- Our covid resilience is declining, according to Bloomberg. (Covid Watch)

- Egyptian stocks could piggyback on the emerging-market rally, says RenCap. (Sentiment)

- Suez Cement sells 51% stake in Kuwait’s Hilal. (M&A Watch)

- Of gold exploration and taking advantage of Turkey on citrus exports. (Commodities)

- NBE to help fund Abu Qir port expansion. (Debt Watch)

- House Planning Committee getting busy with tax, spending legislation. (Legislation Watch)

- The 10th anniversary of the 25 January Revolution dominates foreign press + talk show coverage. (Egypt in the News + Last Night’s Talk Shows)

- It’s Day 2 of Virtual Davos. (What We’re Tracking Today)

- Planet Finance: 2020 was hedgies best year in a decade thanks to covid.

Tuesday, 26 January 2021

A news day slower than molasses on a cold winter morning

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, nice people and welcome to one of the quietest news days we’ve seen in months.

No single story dominates the news agenda here at home or abroad, but covid features prominently in the headlines everywhere.

Among the global stories worth knowing about this morning:

- Investors are getting anxious over the odds we’re in the final days of a stock market bubble, particularly as “valuations and other signals flash red.” The “mania” in shares like GameStop and “surging” options activity also suggest a “market pullback” is coming. (FT and CNBC)

- Former Fed boss Janet Yellen has won confirmation as Joe Biden’s Treasury Secretary, becoming the first woman to hold the job. (WSJ)

- The chief of PE outfit Apollo will quit after the company said he had paid USD 158 mn to pedophile Jeffrey Epstein for “tax advice” and other services. (NYT)

KEEP AN EYE ON THIS- Struggling asset managers facing “relentless” pressure on margins could be takeover targets in a wave of M&A, the Financial Times reports. Look for others to simply close shop and return remaining AUM to their clients.

TURN OFF YOUR DAMN CAMERA- Are you still running your camera for Zoom meetings? It’s killing the environment. One hour of videoconferencing “emits up to 1kg of carbon dioxide, uses up to 12 litres of water, and requires a piece of land the size of an iPad Mini,” PetaPixel writes, picking up on a report in the journal Resources, Conservation and Recycling. Turning off your camera cuts that footprint by 96%. Nobody really needed to see your bookshelf anyway, right?

WHAT’S HAPPENING TODAY-

Foreign Minister Sameh Shoukry is due to brief the House later today on policy, according to Masrawy. Civil Aviation Minister Mohamed Manar Enaba will also appear today.

The Federal Reserve’s two-day monetary policy meeting kicks off today. With the economic recovery and the pandemic still a concern, we can’t see anything other than interest rates staying at rock bottom and its bond-buying program remaining in place.

AmCham’s Entrepreneurship and Innovation Committee is hosting a webinar today on “The Power of Mentorship,” with speakers including Zooba founder Chris Khalifa, Dar Al Mimar Group Chairman Ayman Ismail. The session will be moderated by Qalaa Holdings’ Chief Sustainability and Marketing Officer Ghada Hammouda. Tap / click here to register

AUC’s School of Business is hosting a webinar today on “Rethinking Macroeconomics in the Digital Age” to discuss how technological change is changing the way we think about macroeconomics, investment, training the labor force and access to finance. The event will feature Subir Lall, the IMF’s deputy director of the Middle East and Central Asia Department. You can register for the webinar here.

A virtual roundtable titled “Competitive Advantages of Sukuk” takes place tomorrow featuring seven speakers discussing the components of a successful sukuk issuance, among other topics. Among the panelists: Our friend Bahaa Alieldean, managing partner at Alieldean Weshahi & Partners, Misr Capital CEO Khalil El Bawab, and Amr Hassanein, chairman of MERIS Ratings.

Davos in the Desert kicks off at the Future Investment Initiative in Riyadh tomorrow and runs through Thursday.

Further afield: This year’s Egypt Petroleum Show will kick off on Monday, 31 May at the Egyptian International Exhibition Center. The three-day event will bring together senior execs from global oil and gas companies and energy government officials. You can download the event brochure here.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

|

FROM THE OPENING DAY OF VIRTUAL DAVOS–

Chinese President Xi Jinping warned global leaders against “a new cold war” as US President Joe Biden looks to bolster alliances and counter China’s growing influence around the world, according to AFP. "To build small cliques or start a new Cold War, to reject, threaten or intimidate others… will only push the world into division," Jinping said in a speech during the ongoing virtual Davos forum. US-China relations have been marred by growing tensions in the four years of Donald Trump, mainly due to issues related to trade and tech.

