- Egypt lands c. USD 6.1 bn in loans and other financing from Afreximbank, European Investment Bank. (Speed Round)

- A silver lining to the pandemic? Expedited reforms –Al-Mashat. (Speed Round)

- Agrifoods player Galina Holding eyes IPO in early 2021. (Speed Round)

- MCDR to offload stake in Makasa Sport, will focus on “core activities.” (Speed Round)

- NBE makes offer for minority stake in Raya’s Aman Holding. (Speed Round)

- Amer Group looks to get on Egypt’s corporate sukuk bandwagon. (Speed Round)

- Egypt introduces development fees on mobile phone bills + scratch cards. (Speed Round)

- El Sisi threatens to intervene in Libya, prepares for presidential-level talks on GERD with Ethiopia, Sudan. (Speed Round)

- New covid-19 cases hit two-month low. (Last Night’s Talk Shows)

- The Market Yesterday

Sunday, 19 July 2020

Egypt lands USD 6.1 bn from Afreximbank, European Investment Bank

TL;DR

What We’re Tracking Today

Good morning, friends, and welcome to a holiday-shortened week as we all look forward to a day off on Thursday in observance of the 23 July Revolution. Two things are making us smile this morning:

SMILE #1- Cairo-based product designer and architect Youssef Ghali has won a NASA challenge to design a Venus rover that could beat the Soviet Union’s record of surviving a little over two hours on the incredibly inhospitable planet, NASA’s Jet Propulsion Laboratory announced. You can check out his very cool Youtube video here (watch, runtime: 3:33) or go catch coverage in Syfy and Engadget. All of the winners are here on the challenge page: Exploring Hell: Avoiding obstacles on a clockwork rover.

SMILE #2- We are delighted and honoured to announce that our friends at SODIC have re-upped as pillar supporters of Enterprise. SODIC has been with us since our very first summer and have renewed their three-year advertising contract as our exclusive real estate development partners — and we couldn’t be happier. SODIC’s support, alongside that of Pharos Holding, CIB and Somabay, ensure that we’re able to keep bringing you your morning briefing without charge. SODIC had anchored our Speed Round section since 2015 and now moves to the head of the issue along with Pharos and CIB for the coming three years. Thank you, friends, for your support.

The House of Representatives gives no sign of wanting to go on recess this summer, with MPs set to give their final approval to no less than nine bills today and tomorrow, according to Al Shorouk. Among the bills business-relevant bills expected to come up: the 1% corona tax on employee wages, the Banking and Central Bank Act (with its 1% tithe on industry profits), and amendments to the Public Enterprises Act. The House of Representatives will also discuss today extending Egypt’s joint electricity grid with Libya across North Africa to Tunisia, Algeria and Mauritania, the local press reports. Deputy House Speaker Soliman Wahdan had threatened MPs back in June that their packed agenda and the coming elections for the Senate could mean MPs don’t get a break this summer.

State-run K-12 schools will be back in session on 17 October, the Education Ministry said in a statement, meaning public-school students have just been handed one of the longest summers they’ve ever had. The first term will end on 6 February, followed by a 15-day mid-year break, and the school year will wrap on 24 June 2021. The ministry still hasn’t decided the shape learning will take, but schools are likely to see some form of “blended learning” come fall. Public schools usually open somewhere around the third week of September.

Kids at private schools shouldn’t hold their breath hoping for a long break: We’re aware of three top private schools that have told parents they are sticking to their planned opening dates, with one due to head back as early as mid-August. And there’s been no word on when classes will resume at universities.

Prepare to be flooded with billboard ads of Senate candidates: The National Elections Authority has published campaigning rules for candidates running for the newly reconstituted upper house of parliament as we get ready to head to the polls on 11-12 August.

COVID-19 IN EGYPT-

GOOD NEWS- New cases in Egypt have reached a new two-month low. The Health Ministry yesterday reported 698 new infections — the lowest single-day toll since 19 May when 720 new confirmed cases were reported. Egypt has now reported a total of 87,172 confirmed cases of covid-19. The ministry also confirmed 63 new deaths from covid-19 yesterday, bringing the country’s total death toll to 4,251. We now have a total of 27,868 cases who have fully recovered.

Prominent figures in the tourism industry are calling on the CBE to rethink its tourism support program. The EGP 50 bn initiative, which hands out soft loans to support companies in the sector, requires recipients to allocate 85% of the funding they receive to paying salaries and wages and the remaining 15% to funding other operating expenses. Some in the industry are asking the central bank to allow them more flexibility with how they spend the money, complaining that 15% is insufficient to cover maintenance and utilities and is preventing many companies from reopening, Al Shorouk reports.

