- HSBC sees the Egyptian economy growing at a 2.5-3% clip in FY2020-2021. (Speed Round)

- Give us 3-4 months to prepare for natgas transition, auto firms tell the Trade Ministry. (Speed Round)

- Speed Medical’s acquisition of City Labs will wrap by the end of the year. (Speed Round)

- Cairo-based startup Glamera raises six-figure USD investment from Saudi’s Dual Gate Investment. (Speed Round)

- Good news if you’re looking to integrate your company into the global supply chain — a “reordering” of the system could open up new windows. (The Macro Picture)

- Sudan is boycotting today’s GERD talks — will Egypt follow suit? (Diplomacy + Foreign Trade)

- Education stocks have weathered the covid-19 storm in equity markets that has dragged down other industries. (Blackboard)

- Hospitals in Egypt are gearing up for an anticipated second wave of covid-19 infections. (What We’re Tracking Today)

- The Market Yesterday

Monday, 10 August 2020

Hospitals gird for potential second wave of covid-19 infections

TL;DR

What We’re Tracking Today

Happy Monday morning, friends. The big stories in a slow “peak summer” week here in Egypt: Interest rates, foundering talks with Ethiopia and another return to the polls.

Egyptians abroad: Today is the last day you can vote in the Senate elections. The polls opened for expats yesterday and will close tonight. Voters here at home head to the ballot box tomorrow and Wednesday. Voters will elect 200 of the 300 members of chamber; the remaining 100 are appointed by presidential order. This is the first-ever election for the newly reconstituted upper house of parliament, which replaces the disbanded Shura Council.

What does a senate do, anyway? Among other things, the upper house of our soon-to-be bicameral parliament will be called to weigh in on the government’s economic and social policies in general and to ratify international treaties. Senators may also be asked to comment on any future constitutional amendments and any other policy issues the president sends its way. One key here is the word “opinion,” namely that the Senate will “give its opinion on these matters” to the presidency and to the speaker of the House of Representatives.

GERD talks could resume today … with Ethiopia talking to itself. Negotiations over the filling and operation of the Grand Ethiopian Renaissance Dam are supposed to restart today, but Egypt and Sudan have both suggested they may boycott them over Ethiopian intransigence. We have more in this morning’s Diplomacy + Foreign Trade, below.

The Central Bank of Egypt will meet to review interest rates on Thursday. The CBE is poised to leave rates on hold, Bloomberg suggests, noting that we offer “one of the world’s highest inflation-adjusted interest rates” that have “made the nation [attractive] to carry-trade investors again. Rates in Egypt are on par with Malaysia’s at the head of the list of 50 major economies the business information service tracks.

Inflation data for July is due out today. Annual urban inflation ticked up to 5.6% in June after hitting six-month lows in May.

RiseUp is holding a three-day digital conference starting Thursday: RiseUp from Home will bring together regional entrepreneurs for its first event since the onset of the pandemic and feature talks from some regional entrepreneurs, investors and business experts.

What will the upcoming year look like for public schools and universities? We’ll get a better idea on 20 August. That’s when the ministers of education and higher education are set to present a comprehensive plan to Prime Minister Moustafa Madbouly, according to a cabinet statement. Some form of blended learning is on the menu for the nation’s educational institutions, which will see students divided into smaller groups for the in-person portion of their classes, and will rely on the government’s remote learning platforms for homework, assignments, and tests.

The blended learning model could be here to stay, even when the covid-19 pandemic abates, the statement suggests. Details on the government’s plans moving forward are still scant, but the statement suggests the ministers are looking at how to use the model in the long term. We’ve delved into the transition to blended learning, including what schools and parents think of online education, Blackboard, our weekly deep dive into the education industry.

Starting a new company is an act of optimism — one Egyptians repeated 2,209 times in July. GAFI registered 2,209 new companies last month — an uptick of 2.2% year-on-year and the second month in a row of y-o-y increases after new company formation plunged in April under lockdown measures in place to stem the spread of covid-19.

Qalaa Holdings announced three recipients of full scholarships to pursue graduate studies at top universities in a “limited” edition of the annual program, according to a statement (pdf). The largest private-sector scholarship program, which has been going strong for 14 years, typically awards scholarships to 15-20 recipients each year. However, the Qalaa Holdings Scholarship Foundation elected to limit the number of recipients in its fourteenth class due to disruptions from the pandemic, including restrictions on travel and online learning. This year’s winners will study finance, psychology and law at top universities in the United Kingdom.

