- Banque MIsr’s EGP 3 bn acquisition of 65% of CI Capital has gone through. (Speed Round)

- State banks eye 75% stake of new futures exchange ahead of potential listing. (Speed Round)

- Egypt has zero plans to discontinue use of AstraZeneca’s covid jab. (What We’re Tracking Tonight)

- A private bump to the sector minimum wage is gaining steam + HA Utilities’ M&A — and more. (Speed Round)

- Meet Rencap’s Ahmed Hafez, our analyst of the week. (Go with the Flow)

- Is this UN facility a silver bullet for African indebtedness? (Macro Picture)

- The CIB PSA Black Ball Open 2021 women’s squash event is underway. (Circle Your Calendar)

- Thriller master Harlan Coben’s latest novel is out today. (Under the Lamplight)

Tuesday, 16 March 2021

EnterprisePM — Banque Misr completes CI Capital takeover

TL;DR

WHAT WE’RE TRACKING TONIGHT

Good afternoon, everyone. We made it through hump day together — two more days and we can slide into the weekend. That also brings us two days closer to Ramadan, with the holy month being 28 days out from where we sit right now.

THE BIG STORY here at home this afternoon has to be the finalization of Banque Misr’s EGP 3.06 bn acquisition of 65% of CI Capital. That gives the state-owned behemoth a 90% stake in the financial services outfit. We have chapter and verse in this afternoon’s Speed Round, below.

Continuing the theme of state-owned banks actively expanding into the wider finance industry, we also have news that four state banks are looking to collectively take a 75% in the new futures exchange.

CATCH UP QUICK on the top stories from this morning’s very (policy focused) issue of EnterpriseAM:

- More countries are temporarily suspending use of the AstraZeneca jab — but there’s no evidence it’s causing blood clots.

- Egypt is poised to ride the green finance wave in 2021, we report in the first edition of Going Green, our new weekly vertical on the green economy, brought to you in association with our friends at Infinity.

- Minimum wage increase for civil servants are coming in July — and pensioners will also get a boost.

THE BIG STORY ABROAD- No single story dominates the global business press this afternoon. Reuters is leading with the ongoing (and still unfounded) concerns about the safety of the AstraZeneca covid-19 jab, while Bloomberg notes that the Saudi economy contracted 3.9% in the fourth quarter. The Financial Times says Chinese tech giants are looking for ways around Apple’s privacy rules with tech from a state-backed group, and the WSJ sees the US Federal Reserve holding its ground on rates as the economic outlook brightens.

YOUR MANDATORY COVID STORY- The UAE has started administering third doses of the Sinopharm vaccine amidst concerns that the Chinese vaccine hasn’t generated enough protective antibodies, reports The Wall Street Journal. UAE health officials have declined to disclose how many people are getting a third jab.

What does this mean for Egypt? Our own vaccine rollout here at home involves the Sinopharm and AstraZeneca jabs, with both vaccines now in use as some 1-2k people per day are being vaccinated. Egypt has not yet commented or given any signals that people may need to get a third dose of the Sinopharm jab.

Egypt has no plan to stop using AstraZeneca vaccines as the Health Ministry has not detected any negative side effects from the jab, an unnamed source from the ministry told Masrawy. A number of European countries have temporarily paused use of AstraZeneca amid concerns it may have caused blood clots in a small number of recipients. Canada and Belgium, meanwhile, are among those still using AstraZeneca, and both a top European regulator and the WHO believe that there’s nothing to be concerned about. As we discussed this morning,

Egypt is currently waiting for the first 6 mn of an 8.6 mn dose order of the AstraZeneca vaccine.

Looking ahead, there could be 6-8 new vaccines on the market by the end of the year, including “ones that don’t require needles and can be stored at room temperature,” Bloomberg reports.

Meanwhile, another mutant virus strain has been discovered: The French government has found a new covid-19 strain in Brittany, said the country’s health ministry in a statement (read in French) picked up by Reuters. The variant still isn’t seen as more serious or transmissible than others.

|

???? CIRCLE YOUR CALENDAR-

The CIB PSA Black Ball Open 2021 women’s squash event is underway and will run until Thursday while the men’s event will start on Friday and run until 25 March. Players from all over the world, 48 men and 48 women, will compete for a USD 350k purse split across both divisions in what will be the opening PSA World Tour event of 2021. You can check out the results for women so far, and you can stream the event live on SquashTV or the official Facebook page of the PSA World Tour (excluding Europe and Japan). You can also snag tickets online to attend in person at the Black Ball Sporting Club in New Cairo.

