- Egypt’s macro outlook for next year is looking good -Beltone. (Speed Round)

- The Tharaa headlines continue: Egypt’s sovereign wealth fund receives seven partnership offers. (Speed Round)

- Brokerages aren’t thrilled about the costs of the short selling electronic system. (Speed Round)

- Arabia Holding to offer a <25% stake on EGX by 2021. (Speed Round)

- FRA rejects Adeptio’s Americana MTO. (Speed Round)

- DP World’s USD 520 mn Ain Sokhna port expansion finished by 2Q2020. (Speed Round)

- House to demand gov’t cut natgas prices for industry again. (Speed Round)

- El Sisi urges investment in Africa at G20 Compact, as Egypt and Germany sign agreements worth EUR 300 mn. (Speed Round)

- The Market Yesterday

Wednesday, 20 November 2019

We’re getting a sixth legislative session this year

TL;DR

What We’re Tracking Today

Abdel Aal has spoken: The House is getting a sixth legislative session. The House of Representatives will begin a sixth and final legislative cycle that will begin in October 2020 and wrap up in January 2021, House Speaker Ali Abdel Aal announced yesterday, according to Masrawy. Abdel Aal justified the additional “bridge” cycle by saying that the constitution does not specify the number of cycles parliament should be in session for, meaning that a sixth (or seventh, or eighth…) cycle is not problematic.

Why the extra session? The legislative cycle runs between October and June every year, a slight issue given the current five-year parliamentary term will end in January 2021. An additional mini session is therefore necessary to bridge the gap. It remains unclear whether this will be the system for all forthcoming parliamentary terms, or if our illustrious representatives will find a more long-term solution.

Other parliamentary news worth noting before you begin your day: Abdel Aal adjourned the assembly yesterday, giving our elected MPs a break until 8 December, having according to AMAY.

Russian President Vladimir Putin is coming to Egypt next year, when we officially break ground on the USD 30 bn Dabaa nuclear power plant, Russia’s presidential envoy in the Middle East and Africa Mikhail Bogdanov tells the Russian news agency TASS. The plant’s first reactor is expected to be commissioned in 2026 and the entire plant will be completed by 2029.

Resumption of charter flights in sight? Bogdanov also hinted that there will be “important developments” in Cairo and Moscow’s relationship, and although he did not explicitly mention the issue, we’re hoping an agreement to resume direct flights from Russia to Sharm El Sheikh is on the horizon.

Aramco institutional tranche almost covered in first three days: Arrangers of Saudi Aramco’s IPO have reported strong early demand, with the institutional tranche almost covered in the first three days of book-building, Bloomberg reports. An apparently healthy appetite among institutional investors for shares comes a day after Aramco all but gave up marketing the offering overseas due to low demand among foreign investors. The Saudi government has reportedly been pressuring local investors to buy shares, and relaxed margin lending rules for banks. Aramco still has another two weeks to fill the institutional portion. The book-building period ends 4 December, while the retail subscription runs 17-28 November.

Tech stocks in the US have apparently had their best year in a decade this year, with investors showing interest in companies’ different offerings, according to the Wall Street Journal. The stocks have outperformed on the market, with the S&P 500 technology sector gaining 41% in 2019, its biggest one-year advance since 2009. These figures reflect confidence in the companies’ ability to drive robust sales and growing earnings growth, and working through issues that include a cooling economy, controversies over users’ data privacy, and trade tariffs.

Chinese e-commerce giant Alibaba is closing the book-building process for its USD 13 bn secondary stake sale early because of strong investor demand, with the institutional portion of the sale already oversubscribed, WSJ reports. The Hong Kong-listed group is expected to price its shares today ahead of the sale on 26 November. The transaction’s underwriters had said last week that the sale could be valued at USD 11.7 bn.

US gives greenlight to Israeli colonization of Palestine: The US has claimed that Israeli settlements in the West Bank — long denounced as illegal under international law — are actually legal, effectively giving Israel the greenlight to continue its colonization of the West Bank. The Foreign Ministry rejected the US announcement, calling the settlements “illegal and contrary with international law” in a statement.

International news to keep on your radar:

- Protests in Iran against oil price hikes have subsided shortly after the Revolutionary Guards warned anti-government protesters it could take “decisive action,” an Iranian judiciary spokesman said, according to Reuters. The UN’s human rights office says the demonstrations, which began on Friday, have left dozens dead, according to BBC.

- Lebanese protesters force parliament to close: Lebanese MPs have been prevented from entering parliament, increasing a month-long political crisis which three weeks ago saw PM Saad Hariri and his government resign, Bloomberg writes.