THE LATEST ON COVID-19-

The Health Ministry reported 178 new covid-19 infections yesterday — the fifth consecutive day of rising single-day case numbers after the country hit a 15-week low on 4 August. The ministry also confirmed 17 new deaths from covid-19 yesterday, bringing the country’s total death toll to 5,009. Egypt has now disclosed a total of 95,492 confirmed cases of covid-19.

Hospitals in Egypt are gearing up for an anticipated second wave of covid-19 infections and are re-opening isolation facilities following a directive from Health Minister Hala Zayed, according to the head of Matrouh’s Al Negila Hospital, Mohamed Taleb. The hospital was Egypt’s first isolation facility when the pandemic broke out. Taleb told Masaa DMC’s Eman El Hosary last night that while case counts have been decreasing over the past month, the hospital has begun admitting new cases over the past three days (watch, runtime: 3:08).

Hotels didn’t have a great Eid: Hotel occupancy rates during the Eid break ranged between 25-30%, as fears of covid-19 and the uncertain economic situation continue to weigh on the sector, deputy head of the Hotel Establishment Chamber Hisham Al Shaer said, according to the local press. Things haven’t looked much better for hotels in the first week of August either, with occupancy rates in the Red Sea, South Sinai, and Matrouh governorates ranging between 20-30%. Hotels that have obtained health and safety certificates are allowed to operate at a maximum 50% capacity.

USAID has donated 250 ventilators to hospitals in Egypt under a cooperation framework with multilateral and bilateral development institutions launched in April by the International Cooperation Ministry, Minister Rania Al Mashat was quoted as saying by MENA.

Covid-19 vaccines may be only 75% effective: White House covid-19 advisor Anthony Fauci said the chances of having a highly effective vaccine — one that offers a minimum of 98% protection — are slim, according to CNBC. Scientists are instead hoping for a vaccine that is at least 75% effective while 50% or 60% would also be acceptable. The US Food and Drug Administration (FDA) said it would approve any vaccine that is at least 50% effective.

Lebanese gov’t resignations are beginning to roll in as anger mounts over explosion: Lebanese Information Minister Manal Abdel Samad and Environment Minister Damianos Kattar have resigned amid nationwide protests against the government’s failure to prevent last week’s deadly explosion in Beirut, state television announced, according to Bloomberg. Protestors demanding a regime change clashed yesterday with police as they broke into the housing and transport ministry offices. On Saturday, they briefly occupied the foreign, economy, and energy ministries.

Lebanon isn’t the only country in the region whose government is coming under pressure: Thousands of people protested outside Israeli PM Benjamin Netanyahu’s house on Saturday demanding that he resign over corruption allegations and for his response to the pandemic, Reuters reports.

Aramco sticks to its guns on dividend payouts: Saudi Aramco remains committed to paying out USD 75 bn in dividends this year despite dwindling profits and mounting debt after a tumultuous year for the company, Bloomberg reports. The state-owned oil producer said net income crashed 73% in the second quarter due to the collapse in oil prices in April. At the same time, the company’s debt has surged, due largely to the USD 70 bn loan taken from the country’s sovereign wealth fund to take a 70% stake in chemicals company SABIC from the Public Investment Fund.

Israel’s Leviathan field could be transformed into a global gas supplier with the entry of Chevron as a stakeholder through its acquisition of Noble Energy, Delek Drilling CEO Yossi Abu said, according to Reuters. Chevron will “bring a significant LNG capability” to the concession, Abu said. The Houston-based energy group had last month announced its plan to acquire Noble, which controls the Leviathan natural gas field alongside Delek. For those of you keeping track at home — Noble and Delek are the two companies that had signed a landmark USD 15 bn agreement to export natural gas to Egypt from the field.

Asia, Africa and Latin America saw deforestation accelerating 77% since the start of the pandemic in comparison to 2017-2019 average rates, as many people unable to go to work began to chop down trees for crop production and the sale of wood, according to Global Land Analysis and Discovery data picked up by the Financial Times. Satellites detecting a loss of tree cover showed a sharp uptick in deforestation in Africa and Asia during the first half of the year, especially April and May.