The US responded: The Biden administration views China as its strategic competitor but will approach China foreign policy “with patience,” White House Press Secretary Jen Psaki said during a press briefing yesterday (watch a summary of the US' stance, runtime: 3:18 or Psaki’s full press briefing here, runtime: 1:11:00).

Jinping also called for a more muscular G20 that allows for closer economic coordination between the world’s strongest economies amid what he called a “rather shaky” recovery from the pandemic, reports Reuters.

Star Wars, Episode LX: The Sino-American competition is also heating up in space, the New York Times warns in a piece the nerds among us will appreciate.

ON DAY 2: Panel discussions will cover stakeholder capitalism, covid-19 and climate change, while German Chancellor Angela Merkel, French President Emmanuel Macron, EU Commission President Ursula von der Leyen and South African President Cyril Ramaphosa will all give special addresses.

CIRCLE YOUR CALENDAR-

GOOD NEWS for Canucks in Egypt (or for folks who are studying there / sending their offspring to study in the Great White North): Air Canada will begin operating three weekly direct flights between Montreal and Cairo from 17 June until 29 October, reports Airways Magazine. The flights “seasonal” flights from Cairo to Montreal will run on Sunday, Wednesday, and Friday while Montreal to Cairo leg will fly on Saturday, Tuesday, Thursday. The flights can now be booked through Air Canada’s website. The CAI-YUL flight is AC075 and the first one that shows on Air Canada’s website departs on 18 June at noon and touches down in Montreal at 5pm.

PSA #1- Businesses have until 31 January (next Sunday) to file wage tax returns for 2020 including separate filings for the first and second halves of the year. Sole traders and folks who generate income from outside of their day job will also need to file electronically for the first time. Taxpayers who use the electronic filing and payment system will pay an annual fee of EGP 325, the Finance Ministry said in a decree published this week.

PSA #2- Time is running out if you haven’t paid income, value-added, or real estate taxes and want to settle up without all the late fees. Late taxpayers are still eligible for a 50% exemption on interest fees and late penalties until 12 February under a bill passed last year, Tax Authority boss Reda Abdel Kader said last week, according to Al Shorouk.

MORNING MUST-READ-

Family businesses tend to do well in times of crisis — and covid was no exception: Family-run businesses tend to “embody the best of corporate behavior” by taking the long view, while keeping relatively more frugal than bigger firms, avoiding flashy acquisitions, and innovating, writes the Financial Times’ Pilita Clark. Insolvency rates among big and small family businesses were lower in the UK after the 2008 financial crisis, and anecdotal evidence Clark has come across suggests that the same trend will hold up throughout the pandemic. Family firms are estimated to account for 85% of the world’s companies, from small corner stores to large conglomerates such as Mars.

The once-ailing diamond industry is roaring back to life as the pandemic has shifted luxury spending away from travel and back to jewelry, especially in the US and China, Bloomberg reports. Online shopping for diamonds is fueling demand, which has been stagnant at about USD 80 bn per year for the past five years.

Our friends at MagicCube have become the first startup to be appointed to the board of the PCI Security Standards Council, the company said in a statement this week. Comprised of America’s largest payments companies — from Apple to Google, Citi to Amazon — the council determines standards for payment security industry.

*** Check out the episode of our podcast Making It, where we sat down with MagicCube founders Hisham Shawki and Nancy Zayed about their journey in the industry.

