- 5pm-6am curfew for Eid week, all shops to close — and is EgyptAir preparing to return to the skies in early June? (Speed Round)

- Covid case count up to 12,229 after a record 510 infections were reported yesterday. (What We’re Tracking Today)

- First Abu Dhabi Bank puts Bank Audi Egypt acquisition on ice. (Speed Round)

- Innoventures in talks with potential LPs to raise USD 100 mn fund for food startups. (Speed Round)

- World Bank approves USD 50 mn facility for Egypt’s covid-19 emergency response. (Speed Round)

- CBE to regulate credit risk guarantee companies under new Banking Act provision. (Speed Round)

- Cairo Airport seeking EGP 1.2 bn loan to refurbish Terminal 1. (Speed Round)

- How the shift to research papers in public schools sees the (unpopular) private tutoring industry back in a new guise. (Blackboard)

- The Market Yesterday

Monday, 18 May 2020

Gov’t to tighten lockdown restrictions during the Eid break with 5pm-6am curfew, shops closed

TL;DR

What We’re Tracking Today

THE STORY OF THE DAY- We’re facing a 5pm-6am curfew for Eid El-Fitr as part of a series of tighter measures in effect next week to curb the spread of the virus that causes covid-19. The state will then begin easing some measures throughout June, Prime Minister Moustafa Madbouly said in a speech yesterday.

It also seems EgyptAir could resume commercial flights early next month, although Cabinet spokesman Nader Saad said only that an official announcement would be made in early June. We have the full story in this morning’s Speed Round, below.

Did you need a reminder that we’re in the midst of a heat wave? Look for daytime highs of 42-43°C in the capital city, according to the national weather service (pdf), with a chance of scattered showers this week in Cairo, Sinai and the North Coast, Egyptian Meteorological Authority head Mahmoud Shahin told Ahram Gate. The mercury still looks set to fall just in time for the holiday: Look for a daytime high of 32°C on Saturday (the last day of Ramadan) and 31°C on Sunday (the first day of Eid).

So, when do we eat? Maghrib prayers are at 6:43pm and you’ll have until 3:19am to finish caffeinating. Fajr is coming one minute earlier every day through the end of the Holy Month.

** You only have a few days left to tell us covid-19 is impacting your business. We run an annual reader poll asking what you expect of business conditions and the economy in the year ahead. Covid-19 has us thinking that the results of this year’s survey need updating. Take a minute and tell us how covid-19 has impacted your business, whether it’s changed your outlook on the economy, and what you think of WFH. We’ll have the results for you immediately after the Eid.

COVID-19 IN EGYPT-

Egypt has now disclosed a total of 12,229 confirmed cases of covid-19 after the Health Ministry reported 510 new infections yesterday — the highest single-day total yet. The ministry also said that another 18 people had died from the virus, taking the death toll to 630. We now have a total of 3,742 confirmed cases that have since tested negative for the virus after being hospitalized or isolated, of whom 3,172 have fully recovered.

ON THE GLOBAL FRONT-

Covid infections are on the rise in Africa, the New York Times notes this morning, singling out Nigeria as “just one of Africa’s alarming hotspots” and adding that Tanzania and Somalia have also been hard hit. The news comes as some Asian countries are “battling new clusters of contagion,” the Wall Street Journal writes. Among them: China, which has quarantined some 8k people in the country’s northeast.

GLOBAL MACRO-

Fed chairman Jay Powell sat down with 60 Minutes’ Scott Pelley for a wide-ranging interview on the central bank’s emergency measures, predictions for the US economy, and what has to be done to ensure we end up with a recovery and not the Great Depression Mk II.

Here are the key takeaways from the interview:

- The US economy may not fully recover until a vaccine is found: “Certain parts of the economy will recover much more slowly. Travel, entertainment, things that we do that involve being around lots of other people. So for the economy to fully recover, people will have to be fully confident. And that may have to await the arrival of a vaccine.”

- The US economy will see a historic contraction this quarter: The contraction of the US economy in the second quarter “could easily be in the twenties or thirties.”

- And Great Depression-levels of unemployment: “[20-25% unemployment] sounds about right for what the peak may be.”

- Policymakers must do more: “It may well be that the Fed has to do more. It may be that Congress has to do more. And the reason we've got to do more is to avoid longer run damage to the economy.”

- But a note of optimism: “In the long run, and even in the medium run, you wouldn't want to bet against the American economy. This economy will recover. And that means people will go back to work. Unemployment will get back down. We'll get through this.”

You can watch a clip from the interview and read the full transcript here (watch, runtime: 13:46).