Netflix released its first look images of Egypt’s first Arabic original series on the streaming platform, “Paranormal,” an adaptation of the novel by late author Ahmed Khaled Tawfik. The show follows Dr. Refaat Ismail (Ahmed Amin) and his colleague Maggie Mckillop (Razane Jammal) who experience a series of paranormal incidents and try to save their loved ones from danger. The series is written, produced, and directed by Amr Salama, with Mohamed Hefzy as executive producer. Paranormal is slated for a Fall 2020 release.

Instagram has launched its wholly original app Reels in Egypt, the company said in a statement (pdf) yesterday. Totally not taking its cue from another wildly popular social media app, Reels allows users to take short video clips, set them to music and share them with friends.

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: We revisit the education services sector’s performance on the EGX since the outset of the covid-19 pandemic. The sector has proven itself as a defensive sector, outperforming the broader stock market in the past five months.

Enterprise+: Last Night’s Talk Shows

The latest developments in Lebanon and Egypt’s Senate elections were the main talking points on the airwaves last night.

A donor conference for Lebanon yesterday organized by French President Emmanuel Macron was of particular interest to Ala Mas’ouleety’s Ahmed Moussa (watch, runtime: 6:43) and Masaa DMC’s Eman El Hosary (watch, runtime: 1: 07), who gave viewers a rundown of the key outcomes. International donors pledged EUR 250 mn in emergency aid at the conference. Damage to Beirut in last week’s explosion is more likely in the USD 15 bn range.

The Arab League cannot carry out an independent investigation into the Beirut explosion, but can work with any relevant Arab bodies that decide to probe the incident, Assistant Secretary General Hossam Zaki explained to Moussa (watch, runtime: 15:45).

Closer to home, Immigration Minister Nabila Makram explained how Egyptians living abroad can vote in the Senate elections. The polls close for expats today, and voters living here in Egypt will be able to cast their votes tomorrow and Wednesday (watch, runtime: 9:00).

Electricity Act amendments also got some airtime: Moussa had a chat with House Legislative Committee deputy head Ehab El Tamawi to explain the proposed amendments to the Electricity Act, which we cover in this morning’s Speed Round, below (watch, runtime: 19:09). Electricity Minister spokesman Ayman Hamza also phoned in to Moussa’s show to discuss the bill and the ministry’s plans to improve the quality of service of distribution companies (watch, runtime: 17:01).

Speed Round

HSBC sees the Egyptian economy growing at a 2.5-3% clip in FY2020-2021 as strong economic fundamentals help the country weather the worst of the economic fallout caused by the covid-19 pandemic, according to a research note picked up by the local press. Growth will remain weak for the remainder of 2020, but the outlook over the next 18 months remains positive, with output likely picking up in 2021, the bank said. HSBC’s forecast is significantly below the Finance Ministry’s estimate, which sees GDP growing at a 5% clip this fiscal year.

Egypt’s success at securing international funding and attracting bond investors underlines the country’s economic stability, analysts wrote. The country has obtained USD 8 bn in loans from the IMF and a USD 50 mn facility from the World Bank to help it cope with the effects of the pandemic, while its USD 5 bn eurobond issuance in May was well received by foreign investors.

HSBC sees the budget deficit widening to 9% of GDP by the end of the current fiscal year from 7.8% last year, almost reversing two years’ of progress that saw the deficit narrow from 9.8% in FY2017-2018. The government currently expects the deficit to narrow further to 6.3% this year.

Pressure on Egypt’s key sources of hard currency will continue: Suez Canal revenues will remain weak amid a slowdown in global trade while the tourism sector will take time to recover from the suspension of international travel earlier in the year. Remittance flows will depend to a large extent on the trajectory of the Gulf economies. Recessions in countries with large Egyptian workforces could reduce demand for Egyptian labor as governments look to provide jobs for the local populations.

Give us 3-4 months to prepare for natgas transition, auto firms tell Trade Ministry: Toyota, Al Amal, and Modern Motors are among a group of auto firms that have requested that the Trade Ministry give them 3-4 months to prepare for the government’s dual-fuel engine transition plan, said Al Amal CEO and Automobile Manufacturers Association board member Amr Soliman, according to Al Mal. The firms told ministry representatives in a meeting that they require more time to prepare technical know-how for the initiative and finalize supply agreements for imported car parts needed to outfit cars with dual-fuel engines. Al Amal is currently in talks with Chinese auto firm King Long for a supply agreement that would see the company provide the necessary components, Soliman said.

