- Non-oil business activity hits lowest levels in more than a year. (Speed Round)

- Everything you need to know about FinMin’s epic presser yesterday (and there’s a lot). (Speed Round)

- CBE reserves stable, external debt growth slows. (Speed Round)

- Egypt was the top-performing MENA market in January. (Speed Round)

- Veon looks take Global Telecom private at EGP 5.30 per share. (Speed Round)

- LafargeHolcim considers “strategic options” for its Middle East operations, including in Egypt. (Speed Round)

- House approves new bank tax treatment. (Speed Round)

- Natgas regulator to begin issuing licenses to private sector. (Speed Round)

- 2019 Enterprise CEO Poll: F. John Matouk (founding partner, Matouk Bassiouny)

- 2019 Enterprise CEO Poll: Basel El Hini (chairman and MD, Misr Insurance Holding Company)

- The Market Yesterday

Wednesday, 6 February 2019

PMI hits lowest level in more than a year. Plus: FinMin has tons of news for you

TL;DR

What We’re Tracking Today

** The Enterprise 2019 CEO Week continues today as we touch base with some of Egypt’s top CEOs about the questions that will define the coming 12 months across all industries. The conversations replace our industry news roundups, which will return next week.

The format: Each CEO answered roughly the same set of questions, tailored only for their industry. The interviews have been condensed and edited for clarity and are presented in “as told to” format — that’s journalism speak for “in their own words.”

Today’s participants are:

- F. John Matouk, founding partner, Matouk Bassiouny

- Basel El Hini, chairman and managing director, Misr Insurance Holding Company

So far this week, we have heard from:

- Osama Bishai (CEO, Orascom Construction)

- Hend El Sherbini (CEO, IDH)

- Amr Allam (Co-CEO, Hassan Allam Holding)

- Mohamed El Kalla (CEO, CIRA)

- Riad Armanious (CEO, EvaPharma)

- Elwy Taymour (Chairman and CEO, Pharos)

President Abdel Fattah El Sisi is on a national listening tour as he held yesterday the second in a series of occasional meetings with government officials and members of civil society at the governorate level. El Sisi met in Port Said with the governor as well as other local officials, members of civil society and students. “The meetings come within the framework of the President's keenness on following up on the implementation of developmental plans and services' programs delivered to the citizens,” Ittihadiya said in a statement (pdf) after the meeting. El Sisi spoke yesterday about the new national healthcare program (which Port Said will pilot) as well as conservation of national resources, SME financing and job creation. The meetings kicked off in mid-January in Wadi El Gedid.

The Donald has picked vocal World Bank critic David Malpass to lead … the World Bank,the WSJ reports. The US treasury official has been staunch in his criticism of the bank, particularly over its lending to China. The bank’s board has the final call and will begin considering nominations this Thursday. Tradition since the bank was created after the Second World War is that it is headed by an American. The US controls 16% of votes at the World Bank, but the European Union as a bloc holds 26%.

Whoever gets the nod, the next head of the bank is going to have to get a grip on emerging markets, former World Bank head honcho Robert Zoellick says in an opinion piece for the Financial Times. Zoellick says policymakers need to pay more attention to market dynamics in emerging economies or face the consequences. “When the next downturn or financial crisis hits, emerging markets are likely to prove even more important than they were a decade ago,” he writes. “The new World Bank president should help developing countries to prepare now.”

Also worth knowing this morning:

- A dead(?) cryptobro has taken with him the passwords needed to unlock USD 150 mn in other people’s digital assets. The story, broken by Bloomberg, is getting play everywhere from Coindesk to the Financial Times. CCN has a look at why the case smells a bit fishy.

- The Donald was powering through his state of the union address as we were putting the finishing touches on this morning’s edition. Head on over to the New York Times for the latest.

- Apple’s retail boss is quitting after five years. Angela Ahrendts, who went over from Burberry in 2014, said only she that she was going to pursue (new personal and professional pursuits.” The story is getting plenty of ink in the WSJ and the FT.

It is now the year of the pig in China — the Chinese zodiac sign of the porker represents good fortune and wealth.

PSA- Expect more rain this morning and into the afternoon after a night that included dust, wind and rain. You can expect a daytime high of 18°C and an overnight low of 10°C. The outlook for tomorrow: Sunny with a high of 20°C.

Is there anything better than crisp air in Cairo after a rainstorm? Maybe the air in Cairo on a Friday morning after a rainstorm?

Enterprise+: Last Night’s Talk Shows

Possible constitutional amendments were once again in the limelight on last night’s talk shows. We have the full story in Speed Round, below.

The House of Representatives will debate the amendments over the coming 60 days, Rep. Tarek El Kholy told Al Hayah Al Youm. El Kholy also explained the technicalities of the procedures necessary to pass the amendments (watch, runtime: 07:31). Citizens have the right to partake in discussions of the amendments, Rep. Ahmed El Sherif told Masaa DMC’s Osama Kamal talked to MP Ahmed El Sherif (watch, runtime: 06:41). Yahduth fi Masr’s Sherif Amer also took note of the most recent developments (watch, runtime: 08:22).

