- How would a post-covid commodities boom impact Egypt? Hint: expect higher inflation. (Speed Round)

- It’s official, foreign holdings of EGP debt have overtaken pre-covid levels. (What We’re Tracking Tonight)

- Prime Speed Medical is reducing its target stake in New Al Safwa Specialized Hospital to 4.4% from 10%. (Speed Round)

- Meet our analyst of the week: CI Capital’s Sara Saada. (Go with the Flow)

- Financial institutions and central banks are buying into cryptocurrencies, despite warnings of volatility. (Crypto)

- Carbon emissions are making an alarming comeback as lockdown measures eased up at the end of 2020. (What We’re Tracking Tonight)

- How to go from sneaker-head to sophisticated sneaker derivatives trader. (Lifestyle)

Tuesday, 2 March 2021

EnterprisePM — Can Egypt survive a commodities supercycle?

TL;DR

WHAT WE’RE TRACKING TONIGHT

You made it over the weekly hump, everyone, and you can now begin the countdown to the weekend.

OUR BIG READ- We explore how any potential commodities super-cycle can impact Egypt in the Speed Round below. If you’re anything like us, then the lockdown has made you extra paranoid about what a spike in global commodities prices can mean for your grocery shopping and the macro climate. We talk to analysts and research houses, who tell us that yes, inflation may likely take a hit.

Fears on how it may hurt food prices globally hasn’t abated in the foreign press, with Bloomberg outlining the five hotspots which are most vulnerable to a supercycle. Brazil tops that list after seeing the fastest increase in food prices in the past year relative to overall inflation because of a sustained decline in the currency, followed by Russia who this year imposed tariffs and quotas on wheat to meet local demand. Nigeria is next up on the list, followed by Turkey and India. Arab countries such as Lebanon and Tunisia seem likely to move up the list soon, while even oil-rich UAE is considering possible price caps on some foods.

HAPPENING NOW- Real Estate Registry Act amendments postponed to 2023: The House of Representatives’ Legislative Committee approved postponing implementing amendments to the Real Estate Registry Act till June 2023, in compliance with a presidential directive issued yesterday to allow time for public consultations on the legislation, Al Shorouk reports. The committee also agreed to remove a clause making utility infrastructure access for new properties contingent on the registration of property and payment of real estate tax and

a clause imposing a 1% fee to be paid to the lawyers syndicate upon the registering of new properties.

It’s official, foreign holdings of EGP debt have overtaken pre-covid levels: Foreign investment in Egyptian bonds and treasury bills currently stands at USD 28.5 bn, head of the Finance Ministry’s debt management unit Mohamed Hegazy tells Bloomberg, confirming reports last week. Hegazy noted that inflows have bounced back from 60% capital outflows between March and May last year due a covid-19-induced sell off. Low inflation and high yields were luring foreign investors back to Egypt’s debt markets, which offer some of the highest real return rates in the world, second only to Vietnam, according to Bloomberg indexes.

The International Cooperation Ministry launched a digital campaign today titled #GameChangers to highlight the value of public-private partnership. The campaign will feature several testimonials from private sector firms who partnered with public institutions, including large entrepreneurs and MSMEs, the ministry said in a press release (pdf).

The social media push will also encourage businesses to take steps to pave the way to a greener economy: The first #GameChangers video celebrates Egypt’s flagship project, the Benban Solar Park, which was erected by the ministry’s partnership with the Saudi Fund for Development to finance private sector company IND for Construction and Solar Energy (watch, runtime: 02:03).

Nigeria is looking to Egypt’s electricity buildup as a model, with the two countries set to collaborate to roll out the Nigerian Presidential Power Initiative with Siemens, using Egypt’s successful experience in implementing a power upgrade with the German company, reports Nigeria’s Nairametrics. Siemens had helped build Egypt’s three main combined cycle power plants, which drove our capacity to around 60 GW. The collaboration also comes as Egypt looks to exercise infrastructure diplomacy and cooperation in the region. Read more.