Bill Gates-backed secret solar startup makes breakthrough: An innovative solar company going by the name of Heliogen has found a way to generate heat strong enough to use in industrial processes such as cement, steel and glass manufacturing. The company uses artificial intelligence and a field of mirrors to produce temperatures exceeding 1,000°C, effectively eliminating the need for fossil fuels in an energy-intensive sector of the economy. Check out the company’s press statement here.

The story behind Making It: Wherein our editor talks why it was time to take the plunge and launch a podcast — and why we think we know how to tease details out of some of the country’s top CEOs about how they built a great business. Bonus: You’ll also hear a little bit about our origin story (listen, runtime: 3:02). Already interested? Subscribe now on Apple Podcasts.

Stay tuned for the first episode dropping this Friday, featuring a CEO whose business you may well pass by everyday — and who has always had your stomach’s best interests at heart.

Enterprise+: Last Night’s Talk Shows

President Abdel Fattah El Sisi’s participation in the G20 Compact with Africa summit was the number one topic on the airwaves on an otherwise quiet night.

Al Hayah Al Youm covers the president’s speech: Speaking on behalf of the continent as chair of the African Union, El Sisi called on G20 leaders to support Africa in fighting high levels of debt, poverty, disease, illegal immigration, and climate change by stepping up investment. Al Hayah Al Youm’s Khaled Abu Bakr broke the speech down (watch, runtime: 7:04). We have more on both El Sisi and German Chancellor Angela Merkel’s words in this morning’s Speed Round, below.

El Sisi meets German economic cooperation minister: Hona Al Asema’s Reham Ibrahim took note of El Sisi’s meeting with German Economic Cooperation and Development Minister Gerd Müller on the sidelines of the conference (watch, runtime: 1:00). We have more in Speed Round below.

Six new co-op agreements signed: Ibrahim read out an Investment Ministry statement on cooperation agreements signed between Egypt and Germany on the sidelines of the forum (watch, runtime: 4:32). We have the breakdown in this morning’s Speed Round.

