- Second wave of state privatization program kicked to 2020. (Speed Round)

- Moody’s confirms Egypt’s credit rating at B2 with a stable outlook, citing debt, “persistently weak” gov’t finances. (Speed Round)

- Majid Al Futtaim is expanding its activities in Egypt. (Speed Round)

- Gov’t signs dispute settlement agreement with Al Kholoud on El Nasr for Steam Boilers. (Speed Round)

- Emerging markets just ended their worst August in decades. (The Macro Picture)

- Egypt wins a record-breaking 273 medals at the African Games. (Speed Round)

- Swvl is moving its headquarters out of its birthplace. (Speed Round)

- There may be 130 mn of us by 2030 -El Said. (Egypt Politics + Economics)

- The Market Yesterday

Sunday, 1 September 2019

IPO phase of state privatization program kicked to 2020, Tawfik says

TL;DR

What We’re Tracking Today

Good morning, ladies and gents — and welcome to September. The end of Sahel season as we know it means the promise of slightly better weather to brave the uptick in traffic from the new school year. Across the pond, your colleagues in North America are ringing in the new month with a three-day weekend (unlike us) in observance of Labor Day.

President Abdel Fattah El Sisi landed in Kuwait yesterday for a two-day visit, during which he is set to meet Kuwaiti Emir Sheikh Sabah Al Ahmad Al Sabah and several high-level government officials, according to MENA. Egypt and Kuwait are set to sign a number of agreements during the visit, including a cooperation protocol between the two countries’ prosecutor generals on exchanging information, Al Shorouk reports.

Key news triggers in the coming days:

- PMI: The purchasing managers’ index for Egypt, the UAE and Saudi Arabia will be released on Tuesday, 3 September at 06:15 CLT.

- Foreign reserves: The Central Bank of Egypt is due to release Egypt’s net foreign reserves figures for August this week.

- Inflation: Monthly inflation figures for August at due out next week. Inflation fell unexpectedly to a four-year low of 8.7% in July.

Across the pond, the start of September means fresh tariffs on Chinese imports come into effect today. US President Donald Trump told reporters on Friday that he doesn’t plan on pulling the brakes on the tariff hikes, but that talks with China are scheduled for this month, according to Reuters. A reprieve in the trade war could not come a minute too soon for American consumers and retailers, who are caught in a metaphorical tennis match of who will bear the brunt of increased costs from the tariffs, the Associated Press says. Businesses that hiked prices on affected products were faced with consumers who all but refused to buy, while those who opt to absorb the higher costs say their margins are being eaten away and will eventually have to raise their prices.

