- The IMF’s Middle East + Central Asia boss has given Egypt kudos for deval + rate hike. (What We’re Tracking Today)

- EGP slips just 0.2% in trading yesterday — it’s looking like we may have hit bottom. (What We’re Tracking Today)

- Egypt to borrow USD 2 bn from UN fund to bolster food security. (Debt Watch)

- Egypt car sales hit 4.5-year low in September on supply constraints. (Automotive)

- Egypt wants to raise gas export revenues to USD 12 bn this year. (What We’re Tracking Today)

- IDH to enter Saudi Arabia after sealing JV agreement with Fawaz Alhokair-owned firm. (Healthcare)

- OC + partners break ground on 500-MW Ras Ghareb wind farm. (Energy)

- The first Arab League summit in three years starts today in Algiers, and its looking messy. (What We’re Tracking Today)

- The IMF has upgraded its 2022 growth forecasts for MENA (thanks, in part, to Egypt). (Planet Finance)

- We’re finally getting a single emergency services number: 112. (Last Night’s Talk Shows)

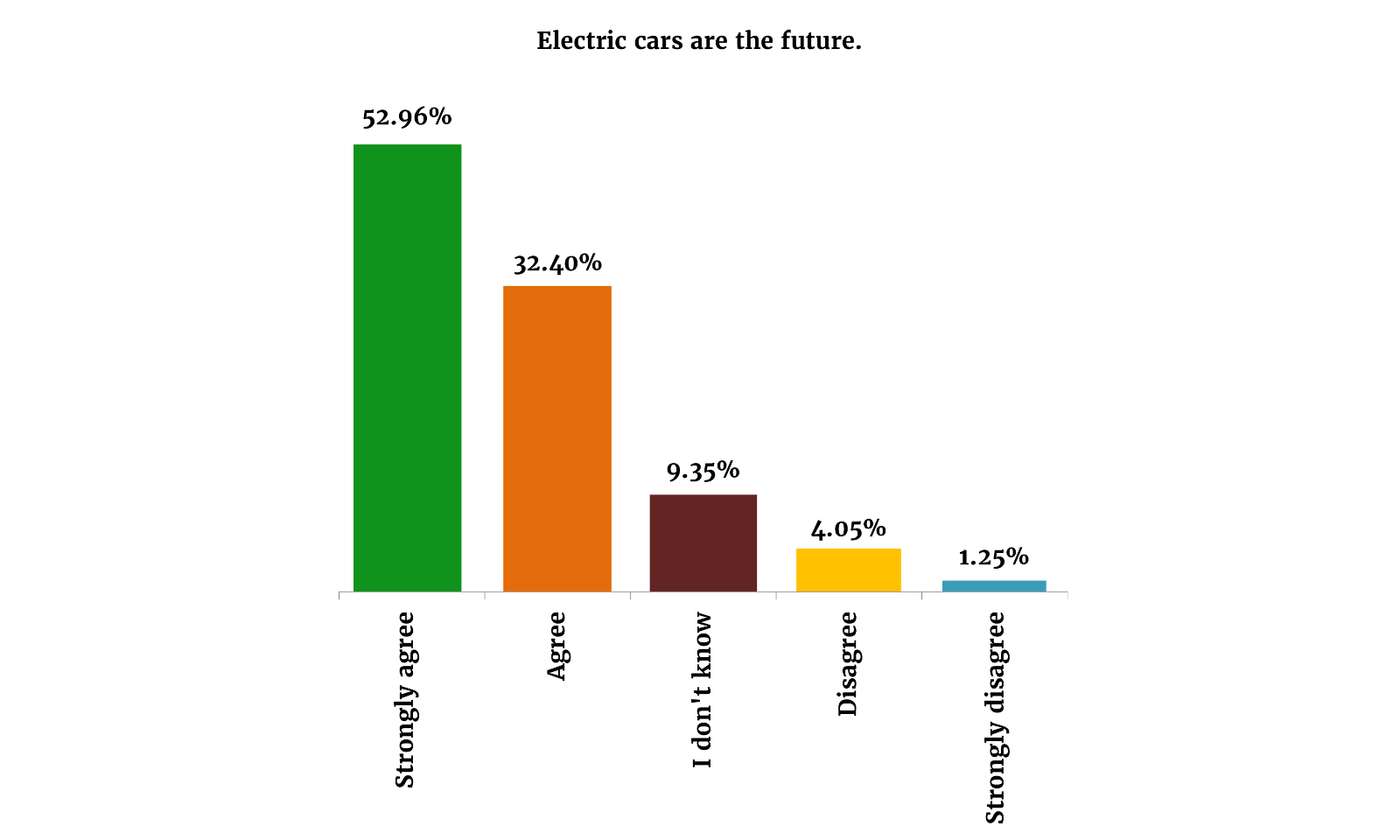

- One in five Egyptian consumers intends to buy an EV this year — and 90% of you would consider doing so within the coming decade. (Going Green)

Tuesday, 1 November 2022

AM — IMF gives us kudos for deval as EGP appears to be hitting the bottom against the greenback

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to the first day of November. We feel we ask this every year, but: Where the hell has 2022 gone? The Colonel was right: Time accelerates as you age.

We’re really looking forward to having breakfast this morning with 20 bold-name CEOs to discuss our focused, five-point plan to build a new Egyptian economy that is export-led and can turn us into a magnet for foreign direct investment. We’ll be talking lots more about this once we get over the hump of COP27, which is going to keep all of us very busy in the couple of weeks to come.

Also this morning: We’ve got the results of our Enterprise Reader Poll on your appetite for electric vehicles (EVs), where we found one in five of you intend to buy an electric car in the next 12 months. Check out this morning’s Going Green, below.

THE BIG STORY THIS MORNING- IMF gives Egypt kudos for deval + rate hike as it looks like the EGP is bottoming out: The IMF’s Middle East and Central Asia boss has praised the Central Bank of Egypt’s (CBE) policy moves last week, saying that the shift to a flexible exchange rate will protect the economy against external shocks and calling the decision to raise interest rates a “step in the right direction,” Reuters reports. (We join them in cheering the deval — but still can’t get behind the rate hike.)

Rewind: The IMF and Egyptian authorities announced a staff-level agreement on a USD 3 bn loan program on Thursday, just hours after the CBE went ahead with a series of measures aimed at restoring liquidity to the FX market. These measures include moving to a “durably flexible foreign exchange rate regime” that allows market forces to determine the value of the EGP — a key condition from the IMF ahead of the assistance package — and hiking interest rates by 200 bps. The move triggered a devaluation of the currency that has seen it fall more than 22% over the past three days.

What the IMF said: A flexible exchange rate “will help the Egyptian economy to be protected from term-of-trade shocks as well as external shocks, especially at a time when global financial conditions have tightened and became more challenging,” Jihad Azour told the newswire. “The measures that the central bank took last week in hiking interest rates … go in the right direction. It's very important to control inflation.”

EGP WATCH- The EGP moved fractionally lower against the greenback yesterday, edging down a very slight 0.2% to 24.1875, according to central bank figures. The currency has now fallen 22.4% since the central bank’s decision to move to a flexible exchange rate on Thursday, and is down 53.3% since the CBE first devalued the currency on 21 March.

In fact, we may have (very slightly) overshot: JP Morgan thinks the EGP will be at 23.50 to the USD at year’s end, and Enterprise readers earlier this fall told us last month they were using (on average) 22.12 in their 2023 budgets. Deutsche Bank is the most bearish on the EGP that we know of right now, and it’s penciling in 25.00 to the greenback by year’s end.