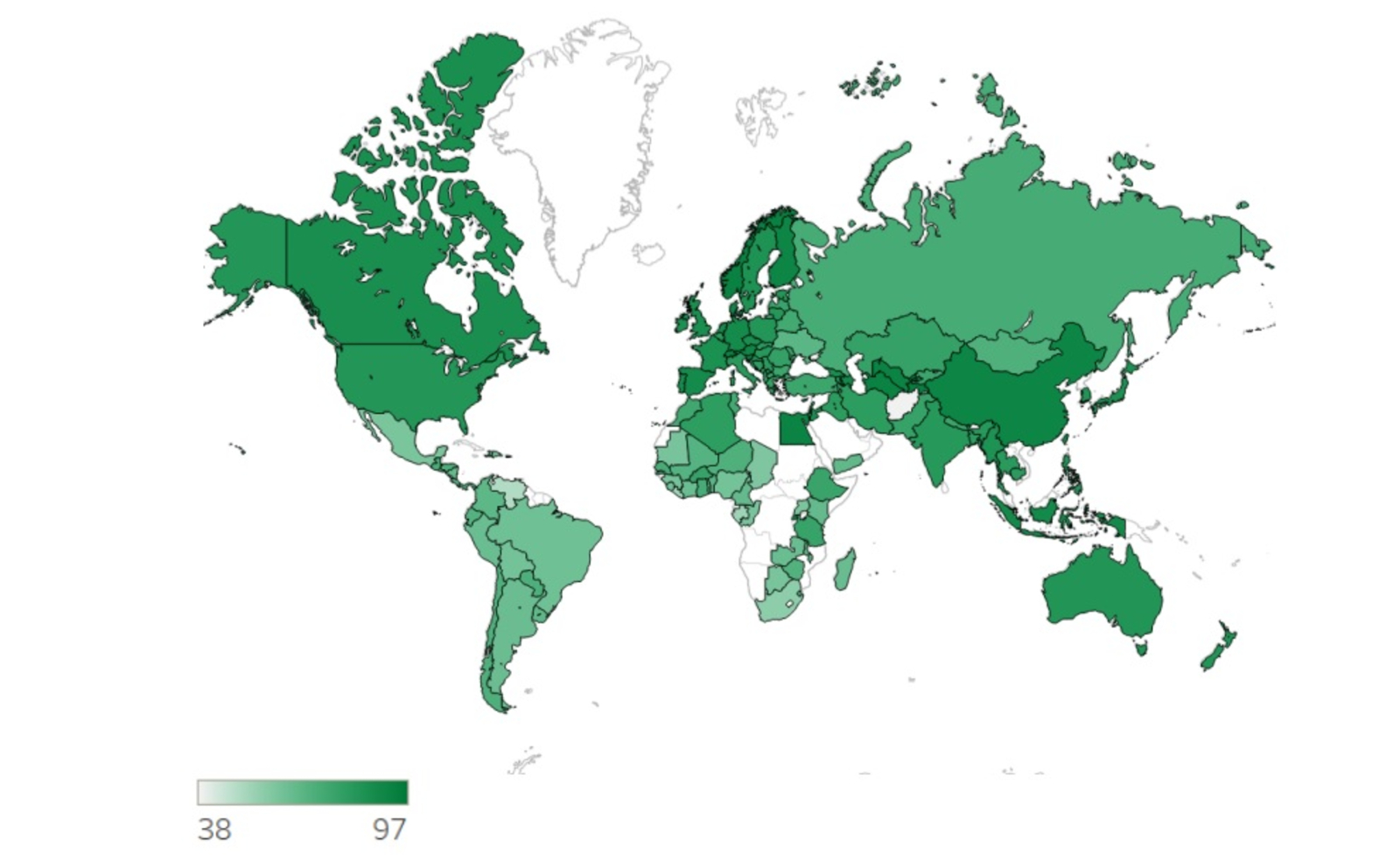

Egypt was named by Gallup as the eighth most secure country in the worldwide, Abu Bakr said, citing the data analytics firm’s 2019 Global Law and Order Report (watch, runtime: 1:26). Egypt’s position improved from 16th in 2018. Masaa DMC’s Ramy Radwan also covered the report (watch, runtime: 1:44).

Speed Round

Speed Round is presented in association with

Egypt’s outlook for next year is looking good, says Beltone’s Alia Mamdouh: The outlook for Egypt’s GDP growth, EGP performance, and inflation targets is “positive” in 2020, Beltone Financial’s macro and strategy director Alia Mamdouh tells Bloomberg TV (watch, runtime: 3:36). The EGP’s sustained stability will support the deceleration of inflation rates, which will in turn give the Central Bank of Egypt (CBE) ample room to continue its easing cycle. Mamdouh says she expects the CBE to push a total of 300 bps rate cuts throughout 2020.

Look for improved BoP with healthier natgas exports, tourism revenues, foreign holdings: An improving trade balance will help keep the currency strong over the coming months, driven by rising natural gas exports. Egypt’s import bill has also been growing at a much slower pace, says Mamdouh. Other sources of optimism for an improved balance of payments include the rally in tourism revenues and increasing investment in Egyptian treasuries. Mamdouh also pointed to improving real interest rates as the economy’s macro stability is in an “outstanding” position and with GDP growing at a 5+% clip.

Liquidity in the bond market should also get a bump from the agreement Egypt signed with Euroclear last month. The agreement with the Belgium-based clearinghouse should also attract more investments to Egyptian securities, which will lend more support to the currency. Meanwhile, Mamdouh expects a slow and gradual pickup in the state’s spending patterns, suggesting the EGP will not come under pressure and inflation will remain unaffected.

Tharaa receives seven partnership offers: Egypt's sovereign wealth fund Tharaa received seven offers from investors for potential partnerships in healthcare, pharma, and agricultural manufacturing ventures, CEO Ayman Soliman tells Al Mal. Soliman did not provide details on the names or nationalities of these investors.

Separately, the fund boss said that partnership negotiations with the Oman Investment Fund will be concluded within weeks. Tharaa has yet to tap a financial advisor for the final agreement with the Omani fund, Soliman said. Our friends at EFG Hermes has reportedly advised Tharaa on the USD 20 bn investment platform with the Abu Dhabi Development Holding Company (ADDH), which will act as a model for our partnership with Oman.

REGULATION WATCH- Brokerages aren’t happy with how much the short selling electronic system is going to cost them: Brokerage firms have voiced concerns to the Financial Regulatory Authority (FRA) that they will be unable to afford the cost of the electronic system needed to short sell on the EGX, sources tell Al Mal. Brokerages will be required to fork out USD 9,500 (EGP 153k), which they say is too hefty a price tag. Large brokerages already use sophisticated software capable of handling short selling transactions. Medium firms, meanwhile, generally do not have the same capability, and may struggle to afford the upgrade. EGX officials are reportedly working with their software developers to reduce the price.

