- STC, Vodafone Group vow to continue acquisition talks after deadline expires without agreement. (Speed Round)

- Don’t expect a tax hike despite the covid-induced hit to state revenues, Maait says. (Speed Round)

- OIH eyeing investment partnership with the Sovereign Fund of Egypt. (Speed Round)

- Gov’t cuts fines for illegal construction in new cities. (Last Night’s Talk Shows)

- Kenya imposts 25% tariffs on some Egyptian goods. (Diplo + Foreign Trade).

- GB Auto lands Goodyear tire distribution rights in Egypt. (Speed Round)

- The education system’s post-covid prospects: An interview with the World Bank’s Amira Kazem. (Blackboard)

- The Market Yesterday

Monday, 14 September 2020

STC, Vodafone Group vow to continue acquisition talks as deadline passes without agreement

TL;DR

What We’re Tracking Today

Good morning, wonderful people — it’s a particularly busy news day, so we’re going to jump straight in.

We’re looking at what could be a strong start to the new (developed world) trading week, with Asian shares in the green in early trading and US and European stock futures on the rise after what CNBC notes was “the market’s first back-to-back weekly declines in months” on the back of a slump in tech stocks. The EGX30 closed up 0.2% yesterday on lighter-than-average trading.

We’ll know on Wednesday the results of last week’s run-off elections for the Senate. The first round of voting last month saw 174 members elected to the newly-constituted upper chamber, and the run-off round will determine another 26. President Abdel Fattah El Sisi will appoint the remaining 100 members of the 300-seat Senate after the final results of the votes are announced.

It’s a great week for our fellow tech nerds: Sony will unveil today its much-leaked A7C full-frame camera, Apple has an event tomorrow, and on Wednesday you can expect Sony to talk PS5 while Nikon takes the wraps off a 50mm prime and a 50mm f/1.2 and a 14-24 f/2.8, both for its new Z mount.

MORNING MUST READ- Half a century later, the jury is still out on how well the economic theory that led to “greed is good” has aged: 50 years ago yesterday, economist Milton Friedman penned an essay for the New York Times Magazine on how businesses’ main objective should be maximizing profits — and that money spent on social responsibility is money taken out of stakeholders’ pockets. Now, the contemporary corporate community is split on whether the Nobel laureate’s ideas are still applicable, particularly as social responsibility has become “in vogue among CEOs.” Read the NYT Dealbook’s series on Friedman’s essay, which includes commentary from Dealbook founder and CNBC host Andrew Ross Sorkin as well as from Kurt Andersen and a poll of big corporate CEOs on where they stand.

It’s (virtual) conference month:

- The Chemical Industries Export Council and Expolink will organize a virtual conference to discuss export options for Egyptian chemical exporters in Kenya and Uganda that takes place today and tomorrow. Also on the agenda: Reports that Kenya is slapping a 25% duty on some Egyptian exports in violation of the Comesa trade pact.

- Talents Arena will host Egypt’s first tech job fair which will be held online on 19 September under the banner JobStack.

- GAFI is hosting a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt sometime this month.

The Health Ministry reported 153 new covid-19 infections yesterday, up from 148 the day before. Egypt has now disclosed a total of 101,009 confirmed cases of covid-19. The ministry also reported 21 new deaths, bringing the country’s total death toll to 5,648. We now have a total of 84,161 confirmed cases that have fully recovered.

International visitors to Luxor arriving on charter flights will now be able to take PCR tests on arrival, Al Shorouk reports. It joins Hurghada, Sharm El Sheikh, Marsa Alam and Taba as the only airports offering tests on arrival.

Are wedding parties about to make a comeback? The government is considering allowing the resumption of wedding parties at hotels, El Watan reports, citing a Tourism Ministry official. Prime Minister Moustafa Madbouly is expected to issue the decision later this week, which would see hotels able to host weddings provided they do not exceed 50% capacity. Public wedding celebrations have been banned since the government first introduced lockdown measures at the end of March. Head of the Federation of Tourism Chambers Hossam El Shaer told El Hekaya’s Amr Adib that the move would be seen favorably by the industry, which has suffered drastic covid-induced drops in hotel occupancy rates (watch, runtime: 5:34)..

Covid news from the region:

Saudi Arabia will lift restrictions on some international flights starting tomorrow to allow travel for “exceptional categories” of people to travel, such as public and military sector employees, diplomats, patients who require treatment abroad, overseas students and sports teams, Reuters reports. The kingdom will lift all travel restrictions for all citizens on 1 January 2021.

Israel is heading into its second lockdown after a botched reopening caused a new surge in covid cases, Bloomberg reports.