Take a deep dive into the story with our three-part series in Hardhat on what it will take to convert or replace the nation’s fleet of cars with dual-fuel vehicles: part 1, part 2 and part 3.

Background: The Sisi administration earlier this year announced a multi-year plan to convert or replace 1.8 mn cars to run on both gasoline and natural gas. Owners of vehicles over 20 years old will receive low-interest loans through the MSME Development Agency to purchase new dual-fuel vehicles, while those with younger vehicles will be able to access zero-interest finance to outfit them with new engines. President Abdel Fattah El Sisi said that car licenses will be conditioned on citizens complying with the program and converting their vehicles.

M&A WATCH- Speed Medical to acquire City Labs by the end of the year: Speed Medical (SPMD) will wrap up its acquisition of a 100% stake in City Labs by the end of 2020, CEO Mahmoud Lasheen told the local press. The company is aiming to finish the due diligence process by the end of 3Q2020 with an eye to complete the takeover by the end of the year, he said.

Background: Speed Medical first announced in June that it had entered acquisition talks with City Labs. The two currently operate 23 medical labs in Port Said, Suez, Ismailia, Damietta, Mansoura and Port Fuad through CitySpeed, a joint venture set up in 2018. The company said it would finalize the transaction after completing a EGP 220 mn capital increase, one of two increases that it hopes will allow it to make the leap from the small-cap NileX to the EGX.

SPMD will also open seven new medical labs in Alexandria next month worth some EGP 12 mn as part of the company’s expansion strategy kicked off late last year, Lasheen said. The company expects to have 30 new outlets under its belt by the end of the year through acquisitions and opening new branches, he said. This would take the company’s branch count to 100, he added.

M&A WATCH- Media Production City increases holdings in Arab Hotel Company: State-owned Egyptian Media Production City (EMPC) has acquired a 97.55% stake in the Arab Hotel Company, by purchasing the shares of five other entities, the company said in an EGX filing (pdf). EMPC bought out other state-owned entities including National Bank of Egypt, Banque Misr, Misr Insurance, Misr Life Insurance, and Arab Contractors. The filing did not disclose the value of the transaction. EMPC’s board had greenlit talks to acquire the Arab Hotel Company from Arab Contractors in July of last year. The company last bought 67% of Arab Contractors’ stake in the hotel last month.

Eight companies have received licenses to provide non-banking financial services this year from the Financial Regulatory Authority (FRA), according to a FRA statement (pdf). These include four companies focused on securities issuances, one venture capital firm, one brokerage firm, one company focused on fund management, and one asset management holding company.

LEGISLATION WATCH- Tougher penalties for stealing electricity, failure to provide services under new legislative amendments: The House Legislative Committee approved changes to the Electricity Act designed to crack down on electricity company employees who either illegally provide connections to the power grid or refuse to install electricity connections, Al Shorouk reports. The changes would impose fines of EGP 10k-100k and prison sentences of at least six months on officials who aid in electricity theft, provide electricity-related services without a valid legal reason, or knowingly fail to notify authorities of such violations. Fines of EGP 20-100k or prison sentences of up to one year would also be imposed on officials who, for any illegitimate reason, refuse to provide electricity installations to entitled parties. The proposed amendments will now be passed on to the House general assembly for a final vote.

Also approved by a House committee yesterday: Changes to the Universities Act to allow the Higher Education Ministry to alter the teaching system when exceptional circumstances arise — such as the covid-19 pandemic.

STARTUP WATCH- Cairo-based beauty services startup Glamera has raised a six-figure USD investment from Saudi’s Dual Gate Investment Holding, according to an emailed statement (pdf). The platform did not disclose the exact size of the investment, which came a little less than one year after raising USD 250k in a seed funding round from an unnamed Saudi-based angel investor. Glamera plans to use the funding to roll out its services in Riyadh and Jeddah, after expanding earlier to Saudi Arabia and Iraq. The app allows users to book appointments and sessions at beauty salons, clinics, spas, and gyms.

EARNINGS WATCH- Emaar Misr recorded a net profit of EGP 366 mn 2Q2020, up from a net loss of EGP 324 mn in the same period last year, according to the company’s quarterly financial statements (pdf). This came despite revenue falling 13% to EGP 771 mn during the quarter. Net profit for 1H2020 surged to EGP 582 mn from EGP 94.3 mn in the same period last year, despite revenues dropping to EGP 1 bn from EGP 1.46 bn.

