- It’s a five-day Eid break for much of the private sector, but finance and banking are waiting for the signal from the CBE. (What We’re Tracking Today)

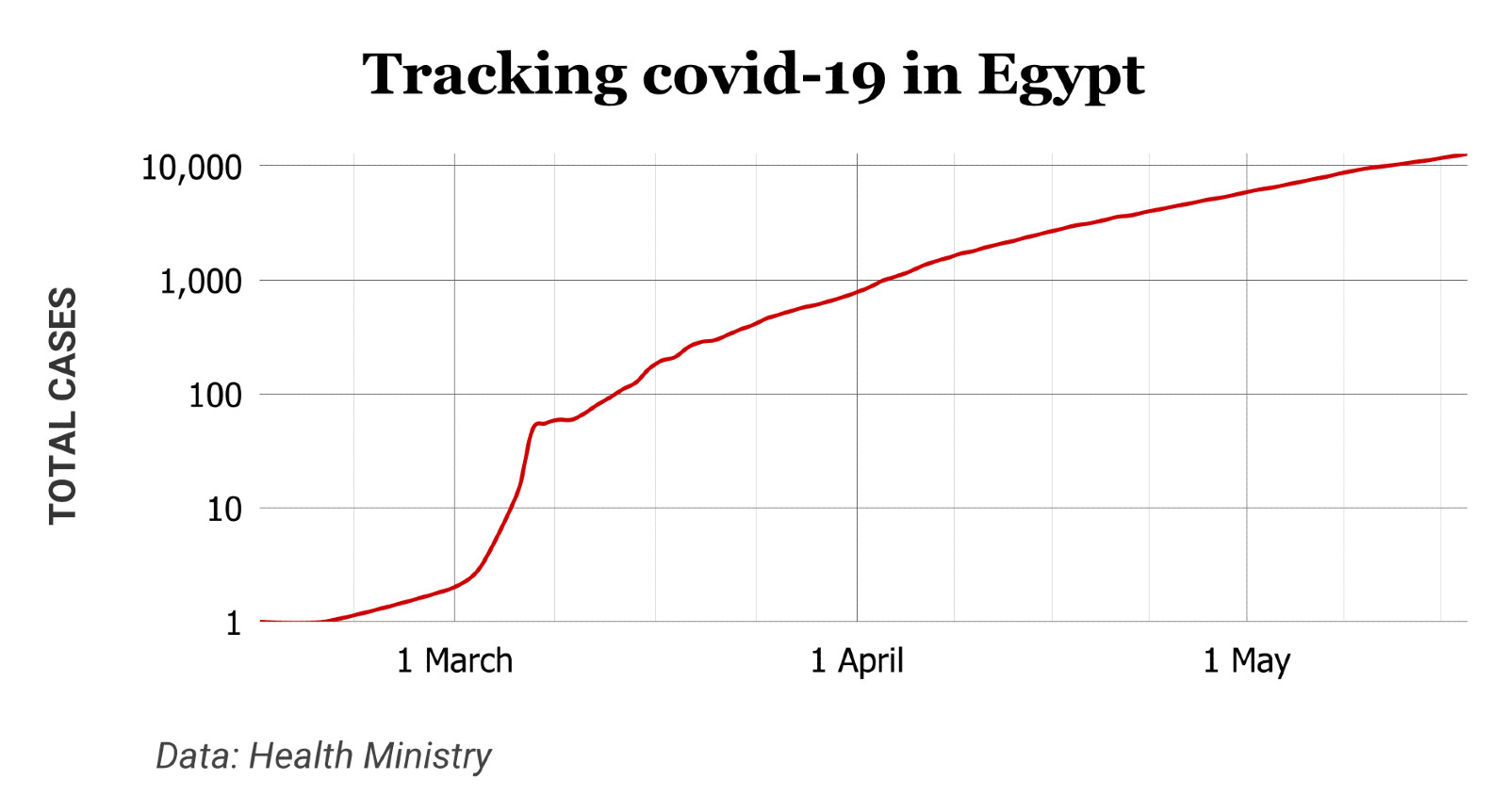

- Egypt reported a record 535 new covid cases yesterday, bringing the total to 12,764. (What We’re Tracking Today)

- FAB, Bank Audi confirm pause on acquisition talks. (Speed Round)

- Good news for food security: Romania is still interested in selling wheat to Egypt. (Speed Round)

- EGP eases to three-month lows against the greenback. (Speed Round)

- Sovereign Fund of Egypt looking at healthcare and pharma logistics amid covid-19. (Speed Round)

- Nearshore companies are increasingly outsourcing their business services to Egypt -ABSL. (Speed Round)

- AI says the best tax system puts heavier taxes on both the rich — and the poor. (Worth Reading)

- Behavioral economists have answers to what’s driving the manic covid stock buying. (The Macro Picture)

- ** You have two days left to tell us how covid-19 is impacting your business.