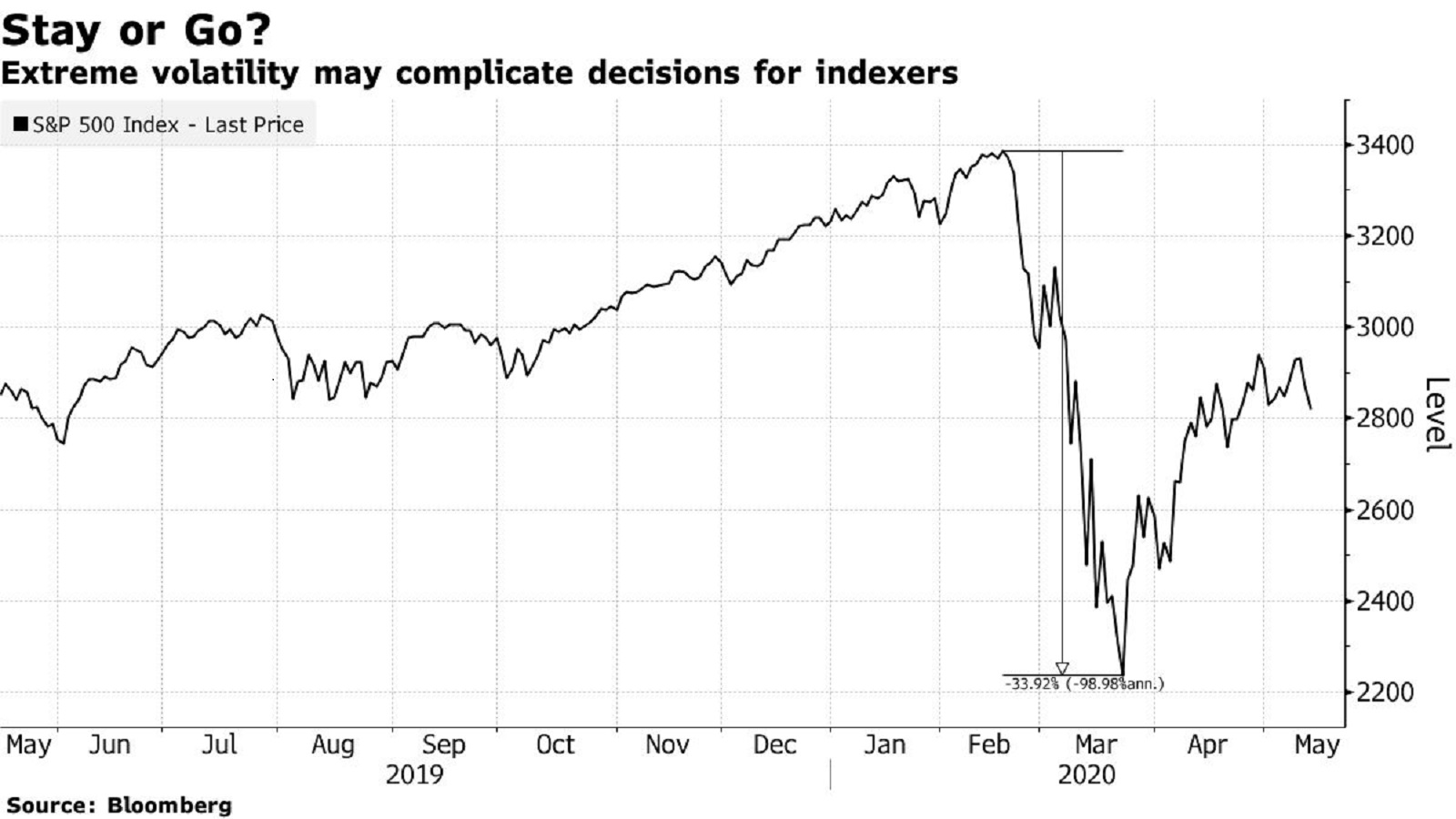

Managers of benchmark indexes like the S&P 500 will soon have to decide whether to dump companies likely to keep bleeding because of covid-19, with market volatility compounding an already difficult task. “The S&P 500 may be the world’s most-followed passive index, but covid-19 and its aftermath is going to force its constructors into some very active choices,” DataTrek Research’s co-founder Nicholas Colas tells Bloomberg, estimating that some 30 companies are hovering on the edge of eviction. The index recovered from its 23 March bottom because it’s anchored in tech and healthcare companies, but those working in retail, industry and energy are at risk.

The collapse in oil prices is increasing the likelihood that GCC currencies break the USD peg, which has been in place since the 1970s, the Financial Times reports. The risk that one of the GCC currencies decouples from the USD remains low, analysts say, but the temperature is rising on the Omani rial, which sunk to all-time lows against the greenback in forward markets last month.

This may not be a problem for much longer as the oil market begins to find its feet: US crude rose above USD 30/bbl for the first time in two months as last month’s huge production cuts ease the supply glut, Bloomberg reports.

AND THE REST OF THE WORLD-

The Evil Empire just got bigger: Never one to let a federal antitrust investigation get in the way of its ambition to dominate all of our online communication, Facebook has announced its acquisition of Giphy in a transaction Axios values at around USD 400 mn.