YOUR MANDATORY COVID STORY- The covid-19 variant found in Brazil is almost twice as transmissible and is more likely to evade natural immunity brought about by prior infection, compared to other virus strains, reports Sky News, citing a study conducted by a UK-Brazilian team of researchers that is yet to be released. The so-called P1 variant was able to evade 25-61% of protective immunity elicited by previous infection, a sign that current vaccines could also be less effective against it. International concern about the P.1 variant is escalating as more than 25 countries have so far detected the variant, including Belgium, Sweden and the UK. The Guardian is out with an explainer outlining what the world currently knows about the P.1 variant, while Virological studies the variant in more medical terms.

|

FOR TOMORROW- PMI day: PMI figures for February will land tomorrow at 6:15am CLT. Non-oil private sector activity in Egypt continued to contract in January, albeit at a slower pace, with the gauge edging up a little to 48.7 from 48.2 in December.

???? CIRCLE YOUR CALENDAR-

AUC is holding Mad March this month, their biggest book sale of the year with up to 75% on all books. The book sale is on everyday from 10am–6pm CLT at AUC Tahrir Bookstore & Garden and is open to the public.

Tough Mudder’s resilience-testing obstacle course will take place this weekend. You can learn more about Tough Mudder Egypt and register for the event on their website.

The IDC Future of Work conference is kicking off next Monday, 8 March, under the theme “The Path to Business Resiliency”.

The Cairo International Furniture Show, Le Marche, is set to take place from 11-14 March at The Cairo International International Convention Centre, with over 300 local and international brands to showcase their pieces. The Cairo Fashion & Tex trade show will also take place at the same venue from 11-13 March.

???? FOR YOUR COMMUTE-

Carbon emissions were up 2% y-o-y in December 2020, coming back fast after their record fall early in the pandemic as economic activity picks up as markets reopen, according data from the International Energy Agency on 2020 emissions out today. The end of the year saw US emissions approaching the level seen in the same period in 2019 while China’s emissions were 7% higher in December 2020 than they were in the same month the year before. Other culprits include Brazil and India, where oil demand also pushed emissions to 2019 highs.

We need to be thankful for whatever emissions cuts we saw in 2020: Overall, the world saw a 6% reduction in carbon emissions in 2020. Both the US and EU saw emissions fall by 10% on an annual basis, while China was the only large economy that saw emissions increase, going up by 0.8%. The sector with the biggest drop in energy-use emissions during 2020 was transportation, as workers quarantined, business slowed or halted, and flights were grounded. Emissions from energy fell 5.8% y-o-y in 2020, compared to the prior year.

Are SPACs a launchpad to the final frontier? More space-focused companies are seeing the benefits of a quick IPO through a merger with a SPAC to fund space operations and R&D. Spire Global and Rocket Lab are the latest in a series of space ventures that have gone public via a SPAC, following companies such as BlackSky, rocket builder Astra, and Virgin Galactic, reports CNBC. These are proving to be a boom for valuations, with Spire being valued at a USD 1.6 bn equity valuation, while Rocket Lab is expected to be valued at more than USD 4 bn when the SPAC merger closes.

Still confused about what a SPAC is? Check out our explainer.

Cairo’s Mosque-Madrassa of Sultan Barquq is first up on a list of 10 virtual tours of spectacular buildings around the world, curated by The Guardian. Other cool additions include Paris’s Palace of Versailles, Barcelona’s Casa Batlló, Moscow’s futuristic Dominion Tower, and Iran’s Golestan Palace. All virtual tour links are included in the article.

???? ON THE TUBE TONIGHT-

Throwback Tuesday, anyone? Netflix seems to be up for the series, encouraging us by adding classics to its roster today such as Batman Begins (Christian Bale was still Batman), Will Smith’s I Am Legend (a very fitting covid watch), and even one of our favorites, Jack Black’s Tenacious D in The Pick of Destiny.