Finance Minister Mohamed Maait’s presser yesterday on Egypt’s economic situation ― which we recap in full in Speed Round, below — also came up on Al Hayah Al Youm (watch, runtime: 03:25). Beltone’s Alia Mamdouh also broke down the significance of certain indicators on Hona Al Asema (watch, runtime: 07:45).

President Abdel Fattah El Sisi paid a visit to Port Said, where some EGP 462 bn worth of projects have been deployed over the past four years, deputy governor Mohamed Hany said on Al Hayah Al Youm (watch, runtime: 04:09).

Speed Round

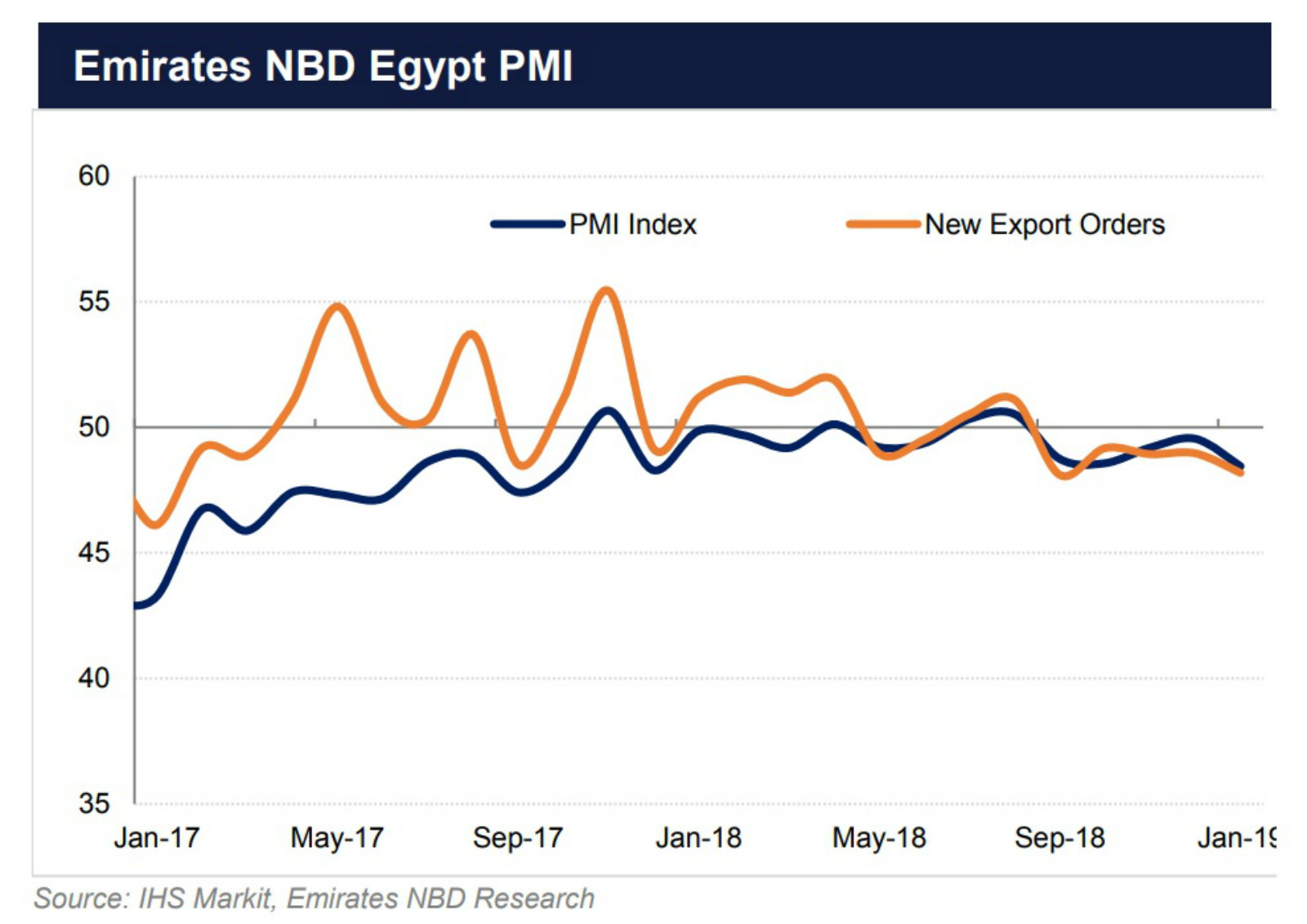

Non-oil business activity hits lowest levels in more than a year: The Egypt purchasing managers’ index (PMI) contracted for the fifth consecutive month in January to reach its lowest level since December 2017, according to Markit / Emirates NBD data. The index fell to 48.5 last month from 49.6 in December, reversing two months of gradual improvements. “Egypt’s recovery over the past two years has so far largely been driven by external rebalancing and public investment, while the private sector has remained under pressure, in part as a result of the ongoing reforms,” Daniel Richards, MENA economist at Emirates NBD, said.

Poor market conditions and bad weather led to the largest decline in output since December 2017 and the biggest fall in new orders since September. Export orders also fell for the fifth month in a row to reach their lowest levels since September.