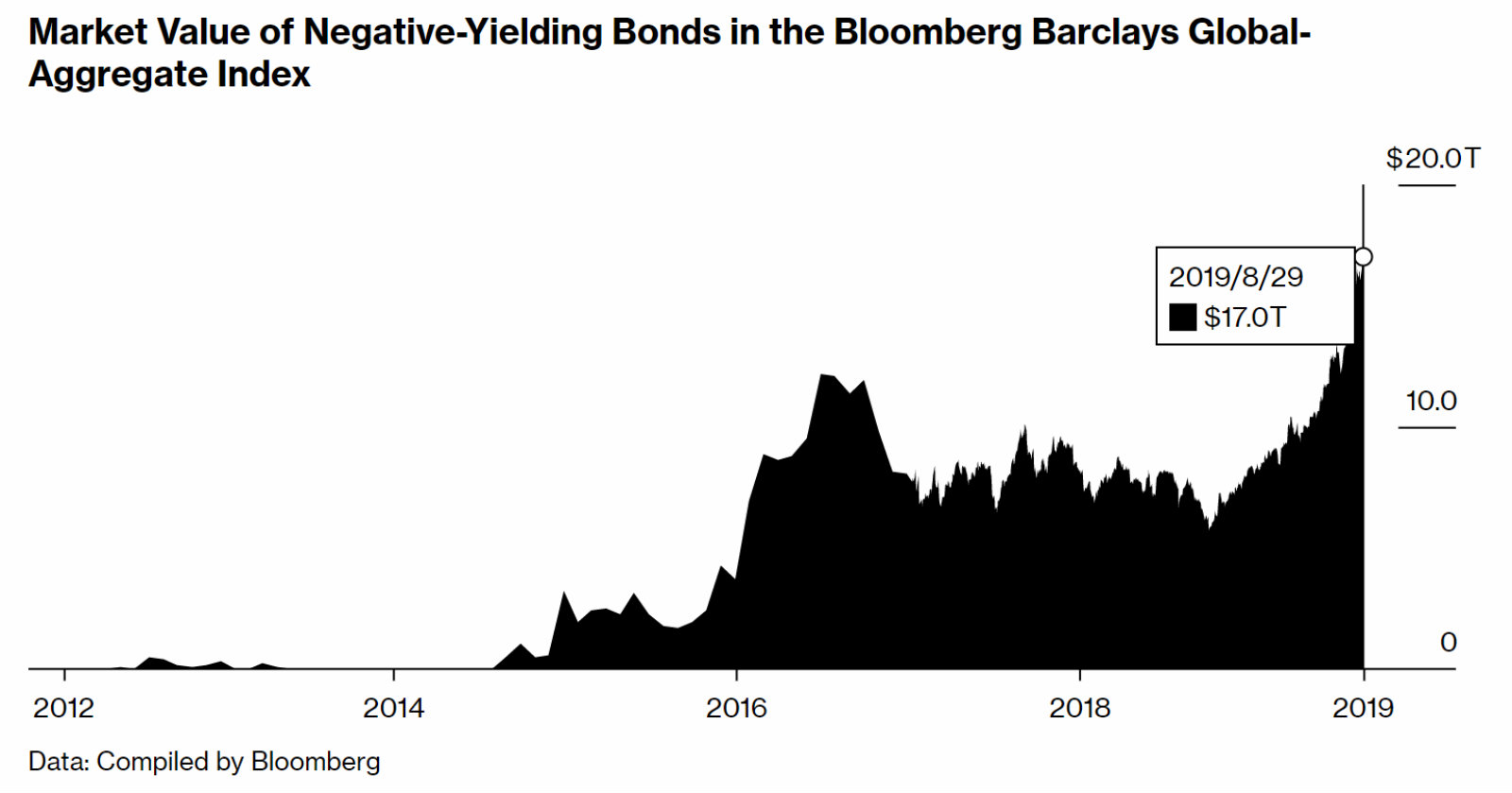

The surge in negative yielding debt shows no signs of letting up: The amount of global negative-yielding debt has risen above USD 17 tn as investors continue piling into bonds, Bloomberg reports. Sustained market volatility pushed yields on USD 2 tn-worth of bonds into negative territory in just the last three weeks of August. Almost a third of all investment-grade bonds are now below zero.

Well, that didn’t go as intended: Investors pulled record amounts of money from the biggest Saudi-focused ETF in the US on Thursday, the same day as the second batch of Saudi shares were added to the MSCI EM Equity Index, Bloomberg reported. iShares MSCI Saudi Arabia outflows recorded USD 119 mn, the most for any day since the ETF’s inception in 2015. MSCI finished the second phase of including Saudi stocks in its EM index last Tuesday which prompted some investors to sell shares, taking advantage of increased liquidity on the securities. The Tadawul stock exchange also fell on Wednesday and Thursday.

A Sudanese court officially charged yesterday ousted president Omar Al Bashir with corruption and “possessing illicit foreign currency,” Reuters reports. The court will determine the length of the former strongman’s sentence separately on Saturday, 7 September. The charges leveled against Al Bashir are punishable by up to 10 years in prison.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi was front and center on the airwaves last night. Masaa DMC took note of the president’s meeting with Japan's Mitsubishi Corporation CEO Takehiko Kakiuchi on the sidelines of the Tokyo International Conference on African Development (Ticad), which we cover in detail in this morning’s Speed Round, below (watch, runtime: 0:31).

More meetings in Japan: The program also aired a report of El Sisi’s separate meeting with Natsuo Yamaguchi, president of Japan’s Komeito party, a partner of the country’s ruling coalition government (watch, runtime: 0:59). The two discussed bilateral cooperation, with a focus on education.

El Sisi’s two-day stop in Kuwait, which we note in What We’re Tracking Today, above, also earned airtime on Hona Al Asema (watch, runtime: 1:40).

North Coast businesses skirting VAT? On a separate note, the Tax Authority paid a few visits to businesses operating in North Coast resorts and found that hundreds of retail and coffee shops are not registered as value-added taxpayers, Hona Al Asema’s Reham Ibrahim pointed out (watch, runtime: 1:17).

Speed Round

Speed Round is presented in association with

EXCLUSIVE- Wave two of state privatization program kicked to early 2020: The second wave of the state privatization program, which consists only of IPOs, has been postponed to after January 2020 from an original September 2019 date, Public Enterprises Minister Hisham Tawfik told Enterprise. “Some procedures have taken longer than expected, and we won’t be able to proceed until the end of the final quarter of the year,” Tawfik said. The IPO phase of the program will see 10 state-owned companies make their EGX debuts. The companies include eight operating in the manufacturing and mining sector, alongside Banque du Caire and payments platform e-Finance.

The first, non-IPO wave, meanwhile, is on track to wrap up by year end, Tawfik said, noting that the government is ready to sell stakes in each of Alexandria Containers and Cargo Handling Company (ACCH), Abu Qir Fertilizers, and Sidi Kerir Petrochemicals (Sidpec). The order, timing, size, and makeup of each of the offerings will be determined during a meeting scheduled for next week based on the opinion of investment banks quarterbacking the sales and market conditions, Tawfik said. We picked up local reports in July that ACCH will sell an additional 20% of its shares at EGP 15.6 apiece. Sidpec, meanwhile, was previously said is planning to offer 23%.