Egyptian tour operators and others in the sector are struggling to collect USD 1 bn in receivables from offshore travel companies, according to estimates by the Federation of Tourism Chambers, Al Shorouk reports.

Some 3k companies are caught up in the unprecedented crisis, which deepened for many in the industry after Saudi Arabia took the unprecedented step of cancelling the Umrah and Hajj pilgrimage trips, according to a report by the International Air Transport Association.

Meanwhile, some 31 hotels across six governorates received health certificates last week that allow them to reopen their doors. The operators are in the Red Sea, South Sinai, Luxor, Greater Cairo, Matrouh and Suez governorates.

ON THE GLOBAL FRONT-

WHO says uptick in cases, limited data in EastMed are cause for concern: The covid-19 pandemic in the Eastern Mediterranean region remains alarming — and unreliable data makes it hard to say just how bad things are, the World Health Organization (WHO) said in a statement. “Saudi Arabia, Pakistan, Iran and Iraq [reported] almost 70% of all cases,” it noted. Even with underreporting, deaths in the region are (outside of Egypt) on an upward trajectory, increasing by 13% last week alone. The total case tally jumped by nearly 10% in the same period, the statement notes added.

G20 finance officials vow more support for global economy… G20 finance ministers and central bankers pledged to keep deploying “all available policy tools” to support the global economy against the coronavirus pandemic, Reuters reports. In a statement following a virtual meeting yesterday, the officials said that the world would recover from the economic shock as countries reopened but said more support was needed to protect jobs, ensure financial stability and hedge against further risks caused by the virus.

…but refused to extend the debt freeze for poorest countries into next year: The G20 have called on bilateral creditors to the world’s poorest countries to freeze debt repayments for only the second half 2020, despite sources claiming strong support for extending it into next year, Reuters said. The statement also didn’t acknowledge calls for full debt cancellation for low-income countries, rather than the current “debt standstill.” Agreed by the G20 in April, the debt service suspension initiative has struggled to make an impact, with less than 60% of eligible countries showing interest and a failure by the private sector to participate.

AND THE REST OF THE WORLD-

Facebook says goodbye to its biggest advertiser after Disney joins ad boycott. Disney has taken an axe to its advertising spending on Facebook, the Wall Street Journal reports, citing people familiar with the matter. Disney was Facebook’s largest advertiser for the first six months of the year, making its decision a particularly large setback for the social media giant. Some of the world’s largest companies — including Coca-Cola, Ford, Unilever and Starbucks — responded to calls for a boycott of Facebook earlier this month over its policies for handling hate speech and political content.

Enterprise+: Last Night’s Talk Shows

The latest developments in Libya dominated the airwaves last night, with all of the nation’s talking heads focused on the potential for Egyptian military intervention in the conflict. And the coronavirus was a topic of conversation for the first time in what seems like weeks, after daily cases continued to fall over the weekend, while Al Kahera Alaan’s Lamees El Hadidi previewed her interview with IMF director Kristalina Georgieva.

Possible Egyptian intervention in Libya: Most of the talkshows dedicated segments to the Foreign Ministry’s statement on Libya, which on Friday accused Turkey of exporting terrorism to Libya and rejected Ankara’s involvement in the conflict. El Hekaya’s Amr Adib seemed to enjoy the statement, describing it as “powerful” (watch, runtime: 2:45). Adib also spoke with Khaled Al Mahjoub, the spokesman for the Tripoli operations room of the Egypt-backed Libyan National Army, who said that splitting Libya into two states is out of the question and claimed that Egypt’s potential intervention has forced Turkey to reassess its position (watch, runtime: 2:51).

Foreign Ministry spokesman Ahmed Hafiz told Al Kahera Alaan’s Lamees El Hadidi that Egypt’s priority is stability and security for the Libyan people (watch, runtime: 6:32), while Al Hadath’s reporter in Washington said that the US is reluctant to interfere directly in the conflict due to its alliances with both Egypt and Turkey (watch, runtime: 12:19). Masaa DMC’s Eman El Hosary (watch, runtime: 20:36) and Ala Mas’ouleety’s Ahmed Moussa also also covered the ministry’s statement in their reports on Libya (watch, runtime: 2:34). We have detailed coverage of the latest out of Libya in this morning’s Speed Round, below.