*** WE’RE HIRING: We’re looking for smart and talented people to join our team at Enterprise, which produces the newsletter you’re reading right now and Making It, our very first podcast. We offer the chance to work in a unique and casual work environment that promises to be intellectually challenging and rewarding. Enterprise is currently in the market for:

- A senior editorial leader, who will work on this product and help launch new products.

- A seasoned reporter to join our team and create stories and packages that fascinate and inform our readers.

Interested in applying? To apply for the editor / reporter positions, please submit your CV along with 2-3 writing samples and a solid cover letter telling us a bit about who you are and why you’re a good fit for our team. The CV is nice, but we’re much more interested in your clips and cover letter. Please submit all applications to jobs@enterprisemea.com.

The Macro Picture

Good news if you’re looking to integrate your company into the global supply chain — a “reordering” of the system could open up new windows: More than a quarter of global product procurement could shift to new countries over the next five years, a new study by McKinsey Global Institute shows. Products worth up to USD 4.6 tn are at stake due to cost considerations and state pressure on manufacturers to become more self-reliant, the research arm of the global consulting firm said in a report. The findings highlight the pandemic-induced shift from long supply chains to “resilience and regionalization,” which were building [up even] before the pandemic hit, says the Financial Times.

The need for resilience: According to MGI’s report, companies can expect a major disruption to their supply chains every 3.7 years, leading to a loss of over 40% of a year’s worth of profits every decade. This is a result of trade tensions, cyber threats, and environmental risk subjecting businesses to “costly interruptions,” said MGI partner Susan Lund.

The take-home lesson: Diversify and keep it in your neighborhood. Companies need to have options and also bring their supply chains closer to home, Lund said. “You can invest in supply chain resilience and still come out ahead.”

Analysts are split on whether we’re going to see a reversal of globalization. Although Boston Consulting Group recently said that US-China trade could shrink by up to 15% from 2019 levels come 2023, S&P Global Ratings analysts say US companies may still be hesitant to lose access to the world’s second-largest economy (and largest manufacturing hub). Many in the US have, however, admitted that their supply chains are becoming overdrawn and complex, Lund said. On the flipside, markets sage Mohamed El Erian had said back in May that we’re entering an era of deglobalization, which will be driven largely by changing company behavior. Businesses will move away from relying on “just-in-time” models as resilience and sustainability become watchwords. That means they will begin localizing supply chains, and that also means there will be an increased intertwining of the public and private sectors in developed markets.

Want more? Go read The great trade unwinding, by the FT’s Rana Foroohar for how this fits into the “dramatic” change we’re about to see in global commerce patterns.

Egypt in the News

It’s a very quiet news day for Egypt in the international press, with the most widely picked-up news being an Associated Press report that nine people died in a Banha car crash. The accident was reportedly caused by speeding.

Worth Watching

How much will Egyptian customers be tipping these robot waiters? Mozo the robot is waiting tables at Kimbo, an Egyptian restaurant, taking orders and delivering food to customers who are wary of interacting with human waiters during the covid-19 pandemic, this Reuters video shows (watch, runtime: 01:19).

Diplomacy + Foreign Trade

Sudan says it’s boycotting new GERD talks over Ethiopian unilateralism — will Egypt follow suit? Sudan will not attend a new round of talks over the Grand Ethiopian Renaissance Dam (GERD) slated for today, citing Ethiopia’s refusal to commit to a filling timetable for the dam’s reservoir, one of the key sticking points, Al Arabiya reports, citing an unnamed government source. As of yesterday, Egypt had not yet formally announced whether it would attend today’s talks, Al Shorouk reports, citing an unnamed official source. The source stressed that Egypt’s position remains unchanged and that Ethiopia was not committing to past agreements. Ethiopian Foreign Ministry spokesman Dina Mufti had said on Friday that Addis Ababa would not sign an agreement that allocates specific Nile water shares to countries downstream of the GERD. The last round of African-Union sponsored talks between Egypt, Ethiopia and Sudan ended in mid-July without the sides reaching an agreement.

ElSewedy subsidiary signs USD 38.6 mn contract to build energy substation in DR Congo: ElSewedy Electric for Transmission and Distribution of Energy — a subsidiary of ElSewedy Electric — signed a USD 38.6 mn contract with DR Congo’s Societe Nationale d'Electricite to build a high-voltage distribution substation in Kasumbalesa City, according to a disclosure (pdf). The project will connect DR Congo’s electricity grid with the Southern Africa Power Pool, as well as increase the province’s electricity supply.