WATCH THIS SPACE- Nomura is going after Japan’s private market, the Financial Times notes. The firm’s new chief executive’s strategy is to “focus on private markets and Japan’s vast hinterland of unlisted companies,” pointing to “Japan’s substantial market for the trading and management of shares in unlisted Japanese companies.”

*** It’s Blackboard day: We have our weekly look at the business of education in Egypt, from pre-K through the highest reaches of higher ed. Blackboard appears every Monday in Enterprise in the place of our traditional industry news roundups.

In today’s issue: The highly unpopular private tutoring industry is back in a new (and possibly more insidious) form since the Education Ministry made research papers central to assessing students in public schools this year. We look at the businesses that have emerged to cater to this new system, and why the same issues that prompted the rise of private tutors is driving their growth today in the time of covid-19.

Enterprise+: Last Night’s Talk Shows

Another quiet Ramadan night on the airwaves: Power couple Lamees El Hadidi and Amr Adib pretty much had the floor to themselves. El Hekaya’s Amr Adib took note of the Madbouly government’s new covid restrictions (watch, runtime: 1:48), which Lamees covered in detail (see Speed Round, below).

Speed Round

Speed Round is presented in association with

Egypt faces stricter lockdown measures for the week of Eid El Fitr, then a gradual loosening in June: Egypt will be under a 5pm-6am curfew and all shops will be closed next week as the Madbouly government enforces tighter restrictions designed to curb the spread of the virus that causes covid-19. Prime Minister Moustafa Madbouly announced the measures at a press conference yesterday, saying they would be in effect from Sunday, 24 May (the presumptive first day of Eid) until Friday, 29 May (watch, runtime: 14:53). The full list of decisions is here, and Reuters also has the story.

The nighttime curfew will run from 5pm until 6am next week, although Cabinet spokesman Nader Saad told late-night maven Lamees El Hadidi (watch, runtime: 23:56) that factory workers will be exempt in a bid to limit the impact on factory output. Food deliveries can also continue past curfew hours.

Stores, restaurants and public spaces will be closed. The measures — which are akin to those the government imposed during the Sham El Nessim holiday last month — include a complete shutdown of all malls, shops, restaurants, public parks, and beaches.

Supermarkets, grocery stores and pharmacies will be allowed to open as will beaches on hotel properties that have reopened and that comply with Health Ministry standards, Saad told Lamees.

Public transportation will also be suspended entirely, particularly as the government looks to curb movement between governorates during the holiday. Saad, however, told state TV host Wael El-Ibrachy that the suspension will not include microbuses (watch, runtime 19:17. There do not appear to be restrictions on the movement of personal vehicles between governorates.

Everyone will be expected to wear face masks in “any closed space” starting 30 May, the PM said, which we’re taking as including government buildings, private offices, malls and retail outlets. People will also need to wear masks when using buses, the metro, trains, taxis and ride-hailing services such as Uber and Careem, Madbouly said. Folks choosing not to wear masks could face legal penalties once masks are “available for everyone,” Saad added. The Health Ministry will coordinate the manufacture of cloth face masks at a cost of as little as EGP 5 each that are reusable for up to a month, Saad told El-Ibrachy.

So, when is Eid, exactly? Madbouly didn’t say other than to note that it likely begins on Sunday, but Saad told Lamees that government and other public-sector employees will have the full week off. Cabinet will make it official with a decree today, Saad said.

The Manpower Ministry is expected to announce today how long the holiday will run for the private sector — we expect it to be Sunday-Tuesday.

Eid prayers will be broadcast from inside El Sayeda Nafisa Mosque, as mosques around the country remain closed. Mosques will only be allowed to recite takbeer el Eid through speakers.

Once Eid week is over, we’re back to the same basic set of restrictions as were in place before Ramadan, with the measures being in place until mid-June. This phase, which officially begins on Saturday, 30 May will run for two weeks, Madbouly suggested, and includes allowing shops and malls to open for part of the day and restaurants to operate as they did during Ramadan, (around-the-clock delivery + allowing customers to place takeaway orders in-store). The nighttime curfew will again be shortened to run from 8pm until 6am (one hour longer than at present).

One note: The Health Ministry has pulled from its website a three-phase reopening plan it released last week. Al Dostor is reporting that it has done so because Cabinet is reviewing the document.

In mid-June, the government will allow houses of worship and some leisure activities to gradually reopen. Churches and mosques will be allowed to have limited prayers and ceremonies, Madbouly said. What’s on offer and when will be announced later, he added. The government will also begin gradually allowing sporting clubs and restaurants to reopen in full, provided they follow specific precautions that will also be outlined at a later date.

Thanaweya Amma exams will begin on 21 June, but students will have the option to postpone sitting the exams until next year, Education Minister Tarek Shawki said at the press conference yesterday. Students who do choose to sit for this year’s exams will be required to maintain safe physical distances within the testing rooms, which will also be rearranged to hold fewer students than normal.

Graduating university seniors will sit their final exams starting 1 July, Higher Education Minister Khaled Abdel Ghafar said.