Moody’s confirms Egypt’s credit rating at B2, outlook stable: Credit rating agency Moody’s has maintained its Egypt rating at B2 with a stable outlook, citing its large debt load and persistently weak albeit improving government finances.

Public finances to continue improving: Moody’s expects the government’s fiscal deficits to continue narrowing as it pushes ahead with removing energy subsidies and applying the fuel indexation mechanism. The government’s interest bill will also fall in line with slowing inflation and lower debt levels, although this will be offset slightly by the transition to longer maturities, the ratings agency says.

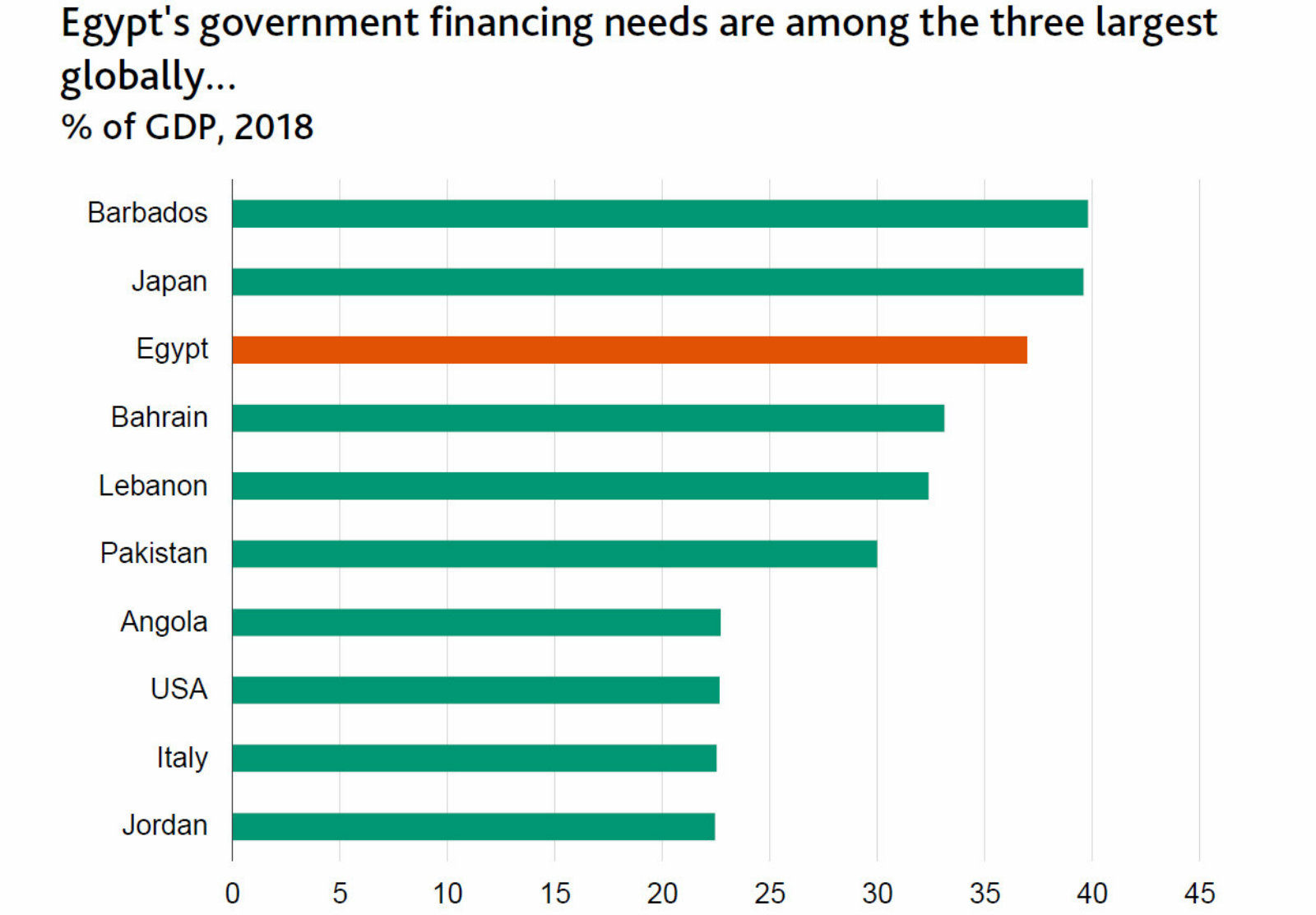

Debt sustainability to remain “very weak”: The affordability of Egypt’s debt will “remain very weak” and its financing needs “very large” (between 30-40% of annual GDP) in the coming years. Egypt will continue to be susceptible to tightening financial conditions, but its declining debt-to-GDP ratio means that it is able to cope with external shocks. Domestic debt levels are expected to decline as the effects of energy price hikes dissipate.

Labor market “improving” but sizeable challenges remain: Moody’s notes that conditions in the Egyptian labor market have recently improved, with the unemployment rate falling to 7.5% in 2Q2019 from 8.1% in 1Q2019. Despite this improvement, the economy is not creating an adequate number of jobs for the rising working-age population and this will continue to pose a challenge in the long term.

