- Egyptian businesses are starting to see through the covid gloom. (Sentiment)

- Hotels nationwide to see a rebound in visitors in 2021. (Tourism)

- FX reserves hold the line in November. (Economy)

- NBFS player Ebtikar plans 1Q2021 EGX debut. (IPO Watch)

- Blom Bank Egypt getting ready for its sale to Bank ABC? (M&A Watch)

- The FAANG Gang could face taxes in Egypt under E-Commerce Act. (Legislation Watch)

- EUR 1 bn Egypt-Sudan railway could get a leg up from Kuwait Fund. (Transport)

- We’re now three months into blended learning. So how’s it holding up? (Blackboard)

- Planet Finance

Monday, 7 December 2020

Egyptian businesses are optimistic about 2021 and beyond –HSBC poll

TL;DR

WHAT WE’RE TRACKING TODAY

Good morning, friends. It’s an oddly quiet Monday on the global front — and a busy newsday here at home — so let’s jump right in:

WHAT’S HAPPENING TODAY- President Abdel Fattah El Sisi is meeting today with France’s Emmanuel Macron in Paris, where El Sisi landed yesterday for a two-day visit.

The Coptic Church has suspended masses and other church services including funerals in Cairo and Alexandria for a month starting today due to rising covid-19 cases, it said in a statement. We have more in Last Night’s Talk Shows, below.

Time is running out for EGX-listed companies without a woman on their BoD, market regulator warns: Companies listed on Egypt’s bourse are fast approaching the 31 December deadline to comply with a regulatory decision to have at least one woman sitting on their board of directors, the Financial Regulatory Authority reiterated in a statement (pdf).

By our math, just under half of the EGX30’s constituents have no women on their boards. Egyptian businesses are lagging behind the rest of the world when it comes to gender diversity in the boardroom, two recent studies found (here and here). Nasdaq-listed companies could also face the same requirements under a new policy proposal, while Germany already imposed the one-woman quota for listed companies’ BoDs last month.

The dispute between real estate developers and the Finance Ministry over the imposition of VAT on non-residential properties could be resolved this month. Developers have been less than pleased by the ministry’s plans to charge 14% VAT on the rent and sale of non-residential properties, and have been trying to persuade it to scrap the plans entirely. But the Federation of Egyptian Industries’ real estate division can broker a compromise by agreeing to an effective 1.4% VAT rate, the local press reports.

|

CIRCLE YOUR CALENDAR-

The Egyptian-American Enterprise Fund is hosting a webinar on the future of Egypt’s private sector at 11am EST (6pm CLT) on Tuesday, 8 December. Speakers include our friends Ashraf Sabry (Fawry) and Magda Habib (Dawi Clinics). You can register for the event here and check out the flyer here (pdf). Note the time change from yesterday’s issue, please, folks.

Other key dates for your diary this month:

- Inflation data for November will be released on Thursday, 10 December.

- The CBE’s Monetary Policy Committee will meet on 24 December to review interest rates.

** Take a few minutes to look up at the sky after dark on 21 December to see Jupiter and Saturn in their closest visible alignment in nearly 800 years. The conjunction will make the two planets and their moons appear to be as close together as the width of a dime — although in reality they will remain 400 mn miles apart. If you miss it? You’re gonna have to wait until 2080 to see this phenomenon again, the New York Times says.

Check out our full calendar on the web for a comprehensive listing of upcoming news events, national holidays and news triggers.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: Back in June, we ran a poll asking how online learning was working out for children and parents, with many of you saying that online platforms needed to be more interactive and less reliant on parental involvement. Now, three months into the new school year, a follow-up survey asks whether the blended learning models being run by schools are an improvement. The short answer? Blended learning tops online learning, but many of you still see it as a poor substitute for being in the classroom full time.

SENTIMENT

You’ll be back to pre-covid profit levels by 2022, an HSBC survey says

Egyptian businesses are starting to see through the covid gloom: Almost nine in 10 (89%) Egyptian businesses forecast revenue growth in 2021 and 83% expect their bottom lines to return to pre-covid levels by the end of 2022, according to the results of an HSBC poll. The bank’s 2020 Navigator survey, which polled 209 firms across various sectors of the economy in September and October, suggest that the mood among Egypt’s private sector is beginning to improve after a tough year marred by the impact of the pandemic.

Tap / click here (pdf) for the full report.

A sense of “cautious optimism”: Despite the challenging conditions, more than three-quarters (76%) of respondents believe the outlook for their businesses will either improve or remain the same in the coming months, falling slightly from 88% in last year’s survey but higher than the global average of 67%.

Finally, that long-awaited return of capex spending? The vast majority of businesses (87%) plan to increase investment in 2021, 20 points higher than the global average and above the 83% of firms in the Middle East, North Africa, and Turkey (MENAT) that said the same. In Egypt, nearly 50% of businesses plan to increase investments by 5-20% and a quarter by more than 20%.

Where do you want to invest? The top priority areas are product innovation, marketing, and geographic expansion, respondents said.

Trade worries persist, but only in the short term: Half of firms say they believe the pandemic will continue to cast a shadow on global trade as we head into the new year, and around two-thirds feel that trading across borders has become harder over the last 12 months. Despite that, only 12% of the businesses said they have a negative view of the next 1-2 years.

Key growth drivers, risks: Businesses expect tech-enabled efficiencies, product innovation, and the ability to attract investment and access to funding as the top three growth drivers moving forward. Meanwhile, exogenous factors such as the resurgence of covid-19 or political uncertainty were cited as the primary obstacles to recovery.

Reshaping supply chains: Egyptian firms were more worried about supply chains than the global average, with 50% (compared to 39% worldwide) saying that an increase in cost is the main problem, followed by a lack of agile suppliers. However, more businesses have broadened rather than limited their overseas suppliers, with 38% anticipating that reshaping their supply chain will be key to improved future access to more markets abroad.

Egyptian companies are paying attention to sustainability: Almost all of the respondents (98%) think a focus on sustainability will generate sales growth and more than 80% have begun or have plans to set targets for ESG issues, higher than the global average.