Falling prices provide relief: Weakening inflation caused input prices to fall to their lowest levels in over two years. In turn, businesses also cut their output prices, which for the first time registered a sub-50.0 reading on the index. “This should contribute to an ongoing decline in CPI inflation, and potentially pave the way for the central bank to begin loosening monetary policy, which would give a much-needed boost to the private sector,” Richards said.

And purchasing activity hits 12-month high: Non-oil purchasing activity hit highs not seen since January 2017, as stocks declined for the first time since September.

It’s a slightly different story in the Gulf: Conditions for the non-oil private sector in the Gulf are continuing to improve. Saudi Arabia’s PMI rose to a 13-month high (up to 56.2 from 54.5) while business activity in the UAE continued to expand, rising to 56.3 from 54.0.

Everything you need to know about the Finance Ministry’s epic presser yesterday — and there is a lot. Foreign holdings in Egyptian treasuries stood at USD 13.1 bn by end-January, Finance Minister Mohamed Maait and Vice Minister of Finance Ahmed Kouchouk said during a press conference held yesterday. January alone saw inflows of USD 900 mn, Maait told reporters. Key points from the presser:

#1- GDP growth target for FY2018-19 is now a bit lower: The ministry has revised downward to 5.6% from 5.8% Egypt’s GDP growth projections for the current fiscal year, which ends in June. The target for the next fiscal year is set at 6%, Maait said. He also reminded us that the IMF is due to complete its final review of Egypt’s economic reform program in July. The IMF approved on Monday the disbursal of our fifth and second-to-last USD 2 bn tranche of its USD 12 bn fund facility.

#2- Fuel hedging may be coming soon: The government has the framework in place to launch its fuel hedging strategy, but has yet to decide on a time frame to pull the trigger, according to Maait. A senior government official had told us on Monday that a number of international banks have approached the government with offers. The official had said the government was also looking to hedge against volatility in the prices of wheat in the coming fiscal year to ensure Egypt meets its budget deficit target. Last December, the government pulled back from fuel hedging contracts with two banks as crude prices turned lower than those in annual budget projections.

#3- The privatization program will resume soon, Maait said, without delving into specifics.A senior government source previously told Enterprise the program is on the agenda for March provided market conditions hold up, adding that the sale of a 4.5% additional stake in Eastern Tobacco is likely still in line to pilot the program.

#4- Asia roadshow confirmed: Kouchouk confirmed the ministry is planning to launch next week an Asia roadshow for Egypt’s upcoming international issuances, starting with Dubai and Abu Dhabi. The ministry is planning to sell between USD 3-7 bn in USD- and EUR-denominated bonds, in addition to green bonds and Egypt’s first JPY-denominated bonds.

#5- The ministry’s comprehensive debt strategy has already been rolled out: A recent focus on promoting long-term treasuries is part of Egypt’s new debt control strategy, which the ministry drafted last month and is set to officially unveil next month. The target of the strategy is to eventually increase the average tenor of all sources of debt to five years,Kouchouk said.

#6- A decision on whether we seek another IMF package will be made by July “in the country’s interest,” Maait told reporters. Speculation had risen late last year that authorities were planning to ask the IMF for further funding, but Maait at the time denied the reports. Egypt will begin making repayments for the USD 12 bn facility starting mid-2020. The repayment plan includes installments of between USD 250-300 mn every six months for five and a half years, Kouchouk said.

#7- Egypt’s national outstanding debt to foreigners has reached USD 10.5 bn, Kouchouk said, noting that annual interest payments on both foreign and local debt increased to EGP 207 bn in the first half of FY18-19, up 19% y-o-y from EGP 173 bn.

Egypt’s net foreign reserves were essentially stable at USD 42.616 bn at the end of January compared to USD 42.551 bn the previous month, the central bank announced on Tuesday. This came after reserves fell in December for the first time since the currency float, coming at USD 42.551 bn from USD 44.513 bn at the end of November.

External debt growth slows in 1Q2018-19, CBE says: Egypt’s external debt grew to USD 93.1 bn in 1Q2018-19, growing rising at a 0.5% clip, compared to a 4.8% q-o-q rate in the previous quarter, according to the CBE’s monthly statistical bulletin (pdf). Gross domestic debt rose to EGP 3.887 tn in 1Q2018-19 from EGP 3.696 tn in the previous quarter, and EGP 3.314 tn during the same quarter a year earlier. Treasury bonds and bills account for EGP 3.511 tn or about 90% of the debt, compared to 92% the previous quarter.

Egypt was the top-performing MENA market in January, beating the MSCI EM and MSCI FM indices, Shuaa Securities say in their monthly briefing. The EGX 30 gained 10% in USD terms, beating Saudi Arabia and the MSCI EM which both rose 9%. Telecoms led the charge, rebounding from being the worst-performing sector in 2018 to gaining 16% over the month. The travel and leisure sector meanwhile continued its 2018 successes, rising 11%.