Japan, African Union sign investment declaration at Ticad: Egypt signed a 13-page declaration with Japan and other African countries to promote Japanese investment in Africa at the end of the three-day Tokyo International Conference on African Development (Ticad) in Yokohama on Friday. The declaration, which aims to channel USD 20 bn of Japanese investment on the African continent over the next three years, will see Japan and African countries work together on issues such as “quality infrastructure, private sector impact investment, macroeconomic stability, technological innovation, economic transformation and social development.”

El Sisi hails landmark summit: President Abdel Fattah El Sisi called the summit “an important turning point” in Japanese-African relations, and called on businesses in a speech at the end of the summit to invest. “I would like to renew the invitation to all private sector companies, Japanese and international companies and international financial institutions to cooperate and invest in Africa. This is the right time to open up to the continent,” he said.

The president also met with his Zambian and Ugandan counterparts on the sidelines of the conference. Zambian President Edgar Lungu called for increasing Egyptian direct investment and support, and deepening security ties during a meeting with El Sisi on the sidelines of the conference, according to an Ittihadiya statement. Elsewedy Electric last week signed an agreement with the Zambian to construct two 50 MW solar PV plants in partnership with Toyota.

Mitsubishi, Marubeni to consider expanding activities in Egypt: Mitsubishi President Takehiko Kakiuchi told El Sisi that the company was open to increasing its activities in Egypt during a meeting on Friday, according to an Ittihadiya statement. El Sisi invited him to invest in the Suez Canal Area Development project. Mitsubishi is currently involved in railway projects in Egypt, having recently won the tender for the first phase of Cairo Metro Line 4 with Orascom, and is bidding to supply equipment to Acwa Power’s Luxor power plant. El Sisi also urged President and CEO of Marubeni Masumi Kakinoki to invest in ports, industrial zones and logistics centers in the Suez Canal Economic Zone.

INVESTMENT WATCH- Majid Al Futtaim plans expansions in Egypt: UAE-based real estate developer and retail giant Majid Al Futtaim (MAF) is planning to open about 12 new stores in Egypt in the coming few months, CEO Alain Bejjani said in an interview with Bloomberg TV (watch; runtime 7:09). “Egypt is today the fastest growing market so it is back and it is back well and hopefully for good…we are very happy with Egypt but there is much more to come,” he said. The company announced in July that it will be opening its USD 437 mn City Center Almaza shopping mall in Heliopolis at the end of September.

The company’s 1H earnings aren’t great: Increased financing costs and impairment charges caused MAF to slip to a AED 429 mn loss in 1H2019 from a AED 464 mn profit in the same period last year, according to its financial statement (pdf). Although revenues increased by 1% y-o-y during the first six months of the year, Bejjani said the company has faced headwinds caused by slowing consumer spending “across the board.” He said the company’s main market in the UAE was “tough” but expected it to improve as EXPO 2020 in Dubai approaches.

DISPUTE WATCH- Gov’t signs dispute settlement agreement with Al Kholoud on El Nasr for Steam Boilers: The government has signed a dispute settlement agreement with Al Kholoud for Touristic and Real Estate over land used by El Nasr for Steam Boilers, Al Mal reports. The Madbouly Cabinet signed off in July on the settlement, under which Al Kholoud will drop its arbitration suit over the sale of a 29-feddan land plot that holds El Nasr’s steam boilers facility. In exchange, the government will drop its claim to EGP 600 mn it says it is owed by Al Kholoud. Al Kholoud will also return the land plot back to the government.

Advisers: Youssef & Partners acted as legal counsel for Al Kholoud during arbitration, and represented investors in the settlement negotiations.

T-bill yields fall in first post-rate cut auction: Average yields on 6-month and 1-year government T-bills fell to 16.521% and 16.263%, respectively, in the first auction since the Central Bank of Egypt cut interest rates by 150 bps earlier this month, CBE data showed. That compares to yields of 16.9% on 6-month notes and 16.511% on 1-year bills at the last auction earlier in August. Yields on 10-years also fell 87 bps to 14.682% in an auction last week.

Meanwhile, local banks have started lowering interest rates on savings accounts and time deposits following the rate cut: Both the National Bank of Egypt and Attijariwafa Bank cut by up to 150 bps yields on different types of savings accounts. Banque du Caire and First Abu Dhabi reduced yields by 150 bps on three-year certificate of deposits (CDs) to 13% and 11%, respectively. Blom Bank Egypt and Arab Bank, meanwhile, have stopped issuing the three-year CDs until obtaining the CBE’s approval to follow suit.

Money supply growth accelerates in July: M2 money supply grew by 12.1% y-o-y in July, compared to a y-o-y 11.85% growth in June, Reuters reported, citing CBE data. The M2 gauge stood at EGP 3.885 tn at the end of July, up from EGP 3.864 tn a month earlier. M2 measures liquid assets such as cash, savings deposits and money market securities.

