- Rameda throws its hat in the ring for GSK’s Egypt business. (M&A Watch)

- Russia’s Sputnik V jab is looking really good. (Covid Watch)

- Travelers from Egypt and 19 other destinations will be barred from entering Saudi Arabia as of today. (What We’re Tracking Today)

- We have a lot of debt, but low risk levels -Morgan Stanley. (Debt Watch)

- GCC firms are pouring into Egypt. (Investment Watch)

- Look away: The final figures for Egypt’s hotel industry in 2020 are here. (Tourism Watch)

- Egypt mounts full-court press on GERD ahead of AU summit. (Current Affairs)

- What’s slowing the growth of Egypt’s data center industry? (Hardhat)

- Planet Finance: A full economic recovery in the GCC ain’t happening soon.

Wednesday, 3 February 2021

GSK has lined up three potential bidders for its Egypt business as Rameda joins the fray

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends, and welcome to a very busy newsday as we spin into the home-stretch of the week.

THE BIG STORY AT HOME- Travelers from Egypt and 19 other destinations will be barred from entering Saudi Arabia as of today as the kingdom tries to curb the spread of covid-19, according to the Saudi Press Agency. The ban does not apply to diplomats, Saudi citizens, or doctors and their families.

How long the ban is in effect will depend on how the situation with covid unfolds, Saudi ambassador to Egypt Osama Al Naqli told Kelma Akhira’s Lamees El Hadidi last night (watch, runtime: 5:25).

EgyptAir’s last flight to Saudi Arabia takes off at 3 pm today, but might be able to squeeze in another flight in the evening (watch, runtime: 0:48). If you have a previously-booked flight to the kingdom with the national flag carrier, you can get a refund or postpone the trip to after the entry ban is lifted, EgyptAir Holding Company Roshdi Zakaria told Masaa DMC’s Ramy Radwan (watch, runtime: 4:48).

|

THE BIG STORY INTERNATIONALLY- Jeff Bezos is stepping down as Amazon CEO, tapping the company’s cloud computing head Andy Jassy — who created cloud platform Amazon Web Services — to take the reins as CEO. Bezos will become Amazon’s executive chairman in the third quarter of the year. The changing of the guard at the e-commerce behemoth comes as Amazon reported a record USD 125.6 bn in 4Q2020 sales and net income jumped to USD 7.2 bn in the final quarter of last year.

The story is front-page news pretty much everywhere this morning: Reuters | The Financial Times | The New York Times | Bloomberg.

But the Wall Street Journal owns the story: Start with How Jeff Bezos has run Amazon, from meetings to managing and take a deep dive into who Jassy really is. Then read Bezos’ email to employees (pdf).

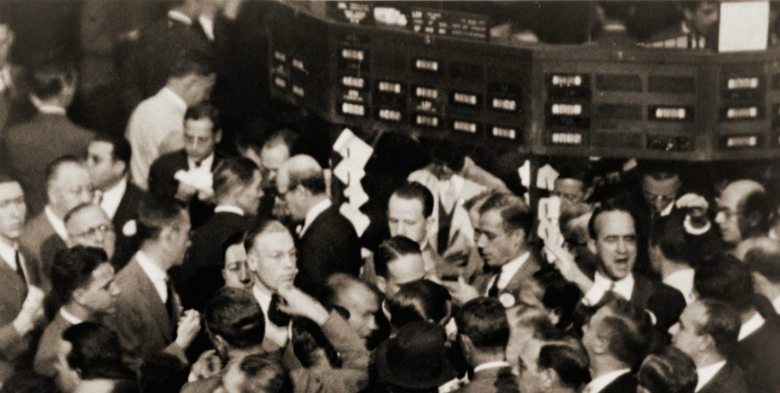

Also making international headlines: GameStop shares dropped 60% yesterday as the bubble caused by a horde of day Reddit and Redbull-fuelled day traders popped. AMC shares slumped nearly 40%. US Treasury boss Janet Yellen is calling a meeting of industry regulators to talk about volatility in the market driven by the horde. Meanwhile, Agent Orange’s defense at his impeachment trial is in the news. In a nutshell: “I really won the election, I didn’t incite nuthin’ — and the Senate doesn’t have the constitutional authority to try me.” The New York Times has the full rundown.

WHAT’S HAPPENING TODAY-

It’s PMI day: Figures measuring business activity in Egypt’s non-oil private sector in January will land here at 6:15 CLT. The recovery stalled in December following two months of promising growth, as mounting covid-19 cases hit consumer demand and business sentiment. Gauges for the UAE and Saudi are also due out this morning.

Lebanese Prime Minister-designate Saad El Hariri is due in Cairo today for a meeting with President Abdel Fattah El Sisi, according to the Lebanese press.

