- Expedition gets most of the Domty shares it wanted + Tabreed is investing EGP 1.6 bn in Egypt. (The Big Stories Today)

- EU could raise EUR 140 bn with proposed cap on non-gas energy companies’ revenues. (The Big Story Abroad)

- Lebanon is seeing a spate of bank robberies as people try to get their own money, but let’s have a moment of silence for the b’naires. (For Your Commute)

- How New Space is paving the way for space tourism and the space economy. (Outer Space)

- Snow and ice-covered wilderness, narrated by Sir David Attenborough. (On the Tube Tonight)

- Wrestler Sarah Hamza becomes the first Egyptian woman to reach World Championship finals. (Sports)

- The USD bn story of hosiery. (Under the Lamplight)

Wednesday, 14 September 2022

PM — Egypt is getting EGP 2 coins

TL;DR

???? WHAT WE’RE TRACKING TONIGHT

Good afternoon, friends. It’s a busy Wednesday afternoon here in Omm El Donia, with a little bit of everything coming out of the news cycle.

THE BIG STORIES TODAY

#1- Expedition Investments gets almost all of its targeted shares in Domty: Shareholders in EGX-listed Domty have agreed to sell 93.2 mn shares to the consortium of investors led by Expedition Investments, according to an EGX bulletin. That’s around 97% of the 96.2 mn shares the consortium was targeting in its bid to acquire a 34% stake in the cheesemaker. Expedition sweetened the offer by upping its offer price by 10% last week.

#2- UAE’s Tabreed is investing EGP 1.6 bn in Egypt: DFM-listed National Central Cooling Company (Tabreed) inked a EGP 1.6 bn (AED 306.4 mn) long-term concession agreement with Egyptians for Healthcare Services (EHCS), according to a disclosure to the DFM (pdf). The agreement will see Tabreed build and operate cooling and heating assets to service Badr City medical park CapitalMed.

ALSO- Egypt is going to start minting EGP 2 coins as part of a cooperation agreement with the UK’s Royal Mint, which will set up a branch in the Suez Canal Economic Zone, according to a cabinet statement.

THE BIG STORY ABROAD

The EU is proposing a cap on soaring revenues from non-gas energy companies and could raise over EUR 140 bn for consumers who need help, European Commission President Ursula von der Leyen told the EU Parliament today. The EU has already handed out tax cuts and subsidies to try to contain its energy crisis and is now turning to those who have been making financial gains from the fallout. Wind and solar farms and nuclear plants would face a cap of EUR 180 per MWh on the revenue they receive for generating electricity, with governments recouping excess revenues and recycling it to support consumers, according to the draft of the proposal seen by Reuters. The story is getting plenty of front-page coverage in the international business press: Bloomberg | CNBC | Washington Post

** CATCH UP QUICK on the top stories from today’s EnterpriseAM:

- FRA tweaks listing procedures + scraps margin trading caps: The Financial Regulatory Authority has handed down a slate of changes designed to boost liquidity on the EGX, including measures to simplify listing requirements and boost margin trading.

- All the industrial investment: Chinese mobile maker Oppo has inked an agreement to build a USD 20 mn factory in Egypt. The announcement came the same day Prime Minister Moustafa Madbouly met with nine foreign and local companies to follow up on pledges to invest more than USD 1 bn in new production facilities.

- Producers of nitrogen fertilizers could see their natural gas bills rise following a government decision to link them to the price of urea fertilizer.

|

FOR TOMORROW-

B Investments is going to have to make up its mind over TotalEnergies Egypt: The private equity player has the right to preempt a bid by Abu Dhabi energy giant Adnoc to acquire a 50% stake in the company, which expires tomorrow.

???? CIRCLE YOUR CALENDAR-

ADD Art is hosting its inaugural AlDau International Art Festival in Hurghada from 22 September until 7 October, according to a statement (pdf). The festival will begin with a weeklong workshop with nearly 40 artists from countries including the US, UK, France, Jordan, Tunisia, Uzbekistan, and Congo. The workshop will be followed by an exhibition from 2-7 October at the AlDau Art Promenade in Hurghada. ADD Art is a subsidiary of AlDau Developments.

PSA- Tech startups have just a little over two weeks to apply for DMZ Cairo’s second eight-month incubation program, which begins in November. Applications for the cycle are open until Thursday, 29 September, according to a statement (pdf). The incubator is based at the Universities of Canada in Egypt and is backed by the Academy of Scientific Research and Technology and the National Technological Incubators Program.