- The Market Yesterday

Tuesday, 19 May 2020

Is the private sector getting a five-day break for Eid?

TL;DR

What We’re Tracking Today

It looks like many private-sector businesses will be required to give employees a five-day Eid next week. A Cabinet statement yesterday said Manpower Minister Mohamed Saafan has ordered a five-day paid Eid El-Fitr holiday for the private sector — the same as for public-sector employees.

It’s already a five-day holiday for retail businesses: The decision comes as the Madbouly government looks to keep people off the streets with stricter lockdown measures next week, including an extended 5pm-6am curfew, the closure of malls and other retail outlets, and measures to limit travel between governorates. Supermarkets and pharmacies are exempt from the closure order.

It’s still an open question whether Planet Finance will follow suit. We’re waiting to see whether the Central Bank of Egypt will order banks to close for the full five days, and it’s unusual for Egypt’s banks to be cut off from the global financial system for a full calendar week. The EGX typically follows the CBE in closing. Enterprise will be off next week whatever days the banks are closed and then slide back into your inbox after the break.

The House general assembly is on break until 7 June, parliament speaker Ali Abdel Aal said yesterday, according to Al Shorouk. Committee meetings will continue as usual. Tap or click here if you need a refresher on what’s on the legislative agenda as we slide toward summer recess.

Speaking of the House: We’re in an election year. Easy to forget amid all the corona news, but we had been scheduled to go to the polls in November to elect a new House as well as senators to fill the newly reconstituted upper house of parliament. The current House will sit one last time from October 2020 until January 2021, we reported lat last year.

Things we’re keeping an eye on this morning:

1- Markets rallied yesterday on hopes that a covid vaccine may not be as far away as most scientists fear after an eight-person trial of an mRNA-based vaccine by American biotech outfit Moderna showed promise. MSCI’s gauge of global stocks was up 2.9% yesterday, and shares in Europe and the US soared. The rally is front-page news on both sides of the Atlantic, with both the Wall Street Journal and the Financial Times leading with it as we eased toward our dispatch deadline this morning. You can read more about the eight-person (yes, 8) in the New York Times and in Bloomberg.

The markets today: Asian markets are uniformly in the green in early trading this morning. Futures suggest a mixed open for European shares and that US stocks are set to open (every so slightly) in the red.

2- The future of air travel on most western airlines is … ugly, the Wall Street Journal writes. Not the future of the industry — your likely experience in the air as flights resume. The headline says it all: The new airline travel: Fewer flights, more layovers, rules for bathrooms. Priority boarding may be a thing of the past, getting off the plane is going to take even longer — the list goes on. The only solution: Fly EgyptAir direct as much as you possibly can.

The heat wave is set to continue unabated until the weekend. Expect a daytime high of 42-43°C through Thursday, 37°C on Friday and then a balmy 32°C on Saturday before things cool off further to 29°C for the Sunday, the first day of Eid.

So, when do we eat? Maghrib prayers are at 6:44pm and you’ll have until 3:18am to finish caffeinating. Fajr is coming one minute earlier every day through the end of the Holy Month.

NEED AN INCENTIVE? Five respondents will get an Enterprise mug and a bag of our own custom coffee from our friends at 30 North. Want to enter? Leave your name, title, company, email address and telephone number in the comments field at the end of the survey.

COVID-19 IN EGYPT-

Egypt has now disclosed a total of 12,764 confirmed cases of covid-19 after the Health Ministry reported 535 new infections yesterday — the highest single-day count to-date. The ministry also said that another 15 people had died from the virus, taking the death toll to 645. We now have a total of 4,001 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 3,440 have fully recovered.

The Madbouly government is actively talking with the business community about what the post-covid economy will look like. Prime Minister Moustafa Madbouly, Planning Minister Hala El Said, and GAFI head Mohamed Abdel Wahab held a discussion yesterday with a working group — which also includes members of academia — to hear proposals on how best to move towards “coexisting” with the virus that causes covid-19 while supporting the economy, according to a statement, which did not name who from the business community attended.

Eighteen hotels and resorts have reopened after meeting covid-19 health and safety standards. The properties are located in Matrouh, the Red Sea, and South Sinai governorates. Tap or click here to check the the full list of destinations. The facilities are presently capped at 25% capacity.