COVID WATCH

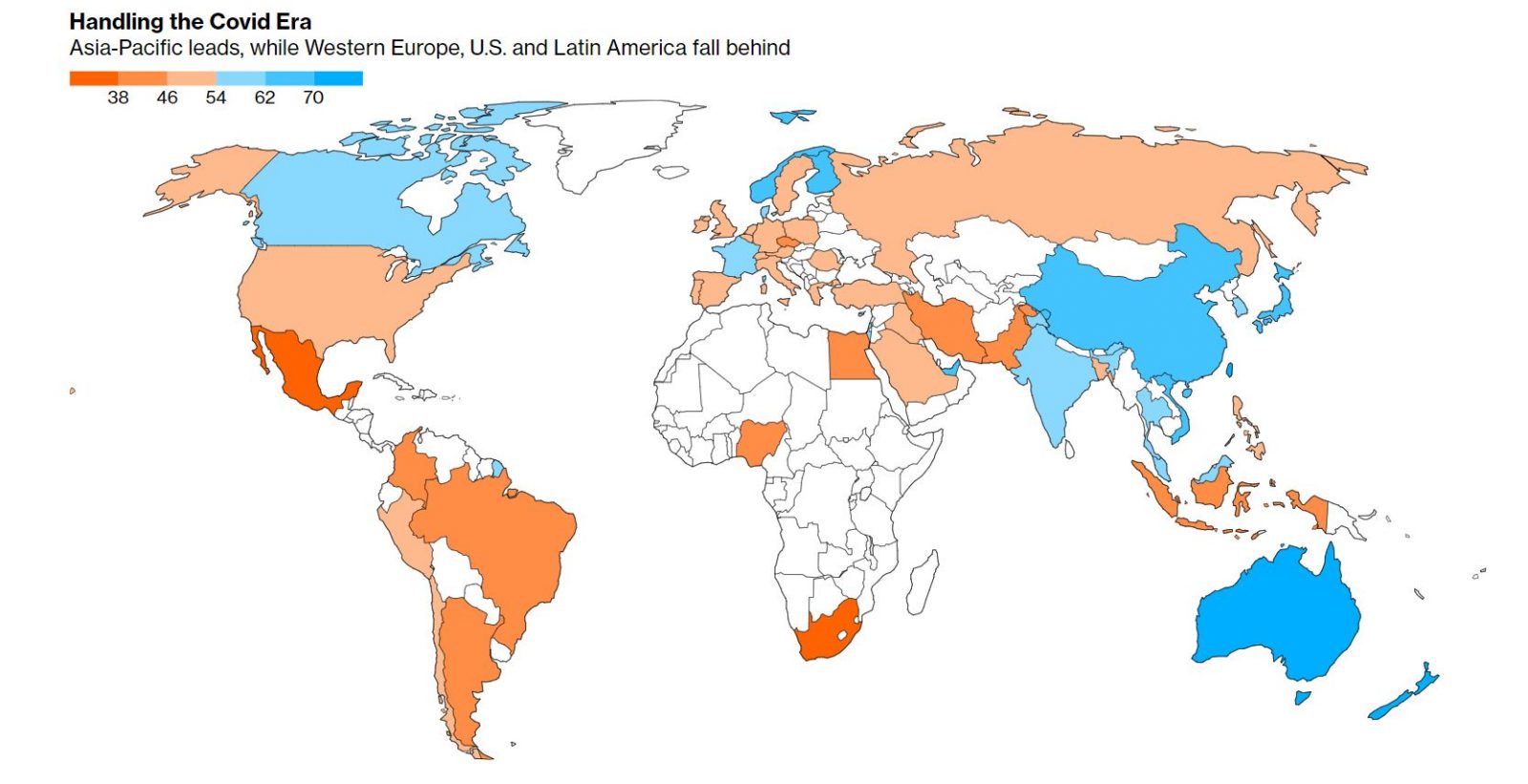

Our covid resilience is declining, according to Bloomberg

Egypt is now ranked 47 on Bloomberg’s Covid Resilience ranking after falling 23 spots in January, down from the 24th spot in December, on the back of “relatively flat outlooks for 2021 GDP growth from a high base of comparison in 2020.” The ranking, which is “a measure of the best places to be in the coronavirus era” by looking at a country’s metrics such as monthly cases and fatality rates, percentage of the population covered by vaccine supply agreements, the strength of its healthcare system, and GDP growth forecasts. New Zealand, Singapore, and Australia snagged the top three spots, while Mexico and South Africa came at the bottom of the list.

Pfizer and BioNTech will provide 40 mn covid-19 vaccine doses to global vaccine alliance Gavi’s Covax scheme under an advance purchase agreement, the World Health Organization announced in a statement. Covax will also receive almost 100 of the 150 mn doses of the Oxford AstraZeneca vaccine through an agreement with Serum Institute of India in the first quarter of the year, and will begin delivery of vaccines to eligible countries in February. Egypt is on course to receive 40 mn doses — enough for 20 mn people — from Gavi in the coming months.

The Health Ministry reported 669 new covid-19 infections yesterday, down from 674 the day before. The ministry also reported 53 new deaths, bringing the country’s total death toll to 9,012. Egypt has now disclosed a total of 162,486 confirmed cases of covid-19.

The Education Ministry has no plans to abandon next month’s midterms or push them to May, Minister Tarek Shawki wrote on Facebook in response to rumors circulating online.

The death of Islamic preacher Abla El Kahlawi after a struggle with the coronavirus received blanket coverage on the talk shows after First Lady Entissar El Sisi posted a tribute to her on social media: Al Hayah Al Youm (watch, runtime: 2:49), Masaa DMC (watch, runtime: 9:57) and El Hekaya (watch, runtime: 11:45) all took note. Al Hayah Al Youm's Lobna Assal rehashed the details of Egypt’s vaccine program in an interview with Health Ministry advisor Noha Assem (watch, runyime: 13:10).