Covid-19 rate declines: Adib spoke with Health Minister Hala Zayed who confirmed that the number of infections and deaths has been decreasing for three consecutive weeks. Only 20% of the country’s ventilators are being used, she said, adding that the doctors have administered over 2 mn treatments since the outbreak began in March. She said that hospitals are already administering Remdesivir and plasma treatments successfully, and that Egypt has booked 30 mn doses of a vaccine being developed by Oxford University's Jenner Institute by bio-pharmaceutical company AstraZeneca, with an eye toward obtaining the license to manufacturer it for distribution across Africa (watch, runtime: 25:07).

Georgieva gives us love — A preview: Lamees El Hadidi aired clips from her interview with IMF boss Kristalina Georgieva, who discussed Egypt’s response to the pandemic and the weekend’s G20 meeting. She commended Egypt on its swift policy response, saying that it dealt quickly with the covid-19 crisis and acted to protect its economy. She said that Egypt has implemented appropriate monetary policies for the USD 8 bn in emergency loans it has received from the IMF. The full interview with Georgieva will air tonight (watch, runtime: 8:43).

Speed Round

DEBT WATCH- Egypt has landed c. USD 6.1 bn in loans and other financing from Afreximbank, European Investment Bank. The African Export-Import Bank (Afreximbank) has earmarked USD 3.9 bn for Egypt to mitigate covid-19 fallout and stimulate trade with the rest of the continent. Afreximbank has disbursed USD 3.55 bn to Egypt’s banking sector under its Pandemic Trade Impact Mitigation Facility (Patifma), the regional lender said in a statement. Afreximbank has also signed off on a further USD 300 mn to the National Bank of Egypt to encourage intra-African trade, as well as a USD 250k grant to the government to support covid-19 relief efforts.

Proceeds provided to banks under Patifma will help shore up the sector’s FX liquidity. Credit facilities under this program aim to prevent disruptions in trade and avert defaults, Afreximbank President Benedict Oramah said. “Egypt has been a regional banking powerhouse for more than a century and will play a vital role in expanding intra-Africa trade as the continent recovers from the pandemic and reaps the benefits of the African Continental FreeTrade Area,” he added.

Separately, we’re getting EUR 1.9 bn from the European Investment Bank (EIB), which signed off last week on a combined EUR 1.9 bn in new financing, according to a statement. The funding includes EUR 800 mn for “covid-19 related business investment” and another EUR 1.1 bn for public transport infrastructure development across the country, the statement says. The pandemic-related investment is designed to “improve public health, strengthen public services and back investment by companies in sectors hit by the pandemic.” The EIB had said last month it was looking at a potential EUR 670 mn financing package for Egypt and some of its developing neighbors to help combat the pandemic.

The EIB funding is part of a EUR 16.6 bn package for “covid-19 health response and economic resilience, climate, clean transport, energy and housing” across its footprint, the bank said.

A “silver lining” to the pandemic? Expedited reforms in Egypt, Al-Mashat says: Egypt has moved quicker over the past couple of months on a host of structural reforms, including moving quicker to digitize the financial system, promoting financial inclusion, and driving online learning and work from home, International Cooperation Minister Rania Al Mashat told CNN’s Richard Quest last week (watch, runtime: 3:02). “The silver lining in the Covid-19 cloud is that many of the reforms have been expedited … all of these efforts have taken place and it does provide for a good story,” Al-Mashat said. The minister also reiterated other points she made in a previous interview, including government support to 1.5 mn seasonal workers identified as vulnerable to the economic fallout.

Want to hear more from the IMF and CBE veteran? We recently spoke with Al-Mashat for Enterprise After Hours, our new podcast featuring business leaders, policymakers and cultural icons. You can listen to the episode on our website, Apple Podcasts, Google Podcasts, Anghami, Omny, or Spotify (for non-MENA accounts). You can also check out edited excerpts of our conversation.

IPO WATCH- Agrifoods player Galina eyes IPO in early 2021: Galina Holding is planning to make its EGX debut around the beginning of next year, by which time it expects markets will have stabilized from the fallout from the covid-19 pandemic, Chairman Abdel Wahed Soliman tells Al Mal. The company has tapped Renaissance Capital to lay out a plan for the offering, including the size of the transaction. The plan should be ready by 3Q2020, with an eye to take the offering to market by early 2021. Galina plans to use proceeds from the IPO to finance capex spending to expand its operations in fruit and vegetable concentrates and meat alternatives.