Here’s another company that’s going to have a rough time with the float: Suez Cement expects to suffer around EGP 800 mn in FX losses on the back of the devaluation, CEO Mohamed Hegazy told Bloomberg Asharq yesterday. The company, like others in the sector, is reliant on imported coal to power its factories, and also imports many of its components and spare parts. Hegazy’s statements came a day after Ezz Steel warned it could lose EGP 2.2 bn due to the weaker EGP.

MEANWHILE- Some legit relief for food manufacturers? Authorities will begin releasing today some of the food manufacturing inputs that have been piling up at ports because of restrictions on import finance, the Supply Ministry was quoted as saying in a statement by state TV (watch, runtime: 0:18). The ministry said all inputs would be released from ports by the end of this week to allow factories to resume production.

A quid pro quo? The decision was taken following a meeting between Supply Minister Ali El Moselhy and food producers. During the meeting the minister implored companies not to raise prices in response to the float.

PSA- But there’s no interest rate meeting this Thursday: The Central Bank of Egypt’s (CBE) won’t hold its scheduled policy meeting on Thursday in light of last week’s special meeting when it hiked interest rates by 200 bps in tandem with the EGP float, it said in a statement (pdf) yesterday. This means that the Monetary Policy Committee will next meet on 22 December in what will be the final meeting of the year.

|

HAPPENING TODAY-

November has come: Here are the key news triggers coming up this week and the next.

- PMI: We’ll know how Egypt’s private sector fared in October tomorrow when S&P Global releases the purchasing managers’ index. A 22-month contraction in private sector activity didn’t show signs of abating in September as high inflation continued to weigh on demand and output.

- Foreign reserves figures for October will be released next week.

- Inflation: Capmas and the central bank will release October’s inflation figures on Thursday, 10 November.

The two-day Arab League summit starts today in Algiers: President Abdel Fattah El Sisi will be among the attendees at the regional summit, which will be the first since the start of the covid-19 pandemic two years ago. This year’s gathering takes place amid a diplomatic spat between Algeria and Morocco which has resulted in Morocco’s King Mohamed VI declining an invitation to attend and arguments break out among diplomats in a pre-summit meeting. Among the other notable absences: Saudi Crown Prince Mohamed bin Salman, who is reportedly not attending for medical reasons, UAE President Mohamed bin Zayed, Kuwait's Emir Nawaf Al Ahmad Al Sabah and Jordan’s King Abdullah II.

It’s the final day of Egypt Energy: The three-day energy conference brings together policymakers and business leaders from the regional energy sector to discuss topics including power generation, clean energy, and PPP and foreign investment. The event is taking place at the Egypt International Exhibition Center.

DATA POINT-

Egypt wants to raise gas export revenues to USD 12 bn this year “if [gas] prices remain elevated,” Oil Minister Tarek El Molla told Sky News Arabia and CNBC Arabia (watch, runtime: 7:46) in interviews yesterday. Export revenues reached USD 7-8 bn in 2021, El Molla said, speaking on the sidelines of the Adipec expo in Abu Dhabi. The ministry expects export volumes to reach 8 mn tons this year, he said.

That’s nothing on where Qatar wants to be by the end of this decade: Qatar is planning to raise LNG output capacity by 60% by 2030, allowing it to export 126 mn tons of gas a year. “I think we will be one of the largest, if not the largest, LNG trader in the world,” energy minister and QatarEnergy CEO Saad Al Kaabi told Bloomberg yesterday.

IN THE HOUSE TODAY-

The November bonus: MPs will take a final vote on the government’s decision to pay a one-off EGP 300 bonus to public-sector workers and pensioners this month to mitigate the impact of the EGP float. The House Manpower Committee approved the move on Sunday.

Simplifying property registration in new cities: The House is also expected to give the thumbs up to amendments that would simplify the real estate registry and notarization process in new urban communities. “Citizens living in new housing communities have long complained of facing many obstacles standing in their way registering their property units or owned plots of land in real estate notarization offices,” the House legislative and housing committees wrote in a recent report. The bill will “help eliminate such obstacles, simplify notarization procedures, and also stimulate private investments,” they wrote.

FYI- The Senate is taking a two-week break due to COP27 and will reconvene on Sunday, 13 November.

COUNTDOWN TO COP (5 days to go)-

Egypt and Iran scored the worst in the region for children’s exposure to climate and environmental shocks, according to the Unicef Children’s Climate Risk Index, which looks at climate risk to children in the MENA region with a special focus on Egypt as this year’s COP host. Our overall score of 7.3 out of 10 means Egyptian children are at “extremely high risk,” with some 5.3 mn children exposed to heatwaves after temperatures rose 0.53 degree Celsius on average every ten years over the past 30 years. Children in Iraq, Morocco, Yemen, and Sudan were the next most exposed to climate risk.

The world’s most famous climate activist is passing on coming to COP: Swedish activist Greta Thunberg said she will not attend the COP27 summit, criticizing the event for “greenwashing” and criticizing our human right record. “I’m not going to COP27 for many reasons, but the space for civil society this year is extremely limited,” she said during a book signing on Sunday. “The COPs are mainly used as an opportunity for leaders and people in power to get attention, using many different kinds of greenwashing.”

The story is leading the conversation on Egypt and the COP27 summit: Reuters | AFP | Washington Post | The Guardian | Fortune | Independent.

The young activist has also joined the international campaign to secure the release of activist Alaa Abdel Fattah: Thunberg joined Abdel Fattah’s sister Sanaa Seif and other protesters outside Whitehall on Sunday, according to the Times.

Conservation group Greenpeace held a boat tour in Hurghada to promote sustainable brands and start a dialogue with local communities in the lead-up to the summit, it said in a press release (pdf).

*** It’s Going Green day — your weekly briefing of all things green in Egypt: Enterprise’s green economy vertical focuses each Tuesday on the business of renewable energy and sustainable practices in Egypt, everything from solar and wind energy through to water, waste management, sustainable building practices and how you can make your business greener, whatever the sector.

In today’s issue: The results of the Enterprise EV Survey.

2CELLOS — LIVE AT SOMABAY on 18 November, 2022: Mark your calendars — world-renowned and wildly popular cellist duo, 2CELLOS will be performing at Somabay on 18 November, 2022. Having racked up a bn-plus audio streams, countless sold-out concerts, and mns of fans across the globe in their 10 years together as 2CELLOS, the Croatian duo of Luka Šulić and HAUSER will be visiting Egypt in their long-awaited 2022 Dedicated World Tour. Book your ticket now: https://www.ticketsmarche.com/tickets/buy-tickets-2-cellos.html. Call us 16390.

DEBT WATCH

We’re borrowing USD 2 bn for food security from the UN’s agriculture fund

Egypt is getting a USD 2 bn loan from the UN’s International Fund for Agricultural Development (IFAD) and unnamed “partner organizations” to support small scale rural-farmers, Bloomberg reports.

Where the money’s going: The loan will be extended to the government until 2030 for “production, food storage and food transportation,” and to “link markets with smallholder” farmers, IFAD President Alvaro Lario told Bloomberg.

This is part of NWFE: The financing is part of the country’s Nexus of Water, Food and Energy (NWFE) program, for which IFAD is heading up the food component. The European Bank for Reconstruction and Development (EBRD) is taking the lead on the energy component of the program while the African Development Bank will oversee financing for water projects.