COVID ABROAD-

Small countries pushing full steam ahead with their vaccine rollouts are seeing greater economic gains than bigger, wealthier nations. Israel’s benchmark index is already up 6.6% YTD, outperforming both the S&P 500 and the Euro Stoxx Index, while the Dubai Financial Market General Index climbed 9.3% YTD, nearly reversing its 10% slump in 2020, reports Bloomberg. So far, the UAE has given the jab to 20% of its population, while Israel has inoculated 30% of its residents — although officials are blatantly excluding Palestinians. JPMorgan estimates that if the two countries sustain the speed of the rollouts, they could reach the threshold required for herd immunity by the middle of the year.

The delay in an equitable vaccine rollout is hurting the global economy, with advanced nations’ bouncebacks likely to suffer if they do not help developing countries speed up their vaccination programs, the Financial Times reports, citing a World Health Organization report released yesterday. The report lays out a worst-case scenario that could see the global economy lose as much as USD 9.2 tn if developing countries do not also manage to vaccinate their populations this year. The WHO warned last week of a “catastrophic moral failure” as wealthier countries secured preferential access to vaccines via bilateral agreements.

Some countries are starting to freak out about the new South Africa variant: US President Joe Biden is planning to ban most non-citizens from entering if they’ve recently been to South Africa to curb the spread of a new variant that is believed to have originated in South Africa, according to Reuters. Moderna is making a vaccine booster “out of an abundance of caution” after a study found that the jab could be less effective against the South African variant.

And hedgies are sounding the alarm: One of the world’s largest macro hedge funds has warned that the covid variant discovered in the UK could cause greater disruption to the European economy than investors and policymakers currently realise. Element Capital believes that European growth forecasts should be scaled back as the variant, shown to be more transmissible than the original virus, spreads across the continent, the Financial Times reports.

SENTIMENT

Can Egyptian equities piggyback on the EM rally?

Are we about to get a piece of this rally in EM equities? Maybe, says RenCap: A strong rebound in equity inflows to emerging markets could spill over to Egypt, potentially reversing the 2020 trend that saw foreign institutional investors firmly positioned as net sellers every month on the EGX, Renaissance Capital’s head of MENA research Ahmed Hafez said in a note yesterday.

EM stocks have been on a tear in past weeks: The MSCI Emerging Markets Index rose to record levels earlier this month as optimism over the global vaccine rollout, Joe Biden’s victory in the US elections, and central bank stimulus caused a surge in risk-on sentiment.

Egypt is yet to reap the benefits, but valuations could prove attractive: “While we are neutral [on] Egypt in our allocation as it does not benefit from the same currency rebound story as other EMs, some inflows could still find their way to the market … on the back of what seems like the widest valuation gap in years,” Hafez says. Foreign investors had snapped up EGP 606 mn-worth of stocks in Egypt by the end of the first two weeks of January, he noted.

Also bolstering the Egypt story: RenCap believes that the worst of the second wave may already be behind us. Daily reported cases have (for the most part) been in decline since 1 January, and with the launch of the country’s vaccination program earlier this week. Business activity also seems to have experienced “far less disruption” in the second wave than it did in the first wave, which saw a nationwide curfew and much more stringent measures to curb the spread of the disease, Hafez notes.

This comes after a not-great year for foreign inflows to the EGX: Foreign investors were net sellers every month last year, offloading EGP 18.9 bn of stocks over the 12 months. This took foreign holdings down to the lowest levels seen in years, falling from USD 2.87 bn (6.1% of market cap) to USD 1.2 bn (2.7%) as of September 2020.

The benchmark EGX30 is up just over 6% year-to-date.

M&A WATCH

An acquisition here, a stake sale there …

Suez Cement has sold its 51% stake in Kuwait’s Hilal Cement for EGP 155.8 mn, the company said in a disclosure (pdf) to the EGX, offloading some 51.7 mn shares at KWD 0.058 apiece, the EGX-listed company said. Hilal later confirmed that Suez Cement’s representatives had resigned from the board.

A product of the cement crisis: Suez Cement had been a majority shareholder in the Kuwaiti firm since 2007 but tumult in the Egyptian cement industry forced it to announce last March that it was looking to sell up. The oversupply crisis that has been plaguing the sector for years resulted in the company’s Tourah plant shutting down production in 2019, contributing to a EGP 1.2 bn loss.