30 for 30 on Amazon Prime also caught our eye… 30 for 30 is a series of short documentaries created by ESPN celebrating interesting people and events in sports history from Muhammad Ali-Larry Holmes boxing rivalry, to how Nelson Mandela and a rugby team helped heal South Africa. Making it even more interesting is that every episode is created by a different director, featuring at points Barry Levinson, Ice Cube, and Clifford Bestall (who teamed up with none other than Morgan Freeman).

The Egyptian Premier League has three matches on today, with El Gouna and Smouha just hitting the field a half hour ago. Meanwhile, Misr Lel Makassa and Al Makawloon will play at 5pm CLT while Al Masry and Pyramids will play at 7pm CLT.

Across the Med in Europe, The English Premier League has a single match between Man City and Wolves today at 10pm CLT, while Serie A will see Lazio play versus Torino at 7:30pm CLT and Juventus versus Spezia at 10pm CLT.

???? EAT THIS TONIGHT-

Feeling experimental? Otto in Garden 8 Mall in New Cairo has some dishes we’ve never seen before and frankly wouldn’t have imagined otherwise. From blueberry risotto to dessert ravioli and truffle everything, it’s a new culinary experience that doesn’t disappoint. If you want your own plate, we recommend their carbonara pasta, but if you’re willing to share with a friend or two, Otto serves a salt-cooked fish dish that comes with a show where they crack the salt off with a hammer at your table and extract the meat to add it to your plate (trust us, it’s cool).

???? OUT AND ABOUT-

Picasso Art Gallery in Zamalek is hosting two openings for exhibitions today, with the first being Blessed by Hanan Youssef, while the second is Brick Paper Scissors by Noura Baraka. Both openings will take place from 5-9pm CLT, while the exhibitions will run until 10 March.

Luke Lehner Studios is kicking off an improv workshop today that aims to improve your intuitive speed, boost your self-confidence, and beat your social anxiety. The workshop consists of 12 sessions, one every Tuesday and Saturday, from 6:30-10pm CLT. The studio in Maadi (Google Maps) has a series of ongoing workshops related to acting, filmmaking, and screenwriting.

The Room Art Space in New Cairo has band Mixtape on today at 9pm CLT to play a collection of favorite hits.

???? UNDER THE LAMPLIGHT-

In honor of the AUC book sale, we thought we’d share some of our favorite picks published by AUC Press this week: Mirrors by Naguib Mahfouz (Arabic version here) is a collection of short stories profiling a person the narrator comes across. Each “profile” comes with a colorful illustration of the subject by artist Seif Wanli, in a book that plays out like a speed-dating scenario between different characters you can relate to, you can’t stand, or you want to know more about. Like much of Mahfouz’s work, Mirrors is timeless and gives context to people you might have met many times before.

???? TOMORROW’S WEATHER- The temperature is taking a dip tomorrow, falling to 17℃ during the day, with nighttime lows of 8℃. Our favorite weather app says a mix of sun and clouds, but knowing Om el Donia, we think the sun will probably shine through.