Photopia’s Cairo Photo Week 2021 is up and running until 20 March. The photo festival features over 100 activities including workshops, panels, photo challenges, exhibitions, portfolio reviews and photo walks throughout the week, all led by more than 80 local and international photographers. You can check out the event program on Photopia’s website, there’s plenty to look at on the group’s Instagram feed @cairophotoweek, and both physical and virtual tickets are available here.

Photographer Karim El Hayawan will be giving a workshop on concept building and development starting tomorrow and running for four days as part of Cairo Photo Week.

AUC Press’s Mad March book sale will be ongoing for the rest of the month. The sale is open to the general public every day from 10am–6pm CLT at AUC Tahrir Bookstore & Garden.

???? FOR YOUR COMMUTE-

The Oracle of Omaha’s Berkshire Hathaway thinks its climate record is none of your business: The USD 600 bn conglomerate is pushing shareholders to dismiss a proposal that would oblige it to undergo a formal annual assessment of the climate risks presented by its businesses, saying the additional scrutiny was not “necessary,” the Financial Times reports. This comes in response to a proposal by three funds that hold USD 2.5 bn of the company’s stock as investors across the board push companies towards more transparency over their impact on the environment. Warren Buffett’s company also shot down another proposal by an advocacy group concerning a review of its diversity and inclusion programs.

What the world could look like in 2030 could scare the ????out of you. We’re down with the end of poverty and the notion of a permanent moon base (thank you, For All Mankind), but the notion of a climate apocalypse and a genetic surveillance state and the end of genetic privacy? No thanks. Read about it all in the surprisingly brief (but meaty) Here’s what the world will look like in 2030 … right?

Netflix’s crackdown on password sharing could see it dealing with higher user-turnover as the streaming platform tests people’s willingness to pay for content, writes Bloomberg. Netflix is currently testing a feature that prompts non-paying viewers to buy a subscription to “ensure people using Netflix accounts are authorized to do so,” a company spokesperson was quoted as saying. While analysts are somewhat confident that users won’t want to give up their ‘Netflix and Chill’ sessions, the move comes as other streaming platforms add mns of subscribers of their own.

SUPERCYCLE WATCH- Aluminum prices are seen going nowhere but up, with the high demand and positive sentiment generated from the vaccine rollout in late 2020 to carry over into 2021, Emirates Global Aluminium CEO Abdulnasser Bin Kalban told Bloomberg. Futures seem to be on track to stay above USD 2k throughout the year, after having joined most other commodities and staged a historic rally from its pandemic low of nearly USD 1.4k, Bloomberg says.

Developing nations are struggling to bounce back from the economic fallout from covid-19 as growing spending and financing costs cause debt to pile up, according to the Financial Times, picking up on an OECD forecast. That could mean EMs need more multilateral support to avoid “a lost decade,” writes Megan Greene of the Harvard Kennedy School in an op-ed for the salmon-colored paper. The IMF’s recent approval of new Special Drawing Rights (SDRs), which increases its development lending firepower, is an encouraging step, but the lender needs to compromise, Green says. Earmarking more SDRs, and reallocating them from richer to poorer countries, will likely come with a set of conditions some EMs might not be able to meet, putting them in a position “too robust … but too weak to make it without support as the pandemic toils on,” especially as the cost of private borrowing continues to rise in response to higher US treasury yields, Greene writes.

???? ON THE TUBE TONIGHT-

(All times in CLT)

The 2021 Oscar nominations are out: Coming out right after the Grammys, the Oscars nominee list also put women front and center, with 70 women receiving a total 76 nominations and Chloé Zhao became the first woman of color to be nominated in the best director category for her film Nomadland, reports CNN. Riz Ahmed, meanwhile, became the first Muslim to be nominated for best actor for his role in Sound of Metal. Netflix’s Mank was the most-nominated flick with 10 nods including for best director (David Fincher), best actor (Gary Oldman) and best supporting actress (Amanda Seyfried) and best picture.

Catch up with the best picture nominations before the award show airs: Films up for best picture include:

- The Father

- Judas and the Black Messiah

- Minari

- Nomadland

- Promising Young Woman

- Sound of Metal

- The Trial of the Chicago 7

- Mank.