Meanwhile, Suez subsidiary Tourah Cement has bought back more than 3 mn shares worth a combined EGP 22.5 mn from its shareholders, the company said in a disclosure to the EGX. The share buyback comes as part of the mandatory tender offer Suez launched for Tourah last year after Suez’s German parent company, HeidelbergCement, lodged an MTO to acquire 100% of Suez.

Heidelberg Cement will now take Suez private: Both Suez and Tourah announced plans to delist their shares on the EGX in December following the completion of the MTOs.

OTHER M&A NEWS-

Speed Medical completed its purchase of Misr Laboratories’ Beni Suef branches yesterday after signing the final contracts, according to an EGX disclosure (pdf). The company is also preparing to sign the final agreements to buy 100% of Al Hayat Labs and 50% of City Lab, according to the statement. Speed previously said it planned to acquire 100% of City Lab.

Not moving ahead: Speed’s plan to establish a healthcare facilities management company, it announced in a separate disclosure (pdf). The company said it was scrapping the plan so as not to create conflict with Saudi Healthcare player Ela, with whom it signed an MoU signed last month to establish medical facilities in North Africa.

Raya Electronics, Distribution acquire i2 and Saudi’s URC: Raya Electronics and Raya Distribution acquired 99.95% of Itsalat International Egypt (i2) at EGP 106.8 per share. The Raya Holdings subsidiaries will also repay a shareholder loan worth EGP 78 mn as part of the acquisition agreement. The duo also acquired 100% of the Saudi-based United Retail Company (URC) at EGP 350 per share, the parent company said in a disclosure (pdf).

Advisors: Elite Consultancy House acted as financial advisor and conducted the fair value assessment of i2 and URC.

COMMODITIES

Of gold exploration and taking advantage of Turkey on citrus exports

Altus Strategies subsidiary Akh Gold expects to land an unspecified number of gold exploration licenses in the Eastern Desert from the Egyptian Mineral Resources Authority, according to a company statement. The UK-based mining firm was one of 11 companies to land exploration rights to 82 concession blocks in the Eastern Desert in a tender launched last March.

Mineral Resources Act, La Mancha’s investments bolstered Altus’ position on Egypt: “Our decision to expand our activities into Egypt follows the strategic investment by Egyptian-owned La Mancha, which acquired a 35% interest in Altus in February 2020, and follows favourable amendments to the Egyptian Mineral Resources Act,” said Altus Chief Executive Steve Poulton. The amendments offering investors more attractive terms were approved in 2019, and Oil Minister Tarek El Molla had announced that Egypt would issue a new gold exploration tender every four months.

A busy week for mining: The government announced earlier this week that it had signed contracts worth USD 13 bn with Canada’s Lotus Gold, Mining and Manufacturing Company (MEDAF), and Egypt’s Ebdaa for Gold as part of the results of the same tender.

OTHER COMMODITIES NEWS-

An expected dip in Spain and Turkey’s capacity for citrus exports has created a gap Egypt is primed to fill in Far East markets, including India, and more European countries, Gehan El Sheref, a specialist for Egyptian agriculture exporter El Rawan, tells FreshPlaza. Spain and Turkey, two of Egypt’s major competitors in the citrus industry, are grappling with lockdowns, bad weather, and decreased volumes, while demand for the produce hasn’t wavered during the pandemic, El Sheref says. While movement in Western Europe and China was a bit slower, overall demand from markets such as in Russia and Gulf countries increased compared to 2019. Egypt exported around 60k tonnes of citrus last year and the number is expected to increase by 10% for the upcoming season, she added.

DEBT WATCH

NBE to help fund Abu Qir port expansion

The National Bank of Egypt (NBE) is leading a EGP 7.5 bn syndicated loan to finance the building of a new shipping container terminal at Abu Qir port, Al Mal, citing anonymous sources. The state-owned bank will act as the lead arranger for the loan, with a syndicate of banks that is expected to include the Bank of Alexandria, Suez Canal Bank, and the Export Development Bank of Egypt. Contracts are expected to be signed by the end of 1Q2021, sources said. The same syndicate of banks had granted an EGP 3.8 bn loan earlier this month to Gharably Integrated Engineering Company for the upgrade of the Abu Qir port.

LEGISLATION WATCH

House Planning Committee getting busy with tax, spending legislation

Importers of strategic commodities are a step closer to seeing VAT on shipping costs scrapped after the House Planning and Budgeting Committee yesterday approved amendments to the VAT Act. The changes would remove VAT paid on freight costs for strategic goods including legumes, grains, table salt, and spices. The changes were greenlit by the Madbouly Cabinet in November.