TOURISM

Hotels nationwide to see a rebound in visitors in 2021

Hotels across Egypt are set to see a rebound in visitors in 2021 as the effects of the global pandemic begin to ease and international travel increases, according to figures published in a new Colliers report. The Red Sea resort towns of Hurghada and Sharm El Sheikh will see the biggest resurgence: Room occupancy in Hurghada is forecast to surge 88% y-o-y to hit 48%, while the rate in Sharm will rise 78% to hit a 43% occupancy rate. Alexandria will likely see the most visitors with an occupancy rate of 62% over the 12-month period while Cairo will rise a little over 53% to achieve a 43% occupancy rate.

2020 unsurprisingly isn’t looking great: Colliers sees occupancy rates falling as much as 64% in 2020 following the three-month suspension of flights in the second quarter and a sluggish rebound in the months since. Sharm and Hurghada will see the lowest occupancy rates (at 24% and 26% respectively) while hotels in Cairo will see a 64% drop in visitors to achieve 28% occupancy while Alexandria will see a rate of 45%, down 44% from 2019.

ECONOMY

FX reserves hold the line in November

Egypt’s foreign currency reserves were broadly stable in November, inching up a modest USD 1.8 mn to USD 39.2 bn, according to Central Bank of Egypt figures. October had seen the largest monthly increase in foreign currency reserves this year, with FX holdings shooting up by USD 800 mn. Foreign reserves have been rebounding since June after declining by USD 10 bn between March and May this year when the central bank stepped in to cover portfolio outflows, debt repayments, and commodity imports during a global selloff of emerging market assets. Despite a steady increase, FX reserves are parked below their USD 45.5 bn February peak thanks to the slow recovery of tourism and other covid-related pressure on FX sources.

IPO WATCH

NBFS player Ebtikar plans 1Q2021 IPO

Ebtikar plans to list a 25-30% stake when it makes its EGX debut in 1Q2021, the local press reports, citing people familiar with the matter. The final size of the offering will be announced after the company wraps up a fair value study, the sources added. Ebtikar is a non-bank financial services firm and joint venture between B Investments and MM Group. MM Group is also planning an EGX debut for a fintech subsidiary recently set up following a merger of two of its separate e-payments businesses, Bee and Masary.

Advisors: MM Group has tapped EFG Hermes as financial advisor on the transactions.

M&A WATCH

Blom Bank Egypt getting ready for its sale to Bank ABC?

Blom Bank Egypt is getting its ducks in a row ahead of its potential sale to Bahrain’s Bank ABC, amending its employee salary structures to comply with Central Bank of Egypt regulations, Al Shorouk reports, citing unnamed sources. In a bidding process that also saw interest from Emirates NBD, Bank ABC announced last week that it is in exclusive talks to acquire Blom Bank’s 99.42% share in its Egypt business, which is exiting Egypt as it faces pressure in its home market.

WATCH THIS SPACE– EG Bank and Suez Canal Bank are planning to each purchase a 10% stake in a recently-formed real estate JV between Talaat Moustafa Group (TMG), the National Bank of Egypt (NBE) and Banque Misr, Al Shorouk reports, citing unnamed sources. The JV was set up to develop residential land owned by the state-owned banks near TMG’s Rehab and Madinaty compounds. It comes after Banque Misr and NBE signed a EGP 4 bn financing agreement with the real estate giant to construct two mixed-use projects in Madinaty and Rehab.

LEGISLATION WATCH

Google and the rest of the FAANG Gang could face taxes in Egypt under bill

Google, Netflix, Amazon and Facebook are among the tech giants whose operations here could face new taxes under an E-Commerce Act that Al Mal writes in its print edition is now making its way back to the Madbouly Cabinet for approval in 1Q2021. Also to be on cabinet’s docket are amendments to the Income Tax Act on electronic filing for companies and individuals alike.

Background: Both bills had previously been shipped to the House of Representatives and the report does not clarify whether new amendments to the laws have been introduced, nor does it provide details on the changes. The Tax Authority is reportedly in talks with Facebook and Google, whose businesses stand to be affected by the 15-20% stamp tax that could be imposed on social media purchases under the new e-commerce Act, the sources say. Stamp taxes typically wouldn’t be paid directly by Google or Facebook, for example, but need to be independently remitted to the state by anyone buying an ad on their platforms.

SMART POLICY- See the draft e-commerce act in the context of the global push to tax non-resident companies selling stuff online, from ads to digital media and online services. Cabinet had been expected to present the bill to the House for committee-level discussion in late 2018, and the bill has been in the works since late 2017. It aims to provide a clear tax framework for online ads and the sale of goods and services.

Amendments to the Income Tax Act, which obliged companies to file their taxes electronically as of this year and will see individual taxpayers follow suit in 2021, was put before parliament last May. Previously-passed amendments also handed state-owned enterprises in which the government owns a minimum 51% stake a capital gains tax break.

WAIT — am I gonna have to file a tax return as a private citizen? Maybe. Most Egyptians and foreign residents pay taxes through payroll taxes deducted at source; individuals who file themselves are self-employed professionals including lawyers, doctors and consultants as well as people who generate income through part-time work outside their day job or folks with income from assets including real estate rents.

TRANSPORT

EUR 1 bn Egypt-Sudan railway could get a leg up from Kuwait Fund

The Kuwait Fund for Arab Economic Development could be on board to fund the 900-km railway linking Egypt and Sudan, Al Shorouk reports, citing an unnamed government official. The fund has agreed in principle to finance the project alongside the Egyptian and Sudanese governments, which the source says will cost some EUR 1 bn. A tender to hire a technical consultant for the project is also expected soon, and will be open to foreign bidders. The project, however, faces “technical difficulties” including “a discrepancy” between Egypt and Sudan’s train lines, the source said without elaborating. Sudan uses narrow-gauge track, while Egypt uses standard-gauge.

Background: Egypt and Sudan last month signed an agreement to conduct feasibility studies for a rail connection that would run between Aswan and Wadi Halfa, providing a direct rail link between Alexandria and Khartoum. The agreement was the latest of several other announcements of a planned railway link since Egypt, Sudan, and Ethiopia agreed to create a joint fund to raise capital for a network of cross-border railway lines and roads back in 2018.

OTHER TRANSPORT NEWS- The National Rail Authority (NRA) plans to launch a tender next year for the upgrade of the Luxor-Aswan rail line’s infrastructure and signaling system, which is expected to cost USD 170 mn, according to a report in Al Mal’s print edition citing an NRA official. The government is planning to spend EGP 17 bn in five years to upgrade signaling systems across the country, which will be financed through facilitated loans from foreign lenders, Transport Minister Kamel El Wazir said last year.