M&A WATCH- Veon looks take Global Telecom private at EGP 5.30 per share: Global Telecom Holding’s (GTH) majority shareholder Veon has unveiled plans to buy out the remaining 42.3% of the company for EGP 5.30 per share, the company said in an EGX disclosure (pdf). The Dutch company intends to submit a mandatory cash tender offer to the Financial Regulatory Authority (FRA) within the next 60 days to purchase the almost 2 bn shares. The offer sits just below estimates given by Shuaa Securities last week, which said that Veon would need to offer between EGP 5.31-7.90 per share to make the move viable. Beltone Financial values GTH shares at EGP 6.70 per share, Al Mal reported, citing a report from the investment bank.

Market reaction: GTH shares were up 4.16% at the close of play yesterday at 4.76 points. The market reaction following the announcement was rather muted, with the move having already been priced in at the end of January.

Background: Veon announced on January 23 that the company was once again considering taking GTH private, and that its general assembly would be postponed until the end of March to consider the move. The Netherlands-based company, which has extensive operations in Russia and the former Soviet Union, deposited a mandatory offer to purchase the shares at EGP 7.90 back in November 2017 but withdrew it the following April after failing to get regulatory approval.

M&A WATCH- LafargeHolcim considers “strategic options” for its Middle East operations, including in Egypt: Some 2,500 Egyptian workers and professionals employed by Swiss cement giant LafargeHolcim could be getting a new corporate parent as the company considers a sale of all or some of its assets in the Middle East, sources close to the matter tell Bloomberg. The potential plan is part of the company’s effort to refocus its operations toward Europe and reduce its debt and sell off assets “that don’t contribute to its core business.” Lafarge has a deep track record of projects in Egypt, including Cairo Festival City, Cairo International Airport’s Terminal 2, and real estate compound Mountain View Hyde Park.

Background: Reports had emerged last year that Lafarge was looking to divest some or all of its Egyptian assets as part of a new cost-cutting and asset sale strategy that would see the company shed USD 4.1 bn in assets and leave two or three countries. Lafarge acquired in 2008 Orascom Construction’s USD 10.1 bn cement business, which included plants in Egypt, Algeria, and the UAE. Nassef Sawiris, the company’s third-largest shareholder, sold off last month USD 67.5 mn-worth of shares in LafargeHolcim, but remains a major shareholder in the company.

LEGISLATION WATCH- House approves new bank tax treatment: The House of Representatives’ general assembly approved yesterday proposed amendments to the Income Tax Act that would change how banks and corporations account for income from investments in government debt, according to state news agency MENA. The measure will require banks and companies alike to separately account for income derived from their holdings of government debt and could see their effective tax rate rise. A senior government official told us last week that the anticipation of the move by banks drove them to ratchet up their participation in treasury auctions, driving down yields and contributing to an influx of inflows and an appreciating EGP.

What’s next? The law now goes to President Abdel Fattah El Sisi for signing. The Finance Ministry will also have to outline executive regulations on the measure.

Natgas regulator to begin issuing licenses to private sector: The Natural Gas Regulatory Authority will reportedly begin issuing this month private sector gas import and distribution licenses, almost a year after it said it’s open for requests, a source from the Oil Ministry said, according to Al Shorouk. Licenses will come at a cost of EGP 50k alongside an EGP 500k deposit. News came after the regulator, which was made responsible last year licensing under the Natural Gas Act, postponed its first issuance in September, saying the private sector was “unprepared.” The authority is handling requests from at least 14 companies, including Rosneft. It also set fees last year for the private sector’s use of the state’s natgas grid.

LEGISLATION WATCH- Proposed constitutional amendments are sent to committee for discussion: The House of Representatives’ general committee, which is comprised of the House speaker and heads of committees, has agreed to formally send proposed constitutional amendments to committee for discussion, according to a statement yesterday carried by Al Shorouk. The amendments, which still need to be approved by the House Constitutional Committee before going to a final vote within parliament, would extend the presidential term to six years instead of the current four and include a transitional clause that could allow El Sisi to run for two additional terms after his current term ends in 2022, according to a document seen by Reuters.

What other changes would be introduced? A lot of it is unclear. The amendments would bring back the Shura Council, allow for the appointment of one or more vice presidents, grant the president the authority to appoint judges and the prosecutor general, and require the Supreme Council of Armed Forces to approve the appointment of a defense minister. Draft legislation would also no longer require review from the judiciary, according to the Associated Press. The Council of State (Maglis El Dawla) is currently required to review all draft bills. It remains unclear what some changes entail, such as the “deepening and restructuring” of the Armed Forces’ role in the country. Also unclear is what the removal of articles governing the National Media Authority and National Press Authority may entail — are they being scrapped? Rolled under a different authority? Or simply left to parliament or the presidency to create and regulate outside the constitution?

The story is getting a lot of attention in the foreign press, with some, including the BBC, noting former presidential candidate Mohamed ElBaradei tweeting that the constitutional amendments are the “Arab Spring in reverse.”

EARNINGS WATCH- Juhayna net profits rise 4% in 4Q2018 y-o-y: Juhayna Food Industries’ net profits rose 4% y-o-y in 4Q2018 to EGP 49 mn, the company said in an EGX disclosure. Quarterly revenues rose 13% y-o-y to EGP 1.71 bn, bringing the company’s total revenue for 2018 to EGP 7.1 bn, a 17% increase from 2017. Meanwhile, the company’s 4Q2018 core attributable net profit surged 24% y-o-y on the back of a 24% rise in core earnings, Beltone Financial said in its results review. The core earnings growth was driven by “improved leverage ratios and top line growth,” the investment bank said.