This isn’t the only VAT change in the pipeline: Other amendments, which received cabinet approval in October, would end VAT exemptions for products including crackers and sweet pastries as well as commercial and administrative real estate. It’s not clear when the committee will discuss these changes.

Exempting eurobonds, Tahya Misr from fees and taxes: The committee gave a nod to a bill to exempt capital gains made from trading government treasuries that were sold on international debt markets from fees and taxes, Al Shorouk reported. State-controlled Tahya Misr Fund would also be tax-exempt from taxes and fees on gains it makes or loans and credit lines it takes out under another bill that earned committee-level approval, according to the newspaper.

Also approved by the committee: A EGP 2 bn overdraft for the FY2020-2021 state budget to help finance measures to prop up the economy and certain sectors amid the fallout from the pandemic which was approved by cabinet last week.

IN THE PIPELINE-

A new pension fund for day laborers? A joint parliamentary committee will consider a draft social security bill that would establish a fund to pay out ins. and provide pensions for informal laborers, Masrawy reports. The proposals, which were referred to the committee by the House speaker yesterday, would see workers over 65 years’ old receive a pension — provided they pay in for 10 years — and ins coverage.

The government has stepped up its support for informal workers in light of covid-19’s effect on the economy, the government has spent EGP 1.5 bn on a series of EGP 500 stipends for day laborers, which were introduced last March but have been extended into this year. Rather than an emergency handout, this bill could act as a parallel pension system, providing long term social security to those employed in the informal economy, an estimated 30% of all labor in Egypt.

Helping out nonprofit hospitals: Non-profit private hospitals (including the 57357 children’s cancer hospital) could see their utility bills slashed by 75% under a law proposed by House Rep. Ayman Abouel Ela yesterday.

ICT

Egypt retains position in ADSL, mobile internet speeds

Egypt has retained its position in Speedtest’s Monthly Global Index in December in fixed broadband and mobile internet speeds. Egypt’s ADSL speed of 34.88 Mbps keeps us at 92 out of 176 countries, while our mobile internet speed was recorded at 20.42 Mbps, leaving us at 102 out of 139 countries. In Egypt, c. 8.29 mn households are subscribed to ADSL services out of a population of 100+ mn.

MOVES

Sherif Sousa tapped as Aton’s new Egypt country manager

MOVES– Egypt-focused gold miner Aton Resources has appointed Sherif Sousa as its new Egypt country manager, the company said in a statement yesterday. Sousa has 40 years’ experience working in the nation’s oil and mining industries and served as the first chairman of the Egyptian Mineral Resources Authority between 2004 and 2006.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

The 10-year anniversary dominated the airwaves last night: Masaa DMC’s Eman El Hosary interviewed journalist Emad El Din Adib, who said that the revolution revealed the bright side of the Egyptian people fighting for their rights, but suggested that the Ikhwan later undermined what they achieved (watch, runtime: 16:55), while Assal interviewed two MPs who said that the revolution empowered the youth to hold leadership positions (watch, runtime: 30: 09). On the flipside, Ala Mas’ouleety’s Ahmed Moussa phoned former head of the national security Hassan Abd El Rahman, who called it a “bad memory in the history of Egypt” (watch, runtime: 34:52), while El Hekaya’s Amr Adib repeated charges that the uprising had been backed by the US to install the brotherhood into power (watch, runtime: 25:49).

President Abdel Fattah El Sisi’s speech to mark the day was picked up by all of the talking heads: Kelma Akhira’s Lamees El Hadidi (watch, runtime: 3:28), Al Hayah Al Youm's Lobna Assal (watch, runtime: 4:39), Masaa DMC’s Eman El Hosary (watch, runtime: 5:32) and Mas’ouleety’s Ahmed Moussa (watch, runtime: 6:58.

It was Manpower Minister Mohamed Safaan’s turn to face MPs yesterday: Assal spoke to MP Alaa Essam, who gave Safaan’s record in the ministry a glowing review. The minister spoke about the EGP 1.5 bn in stipends handed to day laborers in response to the covid-19 crisis, some of the problems the ministry encountered in its attempts to boost youth employment and its role lso some inquiries, related to the Iron and Steel Company workers' and the ministry's role in digital transformation and protecting workers rights (watch, runtime: 8:51).