DEBT WATCH

Who’s in the market for debt?

Egypt-based regional soybean crusher Oilex has upped its EGP 2.4 bn syndicated loan by an additional EGP 2 bn to finance working capital, Al Mal reports, citing informed sources. The company took the original loan in 2018 from a syndicate of five local banks including the National Bank of Egypt, Banque du Caire, First Abu Dhabi Bank, Suez Canal Bank, Arab Bank Egypt. Emirates NBD and Al Baraka Bank Egypt participated in the extension, which takes the value of the loan to EGP 4.4 bn.

STARTUP WATCH

Loyalty app Zeal Rewards secures undisclosed seed funding

Egypt and UK-based e-payments and loyalty app Zeal Rewards has secured an undisclosed amount of seed funding from an unnamed investor, the company said in an emailed statement yesterday. The app, supported by the university-led incubator SETsquared UK, allows people to make mobile payments and collect loyalty rewards at select stores and restaurants in Egypt and the UK. Zeal will use the funding to expand its team and grow its operations.

MAKING IT

A guide to fundraising with Actis Partner Hossam Abou Moussa

Want to learn how to talk to a private equity investor — or build a financial services business? We talk fundraising and the fundamentals of a healthy business as seen by an investor with Actis partner Hossam Abou Moussa, in the third season finale of Making It.

This is a must-listen for: Anyone who wants to kickstart a fintech / financial services business (Hossam invests in FS around the world) or any growing company that’s looking to private equity as a source of growth capital.

Your iPhone already has a podcast player and so does your Android handset. You can also listen on our website | Apple Podcasts | Google Podcasts | Omny. We’re also available on Spotify, but only for non-MENA accounts. Subscribe to Making It on your podcatcher of choice here.

ENTERPRISE+: LAST NIGHT’S TALK SHOWS

Leading the conversation on the airwaves last night: The Coptic Orthodox Church’s decision to suspend mass, funerals, and other prayers and services at churches for one month after five priests passed away from covid-19 and several other worshipers tested positive. The decision applies to Cairo and Alexandria, while churches in other cities across the country have the freedom to decide on their own whether to follow suit, Pope Tawadros II told Kelma Akhira’s Lamees El Hadidi. No decision has been made yet on the fate of Christmas mass, Tawadros said (watch, runtime: 11:03). Masaa DMC’s Eman El Hosary (watch, runtime: 3:58), El Hekaya’s Amr Adib (watch, runtime: 3:18), and Al Hayah Al Youm’s Lobna Assal (watch, runtime: 5:18) all had coverage.

Also getting attention: President Abdel Fattah El Sisi’s anticipated sit-down with French President Emmanuel Macron today: Masaa DMC (watch, runtime: 2:30) | Al Hayah Al Youm (watch, runtime: 1:02).

Also on the airwaves last night:

- Capmas boss Khairat Barakat explained the figures in the latest income and expenditure survey, which found that Egypt’s poverty rate decreased for the first time in 20 years. (Kelma Akhira | watch, runtime: 11:17)

- Fines and penalties will be imposed on individuals who steal electricity from the national grid, Electricity Ministry spokesperson Ayman Hamza said. (El Hekaya | watch, runtime: 10:39)

EGYPT IN THE NEWS

Human rights and civil society still dominate the conversation on Egypt in the international press. The NGOs case: AFP and Gulf News cover the court decision to close the 2011 NGOs case, which was brought against 20 civil society groups accused of receiving illicit foreign funding.

On the rights front: The incoming Biden administration is unlikely to be forgiving of perceived human rights violations in Egypt, writes Bloomberg Opinion writes. Meanwhile, a court has decided to uphold an asset freeze for the three EIPR staff members who were released over the weekend, earning fresh criticism from Amnesty International.

Also making headlines: The planned 2021 opening of the Grand Egyptian Museum gets ink in the New York Times and popstar Rita Ora is all over the UK press this morning, after breaching UK lockdown restrictions following a gig in Egypt. See, by way of example, The Guardian.

ALSO ON OUR RADAR

Egypt aims to raise local wheat production to 3.5 mn feddans this season, up slightly from 3.4 mn feddans last year, Reuters reports, citing an Agriculture Ministry official. Some 900k feddans have been planted since the start of the season in mid-November. The harvest will begin in mid-April 2021. Egypt, the world’s largest importer of wheat, is seeking to reduce its reliance on imports, raising domestic production this year and stockpiling imports in response to fears over food security caused by the pandemic.

Other things we’re keeping an eye on this morning:

- Elsewedy’s EgyTech landed a EGP 193 mn contract to provide the fiber optic cables for the Delta regional control center’s heavy use electricity grid.

- Raya Holding will invest EGP 50 mn to begin manufacturing TVs through Haier Raya Electric, a home appliances JV with Chinese firm Haier Electric.

- Ceramics manufacturers have reached a preliminary debt restructuring agreement with the Oil Ministry to pay outstanding gas bills over 10-15 years with 3% interest, head of the Egyptian Federation for Investors Associations said.

- Japan’s Hitachi ABB will install reactive power compensators in the national power grid for the first time in Owainat’s main transformer station, in an EGP 431 project.

- Fifty exporters have received EGP 1.1 bn of overdue export subsidies since the ministry allowed immediate payments to companies that want to receive their arrears in a single lump-sum rather than in installments.

COVID WATCH

The Health Ministry reported 418 new covid-19 infections yesterday, down from 431 the day before. Egypt has now disclosed a total of 118,432 confirmed cases of covid-19. The ministry also reported 21 new deaths, bringing the country’s total death toll to 6,771.

EgyptAir and Cairo Airport are equipped to ship and distribute vaccines that need to be stored in ultra-cold temperatures, such as the Pfizer / BioNTech and Moderna mRNA vaccines, Rosdhy Zakaria, the chairman of the flag carrier’s parent company, said on the airwaves yesterday morning (watch, runtime: 3:41).

Rudy Giuliani has tested positive for covid-19, Agent Orange said on Twitter. The story is front-page news in most US media outlets this morning, including the NYT and the Wall Street Journal.

The high-profile case comes as the US is planning to give all its citizens access to covid-19 vaccines by April 2020, said US health services chief Alex Azar ahead of the FDA’s expected clearance of Pfizer’s vaccine this week. Meanwhile, Californians have gone into lockdown as the state tries to stem a recent surge in cases, the Associated Press reports.