☀️ TOMORROW’S WEATHER- Temperatures in Cairo will hit 34°C tomorrow during the day before falling to 21°C at night, our favorite weather app tells us.

???? FOR YOUR COMMUTE

How bad is Lebanon’s banking crisis? People are robbing banks — to get their own money: Two armed Lebanese citizens entered two separate banks in Lebanon today to retrieve money from their own accounts, which have been frozen since the country spiraled into a financial crisis in 2019, Reuters reports. The two incidents were apparently not connected to each other. One woman managed to retrieve USD 13k from her account and walked out following a “brief hostage situation,” while another man entering a different bank got his hands on “a portion of his money before he handed himself over to security forces and was detained.”

Meanwhile, please bring out the world’s smallest violin for the world’s richest b’naires, who lost a combined USD 93 bn yesterday, recording their ninth-worst daily drop after US stocks suffered their worst day since June 2020 on the back of higher-than-expected August inflation figures, Bloomberg reported, citing its bn’aire index. The S&P 500 index tumbled 4.3% and the tech-heavy Nasdaq fell 5.2% yesterday on the news. This comes shortly after the bn’aires’ combined fortune dropped USD 1.4 tn in July.

Who lost what? Jeff Bezos topped the losers list, seeing his net worth drop USD 9.8 bn to USD 150 bn — but remains the second wealthiest person in the world. Elon Musk followed with a USD 8.4 bn loss, but remains the world’s richest person with a USD 256 bn fortune.

The bigger picture: The world’s 500 richest have lost a combined USD 1.2 tn since the beginning of the year. Mark Zuckerberg and Binance CEO Changpeng Zhao both lost more than half of their net worth.

???? ENTERPRISE RECOMMENDS

???? ON THE TUBE TONIGHT-

(all times CLT)

Sir David Attenborough’s back with Frozen Planet II, 11 years after the first series’ premiere. The BBC six-part series explores the snow and ice-covered wildernesses that cover a fifth of the planet and the wildlife that reside there. Frozen Planet II pulled out all the stops with the iconic Hans Zimmer scoring the music for the series, and collaborating with pop-star Camila Cabello to create a song for the trailer. The veteran broadcaster’s narration is as captivating as ever but one thing that has changed the decade since the first series was filmed is advances in technology, as is made apparent by the racer drones footage of the different animals including pandas, penguins and polar bears. “This latest offering from the crack team and Sir David accomplishes its goal as effectively as ever; it makes us, in the best way, children again,” The Guardian’s Lucy Mangan writes in a review. The documentary ends with a call to arms, with Attenbrorough stating that much of what has just been shown is disappearing at an unprecedented rate and that we must not allow for that to happen.

⚽ Quite the lineup of Champions League matches tonight: Real Madrid faces RB Leipzig in the Champions League at 9pm, while Manchester City takes on Borussia Dortmund at the same time.

Also happening at 9pm: Chelsea v Salzburg, Maccabi Haifa v Paris Saint Germain, Juventus v Benfica, Rangers v Napoli, and FC Copenhagen v Sevilla.

Earlier at 6:45pm: Milan faces Dinamo Zagreb and Shakhtar Donetsk meets Celtic.

???? Egyptian wrestler Samar Hamza became the first Egyptian woman to reach the World Championship final after defeating Epp Mäe of Estonia 3-2 in the semi-final of the +76 kg freestyle in Serbia, Ahram Online reports. Hamza will face Turkish wrestler Yasemin Adar in the final tonight at 6:30pm.

???? OUT AND ABOUT-

(all times CLT)

It’s shaabi + mahraganat night: El Sawareekh will perform their hits at Cairo Jazz Club 610 at 9pm tonight, followed by shaabi experimentalist Abo Sahar playing his tracks.

If shaabi isn’t your thing, Noha Fekry is taking the stage at the Jazz Bar in Kempinski Nile Hotel at 9:30pm.

Or do the singing yourself at Karaoke Night at Room New Cairo at 8pm.

???? UNDER THE LAMPLIGHT-

The Spanx Story: Eager to wear cream pants she had just bought to a party, and unable to find any underwear that wouldn’t show through the fabric, Sara Blakely got creative. She cut the feet off a pair of pantyhose because she didn’t like the seam that showed through her open-toed sandals. What she did like though was how they gave her a smoother look — something she knew countless women would appreciate and was a eureka moment. She began experimenting with a prototype and despite having no fashion experience built what is now a massive company and household name off that idea. The Spanx Story chronicles her inspiring journey, with all its highs (like Oprah announcing that she loves Spanx on her show) and lows, offering an honest glimpse into a woman’s journey to building an iconic brand and becoming a self-made b’naire.