Stay tuned: The government should announce details at COP27 next week on the NWFE program, through which the International Cooperation Ministry will promote its pipeline of low-carbon projects to investors.

REMEMBER- Food security has become a pressing issue since Russia’s invasion of Ukraine sent global food prices spiraling, highlighting the precarity of food supply chains for import-reliant countries like Egypt. We are the world’s biggest importer of wheat and sourced more than 80% of our grain imports from Russia and Ukraine before the conflict broke out in February. Grain prices had cooled over the summer thanks to the UN-brokered Black Sea pact allowing shipments to exit Ukrainian ports — but pressures could return after Russia this week called off the agreement.

AUTOMOTIVE

Egypt car sales hit 4.5-year low in September on supply constraints — when will you be able to actually buy a car?

Auto sales slump to 4.5-year low: Monthly auto sales fell to their lowest level since 2018 in September as import restrictions continued to weigh on the market. Figures released by the Automotive Information Council (AMIC) yesterday showed that only 6.8k passenger cars were sold during the month, 60% fewer than in September 2021. This is the lowest monthly sales volume since January 2018.

Other vehicle types didn’t fare (quite) as badly: Truck sales fell 33% to around 2.8k while sales of buses were down 8% to around 1.8k. Overall vehicle sales were down 50% to 11.4k, the lowest figure since the covid-19 lockdown in April 2020.

ICYMI- The auto sector has been suffering: Car sales have fallen through most of 2022 thanks to import restrictions. Amid tightening financial conditions globally, the Central Bank of Egypt (CBE) imposed sharp restrictions on imports to preserve foreign currency, which have made it almost impossible for distributors to bring fully built up vehicles, assembly kits, and spare parts into the country and forced a number of global car manufacturers to suspend sales to Egypt.

Light at the end of the tunnel: The central bank will by the end of the year phase out the requirement to finance imports via L/Cs — the measure was the primary way the bank had been stifling imports. In the meantime, new governor Hassan Abdalla is allowing shipments worth as much as USD 500k (up from a previous limit of USD 5k) to be cleared through the old documentary collection system.

That last bit suggests that spares, at least, will likely become more available in the weeks to come — and that some smaller shipments of vehicles in port since spring might come through at the same time.

But it will be months before vehicle supply improves. Global producers have been redirecting to other markets production (of both assembly kids and completely built vehicles) that they had previously earmarked for Egypt. It’s going to take months for distributors here to place orders, global suppliers to make and ship — and then longer still if you’re looking for a model that is assembled in Egypt.

And the Madbouly government’s expat car program is unlikely to eat substantially into pent-up demand. The scheme has opened a four-month window for Egyptians working abroad to pay for vehicles up front in hard currency in return for the right to import a new car with the promise they’ll get taxes and customs back in local currency five years down the road. The Finance Ministry thinks the scheme will convince hundreds of thousands of Egyptians abroad to purchase vehicles.

DEVELOPMENT FINANCE

QNB Al Ahli could be getting USD 20 mn in EBRD funding to lend to youth-led SMEs

EBRD money for youth-led SMEs: Qatar National Bank Al Ahli (QNB Al Ahli) could be getting a senior unsecured loan of up to USD 20 mn from the European Reconstruction and Development Bank (EBRD) for on-lending to youth-led MSMEs, according to the lender’s website.

What’s a senior loan, you ask? A senior bank loan is money lent to a business by a financial institution which is then repackaged and sold to other investors. Senior loans are usually the first to be repaid to creditors in the event of bankruptcy.

And who’s eligible? MSMEs that are majority owned by people under 35 years old will be able to apply for funding under the scheme. “The project is expected to increase the pool of financing available to young individuals in Egypt and to help this group of borrowers build their skill-set and develop their businesses, thereby promoting youth entrepreneurship and youth’s participation in business through an integrated approach,” the lender said.

INVESTMENT WATCH

Beyti is looking to invest EGP 440 mn in Egypt over two years

Dairy and juice producer Beyti plans to invest EGP 440 mn in Egypt over the next two years, split equally between this year and next, CEO Mark Wiley said at a press conference, according to Mubasher. Wiley said earlier this year that the company would invest EGP 250 mn in 2022 to expand the company’s distribution network. The company added six new local production lines this year at a cost of EGP 165 mn, bringing its total number of production lines to 25. Beyti also plans to tap new markets in North Africa and the US in 2023. Saudi dairy product producer Almarai owns and operates the Beyti brand in Egypt as part of a joint venture with PepsiCo.

ENERGY

OC breaks ground on Ras Ghareb wind farm + Suez Cement adds more solar to its energy mix

We have two stories this morning from Egypt’s renewable energy sector after the Orascom-Engie-Toyota Tsusho consortium broke ground on its 500-MW wind farm in Ras Ghareb, while Suez Cement announced an agreement to install a solar facility at its Suez plant.

CONSTRUCTION ON RAS GHAREB WIND FARM UNDER WAY-

Orascom Construction, Toyota Tsusho, and Engie broke ground yesterday on their new 500 MW wind farm in Ras Ghareb, OC said in a statement (pdf). The three companies signed (pdf) a 20-year contract with the Electricity Ministry to develop, construct and operate the plant in October 2021. OC owns a 25% stake in the project and is responsible for building the plant. Implementation is expected to take 30 months.

Clean energy for hundreds of thousands of homes: Once operational, the farm will deliver clean energy to more than 800k homes and help slash CO2 emissions by 1 mn tons annually, the statement added.

How much will this cost? USD 680 mn, according to the Electricity Ministry, which said yesterday that the European Bank for Reconstruction and Development, the Japan Bank for International Cooperation, the Green Climate Fund, and a group of commercial banks had provided finance.

SUEZ CEMENT IS GOING SOLAR-

Intro Group subsidiary Intro Power and Utilities will build a 20-MW solar farm at Suez Cement’s Suez plant under a purchase power agreement (PPA) signed yesterday by the two firms, Suez Cement said in a statement.

By the numbers: The EGP 350 mn facility will provide c.45 GWh of clean electricity to the plant, supplying 20% of the plant’s total energy needs and offsetting some 20k tons of CO2 emissions annually. The plant is scheduled to become operational in 1H 2023, with construction set to begin early next year. The station will be connected to the national grid in 2H 2023 and will supply power to the plant until 2043.

The plant will help Suez Cement reach its goal of nearly halving net CO2 emissions compared to 1990 levels by 2030, Suez Cement Managing Director Mohamed Hegazy said. “Through transitioning to renewable solar energy, we are looking at long-term economic benefits, laying the foundation for a low-carbon business and energy security without jeopardizing the health of our environment,” he added.

ALSO- Solariz Egypt has launched the second phase of its EGP 97 mn solar power plant in El Gouna, generating 7 MWh — some 16% of the city’s needs, according to Al Borsa.

HEALTHCARE

IDH moves into KSA labs market with Fawaz Alhokair JV

EGX- and LSE-listed Integrated Diagnostics Holding (IDH) is set to enter the Saudi healthcare market with a greenfield JV after agreeing to set up a local diagnostics company with Saudi firm Izhoor Medical, it said in a statement (pdf) yesterday. The joint venture will be 50% owned by IDH and its Jordanian subsidiary, Biolab, and 50% owned by Izhoor, a unit of the high-profile Saudi retailer Fawaz Alhokair.

What they’re building: “A full-fledged pathology diagnostic services provider offering a wide array of diagnostics services” on a national basis, the statement said.