Madbouly didn’t say when Egypt plans to reopen its airspace to regularly scheduled international commercial flights. The flight ban, which has been extended multiple times and was due to expire on Saturday, has been extended for up to two more weeks along with other measures designed to curb the spread of the virus.

Look for an announcement “in the first half of June … on a timeline for the resumption of flights and the precautionary measures that will accompany it,” Saad told Lamees last night, noting that, “sooner or later, flights will resume, particularly as we see European and Asian countries planning to reopen their airspace.”

EgyptAir seems to be taking bookings for next month. The online booking feature on national flag carrier EgyptAir’s website shows round-trip flights to several cities available as of 1 June. The carrier has not said when flights will resume, but we understand that aircrew are being told to expect to be in the air once again in June.

We found flights available yesterday from Cairo to London, Washington, New York, Paris, Dubai, Jeddah, Montreal, Amsterdam, and Casablanca, among others. Flight aggregator Expedia also automatically sets 1 June as the first available flight leaving Egypt. Flights to Beijing, Moscow, Athens, and Vienna, among others, will be available as of 2 June, while a Toronto flight is scheduled for 6 June, with return flights available as of this morning on 11 and 13 June.

There are no flights yet available to Frankfurt, Dublin or Tokyo.

Worth remembering: Unless the requirement is amended after Cabinet review, the Health Ministry foresees incoming tourists being required to produce the results of a PCR test completed 48 hours before they embarked on their flights. There has been no official word on whether travelers arriving in June would still face a 14-day quarantine as is presently the case.

The national flag carrier said yesterday it’s cutting by 10% the salaries of its highest paid employees from May’s paychecks due to the covid-19’s heavy toll on its business, Reuters’ Arabic service reported. This came a day after the government said it could extend a EGP 2 bn lifeline to see the airline through until the flight ban is lifted.

What are other airlines doing? Emirates is operating one-way outbound flights to nine cities — including London, Paris, Milan, Chicago, and Sydney — between this Thursday, 21 May and 30 June. British Airways’ travel information allows travelers who have flights booked up until 31 July to reschedule their tickets or claim a refund, but does not indicate whether this is the date it intends to resume air traffic. Turkish Airlines will resume flights on 28 May.

M&A WATCH- First Bank of Abu Dhabi (FAB) has put on ice its plan to acquire Bank Audi’s Egypt assets due to market conditions, Reuters reports, citing unnamed sources. One source, who said the pact was worth USD 700 mn, told the newswire that it is prioritizing supporting the UAE economy due to the covid-19 pandemic.

We’ll find out more in the coming hours: FAB and Bank Audi will issue a joint statement today or tomorrow confirming the status of negotiations, Masrawy reports, citing sources close to the matter.

Background: FAB said last week that it had completed due diligence on Bank Audi’s Egypt arm and was finalizing its offer. A senior executive said in February that the bank will make a final decision on whether to proceed with the acquisition after completing due diligence. FAB has pursued the acquisition despite the covid-19 outbreak after receiving the greenlight from the Central Bank of Egypt in January.

INVESTMENT WATCH- Innoventures in talks with potential LPs to raise USD 100 mn fund for food startups: Local startup investor Innoventures is raising a USD 100 mn fund targeting food startups and is in talks with potential limited partners including UK’s CDC Group and global giant Blackstone, co-founder Rafik Dalala tells Al Mal. Other potential LPs include EBRD, the International Finance Corporation and an unnamed Canadian investment fund. State-owned National Bank of Egypt and Banque Misr have also been pitched. The story doesn’t say when Innoventures hopes to close the fund or to begin deploying capital.

Background: Innoventures is an Egypt-based VC firm that has invested in early stage startups across a range of industries. CDC has invested in a range of Egyptian blue chips via funds managed by emerging markets PE giant Actis and has also made direct investments and extended tier-2 finance to local banks. Meanwhile, Blackstone has long held an interest in Egypt; its subsidiary Zarou was reportedly a frontrunner to acquire a stake in the Siemens-built combined cycle power plants.

The World Bank approved yesterday a USD 50 mn fast-track facility to bolster Egypt’s covid-19 emergency response capabilities, according to a statement. The facility will focus on improving Egypt’s medical infrastructure through the distribution of essential medical supplies, supporting quarantine and treatment facilities, and ramping up contact tracing capabilities through improving first responder preparedness. A portion of the funds will also be earmarked for public awareness campaigns addressing personal hygiene and social distancing. The bank granted Egypt last month a separate USD 400 mn loan for universal healthcare.

IBRD, IDA are responsible for providing the global support mechanism: The rapid financing facility comes as part of the USD 6 bn International Bank for Reconstruction and Development (IBRD) and the International Development Association’s (IDA) Global Fast Track Facility which aims to assist vulnerable populations through economic and medical support. Funds allocated by the international lenders are based on population size. Egypt qualified for the maximum receivable amount under the facility for a population of 100 mn.