CIB has been included in the 2019 Bloomberg Gender-Equality Index (GEI), which recognizes efforts by companies across the globe to promote women’s equality(see full list (pdf). This is the first time an Arab or African company has been included in the index, according to a statement. The 2019 index includes 230 companies operating in 10 sectors across 36 countries. “We are pleased to be recognized by a prestigious international publication for our longstanding commitment to gender equality in our daily operations and at every level of management, including our board,” CIB Chairman Hisham Ezz Al-Arab said.

MOVES- Deezer has appointed Tarek Mounir (LinkedIn) as MENA CEO, the company said (pdf). Mounir will join the global music streaming service on 1 April from broadcast media company Turner where he worked for over eight years.

The Enterprise CEO Poll

F. John Matouk — founding partner, Matouk Bassiouny

In barely a dozen years, Matouk Bassiouny has grown from a five-lawyer shop into one of the MENA region’s premier law firms with offices in Cairo, Dubai and Khartoum.As the firm continues to grow at rapid clip, the question high on the mind of F. John Matouk (LinkedIn) is how to preserve culture and ‘secret sauce’ in a professional services business across multiple countries — all while contending with more competition in his home market from foreign entrants. If you lead a professional services firm or want to make partner at one, this is the interview for you. Since its founding, Matouk Bassiouny has advised on landmark equity capital market and M&A transactions including EFG Hermes’ EGP 1 bn acquisition of Talaat Moustafa Group’s New Cairo-based portfolio of schools, Amazon’s USD 580 mn acquisition of Souq.com, and Mubadala Petroleum’s acquisition of 10% stake in the Zohr gas field, a transaction valued at USD 934 mn. As one of the firm’s co-founders and as head of the firm’s dispute resolution group, Matouk has a track record of work before major arbitral institutions including the International Centre for the Settlement of Investment Disputes, the International Chamber of Commerce (ICC), and the Cairo Regional Center for International Commercial Arbitration (CRCICA).

2018 was the year of regional expansion, the year we transformed from being a national law firm to a regional law firm. We opened an office in Dubai and an office in Khartoum. This is the initial phase in our goal of building a regional platform for provision of legal services in MENA.

Why MENA? Basically we follow what our clients are looking for. There’s a huge demand for professional services in North Africa, including legal services. These markets are difficult to penetrate, but we believe we have the know-how thanks to our experience in Egypt over the past fifteen years. We think we can pretty easily export our know how to these other jurisdictions. The legal systems of most of these other countries are based on Egypt’s, and a significant amount of the lawyers in the region are Egyptian. Also, a lot of local lawyers in each jurisdiction came to Cairo to study, so there’s a natural nexus between Cairo and the region we’re looking to exploit. We also currently have operational country desks — lawyers in Cairo covering Libya or Algeria — and eventually we expect these country desks to evolve into full-fledged offices.

We’ve also invested in acquiring a regional headquarters in Garden City. We bought a building that we are renovating and are hopefully moving in this May.

Institutionalization kicking off in 2018 and continuing through to 2019: We’ve gone through a major rebranding exercise and also continue to focus on institutionalizing the firm, which becomes increasingly important the more one expands regionally. By institutional backbone, I mean all the elements of a professional service provider that a client does not necessarily see but that are fundamental for providing the service. From structuring partner remuneration to putting in the back office support systems that are necessary for a fully-fledged law firm to work. Keeping everything organized as one grows becomes more challenging if it is not done right. It’ll take us two years to finish phase one. Talent acquisition and retention also always remains our top strategic priority.

2019 will be about following up on the regional expansion — and AI. We’re looking to open up in Algeria in H12019. We also are delighted to have a new managing partner starting, Mahmoud Bassiouny — who also heads the Finance & Projects practice — took over on 1 January. Mahmoud is really focused on maximizing our value chain — AI is one thing where we intend to invest significantly in the field to be on the cutting edge of the legal industry. There are some pretty cool, pretty interesting AI program right now for the legal industry that are transforming due diligence, for example. Programs that can do 80-90% of due diligence, bringing down costs for the client and speeding up some processes to a few hours from a few weeks.

As a firm, our biggest challenge will be to keep growing while staying true to our roots. We started off as a five lawyer firm and now we’re above the 200 lawyers mark regionally. Not losing our secret sauce will be our biggest challenge as we grow and expand into different geographic locations. There will be distance between people and this is a people business, so how do we keep the teamwork and the back and forth of ideas — over geographic distances? We need to maintain a single, unified culture to be one firm. We need our capital markets team in Dubai to have the same culture as our projects team in Khartoum or as our corporate team in Algeria.

The regional play is our biggest opportunity as well as our biggest challenge. It’s the flip side that makes it so exciting.

On the wider economy, 2019 looks to me like the year of winners and losers. This is in terms of what I see our clients doing. I think there’ll be volatility and major opportunity. I see a lot of people going for it right now, which is great to see and exciting to watch. I think some will succeed and some will fail. It’ll be a very interesting year.