The system is nearly finalized ahead of the instrument’s launch before the year is out. A meeting between the FRA’s advisory committee, EGX executives, Misr For Central Clearing, Depository & Registry, and the tech companies rolling out the platform, finalized the three options investors will have when deciding who to lend shares to.

- the investor can lend to clients of the same brokerage;

- they can lend to anyone provided they post their shares on the trading platform for other clients to see;

- or, they can lend to clients of specific brokerages.

The advisory committee is coordinating with MCDR to make some final adjustments on settlements, reserving stocks, and returning them after contracts expire, as well as booking shares.

Background: The FRA has been meeting with industry stakeholders to review the system in place to launch short selling on the EGX. The consultations are meant to put the final touches on the electronic system for the financial instrument ahead of its activation next month. EGX Chairman Mohamed Farid said earlier this year that short selling would begin before the year was out, following expectations that it would be launched in the third quarter. 51 brokerage firms have already obtained the license for shorting and are awaiting the regulations to be finalized to begin offering the service.

IPO WATCH- Arabia Holding to offer <25% stake on EGX within two years: Real estate developer Arabia Holding is considering debuting on the EGX sometime over the next two years offering less than 25% of its shares, Chairman Tarek Shoukry tells Al Mal. The company will decide on the exact stake size once it hires a bookrunner for the IPO. Shoukry did not clarify whether the company is already in talks with potential advisors for the offering.

Market conditions will decide when the company pulls the trigger: The real estate developer is keeping an eye on market conditions to determine when would be best to kickstart the process, Shoukry said. The chairman’s comment comes as the EGX has seen only one IPO this year — e-payments platform Fawry — and one secondary offering from Eastern Tobacco. Rameda Pharma also said it intends to float on the EGX before the year is out. However, several other private and state-owned companies have at least temporarily shelved plans to IPO after the emerging market meltdown in the second half of last year.

M&A WATCH- FRA tells Adeptio: Your Americana MTO offer shall not pass: The Financial Regulatory Authority (FRA) has rejected the mandatory tender offer (MTO) from Adeptio to acquire the Egyptian International Tourism Projects Company (Americana), according to a disclosure to the bourse (pdf). The market regulator said that Adeptio’s offer price of EGP 3.9 per share was not in line with the financial evaluation, and cited Adeptio’s "lack of objectivity and reasonableness of assumptions."

FRA obliged Adeptio to hire a new independent financial consultant and present a fresh fair value offer within one month. Fincorp Investment Holding, which prepared the first fair value study, denied the study was unfair, according to Youm7. Americana’s minority shareholders had previously signaled they would only be satisfied with an offer in the range of EGP 24 / share.

Background: Adeptio acquired 67% in Kuwait Food Company (Americana) in June 2016 following a two-year process, giving it indirect ownership of the majority of Americana Egypt. The FRA then ordered Adeptio to submit an MTO to buy the remaining shares in Americana Egypt earlier this year and cover the 9.563% of Americana that Adeptio didn’t already own, but Adeptio had argued that its indirect ownership in the company is less than 90% of its total capital and therefore does not require an MTO submission. Adeptio submitted an appeal against the order, which the FRA promptly rejected. The company then filed a suit with an economic court challenging the FRA’s rejection, but the court also dismissed the appeal.

DP World’s USD 520 mn Ain Sokhna port expansion to be complete by 2Q2020: A USD 520 mn expansion of the Ain Sokhna seaport is due for completion by the second quarter of 2020, UAE-based DP World CEO and managing director for the Middle East and Africa, Suhail Al Banna said, according to Reuters’ Arabic Service. The project involves building a second dock that will double the port’s capacity to 1.75 mn TEU from a current 970k. Its completion will bring DP’s investments in Egypt to USD 1.6 bn. It will make the port the first in the country capable of handling “the largest container vessels in the world,” Al Banna said. DP World owns 49% of the JV executing the project. The rest is owned by the Suez Canal Economic Zone (SCZone).

DP plans new Mediterranean port…: The company is studying a second port that will be located somewhere along the Mediterranean, an anonymous company executive told the press.

…and Tenth of Ramadan logistics hub: DP is planning to set up a logistics zone in the Tenth of Ramadan and in other industrial areas, and is awaiting a Transport Ministry tender to proceed, Al Banna said. Other projects in the pipeline include inland ports to link Alexandria to cities along the Nile River. The company was recently allocated a land plot in the SCZone for another, unspecified project.