LEGISLATION WATCH- House approves draft Banking Act with new provisions: The House of Representatives has approved the long-awaited Banking and Central Bank Act with several new provisions and shipped it off to the State Council for final legal review, the local press reported yesterday, citing MENA. The legislation, which received a preliminary nod from the House earlier this month, would give the Central Bank of Egypt (CBE) increased discretionary powers to regulate the banking sector. The bill won’t become a law until returned to the House for a final vote by the general assembly. It would also require President Abdel Fattah El Sisi’s signature.

CBE to issue licenses for credit risk guarantee companies: The law’s latest provision, added yesterday after a proposal from the CBE, will put the central bank in charge of licensing companies that want to offer credit risk guarantees. Credit risk guarantee arms must be established for the sole purpose of providing services to protect receivables against defaults and must have a minimum of EGP 50 mn in paid-in and issued capital. Companies interested in setting up credit guarantee arms will be subject to a EGP 100k “inspection fee” and EGP 50k for every other new branch.

Authorization for bank bailouts: The law will allow the CBE to provide short-term bailout funding to struggling banks. This would come in the form of a three-month to one-year loan carrying an interest higher than the market average.

The law will also not affect the current CBE board and the boards of commercial banks, which will only be shuffled to comply with the new stipulations after their terms expire. Under the legislation, future boards and chairmen of state-owned banks will be appointed by the Prime Minister and will be subject to some form of competency approval from the CBE.

Background: The draft Banking Act, which has been in the works since 2017, will replace the 2003 Banking Act, as well as cancel overlapping provisions in related laws. Besides increasing the CBE’s oversight over the sector, the law would introduce measures governing e-payment, fintech businesses, and cryptocurrencies, as well as strengthen data protection and consumer privacy. The legislation would also put in place a 1% levy on bank profits to endow an industry development fund. Banks will have 1-3 years to comply with the new provisions once it’s signed into law. You can find out more here and here.

LEGISLATION WATCH- House Speaker submits Income Tax Act, Public Enterprises Act, others, for committee discussion: House Speaker Ali Abdel Aal submitted six draft laws and two protocols to their relevant committees during parliament’s plenary session on Sunday, the local press reports.

Income tax amendments sent to the Planning and Budgeting Committee: Fresh off raising the income tax exemption threshold in amendments passed last month, the planning committee will discuss a fresh set of changes to the legislation — possibly involving the proposal to cut capital gains tax for state-owned companies we caught wind of last week.

Stamp tax amendments head back to the planning committee: The committee last week decided to temper the government’s proposed cuts to stamp tax on EGX transactions, reducing the tax from 0.15% to 0.075% instead of 0.05%.

The Public Enterprises Act amendments were submitted to the Economics Committee. The legislation would reclassify listed companies in which the government holds up to a 75% stake and a cap on board compensation. Members of the Constitutional and Legislative Affairs Committee, and well as the planning and labor committees will participate in the discussions.

Other bills submitted to relevant committees:

- The suspension of tax on agricultural land for two years will be discussed by the agriculture and planning committees.

- A draft law to set up a fund to support tourism and archeological sites was submitted to the tourism, culture, civil aviation, and constitutional committees.

- The civil disputes resolution bill, the protocol to eliminate illicit trade in tobacco products and a presidential decision regarding IMF funding were submitted to the Constitutional Affairs Committee.

- Legislation on waste management was submitted to the Energy and Environment Committee, with participation of members of the constitutional affairs, planning and industry committees.

Cairo Airport seeking EGP 1.2 bn loan to refurbish Terminal 1: The Cairo Airport Company has approached the National Bank of Egypt and Banque Misr for a EGP 1.2 bn loan to part-finance its plan to refurbish Cairo International Airport’s Terminal 1. Sources familiar with the agreement told Al Mal that the company is waiting to receive approval from the banks, and learn which one would be interested in managing the loan, which comes with a 5-7 year repayment term.

What’s happening at the airport? The company’s former chairman, Ahmed Fawzy, said in November that refurbishing the terminal would cost in the region of USD 200 mn. The plan would see the airport’s first and second terminals merged into a single building containing separate local and international departure halls. Terminal 3 would be revamped as an arrival hall and merged with the airport’s mall. An unnamed French company has been selected by the government to develop the Terminal 1 building, while the Cairo Airport Company issued in March a EGP 1 bn tender for local companies to renovate Terminal 2.

DISPUTE WATCH- Gov’t signs settlement with TMG for 2016 dispute over Four Season San Stefano: Talaat Moustafa Group (TMG) and the governorate of Alexandria signed yesterday a settlement agreement over the group's Four Seasons-branded hotel in Alexandria’s San Stefano, according to a cabinet statement. Under the agreement, TMG will pay EGP 7 mn in unspecified fees to the governorate each year, with that amount increasing 12% per annum. The real estate group will also be required to invest EGP 5 mn in “development projects” under its corporate social responsibility umbrella each year.