???? GO WITH THE FLOW

The EGX30 fell 2.0% at today’s close on turnover of EGP 1.59 bn (41.3% above the 90-day average). Local investors were net buyers. The index is down 14.7% YTD.

In the green: Rameda (+1.5%) and Eastern Company (+0.4%).

In the red: Abou Kir Fertilizers (-6.1%), Fawry (-5.4%) and Heliopolis Housing (-4.2%).

???? OUTER SPACE

Fancy a trip to outer space? Soon, you might not have to be an astronaut (or Richard Branson) to journey to the cosmos. As the private sector increasingly looks to capitalize on the burgeoning New Space industry, a casual voyage to the moon might become within the reach of the average person. One report from Research and Markets estimates that the global orbital transportation and space tourism market will reach a whopping USD 2.58 bn by 2031, growing by 17.15% annually for the next decade.

NASA’s Commercial Crew Program is also paving the way for the private sector to make forays into the sector. The high-risk nature of space exploration and questions around NASA’s safety culture following two high-profile accidents — not to mention the high costs associated with building and launching spacecraft — paved the way for the Commercial Crew program. Under the program, NASA awarded SpaceX USD 3.1 bn and Boeing around USD 4.8 bn to develop spacecraft that would replace the Space Shuttle — a move that NASA heads say will likely save the Agency between USD 20 and 30 bn, while providing NASA with two independent crew transport systems. The yet-to-launch Orion Space Launch System is designed as a successor to the Space Shuttle Program that helped build the International Space Station (ISS), which NASA retired in 2011.

Commercial space voyages have been around for a little under two years: SpaceX was the first private company to launch NASA astronauts into space on a privately-owned vessel in November 2020, marking the first orbital crewed mission since NASA grounded the Space Shuttle in 2011 — though it likely won’t be the last given the private sector’s growing role in space exploration. In fact, SpaceX launched 26 missions in 2020, averaging one launch every two weeks (in 2018, it launched 21). Government agencies like NASA are still the primary customers for private aerospace travel, although that is likely to change soon.