The Oscars are slated to take place on 26 April — a bit later than usual thanks to the pandemic.

Streaming sites have beat out major theatrical studios this year, with Netflix raking in a total of 35 nominations while Amazon Prime snagged 12, according to Deadline. The Academy relaxed eligibility conditions last year that insisted Oscar contenders must screen first in a cinema, and play for at least seven days in Los Angeles, amidst the covid-19 pandemic and closed cinemas, writes The Financial Times. This paved the way for more streaming platforms to stand out and participate during the awards show. Tap or click here to check out the full list of nominations.

The CAF Champions League up and running and Al Ahly are already on the field against Congo’s Vita Club. Later tonight, Al Zamalek will go head-to-head with ES Tunis at 9pm. Winners of the matches will qualify for the quarterfinals of the African league.

The Egyptian Premier League will see Ceramica Cleopatra play Wadi Degla at 5pm and El Gaish kick off against Ismaily at 7pm.

Real Madrid will hit the field against Atalanta at 10pm in Europe’s Champions League while Manchester City will go up against Monchengladbach at 10pm.

???? EAT THIS TONIGHT-

Enjoy eating healthy with Lychee: What started off as a juice bar has transformed into a full blown eatery boasting jars of fruity Greek yogurt, breakfast plates, wraps, and a recently added salad bar. Lychee has also expanded its products to include foods you can add to your kitchen at home, among them peanut butter, energy bars, and sealed juices and milk. If you’re doing carbs, we recommend their berry land smoothie, chocolate chip Greek yogurt, and chicken melt wrap. You can find Lychee outlets across Greater Cairo as well as in Gouna, Alexandria, and North Coast. You can also check out their online store.

???? OUT AND ABOUT-

Egyptian female cartoonists are putting a spotlight on gender issues in an exhibition in the Greater Cairo Library in Zamalek. The exhibition, titled Heya, features more than fifty artworks covering topics ranging from violence to child marriage.

???? UNDER THE LAMPLIGHT-

Do you love dark or sardonic humor? Does sarcasm brighten your day, even as you’re secretly a marshmallow inside when it comes to your family? If you answered yes, you’ve probably already discovered the work of New York Times chart-topping author Harlan Coben. Coben’s often-dark thrillers are centered on family, memory, identity and loss. He started out strong with his Myron Bolitar series before his stand-alone novels vaulted him to the top of his field.

Coben’s “Win” is out today, a standalone that draws a central character from the Bolitar series out on his own. Check out Coben’s 33rd book on Amazon or dive into the New York Times’ with the New Jersey author (don’t hold that against him) ahead of the novel’s release: Harlan Coben, suburban dad with 75 mn books in print.

???? TOMORROW’S WEATHER- Expect will be more of the same with daytime highs of 25°C and lows of 13°C, our favorite weather app tells us.

SPEED ROUND: M&A WATCH

Banque Misr officially holds 90% of CI Capital

Banque Misr’s EGP 3.06 bn acquisition of 65% of CI Capital went through today, after completing a mandatory tender offer that saw the sale of 652.8 mn shares at EGP 4.7 per share, the EGX announced in a bulletin today. The MTO was reportedly 1.1x oversubscribed when it closed last Thursday, with shareholders agreeing to sell some 720.8 mn shares. Banque Misr, which already held a 24.7% stake in CI Capital before the transaction, now owns 90% of the company, with the remaining 100 mn shares remaining in freefloat on the EGX. CI Capital’s shares stayed flat during trading today, closing at EGP 4.29 per share.

Banque Misr had announced it was targeting a stake in CI Capital early last month, and launched its MTO days later. CI Capital had originally rejected Banque Misr’s offer price, saying it undervalued the company by around 20%, following which Banque Misr said it had no plans to hike its offer.

The acquisition is the latest in a trend of state-owned banks buying out private investment banks.The acquisition of Pharos by NBE’s Ahly Capital in late 2019 in an EGP 120 mn transaction kicked off the M&A spate, and was followed by the and of Bank Audi’s Arabeya Online brokerage by NI Capital in late 2020.