What was the issue to begin with? Although the statement does not clarify which dispute the agreement is meant to settle, we believe it pertains to a dispute the governorate had with TMG over the lack of an occupants’ union for the hotel and residence complex, claiming that it qualified as a residential building and not a hotel. Under Egypt’s 2008 Building Code, “a building, a development or a gated compound … which consist of 5 units or more are mandatorily required to establish a union for the occupants.” However, the 1973 Hotel and Touristic Facilities Act exempts hotels from the occupant union requirement. In 2018, the Council of State (Maglis El Dawla) ruled that the Four Seasons is a hotel, meaning it is not required to form an occupant union.

EARNINGS WATCH- Rameda profits soar in 1Q: Rameda Pharma almost trebled its profits in 1Q2020, recording net income of EGP 23.9 mn compared to EGP 8.1 mn a year earlier, according to the company’s earnings statement (pdf). Revenues climbed 22% to reach EGP 232.4 mn over the three-month period, up from EGP 189.9 mn last year.

Supply chain issues courtesy of covid-19 failed to dent the company’s recovery from last year’s production disruptions: “Despite the stresses placed on the Egyptian market in specific and global markets in general during the period by the coronavirus pandemic and its associated economic impacts, recovering volumes after last year’s production disruptions combined with improvements in our average price points delivered solid top-line growth for Rameda during 1Q20,” CFO Mahmoud Fayek said, noting that revenue growth was broad based with the exception of export sales, which, “fell on account of disruptions in global trade and logistical restrictions.” .

“Moving forward we will continue to seek opportunistic acquisitions that can drive growth, improve our profitability, and expand our market share,” CEO Amr Morsy said, adding that the company will continue to keep an eye out for potential acquisitions.

Egypt in the News

The detention and later release of Mada Masr Editor-in-chief Lina Attalah dominates the conversation on Egypt in the foreign press this morning. Attalah was detained for several hours yesterday after interviewing the mother of jailed activist Alaa Abd El Fattah, Laila Soueif, outside Torah Prison. Attalah was held at a police station in Maadi, but was released on EGP 2k bail yesterday evening. The story is getting wide attention: AFP | AP | Washington Post | France24 | The Independent | the Guardian | Il Mattino | Committee to Protect Journalists.

Elsewhere in the foreign press: The Financial Times’ Heba Saleh looks at the slowdown businesses are facing as a result of lockdown measures the government has imposed over the past several weeks.

How the shift to research assessments in public schools prompted the rise of an ancillary (and legally dubious) industry: As the covid-19 pandemic forced schools into lockdown mode, the Education Ministry has had to replace in-school exams in public schools with research papers submitted online. While the transition to research papers was praised by many of the people we spoke with — primarily for pushing through reforms away from rote memorization — its sudden nature has created an industry of private tutors and education centers providing support for research.

This industry has been accused of walking a fine line between teaching aid and plagiarism, calling into question the efficacy of the research assessment process. The quick transition coupled with the confusion and lack of readiness of many students has created a vacuum that was soon filled with teachers offering to write the reports for students, education centers turning into hubs to distribute pre-written reports, and stationary stores stocking top-selling research papers. Yet despite these issues, ministry officials, experts, and parents we’ve spoken to tell us they see the long-term merits of this system. Only through teaching students how to research will the need for these new private tutors be mitigated, they said.

But first, a quick recap of the research assessment process: Students from grades 3-9 had to submit research papers on topics set by the ministry, either alone or in a group of five relying on school books, independent online platforms, and the Education Ministry’s Knowledge Bank. Students then had to submit them either as a soft copy online or a hardcopy at schools between 9-13 May. Shawky has repeatedly said that submitting papers is enough for most students to pass, and that assessments would be marked with either a pass or a fail instead of the usual scoring.

Plagiarized reports, hiring writers, and online help is the mainstay of this industry: As a newly emergent industry that relies to some extent on plagiarism (which is illegal), quantifying its size and scope is difficult. But we have managed to pinpoint three main tiers for how this industry profits from the new system: sales of pre-written research papers, the use of tutors to write reports, and an online market providing actual tutoring.

Pre-written papers for sale: Despite being ordered to close by the government in March, Education Ministry advisor Mahmoud Hassouna tells us that education centers have begun selling research papers to students eager to avoid having to do the legwork to complete their courses. This new business model has evidently proven popular among students, with parents telling us of long queues forming outside centers. Prices differ depending on the grade and subject, ranging from as low as EGP 50-100 for primary grades and up to EGP 350 for elementary school students, Deputy Chairman of the Private Schools Owners Association Badawy Allam told Enterprise. Competition in crowded areas keeps the prices in check, while upscale neighborhoods and districts saw higher prices, Allam said. Even students who wrote the papers themselves and showed up at print shops to print their drafts were offered plagiarized copies and even discounts on buying in bulk.