House to call for more natgas price cuts for industry: The House Industrial Committee will ask the government to cut natural gas prices by USD 1 to USD 4.5 / mmbtu for steel, aluminum, copper, ceramics, and porcelain factories, parliamentary sources say. The committee is planning to present this recommendation in a meeting with Trade and Industry Minister Amr Nassar in the coming days. The government set up in October a committee to revise every six months the prices at which it sells gas to the industrial sector following repeated calls by manufacturers. Prices were cut by 25% to USD 8 / mmBtu for cement producers, while metallurgy and ceramics manufacturers saw their rates drop to USD 5.5 from USD 7. A new pricing scheme that would lower the price of natural gas sold to petrochemical factories is also on the way.

Industry would like prices even lower: A source at an iron and steel factory said that the government should lower prices to between USD 3.5 and USD 4 /mmBtu, still lower than the committee’s recommendations. Meanwhile, Mohamed Abou El Enein, president of Ceramic Cleopatra, and Farouk Mostafa, chairman of Ceramica Venice, both called for lower prices for ceramics producers.

El Sisi urges investment in Africa at G20 Compact, as Egypt, Germany sign agreements worth EUR 300 mn: Investment Minister Sahar Nasr inked six cooperation agreements worth EUR 300 mn with German Economic Cooperation and Development Minister Gerd Müller on the sidelines of the G20 Compact with Africa in Berlin yesterday, an Investment Ministry statement said.

The first four will move ahead with protocols signed in 2017 and 2018 worth EUR 145.9 mn. These projects will address energy efficiency, technical education, SMEs and labor market participation, infrastructure in rural areas, private sector-led innovation, water supply networks, solid waste management, and social development. The fifth EUR 151.5 mn agreement was signed in 2019, and will help fund projects in more or less the same areas.

EUR 2 mn grant for combating illegal immigration: Nasr also signed a letter of intent which will see the Immigration Ministry receive a EUR 2 mn grant. No further details on this were provided. Illegal immigration has recentely been a typical feature of Egypt-EU cooperation as the bloc is looking to make us the model for its partnership with North Africa on combating illegal migration to Europe from our region.

Other agreements from Berlin yesterday:

- Military signs smart factories agreement: Military Production Minister Mohamed El Assar signed a letter of intent with chairman of machinery manufacturer DMG Mori Christian Thoenes to set up “smart factories” for consumer goods, including factories for medical products;

- AOI seals digitization agreement: The Arab Organization for Industrialization also signed a separate piece of paper with DMG Mori to support digitization in Egyptian factories;

- EUR 2 mn MoU for Antiquities Ministry: Egypt’s ambassador to Berlin signed an MoU worth EUR 2 mn on behalf of the Antiquities Ministry with the head of the Prussian Cultural Heritage Foundation.

El Sisi, Merkel stress importance of investing in Africa for development: In his speech at the G20 Compact with Africa conference, President Abdel Fattah El Sisi called on the international community to ramp up their investments in Africa to help the continent achieve wide-reaching, sustainable development levels, according to an Ittihadiya. El Sisi, who attended the summit as the current president of the African Union, stressed that spurring development in Africa would create a ripple effect for the global economy. German Chancellor Angela Merkel also called for increased investments in the continent, which would improve living standards and reduce the flow of illegal immigration, according to StarTribune.

Also from Berlin: El Sisi discussed Libya and Syria in a meeting with German Defense Minister Annegret Kramp-Karrenbauer, Ittihadiya said. He also sat down with Muller to talk about how Egypt may benefit from Germany’s education system in light of the success of German schools and universities in Egypt, .

DISPUTE WATCH- Nostra Terra to exit East Ghazalat oil concession to settle payments dispute: Nostra Terra Oil & Gas subsidiary Nostra Terra Inc (NTI) has agreed to hand over its 50% non-operating stake in the Egyptian East Ghazalat concession to North Petroleum International Company in order to settle an ongoing arbitration case, the UK-based company announced in a statement. A London court ruled against NTI in August, finding the company in default for failing to pay concession operator North Petroleum USD 1.06 mn in cash calls in November and December 2015, as well as around USD 125k in interest. Rather than pay the cash calls and interest, Nostra opted to hand over its share in the Western Desert asset due to it being a loss-making “non-core” concession, Nostra Terra CEO Matt Lofgran said. The agreement is subject to governmental approvals. If these are not obtained by 31 December 2019, North Petroleum is able to scrap the agreement provided they submit the notice before 1 May 2020.

Background: The case was referred to the London Court of International Arbitration in April, with the court ruling in favor of North Petroleum in August. Nostra Terra subsidiary Sahara Resources has held a 50% interest in the concession since June 2017, when it acquired Echo Energy’s 25% stake for USD 500k.