SPEED ROUND: MACRO

The post-covid commodities boom: What it means for Egypt

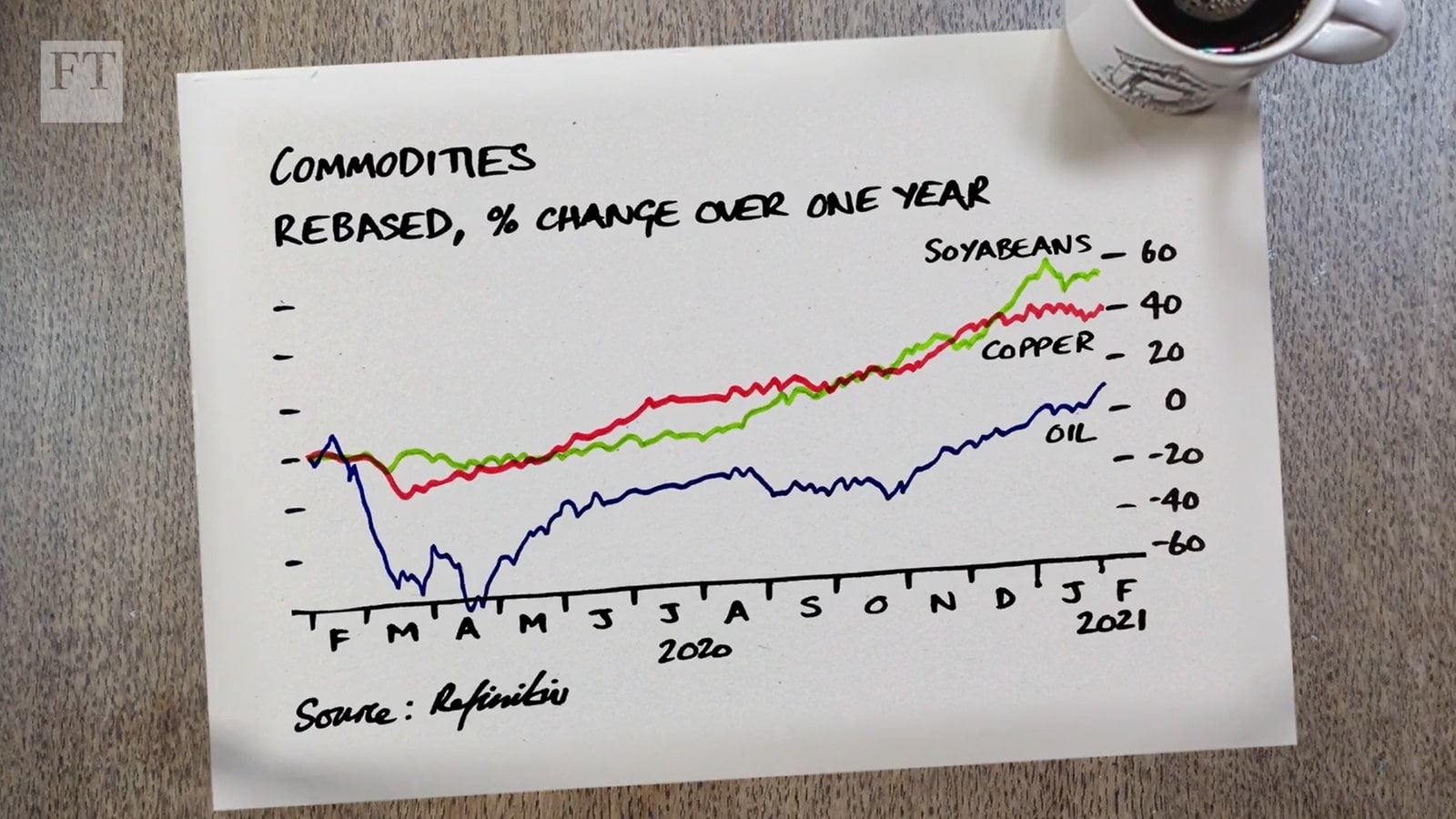

What does the global commodities boom mean for Egypt? In past weeks, speculation that we’re at the beginning of a so-called “commodities supercycle” has been spreading across the pages of the financial press. Commodities prices have been seeing strong gains since the covid-inspired market crash last March, prompting a handful of Wall Street banks to call the start of a multi-year boom driven by the renewable energy revolution, ultra-loose monetary policy, and huge demand from China.

Gains for some commodities, and inflation for the rest of us: Whether or not this is the opening salvo of a supercycle, analysts and market participants tell us that companies in the metals and fertilizers sectors stand to gain from the current environment, though the country’s dependence on imports mean that it will likely hurt us more than it helps us.

Commodity prices have been rising across the board since the market crash caused by the covid-19 pandemic last spring. Mining companies are paying out record dividends in response to a surge in metal prices, particularly iron and copper which have risen more than 80% over the past 12 months. Oil is up more than 230% since the historic near-zero levels it reached last March and April, and food prices rose to six-year highs in January, driven by essentials including wheat, corn and soybeans.