Russia and China are inching closer to a large-scale rollout of covid-19 vaccines: Russia distributed its Sputnik V vaccine to 70 clinics last weekend ahead of a mass vaccination campaign, and China is putting plans in place for mass production of its own inoculations.

And India could get the Pfizer vax before long after the US company applied for emergency approval last week. At least one local Indian manufacturer said it would also supply the shot to private clinics for USD 8 per shot, foreshadowing the possible development of a secondary private market for the vaccine.

PLANET FINANCE

The EGX30 rose 0.1% yesterday on turnover of EGP 1.6 bn (18.5% above the 90-day average). Domestic investors were net sellers. The index is down 21.0% YTD.

In the green: Dice (+6.2%), Orascom Investment Holding (+4.5%) and Beltone Financial Holding (+4.1%).

In the red: Sodic (-2.3%), Juhayna (-2.3%) and Edita (-2.2%).

Asian markets opened in the red this morning and futures suggest Wall Street and European markets will all follow suit later today.

|

|

EGX30 |

11,024 |

+0.1% (YTD: -21.0%) |

|

|

USD (CBE) |

Buy 15.62 |

Sell 15.72 |

|

|

USD at CIB |

Buy 15.62 |

Sell 15.72 |

|

|

Interest rates CBE |

8.25% deposit |

9.25% lending |

|

|

Tadawul |

8,582 |

-1.1% (YTD: +2.3%) |

|

|

ADX |

5,033 |

+1.4% (YTD: -0.8%) |

|

|

DFM |

2,482 |

+2.6% (YTD: -10.2%) |

|

|

S&P 500 |

3,699 |

+0.9% (YTD: +14.5%) |

|

|

FTSE 100 |

6,550 |

+0.9% (YTD: -13.2%) |

|

|

Brent crude |

USD 48.99 |

-0.5% |

|

|

Natural gas (Nymex) |

USD 2.47 |

-4.2% |

|

|

Gold |

USD 1,841.70 |

+0.1% |

|

|

BTC |

USD 19,321.57 |

+0.3% |

US oil producers have signalled intent to join European companies in reducing emissions as investors place pressure on firms to act on climate change, reports the Financial Times. Meanwhile, Iran is preparing to up its oil exports after Biden takes office, banking on a possible easing of US sanctions under the new administration, Iranian state media said, according to Reuters.

A new USD 908 bn fiscal stimulus package could make its way to the US Senate as early as today, the Financial Times reports. The bill would allocate bns for small businesses, unemployment benefits, local government, and aid to struggling industries such as airlines.

The European Central Bank is likely to end 2020 with another burst of stimulus when it meets on Thursday, according to Bloomberg. The ECB kept its interest rate and monetary policy stance unchanged in its most recent meeting in October, but signaled that further accommodative policy action could come this month as eurozone economies suffered another hit by the return to lockdown.

AROUND THE WORLD

World food prices jumped to an almost six-year high in November and saw the biggest m-o-m rise since July 2012 as the pandemic exacerbates global food insecurity, according to an index published by the UN’s Food and Agriculture Organization (FAO). The index measures the change in the price of a food basket and averaged 105 points in November compared to 101 points in October.

Kuwaiti voters were not happy with their previous lawmakers, replacing more than half of sitting MPs in what commentators have described as a public expression of dissatisfaction with parliament’s performance as the economy struggles amid a global oil slump, Bloomberg reports.

IN DIPLOMACY: Iraqi officials are planning to exempt certain Egyptian exports from customs duties, according to a document seen by Al Watan. The industries include building materials and chemicals, pharma, textiles, and metals and refractories. Egypt and Iraq have recently bolstered diplomatic ties, with both countries signing a flurry of agreements in late October that cover everything from energy to boosting exports.

ON THE TRADE FRONT- Egypt will have spent EGP 28 bn on export subsidy programs in 2019 and 2020 by the end of the year, with EGP 20 bn going to the immediate payment scheme, Finance Minister Mohamed Maait said at a press conference.

We’re now three months into blended learning. So how’s it holding up? After our poll about online learning in June, we wanted to see how blended models enabling some (socially distanced) classroom interaction are working. For 69% of respondents, their children’s blended learning model consists of a mixture of online learning and classroom learning, while for 24% it’s alternate periods of computer and classroom learning (usually one week of each). 30% have other models like the concurrent classroom.

Is blended learning a step up from online? Overall, yes — but not a resounding yes: 79% of you see blended learning as effective in helping children absorb knowledge, but of that number only 2% say it’s very effective, compared to 52% who feel it’s somewhat effective, and 25% who term it effective. 21% of you say it isn’t effective at all. “Blended learning is the best of the worst,” says one parent. “If there’s a choice between fully-online and blended, I’d choose blended, but if it’s blended versus offline, I’d choose offline.”

You’re divided down the middle about whether your child’s blended model works well for their grade, with 44% of you saying yes, 45% saying no, and 11% undecided.

When it comes down to it, 67% of you prefer blended to online learning: Where fully-online learning has the edge is its flexibility, say some respondents. And when schools were focused exclusively on online learning, there was consistency and focus on quality that sometimes gets lost in the hybrid model, some parents note. But for most of you, the chance to have any face-to-face interaction is a big plus for blended learning. “My kids are in primary, so it’s very hectic to study online. Offline or blended will always be better,” says one parent.

If necessary, 49% of you would be willing to use the blended learning model as it stands next academic year, while 34% wouldn’t.

And ultimately if covid-19 measures continue next year, 52% of you would want to see blended learning carry on, while only 17% would rather see a return to full-time online learning and 31% a full return to the classroom.