STARTUP WATCH- Egypt’s Botme raises six figures in seed funding from regional angel investors: Chatbot building platform Botme has secured a six-figure seed funding round from unnamed regional angel investors, the startup’s co-founders told MenaBytes. The exact amount of funding was not disclosed. Founded in 2017, Botme allows businesses and individuals to build chatbots to connect and engage with users through platforms such as Slack and Facebook Messenger.

Egypt ranks eighth globally in Gallup law and order index: Egypt ranked eighth globally in a Gallup Law and Order Report gauging how secure people feel in their countries, rising from 16th last year. Gallup surveyed almost 152k people across 142 countries, asking them about their confidence in the police, how safe they feel walking alone at night, and whether they’ve experienced a mugging or robbery in the past 12 months.

Egypt in the News

The government’s reform efforts will be undermined if the military crowds out Egypt’s private sector from the economy, resulting in “little gain for all this pain,” Timothy Kaldas writes in an opinion piece for Bloomberg. Kaldas points out that allowing for greater private sector activity has benefits that extend beyond increasing investment and creating jobs: Private sector firms are subject to higher tax rates, and would therefore improve the government’s fiscal position. Military companies are also more deregulated, a subject discussed by Lamees El Hadidi earlier this month when President Abdel Fattah El Sisi announced that some of them may go public in the future.

Other stories turning heads in the international press:

- HRW on dissident arrests: Human Rights Watch issued a report yesterday claiming that Egyptian authorities have arrested family members of exiled dissidents. The Associated Press also took note of the report.

- [Redacted] harassment campaigns: Fair Observer recaps the various anti-[redacted] harassment campaigns and initiatives in Egypt, including HarassMap and I Saw Harassment.

- Sharm gets props for diving scene: UK’s Dive Magazine has named Aquarius Diving Club in Sharm El Sheikh as the second best diving center in the world in its annual reader-nominated travel awards.

Worth Watching

An optimist’s opinion on EM stocks in 2020: With optimism slowly building for a truce in the US-China trade war, 2020 could shape up to be good for emerging market stocks, managing director and Allianz Global Investors’ senior portfolio manager Kunal Ghosh tells Bloomberg (watch, runtime: 3:23). Tech stocks will be winners as the global economy is increasingly becoming “computation-reliant,” he said. Ghosh is also bullish about precious metals heading into 2020, predicting that we’ll see further monetary or fiscal stimulus in the US next year.

Diplomacy + Foreign Trade

US’ Exim Bank allocates USD 2 bn in funding for Egypt: The Export-Import Bank of the US has earmarked USD 2 bn in funding for Egypt “over the coming period,” board of directors member Judith Pryor said on Monday, according to Al Mal. Speaking at the US-Egypt Prosperity Forum organized by our friends at AmCham, Pryor said the bank is particularly interested in Egypt’s aviation, agriculture, ICT, and infrastructure sectors. She did not clarify the exact timeline for the earmarked funding.

Produce exporters say gov’t regs on pesticide residue are undermining performance: Egyptian agricultural product exporters are complaining that recently-imposed regulations and restrictions from the government on their products, including time-consuming procedures and expensive tests, are causing them to lose out on market share abroad, according to Al Mal. Tests to determine the level of residual pesticides currently cost EGP 10k, having increased more than tenfold from an initial EGP 800 before the new regulations were imposed last year, according to Agricultural Export Council member Reda El Gergawy. The regulations were put in place after several countries banned imports of Egyptian produce due to high levels of residual pesticides were found on multiple shipments. The latest figures available show that Egypt's agro exports in the 2018-2019 export season rose to 4.3 mn tonnes worth USD 2.2 bn.

Energy

House signs off on eight oil and gas exploration agreements

The House of Representatives approved on Sunday eight oil and gas exploration agreements, Al Mal reported. Most of the licenses awarded were for oil concessions: Neptune Energy got the go ahead for exploration and production in the Gulf of Suez, Shell received a license for three areas in the Western Desert, Merlon El Fayum will explore in West Fayoum, and Pacific Oil and Ganope will take Ras El Ush in the Gulf of Suez. Eni’s joint venture IEOC, meanwhile, received a gas license to explore in the South East Siwa and West Razek concessions.

Real Estate + Housing

Arabtec Construction tapped to construct Emaar Misr project on Egypt’s north coast

Emaar Misr has awarded a AED 366 mn contract to Arabtec Construction to construct several residential units in the Greek Village, one of the areas in Emaar’s Marassi compound on Egypt’s north coast, Arabtec said in a DFM disclosure (pdf). Construction is scheduled to take 36 months to complete.