Compensation structure is crucial in a people industry: Again, professional services is all about people and your compensation structure is the driver. Compensation isn’t just financial, it’s also building a sense of ownership and identity, which feeds into a sense of culture and joint identity. We’re committed to making sure that we match compensation to performance, which we measure with objective and hard criteria as well as soft issues. It’s a science, it’s an art. And for the record, we are significantly increasing salaries this year.

Interest rates are not a direct factor for us. We have no debt and we’ve never had debt. While it doesn’t affect our own business, it affects our clients. Obviously, we like to see our clients investing in new business, but interest rates have to go down. Once they do, the Egyptian banking sector should pick up which will help our banking and finance practice, who have mostly worked with development finance institutions and international banks in the last couple of years.

Inflation has not been a major issue for us, frankly, other than salaries which is by far our biggest cost.

We have five IPOs in the pipeline. They’re all delayed now because of market conditions, which is not surprising. I don’t have any crystal ball on the market conditions.

In terms of M&A, we’re currently working on 48-50, which is about 20-25% above average, which I guess is substantial. The ticket size of the M&As is not necessarily as big, in both USD and EGP terms.

We’re not really seeing any trends in sectors that would be interesting at this stage. The M&A activity is opportunistic. There’s just a lot of volatility which is creating opportunity for M&A. Traditionally, M&A has been in defensive sectors like education and healthcare, which is standard, but it’s opening up across the board into other sectors as well. In the projects space, we think 2019 will continue to be a year for Egypt as well as Sudan where the utilities space will gather more interest and players.

We had that M&A boom in 2017 and then 2018 was kind of dry. The buyers shifted. In the old days, the buyers used to be from the UK, Europe, and the US. Then that shifted to GCC and Asian investors and now its shifting back a little bit and we’re seeing more of the classical players. For me, another indicator which is more important than M&As is greenfield projects. We are seeing a lot activity in this respect in infrastructure and energy in Egypt on the national level.

I don’t believe that locals have to commit to greenfield projects before we start seeing foreign direct investment, but there needs to be a local element to the financing. Even on the legal structuring, local banks have a significant role to play from a regulation, security, and enforcement standpoint. Foreign or offshore banks have a much weaker security position under current legislation. Local players are needed.

Then there’s the FX: if it’s all international and hard currency based, how does one hedge properly on currency risk? I think there needs to be an element of local financing for local projects to take off.

What brings FDI back in? That’s the mn USD question. From my point of view, a lot of it has to do with having the correct regulatory regime in place to provide potential investors with the visibility and comfort they need to take the plunge. I think there’s been great strides made in the past few years and we are now in a period of major legislative change. New laws are out and the regulatory authorities are applying those new laws very proactively and asserting their roles in the private sector. This is ultimately a very healthy thing. We’re going through a very natural grey area period which always tends to occur when new laws and regulations are rolled out. Once the dust settles and clarity and visibility is provided, investors will start coming in.

Hospitality and construction will outperform in 2019.

Underperform? Local banking and finance.

If I were to start a new business today, I would invest in tech. Probably fintech, but tech generally, on the AI end of it.

Our industry is changing. The landscape is transforming from a classic local market industry with a lot of family law firms or one man / woman shows to one where international players are entering the market. This is typical as the market gets more mature. We have two or three market entrants every year and I think that’ll be true next year as well. It really changes the landscape and I think it’s great for the country.

Why? It’s good because it increases competition. Not having competition is boring and leads to complacency. And it gives you reference points. On another level, having international firms here helps the legal market because it raises the bar and prices. By definition, international firms have a larger cost base. It’ll be interesting to see who stays and who leaves. The winners will be agile and respond very quickly to major shifts in market conditions, which are chronic in our markets here.

Part of growing while maintaining our roots is that agility. Being able to get a consensus with the major decision makers and implementing it immediately. With multiple offices, the guys on the ground in each respective market understand their conditions better than I do and if we chose the right person to be there and they say we need to make this radical move immediately, we can’t drag our feet on it. I don’t want to change to a pyramid structure. We’re not formal on our partnership structure, we don’t have rigid rules on voting, and we don’t apply our trade on ourselves. We keep it informal, it’s about the human relationships. Part of having built our own thing is we have the privilege of deciding who joins us as a partner, we don’t have partners forced upon us. That allows us to maintain that informal structure. Informality is a very powerful tool if used properly.

The most common question I get are those linked to the regulatory regime. What’s going to happen, how will VAT roll out, how will these new regulations be implemented in whichever sphere. And questions about visibility. Our clients and business need that to make an investment or business plan.

Basel El Hini — Chairman and managing director, Misr Insurance Holding Company (MIHC)

We knew there had to be something to Basel El Hini (LinkedIn) not because we were, at a time, neighbors in Maadi (once upon a time and unbeknownst to each other), but because he has impeccable taste in modern American literature in the form of John Grisham. And forget about A Time To Kill or The Firm — this is a guy who knows about the Ford County short stories and Playing for Pizza. El Hini came to the state-owned MIHC to “take the government-owned insurance sector to another level,” rehabilitating and deriving new value from its insurance, investment and real estate portfolios. The latter is huge: It includes “the majority of Khedival Cairo,” as he put it. For El Hini, it really is a homecoming of a form: He was previously deputy chairman for finance and investment, a post he left in 2016 to pursue opportunities in the private sector before returning late this past fall. He had earlier served at Banque du Caire and Banque Misr in addition to a stint as an advisor to the minister of finance.