Get your 10-year-old their very own research assistant / ghostwriter: The research papers breathed new life to private tutors who have seen business falter during the crisis. Many have reportedly been offering parents to write up these research reports for a fee. Marketing campaigns have also targeted parents and students at homes, where some parents have said they received phone calls from teachers offering to write up the essays for their children, while others made their bids on parents groups on social media. Even classified ads are popping up, featuring new services from “experts” who can help write the research papers for a “small” fee, which in some cases can reach EGP 700.

Above board business practices also exist in the online space: Many teachers have taken their business online, with some still giving paid private lessons and others creating YouTube channels that can potentially become an even more lucrative business. One such channel, which used to specialize in publishing religious content, has turned to brief explainers for research papers, which boosted its engagement and view count. Its 74.2k subscribers and increased viewership are projected to help the channel rake in north of USD 2k per month. The same has been happening on Facebook as well, with some previously-established groups turning their activity towards teaching students how to write papers and growing their membership base significantly since.

Some are truly in it for the education: Networks of activist teachers have been offering help to students to prepare research papers without charge.

The ministry has taken a tough stance against the industry: The Education Ministry has warned that teachers will be expelled if they are caught writing papers for students in return for financial compensation, and threatened to close down stationery stores and education centers that offer such services, Allam told Enterprise. As for students, Education Minister Tarek Shawky warned on Facebook that all students who buy and copy research papers will flunk the year.

Enforcement of online activity is next to impossible, according to Hassouna, who told Enterprise that the ministry cannot oversee all social media content. Even if the ministry is successful in closing down offending Facebook groups, the situation would soon turn into a game of whack-a-mole as new pages crop up, he said.

The ministry says parents are partly to blame: Senior figures in the ministry argue that parents are partly culpable for the rise of the industry, who have paid for the services out of anxiety for their children’s education. Defending the research program in parliament, Education Minister Tarek Shawky noted that parents too lined up outside education centers to spend money on the research papers instead of having their children complete the work themselves, describing the behavior as "one of the pathological phenomena inherited from previous years." "People are inherently worried about the unknown so they would prefer putting their trust in professional teachers writing up essays for their children instead than helping them write their own," Hassouna said.

Coming full circle: Prior to the 2017 education reforms, the prevailing wisdom was that the growth of private tutors came down to oversized classrooms with poor teacher-to-student ratios. Private tutoring helped alleviate the fears of parents that their children were not learning enough in the classroom and provided underpaid teachers a means to earn a little extra. We may be seeing the dynamic repeated here, as the interruptions to the education system drives parents into the arms of this new industry.

Teaching these skills in the classroom is the obvious solution: The old education system was often criticized for not teaching students analytical skills and, instead, memorizing questions and answers that they can identify in exam papers, Walaa Shabana, an education consultant who previously served as head of the private education department at the Education Ministry, tells us. Students in public schools should surely now be taught how to write these papers in the same way as students in international and private schools, which parents we spoke with said gives them a clear advantage.

Which is why it's a good thing that research papers will continue to play a role in public education next year: The Education Ministry advisor Mahmoud Hassouna told us that research papers will not be a one-off and will continue next year as the ministry builds on what it has achieved this year.

And the ministry intends to take action to limit the influence of private tutors and pay-to-play learning on parents and students: Interactive education tools will be introduced that will limit the use of private tutoring, while providing an online platform for students to communicate with their teachers without charge that will waive the need for them to buy reports, Massouna said, pledging to end private tutoring in the next three years.

Your top education stories of the week:

- Kids are staying home indefinitely after Egypt announced a three-stage plan to fully reopen the economy and saying that schools and nurseries will remain closed “during the pandemic.”

- Egypt will manufacture 40% of next year’s educational tablets after investing USD 70 mn in a local facility, according to a cabinet statement.

- AUC’s Executive Education open-enrollment program was ranked 67 in the Financial Times’ top 75 programs worldwide, jumping up seven spots from last year.

- E-learning technology studio Entlaqa has invested USD 2 mn in AlAcademia.com, an Arabic-language online courses platform, according to Al Mal.

- The EGX launched a series of educational videos that explain the basics of investing into the stock market, with the first video featuring EGX Chairman Mohamed Farid (watch, runtime: 06:14).

The Market Yesterday

EGP / USD CBE market average: Buy 15.70 | Sell 15.80

EGP / USD at CIB: Buy 15.72 | Sell 15.82

EGP / USD at NBE: Buy 15.70 | Sell 15.80

EGX30 (Sunday): 10,357 (+0.7%)

Turnover: EGP 371 mn (47% below the 90-day average)

EGX 30 year-to-date: -25.8%

THE MARKET ON SUNDAY: The EGX30 ended Sunday’s session up 0.7%. CIB, the index’s heaviest constituent, ended up 0.7%. EGX30’s top performing constituents were GB Auto up 3.2%, Eastern Company up 2.9%, and Cleopatra Hospitals up 2.9%. Yesterday’s worst performing stocks were Orascom Construction down 1.3%, Dice down 1.2% and Ibnsina Pharma down 0.9%. The market turnover was EGP 371 mn, and regional investors were the sole net buyers.