Investment in the JV will approach USD 20 mn over the next four years, with the business set to start operations sometime between February and April 2023 once regulatory approvals and licenses are in place. The move will see IDH add Saudi to a footprint that already includes Egypt, Jordan, Sudan and Nigeria.

The transaction makes good sense for IDH: The Saudi diagnostics market looks set to be one of the fastest-growing in the Middle East and Africa over the coming six years, IDH says, citing market data. Riyadh is looking to see more private-sector players in the labs industry to serve the country’s population, which is growing at about 2% a year. In addition to rising state spending on healthcare and a parallel privatization drive, Saudi is requiring private-sector employees to offer health ins. for their employees. The JV will also have access to Fawaz Alhokair’s extensive network of malls in KSA, where it is the largest operator in the country.

What they said: “This transaction is directly in line with our long-term regional expansion strategy which sees us pursue high-growth markets where our platform and proven expertise are well-suited to deliver high-quality care to as many patients as possible,” said IDH CEO Hend El Sherbini.

ADVISORS- IDH and Biolab have appointed Khalifeh & Partners to act as their legal advisors on the transaction, while Izhoor were represented by the Law Firm of Wael A. Alissa in association with Dentons. Neither side reported being advised by investment bankers on the transaction.

LEGISLATION WATCH

Senate gives final nod to amendments that could see contractors compensated for suffering losses in Deval 2.0

Good news for government contractors: Senators yesterday approved legal amendments that would allow contractors who have suffered losses because of recent economic reforms to receive compensation from the government.

The current bill was drafted with 2016 in mind: The original 2017 law was drafted to provide compensation for losses caused by economic reforms undertaken between March and December 2016 (read: the EGP devaluation, lifting of fuel subsidies, introduction of VAT etc.).

The legislation will now cover all periods of economic reforms: “We decided that the scope of the bill goes beyond this to include all periods of economic reforms causing financial losses to contractors involved in building projects, and delivering supplies and services for the government,” said Senate Housing Committee Chairman Khaled Said. This means that contractors who have suffered losses because of this year’s currency devaluations and the phasing out of fuel subsidies may be eligible for compensation.

A lifeline for private contractors: "The legislation will help save private contractors who are in charge of implementing government projects from bankruptcy, also putting into account that these projects serve 90 industries," Senator and businessman Ahmed Sabbour said.

What’s next: The bill will make its way to the House of Representatives for a vote and if passed, will be signed into law by President Abdel Fattah El Sisi.

LAST NIGHT’S TALK SHOWS

The talking heads are still talking about taweem 3.0. Plus: 112 = 911 in Egypt

The post-EGP float economy continued to dominate the conversation on the airwaves last night, with the nation’s talking heads continuing to play down the prospects of rising prices and shortages in the wake of the EGP’s 22% plunge against the greenback. Kelma Akhira’s Lamis El Hadidi called for patience and urged citizens to wait for a month as authorities try to get prices under control until the USD price against the EGP stabilizes (watch, runtime: 1:21) while several government officials made appearances to explain what the state is doing to minimize hardship caused by the float.

Among them was Ahmed El Attar, head of the Agriculture Ministry’s quarantine authority, who returned for the second night running to try to calm fears of food shortages and rising prices (watch, runtime: 6:07). He described the ongoing shortage of feed as a “temporary crisis” and said it will be resolved in a few weeks. Thousands of tons of corn and soybeans have been released from ports in the past five days, he said. He reiterated that a slowdown of Ukrainian grain exports won’t threaten Egypt’s food security, though admitted that Russia’s exit from the export pact will likely cause global food prices to spike.

Also making appearances last night:

- Abdel Aziz Al Sayed, head of the Poultry Division in the Cairo Chamber of Commerce, told Al Hadath Al Youm (watch, runtime: 1:29) and Ala Mas’ouleety (watch, runtime: 6:04) that further releases of feed from ports will help to bring prices down.

- Emad El Qenawy, head of the importers division at the Federation of Egyptian Chambers of Commerce (FEDCOC), said that banks have begun phoning importers to provide them with USD for imports (watch, runtime: 5:05). However, he warned that the latest hike in interest rates will tighten financial conditions and weigh on purchasing power. He urged policymakers to introduce banking initiatives that include debt restructuring for struggling manufacturers and importers.

- Mahmoud Al Daour, former head of the Clothing Division, who said that prices of winter clothes have climbed 40% due to the devaluation in March (watch, runtime: 12:28)

We’re getting a new emergency services hotline: Citizens in certain governorates can now dial a single number — 112 — to request a range of emergency services including medical treatment, the police and the fire department. The new hotline is currently in use in Port Said, Ismailia, Suez, South Sinai, Luxor and Aswan governorates, and will be rolled out to the rest of the country next year, Health Minister Khaled Abdel Ghaffar told El Hekaya (watch, runtime: 7:34).

EGYPT IN THE NEWS

The FT’s Big Read goes long on Egypt’s economy + human rights and COP27 are still leading the conversation in the mainstream press

Human rights + COP27 are still topping headlines on Egypt in the foreign press after Swedish climate activist Greta Thunberg yesterday criticized the global summit and the decision to hold it in Egypt (more on this in this morning’s What We’re Tracking Today, above). Meanwhile, the Guardian has a critical take on the government’s pledge to allow protests at the summit.

Abdel Fattah to start full hunger strike: The family of detained political activist Alaa Abdel Fattah said yesterday that he will launch a full hunger strike ahead of the summit, AFP reports. The activist has been engaged in a partial hunger strike for more than 200 days.

MEANWHILE- Will the IMF loan result in more private-sector involvement in the economy? The Financial Times’ Andrew England talks to analysts and (unnamed) business leaders about whether the government will reduce the military’s economic footprint and increase the role of the private sector in the wake of the recently-agreed IMF loan. It’s the FT’s Big Read this morning.

Also making headlines:

- Water scarcity = social tensions: Farmers and climate change experts fear that rising water shortages could lead to social instability. (Reuters)

- Female podcasters on the rise: Feminist-leaning podcasts by female podcasters in Egypt are gaining momentum, according to a study. (The Conversation)

PLANET FINANCE

The IMF has upgraded its 2022 growth forecasts for MENA (thanks, in part, to Egypt)

Egypt is helping to buoy economic growth in the region this year: The IMF has raised its forecast for economic growth in MENA to 4.9% in 2022, up 0.5 percentage points from its April outlook, “in part reflecting a stronger-than-expected performance for Egypt during fiscal year 2022,” the IMF wrote in its latest regional outlook report (pdf) for MENA and Central Asia.

The outlook is not as bright for next year: Elevated interest rates, weakened currencies and limited access to markets are set to pressure emerging markets in MENA — including Egypt — during FY 2022-2023. Headwinds will continue to grow amid a global economic slowdown, volatile commodity prices, and tightening financial conditions, the lender said. Net oil importers and low-income countries in the region will likely be hit the hardest.

REMEMBER- The IMF revised its FY 2022-2023 growth forecast for Egypt down a full 1.5 percentage points to 4.4% last month.