UK-based biotech company Primerdesign has delivered 40k PCR test kits to Egypt, the British Embassy said yesterday.

The Amcham Egypt Foundation has launched a campaign with Egypt’s business community to lend a hand to the Health Ministry in its response to the pandemic, according to an emailed statement (pdf). The campaign will provide more than 260 new and refurbished ventilators within the next few weeks, along with a supply of personal protective equipment. The campaign has backing from AmCham’s 2k members.

You can watch campaign videos, produced by our friends at Tarek Nour Communications, here (runtime: 1:56), here (runtime: 2:08), and here (runtime: 2:19). Among the many CEOs and chairmen making appearances are our friends

- Sherif Elsaid (CIB Foundation)

- Tarek Nour (TNC)

- Moataz ElHout (Nestle)

- Jose Maria Magrina (Suez Cement)

- Mahmoud Bazaan (Hero)

- Sarwat Abd El-Shahid (Shahid Law)

- Khaled Abu Bakr (TAQA Arabia)

- Akef El-Maghraby (Banque Misr)

- Ahmed El Hitamy (MNDH)

DONATIONS-

Our friends at SODIC have helped the Health Ministry to fully equip 50 quarantine units at the Mansoura Chest Hospital and Abbassia Fever Hospital. They have also helped outfit 21 hospital rooms to serve as isolation units at the Mahala Fever Hospital, according to a statement (pdf).

Our friends at Edita have donated EGP 2 mn-worth of products to Tahya Misr’s initiative to distribute 300k boxes of food to families in need in 16 governorates, according to an emailed statement (pdf).

Orange Egypt is helping the Egyptian Cure Bank acquire and repair ventilators for hospitals by donating an unspecified sum to the Breathe Campaign, according to a statement (pdf).

ON THE GLOBAL FRONT-

Europe is slowly but surely restoring a semblance of normality: Shoppers, worshippers and cafe goers were out and about in Italy yesterday as were Greeks on the country’s coastal waters and near the Acropolis, Reuters reports. Cafes in Denmark and Portugal also started receiving some foot traffic, with mostly masked and socially distanced patrons enjoying their first public coffee in many weeks, the AFP reports. Germany, meanwhile, will ease travel restrictions starting mid-June, but sees “no quick return to holidays as usual.”

The same cannot be said many emerging markets:

- More than 100 mn people in the Chinese province of Jilin now find themselves under lockdown after the government suspended transportation and quarantined tens of thousands of people after new clusters of infections were detected, Bloomberg reports.

- India has extended its lockdown measures for another two weeks, and promised to publish new guidelines about how it plans to reopen society, the BBC reports.

- West African countries are facing the risk of a significant rise in infections as they begin reopening mosques for Eid El Fitr, which are expected to attract mass gatherings despite cases already being on the rise, the AFP reports.

GLOBAL MACRO-

The IMF is back with more bad news: The global economy is unlikely to see a full recovery next year as the costs of the pandemic continue to defy expectations, IMF head Kristalina Georgieva told Reuters. The fund will rethink its forecast for 5.8% growth next year in response to weaker-than-expected data from countries across the world, Georgieva said, without disclosing a timeline for a full recovery. The IMF is also likely to revise downwards its forecast for a 3% contraction of the global economy this year, she said, without providing an estimate.

Germany and France hatch European rescue plan: Germany and France have outlined plans for a EUR 500 bn fund to provide emergency fiscal stimulus to Europe’s stricken economies, the Financial Times reports. The plan would see the European Commission capitalize the fund by borrowing in the capital markets — a potential workaround to the long-term dispute about common debt issuance that threatens to hamper the bloc’s response to the crisis.

FIve EU states lift short selling bans today, including Austria, Belgium, France, Greece and Spain. Italy will allow its ban to expire on 15 June, according to the European Securities and Markets Authority.

GCC investors are “flying blind” as the region’s reluctance to share key data make investment decisions increasingly difficult, Bloomberg says. For one, Qatar — although faster than some neighboring countries like Saudi and the UAE — only just released national accounts for 4Q2019 in late April.

Uber is planning to slash 3k more jobs and cut “non-core investments” as part of a sweeping plan to ensure long-term survival outlined by CEO Dara Khosrowshahi yesterday (Reuters | BBC | CNBC). The latest cutbacks come just two weeks after the company announced that 3.7k people would be laid off — including 40% of its Egypt staff — meaning the company has now reduced its global workforce by a quarter. It’s unclear if the latest lay-offs will further affect Egyptian staff.