The listing has been a long time coming: Galina had begun looking at a potential EGX listing in 2018, when it was planning to spin off its fruit and vegetables processing business from its fruit concentrate unit. The company then decided last year it would list both subsidiaries, and had approached investment banks — including Pharos Holdings and EFG Hermes — to manage the planned listings. The company has, in the meantime, pushed ahead with growth plans, saying in May that it is building a new EGP 87 mn plant through a mix of self-financing and loans from AlexBank and the Saudi Investment Bank.

Greening-up its footprint: Separately, Galina has also locked down financing from AlexBank and the EBRD to partially power a facility in Alexandria with solar energy. The EBRD will provide a EUR 2.5 mn grant, while AlexBank signed off on a EGP 25 mn loan.

M&A WATCH- MCDR to offload stake in Makasa Sport, apparently dropping IPO plans: Misr for Central Clearing, Depository and Registry (MCDR) has reportedly received offers from Emirati and Saudi businessmen and an unnamed Egyptian institution to purchase most or all of its 71% stake in Makasa Sport, according to Al Mal, which quotes sources it says have knowledge of the matter. The sources expect the talks, which could wrap up before the end of 3Q2020, to see the buyers acquire nearly 51% in the company, which owns Egyptian Premier League side Misr Lel Makasa Sporting Club. This scenario would mean MCDR would retain minority ownership. The acquisition comes as MCDR aims to focus on its core clearing business. It appears MCDR is moving towards a sale and away from a potential initial public offering for its subsidiary.

M&A WATCH- NBE makes offer for minority stake in Raya’s Aman Holding: The National Bank of Egypt (NBE) has submitted an offer to Raya Holding to purchase a 20-25% stake in its subsidiary Aman Holding, Al Mal reports, citing unnamed informed sources. Raya’s board will meet to assess the offer and decide the process for due diligence, they said, without providing additional details.

Background: Raya received 24 offers for a minority stake in its Aman Holding from domestic and international investors in January. Aman Holding was set up earlier that month to parent Raya’s three non-banking financial service arms — Aman for Financial Services, Aman for E-Payments, and Aman for Microfinance. Aman was among the first two companies – along with Sarwa Capital’s Contact — to be awarded a consumer finance license by the Financial Regulatory Authority in April.

DEBT WATCH- Amer Group is looking to get on the corporate sukuk bandwagon, having signed consumer- and structure-finance player Sarwa Capital and Misr Capital Investments, Banque Misr’s investment arm, as advisors on a potential corporate sukuk issuance, according to a bourse disclosure (pdf). The issuance would be Amer Group’s first. Sarwa and Misr Capital will act as financial advisors for the issuance, including laying out a plan for the size, timing, and strategy for the offering, as well as taking it to market.

Background: Talaat Moustafa Group concluded Egypt’s first corporate sukuk in April with a EGP 2 bn offering. A senior Financial Regulatory Authority official said at the time that five other sukuk offerings worth a combined EGP 5 bn were in the pipeline for this year. It is unclear whether Amer Group’s issuance was among them. Sarwa also said last week that it had submitted the prospectus for a single-tranche EGP 2.5 bn sukuk issuance.

Mobile phone bills + scratch cards are getting a little more expensive: The Finance Ministry has introduced development fees on prepaid mobile phone scratch cards and subscription plans, Youm7 reports. The tax on scratch cards will rise to EGP 0.67 from EGP 0.51 — a 31% increase — while the tax on bills for subscription plans will now become EGP 8, up from EGP 6 — a 33% increase. Subscription plans will also be subject to an additional EGP 0.10 fee once per year.

Confusion as operators mistake development fees for stamp tax: Some mobile networks sent out text messages to customers over the weekend incorrectly telling them that the increased fees were due to a stamp tax hike. But sources cited by Youm7 confirmed that there have been no increases to stamp tax and that the latest hikes are due to the introduction of development fees on mobile services.

Background: Amendments to the development fees bill which introduce new levies on a range of consumer goods, services and imported products were signed into law last month. The fees will be tacked onto items such as mobile phones, internet bills and pet food as the government looks to plug shortfalls in revenue caused by the coronavirus pandemic.

The Banker names CIB, NBE, Banque Misr among top 10 banks in Africa: The Banker, a sister publication of the Financial Times, has named the National Bank of Egypt (NBE), Banque Misr, and CIB among the top 10 banks in Africa in its annual ranking of the Top 1000 World Banks. NBE landed in the fifth top spot in the Africa ranking, while Banque Misr was ranked eighth and CIB — Egypt’s largest private sector bank — ranked ninth. South African banks dominate the four top spots of the regional ranking. Globally, NBE is ranked #237, while Banque Misr is ranked #366, and CIB rose 179 spots to #369.