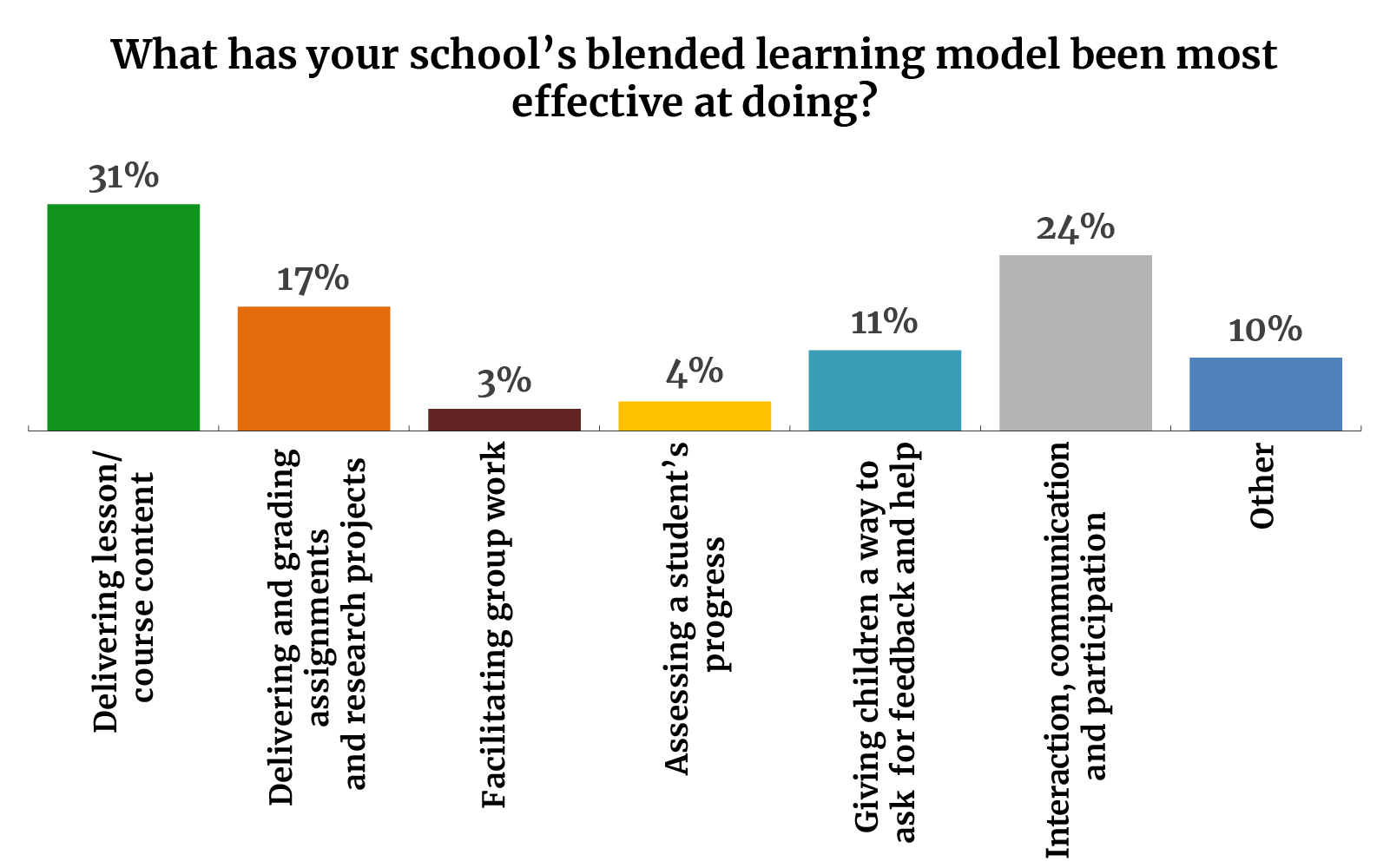

Like online learning, blended learning is quite good at delivering course content and grading assignments, with 31% and 17% of you saying it does well in these areas. Unlike online learning, it also scores relatively highly on communication and interaction, with 24% seeing it as effective. But it’s not a great medium for facilitating group work or assessing student progress.

Difficulties absorbing information through online learning platforms is still the number one user challenge, say 34% of you. Technical challenges, safety concerns with classroom education, and not having enough room to ask questions also present difficulties. E-learning platform reliability varies considerably, with 14% of you reporting disruptions multiple times a day, 19% once a day, 27% once a week, 20% once a month, and 20% seeing none at all.

Blended learning still isn’t interactive enough: “Our daughter’s school held more interactive online classes last year, but now they’re just posting low-quality videos. My daughter can’t follow everything. We’ve had to resort to taking private lessons,” says one parent. “Younger children especially need human interaction and group work, which online learning can’t really contribute to,” says another.

For many children, feeling unsupported also remains a big challenge: 46% of you say your children’s blended learning model doesn’t help to motivate and support them, compared to 32% who say it does. 16% of you say your children feel unsupported or isolated. But this may be endemic to any online learning, not something the school can entirely overcome. “It’s not necessarily because of the learning platform they’re using. They just feel isolated from their teachers and classmates when they aren’t physically with them,” says one parent.