You know we may be in the Investing End Times when the hedgies start talking up gold. Look no further than this Bloomberg report, which suggests some are counting on gold rising to “multiples of its current price” as central banks continue to print money alongside large stimulus packages and widening their balance sheets. Didn’t work out so well back in ‘08, boys and girls, now did it?

AND THE REST OF THE WORLD-

The butting of heads between the US and China is intensifying on multiple fronts:

- A tug of war at the WHO: The battle for influence spilled out into the open at the World Health Organization’s annual meeting yesterday after Chinese president Xi Jinping offered to donate USD 2 bn to fighting the pandemic in Africa, only for the US health secretary to denounce Beijing’s handling of the crisis. (New York Times)

- The economic decoupling could be gathering pace: The US is considering setting up a USD 25 bn “reshoring fund” to draw American companies and key suppliers back to its own soil from China. (Reuters)

- Nasdaq takes aim at Chinese IPOs: Nasdaq will introduce new IPO restrictions in a move that will place more roadblocks in front of Chinese companies hoping to list on the exchange. (Reuters)

- Huawei isn’t happy about the new US sanctions: Chinese tech giant Huawei has called the Trump administration’s decision to block it from importing semiconductors “arbitrary and pernicious.” (Financial Times)

Haftar suffers blow as forces loyal to the UN-backed gov’t seize strategic air base: Forces loyal to Libya’s UN-backed government have seized a key air base southwest of the capital from General Khalifa Haftar’s Libyan National Army in what Reuters suggests is “their most significant advance” in the past year.

Enterprise+: Last Night’s Talk Shows

(Yet) another quiet Ramadan night: Talk show queen Lamees El Hadidi and Ahmed Moussa pretty much had the floor to themselves. The only ‘unusual’ news of the night:

Dakahlia governor Ayman Mokhtar has contracted the virus that causes covid-19, a rapid diagnostic test confirmed yesterday, El Hadidi noted last night (watch, runtime: 6:01). Mokhtar is currently self-isolating at his circuit house in Dakahlia. His condition is currently stable, with only moderate symptoms including lingering coughs and fatigue, the governor told Moussa over the phone (watch, runtime: 2:27).

Speed Round

Speed Round is presented in association with

M&A WATCH- FAB, Bank Audi confirm acquisition talks are on ice: Bank Audi and First Bank of Abu Dhabi (FAB) yesterday confirmed (pdf) earlier reports that FAB’s acquisition of Bank Audi’s Egypt unit would be put on hold because of the coronavirus. The bank said it had agreed with Bank Audi to pause negotiations due to the “unprecedented circumstances and the uncertain outlook” caused by the pandemic. “The two banks have held productive discussions over the past few weeks, with significant progress made on many points,” FAB said, noting that the decision to halt talks is in the best interests of its shareholders, customers and employees.

Background: This came a day after unnamed sources quoted by Reuters said that the Emirati bank was ending talks to prioritize supporting the UAE economy through the pandemic.

Good news on the food security front: Romania is still interested in selling wheat to Egypt: A prolonged drought is expected to send Romanian wheat production plunging this season, but farmers and experts tell Reuters that the country should still be able to run enough of a surplus to participate in Egypt’s wheat tenders. Output in the Black Sea country could fall as much as 50% to between 5 and 7.4 mn tonnes, a year after it harvested a record crop of around 10 mn tonnes. Sebastian Devos, founder of Romanian brokerage Koepta, estimated that Romania will be able to export around 3.5 mn tonnes of wheat this year depending on market factors.

It was only a month ago that Romania decided to ban wheat exports to support its domestic food supply, only to end it a week later under pressure from the European Commission and local farmers.

Egypt is already stocking up on wheat from domestic growers and could look to other suppliers if there’s a shortfall in Romania. State grain buyer GASC (the world’s largest wheat buyer) has only imported 240k tons of wheat since April and participation in its most recent tender attracted just five bids — the fewest in more than a year — as major producers resort to food nationalism and place restrictions on exports. Egypt has pinned hopes of reaching the country’s 800k ton import target on the Northern Hemisphere’s harvest season. As of last week, the government had already purchased 2.1 mn tonnes from local farmers, 30% more than it bought in April last year.

Opportunity for North American traders? Egypt has recently passed on US wheat on concerns about high shipping costs and Canadian wheat has not been a significant component of GASC’s wheat diet since a fuss in 2016 over fungus.