This hasn’t yet been passed to the broader Egyptian economy: Food price inflation has been falling in recent months, and there are no signs that this is going to change anytime soon, Mohamed Abu Basha, head of macro research at EFG Hermes, tells us. This is mainly due to weak consumption, said Noaman Khalid, analyst at Arqaam Capital, who said that heightened prices may take a while to filter through to other parts of the economy. Meanwhile, fuel prices — which are set by the government — will remain stable at least until the end of the quarter. And the annual headline rate has been muted in past months, remaining below 5% for much of the second half of last year.

But analysts are expecting that to change in the months ahead: Arqaam Capital sees inflation at 6-7% through 2021, EFG Hermes is forecasting 6%, while Pharos is penciling in a sustained rise in the headline rate averaging 7% until the fourth quarter, when it might begin to back off.

Egypt will import inflation should prices continue to rise, said Abu Basha. The rally is concentrated in essential commodities, and Egypt doesn’t have a lot of exports to emerge as a winner, he said. The only exception are fertilizers, of which the country is a net exporter, he noted.

Local metal prices have already been climbing: Local steel prices have risen 38% — or nearly EGP 4k per tonne — since November, more or less mirroring a surge in the price of iron ore on the global market. Consumer prices for steel sold by domestic producers are now at EGP 13.9k, up from EGP 10.1k at the start of November. Prices responded to a sharp increase globally between November and December 2020 and then stabilized the following month, after China imposed temporary steel production curbs at the start of 2021. With China’s giant steel industry resuming full capacity in February, global prices are expected to continue on their upward trend.

Though weak demand may prevent local prices from rising further: Factories are at best operating at 50-60% capacity, and the disruption caused by the covid-19 lockdown and the government’s construction ban means they’ve accumulated inventory, which derailed material purchases, Mohamed Hanafy, head of the Chamber of Metallurgical Industries, told Enterprise. The excess inventory meant some were forced to sell at narrow profit margins, or even at small losses, he said.

Whether metal companies benefit will depend on their size: Large, EGX-listed metals producers such as Ezz Steel and Egypt Aluminum will benefit from a commodities rally due to their size and ability to absorb inflationary pressures, EFG Hermes analysts wrote in a research note this week. “The large companies are going to see inflation on their feedstock but the inflation on their product prices means that typically their margins still grow during a super cycle,” EFG’s head of materials and co-author of the report Yousef Husseini told us.

And their position in the value chain: “During a supercycle the margin in the value chain moves up from the end products,” Husseini says. “The closer you are to the end manufactured product, the more negative it is for you, and farther up it’s typically more positive for you.”

Fertilizers will be the big winners should food prices pick up steam: Egyptian fertilizer producers are poised to do well in an environment of rising food prices, Husseini told us. Increasing prices provide an incentive to farmers to produce more so they buy more fertilizers, which in turn allows fertilizer manufacturers to charge higher prices. The fixed price of gas is also a huge plus, giving them the price increase without the additional cost burden, he said.

The government — which is currently considering hedging against rising wheat prices — will take a different view. As the world’s biggest importer of wheat, Egypt’s budget is heavily exposed to large fluctuations in global prices. The ongoing rally has seen wheat prices increase more than 40% from lows witnessed in March to USD 207 per tonne on 1 March. The grain moved with global commodity prices, but also faced further pressure after Russia, the world’s largest producer, announced export restrictions late last year.

Also putting public finances under pressure: Oil. Though state finances have benefited for much of the fiscal year from oil remaining below the USD 61/bbl benchmark price used for the FY 2020-2021 budget, recent gains have pushed Brent up to more than USD 67/bbl, pushing up the government’s import bill. The Finance Ministry may have to consider taking out additional derivatives contracts to hedge against the possibility of further increases in the oil price undermining its fiscal position.

But higher prices may translate into stronger inflows of hard currency: A recovering global economy could mean the goods we would get from being exposed to more trade and investment could outweigh the negatives of cost-driven inflation, Arqaam’s Khalid told us. Rising oil prices will also lead to a stronger GCC and potentially higher remittances from Egyptians working in the Gulf, as well as more Khaleeji FDI, he said. And increases in natural gas prices are a plus, given Egypt’s status as a net gas exporter.