STARTUP WATCH- Swvl is moving its headquarters out of Egypt: Mass transport app Swvl will move its headquarters from Egypt to Dubai by November this year, co-founder and CEO Mostafa Kandil told Menabytes. The company, recently valued at USD 157 mn, is said to already have a team in place in Dubai, and has listed a vacancy for the role of global market launcher on its website. Cairo will remain a hub for the company’s operations and engineering, Kandil said, without explaining the reasoning behind the move.

STARTUP WATCH- TA Telecom has spun off Egyptian fintech startup NowPay after it raised USD 600k in seed funding from Silicon Valley’s Endure Capital and 500 Startups, TA Telecom said in a press release (pdf). The startup seeks to improve the financial security of corporate employees in emerging markets by helping them access their salaries in advance at any time in the month. NowPay was founded earlier this year.

Egypt dominates African Games, landing record-breaking 273 medals: Egypt earned a record-breaking 229 medals at this year’s African Games, bringing home 79 gold, 87 silver, and 59 bronze. The 2019 African Games ran from 19-31 August in Rabat, Morocco and saw 54 African countries participate. Nigeria and Algeria also gave impressive performances, winning a total of 103 and 113 medals, respectively.

Where were we strongest? Our swimmers and weightlifters bossed the competition, winning 41 and 31 medals in the respective sports. Swimmer Hania Moro alone is bringing home four gold medals, and weightlifters Ahmed Saeed, Mohamed Mahmoud, Karim Abokahla, and Rania Mahmoud each won three. We also performed strongly in wrestling, gymnastics, fencing, and chess.

EARNINGS WATCH- AMOC earnings tank in FY2018-2019: Alexandria Mineral Oils Company’s (AMOC) net profits fell 69.7% y-o-y to EGP 450 mn during FY2018-2019 due to increased sales costs, the company said in an EGX disclosure (pdf). Company revenues were up 4.5% y-o-y to EGP 14.664 bn.

Suez Canal revenues fell to EGP 49.1 bn (c. USD 2.98 bn) in 1H2019, down 1.4% y-o-y from EGP 49.8 bn (c. USD 3.02 bn) the previous year, according to calculations of monthly data compiled by CAPMAS (pdf — pp. 4). Revenues for June came at EGP 7.8 bn, down 10.3% y-o-y from EGP 8.7 bn in June 2018. The decrease was attributed to fewer oil tankers and other vessels crossing the canal than in the comparable month last year.

MOVES- The Finance Ministry will appoint Yasser Taimour as advisor for the development of tax projects and Waleed Abdullah as IT advisor for the Tax Authority and the General Authority for Government Services, it said in a statement.

The Macro Picture

Emerging markets suffer worst August in decades: EM stocks suffered USD 873 bn in losses last month and currencies experienced their worst August since 1997, Bloomberg says. The iShares MSCI EM ETF saw a record increase in short interest as yearly gains on EM ETFs were almost entirely wiped out, and USD bond sales hit a 42-month low.

A perfect storm: The EM headache was caused by a handful of factors, the most important of which originated in the US. The tone for August was set at the end of July, when Fed Chairman Jay Powell uttered the fateful words “mid-cycle adjustment.” Cue a market panic that was compounded shortly after by President Donald Trump’s announcement of yet more tariffs on Chinese goods. Investors were given an extra incentive to pull money from EMs after at least 12 central banks cut rates, taking their cue from the Fed’s 25 bps cut in July. Turmoil in EMs also played its part: The TRY fell 4% as Turkey’s 2020 growth prospects were halved, while in the middle of the month primary elections in Argentina resulted in the second-biggest daily market crash in history and what looks to be a ninth sovereign default.

It might not be getting any better: In the absence of a US-China trade agreement, the EM sell-off is likely to continue, analysts told Bloomberg. “September will be more of the same,” said Brendan MacKenna, FX strategist at Wells Fargo. “Even though China laid out their retaliation plans, it wouldn’t surprise me if they got even more aggressive with countermeasures.” Eric Baurmeister, head of Morgan Stanley’s EM debt team, said that investors need to see evidence of Washington and Beijing coming together before EM fortunes start to change. “The benefit of the doubt is gone, and the market needs to see documents signed, trade agreements done before they get really excited.”

Egypt in the News

Rising sea levels due to climate change are posing an increasing threat to Alexandria and the Nile Delta, with at least 5.7 mn people likely to be affected by the end of the century, the Associated Press reports. Despite measures taken by the government to safeguard residential areas and the Corniche, severe floods in 2015 and stronger sea waves have threatened building foundations, forcing residents to leave their homes or rebuild them multiple times, and endangering antiquities like the Citadel of Qaitbay and the Kom El Shouqafa catacombs.

Austerity measures are weighing on Egyptians whose standard of living has yet to catch up with the widespread glowing praise for our economic reforms, Reuters’ Yousef Saba says. Saba points to the spike in Egypt’s poverty rate — particularly as public sector wages have not increased as much as prices — that accompanied improving macro indicators including lower rates of inflation and unemployment (which fell to 7.5% in 2Q2019).