SPEED ROUND: IPO WATCH

State banks eye stakes in new futures exchange ahead of potential listing

The National Bank of Egypt, Banque Misr, Banque du Caire, and United Bank are reportedly interested in a piece of the new futures exchange, according to a letter from the Federation of Egyptian Banks received by the Financial Regulatory Authority (FRA), sources told Al Mal. The banks will be vying for the 75% stake of the exchange on offer to financial institutions that meet solvency standards or with experience in futures contracts, as stipulated in regulations issued last December by the FRA. Some of the banks that are petitioning for a stake want to own over 5%. The regulations limit the ownership each institution can grab at 10%.

What’s banks so excited? Well it could have something to do with the futures exchange potentially being listed on the EGX. The FRA had allowed the exchange to potentially list up to 25% on the stock exchange.

SPEED ROUND: COMMODITIES

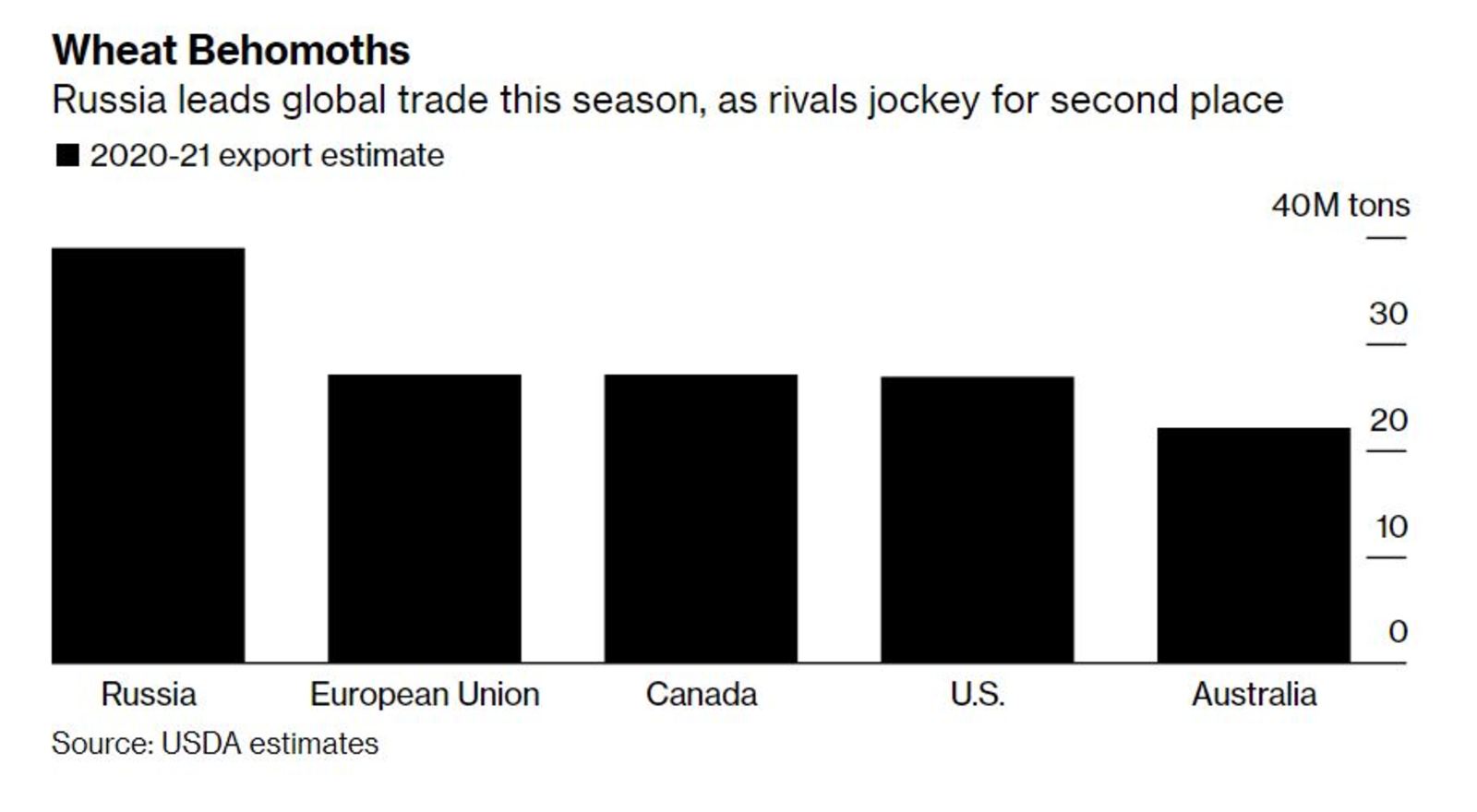

Russia’s wheat export tax may not be permanent

Egypt’s top wheat supplier is open to relaxing grain export duties it recently introduced, but only when it first ensures it has secured supply for its local market, Russian news agency Interfax quoted the country’s agriculture minister, Dmitry Patrushev, as saying. The Russian government may start to look at an alternative approach to regulate the market once it makes sure it has enough wheat for the country and that high exports don’t lead to a supply glut and domestic inflation, Patrushev said. Down the line, Russian authorities may stop interfering with grain markets at all, he added.

Egypt’s state grain buyer dialed back Russian wheat purchases after the export tax was introduced in February. Russian authorities had introduced the restrictions to attempt to slow down domestic inflation and protect local supplies as the pandemic took a tool on Russian household incomes. That prompted GASC to source wheat from the EU, including French, Ukrainian and Romanian varieties in recent tenders — and saw it cancel a tender in January until it got more clarity on the new tax.

How much is the Russian tax? Moscow imposed a levy of EUR 50 per tonne on wheat, EUR 25 per on corn and EUR 15 on barley, as well as a quota on the amount of wheat allowed to leave the country. The flat rate has been effective since 15 February. The system will switch to a floating tax regime on 2 June, with the tax being applied only on wheat sold for more than USD 200. Each USD 1 above the USD 200 mark will be subject to a 70% tax rate.The same goes for corn and barley over the USD 185 mark. This could hurt us considering Russian wheat constituted 80% of Egypt’s wheat purchases last season, with 2.5 mn tonnes bought as of August.