LEGISLATION WATCH- El Sisi ratifies Data Protection + SMEs acts: President Abdel Fattah El Sisi signed into law on Thursday the Data Protection Act, which lays out the ground rules for how businesses use personal information collected online. The legislation does not apply to activities regulated by the Central Bank of Egypt or the Financial Regulatory Authority. El Sisi also ratified the SMEs Act, which includes tax and non-tax incentives to support SMEs to go legit.

The final version of the Data Protection Act still imposes prison sentences on some instances of non-compliance (but not as many as the original). The legislation, which enshrines users’ right to take legal action against parties responsible for data breaches and misuse of private information, will impose a prison sentence of at least six months or a EGP 200k-2 mn fine on individuals who received monetary compensation for data breaches or intentionally distribute private information to harm the involved parties. Prison sentences will also be imposed on anyone found guilty of obstructing justice or preventing a new personal data protection unit under the Information Technology Industry Development Agency — which will be given powers of arrest — from carrying out its work. Check out our comprehensive breakdown of the legislation and how it may affect you and your business.

The president also ratified a law regulating parking attendants (the infamous sayess), which will impose six-month jail terms or fines of up to EGP 10k on unlicensed attendants.

Egypt could enter Libya if security is compromised -El Sisi: Egypt’s military is capable “of changing the military scene [in Libya] quickly and decisively,” and will “not stand idly by” if Egypt’s or Libya’s national security faces a direct threat, President Abdel Fattah El Sisi told a meeting of Libyan tribal leaders in Cairo on Thursday (watch, runtime: 31:21). El Sisi was given the greenlight from the tribes, who are affiliated with the Egypt-backed eastern commander Khalifa Haftar, to intervene in the conflict against the Tripoli-based Government of National Accord (GNA), which in recent weeks has turned the tide in the war, bolstered by Turkish-backed troops.

The question on everyone’s lips: What’s the likelihood of Egypt being dragged into war? El Sisi’s speech hints that any move to enter the war-torn country would come if the GNA and Turkey attack the coastal town of Sirte and Libya’s largest airbase in Jufra, which he considers a red line. On one hand, the president made sure to point out that “the red lines that we announced earlier… were basically a call for peace.” On the other, he made it clear that Egypt would seek parliamentary approval at home and intervene if this frontline is attacked.

An attack on Sirte could be imminent: Turkey and the GNA, which have demanded control of Sirte and Jufra as a precondition for any lasting ceasefire, appear to be moving troops to the frontlines in preparation for an attack, Reuters reported yesterday, citing witnesses and GNA commanders.

A war of words: Turkish President Recep Tayyip Erdoğan denounced both Egypt and the UAE on Friday, describing our backing of Haftar as “an illegal process” and the Emiratis’ as “piratical,” reports Reuters. In response, Egyptian foreign ministry spokesman Ahmed Hafez voiced his “surprise” that Turkey believed its intervention in Libya was legitimate, adding that Egypt rejected Turkish interference in any Arab country, be it Libya, Syria or Iraq, saying it violated resolutions by the UN Security Council.

Sanctions and more sanctions: The US has imposed sanctions on parties linked to Russian mercenary firm the Wagner Group — which has deployed operatives in the country in support of Haftar — and accused it of violating the UN arms embargo on Libya. France, Germany and Italy are also threatening to impose sanctions on any country found to be breaching the embargo.

Shoukry speaks to EU security rep, Italian, Saudi counterparts: Following President Abdel El Fattah El Sisi’s speech, Foreign Minister Sameh Shoukry discussed Libya and other regional developments with High Representative of the European Union Josep Borrell. Shoukry also touched on the same topics in separate phone calls with his Italian and Saudi Arabian counterparts.

Egypt, Sudan, Ethiopia to hold “mini summit” on GERD after AU-led negotiations end with little progress: President Abdel Fattah El Sisi will meet with Sudan and Ethiopia’s heads of state for a limited African Union (AU) presidential summit in another attempt to resolve the Grand Ethiopian Renaissance Dam (GERD) dispute, Sudanese Irrigation Minister Yasser Abbas said on Twitter on Thursday. The latest round of AU-sponsored negotiations between legal and technical teams for the three countries ended on Monday with no resolution.

