouh, Al Shorouk reported. The support package, signed in Rome in February, included a EUR 53.2 mn loan alongside a grant worth some EUR 860k.

EBRD loan to modernize Metro Line 1 also gets a nod: The Transport Committee also approved a presidential decree on a EUR 205 mn loan from the European Bank for Reconstruction and Development to renovate Cairo Metro Line 1, Al Shorouk reported. The loan was signed in August 2018.

Ex-husbands: Pay up or else. The House also approved on Sunday government-proposed amendments to the Penal Code which increase punishment for ex-husbands who fail to pay alimony, Al Shorouk reported. Divorced men whose ex-wives have filed more than one case against them for failing to pay alimony are to be punished by a maximum of one year in prison, scrapping the option of a fine. The amendments also grant defendants the right to reconciliation even if a ruling had already been issued. The amendments have been referred to the State Council.

House calls for committee to fight terrrorism: The House also said yes to a proposal from House Speaker Ali Abdel Aal to form a special committee to fight extremism, violent rhetoric and the threat posed by domestic terrorists returning from abroad, Al Masry Al Youm reported. There are concerns that returning terrorists will want to launch operations in new areas or recruit others to form new cells, Abdel Aal said, without explaining how exactly he intends to have the planned committee tackle the issue.

Also in the legislative pipeline: The Justice Ministry will within two months complete amendments to the Personal Status Act, which will cover matters of marriage, death, inheritance, child custody, etc., Masrawy cited Justice Minister Advisor Mohamed Mahgoub as saying. The committee drafting the amendments will hold its first meeting on Tuesday and refer it to the prime minister’s office before presenting it to parliament.

Egypt in the News

The historic finding of 30 wooden coffins in Luxor on Saturday is continuing to make front page news in the foreign press: BBC│New York Post│Independent.

Egypt’s education system faces multiple structural challenges,with the quality of state education being low and only the wealthy able to afford alternatives in the private sector, perpetuating existing social inequalities, Marc Espanol writes in the Arab Weekly.

Worth Watching

Facebook is creating its own city to (quite literally) retain talent: Even with their creative workspace, big tech companies like Facebook and Google are having trouble finding and retaining talented employees. Facebook’s bright idea to reduce its turnover rate? Developing its own fully-equipped 59-acre city that would basically make it tough for employees to leave the company because Facebook would own their homes, sell them their food, and provide an education for their children. In case you’re unclear on why this is problematic, the city would essentially give Facebook the power of government over its employees. And in reality, turnover is actually not an enemy of corporate growth and success, this video argues (watch, runtime: 08:52).

Diplomacy + Foreign Trade

The government has begun operating a shipping route between Ain Sokhna and Mombasa, marking the beginning of the first phase of the Public Enterprise Ministry’s plan to boost trade with Africa through new trade routes and logistical development, Minister Hisham Tawfik said yesterday, according to Al Masry Al Youm. The plan, known as “Gosoor,” will enter its second phase in 2Q2020, during which the ministry will partner with private sector players to promote locally manufactured products abroad through a USD 10 mn joint venture.

Health + Education

Egypt’s small pharma factories could face shutdown after 4x registration fee hike

A fourfold increase in medical registration fees is putting 154 small-scale pharma manufacturers at risk of shutting down, Medical Union Pharma board member Osama Rostom said, according to Al Shorouk. The Health Ministry recently hiked the one-off registration fee for pharma products to EGP 1 mn from EGP 250k.

Tourism

EgyptAir receives third A220-300 aircraft

EgyptAir has received its third A220-300 Airbus as part of a contract with Canada’s Bombardier that will see the flag carrier receive 12 planes, according to Al Shorouk. The fourth is also expected to be delivered this month.

Automotive + Transportation

Egypt inaugurates Heliopolis metro station

Transport Minister Kamel El Wazir inaugurated yesterday the Heliopolis metro station, the largest station in the Middle East, the ministry said in a statement. The station is part of the fourth phase of Cairo Metro Line 3, which will see more stations opening in December. Separately, El Wazir is also negotiating with 11 local contracting companies to implement a series of projects in the railway sector, a source said to Al Mal. The companies include Orascom Construction, Gamma, Arab Contractors, Al Rowad, El Soadaa Group, General Nasr Contracting, Concord, Siac, Pioneers, and the Holding Company for Roads and Bridges.

Banking + Finance

EIB agrees EUR 500 mn credit line to Banque Misr to support SMEs

The European Investment Bank (EIB) has signed a EUR 500 mn financing agreement with Banque Misr to support SMEs and midcaps across Egypt, according to an EIB statement. The credit line is contingent on the businesses receiving funding from Banque Misr complying with the EIB’s environmental and social standards, the bank said.