EGYPT IN THE NEWS

The 2011 revolution dominates the conversation on Egypt in the international press this morning: Marking the 10-year anniversary of the uprising, Reuters speaks to activists involved in the protests and Deutsche Welle is running an op-ed by an anonymous exiled Egyptian disenfranchised with how things panned out. A journalist writes about her experiences at the protests for Business Insider, while Jack Shenker (writing for Vice) and France 24 look at the state of the country 10 years later. And Twitter lit up with images of Tahrir Square, riot police and crowds of demonstrators.

Cartoonist Ashraf Hamdi was arrested yesterday for posting a video tribute to the protesters of Mohamed Mahmoud St., Reuters reports.

The revolution also coincides with the fifth anniversary of Italian student Giulio Regeni’s disappearance. Italian President Sergio Matarella has called on Egypt to respond to Italy’s allegations concerning Regeni’s torture and death, Italian wire service ANSA reports. Meanwhile, Amnesty International is calling for the improvement of prison conditions and healthcare for detainees.

ALSO ON OUR RADAR

An EGP 13 bn revamp at state-owned Egyptalum will see the state-owned company upgrade its equipment to newer, more energy-efficient models as part of a plan to bring down the company’s energy bill, which makes up 40% of production costs, according to a Public Enterprises Ministry statement. American engineering firm Bechtel is on board to prepare the feasibility study, which should be complete in 1H2021, ahead of the project’s implementation. Egyptalum began a EGP 7 bn project to upgrade a production line in early 2020, as part of its plan to expand its annual production capacities to 570k tonnes. The company also received six proposals for a tender launched in November for the consultancy services to develop the feasibility study for a car rims production line.

Another thing we’re keeping an eye on this morning: Qatar Airways is actively looking to hire a country manager for Egypt, and airport supervisors in the UAE, after it agreed to restore diplomatic ties with the two countries earlier this month.

PLANET FINANCE

The pandemic gave the world’s top hedge funds their best year in a decade: The all-time top 20 hedge fund managers made USD 63.5 bn from the covid-induced market crash last year, accounting for more than half of the industry’s gains last year, according to LCH Investments data cited by Reuters.

But not everyone was able to read the tea leaves: The spectacular market sell-off in last March caused hedge fund earnings to fall to USD 127 bn during 2020 from USD 178 bn the year before. Among the losers was Ray Dalio’s Bridgewater, which lost USD 12.1 bn in the crash.

Corporate share buybacks are on a gradual rise in the US in a sign that big companies have more liquidity to spare after a fall in spending last year thanks to the pandemic, reports Reuters. Investors are cheering on from the sidelines, hopeful that the return of repurchases will put even more rocket fuel under the current market mania.

We’re still a fairly long way from reaching pre-pandemic levels though: S&P 500 companies spent USD 116 bn on share buybacks in 4Q2020, an improvement from USD 102 bn in the previous quarter, but far below the USD 182 bn in 4Q2019.

|

|

EGX30 |

11,510 |

-0.1% (YTD: +6.1%) |

|

|

USD (CBE) |

Buy 15.67 |

Sell 15.77 |

|

|

USD at CIB |

Buy 15.68 |

Sell 15.78 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

8,846 |

+0.2% (YTD: +1.8%) |

|

|

ADX |

5,617 |

+0.1% (YTD: +11.4%) |

|

|

DFM |

2,723 |

+0.3% (YTD: +9.3%) |

|

|

S&P 500 |

3,855 |

+0.4% (YTD: +2.6%) |

|

|

FTSE 100 |

6,638 |

-0.8% (YTD: +2.8%) |

|

|

Brent crude |

USD 55.88 |

+0.9% |

|

|

Natural gas (Nymex) |

USD 2.60 |

– |

|

|

Gold |

USD 1,857 |

-0.1% |

|

|

BTC |

USD 32,580 |

-0.2% |

The EGX30 fell 0.1% yesterday on turnover of EGP 1.6 bn (14.8% above the 90-day average). Foreign investors were net sellers. The index is up 6.1% YTD.

In the green: Dice (+4.6%), Orascom Development Egypt (+2.6%) and Palm Hills (+2.6%).

In the red: Eastern Company (-2.5%), GB Auto (-1.4%) and Ibnsina Pharma (-1.0%).

Shares in China, Korea and Japan are in the red this morning while futures point to a weak opening in Europe in a few hours’ time. Wall Street looks set to open in the red later today.

AROUND THE WORLD

Egypt plans to nominate Ahmed Aboul Gheit to serve a second five-year term as secretary-general of the Arab League, Saudi’s Asharq News reports, citing what it says are diplomatic sources. Egypt will make it official in the coming days, preparing for the March Arab League summit at which the next secretary general is to be appointed. If the summit faces covid-related delays, the nomination will be decided by Arab foreign ministers in a meeting before Aboul Gheit’s term expires on 30 June. Aboul Gheit is a veteran diplomat and continues a long-standing tradition that has seen Egyptians hold the top position at the Arab League for most of its 76-year existence.