Ethiopia doesn't want a legally binding agreement, still thinks initial filling process shouldn’t be mentioned: Ethiopia’s Water and Irrigation Minister Seleshi Bekele said on Thursday that talks on the key sticking points of filling and operating GERD will continue, but the initial filling of the reservoir shouldn’t be part of the negotiations. Addis Ababa will also not accept negotiations that will lead to “legally binding” arrangements as they limit the country’s fair and equitable access to the Nile, Bekele told the Ethiopian News Agency, according to Al Shorouk. As such, the initial filling of the reservoir isn’t part of the negotiations, he said.

Sudan assures Egypt that Ethiopia hasn’t started filling the dam: The Sudanese Foreign Ministry said on Thursday that it has received assurance that reports of Ethiopia starting to fill GERD’s reservoir are false. Ethiopia’s charge d’affaires in Khartoum told a senior ministry official that his country is yet to close GERD’s gates to fill the reservoir, and that the water gathered in the dam is a result of rainfall, the ministry said in a statement. Egypt last week sought urgent clarification from Ethiopia after TV reports emerged that the reservoir was being filled. Later, Ethiopian state TV apologized for what it said was a misinterpretation of comments by Bekele.

The story earned attention from the foreign press over the weekend: Bloomberg (here and here) | Al Monitor | Reuters.

MOVES- President Abdel Fattah El Sisi issued a decree on Thursday appointing new heads of the country’s appeals courts, Al Shorouk reports. Hit the link for the full list of appointees.

CLARIFICATION- Egypt Kuwait Holding (EKH) is resuming its USD 20 mn stock buyback program, and has not approved a new program, as we incorrectly suggested in Thursday’s issue. To date, EKH has purchased 2.7 mn shares. The story has been updated on our web edition.

Egypt in the News

The Grand Ethiopian Renaissance Dam continues to occupy the attention of the international press this morning. We have the latest in this morning’s Speed Round, above. (Bloomberg | New York Times | BBC | CBS)

Bloomberg took note of the amended Central Depository Act as a step towards opening up Egypt’s local debt instruments to foreign investors, saying the changes “could unlock more demand [for Egyptian] bonds,” which carry the fourth-highest return rate among 25 emerging markets. Advisor to the Finance Minister Nevine Mansour also told the business information service that the amendments mark significant progress towards Egypt’s goal of making its debt “Euroclearable” — allowing local debt issuance to be cleared with Belgium-based clearinghouse Euroclear.

Beblawi granted immunity from torture lawsuit: The US State Department has granted ex-PM Hazem El Beblawi immunity from a lawsuit filed by US citizen Mohamed Soltan for alleged torture and abuse, according to court filings released on Friday, the Washington Post reports.