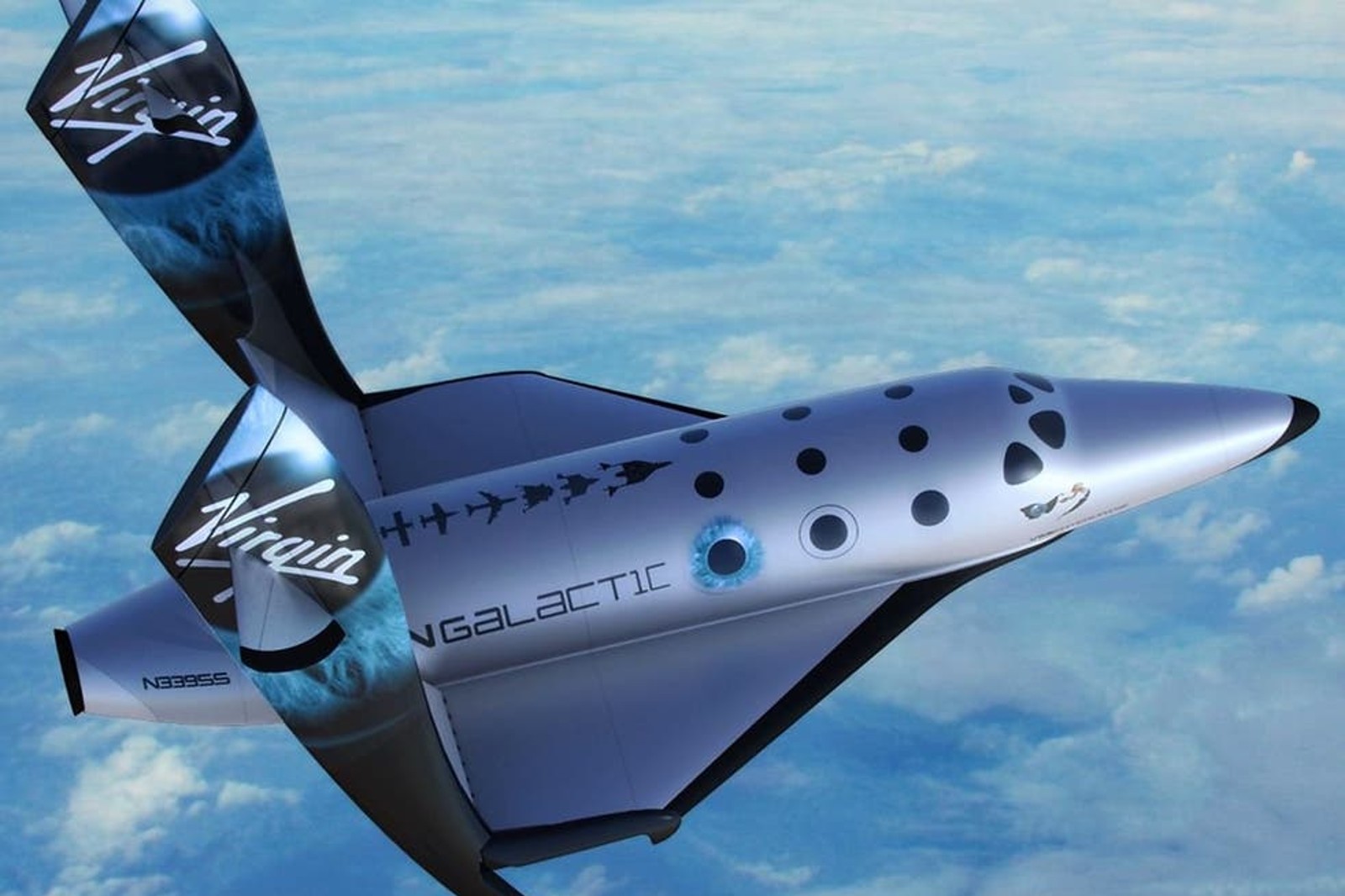

It’s been much of a bn’aire space race: Richard Branson’s Virgin Galactic, which has a spaceflight reservation application on its website and accepts deposits of USD 200k, and Jeff Bezos’ Blue Origin, which auctioned off tickets on its maiden flight for a reported total of USD 100 mn, both took flight for the first time within a week of each other in July 2021. The companies are looking to make orbital and suborbital space flights routine for paying customers. Blue Origin‘s latest journey in August of this year had 29-year-old Egyptian biomedical and mechanical engineer and founder of Deep Space Initiative Sara Sabry on board.

And aerospace tech is advancing fast. Elon Musk’s SpaceX, which was founded in 2002 with the aim of making humanity a “multi-planetary species,” introduced the first fully (functional) reusable multi-stage rocket system. Rather than discarding the first stage of the rocket that propels it into space, the reusable system lands the launcher back on Earth, where it can then be reused on other missions. Boeing’s Starliner will also have a reusable rocket system.

The private space sector’s risk appetite may accelerate development of the space economy — and make it more financially accessible to some: A report by Harvard Business Review (HBR) notes that one of the biggest advantages to introducing the private sector to space is that private companies have a higher risk appetite and are more nimble than government agencies like NASA, allowing them to optimize turnaround time for developing new products and services for the sector.

By the numbers: Axiom Space, a company founded by a former NASA official-turned-contractor, charged customers USD 55 mn each for an eight-day stay on board the ISS in April of this year. By comparison, tickets on board Virgin Galactic’s suborbital flights are expected to set spacefarers back USD 450k each.

This comes as the space economy is booming. The space sector raked in revenues of USD 366 bn in 2019, with 95% of that going towards goods and services produced in space for use on Earth. This includes things like telecoms and internet infrastructure, earth observation capabilities, and national security satellites, among other things. Axiom Space’s core business, for example, is real estate. The company is positioned to build the first privately-owned and managed space station, which will likely replace the soon-to-be decommissioned International Space Station (ISS). Even luxury items are finding their way to space: Argotec and Lavazza’s ISSpresso machine, which landed on board the ISS in 2015, allowed space voyagers to enjoy their favorite cuppa java served up in a pouch in zero-gravity.

But with all this growth comes concerns, including space junk and environmental hazards: So far, the space economy is largely unregulated, leaving companies like SpaceX to build Starlink, a satellite network built in low Earth orbit that aims to provide low-cost internet to remote locations. Astronomers and spaceflight safety experts have raised flags about the hazards of the network, which will have as many as 42k satellites, noting that it might interfere with observations of the universe from earth and warning of collision hazards. Others worry that it might trigger changes to the Earth’s climate. Environmentalists are also raising flags about the as-yet unknown environmental impact that commercial spaceflight could have, which includes emissions from rockets in the upper atmosphere and potential problems arising from space debris. The as-yet lack of regulation around rocket emissions compounds the problem.