Until the restrictions are eased, wheat trade from the world’s largest producer could face further disruptions, reports Bloomberg. This is because once the system switches to a floating tax regime, shippers will only know how much they’re going to be paying when a cargo sails. This limits a trader’s ability to make advanced sales of the cargo

OTHER COMMODITIES NEWS- Thani Stratex could sell an 85% stake in the Hodine gold exploration concession in Egypt to private investment company Red Sea Resources, AIM-listed Oriole Resources — Thani’s parent company — said in a regulatory filing. The non-binding heads of terms agreement could see Red Sea Resources acquire interest in Hodine for committing USD 2.2 mn to fund the exploration and paying other outstanding fees and charges. Thani subsidiary Thani Dubai acquired the Hodine concession in an international tender conducted by EMRA in 2006.

SPEED ROUND: CATCH UP QUICK

A private bump to the sector minimum wage us gaining steam + HA Utilities’ M&A — and more

Picking up where we left off this morning, the story about a bump to the private-sector minimum wage seems to have legs. Al Watan quotes a source at the National Wages Council, which sets the minimum wage, as saying the body may indeed push through a hike that would bring the minimum to EGP 2k per month some time this year. Planning Minister Hala El Said, who is head of the wages council, is set to meet with private sector players soon to hash out how this could take place, we said this morning.

Other stories we’re watching as the workday starts to slow down:

- EgyTrans and HA Utilities Holding will wrap up due diligence and potentially move forward within three months on a high-profile transaction that will see HA Utilities take a majority stake in EgyTrans through a reverse merger (background here).

- Tourism from the Baltics: Tour operator Novaturas Group is doubling the number of weekly flights from Latvia to Hurghada and Sharm El Sheikh to four starting April.

- Production of Egyptian oranges could rise by almost 6.3% to reach a total of 3.4 mn tons in FY2020-2021 thanks to favorable weather conditions.

- The Mubarak family is mulling lodging a lawsuit against the European Council for erroneously sanctioning five members of the family over the past decade.

- The Prosecutor General ordered the detention of three men yesterday over their alleged involvement in the death of a woman who died after falling from her apartment balcony. The suspects are alleged to have physically assaulted the woman and a man inside the flat.

GO WITH THE FLOW

Meet our analyst of the week: RenCap’s Ahmed Hafez

OUR ANALYST OF THE WEEK- Ahmed Hafez, the head of MENA research at Renaissance Capital (Linkedin).