Worth Watching

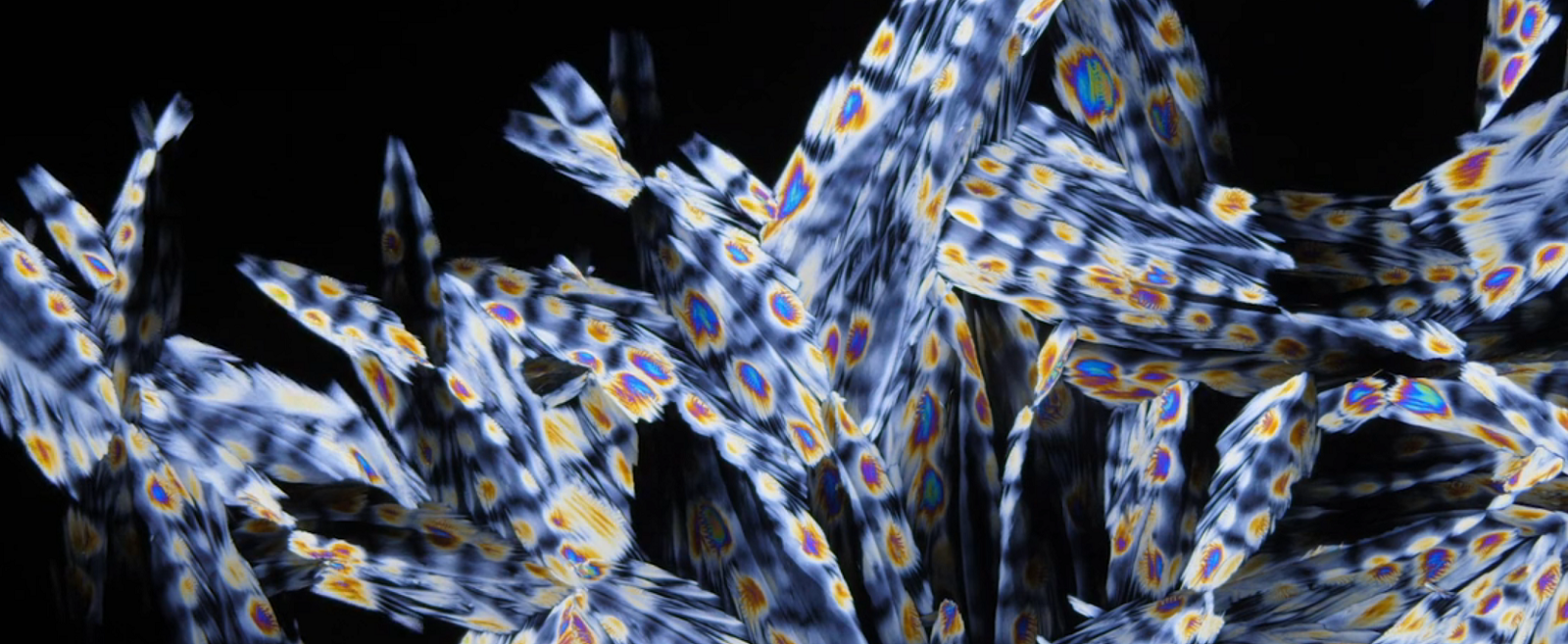

Chemistry as art: The Scientists and photographers behind Envisioning Chemistry have captured the kaleidoscopic crystallization process using a contrast-enhancing polarized light microscope. It’s simply gorgeous. Watch at PetaPixel

Energy

NREA to issue international tender for 50 MW solar plant in Egypt’s Benban park

The New and Renewable Energy Authority plans to issue an international tender next month for the construction of a 50 MW solar power plant in Aswan’s Benban park, Al Mal reports, citing an unnamed Electricity Ministry source. The EGP 1.4 bn plant will be financed by the Kuwait Fund for Arab Economic Development. Construction of the facility should be complete by 2023, according to the source.

Egyptian-Saudi electric interconnection project delayed to 2023

The Egyptian-Saudi electric interconnection project has been delayed by two years and is now expected to be operational at the end of 2023, Al Shorouk reports, citing an unnamed source at the Egyptian Electricity Transmission Company, who said that the delay was caused by the Saudi’s Neom project.

Infrastructure

Supply Ministry to set up new logistics zones in South Sinai

The Supply Ministry plans to set up new logistics zones for commercial supply chains in the South Sinai, with a focus on Sharm El Sheikh, Al Tur, and Ras Sidr, Al Mal reports.

Basic Materials + Commodities

Al Gioshy Steel postpones expansion, blames new import tariffs

Al Gioshy Steel has postponed plans to add a production line to its steel rebar production facility, citing the Trade Ministry’s tariffs on imports of steel and iron billet as a major reason, CEO Tarek Al Gioshy tells Al Mal. The company has resumed operations at its factory after having halted production to protest the duties, which the government imposed last year.

Manufacturing

Futek to invest EGP 60 mn medical devices line

Futek Lighting will invest EGP 60 mn to add a production line for medical devices — including pulse oximeters to measure blood oxygen and sterilization equipment — at its new factory in Sadat City, Al Shorouk reports.

Banking + Finance

Banque Misr arranges 4 loans worth EGP 3.6 bn pounds for Al Marasem developments

Banque Misr has arranged four shariah-compliant syndicated facilities worth EGP 3.6 bn for Al Marasem International Development for projects in the new administrative capital and Suez, Al Shorouk reports, citing unnamed informed sources. The state-owned bank has a 40% share in the first three of the loans, the sources said, adding that other participating banks include the Abu Dhabi Islamic Bank, the First Abu Dhabi Bank, Bank Audi, and SAIB Bank. The first EGP 1 bn loan will part-finance a medical complex in Suez, the second EGP 1.5 bn facility will fund the second stage of the New Garden City development in the administrative capital, and the third will extend EGP 590 mn to develop the administrative capital’s central park.

Other Business News of Note

MAF opens 53rd Egypt Carrefour store in Alexandria

Majid Al Futtaim has opened in Alexandria its 53rd Egyptian Carrefour branch, Masrawy reports. The company plans to invest EGP 37 mn to open another three branches this year, Country Manager Jean Luc Graziato said during the inauguration, without providing further details.