???? CALENDAR

OUR CALENDAR APPEARS in two sections:

- Events with specific dates or months are right here up top

- Events happening in a quarter or other range of time with no specific date / month appear at the bottom of the calendar.

SEPTEMBER

September: Central Bank of Egypt’s Innovation and Financial Technology Center to launch incubator for 50 fintech startups.

September: Egyptian-German Joint Economic Committee.

September: A delegation from Germany’s Aldi will visit Egypt to look at potential investments.

September: Government to launch an international promotional campaign for Egyptian tourism.

11-13 September (Sunday-Tuesday): Environment and Development Forum (EDF), InterContinental City Stars, Cairo.

12 September (Monday): Consoleya will host a Business Meet-up by Cairo Angels, which will focus on Nigeria’s tech ecosystem.

12-13 September (Monday-Tuesday): Cityscape holds its first pre-summit ahead of the main annual exhibition.

13-15 September (Tuesday-Thursday): Hurghada will host the Regional Seminar on Airport Master Planning organized by ICAO.

14 September (Wednesday): Expedition Investments’ MTO for Domty expires.

15 September (Thursday): Deadline for B Investments to respond to Adnoc’s bid for TotalEnergies Egypt.

15 September (Thursday): Deadline to apply for the fifth phase of the export subsidy program.

15 September (Thursday): Egypt and UN-led regional climate roundtable ahead of COP27, Beirut, Lebanon.

15 September (Thursday): The deadline for receiving offers for the renovation of the historic Grand Continental Hotel.

15 September (Thursday): The first Gas Exporting Countries Forum Coordination Meeting in the Run-up to COP 27.

18 September (Sunday): Deadline for brokerage firms, asset managers and financial advisors to register with the Egyptian Securities Federation.

18 September (Sunday): Deadline to apply for investor funding under the Planning Ministry’s Smart Green Governorates initiative.

19-22 September (Monday-Thursday): EFG Hermes One on One Conference, Dubai.

20-21 September (Tuesday-Wednesday): Federal Reserve interest rate meeting.

22 September (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

22 September (Thursday): Deadline to submit prequalification applications for companies interested in submitting a proposal for sea water desalination projects

25-27 September (Sunday-Tuesday) A delegation of executives at Egyptian real estate companies visit Saudi Arabia to present developers with potential investments in Egypt’s real estate sector.

26–27 September (Monday-Tuesday): The Africa Women Innovation and Entrepreneurship Forum (AWIEF) at the Cairo Marriott Hotel.

27-29 September (Tuesday-Thursday): Africa Renewables Investment Summit (ARIS), Cape Town, South Africa.

28-29 September (Wednesday-Thursday): The sixth edition of Arab Pensions and Social Ins. Conference in Sharm El Sheikh.

OCTOBER

October: House of Representatives reconvenes after summer recess

October: Air Sphinx, EgyptAir’s low-cost subsidiary to commence operations.

October: Fuel pricing committee meets to decide quarterly fuel prices.

1 October (Saturday): Use of Nafeza becomes compulsory for air freight.

1 October (Saturday): Start of 2022-2023 public school year.

1 October (Saturday): 2022- 2023 academic year begins for public universities.

4-8 October (Tuesday-Saturday): The Chemical and Fertilizers Export Council of the Trade and Industry Ministry is organizing a trade mission to Kenya.

6 October (Thursday): Armed Forces Day, national holiday.

8 October (Saturday): Prophet Muhammad’s birthday, national holiday.

10 October (Monday): The CEO Women Conference

10-16 October (Monday-Sunday): World Bank and IMF annual meetings, Washington, DC.

15 October (Saturday): Cairo Metro will launch a global tender for maintenance work on the power stations and overhead catenary system of Line 1.

16-19 October (Sunday-Wednesday): Cairo Water Week 2022, Nile Ritz Carlton, Cairo.

17 October (Monday): Fifth Egypt and UN-led regional climate roundtable ahead of COP27, Geneva, Switzerland.

27 October (Thursday): European Central Bank monetary policy meeting.

Late October-14 November: 3Q2022 earnings season.

Late October: First Abu Dhabi Bank to complete full integration with Bank Audi’s Egyptian operations after merger.

NOVEMBER

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

1-2 November (Tuesday-Wednesday): Arab League annual summit, Algiers, Algeria.

3 November (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

7-13 November (Mon-Sun): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

DECEMBER

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday) — First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

**Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish above between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.