And it’s interest rate week: The Central Bank of Egypt will meet on Thursday to review interest rates. Eleven of the 12 analysts and economists polled by Enterprise expect rates to be left unchanged. Meanwhile, 10 of the 14 people surveyed by Reuters said the CBE will leave rates on hold, while a few suggested that the National Investment Bank’s move to slash rates on its investment certificates earlier this week could signal a rate cut, a notion with which EFG Hermes’ Mohamed Abu Basha took exception in a note earlier this week.

Also coming up this month:

- Foreign reserves figures for January should be out toward the end of this week;

- Inflation figures for January will be released on 10 February;

- The deadline for businesses to file wage tax returns is 28 February.

PSA- Expect “turbulent” weather from today through Friday, the national weather office says, calling for showers along the Mediterranean coast starting today. Rain — potentially heavy — will hit Cairo tomorrow and Friday. Our favourite weather app is calling for a high today of 27°C in the capital city before the mercury plunges to 20°C tomorrow. Look for as much as 10 mm of rain tomorrow. Some Red Sea governorates are expected to see heavy rainfall and the possibility of floods.

PSA #2- Spring will be here in no time. That’s according to Shubenacadie Sam and other, uhm, weather-predicting groundhogs in Canada, who are calling for a short winter this year. That caps our annual celebration of GroundHog Day. And if you still haven’t watched the Bill Murray classic…

CIRCLE YOUR CALENDAR-

Egypt is mounting a full-court press on GERD ahead of the African Union’s annual summit scheduled for Saturday and Sunday (6 and 7 February). We have chapter and verse in Current Affairs, below. The summit, which will be held virtually, will mark the official end of South Africa’s chairmanship of the AU. The Democratic Republic of the Congo will take over the position for one year.

CORRECTION- A local press report that we picked up incorrectly stated that Sarwa Capital will manage a EGP 4 bn sukuk issuance for construction outfit Hassan Allam Holding. We have since been informed that real estate developer Hassan Allam Properties will be taking the offering to market and have updated the story on our website.

AND AN APOLOGY- Plenty of readers had issues opening URLs in yesterday’s edition. The glitch was the result of a change in how our back-end editor handles links. We’re sorry — we’ve fixed the glitch and the links are all functional now on our website.

*** It’s Hardhat day — your weekly briefing of all things infrastructure in Egypt: Enterprise’s industry vertical focuses each Wednesday on infrastructure, covering everything from energy, water, transportation, urban development and as well as social infrastructure such as health and education.

In today’s issue: As Egypt’s journey towards becoming a data center hub is gathering steam — pushed along by the government’s digitization strategy — there remain key issues that are weighing on the process.

M&A WATCH

Rameda throws its hat in the ring for GSK’s Egypt business

Ladies and gentlemen, we have a good, old-fashioned bidding war: Rameda Pharma is the latest to show interest in GlaxoSmithKline’s Egypt business, joining LSE-listed Hikma Pharma and pharma industry investor Acdima — who are both planning their own bids. The company has submitted a non-binding letter of interest to GSK and is asking the multinational pharma giant for the green light to start due diligence, Rameda said in an EGX filing (pdf) yesterday.

BACKGROUND- The race began last week, when GSK said that it had signed a non-binding agreement with Hikma ahead of a potential sale of the British pharma major’s 91.2% stake in the Egypt commercialization and manufacturing business. Both Rameda and Acdima plan to target the same stake through a tender offer.

Are you advising one of the parties? Let us know on editorial@enterprise.press.

IN OTHER M&A NEWS-

Hong Kong-based Zeta Investments has submitted an offer to purchase 90% of brokerage house Alexandria National Company for Financial Investments (ANFI) at EGP 5.51 per share, according to disclosures from shareholders El Kahera El Watania Investment (KWIN) (pdf) and Abu Dhabi Islamic Bank (ADIB) (pdf).

Who owns what? KWIN currently owns some 40% of ANFI’s shares, while ADIB directly holds 9%. The Gulf lender has a total indirect stake amounting to 84.99%, due to owning a 74.75% stake in KWIN (pdf) and its subsidiary, ADI Lease, holding a 34.99% stake.

COVID WATCH

Russia’s Sputnik V jab is looking really good

Russia’s Sputnik V vaccine gives around 92% protection against covid-19, based on the results of late stage trials published yesterday in the Lancet medical journal. It has been deemed to be safe, providing complete protection against hospitalization and death.

The vaccine should be cleared for use by the Egyptian government soon. The Russian jab will be included in the shipments that are coming from Gavi, which will eventually send 40 mn doses our way but for the time being will only be able to ship limited quantities. Russia is also open to handing over the technology necessary to produce Sputnik V at Vacsera, the Cairo-based outfit that is Africa’s top producer of vaccines. Domestic production of Sputnik would allow Egypt to more rapidly immunize its population — and maybe become an exporter of the vaccine. Appetite could be strong, as the Financial Times trumpets that African countries are “looking beyond the west” for vaccines.