EGP WATCH- EGP eases to three-month lows against the greenback: The EGP dipped yesterday to its lowest level against the USD since early February, according to Refinitiv data picked up by Reuters. The currency fell to intraday lows of 15.83 from 15.72 at the start of the session. Central bank data shows the EGP falling to 15.72 against the USD from 15.68 on Sunday (pdf).

The EGP has held firm since the onset of the covid-19 pandemic, despite the closure of the tourism sector and large outflows of foreign investment. Foreign investors have pulled USD 17 bn from Egypt over the past two months and dumped half of their holdings in local currency treasury bills. The EGP has lost less than half of its gains against the greenback during the first seven weeks of the year when it climbed more than 3% to 15.49 to the USD.

Sovereign Fund is putting healthcare and pharma storage at the forefront of its sub-fund plans amid covid-19: The covid-19 pandemic has prompted the Sovereign Fund of Egypt (SFE) to recalibrate its priorities for the sub-funds it plans to set up, with healthcare and logistics for the pharma industry currently coming to the forefront. The SFE is also prioritizing electricity, transport, agriculture, and infrastructure for other sub-funds it’s looking to set up, CEO Ayman Soliman said in a meeting with Prime Minister Moustafa Madbouly and Planning Minister Hala El Said, according to a cabinet statement. Soliman didn’t provide further details on the timeline or expected partnerships for these sub-funds.

Background: The SFE has been working to adapt its investment plans in tandem with the development of the pandemic. Last month, Soliman said the fund was preparing a list of potential low-risk investments to present to investors after the outbreak, but didn’t delve into what these investments could include. The SFE previously offered to investors a 70% stake in the three Siemens-built combined-cycle power plants and various military subsidiaries. Ten unspecified military-owned companies were also under study with plans to offer them for co-investment.

Egypt is becoming an increasingly popular destination for nearshore companies to outsource their business services, according to a report published by ABSL. Egypt is the sole non-European country to be included in this year’s edition of the report, which notes that one of the key attractions in Egypt’s business services market is its sheer population size of 100 mn, coupled with the high level of education within the market. The report also gives us props for our low operating costs and the government supporting the sector with “investments in talent and infrastructure [as well as] incentives and support to foreign investors.”

No surprise here: Techies are driving the export-oriented service market to western Europe: Software development is the most popular type of service delivered by export-oriented business service centers, accounting for 62% of the services provided through these centers to western European countries, according to the report. IT helpdesk services in Egypt are also a popularly outsourced service among businesses based in the UK, while US-based businesses outsource a little less than a third of their customer service to business service centers in Egypt. Not so popular in outsourcing to Egypt among Asian countries: Supply chains and logistics.

M&A WATCH- Modern Waterproofing (Bitumode) has agreed to the EGP 3.91 share price Sika Egypt has set in its mandatory tender offer (MTO) for 100% of Bitumode’s 119 mn shares, according to Hapi Journal. The Financial Regulatory Authority had approved the construction chemicals supplier’s MTO last week.

LEGISLATION WATCH- House gives preliminary nod to stamp tax amendments, looks set to give tax break to state-owned enterprises, suspends agriculture land tax: The House of Representatives’ general assembly yesterday gave preliminary approval to government proposals to cut stamp tax on EGX transactions and withholding tax on dividends, Al Mal reported. The planning committee last week decided to cut the stamp tax on EGX transactions to 0.075% instead of 0.05% to narrow the tax rates charged to resident and foreign investors. The amendments would also slash the tax on dividend payouts by listed companies to 5% from 10%.

Capital gains tax break for state-owned enterprises gets initial approval: The House gave preliminary approval to amendments to the Income Tax Act that would hand state-owned enterprises in which the government owns a minimum 51% stake a capital gains tax break. Under the proposals, companies would not be charged capital gains tax on the sale of land to banks as part of debt settlements.

House approves two-year suspension of agriculture land tax: The House of Representatives has approved a two-year suspension of the 14% tax on agricultural land (known informally as the “mud tax”), a day after the legislation was discussed by the agriculture and planning committees, Al Mal reported yesterday. The law extends an existing three-year suspension approved in 2017 until 2022. Finance Minister Mohamed Maait told parliament yesterday that the new suspension is designed to provide support to farmers through the covid-19 crisis, after some lawmakers demanded that the tax be abolished completely.