The Egyptian Cotton Exporters Union signed contracts worth USD 154 mn since the beginning of the season last September, union member Nabil El Sentrisi told Al Mal. The union expects around 10% of the export contracts to be canceled as the pandemic weighs on global markets.

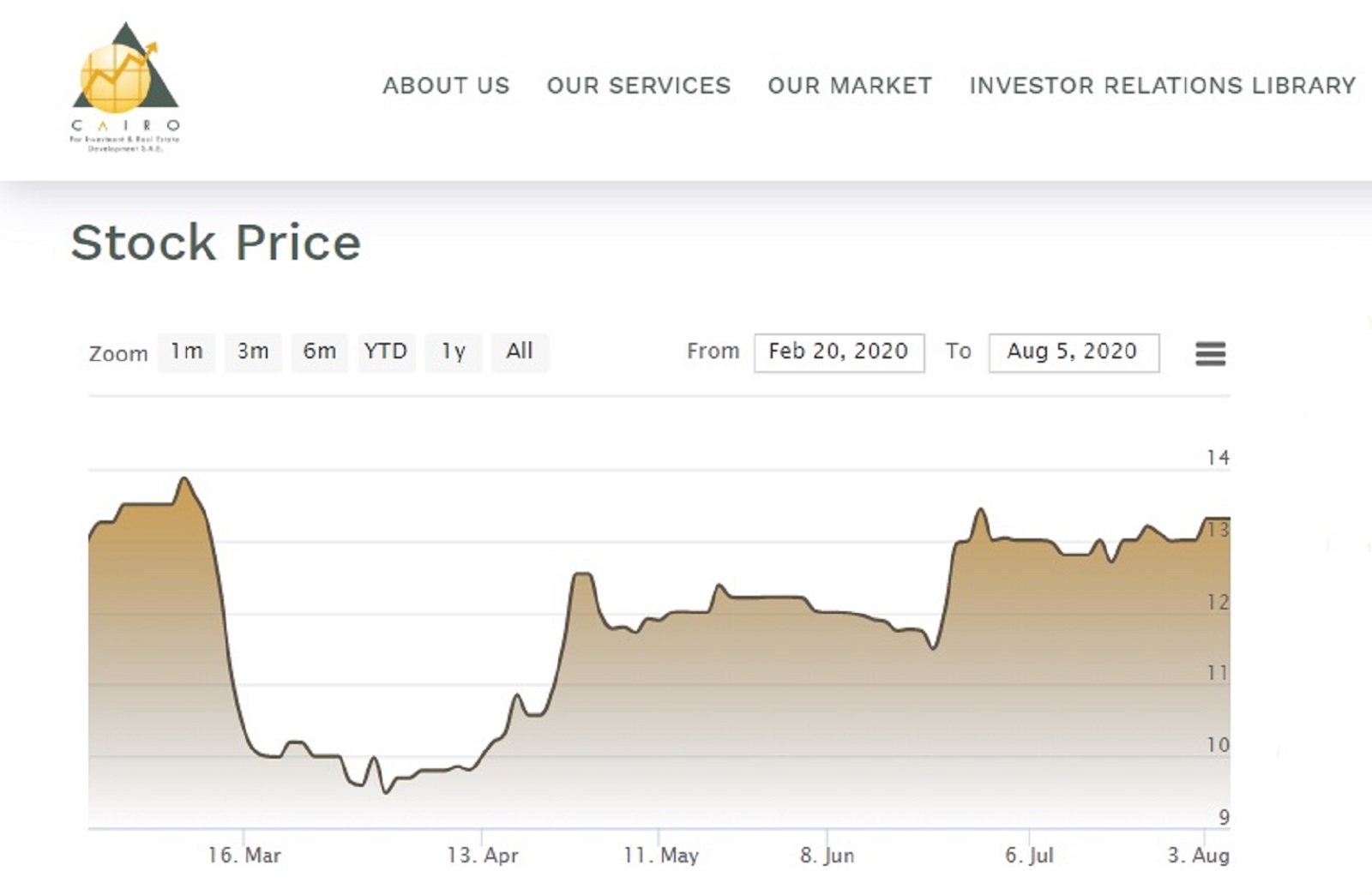

Education stocks have weathered the covid-19 storm in equity markets that has dragged down other industries, underscoring its position as a defensive sector even in the face of a global pandemic. The industry’s performance over the past five months confirms the hypothesis we put out in March that it was on track to be resilient. At the time, the EGX was in decline, but education was falling at just half the rate of the broader market.