Banking + Finance

IFC to invest USD 10 mn in electricity meter manufacturer Global Tronics

The International Finance Corporation (IFC) is considering a USD 10 mn equity investment in local electricity meters manufacturer Global Tronics, the IFC said, according to a local press report. The proceeds will raise working capital and production capacity to allow it to meet high demand from the government, which yesterday said it will install almost 30 mn smart meters in homes, shops, and factories over the coming 3-4 years. The IFC investment would also support Global Tronic’s regional expansion strategy into Saudi Arabia and further into eastern Europe, as well as support its R&D activities.

CIB applies for authorized, paid-in capital increase

CIB submitted a request to the EGX on Monday to raise its authorized capital to 50 mn from 20 mn, and its paid-in capital to EGP 14.69 from 14.56 bn.

Sports

Egypt to play Ivory Coast in U23 Afcon final after easing past South Africa

Egypt’s U23’s beat South Africa 3-0 in the Afcon semi-finals yesterday to set up a showdown with Ivory Coast in the final on Friday, Goal reports. Egypt was handed a controversial penalty midway through the second half, which was converted by Ramadan Sobhi, before Abdel Magdy added a brace late in the game. Yesterday’s victory also saw the Pharaohs qualify for the Tokyo 2020 Summer Olympics.

On Your Way Out

Scientists think they’ve solved the mystery of the mummified ibises: The existence of burial tombs of mummified ibises — sacrificed to the god Thoth — have been known about for years. What has remained a mystery is how Egyptians were able to get hold of mns of the birds. Ancient texts seemed to suggest that the birds were bred and domesticated specifically for ritual sacrifice. New DNA tests, however, provide evidence that birds were not farmed en masse, but were tamed only when needed and remained in their natural habitats for much of their lives. The Science Daily has more.

The Market Yesterday

EGP / USD CBE market average: Buy 16.03 | Sell 16.16

EGP / USD at CIB: Buy 16.04 | Sell 16.14

EGP / USD at NBE: Buy 16.05 | Sell 16.15

EGX30 (Tuesday): 14,313 (-0.5%)

Turnover: EGP 558 mn (23% below the 90-day average)

EGX 30 year-to-date: +9.8%

THE MARKET ON TUESDAY: The EGX30 ended Tuesday’s session down 0.5%. CIB, the index’s heaviest constituent, ended down 0.3%. EGX30’s top performing constituents were Cleopatra Hospital up 0.5%, Qalaa Holdings up 0.4%, and SODIC up 0.3%. Yesterday’s worst performing stocks were Telecom Egypt down 2.2%, Emaar Misr down 2.1% and ADIB down 1.7%. The market turnover was EGP 558 mn, and local investors were the sole net buyers.

Foreigners: Net short | EGP -7.8 mn

Regional: Net short | EGP -20.0 mn

Domestic: Net long | EGP +27.8 mn

Retail: 48.2% of total trades | 43.3% of buyers | 53.1% of sellers

Institutions: 51.8% of total trades | 56.7% of buyers | 46.9% of sellers

WTI: USD 55.21 (-3.2%)

Brent: USD 60.83 (-2.6%)

Natural Gas (Nymex, futures prices) USD 2.51 MMBtu, (-2.2%, December 2019 contract)

Gold: USD 1,474.30 / troy ounce (+0.2%)

TASI: 8,045 (+0.6%) (YTD: +2.8%)

ADX: 5,087 (+0.8%) (YTD: +3.5%)

DFM: 2,701 (+0.7%) (YTD: +6.8%)

KSE Premier Market: 6,308 (+0.5%)

QE: 10,340 (+0.4%) (YTD: +0.4%)

MSM: 4,087 (+0.0%) (YTD: -5.5%)

BB: 1,506 (+0.3%) (YTD: +12.7%)

Calendar

November: Suez Canal Conference for Investment, organized in cooperation with the European Union.

November: British Egyptian Business Association’s Annual door knock mission, United Kingdom.

November: ITIDA to announce the winning bid in a tender to manage three new innovation centers.

20-29 November (Wednesday-Friday): Cairo International Film Festival, Cairo Opera House, Egypt, Cairo, Egypt.

20 November (Wednesday): The Investment Ministry and the Islamic Development Bank will organize the “leaders for change” startup competition as part of the Fekretak Sherketak initiative, location TBD, Cairo, Egypt.