Also getting attention in the foreign press:

- Human rights: Three human rights groups called for the release of detained Egyptian-Palestinian activist Rami Shaath in a statement released on Friday, AP reports.

- Napoleon’s legacy: The 1798 French invasion of Egypt set a precedent for further incursions from western powers into the Middle East, based on the appropriation of land, resources and culture, Alasdair Soussi writes in the National.

- Cairene candle makers under threat: The rise of cheap imports threatens to wipe out the once flourishing candle-making trade in Cairo’s Al Ghourya district, Reuters reports.

Diplomacy + Foreign Trade

Egypt communicates latest GERD vision, postpones trilateral talks to mid-month: Egypt has handed Ethiopia and Sudan its proposal for a method of filling the Grand Ethiopian Renaissance Dam’s (GERD) reservoir, which involves calling for the “early generation” of energy to mitigate any negative effect on Egypt’s share of Nile water, according to a cabinet statement. Egypt has also invited the three countries to hold trilateral talks in mid-September, postponing a round which was scheduled for last month “at Ethiopia’s request,” the statement notes.

China to invest EGP 110 mn in SCZone training center: China will invest CNY 45 mn (c.EGP 110 mn) in building a professional and technical training center for workers in the Suez Canal Economic Zone (SCZone), according to a statement. SCZone President Yehia Zaki and Chinese Minister Counselor for Commercial Affairs Han Bing signed a cooperation protocol for the project at the end of last week. China completed in April the feasibility study for the project, which it plans to finish within three years.

EU tightens food safety regs for 11 Egyptian crops: Egyptian crops will now have to meet several newly outlined food safety regulations by the European Commission to be accepted into the bloc, sources from the Agriculture Ministry told the local press. Under the new regs, the ministry’s Central Department of Agricultural Quarantine will have to communicate to the EU a more detailed account of its quality control procedure for a total of 11 fruits and vegetables.

Egypt proposes long-term Israel ceasefire agreement to Hamas: Egyptian intelligence officials have proposed economic and humanitarian aid to Hamas in return for a long-term ceasefire with Israel, a Hamas source told Lebanese newspaper Al Akhbar. Hamas has not responded to the proposal yet.

Energy

Elsewedy, EETC sign EGP 327 mn agreement for Marsa Alam power lines

Elsewedy Electric for Trading & Distribution has signed a EGP 327 mn agreement with the Egyptian Electricity Transmission Company (EETC) to construct two power lines in Marsa Alam, the company said in a bourse filing (pdf). The company will install two 50-km transmission lines running from Quseer to Berenice through Marsa Alam over the next six months.

Scatec Solar brings fifth 65 MW solar plant in Egypt online

Scatec Solar has begun commercial operations at its fifth 65 MW solar plant in Egypt, raising the Norwegian company’s total output in the country to 325 MW, it said in a press statement. A final plant is expected to come online within months, bringing the company’s production at the Benban solar power park to 390 MW. Scatec Solar’s plants in Benban will generate an estimated annual 870 GWh of electricity when fully operational.

EGAS cancels LNG tender for three cargoes due to low bids

EGAS has canceled an LNG tender for three cargoes from the Idku gas liquefaction plant near Alexandria, market sources told Reuters. The tender, which closed on 28 August, was canceled due to low bids, the sources said.

Manufacturing

Dice’s rubber band factory in Burg Al Arab begins operations

Dice’s new rubber band factory in Burg Al Arab began operations this month, the company said in a bourse filing (pdf). The factory is operating at a 60% production rate and should reach its full production capacity of 20 mn meters a year at the start of 2020.

Health + Education

Amer Group signs agreement with NIS to build school in Port Said

Amer Group has signed with Dr. Nermien Ismail Language Schools (NIS) an agreement to build a school in Port Said, CEO Hosni Amr told the local press. The agreement comes as part of Amer’s plans to expand into the education sector. No details were provided on the cost or timeline of the project.

Tourism

Egypt to build new museum in new administrative capital

The Supreme Council of Antiquities has signed a cooperation protocol with the Masa Group to build in the new administrative capital (NAC) a new museum dedicated to showing how the country’s capital has developed throughout history, Ahram Online reported. The new museum will be located in the NAC’s arts and culture center and its revenues will be divided between the two organizations.

Pyramids renovation project is set to open 1Q 2020

The government is due to open its USD 500 mn pyramids renovation project in 1Q2020, an Antiquities Ministry spokesperson said, according to MENA. The ministry will partner with Orascom Investment Holding to provide electric buses at the plateau starting in April 2020.

Egypt reopens Tanta Museum after restoration and 19 years of inactivity

The Antiquities Ministry has reopened the Tanta Museum after 19 years of being closed to the public, Minister Khaled El Anany said at a press conference, according to Al Masry Al Youm. The museum houses north of 2k ancient Egyptian, Greco-Roman, Coptic and Islamic artifacts discovered in the Nile Delta. It was restored at a cost of nearly EGP 13 mn.