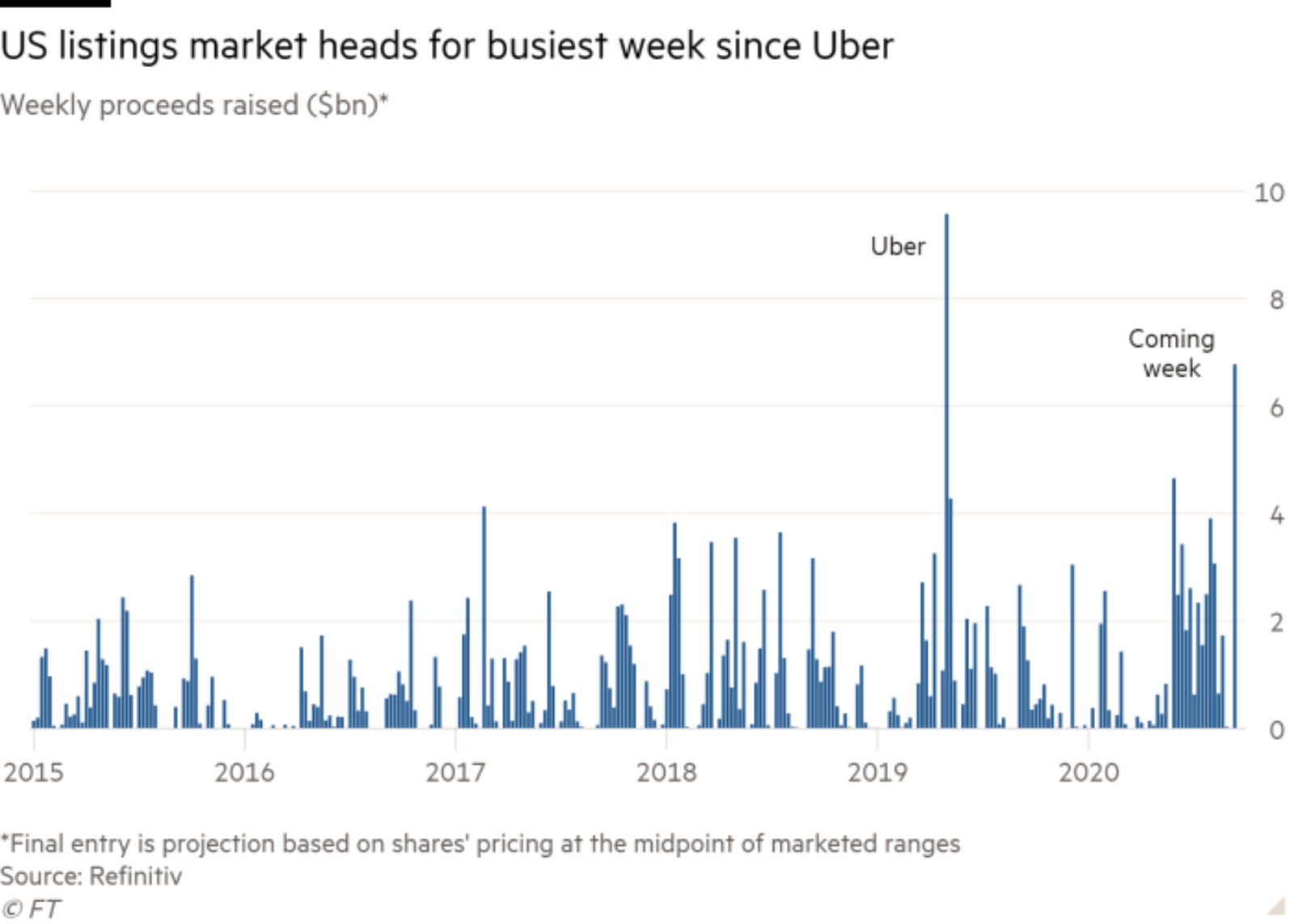

Next week is set to be the biggest for US software listings since Uber’s offering last year. Cloud software company Snowflake is set to rake in USD 2.2 bn, video game software company Unity will raise USD 950 mn, and Sumo Logic, another data software platform, will raise USD 281 mn, the Financial Times reports, citing data provider Refinitiv. The companies are among a dozen IPOs set to raise a total of USD 6.8 bn, as companies capitalize on the market’s insatiable appetite for tech stocks.

TikTok owner ByteDance and US tech company Oracle have come up with a fudge that just might save the Chinese social media firm from being banned in the US. ByteDance has reportedly given up on the idea of selling its US arm and is instead gunning for an agreement with Oracle that would see the US tech firm take over the management of its user data and acquire a stake in its US unit in a bid to assuage authorities that it does not pose a security threat, Reuters reports, citing people familiar with the matter. An agreement with Microsoft seemed to be in the cards after the Trump administration forced the Chinese company to exit the country, but retaliatory export controls from Beijing effectively killed the possibility of a sale.

Those two blockbuster M&As we mentioned yesterday are now sealed:

- Japanese tech conglomerate SoftBank has sold UK chip designer Arm Holdings to US chip manufacturer Nvidia for USD 40 bn, the Financial Times reports.

- Gilead Sciences has reached a final agreement to acquire biotech firm Immunomedics for USD 21 bn, the Wall Street Journal reports.

Jordan’s Capital Bank has begun due diligence to acquire Bank Audi’s Iraq and Jordan arms, Reuters reports. Lebanese banks have sought to scale back their overseas operations since the country’s financial crisis, and First Abu Dhabi Bank is reportedly planning to re-enter talks to acquire Bank Audi’s Egypt assets.