2018 was a year of regrouping and change — and not only for me, for your information, but for the company as a whole. The board of the IHC changed twice, actually — the previous board stepped down in May and the previous chairman with it. And then the minister changed a month later. And then came Minister Hisham Tawfik, and he brought in his own chairman and managing director with two deputies and a new board. It was a lot of change — not just because of me. It was a year of regrouping because we needed to re-focus and re-establish our compass and take it from there.

This coming year will be about unleashing potential. We will be engaging with all of our stakeholders in the market — public and private sector alike. We’re going to be investing in technology. We’re going to be investing in our workforce.

The biggest challenge of 2019 will be the simple fact that the market is stagnant. The market for insurance isn’t growing. All of the players, public and private alike, are fighting for market share in a market that is constrained in size.

The industry is stagnant, first and foremost, because people have no concept of how important insurance is as mode of saving, as a saving vehicle. I believe that insurance, in the mind of the layman, is more associated with compensation in case something happens, which is not a very popular notion in Egypt. So the general population isn’t hot for it. This is the main reason: awareness. Enter new players, who see that the market isn’t growing, but they need to show results, so they focus on taking market share. Increasing awareness and working to grow the demand side are not short-term goals. So it’s a vicious circle, one that needs to be broken somehow, by someone. It’s not just about advertising how great insurance is — it is about changing mindsets as early as in K-12 education.

The biggest opportunity is internal. IHC already has two giants: We already have a large investment portfolio, probably the largest in the market for a company of our size. We already have a large workforce that is passionate about its company. And we have a huge real estate portfolio. With a little extra effort, we’ll be starting from a good place. It’s not as good a place as it was in the past because of the fierce competition today, but it’s a very good place.

Egypt is an emerging market, so we’re not immune to what’s happening around us in EM. Trade wars and talk of recession in developed markets have no roots in EM, but we will be buffeted by them. I’m not so sure what the ultimate effect will be on 2019. The internal economy has its drivers that, if revved up, will do the job, but they someone has to ignite the fire. And my concern is that the external factors might negatively impact us. I’m also hoping that not only macro indicators will continue to improve — what we need are injections of capital from the outside. Foreign direct investment is a catalyst. Better EGX performance will make things better. We need the rally to start somewhere and it will snowball. And you need to keep it all in context — in many ways, we are still regrouping as a country [from events since 2011].

Our approach to compensation in our 2019 budget is probably different than most of the other people you’re talking to. We have a hard balance to strike: We’re limited by government pay scales. I mean, we try. We know that living conditions aren’t getting easier, but we are part of a wider system.

I don’t envy the policymakers when it comes to interest rates. Things are not as straightforward and clear as they might wish. Personally, high interest rates? You’re right — they make investors happy. But at the same time, the economy needs an injection of expansionary measures, not the other way around. I would love to see rates go down because this might be one of the factors that really jumpstart the real economy.

Where will I invest this year? I’m going to answer in a sense different than the one you probably mean. I’m going to invest in people — in the capacity of our people. And in technology.

Yes, I’m also looking to expanding our menu of financial services beyond just insurance. I want us to become a diversified non-bank financial services group. Leasing, factoring, microfinancing — they’re all options.

I would say that I’m hopeful when it comes to the IPO outlook rather than viewing it as definitively positive. I really hope that we see a better year on the IPO front, because we were moving very firmly on the right track. Everyone was anticipating the gov’t-owned IPO program because they would deepen the market and attract new funds from outside the market, which is what the EGX really needs to take a leap forward. I’m hopeful that the market conditions for IPO and M&A will improve. Once that happens, once the EGX moves in a more positive direction, then IPOs will start pouring in. But so much of this is about factors outside of Egypt.

There is much more opportunity on the M&A front than first meets the eye. Assets are really undervalued right now and there are so many great catches out there. I’m probably more optimistic here than I am about the IPO climate.

IHC doesn’t have to do greenfield. If there are good opportunities, then, yes, we’re buyers. If not, then no, we’ll build.

I still like financial services to outperform in the next year. Everyone likes consumer goods, of course. And then the usual suspects — oil and gas, et cetera. But first and foremost, financial services.

Real estate will underperform.

I expect we’ll see more regulation across the board. The Financial Regulatory Authority has been moving quickly to regulate the markets, and I expect this will continue. It is a good trend. I also expect there’s more than a possibility that holding companies like us that have more than 50% of their activities in regulated industries will themselves be regulated by the FRA, and I welcome that. But what I hope is that there will be more stakeholder consultation as these things happen. Sometimes regulators are more intent on accomplishing things and their pace might outstrip the stakeholders. But even so, I hope consultations are given more weight in the consideration and direction of the regulators.

Something about me personally? I miss having time to write and to read. I’ve actually started a novel, but I have had to put it on hold. And I love to read outside business and finance. My hope is that someday I will have time to do these things again.