Banking + Finance

Marakez signs EGP 1.5 bn syndicated loan for Mall of Katameya construction

Mall developer Marakez has signed a EGP 1.5 bn syndicated loan agreement to finance the first phase of its planned Mall of Katameya in east Cairo, according to an emailed statement (pdf). The lending banks are Banque Misr, Banque du Caire, the Arab African International Bank, Misr Iran Development Bank, and the Arab International Bank.

EFG receives EGP 450 mn subscription requests for “Mazid” fund

Our friends at EFG Hermes have received EGP 450 mn-worth of subscription applications for investment certificates issued by the “Mazid” open-ended money market fund, head of asset management at EFG Nabil Moussa said. The firm accepted EGP 250 mn-worth of applications for the fund, which it manages for Emirates NBD. The Mazid fund “invests in a variety of short-term debt securities such as treasury bills and bonds & time deposits,” according to Emirates NBD’s website.

Hegazy & Partners to form consortium with Moamalat advisory on sukuk issuances

Hegazy & Partners law firm is planning to form a consortium with Moamalat advisory firm to co-manage the issuance of about USD 150 mn of sukuks, Managing Partner Walid Hegazy told Al Mal. The issuances are expected in 1H2020, Hegazy said. The firm is also planning to enter partnerships with peers from China and the US.

Legislation + Policy

Egypt’s investor associations union to submit suggestions for NGOs Act exec regs

The Union of Egyptian Investors Associations has asked 52 of its member organizations to compile their suggestions on what they would like to see included in the executive regulations of the recently-ratified NGOs Act, Secretary-General Mohamed Shaaban told the press. The executive regulations must clearly explain the law’s stipulations, Shaaban added, without specifying the union’s expected suggestions. We have a run-down of the key points of the new law here.

Egypt Politics + Economics

Egypt’s population may exceed 130 mn by 2030

Egypt’s population may exceed 130 mn by 2030, posing a challenge to the state’s sustainable development goals, said Planning Minister Hala El Said in a statement yesterday. The ministry has outlined a strategy for this fiscal year to curb the increasing population growth rate. Among the strategy’s goals are raising awareness of family planning and reproductive health in rural areas, as well as launching and improving access to family planning programs.

El Sisi approves EUR 4 mn AfDB grant to support entrepreneurship

President Abdel Fattah El Sisi approved yesterday a EUR 4 mn grant for Egypt from a multi-donor trust fund signed with the African Development Bank (AfDB) in February, Egypt Today reports. The funds will go to Tanmia Wa Tatweer, Egypt’s Entrepreneurship Development Project, which is managed by the AfDB. It is intended to support innovation by women and young people in the areas of agribusiness, renewable energy and the creative industries, and will target some 480 startups of which 50% are owned by women.

NPA to announce new digitization strategy for Egyptian state-owned newspapers

The National Press Authority will announce in the “next few weeks” a new strategy to digitize Egypt’s three state-owned papers — Al Ahram, Al Akhbar, and Al Gomhuria — the authority said in a statement picked up by Ahram Online. The strategy will aim to “employ radical solutions” to face dwindling revenues from the paper press and raise distribution and advertising rates.

Sports

Mohamed Elneny joins Besiktas on season-long loan

Arsenal has agreed to loan midfielder Mohamed Elneny to Turkish football team Besiktas, where he will remain until the end of the season, Ahram Online reports. Elneny joined Arsenal in January 2016, moving from Switzerland's FC Basel.

Egypt’s Al Ahly FC appoints Swiss coach Rene Weiler for top role

Al Ahly has signed Swiss coach Rene Weiler to take on the top role starting the 2019-2020 season, the Cairo giants said in a statement. Three assistant managers, all of whom were unnamed, will add the 45-year-old, the statement notes. Weiler, who succeeds the sacked Uruguayan coach Martin Lasarte, was a former Swiss league defender. He managed several European top tier teams, including Germany’s FC Nürnberg and Belgium’s Anderlecht.

On Your Way Out

Egypt to display coffin of 19th Dynasty’s last ruler for first time: The Antiquities Ministry will in the coming days put on display for the first time the coffin of Ancient Egyptian Queen Tausert, Xinhua reported. Discovered two decades ago at King Bay’s tomb in Luxor’s west bank, the six-tonne granite coffin has been transferred to the Luxor Museum where it will soon be revealed to the public.

The Market Yesterday

EGP / USD CBE market average: Buy 16.49 | Sell 16.62

EGP / USD at CIB: Buy 16.50 | Sell 16.60

EGP / USD at NBE: Buy 16.50 | Sell 16.60

EGX30 (Thursday): 14,835 (+1.6%)

Turnover: EGP 1.3 bn (113% above the 90-day average)

EGX 30 year-to-date: +13.8%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session up 1.6%. CIB, the index’s heaviest constituent, ended up 2.6%. EGX30’s top performing constituents were Egypt Kuwait Holding up 4.3%, EFG Hermes up 3.7%, and CIRA up 3.6%. Thursday’s worst performing stocks were Orascom Construction down 2.1%, Madinet Nasr Housing down 1.5% and Qalaa Holdings down 1.1%. The market turnover was EGP 1.3 bn, and foreign investors were the sole net buyers.