The Banker names NUCA’s EGP 4 bn securitized bond issuance as Africa’s securitization transaction of the year: The Banker, a sister publication of the Financial Times, has recognized Sarwa Capital and Banque Misr’s EGP 4 bn securitized bond issuance on behalf of the New Urban Communities Authority (NUCA) as the securitization transaction of the year in its Africa edition of the accolades. The European Bank for Reconstruction and Development poured EGP 500 mn in the bond and was the sole international investor participating in the issuance, according to a statement from the institution.

Our friends at ALC Alieldean Weshahi & Partners were legal advisors for the issuance.

State-owned Heliopolis for Housing and Development (HHD) reporteldy has a new board of directors after the previous board resigned after the company failed to secure offers for its tender for a 10% stake + management rights in February, prompting it to abandon its share sale plans. Former Giza governor Khaled El Adly has been tapped as the new chairman of the board, according to a report in Al Mal citing unnamed government officials. The new board will officially be announced during HHD’s general assembly meeting on Thursday.

EARNINGS WATCH- CI Capital reported net profits of EGP 102 mn in 1Q2020, down from EGP 123 mn in the previous year, according to an earnings release (pdf). The company’s revenues slid 7.4% y-o-y to reach EGP 526.1 mn, down from EGP 568.0 mn in 1Q0219.

TPay’s Sahar Salama on how to scale up fast: Once upon a time, one page of transactions was plenty of reason for TPay Mobile CEO Sahar Salama and her team to celebrate. Today, TPay is a regional fintech powerhouse, processing almost 51 mn transactions a day across 18 markets in the MENA region. Find out how MENA’s first dragon started and scaled up to where it is today in this week’s episode of Making It.

Tap or click here to listen to the episode on: Our website | Apple Podcast | Google Podcast | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.

The Macro Picture

What makes stock trading so compelling during the covid-19 crisis? A record number of investors, mainly in the US but also around the world, have bought into the “V”-shaped” narrative — the idea that stock prices will soon return to previous highs when the pandemic is over. This narrative has led to a staggering number of new small-scale market entrants, despite US Federal Reserve chairman Jerome Powell’s increasingly pessimistic tone about the pace of the economic recovery and a number of big players warning of historic overvaluations in the equity markets, John Cassidy writes for the New Yorker. Why is it now that so many small-time investors are choosing to dive into the market?

Behaviorists have some answers: Behavioral economics — which examines the psychological, social and cultural factors behind economic decision-making — tells us that while we do invest partly on rational grounds, emotions and subjectivity also inform our choices in the market. We sometimes assess prices and the rate of return, but “a narrative is often more emotionally compelling and resonant than an argument about valuation,” behavioral financier and Nobel Laureate Robert Shiller told Cassidy. It could also simply be that “a lot of people have a lot of time on their hands,” and those that like to gamble are finding stock trading a fitting substitute for the casinos and sports wagering that have been put on hiatus in response to the pandemic, leading behavioral economist Richard Thaler said.

Image of the Day

Yesterday was the 40th anniversary of the eruption of Mount Saint Helens: The image shows a mountaineer looking over as the volcano erupted, spewing ash 80k feet into the sky and flattening everything in a 31km radius.

Correction: 19 May 2020

A previous version of this story incorrectly stated it was the thirtieth anniversary of the eruption.

Egypt in the News

Topping the coverage this morning in the foreign press: Human Rights Watch is calling on Egypt to release prisoners who are in prolonged pretrial detention after court trials were postponed due to covid-19. The Associated Press has picked up the statement.

The National raises the spectre of war between Egypt and Ethiopia: Speculation is rising that Egypt may have to resort to military action against Ethiopia if it follows through on its plans to begin filling the Grand Ethiopian Renaissance Dam in July without an agreement, Hamza Hendawi opines in the UAE’s the National.