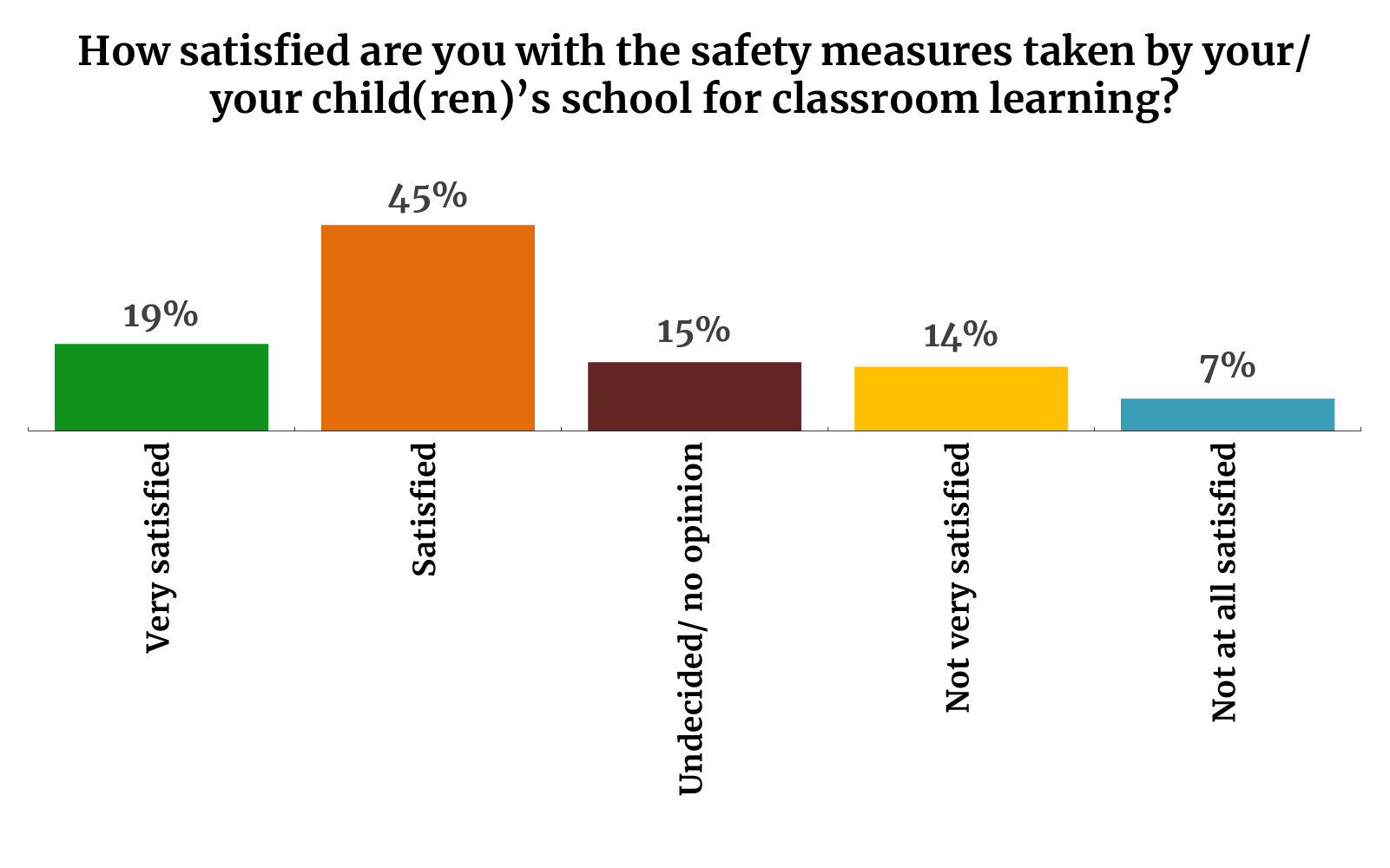

When it comes to safety measures taken for classroom learning, 64% of you feel schools are doing a good job, compared to 21% who aren’t. Schools are being very careful, says one parent, and nothing more could be asked of them in this area.

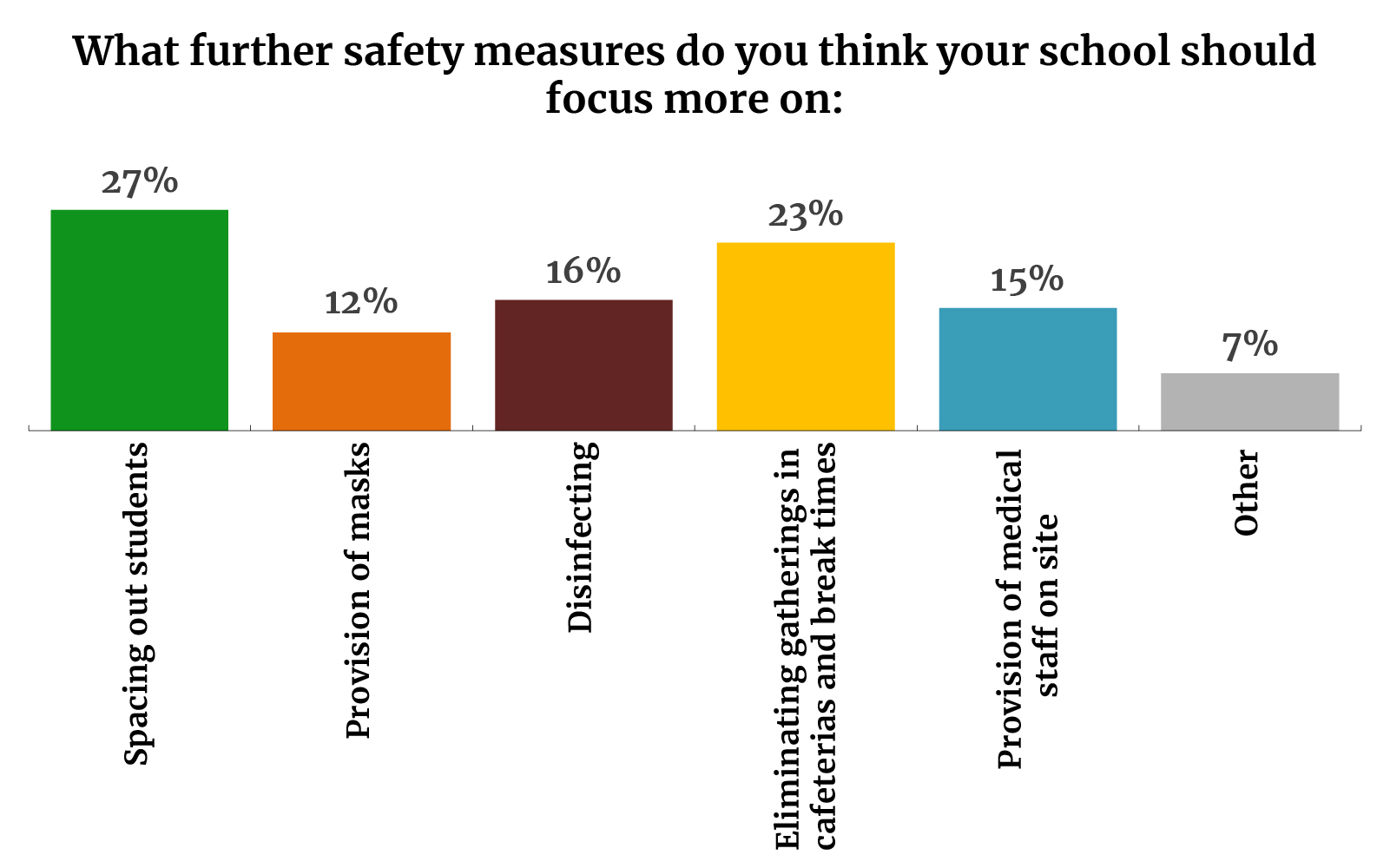

Most safety concerns are about social distancing: 27% of you feel schools should focus more on spacing students out, and 23% want to see break time gatherings stopped. Otherwise, parents need to see basic rules enforced on everyone. School rules should be more strongly enforced because many young people don’t take covid-19 seriously, says one parent. Schools also need to make sure parents understand the importance of safety measures, says another.