Foreigners: Net Short | EGP -45.0 mn

Regional: Net Long | EGP +4.1 mn

Domestic: Net Short | EGP -49.1 mn

Retail: 67.3% of total trades | 70.8% of buyers | 63.9% of sellers

Institutions: 32.7% of total trades | 29.2% of buyers | 36.1% of sellers

WTI: USD 29.43 (+6.79%)

Brent: USD 32.50 (+4.40%)

Natural Gas (Nymex, futures prices) USD 1.65 MMBtu, (-2.08%, Jun 2020 contract)

Gold: USD 1,756.30 / troy ounce (+0.88%)

TASI: 6,824.70 (+1.60%) (YTD: -18.65%)

ADX: 4,065.03 (-0.05%) (YTD: -19.91%)

DFM: 1,911.83 (+0.92%) (YTD: -30.85%)

KSE Premier Market: 5,147.04 (+2.44%)

QE: 8,699.45 (-0.41%) (YTD: -16.56%)

MSM: 3,437.50 (+0.46%) (YTD: -13.66%)

BB: 1,246.14 (+0.44%) (YTD: -22.61%)

Calendar

23 May (Saturday): Earliest date on which suspension of international flights to / from Egypt expires.

23 May (Saturday): Earliest date by which restaurants, gyms, nightclubs, museums and archaeological sites will reopen.

23 May (Saturday): An administrative court will look into an appeal by steel rolling mills to overturn a government’s decision to place import tariffs on steel rebar and iron billets. The hearing was postponed from 22 February 2020.

23-26 May (Saturday-Tuesday): Eid El Fitr (TBC).

31 May (Sunday): A postponed court session for the lawsuit filed by Cairo Development and Auto Industry, a subsidiary of Arabia Investment Holding, against Peugeot Automotive to demand EUR 150 mn compensation.

9-10 June (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 June (Sunday): Anniversary of the June 2013 protests, national holiday.

25 June (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

28-29 July (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

30 July-3 August (Thursday-Monday): Eid El Adha (TBC), national holiday.

13 August (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

20 August (Wednesday-Thursday): Islamic New Year (TBC), national holiday.

15-16 September (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 September (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

24 September- 2 October (Thursday-Friday): El Gouna Film Festival, El Gouna, Egypt.

6 October (Tuesday): Armed Forces Day, national holiday.

29 October (Thursday): Prophet Mohamed’s birthday (TBC), national holiday.

November: Egypt will host simultaneously the International Capital Market Association’s emerging market, and Africa and Middle East meetings.

4-5 November (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

12 November (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

15-16 December (Tuesday-Wednesday): US Federal Open Market Committee will hold its two-day policy meeting to review the interest rate.

24 December (Thursday): The CBE’s Monetary Policy Committee will meet to review interest rates.

25 December (Friday): Western Christmas.

1 January 2021 (Friday): New Year’s Day, national holiday.

7 January 2021 (Thursday): Coptic Christmas, national holiday.

Enterprise is a daily publication of Enterprise Ventures LLC, an Egyptian limited liability company (commercial register 83594), and a subsidiary of Inktank Communications. Summaries are intended for guidance only and are provided on an as-is basis; kindly refer to the source article in its original language prior to undertaking any action. Neither Enterprise Ventures nor its staff assume any responsibility or liability for the accuracy of the information contained in this publication, whether in the form of summaries or analysis. © 2022 Enterprise Ventures LLC.

Enterprise is available without charge thanks to the generous support of HSBC Egypt (tax ID: 204-901-715), the leading corporate and retail lender in Egypt; EFG Hermes (tax ID: 200-178-385), the leading financial services corporation in frontier emerging markets; SODIC (tax ID: 212-168-002), a leading Egyptian real estate developer; SomaBay (tax ID: 204-903-300), our Red Sea holiday partner; Infinity (tax ID: 474-939-359), the ultimate way to power cities, industries, and homes directly from nature right here in Egypt; CIRA (tax ID: 200-069-608), the leading providers of K-12 and higher level education in Egypt; Orascom Construction (tax ID: 229-988-806), the leading construction and engineering company building infrastructure in Egypt and abroad; Moharram & Partners (tax ID: 616-112-459), the leading public policy and government affairs partner; Palm Hills Developments (tax ID: 432-737-014), a leading developer of commercial and residential properties; Mashreq (tax ID: 204-898-862), the MENA region’s leading homegrown personal and digital bank; Industrial Development Group (IDG) (tax ID:266-965-253), the leading builder of industrial parks in Egypt; Hassan Allam Properties (tax ID: 553-096-567), one of Egypt’s most prominent and leading builders; and Saleh, Barsoum & Abdel Aziz (tax ID: 220-002-827), the leading audit, tax and accounting firm in Egypt.