Which education companies are listed on the EGX? CIRA, which operates K-12 schools Mavericks and Futures, as well as Badr University, is the sector heavyweight. There are also two other companies that are listed under the EGX’s education services industry: Cairo for Educational Services — a subsidiary of CIRA — and Suez Canal Company for Technology Settling (SCTS), which owns and operates the Sixth of October University.

As a whole, equity markets saw a steep sell-off in March, but traditional defensive plays, including education, were not hit as severely, Pharos Holding equities analyst Diyar Hozaien explained to Enterprise. “Education proved in this crisis that it is indeed a very resilient sector. It’s just not a service that consumers will stop demanding because of current circumstances — even if these circumstances are a pandemic,” she said.

On a year-to-date basis, the education sector has outperformed the benchmark EGX30. The index is down 21.5% YTD, whereas education services are now up 5.22% YTD.

The sector's performance has bounced back from a drop in mid-March and is now inching back up towards its December 2019 peak. At the beginning of the covid-19 market meltdown in late February and early March, it was down 6.68% YTD on the EGX30. Now, education services are up 5.22% YTD. By way of comparison, banks — which are traditionally strong market performers — are down 19.43% since the beginning of the year.

The only sectors in the green on the EGX on a YTD basis other than education: Telecoms, contracting and construction engineering, textiles, and paper packaging.

The drop in March was limited both in depth and duration and came directly after schools were instructed by the government to suspend in-person teaching and move to remote learning platforms, CIRA CEO Mohamed El Kalla explained to Enterprise. Investors were concerned about education providers’ ability to quickly and effectively deliver remote learning services, and those that succeeded in that area bounced back immediately, El Kalla said. “CIRA is a classic example of that: Within 72 hours of the government announcing the move to remote learning, all of our classrooms were fully moved to our online platform.” El Kalla chalked up the concerns at the time to a “lack of clarity,” saying investors were unsure if providers would rise to the challenge — and also had no outlook on what the following few months would look like.

And as for individual education service providers: CIRA’s shares saw what El Kalla describes as “low turbulence” in March. CIRA shares dipped from EGP 13.87 on 4 March to a low of EGP 9.49 on 31 March. Since then, the company’s shares have rallied, closing at EGP 13.30 apiece as of Thursday, when it was last traded. SCTS shares dropped to EGP 26.53 on 17 March from an all-time high of EGP 47.02 on 11 December 2019. The company’s shares have been rising on low trading volumes since March, closing at EGP 40.00 on 27 July — the last day the stock saw any trading activity. CAED shares have seen more ups and downs than its industry peers on the EGX: The company’s share price dropped to EGP 8.20 apiece on 16 March and has since continued to swing to highs and lows, before settling at EGP 9.50 on 22 July — the last day on which the stock traded hands.

Even with the limited bout of turbulence, El Kalla says that investor sentiment remained strong throughout the pandemic. “Investors have a very growth-focused mindset and they know that the population is growing, which means demand for education services will continue to grow as well.” The limited concerns that were there in mid-March were quickly quelled once schools showed they were able to handle the transition. For CIRA, that was helped by the fact that they already had the necessary infrastructure in place from before the pandemic, noted Pharos’ Hozaien.

As you’d expect from a defensive play, CIRA has continued to perform well financially: In the first nine months of its fiscal year (September-May), CIRA reported a 32% y-o-y increase in net profit to EGP 330.4 mn, while its net revenues soared 54% y-o-y during the period, coming in at EGP 991.9 mn. CIRA also reported that its new projects are all on track to be completed on schedule, after facing minor delays at the outset of the pandemic.

Some education service providers faced other hurdles in the early days of the shift to online learning, including disputes with parents about tuition fees and payments for services the schools were no longer providing, Hozaien told Enterprise. However, these were not reflected in investor sentiment on the sector and did not result in a dip in equity performance, she said. We dove into the dispute in June.

Investors have more clarity as we head into the new academic year. Schools have announced that they will be pushing ahead with a blended learning model — and they have proven their ability to effectively deliver using that model, El Kalla says. Those that initially struggled have had the summer months to adjust and ensure that they will be ready once they open their doors for the new year.