Parents still feel they’re carrying a heavy load: 68% of parents say they’re involved with the blended learning process, with 32% being very involved and 36% somewhat involved. Only 6% say they’re not involved at all. Online learning remains a burden to parents — especially working parents, says one. “I do feel sorry for parents having to juggle so much at this time, and wish companies would understand that their employees can’t work as ‘normal’ if they also have children to care for,” says a teacher.

But teachers were also thrown in at the deep end, and shouldn’t be automatically blamed for systemic problems with online and blended learning amid a climate of general frustration, the teacher adds. Blended learning best practice isn’t being implemented because school management seems to judge that the cost needed to train teachers and invest in the technology is too high. Meanwhile, Egypt’s communications infrastructure isn’t up to the burden placed on it, the teacher says: “I had to give up on most online lessons because of repeated outages, despite fitting good routers. It was teach-by-typing.”

30% of you feel teachers are making good use of blended learning models to set assignments and projects, and 14% believe they’re effectively creating a safe and reassuring classroom environment. Opinion varies on how well they’re doing explaining content — with 24% of you saying they’re doing a good job but 24% also feeling they could be doing better — and creating fun and innovative ways to learn, which 35% of you think they could be doing more of. 11% of you feel they could do better in providing extra support.

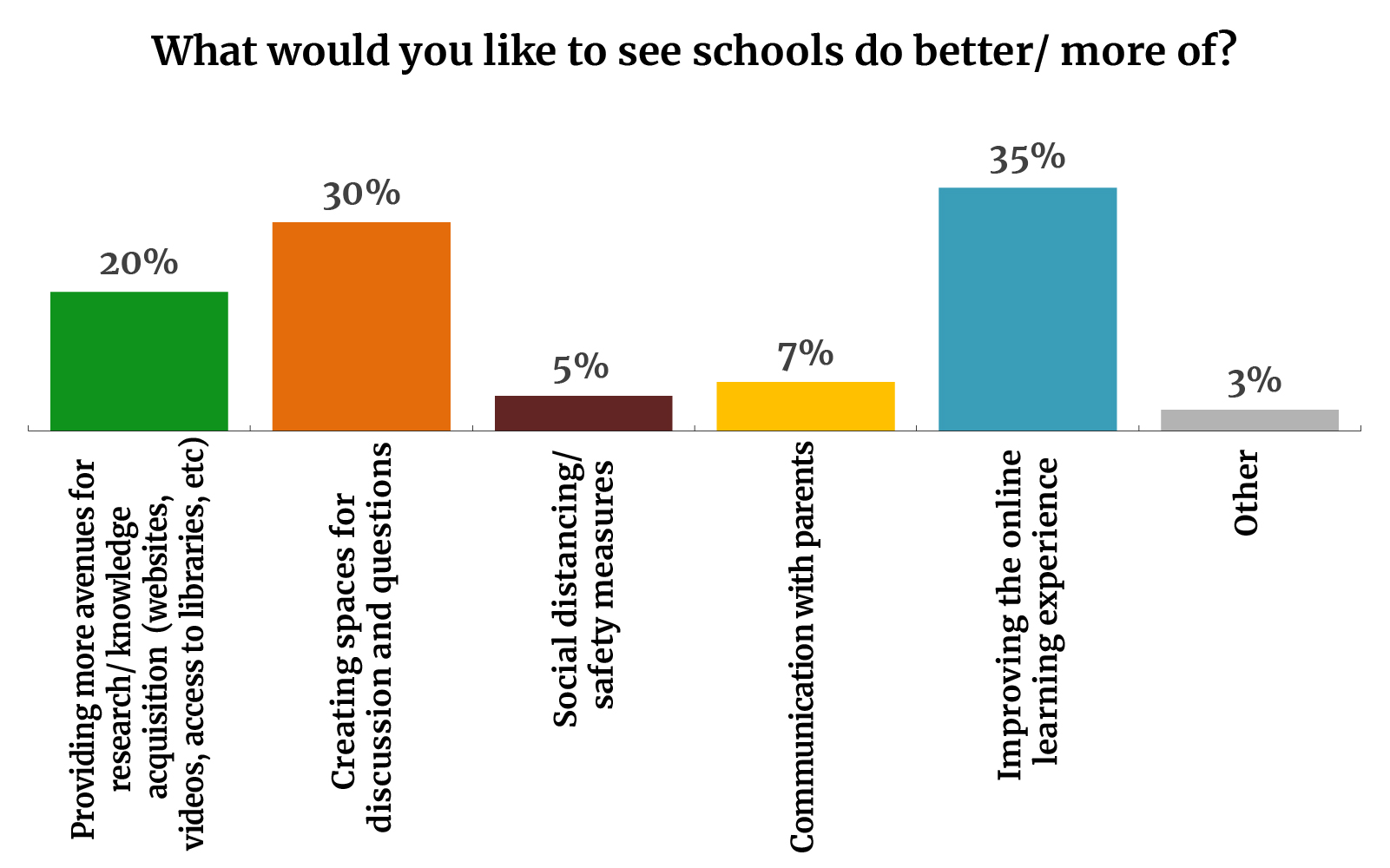

Online engagement levels remain low: Children have short attention spans, and would rather run around than sit at a computer to study, one parent says. They need more teacher-focused conversation time, says another. 20% of you feel schools need to get better at providing more avenues for research and knowledge acquisition, along with creating spaces for discussion and questions and improving the online learning experience.

And running a blended learning model has actually reduced the online educational quality of some schools: Some schools that initially ran good, interactive online lectures or seminars during the first covid wave are now churning out poor-quality content, or having teachers lecture to half a class of students while the other half follows from home, say parents. The schools are spreading themselves too thin and it negatively impacts overall quality, they add.