My name is Ahmed Hafez and I head up MENA research for Renaissance Capital, covering mainly consumer names and diversified industrials. I started my career at HSBC’s global research division, where I was mainly focused on sectors including mining, metals, utilities, and some consumer names. In a big organization, you don’t always get to dip your toes in everything and mostly stay within your own scope. However, that changed when I went to HC Securities in 2011 as an analyst and got more exposure to many sectors, eventually becoming the co-head of research alongside Nemat Choucri.

In 2018, I moved to RenCap and was one of the first people at the Egypt office when they started operating locally. It was difficult in the beginning — from an office space perspective, I felt like I had joined a startup. It's very rewarding to now see everything up and running, but it was a long journey to get here.

The best part of my job is the learning that comes with client interaction. I always say that there is nothing better than a good discussion. Working in this field you often get to meet people with different backgrounds and perspectives that you wouldn’t have thought of otherwise. There’s also the need to always work harder to be more comprehensive and able to cover everything. That often means going back in history to draw parallels between events. I believe if you stop learning at a job, you’ll lose interest or even become complacent, so this field forces you to always be on your toes.

The worst part of my job is when there’s no interest in the product, country, or region you’re working on — you can feel alienated. There have been instances in the past few years where things haven’t been heading in the right direction for investors and it's quite demotivating. Being an analyst is a people’s job so without the people it just becomes a routine.

Less travel is more efficient, but I wouldn’t call it better. You can squeeze in more meetings during the day since there isn’t a commute time to factor in. It remains to be seen whether we’ll return to the same world post-covid, but I do think that travelling and road shows will still be part of the job.

RenCap remains very positive on Egypt in 2021, and while it might not be the year of Egypt, it will definitely be a better year. Last year was unfortunate because we saw some stories people have been looking for in Egypt play out such as capex recovery and faster private consumption, but covid-19 delayed these stories a bit. Nonetheless, there are other stories to get people excited for the year such as the bullish outlook on emerging markets in general.

I think 2022 could be the year of Egypt as key longer term themes start to materialize such as tourism becoming less depressed and monetary policy normalizing. We expect to start seeing more excitement in the tail end of this year.

My advice to retail investors or newcomers to the market is to buy what you understand. When you understand what you’re investing in so you can have clearer judgement when you make decisions. You should know the broad dynamics of an investment and have a good answer if someone asks you, ‘Why are you investing in this?’ It’s the same advice I would give someone buying an apartment or a car. It's very similar since at the end of the day you’re putting your wealth into all of them. I also advise investors to not get greedy when investing in the stock market.

A less obvious factor people should look at before investing is the governance of a company. It’s often harder to make a judgement on governance as opposed to earnings, growth, and similar factors. However, as we’ve seen in the past period, things can go wrong. So it’s important to be comfortable with the governance or else your investment could be vulnerable to things like inaccurate reported numbers or figures. So governance is really at the base of everything else.

When recommending calls or top picks, I try to get a good sense of what would make a stock reprice and what wouldn’t. There are some stocks that are [underpriced], but won’t necessarily rerate quickly while other stocks are more expensive but continue to outperform. This kind of thinking necessitates a more top-down approach to be able to judge the direction a stock is going and make a good call that materializes.

If I had to switch to another industry, I would like to go into operations. It’s a position I would like to explore in any field, whether it's a steel plant or an engineering firm.

I’m a numbers person. I’ve always been comfortable with numbers since I was younger. Meanwhile, words have had to come the hard way [laughs] and a lot of investment has been put into that while on the job.

The last great things I’ve watched were the last season of Narcos Mexico as well as The Mandalorian. My taste in TV shows varies with my mood — sometimes I want to watch something light and comedic while other times I’ll go for something more serious and deep. The last great thing I read was probably Lord of the Rings from my school’s library.

When I’m not working, I like to travel. It astounds me how you can find similarities in culture in the most unexpected countries. I was recently married and went to Hawaii for my honeymoon, so I think that is now my favorite destination. In the future, I think I’d like to devote more of my vacation time to exploring Egypt’s offerings such as Al Wahat and St. Catherine.

The EGX30 fell 0.3% at today’s close on turnover of EGP 805 mn (45.5% below the 90-day average). Local investors were net buyers. The index is up 3.2% YTD.

In the green: GB Auto (+2.5%), Abu Qir Fertilizers (+2.0%) and Orascom Development (+1.9%).

In the red: Ezz Steel (-4.1%), Orascom Financial (-3.8%) and Edita (-3.5%).

THE MACRO PICTURE

Is this UN facility a silver bullet for African indebtedness?