If anything, the shift to blended learning models has actually been a “net positive” for the education industry, GEMS CEO Ahmed Wahby told Enterprise. “Because schools are splitting up classrooms for a rotational system, there are fewer students per classroom and therefore more individual attention.” This has also helped to bolster a positive outlook for investors on the sector, he said.

Your top five education stories of the week:

- Egypt received a USD 15 mn grant from the United States Agency for International Development (USAID) to improve basic education for students and literacy for adults as well as train new teachers.

- Emaar Misr and ElSewedy Education signed an MoU last week to establish The Knowledge Hub Universities project which will host many global universities’ branches in Egypt such as UK’s Coventry University, according to Ahram Online.

- Developing Africa’s Egyptian Cultural Centers: Prime Minister Mostafa Madbouly has tapped the ministry of higher education to prepare an integrated plan to develop all Egyptian cultural centers in Africa as a way to develop bilateral relations with other countries, reports Al Masry Al Youm.

- Egypt ranked no. 42 in US News’ global ranking for quality of education, jumping nine places from last year.

- Some 70k students applied to take the 2020/2021 admission exams for public universities. Thanaweyya Amma results were announced last week and the country had a 81.5% passing rate, according to Ahram Online.

The Market Yesterday

EGP / USD CBE market average: Buy 15.92 | Sell 16.02

EGP / USD at CIB: Buy 15.91 | Sell 16.01

EGP / USD at NBE: Buy 15.91 | Sell 16.01

EGX30 (Sunday): 10,962 (+1.3%)

Turnover: EGP 1.2 bn (25% above the 90-day average)

EGX 30 year-to-date: -21.5%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 1.3%. CIB, the index’s heaviest constituent, ended up 1.7%. EGX30’s top performing constituents were Madinet Nasr Housing up 6.2%, Qalaa Holdings up 5.8%, and GB Auto up 4.4%. Yesterday’s worst performing stocks were Orascom Construction down 2.5%, Porto Group down 1.4% and Orascom Investment Holding down 0.6%. The market turnover was EGP 1.2 bn, and domestic investors were the sole net buyers.

Foreigners: Net Short | EGP -60.6 mn

Regional: Net Short | EGP -2.1 mn

Domestic: Net Long | EGP +62.7 mn

Retail: 82.8% of total trades | 81.8% of buyers | 83.9% of sellers

Institutions: 17.2% of total trades | 18.2% of buyers | 16.1% of sellers

WTI: USD 41.22 (-1.74%)

Brent: USD 44.40 (-1.53%)

Natural Gas (Nymex, futures prices) USD 2.24 MMBtu, (+3.37%, September 2020 contract)

Gold: USD 2,028.00 / troy ounce (-2.00%)

TASI: 7,530.31 (+0.40%) (YTD: -10.24%)

ADX: 4,331.49 (-0.64%) (YTD: -14.66%)

DFM: 2,093.63 (-0.66%) (YTD: -24.28%)

KSE Premier Market: 5,511.89 (+0.51%)

QE: 9,398.90 (-0.14%) (YTD: -9.85%)

MSM: 3,587.35 (+0.54%) (YTD: -9.89%)

BB: 1,292.91 (+0.32%) (YTD: -19.70%)

Calendar

9-10 August (Sunday-Monday): Egyptian expats vote by post in Senate elections.

11-12 August (Tuesday-Wednesday): Senate elections take place.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-15 August (Thursday-Saturday): RiseUp from Home digital event. Pre-registration available here.

16 August (Sunday): House of Representatives reconvenes after a brief recess.

20 August (Thursday): Islamic New Year (TBC), national holiday.

6 September (Sunday): A postponed Cairo Criminal Court trial of former Finance Minister Youssef Boutros Ghali over charges of issuing a decree in 2005 allowing cars confiscated by the Customs Authority to be released for his personal use.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

12 September (Saturday): Court session for Egyptian Resorts Company lawsuit against The Tourism Development Authority

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

20 September (Sunday): A Cairo administrative court is due to issue a ruling in a third-party lawsuit demanding the government block YouTube in Egypt for carrying an allegedly sacreligious video. The case is an infamous 2012-vintage lawsuit still wending its way through the courts.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

16 September (Wednesday): The last day for the final results of the senate elections to be announced.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools and students in public universities

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

12-15 May (Wednesday-Saturday): Eid El Fitr (TBC).

10 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

22 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.