The Market Yesterday

EGP / USD CBE market average: Buy 17.57 | Sell 17.67

EGP / USD at CIB: Buy 17.56 | Sell 17.66

EGP / USD at NBE: Buy 17.55 | Sell 17.65

EGX30 (Tuesday): 14,733 (+2.6%)

Turnover: EGP 2.0 bn (134% above the 90-day average)

EGX 30 year-to-date: +13%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session up 2.6%. CIB, the index heaviest constituent ended up 3.0%. EGX30’s top performing constituents were GB Auto up 6.5%, TMG Holding up 6.0%, Arab Cotton Ginning up 5.1%. Yesterday’s worst performing stocks were Orascom Development Egypt down 0.3%, and Cairo Investment & Real Estate Development down 0.1%. The market turnover was EGP 2.0 bn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -128.8 mn

Regional: Net Short | EGP -26.4 mn

Domestic: Net Long | EGP +155.2 mn

Retail: 54.3% of total trades | 49.1% of buyers | 59.5% of sellers

Institutions: 45.7% of total trades | 50.9% of buyers | 40.5% of sellers

WTI: USD 53.63 (-1.70%)

Brent: USD 61.96 (-0.88%)

Natural Gas (Nymex, futures prices) USD 2.67 MMBtu, (+0.49%, Mar 2019)

Gold: USD 1,319.90 / troy ounce (-0.03%)

TASI: 8,623.92 (+1.21%) (YTD: +10.19%)

ADX: 5,137.30 (+0.18%) (YTD: +4.52%)

DFM: 2,542.82 (+0.54%) (YTD: +0.52%)

KSE Premier Market: 5,451.82 (+0.47%)

QE: 10,715.29 (-0.11%) (YTD: +4.04%)

MSM: 4,169.13 (+0.07%) (YTD: -3.58%)

BB: 1,403.69 (+0.44%) (YTD: +4.97%)

Calendar

07 February (Thursday): Egypt Building Materials Summit, Nile Ritz Carlton, Cairo, Egypt

11-13 February (Monday-Wednesday): Egypt Petroleum Show, Egyptian International Exhibition Center, Cairo.

14 February (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

19 February (Tuesday) The Cairo Economic Court to deliver decision on pharma distributors appeal, Egypt.

19-20 February (Tuesday-Wednesday): The Solar Show MENA 2019, Nile Ritz Carlton Hotel, Cairo, Egypt.

23 February (Saturday): The Supreme Administrative Court will rule in an appeal by Uber and its competitor Careem against a lower court ruling ordering the suspension of their operations.

24-25 February (Sunday-Monday): EU-Arab League summit, Sharm El-Sheikh, Egypt

26-28 February (Tuesday-Thursday): 22nd International Conference on Petroleum Mineral

Resources and Development, Egyptian Petroleum Research Institute, Nasr City, Cairo, Egypt.

03-06 March (Sunday-Wednesday): EFG Hermes One-on-One Conference, Dubai.

March (date TBD): Traders Fair, Nile Ritz Carlton, Cairo, Egypt.

17 March (Sunday): A court will look into a lawsuit by a subsidiary of Arabian Investments, Development and Financial Investment Holding Co. (AIND) against Peugeot Citroen, seeking EUR 150 mn in damages.

17-18 March (Sunday-Monday): OPEC Joint Ministerial Monitoring Committee meeting, Baku (Bloomberg)

18-19 March (Monday-Tuesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

27-30 March (Wednesday-Saturday): Cityscape Egypt 2019, Egypt International Exhibition Center, Nasr City Cairo.

28 March (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

April: The African Tripartite Trade Area (TFTA) agreement is set to take effect in April after a majority from the participating governments ratified it, COMESA Secretary General Chileshe Kapwepwe according to Al Shorouk.

17-18 April (Wednesday-Thursday): OPEC+ meeting, Vienna (Bloomberg)

20-22 April (Friday-Sunday): Spring meetings of the World Bank and International Monetary Fund, Washington, DC.

25 April (Thursday): Sinai Liberation day, national holiday.

28 April (Sunday): Easter Sunday, national holiday.

29 April (Monday): Easter Monday, national holiday.

30 April-1 March (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

01 May (Wednesday): Labor Day, national holiday.

06 May (Monday): First day of Ramadan (TBC).

23 May (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

June: International Forum for small and medium enterprises (SMEs).

05-06 June (Wednesday-Thursday): Eid El Fitr (TBC).

18-19 June (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

30 June (Sunday): June 2013 protests, national holiday.

11 July (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

23 July (Tuesday): 23 July revolution, national holiday.

30-31 July (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

7-11 August (Wednesday-Sunday) Eid El Adha (TBC).

22 August (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

29 August (Thursday): Islamic New Year (TBC), national holiday.

17-18 September (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 September (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

6 October (Sunday): Armed Forces Day, national holiday.

10-13 October (Tuesday-Sunday): Big Industrial Week Arabia 2019, Egypt International Exhibition Center, Cairo, Egypt.

29-30 October (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

9 November (Saturday): Prophet Mohammed’s birthday, national holiday.

December: Egypt will host for the first time the Pack Process trade expo for the Middle East and African region.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee holds two-day policy meeting to review the interest rate.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee meets to review interest rate.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.