LOTS OF UAE IPO NEWS-

There’s a lot of IPO news from the UAE:

- Taaleem: UAE premium school operator Taaleem Holdings is looking to raise AED 750 mn (USD 204 mn) from an IPO and is allocating 2% of the offer shares for qualifying employees and parents. Subscription will open 10 November and shares will start trading at the end of the month. Our friends at EFG-Hermes are the lead advisors for the offering, alongside Emirates NBD Capital. (Statement)

- Empower: District cooling firm Empower’s USD 362 mn share sale was oversubscribed within hours yesterday. The company, which is selling 1 bn shares (equal to a 10% stake) to investors in Dubai, priced shares at AED 1.31-1.33 apiece with its debut scheduled for 15 November 2022. Our friends at EFG-Hermes are managing the IPO, alongside Citigroup, Emirates NBD Capital and Merrill Lynch International, while Moelis & Co. is the financial adviser. (Bloomberg)

- Bayanat AI: Shares in geospatial and data analytics firm Bayanat AI almost tripled on their trading debut, closing 272% higher at AED 4.50 a piece. (The National)

Other stories worth knowing about this morning:

- Saudi Arabia’s economy expanded at a 8.6% clip in 3Q 2022, primarily boosted by the oil sector, which grew 14.5% y-o-y. (General Authority for Statistics, pdf)

- Americana gets the nod on dual listing: The Saudi Capital Market Authority has approved an application by Americana Group — which operates KFC and Pizza Hut in MENA — for a concurrent and dual listing in Riyadh and Abu Dhabi. (Statement)

- Inflation is still climbing in the euro area: Eurozone inflation likely rose to a record high of 10.7% in October, up from 9.9% a month earlier, according to flash estimates. (Eurostat, pdf)

|

|

EGX30 |

11,373 |

+2.5% (YTD: -4.8%) |

|

|

USD (CBE) |

Buy 24.06 |

Sell 24.19 |

|

|

USD at CIB |

Buy 24.00 |

Sell 24.10 |

|

|

Interest rates CBE |

13.25% deposit |

14.25% lending |

|

|

Tadawul |

11,668 |

+0.3% (YTD: +3.4%) |

|

|

ADX |

10,412 |

+1.2% (YTD: +22.7%) |

|

|

DFM |

3,332 |

-0.5% (YTD: +4.3%) |

|

|

S&P 500 |

3,872 |

-0.8% (YTD: -18.8%) |

|

|

FTSE 100 |

7,095 |

+0.7% (YTD: -3.9%) |

|

|

Euro Stoxx 50 |

3,618 |

+0.1% (YTD: -15.8%) |

|

|

Brent crude |

USD 92.81 |

-1.0% |

|

|

Natural gas (Nymex) |

USD 6.36 |

+11.8% |

|

|

Gold |

USD 1,640.70 |

-0.3% |

|

|

BTC |

USD 20,412 |

-1.0% (YTD: -55.8%) |

THE CLOSING BELL-

The EGX30 rose 2.5% at yesterday’s close on turnover of EGP 1.5 bn (29.6% above the 90-day average). Local investors were net sellers. The index is down 4.8% YTD.

In the green: Oriental Weavers (+7.5%), GB Auto (+6.6%) and Ezz Steel (+5.3%).

In the red: Rameda (-2.2%), Credit Agricole Egypt (-1.8%) and Egypt Kuwait Holding-EGP (-1.2%).

DIPLOMACY

More talk of incoming Qatari FDI: Egyptian investment authority GAFI and the Qatari Businessmens’ Association held another in a string of recent meetings to discuss potential investments yesterday, according to a cabinet statement. Members of the Qatari delegation expressed interest in our health and education sectors as well as in building a group of major hotels in the Delta and north Upper Egypt, the statement read. Qatar earlier this year pledged to invest as much as USD 5 bn in Egyptian companies as part of wider Gulf efforts to shore up our economy and provide us with vital FX.

Egypt’s EV industry still has a long way to go — but you folks seem eager for the transition: As Egypt begins to make strides in developing a local electric vehicle industry and the infrastructure to power it, Enterprise readers are excited: 90% of you are planning to buy a EV within the the next 10 years — and one in five respondents said they’ll make a purchase in the next 12 months.

Before we get into it, what’s the current state of the country’s EV industry? Egypt’s industry is still nascent, with its first locally manufactured EV expected sometime next year — and that is only after a protracted search for a partner with which state-owned El Nasr Automotive can produce the EVs ends. On the infrastructure side, the government is still working on plans to establish a nationwide charging network — with our friends at renewable energy player Infinity working to set up 6k vehicle charging points at 3k stations across the country. In other efforts to advance the industry, Egypt’s House of Representatives just gave its final approval to a bill that will establish a new regulatory body to set policy for auto assembly in the country, including EVs, and provide financial incentives for manufacturers.

Meanwhile: EVs enter the country with zero customs duties. They’re not supported by full authorized aftersales service operation, but we’re aware of at least two importers with stock of Tesla and Volkswagen EVs for sale in the capital city.

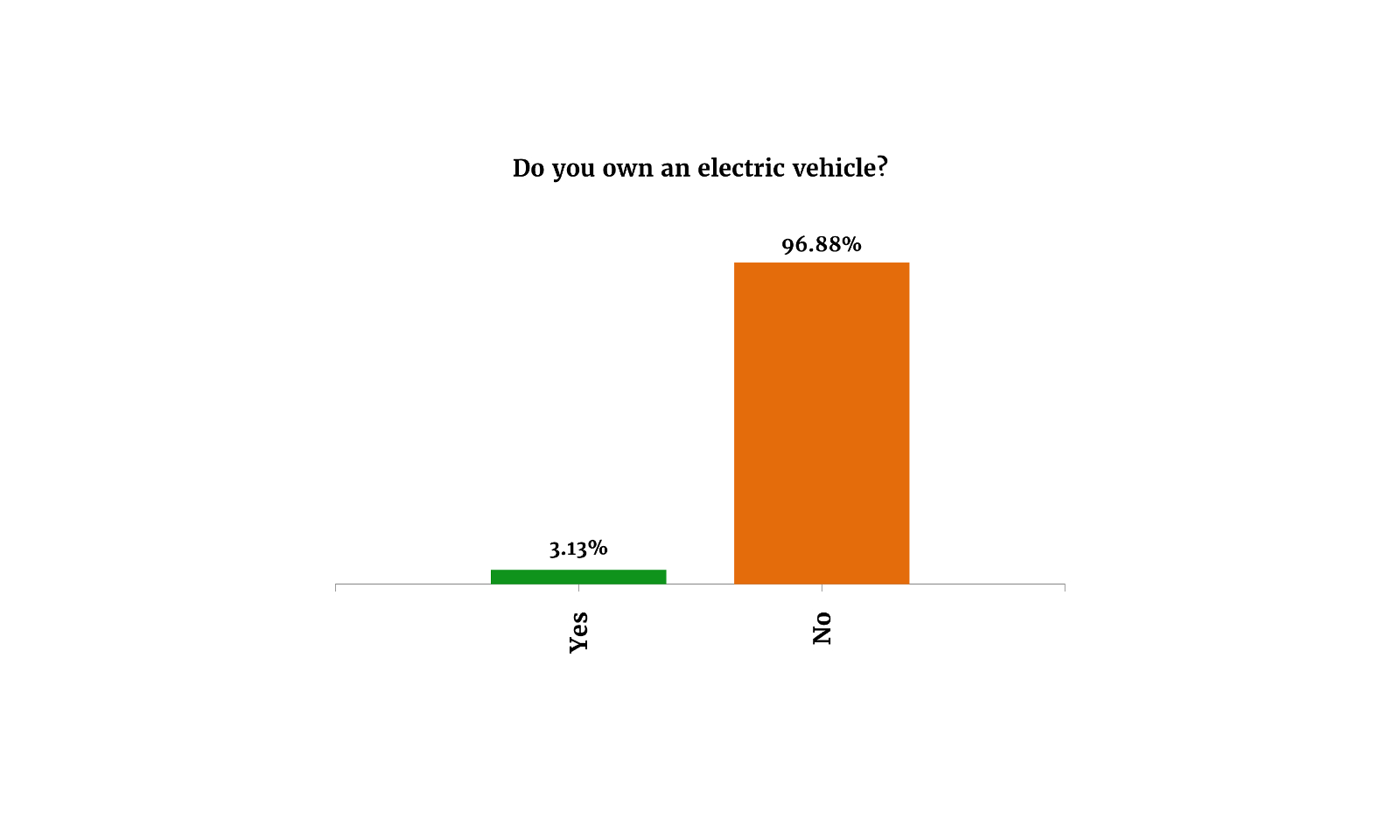

Only a handful of you own an electric car: A whopping 96.9% of you do not own an electric car, but some 20.6% know someone who does, indicating a small but budding trend.