OPEC and its allies will have a lot to think about when they meet on Thursday, as the recent rebound in oil demand shows signs of faltering. Prices fell beneath USD 40/bbl for the first time since June last week as covid-19 continues to hit demand for fuel and concerns about a weak economic recovery rise. This may mean that the Saudi-led cartel and its Russian allies have to reconsider their decision to begin to reverse the huge supply cuts agreed earlier this year in order to put a floor underneath the market, Bloomberg says.

Tensions in the Eastern Mediterranean are starting to cool after Turkey withdrew its survey vessel from contested waters on Sunday, according to Reuters. Greek Prime Minister Kyriakos Mitsotakis called the move a “positive first step” and raised the prospect that Athens may now be willing to resume diplomatic talks.

Egyptian businessman Ahmed El Zayat — the owner of the Triple Crown-winning horse American Pharoah — has filed for Chapter 7 bankruptcy in the US to pay off some USD 19 mn in debts to hundreds of creditors, Bloomberg reports. The creditors include horse trainers and breeders that provided services in the run-up to American Pharoah laying claim to the Triple Crown in 2015, whom he owes some USD 600k. Court filings show that Zayat’s USD 4 mn New Jersey stables have been declared insolvent and are now being liquidated to compensate lenders. El Zayat rose to fame in Egypt as he acquired, turned around and sold Ahram Beverages to Heineken in the early 2000s.

US ELECTION WATCH- The Biden campaign is about to receive a healthy financial injection that could swing one of the most important battleground states: Bn’aire and former presidential candidate Michael Bloomberg will pump USD 100 mn into the Biden campaign’s push to win Florida, Bloomberg reports. The money will be spent on efforts to boost voter turnout and increase Biden’s popularity among Hispanics, while allowing the Democratic Party to divert funds to other states.

Meanwhile, the Donald takes his campaign trail to California today amid devastating wildfires that show no signs of abating, the Financial Times reports.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: We speak with Amira Kazem, senior operations officer at the World Bank, about how the bank has responded to the covid crisis and how it will affect Egypt’s education system over the long term.

Enterprise+: Last Night’s Talk Shows

It was a mixed bag of nuts on the talk shows last night: The talking heads gave us more coverage of the government’s move to reduce fines for building violations and the upcoming covid vaccine trials, as well as info on the upcoming parliamentary elections and the plans to prevent Nile flooding.

National List for Egypt convenes ahead of House elections: Al Hayah Al Youm’s Lobna Assal highlighted the meeting of the National List for Egypt, which consists of around 12 parties that ran in the Senate election under one list, headed by the pro-government Mostaqbal Watan Party. They convened yesterday to discuss forming another unified list to run in the House of Representatives elections next month (watch, runtime: 2:52). Masaa DMC’s Eman El Hosary also covered the gathering, speaking with member Mahmoud El Qott, who talked up the breadth of views and ideologies within the organization and its influence on regular citizens (watch, runtime: 2:34), (watch, runtime: 3:07).

Covid-19 vaccine trials: El Hosary phoned Ihab Kamal, the director-general of the Health Ministry’s fever department, who discussed conditions to volunteer for the covid-19 vaccine trials. Participants must be over 18 years-old and must not have any chronic conditions or have previously contracted covid-19 (watch, runtime: 8:00).

Gov’t cuts fines for illegal construction in new cities: El Hekaya’s Amr Adib spoke with Nafisa Hashem, who heads the Reconciliation Law Inquiries Committee, to discuss fines for illegal construction in new cities, which the Housing Ministry yesterday reduced by 15-25% to encourage citizens to reconcile with the state (watch, runtime: 5:20). People settling violations in New Cairo and Sheikh Zayed will see their fines cut by 15%, El Shorouk and Sixth of October will be reduced by 20%, and buildings in another 24 new cities will receive a 25% discount. This comes a day after the government slashed fines by up to 70% in 23 governorates, and cut them to EGP 50 / sqm for buildings in rural areas.

Preparations ahead of Nile flooding: Adib spoke with Irrigation Ministry spokesperson Mohamed El Sebaei, who discussed the ministry’s efforts to get ahead of any possible Nile flooding which at this stage is limited to monitoring water levels. El Sebaei also mentioned that Egypt has submitted its statement on the latest Grand Ethiopian Renaissance Dam talks to the African Union ahead of the next round of negotiations (watch, runtime: 4:16).

Speed Round

M&A WATCH- STC, Vodafone Group vow to continue acquisition talks after deadline expires without agreement: Saudi Telecom Company (STC) has failed to reach an agreement with Vodafone Group to acquire its 55% stake in Vodafone Egypt after the deadline set by an MoU signed in January expired yesterday, STC said in a statement to the Saudi stock exchange. Local press reports last week suggested that the two companies had reached a preliminary agreement on a reduced valuation, but STC yesterday said that negotiations failed to find a breakthrough “due to misalignment with relevant parties.” Vodafone initially received a USD 2.39 bn non-binding offer for the majority stake, valuing the company at USD 4.4 bn. Cash-strapped Vodafone Plc was reportedly open to fielding a lower offer after STC came under pressure amid slumping oil prices and the covid-19 pandemic.