The Health Ministry reported 521 new covid-19 infections yesterday, down from 541 the day before. The ministry also reported 47 new deaths, bringing the country’s total death toll to 9,407. Egypt has now disclosed a total of 167,013 confirmed cases of covid-19.

DEBT WATCH

We have a lot of debt, but low risk levels -Morgan Stanley

When it comes to the world’s most indebted countries, Egypt is best in class in terms of debt manageability, according to Morgan Stanley, which has lumped the nations with the weakest credit ratings into three categories depending on the level of risk, Reuters reports. Egypt — along with Jordan, Nigeria, Ivory Coast and Senegal — all make it into the first category, having manageable debt levels, no issues accessing the debt markets and existing funding streams with the IMF.

Countries in the other categories aren’t quite as well off: Category two nations such as Pakistan, Cameroon and Kenya need an “extremely supportive” environment to keep up with payments, analysts at the investment bank wrote. The third tier is populated by countries already in default such as Lebanon and Zambia, and those which have been at risk over the long-term.

And things could be getting tougher: Borrowing costs could be about to rise for some of the world’s most indebted countries after Ethiopia’s application to the G20’s debt relief initiative caused the price of its sovereign bonds to crash, analysts said. Expectations that private investors will be forced to take a haircut on Ethiopian debt may result in added scrutiny being applied to the other 73 nations eligible to apply for debt relief, potentially pushing up yields in countries with weaker credit ratings, they said.

INVESTMENT WATCH

GCC firms are pouring into Egypt

We’re seeing plenty of interest in Egypt from GCC-based companies, travel ban to KSA notwithstanding.

Zyda touches down in Egypt: Kuwaiti food tech startup Zyda has launched in Egypt, announcing in a statement (pdf) yesterday that it will invest USD 2 mn here. The platform offers e-commerce services to restaurants, allowing them to market their business online, track sales analytics, and deliver orders. The company charges restaurants a monthly subscription fee rather than commission on orders, and will operate across the country except in the Red Sea. CEO Hamad Al-Judai described Egypt as a “large and promising market.”

The Middle East food market is pretty hot right now: Saudi restaurant management platform Foodics, a Zyda competitor so far as we can tell, said earlier this week it had landed USD 20 mn in a series B funding. And here at home, our friends at Elmenus this week landed an undisclosed investment from former Just Eat CEO David Buttress, who will join the board of the Egyptian food delivery platform.

Real estate developer Sky Abu Dhabi — which has a very light digital footprint — is reportedly planning EGP 15 bn in Egypt over the next two years as part of its regional expansion plans, CEO Abdelrahman Agami said at a press conference Tuesday, according to local press reports. The company is reportedly a subsidiary of Diamond Group (although it is not listed among the company’s subsidiaries). The investment plans include at least EGP 4 bn for a multipurpose development in the new administrative capital, Agami said.

TOURISM

Hotel occupancy falls 60% in 2020

Look away: The final 2020 figures for Egypt’s hotel industry are in. Hotel occupancy in four of Egypt’s biggest tourist destinations fell almost 60% in 2020 to average just 30% as the covid-19 pandemic brought the country’s tourism sector to a halt. Figures in Colliers International’s latest MENA report (pdf) show that the capital’s hotel occupancy rate fell 65% y-o-y in 2020 to average just 27% during the 12-month period. The Red Sea resort towns of Hurghada and Sharm El Sheikh fared even worse, closing out the year with lower rates of 24% and 23% respectively. Room occupancy in Alexandria was the least hit by the pandemic falling 44% to achieve an average occupancy rate of 45% during the year.

Last year was rough, but the recovery is already underway: After the tourism industry all but shuttered during the second quarter with the suspension of international flights, occupancy rates are forecast to pick up this year with the roll-out of covid-19 vaccines, which will help kickstart international travel. Colliers expects Hurghada and Sharm El Sheikh to make the biggest comebacks in room occupancy, surging 88% and 78% respectively over the 12-month period. Alexandria will likely see the most visitors with an occupancy rate of 62% while rates in Cairo could rise by more than 50% to reach 43%.

COMMODITIES

Could France soon replace Russia as our prime wheat supplier?

French wheat could be filling the Russia-shaped hole in Egypt’s import quota: Swiss commodities giant Glencore made the lowest offer in GASC’s international wheat tender yesterday, the first since the state grain buyer canceled a tender in response to possible export restrictions on Russian wheat, Reuters reports. The firm offered to ship 60k tonnes of French wheat at USD 269.10 each. GASC is buying 240k tonnes of French wheat — half of the total amount the grain buyer ordered, Al Masry Al Youm reports, and is also said to be looking into sourcing from Canada and the United States.