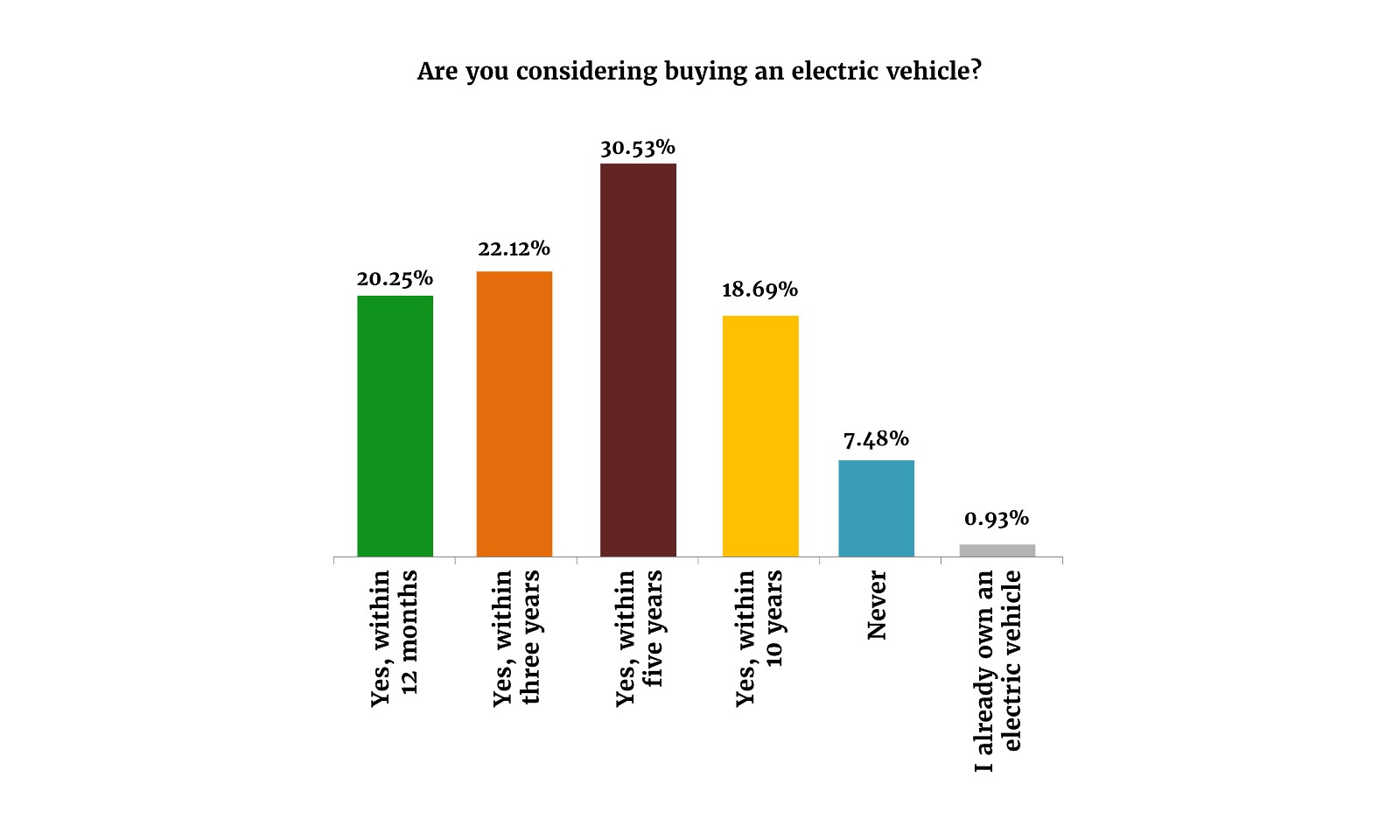

More than 90% of you intend to buy an electric car at some point over the next decade. Some 20.2% of you intend to buy one in the next year, around 22.1% could go for one within three years, while 30.5% are considering buying one in five years, and another 18.7% said they would buy one after ten years.

Only 7.4% of you have ruled it out for good, citing reasons including a lack of charging infrastructure and doubts over the actual “greenness” of the industry.

The law of big numbers: Respondents to our poll in Enterprise Climate and EnterpriseAM are, by definition, at the top of the wealth pyramid — EVs are in no danger of going “mass” anytime soon. But think of it in these terms: If at least 5% of the population can afford to buy an EV (likely an underestimation, in our view), that means the addressable market for the vehicles in Egypt is roughly the same size as the entire population of Denmark, Ireland, Finland or Norway. And thanks to under-motorization and the continued growth of the middle class, the Egyptian passenger car market in 2021 was nearly 2x the size of Ireland’s.