This isn’t the first time proceedings have been delayed: The two companies twice extended the MoU signed in January: a 90-day extension was agreed in April and a further 60-day postponement occurred in mid-July due to “logistical challenges” resulting from the pandemic. The Financial Regulatory Authority has also said it could compel STC to submit a mandatory tender offer for the remaining 45% of the company should the acquisition be completed. This would nearly double the cost of the acquisition, and had caused STC to return to the drawing board and reassess its calculations, Youm7 reports, citing an unnamed source.

This isn’t over: Both companies said that talks will continue, despite the expiry of the MoU. Vodafone “remains in discussions with STC to finalize the transaction in the near future” and “looks to STC and Telecom Egypt (TE) to find a suitable agreement to enable the transaction to close,” Vodafone said in a statement picked up by Bloomberg. Reports suggested last week that STC could move to finalize the transaction at the end of the year, giving it enough time to submit the offer and get regulatory approval.

TE is in “wait and see” mode: Telecom Egypt holds a remaining 44.8% stake in Vodafone Egypt and has the right to exercise its right of first refusal and lodge a bid for the 55% stake held by the UK company. The state-owned firm said it had not been approached by either company and is still considering its options in a statement. Vodafone sources have said that the company doesn’t believe TE will move forward with a counter offer and is in fact more likely to sell its stake given its current debt position. TE’s share price slid by 5.85% during trading yesterday following news that the MoU between STC and Vodafone had expired without a sale.

EXCLUSIVE- Don’t expect a tax hike despite the covid-induced hit to state revenues: The government was left with a EGP 115 bn tax gap and a shortfall on other revenue of the same approximate magnitude in FY2019-2020 as a result of the economic fallout caused by the coronavirus pandemic, Finance Minister Mohamed Maait told Enterprise. The Madbouly government is still working on its customary end-of-fiscal-year report, in which it details the year’s financial performance. Government bodies typically submit these reports to the Finance Ministry in mid-September, which are then compiled and shipped to the House of Representatives for a sign-off before becoming public, according to a recent circular (pdf) issued by the ministry.

The tax shortfall is about 15% of the EGP 760 bn or so in tax revenue the government originally expected to net last year (pdf), but is better than the EGP 125 bn tax gap Maait had forecast in June.

The government still expects tax revenues to grow 12.6% y-o-y in FY2020-2021, according to forecasts approved by the House in April. Those assumptions, however, will likely be tweaked following the release of 1Q fiscal data, Maait told us yesterday. Maait did not clarify whether the budget would be amended, saying it is still too early to tell what steps will be needed.

The good news: Don’t expect a tax hike: Maait reiterated that the government has no plans to raise taxes to make up for the massive shortfall last year, noting that the ministry’s plans to increase the tax base to 2.5% of GDP over the next five years doesn’t imply lining up tax increases, according to a statement denying “rumors” that circulated yesterday.

Egypt’s economy has responded well despite continued challenges: The virus’ continued presence is still making the movement of people, goods, and investments across borders more difficult, Maait told us. Egypt is taking steps in the right direction despite “huge” challenges from decreased mobility in an interlinked global economy, as well as the threat of a second wave and new lockdown measures, he said.

OIH eyes investment partnership with the Sovereign Fund of Egypt: Orascom Investment Holding — post-horizontal demerger — is considering making joint investments with the Sovereign Fund of Egypt (SFE), OIH Chairman Naguib Sawaris told Hapi Journal. Sawiris did not specify which assets in the SFE’s portfolio are of particular interest to the company.

Investment and divestment plans: OIH will likely be looking at potential investments in logistics and entertainment in the coming period, and the group plans to sell off its Brazil assets, including VC Fund Riza Capital, as well as finalize the sale of its submarine cable in Pakistan, Sawiris said.

Beltone Financial is not interested in acquiring Blom Bank Egypt, Sawiris noted, adding that the company has not begun steps towards entering the banking sector. The embattled Lebanese bank had earlier this year announced it was seeking to sell its Egypt assets as its home country suffers its worst economic crisis in decades. Bahrain’s Arab Banking Corporation (Bank ABC), Emirates NBD, and an unnamed NBFS firm are all in the race to acquire the bank’s assets.

Background: The FRA approved last week OIH’s demerger, allowing the group to become two separate companies. Orascom Financial Holding (OFH) and OIH were created from the agreement that would see the former take control of the company’s financial services operations including a 74.5% stake in Beltone Financial and 28.8% of Sarwa Capital. The latter would retain all of its investments in its eight subsidiaries, including Orascom Telecom Ventures, O Capital, and Orascom Pyramids, along with its sister Cheo Joint Venture Technology company.

EGX-listed GB Auto has landed distribution rights for Goodyear tires in Egypt as the American tire manufacturer looks to expand its footprint in the country, according to a company statement (pdf). The agreement “completes and consolidates [GB’s] positions in the premium and prestige segments,” GB Auto COO Karim Gaddas said. The company has its eyes on launching a Goodyear-branded tire express network across Egypt as of next year, which comes as the company plans to “continue investing in the development and upgrade of its distribution networks.” The statement does not provide further details of the plans.

M&A WATCH- NBE taps Grant Thornton, Matouk Bassiouny to advise on Aman stake purchase: State-owned National Bank of Egypt (NBE) has selected Grant Thornton as its financial advisor and Matouk Bassiouny & Hennawy as legal counsel for its planned acquisition of a 20-25% stake of Raya subsidiary Aman Holding, Al Mal reports. The offer received preliminary approval from Raya’s board of directors earlier this year. The value of the transaction will be determined once NBE concludes its ongoing due diligence on Aman.