Worth Reading

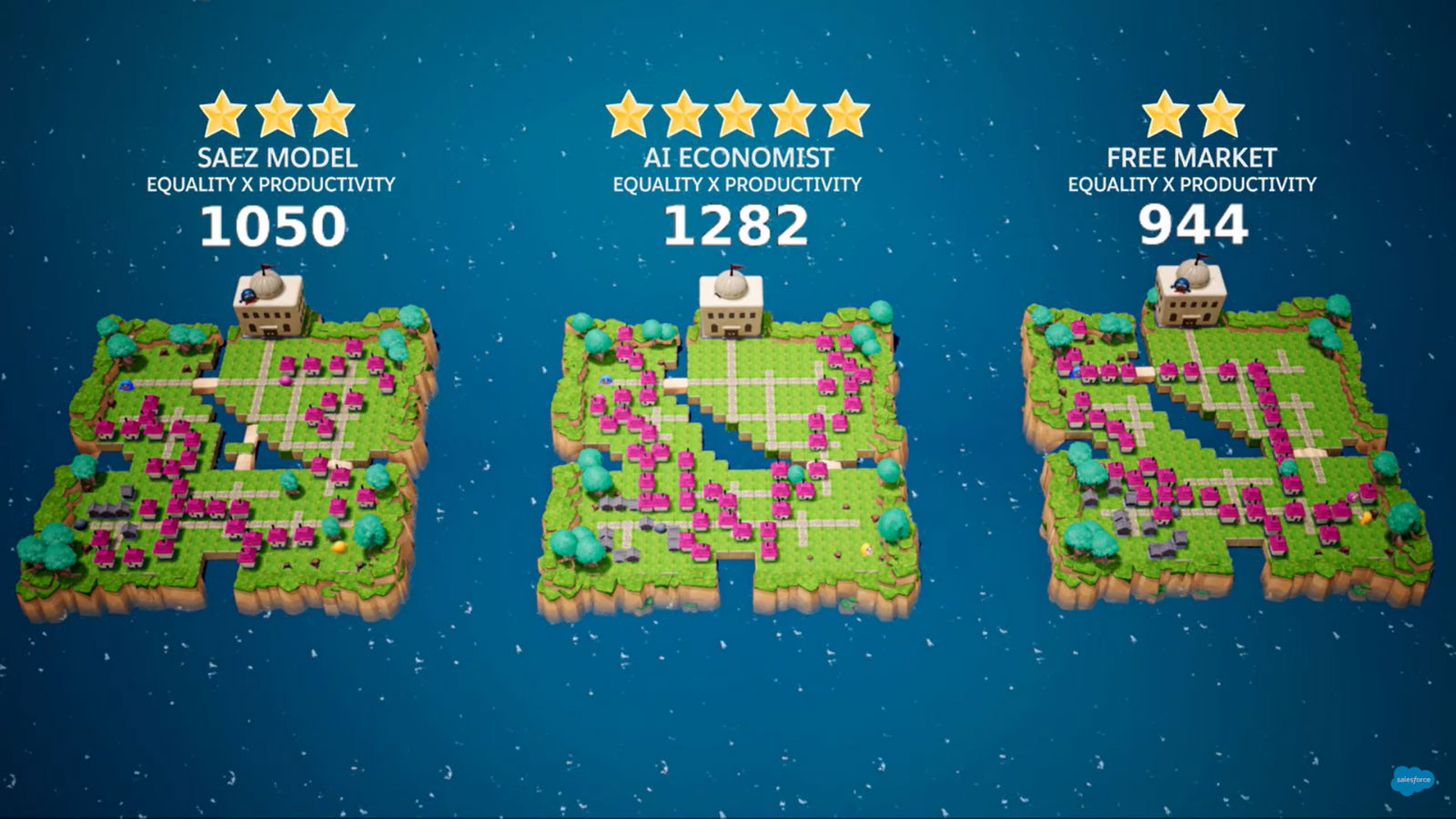

AI says the best tax system puts heavier taxes on both the rich — and the poor: The so-called AI Economist (here and here) is a new artificial intelligence software developed by tech gurus at Salesforce who used reinforced learning AI in the same vein as Google’s famed AlphaGo to try to identify the optimal system for distributing taxes. The idea behind the program is simple: If economists are having a hard time coming up with an optimal taxation strategy, we might as well let machines do the work, geophysics enthusiast Mihai Andrei writes for ZME Science.

Why is this interesting? If you’ve played computer simulated strategy games, you’d know that there’s a lot to learn about how real life works. The main difference between games and reality is that, in a game, we’re in full control and are able to keep testing scenarios until we find the ideal solution. We can take this concept and apply it to taxation, where the goal (a balance between income equality and productivity) is clear but the solution is much less so.

This is what AI Economist did: Programmers created four AI workers with different skill levels and sent them to work gathering resources, trading and building houses. Low-skilled workers perform better if they gather resources while the high-skilled do better if they build houses. An AI policymaker, whose goal is to boost both productivity and income for all four workers, taxes each of them at the end of a simulated year and provides suggestions on how to subsidize and redistribute wealth.

What did it conclude? After repeating the process mns of times, the AI Economist counterintuitively decided that placing heavier taxes on both the rich and poor and lowering taxes on the middle class would best reduce income inequality and provide better social welfare than both the free market and saez tax models.

Energy

Benha University researchers discover new cooling technique for PV solar panels

Scientists at Benha University have discovered a new cooling technique for PV solar panels that allows solar energy to be extracted more efficiently, Afrik21 reports.