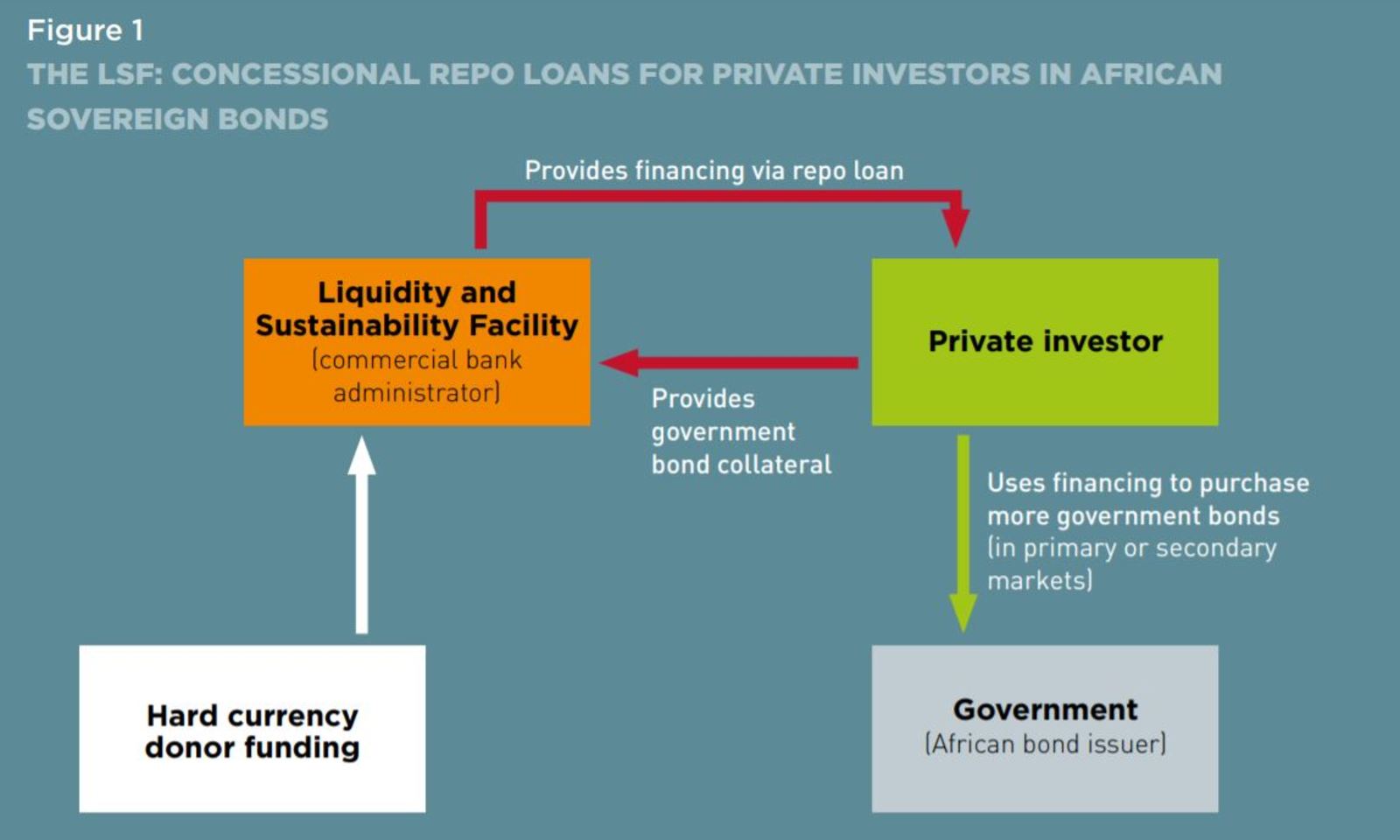

Egypt could have access to a proposed UN facility that would boost liquidity in African sovereign bond markets through a special type of rich-help-poor model. The model for the so-called Liquidity and Sustainability Facility (LSF) put forward (pdf) by the UN and fixed-income asset manager Pimco in September proposes a new mechanism to provide short-term liquidity to developing countries in Africa that have come under severe fiscal and economic pressure because of the pandemic.

The goal? To make African sovereign bonds less risky for investors, to lower borrowing costs and to provide debt relief for poor and middle-income nations.