INVESTMENT WATCH- GAFI approves new projects in IDG’s e2 industrial park in Alamein worth EGP 600 mn: The General Authority for Investment (GAFI) has greenlit 22 new projects worth a combined EGP 600 mn that will be set up in Industrial Development Group’s (IDG) e2 complex in Alamein, according to the local press. No further details were provided on the approved projects. IDG, which was set up by construction outfit Samcrete in 2017 to develop industrial parks, has already allocated land in e2 to nearly 140 investors — a third of whom are foreign. IDG is also the developer of the East Port Said Industrial Zone, on which it broke ground a year ago, and another zone in Sixth of October.

Background: The 2.7 sqkm e2 investment zone is branded as Egypt’s first eco-sustainable park. The park pitches tenants on the benefits of “multiple trade agreements, including COMESA, GAFTA, Egyptian-European partnership, and others.”

REGULATION WATCH- FRA requires futures exchange operating company to separate CEO, MD, chairman positions: The Financial Regulatory Authority (FRA) issued a decree yesterday requiring the joint-stock company that will be set up to operate the planned futures exchange to separate the positions of CEO, chairman, and managing director. The decree also mandates that the company’s chairman and executive board members serve three terms that do not exceed nine years in a bid to improve governance.

Background: In a meeting late last month, the FRA formed a working group to complete regulations and guidelines governing the futures exchange after the introduction of derivatives trading was made possible through 2018 amendments to the executive regulations of the Capital Markets Act. We’ve been getting encouraging signals from FRA boss Mohamed Omran and deputy chairman Khaled El Nashar that the private sector will hold shares in the exchange.

State grain buyer GASC and private sector firms imported a combined 6.6 mn tonnes of wheat so far this year, the local press reports. The news comes after the government looked to shore up its strategic reserves in the wake of threats to the global market from covid-19. GASC accounted for more than 50% of these imports, while some 30 private sector companies imported the remainder. Russia supplied the lion’s share of our imports throughout the first eight months of the year. Other major source markets include Ukraine, France, Romania, Australia, Bulgaria, Canada, and Hungary.

Background: Egypt has been stockpiling wheat in response to the ongoing covid-19 pandemic, and has issued several international tenders during the local harvest season. Supply Minister Ali El Moselhy said earlier this year that Egypt was looking to secure 800k tonnes of imported wheat — a target that was reached in June. The pandemic-fueled scramble to acquire wheat is expected to slightly abate in MY2020-2021, compared to MY2019-2020.

STARTUP WATCH- Egyptian esports team Anubis Gaming raised an additional USD 100k from an unnamed regional ecommerce group last month, bringing their total runding raised to USD 450, Menabytes reports. The team plans to use the funds to expand its coaching staff, recruit more players, and equip a new training facility that can host up to 15 gamers. Designated Egypt's official esports team by the Sport Ministry in 2016, Anubis participates in competitive video gaming tournaments and raises much of its money through sponsorships and prize money.

LEGISLATION WATCH- President Abdel Fattah El Sisi ratified amendments to the Public Enterprises Act, Masrawy reports, noting that the decision was published in the Official Gazette on Sunday. The amendments aim to streamline the public sector, promote financial stability within state-owned enterprises and make management more accountable to shareholders. The amendments were passed by the House of Representatives in July. Read more about the legislation here and here.

El Sisi also ratified amendments to the law governing compensation for public sector medical workers, Masrawy reports. The law, passed by the House in July, provides doctors with an additional EGP 1,225 monthly allowance, dentists, pharmacists, veterinarians and physiotherapists with an extra EGP 875, nurses, chemists and physicists a further EGP 790, and nursing and healthcare technicians with another EGP 700.

Other amendments to draft laws approved by El Sisi as published in the Official Gazette on Sunday:

- A draft law regulating parole, empowering the Interior Ministry to determine whether police supervision can be conducted in the private residence of former detainees;

- Amending the executive regulations of the Universities Act;

- A draft law amending some provisions of the law regulation procedures for litigation in civil cases.

EARNINGS WATCH- Bank Audi Egypt reported a 7% dip in net profits in 2Q2020 to EGP 650.8 mn, down from EGP 700.6 mn in 1Q2019, according to the bank’s earnings release (pdf). The bank’s net interest income dipped marginally to EGP 1.41 bn during the quarter from EGP 1.40 bn last year. The bank’s Egypt unit accounts for almost 16% of the group’s total profits in 1H2020, Bank Audi Egypt’s CEO Mohamed Badir told Al Mal. The Lebanese bank announced plans to exit the country in January amid financial turmoil in its home country. On-again-off-again talks with First Abu Dhabi Bank — which began earlier this year before being temporarily shelved due to covid-19 — were revived last week.

Egypt in the News

It’s a quiet morning in the pages of the foreign press: Four policemen have been detained pending investigations into the death of a 26-year-old man in custody earlier this month, the Associated Press reports. The man was pronounced dead due to heart failure a day after his arrest. Prosecutors have ordered a forensic examination to confirm the cause of death. A journalist for a local news site who reported on the death was separately arrested on charges of spreading false news.

