AI says the best tax system puts heavier taxes on both the rich — and the poor

AI says the best tax system puts heavier taxes on both the rich — and the poor: The so-called AI Economist (here and here) is a new artificial intelligence software developed by tech gurus at Salesforce who used reinforced learning AI in the same vein as Google’s famed AlphaGo to try to identify the optimal system for distributing taxes. The idea behind the program is simple: If economists are having a hard time coming up with an optimal taxation strategy, we might as well let machines do the work, geophysics enthusiast Mihai Andrei writes for ZME Science.

Why is this interesting? If you’ve played computer simulated strategy games, you’d know that there’s a lot to learn about how real life works. The main difference between games and reality is that, in a game, we’re in full control and are able to keep testing scenarios until we find the ideal solution. We can take this concept and apply it to taxation, where the goal (a balance between income equality and productivity) is clear but the solution is much less so.

This is what AI Economist did: Programmers created four AI workers with different skill levels and sent them to work gathering resources, trading and building houses. Low-skilled workers perform better if they gather resources while the high-skilled do better if they build houses. An AI policymaker, whose goal is to boost both productivity and income for all four workers, taxes each of them at the end of a simulated year and provides suggestions on how to subsidize and redistribute wealth.

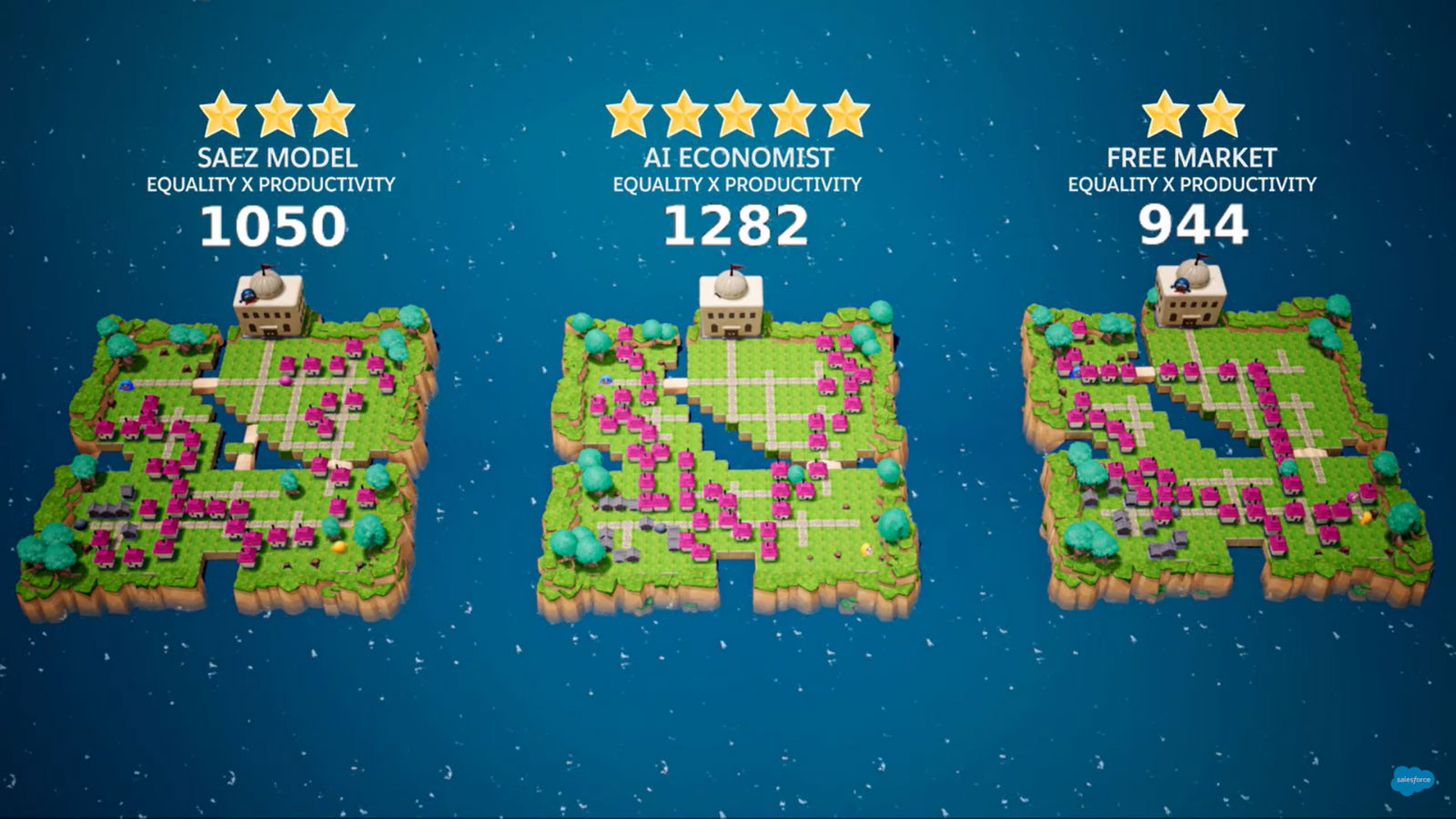

What did it conclude? After repeating the process mns of times, the AI Economist counterintuitively decided that placing heavier taxes on both the rich and poor and lowering taxes on the middle class would best reduce income inequality and provide better social welfare than both the free market and saez tax models.