Foreigners: Net Long | EGP +153.6 mn

Regional: Net Short | EGP -21.5 mn

Domestic: Net Short | EGP -132.1 mn

Retail: 49.3% of total trades | 44.8% of buyers | 53.7% of sellers

Institutions: 50.7% of total trades | 55.2% of buyers | 46.3% of sellers

WTI: USD 55.10 (-2.84%)

Brent: USD 59.25 (-2.05%)

Natural Gas (Nymex, futures prices) USD 2.29 MMBtu, (-0.48, Oct 2019 contract)

Gold: USD 1,529.40 / troy ounce (-0.49%)

TASI: 8,019.77 (-1.85%) (YTD: +2.47%)

ADX: 5,165.57 (+0.72%) (YTD: +5.10%)

DFM: 2,758.60 (+0.03%) (YTD: +9.05%)

KSE Premier Market: 6,527.81 (+0.22%)

QE: 10,232.85 (+2.07%) (YTD: -0.64%)

MSM: 4,004.86 (+0.81%) (YTD: -7.38%)

BB: 1,533.09 (-0.09%) (YTD: +14.64%)

Calendar

September: Cairo will host an Egypt-Hungary business forum, according to a Trade Ministry statement (pdf)

2-4 September (Monday-Wednesday): The Big 5 Construct Egypt, Egypt International Exhibition Center, Nasr City, Cairo.

3-4 September (Tuesday-Wednesday): Shared Services and Outsourcing Forum Middle East, Nile Ritz Carlton, Cairo.

8 September (Sunday): The Supreme Administrative Court has postponed appeals filed by the State Lawsuits Authority and a number of companies to bring back the now-canceled 15% import duty on iron billets after two judges resigned from the panel, Mubasher reported

8-11 September (Sunday-Wednesday): Sahara Expo, Egypt International Exhibition Center, Nasr City, Cairo.

9 September (Monday): Japan Arab Economic Forum, Nile Ritz Carlton, Cairo.

9-12 September (Monday-Thursday): The 9th Annual EFG Hermes London Conference, Arsenal Emirates Stadium, London.

9-10 September (Monday-Tuesday): The Euromoney Egypt Conference 2019, Cairo.

15 September (Sunday): Elections to the board of the Financial Regulatory Authority’s Capital Markets Federation will be held, according to Al Mal.

17 September (Tuesday): E-Commerce Summit 2019, Nile Ritz Carlton, Cairo.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

21 September (Saturday): Cairo’s streets get really, really crowded as students at the nation’s public schools go back to class.

22 September (Sunday): The Justice Ministry’s dispute resolution committee will look into a case filed by Raya Holding’s Chairman Medhat Khalil against the Financial Regulatory Authority (FRA).

26 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee will meet to review interest rates.

October: A forum will be organized by Russia’s Rosatom and the Nuclear Power Plants Authority to introduce local suppliers and contractors to the Dabaa nuclear plant.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Nasr City, Cairo.

22 October (Tuesday): Innovative Finance: A New Vision to Support Investment forum, venue TBD, Cairo.

23-24 October (Wednesday-Thursday): Intelligent Cities Exhibition & Conference, Hilton Heliopolis, Cairo.

23 October-1 November (Wednesday-Friday): CIB PSA Women’s World Championship, Great Pyramid of Giza, Cairo.

24 October (Thursday): Russia-Africa Summit to take place in Sochi, co-chaired by Vladimir Putin and President Abdel Fattah El Sisi.

28 October-22 November (Monday-Friday): World Radiocommunication Conference 2019, Sharm El Sheikh, Egypt.

28 October-31 October (Monday-Thursday): A Cairo court will rule on the stock manipulation case, in which Gamal and Alaa Mubarak are involved, along with seven other defendants.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

29-30 October (Tuesday-Wednesday): South Sudan Oil & Power (SSOP) Conference, Juba, South Sudan.

31 October-2 November (Thursday-Saturday): Angel Oasis 2019, organized by the Middle East Angel Investment Network (MAIN), El Gouna, Egypt.

3-5 November (Sunday-Tuesday): Electrix 2019, Egypt International Exhibition Center, Nasr City, Cairo.

7-9 November (Thursday-Saturday): Vested Summit, Sahl Hasheesh, Red Sea.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

10-14 November (Sunday-Thursday): GeoMEast International Congress and Exhibition, Marriott, Cairo.

11-13 November (Monday-Wednesday): Africa Investment Forum, Gauteng, South Africa.

14-17 November (Thursday-Sunday): Machtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Transpotech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

14-17 November (Thursday-Sunday): Airtech Expo, Egypt International Exhibition Center, Nasr City, Cairo.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

November: Suez Canal Conference for Investment, organized in cooperation with the European Union

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

December: Indian automotive delegation to visit Egypt.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.