SUPERCYCLE- DIVE DEEPER-

- This is how a Goldman Sachs research note started it all.

- Miners are giving mixed signals on the supercycle.

- Kondratieff Waves and how the work of a 20th century Soviet economist is the basis for how we think about supercycles.

- Why are Americans searching for supercycle on Google?

SPEED ROUND: M&A WATCH

Prime Speed Medical Services reduces target stake in Al Safwa

Prime Speed Medical is scaling back the stake it plans to acquire in New Al Safwa Specialized Hospital to 4.4% from 10%, it said in a regulatory filing (pdf), putting the transaction at a value of EGP 8.4 mn instead of the previously announced EGP 15.5 mn. The decision came after not enough of Al Safwa shareholders agreed to sell their stakes to Prime Speed, the disclosure said. Prime Speed was looking to acquire shares in Al Safwa through Speed Hospitals — a subsidiary of Speed Medical (SPMD), Prime’s sister company. Speed Hospital itself wants at least 50% plus one share of Al Safwa along with management rights.

Untangling the whole Speed, Prime Speed ownership: Separately, Prime Speed Medical’s three major shareholders — Prime Egypt Group chairman Tamer Waguih, and Prime Speed Medical board members Ayman Sabry and Mahmoud Farrag — said they would prefer a share swap transaction for their upcoming merger with SPMDl, Waguih reportedly told Al Mal. The three are apparently looking to swap their entire stakes in Prime Speed, which amount to 70% of the company, with SPMD shares. SPMD’s board of directors approved last month buying a 100% stake in Prime Speed Medical, up from a current 30% stake. SPMD had set up Prime Speed Medical Services last year along with other shareholders including Waguih. Zaki Hashem & Partners will manage the transaction.

GO WITH THE FLOW

Meet our analyst of the week: CI Capital’s Sara Saada

OUR ANALYST OF THE WEEK- Sara Saada, senior economist at CI Capital (Linkedin).

My name is Sara Saada and I’ve been at CI Capital since 2019. I graduated from AUC as a double major in finance and marketing and started my career in the central bank’s Reserve Management Unit. I spent almost eight years there and acquired most of my post-graduate knowledge from the CBE. I then left to get a master’s from London’s Cass Business School. When I came back I joined the Domestic Market Unit at the CBE and also acquired my CFA. In 2015, I decided that I wanted to shift from the regulatory side to corporate and joined HC Securities as their chief economist before transferring to CI Capital.

I now focus on macroeconomics in Egypt, Saudi Arabia, Kuwait, and the UAE and also cover the EM, MSCI, and EGX indices. Getting this wide exposure in the region was a big step in my career and I grew to love how fast-paced and dynamic each market is.

The best thing about my job is that you can always dig deeper and find new ideas. Every day is a new challenge with a potential for learning something new. Even when I feel like I found an answer, I try to find another layer by exploring the individual and unique economies of every market I cover which means looking at their politics, consumption, investments, and financial markets. Of course, the cherry on top is the positive feedback you get when you present something valuable or a call that materializes.

The worst part of my job is that I don’t always have all the figures and analysis I need. Not all countries I cover have the same level of financial reporting and it can be frustrating when you’re forced to come up with certain assumptions or proxies because of the lack of data.

I wouldn’t say less travel during the pandemic is necessarily a bad thing. Since covid-19 is a global struggle all countries are feeling, people are more understanding and flexible and the situation is mostly manageable. While nothing beats personal interactions, talking to people at home while their kids are screaming or their dogs are barking in the background also fosters personal relationships [laughs].

Roadshows aren’t dead, but they might be endangered. I definitely think their frequency will decrease except in certain cases where maybe a new team needs to be introduced face-to-face at first.

My theory of analysis is to always do a sensibility test — or in other words make sure that the outcome makes sense. I do that by having all the numbers and looking at the dynamics at play and making sure that they’re aligned with what’s going on on the ground. That includes expanding your view from just local dynamics to encompass global factors as well.