So long, old friend? Russia’s new USD 60.18 per tonne tax on all wheat exports, which is set to go into effect by March, has given French suppliers a competitive edge over our long-time trade partners. Russian wheat constituted 80% of Egypt’s purchases last season, with 2.5 mn tonnes bought as of August 2020. The decision to levy higher taxes on the part of Russian officials comes as part of a protectionist bid to boost the country’s local supply and stabilize prices. GASC nonetheless ordered 120k tonnes of Russian wheat in yesterday’s tender.

SHIPPING

US LNG carriers ❤ Suez Canal

Suez Canal beating out Cape as Panama alternative for US LNG shippers: The Suez Canal in recent weeks has been the preferred shipping route for US LNG carriers heading to East Asia and looking to avoid a highly congested Panama Canal, according to Argus Media. Shippers are finding that the shorter journey offered by Suez offsets the toll they’ll have to pay by choosing the canal over rounding the Cape of Good Hope.

The discounts are paying off: The Suez Canal Authority is offering up to 75% off the crossing toll to LNG carriers traveling between the Gulf of Mexico and East Asia until at least June, reducing the fee for a standard size ship to USD 99k from USD 397k. The idea is to draw in shippers as global manufacturers are struggling with delays and experiencing major bottlenecks and disruptions due to the pandemic. The authority also has similar schemes in place for liquefied petroleum gas ships and oil tankers.

A shortage of ships is also playing a part: A lack of available vessels will likely encourage shipping firms to opt for shorter journey times in order to ensure they are able to meet their loading schedules.

MEANWHILE- The Canal isn’t expecting a significant impact on its revenues from the reactivation of the Eilat-Ashkelon gas pipeline, Suez Canal Authority boss Osama Rabie told Ala Mas’ouleety’s Ahmed Moussa yesterday (watch, runtime: 13:57). Although some 66% of oil sent from the GCC to western countries is shipped through the Suez Canal or the Sumed pipeline linking Alexandria to the Red Sea, Rabie doesn’t expect that the pipeline will entirely replace the Canal — and stressed that oil tankers passing through the Canal only account for some 0.6% of total traffic.

BACKGROUND- Israel and the UAE had signed an MoU late last year to use the pipeline to bypass the Canal and connect the Red Sea to the Mediterranean, allowing the consortium of Emirati and Israeli companies to use a “land bridge” to ship oil between countries in the region through a route that could save time and fuel compared to the Suez Canal.

REGULATION WATCH

Get ready for Nafeza

What the introduction of a pre-registration system means for shippers: Importers, customs agents, and other handlers need to set up an account with the Customs Authority’s new National Single Window for Foreign Trade Facilitation (Nafeza) as Egypt is getting ready to rollout a pre-registration system at seaports around the country, according to guidelines issued by the Finance Ministry yesterday. They also need to obtain a certified digital signature from companies authorized to provide e-Token services. Egypt will trial the Advance Cargo Information (ACI) system — a World Customs Organization protocol that provides shipping lines, port operators and governments real-time information on the potential arrival of goods — on 1 April and make the system mandatory in ports by July.

Once registered, importers will soon be required to submit information on shipments before loading, and obtain a unique advance registration number. This includes handing over codes identifying the seller and port and country of origin, a description of the cargo, an assessment of any custom dues, and other relevant information.

IN OTHER CUSTOMS NEWS- Importers want penalties for failing to file taxes through the government’s new unified tax platform to be waived this year as business owners transition to using the new system, Al Mal reports. The request came as part of a number of recommendations in response to the draft executive regulations of the Unified Tax Act, which were put to public discussion last month.

REFRESHER: The Unified Tax Act passed last year created Egypt’s first unified tax platform, and recent amendments have obliged companies to file their taxes electronically as of this year. The act also imposes tighter deadlines on companies filing VAT returns and imposes penalties on late filers, and is part of the government’s plan to overhaul tax administration and grant authorities better oversight on commercial transactions and tax accounts.

CURRENT AFFAIRS

Egypt mounts full-court press on GERD ahead of weekend African Union summit

Egypt is pushing hard to shore up support for its position on the Grand Ethiopian Renaissance Dam ahead of this weekend’s annual African Union summit, which will see Congo take over the rotating presidency. President Abdel Fattah El Sisi and Foreign Minister Sameh Shoukry have led the push over the past two days with both in-person and telephone meetings with world leaders.

How it’s going down: El Sisi met with Congolese President Félix Tshisekedi in Cairo yesterday and agreed to “ramp up consultations” on the dam. Egypt is still committed to reaching a binding

s agreement on the dam, El Sisi said in a presser after the meeting. El Sisi also spoke with outgoing AU head and current South African President Cyril Ramaphosa, while Shoukry chewed the issue over with Foreign Minister Ernesto Araújo and Portuguese Foreign Minister Augusto Santos Silva in individual phone calls.