The wheels are officially in motion towards a second Trump impeachment trial, after House impeachment managers yesterday delivered the charges to the Senate, CNN reports. Senators agreed last week to delay the trial until 8 February to allow President Joe Biden to finish staffing his administration.

The Biden administration won’t necessarily spell the end of Trump-era protectionism: President Joe Biden signed an signed an executive action yesterday requiring the government to award more federal contracts to local manufacturers — a move that risks souring relations with some of its key allies, which regard the “buy American” rules as an attempt to block their companies from the US market. NPR and the Wall Street Journal have more.

Saudi-led forces at war with the Houthis in Yemen said they prevented an attack on Riyadh on Saturday, reports Reuters. An “enemy air target” fired at the Saudi capital was intercepted and destroyed, the coalition said. The Houthis have denied involvement.

ON YOUR WAY OUT

Mahraganat channels on YouTube will live to see another day in Egypt after the Council of State’s administrative court dismissed a lawsuit attempting to ban them,

for failing to provide any documents or evidence for the case, according to Youm7. While the story does not mention the grounds on which the lawsuit was filed in the first place, the fact that it was filed by Samir Sabry — the lawyer who is apparently single-handedly leading the crusade against sinners and public indecency in Egypt — should speak for itself. Sabry previously filed lawsuits against puppet Abla Fahita, actress Rania Youssef (remember the dress?), and Jennifer Lopez, among many others.

CALENDAR

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship in four venues in Alexandria, Cairo, Giza and the New Capital.

25-29 January (Monday-Friday): The World Economic Forum’s Davos Agenda (virtual).

26 January (Tuesday): AUC’s School of Business webinar on “Rethinking Macroeconomics in the Digital Age.” Registration available here.

26 January (Tuesday): AmCham’s EIC Committee webinar on the “Power of Mentorship.”

26 January (Tuesday): Uber will host a virtual panel discussion titled ‘Tech for Transport Safety’, which will be the inaugural panel in a MENA-wide series of events under the name Ignite.

27-28 January (Wednesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

27 January (Wednesday): Media Avenue will host a virtual roundtable on the “Competitive Advantages Of Sukuk”

28 January (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

31 January (Sunday): The deadline for businesses to electronically submit their annual tax return to the Egyptian Tax Authority.

4 February (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break (public schools — enjoy the break from bumper-to-bumper traffic).

18 March (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

8-10 April (Thursday-Saturday): The TriFactory’s Endurance Festival at Somabay.

13 April (Monday): First day of Ramadan (TBC).

25 April (Sunday): Sinai Liberation Day.

29 April (Thursday): National holiday in observance of Sinai Liberation Day (TBC)

29 April (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 May (Saturday): Labor Day (national holiday).

2 May (Sunday): Easter Sunday.

3 May (Monday): Sham El Nessim.

13-15 May (Thursday-Saturday): Eid El Fitr (TBC).

25-28 May (Tuesday-Friday): The World Economic Forum annual meeting, Singapore.

31 May-2 June (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, New Cairo.

30 May-15 June (Wednesday-Thursday): Cairo International Book Fair.

1 June (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

17 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June (Thursday): End of the 2020-2021 academic year (public schools).

26-29 June (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

30 June (Wednesday): June 30 Revolution Day

1 July: (Thursday): National holiday in observance of 30 June Revolution

30 June- 15 July: National Book Fair.

1 July (Thursday): Large taxpayers that have not yet signed on on to the e-invoicing platform will suffer a host of penalties, including removal from large taxpayer classification, losing access to government services and business, and losing subsidies.

19 July (Monday): Arafat Day (national holiday)

20-23 July (Tuesday-Friday): Eid Al Adha (national holiday)

23 July (Friday): Revolution Day (national holiday)

5 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

9 August (Monday): Islamic New Year

16 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

1 October (Friday): Expo 2020 Dubai opens

6 October (Wednesday): Armed Forces Day

7 October (Thursday): National holiday in observance of Armed Forces Day

18 October (Monday): Prophet’s Birthday

28 October (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-17 December: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

16 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Note to readers: Some national holidays may appear twice above. Since 2020, Egypt has observed most mid-week holidays on Thursdays regardless of the day on which they fall and may also move those days to Sundays. We distinguish below between the actual holiday and its observance.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.