How would it work? Rather than convince bondholders to take losses on their investments, the LSF would subsidize their holdings via repurchase agreements (if you don’t know what these are, check out our explainer here). Investors would effectively borrow cash from the facility in exchange for their sovereign debt portfolio, incentivized by the interest rates and potential haircuts on short-term repo transactions, which are lower than in the private debt markets. This would, in theory at least, increase liquidity and demand for African sovereign debt and lower borrowing costs for distressed governments.

There’s a problem though — where to get the money: The obvious place to turn is the developed world. The UN and Pimco propose persuading central banks in OECD countries to lend out USD 50-100 bn to the facility, but given the damaging effects of the virus on their economies, the political will to sanction bns more in overseas lending is lacking.

Enter the IMF: A recent statement by US Treasury Secretary Janet Yellen backing more firepower for the IMF to lend poorer countries is a signal the Washington-based lender could have an alternative plan in mind. In particular, it could use SDRs — which are its way of giving member countries claims over the hard currency of other members — to fill in the gap and provide the needed lending capacity to the LSF. The IMF’s recent approval to issue USD 500 mn more SDRs already aims to help emerging-markets ease through the covid recovery.

Why this is crucial for Africa: The African Development Bank (AfDB) forecasts that average debt-to-GDP in African countries will grow 10-15% this year due to the fiscal shock of the pandemic. Debt relief efforts were made, including an initiative by G20 Debt Service Suspension Initiative to get rich country lenders to suspend repayments. Even then, already indebted African countries continued to tap debt markets as their financing needs grew. They were reluctant to ask for debt relief in fear of losing access to capital markets.

Sounds cool, right? Well, the idea doesn’t come without risks, neatly rounded up by the Financial Times:

#1 Will the facility be around in hard times? The LSF would use sovereign bonds as collateral as a way of boosting liquidity, meaning it will adopt margin calls, or ask for more securities from repo borrowers when bonds drop in value. As a result of better ratings in good times and worse ratings when conditions worsen, the LSF could create only “cyclical improvements in liquidity,” or access to it only when African borrowers need it least.

#2 Will it accept local bonds as collateral? If it doesn’t, sovereign borrowers could start disproportionately borrowing in foreign currencies, making them more vulnerable to foreign debt outflows, the report says.

#3 Can it undermine monetary policy? The LSF could undermine its efforts to raise liquidity in the markets should it increase haircuts on investors if and when the bonds it holds as collateral become riskier. This threatens to make it more difficult for African monetary policymakers to keep a lid on bond market volatility during stressful times.

Does Egypt really need it? Egypt isn’t on the list of EMs most vulnerable to a debt crisis. The government continued to be able to issue debt during the pandemic and was able to negotiate up to USD 8 bn in emergency funding from the IMF under favorable conditions. The country was also not on the list of nations eligible for G20 debt service relief. At the moment, our policy priority is to reduce short-term refinancing needs by issuing more long-term debt. Still, the potential existence of the LSF will give access to short-term financing that can be used to refinance longer-term obligations.

DIG DEEPER-

CALENDAR

March: Potential visit to Cairo by Russian President Vladimir Putin.

11-20 March (Thursday-Saturday): Photopia’s Cairo Photo Week 2021 will take place with this year’s theme being Depth OFF Field.

16 March (Tuesday): AmCham webinar featuring business tech expert Patrick Schwerdtfeger. Non-members can register here.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

23 March (Tuesday): The second edition of the Egypt Retail Summit takes place at the Nile Ritz Carlton hotel.

23 March (Tuesday): The British-Egyptian Business Association (BEBA) virtual conference on sustainable manufacturing in Africa.

25-27 March (Thursday-Saturday): The Real Gate real estate exhibition, Egyptian International Exhibition Center, Cairo.

29-30 March (Monday-Tuesday): Arab Federation of Exchanges Annual Conference 2021.

31 March (Wednesday): Deadline to visit the moroor and get an RFID sticker affixed to your car’s windshield — or run afoul of the Traffic Police.

31 March (Wednesday): Income tax deadline for individuals. Real estate tax deadline.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

7 June-9 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt.

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-12 November (Monday-Friday): 2021 United Nations Climate Change Conference (COP26), Glasgow, United Kingdom.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

27 June – 3 July 2022 (Monday-Sunday): World University Squash Championships, New Giza.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.