Congo being a Nile Basin country could work in Egypt’s favor as the AU continues to mediate the dispute, former Assistant Foreign Minister Mohamed Hegazy told Masaa DMC’s Ramy Radwan (watch, runtime: 3:20). Pundit Heba Al Bashbishi took the speculation one step further, telling Ala Mas’ouleety’s Ahmed Moussa that Ethiopia could be at risk of having its AU membership suspended if it fails to cooperate in the negotiations (watch, runtime: 18:52)

Meanwhile, Sudanese Irrigation Minister Yasser Abbas warned Addis Ababa against moving ahead with the planned second phase of filling the dam’s reservoir without an agreement with Cairo and Khartoum, saying the move threatens the safety of roughly half of Sudanese citizens living on the banks of the Blue Nile.

FACTOID OF THE DAY: Egypt could lose 130k hectares of cultivated land and miss out on agricultural production worth USD 430 mn with every 1 bcm of water Addis Ababa uses to unilaterally fill its reservoir, the Egyptian embassy in USA says. This also translates into the elimination of some 290k incomes.

MOVES

Dalia Shoukry (LinkedIn) has been appointed the new CFO of Siemens Egypt, effective immediately, the German conglomerate announced (pdf) yesterday. Shoukry has more than 20 years of experience working in corporate finance in the pharma sector, and joins Siemens after serving as the international financial director at AstraZeneca.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The two stories leading the conversation on the airwaves last night: The Grand Ethiopian Renaissance Dam and Saudi Arabia’s decision to bar travelers from Egypt and 19 other countries from entering due to covid-19. We have chapter and verse in What We’re Tracking Today and Current Affairs, above.

Elsewhere, the Nipah virus was still on the agenda for Yahduth Fi Misr's Sherif Amer, who called up World Health Organization Regional Advisor Maha Talaat for yet another confirmation that there is no confirmed outbreak of the virus in China (watch, runtime: 3:00).

SPOTLIGHT

Enterprise sits down with Vezeeta CEO Amir Barsoum, Chief Products Officer Mohamed El Mougi

Vezeeta doubles down on epharma delivery: With e-commerce and e-delivery taking center stage, digital healthcare platform Vezeeta announced yesterday (pdf) that it is the latest entrant in the pharma and meds delivery space, with the official launch of Vezeeta Pharmacy. E-pharma is a space with existing competitors such as Yodawy and 3elagi, with the latter having been embroiled in a dispute alongside Ibnsina Pharma with the Pharma Syndicate over accusations that selling direct to consumers contravenes a 1955 law.

Vezeeta’s service allows patients to book a teleconsultation session with top notch GPs or specialists in Egypt through the app, get consulted by the doctor, get a prescription on the app, and with one click, order the needed medication and get it delivered. In short, it’s an entirely remote interaction from booking the consultation all the way through receiving the medication. Vezeeta ePharmacy has been in the works since February 2020, and served over 1 mn patients since its soft launch in August.

Enterprise had a chat with Barsoum and Chief Product Officer Mohamed El Mougi on the new product, the regulatory framework, and what’s next for the company.

Key highlights of our talk include:

- No IPO in sight yet, but maybe some M&A;

- Vezeeta turned profitable in 2020;

- Demand-forecasting tool for pharmacies in the works;

- E-prescription should become a mainstay in healthcare in Egypt;

- Global telehealth is the future.

READ AN EXCERPT from our talk below or tap / click here to read the full chat on the web.

Vezeeta entered the med delivery market because it is an integral part of the outpatient journey of patients, Barsoum told us. We want to avail data and information to patients to help them decide on what to do, and provide the sector with tools to facilitate interactions in the industry through tech.

Vezeeta Pharm. brings together the complete journey of remote healthcare with the help of AI, El-Mougi said. Patients can also search for the meds they want delivered by taking a photo of the prescription or the pack. There is also the option of calling a pharmacist, who is hired by Vezeeta, to help with ordering the desired medication.

Is automatic diagnosis in the plan down the line? Yes, but we’re still working on it, the chief product officer revealed. One of our dreams is to work with top notch doctors on teleconsultations, take their learnings and integrate them on an automated symptom checker for primary diagnosis. Final diagnosis is a very long journey, though.

Will this make doctors obsolete in the long-run? Probably not, El Mougi says. It will never replace doctors, but rather help them do their job in a more efficient manner. If they receive the symptoms up ahead, it will give them more time per consultation and e-prescriptions will also inform them about possible drug interaction based on the patient’s history of medication usage.

We’re fully compliant with current regulations, Barsoum said. Vezeeta depends 100% on its partner pharmacies and pharmacists, which are all licensed. In our conversations with regulators, it is evident that the government is quite adaptive and responsive to innovation in the market that accelerate quality.