The most important factor I look at before recommending a market is its overall potential on a standalone basis in absolute terms as well as in relative terms. I have to ask myself both “who will grow” and “who will grow more”. It helps me determine what to overweight and what to underweight based on markets’ capacity to grow. I also look at how the political will to stimulate that growth.

2021 definitely could be the year of Egypt, as the worst of the pre-pandemic challenges were largely overcome. We went into 2019 with a monetary easing policy and 2020 saw fiscal consolidation, a strong support package, and an increase in the government’s investment budget that helped us outperform despite the challenges. We’ve also passed a disconnect between wage increase and inflation and the consumption overhead is behind us.

We expect 2021 to see an increase in private sector investing as the pandemic fades whether through vaccines or herd immunity. Having said all this, applying a sensibility test shows that these figures and what we see on the ground support the idea that 2021 could be a great year for Egypt’s economy and growth prospects.

If I had to cover other markets, I’d like to look at regions that are in a transitional phase. Eastern Europe, Latin America, and India interest me a lot. Transitional economies are where all the excitement is. Well-structured and developed countries already have the tools and systems in place, but in transitional countries or EMs, you have to get creative and develop plans and mechanisms that will result in a turnaround.

I’m a big believer that numbers and words have to go together — and also be aligned. In research, we present stories to investors and the numbers have an essential supportive role.

I have a new growing interest in political articles, especially about international relations. I’m a big fan of Thomas Friedman’s New York Times weekly column.

As the mother of two and half year-old Malak, the only thing I watch or listen to these days are nursery rhymes from Cocomelon on YouTube. When not working, most of my time is spent with my family and daughter and I also try to get in a workout every once in a while. Some days I also decide to allocate some time for me to do nothing but stare at the walls.

I stay organized by writing everything down and having a structure to what my week or month will look like. When I have a clear system and deadlines, I have more energy to focus on being creative in my research as opposed to always feeling lost among tons of things to do.

The EGX30 fell 0.4% at today’s close on turnover of EGP 1.67 bn (12.8% above the 90-day average). Foreign investors were net sellers. The index is up 5.77% YTD.

In the green: Sidi Kerir (+5.0%), Orascom Development Egypt (+4.7%) and Sodic (+3.8%).

In the red: Ibn Sina Pharma (-3.5%), Emaar (-2.8%) and Heliopolis Housing (-2.6%).

LIFESTYLE

The sneaker market that is outperforming the S&P 500

Popular sneakers have been transformed into a bona fide asset class in recent years, outperforming the S&P 500 and providing traders with six-digit profits every year. Sneakers have become products as worthy of informed valuation and investment as any other commodity, with derivatives and other financial tools emerging.

Today, the secondary sneaker market is valued at USD 2 bn in North America alone. In the hours after stocking up sneakers from retailers, the resellers essentially sell short-term futures based on street sentiment. By the time prices plateau, ultra-rare shoes become “grails” worth USD 10k or more, while more attainable stock is bundled into tranches and sold on to other resellers at a bulk discount.

A class of hotshot sneaker hedgies is emerging, including 19-year-old Joe Hebert who uses bots to buy limited edition sneakers when they first go online (and sell out in a few minutes) such as Yeezys and Air Jordans, according to this Bloomberg profile. The practice soon turned into a legit business and he opened his company, West Coast Streetwear. Hebert’s growing Instagram following included hundreds of entrepreneurial teens hoping to emulate his success, which led him to a new revenue stream. For USD 250 per month, they could subscribe to a Discord group, West Bricks, where he shared information on upcoming online releases, such as what sneakers would be discounted, when and where the sale would begin, and how many the retailer would have.

Enter StockX, the aptly called marketplace for deadstock sneakers: StockX launched in 2016 and went from processing hundreds of transactions per day to tens of tnds. “The index of the top 500 sneakers increased about 30% since 2018, and about 75% of the sneakers in that portfolio gained resale value,” StockX’s Senior Economist Jesse Einhorn said to Bloomberg.