Other Business News of Note

Egypt offers King Mariout landowners concessions to settle building code violations

The Alexandria Governorate has granted investors in the King Mariout area an option to pay settlement fees for building code violations under a three-year installment plan, Al Shorouk reports. The proposed scheme would require investors to make a 25% down payment before paying off the remaining fees with an annual interest rate of 7%.

On Your Way Out

The Museum of Fine Arts in Boston is dedicating one of the biggest exhibits in its history to explore the history and heritage of the Nubian people, according to Grit Daily. The exhibit, “Ancient Nubia Now,” features over 400 pieces of art and objects, and is running from 13 October 2019 to 20 January 2020.

The Market Yesterday

EGP / USD CBE market average: Buy 16.16 | Sell 16.28

EGP / USD at CIB: Buy 16.16 | Sell 16.26

EGP / USD at NBE: Buy 16.18 | Sell 16.28

EGX30 (Sunday): 14,239 (+0.2%)

Turnover: EGP 336 mn (53% below the 90-day average)

EGX 30 year-to-date: +9.2%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.2%. CIB, the index’s heaviest constituent, ended up 1.1%. EGX30’s top performing constituents were Pioneers Holding up 1.3%, Egypt Kuwait Holding up 1.2%, and CIB up 1.1%. Yesterday’s worst performing stocks were SODIC down 2.1%, Ezz Steel down 2.0% and Egyptian Resorts down 1.8%. The market turnover was EGP 336 mn, and foreign investors were the sole net buyers.

Foreigners: Net long | EGP +15.7 mn

Regional: Net short | EGP -1.2 mn

Domestic: Net short | EGP -14.5 mn

Retail: 82.0% of total trades | 77.0% of buyers | 87.1% of sellers

Institutions: 18.0% of total trades | 23.0% of buyers | 12.9% of sellers

WTI: USD 58.78 (-0.3%)

Brent: USD 59.42 (-0.8%)

Natural Gas (Nymex, futures prices) USD 2.32 MMBtu, (+0.1%, November 2019 contract)

Gold: USD 1,494.10 / troy ounce (-0.3%)

TASI: 7,784 (+2.0%) (YTD: -0.5%)

ADX: 5,089 (-0.1%) (YTD: +3.6%)

DFM: 2,766 (-0.5%) (YTD: +9.3%)

KSE Premier Market: 6,252 (-0.8%)

QE: 10,412 (-0.2%) (YTD: +1.1%)

MSM: 4,015 (+0.3%) (YTD: -7.1%)

BB: 1,527 (+0.0%) (YTD: +14.2%)

Calendar

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

October: German businessman delegation will visit Egypt to discuss good projects in order to spend German funds into Egypt.

October: A delegation of 40-50 Saudi companies will visit Egypt to discuss increasing exports of Egyptian furniture.

20-21 October (Sunday-Monday): The 14th International JODI conference, Egyptian Oil Ministry, Cairo, Egypt

20-24 October (Sunday-Thursday) The 2nd Annual Cairo Water Week Conference, Al-Manara International Conference Center, New Cairo, Cairo, Egypt

20-24 October (Sunday-Thursday): German-Arab Chamber of Industry and Commerce’s ROI Week with ROI Institute, JW Marriott Hotel, New Cairo

21-25 October (Monday-Friday): Radiocommunication Assembly 2019, Sharm El Sheikh, Egypt

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

22 October (Tuesday): 20th Century Middle Eastern Art annual auction: Sotheby’s Gallery, London

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23-24 October (Wednesday-Thursday): Russian-African Summit, Sochi City, Russia.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October (Monday): B2B conference for German companies organized by the German-Arab Chamber of Industry and Commerce and the Bavarian Ministry of Economic Affairs, Regional Development and Energy, InterContinental Semiramis, Cairo.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

28 October- 22 November: World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review key interest rates.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

November: The government will host the Egypt Economic Summit with 40 speakers and experts across all economic fields to discuss the country’s vision post the IMF program.

November: British Egyptian Business Association’s Annual door knock mission, United Kingdom

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7 November (Thursday): AmCham will hold the Prosper Africa Event.

7-9 November (Thursday-Saturday): BiznEx Egypt 2019, Egypt International Exhibition Center, Nasr City, Cairo.

8-22 November: Egypt will host Under-23 Africa Cup of Nations 2019.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

9-11 November (Saturday-Monday): Vested Summit, Sahl Hasheesh, Red Sea.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

12 November (Tuesday): Egypt Economic Summit, venue TBA.

13-15 November (Wednesday-Friday): Africa Early Stage Investor Summit, Cape Town, South Africa.

14 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

18 November (Monday): AmCham’s US-Egypt Proposer Forum in Cairo.

20 November (Wednesday): The Investment Ministry and the Islamic Development Bank will organize the “leaders for change” startup competition as part of the Fekretak Sherketak initiative, location TBD, Cairo, Egypt.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

25 November (Monday): Global Trade Matters international dialogue on climate neutrality, Marriott, Cairo.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

4-5 March (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.