To improve the quality of healthcare, we oblige our partner pharmacies to depend on licensed pharmacists, instead of assistants; a major issue in the Egyptian market, according to Barsoum. Additionally, minimum wages for pharmacists and adoption of technology are key prerequisites for us working together. Pharmacies cannot be doing business the same way they used to 100 years ago and hence, need to adapt — and that is what we are encouraging. These guidelines will improve their top and bottom line, even if it won’t seem that way in the first three or four months.

If there’s one thing lawmakers need to work with, it’s that e-prescriptions are no longer a luxury in 2021, he emphasized.

Pandemic-laden 2020 was the year Vezeeta turned profitable — and that is not directly correlated to the impact of covid developments on the P&Ls, Barsoum said. It’s rather a year in which we introduced smarter economic interactions with our partners, while the volume of business grew to a profitable level. On the top line, Egypt itself 2x-ed.

But covid definitely did help us introduce new products to the market, like telehealth and online consultations, and the ePharmacy product, but they did not add much value to the P&Ls yet, he added. The pandemic is still expected to stay with us until the middle of this year, which could be of tremendous value, as we are planning to expand the pharmacy and telehealth solutions in markets that are in dire need of them.

We don’t raise funds to survive anymore, but for the coming year, acquisitions are definitely on the radar, Barsoum explained. We’re looking at different smaller players for partnerships or even potential M&A activities. But an IPO is not in the pipeline this year.

We’ve done a lot in 2020 and will probably pull the brakes for a bit, he said. We are already operating in Jordan, KSA, Kenya, Nigeria, and Egypt. There are no plans to expand into other countries at this point, but rather turn the existing ones into solid operations. For 2021, we are focused on solidifying the business, investing more in our technology, making sure that the product is a delightful experience, and introducing high quality solutions to the partners in the sector, be it hospitals, labs, doctors, or pharma companies.

We also want to introduce what we internally call “global telehealth,” Barsoum said. We have phenomenal doctors in Egypt who are quite affordable to the African population.

Amended on 3 February 2021 – The story was amended to remove the USD 25 mn investment in Egypt, as sources tell us that these are simply operating expenses and not CAPEX spending as was reported in the local press.

EGYPT IN THE NEWS

It’s another quiet morning for Egypt in the foreign press. Making the rounds: Reporters without Borders is calling on authorities to release journalist Solafa Magdy, who was detained in November 2019 on terrorism charges.

ALSO ON OUR RADAR

New construction timeline for Dabaa? A pandemic-induced slowdown in the construction of the Dabaa nuclear power plant has led Egypt and Russia to agree on a “new timeline” for its completion, Tass cites Russian ambassador to Cairo Georgy Borisenko as saying. Borisenko did not provide a concrete timeline was not given, but said he hoped construction would enter the “main phase” soon.

Other things we’re keeping an eye on this morning:

- Microfinance player Tamweely is making a big push into loans to farmers and small-scale agribusinesses in Upper Egypt and the Delta region after inking an agreement with USAID, Hapi Journal reports.

- AAIB is launching (pdf) a new e-payment platform it is dubbing N-Genius in partnership with MENA-focused payments firm Network International.

PLANET FINANCE

Full economic recovery in the GCC is expected to take at least “several quarters” as the region reels from the combined shock of covid-19 and last year’s oil crash, S&P Global Ratings credit analyst Timucin Engin wrote in a report picked up by Bloomberg. Businesses and infrastructure firms in the six-nation bloc will be conservative this year, holding off on new investments as they focus on “cost optimization [and] proactively managing their liquidity,” said Engin, the ratings agency’s senior director for the region.

| EGX30 | 11,638 | +0.4% (YTD: 7.3%) | |

| USD (CBE) | Buy 15.68 | Sell 15.78 | |

| USD at CIB | Buy 15.68 | Sell 15.78 | |

| Interest rates CBE | 8.25% deposit | 9.25% lending | |

| Tadawul | 8,619 | -0.4% (YTD: -0.8%) | |

| ADX | 5,698 | +1.1% (YTD: +12.9%) | |

| DFM | 2,724 | +1.0% (YTD: +9.3%) | |

| S&P 500 | 3,826 | +1.4% (YTD: +1.9%) | |

| FTSE 100 | 6,517 | +0.8% (YTD: +0.9%) | |

| Brent crude | USD 57.64 | +0.3% | |

| Natural gas (Nymex) | USD 2.81 | -1.1% | |

| Gold | USD 1,884.10 | +0.6% | |

| BTC | USD 35,999.15 | +6.9% |

The EGX30 rose 0.4% yesterday on turnover of EGP 1.7 bn (17.6% above the 90-day average). Foreign investors were net buyers. The index is up 7.3% YTD.

In the green: Palm Hills (+5.1%), Cleopatra Hospitals Group (+4.5%) and Emaar Misr (+3.8%).

In the red: Fawry (-3.1%), MM Group (-1.8%) and Pioneers Holding (-1.8%).