Diplomacy + Foreign Trade

Topping diplomatic coverage this morning: The Kenyan government will move to impose a 25% customs duty on some Egyptian exports in violation of the Comesa trade agreement, which it says it will no longer abide by, Hapi Journal reports, citing unnamed sources familiar with the matter. Egypt’s Trade and Industry Ministry is asking the prime minister’s office to send a delegation to Kenya to address the issue. The ministry will also be holding an emergency session with the Federation of Egyptian Industries to discuss the matter.

Egypt could impose retaliatory measures on Kenya, which would only serve to harm the two countries’ trade relations, House Industry Committee chief and Faragalla Group head Rep. Mohamed Farag Amer told Hapi Journal. Amer — who has business interests in Kenya — urged the government to pursue negotiations instead.

Foreign Minister Sameh Shoukry held a meeting with his Armenian counterpart Foreign Minister Zohrab Mnatsakanyan, the Foreign Ministry said in a statement (watch, runtime: 24:34). Shoukry used the occasion to reiterate that Egypt’s threat to intervene in Libya is designed to bring stability to the country and work towards a political solution.

The education system’s post-covid prospects: An interview with the World Bank’s Amira Kazem. Over the 10 or so months since we debuted our weekly vertical focused on the education sector, the covid-19 pandemic has occupied a sizable chunk of our coverage. And unsurprisingly so: the past six months have seen the country’s education system undergo a once-in-a-lifetime shock. With the nation’s schools shuttered, mns of children had to adjust to a life of virtual learning almost overnight. The Education Ministry now faces the unenviable task of trying to recalibrate the education system in a way that both ends the months of disruption to the learning process and prevents a resurgence of the virus.

To find out more about how the pandemic will change the education system over the long term, we spoke to Amira Kazem, a senior operations officer working on the World Bank’s education projects in Egypt, who told us how the bank has responded to the crisis and what she sees lying ahead. A human development economist, Amira has worked at the World Bank since 1998 on education projects, specializing in skills development, basic and tertiary education.

The key takeaways:

- WB education funding isn’t likely to be affected by the pandemic;

- The digital divide is widening faster than ever before…

- …but the rapid integration of technology into the education system may provide a way out;

- In-class learning will remain vital even as online education becomes a mainstay;

- The private sector needs to engage more as a key stakeholder for Egypt’s reforms to succeed.

Edited excerpts of our conversation:

Education has been a core part of the bank’s response to the pandemic: The WB has mobilized several types of support in response to the covid-19 crisis. Although much of the emergency operations that support countries’ responses to the crisis were focused on health, they also included education. The Bank provided an initial assessment of the disruption to education due to the pandemic. In addition, and jointly with Unicef, UNESCO and the World Food Programme, the WB developed a framework to guide the reopening of schools. The decision on whether to reopen schools is a difficult one, and you need to balance between containing the virus and the need to resume the education. Once the decision is taken, many protocols and conditions are needed for a safe return and the right learning conditions.

The pandemic isn’t likely to hit WB education funding in Egypt: We do not expect a delay or redirection of the agreed funding at this point. The team is in discussions with the Education Ministry to explore changes to the USD 500 mn Supporting Egypt Education Results project (below) that would better serve its response to the pandemic and its plans to reopen schools. Beyond that, future funding hasn’t been discussed and we are continuing to focus on the existing project.

In comparison to the other countries, the disruption to learning in Egypt has been relatively minor — in part thanks to the ministry's response: We recognize the ministry’s quick response to the pandemic. It created and rolled-out digital content to all grades through the Egyptian Knowledge Bank and live streaming, as well as a new digital platform for virtual classrooms in public schools and national distance education TV channels for those with no access to digital devices. Assessments and exams were also adapted to the changing conditions for primary 3-6 and preparatory 1-3 using multidisciplinary research for next grade promotion; and for secondary 1 and 2, students undertook the computer-based tests from home.

Egypt’s education reform program established the connectivity, e-learning material, and computer-based assessment system which was unique in the MENA region (outside of the GCC). Egypt is one of the least-affected MENA countries in terms of disruption to learning, but it is still affected substantially and more is still needed.

Covid is accelerating the digital divide — and a positive cultural shift: The pandemic has provided more evidence that the digital divide must be closed, but has provided an opening to do it faster. The crisis has provided a context to innovate and to accelerate and expand the use of technology in Egypt’s education system. It has led to a tremendous cultural shift, moving from resistance to an appreciation and quest for the use of technological solutions.

Equally important is the change in the culture of learning and testing. In Egypt, the crisis and experience with project-based grading changed the thinking among teachers and parents about learning and testing, moving away from rote learning and subject matter exams to more holistic and social approaches.

The teachers’ role is critical, and they need training to use technology and engage with students in a more up-to-date manner. For countries like Egypt that are moving away from teaching through memorization, remote, in-service and pre-service training to teachers are crucial. Multiple channels should be used to keep parents and communities at large informed and engaged in the changes to how we educate.