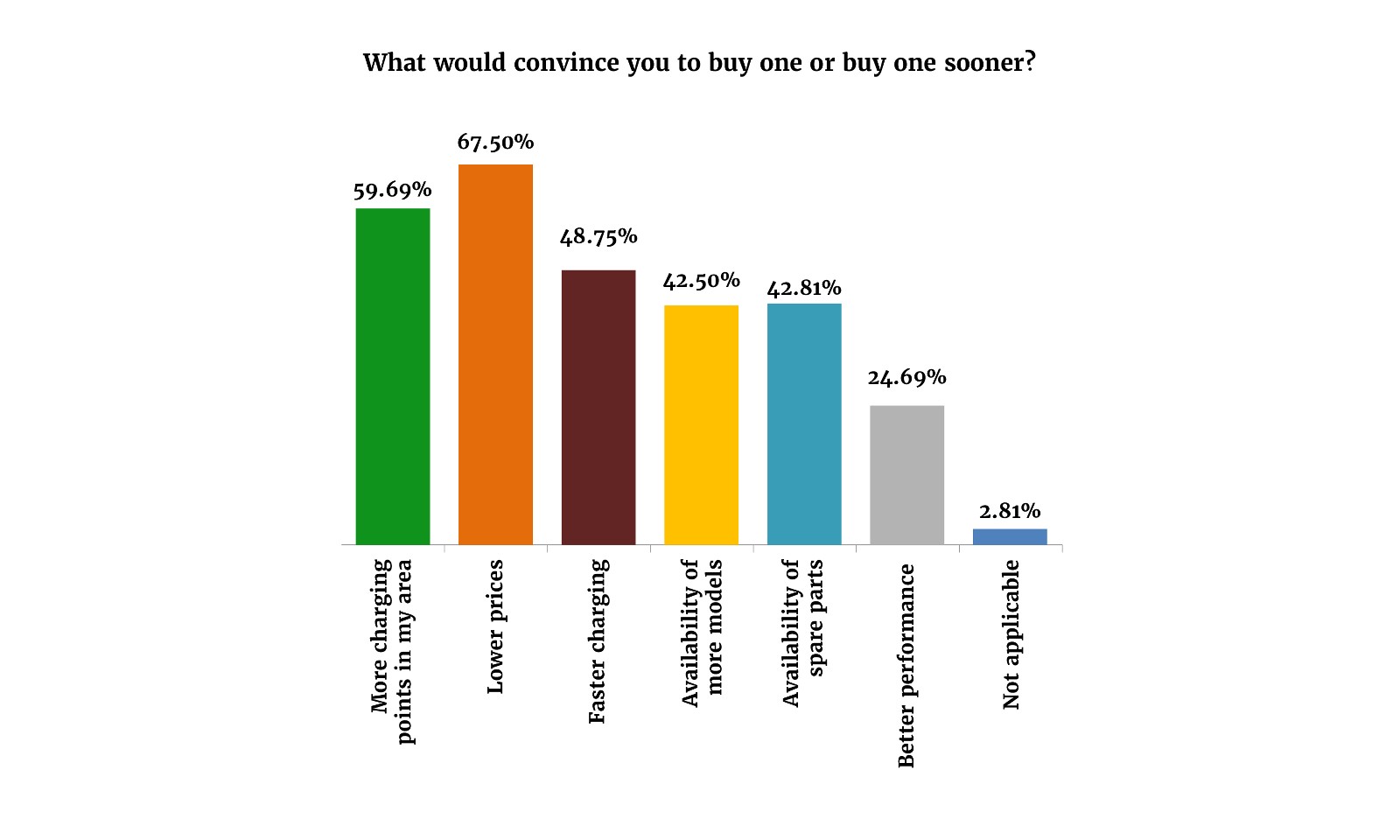

What could motivate you to hop on the EV bandwagon sooner? More than two thirds of you (67.5%) would choose to buy an electric car if they were cheaper, and some 59.7% want there to be more charging points in their area before they make the switch. About 48.8% percent want electric cars to charge faster, while 42.5% are hoping for more models to become available in the market. Around 42.8% want there to be more spare parts available for EVs, and a quarter of you care about better performance.

If you do make the switch, a majority of you (55.8%) would go for a hybrid car over a fully electric one, with most saying they want the extra cushion of a combustion engine in case there are no EV charging stations around. Both hybrid and fully electric cars are much more popular among you lot than a natgas- or dual-fuel-run car, with just 3.8% of respondents choosing it over the other two options.

In fact, most of you seem to dislike natgas-run cars, with three quarters of respondents saying they would stick with a gasoline-run car over a natgas-run or dual-fuel one if they were not able to buy an EV.

Why do you dislike natgas-powered cars? Loss of trunk space, where the CNG cylinder goes.

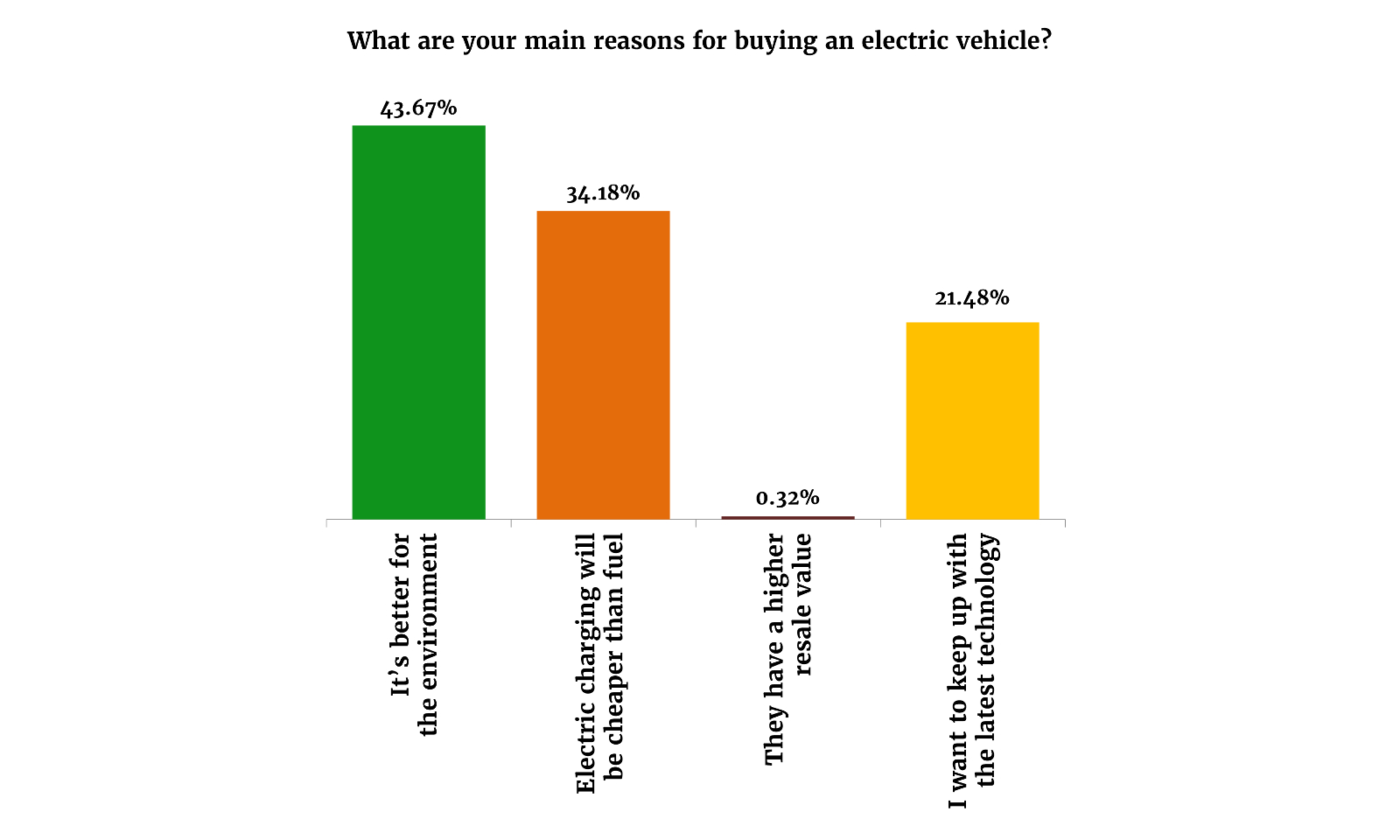

But you are an environmentally conscious lot: Some 43.7% of you say you would buy an electric car for their environmental benefits. More than 34% had look at the money, saying they would go the EV route so they could save on fuel. Only 21.8% would choose to buy an EV to stay up to date with the latest technology, while an even smaller minority would choose an electric car for its resale value.

A wide majority of you (85.4%) believes electric vehicles are the future. That’s much more than the 5.3% of you that don’t see EVs dominating the automotive industry in the coming years.

Plenty of you have your eyes on a Tesla: Some 24% said they would opt for a Tesla if they chose to buy an electric car. Other EV makers getting interest were Mercedes, BMW, Volvo, Volkswagen, and Toyota. Many survey takers were unaware of the options available in the local market, while others said they are waiting for more models to drop.