Tourism

TUI to recommend measures to resume charter flights

TUI will recommend to Egyptian tourism authorities health and safety measures to allow the return of chartered flights to Egypt, the British travel group told Tourism Minister Khaled El Anany.

Banking + Finance

Hassan Allam in talks with banks to obtain new financing

Our friends at Hassan Allam Holding are in talks with several unnamed banks to obtain financing for various projects under development in new cities, co-CEO Hassan Allam told Hapi Journal, The company also hopes to be included within the CBE’s subsidized loan program which was recently extended to contractors, Allam said, adding that the company is still assessing its financing requirements.

Al Marasem reportedly seeking EGP 700 mn facility for New Cairo hospital, medical labs

Al Marasem International Development is reportedly in the market for EGP 700 mn to finance part of a planned EGP 1.5 bn project to build a hospital and medical labs in New Cairo, Al Shorouk reports, quoting anonymous banking sources.

Al Ezz Dekheila Steel in talks with local banks for EGP 3 bn loan to finance working capital

Al Ezz Dekheila Steel is in talks with local banks for an EGP 3 bn facility to finance working capital, Al Shorouk reports, quoting unnamed banking sources; the facility would reportedly include a USD 100 mn foreign currency tranche.

On Your Way Out

A number of our current leaders could do with listening to some Aztec advice for handling pandemics: Turns out the Aztec empire that occupied present-day Mexico throughout much of the second millennium had a handbook for responding to plagues and epidemics, says Zocalo Public Square. The Aztecs ended up succumbing to smallpox — brought to the continent by the Spanish invaders — but within our record of the empire’s moral philosophy, we find extensive warnings to new rulers facing rampant diseases, emphasizing grace and wisdom. The number one Aztec rule: “Do not be a fool.”

The Market Yesterday

EGP / USD CBE market average: Buy 15.73 | Sell 15.83

EGP / USD at CIB: Buy 15.74 | Sell 15.84

EGP / USD at NBE: Buy 15.72 | Sell 15.82

EGX30 (Monday): 10,279 (-0.8%)

Turnover: EGP 642 mn (8% below the 90-day average)

EGX 30 year-to-date: -26.4%

THE MARKET ON MONDAY: The EGX30 ended Monday’s session down -0.8%. CIB, the index’s heaviest constituent, ended down 0.3%. EGX30’s top performing constituents were CIRA up 3.2%, GB Auto up 2.8%, and Heliopolis Housing up 1.6%. Yesterday’s worst performing stocks were Egyptian Resorts down 6.3%, Elsewedy Electric down 4.0% and Dice down 3.6%. The market turnover was EGP 642 mn, and local investors were the sole net buyers.

Foreigners: Net Short | EGP -123.1 mn

Regional: Net Short | EGP -6.9 mn

Domestic: Net Long | EGP +130 mn

Retail: 50.7% of total trades | 52.7% of buyers | 48.6% of sellers

Institutions: 49.3% of total trades | 47.3% of buyers | 51.4% of sellers

WTI: USD 33.12 (+4.09%)

Brent: USD 35.72 (+2.61%)

Natural Gas (Nymex, futures prices) USD 1.79 MMBtu, (+0.22%, Jun 2020 contract)

Gold: USD 1,736.70 / troy ounce (+0.13%)

TASI: 6,921.15 (+1.41%) (YTD: -17.50%)

ADX: 4,060.51 (-0.11%) (YTD: -20.00%)

DFM: 1,919.83 (+0.42%) (YTD: -30.56%)

KSE Premier Market: 5,196.30 (+0.96%)

QE: 8,764.53 (+0.75%) (YTD: -15.93%)

MSM: 3,427.12 (-0.30%) (YTD: -13.92%)

BB: 1,253.95 (+0.63%) (YTD: -22.12%)

Calendar

23 May (Saturday): Earliest date on which suspension of international flights to / from Egypt expires.

23 May (Saturday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

31 May (Sunday): A postponed court session for the lawsuit filed by Cairo Development and Auto Industry, a subsidiary of Arabia Investment Holding, against Peugeot Automotive to demand EUR 150 mn compensation.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 June (Sunday): Anniversary of the June 2013 protests, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 July (Sunday): North Cairo Court will hold a court session for the international arbitration case filed by Syrian Antrados against Porto Group for USD 176 mn after being pushed back from an initial 17 May court date.

The group said in a disclosure to the stock exchange on Monday that thi

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.