Online education is here to stay but in-class learning will remain vital: Online education will be a mainstay in the education system in the future, but it will not replace the crucial role of the teacher and the classroom. The covid situation continues to be uncertain. Still, nothing can replace the rich social experience of being in school, and nothing yet can replace in-person presence, particularly for preschool and primary education students. Thus, online education is part of the mitigation measures that have been set up as a response to the pandemic. Remote learning (as compared to online learning) is likely to take a greater share as we move towards the new normal, in terms of online learning, and educational TV and radio for students that do not have access to digital devices.

Covid-19 might have helped the ministry accelerate public acceptance of technology, including changing parents’ perceptions and teachers’ skills. In the next academic year, the ministry may adopt a blended learning approach, and will work on expanding the available hardware, resources, and platforms to over 20 mn students.

The private sector needs to engage more as a key stakeholder: The private sector is ultimately the first beneficiary of an improved public education system and the first victim of an unreformed school system. With that in mind, employers and the private sector would be most encouraged to engage much more as a key stakeholder and be ready to invest money into public education — and not just private education. Nowadays, you can see inspiring models where the private sector is engaged in technological schools under technical education. You also find private publishers contributing to the Egyptian Knowledge Bank. The international experience has a wealth of examples of ways to involve the private sector in summer internships, career guidance, training of instructors, work-based training and many others that can improve the school-to-work transition.

Assisting education reforms: In September 2018, Egypt embarked on a major education reform program. The aim of the national sector reform is to “bring learning back to the classroom” and equip students with skills that prepare them for life as well as for the labor market. This program targets 22 mn students, 1.3 mn teachers and 50k public schools, and focuses on promoting the foundations of learning towards the skills that matter to the citizens and workers of the 21st century.

The World Bank’s USD 500 mn “Supporting Egypt Education Reform Project” supports this home-grown reform and specifically a set of agreed key results, which are a subset of the national reform program. It supports increasing access to quality early childhood education and enhancing the capacity of teachers, school leaders and supervisors. The project helps to catalyze the use of digital resources for teaching and learning, and the introduction of a new computer-based examination system that regulates secondary graduation and admission to universities.

Like all other WB-funded projects, this initiative is being implemented by the government. Being a results-based project, the WB provides implementation support and authorizes disbursement once the agreed results are achieved and verified by a third party. This means that the ministry assumes a leading role in engaging international and local private sector firms to support reform and project implementation.

The WB team also provides technical support to a number of areas that are first agreed with the ministry. This could be in terms of providing capacity building or providing feedback to draft documents. For example, the WB — with additional financial support from the UK Embassy in Cairo — supports the development of a diagnostics study for kindergarten where the bank team develops the research design, sampling, training of enumerators, and data analysis, while the project funds and manages the actual data collection activities.

Your top education stories of the week:

- School committees to enforce precautionary measures: Schools across the country will have new committees to ensure social distancing and other precautionary measures are implemented once classes are back in session, Education Minister Tarek Shawki said at a presser on Thursday.

- School covid guidelines released: The Education Ministry’s guidelines for reopening schools will see blended learning for K-9 and high school fully online but precise schedules ultimately remain up to individual school administrators.

- Thanaweya Amma is changing: The standardized Thanaweya Amma exam will be amended and electronically administered this year with a shift away from a test focused on memorization to one that places more emphasis on comprehension.

- Mandarin lessons are coming to Egyptian high schools: The Education Ministry and China’s Confucius Institute have signed an MoU to teach Mandarin as a second language in Egyptian high schools, a ministry statement said on Monday. Confucius Institute programs have proven controversial in Canada, where at least three education systems (in Toronto, Manitoba and New Brunswick) are scrapping agreements that deliver (or would have delivered) a Chinese culture and language program in schools amid complaints the programs — funded by the Chinese government — were delivering pro-Beijing messages or stifling discussion of “off-limits” topics.

- CIRA kicks off Badr Uni construction: CIRA began construction work for the first phase of its flagship Badr University in Assiut on Thursday.

- Cabinet green-lights new unis: Two non-profit universities — one in Al Saleheya Al Gadida and another in Sharm El Sheikh — as well as a medical research institute in Assiut, and two new faculties in Fayoum and New Valley universities received cabinet approval earlier this week.

The Market Yesterday

EGP / USD CBE market average: Buy 15.70 | Sell 15.80

EGP / USD at CIB: Buy 15.70 | Sell 15.80

EGP / USD at NBE: Buy 15.72 | Sell 15.82

EGX30 (Sunday): 11,092 (+0.2%)

Turnover: EGP 950 mn (15% below the 90-day average)

EGX 30 year-to-date: -20.6%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.2%. CIB, the index’s heaviest constituent, ended up 0.4%. EGX30’s top performing constituents were Cleopatra Hospital up 4.3%, Ezz Steel up 3.7%, and Orascom Construction up 3.7%. Yesterday’s worst performing stocks were Telecom Egypt down 5.8%, Ibnsina Pharma down 0.9% and Orascom Development Egypt down 0.9%. The market turnover was EGP 950 mn, and local investors were the sole net sellers.