A handful of you just don’t plan on owning cars at all in a few years, choosing instead to opt for Uber or rentals. A number of you also think owning a regular car — let alone an electric one — at this point is just too expensive, while others are holding out hope for an improvement in public transport infrastructure down the line.

Your top green economy stories for the week:

- Empower New Energy inked an agreement with Engazaat to finance construction of a 2.2 MW solar plant.

- Italy will grant EUR 2.3 mn to help train Egyptian water resources and irrigation technicians to optimize water resources management.

- Infinity units eye new wind and EV projects: Infinity Power has its sights set on developing a 200 MW wind farm in the Gulf of Suez.

- MPs approve fresh green finance: The House of Representatives approved a draft presidential decree for a EUR 83 mn loan from the Africa Development Bank (AFDB) to finance the second phase of the Electricity and Green Growth Support Program.

- PPP electric train to sustainably connect our ports: The National Authority for Tunnels, El Didi Group and Gama Construction signed an MoU for an electric train project under a public-private partnership framework at the state’s economic conference.

CALENDAR

NOVEMBER

1 November (Tuesday): Deadline for importers, exporters and customs brokers to join Nafeza.

1-2 November (Tuesday-Wednesday): Federal Reserve interest rate meeting.

1-2 November (Tuesday-Wednesday): Arab League annual summit, Algiers, Algeria.

3-5 November (Thursday-Saturday): Egypt Fashion Week.

4-6 November (Friday-Sunday): Autotech auto exhibition, Cairo International Exhibition and Convention Center.

5-8 November (Sunday-Tuesday): Techne Summit for Investment and Entrepreneurship, Alexandria, Egypt

6-18 November (Sunday-Friday): Egypt will host COP27 in Sharm El Sheikh.

7 November (Monday): Middle East Green Initiative, Sharm El Sheikh.

7 November (Monday): The inauguration of the first line of the high-speed rail.

9 November (Wednesday): Finance Ministry to host “Finance Day” at COP27.

11-12 November (Friday-Saturday): Saudi Green Initiative, Sharm El Sheikh.

7-13 November (Monday-Sunday): The International University Sports Federation (FISU) World University Squash Championships, New Giza.

13 November (Sunday): Senate back in session.

15-16 November (Tuesday-Wednesday): G20 summit, Bali, Indonesia.

21 November-18 December (Monday-Sunday): 2022 Fifa World Cup, Qatar.

22 November- 23 November (Tuesday-Wednesday): The Fingerprint Summit will be held at the Nile Ritz Carlton Hotel.

27 – 28 November (Thursday-Friday): The first edition of the Egypt Media Forum.

27-30 November (Sunday-Wednesday): Cairo ICT, Egypt International Exhibition Center, New Cairo.

DECEMBER

3 December (Saturday): Dior Men’s pre-fall collection show in Giza.

10-12 December (Saturday-Monday): The 2nd edition of the Nebu Expo for Gold and Jewelry kicks off.

13-14 December (Tuesday-Wednesday): Federal Reserve interest rate meeting.

13-15 December (Tuesday-Thursday): US-Africa Leaders Summit.

15 December (Thursday): European Central Bank monetary policy meeting.

22 December (Thursday): Central Bank of Egypt’s Monetary Policy Committee meeting.

December: The Sixth of October dry port will begin operations.

December: Egyptian Automotive Summit.

December: Egypt to expand Sudan electricity link capacity to 300 MW.

JANUARY 2023

January: EGX-listed companies and non-bank lenders will submit ESG reports for the first time.

January: Fuel pricing committee meets to decide quarterly fuel prices.

1 January (Sunday): Use of Nafeza becomes compulsory for air freight.

1 January (Sunday): Residential electricity bills are set to rise as per the government’s six-year roadmap (pdf) to restructure electricity prices by 2025.

7 January (Saturday): Coptic Christmas.

24 January-6 February: The 54th Cairo International Book Fair, Egypt International Exhibition Center

25 January (Wednesday): 25 January revolution anniversary / Police Day.

26 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

30 January-1 February (Monday-Wednesday): CI Capital’s Annual MENA Investor Conference 2023, Cairo, Egypt.

FEBRUARY 2023

11 February (Saturday): Second semester of 2022-2023 academic year begins for public universities.

13-15 February (Monday-Wednesday): The Egypt Petroleum Show (Egyps), Egypt International Exhibition Center, Cairo.

23-27 February (Thursday-Monday): Annual Business Women of Egypt’s Women for Success conference.

MARCH 2023

March: 4Q2022 earnings season.

23 March (Wednesday): First day of Ramadan (TBC). Maghreb will be at 6:08pm CLT.

APRIL 2023

17 April (Monday): Sham El Nessim.

22 April (Saturday): Eid El Fitr (TBC).

25 April (Tuesday): Sinai Liberation Day.

27 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC).

Late April – 15 May: 1Q2023 earnings season.

MAY 2023

1 May (Monday): Labor Day.

4 May (Thursday) National holiday in observance of Labor Day (TBC).

22-26 May (Monday-Friday): Egypt will host the African Development Bank (AfDB) annual meetings in Sharm El Sheikh.

JUNE 2023

19-21 June (Monday-Wednesday) Egypt Infrastructure and Water Expo debuts at the Egypt International Exhibition Center.

28 June-2 July (Wednesday-Sunday): Eid El Adha (TBC).

30 June (Friday): June 30 Revolution Day.

JULY 2023

18 July (Tuesday): Islamic New Year.

20 July (Thursday): National holiday in observance of Islamic New Year (TBC).

23 July (Sunday): Revolution Day.

27 July (Thursday): National holiday in observance of Revolution Day.

Late July-14 August: 2Q2023 earnings season.

SEPTEMBER 2023

26 September (Tuesday): Prophet Muhammad’s birthday (TBC).

28 September (Thursday): National holiday in observance of Prophet Muhammad’s birthday (TBC).

OCTOBER 2023

6 October (Friday): Armed Forces Day.

Late October-14 November: 3Q2023 earnings season.

EVENTS WITH NO SET DATE

2H 2022: The inauguration of the Grand Egyptian Museum.

2H 2022: IEF-IGU Ministerial Gas Forum, Egypt. Date + location TBA.

2H 2022: The government will have vaccinated 70% of the population.

3Q 2022: Ayady’s consumer financing arm, The Egyptian Company for Consumer Finance Services, to release its first financing product.

3Q 2022: Swvl to close acquisition of Urbvan Mobility.

4Q 2022: Infinity + Africa Finance Corporation to close acquisition of Lekela Power.

End of November: SFE’s pre-IPO fund to kick off roadshow.

4Q 2022: Electricity Ministry to tender six solar projects in Aswan Governorate.

4Q2022: Raya Holding subsidiary Aman and Qalaa Holdings’ Taqa Arabia to launch their fintech company.

4Q 2022: Saudi Jamjoom Pharma to inaugurate its EGP 1 bn pharma factory in El Obour.

End of 2022: Decent Life first phase scheduled for completion.

End of 2022: e-Aswaaq’s tourism platform will complete the roll out of its ticketing and online booking portal across Egypt.

2023: Egypt will host the Asian Infrastructure Investment Bank’s Annual Meeting of the Board of Governors in 2023.

1Q 2023: Adnoc Distribution’s acquisition of 50% of TotalEnergies Egypt to close.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.