22-23 November (Friday-Saturday): Invest in Africa 2019 conference, New Administrative Capital.

23 November (Saturday): HHD extraordinary general assembly to approve the 10% stake + management request for proposal

24 November (Sunday): Arabia Investments lawsuit against French Peugeot (after being postponed)

25 November (Monday): Global Trade Matters international dialogue on climate neutrality, Marriott, Cairo.

December: Belarus Industry Minister Pavel Utiupin will visit Egypt to discuss means of cooperation in the SCZone and plan for the seventh Egypt-Belarus Trade Meeting.

December: A Chinese automotive company delegation will visit Egypt to sign an agreement with El Nasr Automotive Manufacturing Company

December: Indian automotive delegation to visit Egypt

1-6 December: Vietnamese trade delegation visits Egypt.

1-4 December (Sunday-Wednesday): E-payment and Innovative Financial Inclusion Expo and Forum (PAFIX), Egypt International Exhibition Center, Nasr City, Cairo.

2-3 December (Monday-Tuesday): The irrigation ministers of Egypt, Sudan, and Ethiopia the second round of Grand Ethiopian Renaissance Dam negotiations in Washington, DC.

3 December (Tuesday): Emirates NBD / Markit PMI for Egypt released.

3-6 December (Tuesday-Friday): Cairo WoodShow, Egypt International Exhibition Center, Nasr City, Cairo.

4 December (Wednesday): Subscription to the Aramco IPO will begin (expected).

5-7 December (Thursday-Saturday): RiseUp Summit, American University in Cairo, New Cairo Campus

8 December (Sunday): Pitch by the Pyramids, Giza Pyramids

8-9 December (Sunday-Monday): The 6 th CEOs THOUGHTS 2019.

9-11 December (Monday-Wednesday): Pacprocess Middle East Africa, Egypt International Exhibition Center, Nasr City, Cairo.

9-11 December (Monday-Wednesday): Food Africa 2019 Expo, Egypt International Exhibition Center, Nasr City, Cairo.

10 December (Tuesday): Egypt Automotive summit, Nile Ritz Carlton, Cairo.

10-11 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

11 December (Wednesday): First day of trading on the Aramco IPO (expected)

12-14 December (Thursday-Saturday): 16 Egyptian real estate development companies will showcase their products at IPS Riyadh, Riyadh, Saudi Arabia

14-17 December (Saturday-Tuesday): World Youth Forum 2019, Sharm El Sheikh.

17-21 December (Tuesday-Saturday): 2019 Automech Formula car expo, Egypt International Exhibition Center, Cairo.

26 December (Thursday): Central Bank of Egypt’s monetary policy committee will meet to review interest rates.

January 2020: 2019 Confederation of African Football (CAF) Awards, Albatros Citadel Resort, Hurghada, Egypt.

January 2020: UK-Africa Investment summit, London, United Kingdom.

9-12 January 2020 (Tuesday-Sunday): PLASTEX, Egypt International Exhibition Center, Nasr City, Cairo.

25 January 2020 (Saturday): 25 January revolution anniversary / Police Day, national holiday.

25 January 2020 (Saturday): Midterm break for public schools and universities. Also known as: Two weeks of good commute.

February 2020: An Italian business delegation will visit Egypt to discuss investments in the Port Said industrial zone.

February 2020: A delegation of Swiss businesses will visit Egypt to discuss investment.

February 2020: Higher Education Minister Khaled Abdel-Ghaffar will visit Minsk, Belarus.

8 February 2020 (Saturday): Midterm break ends. Traffic in Cairo stinks once more.

11-13 February 2020 (Tuesday-Thursday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

March 2020: The Middle East and North Africa Financial Action Task Force (MENAFATF) will visit Egypt to assess the progress of actions taken to combat money laundering and terrorist sponsoring activities.

4-5 March 2020 (Wednesday-Thursday): Women Economic Forum, Cairo.

25-26 March 2020 (Wednesday-Thursday): Mega Projects Conference, Egypt International Exhibition Center, Nasr City, Cairo.

23 April 2020 (Thursday): First day of Ramadan (TBC).

23-26 May 2020 (Saturday-Tuesday): Eid El Fitr (TBC).

5-7 May 2020 (Tuesday-Thursday): AFSIC – Investing in Africa, London, United Kingdom.

30 June 2020 (Sunday): June 2013 protests anniversary, national holiday.

November 2020: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

30 July 2020-3 August 2020 (Thursday-Monday): Eid El Adha (TBC), national holiday.

19-20 August 2020 (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.