Foreigners: Net long | EGP +34.8 mn

Regional: Net long | EGP +22.3 mn

Domestic: Net short | EGP -57.1 mn

Retail: 85.3% of total trades | 85.2% of buyers | 85.4% of sellers

Institutions: 14.7% of total trades | 14.8% of buyers | 14.6% of sellers

WTI: USD 37.33 (+0.08%)

Brent: USD 39.83 (-0.57%)

Natural Gas: (Nymex, futures prices) USD 2.27 MMBtu, (-2.32%, October contract)

Gold: USD 1,947.90 / troy ounce (-0.83%)

TASI: 8,203 (+0.84%) (YTD: -2.21%)

ADX: 4,510 (-0.20%) (YTD: -11.15%)

DFM: 2,274 (+0.17%) (YTD: -17.74%)

KSE Premier Market: 5,854 (+0.32%)

QE: 9,878 (+1.17%) (YTD: -5.25%)

MSM: 3,691 (+0.15%) (YTD: -7.27%)

BB: 1,398 (+0.63%) (YTD: -13.15%)

Calendar

September: The Egyptian Federation for Securities will hold elections for its board of directors after they were postponed in March due to the lockdown.

September: The General Authority for Investment (GAFI) will host a virtual meeting with the Arab-German Chamber of Commerce and Industry and some 120 German companies to discuss investment prospects in Egypt.

14 September (Monday): Postponed EU-China summit in Leipzig to be held as a video conference, focused on trade.

14-15 September (Monday-Tuesday): The Chemical Industries Export Council will organize a virtual conference to discuss export options for Egyptian chemical exporters in Kenya and Uganda.

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

Mid-September: Proposed time slot for UAE-Israel normalization agreement signing ceremony which will be held in Washington, US.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

16 September (Wednesday): The last day for the final results of the senate elections to be announced.

17 September (Thursday): OPEC and its allies will meet to assess whether their recent vast oil production cuts have saved the market from the global glut.

20 September (Sunday): A Cairo administrative court is due to issue a ruling in a third-party lawsuit demanding the government block YouTube in Egypt for carrying an allegedly sacreligious video. The case is an infamous 2012-vintage lawsuit still wending its way through the courts.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24-25 September (Thursday-Friday): The European Union will discuss imposing sanctions on Turkey to limit the country’s ability to expand its search for oil and gas in contested eastern Mediterranean waters.

27 September (Sunday): Former Finance Minister Youssef Boutros Ghali to be retried on charges he squandered public funds in a case related to the printing of coupons for butane canisters.

28 September-3 October (Monday-Saturday): CIB PSA World Tour Finals, Cairo, Egypt.

End of September: Last chance to settle building code violations for illegal buildings.

1 October (Thursday): House of Representatives reconvenes for its sixth and final legislative session before elections for the house later in October or November.

4 October (Sunday): Senate convenes for its first session.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities.

21-23 October (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

24-25 October (Saturday – Sunday) Polls open for first round of Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

November: An Egyptian-Russian ministerial committee will meet to discuss trade and investment in Moscow.

2 November: Former Civil Aviation Minister Ahmed Shafik faces retrial at Cairo Court of Appeals in the so-called Aviation Ministry corruption case.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

4-6 November (Wednesday-Friday): Polls open to international voters for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

4-7 November (Wednesday-Saturday): Cityscape Egypt Expo, International Exhibition Center, Cairo

7-8 November (Saturday-Sunday): Polls open for first round of Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15 November (Sunday): Egyptian Tax Authority’s online intro seminar on new electronic invoice system for first tranche of companies transitioning to e-filing program.

23-24 November (Monday-Tuesday): Reruns for Parliamentary elections in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

30 November (Monday): Final results will be announced for Parliamentary elections held in Giza, Fayoum, Beni Suef, Minya, Assiut, New Valley, Sohag, Qena, Luxor, Aswan, Red Sea, Alexandria, Beheira, Matrouh.

1 December (Tuesday): The IMF will conduct a first review of targets set under the USD 5.2 bn standby loan approved in June (proposed date).

7-8 December (Monday-Tuesday): Reruns for Parliamentary elections in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

14 December (Monday): Final results will be announced for Parliamentary elections held in Cairo, Qalyubia, Menofia, Gharbia, Kafr El Sheikh, Sharqia, Damietta, Port Said, Ismailia, Suez, North Sinai and South Sinai.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

13-31 January (Wednesday-Sunday): Egypt will host the 2021 Men’s Handball World Championship at the Giza Pyramids

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

26-28 January (Tuesday-Thursday): Future Investment Initiative, Riyadh, Saudi Arabia

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May 2021 (Monday): Sham El Nessim.

6 May 2021 (Thursday): National holiday in observance of Sham El Nessim.

12-15 May 2021 (Wednesday-Saturday): Eid El Fitr (TBC).

31 May-2 June 2021 (Monday-Wednesday): Egypt Petroleum Show, Egypt International Exhibition Center, Nasr City, Cairo.

1 June 2021 (Tuesday): The IMF will conduct a second review of targets set under the USD 5.2 bn standby loan approved in June 2020 (proposed date).

10 June 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

26-29 June 2021 (Saturday-Tuesday): The Big 5 Construct Egypt, Cairo International Convention Center

22 July 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

30 July-3 August 2021 (Thursday-Monday): Eid Al Adha, national holiday (TBC).

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.