Asian shares are largely in the green this morning and futures point to a strong open in Europe and on Wall Street later today.

What’s slowing the growth of Egypt’s data center industry? Plans to establish Egypt as a data center hub have been gathering steam, with private sector player Orange and state-owned operator Telecom Egypt undertaking huge data center construction projects, and efforts being made to attract more Cloud Service Providers (CSPs) and OTTs (streaming media services offered directly to viewers via the internet), we previously reported.

An investment priority for TE: Data centers are essential to Egypt’s digitization strategy, and a priority in TE’s investment plan, the company tells Enterprise. Direct investment in data centers only accounted for a small portion of 2019 and 2020 capex spending, of which the bulk was directed towards infrastructure development and network improvements — both a prerequisite for a successful data center business. Data centers are expected to become important contributors to the topline in the long-term, though their input will be minimal in the short-term, as the business grows, TE representatives add.

Egypt currently has strategic advantages driving data center growth: These include geographic positioning, an abundance of subsea cables, TE’s participation in the 2Africa submarine cable project linking Europe, the Middle East, and 16 countries in Africa, surplus electricity, and recently-passed data protection legislation, sources tell Enterprise.

But to capitalize on these, we need to enhance local infrastructure: To become a data hub, Egypt’s local infrastructure needs to better support fiber optics — meaning more and better cables and better bandwidth, says Youssef Amin, market data director at Egypt for Information Dissemination (EGID), a joint venture between the Egyptian Exchange (EGX) and NASDAQ, which owns and operates one of Egypt’s 13 colocation centers.

Egypt’s user speed and bandwidth are well behind global averages, according to data analytics websites The Global Economy and World Population Review. TE has been steadily increasing capacity, and raised Egypt’s bandwidth to 3.7 Tbps by the end of 2020, the company told Enterprise. A report shows steady growth from 1.8 Tbps in 2019 to 2.5 Tbps as of January 2020 (pdf). However, our domestic infrastructure can’t handle the added capacity, sources told Enterprise in July. An EGP 120 bn investment would be needed to expand the use of fiber optic cables locally and improve internet speeds, Federation of Egyptian Industries IT division’s deputy head Hamdy El Leithy estimated in July.

We need to improve our price points: Specifications at Egypt-based data centers can be double the price of those offered by foreign counterparts, says Tarek Ali, chief technology officer at InkTank Communications. Local provider ECC Solutions offers its professional package for USD 127, while a slightly better configuration from Amazon Web Services costs USD 57. High prices at Egypt-based data centers are driven by Egypt’s higher internet costs, says Amin. Both El Leithy and former ICT Minister Khaled Negm have said internet prices are higher than they should be, especially given the quality of the service itself.

Particularly when it comes to pricing international traffic: The pricing of international traffic would need to be lowered to incentivize more private companies to open hyperscale data centers here, says one source, speaking on condition of anonymity.

And especially now Google is looking at building its new Blue Raman fiber-optic network through Saudi Arabia and Israel, bypassing Egypt. Google’s plans to open a new route are designed to alleviate internet congestion through Egypt, sources familiar with the Blue Raman project are quoted in the Wall Street Journal as saying. “The Egyptian government charges telecom operators some of the heaviest fees to traverse its land and waters that can add up to 50% of the cost of a route from Europe to India,” the WSJ reports. Congestion also increases the risk of internet outages caused by breaks in the cables that run under busy shipping lanes, it adds. The new route is likely to consist of a cable running between India and Saudi Arabia, crossing overland through Jordan and Israel, and joining up with another undersea cable travelling across the Mediterranean to Europe.

The project may not go ahead, sources cited in the piece say, because multiple border crossings will require agreements with different regulators. But with its goal to “resolve decades of industry reliance on Egypt,” and the prospect of an alternative route with lower connectivity costs welcomed by the likes of Jordan’s digital economy minister, it may prompt a reexamination of how Egypt can make its pricing more competitive.

Revised pricing, more partnership between the public and private sectors could help the market: Private sector companies working in ICT currently rely on TE’s infrastructure, often leasing cables at high prices. High pricing and a lack of flexibility cut into Egypt’s competitiveness, says Negm. Establishing a data center isn’t that expensive — ranging from USD 100-150 mn — but flexibility from TE is needed to accommodate new players in the market, he adds. Private sector investment alongside the government, or partnership between the two to improve infrastructure, would lead to greater competition, increasing fiber optics and cable efficiency, and benefitting the market, says Amin.

Data protection legislation is important, but it needs to be promoted and enforced to be attractive to major content providers, says Sherif Elmasry, managing director of tech company Cornet Elevated.

And technical know-how is crucial: Constructing hyperscale data centers to the specifications needed by OTTs, and understanding their other requirements, is essential if we want them to come here and house their servers in local data centers, says Elmasry. Scalability is the key requirement, and it needs to be incorporated into the construction mindset, he adds. Investments in infrastructure need to be supplemented by investments in educating and training engineers and technicians, Orange Egypt’s Chief Enterprise Line of Business Officer Hisham Mahran tells Enterprise.