GAFI approves 30 new projects for CPC Egypt

GAFI has approved 30 new projects by CPC Egypt for Industrial Development in Sixth of October, a cabinet statement said on Saturday without providing further details. GAFI CEO Mohamed Abdel Wahab renewed calls to expedite the issuance of six-month licenses for new businesses, especially those producing medical supplies and food commodities.

Correction: 19 July, 2020

An earlier version of this story incorrectly spelled CPC as CBC.

Egypt Politics + Economics

Coptic Church defrocks priest Rewies Aziz Khalil over abuse claims

The Coptic Orthodox Church has defrocked Minya’s Rewies Aziz Khalil amid accusations that he abused children, according to a Church statement on Saturday carried by El Watan. Church goers in Minya’s Abu Qurqas, the US and Canada made allegations against Khalil on social media last week, prompting the church to launch an investigation.

The Market Yesterday

EGP / USD CBE market average: Buy 15.91 | Sell 16.01

EGP / USD at CIB: Buy 15.92 | Sell 16.02

EGP / USD at NBE: Buy 15.92 | Sell 16.02

EGX30 (Thursday): 10.441 (-1.7%)

Turnover: EGP 817 mn (10% below the 90-day average)

EGX 30 year-to-date: -25.2%

THE MARKET ON THURSDAY: The EGX30 ended Thursday’s session down 1.7%. CIB, the index’s heaviest constituent, ended down 2.8%. EGX30’s top performing constituents were CIRA up 2.4%, Sodic up 1.6%, and Eastern Company up 0.5%. Thursday’s worst performing stocks were Dice down 6.1%, Juhayna down 5.4% and Credit Agricole down 5.1%. The market turnover was EGP 817 mn, and foreign investors were the sole net sellers.

Foreigners: Net short | EGP -57.8 mn

Regional: Net long | EGP +19.8 mn

Domestic: Net long | EGP +38 mn

Retail: 67.9% of total trades | 69.5% of buyers | 66.3% of sellers

Institutions: 32.1% of total trades | 30.5% of buyers | 33.7% of sellers

WTI: USD 40.59 (-0.39%)

Brent: USD 43.14 (-0.53%)

Natural Gas (Nymex, futures prices) USD 1.72 MMBtu, (-0.29%, August 2020 contract)

Gold: USD 1,810.00 / troy ounce (+0.54%)

TASI: 7,426 (+0.12%) (YTD: -11.47%)

ADX: 4,274 (+1.26%) (YTD: -15.79%)

DFM: 2,052 (+0.22%) (YTD: -25.76%)

KSE Premier Market: 5,501 (-0.94%)

QE: 9,310 (-0.89%) (YTD: -10.69%)

MSM: 3,450 (-0.32%) (YTD: -13.34%)

BB: 1,302 (-0.14%) (YTD: -19.11%)

Calendar

20-21 July (Monday-Tuesday): Creative Industry Summit virtual edition.

23 July (Thursday): 23 July revolution anniversary, national holiday.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

5 August (Wednesday): IHS Markit PMI for Egypt released.

11-12 August (Tuesday-Wednesday): Senate elections take place.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

13-15 August (Thursday-Saturday): RiseUp from Home digital event. Pre-registration available here.

20 August (Thursday): Islamic New Year (TBC), national holiday.

8-9 September (Tuesday-Wednesday): Run-off Senate elections.

12 September (Saturday): Court session for Egyptian Resorts Company lawsuit against The Tourism Development Authority

15 September (Tuesday): 2019-2020 academic year ends for Egyptian universities.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

6 October (Tuesday): Armed Forces Day.

8 October (Thursday): National holiday in observance of Armed Forces Day.

17 October (Saturday): 2020-2021 academic year begins for K-12 students at state schools.

23-31 October (Friday-Saturday): El Gouna Film Festival, El Gouna, Egypt.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

25 January 2021 (Monday): 25 January revolution anniversary / Police Day.

28 January 2021 (Thursday): National holiday in observance of 25 January revolution anniversary / Police Day.

4 February 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

18 March 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

12 April 2021 (Monday): First day of Ramadan (TBC).

25 April 2021 (Sunday): Sinai Liberation Day.

29 April 2021 (Thursday): National holiday in observance of Sinai Liberation Day.

29 April 2021 (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

3 May (Monday): Sham El Nessim.

6 May (Thursday): National holiday in observance of Sham El Nessim.

12-15 May (Wednesday-Saturday): Eid El Fitr (TBC).

10 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

22 July (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.