StockX also launched Campless, a full blown sneaker data company that offers key data points like average price, volume and volatility on specific sneaker models, they said in a press release.

The pandemic only gave the sneaker market a leg up, with the fastest growth in the secondary market seen in the months after the covid-19 crisis began. This was driven in part by steep discounts from brick-and-mortar shoe companies that faced double-digit sales declines and began offloading the kicks. Einhorn revealed that May and June were the platform’s two biggest months since its launch, fueled as well by ESPN’s release of The Last Dance which featured the “untold story of Micheal Jordan” which drew many older buyers to the sneaker market for Air Jordans. Meanwhile, young Herbert bought a van and went on a nationwide hunt across the US at Nike outlets to buy USD 200k worth of sneakers, which brought him a profit of around USD 50k. He has since branched out to use the same business model with items such as the PS5.

CRYPTO

Big banks flock to crypto despite warnings

Major banks and firms are raising their holdings in cryptocurrencies despite market volatility, leaving US authorities concerned about the creation of a crypto bubble, Bloomberg reports. With Bitcoin and other cryptos having currently achieved a USD 1.47 tn market cap, prominent financial institutions are looking to both invest in, and enable their platforms to support, crypto exchanges.

These include heavy hitters like Goldman Sachs, who will restart trading in Bitcoin in mid-March, unnamed insiders told Bloomberg, while business intelligence and software company MicroStrategy Inc has purchased an additional USD 15 mn worth of Bitcoin, raising its holdings to USD 4 bn, Bloomberg reports. Investment banking group BNY Mellon has also said it will begin facilitating the transfer and issuance of digital currencies, while Mastercard said last month that it will allow users to make payments in crypto “stablecoins” — those pegged to the USD. Visa has also said that if a digital currency “becomes a recognized form of exchange” they will add it to the network, while the world’s first Bitcoin ETF began trading in Canada last month.

And central banks are also looking to get in on the trade: The Bahamas issued the world’s first Central Bank Digital Currency (CBDC) late last year, while China is working on the second trial of its digital yuan in Shenzhen after rolling out an initial test batch of the currency. Sweden is also working on a feasibility study to be complete in 2022 after testing its e-krona last year.

Egypt’s central bank said back in 2018 that the CBE would be studying issuing a digital currency as part of Egypt’s drive towards a cashless society, though did not specify whether the currency would be reserved for inter-bank transactions or could be used by the public. Read our explainer on why central banks are turning to digital currencies.

But bitcoin’s volatility has raised warnings: Trading in digital currencies opens up more avenues for market manipulation, New York’s Attorney General Letitia James said yesterday, calling cryptos “high-risk, unstable investments that could result in devastating losses just as quickly as they can provide gains,” Bloomberg reports. The underlying value of cryptos unpegged to a currency or commodity is subjective, warned James, and could prove difficult to cash out, while exposing investors to heightened risks of fraud.

Major investors are paying attention to these warnings: Hedge fund billionaire Dan Loeb recently shared his two cents on Bitcoin, saying he had been doing a “deep dive” into crypto and was keeping an open mind, but stopping short of issuing a verdict or announcing an investment. But Bill Gates is less open, and has warned against Bitcoin volatility’s effect on smaller investors, as well as the environmental impact of energy-intensive bitcoin mining.

Volatility did accelerate in 2021: Tesla’s USD 1.5 bn investment in Bitcoin last month sent the currency to record highs. It then slumped 20% last week amid a general slide in stocks — its largest drop since a covid-19 induced sell-off in March — but bounced back to levels exceeding its pre-slump highs.

CALENDAR

March: Potential visit to Cairo by Russian President Vladimir Putin.

1-5 March (Monday-Friday): Aswan Forum for Peace and Development will take place virtually.

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

11-13 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

11-14 March (Thursday-Sunday) The Cairo International Furniture Show, Le Marche, is set to take place at The Cairo International International Convention Centre.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.