The bottom line? To capitalize on strategic positioning and other advantages, Egypt also needs to be strategic about pricing and public-private partnership, say sources. With OTTs reportedly already eyeing opportunities to build hyperscale data centers here, using more competitive pricing to transform our infrastructure could be the key to them moving forward with those plans, the sources add.

Your top infrastructure stories for the week:

- EV infrastructure: Spanish manufacturer Zytech expects 100 electric vehicle charging stations to be up and running around the country by the end of the year. The group has already installed 35 stations nationwide.

- Public EV transit: Commercial vehicles manufacturer MCV will work with a Military Production Ministry tank factory to locally assemble electric buses for Egypt’s transportation network within the next eight months.

- Heavy rail: The National Bank of Egypt is considering providing EGP 2 bn in long-term loans to the National Railways Authority to be used to modernize its fleet of carriages over the next three years.

- Electric rail: French transportation outfit RATP Dev will operate the Salam City-Tenth of Ramadan electric train after ministers gave the all-clear to the contract.

- Renewable energy: Cabinet approved procedures to sign a contract with Siemens Gamesa for a project to generate 500 MW of wind energy in the Gulf of Suez as an independent power producer and sell electricity to the government at USD 0.03 per kWh.

CALENDAR

26 January-3 February (Tuesday-Wednesday): CI Capital’s 5th Annual MENA Investor Conference.

February: France’s finance minister, Bruno Le Maire, is set to visit Egypt.

4 February (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-7 February (Saturday-Sunday): African Union annual summit.

6-18 February (Saturday-Thursday): Mid-year school break (public schools — enjoy the break from bumper-to-bumper traffic).

7-28 February (Sunday-Sunday): The Finance Ministry will receive applications from companies wishing to take part in the second phase of its program for the immediate payout of export subsidy arrears to exporters, minus a 15% fee.

8 February (Monday): Egypt leads an emergency Arab League minister-level meeting on the Israel-Palestine peace process.

8 February (Monday): AUC will hold a webinar titled ‘The Rise of Citizen Capitalism’ featuring Michael O'Leary, the managing director of Engine No. 1, and Warren Valdmanis, a partner at Two Sigma.

9 February (Tuesday): International Conference on Global Business, Economics, Finance and Social Sciences, Ramses Hilton, Cairo, Egypt.

10-11 February (Wednesday-Thursday): Egypt will host an arm of the World Conference on Science Engineering and Technology, Hotel Pavillon Winter, Luxor, Egypt.

12 February (Friday): Deadline to reach a settlement with the Tax Authority on overdue income, value-added, or real estate taxes without all the late fees. Late taxpayers are still eligible for a 50% exemption on interest fees and late penalties until 12 February under a bill passed last year, Tax Authority boss Reda Abdel Kader said.

22-24 February (Monday-Wednesday): Second Arab Land Conference on land management, efficient land use, among other topics.

22 February- 5 March (Monday-Friday) Egypt will host the World Shooting Championship in 6 October’s Shooting Club, with 31 countries set to participate

26 February (Thursday): The Afro Future Summit will take place virtually. The event will bring together futurists, investors, tech entrepreneurs, celebrities, politicians and business moguls to address challenges that affect the people of african descent.

28 February (Sunday) Deadline for businesses, sole traders, and those generating income from sources other than their day job to file wage tax returns through the electronic filing system.

March: Potential visit to Cairo by Russian President Vladimir Putin.

4-6 March (Thursday-Saturday): Cairo Fashion & Tex trade show, Cairo International Convention Centre, Cairo, Egypt

8 March (Monday): The IDC Future of Work Egypt conference will be held virtually featuring experts from Egypt and Jordan.

9-11 March (Tuesday-Thursday): EduGate 2021 – Enter The Future conference, Kempinski Royal Maxim Hotel, Cairo, Egypt.

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1-3 April (Thursday-Saturday): HVAC-R Egypt Expo.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC),

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

31 May-2 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo, Egypt,

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center, Cairo, Egypt.

30 June (Wednesday): 30 June Revolution Day.

1 July: (Thursday): National holiday in observance of 30 June Revolution.

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday).

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday).

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year.

12 August (Thursday): National holiday in observance of the Islamic New Year.

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 September-2 October (Thursday-Saturday): Egypt Projects 2021 expo, Egypt International Exhibition Center, Cairo, Egypt.

1 October (Friday): Expo 2020 Dubai opens.

6 October (Wednesday): Armed Forces Day.

7 October (Thursday): National holiday in observance of Armed Forces Day.

18 October (Monday): Prophet’s Birthday.

21 October (Thursday): National holiday in observance of the Prophet’s Birthday.

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.