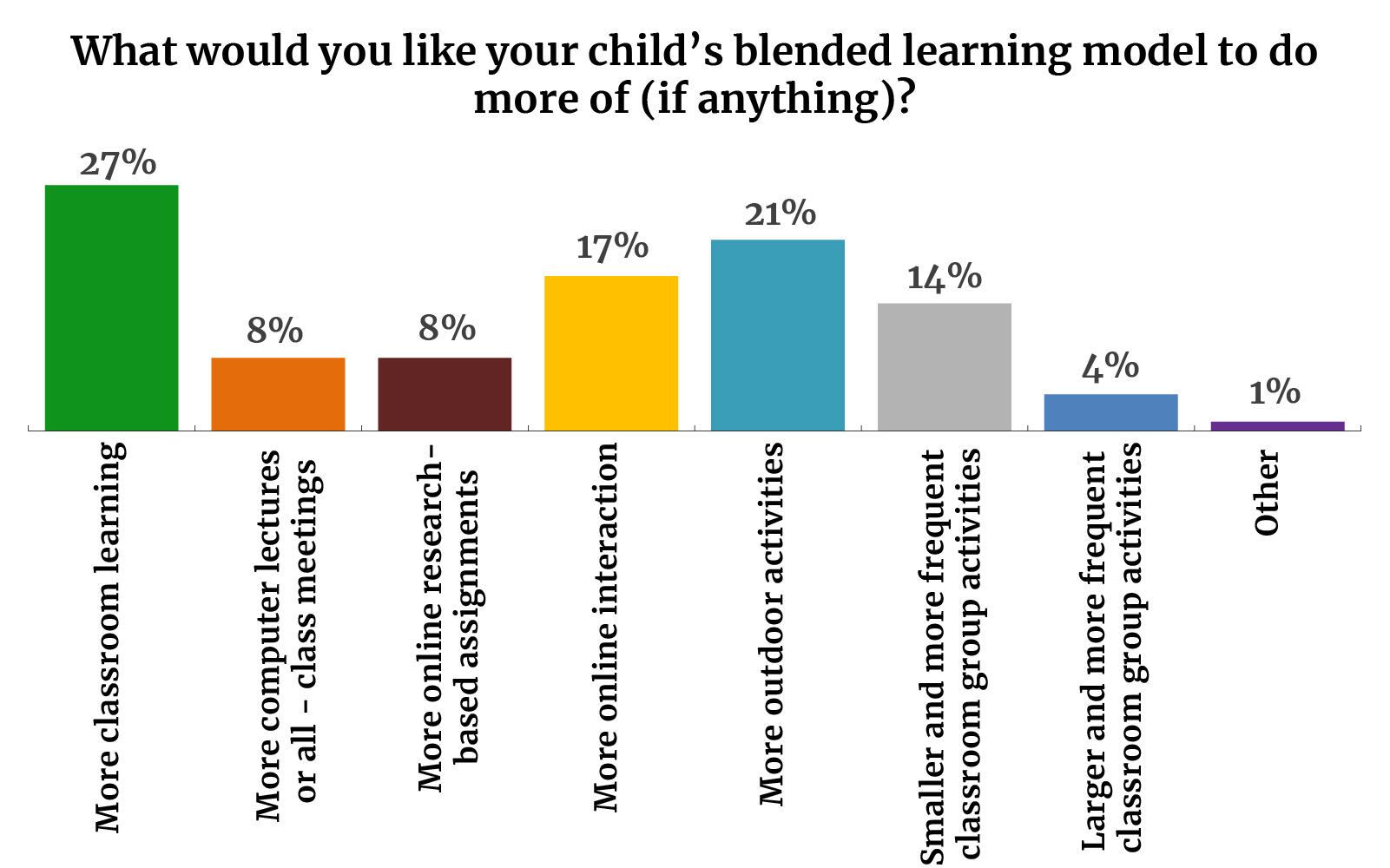

You want more in-person interaction — but safely: 27% of you want more classroom learning, while 17% want more online interaction. Many of you want more outdoor activities, and smaller and more frequent classroom group activities. Very few of you want more computer lectures or online research assignments.

Your top education stories for the week:

- New private unis get the presidential seal of approval: President Abdel Fattah El Sisi has signed decrees to establish four new private universities, the New Salihiyah University, Horus University, Delta University for Science and Technology, and Pharos University, Masrawy reports, citing the Official Gazette.

- Online learning platform goes live: The Education Ministry has launched a paid, interactive, online platform to explain state curricula, to which registration will be free for a limited period, Youm7 reports.

- Tawasol and SODIC inaugurated their second community school in Ezbet Khairallah to provide traditional and vocational programs to 500 students.

CALENDAR

December: Egypt-US Trade and Investment Framework Agreement (TIFA) talks.

December: A meeting to finalize membership and trading rules governing Egypt’s Commodities Exchange (Egycomex).

December: The Egyptian-Iraqi Joint Higher Committee will meet.

7 December: Former Civil Aviation Minister Ahmed Shafik faces trial over embezzlement allegations.

7-8 December (Monday-Tuesday): Runoffs for parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

8 December (Tuesday): EAEF webinar on the future of Egypt’s private sector. Register here.

9-10 December (Wednesday-Thursday): BiznEx, the international business expo in Egypt, Nile Ritz Carlton Hotel, Cairo, Egypt.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15 December (Tuesday): House of Representatives reconvenes from recess.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

31 December (Thursday): Egypt-UK post-Brexit trade agreement to take effect.

31 December (Thursday): Deadline for car owners to comply with traffic regulations to install a RFID electronic sticker on their cars.

1Q2021: The Seventh Annual Egypt Automotive Summit will be held

1H2021: Egypt’s Commodities Exchange (Egycomex) will begin trading.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids.

17 January 2021 (Sunday): A court will hold a postponed hearing to look into an appeal by Syria’s Anataradous against an arbitration ruling in favor of Amer Group and Amer Syria in case 445 of 2019.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

25-29 January 2021 (Monday-Friday): The World Economic Forum’s “Davos Dialogues” will take place virtually.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6-18 February (Saturday-Thursday): Mid-year school break.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

18-21 May 2021 (Tuesday-Friday): The World Economic Forum’s annual meeting will be held under the theme of “The Great Reset” in Lucerne-Bürgenstock, Switzerland

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

30 May-15 June 2021 (Wednesday-Thursday): Cairo International Book Fair.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 June 2021 (Thursday): End of the 2020-2021 academic year.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

30 June- 15 July 2021: National Book Fair.

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

1 October 2021-31 March 2022 (Friday-Thursday): Postponed Expo 2020 Dubai.

December 2021: United Nations Convention against Corruption, Sharm El Sheikh, Egypt.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.